Financial Analysis of A2 Milk

VerifiedAdded on 2020/01/07

|16

|2829

|49

Essay

AI Summary

This assignment requires a financial analysis of A2 Milk using its income statement, cash flow statement, and balance sheet. The analysis should evaluate the company's financial health and performance. For comparative purposes, the financial statements of Dairy Farmers should also be examined and compared to those of A2 Milk. The goal is to understand A2 Milk's financial position and identify key trends and insights.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ANALYZE THE CONCEPTUAL FRAMEWORK

SUBJECT CODE:

STUDENT NAME:

STUDENT ID:

PROFESSOR NAME:

1

SUBJECT CODE:

STUDENT NAME:

STUDENT ID:

PROFESSOR NAME:

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive summary

The AASP standards are helpful in the financial performance of the company. The analysis of

A2 Milk Company and Dairy farmers is done by using AASB standards. The revenue rate and

the profit rate of A2 Milk Company and Dairy Company are helpful here to for getting the better

output. The conceptual framework is vital for the company so that performance can be

maintained through financial activities. The financial statement of these companies is measured

here for the identification of the growth level of the firm in the global market. The liabilities of

these companies are also helpful for evaluating the profit rate. Conceptual framework analysis is

applied for making the accounting framework accurate.

2

The AASP standards are helpful in the financial performance of the company. The analysis of

A2 Milk Company and Dairy farmers is done by using AASB standards. The revenue rate and

the profit rate of A2 Milk Company and Dairy Company are helpful here to for getting the better

output. The conceptual framework is vital for the company so that performance can be

maintained through financial activities. The financial statement of these companies is measured

here for the identification of the growth level of the firm in the global market. The liabilities of

these companies are also helpful for evaluating the profit rate. Conceptual framework analysis is

applied for making the accounting framework accurate.

2

Table of contents

Introduction:....................................................................................................................................5

Financial Analysis:..........................................................................................................................5

Financial statements based upon AASB standards:.........................................................................5

The conceptual framework in case of including Prudence for keeping the disparity in corporate

reporting:..........................................................................................................................................6

Explanation of financial statements in case of A2 milk and Dairy farmers:...................................7

Identification of the differences between A2 milk and Dairy farmers:...........................................8

Conclusion:......................................................................................................................................8

Recommendation:............................................................................................................................9

Reference list:................................................................................................................................10

Appendices:...................................................................................................................................11

3

Introduction:....................................................................................................................................5

Financial Analysis:..........................................................................................................................5

Financial statements based upon AASB standards:.........................................................................5

The conceptual framework in case of including Prudence for keeping the disparity in corporate

reporting:..........................................................................................................................................6

Explanation of financial statements in case of A2 milk and Dairy farmers:...................................7

Identification of the differences between A2 milk and Dairy farmers:...........................................8

Conclusion:......................................................................................................................................8

Recommendation:............................................................................................................................9

Reference list:................................................................................................................................10

Appendices:...................................................................................................................................11

3

Introduction:

Financial analysis is helpful for making the identification of the firm with the help of financial

statements. A2 Milk Company is a milk producing company. It produces dairy milk which is

purely natural and completely additive free. A2 milk is the milk of the cow that contains A2 kind

of beta-casein. Daily Farmers is also a milk producing company of Australia. Dairy Farmers is

the third highest milk producing company. The company sells fresh milk and butter products.

The effective analysis with the help of financial statements for these firms is discussed. The

requirements of AASB standards are also mentioned in this scenario. The critical analysis of

these two firms is measured here through annual reports. At last, the recommendations based on

the accounting framework of these two companies are discussed. Herein, the topic is about an

analysis of conceptual framework which is helpful for meeting the requirements of AASB

standards in case of A2 milk and Dairy farmers.

Financial Analysis:

Financial statements based upon AASB standards:

The Australian accounting standard board (AASB) is the agency of the government that

maintains the financial for both the sectors public as well as private sectors. The financial

statement of A2 Company and the Dairy farmers of Australia are based on the AASB standard.

As per the AASB standard mostly, A2 milk has followed the requirements. In the case of Dairy

farmers few components are not followed for which the effective analysis of conceptual

frameworks are not maintained (a2milk.com.au. 2016).

The A2 Company includes changes in the surplus revaluation as the property of AASB 116 and

AASB 138 mentioned. This company also includes re-measurements in the company benefit

plans as AASB 119 includes the benefits of the employee. The gains and the losses that arise

after translating financial statement is also included as AASB 121 mentioned (Dieckmann and

Plank, 2012). The company also includes the gains and the losses that occur from the investment

which is designed for fair value in the equity instruments. The A2 Company also includes the

changes in the value of forward and spot element. The gains and the losses are measured on

financial assets as the AASB 9 states (Healy and Palepu, 2012).

4

Financial analysis is helpful for making the identification of the firm with the help of financial

statements. A2 Milk Company is a milk producing company. It produces dairy milk which is

purely natural and completely additive free. A2 milk is the milk of the cow that contains A2 kind

of beta-casein. Daily Farmers is also a milk producing company of Australia. Dairy Farmers is

the third highest milk producing company. The company sells fresh milk and butter products.

The effective analysis with the help of financial statements for these firms is discussed. The

requirements of AASB standards are also mentioned in this scenario. The critical analysis of

these two firms is measured here through annual reports. At last, the recommendations based on

the accounting framework of these two companies are discussed. Herein, the topic is about an

analysis of conceptual framework which is helpful for meeting the requirements of AASB

standards in case of A2 milk and Dairy farmers.

Financial Analysis:

Financial statements based upon AASB standards:

The Australian accounting standard board (AASB) is the agency of the government that

maintains the financial for both the sectors public as well as private sectors. The financial

statement of A2 Company and the Dairy farmers of Australia are based on the AASB standard.

As per the AASB standard mostly, A2 milk has followed the requirements. In the case of Dairy

farmers few components are not followed for which the effective analysis of conceptual

frameworks are not maintained (a2milk.com.au. 2016).

The A2 Company includes changes in the surplus revaluation as the property of AASB 116 and

AASB 138 mentioned. This company also includes re-measurements in the company benefit

plans as AASB 119 includes the benefits of the employee. The gains and the losses that arise

after translating financial statement is also included as AASB 121 mentioned (Dieckmann and

Plank, 2012). The company also includes the gains and the losses that occur from the investment

which is designed for fair value in the equity instruments. The A2 Company also includes the

changes in the value of forward and spot element. The gains and the losses are measured on

financial assets as the AASB 9 states (Healy and Palepu, 2012).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The Dairy farmers company has followed the changes in their surplus revaluation. The company

has also followed the gains and the losses that arise after financial statement gets translated. On

the contrary, the company has not followed the gains and the losses that occur from investment

which is designed at the fair value through comprehensive income. Due to this, the management

issues are faced by this company (Hsu et al. 2014). The company has also not designed their

liabilities as fair value in the equity instruments. However, the company follows benefit plan in

their re-measurements.

In the case of A2 milk, it is seen that the gross profit is for $151000 AUD and for Dairy farmers

the rate is for $3000 AUD. With the help of the income statement, it is seen that A2 milk has

operating income for $53000. This, the firm has met its requirements through AASB standards.

In the case of Dairy farmers, it is seen that the operating loss is for $2000. Thus, the standards

are less focused for this company. Hence, the effective information is not maintained through

which the mistreatment has been taken place for Dairy farmers (Finance.yahoo.com. 2016).

The conceptual framework in case of including Prudence for keeping the disparity in

corporate reporting:

Corporate reporting is mainly the set of rules and practices that any organization follows to

achieve its objectives. This corporate reporting is framed to maintain the interests of the

company and various stakeholders like management, suppliers, and the customers.

The A2 milk company has included prudent follows the codes and conducts stated by the

corporate law (Ioannou and Serafeim, 2014). Thus, it has very well framed the company's own

policies and ethics. The company presents its conceptual framework by regular supervision on its

ethical issues for the development of financial activities. The company board of directors’ role is

also vital. It is the board of director responsibility to frame the policy for the company and

monitor the financial performance. The training of the directors is also done so that they can

perform their duties in a better way. The board remuneration committee has been established in

order to determine the packages of the board members (Maditinos et al. 2011). The auditing

department and the risk management committee consist of three directors. It is the responsibility

of the committee to analyze the scope and review the annual performance. In order to avoid

disparity A2 company has defined all the policies and the procedures appropriately (Scott-

5

has also followed the gains and the losses that arise after financial statement gets translated. On

the contrary, the company has not followed the gains and the losses that occur from investment

which is designed at the fair value through comprehensive income. Due to this, the management

issues are faced by this company (Hsu et al. 2014). The company has also not designed their

liabilities as fair value in the equity instruments. However, the company follows benefit plan in

their re-measurements.

In the case of A2 milk, it is seen that the gross profit is for $151000 AUD and for Dairy farmers

the rate is for $3000 AUD. With the help of the income statement, it is seen that A2 milk has

operating income for $53000. This, the firm has met its requirements through AASB standards.

In the case of Dairy farmers, it is seen that the operating loss is for $2000. Thus, the standards

are less focused for this company. Hence, the effective information is not maintained through

which the mistreatment has been taken place for Dairy farmers (Finance.yahoo.com. 2016).

The conceptual framework in case of including Prudence for keeping the disparity in

corporate reporting:

Corporate reporting is mainly the set of rules and practices that any organization follows to

achieve its objectives. This corporate reporting is framed to maintain the interests of the

company and various stakeholders like management, suppliers, and the customers.

The A2 milk company has included prudent follows the codes and conducts stated by the

corporate law (Ioannou and Serafeim, 2014). Thus, it has very well framed the company's own

policies and ethics. The company presents its conceptual framework by regular supervision on its

ethical issues for the development of financial activities. The company board of directors’ role is

also vital. It is the board of director responsibility to frame the policy for the company and

monitor the financial performance. The training of the directors is also done so that they can

perform their duties in a better way. The board remuneration committee has been established in

order to determine the packages of the board members (Maditinos et al. 2011). The auditing

department and the risk management committee consist of three directors. It is the responsibility

of the committee to analyze the scope and review the annual performance. In order to avoid

disparity A2 company has defined all the policies and the procedures appropriately (Scott-

5

Clayton, 2011). This is helpful for them to make the relationship between the management and

client.

The conceptual framework of Dairy farmers also follows the codes and conducts which are

mentioned in the corporate law. The company board directs and monitors on behalf of the

members. The board approves the strategic policy to ensure accountability. This company has

different business units (Woodford, 2010). The farm product and the productivity unit’s focus on

to increase the productivity of the farm whereas trade units focus on to maximize the wealth.

This farm also ensures the safety of the food. The company first priority is the food safety. The

conceptual framework of Dairy farmers is framed in according to avoid disparity. The regulatory

framework of this company ensures safety for its products (Healy and Palepu, 2012). The

company has framed sustainability for enhancing the livelihood of their employee and for

improving the well-being of the animal. This sustainability is also framed to reduce the impact of

the environment.

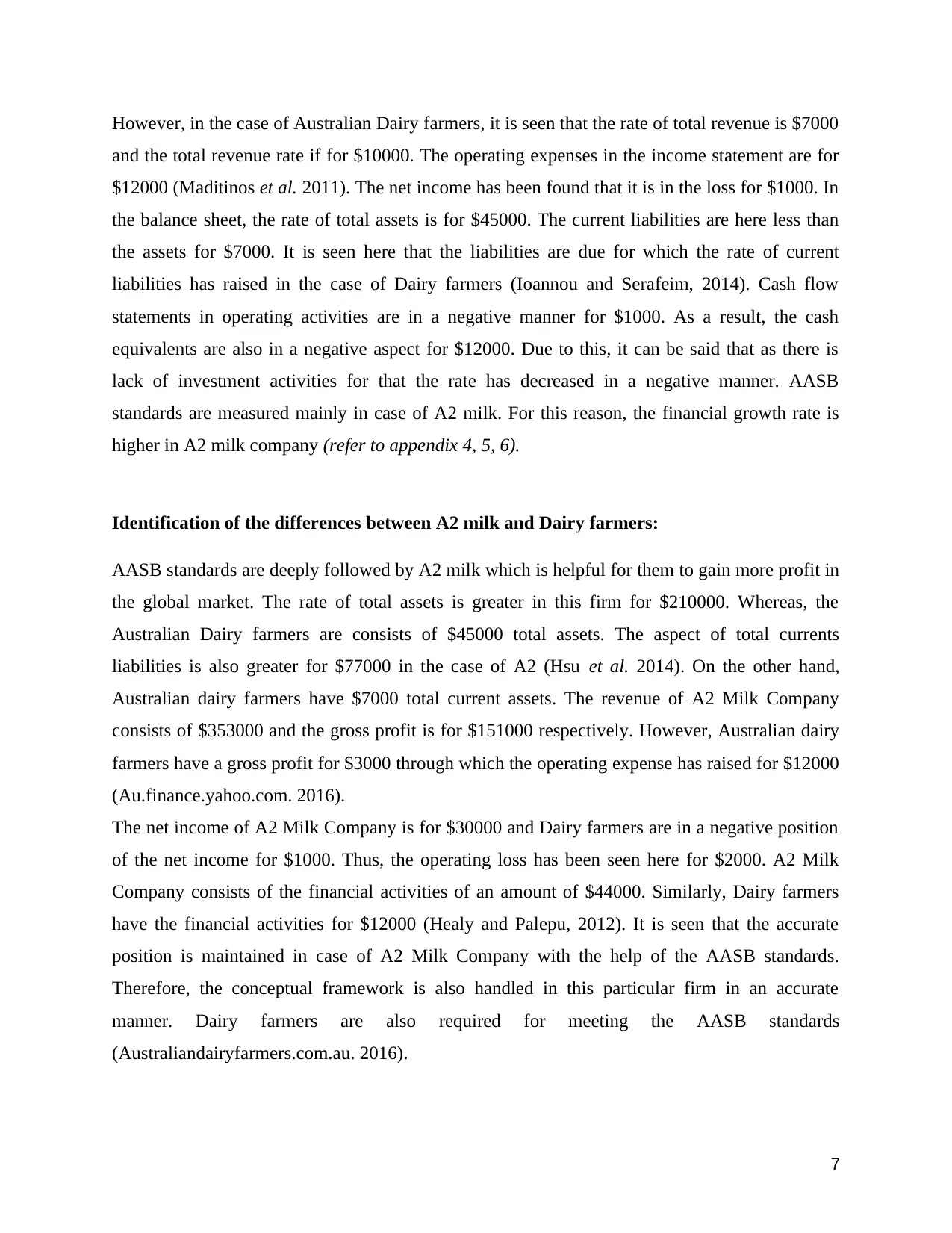

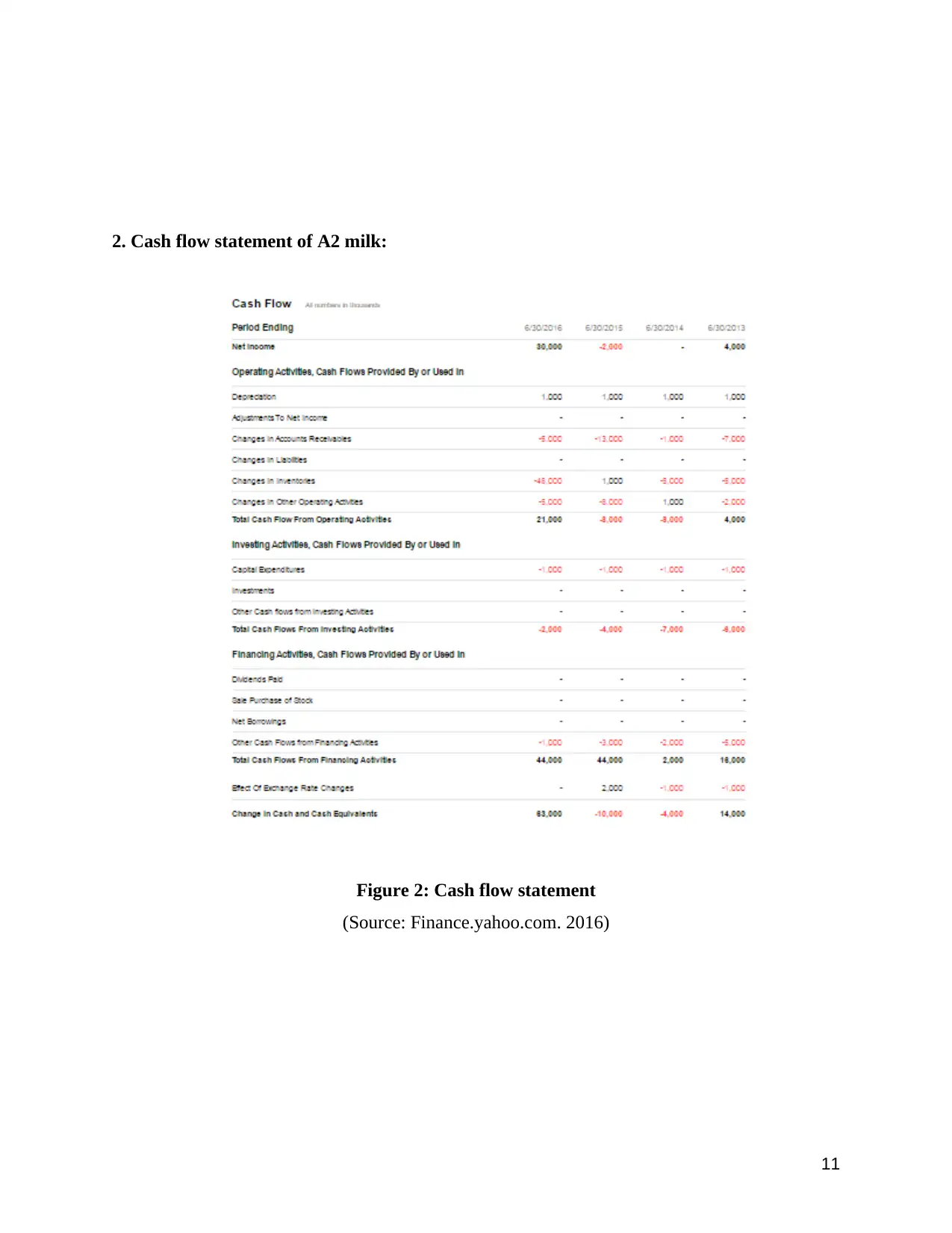

Explanation of financial statements in case of A2 milk and Dairy farmers:

With the help of the financial statement of A2 milk the accuracy of the financial information are

collected. The gross profit rate if for $151000 and the revenue rate is $353000. Due to this the

operating income also gets raised for $53000 (Dieckmann and Plank, 2012). The rate of net

income is $30000. Based upon the income statement the accuracy of the income get framed for

this firm. Based upon cash flow statement the depreciation rate is known which is helpful for

making the operating activities. The total operating activities of A2 milk is for $21000. However,

it is also seen that as the investment rate is higher for that the negative result is seen in the case

of the investing activities for $2000. Financial activities are also seen for $44000 (Healy and

Palepu, 2012). This is helpful for A2 milk firm for changing the cash equivalents for $63000.

With the help of balance sheet, the effective relationship between the assets and liabilities get

maintained. The total current assets are for $182000 and for this the rate of total assets are

$210000 for A2 milk. This denotes that this firm is in a healthy position. The rate of total

liabilities is $77000. These three statements are helpful for A2 milk to identify its financial

position in the global market (refer to appendix 1, 2, 3).

6

client.

The conceptual framework of Dairy farmers also follows the codes and conducts which are

mentioned in the corporate law. The company board directs and monitors on behalf of the

members. The board approves the strategic policy to ensure accountability. This company has

different business units (Woodford, 2010). The farm product and the productivity unit’s focus on

to increase the productivity of the farm whereas trade units focus on to maximize the wealth.

This farm also ensures the safety of the food. The company first priority is the food safety. The

conceptual framework of Dairy farmers is framed in according to avoid disparity. The regulatory

framework of this company ensures safety for its products (Healy and Palepu, 2012). The

company has framed sustainability for enhancing the livelihood of their employee and for

improving the well-being of the animal. This sustainability is also framed to reduce the impact of

the environment.

Explanation of financial statements in case of A2 milk and Dairy farmers:

With the help of the financial statement of A2 milk the accuracy of the financial information are

collected. The gross profit rate if for $151000 and the revenue rate is $353000. Due to this the

operating income also gets raised for $53000 (Dieckmann and Plank, 2012). The rate of net

income is $30000. Based upon the income statement the accuracy of the income get framed for

this firm. Based upon cash flow statement the depreciation rate is known which is helpful for

making the operating activities. The total operating activities of A2 milk is for $21000. However,

it is also seen that as the investment rate is higher for that the negative result is seen in the case

of the investing activities for $2000. Financial activities are also seen for $44000 (Healy and

Palepu, 2012). This is helpful for A2 milk firm for changing the cash equivalents for $63000.

With the help of balance sheet, the effective relationship between the assets and liabilities get

maintained. The total current assets are for $182000 and for this the rate of total assets are

$210000 for A2 milk. This denotes that this firm is in a healthy position. The rate of total

liabilities is $77000. These three statements are helpful for A2 milk to identify its financial

position in the global market (refer to appendix 1, 2, 3).

6

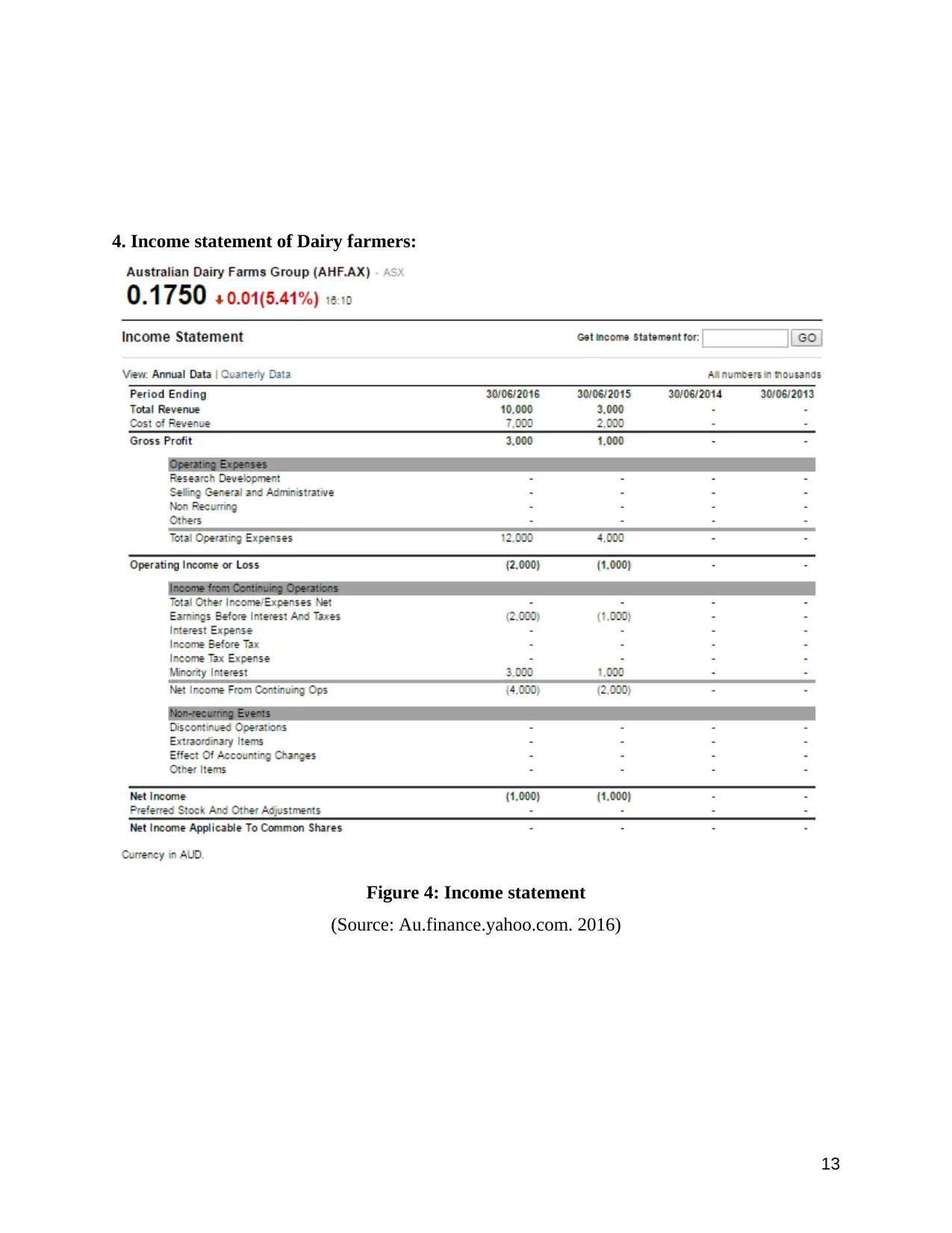

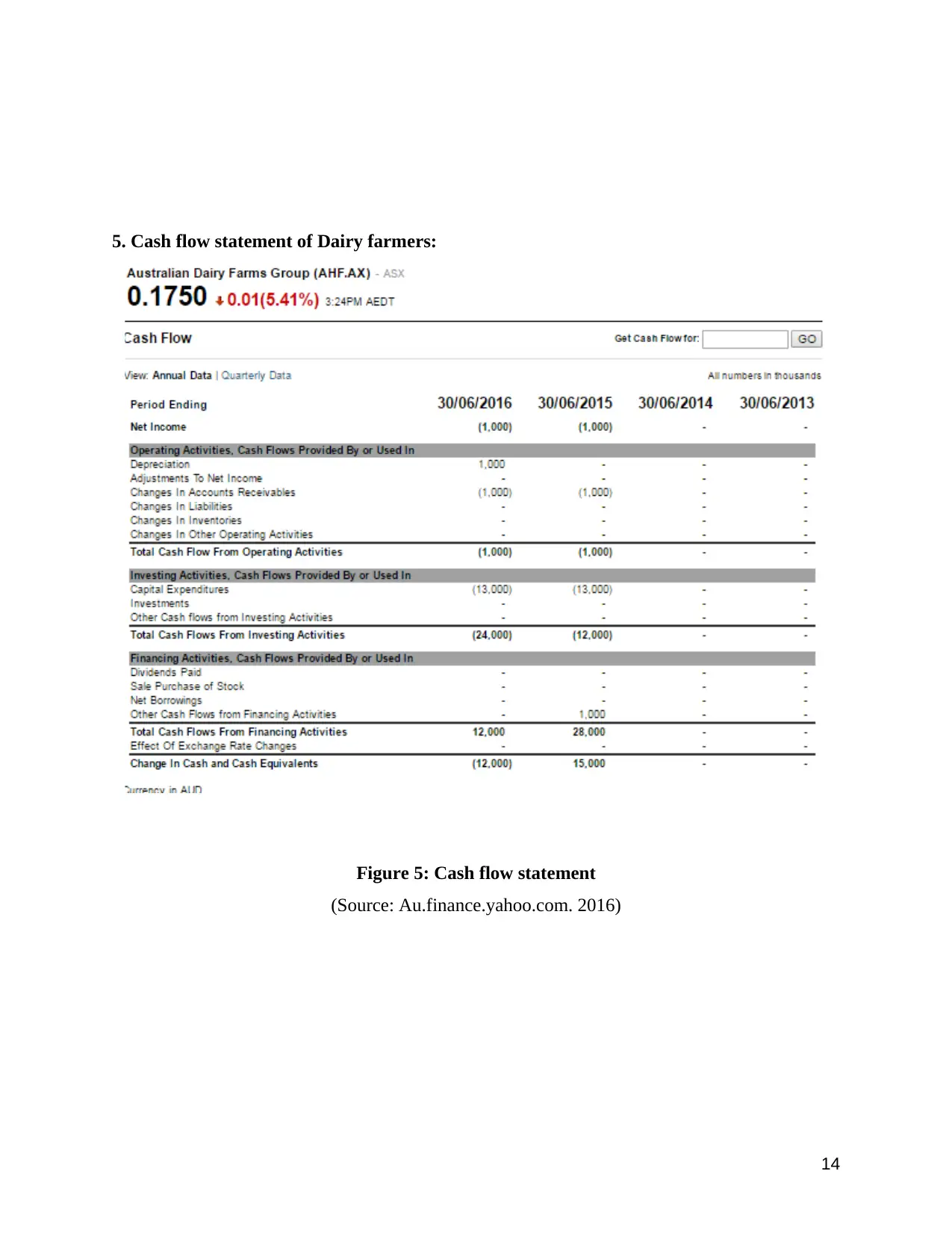

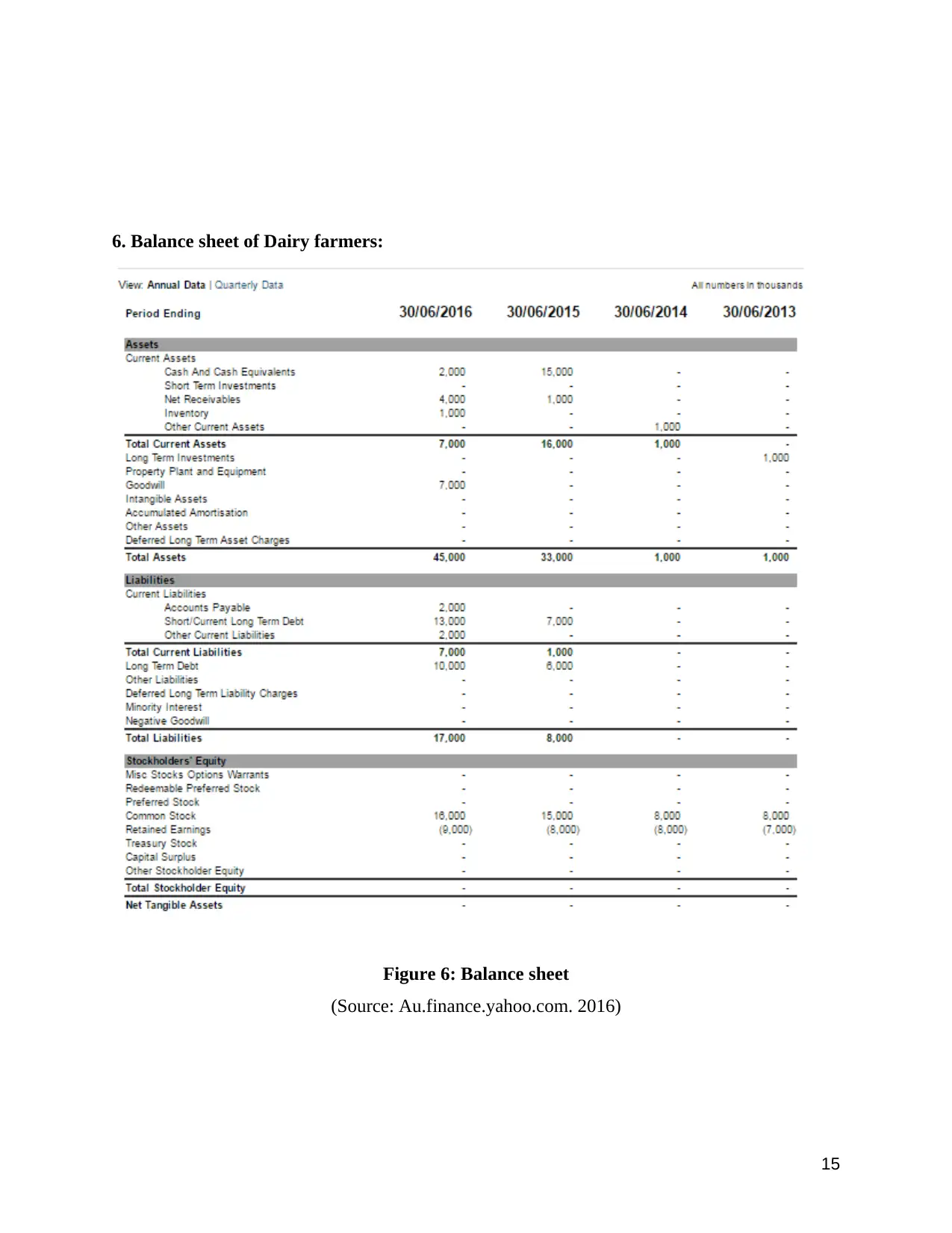

However, in the case of Australian Dairy farmers, it is seen that the rate of total revenue is $7000

and the total revenue rate if for $10000. The operating expenses in the income statement are for

$12000 (Maditinos et al. 2011). The net income has been found that it is in the loss for $1000. In

the balance sheet, the rate of total assets is for $45000. The current liabilities are here less than

the assets for $7000. It is seen here that the liabilities are due for which the rate of current

liabilities has raised in the case of Dairy farmers (Ioannou and Serafeim, 2014). Cash flow

statements in operating activities are in a negative manner for $1000. As a result, the cash

equivalents are also in a negative aspect for $12000. Due to this, it can be said that as there is

lack of investment activities for that the rate has decreased in a negative manner. AASB

standards are measured mainly in case of A2 milk. For this reason, the financial growth rate is

higher in A2 milk company (refer to appendix 4, 5, 6).

Identification of the differences between A2 milk and Dairy farmers:

AASB standards are deeply followed by A2 milk which is helpful for them to gain more profit in

the global market. The rate of total assets is greater in this firm for $210000. Whereas, the

Australian Dairy farmers are consists of $45000 total assets. The aspect of total currents

liabilities is also greater for $77000 in the case of A2 (Hsu et al. 2014). On the other hand,

Australian dairy farmers have $7000 total current assets. The revenue of A2 Milk Company

consists of $353000 and the gross profit is for $151000 respectively. However, Australian dairy

farmers have a gross profit for $3000 through which the operating expense has raised for $12000

(Au.finance.yahoo.com. 2016).

The net income of A2 Milk Company is for $30000 and Dairy farmers are in a negative position

of the net income for $1000. Thus, the operating loss has been seen here for $2000. A2 Milk

Company consists of the financial activities of an amount of $44000. Similarly, Dairy farmers

have the financial activities for $12000 (Healy and Palepu, 2012). It is seen that the accurate

position is maintained in case of A2 Milk Company with the help of the AASB standards.

Therefore, the conceptual framework is also handled in this particular firm in an accurate

manner. Dairy farmers are also required for meeting the AASB standards

(Australiandairyfarmers.com.au. 2016).

7

and the total revenue rate if for $10000. The operating expenses in the income statement are for

$12000 (Maditinos et al. 2011). The net income has been found that it is in the loss for $1000. In

the balance sheet, the rate of total assets is for $45000. The current liabilities are here less than

the assets for $7000. It is seen here that the liabilities are due for which the rate of current

liabilities has raised in the case of Dairy farmers (Ioannou and Serafeim, 2014). Cash flow

statements in operating activities are in a negative manner for $1000. As a result, the cash

equivalents are also in a negative aspect for $12000. Due to this, it can be said that as there is

lack of investment activities for that the rate has decreased in a negative manner. AASB

standards are measured mainly in case of A2 milk. For this reason, the financial growth rate is

higher in A2 milk company (refer to appendix 4, 5, 6).

Identification of the differences between A2 milk and Dairy farmers:

AASB standards are deeply followed by A2 milk which is helpful for them to gain more profit in

the global market. The rate of total assets is greater in this firm for $210000. Whereas, the

Australian Dairy farmers are consists of $45000 total assets. The aspect of total currents

liabilities is also greater for $77000 in the case of A2 (Hsu et al. 2014). On the other hand,

Australian dairy farmers have $7000 total current assets. The revenue of A2 Milk Company

consists of $353000 and the gross profit is for $151000 respectively. However, Australian dairy

farmers have a gross profit for $3000 through which the operating expense has raised for $12000

(Au.finance.yahoo.com. 2016).

The net income of A2 Milk Company is for $30000 and Dairy farmers are in a negative position

of the net income for $1000. Thus, the operating loss has been seen here for $2000. A2 Milk

Company consists of the financial activities of an amount of $44000. Similarly, Dairy farmers

have the financial activities for $12000 (Healy and Palepu, 2012). It is seen that the accurate

position is maintained in case of A2 Milk Company with the help of the AASB standards.

Therefore, the conceptual framework is also handled in this particular firm in an accurate

manner. Dairy farmers are also required for meeting the AASB standards

(Australiandairyfarmers.com.au. 2016).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion:

It is concluded that financial analysis is helpful for conducting the conceptual framework. It is

seen that A2 Milk Company has followed all the AASB standards whereas Dairy farmers has not

followed all the AASB standards. The gross profit rate and revenue rate of A2 Milk Company

are higher in comparison to Dairy farmers. The net income of Dairy farmers is low in

comparison to A2 Milk Company as it has not followed the entire AASB standard. A2 Milk

Company and Dairy farmers have framed their corporate reporting so that disparity can be

avoided and prudence can be maintained. The current liabilities of Dairy farmers are increasing

in comparison to A2 Milk Company. Further, it has been concluded that conceptual framework is

essential for the identification of the financial company so that the performance of the company

can be maintained.

Recommendation:

Dairy farmers should maintain all the AASB standards so that the farm can meet their financial

requirement in the global market. They should also increase its revenue rate and gross profit rate

so that the performance can be maintained in an effective manner. The cash flow statement of

this firm also should be managed with the help of investing activities. In the case of A2 Milk

Company the investing activities also must be focused so that the accounting framework gets

maintained. Dairy farmers also must maintain their financial performance so that healthy

relationship between the management and the clients of this firm get framed.

8

It is concluded that financial analysis is helpful for conducting the conceptual framework. It is

seen that A2 Milk Company has followed all the AASB standards whereas Dairy farmers has not

followed all the AASB standards. The gross profit rate and revenue rate of A2 Milk Company

are higher in comparison to Dairy farmers. The net income of Dairy farmers is low in

comparison to A2 Milk Company as it has not followed the entire AASB standard. A2 Milk

Company and Dairy farmers have framed their corporate reporting so that disparity can be

avoided and prudence can be maintained. The current liabilities of Dairy farmers are increasing

in comparison to A2 Milk Company. Further, it has been concluded that conceptual framework is

essential for the identification of the financial company so that the performance of the company

can be maintained.

Recommendation:

Dairy farmers should maintain all the AASB standards so that the farm can meet their financial

requirement in the global market. They should also increase its revenue rate and gross profit rate

so that the performance can be maintained in an effective manner. The cash flow statement of

this firm also should be managed with the help of investing activities. In the case of A2 Milk

Company the investing activities also must be focused so that the accounting framework gets

maintained. Dairy farmers also must maintain their financial performance so that healthy

relationship between the management and the clients of this firm get framed.

8

Reference list:

a2milk.com.au. (2016). Milk that’s naturally all A2 - a2Milk™ | Feel the Difference. Available

at: https://a2milk.com.au/ [Accessed on 15 Dec. 2016].

Au.finance.yahoo.com. (2016). AHF.AX Income Statement | AUSDAIRY STAPLED Stock -

Yahoo!7 Finance. Available at: https://au.finance.yahoo.com/q/is?s=AHF.AX&annual [Accessed

on 15 Dec. 2016].

Australiandairyfarmers.com.au. (2016). Dairy Farmers Australia | Dairy Advocacy Group |

Australian Dairy Farmers. Available at: http://www.australiandairyfarmers.com.au/ [Accessed

on 15 Dec. 2016].

Dieckmann, S. and Plank, T., (2012). Default risk of advanced economies: An empirical analysis

of credit default swaps during the financial crisis. Review of Finance, 16(4), pp.903-934.

Finance.yahoo.com. (2016). A2M.AX Income Statement | Balance Sheet | Cash Flow | A2 MILK

FPO NZ Stock - Yahoo Finance. Available at:

http://finance.yahoo.com/quote/A2M.AX/financials?ltr=1 [Accessed on 15 Dec. 2016].

Healy, P.M. and Palepu, K.G., (2012). Business Analysis Valuation: Using Financial Statements.

Cengage Learning.

Hsu, P.H., Tian, X. and Xu, Y., (2014). Financial development and innovation: Cross-country

evidence. Journal of Financial Economics, 112(1), pp.116-135.

Ioannou, I. and Serafeim, G., (2014). The consequences of mandatory corporate sustainability

reporting: evidence from four countries. Harvard Business School Research Working Paper, (11-

100).

Maditinos, D., Chatzoudes, D., Tsairidis, C. and Theriou, G., (2011). The impact of intellectual

capital on firms' market value and financial performance. Journal of intellectual capital, 12(1),

pp.132-151.

Scott-Clayton, J., (2011). On money and motivation a quasi-experimental analysis of financial

incentives for college achievement. Journal of Human Resources, 46(3), pp.614-646.

9

a2milk.com.au. (2016). Milk that’s naturally all A2 - a2Milk™ | Feel the Difference. Available

at: https://a2milk.com.au/ [Accessed on 15 Dec. 2016].

Au.finance.yahoo.com. (2016). AHF.AX Income Statement | AUSDAIRY STAPLED Stock -

Yahoo!7 Finance. Available at: https://au.finance.yahoo.com/q/is?s=AHF.AX&annual [Accessed

on 15 Dec. 2016].

Australiandairyfarmers.com.au. (2016). Dairy Farmers Australia | Dairy Advocacy Group |

Australian Dairy Farmers. Available at: http://www.australiandairyfarmers.com.au/ [Accessed

on 15 Dec. 2016].

Dieckmann, S. and Plank, T., (2012). Default risk of advanced economies: An empirical analysis

of credit default swaps during the financial crisis. Review of Finance, 16(4), pp.903-934.

Finance.yahoo.com. (2016). A2M.AX Income Statement | Balance Sheet | Cash Flow | A2 MILK

FPO NZ Stock - Yahoo Finance. Available at:

http://finance.yahoo.com/quote/A2M.AX/financials?ltr=1 [Accessed on 15 Dec. 2016].

Healy, P.M. and Palepu, K.G., (2012). Business Analysis Valuation: Using Financial Statements.

Cengage Learning.

Hsu, P.H., Tian, X. and Xu, Y., (2014). Financial development and innovation: Cross-country

evidence. Journal of Financial Economics, 112(1), pp.116-135.

Ioannou, I. and Serafeim, G., (2014). The consequences of mandatory corporate sustainability

reporting: evidence from four countries. Harvard Business School Research Working Paper, (11-

100).

Maditinos, D., Chatzoudes, D., Tsairidis, C. and Theriou, G., (2011). The impact of intellectual

capital on firms' market value and financial performance. Journal of intellectual capital, 12(1),

pp.132-151.

Scott-Clayton, J., (2011). On money and motivation a quasi-experimental analysis of financial

incentives for college achievement. Journal of Human Resources, 46(3), pp.614-646.

9

Woodford, M., (2010). Financial intermediation and macroeconomic analysis. The Journal of

Economic Perspectives, 24(4), pp.21-44.

Appendices:

1. Income statement of A2 milk:

Figure 1: Income statement

(Source: Finance.yahoo.com. 2016)

10

Economic Perspectives, 24(4), pp.21-44.

Appendices:

1. Income statement of A2 milk:

Figure 1: Income statement

(Source: Finance.yahoo.com. 2016)

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2. Cash flow statement of A2 milk:

Figure 2: Cash flow statement

(Source: Finance.yahoo.com. 2016)

11

Figure 2: Cash flow statement

(Source: Finance.yahoo.com. 2016)

11

3. Balance sheet of A2 milk:

Figure 3: Balance sheet

(Source: Finance.yahoo.com. 2016)

12

Figure 3: Balance sheet

(Source: Finance.yahoo.com. 2016)

12

4. Income statement of Dairy farmers:

Figure 4: Income statement

(Source: Au.finance.yahoo.com. 2016)

13

Figure 4: Income statement

(Source: Au.finance.yahoo.com. 2016)

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5. Cash flow statement of Dairy farmers:

Figure 5: Cash flow statement

(Source: Au.finance.yahoo.com. 2016)

14

Figure 5: Cash flow statement

(Source: Au.finance.yahoo.com. 2016)

14

6. Balance sheet of Dairy farmers:

Figure 6: Balance sheet

(Source: Au.finance.yahoo.com. 2016)

15

Figure 6: Balance sheet

(Source: Au.finance.yahoo.com. 2016)

15

16

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.