Facebook Financial Analysis Report

VerifiedAdded on 2019/09/18

|15

|3458

|327

Report

AI Summary

This report provides a comprehensive financial analysis of Facebook Inc., covering a five-year period. The analysis includes liquidity ratios (current and quick ratios), profitability ratios (operating margin, net profit margin, ROE, and ROA), efficiency ratios (receivable turnover, fixed asset turnover, and asset turnover), and capital structure analysis (debt/equity and times interest coverage). The report also examines Facebook's stock market performance, including price changes and valuation ratios (P/E, price-to-sales, price-to-book, and price-to-cash flow). A comparative analysis against industry averages is conducted throughout. The report concludes with limitations of the analysis (lack of qualitative analysis and future strategy assessment) and recommendations for Facebook, focusing on improving efficiency, receivables management, asset utilization, and cost control to maintain and enhance profitability and stock performance.

Running Head: FACEBOOK ANALYSIS

Assignment Title

Student Name

Student Number

Course Name

Instructor Name

Date

1

Assignment Title

Student Name

Student Number

Course Name

Instructor Name

Date

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FACEBOOK ANALYSIS

Table of Contents

Introduction......................................................................................................................................3

Financial Performance Analysis......................................................................................................3

Liquidity Analysis.......................................................................................................................4

Profitability..................................................................................................................................5

Efficiency.....................................................................................................................................7

Capital Structure..........................................................................................................................9

Stock Market Performance........................................................................................................10

Problems or Limitation..................................................................................................................11

Recommendation...........................................................................................................................12

Conclusion.....................................................................................................................................13

Reference.......................................................................................................................................14

2

Table of Contents

Introduction......................................................................................................................................3

Financial Performance Analysis......................................................................................................3

Liquidity Analysis.......................................................................................................................4

Profitability..................................................................................................................................5

Efficiency.....................................................................................................................................7

Capital Structure..........................................................................................................................9

Stock Market Performance........................................................................................................10

Problems or Limitation..................................................................................................................11

Recommendation...........................................................................................................................12

Conclusion.....................................................................................................................................13

Reference.......................................................................................................................................14

2

FACEBOOK ANALYSIS

Introduction

Facebook Inc., is a company that falls under the Internet information providing industry

was incorporated on 29, July 2004 (Yahoo Finance, n.d.). Facebook focuses on building products

that would make people connect with each other using a computer, mobile or any other devices

(Reuters, n.d.). The Company provides a safe and secured platform to share their personal and

professional information with others across the world and provides all world information to

them. The product of the company includes Facebook, WhatsApp, Instagram, Oculus, and

Messengers (Weinberger, 2015). They provide platforms that are extensively used by various

companies for marketing their products, and they generate revenue by selling advertisement

placements to marketers. Facebook is popular around the world and is used by millions of people

across the globe. In this paper, there is a detailed financial analysis performed to know about the

financial performed of Facebook and recommendations are provided for improving them.

Financial Performance Analysis

It is essential to make a comparative financial analysis using the historical financial

information of the company. In this case, the five-year financial ratio is taken into consideration

for making an analysis of the financial performance and position of the company (Horngren,

Harrison and Oliver, 2011). There are industrial data available for the company that is used for

making a comparative analysis so an appropriate evaluation of the financial performance of

Facebook can be performed. In this section, there is a detailed analysis of liquidity, profitability,

efficiency, capital structure and stock performance of the company over the past five years.

3

Introduction

Facebook Inc., is a company that falls under the Internet information providing industry

was incorporated on 29, July 2004 (Yahoo Finance, n.d.). Facebook focuses on building products

that would make people connect with each other using a computer, mobile or any other devices

(Reuters, n.d.). The Company provides a safe and secured platform to share their personal and

professional information with others across the world and provides all world information to

them. The product of the company includes Facebook, WhatsApp, Instagram, Oculus, and

Messengers (Weinberger, 2015). They provide platforms that are extensively used by various

companies for marketing their products, and they generate revenue by selling advertisement

placements to marketers. Facebook is popular around the world and is used by millions of people

across the globe. In this paper, there is a detailed financial analysis performed to know about the

financial performed of Facebook and recommendations are provided for improving them.

Financial Performance Analysis

It is essential to make a comparative financial analysis using the historical financial

information of the company. In this case, the five-year financial ratio is taken into consideration

for making an analysis of the financial performance and position of the company (Horngren,

Harrison and Oliver, 2011). There are industrial data available for the company that is used for

making a comparative analysis so an appropriate evaluation of the financial performance of

Facebook can be performed. In this section, there is a detailed analysis of liquidity, profitability,

efficiency, capital structure and stock performance of the company over the past five years.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FACEBOOK ANALYSIS

Liquidity Analysis

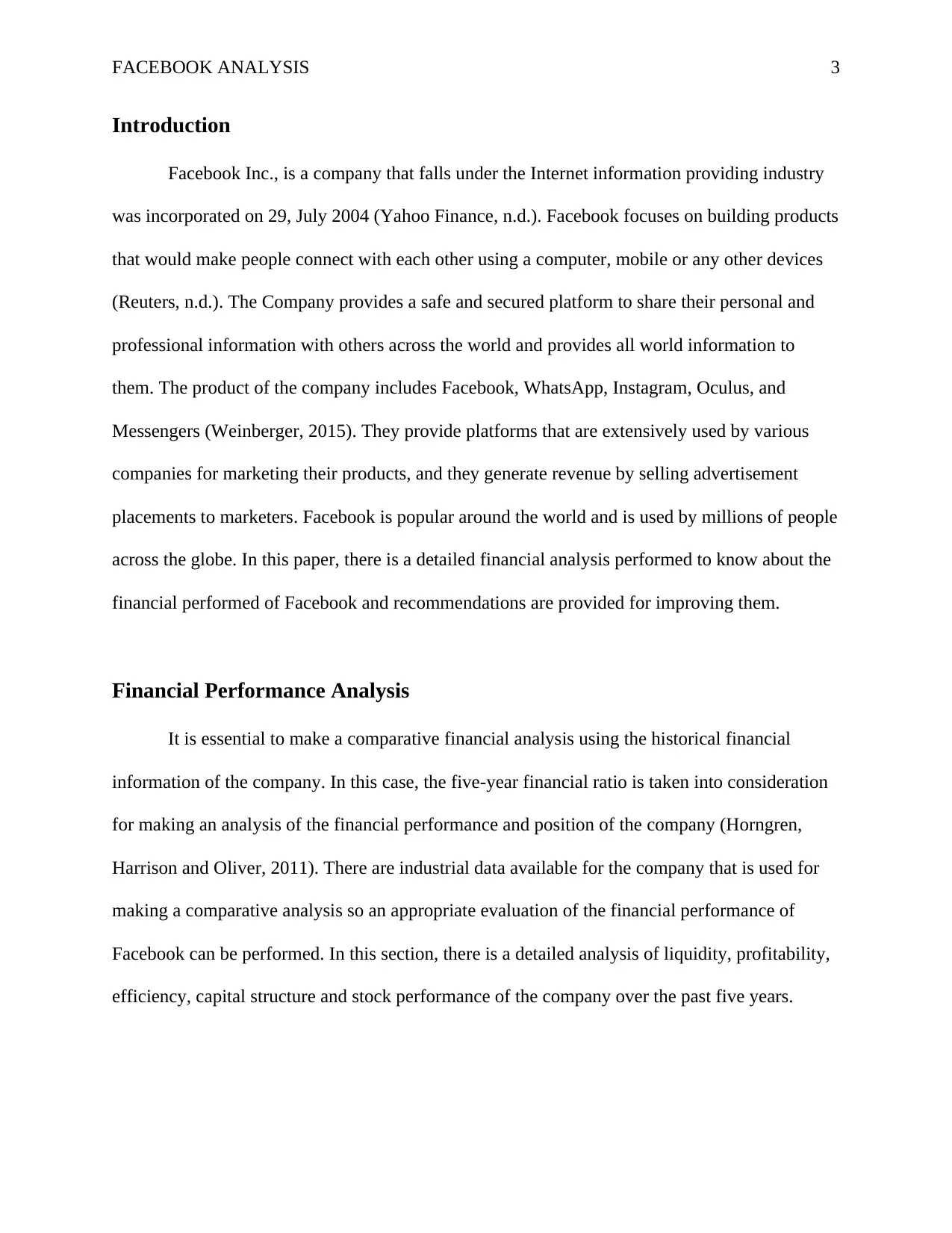

The five-year liquidity ratios of the Facebook are as follows:

2012 2013 2014 2015 2016 Industry

Current Ratio 10.71 11.88 9.6 11.25 11.97 2.41

Quick Ratio 10.26 11.46 9.04 10.91 11.63 1.33

Data Source: Reuters, n.d. and Morningstar, n.d.

Current ratio and quick ratio indicates the liquidity position of the company (Reilly and

Brown, 2011). The current ratio of the company is disclosing a fluctuating trend. It increased

during 2013 and decreased during 2014. But the current ratio of the company is consistently

increased from 2015. When compared to the industrial ratio the current ratio of Facebook is

considerably higher. A quick ratio of the company is disclosing a fluctuating trend (Green,

2013). It increased during 2013 and decreased during 2014. But the quick ratio of the company is

consistently increased from 2015. When compared to the industrial ratio the quick ratio of

Facebook is considerably higher. Thus, the overall liquidity position of the company is

significantly higher when compared to the industry. It indicates that Facebook has better working

capital management and has strong liquidity position that will enable them to have better

business operation management (Hoefflinger, 2017).

4

Liquidity Analysis

The five-year liquidity ratios of the Facebook are as follows:

2012 2013 2014 2015 2016 Industry

Current Ratio 10.71 11.88 9.6 11.25 11.97 2.41

Quick Ratio 10.26 11.46 9.04 10.91 11.63 1.33

Data Source: Reuters, n.d. and Morningstar, n.d.

Current ratio and quick ratio indicates the liquidity position of the company (Reilly and

Brown, 2011). The current ratio of the company is disclosing a fluctuating trend. It increased

during 2013 and decreased during 2014. But the current ratio of the company is consistently

increased from 2015. When compared to the industrial ratio the current ratio of Facebook is

considerably higher. A quick ratio of the company is disclosing a fluctuating trend (Green,

2013). It increased during 2013 and decreased during 2014. But the quick ratio of the company is

consistently increased from 2015. When compared to the industrial ratio the quick ratio of

Facebook is considerably higher. Thus, the overall liquidity position of the company is

significantly higher when compared to the industry. It indicates that Facebook has better working

capital management and has strong liquidity position that will enable them to have better

business operation management (Hoefflinger, 2017).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FACEBOOK ANALYSIS

Profitability

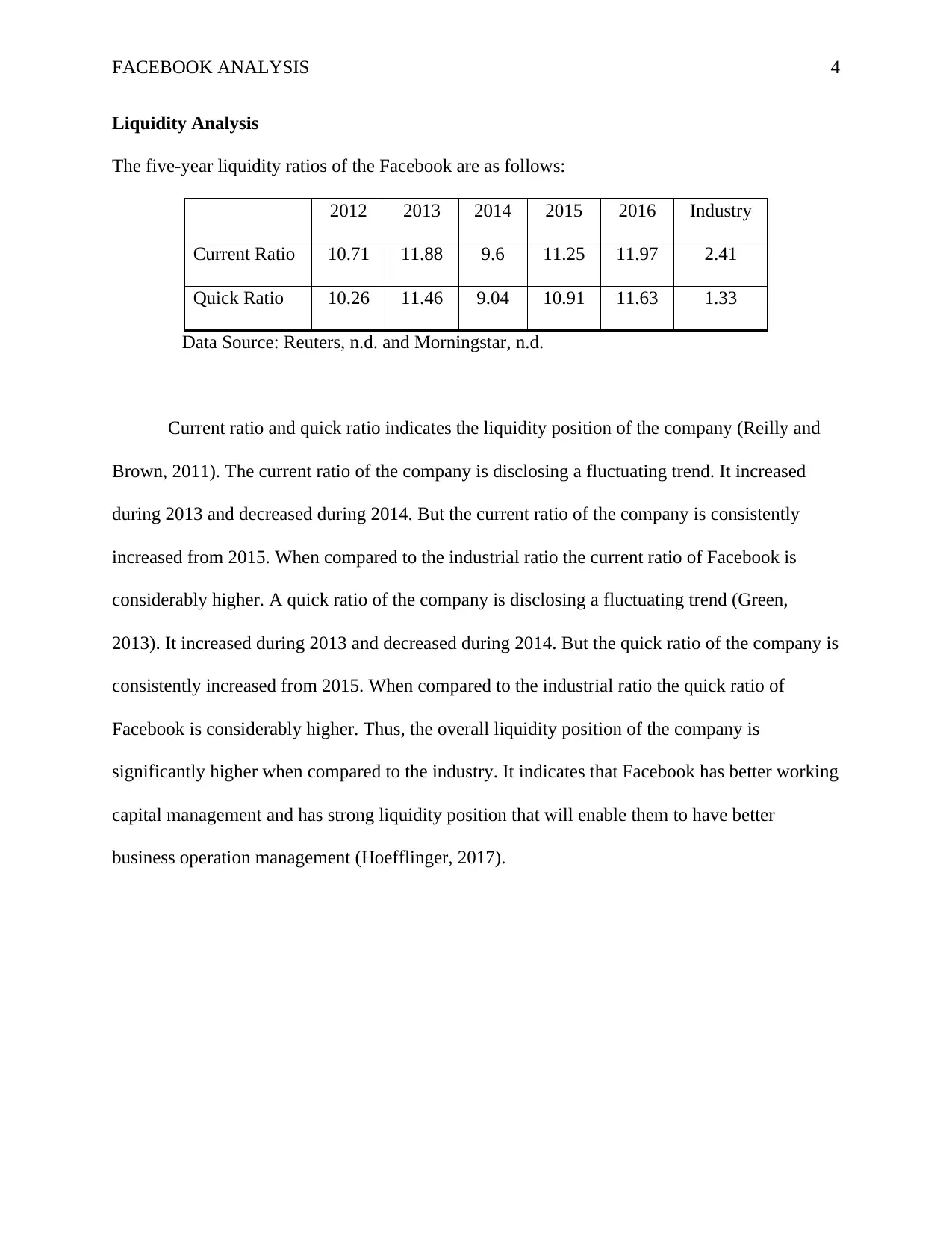

The five-year profitability ratio and percentage change on Year on Year basis for all the

ratios:

2012 2013 2014 2015 2016 Industry

Operating Margin

10.57

% 35.62% 40.06% 34.72% 44.96% -1.98%

% change 237% 12% -13% 29%

Net profit margin 0.63% 18.94% 23.46% 20.47% 36.86% -12.24%

% change 2906% 24% -13% 80%

ROE 0.40% 10.95% 11.34% 9.14% 19.70% 10.07%

% change 2638% 4% -19% 116%

ROA 0.30% 9.04% 10.07% 8.19% 17.82% 17.20%

% change 2913% 11% -19% 118%

Data Source: Reuters, n.d. and Morningstar, n.d.

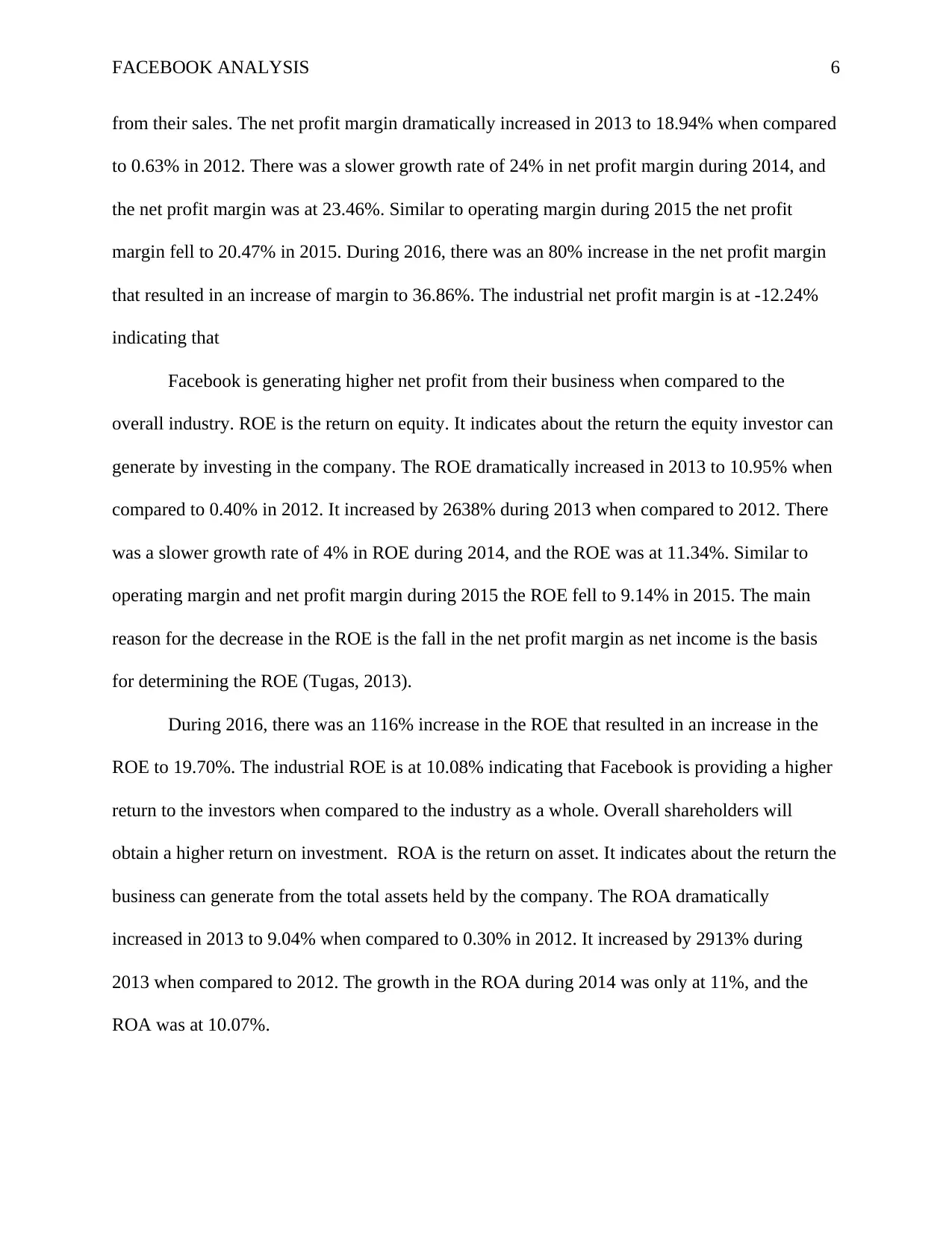

The operating margin of the company indicates the profit-generating capacity of the core

business operations of the company (Green, 2013). The operating margin dramatically increased

in 2013 by 237% when compared to 2012, and it continued at the rate of 12% during 2014. But

during 2015 the operating margin fell from 40.06% in 2014 to 34.72% in 2015. During 2016,

there was a 29% increase in the operating margin to 44.96%. The industrial operating margin is

at -1.98% indicating that Facebook is generating higher profit from their business operation

when compared to the overall industry.

Net profit margin of the company indicates about the ability of the company to convert

their revenue into the profit (Tugas, 2013). It is the net profit that is generated by the company

5

Profitability

The five-year profitability ratio and percentage change on Year on Year basis for all the

ratios:

2012 2013 2014 2015 2016 Industry

Operating Margin

10.57

% 35.62% 40.06% 34.72% 44.96% -1.98%

% change 237% 12% -13% 29%

Net profit margin 0.63% 18.94% 23.46% 20.47% 36.86% -12.24%

% change 2906% 24% -13% 80%

ROE 0.40% 10.95% 11.34% 9.14% 19.70% 10.07%

% change 2638% 4% -19% 116%

ROA 0.30% 9.04% 10.07% 8.19% 17.82% 17.20%

% change 2913% 11% -19% 118%

Data Source: Reuters, n.d. and Morningstar, n.d.

The operating margin of the company indicates the profit-generating capacity of the core

business operations of the company (Green, 2013). The operating margin dramatically increased

in 2013 by 237% when compared to 2012, and it continued at the rate of 12% during 2014. But

during 2015 the operating margin fell from 40.06% in 2014 to 34.72% in 2015. During 2016,

there was a 29% increase in the operating margin to 44.96%. The industrial operating margin is

at -1.98% indicating that Facebook is generating higher profit from their business operation

when compared to the overall industry.

Net profit margin of the company indicates about the ability of the company to convert

their revenue into the profit (Tugas, 2013). It is the net profit that is generated by the company

5

FACEBOOK ANALYSIS

from their sales. The net profit margin dramatically increased in 2013 to 18.94% when compared

to 0.63% in 2012. There was a slower growth rate of 24% in net profit margin during 2014, and

the net profit margin was at 23.46%. Similar to operating margin during 2015 the net profit

margin fell to 20.47% in 2015. During 2016, there was an 80% increase in the net profit margin

that resulted in an increase of margin to 36.86%. The industrial net profit margin is at -12.24%

indicating that

Facebook is generating higher net profit from their business when compared to the

overall industry. ROE is the return on equity. It indicates about the return the equity investor can

generate by investing in the company. The ROE dramatically increased in 2013 to 10.95% when

compared to 0.40% in 2012. It increased by 2638% during 2013 when compared to 2012. There

was a slower growth rate of 4% in ROE during 2014, and the ROE was at 11.34%. Similar to

operating margin and net profit margin during 2015 the ROE fell to 9.14% in 2015. The main

reason for the decrease in the ROE is the fall in the net profit margin as net income is the basis

for determining the ROE (Tugas, 2013).

During 2016, there was an 116% increase in the ROE that resulted in an increase in the

ROE to 19.70%. The industrial ROE is at 10.08% indicating that Facebook is providing a higher

return to the investors when compared to the industry as a whole. Overall shareholders will

obtain a higher return on investment. ROA is the return on asset. It indicates about the return the

business can generate from the total assets held by the company. The ROA dramatically

increased in 2013 to 9.04% when compared to 0.30% in 2012. It increased by 2913% during

2013 when compared to 2012. The growth in the ROA during 2014 was only at 11%, and the

ROA was at 10.07%.

6

from their sales. The net profit margin dramatically increased in 2013 to 18.94% when compared

to 0.63% in 2012. There was a slower growth rate of 24% in net profit margin during 2014, and

the net profit margin was at 23.46%. Similar to operating margin during 2015 the net profit

margin fell to 20.47% in 2015. During 2016, there was an 80% increase in the net profit margin

that resulted in an increase of margin to 36.86%. The industrial net profit margin is at -12.24%

indicating that

Facebook is generating higher net profit from their business when compared to the

overall industry. ROE is the return on equity. It indicates about the return the equity investor can

generate by investing in the company. The ROE dramatically increased in 2013 to 10.95% when

compared to 0.40% in 2012. It increased by 2638% during 2013 when compared to 2012. There

was a slower growth rate of 4% in ROE during 2014, and the ROE was at 11.34%. Similar to

operating margin and net profit margin during 2015 the ROE fell to 9.14% in 2015. The main

reason for the decrease in the ROE is the fall in the net profit margin as net income is the basis

for determining the ROE (Tugas, 2013).

During 2016, there was an 116% increase in the ROE that resulted in an increase in the

ROE to 19.70%. The industrial ROE is at 10.08% indicating that Facebook is providing a higher

return to the investors when compared to the industry as a whole. Overall shareholders will

obtain a higher return on investment. ROA is the return on asset. It indicates about the return the

business can generate from the total assets held by the company. The ROA dramatically

increased in 2013 to 9.04% when compared to 0.30% in 2012. It increased by 2913% during

2013 when compared to 2012. The growth in the ROA during 2014 was only at 11%, and the

ROA was at 10.07%.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FACEBOOK ANALYSIS

Similar to the other profitability ratios during 2015 the ROA fell to 8.19% in 2015 there

was a decrease in ROA by 19%. The main reason for the decrease in the ROA is the fall in the

net income. During 2016, there was 118% increase in the ROA that resulted in an increase in the

ROA to 17.82%. The industrial ROA is at 17.22% indicating that Facebook is generating similar

return like that of the industry. From the overall profitability ratios of the company, it is clear

that Facebook is a highly profitable company. There is fluctuation in the profit generating

capacity of the company.

When compared to the industrial average, the overall profit-generating capacity of the

company is significantly higher. Facebook is financially performing better than the entire

industry indicating that Facebook has better potential to generate a higher return in future. Equity

investors who seek to make an investment in this industry will prefer to make an investment in

Facebook as they are generating higher ROE when compared to the industry as a whole.

Similarly, the business has higher potential to generate profit indicating about the good

performance of the business. Facebook is a profitable company and holds a better position in the

industry.

Efficiency

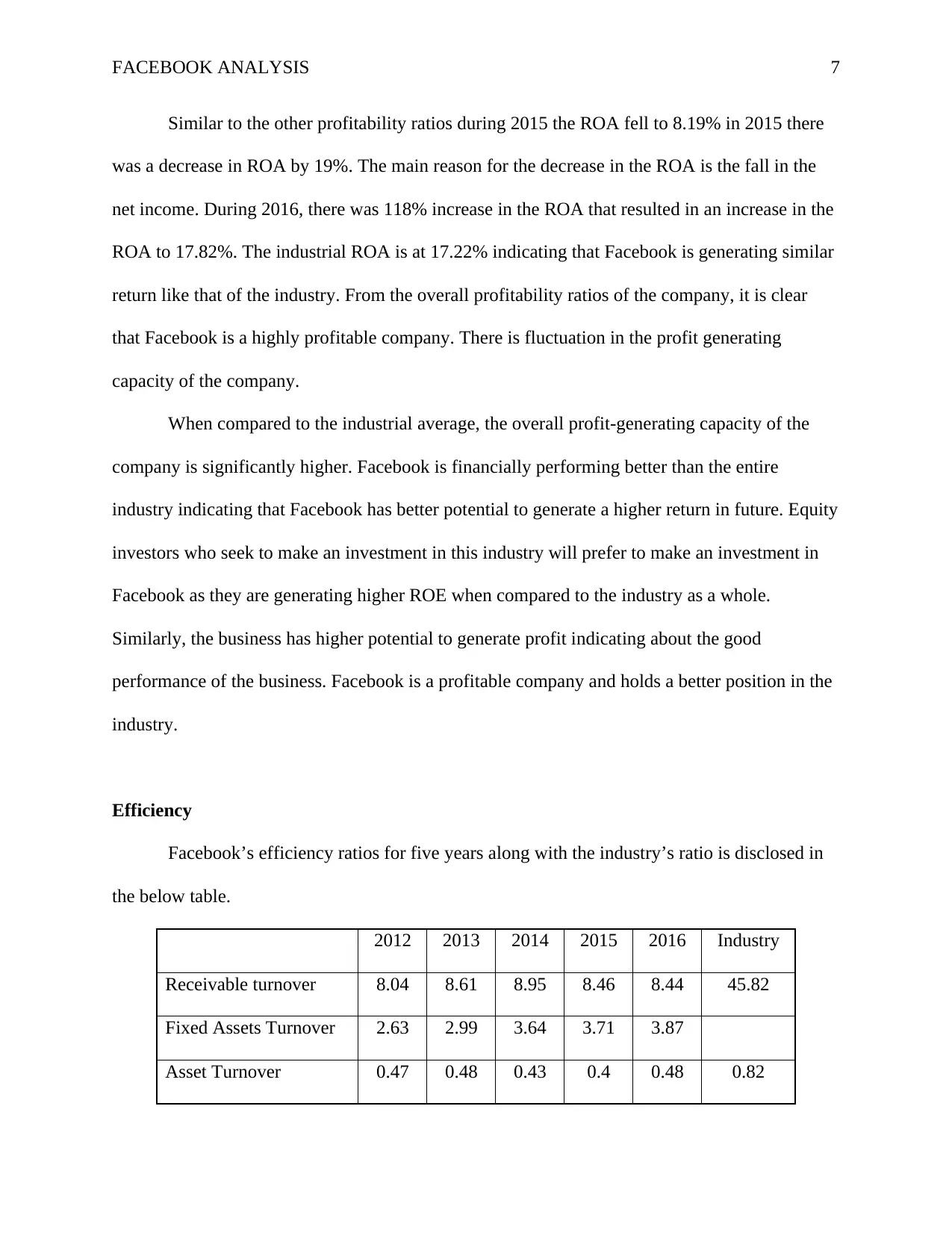

Facebook’s efficiency ratios for five years along with the industry’s ratio is disclosed in

the below table.

2012 2013 2014 2015 2016 Industry

Receivable turnover 8.04 8.61 8.95 8.46 8.44 45.82

Fixed Assets Turnover 2.63 2.99 3.64 3.71 3.87

Asset Turnover 0.47 0.48 0.43 0.4 0.48 0.82

7

Similar to the other profitability ratios during 2015 the ROA fell to 8.19% in 2015 there

was a decrease in ROA by 19%. The main reason for the decrease in the ROA is the fall in the

net income. During 2016, there was 118% increase in the ROA that resulted in an increase in the

ROA to 17.82%. The industrial ROA is at 17.22% indicating that Facebook is generating similar

return like that of the industry. From the overall profitability ratios of the company, it is clear

that Facebook is a highly profitable company. There is fluctuation in the profit generating

capacity of the company.

When compared to the industrial average, the overall profit-generating capacity of the

company is significantly higher. Facebook is financially performing better than the entire

industry indicating that Facebook has better potential to generate a higher return in future. Equity

investors who seek to make an investment in this industry will prefer to make an investment in

Facebook as they are generating higher ROE when compared to the industry as a whole.

Similarly, the business has higher potential to generate profit indicating about the good

performance of the business. Facebook is a profitable company and holds a better position in the

industry.

Efficiency

Facebook’s efficiency ratios for five years along with the industry’s ratio is disclosed in

the below table.

2012 2013 2014 2015 2016 Industry

Receivable turnover 8.04 8.61 8.95 8.46 8.44 45.82

Fixed Assets Turnover 2.63 2.99 3.64 3.71 3.87

Asset Turnover 0.47 0.48 0.43 0.4 0.48 0.82

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FACEBOOK ANALYSIS

Data Source: Data Source: Reuters, n.d. and Morningstar, n.d.

From the receivable turnover ratio of Facebook for the past five years from 2012 to 2016

it is clear that company is managing a constant receivables turnover ratio. There are no

significant changes in the receivables turnover ratios. The receivables turnover ratio of the

company is poor indicating that Facebook takes a longer time to convert their receivables into

cash. On the other hand, the industrial receivables turnover ratio is significantly higher indicating

that on an average company in this industry are converting their receivables into cash quicker

than Facebook. Facebook has poor receivables turnover and requires strategy to improve them to

increase the efficiency. The fixed asset turnover ratio of the company has consistence and

continuously improved over the five years from 2.63 in 2012 to 3.87 in 2016.

Fixed asset turnover ratio indicates about the contribution made by the fixed assets for

generating sales. When the fixed asset turnover ratio is, higher and increasing, it indicates that

the management of the company is efficiently making use of their fixed assets for generating

more revenue. Similarly, the asset turnover ratio indicates the capacity of the total assets in

generating sales. The asset turnover ratio of the company is poor, and there is a requirement for

the company to improve their turnover ratio as they are far behind than the industrial ratio.

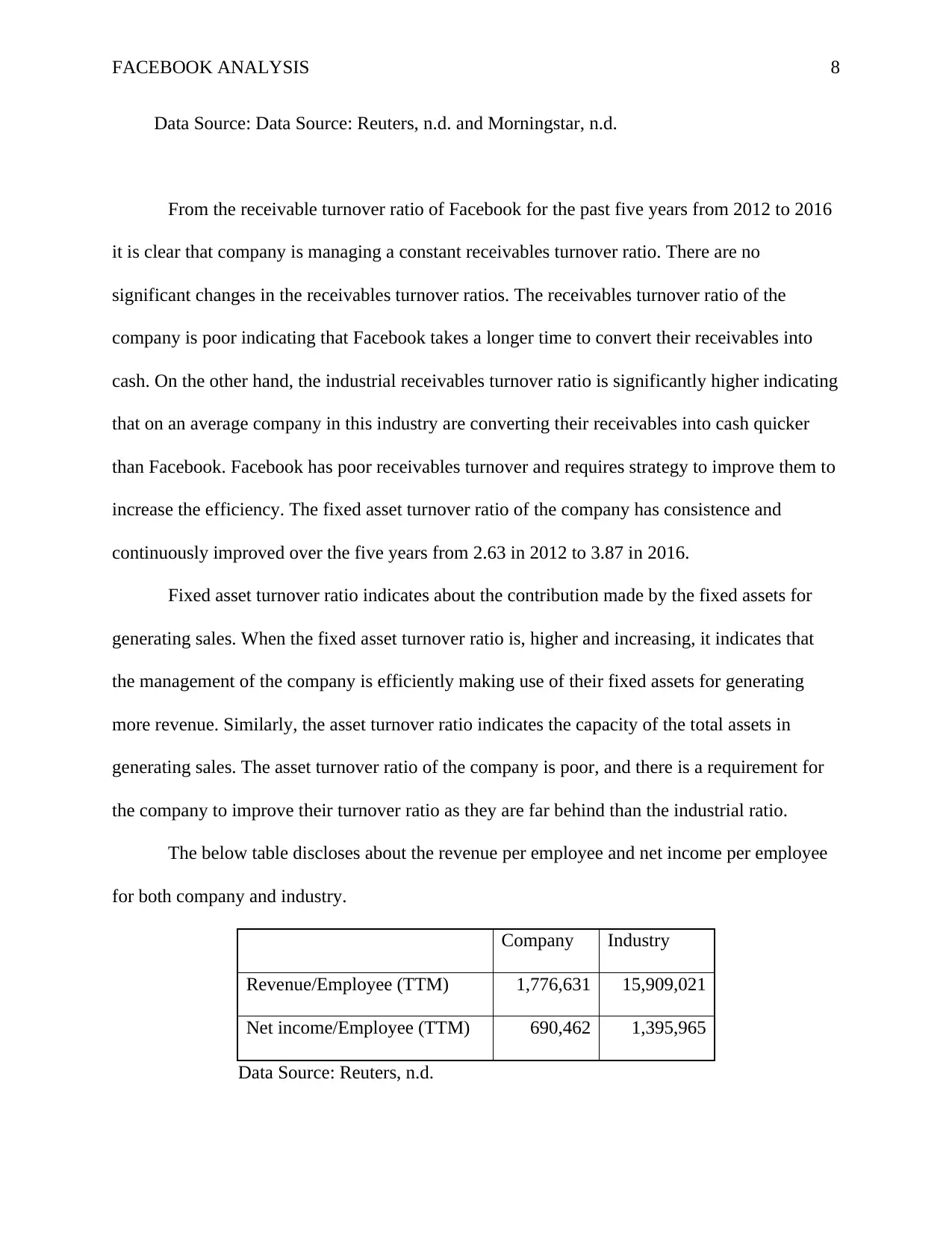

The below table discloses about the revenue per employee and net income per employee

for both company and industry.

Company Industry

Revenue/Employee (TTM) 1,776,631 15,909,021

Net income/Employee (TTM) 690,462 1,395,965

Data Source: Reuters, n.d.

8

Data Source: Data Source: Reuters, n.d. and Morningstar, n.d.

From the receivable turnover ratio of Facebook for the past five years from 2012 to 2016

it is clear that company is managing a constant receivables turnover ratio. There are no

significant changes in the receivables turnover ratios. The receivables turnover ratio of the

company is poor indicating that Facebook takes a longer time to convert their receivables into

cash. On the other hand, the industrial receivables turnover ratio is significantly higher indicating

that on an average company in this industry are converting their receivables into cash quicker

than Facebook. Facebook has poor receivables turnover and requires strategy to improve them to

increase the efficiency. The fixed asset turnover ratio of the company has consistence and

continuously improved over the five years from 2.63 in 2012 to 3.87 in 2016.

Fixed asset turnover ratio indicates about the contribution made by the fixed assets for

generating sales. When the fixed asset turnover ratio is, higher and increasing, it indicates that

the management of the company is efficiently making use of their fixed assets for generating

more revenue. Similarly, the asset turnover ratio indicates the capacity of the total assets in

generating sales. The asset turnover ratio of the company is poor, and there is a requirement for

the company to improve their turnover ratio as they are far behind than the industrial ratio.

The below table discloses about the revenue per employee and net income per employee

for both company and industry.

Company Industry

Revenue/Employee (TTM) 1,776,631 15,909,021

Net income/Employee (TTM) 690,462 1,395,965

Data Source: Reuters, n.d.

8

FACEBOOK ANALYSIS

From the table, it is clear that the company is competitive in generating higher revenue

and net income per employee. The overall business efficiency of Facebook is below average

when compared to the industry.

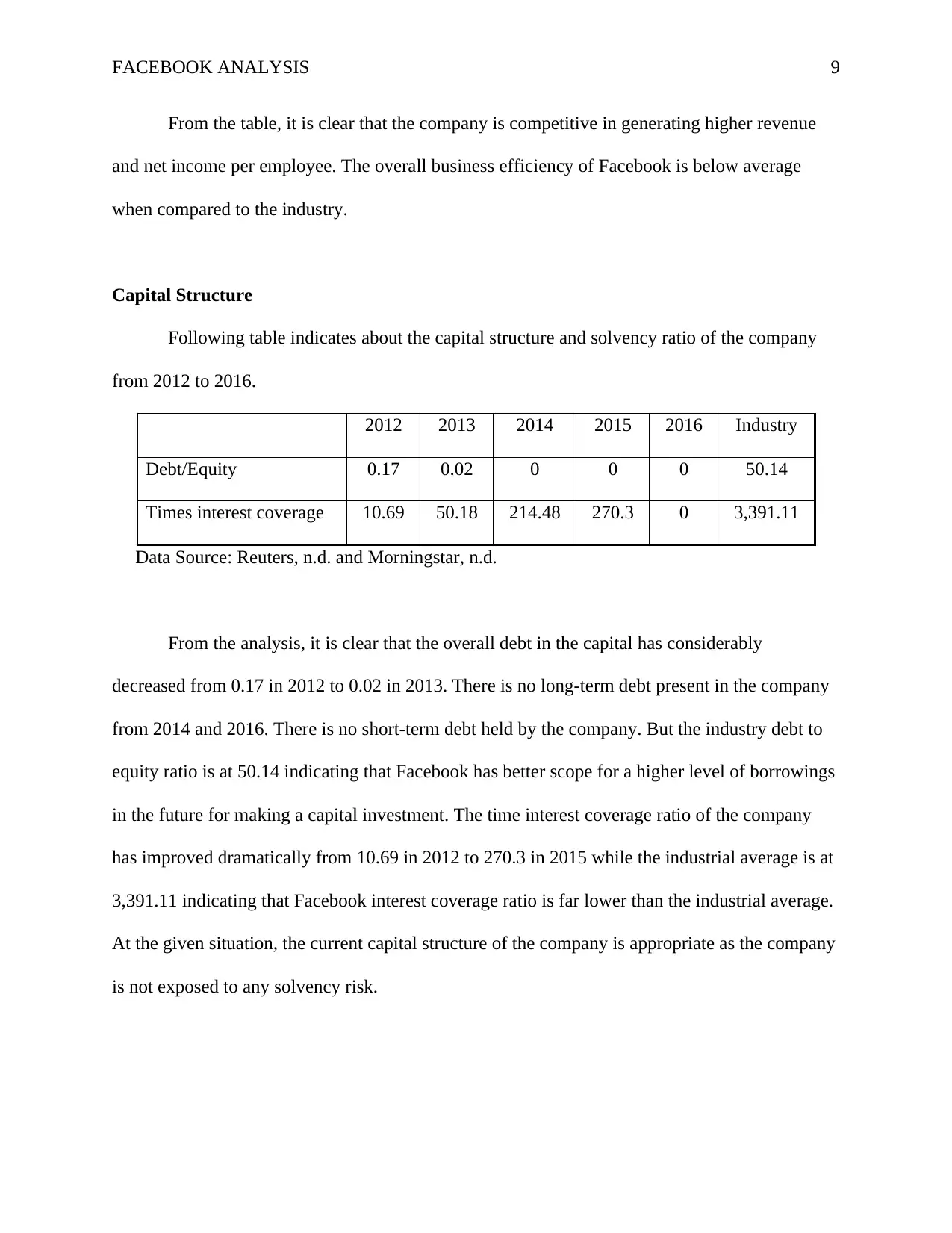

Capital Structure

Following table indicates about the capital structure and solvency ratio of the company

from 2012 to 2016.

2012 2013 2014 2015 2016 Industry

Debt/Equity 0.17 0.02 0 0 0 50.14

Times interest coverage 10.69 50.18 214.48 270.3 0 3,391.11

Data Source: Reuters, n.d. and Morningstar, n.d.

From the analysis, it is clear that the overall debt in the capital has considerably

decreased from 0.17 in 2012 to 0.02 in 2013. There is no long-term debt present in the company

from 2014 and 2016. There is no short-term debt held by the company. But the industry debt to

equity ratio is at 50.14 indicating that Facebook has better scope for a higher level of borrowings

in the future for making a capital investment. The time interest coverage ratio of the company

has improved dramatically from 10.69 in 2012 to 270.3 in 2015 while the industrial average is at

3,391.11 indicating that Facebook interest coverage ratio is far lower than the industrial average.

At the given situation, the current capital structure of the company is appropriate as the company

is not exposed to any solvency risk.

9

From the table, it is clear that the company is competitive in generating higher revenue

and net income per employee. The overall business efficiency of Facebook is below average

when compared to the industry.

Capital Structure

Following table indicates about the capital structure and solvency ratio of the company

from 2012 to 2016.

2012 2013 2014 2015 2016 Industry

Debt/Equity 0.17 0.02 0 0 0 50.14

Times interest coverage 10.69 50.18 214.48 270.3 0 3,391.11

Data Source: Reuters, n.d. and Morningstar, n.d.

From the analysis, it is clear that the overall debt in the capital has considerably

decreased from 0.17 in 2012 to 0.02 in 2013. There is no long-term debt present in the company

from 2014 and 2016. There is no short-term debt held by the company. But the industry debt to

equity ratio is at 50.14 indicating that Facebook has better scope for a higher level of borrowings

in the future for making a capital investment. The time interest coverage ratio of the company

has improved dramatically from 10.69 in 2012 to 270.3 in 2015 while the industrial average is at

3,391.11 indicating that Facebook interest coverage ratio is far lower than the industrial average.

At the given situation, the current capital structure of the company is appropriate as the company

is not exposed to any solvency risk.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FACEBOOK ANALYSIS

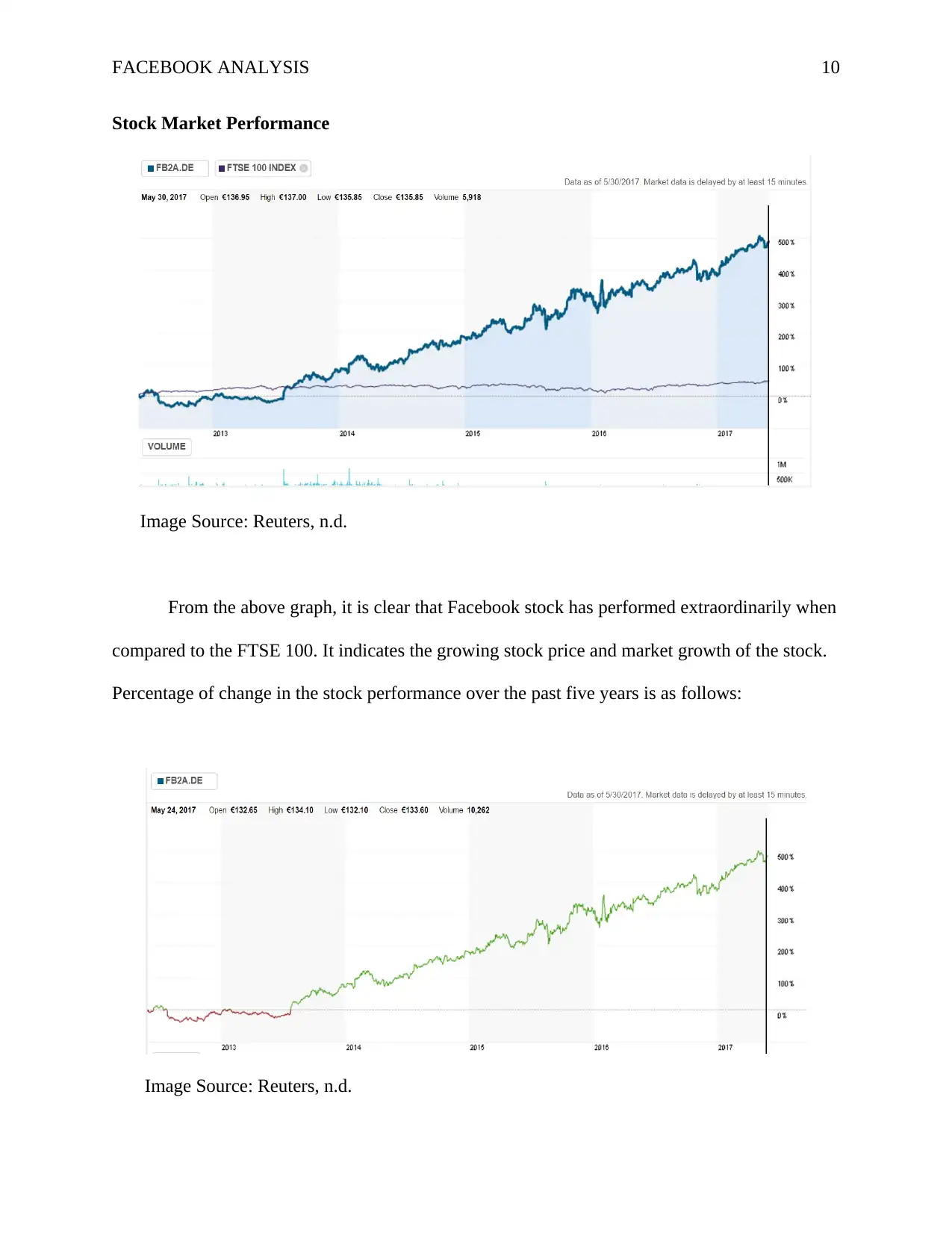

Stock Market Performance

Image Source: Reuters, n.d.

From the above graph, it is clear that Facebook stock has performed extraordinarily when

compared to the FTSE 100. It indicates the growing stock price and market growth of the stock.

Percentage of change in the stock performance over the past five years is as follows:

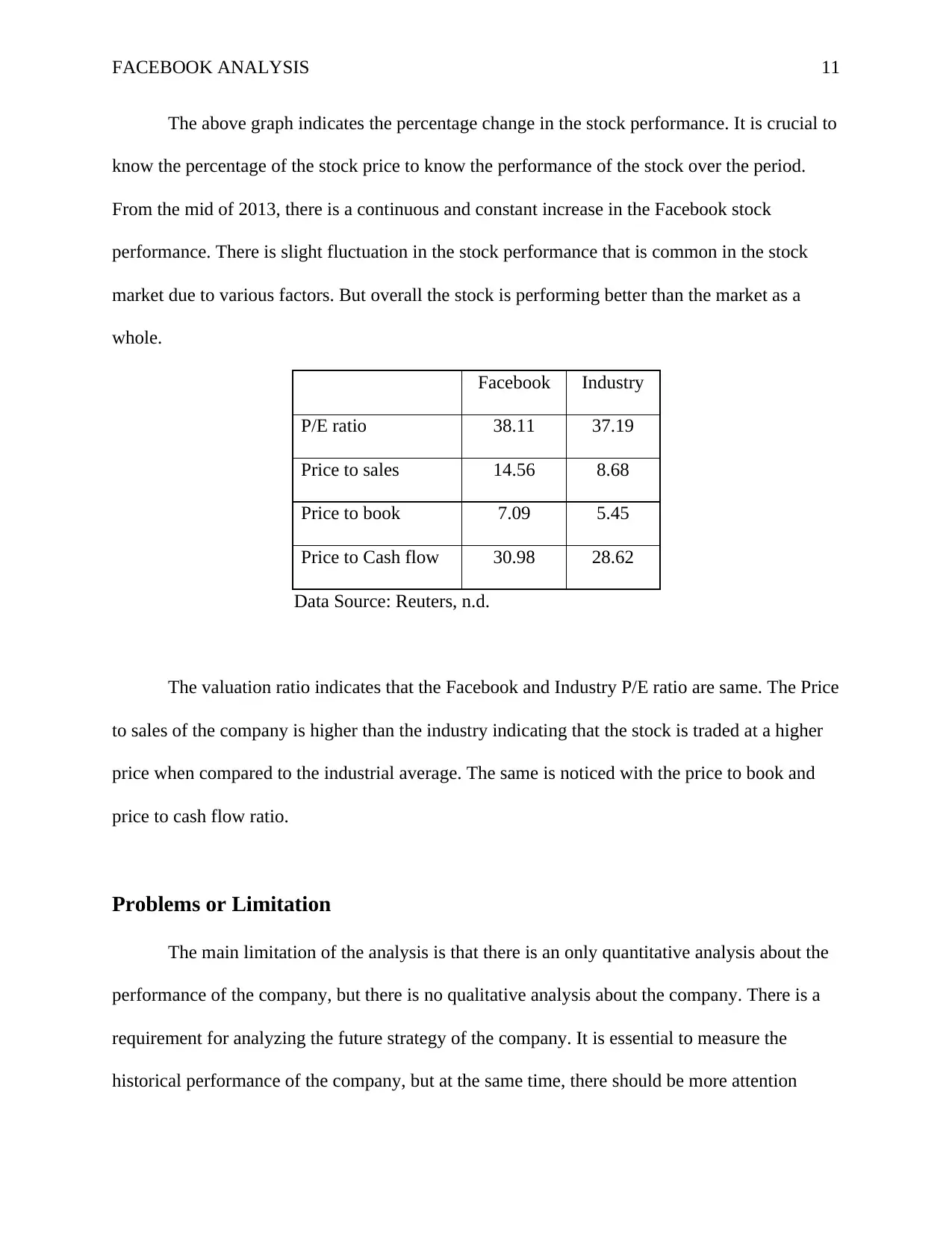

Image Source: Reuters, n.d.

10

Stock Market Performance

Image Source: Reuters, n.d.

From the above graph, it is clear that Facebook stock has performed extraordinarily when

compared to the FTSE 100. It indicates the growing stock price and market growth of the stock.

Percentage of change in the stock performance over the past five years is as follows:

Image Source: Reuters, n.d.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FACEBOOK ANALYSIS

The above graph indicates the percentage change in the stock performance. It is crucial to

know the percentage of the stock price to know the performance of the stock over the period.

From the mid of 2013, there is a continuous and constant increase in the Facebook stock

performance. There is slight fluctuation in the stock performance that is common in the stock

market due to various factors. But overall the stock is performing better than the market as a

whole.

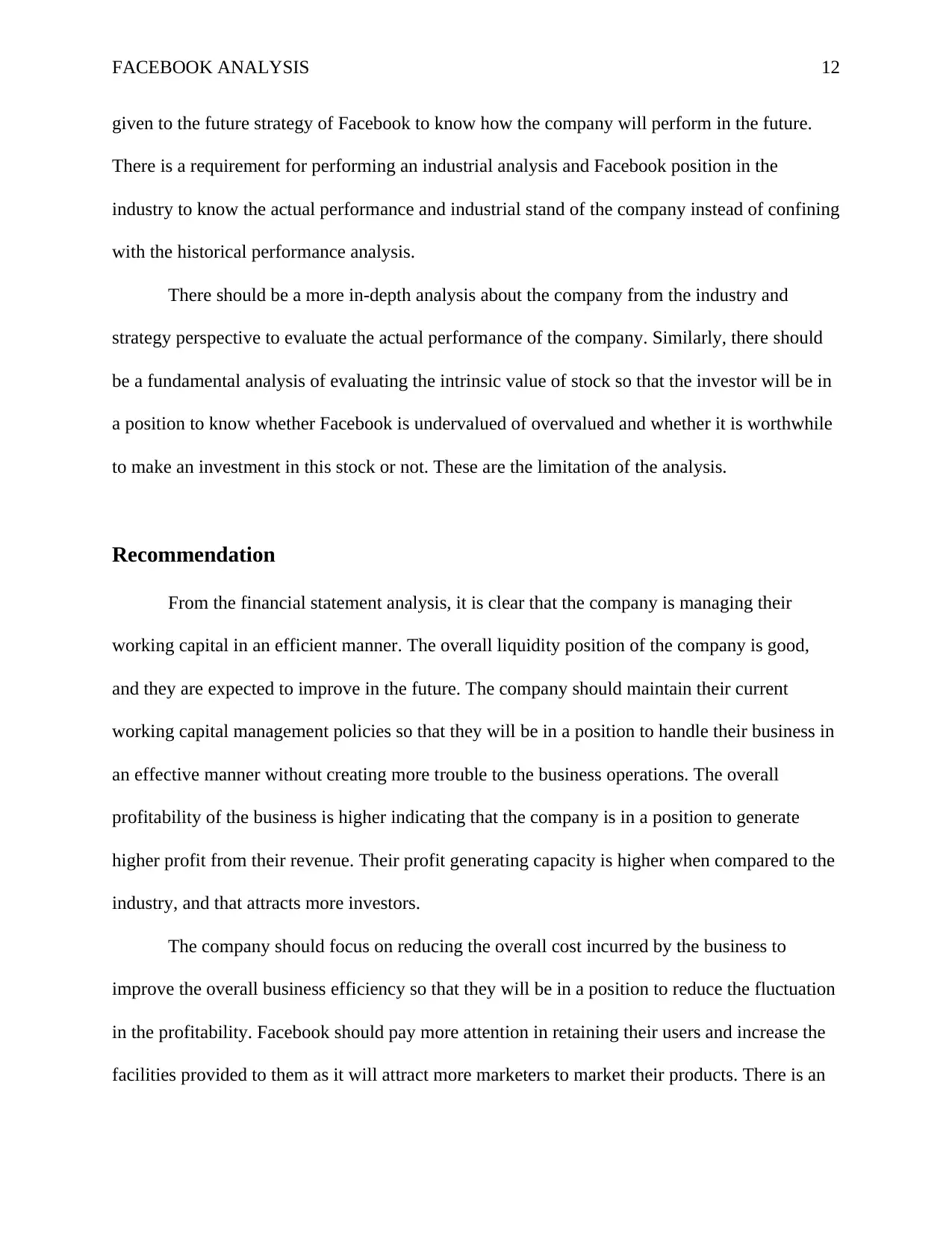

Facebook Industry

P/E ratio 38.11 37.19

Price to sales 14.56 8.68

Price to book 7.09 5.45

Price to Cash flow 30.98 28.62

Data Source: Reuters, n.d.

The valuation ratio indicates that the Facebook and Industry P/E ratio are same. The Price

to sales of the company is higher than the industry indicating that the stock is traded at a higher

price when compared to the industrial average. The same is noticed with the price to book and

price to cash flow ratio.

Problems or Limitation

The main limitation of the analysis is that there is an only quantitative analysis about the

performance of the company, but there is no qualitative analysis about the company. There is a

requirement for analyzing the future strategy of the company. It is essential to measure the

historical performance of the company, but at the same time, there should be more attention

11

The above graph indicates the percentage change in the stock performance. It is crucial to

know the percentage of the stock price to know the performance of the stock over the period.

From the mid of 2013, there is a continuous and constant increase in the Facebook stock

performance. There is slight fluctuation in the stock performance that is common in the stock

market due to various factors. But overall the stock is performing better than the market as a

whole.

Facebook Industry

P/E ratio 38.11 37.19

Price to sales 14.56 8.68

Price to book 7.09 5.45

Price to Cash flow 30.98 28.62

Data Source: Reuters, n.d.

The valuation ratio indicates that the Facebook and Industry P/E ratio are same. The Price

to sales of the company is higher than the industry indicating that the stock is traded at a higher

price when compared to the industrial average. The same is noticed with the price to book and

price to cash flow ratio.

Problems or Limitation

The main limitation of the analysis is that there is an only quantitative analysis about the

performance of the company, but there is no qualitative analysis about the company. There is a

requirement for analyzing the future strategy of the company. It is essential to measure the

historical performance of the company, but at the same time, there should be more attention

11

FACEBOOK ANALYSIS

given to the future strategy of Facebook to know how the company will perform in the future.

There is a requirement for performing an industrial analysis and Facebook position in the

industry to know the actual performance and industrial stand of the company instead of confining

with the historical performance analysis.

There should be a more in-depth analysis about the company from the industry and

strategy perspective to evaluate the actual performance of the company. Similarly, there should

be a fundamental analysis of evaluating the intrinsic value of stock so that the investor will be in

a position to know whether Facebook is undervalued of overvalued and whether it is worthwhile

to make an investment in this stock or not. These are the limitation of the analysis.

Recommendation

From the financial statement analysis, it is clear that the company is managing their

working capital in an efficient manner. The overall liquidity position of the company is good,

and they are expected to improve in the future. The company should maintain their current

working capital management policies so that they will be in a position to handle their business in

an effective manner without creating more trouble to the business operations. The overall

profitability of the business is higher indicating that the company is in a position to generate

higher profit from their revenue. Their profit generating capacity is higher when compared to the

industry, and that attracts more investors.

The company should focus on reducing the overall cost incurred by the business to

improve the overall business efficiency so that they will be in a position to reduce the fluctuation

in the profitability. Facebook should pay more attention in retaining their users and increase the

facilities provided to them as it will attract more marketers to market their products. There is an

12

given to the future strategy of Facebook to know how the company will perform in the future.

There is a requirement for performing an industrial analysis and Facebook position in the

industry to know the actual performance and industrial stand of the company instead of confining

with the historical performance analysis.

There should be a more in-depth analysis about the company from the industry and

strategy perspective to evaluate the actual performance of the company. Similarly, there should

be a fundamental analysis of evaluating the intrinsic value of stock so that the investor will be in

a position to know whether Facebook is undervalued of overvalued and whether it is worthwhile

to make an investment in this stock or not. These are the limitation of the analysis.

Recommendation

From the financial statement analysis, it is clear that the company is managing their

working capital in an efficient manner. The overall liquidity position of the company is good,

and they are expected to improve in the future. The company should maintain their current

working capital management policies so that they will be in a position to handle their business in

an effective manner without creating more trouble to the business operations. The overall

profitability of the business is higher indicating that the company is in a position to generate

higher profit from their revenue. Their profit generating capacity is higher when compared to the

industry, and that attracts more investors.

The company should focus on reducing the overall cost incurred by the business to

improve the overall business efficiency so that they will be in a position to reduce the fluctuation

in the profitability. Facebook should pay more attention in retaining their users and increase the

facilities provided to them as it will attract more marketers to market their products. There is an

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.