Report: Financial Performance Analysis of Telstra Corporation Limited

VerifiedAdded on 2022/05/11

|12

|2396

|51

Report

AI Summary

This report provides a detailed financial analysis of Telstra Corporation Limited, evaluating its performance over the financial years 2017 and 2018. The analysis utilizes ratio analysis techniques, drawing data from Telstra's annual reports to assess key financial aspects. The report examines profitability ratios (ROE, Net Profit Ratio), liquidity ratios (Current Ratio, Quick Ratio), leverage ratios (Debt to Equity Ratio, Interest Coverage Ratio), asset efficiency ratios (Accounts Receivable Turnover, Asset Turnover), and market ratios (Earnings per Share, Dividend Yield). The findings indicate a weakening in Telstra's financial performance in 2018 compared to 2017 across various metrics. The analysis offers recommendations for the company's management and provides insights for potential investors, highlighting areas for improvement and suggesting caution in investment decisions based on the observed trends. The report concludes by summarizing the overall financial health and providing an outlook based on the analyzed data.

1

Financial Analysis of Telstra Corporation Limited

Financial Analysis of Telstra Corporation Limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive Summary

The underlying report is being prepared for carrying out the financial analysis of a

selected company over the past two financial years of 2017 to 2018. This has been carried out in

the report with the use of ratio analysis technique by extracting data from the annual report of the

selected company. The company selected for evaluation purpose is Telstra Corporation Limited.

It has been depicted form the use of ratio analysis that the performance of the company has been

weakened in the year 2018 as compared with that of the year 2018. This has been done through

calculation of profitability, liquidity, leverage, efficiency and market performance ratio’s within

the report.

Executive Summary

The underlying report is being prepared for carrying out the financial analysis of a

selected company over the past two financial years of 2017 to 2018. This has been carried out in

the report with the use of ratio analysis technique by extracting data from the annual report of the

selected company. The company selected for evaluation purpose is Telstra Corporation Limited.

It has been depicted form the use of ratio analysis that the performance of the company has been

weakened in the year 2018 as compared with that of the year 2018. This has been done through

calculation of profitability, liquidity, leverage, efficiency and market performance ratio’s within

the report.

3

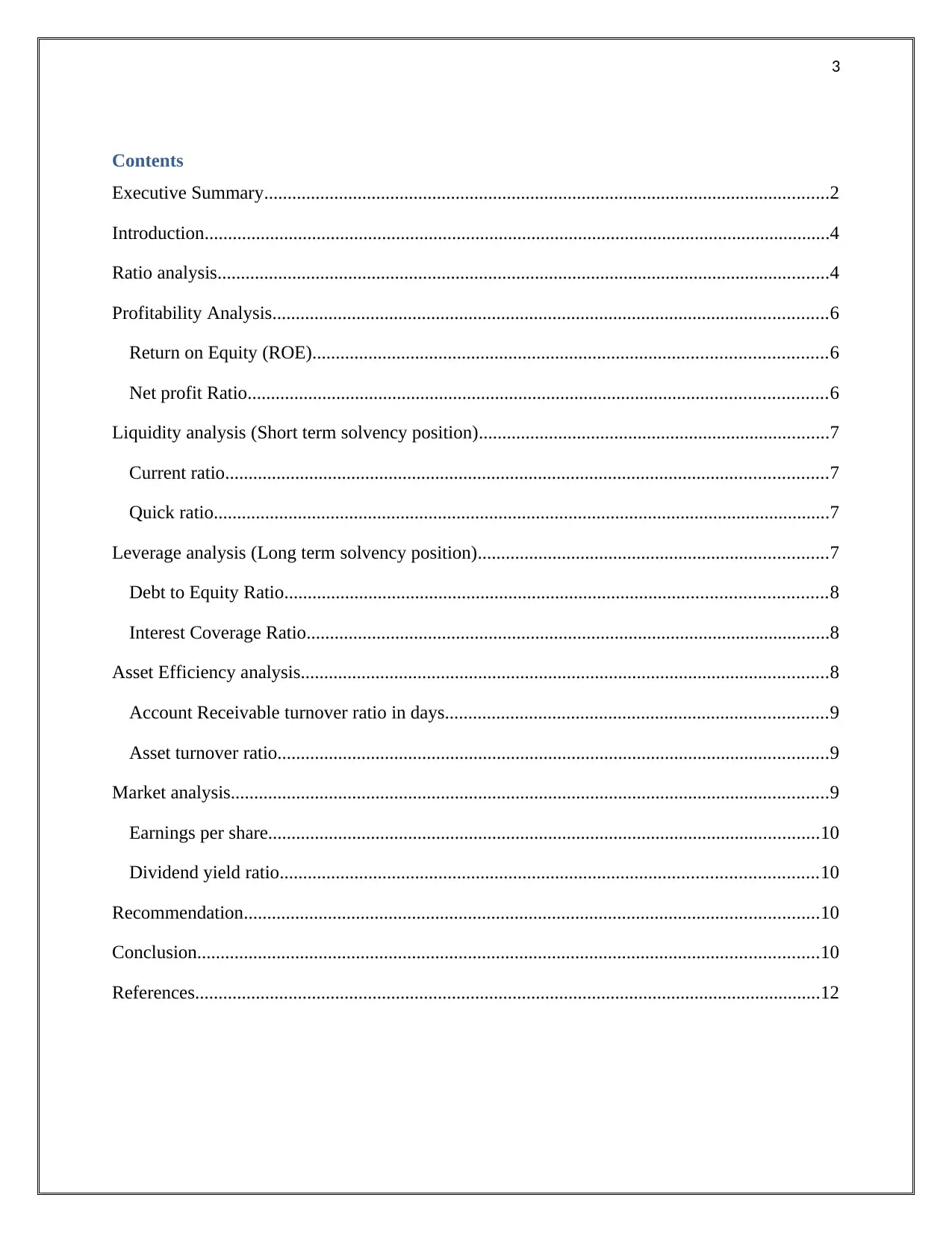

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Ratio analysis...................................................................................................................................4

Profitability Analysis.......................................................................................................................6

Return on Equity (ROE)..............................................................................................................6

Net profit Ratio............................................................................................................................6

Liquidity analysis (Short term solvency position)...........................................................................7

Current ratio.................................................................................................................................7

Quick ratio....................................................................................................................................7

Leverage analysis (Long term solvency position)...........................................................................7

Debt to Equity Ratio....................................................................................................................8

Interest Coverage Ratio................................................................................................................8

Asset Efficiency analysis.................................................................................................................8

Account Receivable turnover ratio in days..................................................................................9

Asset turnover ratio......................................................................................................................9

Market analysis................................................................................................................................9

Earnings per share......................................................................................................................10

Dividend yield ratio...................................................................................................................10

Recommendation...........................................................................................................................10

Conclusion.....................................................................................................................................10

References......................................................................................................................................12

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Ratio analysis...................................................................................................................................4

Profitability Analysis.......................................................................................................................6

Return on Equity (ROE)..............................................................................................................6

Net profit Ratio............................................................................................................................6

Liquidity analysis (Short term solvency position)...........................................................................7

Current ratio.................................................................................................................................7

Quick ratio....................................................................................................................................7

Leverage analysis (Long term solvency position)...........................................................................7

Debt to Equity Ratio....................................................................................................................8

Interest Coverage Ratio................................................................................................................8

Asset Efficiency analysis.................................................................................................................8

Account Receivable turnover ratio in days..................................................................................9

Asset turnover ratio......................................................................................................................9

Market analysis................................................................................................................................9

Earnings per share......................................................................................................................10

Dividend yield ratio...................................................................................................................10

Recommendation...........................................................................................................................10

Conclusion.....................................................................................................................................10

References......................................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

The present report is developed for providing an insight into the process of financial

analysis used for evaluating the financial performance of a company. In this context, the report

presents the comparison of financial results of a selected company over the two financial years

from 2017 to 2018. This is carried out through extraction of financial information from the

annual reports for calculation of the relevant ratios. This is done for identifying the

improvements within the financial position and profitability of the company over the selected

financial period.

The company selected for the financial analysis purpose is Telstra Corporation Limited.

The company is recognized to be a leading telecommunication company within Australia that is

involved in operating telecommunication networks and other related products and services. The

company is involved in providing about 17.7 million retail mobile services and about 4.9 million

retail fixed voice services to its customers (Telstra, 2018). It is having international presence in

about 20 countries and is recognized as one of the largest and fastest national mobile network

(Telstra, 2018).

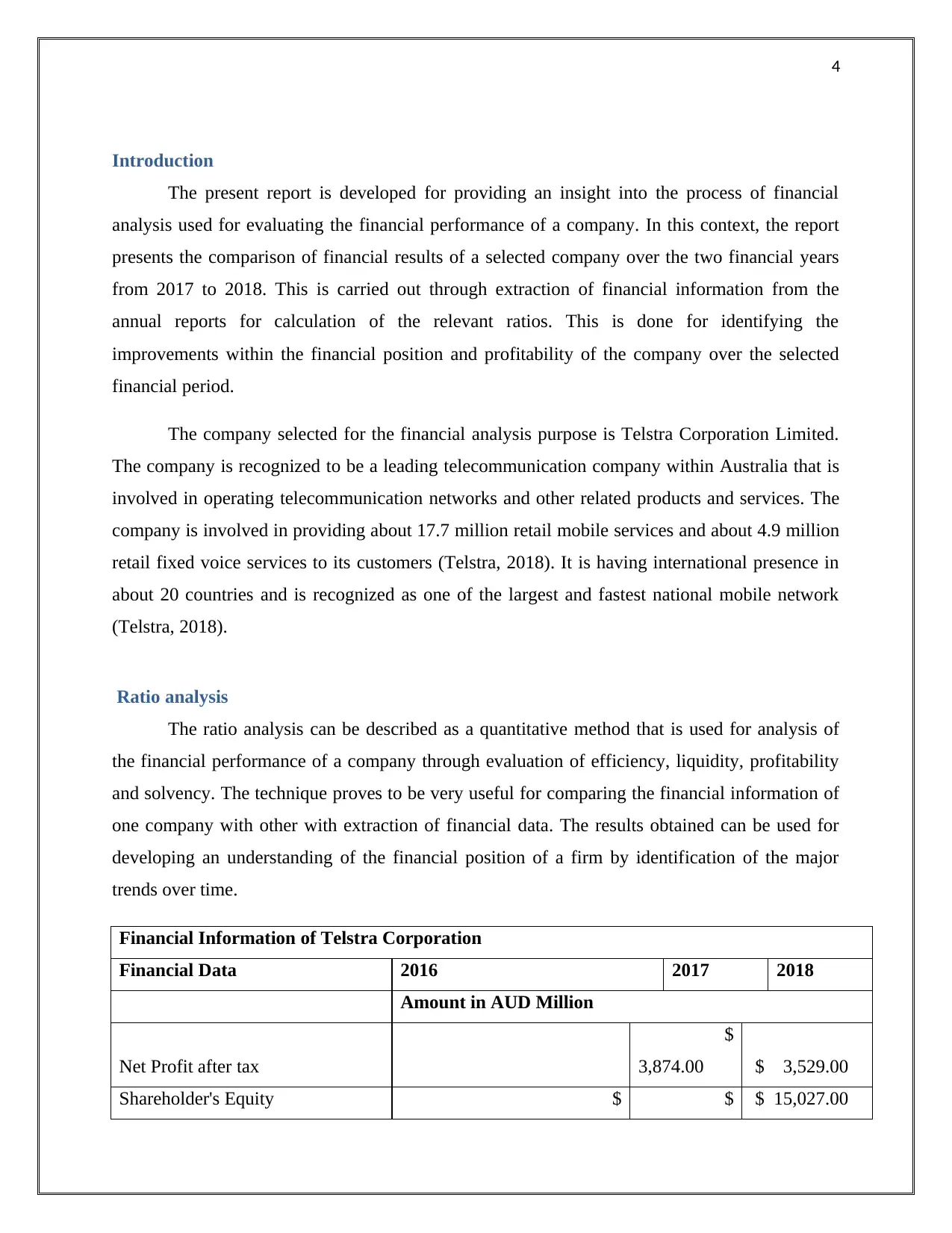

Ratio analysis

The ratio analysis can be described as a quantitative method that is used for analysis of

the financial performance of a company through evaluation of efficiency, liquidity, profitability

and solvency. The technique proves to be very useful for comparing the financial information of

one company with other with extraction of financial data. The results obtained can be used for

developing an understanding of the financial position of a firm by identification of the major

trends over time.

Financial Information of Telstra Corporation

Financial Data 2016 2017 2018

Amount in AUD Million

Net Profit after tax

$

3,874.00 $ 3,529.00

Shareholder's Equity $ $ $ 15,027.00

Introduction

The present report is developed for providing an insight into the process of financial

analysis used for evaluating the financial performance of a company. In this context, the report

presents the comparison of financial results of a selected company over the two financial years

from 2017 to 2018. This is carried out through extraction of financial information from the

annual reports for calculation of the relevant ratios. This is done for identifying the

improvements within the financial position and profitability of the company over the selected

financial period.

The company selected for the financial analysis purpose is Telstra Corporation Limited.

The company is recognized to be a leading telecommunication company within Australia that is

involved in operating telecommunication networks and other related products and services. The

company is involved in providing about 17.7 million retail mobile services and about 4.9 million

retail fixed voice services to its customers (Telstra, 2018). It is having international presence in

about 20 countries and is recognized as one of the largest and fastest national mobile network

(Telstra, 2018).

Ratio analysis

The ratio analysis can be described as a quantitative method that is used for analysis of

the financial performance of a company through evaluation of efficiency, liquidity, profitability

and solvency. The technique proves to be very useful for comparing the financial information of

one company with other with extraction of financial data. The results obtained can be used for

developing an understanding of the financial position of a firm by identification of the major

trends over time.

Financial Information of Telstra Corporation

Financial Data 2016 2017 2018

Amount in AUD Million

Net Profit after tax

$

3,874.00 $ 3,529.00

Shareholder's Equity $ $ $ 15,027.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

15,871.00 14,541.00

Net Sales

$

25,912.00 $ 25,667.00

Average shareholder's equity

$

15,206.00 $ 14,784.00

Current Assets

$

7,862.00 $ 7,077.00

Current Liabilities

$

9,159.00 $ 8,816.00

Inventory

$

893.00 $ 801.00

Quick assets

$

6,969.00 $ 6,276.00

Total Liabilities

$

27,592.00 $ 27,843.00

EBIT

$

6,238.00 $ 5,651.00

Finance Cost

$

729.00 $ 631.00

Account receivables

$

3,343.00

$

3,635.00 $ 3,146.00

Average accounts receivables

$

3,489.00 $ 3,390.50

Total Assets

$

43,286.00

$

42,133.00 $ 42,870.00

Average Total Assets

$

42,709.50 $ 42,501.50

Profit Attributable to equity

shareholder's

$

3,891.00 $ 3,563.00

WANS in million 11968 11877

Dividend paid per share $ $ 0.22

15,871.00 14,541.00

Net Sales

$

25,912.00 $ 25,667.00

Average shareholder's equity

$

15,206.00 $ 14,784.00

Current Assets

$

7,862.00 $ 7,077.00

Current Liabilities

$

9,159.00 $ 8,816.00

Inventory

$

893.00 $ 801.00

Quick assets

$

6,969.00 $ 6,276.00

Total Liabilities

$

27,592.00 $ 27,843.00

EBIT

$

6,238.00 $ 5,651.00

Finance Cost

$

729.00 $ 631.00

Account receivables

$

3,343.00

$

3,635.00 $ 3,146.00

Average accounts receivables

$

3,489.00 $ 3,390.50

Total Assets

$

43,286.00

$

42,133.00 $ 42,870.00

Average Total Assets

$

42,709.50 $ 42,501.50

Profit Attributable to equity

shareholder's

$

3,891.00 $ 3,563.00

WANS in million 11968 11877

Dividend paid per share $ $ 0.22

6

0.31

(Annual Report, 2018)

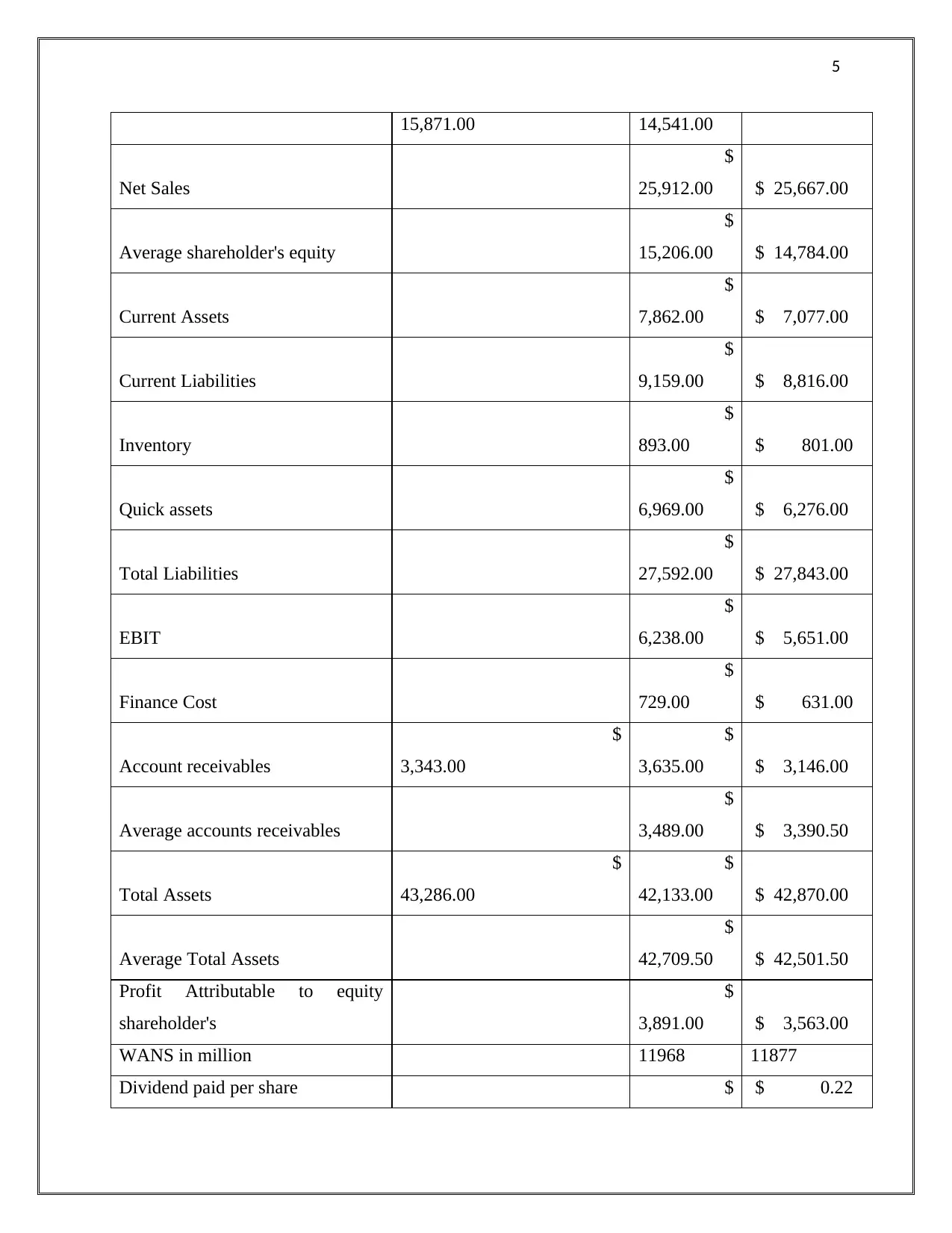

Profitability Analysis

Profitability ratios can be described as financial metrics that are used for mainly for

depicting the ability of a company to generate income against the expenditure incurred in

carrying the overall operational activities. The profitability analysis of Telstra over the selected

financial period can be done by evaluation of the following ratios:

Financial ratios of Telstra for year 2017 and 2018

Profitability Ratios Formula 2017 2018

Return on Equity

Net profit after tax/Average

shareholder's equity 25.48% 23.87%

Net Profit ratio Net Profit/Net Sales 14.95% 13.75%

(Brigham & Michael, 2013)

Return on Equity (ROE)

The ratio is manly used for assessing the profits generated by the company with each

dollar of shareholder’s equity. It can be stated from the calculation of ROE of Telstra over the

selected financial period that it has maintained a satisfactory ratio depicting that it is able to

generate profits for its shareholders. However, the ratio has depicted a decreasing trend over the

selected financial period which means that its ability to genre revenue for shareholders has been

reduced with the use of their equity resources.

Net profit Ratio

The net profit ratio is used for expressing the relation between the net profits of a firm

that can be described as revenue realized after meeting its operating expenses in comparison to

the net sales. As depicted in the above table, the net profitability of Telstra has been gradually

reduced over the years 2017-2018 depicting the increase in its cost of goods sold over the

financial period in comparison to the revenue. However, it can be said that the company has

maintained a satisfactory net profit margin over the selected financial period that means it has

maintained a control over its operational expenses.

0.31

(Annual Report, 2018)

Profitability Analysis

Profitability ratios can be described as financial metrics that are used for mainly for

depicting the ability of a company to generate income against the expenditure incurred in

carrying the overall operational activities. The profitability analysis of Telstra over the selected

financial period can be done by evaluation of the following ratios:

Financial ratios of Telstra for year 2017 and 2018

Profitability Ratios Formula 2017 2018

Return on Equity

Net profit after tax/Average

shareholder's equity 25.48% 23.87%

Net Profit ratio Net Profit/Net Sales 14.95% 13.75%

(Brigham & Michael, 2013)

Return on Equity (ROE)

The ratio is manly used for assessing the profits generated by the company with each

dollar of shareholder’s equity. It can be stated from the calculation of ROE of Telstra over the

selected financial period that it has maintained a satisfactory ratio depicting that it is able to

generate profits for its shareholders. However, the ratio has depicted a decreasing trend over the

selected financial period which means that its ability to genre revenue for shareholders has been

reduced with the use of their equity resources.

Net profit Ratio

The net profit ratio is used for expressing the relation between the net profits of a firm

that can be described as revenue realized after meeting its operating expenses in comparison to

the net sales. As depicted in the above table, the net profitability of Telstra has been gradually

reduced over the years 2017-2018 depicting the increase in its cost of goods sold over the

financial period in comparison to the revenue. However, it can be said that the company has

maintained a satisfactory net profit margin over the selected financial period that means it has

maintained a control over its operational expenses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

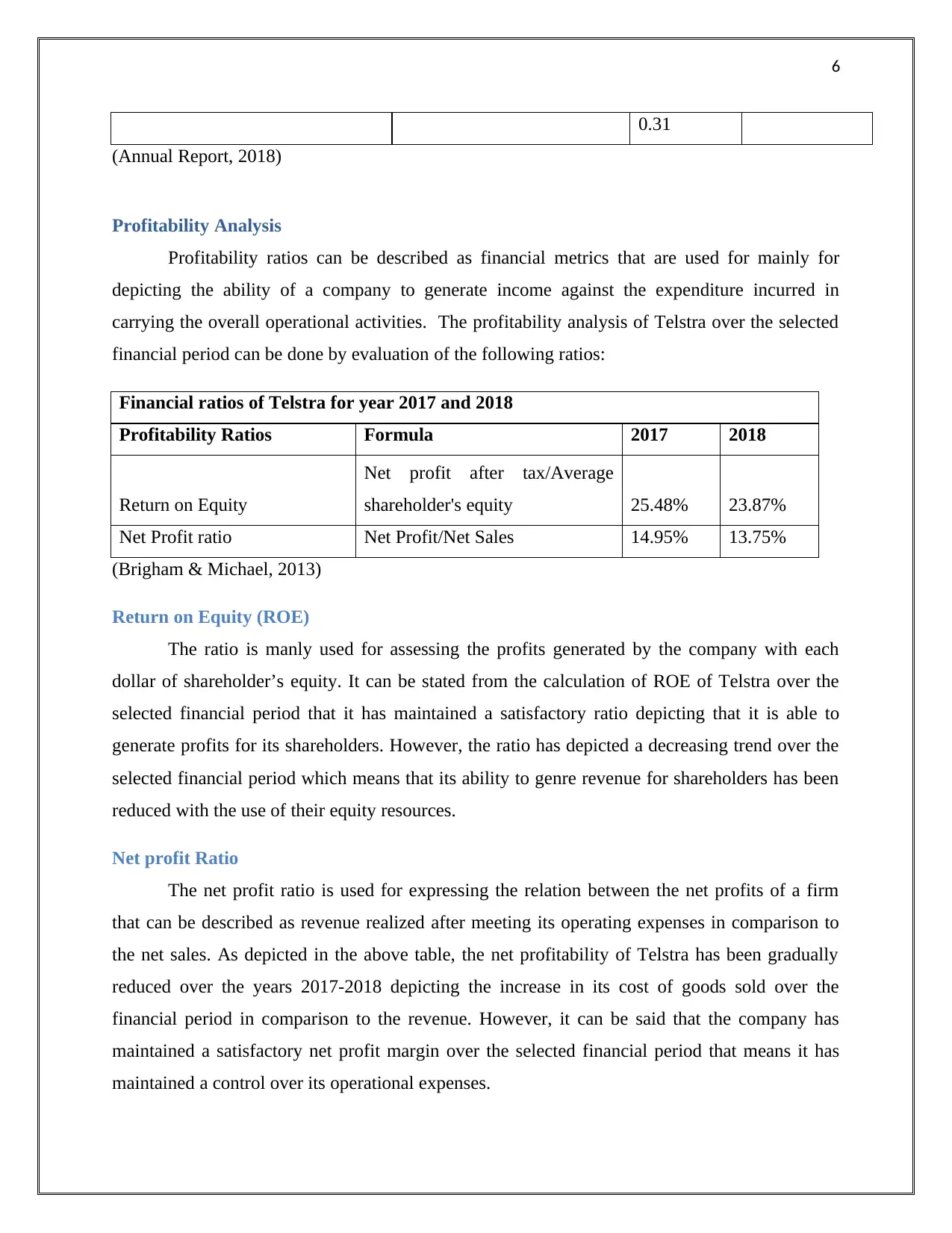

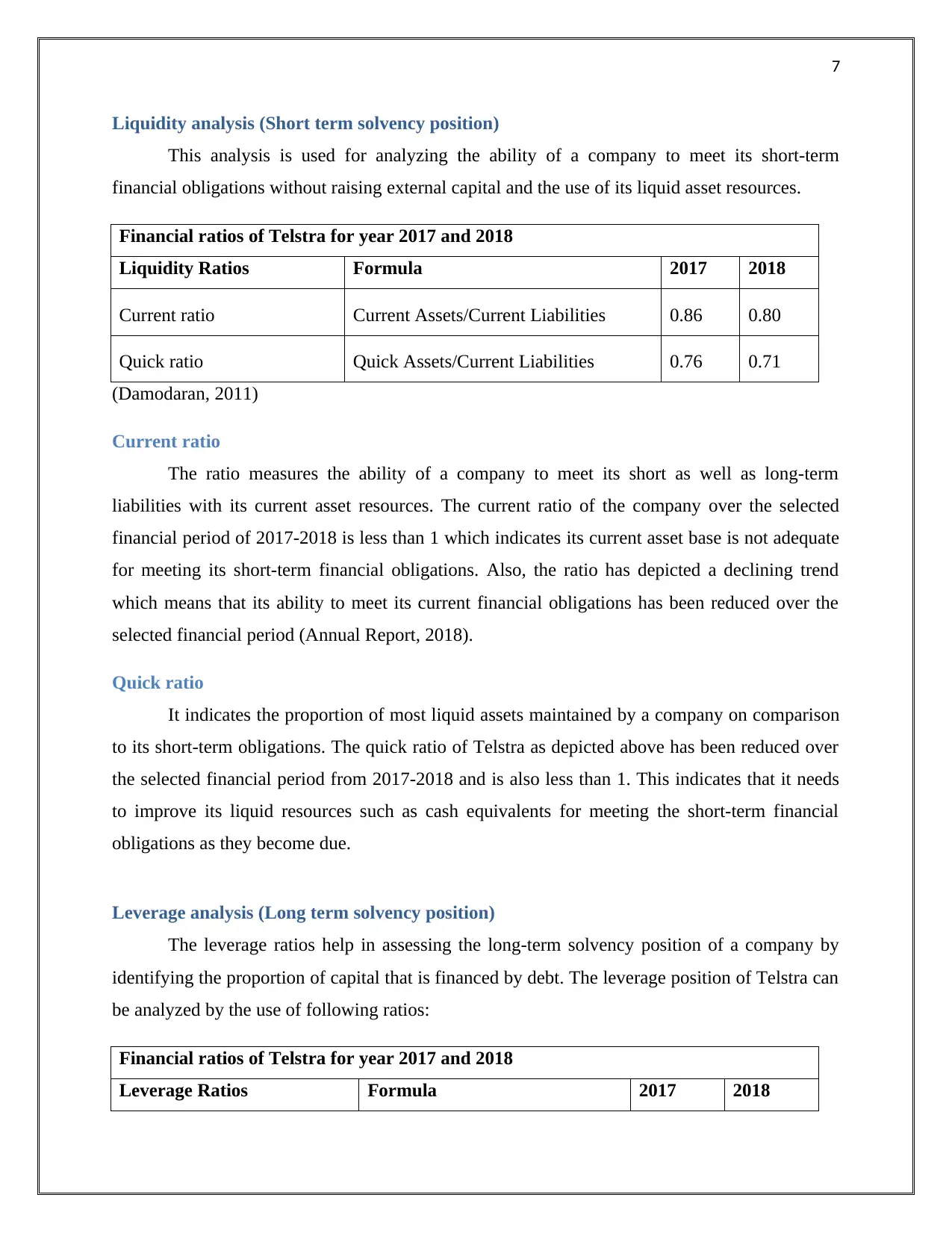

Liquidity analysis (Short term solvency position)

This analysis is used for analyzing the ability of a company to meet its short-term

financial obligations without raising external capital and the use of its liquid asset resources.

Financial ratios of Telstra for year 2017 and 2018

Liquidity Ratios Formula 2017 2018

Current ratio Current Assets/Current Liabilities 0.86 0.80

Quick ratio Quick Assets/Current Liabilities 0.76 0.71

(Damodaran, 2011)

Current ratio

The ratio measures the ability of a company to meet its short as well as long-term

liabilities with its current asset resources. The current ratio of the company over the selected

financial period of 2017-2018 is less than 1 which indicates its current asset base is not adequate

for meeting its short-term financial obligations. Also, the ratio has depicted a declining trend

which means that its ability to meet its current financial obligations has been reduced over the

selected financial period (Annual Report, 2018).

Quick ratio

It indicates the proportion of most liquid assets maintained by a company on comparison

to its short-term obligations. The quick ratio of Telstra as depicted above has been reduced over

the selected financial period from 2017-2018 and is also less than 1. This indicates that it needs

to improve its liquid resources such as cash equivalents for meeting the short-term financial

obligations as they become due.

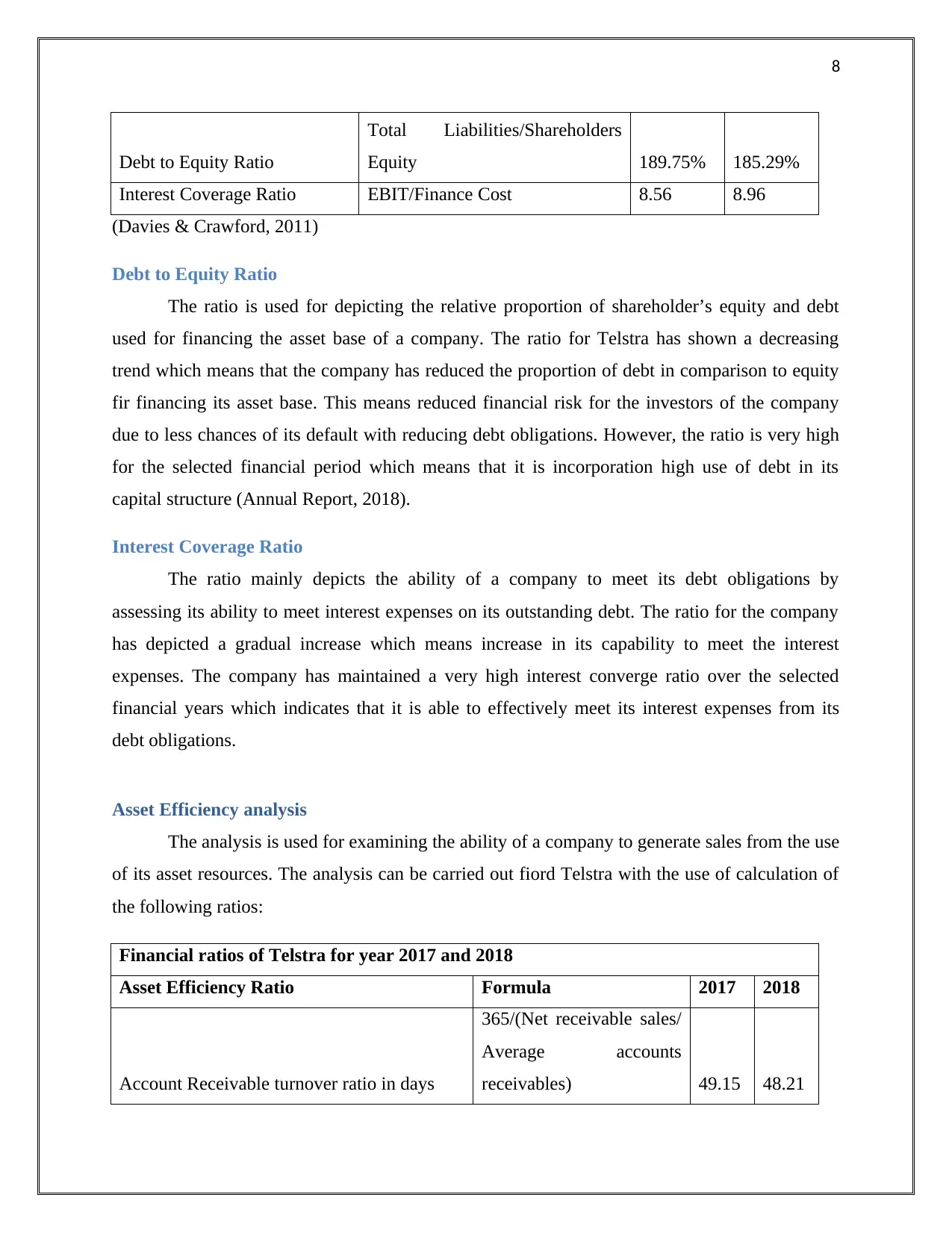

Leverage analysis (Long term solvency position)

The leverage ratios help in assessing the long-term solvency position of a company by

identifying the proportion of capital that is financed by debt. The leverage position of Telstra can

be analyzed by the use of following ratios:

Financial ratios of Telstra for year 2017 and 2018

Leverage Ratios Formula 2017 2018

Liquidity analysis (Short term solvency position)

This analysis is used for analyzing the ability of a company to meet its short-term

financial obligations without raising external capital and the use of its liquid asset resources.

Financial ratios of Telstra for year 2017 and 2018

Liquidity Ratios Formula 2017 2018

Current ratio Current Assets/Current Liabilities 0.86 0.80

Quick ratio Quick Assets/Current Liabilities 0.76 0.71

(Damodaran, 2011)

Current ratio

The ratio measures the ability of a company to meet its short as well as long-term

liabilities with its current asset resources. The current ratio of the company over the selected

financial period of 2017-2018 is less than 1 which indicates its current asset base is not adequate

for meeting its short-term financial obligations. Also, the ratio has depicted a declining trend

which means that its ability to meet its current financial obligations has been reduced over the

selected financial period (Annual Report, 2018).

Quick ratio

It indicates the proportion of most liquid assets maintained by a company on comparison

to its short-term obligations. The quick ratio of Telstra as depicted above has been reduced over

the selected financial period from 2017-2018 and is also less than 1. This indicates that it needs

to improve its liquid resources such as cash equivalents for meeting the short-term financial

obligations as they become due.

Leverage analysis (Long term solvency position)

The leverage ratios help in assessing the long-term solvency position of a company by

identifying the proportion of capital that is financed by debt. The leverage position of Telstra can

be analyzed by the use of following ratios:

Financial ratios of Telstra for year 2017 and 2018

Leverage Ratios Formula 2017 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Debt to Equity Ratio

Total Liabilities/Shareholders

Equity 189.75% 185.29%

Interest Coverage Ratio EBIT/Finance Cost 8.56 8.96

(Davies & Crawford, 2011)

Debt to Equity Ratio

The ratio is used for depicting the relative proportion of shareholder’s equity and debt

used for financing the asset base of a company. The ratio for Telstra has shown a decreasing

trend which means that the company has reduced the proportion of debt in comparison to equity

fir financing its asset base. This means reduced financial risk for the investors of the company

due to less chances of its default with reducing debt obligations. However, the ratio is very high

for the selected financial period which means that it is incorporation high use of debt in its

capital structure (Annual Report, 2018).

Interest Coverage Ratio

The ratio mainly depicts the ability of a company to meet its debt obligations by

assessing its ability to meet interest expenses on its outstanding debt. The ratio for the company

has depicted a gradual increase which means increase in its capability to meet the interest

expenses. The company has maintained a very high interest converge ratio over the selected

financial years which indicates that it is able to effectively meet its interest expenses from its

debt obligations.

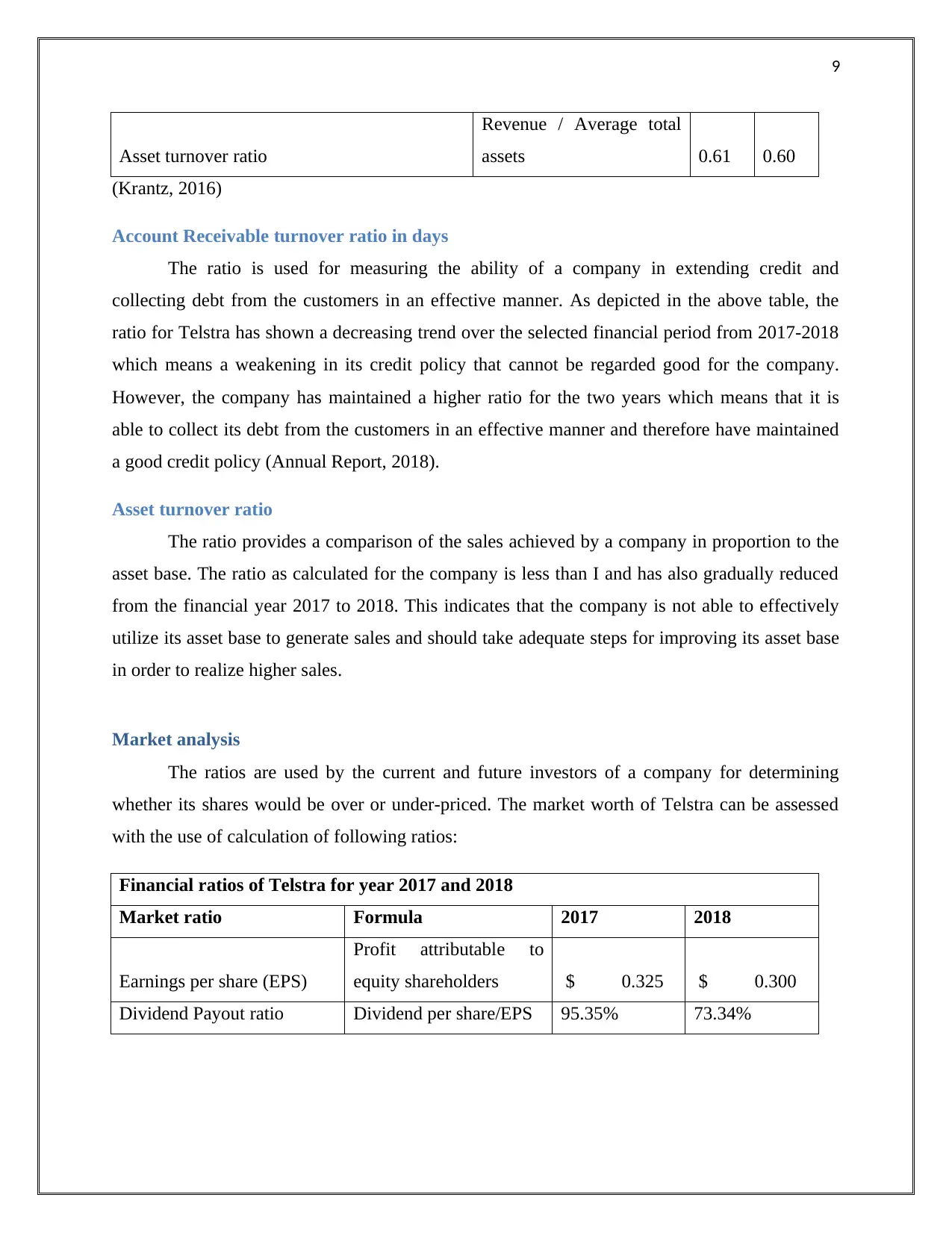

Asset Efficiency analysis

The analysis is used for examining the ability of a company to generate sales from the use

of its asset resources. The analysis can be carried out fiord Telstra with the use of calculation of

the following ratios:

Financial ratios of Telstra for year 2017 and 2018

Asset Efficiency Ratio Formula 2017 2018

Account Receivable turnover ratio in days

365/(Net receivable sales/

Average accounts

receivables) 49.15 48.21

Debt to Equity Ratio

Total Liabilities/Shareholders

Equity 189.75% 185.29%

Interest Coverage Ratio EBIT/Finance Cost 8.56 8.96

(Davies & Crawford, 2011)

Debt to Equity Ratio

The ratio is used for depicting the relative proportion of shareholder’s equity and debt

used for financing the asset base of a company. The ratio for Telstra has shown a decreasing

trend which means that the company has reduced the proportion of debt in comparison to equity

fir financing its asset base. This means reduced financial risk for the investors of the company

due to less chances of its default with reducing debt obligations. However, the ratio is very high

for the selected financial period which means that it is incorporation high use of debt in its

capital structure (Annual Report, 2018).

Interest Coverage Ratio

The ratio mainly depicts the ability of a company to meet its debt obligations by

assessing its ability to meet interest expenses on its outstanding debt. The ratio for the company

has depicted a gradual increase which means increase in its capability to meet the interest

expenses. The company has maintained a very high interest converge ratio over the selected

financial years which indicates that it is able to effectively meet its interest expenses from its

debt obligations.

Asset Efficiency analysis

The analysis is used for examining the ability of a company to generate sales from the use

of its asset resources. The analysis can be carried out fiord Telstra with the use of calculation of

the following ratios:

Financial ratios of Telstra for year 2017 and 2018

Asset Efficiency Ratio Formula 2017 2018

Account Receivable turnover ratio in days

365/(Net receivable sales/

Average accounts

receivables) 49.15 48.21

9

Asset turnover ratio

Revenue / Average total

assets 0.61 0.60

(Krantz, 2016)

Account Receivable turnover ratio in days

The ratio is used for measuring the ability of a company in extending credit and

collecting debt from the customers in an effective manner. As depicted in the above table, the

ratio for Telstra has shown a decreasing trend over the selected financial period from 2017-2018

which means a weakening in its credit policy that cannot be regarded good for the company.

However, the company has maintained a higher ratio for the two years which means that it is

able to collect its debt from the customers in an effective manner and therefore have maintained

a good credit policy (Annual Report, 2018).

Asset turnover ratio

The ratio provides a comparison of the sales achieved by a company in proportion to the

asset base. The ratio as calculated for the company is less than I and has also gradually reduced

from the financial year 2017 to 2018. This indicates that the company is not able to effectively

utilize its asset base to generate sales and should take adequate steps for improving its asset base

in order to realize higher sales.

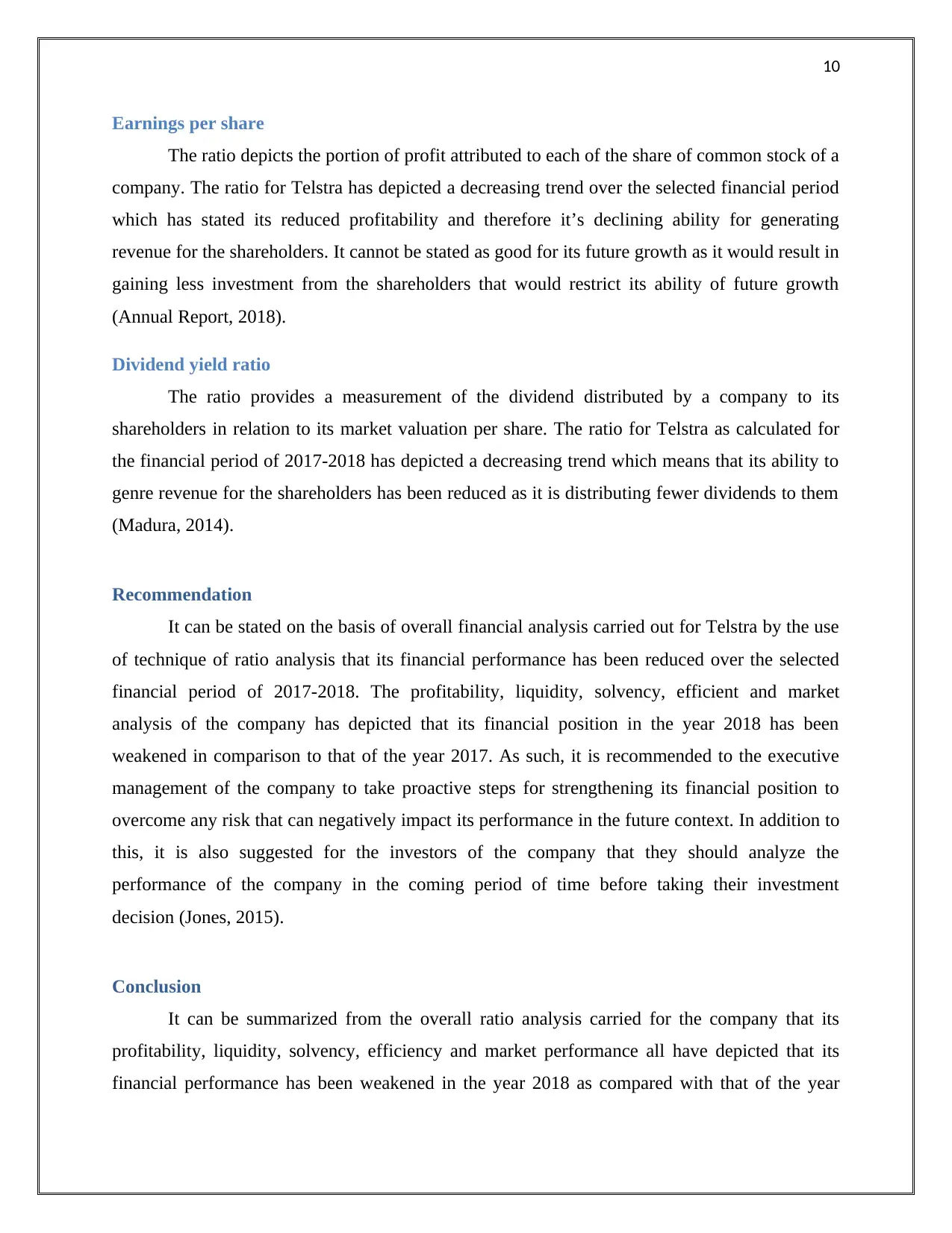

Market analysis

The ratios are used by the current and future investors of a company for determining

whether its shares would be over or under-priced. The market worth of Telstra can be assessed

with the use of calculation of following ratios:

Financial ratios of Telstra for year 2017 and 2018

Market ratio Formula 2017 2018

Earnings per share (EPS)

Profit attributable to

equity shareholders $ 0.325 $ 0.300

Dividend Payout ratio Dividend per share/EPS 95.35% 73.34%

Asset turnover ratio

Revenue / Average total

assets 0.61 0.60

(Krantz, 2016)

Account Receivable turnover ratio in days

The ratio is used for measuring the ability of a company in extending credit and

collecting debt from the customers in an effective manner. As depicted in the above table, the

ratio for Telstra has shown a decreasing trend over the selected financial period from 2017-2018

which means a weakening in its credit policy that cannot be regarded good for the company.

However, the company has maintained a higher ratio for the two years which means that it is

able to collect its debt from the customers in an effective manner and therefore have maintained

a good credit policy (Annual Report, 2018).

Asset turnover ratio

The ratio provides a comparison of the sales achieved by a company in proportion to the

asset base. The ratio as calculated for the company is less than I and has also gradually reduced

from the financial year 2017 to 2018. This indicates that the company is not able to effectively

utilize its asset base to generate sales and should take adequate steps for improving its asset base

in order to realize higher sales.

Market analysis

The ratios are used by the current and future investors of a company for determining

whether its shares would be over or under-priced. The market worth of Telstra can be assessed

with the use of calculation of following ratios:

Financial ratios of Telstra for year 2017 and 2018

Market ratio Formula 2017 2018

Earnings per share (EPS)

Profit attributable to

equity shareholders $ 0.325 $ 0.300

Dividend Payout ratio Dividend per share/EPS 95.35% 73.34%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Earnings per share

The ratio depicts the portion of profit attributed to each of the share of common stock of a

company. The ratio for Telstra has depicted a decreasing trend over the selected financial period

which has stated its reduced profitability and therefore it’s declining ability for generating

revenue for the shareholders. It cannot be stated as good for its future growth as it would result in

gaining less investment from the shareholders that would restrict its ability of future growth

(Annual Report, 2018).

Dividend yield ratio

The ratio provides a measurement of the dividend distributed by a company to its

shareholders in relation to its market valuation per share. The ratio for Telstra as calculated for

the financial period of 2017-2018 has depicted a decreasing trend which means that its ability to

genre revenue for the shareholders has been reduced as it is distributing fewer dividends to them

(Madura, 2014).

Recommendation

It can be stated on the basis of overall financial analysis carried out for Telstra by the use

of technique of ratio analysis that its financial performance has been reduced over the selected

financial period of 2017-2018. The profitability, liquidity, solvency, efficient and market

analysis of the company has depicted that its financial position in the year 2018 has been

weakened in comparison to that of the year 2017. As such, it is recommended to the executive

management of the company to take proactive steps for strengthening its financial position to

overcome any risk that can negatively impact its performance in the future context. In addition to

this, it is also suggested for the investors of the company that they should analyze the

performance of the company in the coming period of time before taking their investment

decision (Jones, 2015).

Conclusion

It can be summarized from the overall ratio analysis carried for the company that its

profitability, liquidity, solvency, efficiency and market performance all have depicted that its

financial performance has been weakened in the year 2018 as compared with that of the year

Earnings per share

The ratio depicts the portion of profit attributed to each of the share of common stock of a

company. The ratio for Telstra has depicted a decreasing trend over the selected financial period

which has stated its reduced profitability and therefore it’s declining ability for generating

revenue for the shareholders. It cannot be stated as good for its future growth as it would result in

gaining less investment from the shareholders that would restrict its ability of future growth

(Annual Report, 2018).

Dividend yield ratio

The ratio provides a measurement of the dividend distributed by a company to its

shareholders in relation to its market valuation per share. The ratio for Telstra as calculated for

the financial period of 2017-2018 has depicted a decreasing trend which means that its ability to

genre revenue for the shareholders has been reduced as it is distributing fewer dividends to them

(Madura, 2014).

Recommendation

It can be stated on the basis of overall financial analysis carried out for Telstra by the use

of technique of ratio analysis that its financial performance has been reduced over the selected

financial period of 2017-2018. The profitability, liquidity, solvency, efficient and market

analysis of the company has depicted that its financial position in the year 2018 has been

weakened in comparison to that of the year 2017. As such, it is recommended to the executive

management of the company to take proactive steps for strengthening its financial position to

overcome any risk that can negatively impact its performance in the future context. In addition to

this, it is also suggested for the investors of the company that they should analyze the

performance of the company in the coming period of time before taking their investment

decision (Jones, 2015).

Conclusion

It can be summarized from the overall ratio analysis carried for the company that its

profitability, liquidity, solvency, efficiency and market performance all have depicted that its

financial performance has been weakened in the year 2018 as compared with that of the year

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

2017. The Board of the company should identify and take proactive measures for overcoming

these gaps in performance to foster its growth and development in the future context of time.

2017. The Board of the company should identify and take proactive measures for overcoming

these gaps in performance to foster its growth and development in the future context of time.

12

References

Annual Report. (2018). Telstra. Retrieved 20 January, 2019, from

https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F/2018-Annual-

Report.pdf

Brigham, F., & Michael C. (2013). Financial management: Theory & practice. Boston, USA:

Cengage Learning.

Damodaran, A, (2011). Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I., (2011). Business accounting and finance. London: Pearson.

Jones, S. (2015). The Routledge Companion to Financial Accounting Theory. London:

Routledge.

Krantz, M. (2016). Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Madura, J. (2014). Financial Markets and Institutions. USA: Cengage Learning.

Telstra. (2018). Our Company. Retrieved 20 January, 2019, from

https://www.telstra.com.au/aboutus/our-company

References

Annual Report. (2018). Telstra. Retrieved 20 January, 2019, from

https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F/2018-Annual-

Report.pdf

Brigham, F., & Michael C. (2013). Financial management: Theory & practice. Boston, USA:

Cengage Learning.

Damodaran, A, (2011). Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I., (2011). Business accounting and finance. London: Pearson.

Jones, S. (2015). The Routledge Companion to Financial Accounting Theory. London:

Routledge.

Krantz, M. (2016). Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Madura, J. (2014). Financial Markets and Institutions. USA: Cengage Learning.

Telstra. (2018). Our Company. Retrieved 20 January, 2019, from

https://www.telstra.com.au/aboutus/our-company

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.