Economic principles and decision making

VerifiedAdded on 2022/09/18

|15

|4552

|24

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ECONOMIC PRINCIPLES AND DECISION MAKING

Economic Principles and Decision Making

Name of the Student:

Name of the University:

Author note:

Economic Principles and Decision Making

Name of the Student:

Name of the University:

Author note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ECONOMIC PRINCIPLES AND DECISION MAKING

Introduction

The Australian economy has achieved a world record for achieving the longest running

period of growth since July 1991. The global economic growth rate has been fluctuating over the

past few years but Australia has succeeded in maintaining a positive growth rate even during the

global financial crisis (GFC). In spite of experiencing a fall in the biggest economic sector,

mining, the country was able to tone down the negative blow on the economy. Bell (2017)

highlighted that the monetary policies introduced by the Reserve Bank of Australia (RBA) had a

significant contribution in helping the economy to rise above the challenges emerged from the

global financial crisis in 2007-2008. The GDP of Australia was AU $1.69 trillion in 2017, and its

total wealth as of 2016 was AU $8.9 trillion (Greasley et al. 2017). The rate of inflation has been

almost stable over the time period and it was 1.9% in the first quarter of 2019, implying a

reasonable economic growth. The unemployment rate is around 5% in 2018-19 in spite of job

creation (Davidson & Dorsch, 2018). Cash rate influences the money market significantly. It is a

significant element of monetary policies planned by the RBA. Cash rate refers to the overnight

money market interest rate. Change in the cash rate has knock-on effects investment, spending,

inflation and unemployment in the economy (Hijzen et al., 2018). The cash rate is assumed to

decline more from 1.5% and the GDP might also decline from 3% in 2019. These would indicate

a slower growth for the economy of Australia. Furthermore, the biggest trading partner of

Australia is China, and it is also experiencing a slowdown in the economy, which would also

impact the growth rate of the Australian economy. This report will discuss the above mentioned

aspects of the Australian economy along with the external aspects, such as, the economic

slowdown of China and its effect on the Australian economy in order to explore and examine the

growth possibility of the country.

Introduction

The Australian economy has achieved a world record for achieving the longest running

period of growth since July 1991. The global economic growth rate has been fluctuating over the

past few years but Australia has succeeded in maintaining a positive growth rate even during the

global financial crisis (GFC). In spite of experiencing a fall in the biggest economic sector,

mining, the country was able to tone down the negative blow on the economy. Bell (2017)

highlighted that the monetary policies introduced by the Reserve Bank of Australia (RBA) had a

significant contribution in helping the economy to rise above the challenges emerged from the

global financial crisis in 2007-2008. The GDP of Australia was AU $1.69 trillion in 2017, and its

total wealth as of 2016 was AU $8.9 trillion (Greasley et al. 2017). The rate of inflation has been

almost stable over the time period and it was 1.9% in the first quarter of 2019, implying a

reasonable economic growth. The unemployment rate is around 5% in 2018-19 in spite of job

creation (Davidson & Dorsch, 2018). Cash rate influences the money market significantly. It is a

significant element of monetary policies planned by the RBA. Cash rate refers to the overnight

money market interest rate. Change in the cash rate has knock-on effects investment, spending,

inflation and unemployment in the economy (Hijzen et al., 2018). The cash rate is assumed to

decline more from 1.5% and the GDP might also decline from 3% in 2019. These would indicate

a slower growth for the economy of Australia. Furthermore, the biggest trading partner of

Australia is China, and it is also experiencing a slowdown in the economy, which would also

impact the growth rate of the Australian economy. This report will discuss the above mentioned

aspects of the Australian economy along with the external aspects, such as, the economic

slowdown of China and its effect on the Australian economy in order to explore and examine the

growth possibility of the country.

2ECONOMIC PRINCIPLES AND DECISION MAKING

Discussion

Economic growth and impact of cash rate

Economic growth refers to the expansion or increase in the size of the economy of a

country over a given period of time. The economy’s size is generally measured by its Gross

Domestic Product (GDP), which represents the total level of goods and services produced within

the geographic boundaries of a nation in a given period of time (Minford & Peel, 2019). The

GDP of a nation depends on different factors of production combined with several other

intangible aspects of the economy, such as, demand and expenditure level, money supply, rate of

interest, inflation and unemployment, tax rates, import and export levels, tariffs etc. (Johnson,

2017). Thus, RBA plays a significant role in influencing the aggregate level of goods and

services production in the Australian economy. Cash rate is a significant measure among all the

other measures planned and implemented by the RBA for controlling the money supply in the

market. This in turn affects the market forces, that is, the demand and supply of the goods and

services in the Australian economy and other variables influencing economic growth.

According to RBA (2019), cash rate denotes the metric, which is used for representing

the interest rate on the overnight funds. The overnight funds refer to those that are used by the

commercial banks to lend money to each other to meet their daily cash needs on an immediate

basis. It also serves as the benchmark rate for all kinds of lending, like, rates of interest on the

savings accounts, mortgages, rates of exchange, and many other lending transactions in the

monetary policy implemented by the RBA. Thus, the cash rate impacts all types of channels of

money supply within the economy. It can be explained in the following way; when there is rising

inflation in the economy, that is, the economy is strong and the prices of goods and services are

pushed up by the market demand, then RBA raises the cash rate for slowing down the economy

Discussion

Economic growth and impact of cash rate

Economic growth refers to the expansion or increase in the size of the economy of a

country over a given period of time. The economy’s size is generally measured by its Gross

Domestic Product (GDP), which represents the total level of goods and services produced within

the geographic boundaries of a nation in a given period of time (Minford & Peel, 2019). The

GDP of a nation depends on different factors of production combined with several other

intangible aspects of the economy, such as, demand and expenditure level, money supply, rate of

interest, inflation and unemployment, tax rates, import and export levels, tariffs etc. (Johnson,

2017). Thus, RBA plays a significant role in influencing the aggregate level of goods and

services production in the Australian economy. Cash rate is a significant measure among all the

other measures planned and implemented by the RBA for controlling the money supply in the

market. This in turn affects the market forces, that is, the demand and supply of the goods and

services in the Australian economy and other variables influencing economic growth.

According to RBA (2019), cash rate denotes the metric, which is used for representing

the interest rate on the overnight funds. The overnight funds refer to those that are used by the

commercial banks to lend money to each other to meet their daily cash needs on an immediate

basis. It also serves as the benchmark rate for all kinds of lending, like, rates of interest on the

savings accounts, mortgages, rates of exchange, and many other lending transactions in the

monetary policy implemented by the RBA. Thus, the cash rate impacts all types of channels of

money supply within the economy. It can be explained in the following way; when there is rising

inflation in the economy, that is, the economy is strong and the prices of goods and services are

pushed up by the market demand, then RBA raises the cash rate for slowing down the economy

3ECONOMIC PRINCIPLES AND DECISION MAKING

and keeping the inflation within a healthy range (rba.gov.au, 2019). Likewise, when the economy

is slow, then the cash rate is lowered by the RBA for encouraging the investment and

expenditure in the economy and pushing the market price upwards for accelerating growth by

increasing the cash flow in the economy. Hence, it can be stated that the increase (decrease) in

cash rate implies an increase (decrease) in the rate of interest in the economy and decreased

(increased) flow of money.

The cash rate was maintained at the highest of 4.75 during 2011 and it has started to fall

since 2012. As per the reports by the RBA (2019), the cash rate was fixed at 1.50% since August

2016 until recently, that is, in June 2019, it was cut by 25 basis points, to 1.25% and in July

2019, RBA further reduced the cash rate by another 25 basis points to 1%. The fall in the cash

rate indicates that the economy of Australia has been experiencing a slower growth, and to boost

the growth, RBA decided to cut the cash rate.

As stated by Alim & Connolly (2018), various factors affect the cash rate decisions, such

as, economic growth, employment, inflation, and international economy. The inflation rate of

Australia is 1.9%, lower than the target range of 2% to 3%. This indicates that a boost up is

required in the economy and a cut in the cash rate is useful for that. The last recorded

information on the cash rate shows that in June 2019, RBA has cut the cash rate by 25 basis

points and by another 25 basis points in July 2019, and this action has pushed down the cash rate

from 1.5% to 1% (RBA, 2019). Moreover, the global economic condition also affects the

decision on cash rates by RBA. Any fluctuation in the international economy has significant

effect on the cash rate. Economic growth in the trade partners indicates an increase in the

demand for the Australian products, on the other hand, weak economic condition in the trade

partners results in lower demand for Australian goods and thus, overseas economic conditions

and keeping the inflation within a healthy range (rba.gov.au, 2019). Likewise, when the economy

is slow, then the cash rate is lowered by the RBA for encouraging the investment and

expenditure in the economy and pushing the market price upwards for accelerating growth by

increasing the cash flow in the economy. Hence, it can be stated that the increase (decrease) in

cash rate implies an increase (decrease) in the rate of interest in the economy and decreased

(increased) flow of money.

The cash rate was maintained at the highest of 4.75 during 2011 and it has started to fall

since 2012. As per the reports by the RBA (2019), the cash rate was fixed at 1.50% since August

2016 until recently, that is, in June 2019, it was cut by 25 basis points, to 1.25% and in July

2019, RBA further reduced the cash rate by another 25 basis points to 1%. The fall in the cash

rate indicates that the economy of Australia has been experiencing a slower growth, and to boost

the growth, RBA decided to cut the cash rate.

As stated by Alim & Connolly (2018), various factors affect the cash rate decisions, such

as, economic growth, employment, inflation, and international economy. The inflation rate of

Australia is 1.9%, lower than the target range of 2% to 3%. This indicates that a boost up is

required in the economy and a cut in the cash rate is useful for that. The last recorded

information on the cash rate shows that in June 2019, RBA has cut the cash rate by 25 basis

points and by another 25 basis points in July 2019, and this action has pushed down the cash rate

from 1.5% to 1% (RBA, 2019). Moreover, the global economic condition also affects the

decision on cash rates by RBA. Any fluctuation in the international economy has significant

effect on the cash rate. Economic growth in the trade partners indicates an increase in the

demand for the Australian products, on the other hand, weak economic condition in the trade

partners results in lower demand for Australian goods and thus, overseas economic conditions

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ECONOMIC PRINCIPLES AND DECISION MAKING

affect the Australian economy significantly. Povey, Boreham & Tomaszewski (2016) also stated

that the level of unemployment in Australia is also another important indicator of the health of

the economy. When the unemployment level is high, RBA might cut the cash rate for stimulating

the economy by lowering interest rate and increasing expenditure, investment and creation of job

opportunities. Hence, it can be stated that RBA stimulates domestic economy by decreasing the

cash rate, that is, by lowering the interest rate in the economy and encouraging the flow of

money through spending and investment. In the recent years, the economic growth of Australia

was quite slow. Scutt (2019) reports that in the financial year on 2018-19, the Australian

economy grew by only 1.8%, which is the weakest since the global financial crisis happened in

2007-08. Household consumption constitutes the largest part of the total consumption in the

economy and it was found to be very weak. This was reinforced by the demand in the market

created by the Australian government and GDP per capita has decreased marginally. All these

contributed in the extension of the per capita recession in the Australian economy into third

consecutive quarter. However, the nominal GDP continued to be strong and that boosted the

revenues for the government, even though the overall growth was remarkably slow.

Trade war between the US and China and its effect on Australian Economy

Another significant reason contributing in the slower growth of the Australian economy

is the trade war between the USA and China and the resultant slower growth of China’s

economy. China is the largest trade partner of Australia and the major exports from Australia are

iron ore, coal and liquefied natural gas. China contributed approximately $194.6 billion in the

Australian economy through trading in 2017-18 (Qi & Zhang, 2018). The large Australian

mining companies depend heavily on China for exports (Parker, Cox & Thompson, 2018). At the

same time, USA is also a trade partner of Australia and hence, if the economies of the trade

affect the Australian economy significantly. Povey, Boreham & Tomaszewski (2016) also stated

that the level of unemployment in Australia is also another important indicator of the health of

the economy. When the unemployment level is high, RBA might cut the cash rate for stimulating

the economy by lowering interest rate and increasing expenditure, investment and creation of job

opportunities. Hence, it can be stated that RBA stimulates domestic economy by decreasing the

cash rate, that is, by lowering the interest rate in the economy and encouraging the flow of

money through spending and investment. In the recent years, the economic growth of Australia

was quite slow. Scutt (2019) reports that in the financial year on 2018-19, the Australian

economy grew by only 1.8%, which is the weakest since the global financial crisis happened in

2007-08. Household consumption constitutes the largest part of the total consumption in the

economy and it was found to be very weak. This was reinforced by the demand in the market

created by the Australian government and GDP per capita has decreased marginally. All these

contributed in the extension of the per capita recession in the Australian economy into third

consecutive quarter. However, the nominal GDP continued to be strong and that boosted the

revenues for the government, even though the overall growth was remarkably slow.

Trade war between the US and China and its effect on Australian Economy

Another significant reason contributing in the slower growth of the Australian economy

is the trade war between the USA and China and the resultant slower growth of China’s

economy. China is the largest trade partner of Australia and the major exports from Australia are

iron ore, coal and liquefied natural gas. China contributed approximately $194.6 billion in the

Australian economy through trading in 2017-18 (Qi & Zhang, 2018). The large Australian

mining companies depend heavily on China for exports (Parker, Cox & Thompson, 2018). At the

same time, USA is also a trade partner of Australia and hence, if the economies of the trade

5ECONOMIC PRINCIPLES AND DECISION MAKING

partners get affected due to trade war, that would affect Australia’s economy also. The trade war

between the USA and China was started when the US government decided in 2018 to apply tariff

on the Chinese imports worth of US $50-60 billion with the assistance of the United States Trade

Representative (USTR) with an aim to reduce the unfair trade practices by China over the years.

The unfair practices also included the theft of intellectual property of the USA (Liu & Woo,

2018). The government listed more than 1300 categories of Chinese goods for tariffs, such as,

medical devices, batteries, aircraft parts, various weapons, flat-panel television and satellites

(Guttmann et al., 2019). In the response to the tariff imposition by the US, China imposed tariffs

on around 128 product types that are imported from the US. These include cars, airplanes,

soybeans, pork, fruits and nuts, steel piping and aluminium, (Liu & Woo, 2018). In the next

course of time, both the countries kept on imposing as well as increasing tariffs on imported

goods worth of billions. Because of these economic turbulences, the exports of the Chinese

economy have been affected and it has been experiencing a slowdown. Furthermore, there are

some other macroeconomic issues also, such as, diminishing birth rate, speedily aging

population, tightening Federal Reserve and a slackening global economy (Loke, 2018), which

are also contributing in the economic slowdown of China. The Chinese economy experienced

only 6.6% growth in 2018 which is a sharp fall from 10% in 2011 (RBA, 2019).

The Chinese economy is the second biggest in the world and slowdown of this economy

has significant consequence on the global economy. As the trade relations between China and

Australia are quite strong, a slowdown in China’s economy is likely to have a negative effect on

Australia’s economy. As highlighted by Qi & Zhang (2018), at least one-third of the total exports

from Australia goes to China, and, if the US government makes a deal with China to reduce the

USD 400 billion trade gap, the Australian economy would likely to suffer. It is estimated that to

partners get affected due to trade war, that would affect Australia’s economy also. The trade war

between the USA and China was started when the US government decided in 2018 to apply tariff

on the Chinese imports worth of US $50-60 billion with the assistance of the United States Trade

Representative (USTR) with an aim to reduce the unfair trade practices by China over the years.

The unfair practices also included the theft of intellectual property of the USA (Liu & Woo,

2018). The government listed more than 1300 categories of Chinese goods for tariffs, such as,

medical devices, batteries, aircraft parts, various weapons, flat-panel television and satellites

(Guttmann et al., 2019). In the response to the tariff imposition by the US, China imposed tariffs

on around 128 product types that are imported from the US. These include cars, airplanes,

soybeans, pork, fruits and nuts, steel piping and aluminium, (Liu & Woo, 2018). In the next

course of time, both the countries kept on imposing as well as increasing tariffs on imported

goods worth of billions. Because of these economic turbulences, the exports of the Chinese

economy have been affected and it has been experiencing a slowdown. Furthermore, there are

some other macroeconomic issues also, such as, diminishing birth rate, speedily aging

population, tightening Federal Reserve and a slackening global economy (Loke, 2018), which

are also contributing in the economic slowdown of China. The Chinese economy experienced

only 6.6% growth in 2018 which is a sharp fall from 10% in 2011 (RBA, 2019).

The Chinese economy is the second biggest in the world and slowdown of this economy

has significant consequence on the global economy. As the trade relations between China and

Australia are quite strong, a slowdown in China’s economy is likely to have a negative effect on

Australia’s economy. As highlighted by Qi & Zhang (2018), at least one-third of the total exports

from Australia goes to China, and, if the US government makes a deal with China to reduce the

USD 400 billion trade gap, the Australian economy would likely to suffer. It is estimated that to

6ECONOMIC PRINCIPLES AND DECISION MAKING

settle the deal with the US, China might agree to import more American LNG, which presently

constitutes a big part of the Australian exports to China, and this trade decision would affect the

Australian economy, as observed in case of coking coal exports of China. It is seen that in 2019,

the Australian coal exports to China dropped 21% while the imports of Mongolian coal to China

increased 47%. This had a strong effect on the coal mining industry of Australia (Jotzo, Mazouz

& Wiseman, 2018). In case of an US – China trade agreement resolution, there would be

increase in the export of American goods to China, including LNG. This implies that the

Australian exports to China, especially LNG and agricultural products, would fall further,

leading to a blow to the Australian economy (Wang, 2019).

Li, He & Lin (2018) emphasized that as the US government is imposing more tariffs on

the Chinese imports, the amount of Chinese imports would decrease in the US, and that would

affect the manufacturing and other export sectors of China. Moreover, the dependency of the

Australian export sectors on China’s economy results in uncertainty in Australia due to the

slowdown in China. Thus, RBA estimated that a 5% fall in the growth rate of Chinese economy

would lead to a 2.5% fall in the growth rate of the Australian GDP with commodity prices and

equity taking a hit. According to RBA, the impact of the Chinese economy slowdown could be

reflected through various channels in the Australian economy, such as, trade, factors of financial

market, equity price, exchange rate and cash rate (Turner, 2019). Among these, the trade

relations are the most important channels influencing the Australian economy.

As the Chinese economy is getting affected due to trade war with America, the reduced

international trade and demand from China and its other trade partners, lead to a decline in the

GDP of Australia by 1.3% over the next three years. After 2 years, the amount of the non-

resource exports is expected to fall by up to 1.5% relative to the baseline and after 3 years, the

settle the deal with the US, China might agree to import more American LNG, which presently

constitutes a big part of the Australian exports to China, and this trade decision would affect the

Australian economy, as observed in case of coking coal exports of China. It is seen that in 2019,

the Australian coal exports to China dropped 21% while the imports of Mongolian coal to China

increased 47%. This had a strong effect on the coal mining industry of Australia (Jotzo, Mazouz

& Wiseman, 2018). In case of an US – China trade agreement resolution, there would be

increase in the export of American goods to China, including LNG. This implies that the

Australian exports to China, especially LNG and agricultural products, would fall further,

leading to a blow to the Australian economy (Wang, 2019).

Li, He & Lin (2018) emphasized that as the US government is imposing more tariffs on

the Chinese imports, the amount of Chinese imports would decrease in the US, and that would

affect the manufacturing and other export sectors of China. Moreover, the dependency of the

Australian export sectors on China’s economy results in uncertainty in Australia due to the

slowdown in China. Thus, RBA estimated that a 5% fall in the growth rate of Chinese economy

would lead to a 2.5% fall in the growth rate of the Australian GDP with commodity prices and

equity taking a hit. According to RBA, the impact of the Chinese economy slowdown could be

reflected through various channels in the Australian economy, such as, trade, factors of financial

market, equity price, exchange rate and cash rate (Turner, 2019). Among these, the trade

relations are the most important channels influencing the Australian economy.

As the Chinese economy is getting affected due to trade war with America, the reduced

international trade and demand from China and its other trade partners, lead to a decline in the

GDP of Australia by 1.3% over the next three years. After 2 years, the amount of the non-

resource exports is expected to fall by up to 1.5% relative to the baseline and after 3 years, the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC PRINCIPLES AND DECISION MAKING

GDP would be dropped by 0.3%. The service and manufacturing sectors of Australia get

impacted with the maximum effect reflecting high demand from China for Australian

manufactured food, tourism and education. In December 2018, the imports of China fell by 7.6%

and the exports fell by 4.4% (Chau, 2019). Secondly, it has been witnessed that as a reason of

China’s economic slowdown, the equity prices fell by 10% in the first year, leading to lesser

household consumption as well as wealth. This would reflect in the increase in the

unemployment rate by 0.9% and decline in the rate of inflation by 0.2% after 3 years. Thirdly,

the slack in China affects the exchange rate and cash rate of Australia. A negative shock from an

economy affects the rate of exchange of another economy as the terms of trade decreases and this

puts a descending pressure on Australia’s real exchange rate. RBA cuts the cash rate by 25 basis

points in June 2019, from 1.5% to 1.25% in a revised monetary policy for maintaining the

growth of the economy even during the slowdown in China (Chau, 2019).

Thus, it can be inferred that slowdown in China has cast an important impact on the

slower growth of the Australian economy. Volume of trade, exchange rate, terms of trade, cash

rate, equity prices, commodity prices, are some of the features that bear the majority of the

impact of China’s economic slowdown. Australia’s GDP is affected by these aspects and hence

leading to inflation and greater unemployment and for controlling this situation, the RBA had to

take the decision of controlling the monetary policy of Australia through cash rate modification.

Poor level of consumer expenditure, investment and slugging of the housing sector in

Australia

The poor level of growth of Australia’s economy can also be explained by the poor level

of consumer expenditure. Lower than expected growth was recorded in 2018 due to a sharp fall

in the housing sector and tedious consumer expenditure raise an alarm about the future direction

GDP would be dropped by 0.3%. The service and manufacturing sectors of Australia get

impacted with the maximum effect reflecting high demand from China for Australian

manufactured food, tourism and education. In December 2018, the imports of China fell by 7.6%

and the exports fell by 4.4% (Chau, 2019). Secondly, it has been witnessed that as a reason of

China’s economic slowdown, the equity prices fell by 10% in the first year, leading to lesser

household consumption as well as wealth. This would reflect in the increase in the

unemployment rate by 0.9% and decline in the rate of inflation by 0.2% after 3 years. Thirdly,

the slack in China affects the exchange rate and cash rate of Australia. A negative shock from an

economy affects the rate of exchange of another economy as the terms of trade decreases and this

puts a descending pressure on Australia’s real exchange rate. RBA cuts the cash rate by 25 basis

points in June 2019, from 1.5% to 1.25% in a revised monetary policy for maintaining the

growth of the economy even during the slowdown in China (Chau, 2019).

Thus, it can be inferred that slowdown in China has cast an important impact on the

slower growth of the Australian economy. Volume of trade, exchange rate, terms of trade, cash

rate, equity prices, commodity prices, are some of the features that bear the majority of the

impact of China’s economic slowdown. Australia’s GDP is affected by these aspects and hence

leading to inflation and greater unemployment and for controlling this situation, the RBA had to

take the decision of controlling the monetary policy of Australia through cash rate modification.

Poor level of consumer expenditure, investment and slugging of the housing sector in

Australia

The poor level of growth of Australia’s economy can also be explained by the poor level

of consumer expenditure. Lower than expected growth was recorded in 2018 due to a sharp fall

in the housing sector and tedious consumer expenditure raise an alarm about the future direction

8ECONOMIC PRINCIPLES AND DECISION MAKING

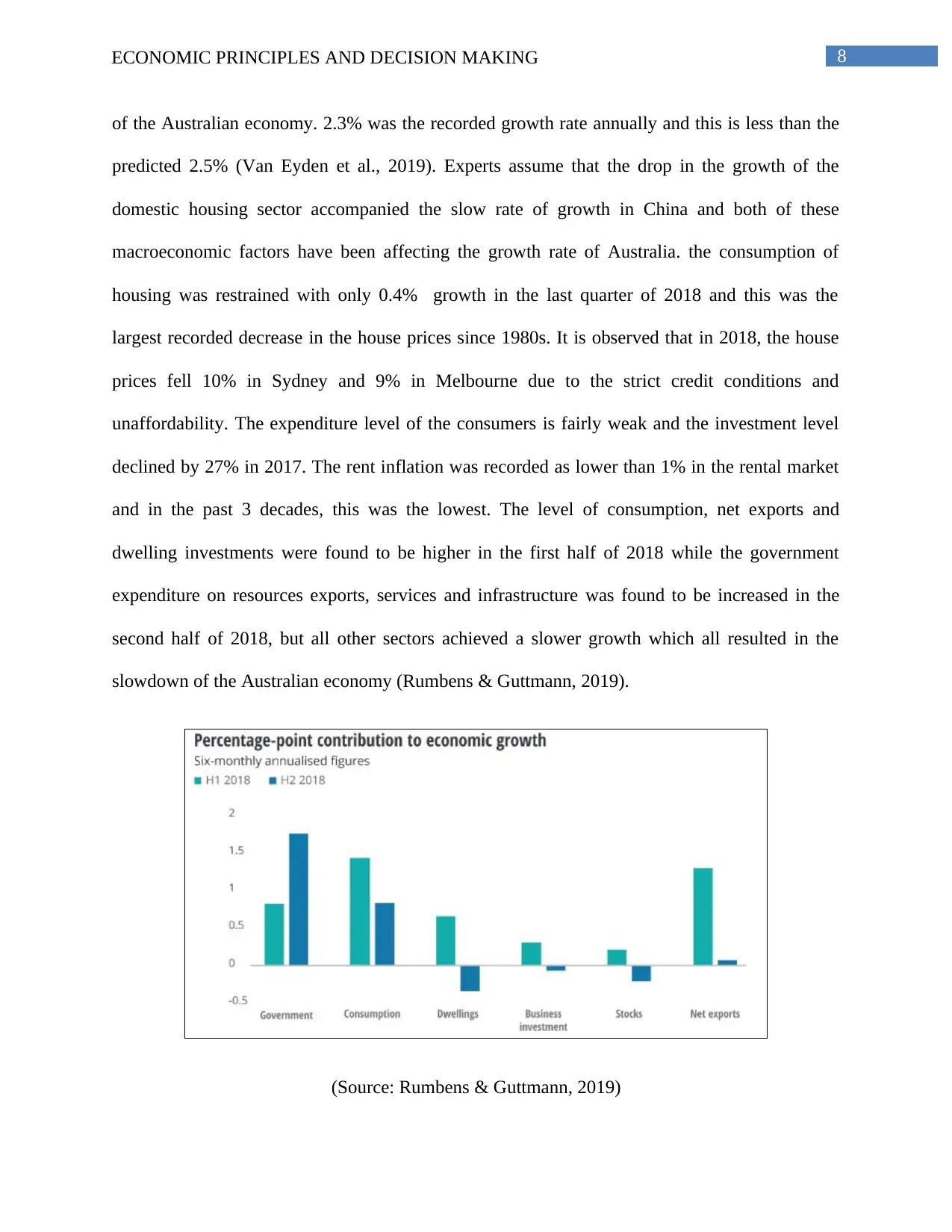

of the Australian economy. 2.3% was the recorded growth rate annually and this is less than the

predicted 2.5% (Van Eyden et al., 2019). Experts assume that the drop in the growth of the

domestic housing sector accompanied the slow rate of growth in China and both of these

macroeconomic factors have been affecting the growth rate of Australia. the consumption of

housing was restrained with only 0.4% growth in the last quarter of 2018 and this was the

largest recorded decrease in the house prices since 1980s. It is observed that in 2018, the house

prices fell 10% in Sydney and 9% in Melbourne due to the strict credit conditions and

unaffordability. The expenditure level of the consumers is fairly weak and the investment level

declined by 27% in 2017. The rent inflation was recorded as lower than 1% in the rental market

and in the past 3 decades, this was the lowest. The level of consumption, net exports and

dwelling investments were found to be higher in the first half of 2018 while the government

expenditure on resources exports, services and infrastructure was found to be increased in the

second half of 2018, but all other sectors achieved a slower growth which all resulted in the

slowdown of the Australian economy (Rumbens & Guttmann, 2019).

(Source: Rumbens & Guttmann, 2019)

of the Australian economy. 2.3% was the recorded growth rate annually and this is less than the

predicted 2.5% (Van Eyden et al., 2019). Experts assume that the drop in the growth of the

domestic housing sector accompanied the slow rate of growth in China and both of these

macroeconomic factors have been affecting the growth rate of Australia. the consumption of

housing was restrained with only 0.4% growth in the last quarter of 2018 and this was the

largest recorded decrease in the house prices since 1980s. It is observed that in 2018, the house

prices fell 10% in Sydney and 9% in Melbourne due to the strict credit conditions and

unaffordability. The expenditure level of the consumers is fairly weak and the investment level

declined by 27% in 2017. The rent inflation was recorded as lower than 1% in the rental market

and in the past 3 decades, this was the lowest. The level of consumption, net exports and

dwelling investments were found to be higher in the first half of 2018 while the government

expenditure on resources exports, services and infrastructure was found to be increased in the

second half of 2018, but all other sectors achieved a slower growth which all resulted in the

slowdown of the Australian economy (Rumbens & Guttmann, 2019).

(Source: Rumbens & Guttmann, 2019)

9ECONOMIC PRINCIPLES AND DECISION MAKING

Australian economy also experienced productivity slump, and this reflected 1 of the

lowest value in successive 3 quarters. The low growth of wage is disturbing the market

productivity. Moreover, the level of investment in infrastructure is also low, indicating less flow

of money in the market. Therefore, a sharp fall in the property market and low investment and

consumer expenditure level has been affecting the growth rate of the Australian economy in

2017-18. The rise in the GDP was also much lower, recorded as only 2.3% since the mid of 2017

and this is lower than the expected 2.5%. The last quarter of 2018 witnessed a negative growth

rate of 1.6% in the agricultural forestry and fishing sector (Hutchens, 2018). Along with that, the

construction industry also faced a slowdown. All of these factors contributed in the fall of the

annual growth rate to 2.8% from 3.4% in the last quarter (Rumbens & Guttmann, 2019). Hence,

to stimulate the economy, RBA may resort to a cut in the cash rate.

RBA may decrease the corporate taxes and the cash rate to adjust the level of investment

and expenditure in the economy, to preserve a stable rate of wage and steady inflation as since

1980s, the country was experiencing a per capita recession first time (Reuters.com, 2019).

Through flexible monetary policy and revised rate cuts, the Australian government tries to

sustain the economic growth. Since, the reduced trade with China, global economic slowdown,

fall in the growth rate of manufacturing, mining and housing sector, reduction in inflation and

rise in the unemployment are resulting in the slower growth of the Australian economy, the

central bank needs to boost up the economy by increasing the supply of money into the market

and preventing more drop in the macroeconomic components.

Thus, to attain these objectives, the cash rate cut by 25 basis points seems to be a suitable

measure. By dropping the cash rate, RBA will encourage economic activities, such as,

investment and expenditure in the economy. This will also aid in gaining stability in currency

Australian economy also experienced productivity slump, and this reflected 1 of the

lowest value in successive 3 quarters. The low growth of wage is disturbing the market

productivity. Moreover, the level of investment in infrastructure is also low, indicating less flow

of money in the market. Therefore, a sharp fall in the property market and low investment and

consumer expenditure level has been affecting the growth rate of the Australian economy in

2017-18. The rise in the GDP was also much lower, recorded as only 2.3% since the mid of 2017

and this is lower than the expected 2.5%. The last quarter of 2018 witnessed a negative growth

rate of 1.6% in the agricultural forestry and fishing sector (Hutchens, 2018). Along with that, the

construction industry also faced a slowdown. All of these factors contributed in the fall of the

annual growth rate to 2.8% from 3.4% in the last quarter (Rumbens & Guttmann, 2019). Hence,

to stimulate the economy, RBA may resort to a cut in the cash rate.

RBA may decrease the corporate taxes and the cash rate to adjust the level of investment

and expenditure in the economy, to preserve a stable rate of wage and steady inflation as since

1980s, the country was experiencing a per capita recession first time (Reuters.com, 2019).

Through flexible monetary policy and revised rate cuts, the Australian government tries to

sustain the economic growth. Since, the reduced trade with China, global economic slowdown,

fall in the growth rate of manufacturing, mining and housing sector, reduction in inflation and

rise in the unemployment are resulting in the slower growth of the Australian economy, the

central bank needs to boost up the economy by increasing the supply of money into the market

and preventing more drop in the macroeconomic components.

Thus, to attain these objectives, the cash rate cut by 25 basis points seems to be a suitable

measure. By dropping the cash rate, RBA will encourage economic activities, such as,

investment and expenditure in the economy. This will also aid in gaining stability in currency

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ECONOMIC PRINCIPLES AND DECISION MAKING

values, creation of jobs and maintaining the market prices at a steady rate. The domestic

economy will be boosted with low cash rate and the international trade relationships with other

nations than China may recover.

Conclusion

It can be concluded from the above discussion, that there are some significant reasons for

the sluggish economic growth of Australia, and all of those have important influence on various

features of the economy. While on one hand, the trade war between America and China impends

the Australian economy for going through a major slowdown by influencing the trade relations

with China, on the other hand, the decline in the terms of trade, trade volume and currency prices

affects the production level, particularly in the mining, manufacturing and service sectors,

leading to a fall in the commodity prices, lack of spending and investment in the economy, rise

in unemployment, and slump in the housing sector. The GDP of Australia is also rising at a

diminishing rate, that is, at 2.8%, and this is less than the estimated 3%. Hence, the Australian

economy would be facing tough challenges for achieving substantial growth and for increasing

money flow into the economy, a cut in the cash rate appears to be the most appropriate decision

by the RBA. It will be decreased by 25 basis points from 1.5% for encouraging more investment

and expenditure in the economy, developing production and service sectors and stabilizing the

currency prices.

values, creation of jobs and maintaining the market prices at a steady rate. The domestic

economy will be boosted with low cash rate and the international trade relationships with other

nations than China may recover.

Conclusion

It can be concluded from the above discussion, that there are some significant reasons for

the sluggish economic growth of Australia, and all of those have important influence on various

features of the economy. While on one hand, the trade war between America and China impends

the Australian economy for going through a major slowdown by influencing the trade relations

with China, on the other hand, the decline in the terms of trade, trade volume and currency prices

affects the production level, particularly in the mining, manufacturing and service sectors,

leading to a fall in the commodity prices, lack of spending and investment in the economy, rise

in unemployment, and slump in the housing sector. The GDP of Australia is also rising at a

diminishing rate, that is, at 2.8%, and this is less than the estimated 3%. Hence, the Australian

economy would be facing tough challenges for achieving substantial growth and for increasing

money flow into the economy, a cut in the cash rate appears to be the most appropriate decision

by the RBA. It will be decreased by 25 basis points from 1.5% for encouraging more investment

and expenditure in the economy, developing production and service sectors and stabilizing the

currency prices.

11ECONOMIC PRINCIPLES AND DECISION MAKING

References

Alim, S., & Connolly, E. (2018). Interest rate benchmarks for the Australian dollar. Reserve

Bank of Australia, Bulletin, September.

Chau, D. (2019). How much does Australia's economy rely on China?. Retrieved 6 August 2019,

from https://www.abc.net.au/news/2019-01-15/china-economy-slowdown-will-affect-

australia/10716240

Davidson, P., & Dorsch, P. (2018). Faces of unemployment. ACOSS Papers, 25. ISSN 1326-

7124. ISBN 9780858710856.

Greasley, D., McLaughlin, E., Hanley, N., & Oxley, L. (2017). Australia: a land of missed

opportunities?. Environment and Development Economics, 22(6), 674-698.

Guttmann, R., Hickie, K., Rickards, P., & Roberts, I. (2019). Spillovers to Australia from the

Chinese Economy | Bulletin – June Quarter 2019. Retrieved 6 August 2019, from

https://www.rba.gov.au/publications/bulletin/2019/jun/spillovers-to-australia-from-the-

chinese-economy.html

Hijzen, A., Kappeler, A., Pak, M., & Schwellnus, C. (2018). Labour market resilience: The role

of structural and macroeconomic policies. In Structural Reforms (pp. 173-198). Springer,

Cham.DOI: https://doi.org/10.1007/978-3-319-74400-1_8

Hutchens, G. (2019). Australia's GDP growth slows to 2.8% as weaker spending hits economy.

Retrieved 6 August 2019, from

References

Alim, S., & Connolly, E. (2018). Interest rate benchmarks for the Australian dollar. Reserve

Bank of Australia, Bulletin, September.

Chau, D. (2019). How much does Australia's economy rely on China?. Retrieved 6 August 2019,

from https://www.abc.net.au/news/2019-01-15/china-economy-slowdown-will-affect-

australia/10716240

Davidson, P., & Dorsch, P. (2018). Faces of unemployment. ACOSS Papers, 25. ISSN 1326-

7124. ISBN 9780858710856.

Greasley, D., McLaughlin, E., Hanley, N., & Oxley, L. (2017). Australia: a land of missed

opportunities?. Environment and Development Economics, 22(6), 674-698.

Guttmann, R., Hickie, K., Rickards, P., & Roberts, I. (2019). Spillovers to Australia from the

Chinese Economy | Bulletin – June Quarter 2019. Retrieved 6 August 2019, from

https://www.rba.gov.au/publications/bulletin/2019/jun/spillovers-to-australia-from-the-

chinese-economy.html

Hijzen, A., Kappeler, A., Pak, M., & Schwellnus, C. (2018). Labour market resilience: The role

of structural and macroeconomic policies. In Structural Reforms (pp. 173-198). Springer,

Cham.DOI: https://doi.org/10.1007/978-3-319-74400-1_8

Hutchens, G. (2019). Australia's GDP growth slows to 2.8% as weaker spending hits economy.

Retrieved 6 August 2019, from

12ECONOMIC PRINCIPLES AND DECISION MAKING

https://www.theguardian.com/business/2018/dec/05/australias-economic-growth-slows-

to-28-as-weaker-spending-hits

Johnson, H. G. (2017). Macroeconomics and monetary theory. Routledge.

Jotzo, F., Mazouz, S., & Wiseman, J. (2018). Coal Transition in Australia: an overview of

issues (No. 1811). Centre for Climate Economics & Policy, Crawford School of Public

Policy, The Australian National University.

Li, C., He, C., & Lin, C. (2018). Economic Impacts of the Possible China–US Trade

War. Emerging Markets Finance and Trade, 54(7), 1557-1577.DOI:

https://doi.org/10.1080/1540496X.2018.1446131

Liu, T., & Woo, W. T. (2018). Understanding the US-China trade war. China Economic

Journal, 11(3), 319-340. DOI: https://doi.org/10.1080/17538963.2018.1516256

Loke, B. (2018). China's economic slowdown: implications for Beijing's institutional power and

global governance role. The Pacific Review, 31(5), 673-691. DOI:

https://doi.org/10.1080/09512748.2017.1408674

Minford, P., & Peel, D. (2019). Advanced macroeconomics: a primer. Edward Elgar Publishing.

Parker, R., Cox, S., & Thompson, P. (2018). Financialization and Value-based Control: Lessons

from the Australian Mining Supply Chain. Economic Geography, 94(1), 49-67. DOI:

https://doi.org/10.1080/00130095.2017.1330118

Povey, J., Boreham, P., & Tomaszewski, W. (2016). The development of a new multi-faceted

model of social wellbeing: Does income level make a difference?. Journal of

Sociology, 52(2), 155-172. DOI: https://doi.org/10.1177/1440783313507491

https://www.theguardian.com/business/2018/dec/05/australias-economic-growth-slows-

to-28-as-weaker-spending-hits

Johnson, H. G. (2017). Macroeconomics and monetary theory. Routledge.

Jotzo, F., Mazouz, S., & Wiseman, J. (2018). Coal Transition in Australia: an overview of

issues (No. 1811). Centre for Climate Economics & Policy, Crawford School of Public

Policy, The Australian National University.

Li, C., He, C., & Lin, C. (2018). Economic Impacts of the Possible China–US Trade

War. Emerging Markets Finance and Trade, 54(7), 1557-1577.DOI:

https://doi.org/10.1080/1540496X.2018.1446131

Liu, T., & Woo, W. T. (2018). Understanding the US-China trade war. China Economic

Journal, 11(3), 319-340. DOI: https://doi.org/10.1080/17538963.2018.1516256

Loke, B. (2018). China's economic slowdown: implications for Beijing's institutional power and

global governance role. The Pacific Review, 31(5), 673-691. DOI:

https://doi.org/10.1080/09512748.2017.1408674

Minford, P., & Peel, D. (2019). Advanced macroeconomics: a primer. Edward Elgar Publishing.

Parker, R., Cox, S., & Thompson, P. (2018). Financialization and Value-based Control: Lessons

from the Australian Mining Supply Chain. Economic Geography, 94(1), 49-67. DOI:

https://doi.org/10.1080/00130095.2017.1330118

Povey, J., Boreham, P., & Tomaszewski, W. (2016). The development of a new multi-faceted

model of social wellbeing: Does income level make a difference?. Journal of

Sociology, 52(2), 155-172. DOI: https://doi.org/10.1177/1440783313507491

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ECONOMIC PRINCIPLES AND DECISION MAKING

Qi, C., & Zhang, J. X. (2018). The economic impacts of the China-Australia Free Trade

Agreement-A general equilibrium analysis. China Economic Review, 47, 1-11. DOI:

https://doi.org/10.1016/j.chieco.2017.11.002

RBA. (2019). Cash Rate. Retrieved 6 August 2019, from https://www.rba.gov.au/statistics/cash-

rate/

rba.gov.au. (2019). 4 June 2019 | Minutes of the Monetary Policy Meeting of the Board.

Retrieved 6 August 2019, from https://www.rba.gov.au/monetary-policy/rba-board-

minutes/2019/2019-06-04.html

Reuters.com. (2019). Australia GDP slowdown opens door wide for rate cuts this year. Retrieved

6 August 2019, from https://www.reuters.com/article/us-australia-economy-gdp/australia-

gdp-slowdown-opens-door-wide-for-rate-cuts-this-year-idUSKCN1QN0BD

Rumbens, D., & Guttmann, B. (2019). Australia Economy is a tale of two halves. Retrieved 6

August 2019, from

https://www2.deloitte.com/insights/us/en/economy/asia-pacific/australia-economic-

outlook.html

Scutt, D. (2019). Australian economic growth hasn't been this slow since the GFC. Retrieved 6

August 2019, from https://www.businessinsider.com.au/australia-gdp-economic-growth-

rba-2019-6

Turner, S. (2019). Here's How Much a China Slowdown Would Hurt Australia's Economy -

Caixin Global. Retrieved 6 August 2019, from https://www.caixinglobal.com/2019-06-

21/heres-how-much-a-china-slowdown-would-hurt-australias-economy-101429827.html

Qi, C., & Zhang, J. X. (2018). The economic impacts of the China-Australia Free Trade

Agreement-A general equilibrium analysis. China Economic Review, 47, 1-11. DOI:

https://doi.org/10.1016/j.chieco.2017.11.002

RBA. (2019). Cash Rate. Retrieved 6 August 2019, from https://www.rba.gov.au/statistics/cash-

rate/

rba.gov.au. (2019). 4 June 2019 | Minutes of the Monetary Policy Meeting of the Board.

Retrieved 6 August 2019, from https://www.rba.gov.au/monetary-policy/rba-board-

minutes/2019/2019-06-04.html

Reuters.com. (2019). Australia GDP slowdown opens door wide for rate cuts this year. Retrieved

6 August 2019, from https://www.reuters.com/article/us-australia-economy-gdp/australia-

gdp-slowdown-opens-door-wide-for-rate-cuts-this-year-idUSKCN1QN0BD

Rumbens, D., & Guttmann, B. (2019). Australia Economy is a tale of two halves. Retrieved 6

August 2019, from

https://www2.deloitte.com/insights/us/en/economy/asia-pacific/australia-economic-

outlook.html

Scutt, D. (2019). Australian economic growth hasn't been this slow since the GFC. Retrieved 6

August 2019, from https://www.businessinsider.com.au/australia-gdp-economic-growth-

rba-2019-6

Turner, S. (2019). Here's How Much a China Slowdown Would Hurt Australia's Economy -

Caixin Global. Retrieved 6 August 2019, from https://www.caixinglobal.com/2019-06-

21/heres-how-much-a-china-slowdown-would-hurt-australias-economy-101429827.html

14ECONOMIC PRINCIPLES AND DECISION MAKING

Van Eyden, R., Difeto, M., Gupta, R., & Wohar, M. E. (2019). Oil price volatility and economic

growth: Evidence from advanced economies using more than a century’s data. Applied

energy, 233, 612-621. DOI: https://doi.org/10.1016/j.apenergy.2018.10.049

Wang, H. (2019). How will the US-China trade war affect Australia?. Retrieved 6 August 2019,

from https://newsroom.unsw.edu.au/news/business-law/how-will-us-china-trade-war-

affect-australia

Van Eyden, R., Difeto, M., Gupta, R., & Wohar, M. E. (2019). Oil price volatility and economic

growth: Evidence from advanced economies using more than a century’s data. Applied

energy, 233, 612-621. DOI: https://doi.org/10.1016/j.apenergy.2018.10.049

Wang, H. (2019). How will the US-China trade war affect Australia?. Retrieved 6 August 2019,

from https://newsroom.unsw.edu.au/news/business-law/how-will-us-china-trade-war-

affect-australia

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.