Corporate Accounting: Analysis of Consolidated Financial Statements

VerifiedAdded on 2023/04/23

|10

|1435

|458

Report

AI Summary

This report presents a detailed analysis of corporate accounting practices, focusing on the consolidated financial statements of Lead Beaters Ltd. The report includes a consolidated income statement and balance sheet, along with an acquisition analysis of Possum Ltd., which Lead Beaters Ltd. acquired. It provides a thorough examination of consolidation journals, a comprehensive consolidation worksheet, and a rationale for intragroup transactions. The analysis covers adjustments for inventory, income tax expenses, and retained earnings, ensuring a clear understanding of the financial reporting process. The report offers insights into the financial performance of Lead Beaters Ltd. and its subsidiary, Possum Ltd., providing a complete overview of the consolidation process and the impact of various accounting treatments. References and bibliography are included to support the analysis.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

Table of Contents

Consolidated Income Statement:.....................................................................................................2

Consolidated Balance Sheet:...........................................................................................................3

Acquisition Analysis:.......................................................................................................................4

Consolidation Journals:...................................................................................................................5

Worksheet:.......................................................................................................................................7

Rationale of Intragroup Transaction:...............................................................................................7

Reference & Bibliography:..............................................................................................................9

Table of Contents

Consolidated Income Statement:.....................................................................................................2

Consolidated Balance Sheet:...........................................................................................................3

Acquisition Analysis:.......................................................................................................................4

Consolidation Journals:...................................................................................................................5

Worksheet:.......................................................................................................................................7

Rationale of Intragroup Transaction:...............................................................................................7

Reference & Bibliography:..............................................................................................................9

2CORPORATE ACCOUNTING

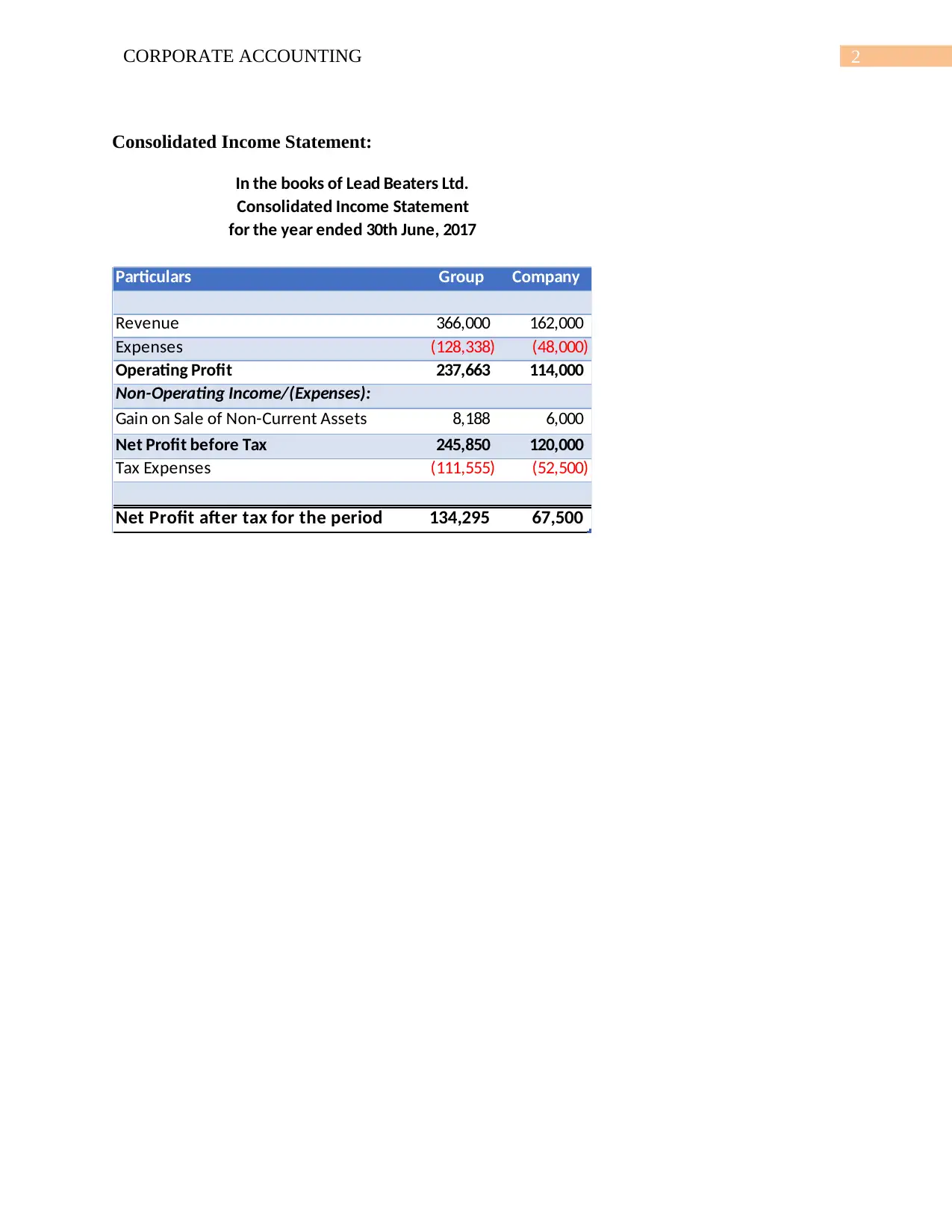

Consolidated Income Statement:

Particulars Group Company

Revenue 366,000 162,000

Expenses (128,338) (48,000)

Operating Profit 237,663 114,000

Non-Operating Income/(Expenses):

Gain on Sale of Non-Current Assets 8,188 6,000

Net Profit before Tax 245,850 120,000

Tax Expenses (111,555) (52,500)

Net Profit after tax for the period 134,295 67,500

In the books of Lead Beaters Ltd.

Consolidated Income Statement

for the year ended 30th June, 2017

Consolidated Income Statement:

Particulars Group Company

Revenue 366,000 162,000

Expenses (128,338) (48,000)

Operating Profit 237,663 114,000

Non-Operating Income/(Expenses):

Gain on Sale of Non-Current Assets 8,188 6,000

Net Profit before Tax 245,850 120,000

Tax Expenses (111,555) (52,500)

Net Profit after tax for the period 134,295 67,500

In the books of Lead Beaters Ltd.

Consolidated Income Statement

for the year ended 30th June, 2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING

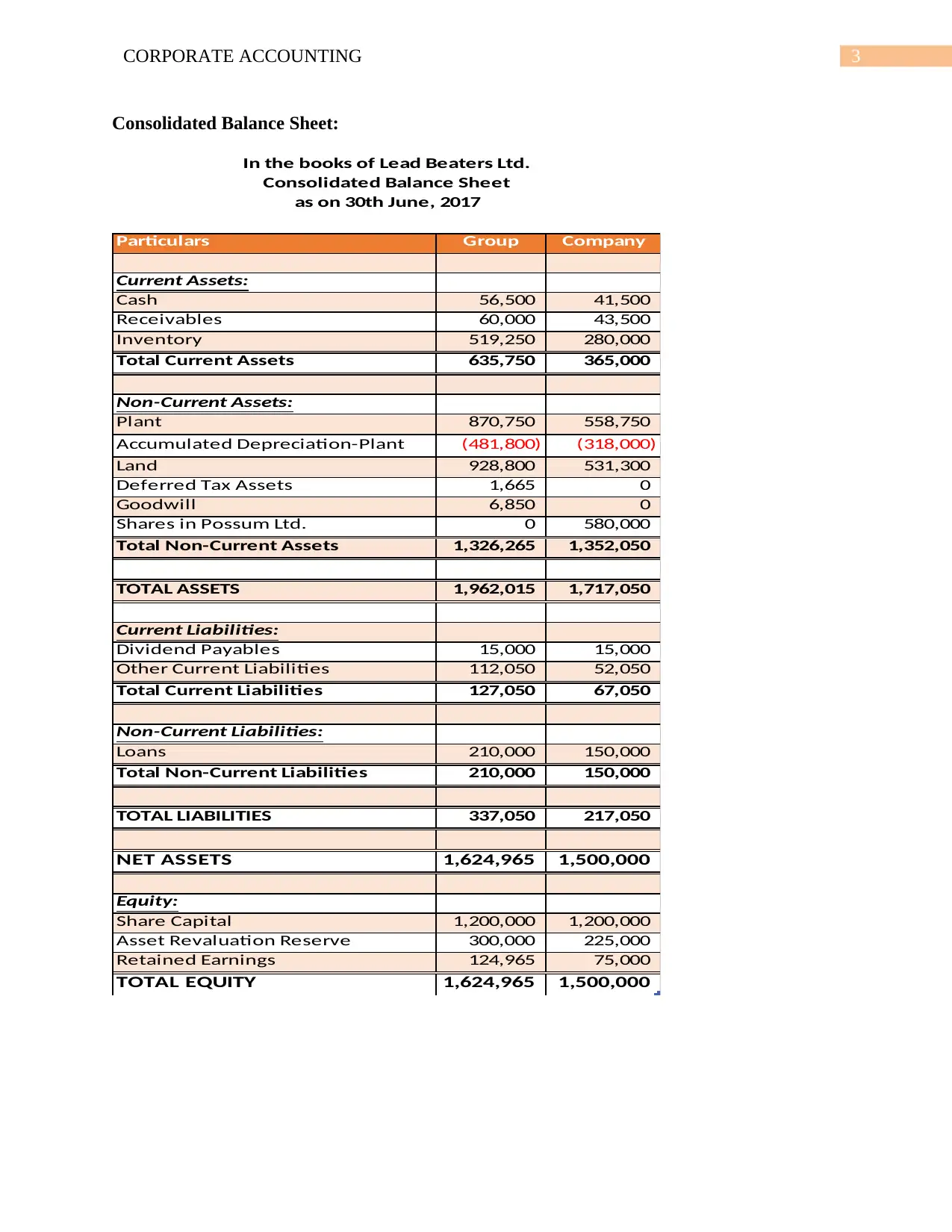

Consolidated Balance Sheet:

Particulars Group Company

Current Assets:

Cash 56,500 41,500

Receivables 60,000 43,500

Inventory 519,250 280,000

Total Current Assets 635,750 365,000

Non-Current Assets:

Plant 870,750 558,750

Accumulated Depreciation-Plant (481,800) (318,000)

Land 928,800 531,300

Deferred Tax Assets 1,665 0

Goodwill 6,850 0

Shares in Possum Ltd. 0 580,000

Total Non-Current Assets 1,326,265 1,352,050

TOTAL ASSETS 1,962,015 1,717,050

Current Liabilities:

Dividend Payables 15,000 15,000

Other Current Liabilities 112,050 52,050

Total Current Liabilities 127,050 67,050

Non-Current Liabilities:

Loans 210,000 150,000

Total Non-Current Liabilities 210,000 150,000

TOTAL LIABILITIES 337,050 217,050

NET ASSETS 1,624,965 1,500,000

Equity:

Share Capital 1,200,000 1,200,000

Asset Revaluation Reserve 300,000 225,000

Retained Earnings 124,965 75,000

TOTAL EQUITY 1,624,965 1,500,000

In the books of Lead Beaters Ltd.

Consolidated Balance Sheet

as on 30th June, 2017

Consolidated Balance Sheet:

Particulars Group Company

Current Assets:

Cash 56,500 41,500

Receivables 60,000 43,500

Inventory 519,250 280,000

Total Current Assets 635,750 365,000

Non-Current Assets:

Plant 870,750 558,750

Accumulated Depreciation-Plant (481,800) (318,000)

Land 928,800 531,300

Deferred Tax Assets 1,665 0

Goodwill 6,850 0

Shares in Possum Ltd. 0 580,000

Total Non-Current Assets 1,326,265 1,352,050

TOTAL ASSETS 1,962,015 1,717,050

Current Liabilities:

Dividend Payables 15,000 15,000

Other Current Liabilities 112,050 52,050

Total Current Liabilities 127,050 67,050

Non-Current Liabilities:

Loans 210,000 150,000

Total Non-Current Liabilities 210,000 150,000

TOTAL LIABILITIES 337,050 217,050

NET ASSETS 1,624,965 1,500,000

Equity:

Share Capital 1,200,000 1,200,000

Asset Revaluation Reserve 300,000 225,000

Retained Earnings 124,965 75,000

TOTAL EQUITY 1,624,965 1,500,000

In the books of Lead Beaters Ltd.

Consolidated Balance Sheet

as on 30th June, 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

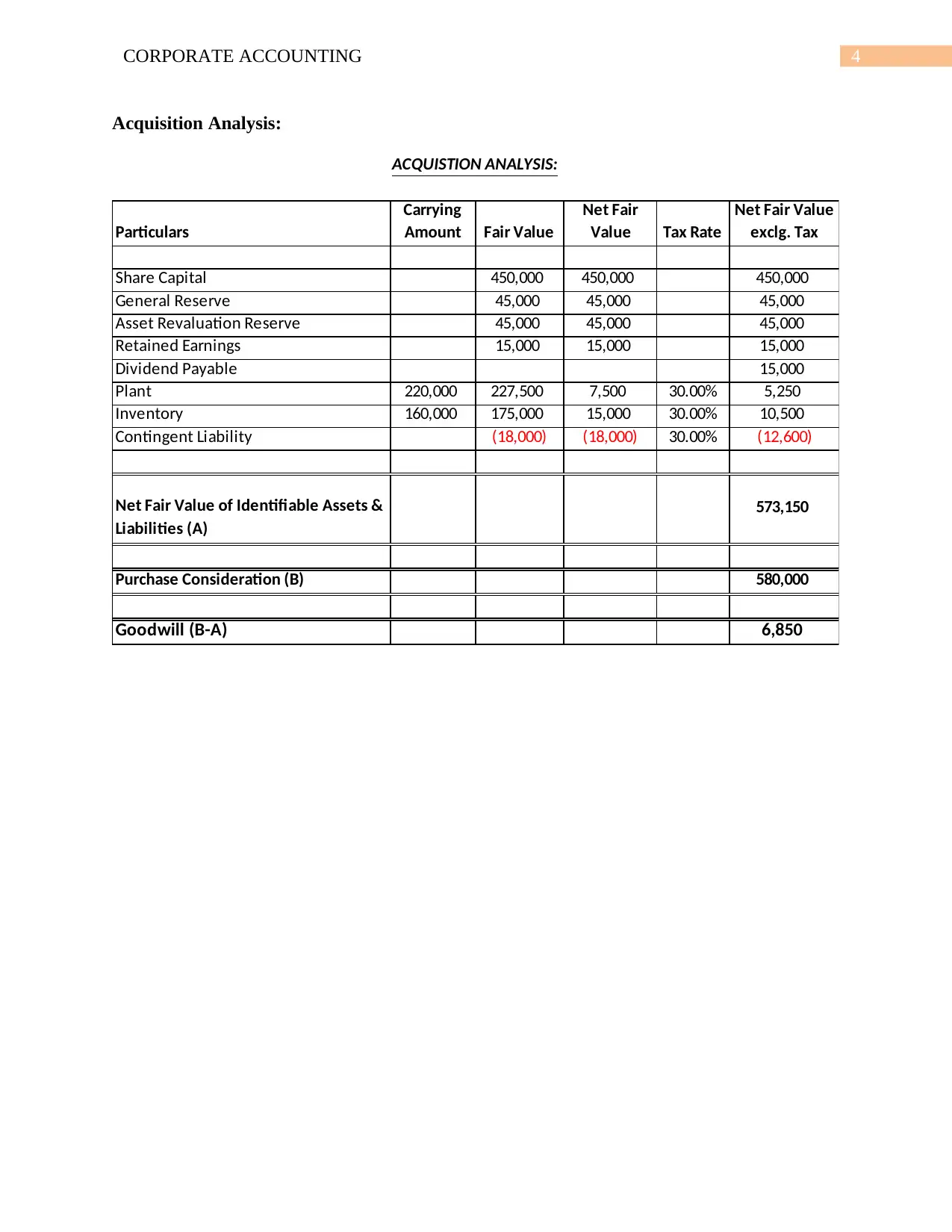

Acquisition Analysis:

Particulars

Carrying

Amount Fair Value

Net Fair

Value Tax Rate

Net Fair Value

exclg. Tax

Share Capital 450,000 450,000 450,000

General Reserve 45,000 45,000 45,000

Asset Revaluation Reserve 45,000 45,000 45,000

Retained Earnings 15,000 15,000 15,000

Dividend Payable 15,000

Plant 220,000 227,500 7,500 30.00% 5,250

Inventory 160,000 175,000 15,000 30.00% 10,500

Contingent Liability (18,000) (18,000) 30.00% (12,600)

Net Fair Value of Identifiable Assets &

Liabilities (A)

573,150

Purchase Consideration (B) 580,000

Goodwill (B-A) 6,850

ACQUISTION ANALYSIS:

Acquisition Analysis:

Particulars

Carrying

Amount Fair Value

Net Fair

Value Tax Rate

Net Fair Value

exclg. Tax

Share Capital 450,000 450,000 450,000

General Reserve 45,000 45,000 45,000

Asset Revaluation Reserve 45,000 45,000 45,000

Retained Earnings 15,000 15,000 15,000

Dividend Payable 15,000

Plant 220,000 227,500 7,500 30.00% 5,250

Inventory 160,000 175,000 15,000 30.00% 10,500

Contingent Liability (18,000) (18,000) 30.00% (12,600)

Net Fair Value of Identifiable Assets &

Liabilities (A)

573,150

Purchase Consideration (B) 580,000

Goodwill (B-A) 6,850

ACQUISTION ANALYSIS:

5CORPORATE ACCOUNTING

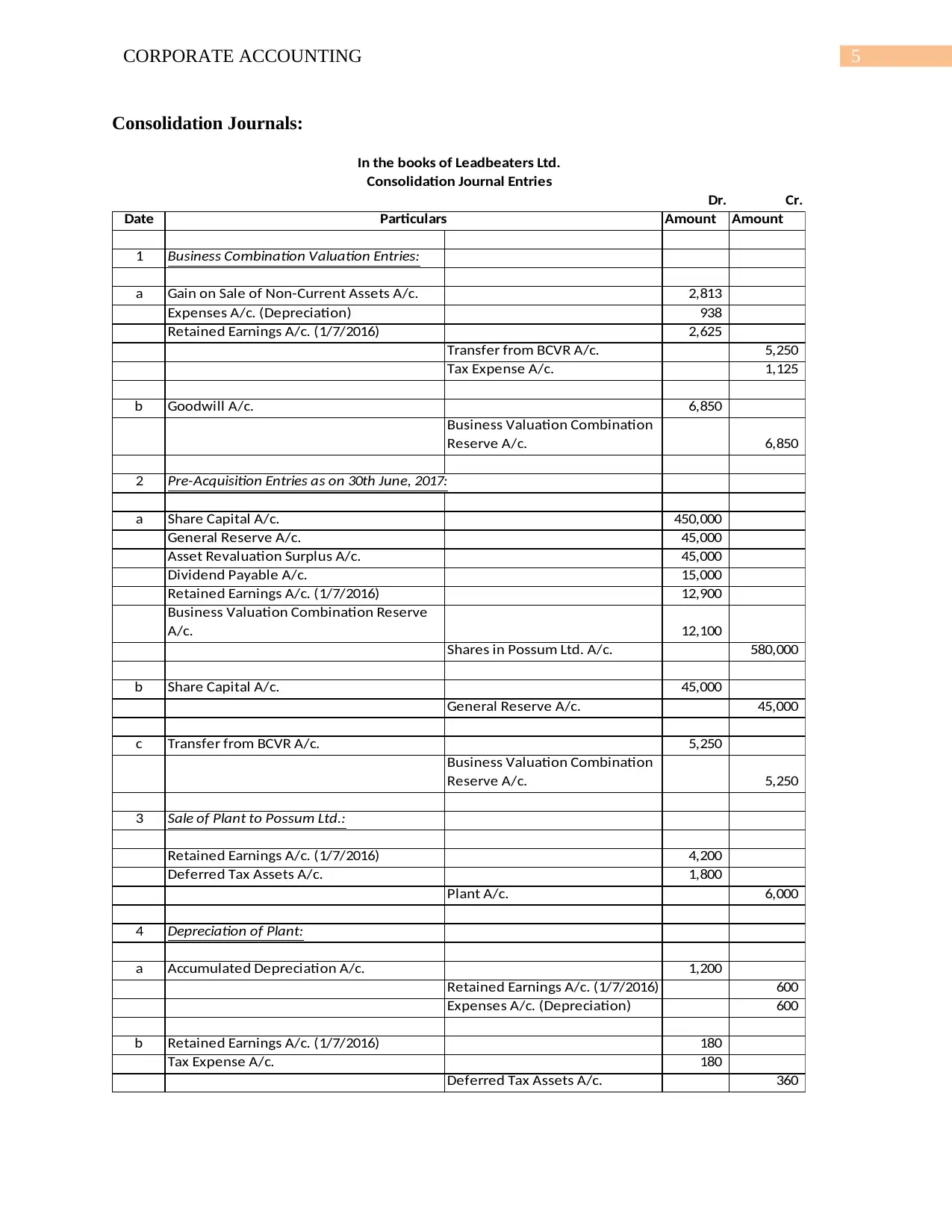

Consolidation Journals:

Dr. Cr.

Date Amount Amount

1 Business Combination Valuation Entries:

a Gain on Sale of Non-Current Assets A/c. 2,813

Expenses A/c. (Depreciation) 938

Retained Earnings A/c. (1/7/2016) 2,625

Transfer from BCVR A/c. 5,250

Tax Expense A/c. 1,125

b Goodwill A/c. 6,850

Business Valuation Combination

Reserve A/c. 6,850

2 Pre-Acquisition Entries as on 30th June, 2017:

a Share Capital A/c. 450,000

General Reserve A/c. 45,000

Asset Revaluation Surplus A/c. 45,000

Dividend Payable A/c. 15,000

Retained Earnings A/c. (1/7/2016) 12,900

Business Valuation Combination Reserve

A/c. 12,100

Shares in Possum Ltd. A/c. 580,000

b Share Capital A/c. 45,000

General Reserve A/c. 45,000

c Transfer from BCVR A/c. 5,250

Business Valuation Combination

Reserve A/c. 5,250

3 Sale of Plant to Possum Ltd.:

Retained Earnings A/c. (1/7/2016) 4,200

Deferred Tax Assets A/c. 1,800

Plant A/c. 6,000

4 Depreciation of Plant:

a Accumulated Depreciation A/c. 1,200

Retained Earnings A/c. (1/7/2016) 600

Expenses A/c. (Depreciation) 600

b Retained Earnings A/c. (1/7/2016) 180

Tax Expense A/c. 180

Deferred Tax Assets A/c. 360

Particulars

In the books of Leadbeaters Ltd.

Consolidation Journal Entries

Consolidation Journals:

Dr. Cr.

Date Amount Amount

1 Business Combination Valuation Entries:

a Gain on Sale of Non-Current Assets A/c. 2,813

Expenses A/c. (Depreciation) 938

Retained Earnings A/c. (1/7/2016) 2,625

Transfer from BCVR A/c. 5,250

Tax Expense A/c. 1,125

b Goodwill A/c. 6,850

Business Valuation Combination

Reserve A/c. 6,850

2 Pre-Acquisition Entries as on 30th June, 2017:

a Share Capital A/c. 450,000

General Reserve A/c. 45,000

Asset Revaluation Surplus A/c. 45,000

Dividend Payable A/c. 15,000

Retained Earnings A/c. (1/7/2016) 12,900

Business Valuation Combination Reserve

A/c. 12,100

Shares in Possum Ltd. A/c. 580,000

b Share Capital A/c. 45,000

General Reserve A/c. 45,000

c Transfer from BCVR A/c. 5,250

Business Valuation Combination

Reserve A/c. 5,250

3 Sale of Plant to Possum Ltd.:

Retained Earnings A/c. (1/7/2016) 4,200

Deferred Tax Assets A/c. 1,800

Plant A/c. 6,000

4 Depreciation of Plant:

a Accumulated Depreciation A/c. 1,200

Retained Earnings A/c. (1/7/2016) 600

Expenses A/c. (Depreciation) 600

b Retained Earnings A/c. (1/7/2016) 180

Tax Expense A/c. 180

Deferred Tax Assets A/c. 360

Particulars

In the books of Leadbeaters Ltd.

Consolidation Journal Entries

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

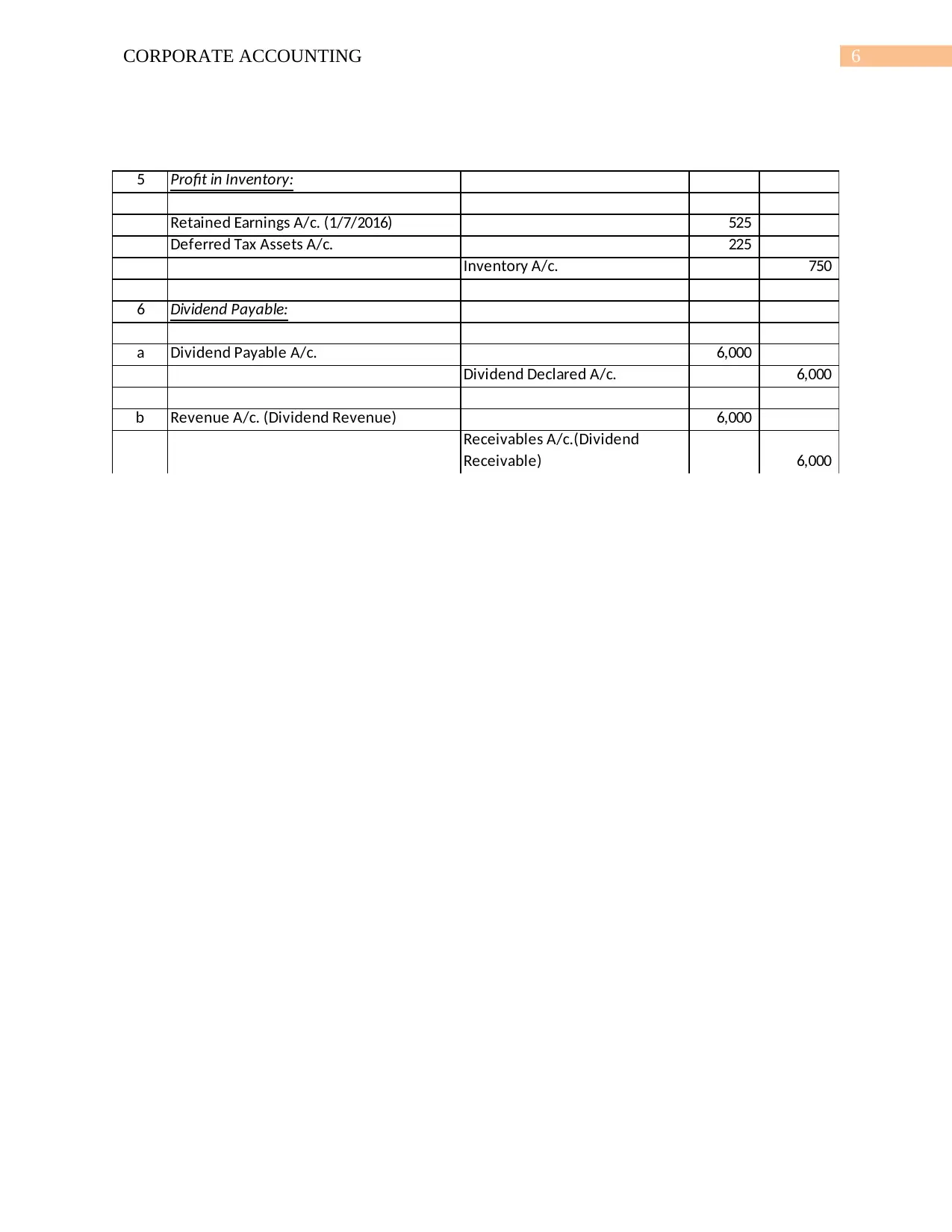

5 Profit in Inventory:

Retained Earnings A/c. (1/7/2016) 525

Deferred Tax Assets A/c. 225

Inventory A/c. 750

6 Dividend Payable:

a Dividend Payable A/c. 6,000

Dividend Declared A/c. 6,000

b Revenue A/c. (Dividend Revenue) 6,000

Receivables A/c.(Dividend

Receivable) 6,000

5 Profit in Inventory:

Retained Earnings A/c. (1/7/2016) 525

Deferred Tax Assets A/c. 225

Inventory A/c. 750

6 Dividend Payable:

a Dividend Payable A/c. 6,000

Dividend Declared A/c. 6,000

b Revenue A/c. (Dividend Revenue) 6,000

Receivables A/c.(Dividend

Receivable) 6,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

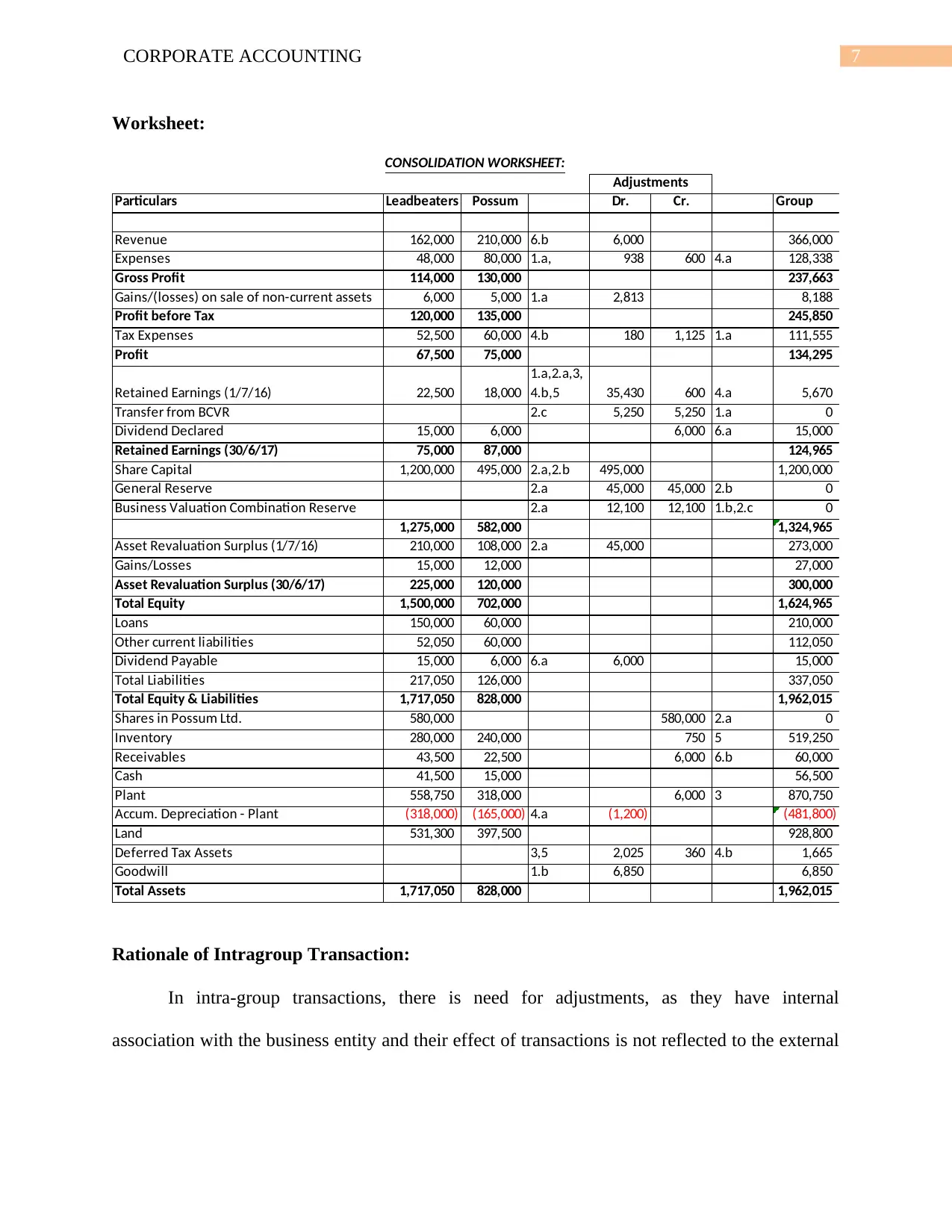

Worksheet:

Particulars Leadbeaters Possum Dr. Cr. Group

Revenue 162,000 210,000 6.b 6,000 366,000

Expenses 48,000 80,000 1.a, 938 600 4.a 128,338

Gross Profit 114,000 130,000 237,663

Gains/(losses) on sale of non-current assets 6,000 5,000 1.a 2,813 8,188

Profit before Tax 120,000 135,000 245,850

Tax Expenses 52,500 60,000 4.b 180 1,125 1.a 111,555

Profit 67,500 75,000 134,295

Retained Earnings (1/7/16) 22,500 18,000

1.a,2.a,3,

4.b,5 35,430 600 4.a 5,670

Transfer from BCVR 2.c 5,250 5,250 1.a 0

Dividend Declared 15,000 6,000 6,000 6.a 15,000

Retained Earnings (30/6/17) 75,000 87,000 124,965

Share Capital 1,200,000 495,000 2.a,2.b 495,000 1,200,000

General Reserve 2.a 45,000 45,000 2.b 0

Business Valuation Combination Reserve 2.a 12,100 12,100 1.b,2.c 0

1,275,000 582,000 1,324,965

Asset Revaluation Surplus (1/7/16) 210,000 108,000 2.a 45,000 273,000

Gains/Losses 15,000 12,000 27,000

Asset Revaluation Surplus (30/6/17) 225,000 120,000 300,000

Total Equity 1,500,000 702,000 1,624,965

Loans 150,000 60,000 210,000

Other current liabilities 52,050 60,000 112,050

Dividend Payable 15,000 6,000 6.a 6,000 15,000

Total Liabilities 217,050 126,000 337,050

Total Equity & Liabilities 1,717,050 828,000 1,962,015

Shares in Possum Ltd. 580,000 580,000 2.a 0

Inventory 280,000 240,000 750 5 519,250

Receivables 43,500 22,500 6,000 6.b 60,000

Cash 41,500 15,000 56,500

Plant 558,750 318,000 6,000 3 870,750

Accum. Depreciation - Plant (318,000) (165,000) 4.a (1,200) (481,800)

Land 531,300 397,500 928,800

Deferred Tax Assets 3,5 2,025 360 4.b 1,665

Goodwill 1.b 6,850 6,850

Total Assets 1,717,050 828,000 1,962,015

Adjustments

CONSOLIDATION WORKSHEET:

Rationale of Intragroup Transaction:

In intra-group transactions, there is need for adjustments, as they have internal

association with the business entity and their effect of transactions is not reflected to the external

Worksheet:

Particulars Leadbeaters Possum Dr. Cr. Group

Revenue 162,000 210,000 6.b 6,000 366,000

Expenses 48,000 80,000 1.a, 938 600 4.a 128,338

Gross Profit 114,000 130,000 237,663

Gains/(losses) on sale of non-current assets 6,000 5,000 1.a 2,813 8,188

Profit before Tax 120,000 135,000 245,850

Tax Expenses 52,500 60,000 4.b 180 1,125 1.a 111,555

Profit 67,500 75,000 134,295

Retained Earnings (1/7/16) 22,500 18,000

1.a,2.a,3,

4.b,5 35,430 600 4.a 5,670

Transfer from BCVR 2.c 5,250 5,250 1.a 0

Dividend Declared 15,000 6,000 6,000 6.a 15,000

Retained Earnings (30/6/17) 75,000 87,000 124,965

Share Capital 1,200,000 495,000 2.a,2.b 495,000 1,200,000

General Reserve 2.a 45,000 45,000 2.b 0

Business Valuation Combination Reserve 2.a 12,100 12,100 1.b,2.c 0

1,275,000 582,000 1,324,965

Asset Revaluation Surplus (1/7/16) 210,000 108,000 2.a 45,000 273,000

Gains/Losses 15,000 12,000 27,000

Asset Revaluation Surplus (30/6/17) 225,000 120,000 300,000

Total Equity 1,500,000 702,000 1,624,965

Loans 150,000 60,000 210,000

Other current liabilities 52,050 60,000 112,050

Dividend Payable 15,000 6,000 6.a 6,000 15,000

Total Liabilities 217,050 126,000 337,050

Total Equity & Liabilities 1,717,050 828,000 1,962,015

Shares in Possum Ltd. 580,000 580,000 2.a 0

Inventory 280,000 240,000 750 5 519,250

Receivables 43,500 22,500 6,000 6.b 60,000

Cash 41,500 15,000 56,500

Plant 558,750 318,000 6,000 3 870,750

Accum. Depreciation - Plant (318,000) (165,000) 4.a (1,200) (481,800)

Land 531,300 397,500 928,800

Deferred Tax Assets 3,5 2,025 360 4.b 1,665

Goodwill 1.b 6,850 6,850

Total Assets 1,717,050 828,000 1,962,015

Adjustments

CONSOLIDATION WORKSHEET:

Rationale of Intragroup Transaction:

In intra-group transactions, there is need for adjustments, as they have internal

association with the business entity and their effect of transactions is not reflected to the external

8CORPORATE ACCOUNTING

parties (Beuselinck and Deloof 2014). For Leadbeaters Limited and Possum Limited, certain

intra-group transactions are made, which are discussed below:

Inventory:

Leadbeaters Limited has stock in hand from the intra-group transactions of the past year

and recording is made at cost that takes into account unrealised profit as well. This cost of stock

to the group is lower compared to the recorded amount, which has lead to fall in value of

inventory.

Income tax expense or deferred tax assets:

If any change is observed in the carrying amount of inventory, it results in temporary

difference between the tax base associated with the asset and he carrying amount of the

concerned asset. As a result, it leads to the formation of deferred tax assets owing to the decline

in carrying amount (Haier, Molchanov and Schmutz 2016).

Retained earnings:

The transaction is carried out for the past year where Possum Limited has before tax of

$750 or earnings after tax of $525 on inventory sale, which is internal to the group. Since the sale

is carried out by not taking into account the external entities, the profit needs to be eliminated on

consolidation. Any profit on sale of inventory to the external parties does not require

consolidated adjustments, as the gains made on sale are recognised on the part of the group.

parties (Beuselinck and Deloof 2014). For Leadbeaters Limited and Possum Limited, certain

intra-group transactions are made, which are discussed below:

Inventory:

Leadbeaters Limited has stock in hand from the intra-group transactions of the past year

and recording is made at cost that takes into account unrealised profit as well. This cost of stock

to the group is lower compared to the recorded amount, which has lead to fall in value of

inventory.

Income tax expense or deferred tax assets:

If any change is observed in the carrying amount of inventory, it results in temporary

difference between the tax base associated with the asset and he carrying amount of the

concerned asset. As a result, it leads to the formation of deferred tax assets owing to the decline

in carrying amount (Haier, Molchanov and Schmutz 2016).

Retained earnings:

The transaction is carried out for the past year where Possum Limited has before tax of

$750 or earnings after tax of $525 on inventory sale, which is internal to the group. Since the sale

is carried out by not taking into account the external entities, the profit needs to be eliminated on

consolidation. Any profit on sale of inventory to the external parties does not require

consolidated adjustments, as the gains made on sale are recognised on the part of the group.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE ACCOUNTING

Reference & Bibliography:

Beuselinck, C. and Deloof, M., 2014. Earnings management in business groups: Tax incentives

or expropriation concealment?. The International Journal of Accounting, 49(1), pp.27-52.

Haier, A., Molchanov, I. and Schmutz, M., 2016. Intragroup transfers, intragroup diversification

and their risk assessment. Annals of finance, 12(3-4), pp.363-392.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Khan, M., 2015. Accounting: Financial. In Encyclopedia of Public Administration and Public

Policy, Third Edition-5 Volume Set (pp. 1-6). Routledge.

Narayanaswamy, R., 2017. Financial Accounting: A Managerial Perspective. PHI Learning Pvt.

Ltd..

Trotman, K. and Carson, E., 2018. Financial accounting: an integrated approach. Cengage AU.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

Reference & Bibliography:

Beuselinck, C. and Deloof, M., 2014. Earnings management in business groups: Tax incentives

or expropriation concealment?. The International Journal of Accounting, 49(1), pp.27-52.

Haier, A., Molchanov, I. and Schmutz, M., 2016. Intragroup transfers, intragroup diversification

and their risk assessment. Annals of finance, 12(3-4), pp.363-392.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Khan, M., 2015. Accounting: Financial. In Encyclopedia of Public Administration and Public

Policy, Third Edition-5 Volume Set (pp. 1-6). Routledge.

Narayanaswamy, R., 2017. Financial Accounting: A Managerial Perspective. PHI Learning Pvt.

Ltd..

Trotman, K. and Carson, E., 2018. Financial accounting: an integrated approach. Cengage AU.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.