Caltex Australia Limited: Financial Risk Management Strategies Report

VerifiedAdded on 2023/01/23

|11

|2895

|57

Report

AI Summary

This report provides a comprehensive analysis of the financial risks faced by Caltex Australia Limited, a prominent company in the refining and petroleum manufacturing sector. It delves into the company's exposure to foreign exchange risk, commodity price risk, and customer credit risk, highlighting the potential impact of these risks on its operations and financial performance. The report examines Caltex's risk management approach, including its framework for identifying, evaluating, and addressing risks, as well as its hedging strategies to mitigate the impact of currency fluctuations and commodity price volatility. It details the types of hedging instruments employed by the company, such as swaps, options, and forwards, and how these instruments are utilized to manage cash flow and fair value exposures. Furthermore, the report provides insights into the company's credit risk management policies and its efforts to minimize the impact of customer credit risk. Overall, the report offers a detailed overview of Caltex Australia Limited's financial risk profile and its proactive approach to managing these risks.

Financial risk management

2019

2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Caltex Australia Limited

Executive Summary

A company cannot perform without expanding and with the expansion comes the concept of

risk. To ensure growth and a higher level of return it is imperative that the company will face

risks of various kinds. In this report, the emphasis is on the Caltex Australia Limited which

happens to be listed on the Australian Stock exchange. The company is a pioneer in the field

of refining and petroleum manufacturing. The following report projects the performance of

the group together with the financial risks that it faces. The report highlights the relevant risks

and the risks management procedure of the company. The second part of the report deals in

hedging technique of the company and the instruments utilized by it.

2

Executive Summary

A company cannot perform without expanding and with the expansion comes the concept of

risk. To ensure growth and a higher level of return it is imperative that the company will face

risks of various kinds. In this report, the emphasis is on the Caltex Australia Limited which

happens to be listed on the Australian Stock exchange. The company is a pioneer in the field

of refining and petroleum manufacturing. The following report projects the performance of

the group together with the financial risks that it faces. The report highlights the relevant risks

and the risks management procedure of the company. The second part of the report deals in

hedging technique of the company and the instruments utilized by it.

2

Caltex Australia Limited

Contents

Introduction...........................................................................................................................................3

Operations.............................................................................................................................................3

The financial risk of Caltex.....................................................................................................................3

Risk management approach..................................................................................................................5

Hedging by Caltex..................................................................................................................................6

Types and the manner of usage of Hedging in Caltex............................................................................6

Conclusion.............................................................................................................................................8

References.............................................................................................................................................9

Figure 1 Foreign exchange risk..............................................................................................................4

Figure 2Commodity price risk................................................................................................................5

3

Contents

Introduction...........................................................................................................................................3

Operations.............................................................................................................................................3

The financial risk of Caltex.....................................................................................................................3

Risk management approach..................................................................................................................5

Hedging by Caltex..................................................................................................................................6

Types and the manner of usage of Hedging in Caltex............................................................................6

Conclusion.............................................................................................................................................8

References.............................................................................................................................................9

Figure 1 Foreign exchange risk..............................................................................................................4

Figure 2Commodity price risk................................................................................................................5

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Caltex Australia Limited

Introduction

Caltex presently ranks at number 12 amongst 2000 other organizations based in Australia and

enjoys the status of a public limited company. Caltex Australia Limited derives most of its

revenues from its activities concerned with the refining and manufacturing of Petroleum.

Caltex Australia Limited had an overall workforce of 4918 employees in Australia and

yielded revenues from sales and other activities of not less than $21,746,567,000 in the year

2018.

Caltex functions from an oil refinery in Lytton, Queensland. Crude oil and refined products

are procured by Caltex from the international markets. The company has a fuel import

terminal in Kurnell, NSW which earlier used to be its alternate unit. Crude oil sourced by the

company is refined into biofuel, jet fuel, petrol, diesel, LPG, etc which are then supplied by

means of fleets, terminals, depots, and pipelines.

Operations

Caltex undertakes a series of marketing activities that comprises functioning of service

stations and convenience stores and is branded beneath Caltex Woolworths and Star Mart as

well. Some service stations offer automotive service and car wash facilities while others are

used so as to retail automotive products, fuel, fast foods, groceries, and etc. The company

owns/ leases at least 1100 of the sites while the remaining ones are run by independent

resellers or franchisees (Caltex, 2018).

The company offers a better payment alternative such as PayPump, StarCard, and Starfleet.

The company is also available online so as to procure orders, provide pricing and other

information, engineering consultation, management of grease, oil, and hydrocarbon. The

company also deals in the resale of depots in Australia. Hence, it is seen that the company

deals in various products and has a long history in terms of functioning and competitive

market. With the aid of new format, products, technology, and new services, the company is

endorsing a strong answer on the definition of convenience (Madura & Fox, 2011).

The financial risk of Caltex

Foreign exchange risk- Caltex Australia Limited is highly prone to foreign exchange risks. It

is assessed that the constant change in currency rates might allow the company to face dire

4

Introduction

Caltex presently ranks at number 12 amongst 2000 other organizations based in Australia and

enjoys the status of a public limited company. Caltex Australia Limited derives most of its

revenues from its activities concerned with the refining and manufacturing of Petroleum.

Caltex Australia Limited had an overall workforce of 4918 employees in Australia and

yielded revenues from sales and other activities of not less than $21,746,567,000 in the year

2018.

Caltex functions from an oil refinery in Lytton, Queensland. Crude oil and refined products

are procured by Caltex from the international markets. The company has a fuel import

terminal in Kurnell, NSW which earlier used to be its alternate unit. Crude oil sourced by the

company is refined into biofuel, jet fuel, petrol, diesel, LPG, etc which are then supplied by

means of fleets, terminals, depots, and pipelines.

Operations

Caltex undertakes a series of marketing activities that comprises functioning of service

stations and convenience stores and is branded beneath Caltex Woolworths and Star Mart as

well. Some service stations offer automotive service and car wash facilities while others are

used so as to retail automotive products, fuel, fast foods, groceries, and etc. The company

owns/ leases at least 1100 of the sites while the remaining ones are run by independent

resellers or franchisees (Caltex, 2018).

The company offers a better payment alternative such as PayPump, StarCard, and Starfleet.

The company is also available online so as to procure orders, provide pricing and other

information, engineering consultation, management of grease, oil, and hydrocarbon. The

company also deals in the resale of depots in Australia. Hence, it is seen that the company

deals in various products and has a long history in terms of functioning and competitive

market. With the aid of new format, products, technology, and new services, the company is

endorsing a strong answer on the definition of convenience (Madura & Fox, 2011).

The financial risk of Caltex

Foreign exchange risk- Caltex Australia Limited is highly prone to foreign exchange risks. It

is assessed that the constant change in currency rates might allow the company to face dire

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Caltex Australia Limited

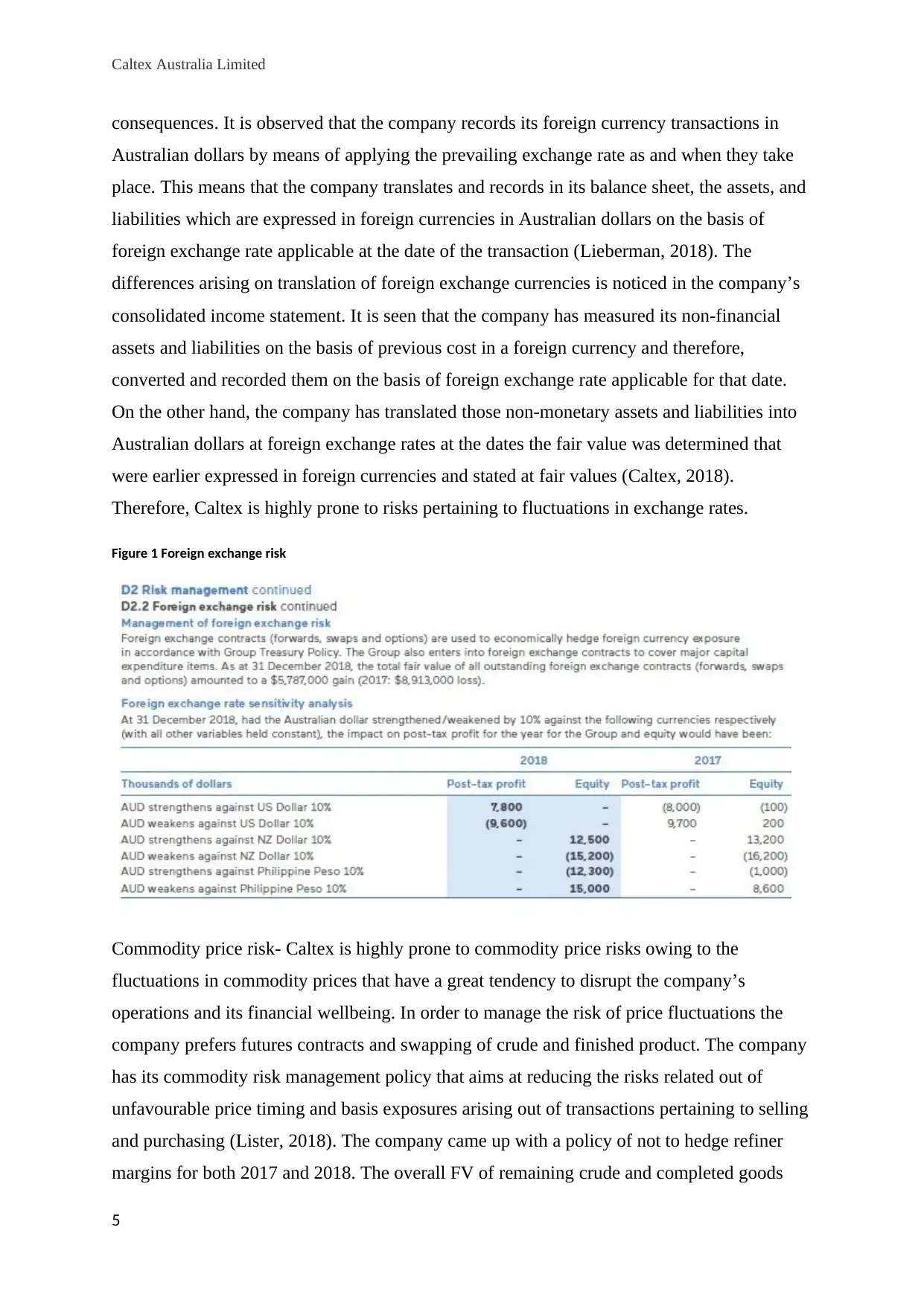

consequences. It is observed that the company records its foreign currency transactions in

Australian dollars by means of applying the prevailing exchange rate as and when they take

place. This means that the company translates and records in its balance sheet, the assets, and

liabilities which are expressed in foreign currencies in Australian dollars on the basis of

foreign exchange rate applicable at the date of the transaction (Lieberman, 2018). The

differences arising on translation of foreign exchange currencies is noticed in the company’s

consolidated income statement. It is seen that the company has measured its non-financial

assets and liabilities on the basis of previous cost in a foreign currency and therefore,

converted and recorded them on the basis of foreign exchange rate applicable for that date.

On the other hand, the company has translated those non-monetary assets and liabilities into

Australian dollars at foreign exchange rates at the dates the fair value was determined that

were earlier expressed in foreign currencies and stated at fair values (Caltex, 2018).

Therefore, Caltex is highly prone to risks pertaining to fluctuations in exchange rates.

Figure 1 Foreign exchange risk

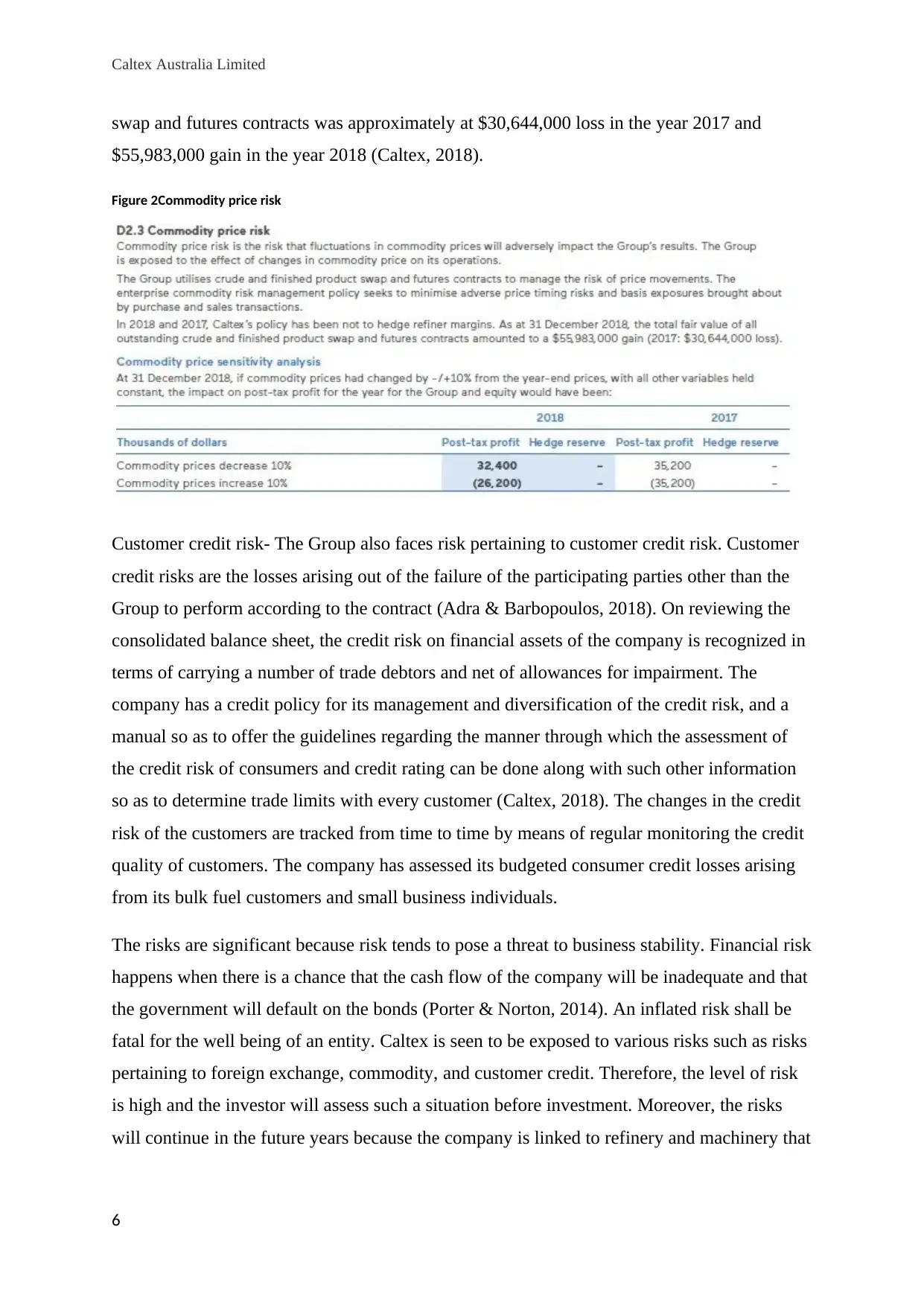

Commodity price risk- Caltex is highly prone to commodity price risks owing to the

fluctuations in commodity prices that have a great tendency to disrupt the company’s

operations and its financial wellbeing. In order to manage the risk of price fluctuations the

company prefers futures contracts and swapping of crude and finished product. The company

has its commodity risk management policy that aims at reducing the risks related out of

unfavourable price timing and basis exposures arising out of transactions pertaining to selling

and purchasing (Lister, 2018). The company came up with a policy of not to hedge refiner

margins for both 2017 and 2018. The overall FV of remaining crude and completed goods

5

consequences. It is observed that the company records its foreign currency transactions in

Australian dollars by means of applying the prevailing exchange rate as and when they take

place. This means that the company translates and records in its balance sheet, the assets, and

liabilities which are expressed in foreign currencies in Australian dollars on the basis of

foreign exchange rate applicable at the date of the transaction (Lieberman, 2018). The

differences arising on translation of foreign exchange currencies is noticed in the company’s

consolidated income statement. It is seen that the company has measured its non-financial

assets and liabilities on the basis of previous cost in a foreign currency and therefore,

converted and recorded them on the basis of foreign exchange rate applicable for that date.

On the other hand, the company has translated those non-monetary assets and liabilities into

Australian dollars at foreign exchange rates at the dates the fair value was determined that

were earlier expressed in foreign currencies and stated at fair values (Caltex, 2018).

Therefore, Caltex is highly prone to risks pertaining to fluctuations in exchange rates.

Figure 1 Foreign exchange risk

Commodity price risk- Caltex is highly prone to commodity price risks owing to the

fluctuations in commodity prices that have a great tendency to disrupt the company’s

operations and its financial wellbeing. In order to manage the risk of price fluctuations the

company prefers futures contracts and swapping of crude and finished product. The company

has its commodity risk management policy that aims at reducing the risks related out of

unfavourable price timing and basis exposures arising out of transactions pertaining to selling

and purchasing (Lister, 2018). The company came up with a policy of not to hedge refiner

margins for both 2017 and 2018. The overall FV of remaining crude and completed goods

5

Caltex Australia Limited

swap and futures contracts was approximately at $30,644,000 loss in the year 2017 and

$55,983,000 gain in the year 2018 (Caltex, 2018).

Figure 2Commodity price risk

Customer credit risk- The Group also faces risk pertaining to customer credit risk. Customer

credit risks are the losses arising out of the failure of the participating parties other than the

Group to perform according to the contract (Adra & Barbopoulos, 2018). On reviewing the

consolidated balance sheet, the credit risk on financial assets of the company is recognized in

terms of carrying a number of trade debtors and net of allowances for impairment. The

company has a credit policy for its management and diversification of the credit risk, and a

manual so as to offer the guidelines regarding the manner through which the assessment of

the credit risk of consumers and credit rating can be done along with such other information

so as to determine trade limits with every customer (Caltex, 2018). The changes in the credit

risk of the customers are tracked from time to time by means of regular monitoring the credit

quality of customers. The company has assessed its budgeted consumer credit losses arising

from its bulk fuel customers and small business individuals.

The risks are significant because risk tends to pose a threat to business stability. Financial risk

happens when there is a chance that the cash flow of the company will be inadequate and that

the government will default on the bonds (Porter & Norton, 2014). An inflated risk shall be

fatal for the well being of an entity. Caltex is seen to be exposed to various risks such as risks

pertaining to foreign exchange, commodity, and customer credit. Therefore, the level of risk

is high and the investor will assess such a situation before investment. Moreover, the risks

will continue in the future years because the company is linked to refinery and machinery that

6

swap and futures contracts was approximately at $30,644,000 loss in the year 2017 and

$55,983,000 gain in the year 2018 (Caltex, 2018).

Figure 2Commodity price risk

Customer credit risk- The Group also faces risk pertaining to customer credit risk. Customer

credit risks are the losses arising out of the failure of the participating parties other than the

Group to perform according to the contract (Adra & Barbopoulos, 2018). On reviewing the

consolidated balance sheet, the credit risk on financial assets of the company is recognized in

terms of carrying a number of trade debtors and net of allowances for impairment. The

company has a credit policy for its management and diversification of the credit risk, and a

manual so as to offer the guidelines regarding the manner through which the assessment of

the credit risk of consumers and credit rating can be done along with such other information

so as to determine trade limits with every customer (Caltex, 2018). The changes in the credit

risk of the customers are tracked from time to time by means of regular monitoring the credit

quality of customers. The company has assessed its budgeted consumer credit losses arising

from its bulk fuel customers and small business individuals.

The risks are significant because risk tends to pose a threat to business stability. Financial risk

happens when there is a chance that the cash flow of the company will be inadequate and that

the government will default on the bonds (Porter & Norton, 2014). An inflated risk shall be

fatal for the well being of an entity. Caltex is seen to be exposed to various risks such as risks

pertaining to foreign exchange, commodity, and customer credit. Therefore, the level of risk

is high and the investor will assess such a situation before investment. Moreover, the risks

will continue in the future years because the company is linked to refinery and machinery that

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Caltex Australia Limited

is a highly volatile area (Caltex, 2018). In tune to this, it can be commented that the company

will continue to face a high level of financial risk in the coming future.

As per AASB 9, the company has reviewed its bad debt provision balances and write-offs and

therefore, came up with a conclusion that there is no significant adjustment left upon

adoption (Sword, 2018). The company has opted for transactions that have a huge base of

customers so as to minimize its probabilities and impact of credit risk. Hence, the company

used this concept to mitigate the risk (Lieberman, 2018).

Risk management approach

The group has designed its own risk management framework so as to trace, evaluate and

address such risks that have a tendency to affect the same form attaining its pre-determined

goals. To identify the possible risks and their impacts, the framework integrates the same into

activities and thereafter, identifies the control measures and schedules and implements

improvement plans so as to tackle the same (Leo, 2011). In order to support the proper

functioning of the framework, it is the responsibility of each department to actively

participate in tracing and reporting all kinds of risks. Also, the company needs an effective

procedure so as to construe new projects so as to minimise or eliminate the risks pertaining to

its giant projects. There must be identification and documentation of key business risks for

supporting the effective functioning of the framework (Caltex, 2018). There must be

improvements in the control as and when shortcomings in the same are identified. The Caltex

Leadership Team and departmental leadership teams are regularly updated about the risks

that have a relatively lower impact. The Board and its committees such as the Human

Resources Committee, Audit Committee and the OHS & Environmental Risk Committee are

updated about the efficacy of control measures pertaining to all the material risks from time

to time.

Hedging by Caltex

The company is highly prone to risks pertaining to foreign exchange rates. The frequent

variations in the currency rates might allow the functioning and wellbeing of the company to

suffer (Mersland & Urgeghe, 2013). The Group suffers from foreign exchange risks as it

resale its products in AUD while the same was procured in USD and with pricing formulas

that highlight the fluctuations in the foreign exchange rate. Therefore, the cash flows and

revenues of the group are likely to get adversely impacted due to fluctuations in USD/AUD

7

is a highly volatile area (Caltex, 2018). In tune to this, it can be commented that the company

will continue to face a high level of financial risk in the coming future.

As per AASB 9, the company has reviewed its bad debt provision balances and write-offs and

therefore, came up with a conclusion that there is no significant adjustment left upon

adoption (Sword, 2018). The company has opted for transactions that have a huge base of

customers so as to minimize its probabilities and impact of credit risk. Hence, the company

used this concept to mitigate the risk (Lieberman, 2018).

Risk management approach

The group has designed its own risk management framework so as to trace, evaluate and

address such risks that have a tendency to affect the same form attaining its pre-determined

goals. To identify the possible risks and their impacts, the framework integrates the same into

activities and thereafter, identifies the control measures and schedules and implements

improvement plans so as to tackle the same (Leo, 2011). In order to support the proper

functioning of the framework, it is the responsibility of each department to actively

participate in tracing and reporting all kinds of risks. Also, the company needs an effective

procedure so as to construe new projects so as to minimise or eliminate the risks pertaining to

its giant projects. There must be identification and documentation of key business risks for

supporting the effective functioning of the framework (Caltex, 2018). There must be

improvements in the control as and when shortcomings in the same are identified. The Caltex

Leadership Team and departmental leadership teams are regularly updated about the risks

that have a relatively lower impact. The Board and its committees such as the Human

Resources Committee, Audit Committee and the OHS & Environmental Risk Committee are

updated about the efficacy of control measures pertaining to all the material risks from time

to time.

Hedging by Caltex

The company is highly prone to risks pertaining to foreign exchange rates. The frequent

variations in the currency rates might allow the functioning and wellbeing of the company to

suffer (Mersland & Urgeghe, 2013). The Group suffers from foreign exchange risks as it

resale its products in AUD while the same was procured in USD and with pricing formulas

that highlight the fluctuations in the foreign exchange rate. Therefore, the cash flows and

revenues of the group are likely to get adversely impacted due to fluctuations in USD/AUD

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Caltex Australia Limited

exchange rate owing to the dissimilarity in time that exists between the payment made for

procurement of products and assessing the price of its sales. Also, the CRM is calculated on

the basis of USD Singapore spot product price which is further related to the US dollar Brent

crude price. The Group’s dollar refiner margin along with its cash flows and revenues are

most likely to have an adverse effect if there is a rise in the USD/AUD exchange rate (Caltex,

2018).

Swaps, options and forwards are international exchange contracts that are taken into use as

per the Group Treasury Policy so as to hedge international currency exposure. The company

is prone to various risks such as FV international exchange rate risk and counter party credit

risks due to the instruments that are used to manage foreign exchange risks. Once can affirm

whether the company is prone to such counter party credit risks or not by means of setting

exposure limits for every single counterparty credit risks (Lieberman, 2018).

Types and the manner of usage of Hedging in Caltex

Cash flow hedges- Cash flow hedges are used by the company so as to minimize or eliminate

the exposure it faces due to fluctuations in the cash flows which are caused as a result of

fluctuations in a particular risk or foreign currency movements (Laux, 2014).

Financial instruments – The financial instruments of cash flow hedges are interest rate swap

contracts (floating to fixed) and foreign exchange contracts (forwards, swaps and options). A

significant part of fluctuations in nominal value of foreign exchange contracts and interest

rate swap contracts is termed as equity. The profit or loss concerned with the ineffective part

of fluctuations in nominal value of financial instruments is recorded in the consolidated

financial statements (Caltex, 2018). The cumulative gain or loss in the consolidated income

statements records the period in which the hedged instrument affects the profits or losses

(Melville, 2013). When a hedging instrument is sold or expired or when it is no longer able to

fulfil the requirements for hedge accounting then the same results in the presence of a

cumulative profit or loss in the equity which is further recognized when a pre-determined

transaction impacts profit and loss accounts (Hanly, Morales & Cassells, 2018).

Fair value hedges are undertaken by an organization or a stockholder with a motive to

safeguard the FV of a particular liability or asset from such risks which may adversely impact

the gains or losses (Gowthrope, 2011). These instruments are used to provide a leverage to

the company that is prone to fluctuations in the FV of a specific liability or asset due to

8

exchange rate owing to the dissimilarity in time that exists between the payment made for

procurement of products and assessing the price of its sales. Also, the CRM is calculated on

the basis of USD Singapore spot product price which is further related to the US dollar Brent

crude price. The Group’s dollar refiner margin along with its cash flows and revenues are

most likely to have an adverse effect if there is a rise in the USD/AUD exchange rate (Caltex,

2018).

Swaps, options and forwards are international exchange contracts that are taken into use as

per the Group Treasury Policy so as to hedge international currency exposure. The company

is prone to various risks such as FV international exchange rate risk and counter party credit

risks due to the instruments that are used to manage foreign exchange risks. Once can affirm

whether the company is prone to such counter party credit risks or not by means of setting

exposure limits for every single counterparty credit risks (Lieberman, 2018).

Types and the manner of usage of Hedging in Caltex

Cash flow hedges- Cash flow hedges are used by the company so as to minimize or eliminate

the exposure it faces due to fluctuations in the cash flows which are caused as a result of

fluctuations in a particular risk or foreign currency movements (Laux, 2014).

Financial instruments – The financial instruments of cash flow hedges are interest rate swap

contracts (floating to fixed) and foreign exchange contracts (forwards, swaps and options). A

significant part of fluctuations in nominal value of foreign exchange contracts and interest

rate swap contracts is termed as equity. The profit or loss concerned with the ineffective part

of fluctuations in nominal value of financial instruments is recorded in the consolidated

financial statements (Caltex, 2018). The cumulative gain or loss in the consolidated income

statements records the period in which the hedged instrument affects the profits or losses

(Melville, 2013). When a hedging instrument is sold or expired or when it is no longer able to

fulfil the requirements for hedge accounting then the same results in the presence of a

cumulative profit or loss in the equity which is further recognized when a pre-determined

transaction impacts profit and loss accounts (Hanly, Morales & Cassells, 2018).

Fair value hedges are undertaken by an organization or a stockholder with a motive to

safeguard the FV of a particular liability or asset from such risks which may adversely impact

the gains or losses (Gowthrope, 2011). These instruments are used to provide a leverage to

the company that is prone to fluctuations in the FV of a specific liability or asset due to

8

Caltex Australia Limited

constant fluctuations in interest rates. The financial instrument used in fair value hedge is

interest rate swap contracts (fixed-to-floating).

The consolidated income statement of the company records the FV hedges along with the

fluctuations in the FV of a specific liability or assets from such risks which may negatively

impact the profits or losses (Caltex, 2018).

Net investment hedges are used in order to minimize or eliminate risks arising out of a

company’s net investment in an international activity. The instrument used in net investment

hedges is foreign currency borrowings (Caltex, 2018). Net investment hedges are treated by

means of recording the same in the consolidated income statement as and when the

completion of an international activity takes place.

9

constant fluctuations in interest rates. The financial instrument used in fair value hedge is

interest rate swap contracts (fixed-to-floating).

The consolidated income statement of the company records the FV hedges along with the

fluctuations in the FV of a specific liability or assets from such risks which may negatively

impact the profits or losses (Caltex, 2018).

Net investment hedges are used in order to minimize or eliminate risks arising out of a

company’s net investment in an international activity. The instrument used in net investment

hedges is foreign currency borrowings (Caltex, 2018). Net investment hedges are treated by

means of recording the same in the consolidated income statement as and when the

completion of an international activity takes place.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Caltex Australia Limited

Conclusion

Going by the overall profile of the company, it can be commented that the company operates

under immense challenges. The vision and the performance of the company indicate that the

company is vulnerable to the risks. As discussed the company is exposed to various kinds of

financial risks that pose a threat to the business. Hence, it is imperative for the group to

ensure that the relationship of hedge accounting is in link with the objectives of risks

management. This will enable the company to have a forward-looking insight into the

operations. As the company is operating on an international basis thereby it is exposed to

financial risks and counterparty risks. The company needs to have strict regulation on the

exposure limit that will safeguard the company in the counterparty credit risks.

10

Conclusion

Going by the overall profile of the company, it can be commented that the company operates

under immense challenges. The vision and the performance of the company indicate that the

company is vulnerable to the risks. As discussed the company is exposed to various kinds of

financial risks that pose a threat to the business. Hence, it is imperative for the group to

ensure that the relationship of hedge accounting is in link with the objectives of risks

management. This will enable the company to have a forward-looking insight into the

operations. As the company is operating on an international basis thereby it is exposed to

financial risks and counterparty risks. The company needs to have strict regulation on the

exposure limit that will safeguard the company in the counterparty credit risks.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Caltex Australia Limited

References

Adra, S., & Barbopoulos, L.G. (2018). The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. 45, 108-125. Retrieved from:

https://doi.org/10.1016/j.jempfin.2017.10.001

Caltex. (2018). Caltex 2018 annual report and accounts. Retrieved from

https://www.caltex.com.au/annual-report-2018

Gowthrope, C. (2011). Business accounting and finance for non specialists (3rd ed.). South

Western

Hanly, J., Morales, H. & Cassells, D. (2018). The efficacy of financial futures as a hedging

tool in electricity markets. International journal of finance and economics. 23(10, 29-

40. DOI: https://doi.org/10.1002/ijfe.1600

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting.

Accounting and Business Research. 44(4), 380-382. Retrieved from:

https://doi.org/10.1080/00014788.2014.897867

Leo, K. J. (2011). Company Accounting (9th ed). Boston:McGraw Hill

Lieberman, D.L. (2018). Hedge Funds and Impact Investing: Considerations for Institutional

Investors. The Journal of Investing Summer 2018, 27 (2) 47-55; DOI:

https://doi.org/10.3905/joi.2018.27.2.047

Lister, J. (2018). Advantages and Disadvantages of Financial Risks Within Companies.

Retrieved from: https://smallbusiness.chron.com/advantages-disadvantages-financial-

risks-within-companies-16048.html

Madura, R., & Fox, J. (2011). International financial management (2nd ed.). South Western

Melville, A. (2013). International Financial Reporting – A Practical Guide (4th ed). Pearson,

Education Limited, UK

Mersland, R., & Urgeghe, L. (2013). International Debt Financing and Performance of

Microfinance Institutions. Strategic Change. 22, 36-47. Doi:10.1002/jsc.1919.

Porter, G. and Norton, C. (2014). Financial Accounting: The Impact on Decision Maker.

Texas: Cengage Learning

Sword. (2018). Active Risk Manager (ARM): The Technology Behind Leading Edge Risk

Management, Retrieved from http://www.sword-activerisk.com/products/active-risk-

manager-arm/

11

References

Adra, S., & Barbopoulos, L.G. (2018). The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. 45, 108-125. Retrieved from:

https://doi.org/10.1016/j.jempfin.2017.10.001

Caltex. (2018). Caltex 2018 annual report and accounts. Retrieved from

https://www.caltex.com.au/annual-report-2018

Gowthrope, C. (2011). Business accounting and finance for non specialists (3rd ed.). South

Western

Hanly, J., Morales, H. & Cassells, D. (2018). The efficacy of financial futures as a hedging

tool in electricity markets. International journal of finance and economics. 23(10, 29-

40. DOI: https://doi.org/10.1002/ijfe.1600

Laux, B. (2014). Discussion of The role of revenue recognition in performance reporting.

Accounting and Business Research. 44(4), 380-382. Retrieved from:

https://doi.org/10.1080/00014788.2014.897867

Leo, K. J. (2011). Company Accounting (9th ed). Boston:McGraw Hill

Lieberman, D.L. (2018). Hedge Funds and Impact Investing: Considerations for Institutional

Investors. The Journal of Investing Summer 2018, 27 (2) 47-55; DOI:

https://doi.org/10.3905/joi.2018.27.2.047

Lister, J. (2018). Advantages and Disadvantages of Financial Risks Within Companies.

Retrieved from: https://smallbusiness.chron.com/advantages-disadvantages-financial-

risks-within-companies-16048.html

Madura, R., & Fox, J. (2011). International financial management (2nd ed.). South Western

Melville, A. (2013). International Financial Reporting – A Practical Guide (4th ed). Pearson,

Education Limited, UK

Mersland, R., & Urgeghe, L. (2013). International Debt Financing and Performance of

Microfinance Institutions. Strategic Change. 22, 36-47. Doi:10.1002/jsc.1919.

Porter, G. and Norton, C. (2014). Financial Accounting: The Impact on Decision Maker.

Texas: Cengage Learning

Sword. (2018). Active Risk Manager (ARM): The Technology Behind Leading Edge Risk

Management, Retrieved from http://www.sword-activerisk.com/products/active-risk-

manager-arm/

11

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.