Interaction of Cryptography and Economics

VerifiedAdded on 2023/04/04

|14

|1839

|390

AI Summary

The interaction between cryptography and economics can be referred to as crypto economics. The process of ultimately securing a network from parties who can listen and control the channel is referred to as cryptography.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

NB: The data set used is obtained from yahoo finance, historical data from January 31 2018 to January

31 2019.

(Q1)

Interaction of Cryptography and Economics

In a decentralized system, access is limited parties involved with interacting with the system. Bad

actors will always try to disrupt and gain access to the system. The approaches of cryptography and

economics aim to establish a decentralized network can thrive besides attempt to disruption. The

underlying concepts that make the P2P network communication secure between the parties are the

cryptography while economics is the aspect that motivates the actors to contribute to the network to

ensure its continuity.

Economics provides a layer of abstraction that ensures coordination and interaction between the

network participants in the decentralized cryptographic system. The interaction between cryptography

and economics can be referred to as crypto economics. The process of ultimately securing a network

from parties who can listen and control the channel is referred to as cryptography.

Understanding Block chain technology

This refers to a list of records that are linked together using the concepts of cryptography. Each of the

consecutive blocks of record contains a timestamp and a cryptographic hash from the previous block.

The blocks can be used to store information between two parties and the transactions involved by the

parties using a digital signature. Records that are captured using block chain are verified in a way such

that the records cannot be altered.

The invention of the block chain was meant to act as a decentralized public ledger that can manage

transactions using the cryptocurrencies. Block chain enables participants to alter and audit the

transactions independently.

Participating not involved in the communication can be able to alter the data without changing the

subsequent blocks. The block chain network has no central authority since it shared. Hence any

infrastructure built on block chain is transparent, and the parties are responsible for every transaction.

NB: The data set used is obtained from yahoo finance, historical data from January 31 2018 to January

31 2019.

(Q1)

Interaction of Cryptography and Economics

In a decentralized system, access is limited parties involved with interacting with the system. Bad

actors will always try to disrupt and gain access to the system. The approaches of cryptography and

economics aim to establish a decentralized network can thrive besides attempt to disruption. The

underlying concepts that make the P2P network communication secure between the parties are the

cryptography while economics is the aspect that motivates the actors to contribute to the network to

ensure its continuity.

Economics provides a layer of abstraction that ensures coordination and interaction between the

network participants in the decentralized cryptographic system. The interaction between cryptography

and economics can be referred to as crypto economics. The process of ultimately securing a network

from parties who can listen and control the channel is referred to as cryptography.

Understanding Block chain technology

This refers to a list of records that are linked together using the concepts of cryptography. Each of the

consecutive blocks of record contains a timestamp and a cryptographic hash from the previous block.

The blocks can be used to store information between two parties and the transactions involved by the

parties using a digital signature. Records that are captured using block chain are verified in a way such

that the records cannot be altered.

The invention of the block chain was meant to act as a decentralized public ledger that can manage

transactions using the cryptocurrencies. Block chain enables participants to alter and audit the

transactions independently.

Participating not involved in the communication can be able to alter the data without changing the

subsequent blocks. The block chain network has no central authority since it shared. Hence any

infrastructure built on block chain is transparent, and the parties are responsible for every transaction.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

(Q2)

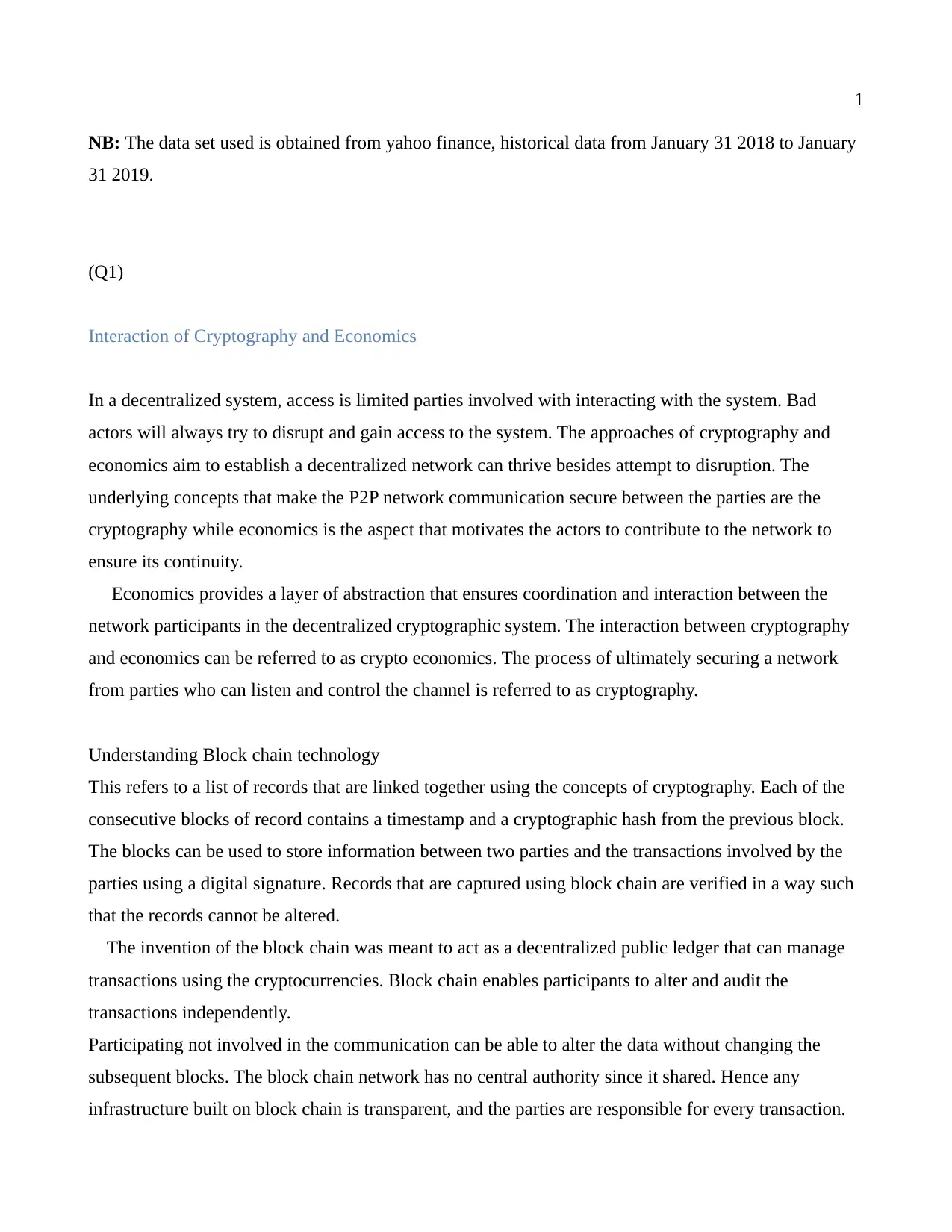

The year between 2018 and 2019 turned to be a terrible year for the bitcoin. The cryptocurrency lost

momentum and was outperformed by other cryptocurrencies. Besides shaping a great portion in the

cryptocurrency market, bitcoin continues to surge backward with as low as prices slightly above $3000.

The price of bitcoin is seen to drop at several sections of the graph. A 10% drop from the previous

recording. The key events took place between January 2018 and May 2018, when the prices of bitcoin

were high with values of up to $ 9000.

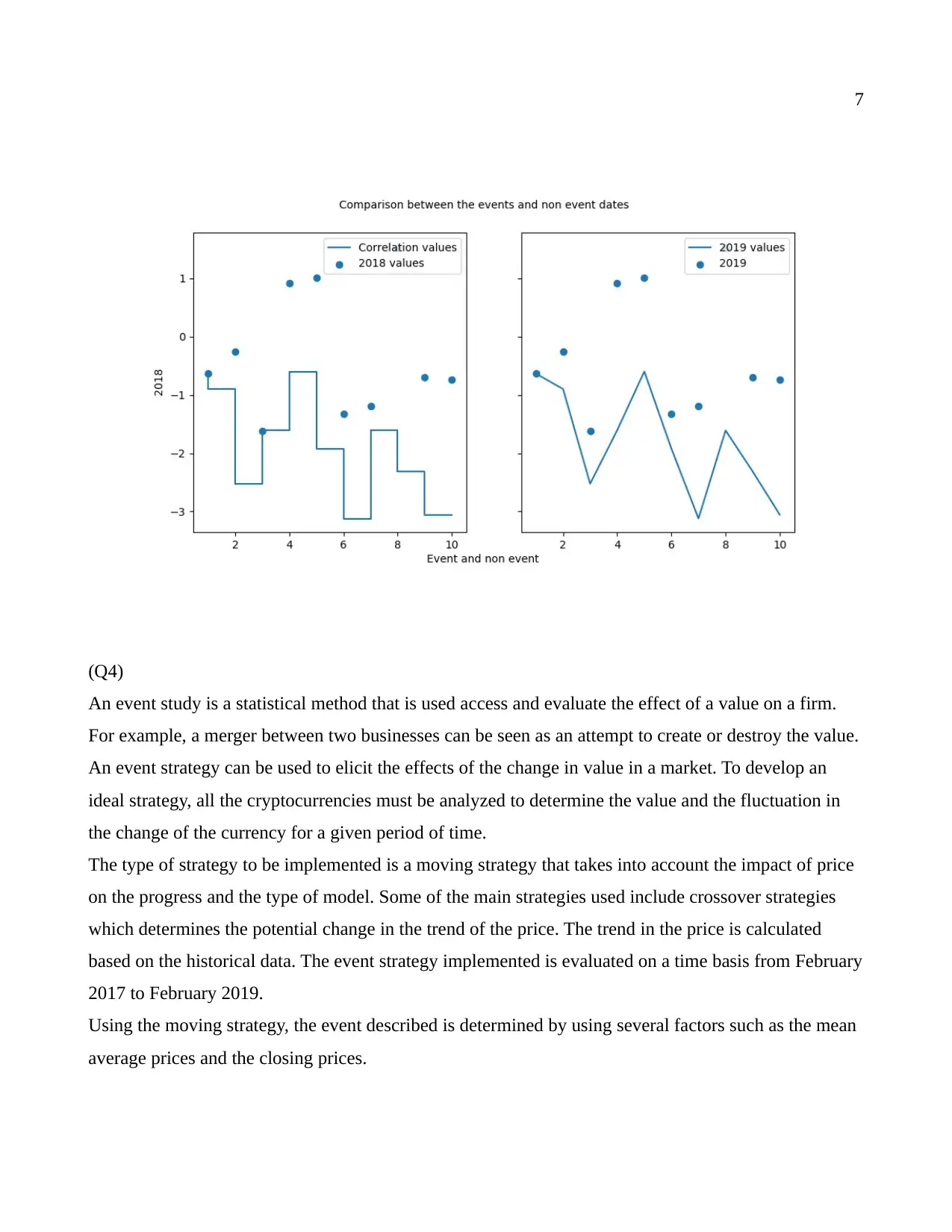

Correlations on the key and non-key events

The cryptocurrency correlation coefficient in 2018 is greater than that of 2019.

(Q2)

The year between 2018 and 2019 turned to be a terrible year for the bitcoin. The cryptocurrency lost

momentum and was outperformed by other cryptocurrencies. Besides shaping a great portion in the

cryptocurrency market, bitcoin continues to surge backward with as low as prices slightly above $3000.

The price of bitcoin is seen to drop at several sections of the graph. A 10% drop from the previous

recording. The key events took place between January 2018 and May 2018, when the prices of bitcoin

were high with values of up to $ 9000.

Correlations on the key and non-key events

The cryptocurrency correlation coefficient in 2018 is greater than that of 2019.

3

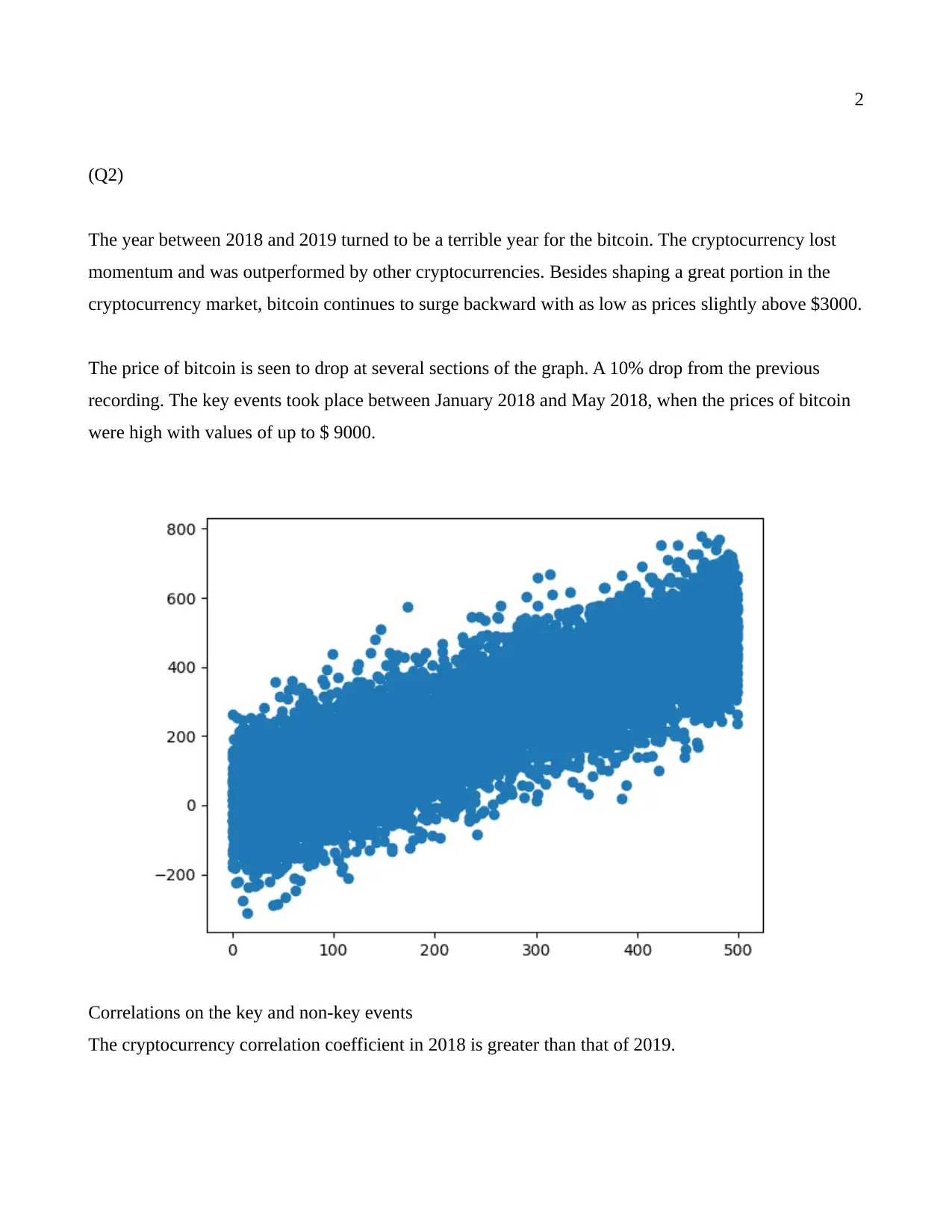

Correlation matrix which is based on the key events and the non key events. A Correlation matrix

explains the relationship between a set of given variables.

Values of standard deviation together with the defined set of variables can be used to find the

coefficient of the correlation and are based on the occurrence of the events.

It is identified that when there is a change in price for the events, the correlation value is identified to

have an exponential rise.

import pandas as _panda

_data_frame = _panda.read_csv('BTC-USD (1).csv', 'Date', True)

print(_data_frame.describe())

Correlation matrix which is based on the key events and the non key events. A Correlation matrix

explains the relationship between a set of given variables.

Values of standard deviation together with the defined set of variables can be used to find the

coefficient of the correlation and are based on the occurrence of the events.

It is identified that when there is a change in price for the events, the correlation value is identified to

have an exponential rise.

import pandas as _panda

_data_frame = _panda.read_csv('BTC-USD (1).csv', 'Date', True)

print(_data_frame.describe())

4

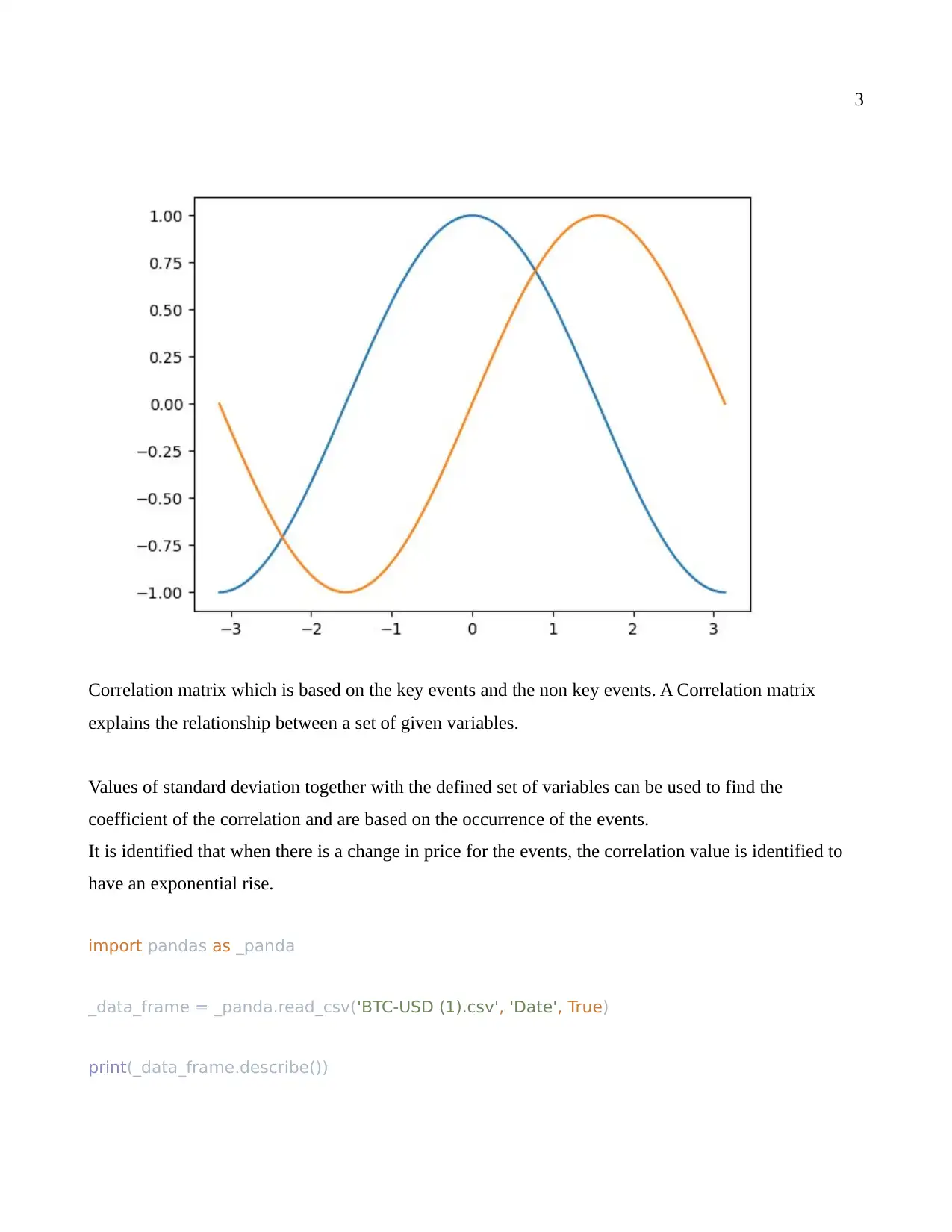

Regression analysis

Regression analysis is a statistical method that is used to identify and give the relationship between a

defined set of variables. Regression is calculated based on the key and the non key events. The key

events are identified to have a higher regression value than no key events. The price at key events is

identified to rise exponential up to a certain optimal point where it starts to drop again.

import seaborn as _sea

import pandas as _pandas

_value_of_reg = _pandas.read_csv('BTC-USD (1).csv')

_value_of_reg.head()

_value_of_reg.info()

_value_of_reg.describe()

# plot

_sea.pairplot(_value_of_reg)

print(_value_of_reg.corr)

Regression analysis

Regression analysis is a statistical method that is used to identify and give the relationship between a

defined set of variables. Regression is calculated based on the key and the non key events. The key

events are identified to have a higher regression value than no key events. The price at key events is

identified to rise exponential up to a certain optimal point where it starts to drop again.

import seaborn as _sea

import pandas as _pandas

_value_of_reg = _pandas.read_csv('BTC-USD (1).csv')

_value_of_reg.head()

_value_of_reg.info()

_value_of_reg.describe()

# plot

_sea.pairplot(_value_of_reg)

print(_value_of_reg.corr)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

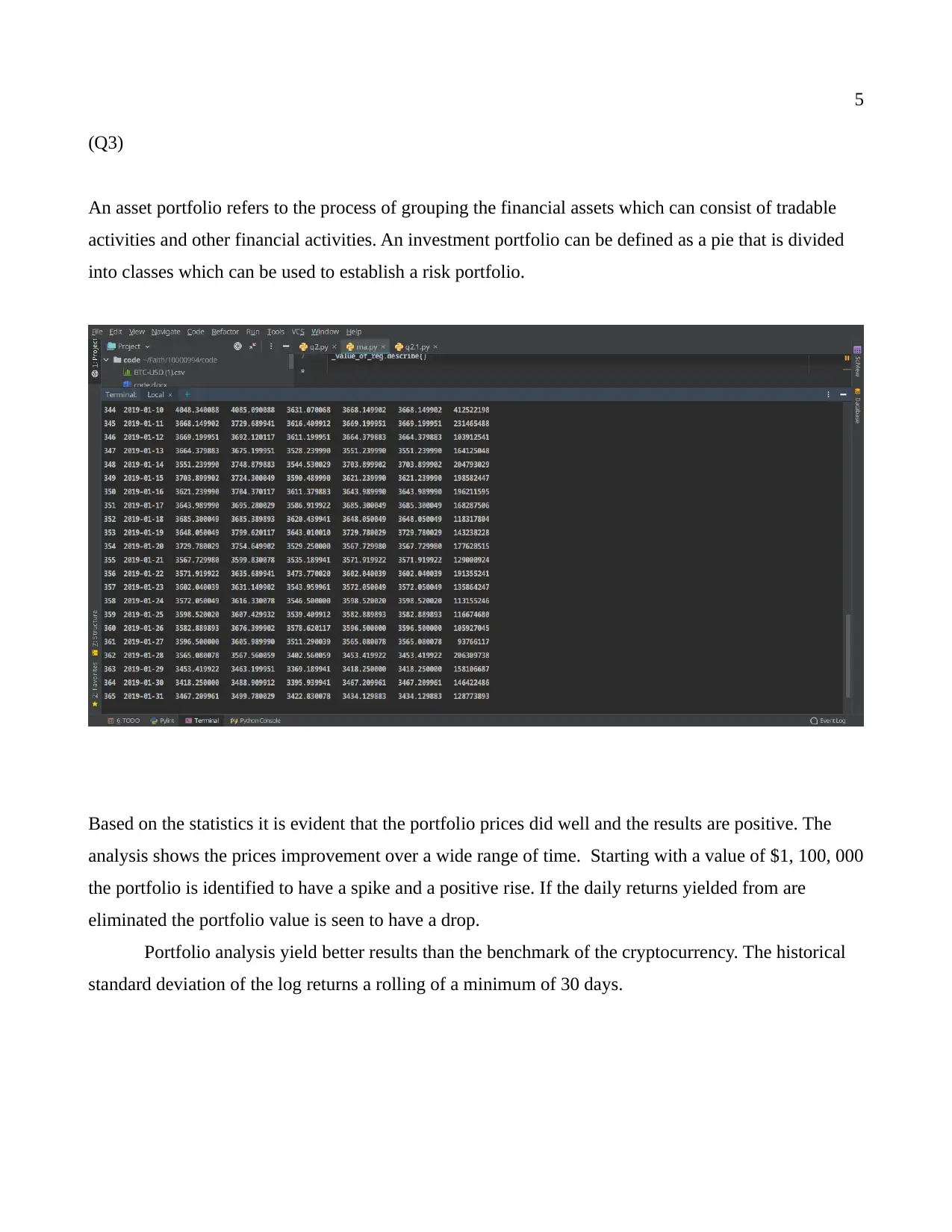

(Q3)

An asset portfolio refers to the process of grouping the financial assets which can consist of tradable

activities and other financial activities. An investment portfolio can be defined as a pie that is divided

into classes which can be used to establish a risk portfolio.

Based on the statistics it is evident that the portfolio prices did well and the results are positive. The

analysis shows the prices improvement over a wide range of time. Starting with a value of $1, 100, 000

the portfolio is identified to have a spike and a positive rise. If the daily returns yielded from are

eliminated the portfolio value is seen to have a drop.

Portfolio analysis yield better results than the benchmark of the cryptocurrency. The historical

standard deviation of the log returns a rolling of a minimum of 30 days.

(Q3)

An asset portfolio refers to the process of grouping the financial assets which can consist of tradable

activities and other financial activities. An investment portfolio can be defined as a pie that is divided

into classes which can be used to establish a risk portfolio.

Based on the statistics it is evident that the portfolio prices did well and the results are positive. The

analysis shows the prices improvement over a wide range of time. Starting with a value of $1, 100, 000

the portfolio is identified to have a spike and a positive rise. If the daily returns yielded from are

eliminated the portfolio value is seen to have a drop.

Portfolio analysis yield better results than the benchmark of the cryptocurrency. The historical

standard deviation of the log returns a rolling of a minimum of 30 days.

6

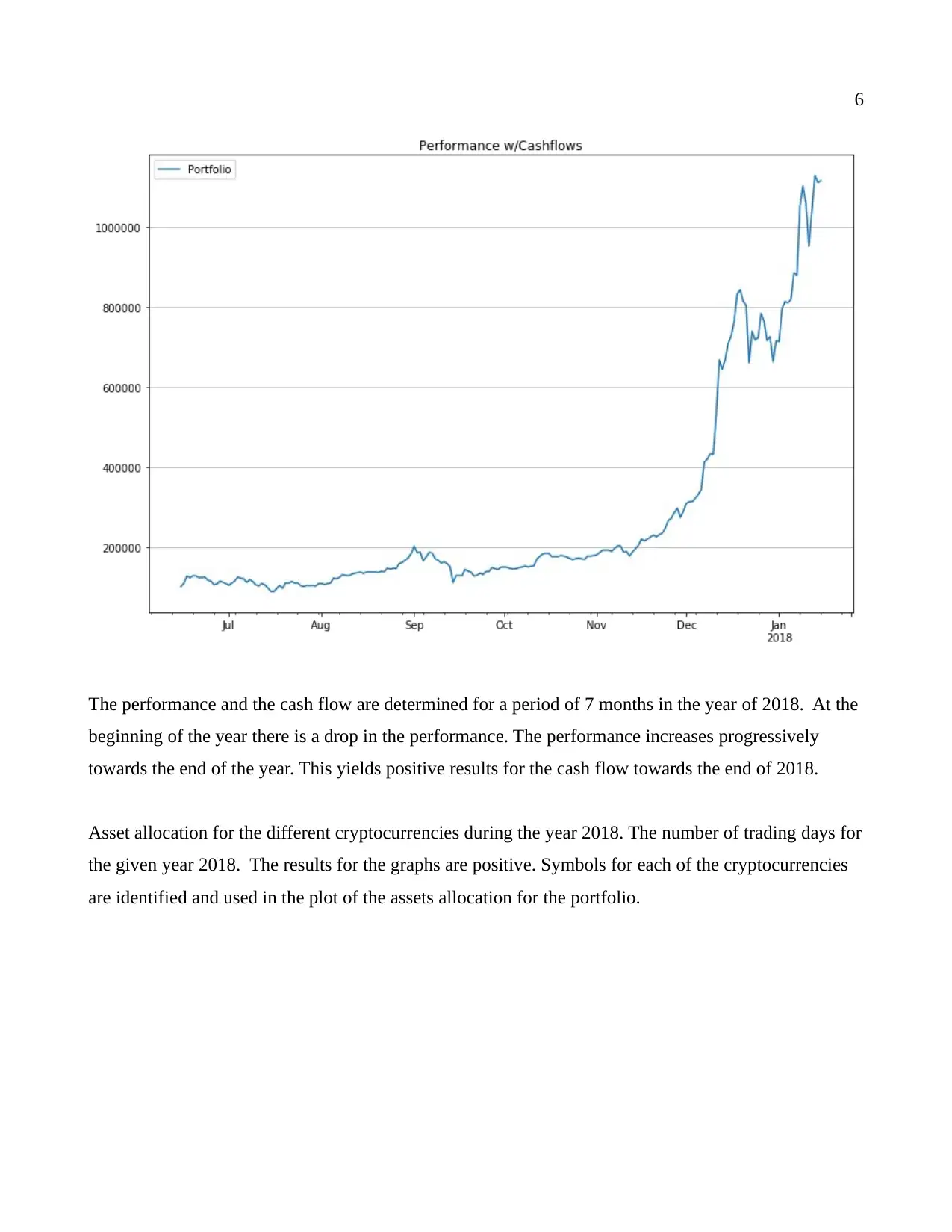

The performance and the cash flow are determined for a period of 7 months in the year of 2018. At the

beginning of the year there is a drop in the performance. The performance increases progressively

towards the end of the year. This yields positive results for the cash flow towards the end of 2018.

Asset allocation for the different cryptocurrencies during the year 2018. The number of trading days for

the given year 2018. The results for the graphs are positive. Symbols for each of the cryptocurrencies

are identified and used in the plot of the assets allocation for the portfolio.

The performance and the cash flow are determined for a period of 7 months in the year of 2018. At the

beginning of the year there is a drop in the performance. The performance increases progressively

towards the end of the year. This yields positive results for the cash flow towards the end of 2018.

Asset allocation for the different cryptocurrencies during the year 2018. The number of trading days for

the given year 2018. The results for the graphs are positive. Symbols for each of the cryptocurrencies

are identified and used in the plot of the assets allocation for the portfolio.

7

(Q4)

An event study is a statistical method that is used access and evaluate the effect of a value on a firm.

For example, a merger between two businesses can be seen as an attempt to create or destroy the value.

An event strategy can be used to elicit the effects of the change in value in a market. To develop an

ideal strategy, all the cryptocurrencies must be analyzed to determine the value and the fluctuation in

the change of the currency for a given period of time.

The type of strategy to be implemented is a moving strategy that takes into account the impact of price

on the progress and the type of model. Some of the main strategies used include crossover strategies

which determines the potential change in the trend of the price. The trend in the price is calculated

based on the historical data. The event strategy implemented is evaluated on a time basis from February

2017 to February 2019.

Using the moving strategy, the event described is determined by using several factors such as the mean

average prices and the closing prices.

(Q4)

An event study is a statistical method that is used access and evaluate the effect of a value on a firm.

For example, a merger between two businesses can be seen as an attempt to create or destroy the value.

An event strategy can be used to elicit the effects of the change in value in a market. To develop an

ideal strategy, all the cryptocurrencies must be analyzed to determine the value and the fluctuation in

the change of the currency for a given period of time.

The type of strategy to be implemented is a moving strategy that takes into account the impact of price

on the progress and the type of model. Some of the main strategies used include crossover strategies

which determines the potential change in the trend of the price. The trend in the price is calculated

based on the historical data. The event strategy implemented is evaluated on a time basis from February

2017 to February 2019.

Using the moving strategy, the event described is determined by using several factors such as the mean

average prices and the closing prices.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

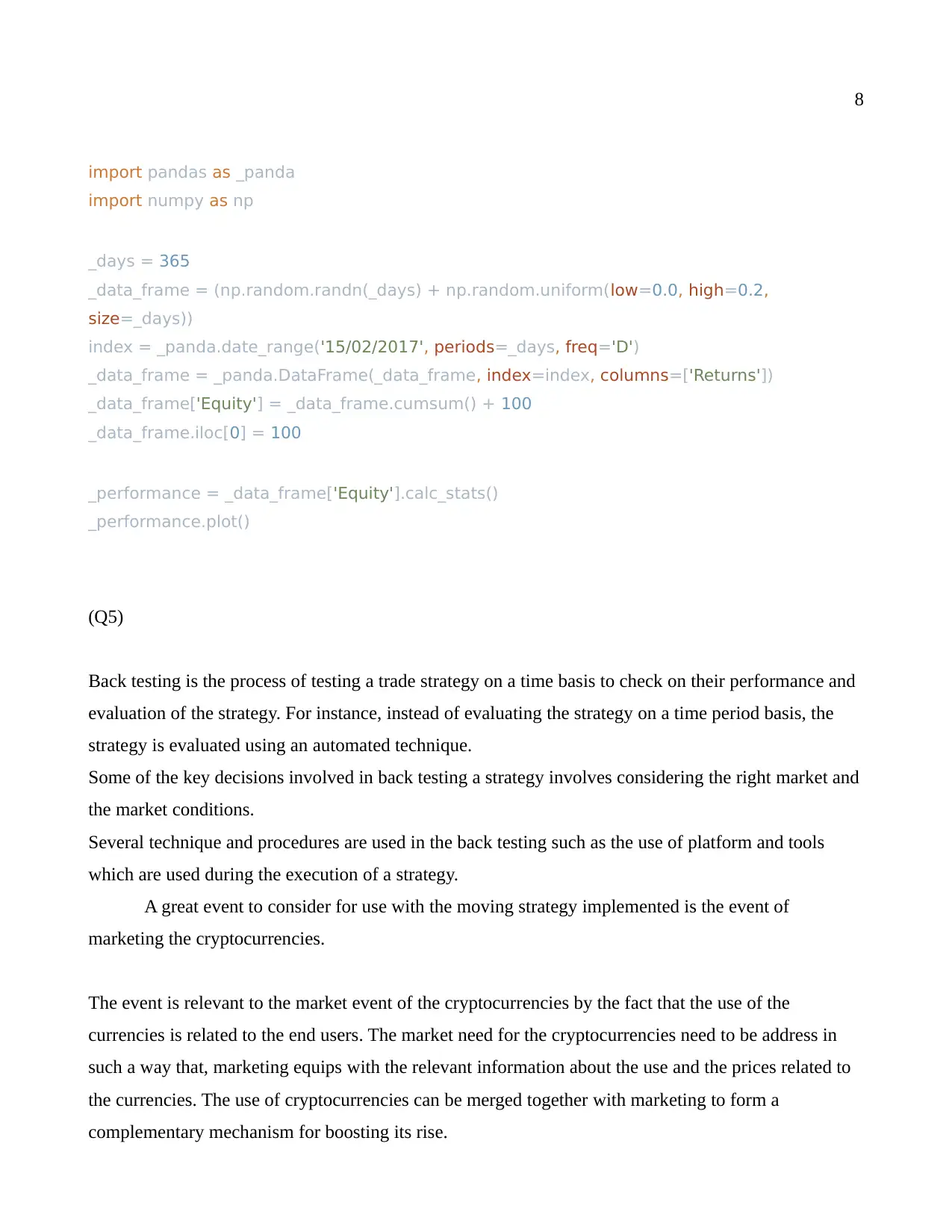

import pandas as _panda

import numpy as np

_days = 365

_data_frame = (np.random.randn(_days) + np.random.uniform(low=0.0, high=0.2,

size=_days))

index = _panda.date_range('15/02/2017', periods=_days, freq='D')

_data_frame = _panda.DataFrame(_data_frame, index=index, columns=['Returns'])

_data_frame['Equity'] = _data_frame.cumsum() + 100

_data_frame.iloc[0] = 100

_performance = _data_frame['Equity'].calc_stats()

_performance.plot()

(Q5)

Back testing is the process of testing a trade strategy on a time basis to check on their performance and

evaluation of the strategy. For instance, instead of evaluating the strategy on a time period basis, the

strategy is evaluated using an automated technique.

Some of the key decisions involved in back testing a strategy involves considering the right market and

the market conditions.

Several technique and procedures are used in the back testing such as the use of platform and tools

which are used during the execution of a strategy.

A great event to consider for use with the moving strategy implemented is the event of

marketing the cryptocurrencies.

The event is relevant to the market event of the cryptocurrencies by the fact that the use of the

currencies is related to the end users. The market need for the cryptocurrencies need to be address in

such a way that, marketing equips with the relevant information about the use and the prices related to

the currencies. The use of cryptocurrencies can be merged together with marketing to form a

complementary mechanism for boosting its rise.

import pandas as _panda

import numpy as np

_days = 365

_data_frame = (np.random.randn(_days) + np.random.uniform(low=0.0, high=0.2,

size=_days))

index = _panda.date_range('15/02/2017', periods=_days, freq='D')

_data_frame = _panda.DataFrame(_data_frame, index=index, columns=['Returns'])

_data_frame['Equity'] = _data_frame.cumsum() + 100

_data_frame.iloc[0] = 100

_performance = _data_frame['Equity'].calc_stats()

_performance.plot()

(Q5)

Back testing is the process of testing a trade strategy on a time basis to check on their performance and

evaluation of the strategy. For instance, instead of evaluating the strategy on a time period basis, the

strategy is evaluated using an automated technique.

Some of the key decisions involved in back testing a strategy involves considering the right market and

the market conditions.

Several technique and procedures are used in the back testing such as the use of platform and tools

which are used during the execution of a strategy.

A great event to consider for use with the moving strategy implemented is the event of

marketing the cryptocurrencies.

The event is relevant to the market event of the cryptocurrencies by the fact that the use of the

currencies is related to the end users. The market need for the cryptocurrencies need to be address in

such a way that, marketing equips with the relevant information about the use and the prices related to

the currencies. The use of cryptocurrencies can be merged together with marketing to form a

complementary mechanism for boosting its rise.

9

The promotion is a technique that can be used as a marketing strategy to identify and influence the

growth of the cryptocurrencies to the target market.

It is possible to make money using this event. Marketing is an income generating event that can be used

to generate income. The strategies and the methods used in the strategy are the common factors that can

be used to determine the amount of money to earn from the event.

The strategy is a risking one to some extent. It involves reaching out to end-users who have no ideas

about the cryptocurrencies. The strategy is not only focused and triggered to a certain market, but also

involves the entire market.

It is estimated to make an average earning of $3000 for each of the given trade for a general term of

year. Working on this strategy involves a lot overhead that increase the risk of working with the

strategy and might affect the duration of time and operation on the strategy.

The risk can be reduced by analyzing the target strategy with the target market where the strategy it to

be carried out.

The promotion is a technique that can be used as a marketing strategy to identify and influence the

growth of the cryptocurrencies to the target market.

It is possible to make money using this event. Marketing is an income generating event that can be used

to generate income. The strategies and the methods used in the strategy are the common factors that can

be used to determine the amount of money to earn from the event.

The strategy is a risking one to some extent. It involves reaching out to end-users who have no ideas

about the cryptocurrencies. The strategy is not only focused and triggered to a certain market, but also

involves the entire market.

It is estimated to make an average earning of $3000 for each of the given trade for a general term of

year. Working on this strategy involves a lot overhead that increase the risk of working with the

strategy and might affect the duration of time and operation on the strategy.

The risk can be reduced by analyzing the target strategy with the target market where the strategy it to

be carried out.

10

References

Apte, S., & Petrovsky, N., 2016. Will blockchain technology revolutionize excipient supply chain

management? .Journal of Excipients and Food Chemicals, 7(3), 910.

Buterin, V., 2017. Introduction to cryptoeconomics.

Jin, S., Ali, R., & Vlasov, A. V., 2017. Cryptoeconomics: Data Application for Token Sales Analysis. In

International Conference Information Systems.

Swan, M., 2015. Blockchain: Blueprint for a new economy. " O'Reilly Media, Inc.".

References

Apte, S., & Petrovsky, N., 2016. Will blockchain technology revolutionize excipient supply chain

management? .Journal of Excipients and Food Chemicals, 7(3), 910.

Buterin, V., 2017. Introduction to cryptoeconomics.

Jin, S., Ali, R., & Vlasov, A. V., 2017. Cryptoeconomics: Data Application for Token Sales Analysis. In

International Conference Information Systems.

Swan, M., 2015. Blockchain: Blueprint for a new economy. " O'Reilly Media, Inc.".

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

APPENDIX

Q2.

Formulation of Corelation is based on:

x_vlu, _y_value = sum(x) / len(x), sum(y) / len(y)

cov = sum([(a - x_vlu) * (b - _y_value) for a, b in zip(x, y)])

return (cov / math.sqrt(x_vlu)) / math.sqrt(sum([(b - _y_value) ** 2 for b in y]))

import pandas as panda

import seaborn as sns

_data_file = panda.read_csv('BTC-USD (1).csv', 'Date', True)

_data_file['H-L'] = _data_file.High - _data_file.Low

# data from file

regression = panda.read_csv('BTC-USD (1).csv')

# represent the regression data for the file

regression.head()

regression.info()

regression.describe()

regression.columns

# describe the data from the file

print(_data_file.describe())

# statistical data analysis

sns.pairplot(regression)

sns.distplot(regression['Date'])

print(regression.corr)

# used to calculate the positive correlation and plot a graph

import numpy as _numpy

import matplotlib

import matplotlib.pyplot as _plot

APPENDIX

Q2.

Formulation of Corelation is based on:

x_vlu, _y_value = sum(x) / len(x), sum(y) / len(y)

cov = sum([(a - x_vlu) * (b - _y_value) for a, b in zip(x, y)])

return (cov / math.sqrt(x_vlu)) / math.sqrt(sum([(b - _y_value) ** 2 for b in y]))

import pandas as panda

import seaborn as sns

_data_file = panda.read_csv('BTC-USD (1).csv', 'Date', True)

_data_file['H-L'] = _data_file.High - _data_file.Low

# data from file

regression = panda.read_csv('BTC-USD (1).csv')

# represent the regression data for the file

regression.head()

regression.info()

regression.describe()

regression.columns

# describe the data from the file

print(_data_file.describe())

# statistical data analysis

sns.pairplot(regression)

sns.distplot(regression['Date'])

print(regression.corr)

# used to calculate the positive correlation and plot a graph

import numpy as _numpy

import matplotlib

import matplotlib.pyplot as _plot

12

_numpy.random.seed(1)

# seed

_value_x = _numpy.random.randint(0, 500, 10000)

# find the positive correlations with the given values

_value_y = _value_x + _numpy.random.normal(0, 100, 10000)

_numpy.corrcoef(_value_x, _value_y)

_plot.scatter(_value_x, _value_y)

_plot.show()

Q3.

import os

import pandas as pd

def assess_portfolio(_assest):

# function takes asset_allocation as the input

_tr = pd.read_csv('BTC-USD (1).csv', index_col=0)

_tr.index = pd.to_datetime(_tr.index)

fiat = 'usd'

tickers = list(set(_tr['Price']))

tickers = [ticker.lower() for ticker in tickers if ticker.lower() != fiat]

# read the columns of data from the file

column_names = ['Date', 'Open', 'High', 'Low']

_numpy.random.seed(1)

# seed

_value_x = _numpy.random.randint(0, 500, 10000)

# find the positive correlations with the given values

_value_y = _value_x + _numpy.random.normal(0, 100, 10000)

_numpy.corrcoef(_value_x, _value_y)

_plot.scatter(_value_x, _value_y)

_plot.show()

Q3.

import os

import pandas as pd

def assess_portfolio(_assest):

# function takes asset_allocation as the input

_tr = pd.read_csv('BTC-USD (1).csv', index_col=0)

_tr.index = pd.to_datetime(_tr.index)

fiat = 'usd'

tickers = list(set(_tr['Price']))

tickers = [ticker.lower() for ticker in tickers if ticker.lower() != fiat]

# read the columns of data from the file

column_names = ['Date', 'Open', 'High', 'Low']

13

_market = {}

for _f in os.listdir('data'):

ticker = _f.split('-')[0].lower()

if ticker not in tickers:

continue

# capture data from the file

_data_from_file = pd.read_csv('data' + os.sep + _f)

_cur_col = list(_data_from_file)

column_names_map = {_cur_col[_i]: column_names[_i] for _i in

range(len(column_names))}

_data_from_file.rename(columns=column_names_map, inplace=True)

# set the starting date for the strategy

_data_from_file.set_index(['Date'], inplace=True)

_data_from_file.index = pd.to_datetime(_data_from_file.index)

_market[ticker] = _data_from_file

Q4.

import pandas as _panda

import numpy as np

_days = 365

_data_frame = (np.random.randn(_days) + np.random.uniform(low=0.0, high=0.2,

size=_days))

index = _panda.date_range('15/02/2017', periods=_days, freq='D')

_data_frame = _panda.DataFrame(_data_frame, index=index, columns=['Returns'])

_data_frame['Equity'] = _data_frame.cumsum() + 100

_data_frame.iloc[0] = 100

_market = {}

for _f in os.listdir('data'):

ticker = _f.split('-')[0].lower()

if ticker not in tickers:

continue

# capture data from the file

_data_from_file = pd.read_csv('data' + os.sep + _f)

_cur_col = list(_data_from_file)

column_names_map = {_cur_col[_i]: column_names[_i] for _i in

range(len(column_names))}

_data_from_file.rename(columns=column_names_map, inplace=True)

# set the starting date for the strategy

_data_from_file.set_index(['Date'], inplace=True)

_data_from_file.index = pd.to_datetime(_data_from_file.index)

_market[ticker] = _data_from_file

Q4.

import pandas as _panda

import numpy as np

_days = 365

_data_frame = (np.random.randn(_days) + np.random.uniform(low=0.0, high=0.2,

size=_days))

index = _panda.date_range('15/02/2017', periods=_days, freq='D')

_data_frame = _panda.DataFrame(_data_frame, index=index, columns=['Returns'])

_data_frame['Equity'] = _data_frame.cumsum() + 100

_data_frame.iloc[0] = 100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

_performance = _data_frame['Equity'].calc_stats()

_performance.plot()

_performance = _data_frame['Equity'].calc_stats()

_performance.plot()

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.