BIZ201: Crystal Hotel Financial Performance and Ratio Analysis Report

VerifiedAdded on 2023/01/19

|12

|2508

|100

Report

AI Summary

This report provides a detailed financial analysis of Crystal Hotel, utilizing both ratio and vertical analysis techniques to evaluate its performance. The report examines the hotel's income statement, comparing it with industry benchmarks to assess revenue streams, cost of sales, and personnel costs. Profitability, efficiency, liquidity, and solvency ratios are calculated and interpreted to provide insights into the hotel's financial health. The analysis includes key performance indicators such as gross profit margin, net profit margin, return on assets, return on equity, inventory turnover, accounts receivable collection period, current ratio, quick ratio, debt-to-equity ratio, and other industry-specific metrics like average daily rate and revenue per available room. The report concludes with recommendations for improvement, focusing on areas such as cost reduction, staff management, and liquidity management to enhance Crystal Hotel's overall financial position and support its renovation plans.

1

BIZ201 Accounting for Decision Making

BIZ201 Accounting for Decision Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive Summary

The present report has been presented for carrying out an analysis of the financial

position of Crystal Hotel by the use of financial analysis technique of ratio and vertical analysis.

It has been identified with the use of these techniques that the hotel need to improvise over its

problem of improving the employee wages and reducing the outstanding invoices amount for

supporting its renovation model.

Executive Summary

The present report has been presented for carrying out an analysis of the financial

position of Crystal Hotel by the use of financial analysis technique of ratio and vertical analysis.

It has been identified with the use of these techniques that the hotel need to improvise over its

problem of improving the employee wages and reducing the outstanding invoices amount for

supporting its renovation model.

3

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Income statement comparison with industry benchmark using vertical analysis............................5

Comment on the profitability, efficiency, liquidity and solvency of Crystal Hotel through using

the financial ratios............................................................................................................................6

Additional industry specific performance indicators used as benchmarks to compare the

performance...................................................................................................................................10

Conclusion and Recommendation.................................................................................................11

References......................................................................................................................................12

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Income statement comparison with industry benchmark using vertical analysis............................5

Comment on the profitability, efficiency, liquidity and solvency of Crystal Hotel through using

the financial ratios............................................................................................................................6

Additional industry specific performance indicators used as benchmarks to compare the

performance...................................................................................................................................10

Conclusion and Recommendation.................................................................................................11

References......................................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

This report has been carried out for demonstrating the application of relevant accounting

concepts for analyzing a given business scenario. The given case study has presented a business

scenario relating to Crystal Hotel Pty Ltd that is a privately owned star hotel located within

Sydney. It is recently facing the issues regarding its long-term contracts that lead to the issue of

developing outstanding invoices. Also, the hotel is facing the difficulty regarding maintaining

good quality staff. The owners are considering renovation of the hotel and as such considering

capital investment for improving its financial performance. In this context, the hotel presents an

analysis of the financial statements of the hotel for identifying the areas for improvement and

carrying out future analysis. The financial statement analysis consists mainly of carrying out

vertical and ratio analysis for evaluation of the financial position of the hotel in comparison to

the industry benchmarks.

Introduction

This report has been carried out for demonstrating the application of relevant accounting

concepts for analyzing a given business scenario. The given case study has presented a business

scenario relating to Crystal Hotel Pty Ltd that is a privately owned star hotel located within

Sydney. It is recently facing the issues regarding its long-term contracts that lead to the issue of

developing outstanding invoices. Also, the hotel is facing the difficulty regarding maintaining

good quality staff. The owners are considering renovation of the hotel and as such considering

capital investment for improving its financial performance. In this context, the hotel presents an

analysis of the financial statements of the hotel for identifying the areas for improvement and

carrying out future analysis. The financial statement analysis consists mainly of carrying out

vertical and ratio analysis for evaluation of the financial position of the hotel in comparison to

the industry benchmarks.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

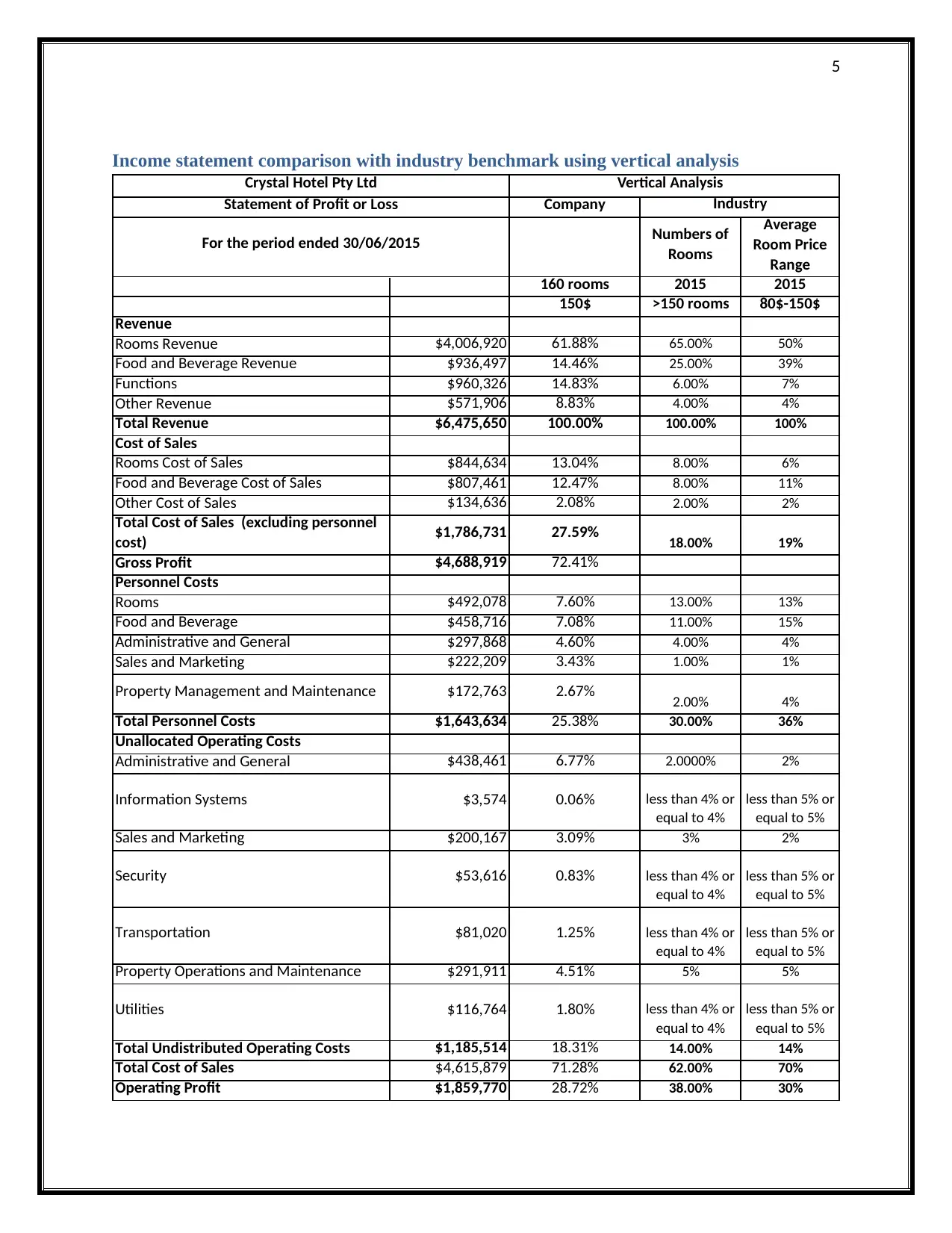

Income statement comparison with industry benchmark using vertical analysis

Company

Numbers of

Rooms

Average

Room Price

Range

160 rooms 2015 2015

150$ >150 rooms 80$-150$

Revenue

Rooms Revenue $4,006,920 61.88% 65.00% 50%

Food and Beverage Revenue $936,497 14.46% 25.00% 39%

Functions $960,326 14.83% 6.00% 7%

Other Revenue $571,906 8.83% 4.00% 4%

Total Revenue $6,475,650 100.00% 100.00% 100%

Cost of Sales

Rooms Cost of Sales $844,634 13.04% 8.00% 6%

Food and Beverage Cost of Sales $807,461 12.47% 8.00% 11%

Other Cost of Sales $134,636 2.08% 2.00% 2%

Total Cost of Sales (excluding personnel

cost) $1,786,731 27.59% 18.00% 19%

Gross Profit $4,688,919 72.41%

Personnel Costs

Rooms $492,078 7.60% 13.00% 13%

Food and Beverage $458,716 7.08% 11.00% 15%

Administrative and General $297,868 4.60% 4.00% 4%

Sales and Marketing $222,209 3.43% 1.00% 1%

Property Management and Maintenance $172,763 2.67% 2.00% 4%

Total Personnel Costs $1,643,634 25.38% 30.00% 36%

Unallocated Operating Costs

Administrative and General $438,461 6.77% 2.0000% 2%

Information Systems $3,574 0.06% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Sales and Marketing $200,167 3.09% 3% 2%

Security $53,616 0.83% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Transportation $81,020 1.25% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Property Operations and Maintenance $291,911 4.51% 5% 5%

Utilities $116,764 1.80% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Total Undistributed Operating Costs $1,185,514 18.31% 14.00% 14%

Total Cost of Sales $4,615,879 71.28% 62.00% 70%

Operating Profit $1,859,770 28.72% 38.00% 30%

Crystal Hotel Pty Ltd

Statement of Profit or Loss

For the period ended 30/06/2015

Vertical Analysis

Industry

Income statement comparison with industry benchmark using vertical analysis

Company

Numbers of

Rooms

Average

Room Price

Range

160 rooms 2015 2015

150$ >150 rooms 80$-150$

Revenue

Rooms Revenue $4,006,920 61.88% 65.00% 50%

Food and Beverage Revenue $936,497 14.46% 25.00% 39%

Functions $960,326 14.83% 6.00% 7%

Other Revenue $571,906 8.83% 4.00% 4%

Total Revenue $6,475,650 100.00% 100.00% 100%

Cost of Sales

Rooms Cost of Sales $844,634 13.04% 8.00% 6%

Food and Beverage Cost of Sales $807,461 12.47% 8.00% 11%

Other Cost of Sales $134,636 2.08% 2.00% 2%

Total Cost of Sales (excluding personnel

cost) $1,786,731 27.59% 18.00% 19%

Gross Profit $4,688,919 72.41%

Personnel Costs

Rooms $492,078 7.60% 13.00% 13%

Food and Beverage $458,716 7.08% 11.00% 15%

Administrative and General $297,868 4.60% 4.00% 4%

Sales and Marketing $222,209 3.43% 1.00% 1%

Property Management and Maintenance $172,763 2.67% 2.00% 4%

Total Personnel Costs $1,643,634 25.38% 30.00% 36%

Unallocated Operating Costs

Administrative and General $438,461 6.77% 2.0000% 2%

Information Systems $3,574 0.06% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Sales and Marketing $200,167 3.09% 3% 2%

Security $53,616 0.83% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Transportation $81,020 1.25% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Property Operations and Maintenance $291,911 4.51% 5% 5%

Utilities $116,764 1.80% less than 4% or

equal to 4%

less than 5% or

equal to 5%

Total Undistributed Operating Costs $1,185,514 18.31% 14.00% 14%

Total Cost of Sales $4,615,879 71.28% 62.00% 70%

Operating Profit $1,859,770 28.72% 38.00% 30%

Crystal Hotel Pty Ltd

Statement of Profit or Loss

For the period ended 30/06/2015

Vertical Analysis

Industry

6

(Arnold, 2013)

This part of the report will help to provide the comparative analysis of income statement

of Crystal Hotel with that of industry benchmark through using vertical analysis method. The

industry benchmarks have been based on two main criteria i.e. number of rooms and average

room price. Vertical analysis of income statement of company has been compared with industry

benchmark for both category and have presented above in table format. Using the information

from above some important sections of income statement have been discussed below:

Revenue or total sales: Crystal Hotel earns their revenue from all the sources of revenue

stream as defined in industry benchmark. Major revenue of this hotel comes from

accommodation services and lowest from other sources. When different revenue stream

percentage of this company has been compared with industry benchmark it has been

found that pricing policy of company is very likely to provide maximum revenue from

accommodation services. Although company has failed to reach at full occupancy of

hotel rooms as it room revenue of company is 61.88% while it was 65% for industry in

case when rooms are greater than 150. The second most important source of revenue for

the company is functions and company makes 14.83 % of revenue from them. It means

company make excellent use of facility of functions and provides best service to the

guest. Sales from food and beverages was very low as compared industry benchmark

which indicates that company make sales of limited food and beverages as compared to

other competitors in this business (Baker & Powell, 2009).

Cost of Sales: Cost of sales of company represents 27.59% of total sales revenue while it

was less than 19% in case of both given criteria of industry benchmark. It means Crystal

Hotel uses more resources in providing the same services as compared to other

competitors in same business.

Personnel Cost: Total proportion of personnel cost as compared to revenue was 25.38%

for the Crystal Hotel which was lower than industry benchmarks. The overall cost paid to

room personnel was significantly low as compared to industry benchmark under both the

mentioned criteria. It means company does not maintain the proper staff to provide

quality services to the guest or personnel hired are of lower skill as compared to industry

norms. It means company has to pay more attention to what is lacking behind in its

performance.

Total Cost: It has been seen that overall cost of the company is greater than the industry

benchmark which has to be further analyzed and necessary changes must be made before

presenting the proposal to the investors (Brigham & Michael, 2013).

Comment on the profitability, efficiency, liquidity and solvency of Crystal Hotel through

using the financial ratios

Profitability Ratios

(Arnold, 2013)

This part of the report will help to provide the comparative analysis of income statement

of Crystal Hotel with that of industry benchmark through using vertical analysis method. The

industry benchmarks have been based on two main criteria i.e. number of rooms and average

room price. Vertical analysis of income statement of company has been compared with industry

benchmark for both category and have presented above in table format. Using the information

from above some important sections of income statement have been discussed below:

Revenue or total sales: Crystal Hotel earns their revenue from all the sources of revenue

stream as defined in industry benchmark. Major revenue of this hotel comes from

accommodation services and lowest from other sources. When different revenue stream

percentage of this company has been compared with industry benchmark it has been

found that pricing policy of company is very likely to provide maximum revenue from

accommodation services. Although company has failed to reach at full occupancy of

hotel rooms as it room revenue of company is 61.88% while it was 65% for industry in

case when rooms are greater than 150. The second most important source of revenue for

the company is functions and company makes 14.83 % of revenue from them. It means

company make excellent use of facility of functions and provides best service to the

guest. Sales from food and beverages was very low as compared industry benchmark

which indicates that company make sales of limited food and beverages as compared to

other competitors in this business (Baker & Powell, 2009).

Cost of Sales: Cost of sales of company represents 27.59% of total sales revenue while it

was less than 19% in case of both given criteria of industry benchmark. It means Crystal

Hotel uses more resources in providing the same services as compared to other

competitors in same business.

Personnel Cost: Total proportion of personnel cost as compared to revenue was 25.38%

for the Crystal Hotel which was lower than industry benchmarks. The overall cost paid to

room personnel was significantly low as compared to industry benchmark under both the

mentioned criteria. It means company does not maintain the proper staff to provide

quality services to the guest or personnel hired are of lower skill as compared to industry

norms. It means company has to pay more attention to what is lacking behind in its

performance.

Total Cost: It has been seen that overall cost of the company is greater than the industry

benchmark which has to be further analyzed and necessary changes must be made before

presenting the proposal to the investors (Brigham & Michael, 2013).

Comment on the profitability, efficiency, liquidity and solvency of Crystal Hotel through

using the financial ratios

Profitability Ratios

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

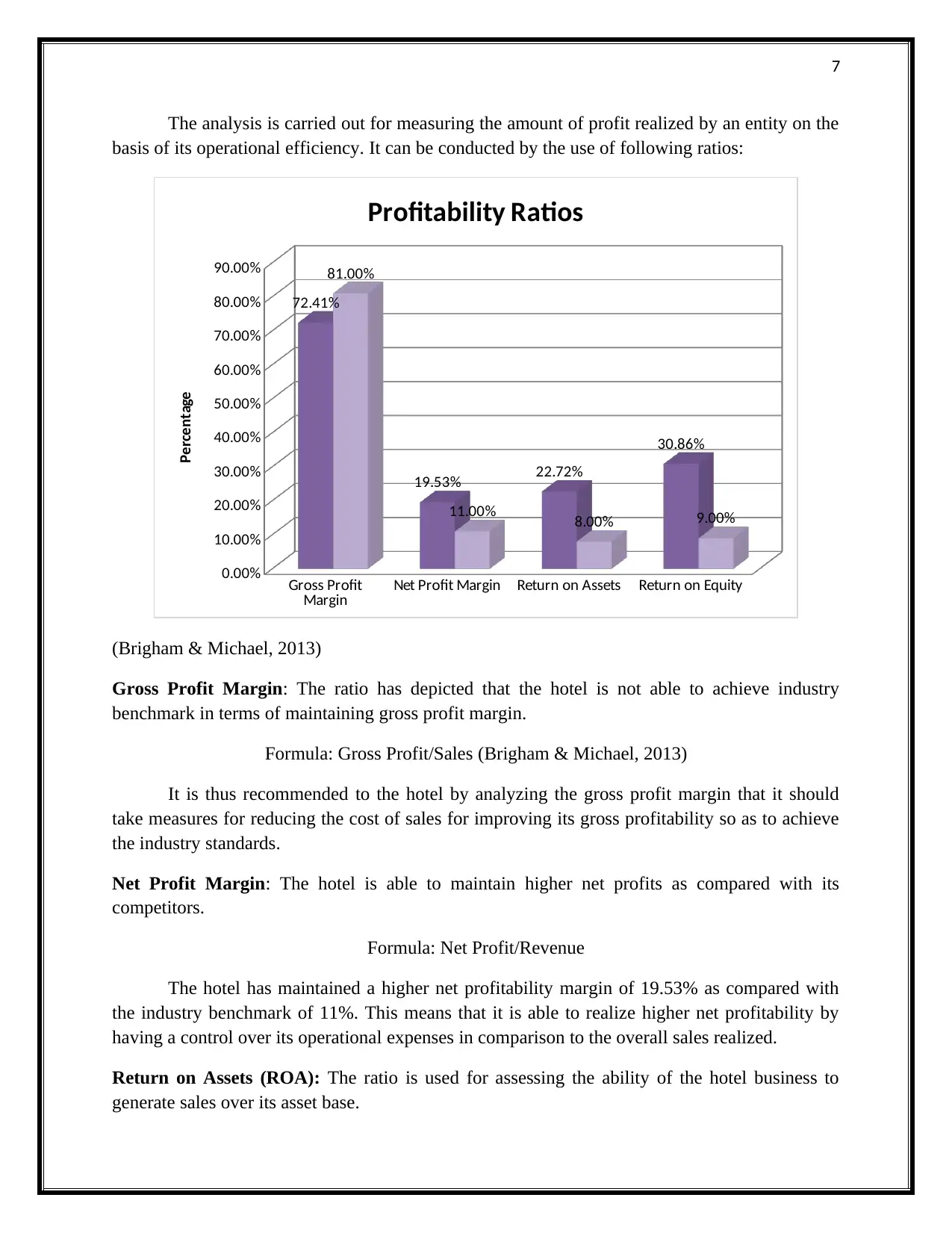

The analysis is carried out for measuring the amount of profit realized by an entity on the

basis of its operational efficiency. It can be conducted by the use of following ratios:

Gross Profit

Margin Net Profit Margin Return on Assets Return on Equity

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

72.41%

19.53% 22.72%

30.86%

81.00%

11.00% 8.00% 9.00%

Profitability Ratios

Percentage

(Brigham & Michael, 2013)

Gross Profit Margin: The ratio has depicted that the hotel is not able to achieve industry

benchmark in terms of maintaining gross profit margin.

Formula: Gross Profit/Sales (Brigham & Michael, 2013)

It is thus recommended to the hotel by analyzing the gross profit margin that it should

take measures for reducing the cost of sales for improving its gross profitability so as to achieve

the industry standards.

Net Profit Margin: The hotel is able to maintain higher net profits as compared with its

competitors.

Formula: Net Profit/Revenue

The hotel has maintained a higher net profitability margin of 19.53% as compared with

the industry benchmark of 11%. This means that it is able to realize higher net profitability by

having a control over its operational expenses in comparison to the overall sales realized.

Return on Assets (ROA): The ratio is used for assessing the ability of the hotel business to

generate sales over its asset base.

The analysis is carried out for measuring the amount of profit realized by an entity on the

basis of its operational efficiency. It can be conducted by the use of following ratios:

Gross Profit

Margin Net Profit Margin Return on Assets Return on Equity

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

72.41%

19.53% 22.72%

30.86%

81.00%

11.00% 8.00% 9.00%

Profitability Ratios

Percentage

(Brigham & Michael, 2013)

Gross Profit Margin: The ratio has depicted that the hotel is not able to achieve industry

benchmark in terms of maintaining gross profit margin.

Formula: Gross Profit/Sales (Brigham & Michael, 2013)

It is thus recommended to the hotel by analyzing the gross profit margin that it should

take measures for reducing the cost of sales for improving its gross profitability so as to achieve

the industry standards.

Net Profit Margin: The hotel is able to maintain higher net profits as compared with its

competitors.

Formula: Net Profit/Revenue

The hotel has maintained a higher net profitability margin of 19.53% as compared with

the industry benchmark of 11%. This means that it is able to realize higher net profitability by

having a control over its operational expenses in comparison to the overall sales realized.

Return on Assets (ROA): The ratio is used for assessing the ability of the hotel business to

generate sales over its asset base.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

ROA: Net Income/Total value of assets

The ratio has maintained a higher growth margin of 22.72% as compared with the

industry benchmark of 8%. This depicts that is able to effectively generate sales from the use of

asset base in comparison to its other competitors.

Return on Equity (ROE): The hotel is able to realize higher profits with the use of its equity

resources as compared with the overall industry as reflected from the results of the ratio.

Formula: Net income/shareholder’s equity (Damodaran, 2011)

ROE of the hotel is 30.86% in comparison to the industry benchmark of 9% which means

that it has achieved a competitive position over other players within the industry.

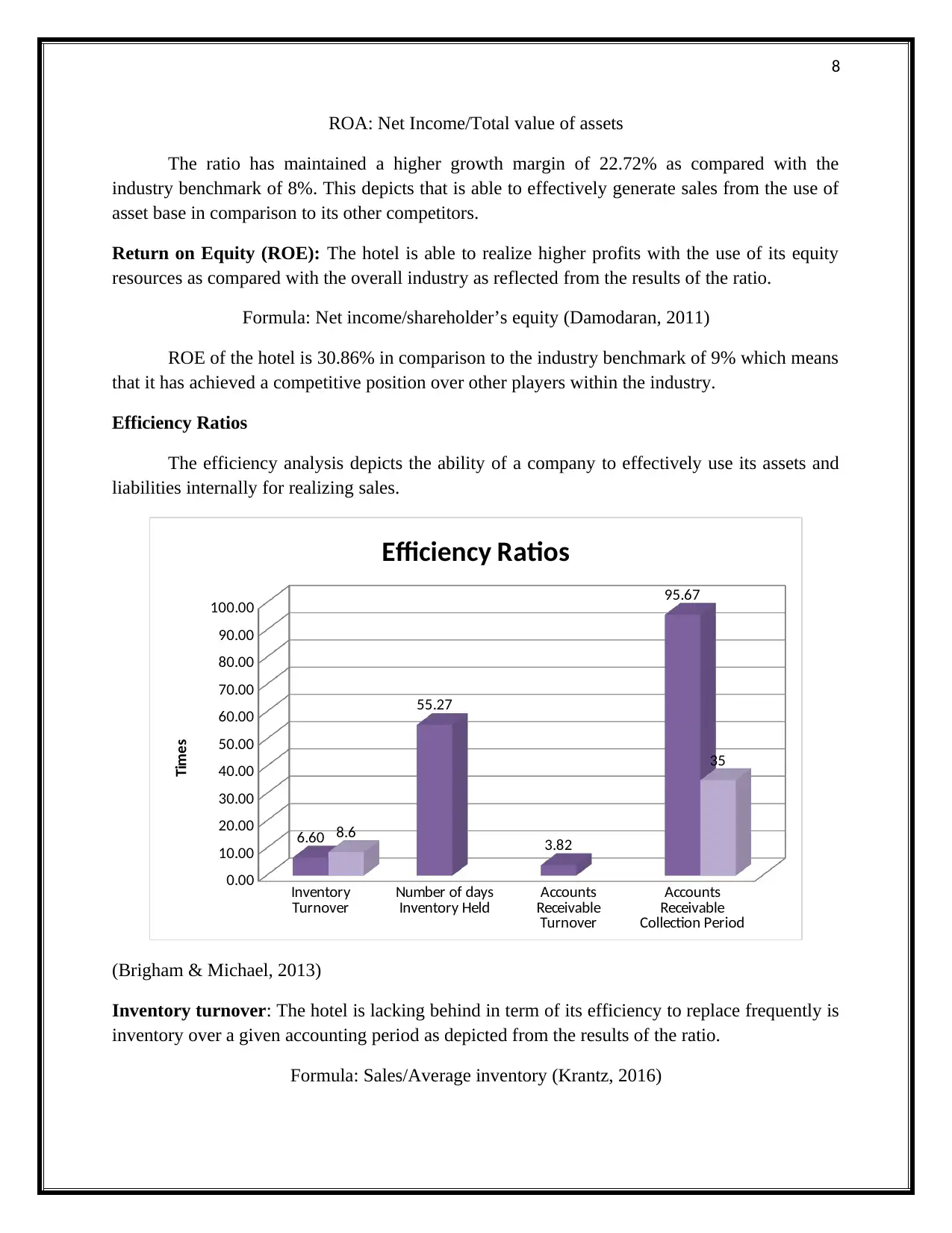

Efficiency Ratios

The efficiency analysis depicts the ability of a company to effectively use its assets and

liabilities internally for realizing sales.

Inventory

Turnover Number of days

Inventory Held Accounts

Receivable

Turnover

Accounts

Receivable

Collection Period

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

90.00

100.00

6.60

55.27

3.82

95.67

8.6

35

Efficiency Ratios

Times

(Brigham & Michael, 2013)

Inventory turnover: The hotel is lacking behind in term of its efficiency to replace frequently is

inventory over a given accounting period as depicted from the results of the ratio.

Formula: Sales/Average inventory (Krantz, 2016)

ROA: Net Income/Total value of assets

The ratio has maintained a higher growth margin of 22.72% as compared with the

industry benchmark of 8%. This depicts that is able to effectively generate sales from the use of

asset base in comparison to its other competitors.

Return on Equity (ROE): The hotel is able to realize higher profits with the use of its equity

resources as compared with the overall industry as reflected from the results of the ratio.

Formula: Net income/shareholder’s equity (Damodaran, 2011)

ROE of the hotel is 30.86% in comparison to the industry benchmark of 9% which means

that it has achieved a competitive position over other players within the industry.

Efficiency Ratios

The efficiency analysis depicts the ability of a company to effectively use its assets and

liabilities internally for realizing sales.

Inventory

Turnover Number of days

Inventory Held Accounts

Receivable

Turnover

Accounts

Receivable

Collection Period

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

90.00

100.00

6.60

55.27

3.82

95.67

8.6

35

Efficiency Ratios

Times

(Brigham & Michael, 2013)

Inventory turnover: The hotel is lacking behind in term of its efficiency to replace frequently is

inventory over a given accounting period as depicted from the results of the ratio.

Formula: Sales/Average inventory (Krantz, 2016)

9

The ratio which is 6.60% is slightly lower as compared with the industry margins of

8.60% which depicts that it needs to improve its efficiency of converting inventory to achieve

sales.

Accounts Receivable Collection Period: The hotel has achieved higher ratio of accounts

receivable of 95.67% as compared with the competitors of 35%.

Formula: Sales/Average inventory (Moles & Kidwekk, 2011)

This presents a point of concern for the hotel due to increase in the outstanding invoices

which can negatively impact its future growth prospects.

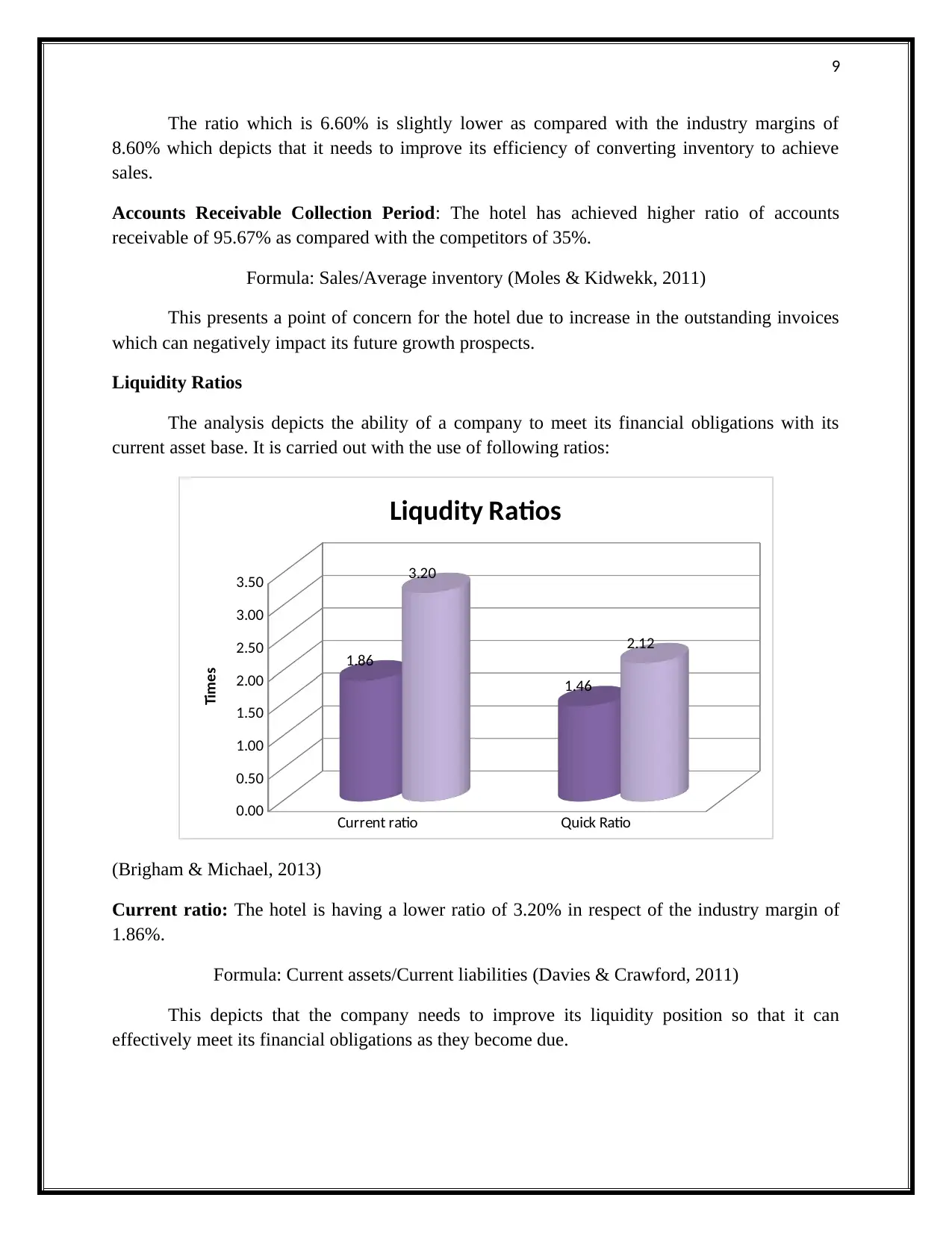

Liquidity Ratios

The analysis depicts the ability of a company to meet its financial obligations with its

current asset base. It is carried out with the use of following ratios:

Current ratio Quick Ratio

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

1.86

1.46

3.20

2.12

Liqudity Ratios

Times

(Brigham & Michael, 2013)

Current ratio: The hotel is having a lower ratio of 3.20% in respect of the industry margin of

1.86%.

Formula: Current assets/Current liabilities (Davies & Crawford, 2011)

This depicts that the company needs to improve its liquidity position so that it can

effectively meet its financial obligations as they become due.

The ratio which is 6.60% is slightly lower as compared with the industry margins of

8.60% which depicts that it needs to improve its efficiency of converting inventory to achieve

sales.

Accounts Receivable Collection Period: The hotel has achieved higher ratio of accounts

receivable of 95.67% as compared with the competitors of 35%.

Formula: Sales/Average inventory (Moles & Kidwekk, 2011)

This presents a point of concern for the hotel due to increase in the outstanding invoices

which can negatively impact its future growth prospects.

Liquidity Ratios

The analysis depicts the ability of a company to meet its financial obligations with its

current asset base. It is carried out with the use of following ratios:

Current ratio Quick Ratio

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

1.86

1.46

3.20

2.12

Liqudity Ratios

Times

(Brigham & Michael, 2013)

Current ratio: The hotel is having a lower ratio of 3.20% in respect of the industry margin of

1.86%.

Formula: Current assets/Current liabilities (Davies & Crawford, 2011)

This depicts that the company needs to improve its liquidity position so that it can

effectively meet its financial obligations as they become due.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Quick Ratio: The ratio that provides an account of the most liquid asset base maintained by a

company, for the hotel is 1.46% which is less as compared with the industry benchmark of

2.12%.

Formula: (Cash+ marketable securities+ Accounts Receivable)/Current liabilities

This depicts that the hotel management need to take steps for maintaining its cash

resources as compared with the competitors to strengthen its liquidity position in the mind of its

investors.

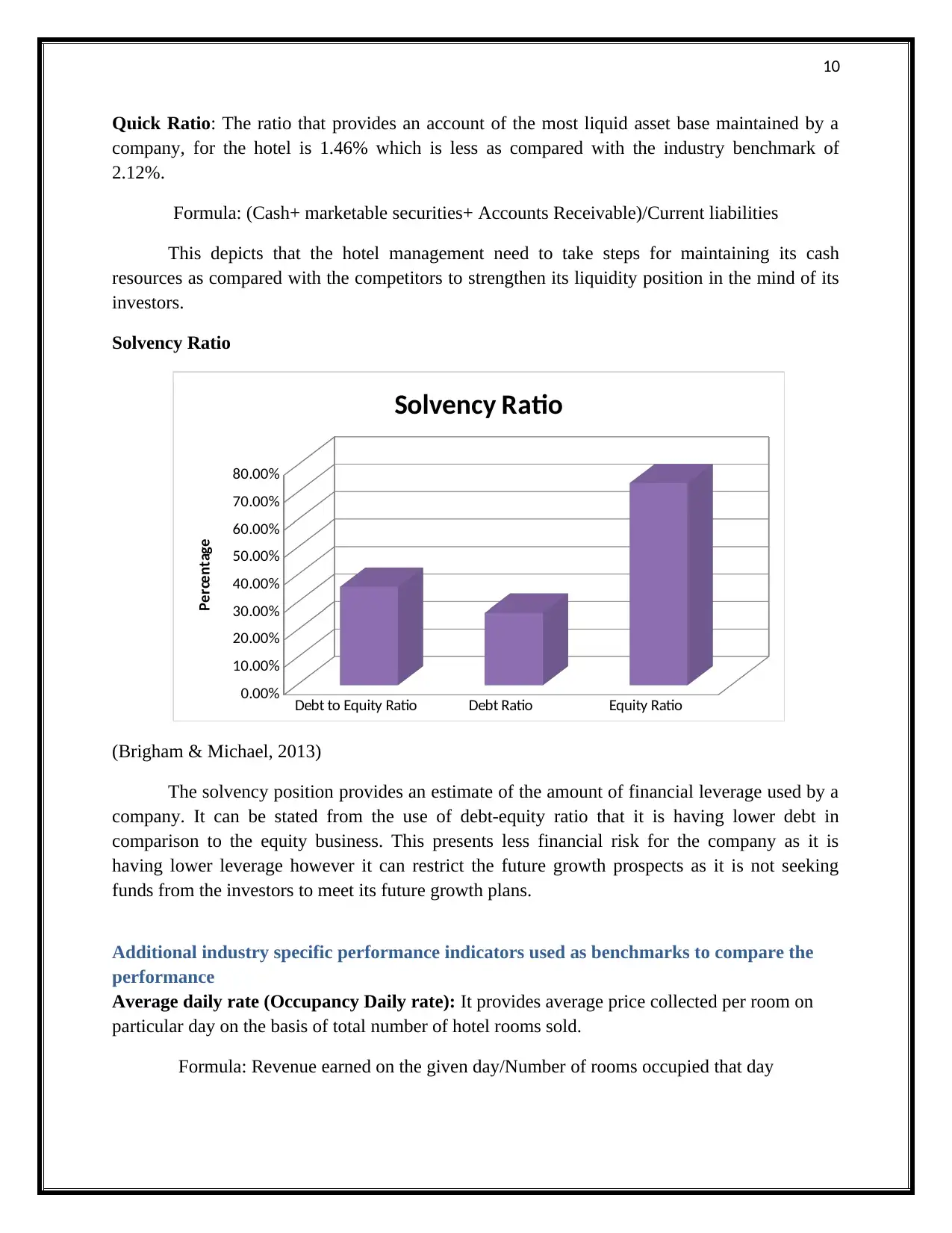

Solvency Ratio

Debt to Equity Ratio Debt Ratio Equity Ratio

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

Solvency Ratio

Percentage

(Brigham & Michael, 2013)

The solvency position provides an estimate of the amount of financial leverage used by a

company. It can be stated from the use of debt-equity ratio that it is having lower debt in

comparison to the equity business. This presents less financial risk for the company as it is

having lower leverage however it can restrict the future growth prospects as it is not seeking

funds from the investors to meet its future growth plans.

Additional industry specific performance indicators used as benchmarks to compare the

performance

Average daily rate (Occupancy Daily rate): It provides average price collected per room on

particular day on the basis of total number of hotel rooms sold.

Formula: Revenue earned on the given day/Number of rooms occupied that day

Quick Ratio: The ratio that provides an account of the most liquid asset base maintained by a

company, for the hotel is 1.46% which is less as compared with the industry benchmark of

2.12%.

Formula: (Cash+ marketable securities+ Accounts Receivable)/Current liabilities

This depicts that the hotel management need to take steps for maintaining its cash

resources as compared with the competitors to strengthen its liquidity position in the mind of its

investors.

Solvency Ratio

Debt to Equity Ratio Debt Ratio Equity Ratio

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

Solvency Ratio

Percentage

(Brigham & Michael, 2013)

The solvency position provides an estimate of the amount of financial leverage used by a

company. It can be stated from the use of debt-equity ratio that it is having lower debt in

comparison to the equity business. This presents less financial risk for the company as it is

having lower leverage however it can restrict the future growth prospects as it is not seeking

funds from the investors to meet its future growth plans.

Additional industry specific performance indicators used as benchmarks to compare the

performance

Average daily rate (Occupancy Daily rate): It provides average price collected per room on

particular day on the basis of total number of hotel rooms sold.

Formula: Revenue earned on the given day/Number of rooms occupied that day

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

Revenue per available room REVPAR: This performance ratio measures the revenue earned

on average basis on the given number of rooms.

Formula: Total Room Revenue/Rooms available

Occupancy %: It provides total number of rooms occupied as compared to rooms available

Formula: Rooms Occupied/Rooms Available (Zimmerman & Yahya-Zadeh, 2011)

Conclusion and Recommendation

It can be stated from analyzing the financial performance of Crystal Hotel with the use of

vertical and ratio analysis technique that it need to improve in certain areas for achieving the

industry margin. The vertical analysis has depicted that it need to focus on reducing its overall

expenses and place emphasis on improving the personnel cost as compared with the competitors

for reducing the problem of staff turnover. Also, it needs to improve on its ability to maintain

current asset base for meeting the financial obligations. The hotel business also needs to improve

the account receivable turnover position for reducing its outstanding invoices amount and

realizing the amount of its credit sales appropriately.

Revenue per available room REVPAR: This performance ratio measures the revenue earned

on average basis on the given number of rooms.

Formula: Total Room Revenue/Rooms available

Occupancy %: It provides total number of rooms occupied as compared to rooms available

Formula: Rooms Occupied/Rooms Available (Zimmerman & Yahya-Zadeh, 2011)

Conclusion and Recommendation

It can be stated from analyzing the financial performance of Crystal Hotel with the use of

vertical and ratio analysis technique that it need to improve in certain areas for achieving the

industry margin. The vertical analysis has depicted that it need to focus on reducing its overall

expenses and place emphasis on improving the personnel cost as compared with the competitors

for reducing the problem of staff turnover. Also, it needs to improve on its ability to maintain

current asset base for meeting the financial obligations. The hotel business also needs to improve

the account receivable turnover position for reducing its outstanding invoices amount and

realizing the amount of its credit sales appropriately.

12

References

Arnold, G., 2013. Corporate financial management. USA: Pearson Higher Ed.

Baker, K. & Powell, G. 2009. Understanding Financial Management: A Practical Guide. USA:

John Wiley & Sons.

Brigham, F., & Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I., 2011. Business accounting and finance. USA: Pearson.

Krantz, M. 2016. Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Moles, P. & Kidwekk, D. 2011. Corporate finance. USA: John Wiley &sons.

Zimmerman, J.L. & Yahya-Zadeh, M., 2011. Accounting for decision making and control. Issues

in Accounting Education, 26(1), pp.258-259.

References

Arnold, G., 2013. Corporate financial management. USA: Pearson Higher Ed.

Baker, K. & Powell, G. 2009. Understanding Financial Management: A Practical Guide. USA:

John Wiley & Sons.

Brigham, F., & Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I., 2011. Business accounting and finance. USA: Pearson.

Krantz, M. 2016. Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Moles, P. & Kidwekk, D. 2011. Corporate finance. USA: John Wiley &sons.

Zimmerman, J.L. & Yahya-Zadeh, M., 2011. Accounting for decision making and control. Issues

in Accounting Education, 26(1), pp.258-259.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.