Diversification and Systematic Risk in Crown Resorts Ltd

VerifiedAdded on 2023/04/21

|19

|4481

|372

AI Summary

This report discusses the concept of diversification and its role in managing systematic and unsystematic risks in Crown Resorts Ltd. It also explores the global factors affecting share prices and provides an analysis of the company's performance in terms of risk and return.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ECF1120 Semester 1 2019

Assignment Instructions

2019

Assignment Instructions

2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Crown Resorts Ltd

Executive Summary

Diversification is the need of the hour because the market is exposed to various risks and

uncertainties. It is one of the vital aspects when it comes to long term planning and return

generation. The current report is based on the concept of diversification and deal with the

ASX listed company called Crown Resorts Ltd. The reports provide a strong emphasis on

diversification together with systematic and unsystematic risk. Further, the global factors that

affect the share prices is even discussed. The report differentiates the company’s return in

comparison to the market return. Overall, the project defines the system of diversification and

how it helps the investor to beat the risks of market.

2

Executive Summary

Diversification is the need of the hour because the market is exposed to various risks and

uncertainties. It is one of the vital aspects when it comes to long term planning and return

generation. The current report is based on the concept of diversification and deal with the

ASX listed company called Crown Resorts Ltd. The reports provide a strong emphasis on

diversification together with systematic and unsystematic risk. Further, the global factors that

affect the share prices is even discussed. The report differentiates the company’s return in

comparison to the market return. Overall, the project defines the system of diversification and

how it helps the investor to beat the risks of market.

2

Crown Resorts Ltd

Contents

Introduction...........................................................................................................................................4

Key events and driving factors affecting global financial markets........................................................4

Share price trends of the market index and company...........................................................................5

Performance of Market and Crown Resorts in terms of risk and return...............................................8

Diversification, systematic and unsystematic risks................................................................................9

Company’s operations, developments, and/or initiatives from 2014 - 2018.......................................11

Systematic and unsystematic risk........................................................................................................13

Key events and driving factors of global financial markets from 2014 - 2018.....................................14

Recommendation................................................................................................................................15

Conclusion...........................................................................................................................................16

References...........................................................................................................................................17

3

Contents

Introduction...........................................................................................................................................4

Key events and driving factors affecting global financial markets........................................................4

Share price trends of the market index and company...........................................................................5

Performance of Market and Crown Resorts in terms of risk and return...............................................8

Diversification, systematic and unsystematic risks................................................................................9

Company’s operations, developments, and/or initiatives from 2014 - 2018.......................................11

Systematic and unsystematic risk........................................................................................................13

Key events and driving factors of global financial markets from 2014 - 2018.....................................14

Recommendation................................................................................................................................15

Conclusion...........................................................................................................................................16

References...........................................................................................................................................17

3

Crown Resorts Ltd

Introduction

The Crown Resorts Ltd has been a major mover in terms of share price and the segment has

done a commendable business in Australia. However, the market cannot operate in isolation,

it is influenced by the conditions in the economy as a whole. There are various international

and other domestic factors that influences the operations of the company. The same has been

highlighted and discussed in the report. Further, systematic and unsystematic risk has been

discussed that have a major role to play in the company’s functioning. The continuous

movement of the share price in this domain projects that the company has been doing

reasonably well.

Key events and driving factors affecting global financial markets.

The government exercises a lot of control over the free markets. All the policies that are

being propounded by the government in relation to the monetary terms play a very vital role

in the financial sector of the country. By increasing or decreasing the interest rates, the

government can regulate the speed and growth of the country. The increase in government

activities also leads to remove unemployment and stabilize prices of goods all over the

country. Inconsistent interest rates in the market also lead the international market to be much

more stimulated because of the regular investment inflows and outflows of the country.

International Stocks

It is generally noticed that international stocks are affected because of the general economic

conditions of the country. These stocks are also related to the economy of various other

countries. The US economy is the largest in the world and is one of the most important

financial pillars because of which any kind of economic struggle in the US will affect the

whole world's economy.

Emerging markets

Decoupling has become very popular in the present situation. This is a general economic term

that is used to describe a market which is gradually getting unlinked to another market

(Lapsley, 2012). The huge economies of the world like the United States are highly volatile

4

Introduction

The Crown Resorts Ltd has been a major mover in terms of share price and the segment has

done a commendable business in Australia. However, the market cannot operate in isolation,

it is influenced by the conditions in the economy as a whole. There are various international

and other domestic factors that influences the operations of the company. The same has been

highlighted and discussed in the report. Further, systematic and unsystematic risk has been

discussed that have a major role to play in the company’s functioning. The continuous

movement of the share price in this domain projects that the company has been doing

reasonably well.

Key events and driving factors affecting global financial markets.

The government exercises a lot of control over the free markets. All the policies that are

being propounded by the government in relation to the monetary terms play a very vital role

in the financial sector of the country. By increasing or decreasing the interest rates, the

government can regulate the speed and growth of the country. The increase in government

activities also leads to remove unemployment and stabilize prices of goods all over the

country. Inconsistent interest rates in the market also lead the international market to be much

more stimulated because of the regular investment inflows and outflows of the country.

International Stocks

It is generally noticed that international stocks are affected because of the general economic

conditions of the country. These stocks are also related to the economy of various other

countries. The US economy is the largest in the world and is one of the most important

financial pillars because of which any kind of economic struggle in the US will affect the

whole world's economy.

Emerging markets

Decoupling has become very popular in the present situation. This is a general economic term

that is used to describe a market which is gradually getting unlinked to another market

(Lapsley, 2012). The huge economies of the world like the United States are highly volatile

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Crown Resorts Ltd

in nature because of which any kind of sell-off ordeal will affect the whole world's economy.

It is of the common factor that investors try to invest in markets which are emerging

constantly so that they can make better revenue (Julia & Elizabeth, 2010). Hence the sell-offs

are very important for the emerging markets because it will make the market more popular

because of which the investors will be attracted towards it. There are many different

commodity markets that have large natural resources reserve. The investors try to invest in a

market where every day new opportunities are arising so that they can pull out money easily

whenever required. Generally, the investors try to track the overall strength and weakness of

the world economy so that they can understand the shift of the market with the change in time

(Gowthrope, 2011).

It was observed that the share of the crown resorts located was one of the most traded stocks

after a clear analysis of the full-year result. Also, it was observed that during the time of

writing, the casino and resort operators share up to almost 3.5% or $13.80.

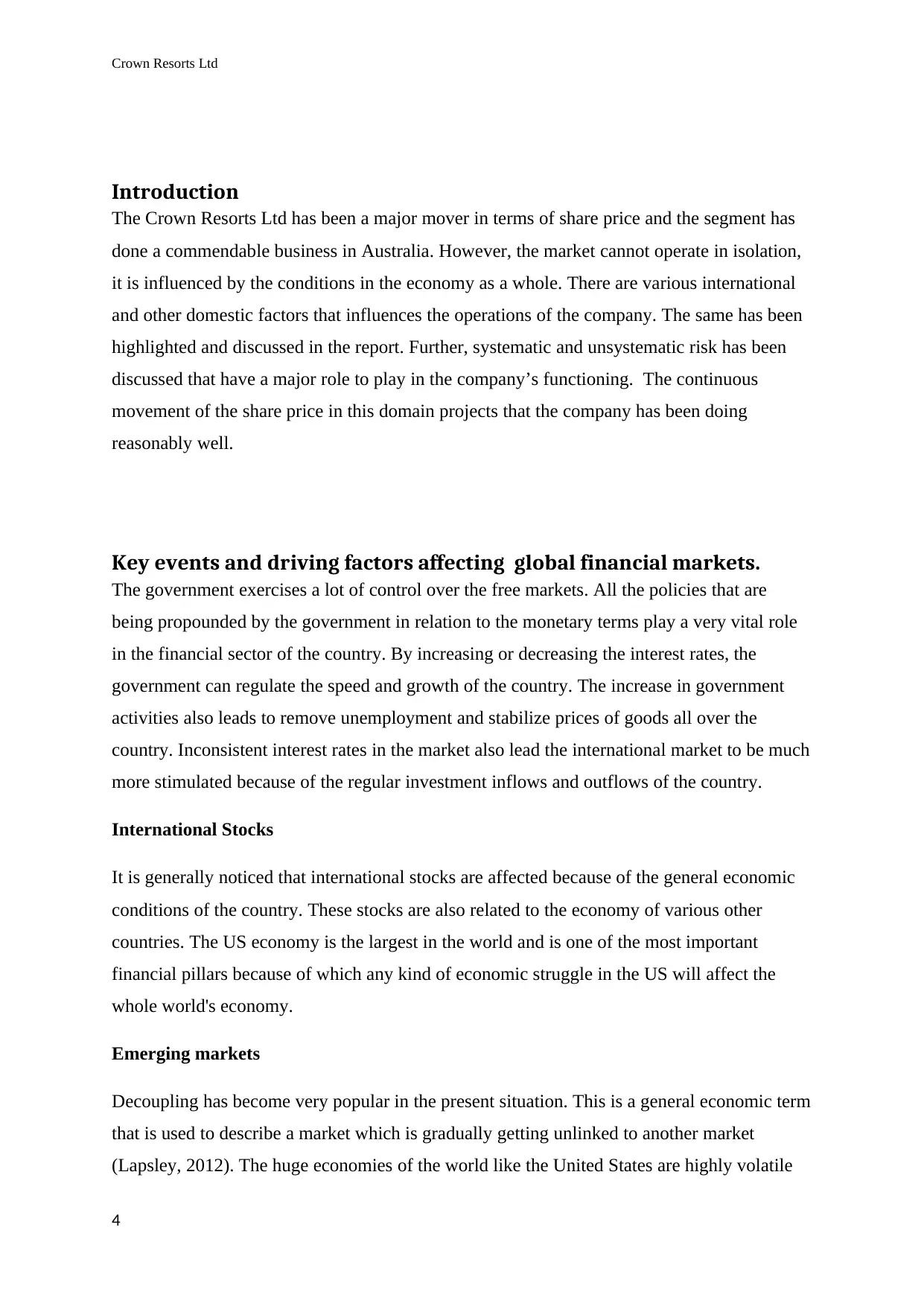

Share price trends of the market index and company

In the financial year 2018, an increase of 8.5 % in the revenue to $3511.3 million and also a

12.7% increase in normalized net profit after tax amounting to $368.8 million was observed.

Also, it was reported that the revenue who was 4.5 % higher at $3493 million and also the net

profit after tax was down to 70% by $558.9 million. It was clearly noted in the last year

reports about the results of revenue that was gained on the melon resorts and entertainment

which amounted to $1745.5 million. Also, the report stated that expenses and restructuring

cost amounted to $260.2 million (Crown resorts, 2018). The company was also observed to

have diluted earnings of 81.2 cents per share out of which 74% was paid out as dividend after

declaration by the crowns board of 30 cents per share bringing the rate to a dividend of 60

cents in the complete year. The net operating cash flow for a particular period was observed

to be higher than that of the previous year. The current figure amounts to $731.7 million

whereas previously it was $465.7 million.

Figure 1 Share price trend

5

in nature because of which any kind of sell-off ordeal will affect the whole world's economy.

It is of the common factor that investors try to invest in markets which are emerging

constantly so that they can make better revenue (Julia & Elizabeth, 2010). Hence the sell-offs

are very important for the emerging markets because it will make the market more popular

because of which the investors will be attracted towards it. There are many different

commodity markets that have large natural resources reserve. The investors try to invest in a

market where every day new opportunities are arising so that they can pull out money easily

whenever required. Generally, the investors try to track the overall strength and weakness of

the world economy so that they can understand the shift of the market with the change in time

(Gowthrope, 2011).

It was observed that the share of the crown resorts located was one of the most traded stocks

after a clear analysis of the full-year result. Also, it was observed that during the time of

writing, the casino and resort operators share up to almost 3.5% or $13.80.

Share price trends of the market index and company

In the financial year 2018, an increase of 8.5 % in the revenue to $3511.3 million and also a

12.7% increase in normalized net profit after tax amounting to $368.8 million was observed.

Also, it was reported that the revenue who was 4.5 % higher at $3493 million and also the net

profit after tax was down to 70% by $558.9 million. It was clearly noted in the last year

reports about the results of revenue that was gained on the melon resorts and entertainment

which amounted to $1745.5 million. Also, the report stated that expenses and restructuring

cost amounted to $260.2 million (Crown resorts, 2018). The company was also observed to

have diluted earnings of 81.2 cents per share out of which 74% was paid out as dividend after

declaration by the crowns board of 30 cents per share bringing the rate to a dividend of 60

cents in the complete year. The net operating cash flow for a particular period was observed

to be higher than that of the previous year. The current figure amounts to $731.7 million

whereas previously it was $465.7 million.

Figure 1 Share price trend

5

Crown Resorts Ltd

The major drivers of revenue and growing profit

It was mentioned in the Australian report segment that an increase in the revenue for non-

gaming facilities, main gaming floor, and VIP turnover was observed. The chairman of the

Melbourne operation, John Alexander plays a very important role while subduing the trade in

Perth. The VIP play of crown Melbourne was been highlighted by a profit of 73.9% on the

corresponding period (Crown resorts, 2018). Also, portfolio of the hotels in Melbourne

enjoyed very high occupancy levels because of which a strong demand in the luxury hotel

accommodation has been observed in the past few years and the average occupancy rate was

also increased to 95%. An increased occupancy level was observed for the hotels present in

Perth.

The digital segment of the crown was observed to have declined revenue. The revenue fell

from $293 million to $266.1 million. Also, this resulted to decrease the earnings before

interest and tax because of which a loss of $7.5 million was observed in the past year. There

are no practical guidelines provided by the management for the financial year 2019 but it has

been stated that the earnings per share will be boosted because of the increased market

buybacks.

Crown was able to buy back only 1.43 million worth of share, but it intended to overtake on

market shares worth $400 million.

6

The major drivers of revenue and growing profit

It was mentioned in the Australian report segment that an increase in the revenue for non-

gaming facilities, main gaming floor, and VIP turnover was observed. The chairman of the

Melbourne operation, John Alexander plays a very important role while subduing the trade in

Perth. The VIP play of crown Melbourne was been highlighted by a profit of 73.9% on the

corresponding period (Crown resorts, 2018). Also, portfolio of the hotels in Melbourne

enjoyed very high occupancy levels because of which a strong demand in the luxury hotel

accommodation has been observed in the past few years and the average occupancy rate was

also increased to 95%. An increased occupancy level was observed for the hotels present in

Perth.

The digital segment of the crown was observed to have declined revenue. The revenue fell

from $293 million to $266.1 million. Also, this resulted to decrease the earnings before

interest and tax because of which a loss of $7.5 million was observed in the past year. There

are no practical guidelines provided by the management for the financial year 2019 but it has

been stated that the earnings per share will be boosted because of the increased market

buybacks.

Crown was able to buy back only 1.43 million worth of share, but it intended to overtake on

market shares worth $400 million.

6

Crown Resorts Ltd

Discussion of share price trends and market index of the company in relation to key

events and major factors

The huge stocks with large market capitals like crown resorts Limited do not attract much

attention of the investors because of the differences present in their capitals. It can also be

observed that in the past that the companies have performed much better while working with

risks than the smaller largest segment of the market. The financial liquidity of the

organization and the concentration of assets have led to acquisitions and cyclical pressures.

This topic requires a very broad focus because of the deep analysis that is required for the

financial reports.

It was observed in the past year that CWN reduced its debt from AU$2.28 billion to AU$1.95

billion comprising of both long and short term debt. Also, a cash flow of AU$465.66 million

was generated during the same period because of which the operating cash was increased to

cover the debt (Breen, 2018). This ratio also determines the operational efficiency of the

organization as an alternative to the return on assets.

7

Discussion of share price trends and market index of the company in relation to key

events and major factors

The huge stocks with large market capitals like crown resorts Limited do not attract much

attention of the investors because of the differences present in their capitals. It can also be

observed that in the past that the companies have performed much better while working with

risks than the smaller largest segment of the market. The financial liquidity of the

organization and the concentration of assets have led to acquisitions and cyclical pressures.

This topic requires a very broad focus because of the deep analysis that is required for the

financial reports.

It was observed in the past year that CWN reduced its debt from AU$2.28 billion to AU$1.95

billion comprising of both long and short term debt. Also, a cash flow of AU$465.66 million

was generated during the same period because of which the operating cash was increased to

cover the debt (Breen, 2018). This ratio also determines the operational efficiency of the

organization as an alternative to the return on assets.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Crown Resorts Ltd

Task 8

Performance of Market and Crown Resorts in terms of risk and return.

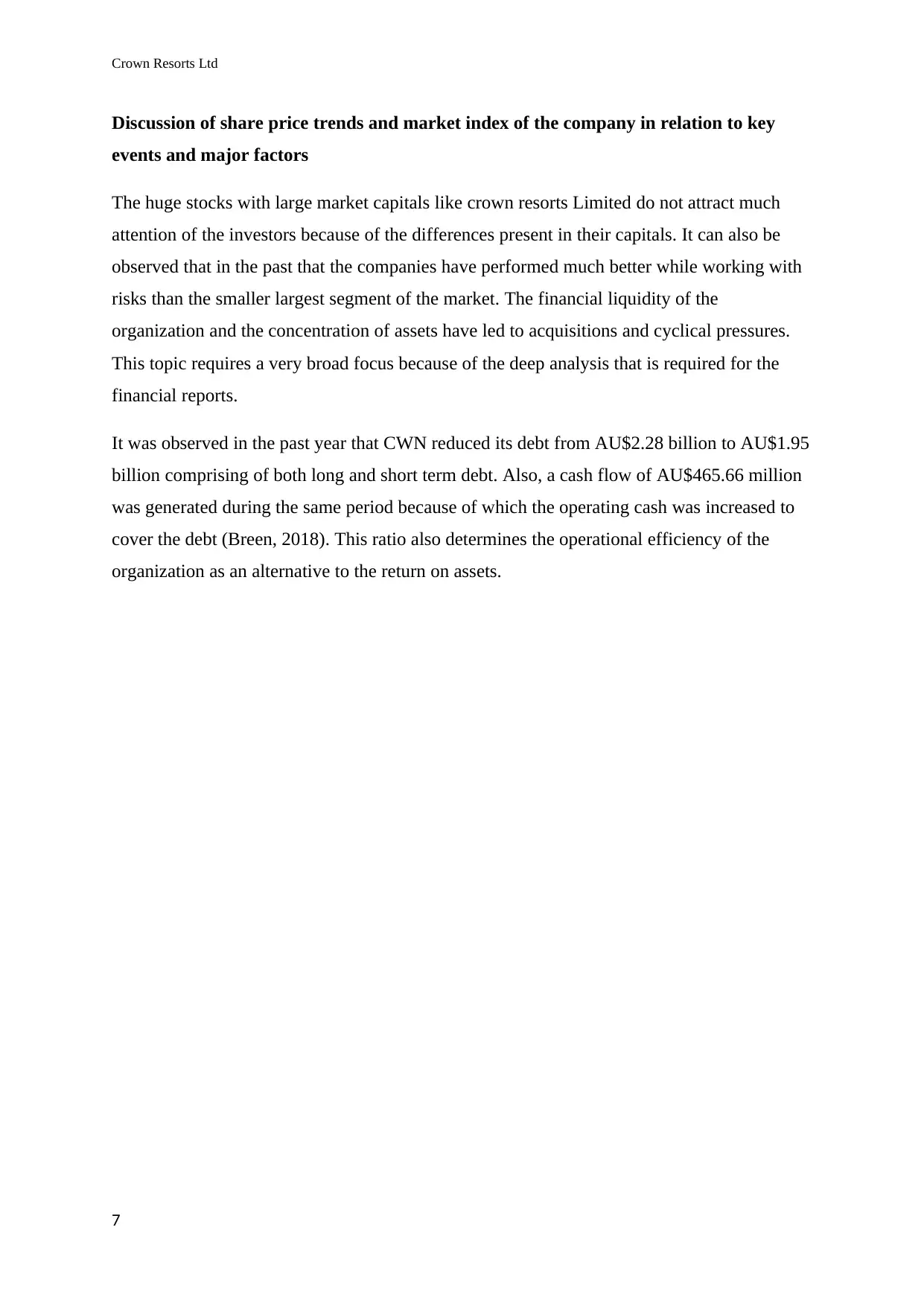

Figure 2 Market comparison

As it is seen above the ratios, CWN earnings are better than the market and sector numbers.

This shows that on the font of earnings CWN is better than its peers and market. When it

comes to Price earnings ratio, the company CWN have the best numbers, as it depicts that the

market share is 24 times the earning per share of the company. This also shows that investors

predict the future growth of share price. It is also said that it is way higher than the

competitors and market trends (Breen, 2018).

Also, the other ratios that are a price to book value ratios and price earning growth ratios are

also better the market and competitors trends. Hence it is seen that company financial

numbers are good. It is a good investment option for its stakeholders. Also when it comes to

other parameters like market capitalization, p/e, and dividend yield, it is among the top

performers.

Figure 3 Crown resort financial

8

Task 8

Performance of Market and Crown Resorts in terms of risk and return.

Figure 2 Market comparison

As it is seen above the ratios, CWN earnings are better than the market and sector numbers.

This shows that on the font of earnings CWN is better than its peers and market. When it

comes to Price earnings ratio, the company CWN have the best numbers, as it depicts that the

market share is 24 times the earning per share of the company. This also shows that investors

predict the future growth of share price. It is also said that it is way higher than the

competitors and market trends (Breen, 2018).

Also, the other ratios that are a price to book value ratios and price earning growth ratios are

also better the market and competitors trends. Hence it is seen that company financial

numbers are good. It is a good investment option for its stakeholders. Also when it comes to

other parameters like market capitalization, p/e, and dividend yield, it is among the top

performers.

Figure 3 Crown resort financial

8

Crown Resorts Ltd

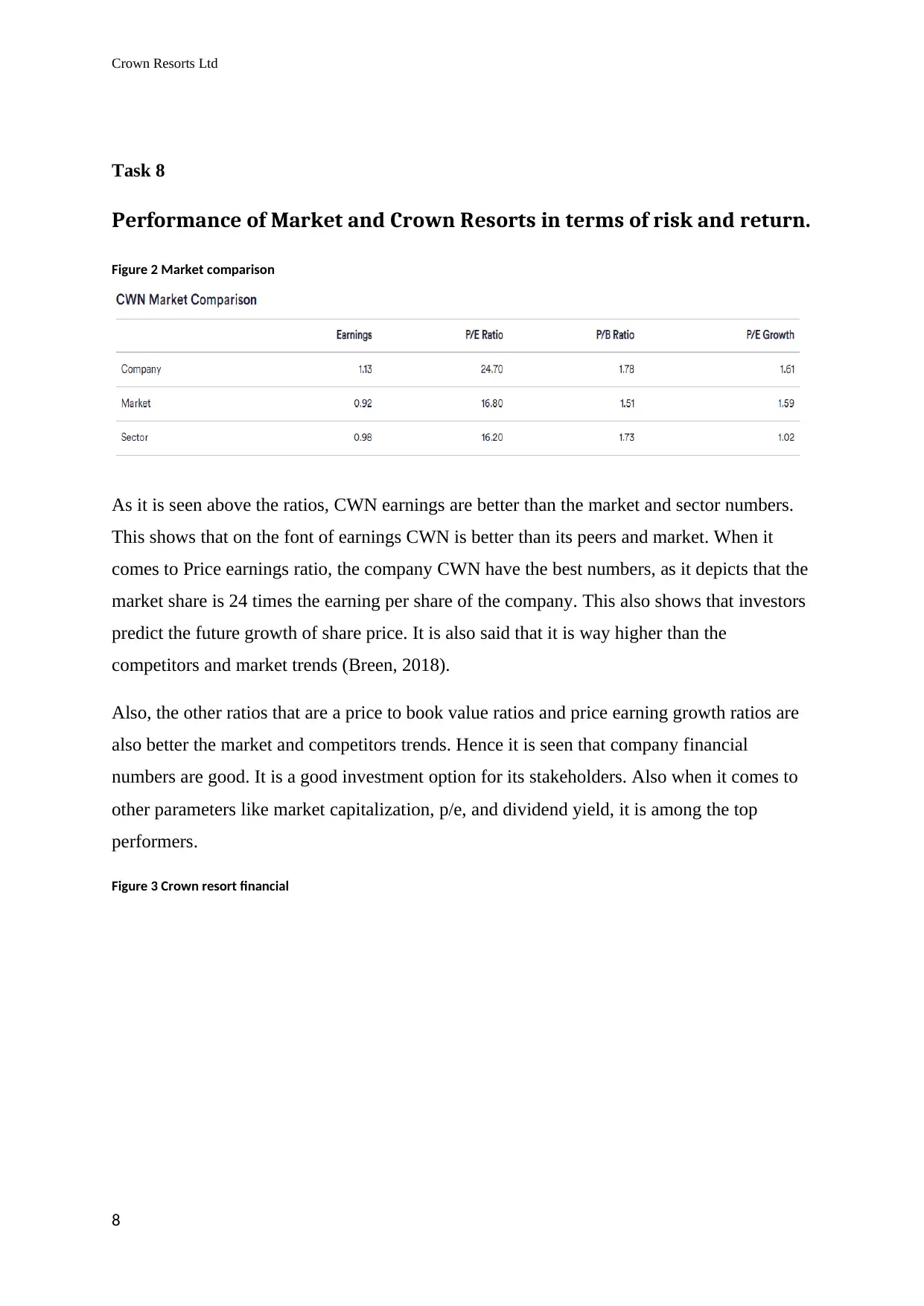

(Crown resorts, 2018)-

Below is shown Cost of capital of CWN which comes down to 2.67% while the return on

investment of CWN is 10.37% which is positive sign for the company. The company shall be

able to pay of its capital cost and the company shall always have surplus position.

Figure 4 Crown resort WACC

Diversification, systematic and unsystematic risks

A diversified portfolio is generally a combination of such multiple assets like commodities,

stocks and fixed income that carries the lowest of the risk and alternatively yielding highest

9

(Crown resorts, 2018)-

Below is shown Cost of capital of CWN which comes down to 2.67% while the return on

investment of CWN is 10.37% which is positive sign for the company. The company shall be

able to pay of its capital cost and the company shall always have surplus position.

Figure 4 Crown resort WACC

Diversification, systematic and unsystematic risks

A diversified portfolio is generally a combination of such multiple assets like commodities,

stocks and fixed income that carries the lowest of the risk and alternatively yielding highest

9

Crown Resorts Ltd

returns at the same time. The impact on all these assets arising out of the same economic

event varies from one another and therefore, it is why diversification always works (Adra &

Barbopoulos, 2018). A typical diversified portfolio is one where there is an accumulation of

multiple investment vehicles having numerous features. An investor might only benefit from

diversification if there is a slight correlation between the investments that are accumulated in

the portfolio (Laux, 2014).

An investor shall make use of such investments till the time they are available in the market

and are just slightly correlated with other investments in the portfolio for there is as such no

limit on diversification. Diversification hardly allows the assets to correlate with one another

for when there is a drop in other assets at least there is one asset that rises (Adra &

Barbopoulos, 2018). Therefore, even if few assets are not doing well there are certainly some

other assets that are performing great and this will ultimately lessen the overall risk to a great

extent. Undoubtedly, the benefits are derived from such assets at the lowest risk. One can opt

for a diversified portfolio of investments and make the best use of it so as to combat any

financial crisis (Titman, Martin, Keown, & Martin, 2016)

Unsystematic risk is a risk that specifically impacts a single organization or a few

organizations. To overcome or ease unsystematic risk one can take up diversification as an

effective strategy (Leo, 2011). A diversified portfolio of investments will allow an

organization to overcome the losses arising out of less performing investments from the

investments that are performing great. The risk that can be diversified differs from

organization to organization that is if an organization is yielding huge revenues then it's stock

price shall be higher while if an organization is yielding low revenues then it's stock price

shall be lower.

In order to lower or get rid of risks, investors opt for diversification strategy where the shares

of various companies are purchased. Higher diversification will result in lower risks. Multiple

risk management strategies and tools are implemented so as to deal with unsystematic risk.

Investment such as shares or debentures always carries a significant amount of risk. Both

systematic and unsystematic risks are significant components of risk and account for total

risk when combined together (Madura & Fox, 2011). Variables that are external and

uncontrollable and aren’t firm-specific accounts for systematic risk. It impacts the overall

market which ultimately influences the prices of all the securities. It is a risk that is related to

the market. While unsystematic risk is one that is firm-specific and arises out of internal and

10

returns at the same time. The impact on all these assets arising out of the same economic

event varies from one another and therefore, it is why diversification always works (Adra &

Barbopoulos, 2018). A typical diversified portfolio is one where there is an accumulation of

multiple investment vehicles having numerous features. An investor might only benefit from

diversification if there is a slight correlation between the investments that are accumulated in

the portfolio (Laux, 2014).

An investor shall make use of such investments till the time they are available in the market

and are just slightly correlated with other investments in the portfolio for there is as such no

limit on diversification. Diversification hardly allows the assets to correlate with one another

for when there is a drop in other assets at least there is one asset that rises (Adra &

Barbopoulos, 2018). Therefore, even if few assets are not doing well there are certainly some

other assets that are performing great and this will ultimately lessen the overall risk to a great

extent. Undoubtedly, the benefits are derived from such assets at the lowest risk. One can opt

for a diversified portfolio of investments and make the best use of it so as to combat any

financial crisis (Titman, Martin, Keown, & Martin, 2016)

Unsystematic risk is a risk that specifically impacts a single organization or a few

organizations. To overcome or ease unsystematic risk one can take up diversification as an

effective strategy (Leo, 2011). A diversified portfolio of investments will allow an

organization to overcome the losses arising out of less performing investments from the

investments that are performing great. The risk that can be diversified differs from

organization to organization that is if an organization is yielding huge revenues then it's stock

price shall be higher while if an organization is yielding low revenues then it's stock price

shall be lower.

In order to lower or get rid of risks, investors opt for diversification strategy where the shares

of various companies are purchased. Higher diversification will result in lower risks. Multiple

risk management strategies and tools are implemented so as to deal with unsystematic risk.

Investment such as shares or debentures always carries a significant amount of risk. Both

systematic and unsystematic risks are significant components of risk and account for total

risk when combined together (Madura & Fox, 2011). Variables that are external and

uncontrollable and aren’t firm-specific accounts for systematic risk. It impacts the overall

market which ultimately influences the prices of all the securities. It is a risk that is related to

the market. While unsystematic risk is one that is firm-specific and arises out of internal and

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Crown Resorts Ltd

controlled variables. The diversified portfolio of investment helps in reducing or eliminating

unsystematic risk while systematic risk cannot be reduced or avoided by the same (Melville,

2013).

Diversification

Diversification in the context of investment portfolio means a variety of assets which are

combined together for the purpose of minimizing risk and maximizing profits in the portfolio.

The main purpose of diversification is risk management (Petty et. al, 2012). Investment in

various portfolios (Like Government securities, shares and debentures) increase the risk and

to minimize the risk, the portfolio should be designed in such a way that risk is minimized

and return is maximized (Sword, 2018). Investing in different assets of varied industries and

companies helps in risk management as a value of assets of different companies and

industries will not move together (Mersland & Urgeghem, 2013). For this reason,

diversification is done.

Systematic Risk- It is that type of risk which can`t be controlled. It is present in every market,

sector, and segment. It is inherent in the industry and businesses itself. These risks are highly

unpredictable and can’t be avoided by framing any policies. For Example Global Slowdown,

Change in Interest Rates, Natural calamity, etc (Crown resorts, 2018).

Unsystematic Risk- On the other hand, this risk can be predicted, understood and to an extent

nullified also. This risk is inherent to any product, services or industry. For example

Management exit, New Competitor, Change in customer taste or regulatory change.

1Company’s operations, developments, and/or initiatives from 20 4 -

1820

As seen from the Annual report 2018 published by the company for its stakeholders, it can be

said the company Main floor gaming revenue has increased by 1.5% and modest growth in

Melbourne. Also, the VIP program play turnover has increased by 54.5% compared to last

years. Normalized EBITDA increased by 7.2 % (Crown resorts, 2018). The resorts of CWN

are some of the finest in the country which attracts the world`s tourist for luxury and its

hospitality. The company has completed its all capital expenditure projects as well, giving

them a strategic edge over its peers. The company also offers loyalty rewards to its members

in the form of an invitation to special events and all year events and discounted prices

(Pearson, 2019). This move has increased its customer base and edge over its competitors.

11

controlled variables. The diversified portfolio of investment helps in reducing or eliminating

unsystematic risk while systematic risk cannot be reduced or avoided by the same (Melville,

2013).

Diversification

Diversification in the context of investment portfolio means a variety of assets which are

combined together for the purpose of minimizing risk and maximizing profits in the portfolio.

The main purpose of diversification is risk management (Petty et. al, 2012). Investment in

various portfolios (Like Government securities, shares and debentures) increase the risk and

to minimize the risk, the portfolio should be designed in such a way that risk is minimized

and return is maximized (Sword, 2018). Investing in different assets of varied industries and

companies helps in risk management as a value of assets of different companies and

industries will not move together (Mersland & Urgeghem, 2013). For this reason,

diversification is done.

Systematic Risk- It is that type of risk which can`t be controlled. It is present in every market,

sector, and segment. It is inherent in the industry and businesses itself. These risks are highly

unpredictable and can’t be avoided by framing any policies. For Example Global Slowdown,

Change in Interest Rates, Natural calamity, etc (Crown resorts, 2018).

Unsystematic Risk- On the other hand, this risk can be predicted, understood and to an extent

nullified also. This risk is inherent to any product, services or industry. For example

Management exit, New Competitor, Change in customer taste or regulatory change.

1Company’s operations, developments, and/or initiatives from 20 4 -

1820

As seen from the Annual report 2018 published by the company for its stakeholders, it can be

said the company Main floor gaming revenue has increased by 1.5% and modest growth in

Melbourne. Also, the VIP program play turnover has increased by 54.5% compared to last

years. Normalized EBITDA increased by 7.2 % (Crown resorts, 2018). The resorts of CWN

are some of the finest in the country which attracts the world`s tourist for luxury and its

hospitality. The company has completed its all capital expenditure projects as well, giving

them a strategic edge over its peers. The company also offers loyalty rewards to its members

in the form of an invitation to special events and all year events and discounted prices

(Pearson, 2019). This move has increased its customer base and edge over its competitors.

11

Crown Resorts Ltd

The company also take cares of its employees as well by offering them the world best

training facilities and growth options. The company runs various training levels in the

company in which the company enrols its employees and trainees as well. The company one

of the objective is to keep its employees at best at what they do. The company keeps check of

health, safety and other well being of its employees. The company has 1600 guest rooms in

their three hotels namely Crown towers, Metropol & promenade with total 878,000 guest’s

rounds the year and 93% occupancy which shows that the company hotel is high in demand.

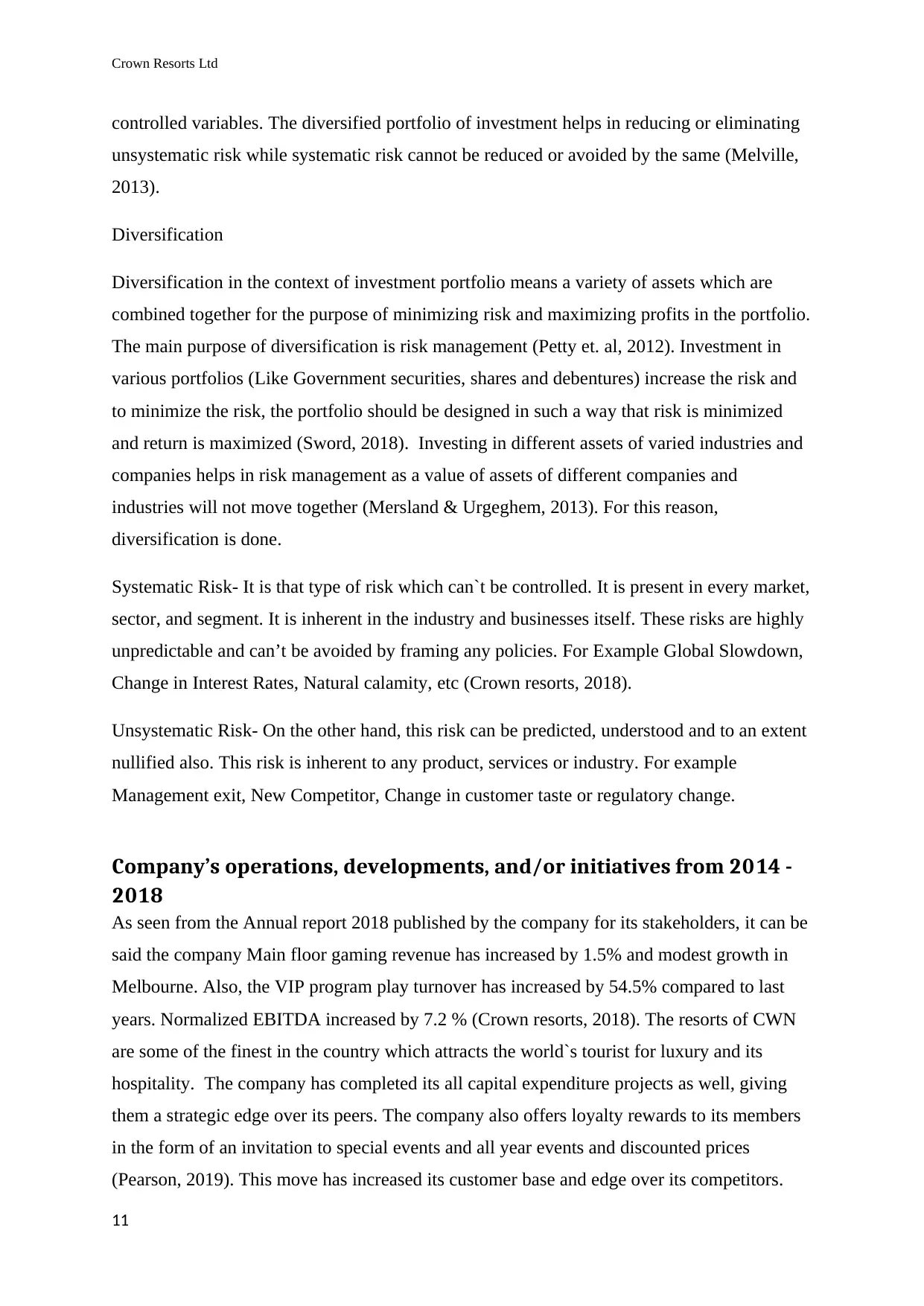

Figure 5 5 years financial data

(Crown resorts, 2018)

Here it can be seen that the company revenue are steady despite a fall in the year 2017, the

company revenues are stable. The operating income & margins have taken a big dip in the

year 2018 on account of inflation. The net incomes are in positive numbers in all 5 years.

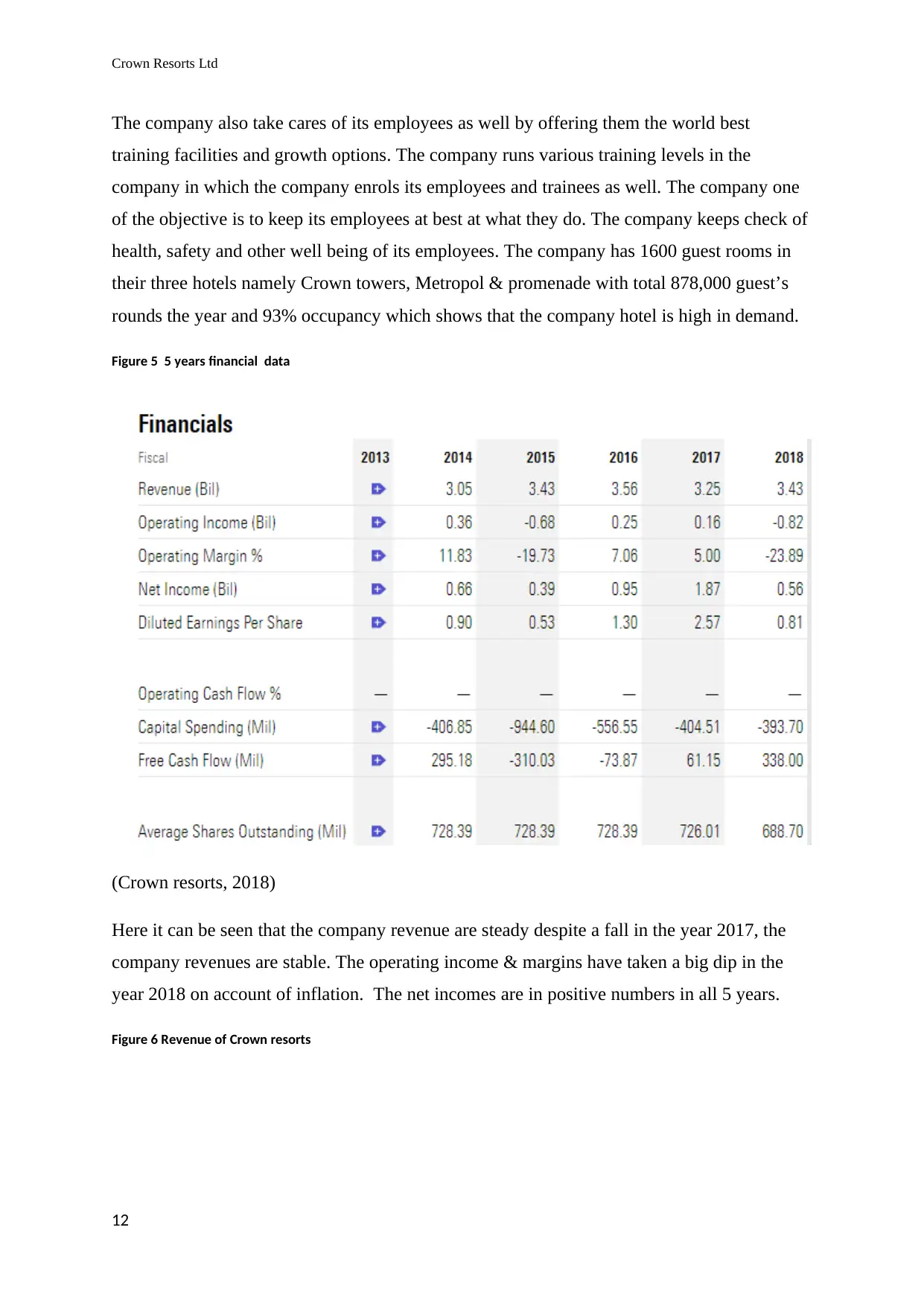

Figure 6 Revenue of Crown resorts

12

The company also take cares of its employees as well by offering them the world best

training facilities and growth options. The company runs various training levels in the

company in which the company enrols its employees and trainees as well. The company one

of the objective is to keep its employees at best at what they do. The company keeps check of

health, safety and other well being of its employees. The company has 1600 guest rooms in

their three hotels namely Crown towers, Metropol & promenade with total 878,000 guest’s

rounds the year and 93% occupancy which shows that the company hotel is high in demand.

Figure 5 5 years financial data

(Crown resorts, 2018)

Here it can be seen that the company revenue are steady despite a fall in the year 2017, the

company revenues are stable. The operating income & margins have taken a big dip in the

year 2018 on account of inflation. The net incomes are in positive numbers in all 5 years.

Figure 6 Revenue of Crown resorts

12

Crown Resorts Ltd

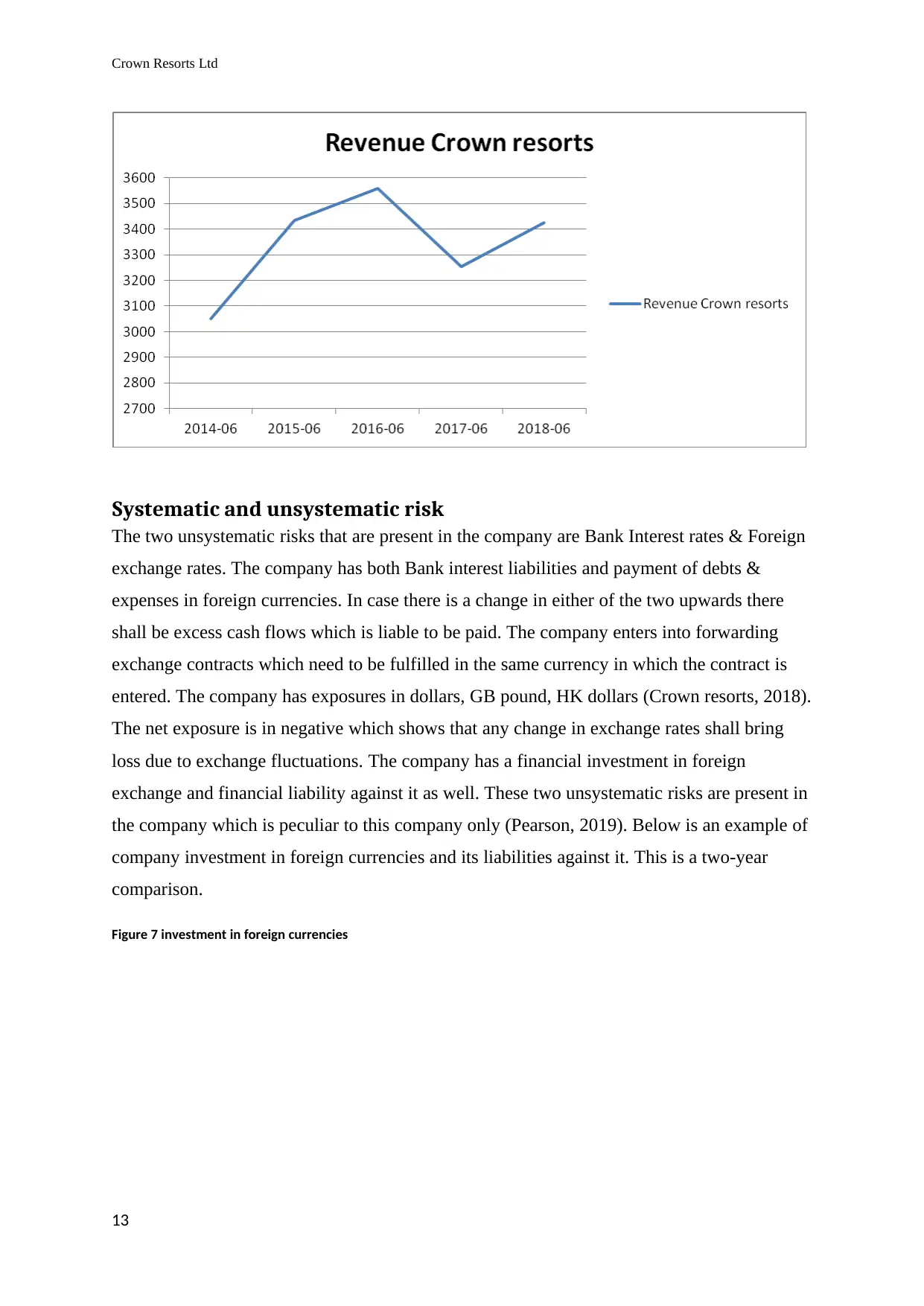

Systematic and unsystematic risk

The two unsystematic risks that are present in the company are Bank Interest rates & Foreign

exchange rates. The company has both Bank interest liabilities and payment of debts &

expenses in foreign currencies. In case there is a change in either of the two upwards there

shall be excess cash flows which is liable to be paid. The company enters into forwarding

exchange contracts which need to be fulfilled in the same currency in which the contract is

entered. The company has exposures in dollars, GB pound, HK dollars (Crown resorts, 2018).

The net exposure is in negative which shows that any change in exchange rates shall bring

loss due to exchange fluctuations. The company has a financial investment in foreign

exchange and financial liability against it as well. These two unsystematic risks are present in

the company which is peculiar to this company only (Pearson, 2019). Below is an example of

company investment in foreign currencies and its liabilities against it. This is a two-year

comparison.

Figure 7 investment in foreign currencies

13

Systematic and unsystematic risk

The two unsystematic risks that are present in the company are Bank Interest rates & Foreign

exchange rates. The company has both Bank interest liabilities and payment of debts &

expenses in foreign currencies. In case there is a change in either of the two upwards there

shall be excess cash flows which is liable to be paid. The company enters into forwarding

exchange contracts which need to be fulfilled in the same currency in which the contract is

entered. The company has exposures in dollars, GB pound, HK dollars (Crown resorts, 2018).

The net exposure is in negative which shows that any change in exchange rates shall bring

loss due to exchange fluctuations. The company has a financial investment in foreign

exchange and financial liability against it as well. These two unsystematic risks are present in

the company which is peculiar to this company only (Pearson, 2019). Below is an example of

company investment in foreign currencies and its liabilities against it. This is a two-year

comparison.

Figure 7 investment in foreign currencies

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Crown Resorts Ltd

(Crown, 2018)

1Key events and driving factors of global financial markets from 20 4 -

1820

Since the world has opened up its economy to globalization more and more countries have

come up to join hands and help each other in this need of the hour. The world is now facing a

debt crisis where banks are not able to recover its debts from its borrowers. The banks play

like the right hand of the government. Oil prices play a major role in deciding the fate of any

country. Unfortunately, oil and its components are found in limited parts of the world which

limits its supply but increases its prices at large (Crown resorts, 2018). The world is facing a

mortgage crisis in which thousands have not been able to repay their housing loans and banks

have become bankrupts due to this. For instance: Lehman Brothers, Barclays, and Bank of

America.

In the year 2015, China emerged as the world largest economy ahead of the European Union

and the USA. Even in the year, 2015 Greece defaulted all its debt payments so it triggered the

eurozone debt crises. This created a global fear of slowdown. The world other countries are

14

(Crown, 2018)

1Key events and driving factors of global financial markets from 20 4 -

1820

Since the world has opened up its economy to globalization more and more countries have

come up to join hands and help each other in this need of the hour. The world is now facing a

debt crisis where banks are not able to recover its debts from its borrowers. The banks play

like the right hand of the government. Oil prices play a major role in deciding the fate of any

country. Unfortunately, oil and its components are found in limited parts of the world which

limits its supply but increases its prices at large (Crown resorts, 2018). The world is facing a

mortgage crisis in which thousands have not been able to repay their housing loans and banks

have become bankrupts due to this. For instance: Lehman Brothers, Barclays, and Bank of

America.

In the year 2015, China emerged as the world largest economy ahead of the European Union

and the USA. Even in the year, 2015 Greece defaulted all its debt payments so it triggered the

eurozone debt crises. This created a global fear of slowdown. The world other countries are

14

Crown Resorts Ltd

also facing a debt crisis. Time to time, any natural calamity hits and it costs millions to cover

up the loss of lives and other things. For ex: In the year 2017, Hurricane Harvard hit parts of

USA and caused $ 180 billion of damage. This was the biggest natural disaster in history.

There have several terrorist attacks by terror organizations and counter them a huge GDP part

is to be diverted to control these events. These events are hard to control and out of

proportion. Also, the countries in need to gain supremacy are investing heavy in arms and

nuclear power, while it is estimated that more than 20% of the world population are below

the poverty line or are at bad living conditions (Crown resorts, 2018). The limited drinking

water is also a big problem which is now becoming a global problem. In the light of all these

financial events, The systematic risks at large events like these which are totally out of

control of any country or world. Entire economy takes a hit by large and effects investments

by potential investors.

15

also facing a debt crisis. Time to time, any natural calamity hits and it costs millions to cover

up the loss of lives and other things. For ex: In the year 2017, Hurricane Harvard hit parts of

USA and caused $ 180 billion of damage. This was the biggest natural disaster in history.

There have several terrorist attacks by terror organizations and counter them a huge GDP part

is to be diverted to control these events. These events are hard to control and out of

proportion. Also, the countries in need to gain supremacy are investing heavy in arms and

nuclear power, while it is estimated that more than 20% of the world population are below

the poverty line or are at bad living conditions (Crown resorts, 2018). The limited drinking

water is also a big problem which is now becoming a global problem. In the light of all these

financial events, The systematic risks at large events like these which are totally out of

control of any country or world. Entire economy takes a hit by large and effects investments

by potential investors.

15

Crown Resorts Ltd

Recommendation

Crown resorts operates with a practice of a stable dividend policy and aims to pay

approximately 60 percent per share in a financial year, however, is subjected to the

company’s financial position. The dividend policy is a major key for the mature companies

and is set at a level where the company still comprises of cash for re-investment. In 2018, the

dividend of Crown was 74% of the EPS. The dividend is suited to the investors who are

income seekers and looks sustainable depending on the earnings of the company. Crown is

investing in new projects and will help in the earnings over the coming years. By providing a

strong dividend yield of 4.5%, Crown has a huge PE ratio that is 25.6. If Crown is purchased

today then the investment will be locked in the PE ratio of 20 and the same 4.5% dividend

yield by 2020. Moreover, the debt to equity ratio of 0.38:1 is more than the market average of

0.28:1. Crown is a company with strong fundamentals however; the present price tag is

expensive considering the regulatory impacts. Australia is highly relaxed with the law of

gambling that has allowed businesses in this space to prosper. Going by the overall study, it

can be commented that it is better to invest in a diversified portfolio because it can help to

beat the risks of the market. Investing in a single stock is highly risky as in the case of

downfall, the entire return will be beaten however in the case of portfolio the downfall can be

minimized.

16

Recommendation

Crown resorts operates with a practice of a stable dividend policy and aims to pay

approximately 60 percent per share in a financial year, however, is subjected to the

company’s financial position. The dividend policy is a major key for the mature companies

and is set at a level where the company still comprises of cash for re-investment. In 2018, the

dividend of Crown was 74% of the EPS. The dividend is suited to the investors who are

income seekers and looks sustainable depending on the earnings of the company. Crown is

investing in new projects and will help in the earnings over the coming years. By providing a

strong dividend yield of 4.5%, Crown has a huge PE ratio that is 25.6. If Crown is purchased

today then the investment will be locked in the PE ratio of 20 and the same 4.5% dividend

yield by 2020. Moreover, the debt to equity ratio of 0.38:1 is more than the market average of

0.28:1. Crown is a company with strong fundamentals however; the present price tag is

expensive considering the regulatory impacts. Australia is highly relaxed with the law of

gambling that has allowed businesses in this space to prosper. Going by the overall study, it

can be commented that it is better to invest in a diversified portfolio because it can help to

beat the risks of the market. Investing in a single stock is highly risky as in the case of

downfall, the entire return will be beaten however in the case of portfolio the downfall can be

minimized.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Crown Resorts Ltd

Conclusion

Hence, from the overall discussion, it can be commented that diversification is the need of the

hour as it helps in maximization of return by investment in different areas that will react to

the multiple events. Though, guarantee cannot be provided against the loss yet it is the main

tool through which long range financial goals can be attained. In the case of Crown resorts, it

can be commented that the company is exposed to different systematic and unsystematic risk

and in the event of this any negative impact can lead to a decline in the price of share. Hence,

it is imperative that creating a portfolio will help thee investor to attain a better perspective

and returns.

17

Conclusion

Hence, from the overall discussion, it can be commented that diversification is the need of the

hour as it helps in maximization of return by investment in different areas that will react to

the multiple events. Though, guarantee cannot be provided against the loss yet it is the main

tool through which long range financial goals can be attained. In the case of Crown resorts, it

can be commented that the company is exposed to different systematic and unsystematic risk

and in the event of this any negative impact can lead to a decline in the price of share. Hence,

it is imperative that creating a portfolio will help thee investor to attain a better perspective

and returns.

17

Crown Resorts Ltd

References

Adra, S., & Barbopoulos, L.G. (2018). The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. 45, 108-125. Retrieved from:

https://doi.org/10.1016/j.jempfin.2017.10.001

Breen, M. (2018). Why I think Crown Resorts Limited (ASX:CWN) is a sell. Retrieved from

https://www.fool.com.au/2018/05/22/why-i-think-crown-resorts-limited-asxcwn-is-a-

sell/

Crown resorts. (2018). Crown Resorts 2018 annual reports an accounts 2018. Retrieved from

https://www.crownresorts.com.au/CrownResorts/files/81/817f60e1-b1ef-46e4-b687-

7b60140c0578.pdf

Gowthrope, C. (2011). Business accounting and finance for non specialists (3rd ed.). South

Western

Julia, S.K & Elizabeth C. R. (2010). Conflict Between Doing Well And Doing Good? Capital

Budgeting Case Study – Coors. Journal of Business Case Studies. 6(6), 123-130.

Retrieved from:

https://www.ssoar.info/ssoar/bitstream/handle/document/36873/ssoar-2010-

graaf_et_al-The_good_cause__theoretical.pdf?sequence=1

Lapsley, I. (2012). Commentary: Financial Accountability & Management. Qualitative

Research in Accounting & Management. 9(3), pp. 291-292. Retrieved from

https://doi.org/10.1111/1468-0408.00081

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting.

Accounting and Business Research. 44(4), 380-382. Retrieved from:

https://doi.org/10.1080/00014788.2014.897867

Leo, K. J. (2011). Company Accounting (9th ed). Boston:McGraw Hill

Madura, R., & Fox, J. (2011). International financial management (2nd ed.). South Western

Melville, A. (2013). International Financial Reporting – A Practical Guide (4th ed). Pearson,

Education Limited, UK

Mersland, R., & Urgeghe, L. (2013). International Debt Financing and Performance of

Microfinance Institutions. Strategic Change. 22, 36-47. Doi:10.1002/jsc.1919.

Pearson, R. (2019). Read this before buying Crown Resorts Ltd for its dividend. Retrieved from

https://www.fool.com.au/2019/03/15/read-this-before-buying-crown-resorts-ltd-for-

its-dividend/

18

References

Adra, S., & Barbopoulos, L.G. (2018). The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. 45, 108-125. Retrieved from:

https://doi.org/10.1016/j.jempfin.2017.10.001

Breen, M. (2018). Why I think Crown Resorts Limited (ASX:CWN) is a sell. Retrieved from

https://www.fool.com.au/2018/05/22/why-i-think-crown-resorts-limited-asxcwn-is-a-

sell/

Crown resorts. (2018). Crown Resorts 2018 annual reports an accounts 2018. Retrieved from

https://www.crownresorts.com.au/CrownResorts/files/81/817f60e1-b1ef-46e4-b687-

7b60140c0578.pdf

Gowthrope, C. (2011). Business accounting and finance for non specialists (3rd ed.). South

Western

Julia, S.K & Elizabeth C. R. (2010). Conflict Between Doing Well And Doing Good? Capital

Budgeting Case Study – Coors. Journal of Business Case Studies. 6(6), 123-130.

Retrieved from:

https://www.ssoar.info/ssoar/bitstream/handle/document/36873/ssoar-2010-

graaf_et_al-The_good_cause__theoretical.pdf?sequence=1

Lapsley, I. (2012). Commentary: Financial Accountability & Management. Qualitative

Research in Accounting & Management. 9(3), pp. 291-292. Retrieved from

https://doi.org/10.1111/1468-0408.00081

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting.

Accounting and Business Research. 44(4), 380-382. Retrieved from:

https://doi.org/10.1080/00014788.2014.897867

Leo, K. J. (2011). Company Accounting (9th ed). Boston:McGraw Hill

Madura, R., & Fox, J. (2011). International financial management (2nd ed.). South Western

Melville, A. (2013). International Financial Reporting – A Practical Guide (4th ed). Pearson,

Education Limited, UK

Mersland, R., & Urgeghe, L. (2013). International Debt Financing and Performance of

Microfinance Institutions. Strategic Change. 22, 36-47. Doi:10.1002/jsc.1919.

Pearson, R. (2019). Read this before buying Crown Resorts Ltd for its dividend. Retrieved from

https://www.fool.com.au/2019/03/15/read-this-before-buying-crown-resorts-ltd-for-

its-dividend/

18

Crown Resorts Ltd

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012).

Financial Management: Principles and Applications, 6th ed. Australia: Pearson

Education Australia.

Sword. (2018). Active Risk Manager (ARM): The Technology Behind Leading Edge Risk

Management, Retrieved from http://www.sword-activerisk.com/products/active-risk-

manager-arm/

Titman, S, Martin, T, Keown, AJ & Martin, JD. (2016). Financial management: principles

and applications, 7th edn, Pearson Australia, Vic.

19

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012).

Financial Management: Principles and Applications, 6th ed. Australia: Pearson

Education Australia.

Sword. (2018). Active Risk Manager (ARM): The Technology Behind Leading Edge Risk

Management, Retrieved from http://www.sword-activerisk.com/products/active-risk-

manager-arm/

Titman, S, Martin, T, Keown, AJ & Martin, JD. (2016). Financial management: principles

and applications, 7th edn, Pearson Australia, Vic.

19

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.