BSMAN 3009: Accounting for Managers - Lehman Brothers Crisis Analysis

VerifiedAdded on 2021/09/14

BSMAN 3009 Accounting for Managers

BSMAN 3009 Accounting for Managers

Paraphrase This Document

BSMAN 3009 Accounting for Managers

Assessment 1

Executive Summary

Financial crisis can be effectively predicted well in advance when an organization

undertakes regular and continuous analysis and review of its financial statement. The essential

management planning and decision making are facilitated with the help of financial statements

that enhance business performance. The current assignment includes two different assessments.

The Assessment 1 provides a detail explanation regarding the financial crisis in the Lehman

Brothers Company while the Assessment 2 focuses over the calculation of different types of

ratios for the BCE Company along with the suitable interpretation of the ratios.

BSMAN 3009 Accounting for Managers

Table of Contents

Assessment 1...............................................................................................................................................2

Executive Summary.....................................................................................................................................2

Essay on financial crisis in Lehman Brothers...............................................................................................5

Introduction.............................................................................................................................................5

Background of the company including the formation of the company...................................................6

Major primary success drivers, achievements and financial milestones achieved by the Lehman

Brothers...................................................................................................................................................6

Changes in the structure of the Lehman Brothers over its useful life: Merger of Barclays and Lehman

Brothers...................................................................................................................................................7

Causes of failure for the company...........................................................................................................8

Social impacts of the failure of the company..........................................................................................9

Summary of the lessons learned from the financial crisis within the Lehman Brothers........................10

Conclusion.............................................................................................................................................12

Assessment 2.............................................................................................................................................13

Calculation of financial ratios for the BCE Company..................................................................................13

Introduction...........................................................................................................................................13

Profitability ratios:.................................................................................................................................13

Return on Assets:...................................................................................................................................14

Return on Equity:..................................................................................................................................14

Profit margin ratio.................................................................................................................................15

Asset Efficiency ratio................................................................................................................................16

Account receivable turnover ratio:.........................................................................................................16

Working capital ratio.............................................................................................................................17

Liquidity ratios:.........................................................................................................................................18

Quick ratio:............................................................................................................................................18

Time interest earned ratio:.....................................................................................................................19

Capital structure ratios...............................................................................................................................20

Debt to equity ratio:...............................................................................................................................20

Equity to fixed assets ratio:....................................................................................................................20

Equity ratio:...........................................................................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

Market performance ratios.........................................................................................................................22

Earnings per share.................................................................................................................................22

Price earnings ratio................................................................................................................................23

Dividend payout ratio............................................................................................................................24

Conclusion.................................................................................................................................................25

References.................................................................................................................................................26

Paraphrase This Document

BSMAN 3009 Accounting for Managers

Essay on the financial crisis in Lehman Brothers

Introduction

The financial crisis is identified as a combination of diverse circumstances and situations

that result in the reduction in the nominal value of the financial assets of an organization. The

various causes that can be held responsible for the occurrence of a financial crisis can be global

recessions, crashing of the stock market, and reduction in the monetary value of currency along

with sovereign defaults. The current essay is a critical evaluation of a public listed organization

that has recently faced severe financial crises or has become insolvent in the last ten to fifteen

years. For the purpose of this assignment, Lehman Brothers Company has been chosen which is

a publicly listed under the New Stork Stock Exchange.

BSMAN 3009 Accounting for Managers

Background of the company including the formation of the company

The Lehman Brothers were identified as a global organization that was basically engaged

in financial services. The company became defunct in the year 2008 and before filling for the

bankruptcy, the company was considered to be the fourth largest investment organization in the

US after the competitors like Merrill Lynch, Goldman Sachs, and Morgan Stanley. The main

business of the company was investment banking, investment management, trading of private

equity and the sale of fixed income securities along with private banking (Azadinamin, 2012).

The organization was formed by Henry Lehman in the year 1850 and was soon joined by his

brothers Emanuel and Mayer and thereby received its name the Lehman Brothers.

The firm was considered as a symbol of power and prominence at both global and

domestic level. The American Express after owing the firm for ten years spun off Lehman

Brothers in 1994 through the creation of an initial public offering of around $ 3.3 billion

capitalizations. The offerings were further extended in the year 1999 with the repeal of Glass-

Steagall Act which resulted in the combination of investment banking and commercial activities

(Fernando, et. al., 2012). The expansion of the Lehman Brothers helped in developing newer

capabilities for dealing in the segment of proprietary banking, asset and securities management.

The uncontrolled expansion and the global financial crisis of the year 2008 laid the foundation

for the collapse of the Lehman Brothers.

Major primary success drivers, achievements and financial milestones

achieved by the Lehman Brothers

Considering the achievements and financial milestones that were achieved by the

Lehman Brothers, the core success factor was the mortgage orientation of the company. Lehman

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

was identified as the one of the primary Wall street organization that was focusing over the

mortgaging business. In the year 1997, the Lehman Brother acquired the Colorado-based lender,

the Aurora loan service which was one of the top lenders of its time. Continuing the expansion in

the year 2000, the purchase of BNC Mortgage LLC, which was basically a west coast subprime

mortgage lender, was made by Lehman Brothers. With these two acquisitions, the Lehman

Brothers soon became a renowned name in the subprime mortgaging sector. In the year 2003, a

potential amount of $ 18.2 billion was earned by the Lehman Brothers through loans and

mortgaging and it was ranked as the third top organization in the lending and mortgaging sector

(Chakrabarty & Zhang, 2012). The number increased by $ 40 billion in the year 2004 and then

by the year 2006 both BNC and Aurora were lending an amount of $ 50 billion on monthly basis.

The Lehman Brother had a total of $ 680 billion assets that were backed up by just $ 22.5 billion

of firm capital. It was quite risky at that from an equity viewpoint because the holdings of the

commercial real estate were greater than the capital almost three times. This means a reduction

of 3% to 5% in a highly levered structure in the real estate values would result in wiping of the

entire capital.

Changes in the structure of the Lehman Brothers over its useful life: Merger of

Barclays and Lehman Brothers

The merger of the Lehman Brother with the Barclays was done in order to improve the

existing financial condition of the Lehman Brothers. The Lehman Brothers sold its capital

market and investment banking operations to the Barclays for an amount of $ 250 million. The

Lehman Brother’s acquisition was considered as beneficial for the Barclays in the process of

merger and acquisition; the Barclays become one of the most powerful franchises and the

seventh-largest investment bank in the United States. The deal was preferably better for the

Paraphrase This Document

BSMAN 3009 Accounting for Managers

Barclays as it made a careful assessment for the future liabilities and made possible attempts for

limiting it (Mio & Fasan, 2012). The Barclay’s regulator restricted Barclays to go for acquisition

before the declaration of the insolvency which was proved to be positive for the organization as

at the time of the merger, the Barclays avoided from undertaking toxic assets of the Lehman

Brother which was around $ 600 billion in debt. Thus, as a result of this, Barclays managed to

avoid liabilities for most of such assets of the company.

Causes of failure for the company

There were several factors that resulted in the financial crisis and ultimate collapse of the

company but from a deeper analysis, the major reasons that were suggested by the financial

experts were the low level of trust within the company, the poor strategy regarding long-term

investment of the company, inadequate funding and the over-leveraging. One of the core causes

of the firm’s collapse was recognized as overzealous lending between years 2003 to 2004 during

the housing bubble (Aragon & Strahan, 2012). The Lehman Brother was assumed to be investing

in a risky affair with the acquisition of the top five lending firms whose major business was

subprime lending. In the year 2007, although the company was earning a significant market

capitalization of around $ 60 billion, the company faced problems due to mounting defaults in

the subprime loans. The value of the mortgage portfolio of the Lehman Brother was no longer

compelling as the company was over-leveraged at that time. Many of the regulatory

organizations were of the view that the Lehman Brothers did not have the required collateral for

covering the bailout period (Lioudis, 2017). As no potential aid was provided to the Lehman

Brothers by the Federal Reserve Bank, the only option left with the company was to quit its

operations and functions.

BSMAN 3009 Accounting for Managers

In addition to this, the housing market began to crash in the year 2006 due to lenders that

were defaulting on the unsustainable subprime mortgages and the risky loans but the Lehman

Brother continued its operations which resulted in the rise in the real estate share of the company

up to $ 111 billion in the securities and assets in the year 2007. In September, there was an

unpredicted loss of $ 3.9 billion in the third quarter but in order to improve its situation, the

Lehman Brothers reduced mortgage loan by 20%, leveraging factor by seven points and

enhanced the liquidity by $ 45 billion (Sraders, 2018). The stock of the company was decreasing

drastically at the rate of about 77%. Although efforts were made by the Bank of America and the

Barclays through company takeover but all in vain and on 15 September 2008, the Lehman

Brother was finally declared bankrupt.

Social impacts of the failure of the company

The financial crisis of the Lehman Brother was not less than a disaster in the history of

the world economy. The widespread recession that was generated due to the elements of the

economic turmoil created by this collapse. It was estimated that around 6 million jobs were

practically lost that result in the rise in the unemployment rate by 10%. The Dow Jones Industrial

Average reduced by 5000 points and adverse social impacts were experienced in the economies

of countries like the European Union, Latvia, Lithuania and Hungary (Davies, 2017). The effects

were also felt by countries like Pakistan that managed to seek a bailout from the IMF along with

the crisis at Iceland wherein it was announced by the officials that the Government of the country

had no significant amount of funds to enhance the existing condition of the major banks in the

country. The bankruptcy of the Lehman Brothers was considered to be synonymous with wealth

destruction and financial crisis in the global banking history.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

Summary of the lessons learned from the financial crisis within the Lehman

Brothers

The regulatory changes relate to the regulatory responses toward the subprime crisis and

involve actions taken over by the government all over the globe for effectively dealing with the

subprime mortgage crisis within the world economy. The various regulators and legislation focus

over action with respect to lending practices, the credit counseling, bankruptcy protection,

financial education and licensing, the affordable housing policies and tax policies. The guidelines

that are issued in this respect aims at influencing the nature, transparency and the regulatory

requirements regarding the securities and complex legal companies involved in such kind of

transactions (Davies, 2017). In order to protect the financial sector that remained after the

occurrence of the Lehman Brother financial crisis, the then US President, George Bush made an

announcement for $ 700 billion bailout plan. This was followed by the Dodd-Frank Act which

was mainly implemented for enhancing financial regulation in the finance sector.

In the year 2009, the President with the top financial advisers developed and provided

comprehensive regulatory proposals. These proposals majorly addressed towards the financial

cushions and capital requirements of the bank, consumer protection, expansion of the regulation

regarding derivates and shadow banking system, executive pay and the increased authority of the

Federal Reserve in systematically managing the important institutions (Cassidy, 2013). The

Dodd-Frank Wall Street Reform and Consumer Protection Act mainly address the following

elements with a varying amount of degree along with the creation of the Consumer Financial

Protection Bureau. These are as follows:

Expansion of the FDIC (Federal Deposit Insurance Scheme) in the banking

resolution mechanism for inclusion of non-banking financial institutions

Paraphrase This Document

BSMAN 3009 Accounting for Managers

To ensure the corporations fail in an organized manner does not need to be

rescued

Need to develop stronger liquidity and capital positions for financial corporations

and the associated regulatory authority

Application of suitable checks and balances to the Federal Reserve and FDIC in

the process of resolution

The other regulatory changes included setting the minimum requirement for the home

mortgage by 10% along with the income verification, maintenance of sufficient capital by the

financial institutions, the establishment of an early-warning system in order to detect the system

generated risk (Lioudis, 2017). Along with this, it also included regulation of credit derivatives

for ensuring that are adequately traded on the efficiently capitalized exchanges in order to reduce

the counterparty risk.

BSMAN 3009 Accounting for Managers

Conclusion

The above essay helped in critically evaluating the financial crisis and the subsequent

insolvency and bankruptcy in the US-based public listed company Lehman Brothers and what

important lessons were learned by the world economies after the occurrence of this financial

crisis. The essay provides a thorough discussion regarding the background information of the

company, the major achievements, and factors responsible for the success of the Lehman

Brothers, the merger of the company with Barclays, the well-known reasons for the failure of the

company along with the adverse social impact both internally and externally. In addition to this,

the in-depth summary has been provided to explain the regulatory changes made after the crisis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

Assessment 2

Calculation of financial ratios for the BCE Company

Introduction

BCE is the largest communication company in Canada. The company provides the broadband

communication services to the public on the large scale. The company is expanding its business

worldwide by making the additional capital investment in the year 2017 (Chiaramonte & Casu,

2017). Here in the present report, the discussion about the financial performance of the company

is made after calculating the certain ratios of the company based on the financial statements of

the company at the year-end of 2017.

Calculations of the financial ratios of the company which helps the manager of the company in

planning the activities of the company and also allows the manager in the decision making of the

company:

Description of various ratios for the financial performance of the company is calculated as under:

Profitability ratios:

Profitability ratios make the comparison between the income statements of the company and

various categories of it to reflect the company’s ability to operate profitability from various

options of the company (Delen, et. al., 2013).

The main reason for the calculation of profitability ratio in an organization is to calculate the

companies return from the investment made by it the assets and the inventory of the company.

Paraphrase This Document

BSMAN 3009 Accounting for Managers

This ratio mainly reflects the profits gained by the company from various operations of the

company.

Various type of profitability ratios of the company are:

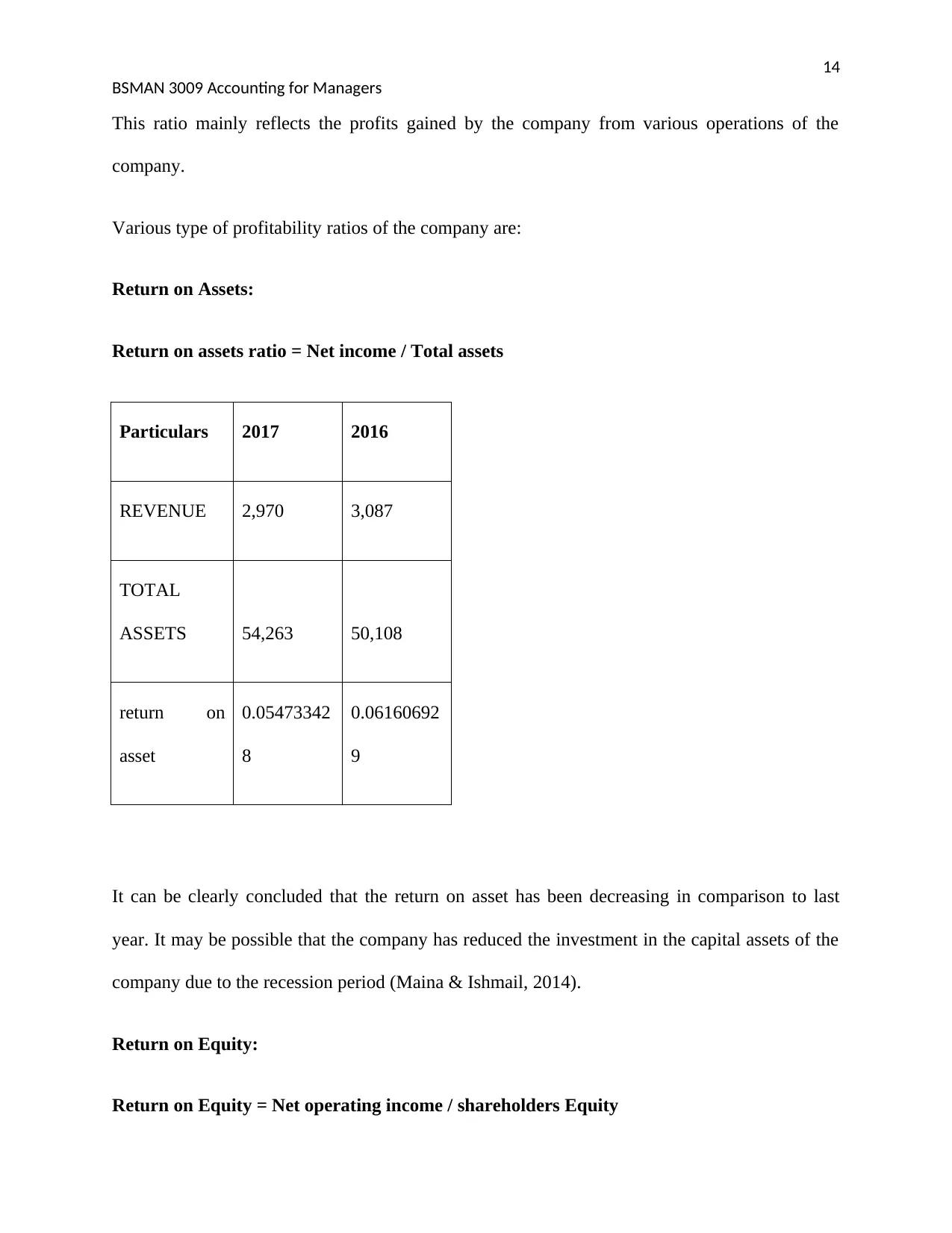

Return on Assets:

Return on assets ratio = Net income / Total assets

Particulars 2017 2016

REVENUE 2,970 3,087

TOTAL

ASSETS 54,263 50,108

return on

asset

0.05473342

8

0.06160692

9

It can be clearly concluded that the return on asset has been decreasing in comparison to last

year. It may be possible that the company has reduced the investment in the capital assets of the

company due to the recession period (Maina & Ishmail, 2014).

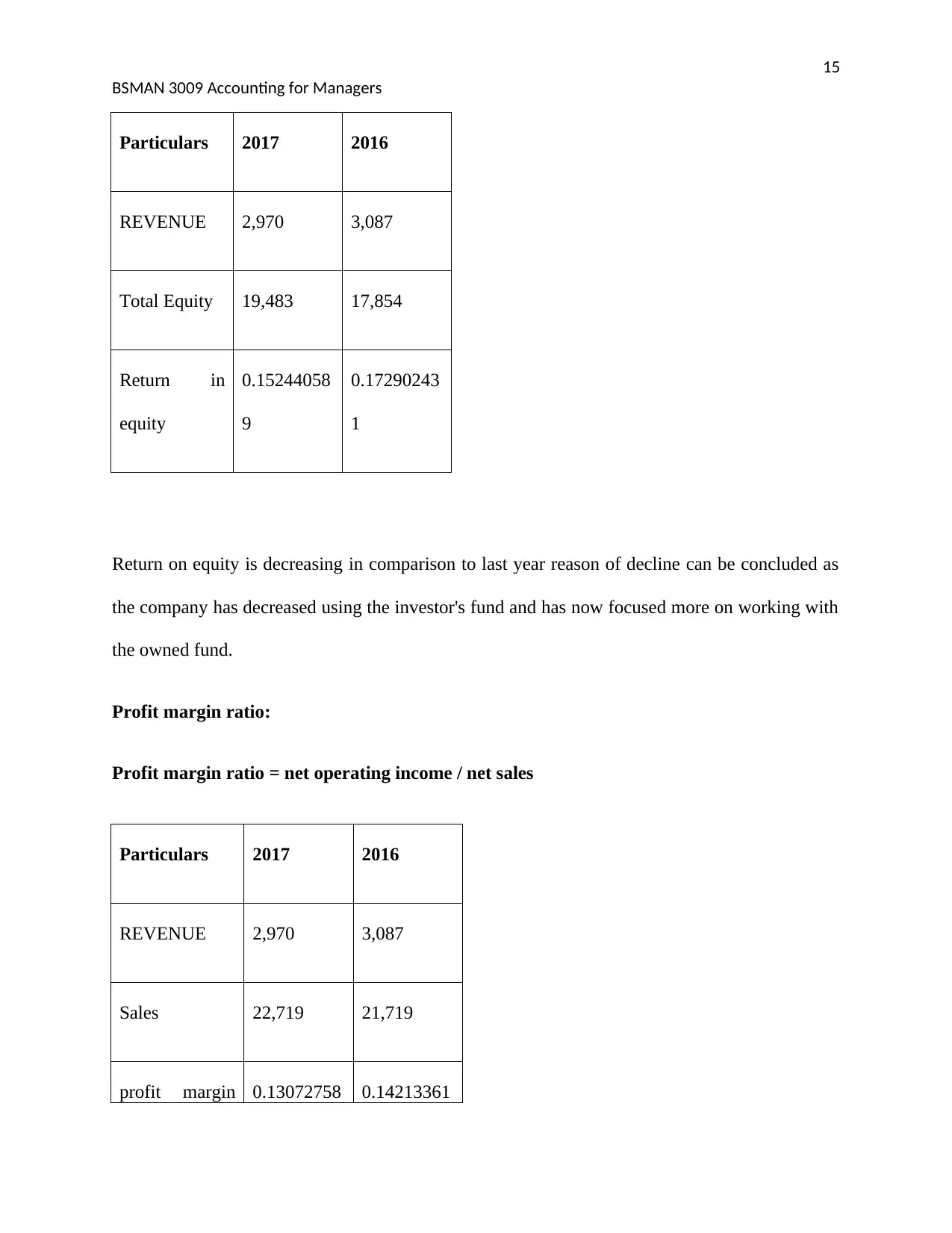

Return on Equity:

Return on Equity = Net operating income / shareholders Equity

BSMAN 3009 Accounting for Managers

Particulars 2017 2016

REVENUE 2,970 3,087

Total Equity 19,483 17,854

Return in

equity

0.15244058

9

0.17290243

1

Return on equity is decreasing in comparison to last year reason of decline can be concluded as

the company has decreased using the investor's fund and has now focused more on working with

the owned fund.

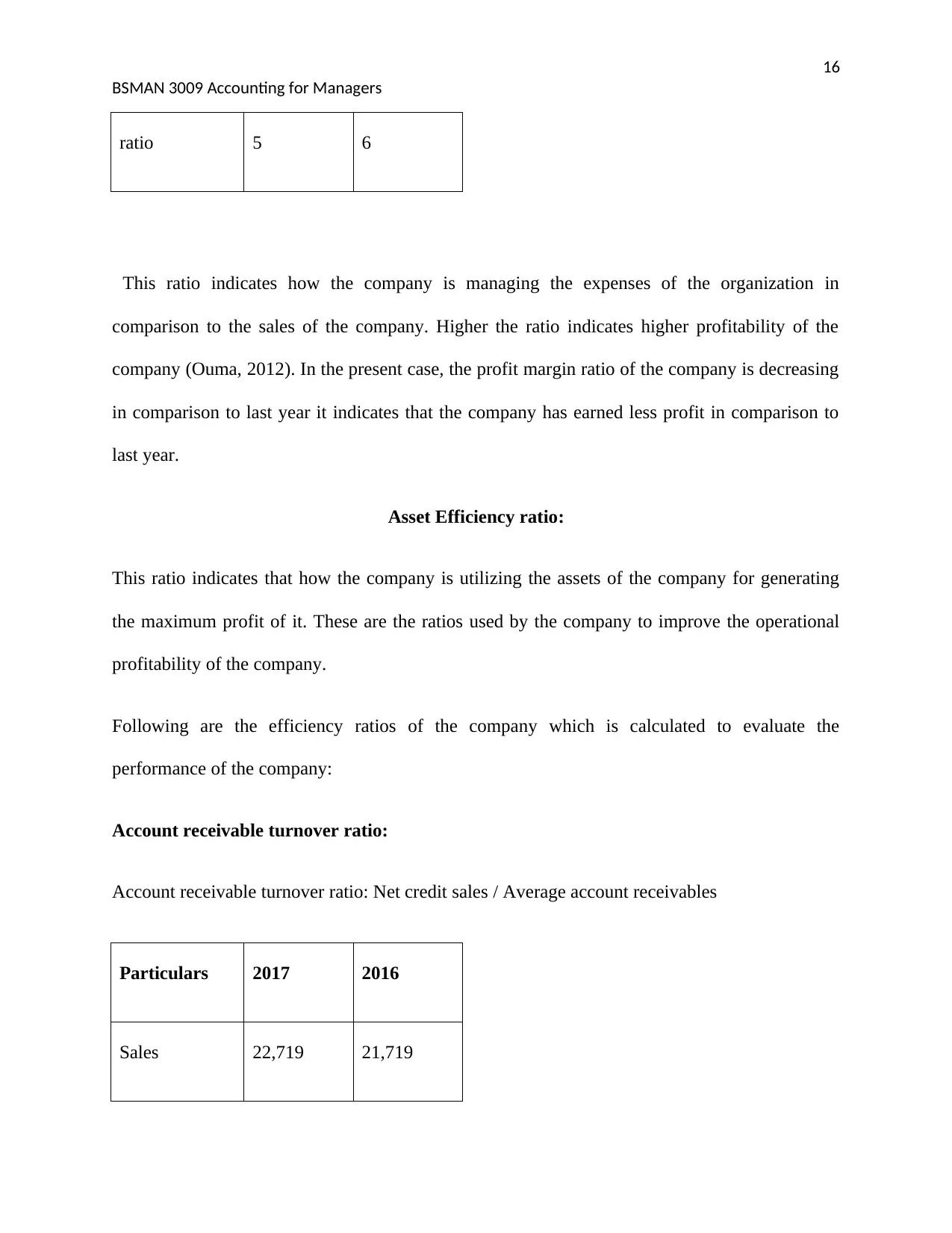

Profit margin ratio:

Profit margin ratio = net operating income / net sales

Particulars 2017 2016

REVENUE 2,970 3,087

Sales 22,719 21,719

profit margin 0.13072758 0.14213361

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

ratio 5 6

This ratio indicates how the company is managing the expenses of the organization in

comparison to the sales of the company. Higher the ratio indicates higher profitability of the

company (Ouma, 2012). In the present case, the profit margin ratio of the company is decreasing

in comparison to last year it indicates that the company has earned less profit in comparison to

last year.

Asset Efficiency ratio:

This ratio indicates that how the company is utilizing the assets of the company for generating

the maximum profit of it. These are the ratios used by the company to improve the operational

profitability of the company.

Following are the efficiency ratios of the company which is calculated to evaluate the

performance of the company:

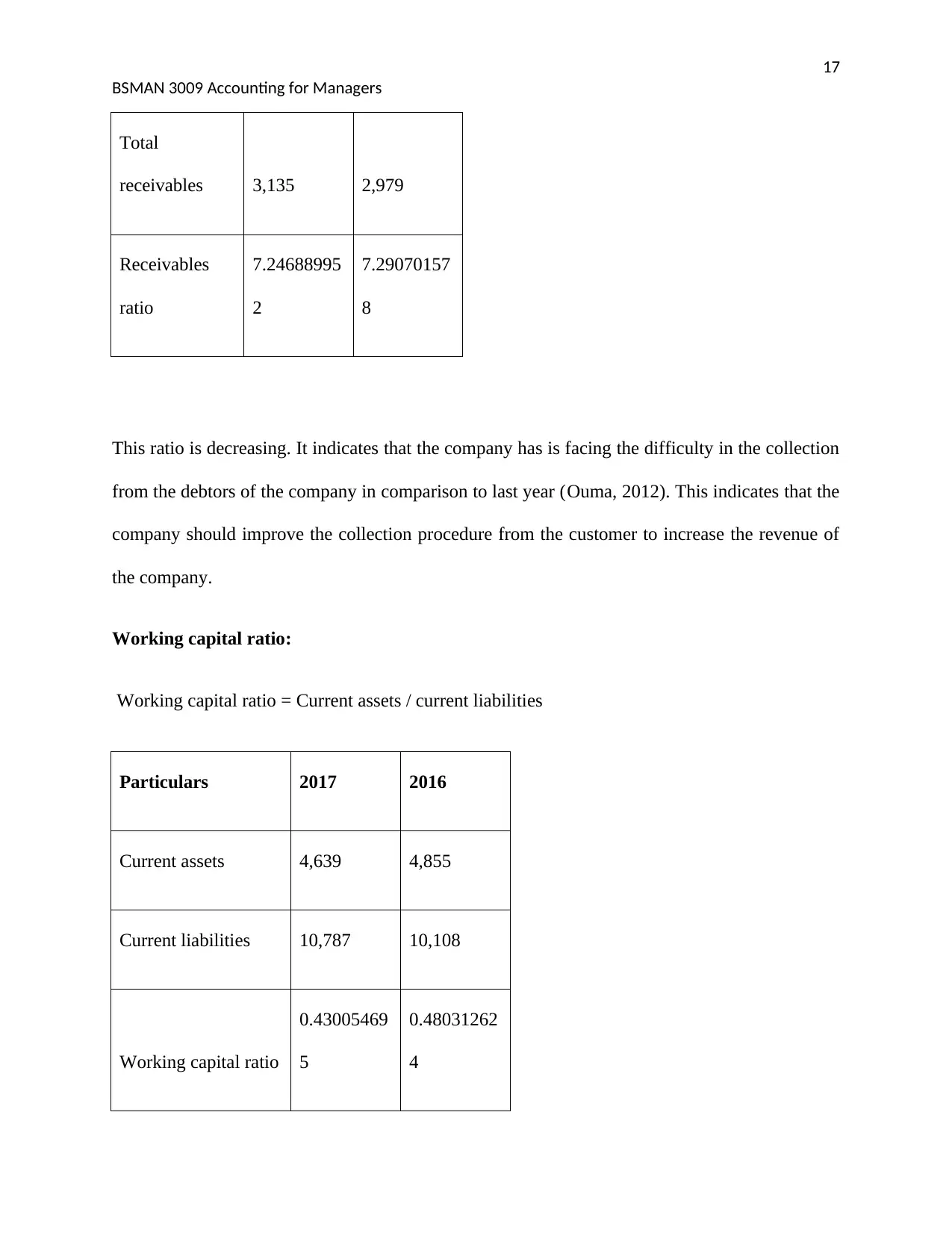

Account receivable turnover ratio:

Account receivable turnover ratio: Net credit sales / Average account receivables

Particulars 2017 2016

Sales 22,719 21,719

Paraphrase This Document

BSMAN 3009 Accounting for Managers

Total

receivables 3,135 2,979

Receivables

ratio

7.24688995

2

7.29070157

8

This ratio is decreasing. It indicates that the company has is facing the difficulty in the collection

from the debtors of the company in comparison to last year (Ouma, 2012). This indicates that the

company should improve the collection procedure from the customer to increase the revenue of

the company.

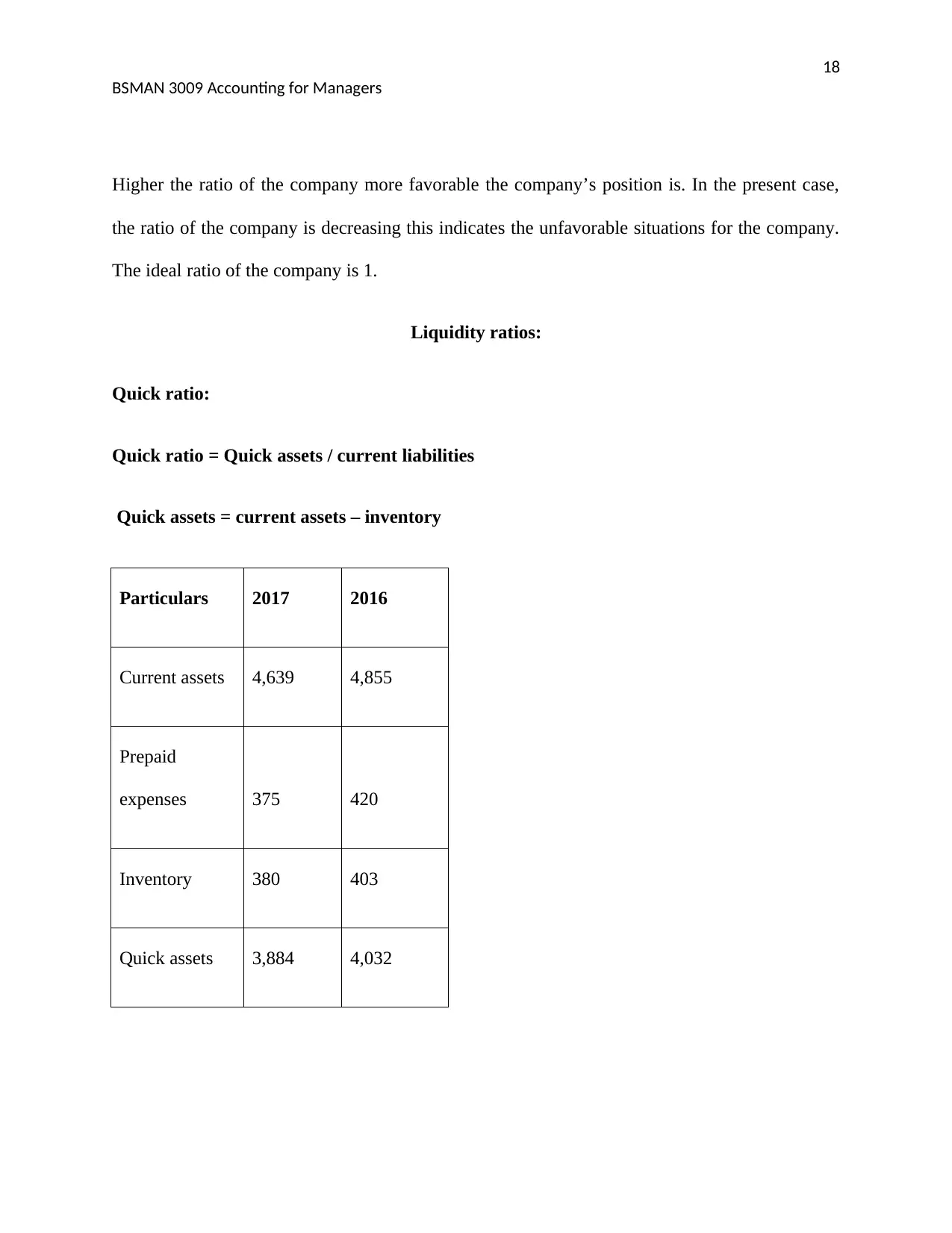

Working capital ratio:

Working capital ratio = Current assets / current liabilities

Particulars 2017 2016

Current assets 4,639 4,855

Current liabilities 10,787 10,108

Working capital ratio

0.43005469

5

0.48031262

4

BSMAN 3009 Accounting for Managers

Higher the ratio of the company more favorable the company’s position is. In the present case,

the ratio of the company is decreasing this indicates the unfavorable situations for the company.

The ideal ratio of the company is 1.

Liquidity ratios:

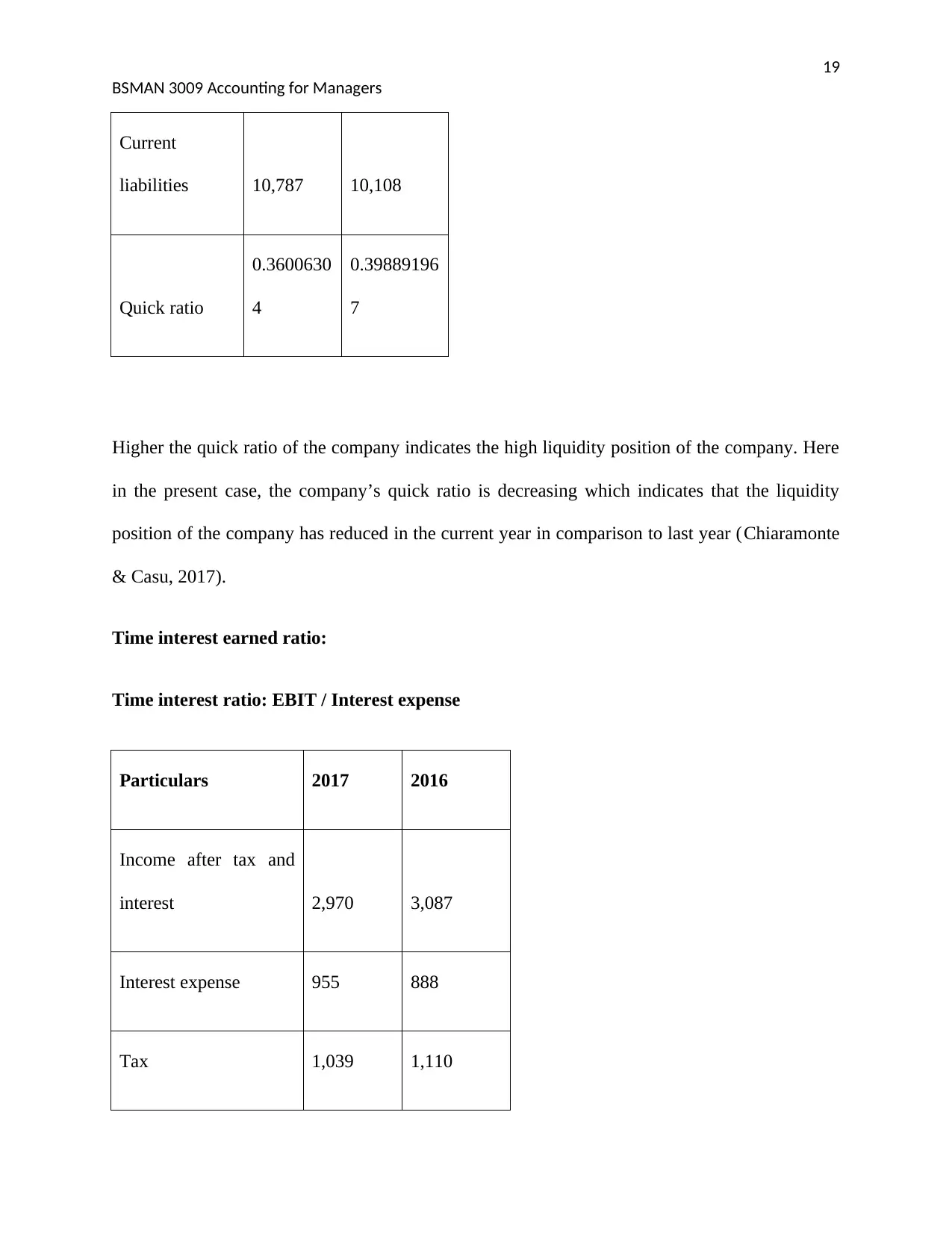

Quick ratio:

Quick ratio = Quick assets / current liabilities

Quick assets = current assets – inventory

Particulars 2017 2016

Current assets 4,639 4,855

Prepaid

expenses 375 420

Inventory 380 403

Quick assets 3,884 4,032

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

Current

liabilities 10,787 10,108

Quick ratio

0.3600630

4

0.39889196

7

Higher the quick ratio of the company indicates the high liquidity position of the company. Here

in the present case, the company’s quick ratio is decreasing which indicates that the liquidity

position of the company has reduced in the current year in comparison to last year (Chiaramonte

& Casu, 2017).

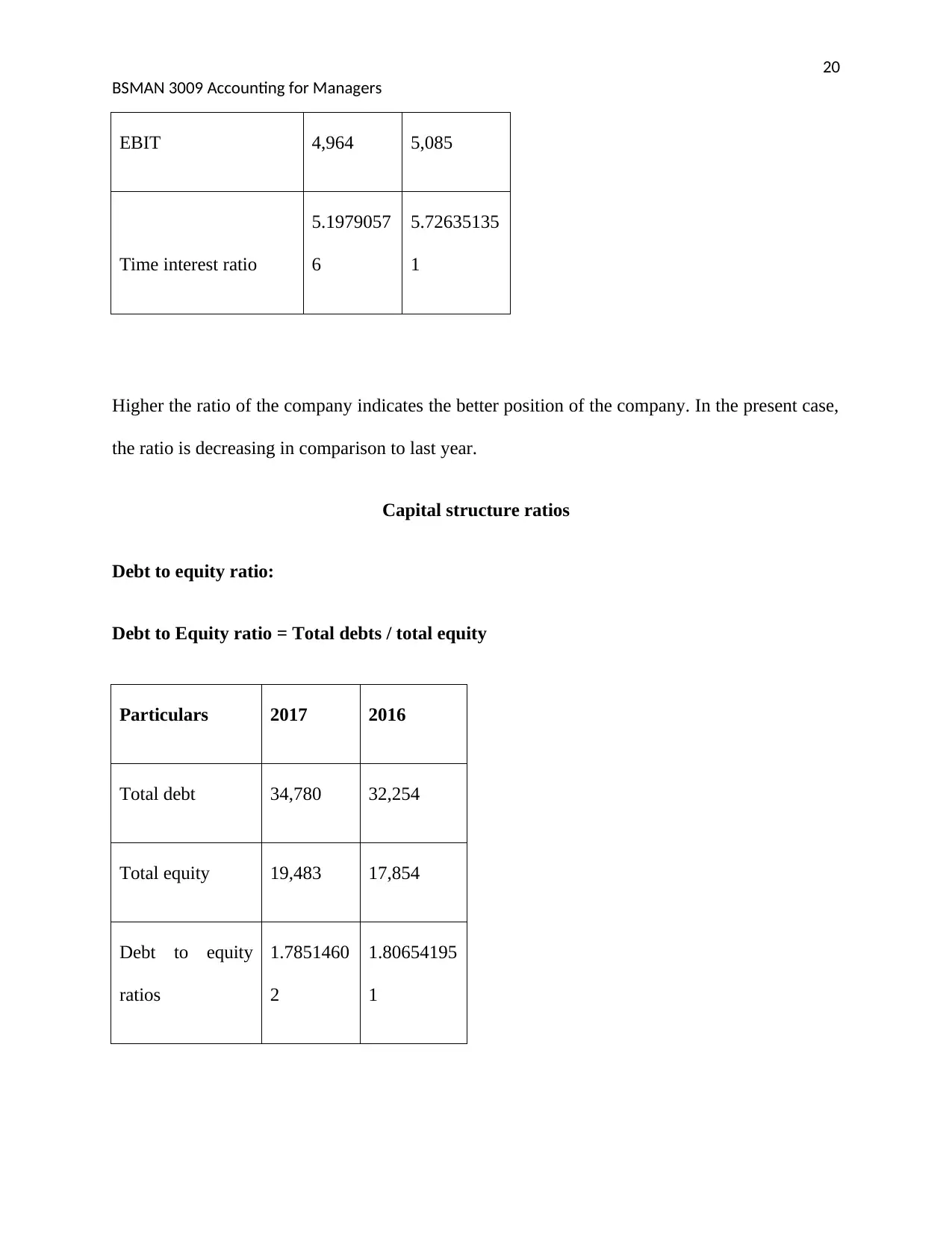

Time interest earned ratio:

Time interest ratio: EBIT / Interest expense

Particulars 2017 2016

Income after tax and

interest 2,970 3,087

Interest expense 955 888

Tax 1,039 1,110

Paraphrase This Document

BSMAN 3009 Accounting for Managers

EBIT 4,964 5,085

Time interest ratio

5.1979057

6

5.72635135

1

Higher the ratio of the company indicates the better position of the company. In the present case,

the ratio is decreasing in comparison to last year.

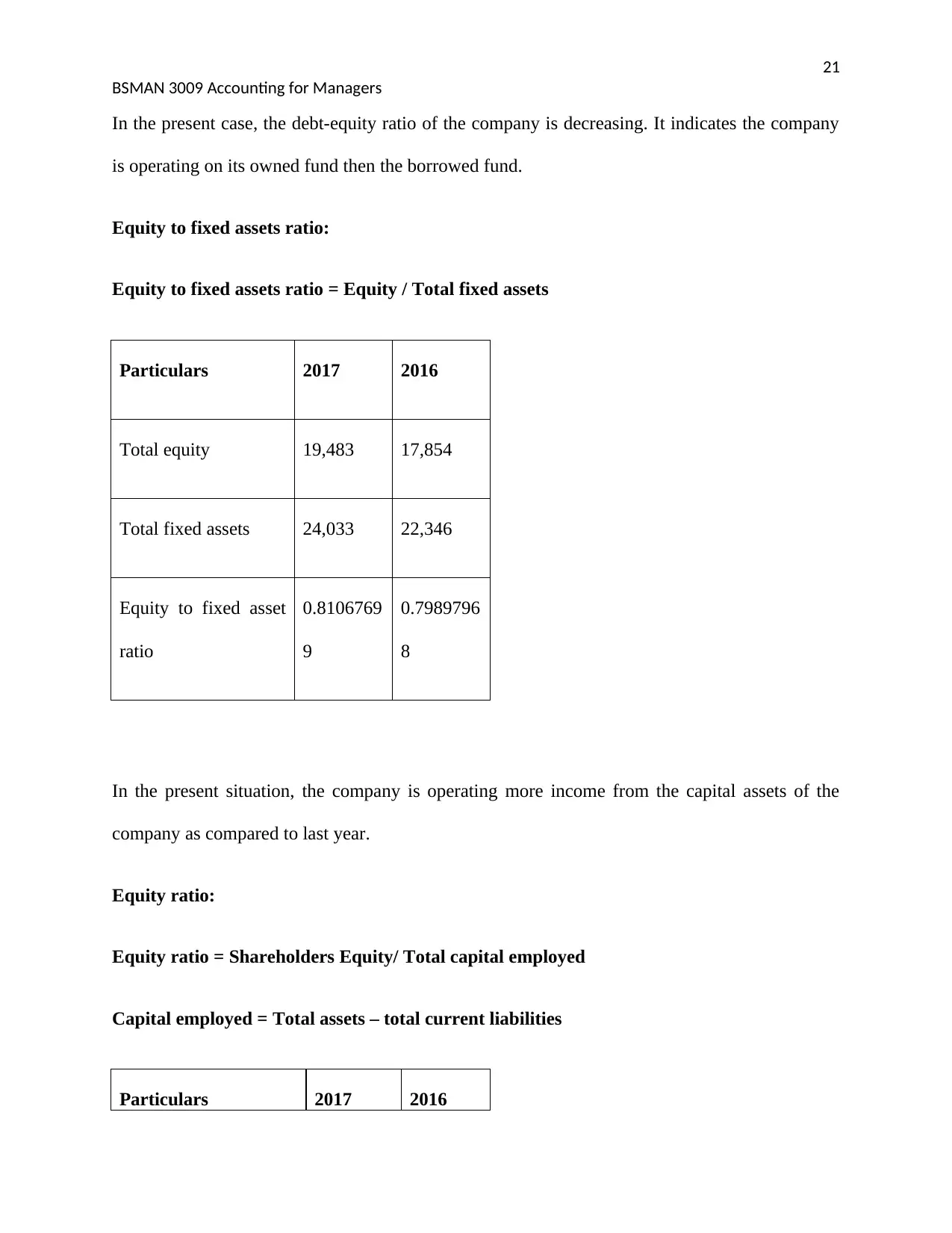

Capital structure ratios

Debt to equity ratio:

Debt to Equity ratio = Total debts / total equity

Particulars 2017 2016

Total debt 34,780 32,254

Total equity 19,483 17,854

Debt to equity

ratios

1.7851460

2

1.80654195

1

BSMAN 3009 Accounting for Managers

In the present case, the debt-equity ratio of the company is decreasing. It indicates the company

is operating on its owned fund then the borrowed fund.

Equity to fixed assets ratio:

Equity to fixed assets ratio = Equity / Total fixed assets

Particulars 2017 2016

Total equity 19,483 17,854

Total fixed assets 24,033 22,346

Equity to fixed asset

ratio

0.8106769

9

0.7989796

8

In the present situation, the company is operating more income from the capital assets of the

company as compared to last year.

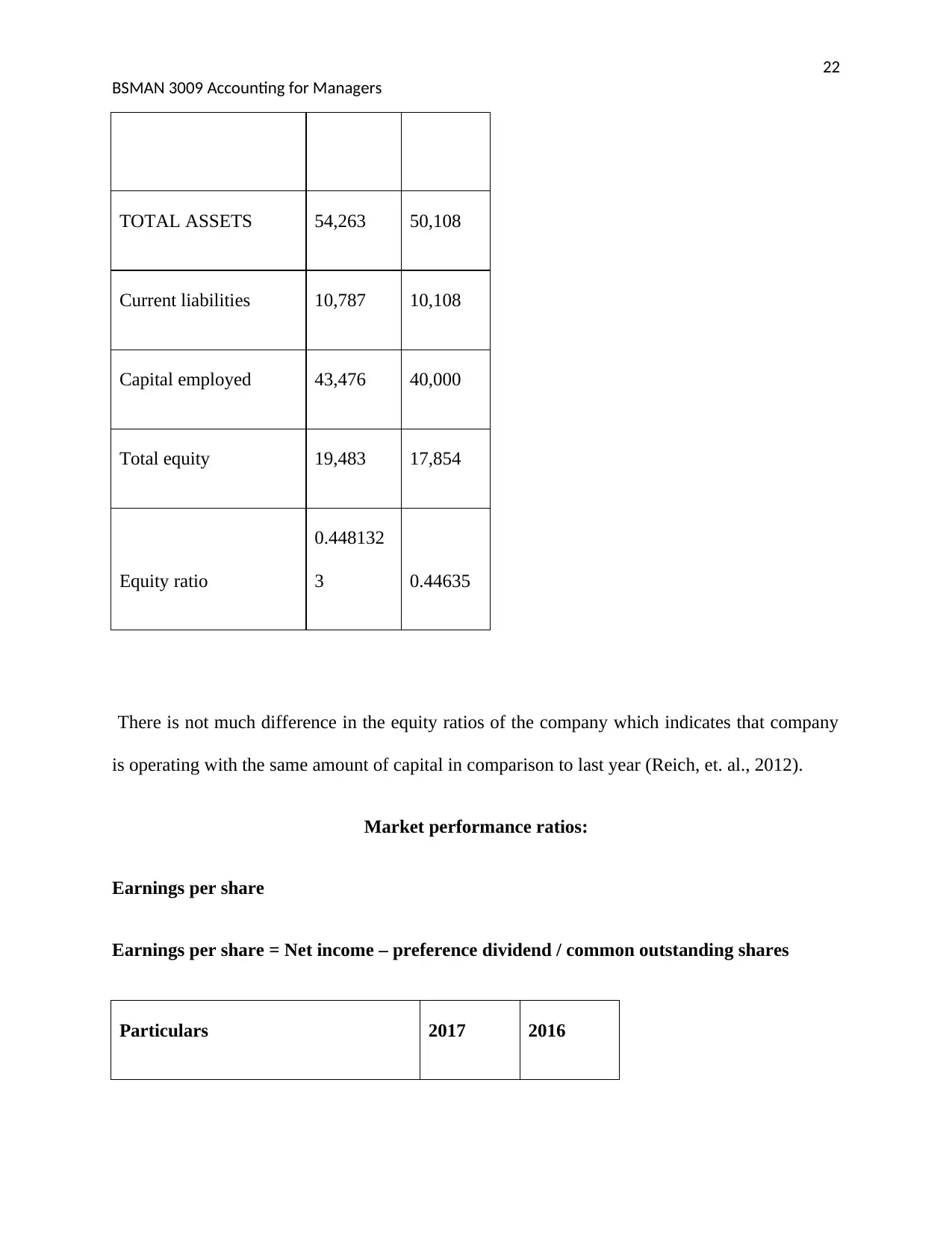

Equity ratio:

Equity ratio = Shareholders Equity/ Total capital employed

Capital employed = Total assets – total current liabilities

Particulars 2017 2016

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

TOTAL ASSETS 54,263 50,108

Current liabilities 10,787 10,108

Capital employed 43,476 40,000

Total equity 19,483 17,854

Equity ratio

0.448132

3 0.44635

There is not much difference in the equity ratios of the company which indicates that company

is operating with the same amount of capital in comparison to last year (Reich, et. al., 2012).

Market performance ratios:

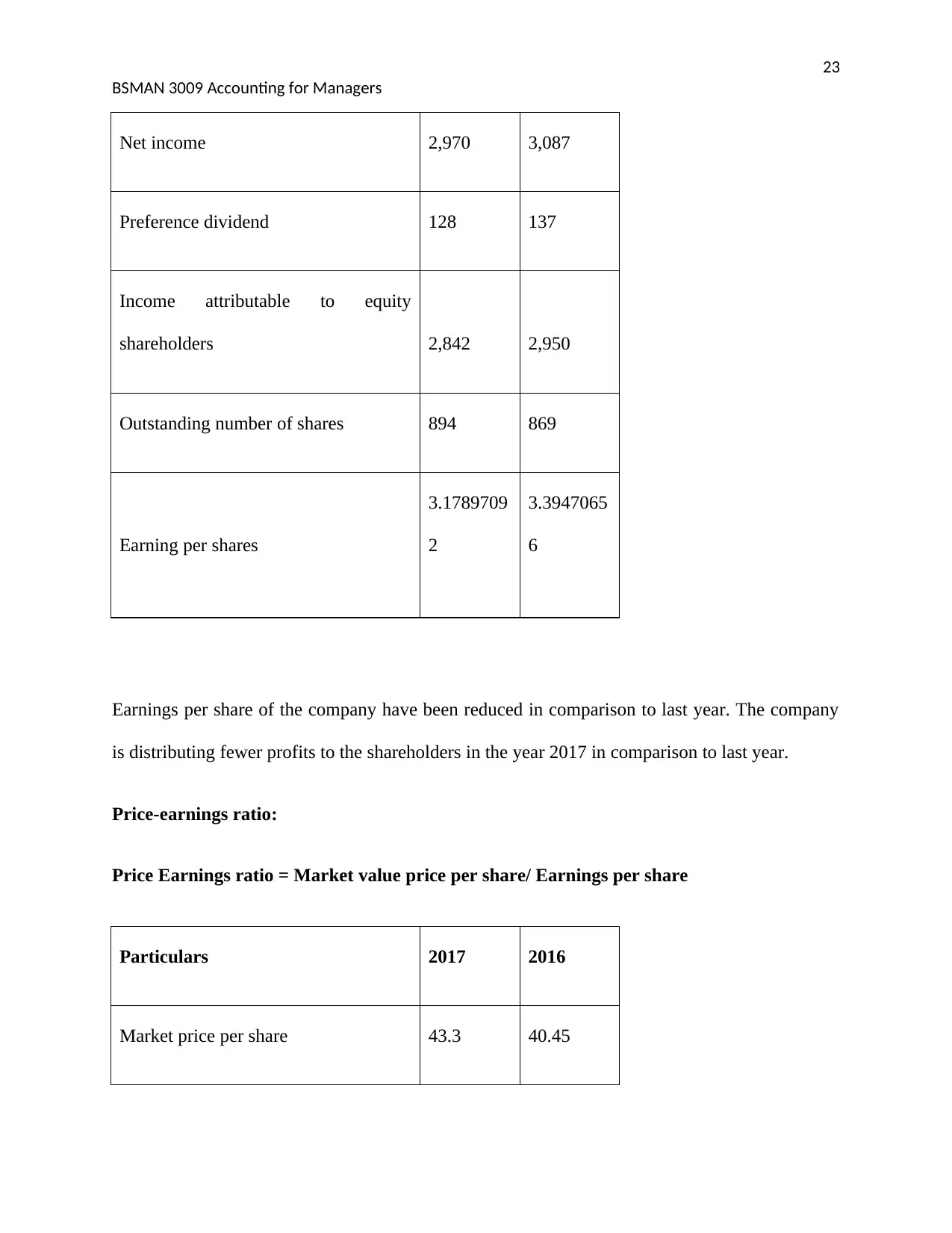

Earnings per share

Earnings per share = Net income – preference dividend / common outstanding shares

Particulars 2017 2016

Paraphrase This Document

BSMAN 3009 Accounting for Managers

Net income 2,970 3,087

Preference dividend 128 137

Income attributable to equity

shareholders 2,842 2,950

Outstanding number of shares 894 869

Earning per shares

3.1789709

2

3.3947065

6

Earnings per share of the company have been reduced in comparison to last year. The company

is distributing fewer profits to the shareholders in the year 2017 in comparison to last year.

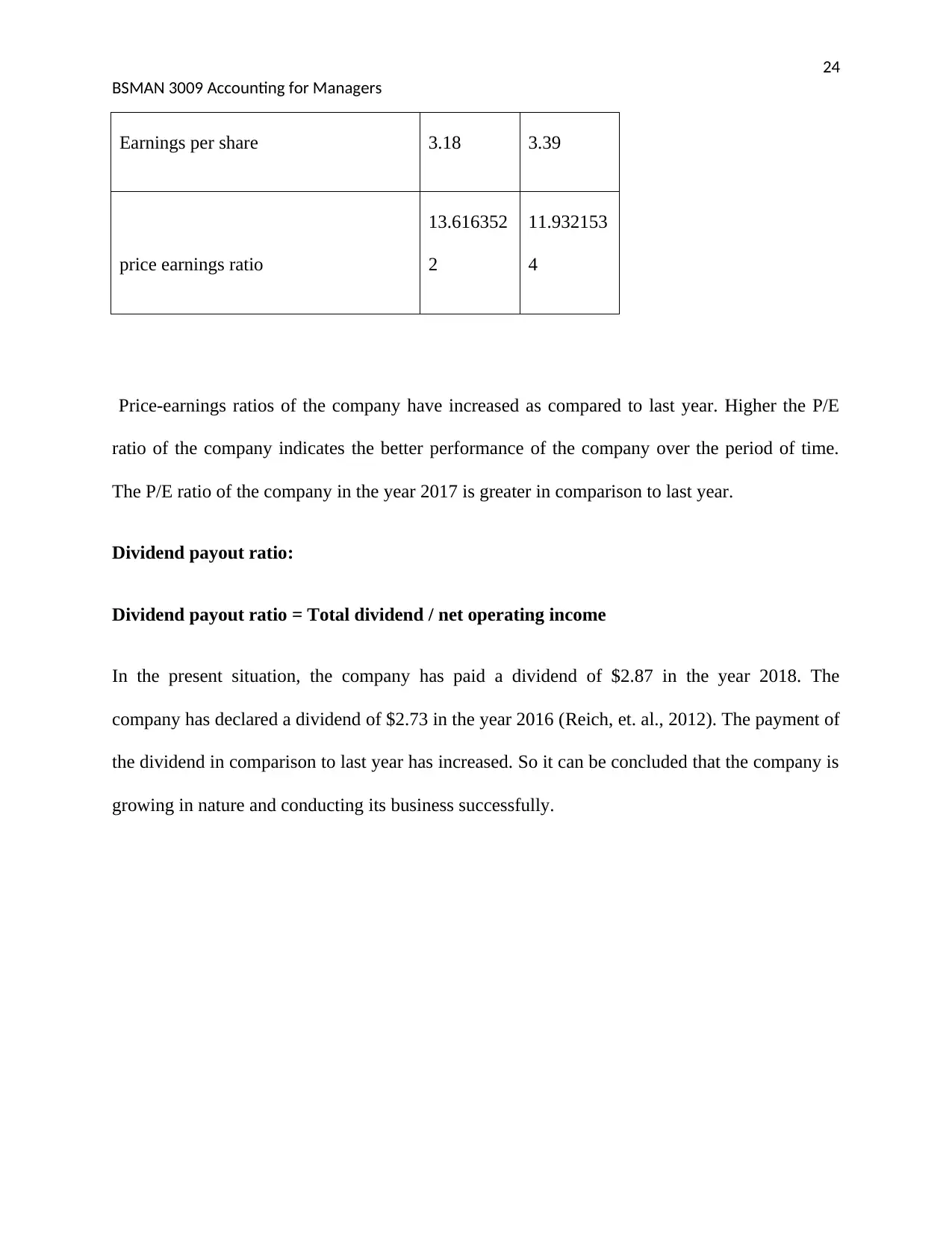

Price-earnings ratio:

Price Earnings ratio = Market value price per share/ Earnings per share

Particulars 2017 2016

Market price per share 43.3 40.45

BSMAN 3009 Accounting for Managers

Earnings per share 3.18 3.39

price earnings ratio

13.616352

2

11.932153

4

Price-earnings ratios of the company have increased as compared to last year. Higher the P/E

ratio of the company indicates the better performance of the company over the period of time.

The P/E ratio of the company in the year 2017 is greater in comparison to last year.

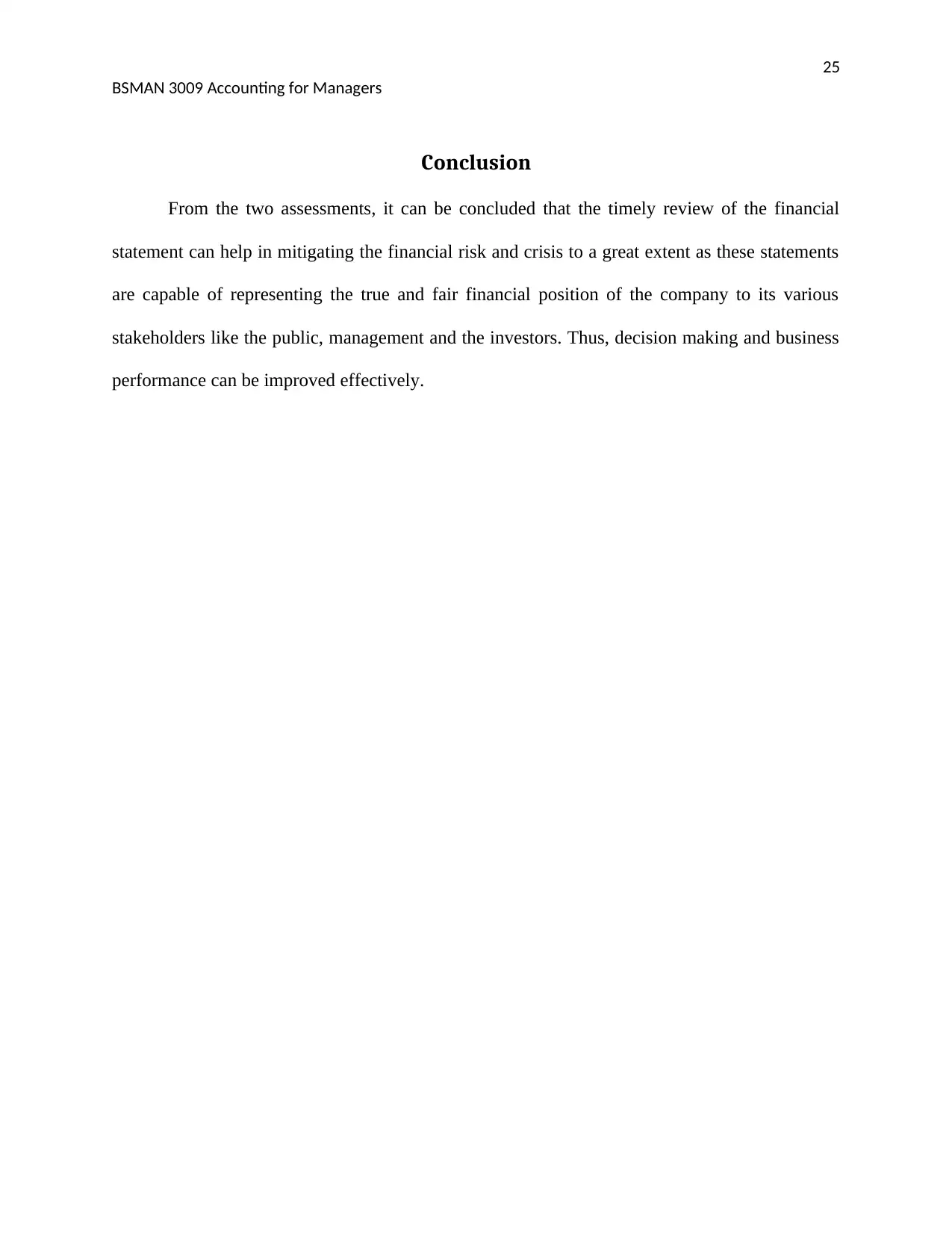

Dividend payout ratio:

Dividend payout ratio = Total dividend / net operating income

In the present situation, the company has paid a dividend of $2.87 in the year 2018. The

company has declared a dividend of $2.73 in the year 2016 (Reich, et. al., 2012). The payment of

the dividend in comparison to last year has increased. So it can be concluded that the company is

growing in nature and conducting its business successfully.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSMAN 3009 Accounting for Managers

Conclusion

From the two assessments, it can be concluded that the timely review of the financial

statement can help in mitigating the financial risk and crisis to a great extent as these statements

are capable of representing the true and fair financial position of the company to its various

stakeholders like the public, management and the investors. Thus, decision making and business

performance can be improved effectively.

Paraphrase This Document

BSMAN 3009 Accounting for Managers

References

Aragon, G. O., & Strahan, P. E. (2012). Hedge funds as liquidity providers: Evidence from the

Lehman bankruptcy. Journal of Financial Economics, 103(3), 570-587.

Azadinamin, A. (2012). The bankruptcy of Lehman Brothers: Causes of Failure &

recommendations going forward. Swiss Management Center.

Chakrabarty, B., & Zhang, G. (2012). Credit contagion channels: Market microstructure

evidence from Lehman Brothers’ bankruptcy. Financial Management, 41(2), 320-343.

Chiaramonte, L., & Casu, B. (2017). Capital and liquidity ratios and financial distress. Evidence

from the European banking industry. The British Accounting Review, 49(2), 138-161.

Delen, D., Kuzey, C., & Uyar, A. (2013). Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

Fernando, C. S., May, A. D., & Megginson, W. L. (2012). The value of investment banking

relationships: evidence from the collapse of Lehman Brothers. The Journal of

Finance, 67(1), 235-270.

Maina, L., & Ishmail, M. (2014). Capital structure and financial performance in Kenya:

Evidence from firms listed at the Nairobi Securities Exchange. International Journal of

Social Sciences and Entrepreneurship, 1(11), 209-223.

BSMAN 3009 Accounting for Managers

Mio, C., & Fasan, M. (2012). Does corporate social performance yield any tangible financial

benefit during a crisis? An event study of Lehman Brothers’ Bankruptcy. Corporate

reputation review, 15(4), 263-284.

Ouma, O. P. (2012). The relationship between dividend payout and firm performance: a study of

listed companies in Kenya. European Scientific Journal, ESJ, 8(9).

Reich, N. H., Mueller, B., Armbruster, A., Van Sark, W. G., Kiefer, K., & Reise, C. (2012).

Performance ratio revisited: is PR> 90% realistic?. Progress in Photovoltaics: Research

and Applications, 20(6), 717-726.

Cassidy, J. (2013, August 28). What Has Changed Since Lehman Failed? Retrieved November

2, 2018, from The New Yorker: https://www.newyorker.com/news/john-cassidy/what-

has-changed-since-lehman-failed

Davies, J. (2017, June 23). Global Financial Crisis - What caused it and how the world

responded. Retrieved November 2, 2018, from Canstar:

https://www.canstar.com.au/home-loans/global-financial-crisis

Lioudis, N. K. (2017, December 11). The collapse of Lehman Brothers: A case study. Retrieved

November 2018, 2018, from Investopedia:

https://www.investopedia.com/articles/economics/09/lehman-brothers-collapse.asp

Nageswaran, V. A. (2018, March 13). What has changed since the 2008 financial crisis?

Retrieved November 2, 2018, from Live mint:

https://www.livemint.com/Opinion/Qk0YdpJiHzW7YA5MAIhutL/What-has-changed-

since-the-2008-financial-crisis.html

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.