Deakin University MAF203 Business Finance Assignment Solution - 2019

VerifiedAdded on 2022/12/30

|12

|2605

|1

Homework Assignment

AI Summary

This document presents a comprehensive solution to a business finance assignment, focusing on capital budgeting and financial decision-making. The solution includes detailed calculations for Net Present Value (NPV) and Internal Rate of Return (IRR), assessing the viability of a project. It also explores the concept of hurdle rates and their implications on investment decisions, differentiating them from discount rates. Furthermore, the assignment incorporates sensitivity analysis to evaluate the impact of changes in sales, costs, and the cost of capital on the project's profitability. The analysis extends to discussing the paper and pulp industry's challenges, including technological obsolescence, climate change, and government regulations, and their effect on the industry's growth. The solution provides a thorough understanding of financial concepts and their practical application in real-world business scenarios, making it a valuable resource for students studying business finance.

1

Business finance

Business finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

Part B...............................................................................................................................................3

a)..................................................................................................................................................3

b)..................................................................................................................................................4

c)..................................................................................................................................................5

d)..................................................................................................................................................8

References......................................................................................................................................11

Table of Contents

Part B...............................................................................................................................................3

a)..................................................................................................................................................3

b)..................................................................................................................................................4

c)..................................................................................................................................................5

d)..................................................................................................................................................8

References......................................................................................................................................11

3

Part B

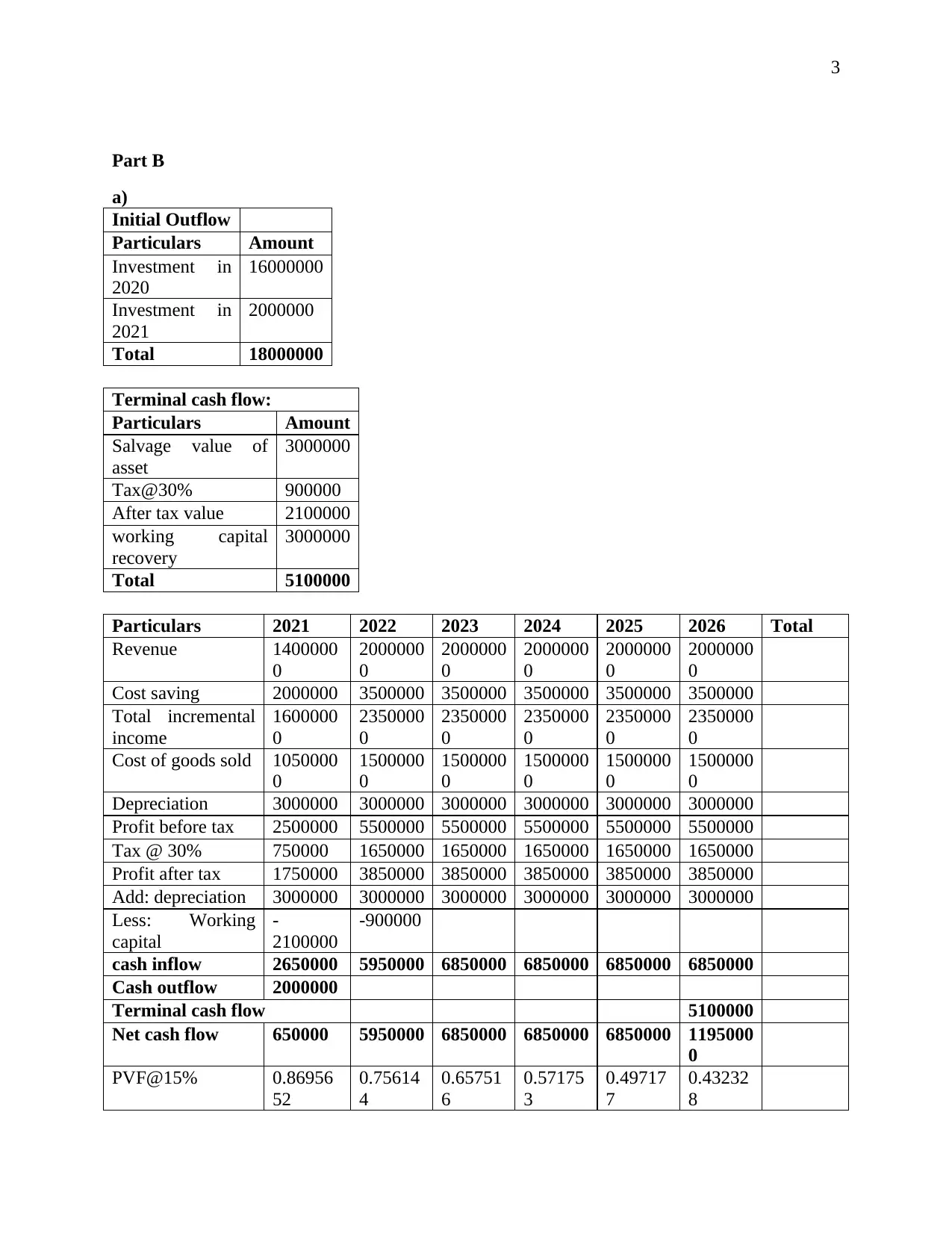

a)

Initial Outflow

Particulars Amount

Investment in

2020

16000000

Investment in

2021

2000000

Total 18000000

Terminal cash flow:

Particulars Amount

Salvage value of

asset

3000000

Tax@30% 900000

After tax value 2100000

working capital

recovery

3000000

Total 5100000

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

Part B

a)

Initial Outflow

Particulars Amount

Investment in

2020

16000000

Investment in

2021

2000000

Total 18000000

Terminal cash flow:

Particulars Amount

Salvage value of

asset

3000000

Tax@30% 900000

After tax value 2100000

working capital

recovery

3000000

Total 5100000

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

PV 565217.

39

4499055 4503986 3916510 3405661 5166315 2205674

4

Initial outflow -

1600000

0

NPV 6056743

.5

The calculation for the net present value has been made and it can be seen that the same is

positive. This shows that the business will be making the profits and so the proposal shall be

accepted.

Calculation of

IRR

Particulars Amount

Year 2020 -

16000000

Year 2021 650000

Year 2022 5950000

Year 2023 6850000

Year 2024 6850000

Year 2025 6850000

Year 2026 11950000

IRR 25.04%

The discount rate of the company is 15% and the IRR is determined to be 25.04%. As the IRR is

more than that of the cost of capital, the project will, therefore, be taken into consideration and

company will be performing accordingly.

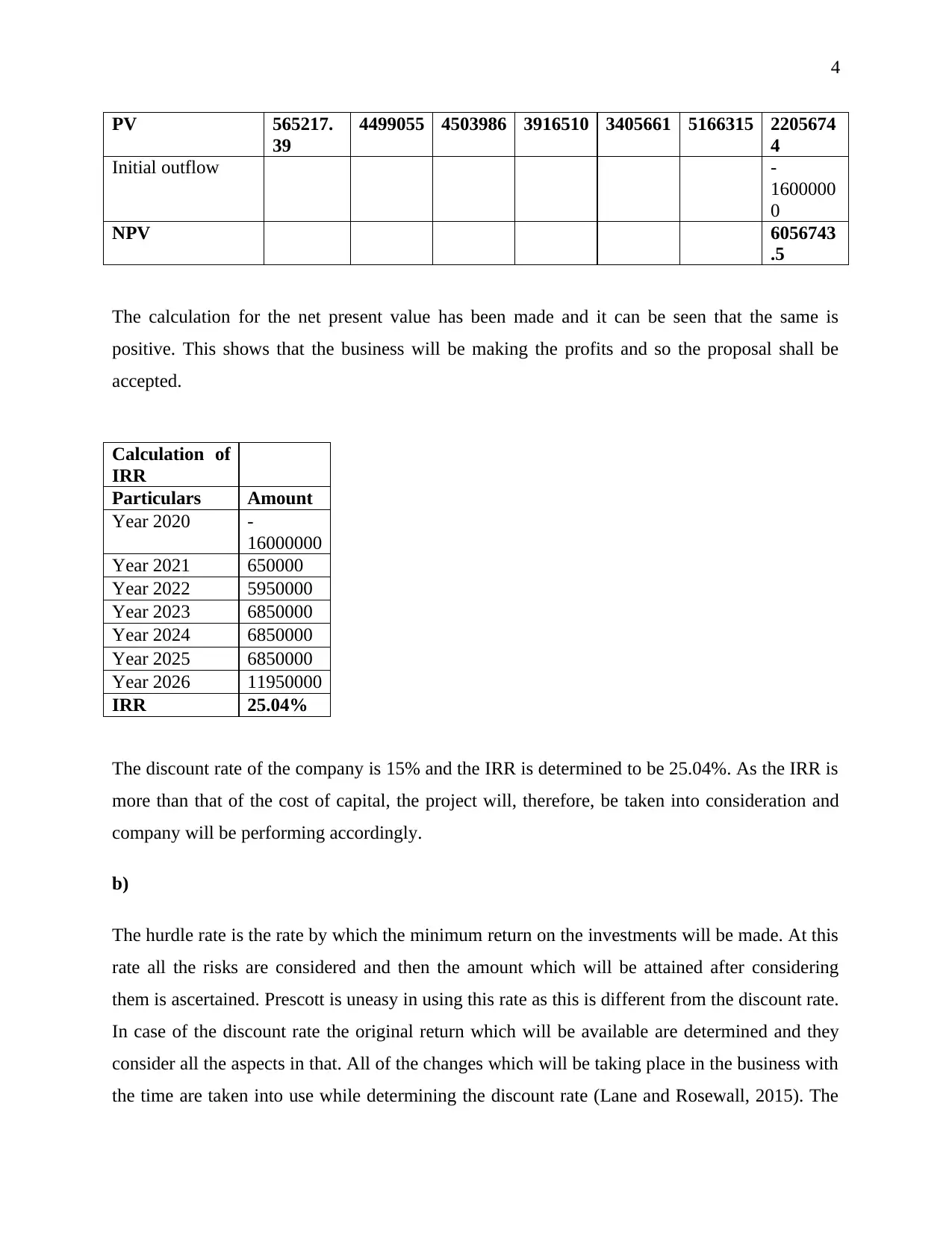

b)

The hurdle rate is the rate by which the minimum return on the investments will be made. At this

rate all the risks are considered and then the amount which will be attained after considering

them is ascertained. Prescott is uneasy in using this rate as this is different from the discount rate.

In case of the discount rate the original return which will be available are determined and they

consider all the aspects in that. All of the changes which will be taking place in the business with

the time are taken into use while determining the discount rate (Lane and Rosewall, 2015). The

PV 565217.

39

4499055 4503986 3916510 3405661 5166315 2205674

4

Initial outflow -

1600000

0

NPV 6056743

.5

The calculation for the net present value has been made and it can be seen that the same is

positive. This shows that the business will be making the profits and so the proposal shall be

accepted.

Calculation of

IRR

Particulars Amount

Year 2020 -

16000000

Year 2021 650000

Year 2022 5950000

Year 2023 6850000

Year 2024 6850000

Year 2025 6850000

Year 2026 11950000

IRR 25.04%

The discount rate of the company is 15% and the IRR is determined to be 25.04%. As the IRR is

more than that of the cost of capital, the project will, therefore, be taken into consideration and

company will be performing accordingly.

b)

The hurdle rate is the rate by which the minimum return on the investments will be made. At this

rate all the risks are considered and then the amount which will be attained after considering

them is ascertained. Prescott is uneasy in using this rate as this is different from the discount rate.

In case of the discount rate the original return which will be available are determined and they

consider all the aspects in that. All of the changes which will be taking place in the business with

the time are taken into use while determining the discount rate (Lane and Rosewall, 2015). The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

hurdle rate remains constant and in that uncertainty is involved which is not considered. The rate

remains same for the long period so the evaluation becomes difficult for the different projects

with different time duration. The company will not be able to analyze the position at the profits

which is expected by it and so the decision will not be made in accordance with the requirements

of the company.

The use of the hurdle rate will be ensuring that the risk will be avoided but the amount of the

return which will be earned by taking into account all the available changes is not considered.

there will be no consideration of the uncertainty and the calculation will be made at a specified

rate only for all the years (Baldenius, Nezlobin and Vaysman, 2015). The company will not be

receiving the results which will focus on the expected return but the minimum amount of the

returns will be made available. Due to all of the reasons which are identified there is the

uneasiness which is faced by the company while using hurdle rate for the calculations in the

business.

c)

Sensitivity analysis

Option 1: Sales increase by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1540000

0

2200000

0

2200000

0

2200000

0

2200000

0

2200000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1740000

0

2550000

0

2550000

0

2550000

0

2550000

0

2550000

0

Cost of goods sold 1155000

0

1650000

0

1650000

0

1650000

0

1650000

0

1650000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2850000 6000000 6000000 6000000 6000000 6000000

Tax @ 30% 855000 1800000 1800000 1800000 1800000 1800000

Profit after tax 1995000 4200000 4200000 4200000 4200000 4200000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2310000

-990000 3300000

cash inflow 2685000 6210000 7200000 7200000 7200000 7200000

Cash outflow 2000000

Terminal cash flow 5400000

Net cash flow 685000 6210000 7200000 7200000 7200000 1260000

0

hurdle rate remains constant and in that uncertainty is involved which is not considered. The rate

remains same for the long period so the evaluation becomes difficult for the different projects

with different time duration. The company will not be able to analyze the position at the profits

which is expected by it and so the decision will not be made in accordance with the requirements

of the company.

The use of the hurdle rate will be ensuring that the risk will be avoided but the amount of the

return which will be earned by taking into account all the available changes is not considered.

there will be no consideration of the uncertainty and the calculation will be made at a specified

rate only for all the years (Baldenius, Nezlobin and Vaysman, 2015). The company will not be

receiving the results which will focus on the expected return but the minimum amount of the

returns will be made available. Due to all of the reasons which are identified there is the

uneasiness which is faced by the company while using hurdle rate for the calculations in the

business.

c)

Sensitivity analysis

Option 1: Sales increase by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1540000

0

2200000

0

2200000

0

2200000

0

2200000

0

2200000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1740000

0

2550000

0

2550000

0

2550000

0

2550000

0

2550000

0

Cost of goods sold 1155000

0

1650000

0

1650000

0

1650000

0

1650000

0

1650000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2850000 6000000 6000000 6000000 6000000 6000000

Tax @ 30% 855000 1800000 1800000 1800000 1800000 1800000

Profit after tax 1995000 4200000 4200000 4200000 4200000 4200000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2310000

-990000 3300000

cash inflow 2685000 6210000 7200000 7200000 7200000 7200000

Cash outflow 2000000

Terminal cash flow 5400000

Net cash flow 685000 6210000 7200000 7200000 7200000 1260000

0

6

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

PV 595652.

17

4695652 4734117 4116623 3579672 5447328 2316904

5

Initial outflow -

1600000

0

NPV 7169044

.8

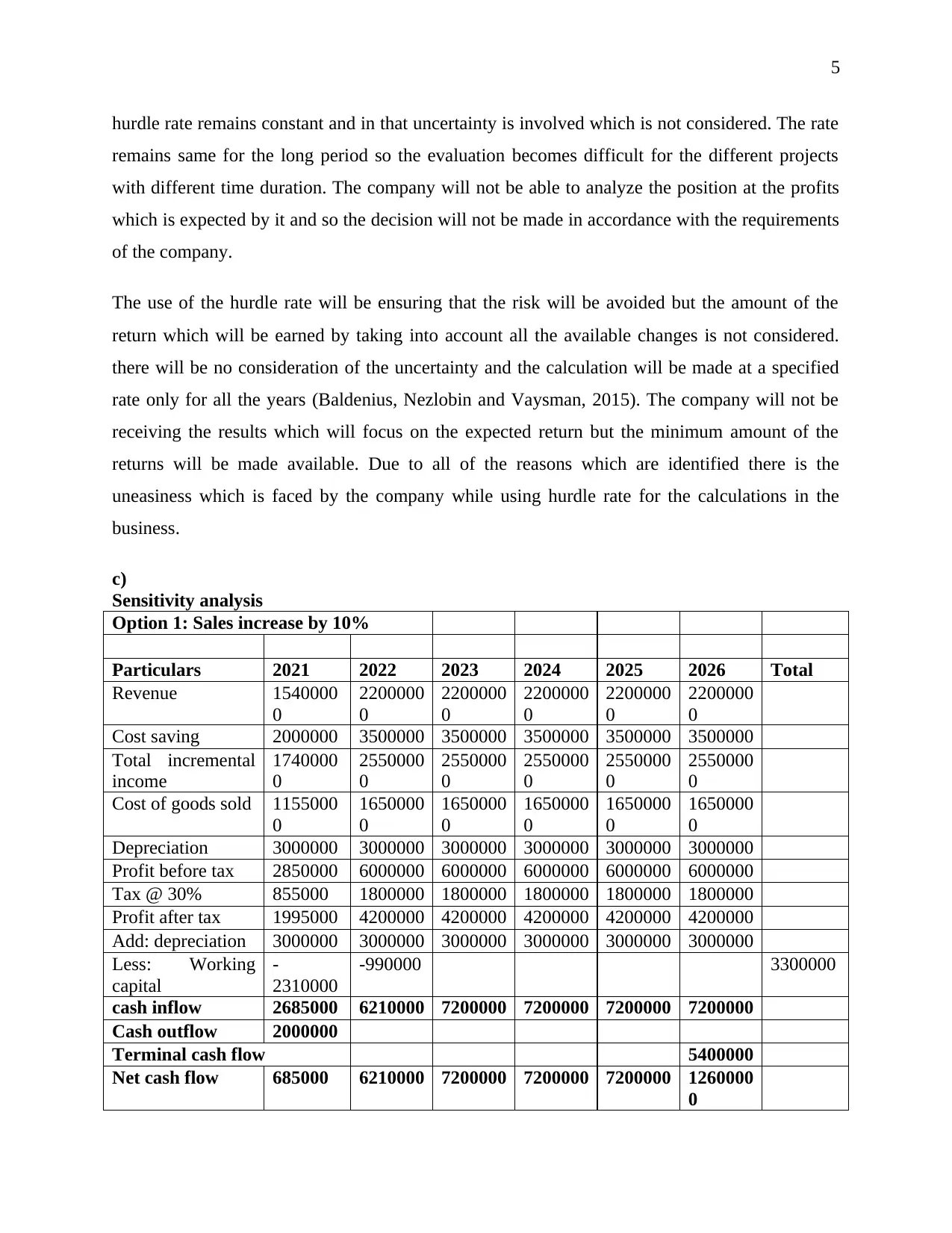

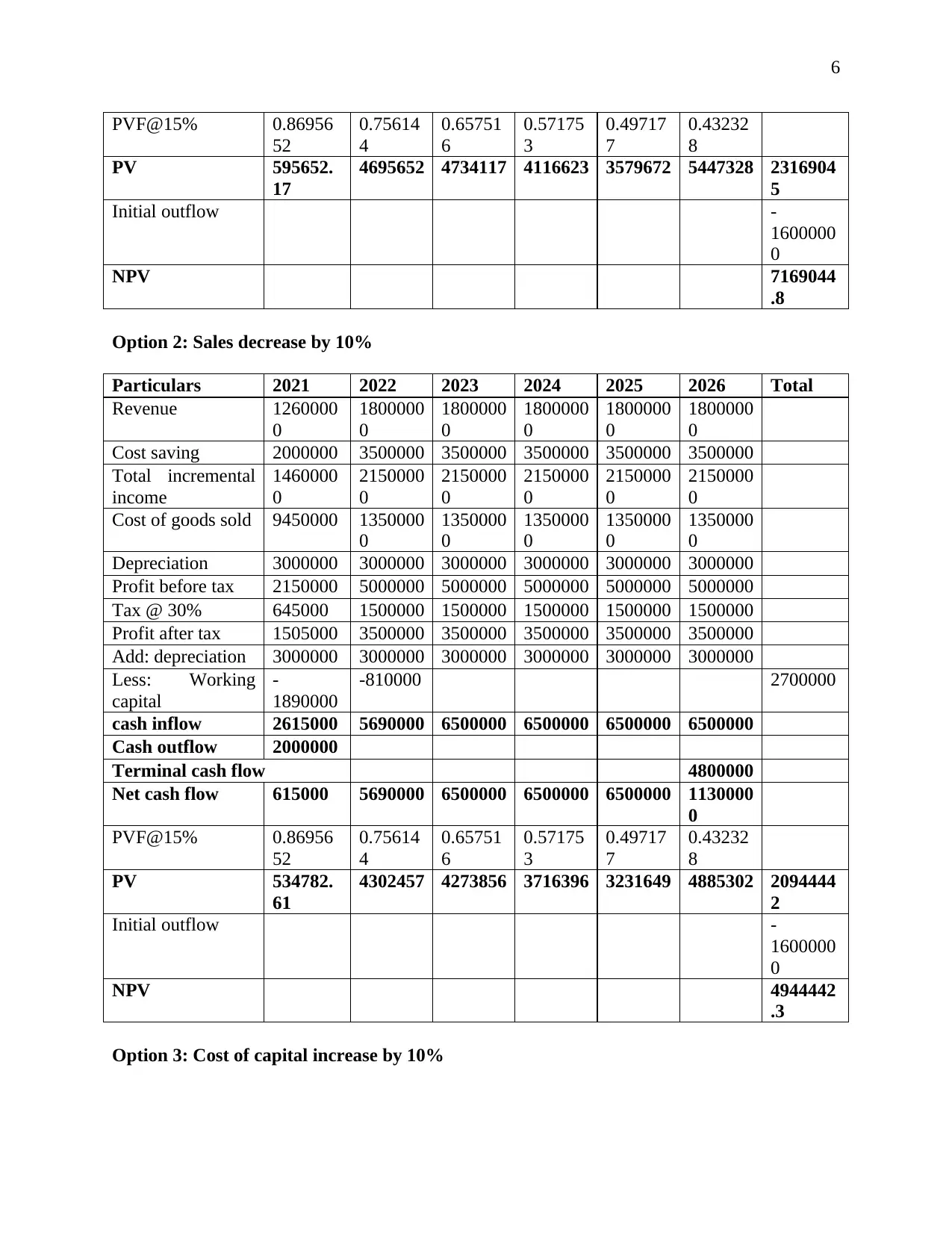

Option 2: Sales decrease by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1260000

0

1800000

0

1800000

0

1800000

0

1800000

0

1800000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1460000

0

2150000

0

2150000

0

2150000

0

2150000

0

2150000

0

Cost of goods sold 9450000 1350000

0

1350000

0

1350000

0

1350000

0

1350000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2150000 5000000 5000000 5000000 5000000 5000000

Tax @ 30% 645000 1500000 1500000 1500000 1500000 1500000

Profit after tax 1505000 3500000 3500000 3500000 3500000 3500000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

1890000

-810000 2700000

cash inflow 2615000 5690000 6500000 6500000 6500000 6500000

Cash outflow 2000000

Terminal cash flow 4800000

Net cash flow 615000 5690000 6500000 6500000 6500000 1130000

0

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

PV 534782.

61

4302457 4273856 3716396 3231649 4885302 2094444

2

Initial outflow -

1600000

0

NPV 4944442

.3

Option 3: Cost of capital increase by 10%

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

PV 595652.

17

4695652 4734117 4116623 3579672 5447328 2316904

5

Initial outflow -

1600000

0

NPV 7169044

.8

Option 2: Sales decrease by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1260000

0

1800000

0

1800000

0

1800000

0

1800000

0

1800000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1460000

0

2150000

0

2150000

0

2150000

0

2150000

0

2150000

0

Cost of goods sold 9450000 1350000

0

1350000

0

1350000

0

1350000

0

1350000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2150000 5000000 5000000 5000000 5000000 5000000

Tax @ 30% 645000 1500000 1500000 1500000 1500000 1500000

Profit after tax 1505000 3500000 3500000 3500000 3500000 3500000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

1890000

-810000 2700000

cash inflow 2615000 5690000 6500000 6500000 6500000 6500000

Cash outflow 2000000

Terminal cash flow 4800000

Net cash flow 615000 5690000 6500000 6500000 6500000 1130000

0

PVF@15% 0.86956

52

0.75614

4

0.65751

6

0.57175

3

0.49717

7

0.43232

8

PV 534782.

61

4302457 4273856 3716396 3231649 4885302 2094444

2

Initial outflow -

1600000

0

NPV 4944442

.3

Option 3: Cost of capital increase by 10%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Particulars 2021 2022 2023 2024 2025 2026 Total

Particulars 2021 2022 2023 2024 2025 2026 Total

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

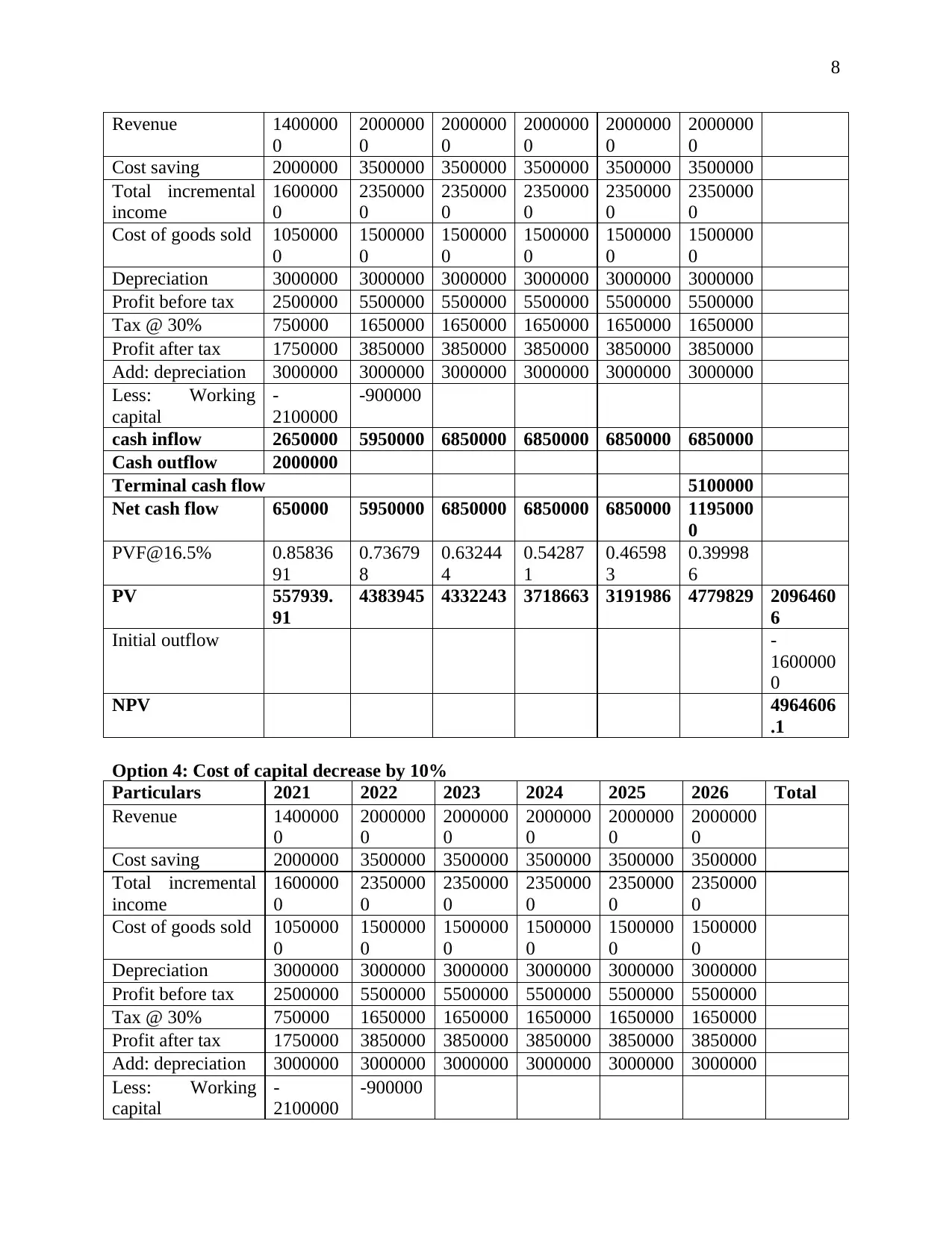

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@16.5% 0.85836

91

0.73679

8

0.63244

4

0.54287

1

0.46598

3

0.39998

6

PV 557939.

91

4383945 4332243 3718663 3191986 4779829 2096460

6

Initial outflow -

1600000

0

NPV 4964606

.1

Option 4: Cost of capital decrease by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@16.5% 0.85836

91

0.73679

8

0.63244

4

0.54287

1

0.46598

3

0.39998

6

PV 557939.

91

4383945 4332243 3718663 3191986 4779829 2096460

6

Initial outflow -

1600000

0

NPV 4964606

.1

Option 4: Cost of capital decrease by 10%

Particulars 2021 2022 2023 2024 2025 2026 Total

Revenue 1400000

0

2000000

0

2000000

0

2000000

0

2000000

0

2000000

0

Cost saving 2000000 3500000 3500000 3500000 3500000 3500000

Total incremental

income

1600000

0

2350000

0

2350000

0

2350000

0

2350000

0

2350000

0

Cost of goods sold 1050000

0

1500000

0

1500000

0

1500000

0

1500000

0

1500000

0

Depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Profit before tax 2500000 5500000 5500000 5500000 5500000 5500000

Tax @ 30% 750000 1650000 1650000 1650000 1650000 1650000

Profit after tax 1750000 3850000 3850000 3850000 3850000 3850000

Add: depreciation 3000000 3000000 3000000 3000000 3000000 3000000

Less: Working

capital

-

2100000

-900000

9

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@13.5% 0.881057

3

0.77626

2

0.68393

1

0.60258

3

0.53091 0.46776

2

PV 572687.2

2

4618758 4684929 4127690 3636732 5589755 2323055

1

Initial outflow -

1600000

0

NPV 7230551

Particulars Origina

l

Option

1

Option

2

Option 3 Option 4

NPV 6056744 7169045 494444

2

4964606 7230551

% Change in NPV (A) 18.36% -18.36% -18.03% 19.38%

Input which is changing Sales Sales cost of

capital

cost of

capital

% change in Input (B) 10% 10% 10% 10%

Sensitivity

(A/B)

1.83647 -1.8365 -1.8032 1.93802

Worst Best case

d)

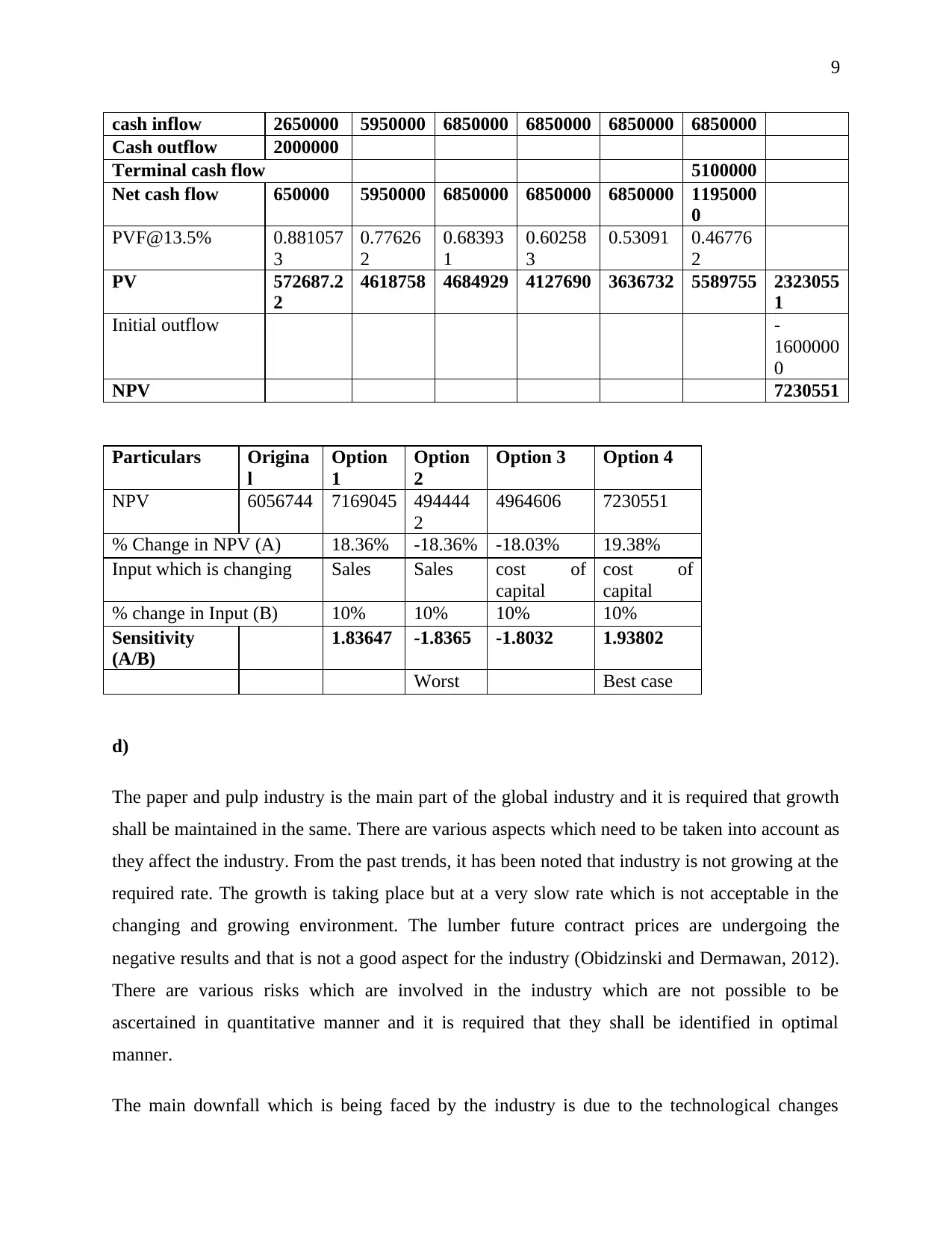

The paper and pulp industry is the main part of the global industry and it is required that growth

shall be maintained in the same. There are various aspects which need to be taken into account as

they affect the industry. From the past trends, it has been noted that industry is not growing at the

required rate. The growth is taking place but at a very slow rate which is not acceptable in the

changing and growing environment. The lumber future contract prices are undergoing the

negative results and that is not a good aspect for the industry (Obidzinski and Dermawan, 2012).

There are various risks which are involved in the industry which are not possible to be

ascertained in quantitative manner and it is required that they shall be identified in optimal

manner.

The main downfall which is being faced by the industry is due to the technological changes

cash inflow 2650000 5950000 6850000 6850000 6850000 6850000

Cash outflow 2000000

Terminal cash flow 5100000

Net cash flow 650000 5950000 6850000 6850000 6850000 1195000

0

PVF@13.5% 0.881057

3

0.77626

2

0.68393

1

0.60258

3

0.53091 0.46776

2

PV 572687.2

2

4618758 4684929 4127690 3636732 5589755 2323055

1

Initial outflow -

1600000

0

NPV 7230551

Particulars Origina

l

Option

1

Option

2

Option 3 Option 4

NPV 6056744 7169045 494444

2

4964606 7230551

% Change in NPV (A) 18.36% -18.36% -18.03% 19.38%

Input which is changing Sales Sales cost of

capital

cost of

capital

% change in Input (B) 10% 10% 10% 10%

Sensitivity

(A/B)

1.83647 -1.8365 -1.8032 1.93802

Worst Best case

d)

The paper and pulp industry is the main part of the global industry and it is required that growth

shall be maintained in the same. There are various aspects which need to be taken into account as

they affect the industry. From the past trends, it has been noted that industry is not growing at the

required rate. The growth is taking place but at a very slow rate which is not acceptable in the

changing and growing environment. The lumber future contract prices are undergoing the

negative results and that is not a good aspect for the industry (Obidzinski and Dermawan, 2012).

There are various risks which are involved in the industry which are not possible to be

ascertained in quantitative manner and it is required that they shall be identified in optimal

manner.

The main downfall which is being faced by the industry is due to the technological changes

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

which are taking place. The companies in this industry are using old technology in the current

scenario also. They are not developed as per the requirements and due to that the production is

affected greatly (Meleo, 2014). In such companies the raw material which will be required for

the production and the time which is consumed in the same is high. There are various processes

which are involved and the carrying out of them covers consumption of more time in comparison

to the latest technologies. Also the quality is hampered with the low-quality raw material and

there is not the sufficient availability of the same. The technology is changing at fast pace and it

becomes difficult to compete with it and keep the updates regarding all the innovations which are

taking place. This leads to the use of the outdated technology which affects the growth of the

industry in negative manner.

Climatic change is another factor which is responsible for the declining growth. With the adverse

weather conditions, the wildlife and forests both are affected in negative manner. The trees are

the main source of the raw material to make paper and with the climatic change they are affected

and destroyed (Mckinsey, 2019). This leads to the shortfall of the raw material which is required.

The raw material in such circumstances is available at high cost which is not beneficial for the

companies and they avoid production due to the same. In the changing climate the wildlife is

affected as their habitat is destroyed. They do not get the proper food on which they can survive

or the place to live. This leads to their reduction or extinction which again affects the industry in

negative manner. There are various reasons for such climate conditions such as the changing

lifestyle of humans by which global warming is taking place.

With the change in the world, there are increased interventions by the government. They frame

various rules and regulations which need to be followed by all. In them there are various related

to the environment and forest safety (Environmental paper, 2018). There are many restrictions

which are placed in them in relation to the various activities which are performed in the forests.

The cutting of the trees is banned and also the wildlife is protected under law. Due to this the

main source of the requirements is affected and there is less availability of the raw material. The

companies dealing in this industry are required to comply with the laws and that imposes various

limitations on them. They are not able to acquire the required resources in adequate quantity and

with that the demand in the market is not fulfilled and the growth is declined.

which are taking place. The companies in this industry are using old technology in the current

scenario also. They are not developed as per the requirements and due to that the production is

affected greatly (Meleo, 2014). In such companies the raw material which will be required for

the production and the time which is consumed in the same is high. There are various processes

which are involved and the carrying out of them covers consumption of more time in comparison

to the latest technologies. Also the quality is hampered with the low-quality raw material and

there is not the sufficient availability of the same. The technology is changing at fast pace and it

becomes difficult to compete with it and keep the updates regarding all the innovations which are

taking place. This leads to the use of the outdated technology which affects the growth of the

industry in negative manner.

Climatic change is another factor which is responsible for the declining growth. With the adverse

weather conditions, the wildlife and forests both are affected in negative manner. The trees are

the main source of the raw material to make paper and with the climatic change they are affected

and destroyed (Mckinsey, 2019). This leads to the shortfall of the raw material which is required.

The raw material in such circumstances is available at high cost which is not beneficial for the

companies and they avoid production due to the same. In the changing climate the wildlife is

affected as their habitat is destroyed. They do not get the proper food on which they can survive

or the place to live. This leads to their reduction or extinction which again affects the industry in

negative manner. There are various reasons for such climate conditions such as the changing

lifestyle of humans by which global warming is taking place.

With the change in the world, there are increased interventions by the government. They frame

various rules and regulations which need to be followed by all. In them there are various related

to the environment and forest safety (Environmental paper, 2018). There are many restrictions

which are placed in them in relation to the various activities which are performed in the forests.

The cutting of the trees is banned and also the wildlife is protected under law. Due to this the

main source of the requirements is affected and there is less availability of the raw material. The

companies dealing in this industry are required to comply with the laws and that imposes various

limitations on them. They are not able to acquire the required resources in adequate quantity and

with that the demand in the market is not fulfilled and the growth is declined.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

The Prescott will be considering these aspects in the evaluation of the new project as they will

also be affecting the working of the project. In the new proposal also there will be a requirement

of the wood and that will not be available in the adequate quantity because of the above

limitations which have been identified (Hoffman et al., 2015). The company will not be able to

manage the work with the available resources and with the increasing global warming there will

be limited supply of the same in the market. The higher price will be demanded which will be

reducing the profits of the company and that shall also be considered in making any decisions. If

the cost will be more and there will be no supply in that area of the project then the feasibility of

the project will be affected. The weather conditions of the location will be considered and if they

are unfavorable then the decision of the company will be affected by the same as the project will

not be considered to be feasible.

The Prescott will be considering these aspects in the evaluation of the new project as they will

also be affecting the working of the project. In the new proposal also there will be a requirement

of the wood and that will not be available in the adequate quantity because of the above

limitations which have been identified (Hoffman et al., 2015). The company will not be able to

manage the work with the available resources and with the increasing global warming there will

be limited supply of the same in the market. The higher price will be demanded which will be

reducing the profits of the company and that shall also be considered in making any decisions. If

the cost will be more and there will be no supply in that area of the project then the feasibility of

the project will be affected. The weather conditions of the location will be considered and if they

are unfavorable then the decision of the company will be affected by the same as the project will

not be considered to be feasible.

12

References

Baldenius, T., Nezlobin, A.A. and Vaysman, I. (2015) Managerial performance evaluation and

real options. The Accounting Review, 91(3), pp.741-766.

Environmental paper. ( 2018) The state of global paper industry. [Online] Available at:

https://environmentalpaper.org/wp-content/uploads/2018/04/StateOfTheGlobalPaperIndustry201

8_FullReport-Final-1.pdf [Accessed 9 September 2019]

Hoffman, E., Bernier, M., Blotnicky, B., Golden, P.G., Janes, J., Kader, A., Kovacs-Da Costa,

R., Pettipas, S., Vermeulen, S. and Walker, T.R. (2015) Assessment of public perception and

environmental compliance at a pulp and paper facility: a Canadian case study. Environmental

monitoring and assessment, 187(12), p.766.

Lane, K. and Rosewall, T. (2015) Firms’ investment decisions and interest rates. Firms’

Investment Decisions and Interest Rates 1 Why Is Wage Growth So Low? 9 Developments in

Thermal Coal Markets 19 Potential Growth and Rebalancing in China 29 Banking Fees in

Australia 39, p.1.

Mckinsey. ( 2019) Pulp, paper, and packaging in the next decade: Transformational change.

[Online] Available at: https://www.mckinsey.com/industries/paper-and-forest-products/our-

insights/pulp-paper-and-packaging-in-the-next-decade-transformational-change [Accessed 9

September 2019]

Meleo, L. (2014) On the determinants of industrial competitiveness: The European Union

emission trading scheme and the Italian paper industry. Energy Policy, 74, pp.535-546.

Obidzinski, K. and Dermawan, A. (2012) Pulp industry and environment in Indonesia: is there

sustainable future?. Regional Environmental Change, 12(4), pp.961-966.

References

Baldenius, T., Nezlobin, A.A. and Vaysman, I. (2015) Managerial performance evaluation and

real options. The Accounting Review, 91(3), pp.741-766.

Environmental paper. ( 2018) The state of global paper industry. [Online] Available at:

https://environmentalpaper.org/wp-content/uploads/2018/04/StateOfTheGlobalPaperIndustry201

8_FullReport-Final-1.pdf [Accessed 9 September 2019]

Hoffman, E., Bernier, M., Blotnicky, B., Golden, P.G., Janes, J., Kader, A., Kovacs-Da Costa,

R., Pettipas, S., Vermeulen, S. and Walker, T.R. (2015) Assessment of public perception and

environmental compliance at a pulp and paper facility: a Canadian case study. Environmental

monitoring and assessment, 187(12), p.766.

Lane, K. and Rosewall, T. (2015) Firms’ investment decisions and interest rates. Firms’

Investment Decisions and Interest Rates 1 Why Is Wage Growth So Low? 9 Developments in

Thermal Coal Markets 19 Potential Growth and Rebalancing in China 29 Banking Fees in

Australia 39, p.1.

Mckinsey. ( 2019) Pulp, paper, and packaging in the next decade: Transformational change.

[Online] Available at: https://www.mckinsey.com/industries/paper-and-forest-products/our-

insights/pulp-paper-and-packaging-in-the-next-decade-transformational-change [Accessed 9

September 2019]

Meleo, L. (2014) On the determinants of industrial competitiveness: The European Union

emission trading scheme and the Italian paper industry. Energy Policy, 74, pp.535-546.

Obidzinski, K. and Dermawan, A. (2012) Pulp industry and environment in Indonesia: is there

sustainable future?. Regional Environmental Change, 12(4), pp.961-966.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.