Financial Performance Analysis and Budgeting for Jeffery & Son's

VerifiedAdded on 2023/04/22

|21

|5124

|225

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles applied to Jeffery & Son's, a manufacturing company aiming to reduce operating costs. It covers various aspects including cost classification, job costing, absorption costing, and variance analysis. The report details the calculation of unit and total job costs, allocation and apportionment of overheads, and the development of production and cash budgets. It also identifies areas for potential improvements based on performance indicators, suggests ways to reduce costs and enhance value, and assesses the causes of variances while recommending corrective measures. The analysis encompasses the preparation of operating statements and the evaluation of responsibility centers, offering a thorough examination of the company's financial performance and potential strategies for optimization.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

introduction......................................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explaining different types of cost classification....................................................................1

1.2 Calculation of unit cost and total job cost for Job 444 using job costing method.................3

1.3 Calculation of the cost of Exquisite by using absorption costing technique.........................4

a. Allocation and apportion overheads to the three production departments..........................4

b. Reapportion the service or support department costs to the production departments.........5

c. Deducing overhead absorption rates for each of the production department X, Y and

Assembly using the using machine hours................................................................................5

d. Using the absorption rate to calculate overhead charge to the product...............................6

1.4 Analyses of the cost data of Exquisite by using appropriate techniques...............................6

TASK 2............................................................................................................................................7

2.1 Preparing and analyzing the cost report and commenting variances.....................................7

2.2 Areas for potential improvements on the basis of performance indicators...........................8

2.3 Ways to reduce costs and enhance value and quality............................................................9

TASK 3..........................................................................................................................................10

3.1 Stating the purpose and nature of the budgeting process to the budget holders of Jeffery &

Son's...........................................................................................................................................10

3.2 Opt the suitable budgeting method for the company along with its needs..........................10

3.3 Preparation of the production and material purchase budget..............................................11

3.4 Preparation of cash budget...................................................................................................12

TASK 4..........................................................................................................................................13

4.1 Calculating variances, assessment of causes and recommending the corrective measures.13

4.2 Preparing the operating statement which reconcile both the budgeted and actual results...15

4.3 Responsibility centers..........................................................................................................16

conclusion......................................................................................................................................16

references.......................................................................................................................................17

introduction......................................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explaining different types of cost classification....................................................................1

1.2 Calculation of unit cost and total job cost for Job 444 using job costing method.................3

1.3 Calculation of the cost of Exquisite by using absorption costing technique.........................4

a. Allocation and apportion overheads to the three production departments..........................4

b. Reapportion the service or support department costs to the production departments.........5

c. Deducing overhead absorption rates for each of the production department X, Y and

Assembly using the using machine hours................................................................................5

d. Using the absorption rate to calculate overhead charge to the product...............................6

1.4 Analyses of the cost data of Exquisite by using appropriate techniques...............................6

TASK 2............................................................................................................................................7

2.1 Preparing and analyzing the cost report and commenting variances.....................................7

2.2 Areas for potential improvements on the basis of performance indicators...........................8

2.3 Ways to reduce costs and enhance value and quality............................................................9

TASK 3..........................................................................................................................................10

3.1 Stating the purpose and nature of the budgeting process to the budget holders of Jeffery &

Son's...........................................................................................................................................10

3.2 Opt the suitable budgeting method for the company along with its needs..........................10

3.3 Preparation of the production and material purchase budget..............................................11

3.4 Preparation of cash budget...................................................................................................12

TASK 4..........................................................................................................................................13

4.1 Calculating variances, assessment of causes and recommending the corrective measures.13

4.2 Preparing the operating statement which reconcile both the budgeted and actual results...15

4.3 Responsibility centers..........................................................................................................16

conclusion......................................................................................................................................16

references.......................................................................................................................................17

LIST OF TABLES

Table 1: Cost classification..............................................................................................................1

Table 2: Job cost sheet.....................................................................................................................3

Table 3: Production budget............................................................................................................11

Table 4: Material budget................................................................................................................12

Table 5: Cash budget.....................................................................................................................12

Table 6: Calculation of sales variance...........................................................................................13

Table 7: Calculation of material variance......................................................................................13

Table 8: Calculation of labor variance...........................................................................................14

Table 9: Calculation of fixed overhead variance...........................................................................14

Table 10: Operating statement for the month of May...................................................................15

Table 1: Cost classification..............................................................................................................1

Table 2: Job cost sheet.....................................................................................................................3

Table 3: Production budget............................................................................................................11

Table 4: Material budget................................................................................................................12

Table 5: Cash budget.....................................................................................................................12

Table 6: Calculation of sales variance...........................................................................................13

Table 7: Calculation of material variance......................................................................................13

Table 8: Calculation of labor variance...........................................................................................14

Table 9: Calculation of fixed overhead variance...........................................................................14

Table 10: Operating statement for the month of May...................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is a provision of financial data and information which helps

organization’s managers in non-financial decision making of the company. It comprises of cost

accounting, performance evaluation and analysis, planning and decisions support, etc (Gibassier

and Schaltegger, 2015). All these aspects play a significant role in attaining financial and non-

financial goals of the company. The current research project is based on management

accounting. It focuses on business of Jeffery and Son’s which a manufacturing company that

manufactures various popular is and brand products called Exquisite. Now, company wants to

reduce its operating cost for attaining competitive business environment. The current study

focuses on analysis of cost information for analyzing business performance. Along with this, it

also includes different methods to reduce costs and enhance value within business. Further, study

will forecast and prepare budget for different business operations. Including this, monitoring and

comparing process of actual and budgeted performance of the business are also describing in the

following paragraphs of the report.

TASK 1

1.1 Explaining different types of cost classification

Cost classification process is based on different attributes and this procedure helps in

categorizing total cost of Jeffery and Son’s in different groups such as element, nature, behavior,

function, etc (McLean, McGovern and Davie, 2015). All these types of cost classification as

described as under:

Table 1: Cost classification

Types of cost classification

Function Production cost: For Jeffery and Son’s

total manufacturing cost of Exquisite

is considered as production cost.

Commercial cost: Other operational

expenditures such as administration

cost, selling and distribution cost are

involved in this type of cost.

Nature Labor cost: It means cost of wages,

1 | P a g e

Management accounting is a provision of financial data and information which helps

organization’s managers in non-financial decision making of the company. It comprises of cost

accounting, performance evaluation and analysis, planning and decisions support, etc (Gibassier

and Schaltegger, 2015). All these aspects play a significant role in attaining financial and non-

financial goals of the company. The current research project is based on management

accounting. It focuses on business of Jeffery and Son’s which a manufacturing company that

manufactures various popular is and brand products called Exquisite. Now, company wants to

reduce its operating cost for attaining competitive business environment. The current study

focuses on analysis of cost information for analyzing business performance. Along with this, it

also includes different methods to reduce costs and enhance value within business. Further, study

will forecast and prepare budget for different business operations. Including this, monitoring and

comparing process of actual and budgeted performance of the business are also describing in the

following paragraphs of the report.

TASK 1

1.1 Explaining different types of cost classification

Cost classification process is based on different attributes and this procedure helps in

categorizing total cost of Jeffery and Son’s in different groups such as element, nature, behavior,

function, etc (McLean, McGovern and Davie, 2015). All these types of cost classification as

described as under:

Table 1: Cost classification

Types of cost classification

Function Production cost: For Jeffery and Son’s

total manufacturing cost of Exquisite

is considered as production cost.

Commercial cost: Other operational

expenditures such as administration

cost, selling and distribution cost are

involved in this type of cost.

Nature Labor cost: It means cost of wages,

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

salary paid to employees of Jeffery

and Son’s. Along with this, it also

comprises cost of benefits, payrolls,

etc (Kaimenaki and Cohen, 2011).

Material Cost: It includes the cost of

company to purchase and maintain

raw materials for production of

Exquisite.

Overhead costs: It is also known as

operating cost of the organization

which incurs due to the business

function and activities.

Behavior (Activity or Volume) Fixed Cost: It can be defined as a cost

which remains same even when

changes take place in volume of

production and manufacturing of

Exquisite. For example: salary, wages,

rent of building, etc (Wahlen and et.al,

2011).

Variable Cost: This type of cost may

change in case of changing production

volume. For example: cost of raw

material, etc.

Semi Variable cost: In this type, cost

remain same at some level of

production but it can change when

level of output exceeds (Kate-Riin

Kont, 2012).

Element Direct Cost: It can be defined as a cost

which can be easily outlined to a cost

object. Product, department and

2 | P a g e

and Son’s. Along with this, it also

comprises cost of benefits, payrolls,

etc (Kaimenaki and Cohen, 2011).

Material Cost: It includes the cost of

company to purchase and maintain

raw materials for production of

Exquisite.

Overhead costs: It is also known as

operating cost of the organization

which incurs due to the business

function and activities.

Behavior (Activity or Volume) Fixed Cost: It can be defined as a cost

which remains same even when

changes take place in volume of

production and manufacturing of

Exquisite. For example: salary, wages,

rent of building, etc (Wahlen and et.al,

2011).

Variable Cost: This type of cost may

change in case of changing production

volume. For example: cost of raw

material, etc.

Semi Variable cost: In this type, cost

remain same at some level of

production but it can change when

level of output exceeds (Kate-Riin

Kont, 2012).

Element Direct Cost: It can be defined as a cost

which can be easily outlined to a cost

object. Product, department and

2 | P a g e

project are considered as cost object.

Indirect Cost: This type of cost cannot

easily attributed to specific cost

object. For example, depreciation cost,

insurance, etc (Hughes and Bartlett,

2002).

1.2 Calculation of unit cost and total job cost for Job 444 using job costing method

Job costing is a specific technique to calculate unit and total job cost. It is used by

organizations in a situation where every job is different from other and helps in satisfying needs

and requirements of particular customer. These jobs are performed on the basis of customer’s

specifications. It comprises direct material and labor cost and manufacturing overheads assigned

to each and every job (Birnberg and Sisaye, 2010). As per the given information, calculation of

unit and total job cost is as follows:

Table 2: Job cost sheet

Job cost sheet for Job no. 444

Particulars Total cost

Direct material 40000

Direct Labor 54000

Fixed production overhead 24000

variable production overhead 36000

Total cost 154000

Unit cost 770

Working note:

Direct material cost

Material cost=Quantity∗price per kg .

¿ 50 kg∗4 £ per kg .∗200 units=£ 400000

Direct labor cost

Labor cost=Total working hours∗rate per hour

Labor hours=30 hours per unit∗200 Units=6000 Hours

Overhead

3 | P a g e

Indirect Cost: This type of cost cannot

easily attributed to specific cost

object. For example, depreciation cost,

insurance, etc (Hughes and Bartlett,

2002).

1.2 Calculation of unit cost and total job cost for Job 444 using job costing method

Job costing is a specific technique to calculate unit and total job cost. It is used by

organizations in a situation where every job is different from other and helps in satisfying needs

and requirements of particular customer. These jobs are performed on the basis of customer’s

specifications. It comprises direct material and labor cost and manufacturing overheads assigned

to each and every job (Birnberg and Sisaye, 2010). As per the given information, calculation of

unit and total job cost is as follows:

Table 2: Job cost sheet

Job cost sheet for Job no. 444

Particulars Total cost

Direct material 40000

Direct Labor 54000

Fixed production overhead 24000

variable production overhead 36000

Total cost 154000

Unit cost 770

Working note:

Direct material cost

Material cost=Quantity∗price per kg .

¿ 50 kg∗4 £ per kg .∗200 units=£ 400000

Direct labor cost

Labor cost=Total working hours∗rate per hour

Labor hours=30 hours per unit∗200 Units=6000 Hours

Overhead

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

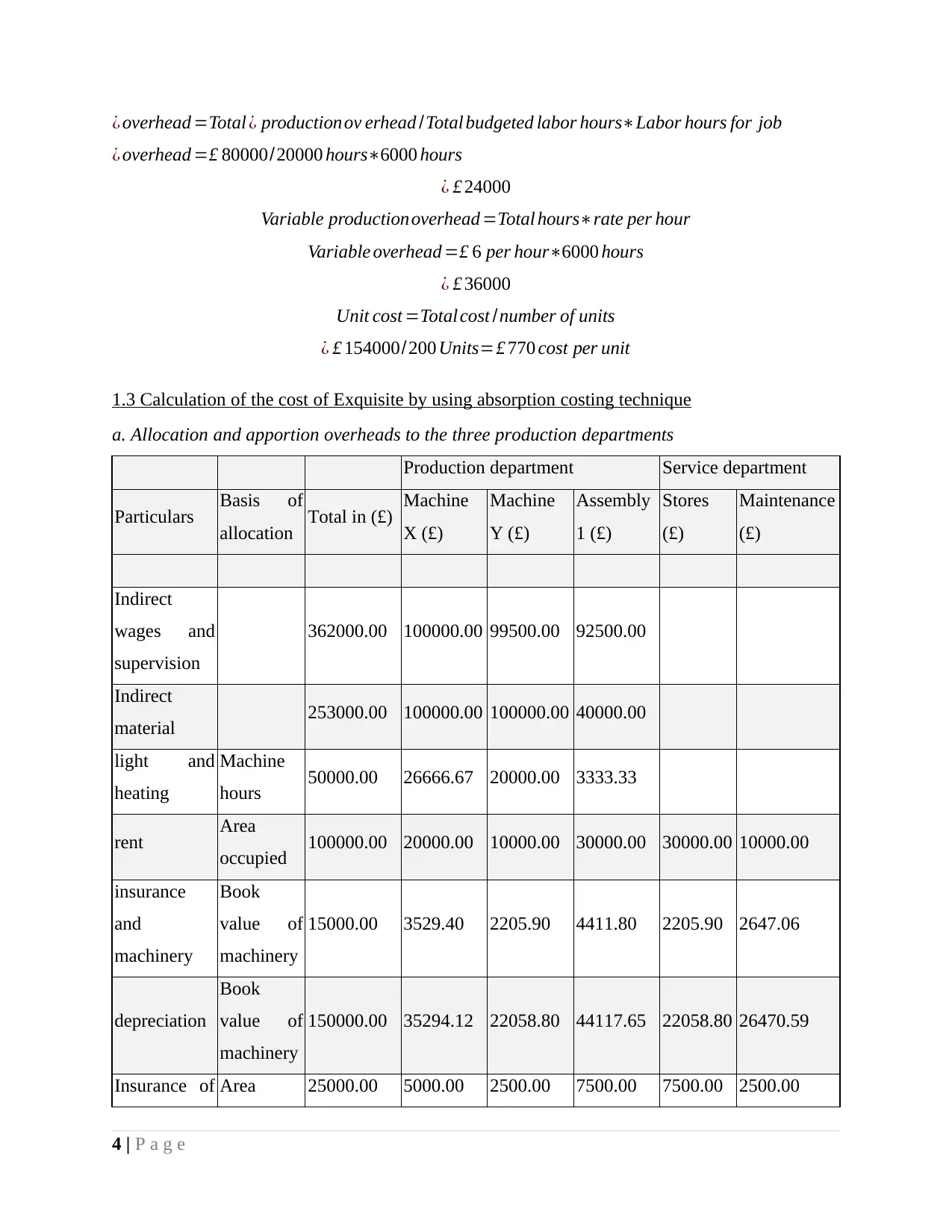

¿ overhead =Total ¿ productionov erhead /Total budgeted labor hours∗Labor hours for job

¿ overhead =£ 80000/20000 hours∗6000 hours

¿ £ 24000

Variable productionoverhead =Total hours∗rate per hour

Variable overhead =£ 6 per hour∗6000 hours

¿ £ 36000

Unit cost =Total cost /number of units

¿ £ 154000/200 Units=£ 770 cost per unit

1.3 Calculation of the cost of Exquisite by using absorption costing technique

a. Allocation and apportion overheads to the three production departments

Production department Service department

Particulars Basis of

allocation Total in (£) Machine

X (£)

Machine

Y (£)

Assembly

1 (£)

Stores

(£)

Maintenance

(£)

Indirect

wages and

supervision

362000.00 100000.00 99500.00 92500.00

Indirect

material 253000.00 100000.00 100000.00 40000.00

light and

heating

Machine

hours 50000.00 26666.67 20000.00 3333.33

rent Area

occupied 100000.00 20000.00 10000.00 30000.00 30000.00 10000.00

insurance

and

machinery

Book

value of

machinery

15000.00 3529.40 2205.90 4411.80 2205.90 2647.06

depreciation

Book

value of

machinery

150000.00 35294.12 22058.80 44117.65 22058.80 26470.59

Insurance of Area 25000.00 5000.00 2500.00 7500.00 7500.00 2500.00

4 | P a g e

¿ overhead =£ 80000/20000 hours∗6000 hours

¿ £ 24000

Variable productionoverhead =Total hours∗rate per hour

Variable overhead =£ 6 per hour∗6000 hours

¿ £ 36000

Unit cost =Total cost /number of units

¿ £ 154000/200 Units=£ 770 cost per unit

1.3 Calculation of the cost of Exquisite by using absorption costing technique

a. Allocation and apportion overheads to the three production departments

Production department Service department

Particulars Basis of

allocation Total in (£) Machine

X (£)

Machine

Y (£)

Assembly

1 (£)

Stores

(£)

Maintenance

(£)

Indirect

wages and

supervision

362000.00 100000.00 99500.00 92500.00

Indirect

material 253000.00 100000.00 100000.00 40000.00

light and

heating

Machine

hours 50000.00 26666.67 20000.00 3333.33

rent Area

occupied 100000.00 20000.00 10000.00 30000.00 30000.00 10000.00

insurance

and

machinery

Book

value of

machinery

15000.00 3529.40 2205.90 4411.80 2205.90 2647.06

depreciation

Book

value of

machinery

150000.00 35294.12 22058.80 44117.65 22058.80 26470.59

Insurance of Area 25000.00 5000.00 2500.00 7500.00 7500.00 2500.00

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

building occupied

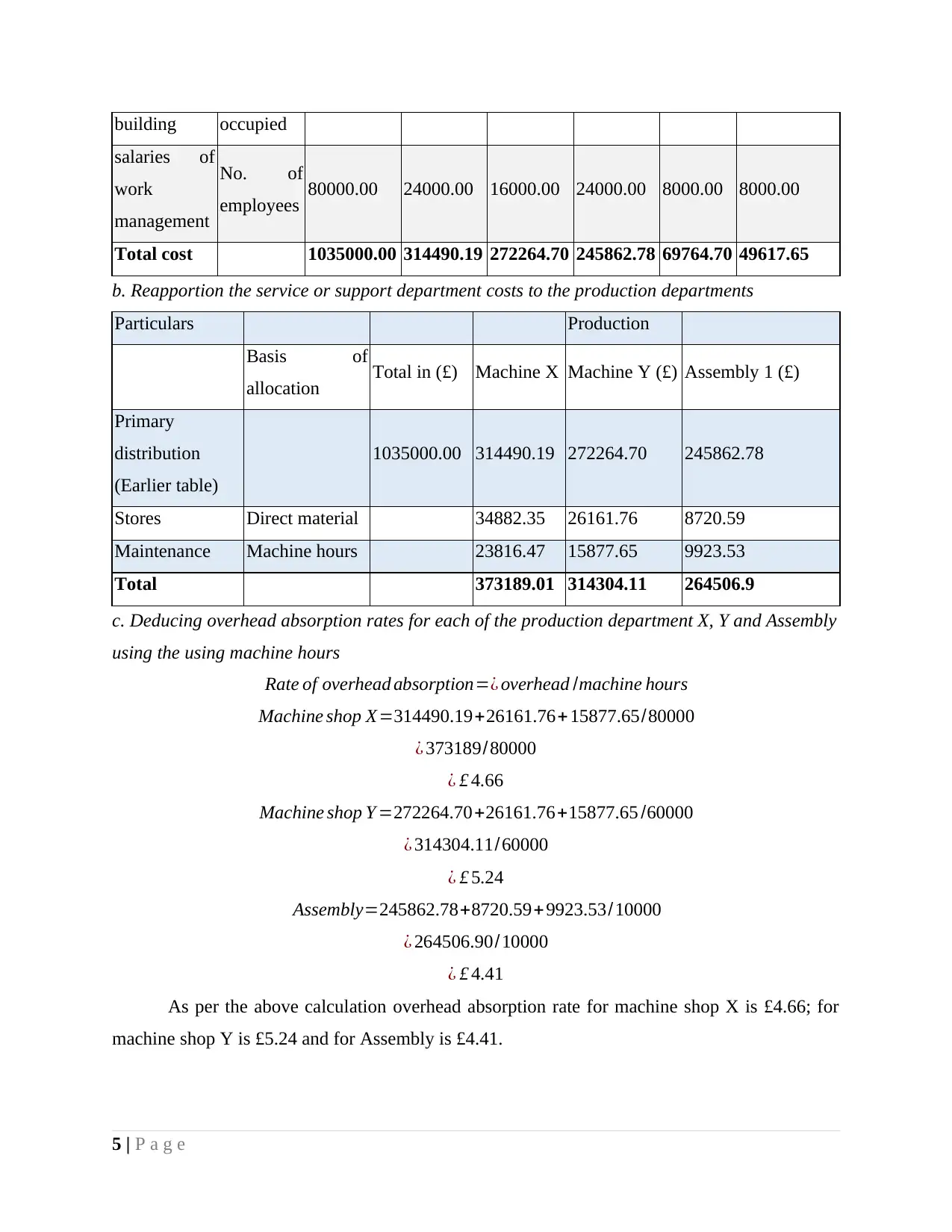

salaries of

work

management

No. of

employees 80000.00 24000.00 16000.00 24000.00 8000.00 8000.00

Total cost 1035000.00 314490.19 272264.70 245862.78 69764.70 49617.65

b. Reapportion the service or support department costs to the production departments

Particulars Production

Basis of

allocation Total in (£) Machine X Machine Y (£) Assembly 1 (£)

Primary

distribution

(Earlier table)

1035000.00 314490.19 272264.70 245862.78

Stores Direct material 34882.35 26161.76 8720.59

Maintenance Machine hours 23816.47 15877.65 9923.53

Total 373189.01 314304.11 264506.9

c. Deducing overhead absorption rates for each of the production department X, Y and Assembly

using the using machine hours

Rate of overhead absorption=¿ overhead /machine hours

Machine shop X=314490.19+26161.76+ 15877.65/80000

¿ 373189/80000

¿ £ 4.66

Machine shop Y =272264.70+26161.76+15877.65 /60000

¿ 314304.11/60000

¿ £ 5.24

Assembly=245862.78+8720.59+9923.53/10000

¿ 264506.90/10000

¿ £ 4.41

As per the above calculation overhead absorption rate for machine shop X is £4.66; for

machine shop Y is £5.24 and for Assembly is £4.41.

5 | P a g e

salaries of

work

management

No. of

employees 80000.00 24000.00 16000.00 24000.00 8000.00 8000.00

Total cost 1035000.00 314490.19 272264.70 245862.78 69764.70 49617.65

b. Reapportion the service or support department costs to the production departments

Particulars Production

Basis of

allocation Total in (£) Machine X Machine Y (£) Assembly 1 (£)

Primary

distribution

(Earlier table)

1035000.00 314490.19 272264.70 245862.78

Stores Direct material 34882.35 26161.76 8720.59

Maintenance Machine hours 23816.47 15877.65 9923.53

Total 373189.01 314304.11 264506.9

c. Deducing overhead absorption rates for each of the production department X, Y and Assembly

using the using machine hours

Rate of overhead absorption=¿ overhead /machine hours

Machine shop X=314490.19+26161.76+ 15877.65/80000

¿ 373189/80000

¿ £ 4.66

Machine shop Y =272264.70+26161.76+15877.65 /60000

¿ 314304.11/60000

¿ £ 5.24

Assembly=245862.78+8720.59+9923.53/10000

¿ 264506.90/10000

¿ £ 4.41

As per the above calculation overhead absorption rate for machine shop X is £4.66; for

machine shop Y is £5.24 and for Assembly is £4.41.

5 | P a g e

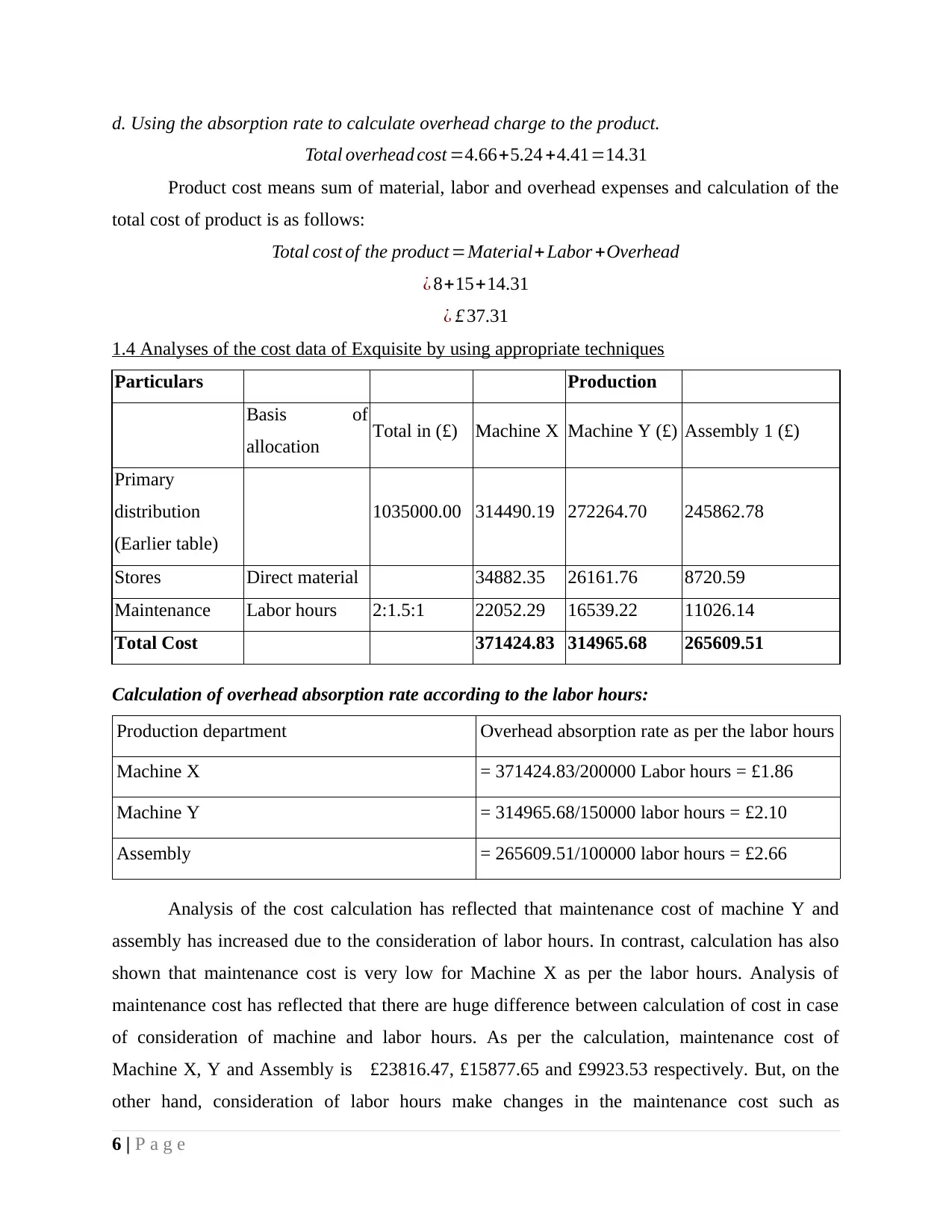

d. Using the absorption rate to calculate overhead charge to the product.

Total overhead cost =4.66+5.24 +4.41=14.31

Product cost means sum of material, labor and overhead expenses and calculation of the

total cost of product is as follows:

Total cost of the product =Material+ Labor +Overhead

¿ 8+15+14.31

¿ £ 37.31

1.4 Analyses of the cost data of Exquisite by using appropriate techniques

Particulars Production

Basis of

allocation Total in (£) Machine X Machine Y (£) Assembly 1 (£)

Primary

distribution

(Earlier table)

1035000.00 314490.19 272264.70 245862.78

Stores Direct material 34882.35 26161.76 8720.59

Maintenance Labor hours 2:1.5:1 22052.29 16539.22 11026.14

Total Cost 371424.83 314965.68 265609.51

Calculation of overhead absorption rate according to the labor hours:

Production department Overhead absorption rate as per the labor hours

Machine X = 371424.83/200000 Labor hours = £1.86

Machine Y = 314965.68/150000 labor hours = £2.10

Assembly = 265609.51/100000 labor hours = £2.66

Analysis of the cost calculation has reflected that maintenance cost of machine Y and

assembly has increased due to the consideration of labor hours. In contrast, calculation has also

shown that maintenance cost is very low for Machine X as per the labor hours. Analysis of

maintenance cost has reflected that there are huge difference between calculation of cost in case

of consideration of machine and labor hours. As per the calculation, maintenance cost of

Machine X, Y and Assembly is £23816.47, £15877.65 and £9923.53 respectively. But, on the

other hand, consideration of labor hours make changes in the maintenance cost such as

6 | P a g e

Total overhead cost =4.66+5.24 +4.41=14.31

Product cost means sum of material, labor and overhead expenses and calculation of the

total cost of product is as follows:

Total cost of the product =Material+ Labor +Overhead

¿ 8+15+14.31

¿ £ 37.31

1.4 Analyses of the cost data of Exquisite by using appropriate techniques

Particulars Production

Basis of

allocation Total in (£) Machine X Machine Y (£) Assembly 1 (£)

Primary

distribution

(Earlier table)

1035000.00 314490.19 272264.70 245862.78

Stores Direct material 34882.35 26161.76 8720.59

Maintenance Labor hours 2:1.5:1 22052.29 16539.22 11026.14

Total Cost 371424.83 314965.68 265609.51

Calculation of overhead absorption rate according to the labor hours:

Production department Overhead absorption rate as per the labor hours

Machine X = 371424.83/200000 Labor hours = £1.86

Machine Y = 314965.68/150000 labor hours = £2.10

Assembly = 265609.51/100000 labor hours = £2.66

Analysis of the cost calculation has reflected that maintenance cost of machine Y and

assembly has increased due to the consideration of labor hours. In contrast, calculation has also

shown that maintenance cost is very low for Machine X as per the labor hours. Analysis of

maintenance cost has reflected that there are huge difference between calculation of cost in case

of consideration of machine and labor hours. As per the calculation, maintenance cost of

Machine X, Y and Assembly is £23816.47, £15877.65 and £9923.53 respectively. But, on the

other hand, consideration of labor hours make changes in the maintenance cost such as

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

maintenance cost for X, Y and assembly is £22052.29, £16539.22 and £11026.14. Change in the

maintenance cost affect per unit cost of finished goods and services (VanDerbeck, 2012).

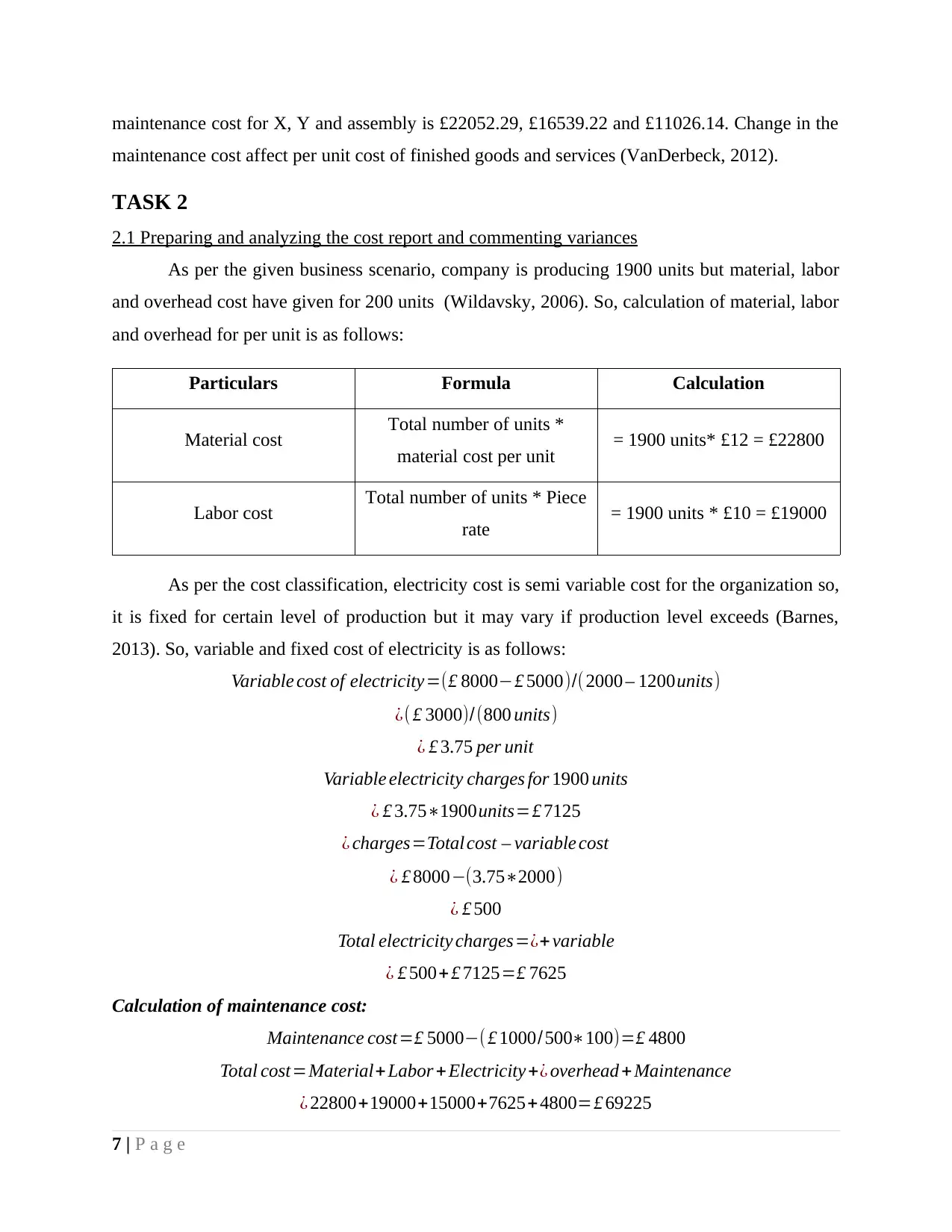

TASK 2

2.1 Preparing and analyzing the cost report and commenting variances

As per the given business scenario, company is producing 1900 units but material, labor

and overhead cost have given for 200 units (Wildavsky, 2006). So, calculation of material, labor

and overhead for per unit is as follows:

Particulars Formula Calculation

Material cost Total number of units *

material cost per unit = 1900 units* £12 = £22800

Labor cost Total number of units * Piece

rate = 1900 units * £10 = £19000

As per the cost classification, electricity cost is semi variable cost for the organization so,

it is fixed for certain level of production but it may vary if production level exceeds (Barnes,

2013). So, variable and fixed cost of electricity is as follows:

Variable cost of electricity=(£ 8000−£ 5000)/( 2000 – 1200units)

¿( £ 3000)/(800 units)

¿ £ 3.75 per unit

Variable electricity charges for 1900 units

¿ £ 3.75∗1900units=£ 7125

¿ charges=Total cost – variable cost

¿ £ 8000−(3.75∗2000)

¿ £ 500

Total electricity charges=¿+ variable

¿ £ 500+ £ 7125=£ 7625

Calculation of maintenance cost:

Maintenance cost=£ 5000−( £ 1000/500∗100)=£ 4800

Total cost=Material+ Labor + Electricity +¿ overhead + Maintenance

¿ 22800+19000+15000+7625+4800=£ 69225

7 | P a g e

maintenance cost affect per unit cost of finished goods and services (VanDerbeck, 2012).

TASK 2

2.1 Preparing and analyzing the cost report and commenting variances

As per the given business scenario, company is producing 1900 units but material, labor

and overhead cost have given for 200 units (Wildavsky, 2006). So, calculation of material, labor

and overhead for per unit is as follows:

Particulars Formula Calculation

Material cost Total number of units *

material cost per unit = 1900 units* £12 = £22800

Labor cost Total number of units * Piece

rate = 1900 units * £10 = £19000

As per the cost classification, electricity cost is semi variable cost for the organization so,

it is fixed for certain level of production but it may vary if production level exceeds (Barnes,

2013). So, variable and fixed cost of electricity is as follows:

Variable cost of electricity=(£ 8000−£ 5000)/( 2000 – 1200units)

¿( £ 3000)/(800 units)

¿ £ 3.75 per unit

Variable electricity charges for 1900 units

¿ £ 3.75∗1900units=£ 7125

¿ charges=Total cost – variable cost

¿ £ 8000−(3.75∗2000)

¿ £ 500

Total electricity charges=¿+ variable

¿ £ 500+ £ 7125=£ 7625

Calculation of maintenance cost:

Maintenance cost=£ 5000−( £ 1000/500∗100)=£ 4800

Total cost=Material+ Labor + Electricity +¿ overhead + Maintenance

¿ 22800+19000+15000+7625+4800=£ 69225

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Per unit cost=Total cost /total number of units

¿ £ 69225/1900 units=£ 36.43

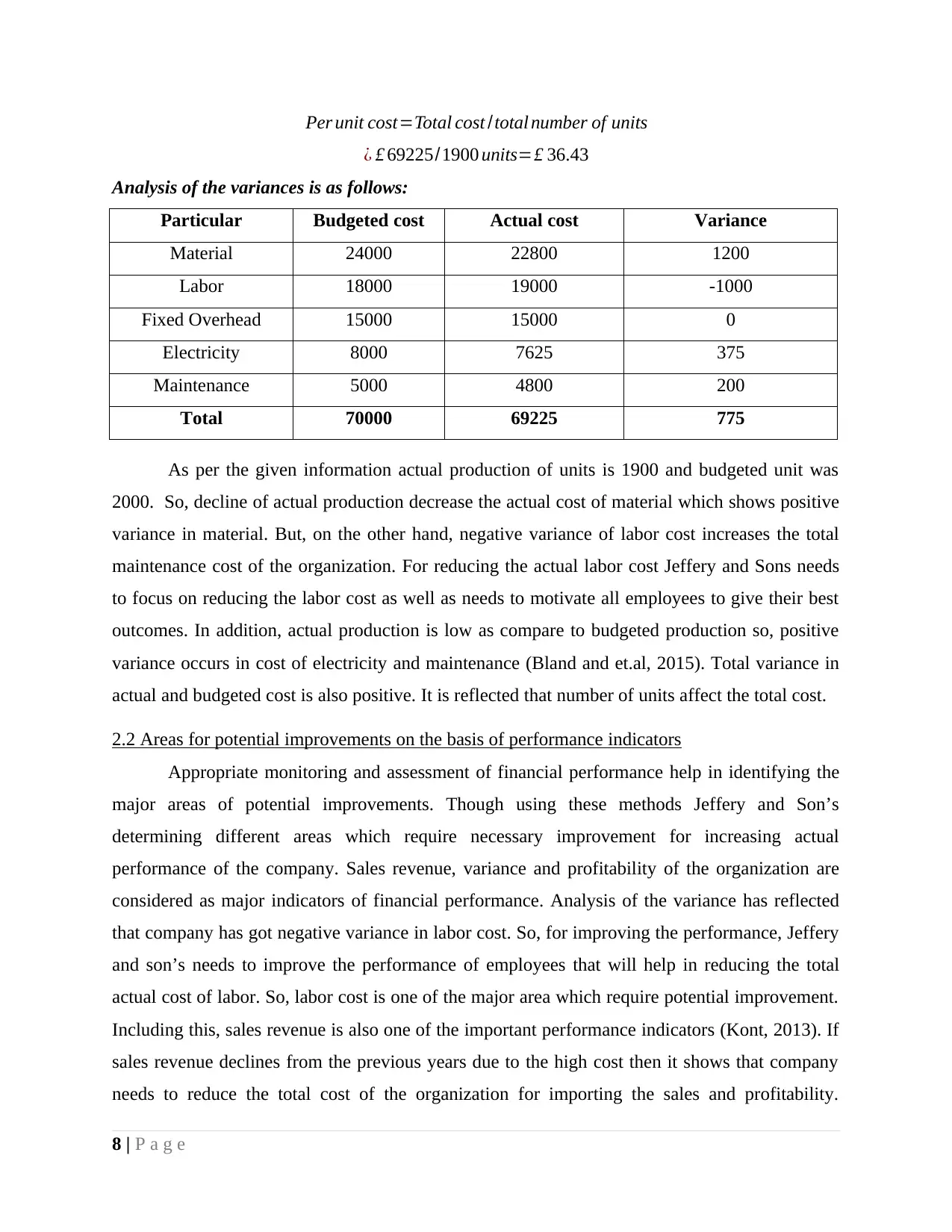

Analysis of the variances is as follows:

Particular Budgeted cost Actual cost Variance

Material 24000 22800 1200

Labor 18000 19000 -1000

Fixed Overhead 15000 15000 0

Electricity 8000 7625 375

Maintenance 5000 4800 200

Total 70000 69225 775

As per the given information actual production of units is 1900 and budgeted unit was

2000. So, decline of actual production decrease the actual cost of material which shows positive

variance in material. But, on the other hand, negative variance of labor cost increases the total

maintenance cost of the organization. For reducing the actual labor cost Jeffery and Sons needs

to focus on reducing the labor cost as well as needs to motivate all employees to give their best

outcomes. In addition, actual production is low as compare to budgeted production so, positive

variance occurs in cost of electricity and maintenance (Bland and et.al, 2015). Total variance in

actual and budgeted cost is also positive. It is reflected that number of units affect the total cost.

2.2 Areas for potential improvements on the basis of performance indicators

Appropriate monitoring and assessment of financial performance help in identifying the

major areas of potential improvements. Though using these methods Jeffery and Son’s

determining different areas which require necessary improvement for increasing actual

performance of the company. Sales revenue, variance and profitability of the organization are

considered as major indicators of financial performance. Analysis of the variance has reflected

that company has got negative variance in labor cost. So, for improving the performance, Jeffery

and son’s needs to improve the performance of employees that will help in reducing the total

actual cost of labor. So, labor cost is one of the major area which require potential improvement.

Including this, sales revenue is also one of the important performance indicators (Kont, 2013). If

sales revenue declines from the previous years due to the high cost then it shows that company

needs to reduce the total cost of the organization for importing the sales and profitability.

8 | P a g e

¿ £ 69225/1900 units=£ 36.43

Analysis of the variances is as follows:

Particular Budgeted cost Actual cost Variance

Material 24000 22800 1200

Labor 18000 19000 -1000

Fixed Overhead 15000 15000 0

Electricity 8000 7625 375

Maintenance 5000 4800 200

Total 70000 69225 775

As per the given information actual production of units is 1900 and budgeted unit was

2000. So, decline of actual production decrease the actual cost of material which shows positive

variance in material. But, on the other hand, negative variance of labor cost increases the total

maintenance cost of the organization. For reducing the actual labor cost Jeffery and Sons needs

to focus on reducing the labor cost as well as needs to motivate all employees to give their best

outcomes. In addition, actual production is low as compare to budgeted production so, positive

variance occurs in cost of electricity and maintenance (Bland and et.al, 2015). Total variance in

actual and budgeted cost is also positive. It is reflected that number of units affect the total cost.

2.2 Areas for potential improvements on the basis of performance indicators

Appropriate monitoring and assessment of financial performance help in identifying the

major areas of potential improvements. Though using these methods Jeffery and Son’s

determining different areas which require necessary improvement for increasing actual

performance of the company. Sales revenue, variance and profitability of the organization are

considered as major indicators of financial performance. Analysis of the variance has reflected

that company has got negative variance in labor cost. So, for improving the performance, Jeffery

and son’s needs to improve the performance of employees that will help in reducing the total

actual cost of labor. So, labor cost is one of the major area which require potential improvement.

Including this, sales revenue is also one of the important performance indicators (Kont, 2013). If

sales revenue declines from the previous years due to the high cost then it shows that company

needs to reduce the total cost of the organization for importing the sales and profitability.

8 | P a g e

Similarly, if net profit of the company has declined due to the high operating costs so,

organization needs to reduce the total operating cost because it will help in increasing the net

profitability of the Jeffery and Son’s. Therefore, using all these performance indicators

organization can determine the different areas of improvement (Ahrens and Ferry, 2015).

2.3 Ways to reduce costs and enhance value and quality

There are different techniques which help in reducing cost and improving quality and

value of the organization. These include Value chain analysis, Total quality management and

Added value system. Value chain analysis focuses on the increasing the satisfaction level of

customers by reducing the total cost. It also helps in allocation of the resources in effective

manner which leads to increment in resources and capabilities of the company. Therefore, it

helps in reducing the total cost of the organization as well as optimum utilization of resources.

Jeffery and Son’s needs to use value chain analysis method for improving the use of labors

which will play significant role in reducing the labor cost. Further, Organization should use total

quality management model for improving quality of products and services (Anderson, 2011). It

will be appropriate for Jeffry and Son’s because it focuses on the customer’s needs and

requirements, planning, management and total participation of the employees. Further, it also

assures about the low defects and wastage which will help Jeffery and Sons in reducing

unnecessary cost and improving quality of the products and services. Along with this added

value system is also most appropriate method for improving quality and adding value in products

and services. So, Jeffery and Sons can use this method also. Major objective of this system is to

give highest value to the customers of their purchase money as well as it also assure about the

appropriate profitability of the company. So, it will help in improving value as well as financial

performance of Jeffry and Son’s (Reid, 2002).

TASK 3

3.1 Stating the purpose and nature of the budgeting process to the budget holders of Jeffery &

Son's

A budget can be defined as a key management tool which helps organization in planning,

organizing, maintaining and controlling all financial information in effective manner. Budget is

also very important for forecasting income and expenses of the organization for a financial year.

It follows a very systematic process of managing income and expenditure which is known as

9 | P a g e

organization needs to reduce the total operating cost because it will help in increasing the net

profitability of the Jeffery and Son’s. Therefore, using all these performance indicators

organization can determine the different areas of improvement (Ahrens and Ferry, 2015).

2.3 Ways to reduce costs and enhance value and quality

There are different techniques which help in reducing cost and improving quality and

value of the organization. These include Value chain analysis, Total quality management and

Added value system. Value chain analysis focuses on the increasing the satisfaction level of

customers by reducing the total cost. It also helps in allocation of the resources in effective

manner which leads to increment in resources and capabilities of the company. Therefore, it

helps in reducing the total cost of the organization as well as optimum utilization of resources.

Jeffery and Son’s needs to use value chain analysis method for improving the use of labors

which will play significant role in reducing the labor cost. Further, Organization should use total

quality management model for improving quality of products and services (Anderson, 2011). It

will be appropriate for Jeffry and Son’s because it focuses on the customer’s needs and

requirements, planning, management and total participation of the employees. Further, it also

assures about the low defects and wastage which will help Jeffery and Sons in reducing

unnecessary cost and improving quality of the products and services. Along with this added

value system is also most appropriate method for improving quality and adding value in products

and services. So, Jeffery and Sons can use this method also. Major objective of this system is to

give highest value to the customers of their purchase money as well as it also assure about the

appropriate profitability of the company. So, it will help in improving value as well as financial

performance of Jeffry and Son’s (Reid, 2002).

TASK 3

3.1 Stating the purpose and nature of the budgeting process to the budget holders of Jeffery &

Son's

A budget can be defined as a key management tool which helps organization in planning,

organizing, maintaining and controlling all financial information in effective manner. Budget is

also very important for forecasting income and expenses of the organization for a financial year.

It follows a very systematic process of managing income and expenditure which is known as

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.