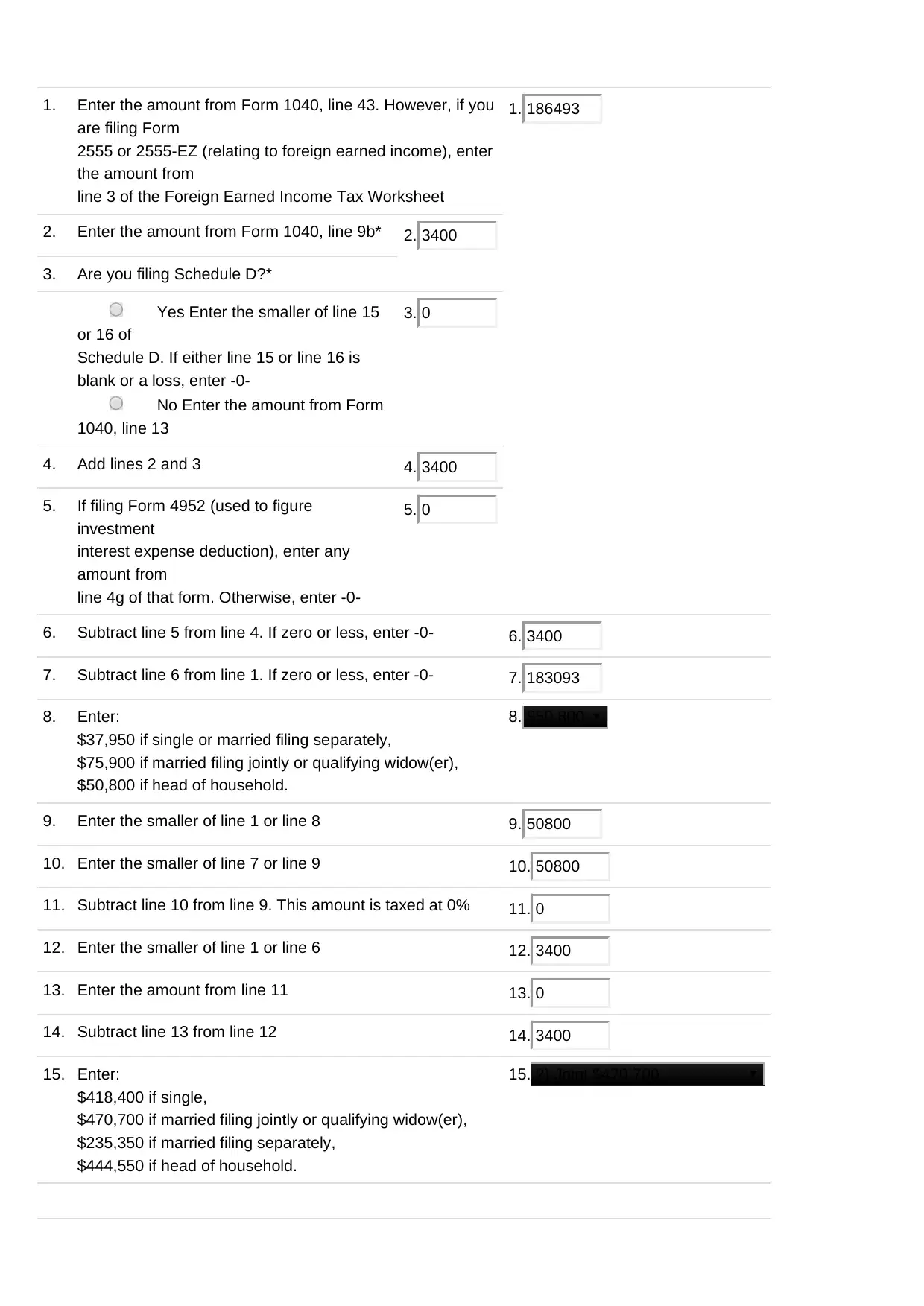

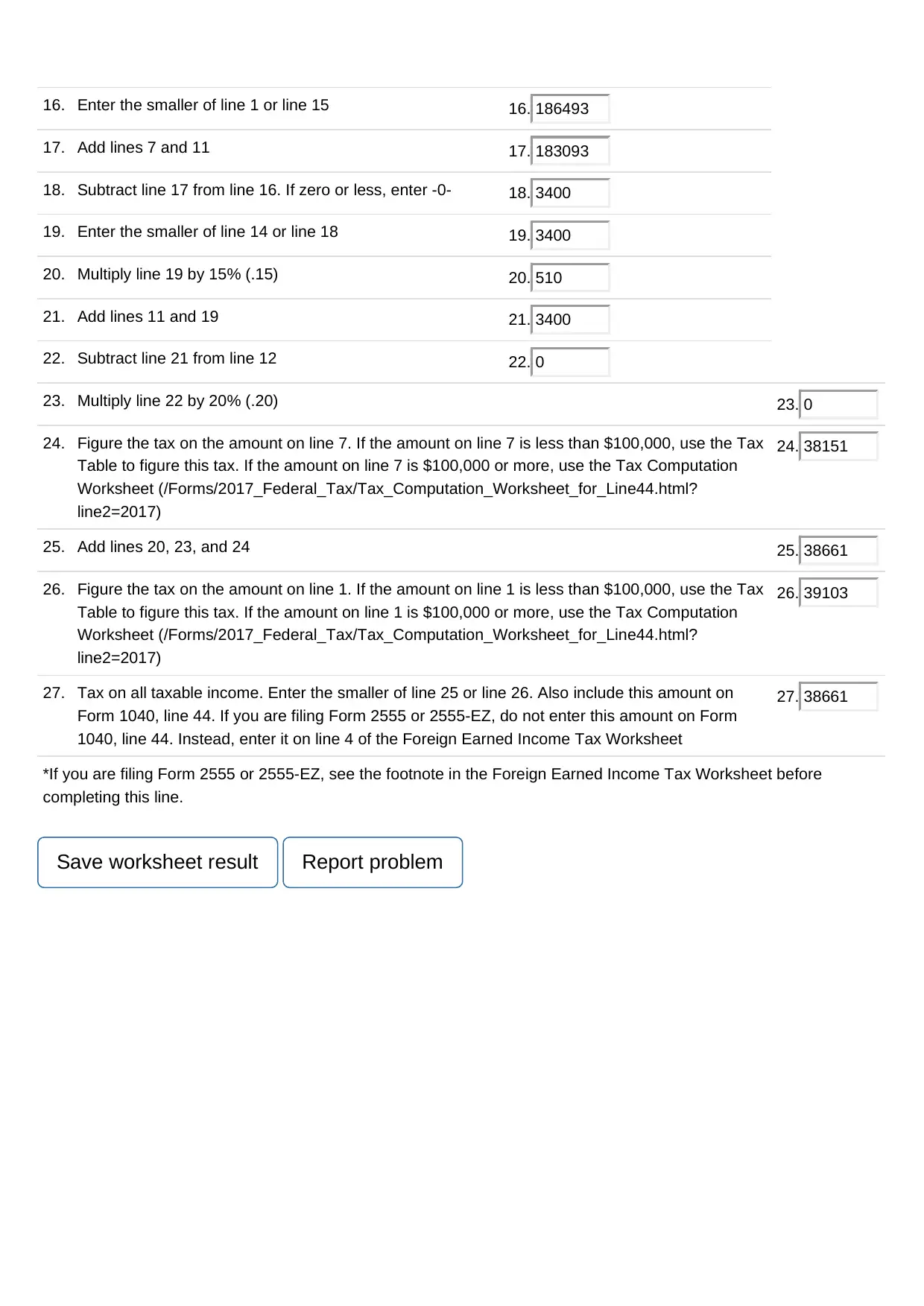

2017 Tax Computation Worksheet - Form 1040

VerifiedAdded on 2023/06/11

|2

|686

|107

AI Summary

This Tax Computation Worksheet for Form 1040 helps taxpayers calculate their federal tax liability for the year 2017. It provides step-by-step instructions and examples for each line of the worksheet, including how to calculate taxable income, investment interest expense deduction, and foreign earned income tax. The worksheet also includes a Tax Table and Tax Computation Worksheet for Line 44, which taxpayers can use to figure their tax liability based on their income level. The output includes the final tax amount to be entered on Form 1040, line 44.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 2

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)