Financial Ratio Analysis of Cement Companies in Bangladesh (FIN254)

VerifiedAdded on 2021/01/05

|34

|4782

|180

Project

AI Summary

This project, submitted for the Introduction to Financial Management (FIN254) course, presents a comprehensive ratio analysis of Heidelberg Cement Bangladesh Limited and LafargeHolcim Bangladesh Limited. The analysis covers the period from 2016 to 2019, encompassing liquidity, activity, solvency, profitability, and market ratios. The report includes detailed calculations and a comparative analysis of the two companies' financial performance, providing insights into their strengths and weaknesses based on key financial indicators such as current ratio, quick ratio, accounts receivable turnover, debt ratio, and return on equity. The project aims to demonstrate an understanding of financial statement analysis and its application in assessing corporate financial health within the context of the Bangladeshi cement industry.

Ratio Analysis of 2 Cement Companies in Bangladesh

Course: Introduction to Financial Management (FIN254)

Section 18

Submitted to: Khaiyyum Hashem

Senior Lecturer, Department of Accounting and Finance

Ratio Analysis of

Heidelberg Cement Bangladesh Limited & LafargeHolcim Bangladesh Limited

Submitted by:

Rowzatur Rumman Kashfi 1620135020

Anika Fairuse 1311209630

Course: Introduction to Financial Management (FIN254)

Section 18

Submitted to: Khaiyyum Hashem

Senior Lecturer, Department of Accounting and Finance

Ratio Analysis of

Heidelberg Cement Bangladesh Limited & LafargeHolcim Bangladesh Limited

Submitted by:

Rowzatur Rumman Kashfi 1620135020

Anika Fairuse 1311209630

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

December 22nd, 2018

Khaiyyum Hashem

Lecturer

Department of Accounting and Finance

North South University

Bashundhara R/A, Dhaka-1229

Subject: Submission of Group Project

Dear Sir

We would like to express our gratitude to you for giving us the opportunity to do a project on

ratio analysis which not only helped us learn calculating ratios but also helped us to know the

effects of the change in these ratios in decision making.

Here is the report you asked us to submit on the analysis of financial statement of two

publicly listed companies. We have chosen Heidelberg Cement Bangladesh Ltd and

LafargeHolcim Bangladesh Limited to do our report on.

We have tried our level best to follow it according to your guidelines along with your

instructions. Any question about the report or any feedback is most welcomed.

Sincerely,

Rowzatur Rumman Kashfi

……………………….

Anika Fairuse

……………………….

December 22nd, 2018

Khaiyyum Hashem

Lecturer

Department of Accounting and Finance

North South University

Bashundhara R/A, Dhaka-1229

Subject: Submission of Group Project

Dear Sir

We would like to express our gratitude to you for giving us the opportunity to do a project on

ratio analysis which not only helped us learn calculating ratios but also helped us to know the

effects of the change in these ratios in decision making.

Here is the report you asked us to submit on the analysis of financial statement of two

publicly listed companies. We have chosen Heidelberg Cement Bangladesh Ltd and

LafargeHolcim Bangladesh Limited to do our report on.

We have tried our level best to follow it according to your guidelines along with your

instructions. Any question about the report or any feedback is most welcomed.

Sincerely,

Rowzatur Rumman Kashfi

……………………….

Anika Fairuse

……………………….

3

Table of Contents

1 Executive Summary..............................................................................................................................5

2 Company Introductions.........................................................................................................................6

2.1 Heidelberg Cement Bangladesh Limited.......................................................................................6

2.2 LafargeHolcim Bangladesh Limited..............................................................................................6

3 Ratio Analysis (Time Series & Cross Sectional)..................................................................................7

3.1 Liquidity Ratios.............................................................................................................................7

3.1.1 Current Ratio...........................................................................................................................7

3.1.2 Quick (Acid-Test) Ratio.........................................................................................................8

3.2 Activity Ratios...............................................................................................................................9

3.2.1 Accounts Receivable Turnover...............................................................................................9

3.2.2 Average Collection Period....................................................................................................10

3.2.3 Accounts Payable Turnover..................................................................................................11

3.2.4 Average Payment Period......................................................................................................12

3.3.5 Inventory Turnover...............................................................................................................13

3.2.6 Average Age of Inventory....................................................................................................14

3.2.7 Total Asset Turnover............................................................................................................15

3.2.8 Fixed Asset Turnover............................................................................................................16

3.3 Solvency Ratios...........................................................................................................................17

3.3.1 Debt Ratio.............................................................................................................................17

3.3.2 Debt-Equity Ratio.................................................................................................................18

3.3.3 Times Interest Earned...........................................................................................................19

3.4 Profitability Ratios.......................................................................................................................20

3.4.1 Gross Profit Margin..............................................................................................................20

3.4.2 Net Profit Margin..................................................................................................................21

3.4.3 Return on Total Assets (ROA)..............................................................................................22

3.4.4 Return on Equity...................................................................................................................23

3.5 Market Ratios...............................................................................................................................24

3.5.1 Earning Per Share.................................................................................................................24

Table of Contents

1 Executive Summary..............................................................................................................................5

2 Company Introductions.........................................................................................................................6

2.1 Heidelberg Cement Bangladesh Limited.......................................................................................6

2.2 LafargeHolcim Bangladesh Limited..............................................................................................6

3 Ratio Analysis (Time Series & Cross Sectional)..................................................................................7

3.1 Liquidity Ratios.............................................................................................................................7

3.1.1 Current Ratio...........................................................................................................................7

3.1.2 Quick (Acid-Test) Ratio.........................................................................................................8

3.2 Activity Ratios...............................................................................................................................9

3.2.1 Accounts Receivable Turnover...............................................................................................9

3.2.2 Average Collection Period....................................................................................................10

3.2.3 Accounts Payable Turnover..................................................................................................11

3.2.4 Average Payment Period......................................................................................................12

3.3.5 Inventory Turnover...............................................................................................................13

3.2.6 Average Age of Inventory....................................................................................................14

3.2.7 Total Asset Turnover............................................................................................................15

3.2.8 Fixed Asset Turnover............................................................................................................16

3.3 Solvency Ratios...........................................................................................................................17

3.3.1 Debt Ratio.............................................................................................................................17

3.3.2 Debt-Equity Ratio.................................................................................................................18

3.3.3 Times Interest Earned...........................................................................................................19

3.4 Profitability Ratios.......................................................................................................................20

3.4.1 Gross Profit Margin..............................................................................................................20

3.4.2 Net Profit Margin..................................................................................................................21

3.4.3 Return on Total Assets (ROA)..............................................................................................22

3.4.4 Return on Equity...................................................................................................................23

3.5 Market Ratios...............................................................................................................................24

3.5.1 Earning Per Share.................................................................................................................24

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

3.5.2 Price/ Earnings (P/E) Ratio...................................................................................................25

3.5.3 Book Value per Share...........................................................................................................26

3.5.4 Market/ Book Ratio..............................................................................................................27

3.5.5 Dividend per Share...............................................................................................................28

3.5.6 Dividend Yield......................................................................................................................29

3.5.7 Dividend Payout...................................................................................................................30

4 Recommendations and Conclusion.....................................................................................................31

5 calculations.........................................................................................................................................32

5.1 Heidelberg Cement Bangladesh...................................................................................................32

5.2 LafargeHolcim Bangladesh.........................................................................................................35

6 References...........................................................................................................................................38

3.5.2 Price/ Earnings (P/E) Ratio...................................................................................................25

3.5.3 Book Value per Share...........................................................................................................26

3.5.4 Market/ Book Ratio..............................................................................................................27

3.5.5 Dividend per Share...............................................................................................................28

3.5.6 Dividend Yield......................................................................................................................29

3.5.7 Dividend Payout...................................................................................................................30

4 Recommendations and Conclusion.....................................................................................................31

5 calculations.........................................................................................................................................32

5.1 Heidelberg Cement Bangladesh...................................................................................................32

5.2 LafargeHolcim Bangladesh.........................................................................................................35

6 References...........................................................................................................................................38

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

1 Executive Summary

We had to calculate the financial ratios of two publicly listed companies using their financial

statements for the range of 3 years- 2014 to 2017. We found out the Liquidity ratios, Activity

ratios, Solvency ratios, Profitability ratios and Market for both the companies. After that we

analyzed the ratios to understand the real finance standings of the company.

We consequently did the ‘year wise’ analysis on the 2 cement industries of Bangladesh

(Heidelberg Cement Bangladesh Ltd & LafargeHolcim Bangladesh Limited) and then we

compared the ratios of the two companies with each other. We tried our best to make accurate

calculations and analysis and this term paper has benefitted all of our team members.

1 Executive Summary

We had to calculate the financial ratios of two publicly listed companies using their financial

statements for the range of 3 years- 2014 to 2017. We found out the Liquidity ratios, Activity

ratios, Solvency ratios, Profitability ratios and Market for both the companies. After that we

analyzed the ratios to understand the real finance standings of the company.

We consequently did the ‘year wise’ analysis on the 2 cement industries of Bangladesh

(Heidelberg Cement Bangladesh Ltd & LafargeHolcim Bangladesh Limited) and then we

compared the ratios of the two companies with each other. We tried our best to make accurate

calculations and analysis and this term paper has benefitted all of our team members.

6

2 Company Introductions

2.1 Heidelberg Cement Bangladesh Limited

Heidelberg Cement Bangladesh Limited is one of the largest producers of cement in

Bangladesh. Sale of Portland Composite Cement (PCC) through two brands namely Scan

Cement and Ruby Cement is the key revenue driver of this company. Its manufacturing

unites are situated in Chittagong and Kanchpur having a total installed capacity of 2.1 million

MT. Recently, additional capacity of grinding unit of 750,000 MT/year in Chittagong had

started its commercial operation since January 12, 2012.

2.2 LafargeHolcim Bangladesh Limited

LafargeHolcim is the leading global construction materials and solutions company serving

masons, builders, architects and engineers all over the world. LafargeHolcim was born of the

merger of Lafarge and Holcim in 2015. With over 180 years of combined experience. Our

operations produce cement, aggregates and ready-mix concrete which are used in building

projects ranging from affordable housing and small, local projects to the biggest, most

technically and architecturally challenging infrastructure projects. As urbanization

increasingly impacts people and the planet, we provide innovative products and building

solutions with a clear commitment to social and environmental sustainability.

2 Company Introductions

2.1 Heidelberg Cement Bangladesh Limited

Heidelberg Cement Bangladesh Limited is one of the largest producers of cement in

Bangladesh. Sale of Portland Composite Cement (PCC) through two brands namely Scan

Cement and Ruby Cement is the key revenue driver of this company. Its manufacturing

unites are situated in Chittagong and Kanchpur having a total installed capacity of 2.1 million

MT. Recently, additional capacity of grinding unit of 750,000 MT/year in Chittagong had

started its commercial operation since January 12, 2012.

2.2 LafargeHolcim Bangladesh Limited

LafargeHolcim is the leading global construction materials and solutions company serving

masons, builders, architects and engineers all over the world. LafargeHolcim was born of the

merger of Lafarge and Holcim in 2015. With over 180 years of combined experience. Our

operations produce cement, aggregates and ready-mix concrete which are used in building

projects ranging from affordable housing and small, local projects to the biggest, most

technically and architecturally challenging infrastructure projects. As urbanization

increasingly impacts people and the planet, we provide innovative products and building

solutions with a clear commitment to social and environmental sustainability.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

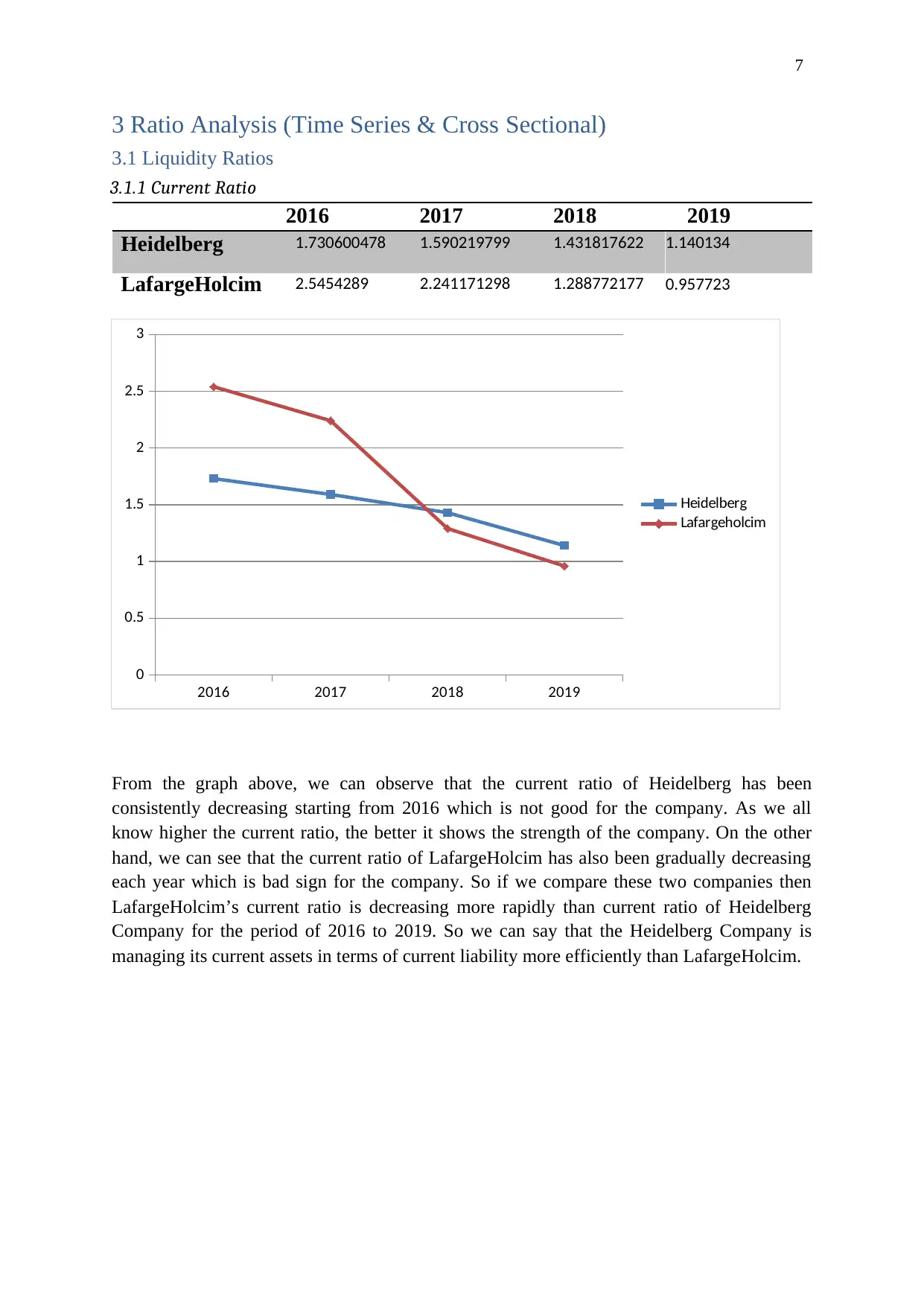

3 Ratio Analysis (Time Series & Cross Sectional)

3.1 Liquidity Ratios

3.1.1 Current Ratio

2016 2017 2018 2019

Heidelberg 1.730600478 1.590219799 1.431817622 1.140134

LafargeHolcim 2.5454289 2.241171298 1.288772177 0.957723

2016 2017 2018 2019

0

0.5

1

1.5

2

2.5

3

Heidelberg

Lafargeholcim

From the graph above, we can observe that the current ratio of Heidelberg has been

consistently decreasing starting from 2016 which is not good for the company. As we all

know higher the current ratio, the better it shows the strength of the company. On the other

hand, we can see that the current ratio of LafargeHolcim has also been gradually decreasing

each year which is bad sign for the company. So if we compare these two companies then

LafargeHolcim’s current ratio is decreasing more rapidly than current ratio of Heidelberg

Company for the period of 2016 to 2019. So we can say that the Heidelberg Company is

managing its current assets in terms of current liability more efficiently than LafargeHolcim.

3 Ratio Analysis (Time Series & Cross Sectional)

3.1 Liquidity Ratios

3.1.1 Current Ratio

2016 2017 2018 2019

Heidelberg 1.730600478 1.590219799 1.431817622 1.140134

LafargeHolcim 2.5454289 2.241171298 1.288772177 0.957723

2016 2017 2018 2019

0

0.5

1

1.5

2

2.5

3

Heidelberg

Lafargeholcim

From the graph above, we can observe that the current ratio of Heidelberg has been

consistently decreasing starting from 2016 which is not good for the company. As we all

know higher the current ratio, the better it shows the strength of the company. On the other

hand, we can see that the current ratio of LafargeHolcim has also been gradually decreasing

each year which is bad sign for the company. So if we compare these two companies then

LafargeHolcim’s current ratio is decreasing more rapidly than current ratio of Heidelberg

Company for the period of 2016 to 2019. So we can say that the Heidelberg Company is

managing its current assets in terms of current liability more efficiently than LafargeHolcim.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

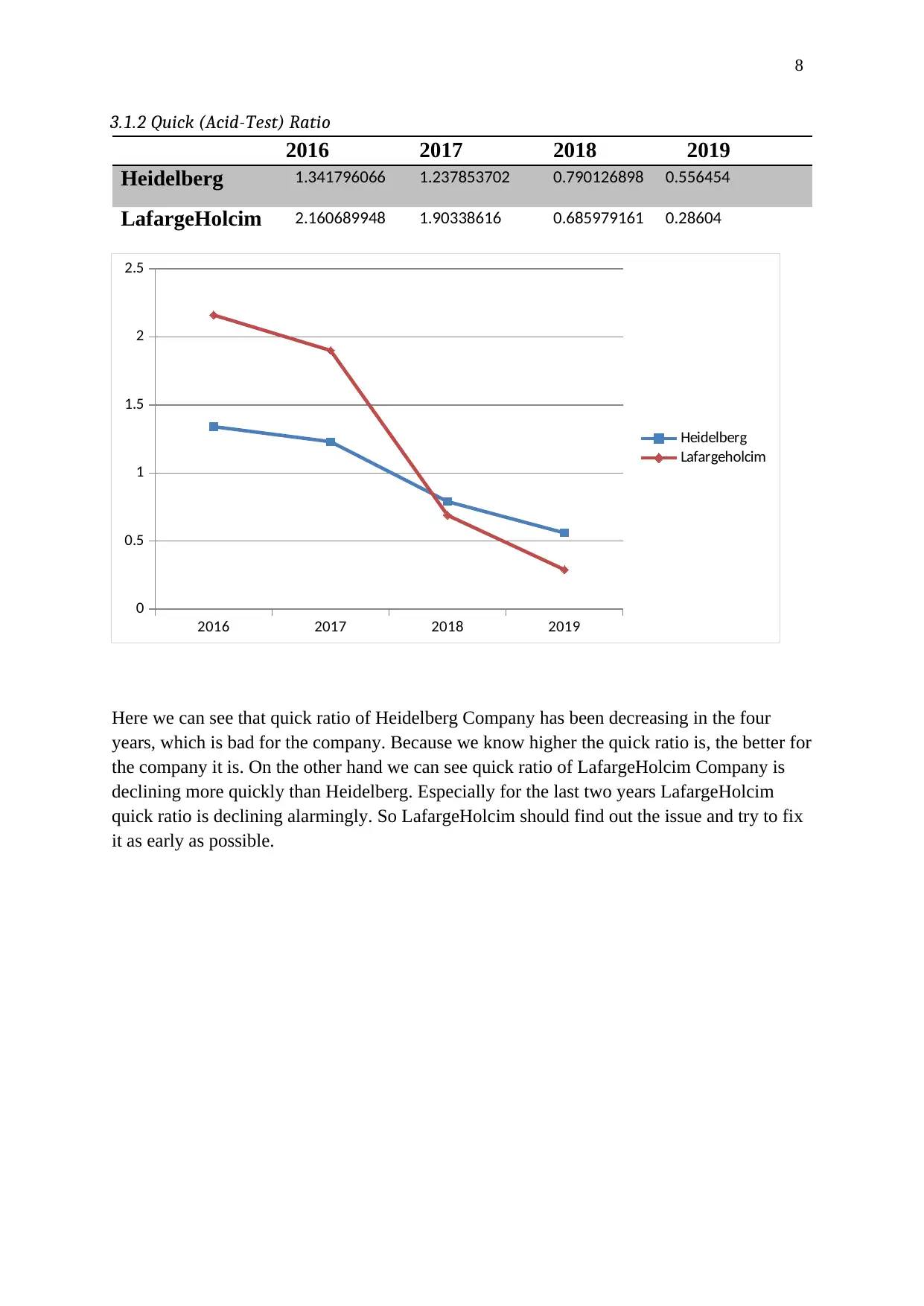

3.1.2 Quick (Acid-Test) Ratio

2016 2017 2018 2019

Heidelberg 1.341796066 1.237853702 0.790126898 0.556454

LafargeHolcim 2.160689948 1.90338616 0.685979161 0.28604

2016 2017 2018 2019

0

0.5

1

1.5

2

2.5

Heidelberg

Lafargeholcim

Here we can see that quick ratio of Heidelberg Company has been decreasing in the four

years, which is bad for the company. Because we know higher the quick ratio is, the better for

the company it is. On the other hand we can see quick ratio of LafargeHolcim Company is

declining more quickly than Heidelberg. Especially for the last two years LafargeHolcim

quick ratio is declining alarmingly. So LafargeHolcim should find out the issue and try to fix

it as early as possible.

3.1.2 Quick (Acid-Test) Ratio

2016 2017 2018 2019

Heidelberg 1.341796066 1.237853702 0.790126898 0.556454

LafargeHolcim 2.160689948 1.90338616 0.685979161 0.28604

2016 2017 2018 2019

0

0.5

1

1.5

2

2.5

Heidelberg

Lafargeholcim

Here we can see that quick ratio of Heidelberg Company has been decreasing in the four

years, which is bad for the company. Because we know higher the quick ratio is, the better for

the company it is. On the other hand we can see quick ratio of LafargeHolcim Company is

declining more quickly than Heidelberg. Especially for the last two years LafargeHolcim

quick ratio is declining alarmingly. So LafargeHolcim should find out the issue and try to fix

it as early as possible.

9

3.2 Activity Ratios

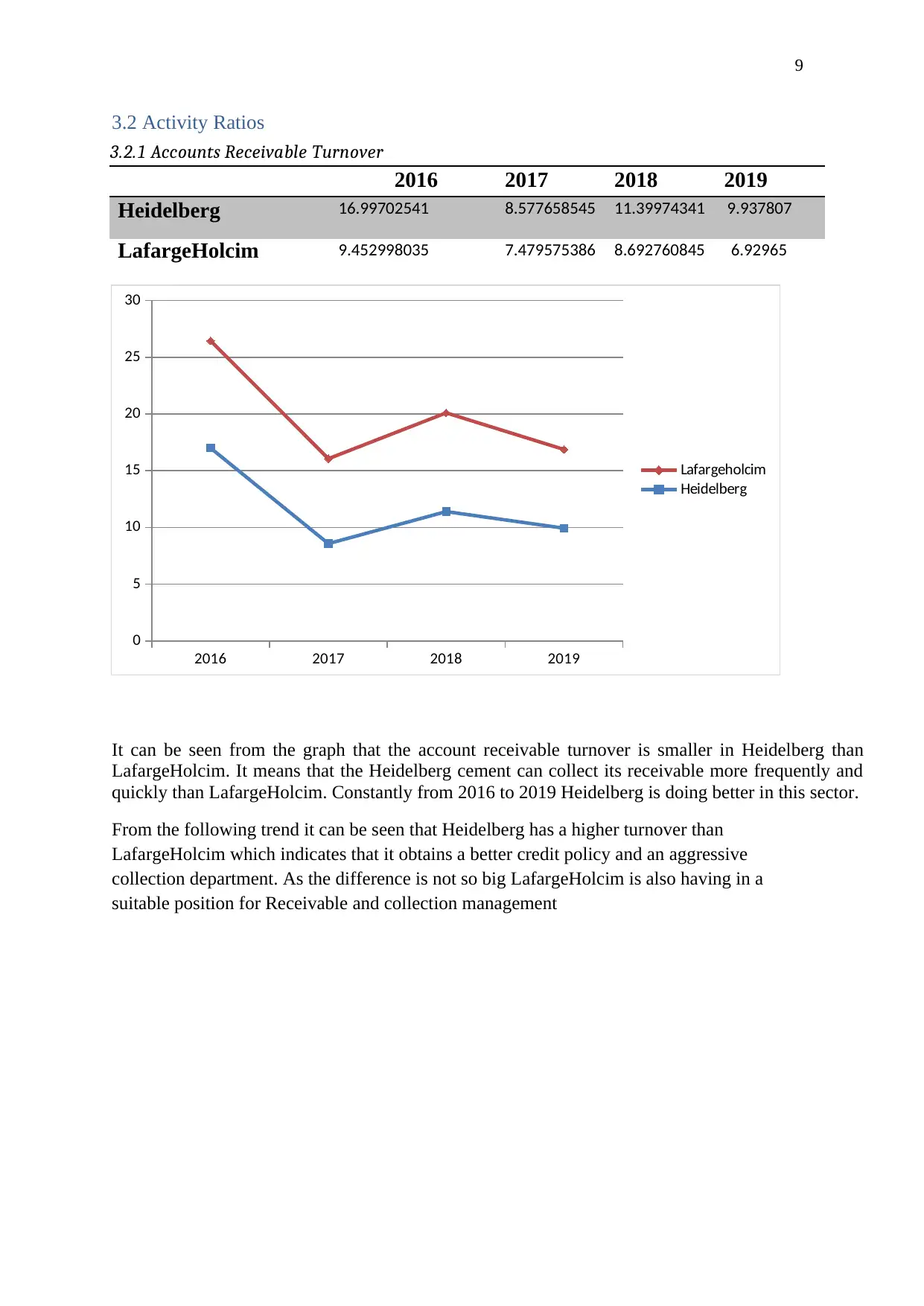

3.2.1 Accounts Receivable Turnover

2016 2017 2018 2019

Heidelberg 16.99702541 8.577658545 11.39974341 9.937807

LafargeHolcim 9.452998035 7.479575386 8.692760845 6.92965

2016 2017 2018 2019

0

5

10

15

20

25

30

Lafargeholcim

Heidelberg

It can be seen from the graph that the account receivable turnover is smaller in Heidelberg than

LafargeHolcim. It means that the Heidelberg cement can collect its receivable more frequently and

quickly than LafargeHolcim. Constantly from 2016 to 2019 Heidelberg is doing better in this sector.

From the following trend it can be seen that Heidelberg has a higher turnover than

LafargeHolcim which indicates that it obtains a better credit policy and an aggressive

collection department. As the difference is not so big LafargeHolcim is also having in a

suitable position for Receivable and collection management

3.2 Activity Ratios

3.2.1 Accounts Receivable Turnover

2016 2017 2018 2019

Heidelberg 16.99702541 8.577658545 11.39974341 9.937807

LafargeHolcim 9.452998035 7.479575386 8.692760845 6.92965

2016 2017 2018 2019

0

5

10

15

20

25

30

Lafargeholcim

Heidelberg

It can be seen from the graph that the account receivable turnover is smaller in Heidelberg than

LafargeHolcim. It means that the Heidelberg cement can collect its receivable more frequently and

quickly than LafargeHolcim. Constantly from 2016 to 2019 Heidelberg is doing better in this sector.

From the following trend it can be seen that Heidelberg has a higher turnover than

LafargeHolcim which indicates that it obtains a better credit policy and an aggressive

collection department. As the difference is not so big LafargeHolcim is also having in a

suitable position for Receivable and collection management

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

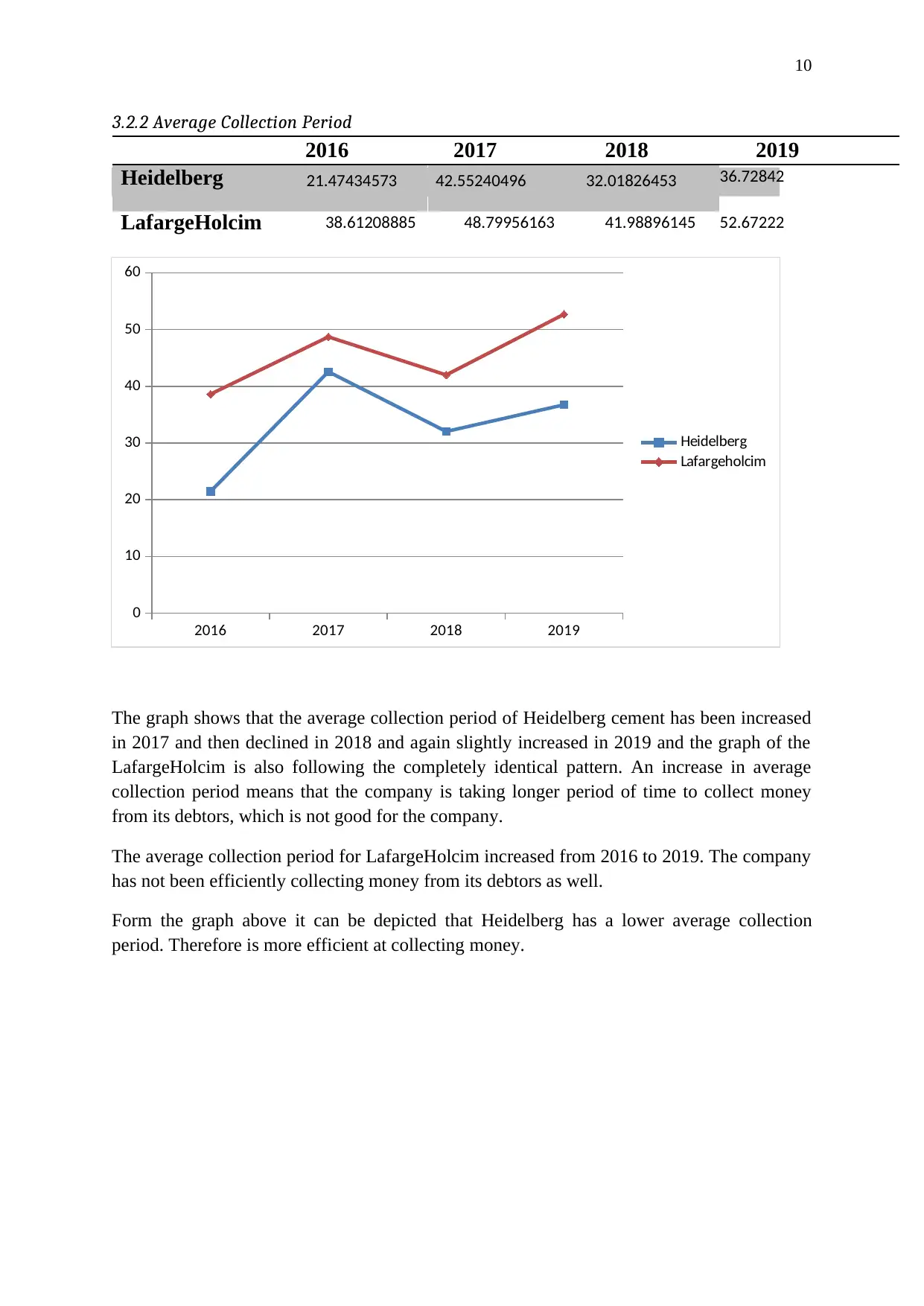

3.2.2 Average Collection Period

2016 2017 2018 2019

Heidelberg 21.47434573 42.55240496 32.01826453 36.72842

LafargeHolcim 38.61208885 48.79956163 41.98896145 52.67222

2016 2017 2018 2019

0

10

20

30

40

50

60

Heidelberg

Lafargeholcim

The graph shows that the average collection period of Heidelberg cement has been increased

in 2017 and then declined in 2018 and again slightly increased in 2019 and the graph of the

LafargeHolcim is also following the completely identical pattern. An increase in average

collection period means that the company is taking longer period of time to collect money

from its debtors, which is not good for the company.

The average collection period for LafargeHolcim increased from 2016 to 2019. The company

has not been efficiently collecting money from its debtors as well.

Form the graph above it can be depicted that Heidelberg has a lower average collection

period. Therefore is more efficient at collecting money.

3.2.2 Average Collection Period

2016 2017 2018 2019

Heidelberg 21.47434573 42.55240496 32.01826453 36.72842

LafargeHolcim 38.61208885 48.79956163 41.98896145 52.67222

2016 2017 2018 2019

0

10

20

30

40

50

60

Heidelberg

Lafargeholcim

The graph shows that the average collection period of Heidelberg cement has been increased

in 2017 and then declined in 2018 and again slightly increased in 2019 and the graph of the

LafargeHolcim is also following the completely identical pattern. An increase in average

collection period means that the company is taking longer period of time to collect money

from its debtors, which is not good for the company.

The average collection period for LafargeHolcim increased from 2016 to 2019. The company

has not been efficiently collecting money from its debtors as well.

Form the graph above it can be depicted that Heidelberg has a lower average collection

period. Therefore is more efficient at collecting money.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

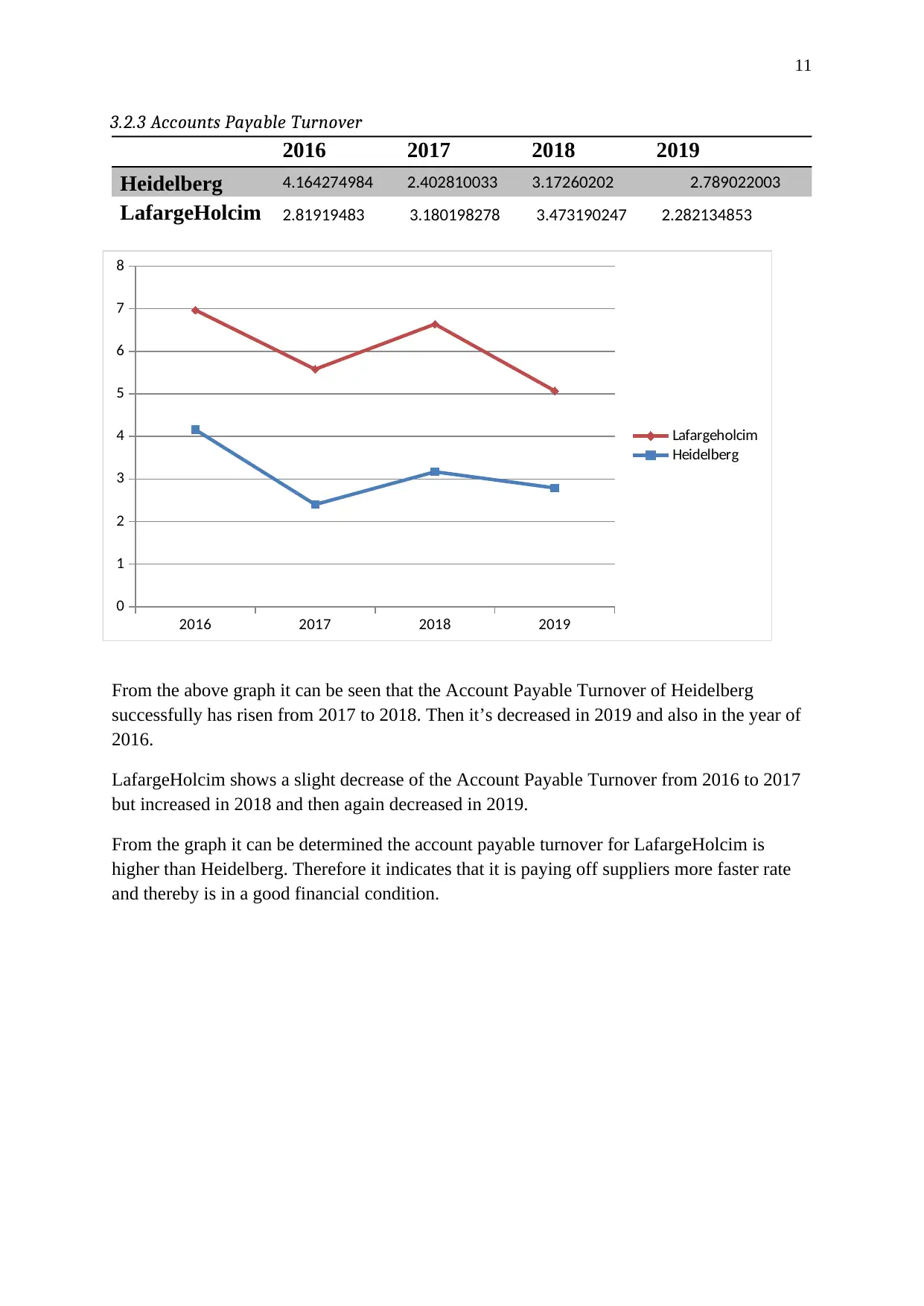

3.2.3 Accounts Payable Turnover

2016 2017 2018 2019

Heidelberg 4.164274984 2.402810033 3.17260202 2.789022003

LafargeHolcim 2.81919483 3.180198278 3.473190247 2.282134853

2016 2017 2018 2019

0

1

2

3

4

5

6

7

8

Lafargeholcim

Heidelberg

From the above graph it can be seen that the Account Payable Turnover of Heidelberg

successfully has risen from 2017 to 2018. Then it’s decreased in 2019 and also in the year of

2016.

LafargeHolcim shows a slight decrease of the Account Payable Turnover from 2016 to 2017

but increased in 2018 and then again decreased in 2019.

From the graph it can be determined the account payable turnover for LafargeHolcim is

higher than Heidelberg. Therefore it indicates that it is paying off suppliers more faster rate

and thereby is in a good financial condition.

3.2.3 Accounts Payable Turnover

2016 2017 2018 2019

Heidelberg 4.164274984 2.402810033 3.17260202 2.789022003

LafargeHolcim 2.81919483 3.180198278 3.473190247 2.282134853

2016 2017 2018 2019

0

1

2

3

4

5

6

7

8

Lafargeholcim

Heidelberg

From the above graph it can be seen that the Account Payable Turnover of Heidelberg

successfully has risen from 2017 to 2018. Then it’s decreased in 2019 and also in the year of

2016.

LafargeHolcim shows a slight decrease of the Account Payable Turnover from 2016 to 2017

but increased in 2018 and then again decreased in 2019.

From the graph it can be determined the account payable turnover for LafargeHolcim is

higher than Heidelberg. Therefore it indicates that it is paying off suppliers more faster rate

and thereby is in a good financial condition.

12

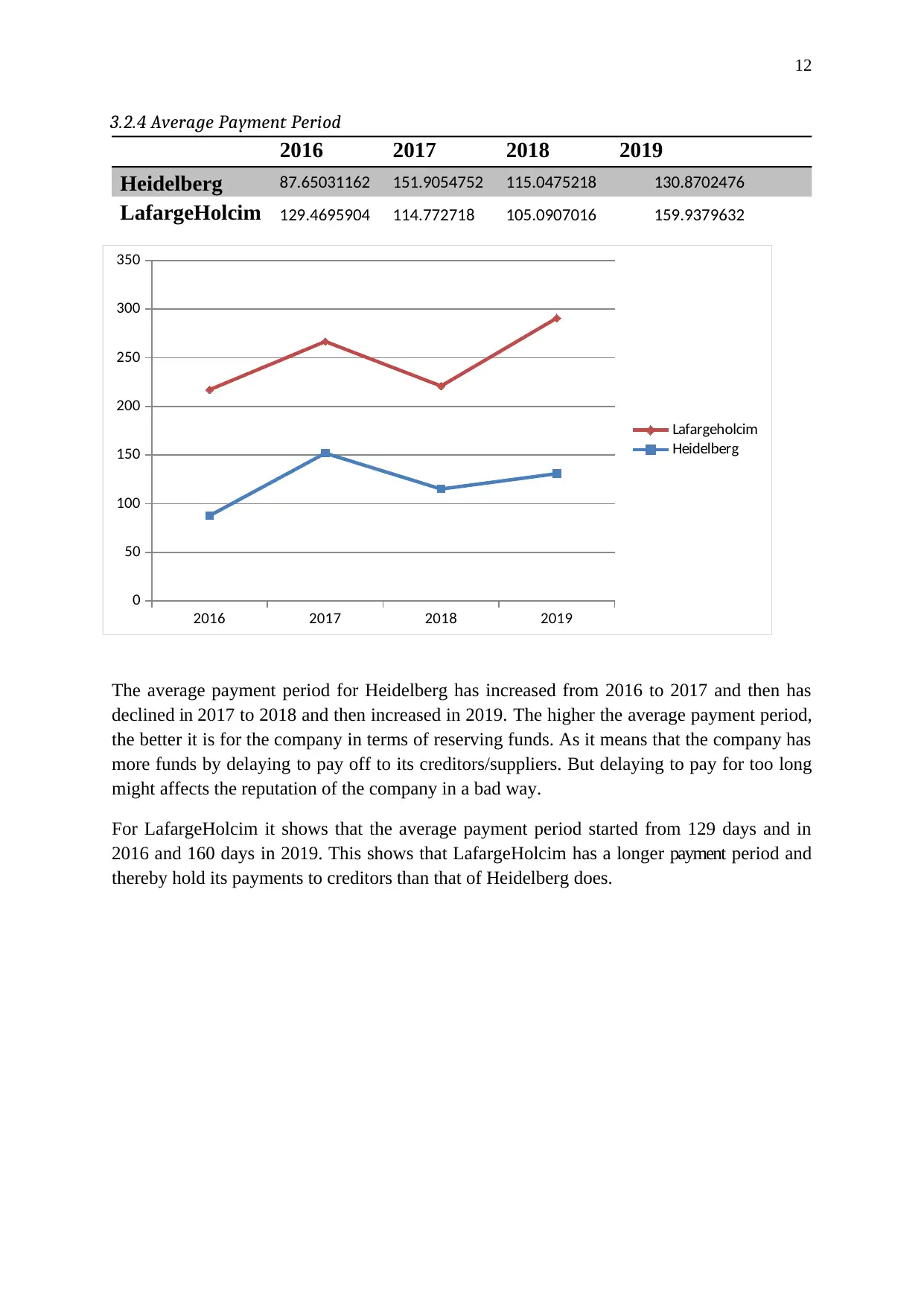

3.2.4 Average Payment Period

2016 2017 2018 2019

Heidelberg 87.65031162 151.9054752 115.0475218 130.8702476

LafargeHolcim 129.4695904 114.772718 105.0907016 159.9379632

2016 2017 2018 2019

0

50

100

150

200

250

300

350

Lafargeholcim

Heidelberg

The average payment period for Heidelberg has increased from 2016 to 2017 and then has

declined in 2017 to 2018 and then increased in 2019. The higher the average payment period,

the better it is for the company in terms of reserving funds. As it means that the company has

more funds by delaying to pay off to its creditors/suppliers. But delaying to pay for too long

might affects the reputation of the company in a bad way.

For LafargeHolcim it shows that the average payment period started from 129 days and in

2016 and 160 days in 2019. This shows that LafargeHolcim has a longer payment period and

thereby hold its payments to creditors than that of Heidelberg does.

3.2.4 Average Payment Period

2016 2017 2018 2019

Heidelberg 87.65031162 151.9054752 115.0475218 130.8702476

LafargeHolcim 129.4695904 114.772718 105.0907016 159.9379632

2016 2017 2018 2019

0

50

100

150

200

250

300

350

Lafargeholcim

Heidelberg

The average payment period for Heidelberg has increased from 2016 to 2017 and then has

declined in 2017 to 2018 and then increased in 2019. The higher the average payment period,

the better it is for the company in terms of reserving funds. As it means that the company has

more funds by delaying to pay off to its creditors/suppliers. But delaying to pay for too long

might affects the reputation of the company in a bad way.

For LafargeHolcim it shows that the average payment period started from 129 days and in

2016 and 160 days in 2019. This shows that LafargeHolcim has a longer payment period and

thereby hold its payments to creditors than that of Heidelberg does.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 34

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.