Arden University FIN4001 Assignment: Finance and Budgeting Analysis

VerifiedAdded on 2022/11/14

|12

|2983

|230

Homework Assignment

AI Summary

This document presents a comprehensive solution to a FIN4001 Introduction to Finance assignment. The solution addresses several key areas, including the implications of corporate governance codes in preventing corporate scandals, contrasting the advantages of a sole trader versus a company, and providing detailed budgeting exercises. The budgeting section includes a production budget, calculation of unit costs, and a cash budget, as well as a discussion on the disadvantages of zero-based budgeting. Furthermore, the assignment analyzes cost-volume-profit analysis, including its strengths and weaknesses. Finally, the solution outlines various funding options available to an entrepreneur, considering equity sources and personal investment strategies to maintain a specific ownership stake. The document provides detailed calculations, explanations, and analyses to aid in understanding the concepts of finance.

1

FIN4001

Introduction to Finance

FIN4001

Introduction to Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Question 1:

Part A: Implication of adherence to various corporate governance codes in prevention of

corporate scandals and collapses

The corporate governance systems and mechanism within organizations has been a

subject of discussion among the investors and the professional bodies involved in developing and

implementation of the governance reforms since many years. They can be defined as the

structures and processes that need to be adopted by businesses for maintaining direction and

control in order to protect the interest of the stakeholders. The importance of such structures and

processes has been emphasized after the occurrence of corporate collapse such as Enron,

WorldCom and others high profile organization mainly due to their weak corporate governance

structures (Adewale, 2013). These corporate collapses have highlighted the importance of

development and implementation of strong corporate governance mechanism within

organizations for increasing transparency and accountability in the business operations.

The typical method for ensuring effective corporate governance structures in the

companies is through implementation of corporate governance codes that are the documents

stating rules and procedures for governing and managing corporations. The codes are developed

by self-regulating professional bodies in coordination with the relevant government regulating

agencies. However, these are adopted and implemented by the board of directors of a business

corporation. The compliance with these codes is regarded to be necessary for the prevention of

corporate frauds and scandals. For example, it has been demonstrated by the case of corporate

collapse of Enron that the main reason for its downfall is lack of an effective corporate

governance structure which lead to the occurrence of agency issues. The lack of alignment

between the shareholders and the company directors lead to the rise of principal-agency issues.

The business managers were driven by the pursuit of maximizing their self-interest and relatively

ignored the interest of the shareholders which eventually lead to the downfall of the company.

The board of directors failed to meet their regulatory role within the company resulting in

prevalence of illegal activities which eventually lead to its downfall (Cuong, 2011).

Thus, the presence of corporate governance codes helps in ensuring that business

conducts their operations in an ethical manner and helps in resolution of agency problem or any

type of conflict of interest between the shareholders and the business managers. These codes

help in ensuring that managers acting as agents are continually monitored for prevention of abuse

of power and they act in the best interests of the organization. They act as proper checks and

helps in overcoming the agency issues by ensuring that agent goals are aligned with that of

principal (Otusanya, Lauwo and Adeyeye, 2012).

Part B: Advantages of Organization acting as a sole trader as compared to that of a

Company

Question 1:

Part A: Implication of adherence to various corporate governance codes in prevention of

corporate scandals and collapses

The corporate governance systems and mechanism within organizations has been a

subject of discussion among the investors and the professional bodies involved in developing and

implementation of the governance reforms since many years. They can be defined as the

structures and processes that need to be adopted by businesses for maintaining direction and

control in order to protect the interest of the stakeholders. The importance of such structures and

processes has been emphasized after the occurrence of corporate collapse such as Enron,

WorldCom and others high profile organization mainly due to their weak corporate governance

structures (Adewale, 2013). These corporate collapses have highlighted the importance of

development and implementation of strong corporate governance mechanism within

organizations for increasing transparency and accountability in the business operations.

The typical method for ensuring effective corporate governance structures in the

companies is through implementation of corporate governance codes that are the documents

stating rules and procedures for governing and managing corporations. The codes are developed

by self-regulating professional bodies in coordination with the relevant government regulating

agencies. However, these are adopted and implemented by the board of directors of a business

corporation. The compliance with these codes is regarded to be necessary for the prevention of

corporate frauds and scandals. For example, it has been demonstrated by the case of corporate

collapse of Enron that the main reason for its downfall is lack of an effective corporate

governance structure which lead to the occurrence of agency issues. The lack of alignment

between the shareholders and the company directors lead to the rise of principal-agency issues.

The business managers were driven by the pursuit of maximizing their self-interest and relatively

ignored the interest of the shareholders which eventually lead to the downfall of the company.

The board of directors failed to meet their regulatory role within the company resulting in

prevalence of illegal activities which eventually lead to its downfall (Cuong, 2011).

Thus, the presence of corporate governance codes helps in ensuring that business

conducts their operations in an ethical manner and helps in resolution of agency problem or any

type of conflict of interest between the shareholders and the business managers. These codes

help in ensuring that managers acting as agents are continually monitored for prevention of abuse

of power and they act in the best interests of the organization. They act as proper checks and

helps in overcoming the agency issues by ensuring that agent goals are aligned with that of

principal (Otusanya, Lauwo and Adeyeye, 2012).

Part B: Advantages of Organization acting as a sole trader as compared to that of a

Company

3

The major advantage of acting as a sole trader as compared to that of a company it

provides complete control over the business. Being a sole trader, one can retain all the profits

after tax while in a company there is less control of the owner over the business as the profits can

be retained only after meeting the corporation tax and the dividend payments. In addition to this,

it provides the benefit of making the decisions alone and this it is relatively easy to make the

significant changes as per the external conditions. For example, it is easier for causing changes in

the prices or making modifications in the product to meet the needs and requirements of the

customers (Bouchoux, 2009). Thus, the ability to make quick decisions can provide major

benefits for a sole trader in a competitive and dynamic market. On the other hand, in a limited

company the decision-making is slow as the owners cannot make the necessary changes by

themselves and the decision are taken in mutual consent with the board of directors.

The formation of sole trader is also regarded as the quickest and simplest way for running

a business in comparison to that of establishment of a limited company. This is because there is

no requirement for registration of a company unlike to that in the case of a limited company

which requires registration and therefore the process of its establishment is rather complex. Also,

the business running in the form of sole proprietorship does not require professional guidance

which significantly reduces the cost of establishing a business. On the contrary, the owners

usually employ the services of a formation agent during the establishment of a limited company

which consequently leads to increase in the cost as fees need to be paid to them for their

professional guidance. The accounting processes in the case of sole traders is much simple as

compared to that for a limited company with no requirement of developing financial reports on

an annual basis or filing tax returns. There only exist requirements of maintaining records of

invoices and expenses whereas in case of limited company there is complex accounting process

that involves recording and maintaining of financial statements (Miller and Jentz, 2009).

The major advantage of acting as a sole trader as compared to that of a company it

provides complete control over the business. Being a sole trader, one can retain all the profits

after tax while in a company there is less control of the owner over the business as the profits can

be retained only after meeting the corporation tax and the dividend payments. In addition to this,

it provides the benefit of making the decisions alone and this it is relatively easy to make the

significant changes as per the external conditions. For example, it is easier for causing changes in

the prices or making modifications in the product to meet the needs and requirements of the

customers (Bouchoux, 2009). Thus, the ability to make quick decisions can provide major

benefits for a sole trader in a competitive and dynamic market. On the other hand, in a limited

company the decision-making is slow as the owners cannot make the necessary changes by

themselves and the decision are taken in mutual consent with the board of directors.

The formation of sole trader is also regarded as the quickest and simplest way for running

a business in comparison to that of establishment of a limited company. This is because there is

no requirement for registration of a company unlike to that in the case of a limited company

which requires registration and therefore the process of its establishment is rather complex. Also,

the business running in the form of sole proprietorship does not require professional guidance

which significantly reduces the cost of establishing a business. On the contrary, the owners

usually employ the services of a formation agent during the establishment of a limited company

which consequently leads to increase in the cost as fees need to be paid to them for their

professional guidance. The accounting processes in the case of sole traders is much simple as

compared to that for a limited company with no requirement of developing financial reports on

an annual basis or filing tax returns. There only exist requirements of maintaining records of

invoices and expenses whereas in case of limited company there is complex accounting process

that involves recording and maintaining of financial statements (Miller and Jentz, 2009).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

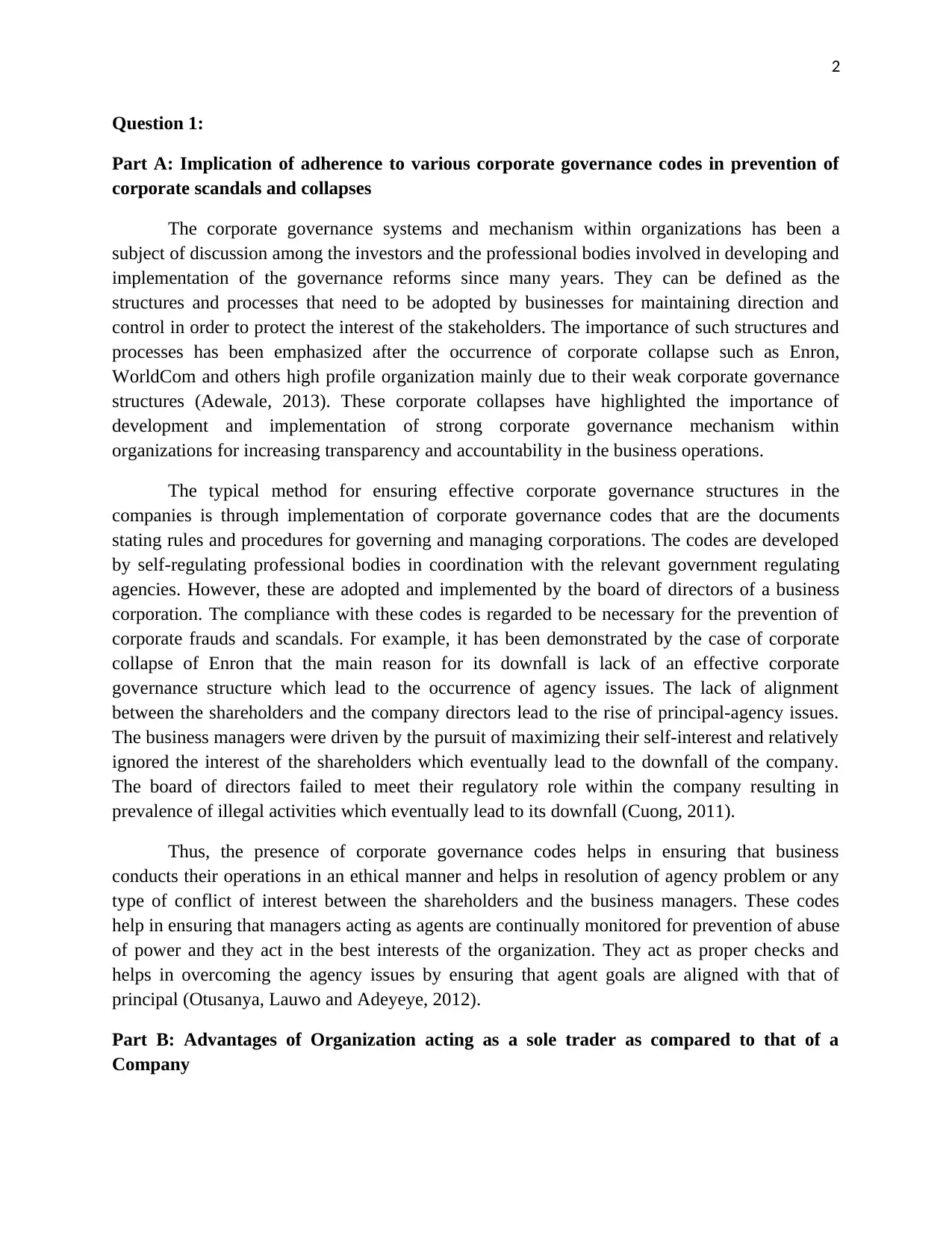

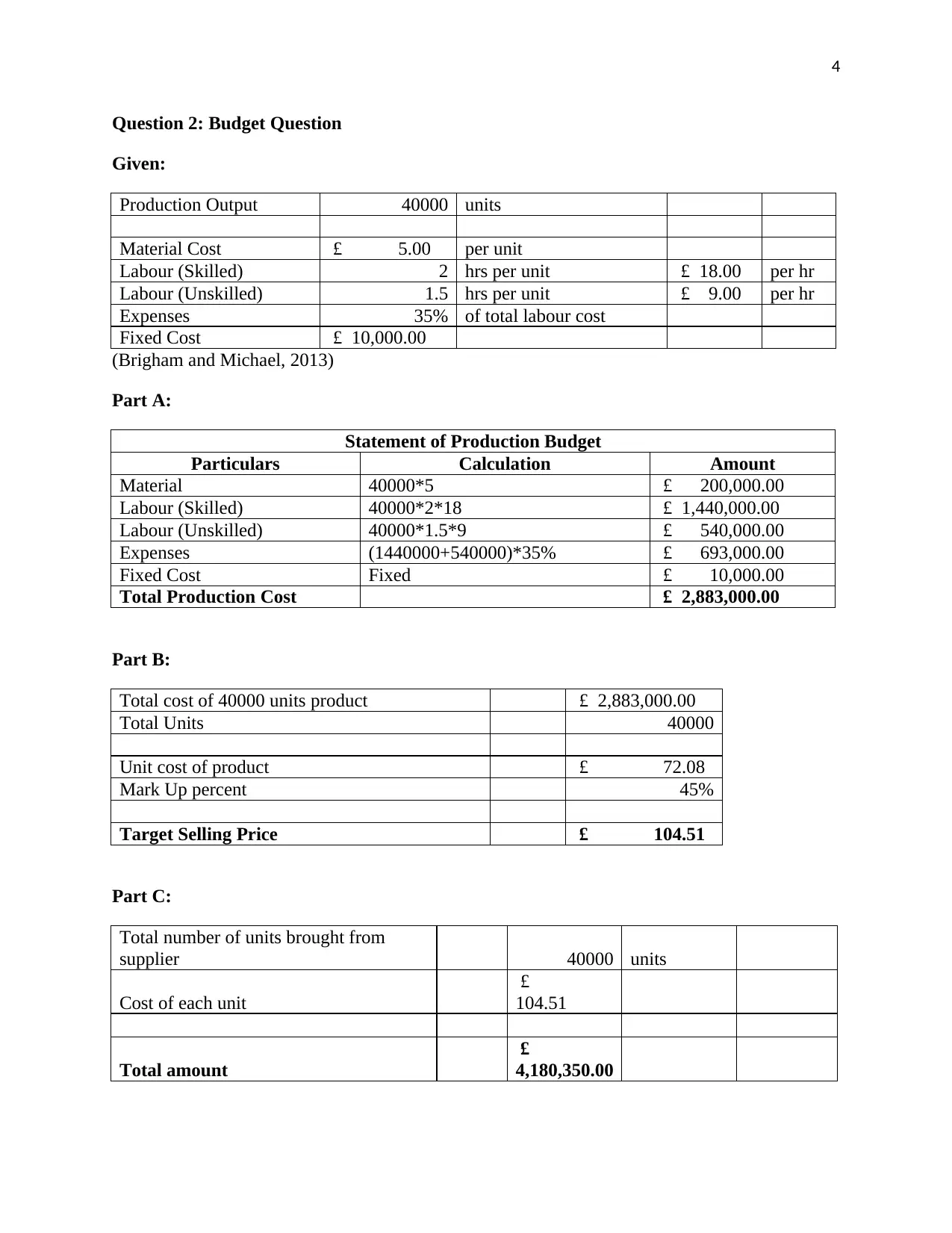

Question 2: Budget Question

Given:

Production Output 40000 units

Material Cost £ 5.00 per unit

Labour (Skilled) 2 hrs per unit £ 18.00 per hr

Labour (Unskilled) 1.5 hrs per unit £ 9.00 per hr

Expenses 35% of total labour cost

Fixed Cost £ 10,000.00

(Brigham and Michael, 2013)

Part A:

Statement of Production Budget

Particulars Calculation Amount

Material 40000*5 £ 200,000.00

Labour (Skilled) 40000*2*18 £ 1,440,000.00

Labour (Unskilled) 40000*1.5*9 £ 540,000.00

Expenses (1440000+540000)*35% £ 693,000.00

Fixed Cost Fixed £ 10,000.00

Total Production Cost £ 2,883,000.00

Part B:

Total cost of 40000 units product £ 2,883,000.00

Total Units 40000

Unit cost of product £ 72.08

Mark Up percent 45%

Target Selling Price £ 104.51

Part C:

Total number of units brought from

supplier 40000 units

Cost of each unit

£

104.51

Total amount

£

4,180,350.00

Question 2: Budget Question

Given:

Production Output 40000 units

Material Cost £ 5.00 per unit

Labour (Skilled) 2 hrs per unit £ 18.00 per hr

Labour (Unskilled) 1.5 hrs per unit £ 9.00 per hr

Expenses 35% of total labour cost

Fixed Cost £ 10,000.00

(Brigham and Michael, 2013)

Part A:

Statement of Production Budget

Particulars Calculation Amount

Material 40000*5 £ 200,000.00

Labour (Skilled) 40000*2*18 £ 1,440,000.00

Labour (Unskilled) 40000*1.5*9 £ 540,000.00

Expenses (1440000+540000)*35% £ 693,000.00

Fixed Cost Fixed £ 10,000.00

Total Production Cost £ 2,883,000.00

Part B:

Total cost of 40000 units product £ 2,883,000.00

Total Units 40000

Unit cost of product £ 72.08

Mark Up percent 45%

Target Selling Price £ 104.51

Part C:

Total number of units brought from

supplier 40000 units

Cost of each unit

£

104.51

Total amount

£

4,180,350.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

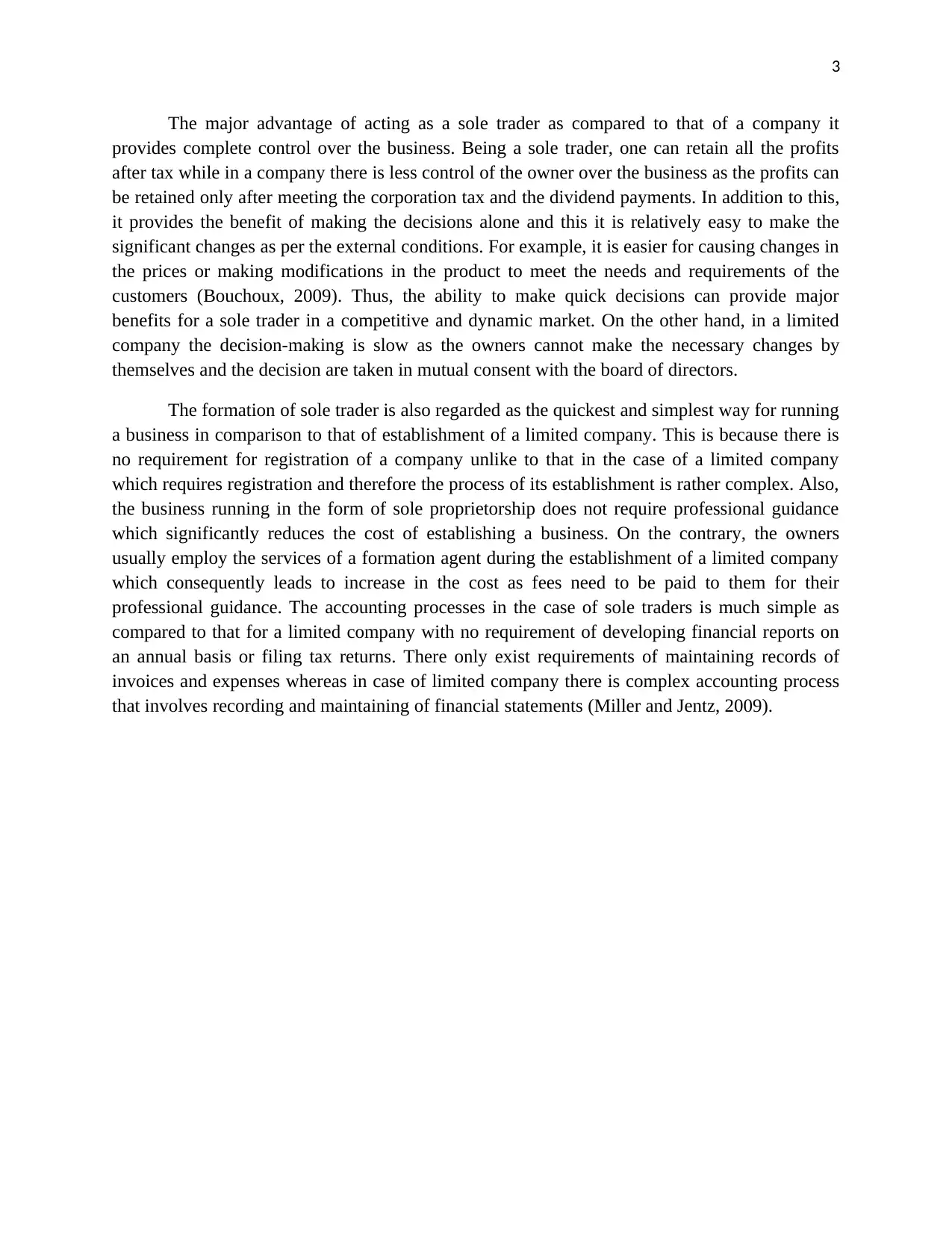

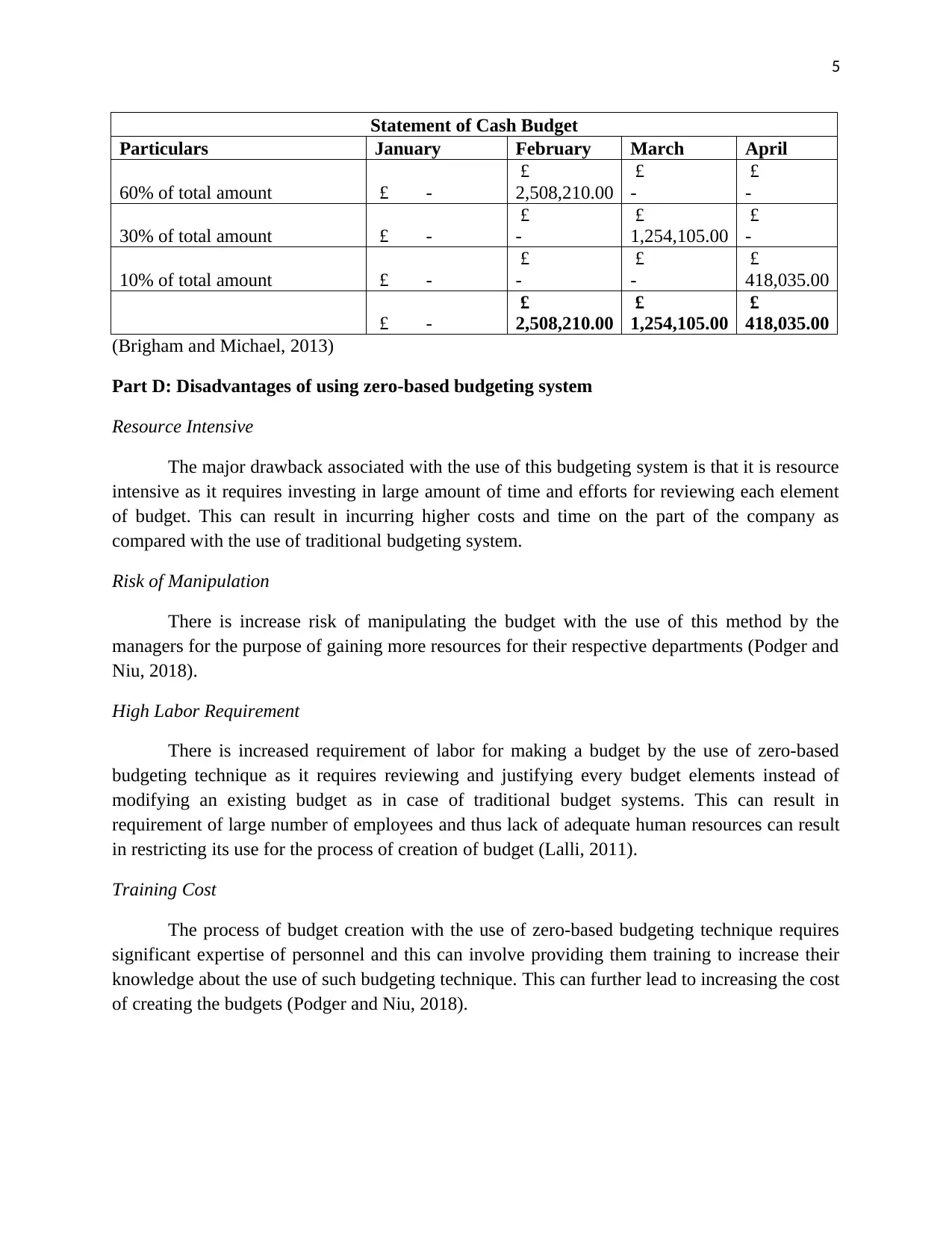

Statement of Cash Budget

Particulars January February March April

60% of total amount £ -

£

2,508,210.00

£

-

£

-

30% of total amount £ -

£

-

£

1,254,105.00

£

-

10% of total amount £ -

£

-

£

-

£

418,035.00

£ -

£

2,508,210.00

£

1,254,105.00

£

418,035.00

(Brigham and Michael, 2013)

Part D: Disadvantages of using zero-based budgeting system

Resource Intensive

The major drawback associated with the use of this budgeting system is that it is resource

intensive as it requires investing in large amount of time and efforts for reviewing each element

of budget. This can result in incurring higher costs and time on the part of the company as

compared with the use of traditional budgeting system.

Risk of Manipulation

There is increase risk of manipulating the budget with the use of this method by the

managers for the purpose of gaining more resources for their respective departments (Podger and

Niu, 2018).

High Labor Requirement

There is increased requirement of labor for making a budget by the use of zero-based

budgeting technique as it requires reviewing and justifying every budget elements instead of

modifying an existing budget as in case of traditional budget systems. This can result in

requirement of large number of employees and thus lack of adequate human resources can result

in restricting its use for the process of creation of budget (Lalli, 2011).

Training Cost

The process of budget creation with the use of zero-based budgeting technique requires

significant expertise of personnel and this can involve providing them training to increase their

knowledge about the use of such budgeting technique. This can further lead to increasing the cost

of creating the budgets (Podger and Niu, 2018).

Statement of Cash Budget

Particulars January February March April

60% of total amount £ -

£

2,508,210.00

£

-

£

-

30% of total amount £ -

£

-

£

1,254,105.00

£

-

10% of total amount £ -

£

-

£

-

£

418,035.00

£ -

£

2,508,210.00

£

1,254,105.00

£

418,035.00

(Brigham and Michael, 2013)

Part D: Disadvantages of using zero-based budgeting system

Resource Intensive

The major drawback associated with the use of this budgeting system is that it is resource

intensive as it requires investing in large amount of time and efforts for reviewing each element

of budget. This can result in incurring higher costs and time on the part of the company as

compared with the use of traditional budgeting system.

Risk of Manipulation

There is increase risk of manipulating the budget with the use of this method by the

managers for the purpose of gaining more resources for their respective departments (Podger and

Niu, 2018).

High Labor Requirement

There is increased requirement of labor for making a budget by the use of zero-based

budgeting technique as it requires reviewing and justifying every budget elements instead of

modifying an existing budget as in case of traditional budget systems. This can result in

requirement of large number of employees and thus lack of adequate human resources can result

in restricting its use for the process of creation of budget (Lalli, 2011).

Training Cost

The process of budget creation with the use of zero-based budgeting technique requires

significant expertise of personnel and this can involve providing them training to increase their

knowledge about the use of such budgeting technique. This can further lead to increasing the cost

of creating the budgets (Podger and Niu, 2018).

6

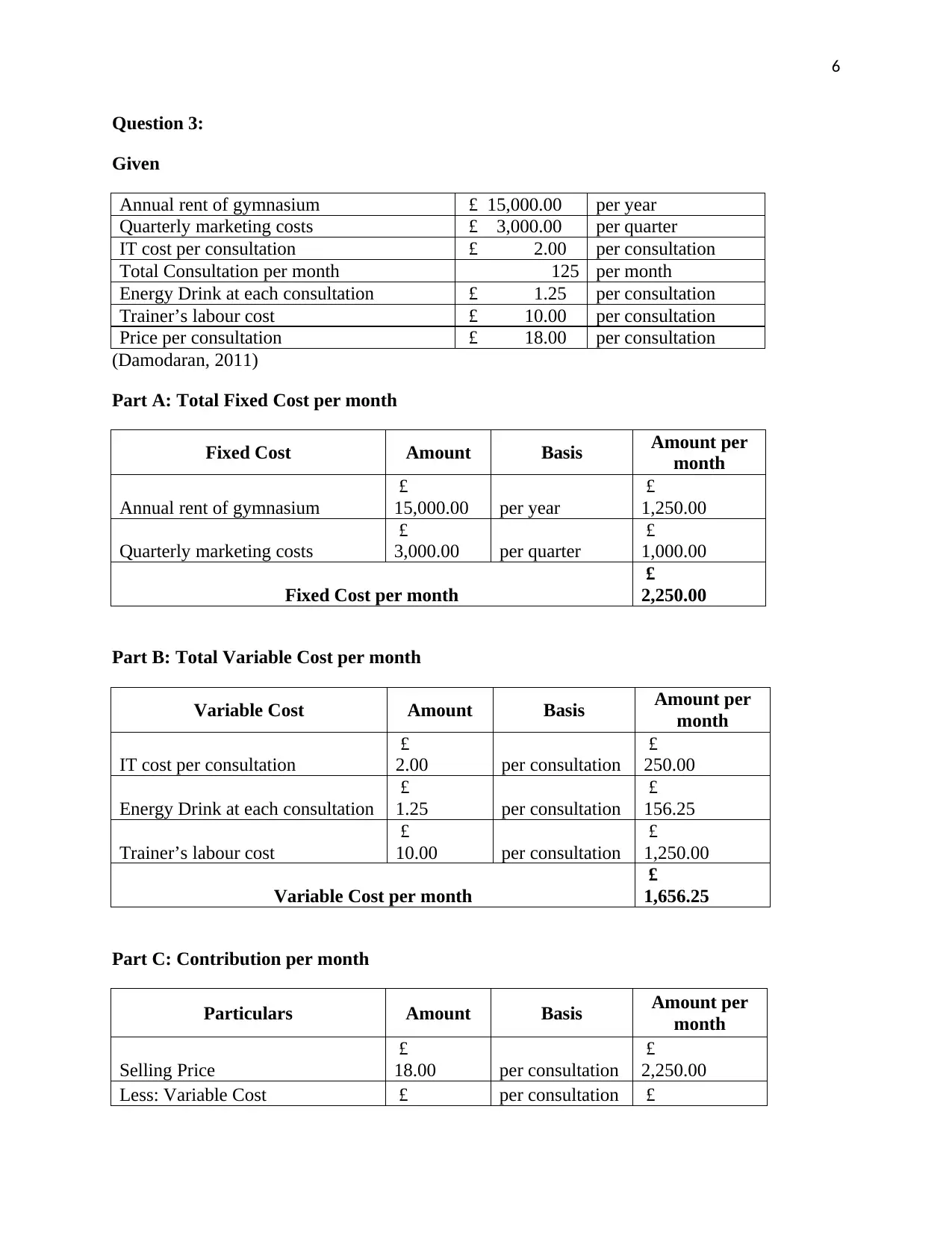

Question 3:

Given

Annual rent of gymnasium £ 15,000.00 per year

Quarterly marketing costs £ 3,000.00 per quarter

IT cost per consultation £ 2.00 per consultation

Total Consultation per month 125 per month

Energy Drink at each consultation £ 1.25 per consultation

Trainer’s labour cost £ 10.00 per consultation

Price per consultation £ 18.00 per consultation

(Damodaran, 2011)

Part A: Total Fixed Cost per month

Fixed Cost Amount Basis Amount per

month

Annual rent of gymnasium

£

15,000.00 per year

£

1,250.00

Quarterly marketing costs

£

3,000.00 per quarter

£

1,000.00

Fixed Cost per month

£

2,250.00

Part B: Total Variable Cost per month

Variable Cost Amount Basis Amount per

month

IT cost per consultation

£

2.00 per consultation

£

250.00

Energy Drink at each consultation

£

1.25 per consultation

£

156.25

Trainer’s labour cost

£

10.00 per consultation

£

1,250.00

Variable Cost per month

£

1,656.25

Part C: Contribution per month

Particulars Amount Basis Amount per

month

Selling Price

£

18.00 per consultation

£

2,250.00

Less: Variable Cost £ per consultation £

Question 3:

Given

Annual rent of gymnasium £ 15,000.00 per year

Quarterly marketing costs £ 3,000.00 per quarter

IT cost per consultation £ 2.00 per consultation

Total Consultation per month 125 per month

Energy Drink at each consultation £ 1.25 per consultation

Trainer’s labour cost £ 10.00 per consultation

Price per consultation £ 18.00 per consultation

(Damodaran, 2011)

Part A: Total Fixed Cost per month

Fixed Cost Amount Basis Amount per

month

Annual rent of gymnasium

£

15,000.00 per year

£

1,250.00

Quarterly marketing costs

£

3,000.00 per quarter

£

1,000.00

Fixed Cost per month

£

2,250.00

Part B: Total Variable Cost per month

Variable Cost Amount Basis Amount per

month

IT cost per consultation

£

2.00 per consultation

£

250.00

Energy Drink at each consultation

£

1.25 per consultation

£

156.25

Trainer’s labour cost

£

10.00 per consultation

£

1,250.00

Variable Cost per month

£

1,656.25

Part C: Contribution per month

Particulars Amount Basis Amount per

month

Selling Price

£

18.00 per consultation

£

2,250.00

Less: Variable Cost £ per consultation £

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

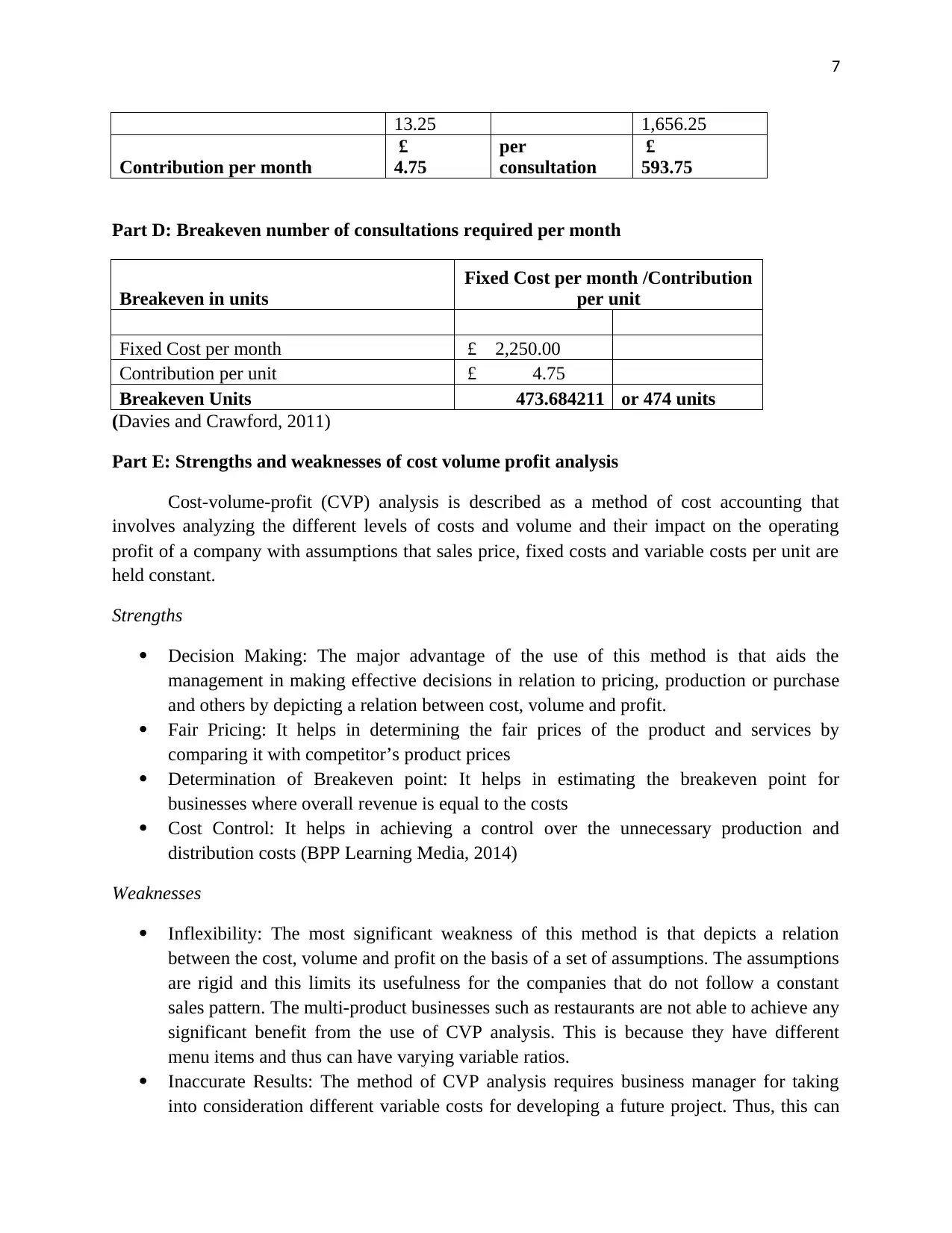

13.25 1,656.25

Contribution per month

£

4.75

per

consultation

£

593.75

Part D: Breakeven number of consultations required per month

Breakeven in units

Fixed Cost per month /Contribution

per unit

Fixed Cost per month £ 2,250.00

Contribution per unit £ 4.75

Breakeven Units 473.684211 or 474 units

(Davies and Crawford, 2011)

Part E: Strengths and weaknesses of cost volume profit analysis

Cost-volume-profit (CVP) analysis is described as a method of cost accounting that

involves analyzing the different levels of costs and volume and their impact on the operating

profit of a company with assumptions that sales price, fixed costs and variable costs per unit are

held constant.

Strengths

Decision Making: The major advantage of the use of this method is that aids the

management in making effective decisions in relation to pricing, production or purchase

and others by depicting a relation between cost, volume and profit.

Fair Pricing: It helps in determining the fair prices of the product and services by

comparing it with competitor’s product prices

Determination of Breakeven point: It helps in estimating the breakeven point for

businesses where overall revenue is equal to the costs

Cost Control: It helps in achieving a control over the unnecessary production and

distribution costs (BPP Learning Media, 2014)

Weaknesses

Inflexibility: The most significant weakness of this method is that depicts a relation

between the cost, volume and profit on the basis of a set of assumptions. The assumptions

are rigid and this limits its usefulness for the companies that do not follow a constant

sales pattern. The multi-product businesses such as restaurants are not able to achieve any

significant benefit from the use of CVP analysis. This is because they have different

menu items and thus can have varying variable ratios.

Inaccurate Results: The method of CVP analysis requires business manager for taking

into consideration different variable costs for developing a future project. Thus, this can

13.25 1,656.25

Contribution per month

£

4.75

per

consultation

£

593.75

Part D: Breakeven number of consultations required per month

Breakeven in units

Fixed Cost per month /Contribution

per unit

Fixed Cost per month £ 2,250.00

Contribution per unit £ 4.75

Breakeven Units 473.684211 or 474 units

(Davies and Crawford, 2011)

Part E: Strengths and weaknesses of cost volume profit analysis

Cost-volume-profit (CVP) analysis is described as a method of cost accounting that

involves analyzing the different levels of costs and volume and their impact on the operating

profit of a company with assumptions that sales price, fixed costs and variable costs per unit are

held constant.

Strengths

Decision Making: The major advantage of the use of this method is that aids the

management in making effective decisions in relation to pricing, production or purchase

and others by depicting a relation between cost, volume and profit.

Fair Pricing: It helps in determining the fair prices of the product and services by

comparing it with competitor’s product prices

Determination of Breakeven point: It helps in estimating the breakeven point for

businesses where overall revenue is equal to the costs

Cost Control: It helps in achieving a control over the unnecessary production and

distribution costs (BPP Learning Media, 2014)

Weaknesses

Inflexibility: The most significant weakness of this method is that depicts a relation

between the cost, volume and profit on the basis of a set of assumptions. The assumptions

are rigid and this limits its usefulness for the companies that do not follow a constant

sales pattern. The multi-product businesses such as restaurants are not able to achieve any

significant benefit from the use of CVP analysis. This is because they have different

menu items and thus can have varying variable ratios.

Inaccurate Results: The method of CVP analysis requires business manager for taking

into consideration different variable costs for developing a future project. Thus, this can

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

result in creating problems for the managers as they have to collect every significant

detail precisely for depicting accurate results. The incorrect collection of data can lead in

developing inaccurate projections (Brigham and Michael, 2013).

result in creating problems for the managers as they have to collect every significant

detail precisely for depicting accurate results. The incorrect collection of data can lead in

developing inaccurate projections (Brigham and Michael, 2013).

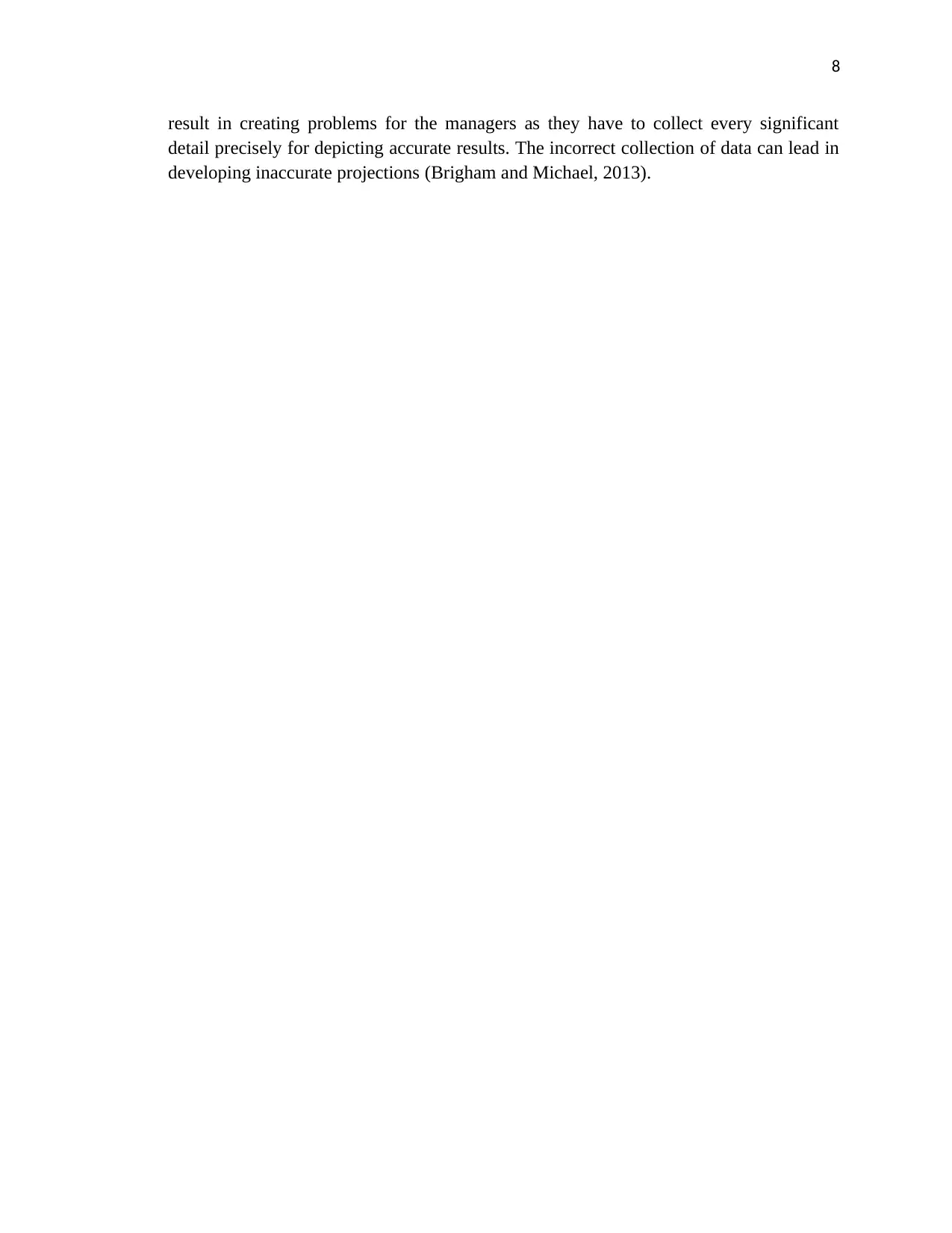

9

Question 4:

Part A:

There are various funding options both debt and equity available with the entrepreneur

but in order to make sure that 55% of equity stake is kept with the entrepreneur himself it is

required to select sources of funding in right manner. The total start-up cost of the business is as

follows:

Office equipment £ 20,000.00

First year staff salaries (2 assistants): £ 50,000.00

Registrations and indemnity insurance £ 5,000.00

Marketing costs £ 10,000.00

Total Cost £ 85,000.00

From the total cost of 85000 pounds, entrepreneur owns 1000 pounds and in addition to

this he has house that can be put to mortgage to avail loans. He also earns 20000 pounds revenue

from other business that can be used to pay the loan repayments.

Equity Sources of Funding

Personal Investment

This funding comes from own sources of funds such as cash and through collateral the

assets. In this regards entrepreneur has investing 1000 pounds cash and ready to put his own

house on mortgage to avail the loan for business use. Out of 85000 pounds, entrepreneur needs

46750 pounds to have 55% personal stake in total funding. So, it is advised to make 45750

pounds from collateral of house.

The main advantage of this funding is that it is personal funding and there is only

personal risk as entrepreneur himself invested the amount. It gives personal equity stake in the

business that retains the ownership with the entrepreneur. The main disadvantage of this source

of funding is that there is high risk involve as personal investment has been made that means if

there is loss in business it has to borne by entrepreneur by himself (Moles and Kidwekk, 2011).

Venture Capital

They are investors that provide finances to the start-up companies and they hold equity

position in the company. Investors may be investment banks, wealthy investors and other

financial institutions.

Advantages of venture capital are that it helps in providing business expertise to the entrepreneur

and also provides additional resources when it was needed. The main disadvantage is that there is

loss of control in this source of finance (Zimmerman and Yahya-Zadeh, 2011).

Question 4:

Part A:

There are various funding options both debt and equity available with the entrepreneur

but in order to make sure that 55% of equity stake is kept with the entrepreneur himself it is

required to select sources of funding in right manner. The total start-up cost of the business is as

follows:

Office equipment £ 20,000.00

First year staff salaries (2 assistants): £ 50,000.00

Registrations and indemnity insurance £ 5,000.00

Marketing costs £ 10,000.00

Total Cost £ 85,000.00

From the total cost of 85000 pounds, entrepreneur owns 1000 pounds and in addition to

this he has house that can be put to mortgage to avail loans. He also earns 20000 pounds revenue

from other business that can be used to pay the loan repayments.

Equity Sources of Funding

Personal Investment

This funding comes from own sources of funds such as cash and through collateral the

assets. In this regards entrepreneur has investing 1000 pounds cash and ready to put his own

house on mortgage to avail the loan for business use. Out of 85000 pounds, entrepreneur needs

46750 pounds to have 55% personal stake in total funding. So, it is advised to make 45750

pounds from collateral of house.

The main advantage of this funding is that it is personal funding and there is only

personal risk as entrepreneur himself invested the amount. It gives personal equity stake in the

business that retains the ownership with the entrepreneur. The main disadvantage of this source

of funding is that there is high risk involve as personal investment has been made that means if

there is loss in business it has to borne by entrepreneur by himself (Moles and Kidwekk, 2011).

Venture Capital

They are investors that provide finances to the start-up companies and they hold equity

position in the company. Investors may be investment banks, wealthy investors and other

financial institutions.

Advantages of venture capital are that it helps in providing business expertise to the entrepreneur

and also provides additional resources when it was needed. The main disadvantage is that there is

loss of control in this source of finance (Zimmerman and Yahya-Zadeh, 2011).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Bank loan

Bank loan refers to debt source of finance as under this finance option banks or financial

institutions grants funds to company on specific interest rate.

The main advantage of this source of finance is easy to avail and also it does not create

ownership. On the other hand biggest disadvantage is company required to pay fixed interest

whether there is profit or not.

Part B: Differences between discounted and non-discounted methods of investment

appraisal

Discounted vs undiscounted cash flows

The discounted methods of investment appraisal involves discounting the cash flows that

is adjusting them for incorporate the time value of money for evaluation the potential of an

investment. The cash flows are discounted with use of a discount rate for estimating the present

value of an investment. On the other hand, in the use of non-discounted methods the cash flows

are not adjusted as per the time value of money concept and thus yields undiscounted cash flows

(Kleemann, 2012).

Accuracy

The discounted methods incorporate the use discounted cash flows and thus are regarded

as yielding accurate decisions regarding the potential investment value. On the other hand, non-

discounted methods do not consider the reduction in value of money over time and thus does not

result in depicting accurate investment decisions.

Usefulness in Investment Appraisal

The discounted methods such as NPV (Net Present Value) are used in investment

appraisal as they yield accurate results whereas non-discounted methods are not considered to be

reliable and as such not used in investment appraisal (Reilly and Brown, 2011).

Bank loan

Bank loan refers to debt source of finance as under this finance option banks or financial

institutions grants funds to company on specific interest rate.

The main advantage of this source of finance is easy to avail and also it does not create

ownership. On the other hand biggest disadvantage is company required to pay fixed interest

whether there is profit or not.

Part B: Differences between discounted and non-discounted methods of investment

appraisal

Discounted vs undiscounted cash flows

The discounted methods of investment appraisal involves discounting the cash flows that

is adjusting them for incorporate the time value of money for evaluation the potential of an

investment. The cash flows are discounted with use of a discount rate for estimating the present

value of an investment. On the other hand, in the use of non-discounted methods the cash flows

are not adjusted as per the time value of money concept and thus yields undiscounted cash flows

(Kleemann, 2012).

Accuracy

The discounted methods incorporate the use discounted cash flows and thus are regarded

as yielding accurate decisions regarding the potential investment value. On the other hand, non-

discounted methods do not consider the reduction in value of money over time and thus does not

result in depicting accurate investment decisions.

Usefulness in Investment Appraisal

The discounted methods such as NPV (Net Present Value) are used in investment

appraisal as they yield accurate results whereas non-discounted methods are not considered to be

reliable and as such not used in investment appraisal (Reilly and Brown, 2011).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

References

Adewale, A. 2013. Corporate Governance: a Comparative Study of the Corporate Governance

Codes of a Developing Economy with Developed Economies. Research Journal of Finance and

Accounting 4(1), pp. 65-76.

Bouchoux, D. 2009. Business Organizations for Paralegals. US: Aspen Publishers.

BPP Learning Media. 2014. ACCA Skills F5 Performance Management Study Text 2014. UK:

BPP Learning Media.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Cuong, N.H. 2011. Factors Causing Enron's Collapse: An Investigation into Corporate

Governance and Company Culture. Corporate Ownership and Control 8(3), pp.585-593.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. and Crawford, I., 2011. Business accounting and finance. USA: Pearson.

Kleemann, F.C. 2012. Investment Appraisal and Financial Analysis. Germany: GRIN Verlag.

Lalli, W. 2011. Handbook of Budgeting. US: John Wiley & Sons.

Miller, R. and Jentz, G. 2009. Cengage Advantage Books: Fundamentals of Business Law:

Excerpted Cases. US: Cengage Learning.

Moles, P. and Kidwekk, D. 2011. Corporate finance. USA: John Wiley &sons.

Otusanya, J.O., Lauwo S. and Adeyeye, G.B. 2012. A Critical Examination of the Multinational

Companies’ AntiCorruption Policy in Nigeria”. Accountancy Business and the Public Interest,

pp. 1-49.

References

Adewale, A. 2013. Corporate Governance: a Comparative Study of the Corporate Governance

Codes of a Developing Economy with Developed Economies. Research Journal of Finance and

Accounting 4(1), pp. 65-76.

Bouchoux, D. 2009. Business Organizations for Paralegals. US: Aspen Publishers.

BPP Learning Media. 2014. ACCA Skills F5 Performance Management Study Text 2014. UK:

BPP Learning Media.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Cuong, N.H. 2011. Factors Causing Enron's Collapse: An Investigation into Corporate

Governance and Company Culture. Corporate Ownership and Control 8(3), pp.585-593.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. and Crawford, I., 2011. Business accounting and finance. USA: Pearson.

Kleemann, F.C. 2012. Investment Appraisal and Financial Analysis. Germany: GRIN Verlag.

Lalli, W. 2011. Handbook of Budgeting. US: John Wiley & Sons.

Miller, R. and Jentz, G. 2009. Cengage Advantage Books: Fundamentals of Business Law:

Excerpted Cases. US: Cengage Learning.

Moles, P. and Kidwekk, D. 2011. Corporate finance. USA: John Wiley &sons.

Otusanya, J.O., Lauwo S. and Adeyeye, G.B. 2012. A Critical Examination of the Multinational

Companies’ AntiCorruption Policy in Nigeria”. Accountancy Business and the Public Interest,

pp. 1-49.

12

Podger, A. and Niu, M. 2018. Value for Money: Budget and financial management reform in the

People's Republic of China, Taiwan and Australia. Australia: ANU Press.

Reilly.F.K. and Brown.K.C. 2011. Investment analysis & portfolio management. UK: South

western Cengage learning.

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

Podger, A. and Niu, M. 2018. Value for Money: Budget and financial management reform in the

People's Republic of China, Taiwan and Australia. Australia: ANU Press.

Reilly.F.K. and Brown.K.C. 2011. Investment analysis & portfolio management. UK: South

western Cengage learning.

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.