Ask a question from expert

Investment Appraisal Techniques and Best Proposed Project for XYZ Company

7 Pages983 Words309 Views

Added on 2019-09-19

About This Document

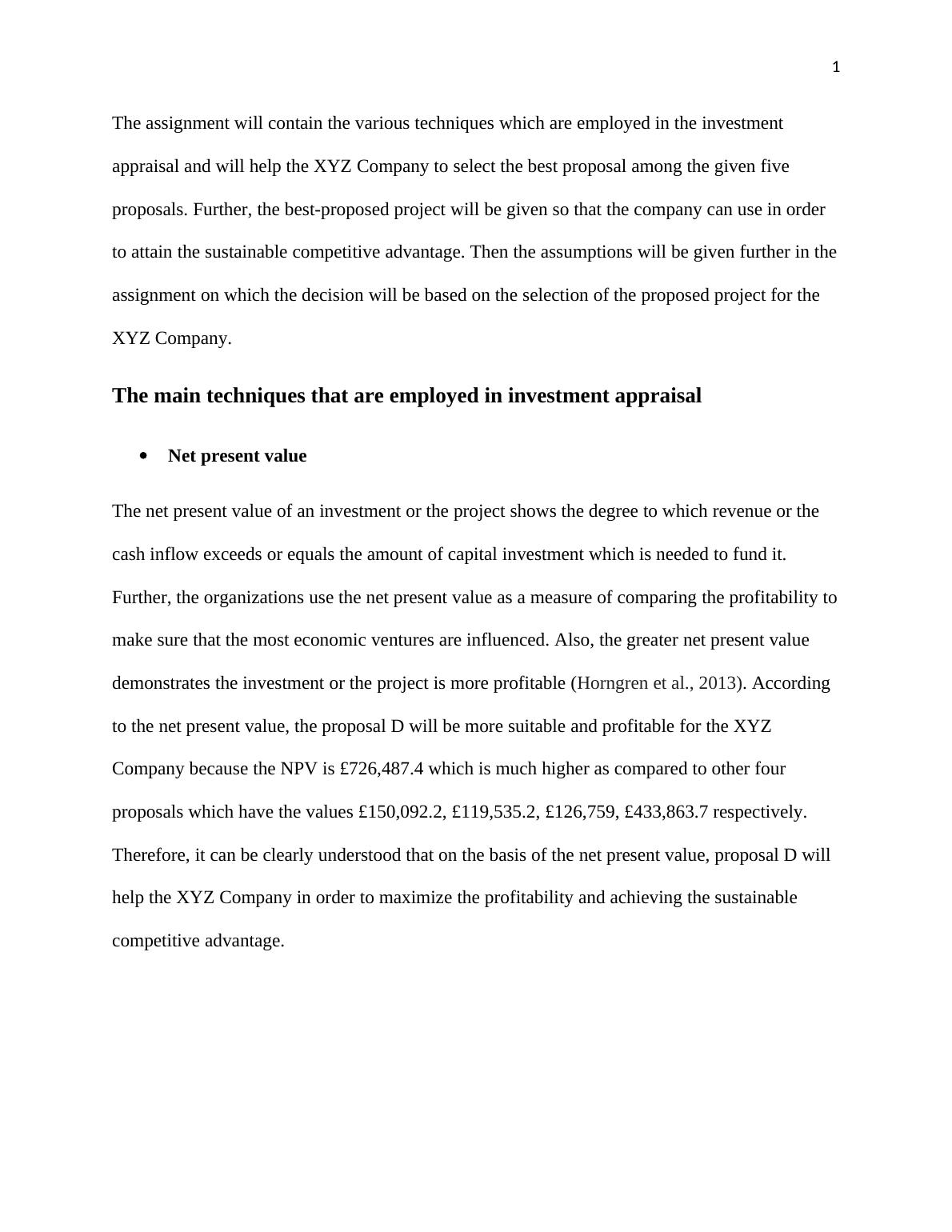

This assignment discusses the various techniques employed in investment appraisal and helps XYZ Company select the best proposal among five proposals. It also suggests the best-proposed project for sustainable competitive advantage and assumptions on which the decision is based.

Investment Appraisal Techniques and Best Proposed Project for XYZ Company

Added on 2019-09-19

BookmarkShareRelated Documents

End of preview

Want to access all the pages? Upload your documents or become a member.

Assessing suitable project for investment purpose using capital budgeting tools and techniques

|8

|1280

|90

Evaluation of Financial Analysis - PDF

|7

|1337

|32

Business Decision Making

|8

|1360

|28

Hospitality Business Management

|10

|1930

|89

Capital Budgeting and Cost of Capital

|11

|1351

|39

Evaluating the Viability of Project Using Investment Appraisal Tools and Techniques

|8

|1236

|37