ACCT20073 Company Accounting: Goodwill Accounting and Analysis

VerifiedAdded on 2023/02/01

|6

|584

|42

Report

AI Summary

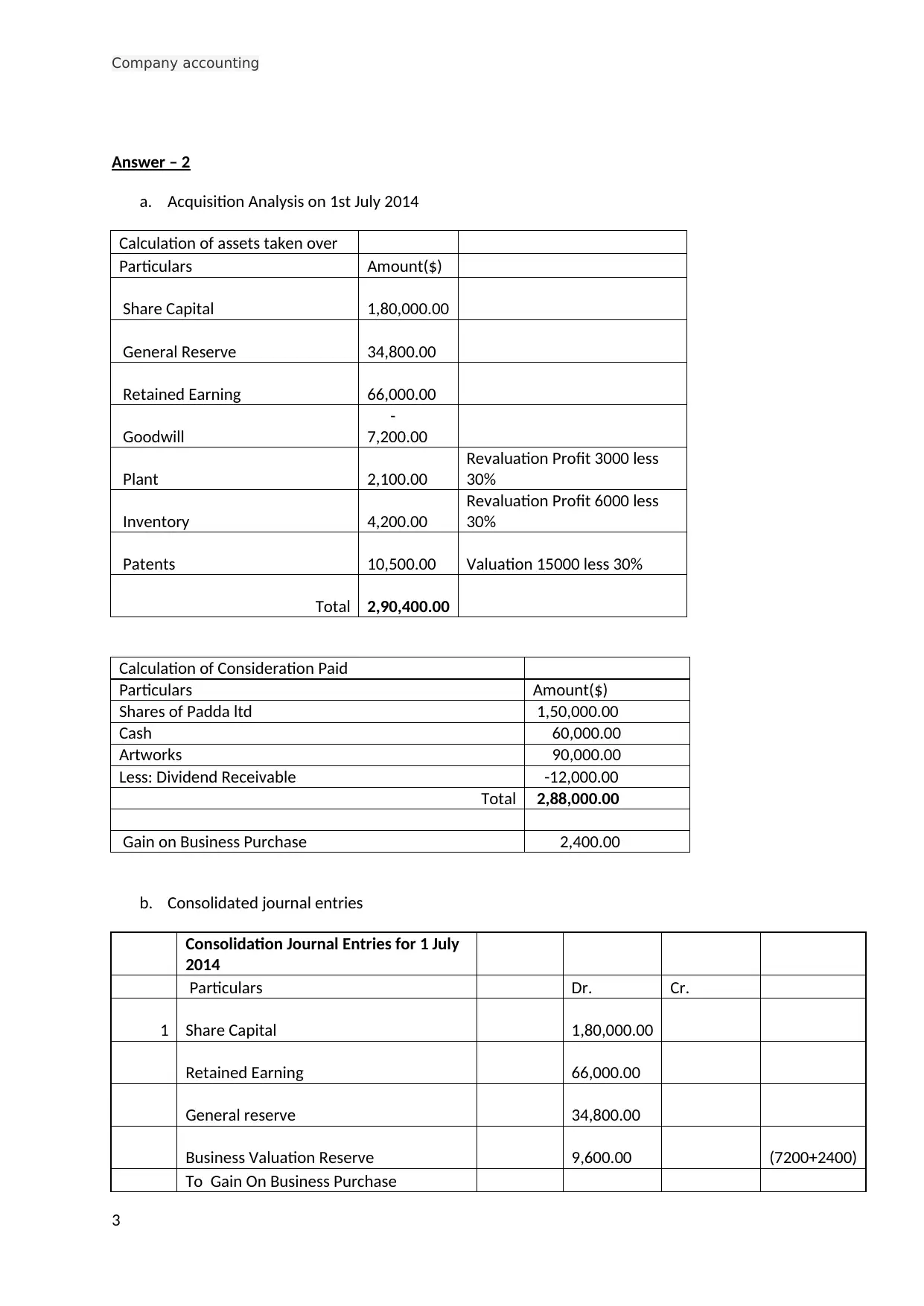

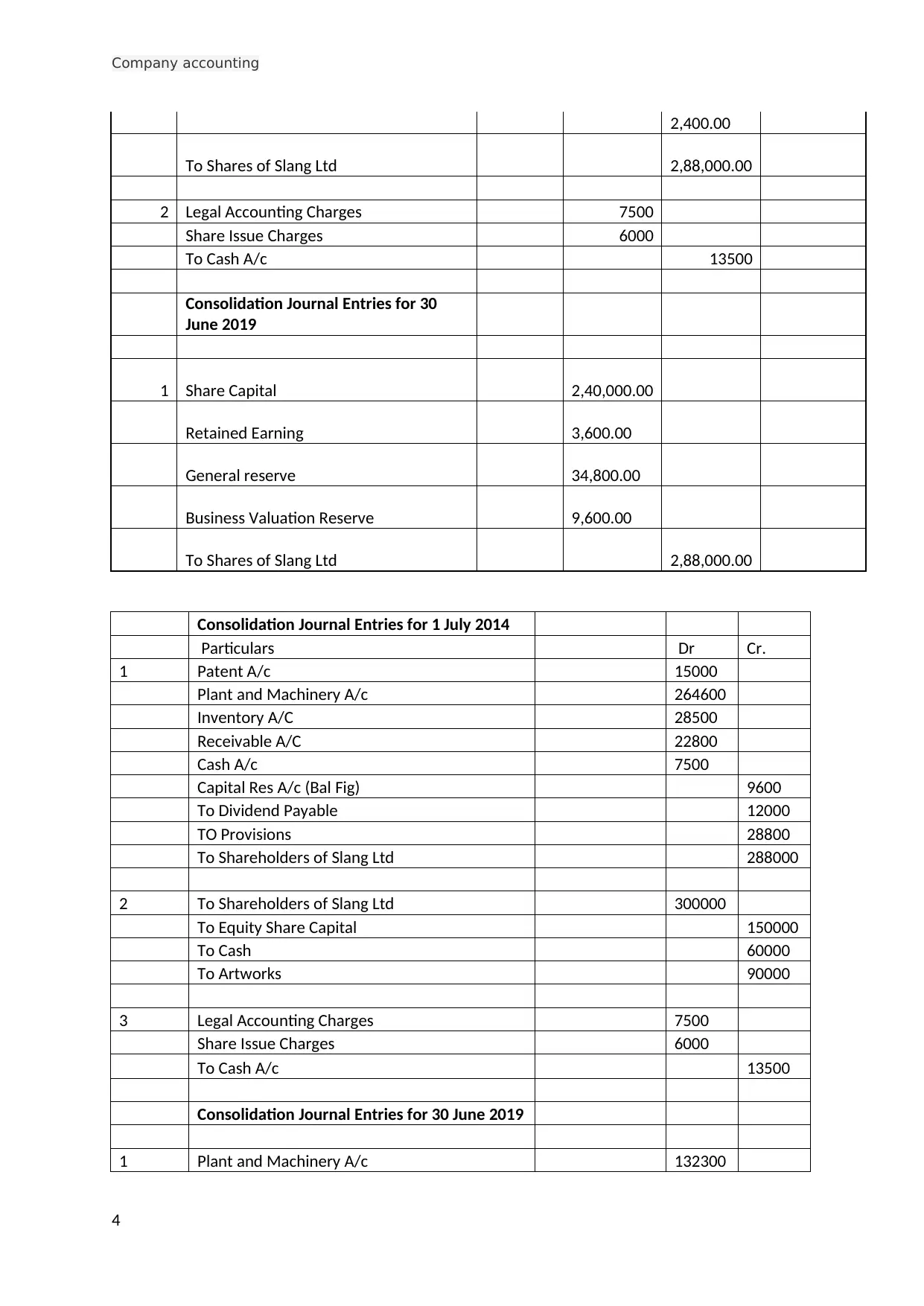

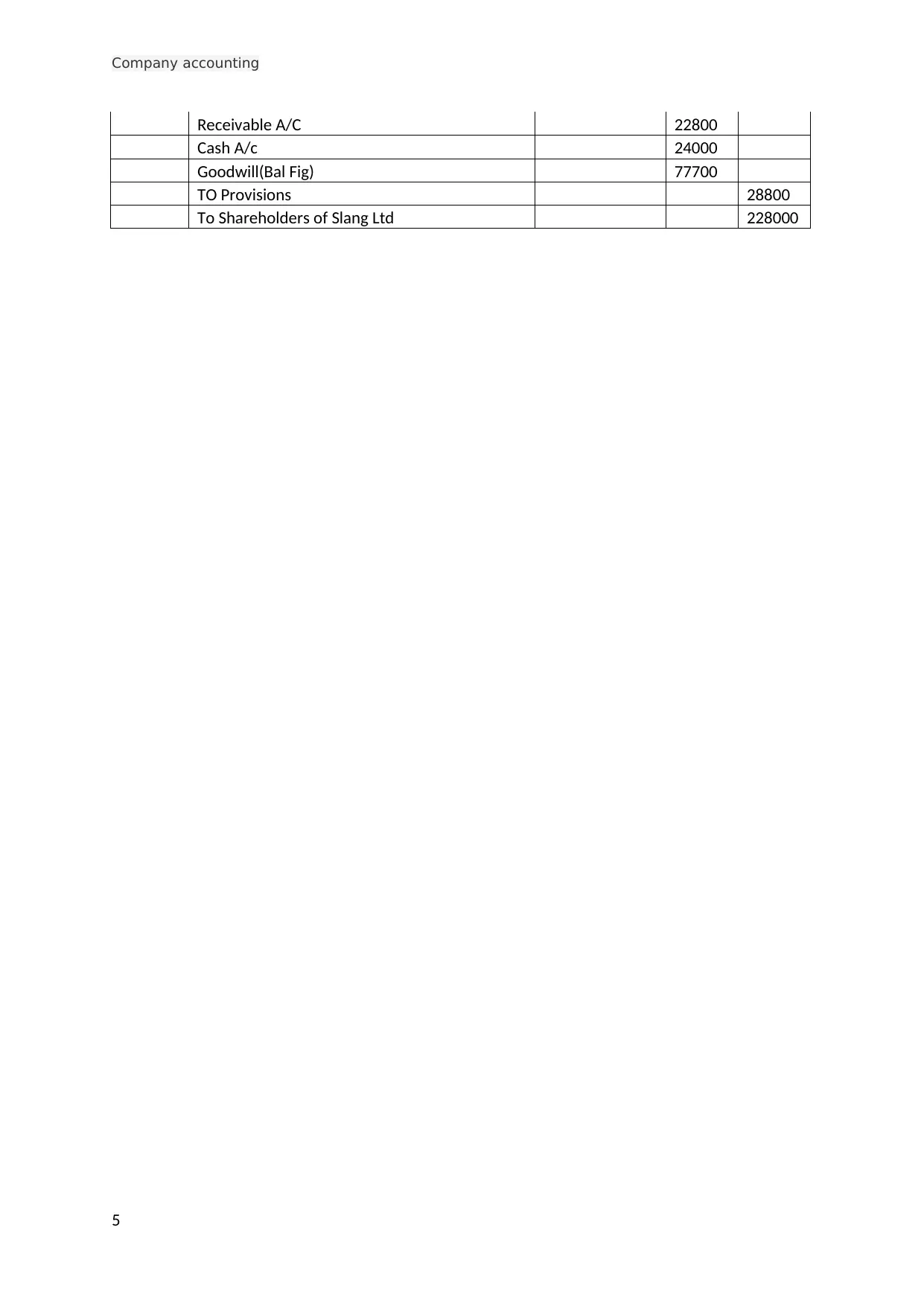

This report addresses the nature of goodwill and its accounting treatment, focusing on the acquisition of Salto Ltd. It explains goodwill calculation, arising from the difference between fair value and purchase consideration, emphasizing factors like brand value and customer relations. The report details the recording of goodwill as an intangible asset and its annual impairment evaluation. It includes an acquisition analysis calculating assets taken over and consideration paid, followed by consolidated journal entries for July 1, 2014, and June 30, 2019, covering share capital, retained earnings, general reserve, and various asset and liability adjustments. The report provides references to support its analysis.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)