Acacia Coal Limited: A Comprehensive Financial Analysis

VerifiedAdded on 2024/05/31

|15

|2954

|339

AI Summary

This report provides a detailed financial analysis of Acacia Coal Limited, a company involved in coal mining and exploration in Australia. The analysis covers key financial ratios, share price performance, weighted average cost of capital, debt ratio, and dividend policy. The report also includes a graphical representation of data and a correlation analysis between the company's share price and the All Ordinaries Index. The analysis reveals that Acacia Coal has been struggling financially in recent years, with declining revenues and net losses. The report concludes with key suggestions for the company to improve its financial performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Table of Contents

Brief overview of Acacia Coal Limited.........................................................................................................2

Ownership and Governance of the company..............................................................................................2

Financial ratios of Acacia Coal.....................................................................................................................5

Graphical representation of data................................................................................................................7

Key aspects on share price........................................................................................................................10

Calculation of Weighted average cost of capital.......................................................................................10

Overall analysis of debt ratio.....................................................................................................................11

Dividend policy..........................................................................................................................................12

Key suggestions.........................................................................................................................................12

Conclusion.................................................................................................................................................12

References.................................................................................................................................................13

Brief overview of Acacia Coal Limited.........................................................................................................2

Ownership and Governance of the company..............................................................................................2

Financial ratios of Acacia Coal.....................................................................................................................5

Graphical representation of data................................................................................................................7

Key aspects on share price........................................................................................................................10

Calculation of Weighted average cost of capital.......................................................................................10

Overall analysis of debt ratio.....................................................................................................................11

Dividend policy..........................................................................................................................................12

Key suggestions.........................................................................................................................................12

Conclusion.................................................................................................................................................12

References.................................................................................................................................................13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Brief overview of Acacia Coal Limited

The main purpose of the assignment is to understand and apprehend a detaied financial ratio

analysis of a company which is seleted by the researcher, the study is mainly based on the

secondary data which is from the company financial reports and related websites. The company

which is selected by the student is Acacia coal limited which is mainly involved in the mining

and exploration of coal and related aspects in Australia, the main asset of the company is the

interest in the Comet Ride projects in the Central Queensland. Previously the company was

known as Newland resources and the name was changed into Acacial Coal limited in December

2011. The business enterprise mainly operates in the coal segmet and is more focused on the

Comet Ridget project number EPC 1230, the tenement is mainly surrounfed by Esham and other

operating coal mines in Rangal measures which produced thermal and coking products. The

exploration in the main region is mainly on the shallow hill coal in the south area. As of 2017,

the company posted a total revenue of 176,861 and a net loss of 2,470,979. The management of

the business is focused in implementing new strateges so as to enhance the value of the

shareholders and is focused in achieving efficiency in the project, this will enable them to

generate more profits for the business. The company tend to leverage the strength of the

employees and implement key measures which will enable them to expand the business and

generate more revenues and profits. (Acacia, 2017).

Ownership and Governance of the company

This part of the assignment deals in stating the ownership and governance aspects implemented

by the company

The main purpose of the assignment is to understand and apprehend a detaied financial ratio

analysis of a company which is seleted by the researcher, the study is mainly based on the

secondary data which is from the company financial reports and related websites. The company

which is selected by the student is Acacia coal limited which is mainly involved in the mining

and exploration of coal and related aspects in Australia, the main asset of the company is the

interest in the Comet Ride projects in the Central Queensland. Previously the company was

known as Newland resources and the name was changed into Acacial Coal limited in December

2011. The business enterprise mainly operates in the coal segmet and is more focused on the

Comet Ridget project number EPC 1230, the tenement is mainly surrounfed by Esham and other

operating coal mines in Rangal measures which produced thermal and coking products. The

exploration in the main region is mainly on the shallow hill coal in the south area. As of 2017,

the company posted a total revenue of 176,861 and a net loss of 2,470,979. The management of

the business is focused in implementing new strateges so as to enhance the value of the

shareholders and is focused in achieving efficiency in the project, this will enable them to

generate more profits for the business. The company tend to leverage the strength of the

employees and implement key measures which will enable them to expand the business and

generate more revenues and profits. (Acacia, 2017).

Ownership and Governance of the company

This part of the assignment deals in stating the ownership and governance aspects implemented

by the company

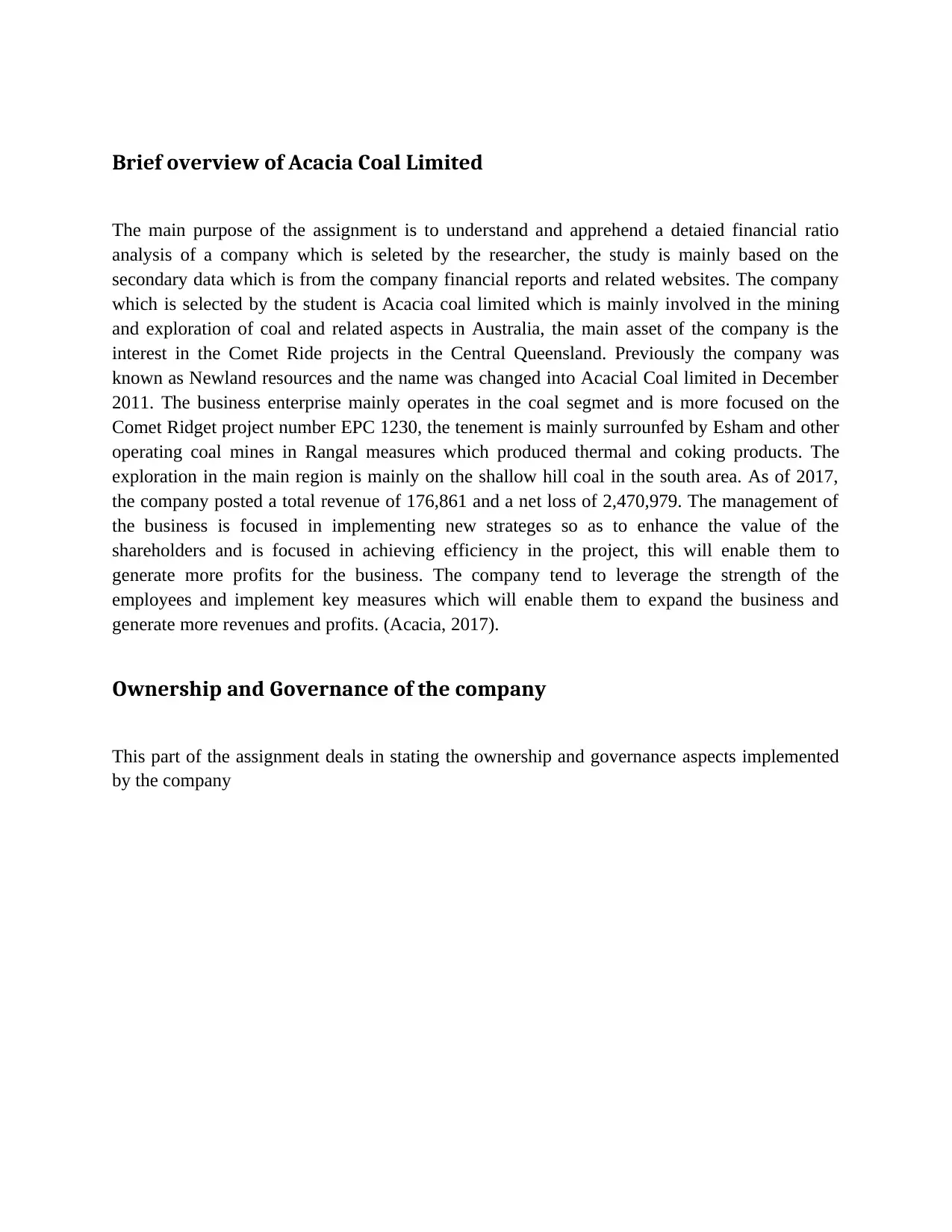

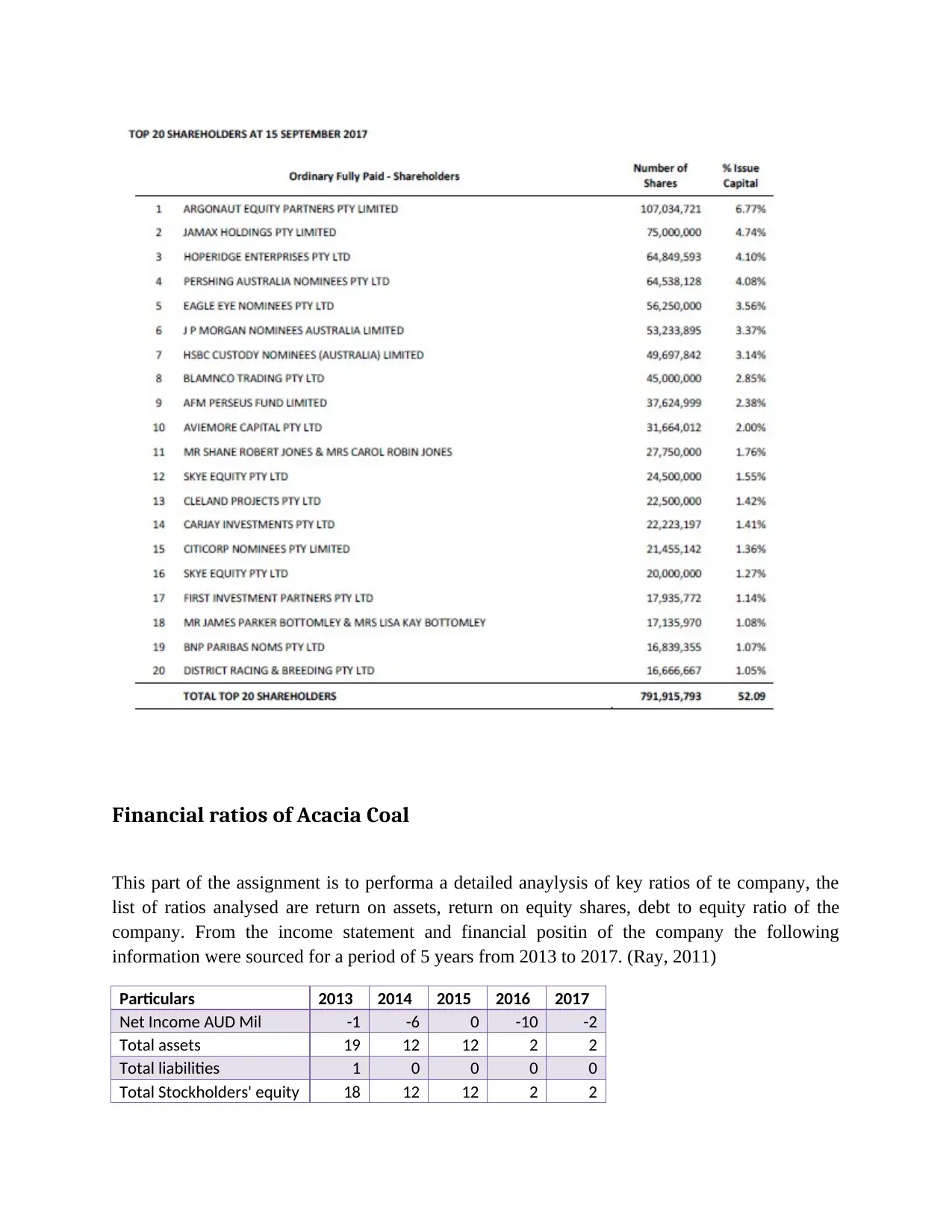

From the annual report of the company, it is noted that the Argonaut equity partners holds the

largest shares of the company, the equity partners tend to possess nearly 107,034,721 shares

which accounts to nearly 6.77%, the next largest shares were held by Jamax holdings they have

nearly 75,000,000 shares which is 4.74% of the total shares of the company, Hoperidge

enterprises possess 64,849,593 shares which is nearly 4.10%. The top 7 shareholders of the

company possess 29.74% of the total shares of the company.

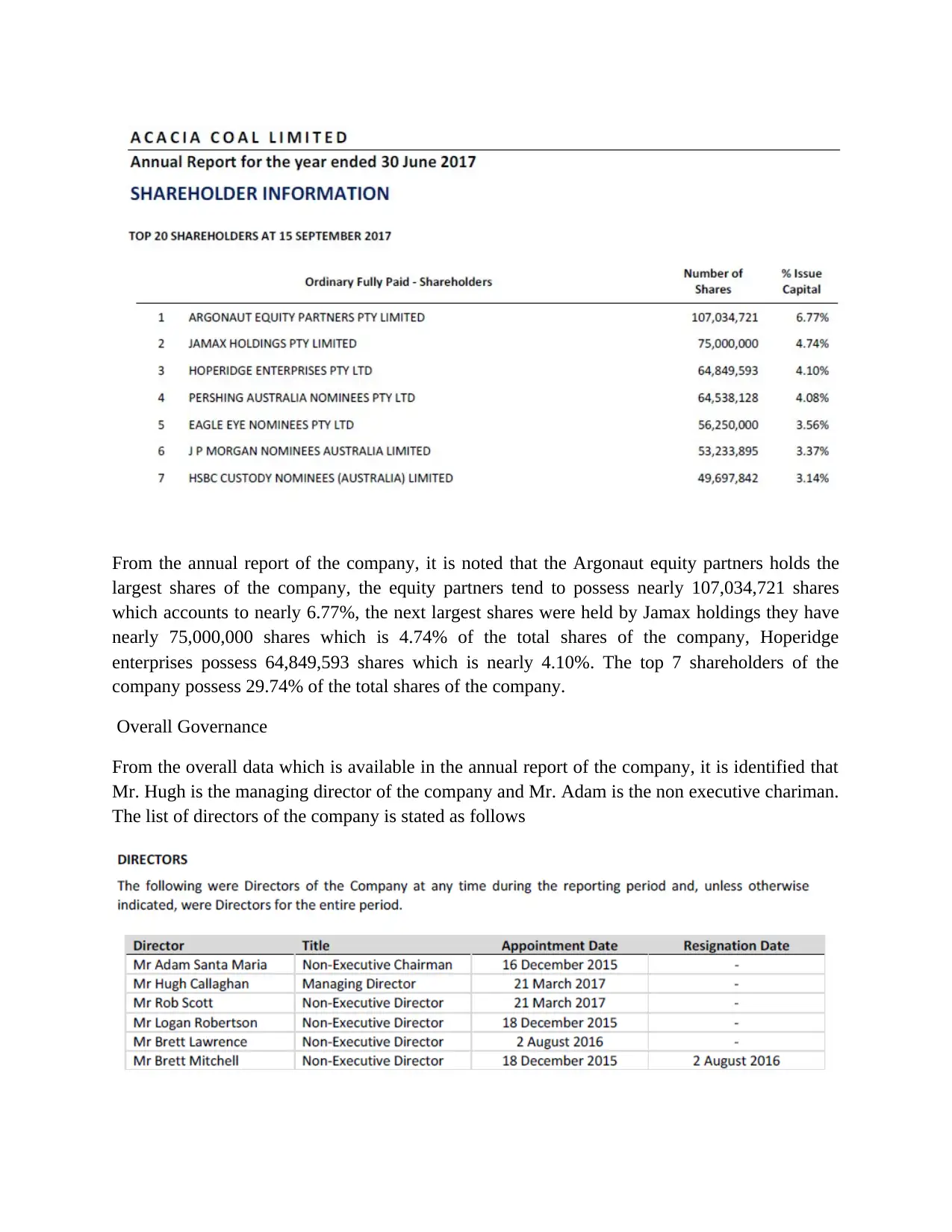

Overall Governance

From the overall data which is available in the annual report of the company, it is identified that

Mr. Hugh is the managing director of the company and Mr. Adam is the non executive chariman.

The list of directors of the company is stated as follows

largest shares of the company, the equity partners tend to possess nearly 107,034,721 shares

which accounts to nearly 6.77%, the next largest shares were held by Jamax holdings they have

nearly 75,000,000 shares which is 4.74% of the total shares of the company, Hoperidge

enterprises possess 64,849,593 shares which is nearly 4.10%. The top 7 shareholders of the

company possess 29.74% of the total shares of the company.

Overall Governance

From the overall data which is available in the annual report of the company, it is identified that

Mr. Hugh is the managing director of the company and Mr. Adam is the non executive chariman.

The list of directors of the company is stated as follows

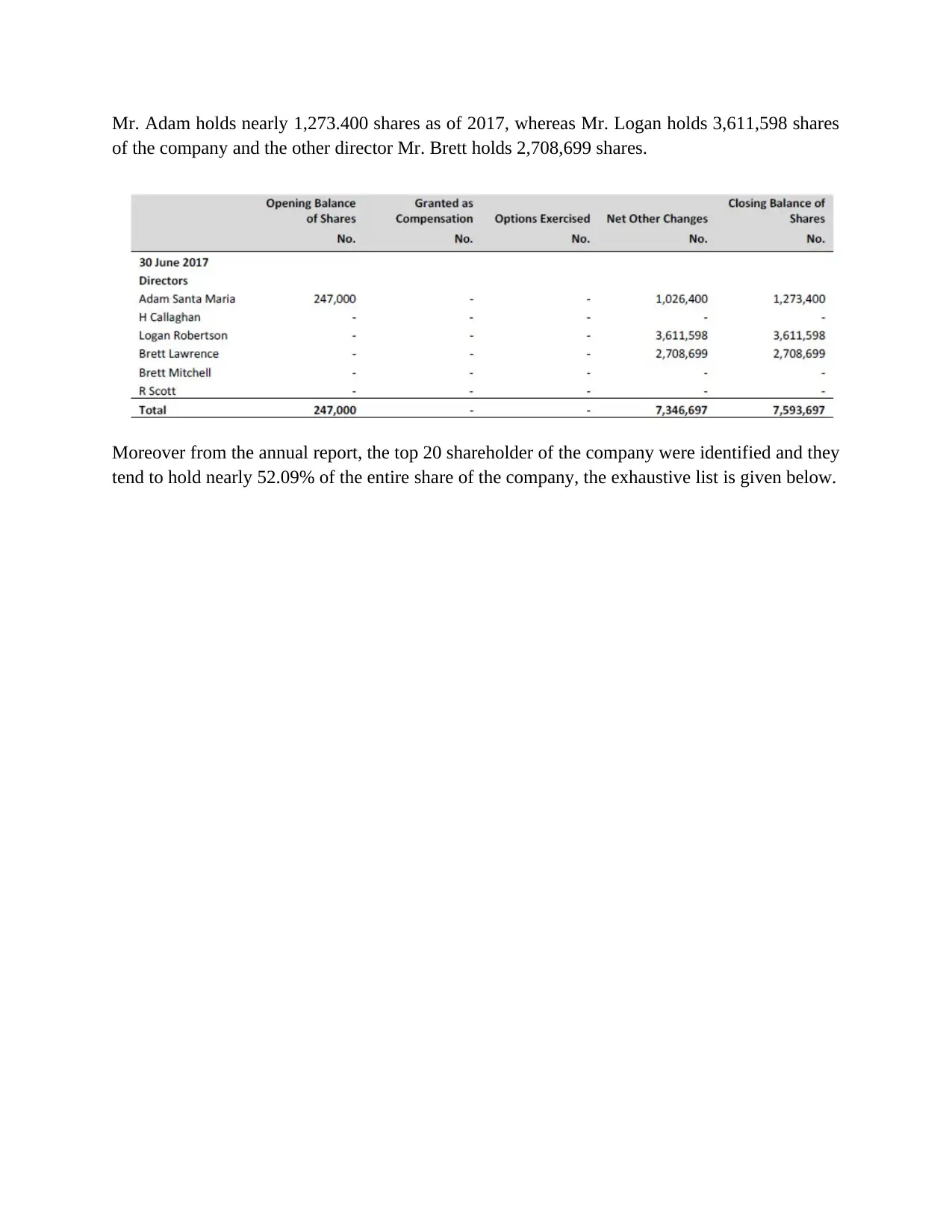

Mr. Adam holds nearly 1,273.400 shares as of 2017, whereas Mr. Logan holds 3,611,598 shares

of the company and the other director Mr. Brett holds 2,708,699 shares.

Moreover from the annual report, the top 20 shareholder of the company were identified and they

tend to hold nearly 52.09% of the entire share of the company, the exhaustive list is given below.

of the company and the other director Mr. Brett holds 2,708,699 shares.

Moreover from the annual report, the top 20 shareholder of the company were identified and they

tend to hold nearly 52.09% of the entire share of the company, the exhaustive list is given below.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

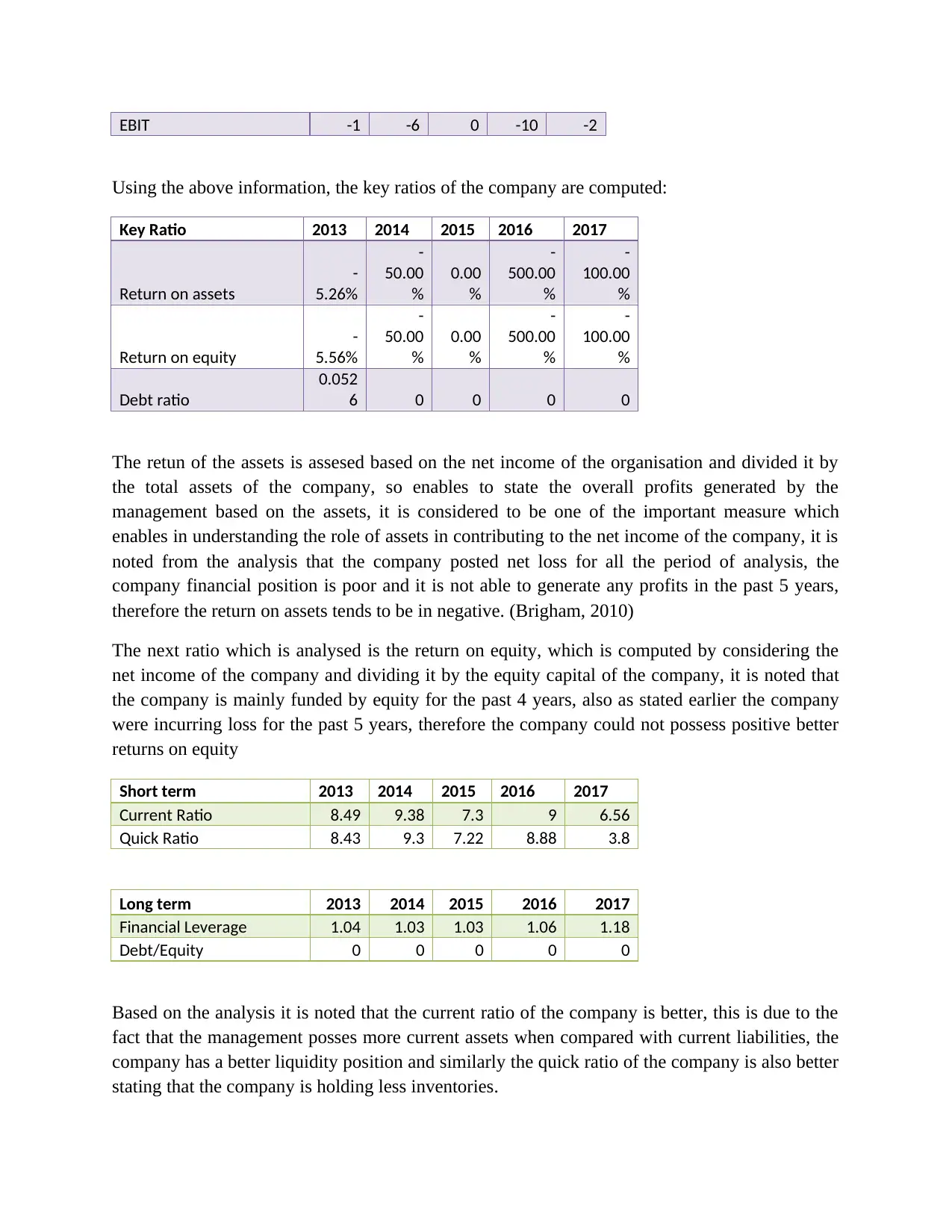

Financial ratios of Acacia Coal

This part of the assignment is to performa a detailed anaylysis of key ratios of te company, the

list of ratios analysed are return on assets, return on equity shares, debt to equity ratio of the

company. From the income statement and financial positin of the company the following

information were sourced for a period of 5 years from 2013 to 2017. (Ray, 2011)

Particulars 2013 2014 2015 2016 2017

Net Income AUD Mil -1 -6 0 -10 -2

Total assets 19 12 12 2 2

Total liabilities 1 0 0 0 0

Total Stockholders' equity 18 12 12 2 2

This part of the assignment is to performa a detailed anaylysis of key ratios of te company, the

list of ratios analysed are return on assets, return on equity shares, debt to equity ratio of the

company. From the income statement and financial positin of the company the following

information were sourced for a period of 5 years from 2013 to 2017. (Ray, 2011)

Particulars 2013 2014 2015 2016 2017

Net Income AUD Mil -1 -6 0 -10 -2

Total assets 19 12 12 2 2

Total liabilities 1 0 0 0 0

Total Stockholders' equity 18 12 12 2 2

EBIT -1 -6 0 -10 -2

Using the above information, the key ratios of the company are computed:

Key Ratio 2013 2014 2015 2016 2017

Return on assets

-

5.26%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Return on equity

-

5.56%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Debt ratio

0.052

6 0 0 0 0

The retun of the assets is assesed based on the net income of the organisation and divided it by

the total assets of the company, so enables to state the overall profits generated by the

management based on the assets, it is considered to be one of the important measure which

enables in understanding the role of assets in contributing to the net income of the company, it is

noted from the analysis that the company posted net loss for all the period of analysis, the

company financial position is poor and it is not able to generate any profits in the past 5 years,

therefore the return on assets tends to be in negative. (Brigham, 2010)

The next ratio which is analysed is the return on equity, which is computed by considering the

net income of the company and dividing it by the equity capital of the company, it is noted that

the company is mainly funded by equity for the past 4 years, also as stated earlier the company

were incurring loss for the past 5 years, therefore the company could not possess positive better

returns on equity

Short term 2013 2014 2015 2016 2017

Current Ratio 8.49 9.38 7.3 9 6.56

Quick Ratio 8.43 9.3 7.22 8.88 3.8

Long term 2013 2014 2015 2016 2017

Financial Leverage 1.04 1.03 1.03 1.06 1.18

Debt/Equity 0 0 0 0 0

Based on the analysis it is noted that the current ratio of the company is better, this is due to the

fact that the management posses more current assets when compared with current liabilities, the

company has a better liquidity position and similarly the quick ratio of the company is also better

stating that the company is holding less inventories.

Using the above information, the key ratios of the company are computed:

Key Ratio 2013 2014 2015 2016 2017

Return on assets

-

5.26%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Return on equity

-

5.56%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Debt ratio

0.052

6 0 0 0 0

The retun of the assets is assesed based on the net income of the organisation and divided it by

the total assets of the company, so enables to state the overall profits generated by the

management based on the assets, it is considered to be one of the important measure which

enables in understanding the role of assets in contributing to the net income of the company, it is

noted from the analysis that the company posted net loss for all the period of analysis, the

company financial position is poor and it is not able to generate any profits in the past 5 years,

therefore the return on assets tends to be in negative. (Brigham, 2010)

The next ratio which is analysed is the return on equity, which is computed by considering the

net income of the company and dividing it by the equity capital of the company, it is noted that

the company is mainly funded by equity for the past 4 years, also as stated earlier the company

were incurring loss for the past 5 years, therefore the company could not possess positive better

returns on equity

Short term 2013 2014 2015 2016 2017

Current Ratio 8.49 9.38 7.3 9 6.56

Quick Ratio 8.43 9.3 7.22 8.88 3.8

Long term 2013 2014 2015 2016 2017

Financial Leverage 1.04 1.03 1.03 1.06 1.18

Debt/Equity 0 0 0 0 0

Based on the analysis it is noted that the current ratio of the company is better, this is due to the

fact that the management posses more current assets when compared with current liabilities, the

company has a better liquidity position and similarly the quick ratio of the company is also better

stating that the company is holding less inventories.

Verification of Eq. 2013 2014 2015 2016 2017

EBIT/TA -0.05 -0.50 0.00 -5.00 -1.00

NPAT/EBIT 1.00 1.00 0.00 1.00 1.00

TA/OE 1.06 1.00 1.00 1.00 1.00

Product -0.06 -0.50 0.00 -5.00 -1.00

NPA/OE

-

0.056 -0.5 0 -5 -1

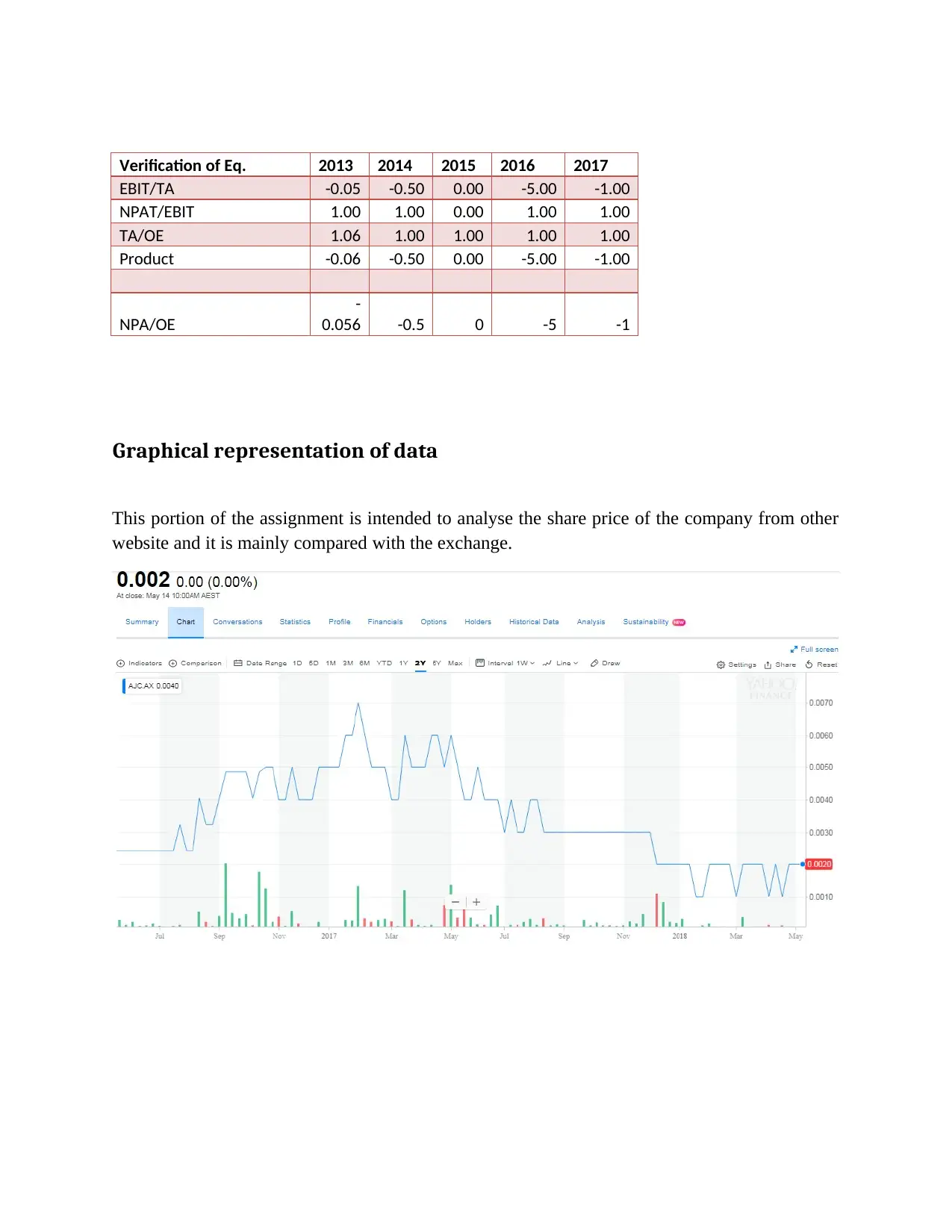

Graphical representation of data

This portion of the assignment is intended to analyse the share price of the company from other

website and it is mainly compared with the exchange.

EBIT/TA -0.05 -0.50 0.00 -5.00 -1.00

NPAT/EBIT 1.00 1.00 0.00 1.00 1.00

TA/OE 1.06 1.00 1.00 1.00 1.00

Product -0.06 -0.50 0.00 -5.00 -1.00

NPA/OE

-

0.056 -0.5 0 -5 -1

Graphical representation of data

This portion of the assignment is intended to analyse the share price of the company from other

website and it is mainly compared with the exchange.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The student will perform a detailed analysis of the stock price of the company in the previous 2

years and their measures is compared with the All ordinaries index for the given period of time,

the performance of the stock is very poor since the company incurred loss in the past 5 years,

whereas the market index has increased significantly during the given period.

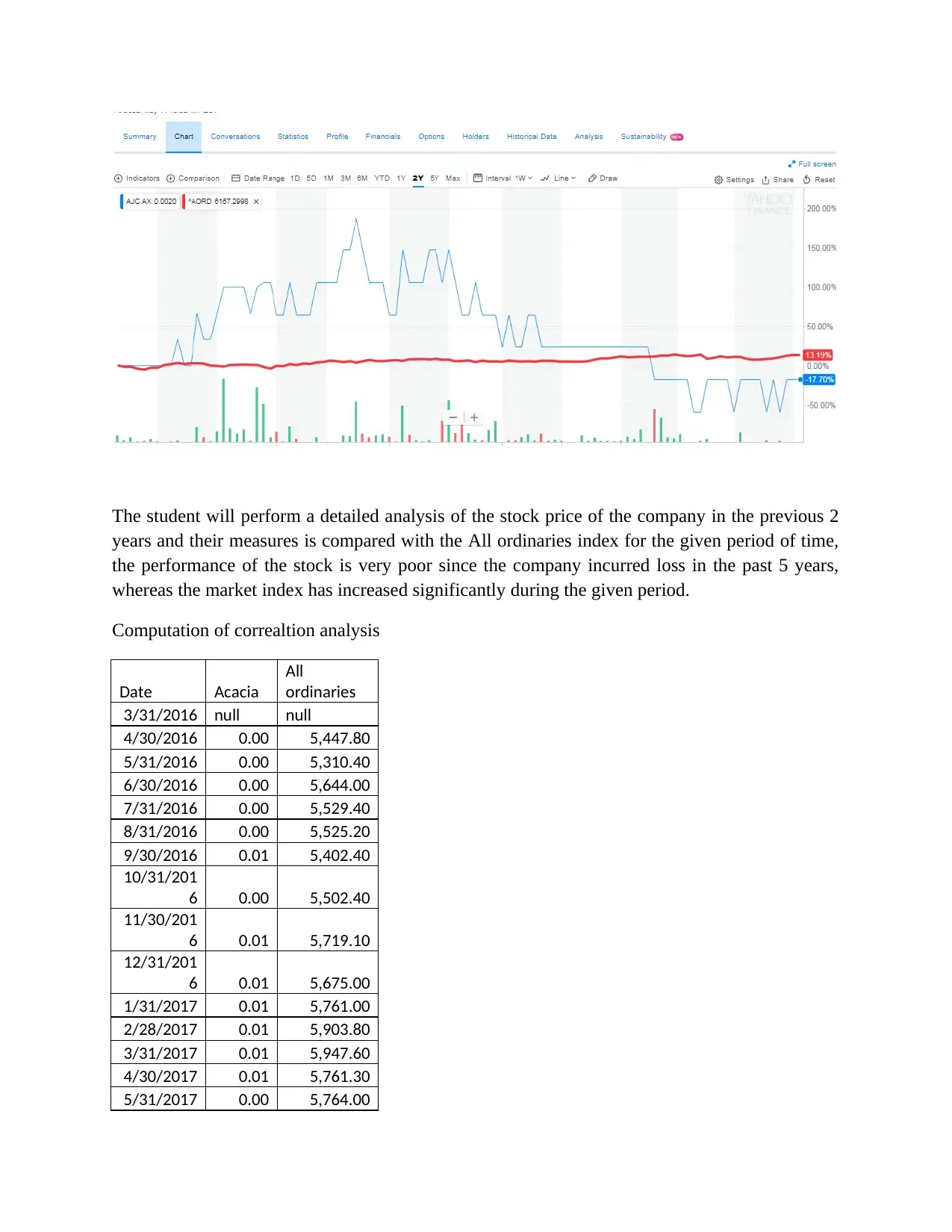

Computation of correaltion analysis

Date Acacia

All

ordinaries

3/31/2016 null null

4/30/2016 0.00 5,447.80

5/31/2016 0.00 5,310.40

6/30/2016 0.00 5,644.00

7/31/2016 0.00 5,529.40

8/31/2016 0.00 5,525.20

9/30/2016 0.01 5,402.40

10/31/201

6 0.00 5,502.40

11/30/201

6 0.01 5,719.10

12/31/201

6 0.01 5,675.00

1/31/2017 0.01 5,761.00

2/28/2017 0.01 5,903.80

3/31/2017 0.01 5,947.60

4/30/2017 0.01 5,761.30

5/31/2017 0.00 5,764.00

years and their measures is compared with the All ordinaries index for the given period of time,

the performance of the stock is very poor since the company incurred loss in the past 5 years,

whereas the market index has increased significantly during the given period.

Computation of correaltion analysis

Date Acacia

All

ordinaries

3/31/2016 null null

4/30/2016 0.00 5,447.80

5/31/2016 0.00 5,310.40

6/30/2016 0.00 5,644.00

7/31/2016 0.00 5,529.40

8/31/2016 0.00 5,525.20

9/30/2016 0.01 5,402.40

10/31/201

6 0.00 5,502.40

11/30/201

6 0.01 5,719.10

12/31/201

6 0.01 5,675.00

1/31/2017 0.01 5,761.00

2/28/2017 0.01 5,903.80

3/31/2017 0.01 5,947.60

4/30/2017 0.01 5,761.30

5/31/2017 0.00 5,764.00

6/30/2017 0.00 5,773.90

7/31/2017 0.00 5,776.30

8/31/2017 0.00 5,744.90

9/30/2017 0.00 5,976.40

10/31/201

7 0.00 6,057.20

11/30/201

7 0.00 6,167.30

12/31/201

7 0.00 6,146.50

1/31/2018 0.00 6,117.30

2/28/2018 0.00 5,868.90

3/31/2018 0.00 6,071.60

4/30/2018 0.00 6,197.20

5/14/2018 0.00 6,190.90

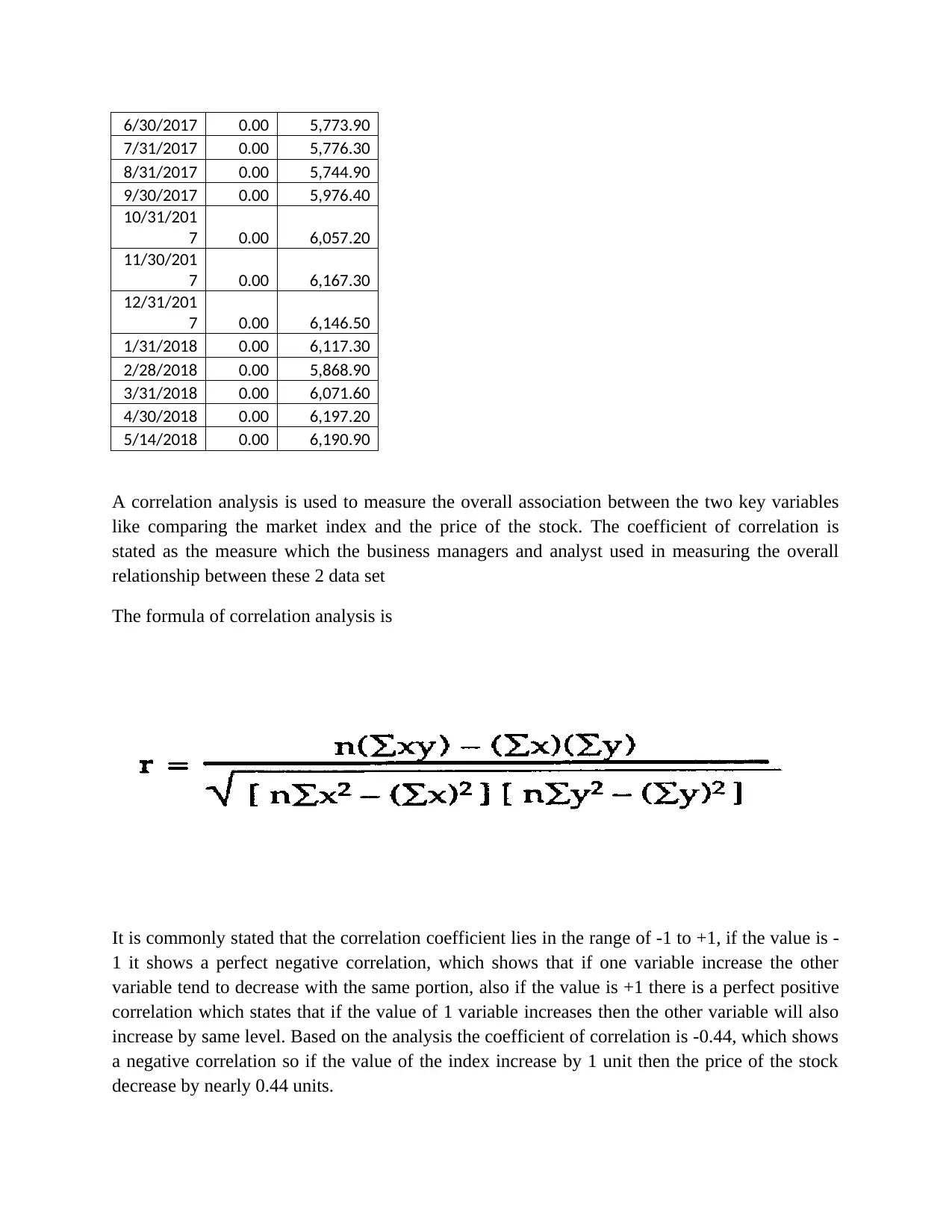

A correlation analysis is used to measure the overall association between the two key variables

like comparing the market index and the price of the stock. The coefficient of correlation is

stated as the measure which the business managers and analyst used in measuring the overall

relationship between these 2 data set

The formula of correlation analysis is

It is commonly stated that the correlation coefficient lies in the range of -1 to +1, if the value is -

1 it shows a perfect negative correlation, which shows that if one variable increase the other

variable tend to decrease with the same portion, also if the value is +1 there is a perfect positive

correlation which states that if the value of 1 variable increases then the other variable will also

increase by same level. Based on the analysis the coefficient of correlation is -0.44, which shows

a negative correlation so if the value of the index increase by 1 unit then the price of the stock

decrease by nearly 0.44 units.

7/31/2017 0.00 5,776.30

8/31/2017 0.00 5,744.90

9/30/2017 0.00 5,976.40

10/31/201

7 0.00 6,057.20

11/30/201

7 0.00 6,167.30

12/31/201

7 0.00 6,146.50

1/31/2018 0.00 6,117.30

2/28/2018 0.00 5,868.90

3/31/2018 0.00 6,071.60

4/30/2018 0.00 6,197.20

5/14/2018 0.00 6,190.90

A correlation analysis is used to measure the overall association between the two key variables

like comparing the market index and the price of the stock. The coefficient of correlation is

stated as the measure which the business managers and analyst used in measuring the overall

relationship between these 2 data set

The formula of correlation analysis is

It is commonly stated that the correlation coefficient lies in the range of -1 to +1, if the value is -

1 it shows a perfect negative correlation, which shows that if one variable increase the other

variable tend to decrease with the same portion, also if the value is +1 there is a perfect positive

correlation which states that if the value of 1 variable increases then the other variable will also

increase by same level. Based on the analysis the coefficient of correlation is -0.44, which shows

a negative correlation so if the value of the index increase by 1 unit then the price of the stock

decrease by nearly 0.44 units.

Key aspects on share price

Decrease in revenue: The main reason for the decrease in the price of the share is due to less

sales of the business, in the overall comparison of the business for the past 5 years it is noted that

the management could not generate adequate revenues, this impacts the net profits of the

company and its price.

No diversification: The company does not possess more assets or coal mines which impact the

price of the share, the business holds only a little portion of coal mines and the revenues from the

coal extraction is not sufficient for the company to meet all the expenses, moreover the company

did not diversify any other business

High operating cost: The business holds higher operating cost, this impact the overall profits and

share price of the company.

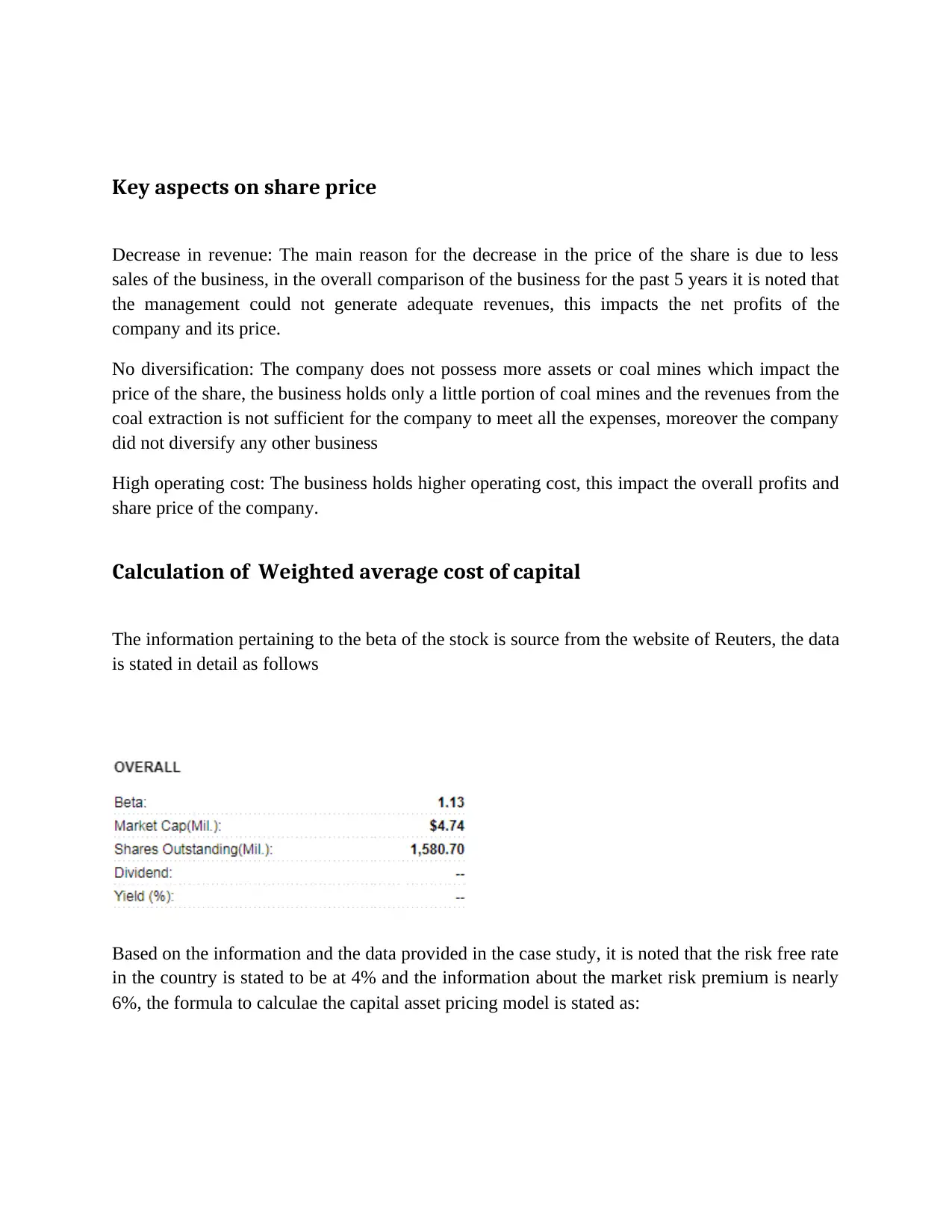

Calculation of Weighted average cost of capital

The information pertaining to the beta of the stock is source from the website of Reuters, the data

is stated in detail as follows

Based on the information and the data provided in the case study, it is noted that the risk free rate

in the country is stated to be at 4% and the information about the market risk premium is nearly

6%, the formula to calculae the capital asset pricing model is stated as:

Decrease in revenue: The main reason for the decrease in the price of the share is due to less

sales of the business, in the overall comparison of the business for the past 5 years it is noted that

the management could not generate adequate revenues, this impacts the net profits of the

company and its price.

No diversification: The company does not possess more assets or coal mines which impact the

price of the share, the business holds only a little portion of coal mines and the revenues from the

coal extraction is not sufficient for the company to meet all the expenses, moreover the company

did not diversify any other business

High operating cost: The business holds higher operating cost, this impact the overall profits and

share price of the company.

Calculation of Weighted average cost of capital

The information pertaining to the beta of the stock is source from the website of Reuters, the data

is stated in detail as follows

Based on the information and the data provided in the case study, it is noted that the risk free rate

in the country is stated to be at 4% and the information about the market risk premium is nearly

6%, the formula to calculae the capital asset pricing model is stated as:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Risk free rate of the country + Beta of the stock X premium of the market

= 4% + 1.13x 6%

= 4% + 6.78%

= 10.78%

Based on the analysis it is noted that the expected return of the stock by the equity shareholders =

10.78%

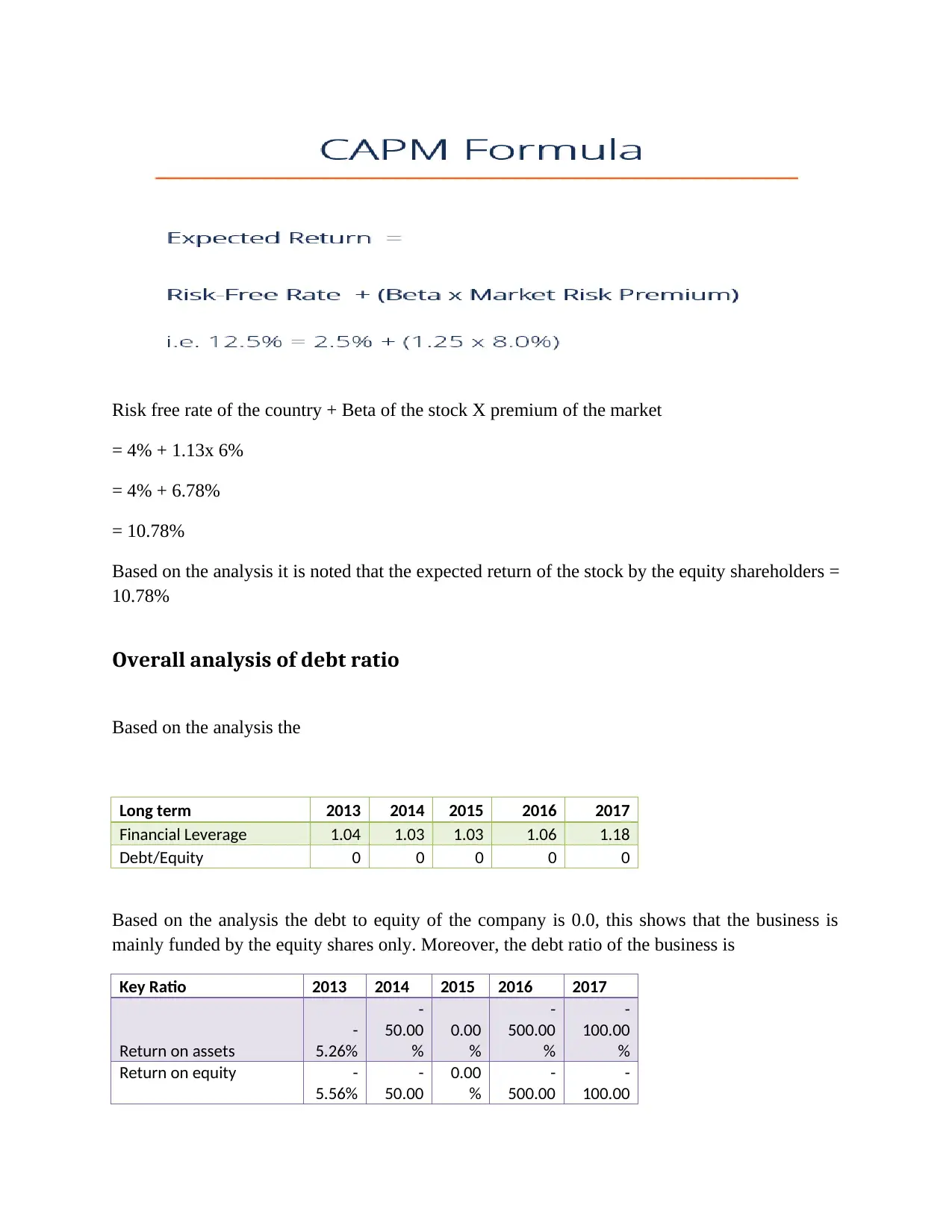

Overall analysis of debt ratio

Based on the analysis the

Long term 2013 2014 2015 2016 2017

Financial Leverage 1.04 1.03 1.03 1.06 1.18

Debt/Equity 0 0 0 0 0

Based on the analysis the debt to equity of the company is 0.0, this shows that the business is

mainly funded by the equity shares only. Moreover, the debt ratio of the business is

Key Ratio 2013 2014 2015 2016 2017

Return on assets

-

5.26%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Return on equity -

5.56%

-

50.00

0.00

%

-

500.00

-

100.00

= 4% + 1.13x 6%

= 4% + 6.78%

= 10.78%

Based on the analysis it is noted that the expected return of the stock by the equity shareholders =

10.78%

Overall analysis of debt ratio

Based on the analysis the

Long term 2013 2014 2015 2016 2017

Financial Leverage 1.04 1.03 1.03 1.06 1.18

Debt/Equity 0 0 0 0 0

Based on the analysis the debt to equity of the company is 0.0, this shows that the business is

mainly funded by the equity shares only. Moreover, the debt ratio of the business is

Key Ratio 2013 2014 2015 2016 2017

Return on assets

-

5.26%

-

50.00

%

0.00

%

-

500.00

%

-

100.00

%

Return on equity -

5.56%

-

50.00

0.00

%

-

500.00

-

100.00

% % %

Debt ratio

0.052

6 0 0 0 0

Dividend policy

Based on the analysis it is noted that the company has not declared any dividends to the

shareholders this is mainly due to the net loss incurred by the business for the past 5 years. The

management of the company is poised to increase the revenue and profits of the company.

Key suggestions

With this comment, the student use data from the last 12 months to update the latest update

results for the term annually or in some cases the latest annual report is the latest financial data.

This allows me to compare different companies with the most important data points. For

acacacol, the last half of the results - $ 2.39 million, which has been more negative compared

with the previous year. Since these numbers can be calculated in the short term, I calculated a

five-year profit from a coal gain of $ 3.10 million a year. This means net profit negative, has

become less negative in recent years. Looking further at the loss of Acacia Coal, we can

investigate which industries have been in recent years. In the last five years, colony calacia fell

on average by -22.98%. This unfavorable movement in the company can not break down the

driving force. Is the opposite wind all over the region? The Australian oil and gas industry

accelerated growth, which more than doubled its average sales last year and 12.36% double-digit

growth over the last five years. This shows that acacia could not make a profit, unlike the

corresponding industries.

While earlier data from Acacia Coal are useful, it's only an aspect of my investment thesis. For

today's red business it's always hard to tell what's going to happen in the future and when. The

most reliable step is to assess the business issues facing Acacia Seeds and to examine how the

guidelines are followed consistently in the past. I suggest continuing the Acacia Coal survey to

look more holistic: Financial Health: Is AJC's business economically profitable? The scale is

difficult to analyze, so we did it for you. Check your financial verification here.

Conclusion

Thus from the analysis it is identified that the performance of the company is very poor and the

business could not able to generate more revenues and profits in the past 5 years. So, the investor

can look to ignore the stock as the future prospect of the business is very weak. The company

need to focus in increasing the sales of the company and control the operating cost.

Debt ratio

0.052

6 0 0 0 0

Dividend policy

Based on the analysis it is noted that the company has not declared any dividends to the

shareholders this is mainly due to the net loss incurred by the business for the past 5 years. The

management of the company is poised to increase the revenue and profits of the company.

Key suggestions

With this comment, the student use data from the last 12 months to update the latest update

results for the term annually or in some cases the latest annual report is the latest financial data.

This allows me to compare different companies with the most important data points. For

acacacol, the last half of the results - $ 2.39 million, which has been more negative compared

with the previous year. Since these numbers can be calculated in the short term, I calculated a

five-year profit from a coal gain of $ 3.10 million a year. This means net profit negative, has

become less negative in recent years. Looking further at the loss of Acacia Coal, we can

investigate which industries have been in recent years. In the last five years, colony calacia fell

on average by -22.98%. This unfavorable movement in the company can not break down the

driving force. Is the opposite wind all over the region? The Australian oil and gas industry

accelerated growth, which more than doubled its average sales last year and 12.36% double-digit

growth over the last five years. This shows that acacia could not make a profit, unlike the

corresponding industries.

While earlier data from Acacia Coal are useful, it's only an aspect of my investment thesis. For

today's red business it's always hard to tell what's going to happen in the future and when. The

most reliable step is to assess the business issues facing Acacia Seeds and to examine how the

guidelines are followed consistently in the past. I suggest continuing the Acacia Coal survey to

look more holistic: Financial Health: Is AJC's business economically profitable? The scale is

difficult to analyze, so we did it for you. Check your financial verification here.

Conclusion

Thus from the analysis it is identified that the performance of the company is very poor and the

business could not able to generate more revenues and profits in the past 5 years. So, the investor

can look to ignore the stock as the future prospect of the business is very weak. The company

need to focus in increasing the sales of the company and control the operating cost.

References

Acacia (2017). Annual report of Acacia Coal Limited

Berman, K. (2013). Financial Intelligence. 2nd edition. Harvard Business Review Press.

Bragg, Steven. (2017). Throughput Accounting: A Guide to Constraint Management. 1st edition.

Wiley & Sons

Brigham, E. F. (2010). Financial Management: Theory & Practice. 5th edition. Cengage

Learning.

Brooks, R. M. (2012). Financial Management. 4th edition. Prentice Hall.

Kaplan, R. S., & Young, M. S. (2011). Management Accounting. 3rd edition. Prentice Hall.

Ray, G., & Eric, N. (2011). Managerial Accounting. McGraw-Hill/Irwin.

Titman, S. J. (2010). Financial Management. Prentice Hall.

Weygandt. (2011). Managerial Accounting: Tools for Business Decision Making (6th ed.).

Wiley.

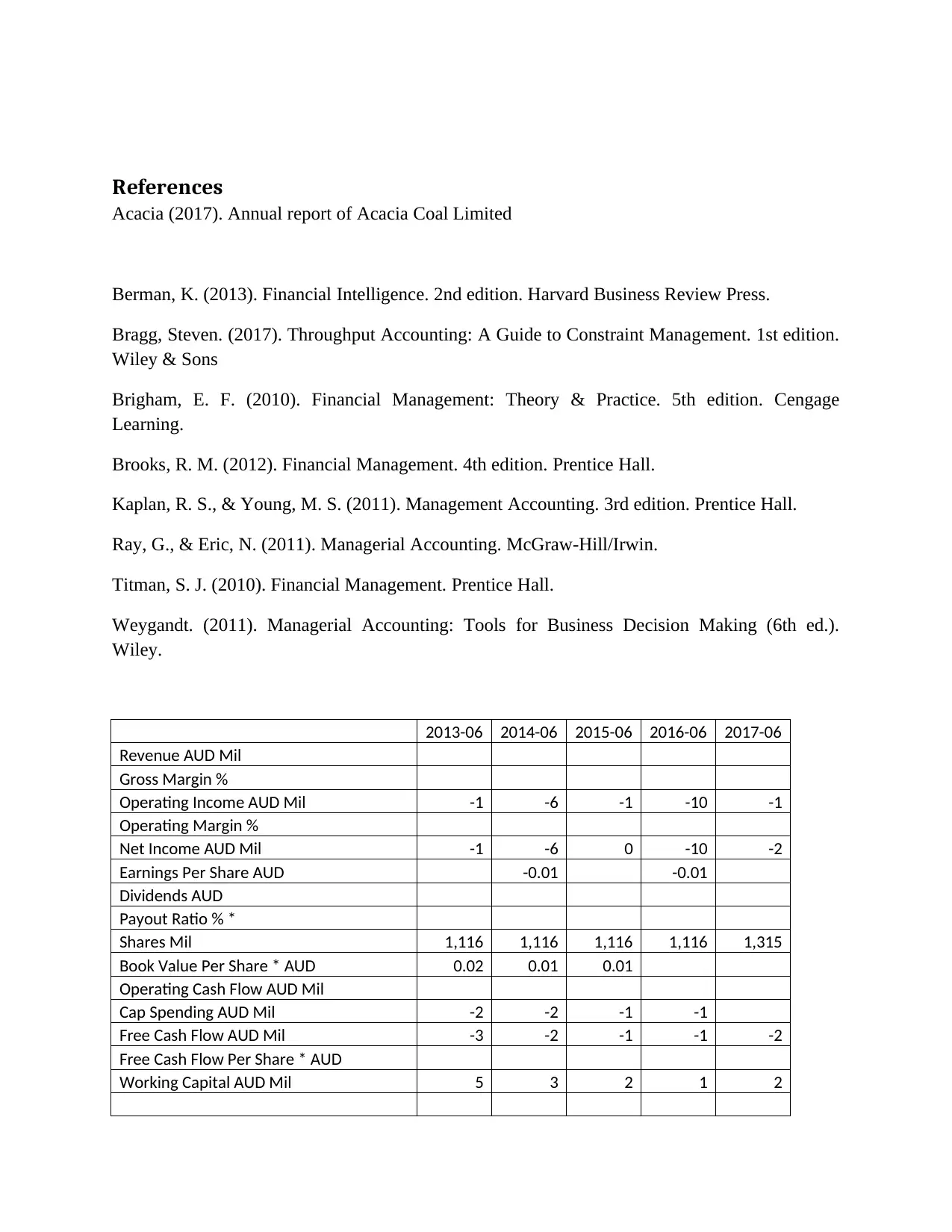

2013-06 2014-06 2015-06 2016-06 2017-06

Revenue AUD Mil

Gross Margin %

Operating Income AUD Mil -1 -6 -1 -10 -1

Operating Margin %

Net Income AUD Mil -1 -6 0 -10 -2

Earnings Per Share AUD -0.01 -0.01

Dividends AUD

Payout Ratio % *

Shares Mil 1,116 1,116 1,116 1,116 1,315

Book Value Per Share * AUD 0.02 0.01 0.01

Operating Cash Flow AUD Mil

Cap Spending AUD Mil -2 -2 -1 -1

Free Cash Flow AUD Mil -3 -2 -1 -1 -2

Free Cash Flow Per Share * AUD

Working Capital AUD Mil 5 3 2 1 2

Acacia (2017). Annual report of Acacia Coal Limited

Berman, K. (2013). Financial Intelligence. 2nd edition. Harvard Business Review Press.

Bragg, Steven. (2017). Throughput Accounting: A Guide to Constraint Management. 1st edition.

Wiley & Sons

Brigham, E. F. (2010). Financial Management: Theory & Practice. 5th edition. Cengage

Learning.

Brooks, R. M. (2012). Financial Management. 4th edition. Prentice Hall.

Kaplan, R. S., & Young, M. S. (2011). Management Accounting. 3rd edition. Prentice Hall.

Ray, G., & Eric, N. (2011). Managerial Accounting. McGraw-Hill/Irwin.

Titman, S. J. (2010). Financial Management. Prentice Hall.

Weygandt. (2011). Managerial Accounting: Tools for Business Decision Making (6th ed.).

Wiley.

2013-06 2014-06 2015-06 2016-06 2017-06

Revenue AUD Mil

Gross Margin %

Operating Income AUD Mil -1 -6 -1 -10 -1

Operating Margin %

Net Income AUD Mil -1 -6 0 -10 -2

Earnings Per Share AUD -0.01 -0.01

Dividends AUD

Payout Ratio % *

Shares Mil 1,116 1,116 1,116 1,116 1,315

Book Value Per Share * AUD 0.02 0.01 0.01

Operating Cash Flow AUD Mil

Cap Spending AUD Mil -2 -2 -1 -1

Free Cash Flow AUD Mil -3 -2 -1 -1 -2

Free Cash Flow Per Share * AUD

Working Capital AUD Mil 5 3 2 1 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

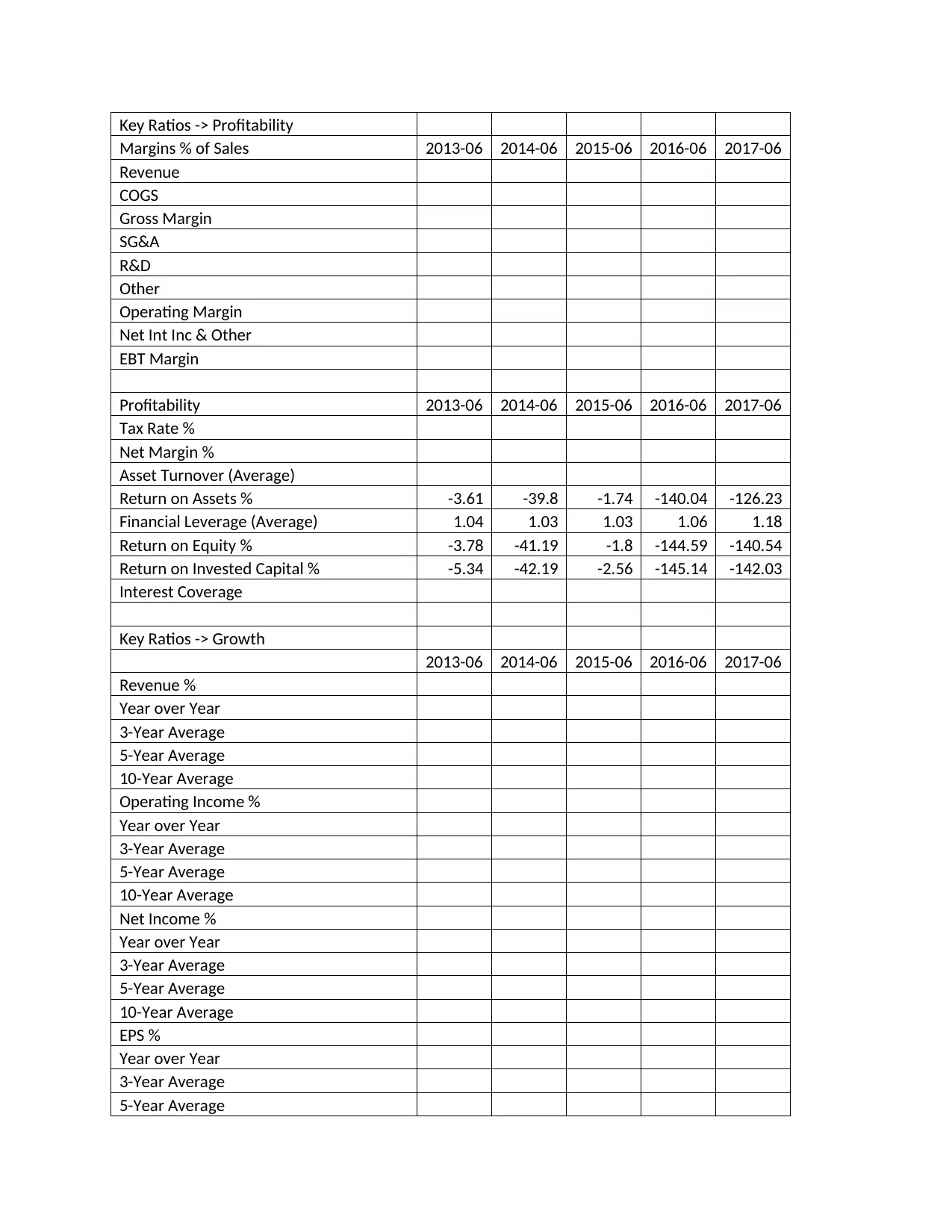

Key Ratios -> Profitability

Margins % of Sales 2013-06 2014-06 2015-06 2016-06 2017-06

Revenue

COGS

Gross Margin

SG&A

R&D

Other

Operating Margin

Net Int Inc & Other

EBT Margin

Profitability 2013-06 2014-06 2015-06 2016-06 2017-06

Tax Rate %

Net Margin %

Asset Turnover (Average)

Return on Assets % -3.61 -39.8 -1.74 -140.04 -126.23

Financial Leverage (Average) 1.04 1.03 1.03 1.06 1.18

Return on Equity % -3.78 -41.19 -1.8 -144.59 -140.54

Return on Invested Capital % -5.34 -42.19 -2.56 -145.14 -142.03

Interest Coverage

Key Ratios -> Growth

2013-06 2014-06 2015-06 2016-06 2017-06

Revenue %

Year over Year

3-Year Average

5-Year Average

10-Year Average

Operating Income %

Year over Year

3-Year Average

5-Year Average

10-Year Average

Net Income %

Year over Year

3-Year Average

5-Year Average

10-Year Average

EPS %

Year over Year

3-Year Average

5-Year Average

Margins % of Sales 2013-06 2014-06 2015-06 2016-06 2017-06

Revenue

COGS

Gross Margin

SG&A

R&D

Other

Operating Margin

Net Int Inc & Other

EBT Margin

Profitability 2013-06 2014-06 2015-06 2016-06 2017-06

Tax Rate %

Net Margin %

Asset Turnover (Average)

Return on Assets % -3.61 -39.8 -1.74 -140.04 -126.23

Financial Leverage (Average) 1.04 1.03 1.03 1.06 1.18

Return on Equity % -3.78 -41.19 -1.8 -144.59 -140.54

Return on Invested Capital % -5.34 -42.19 -2.56 -145.14 -142.03

Interest Coverage

Key Ratios -> Growth

2013-06 2014-06 2015-06 2016-06 2017-06

Revenue %

Year over Year

3-Year Average

5-Year Average

10-Year Average

Operating Income %

Year over Year

3-Year Average

5-Year Average

10-Year Average

Net Income %

Year over Year

3-Year Average

5-Year Average

10-Year Average

EPS %

Year over Year

3-Year Average

5-Year Average

10-Year Average

Key Ratios -> Cash Flow

Cash Flow Ratios 2013-06 2014-06 2015-06 2016-06 2017-06

Operating Cash Flow Growth % YOY

Free Cash Flow Growth % YOY

Cap Ex as a % of Sales

Free Cash Flow/Sales %

Free Cash Flow/Net Income 4.25 0.29 6.25 0.13 0.62

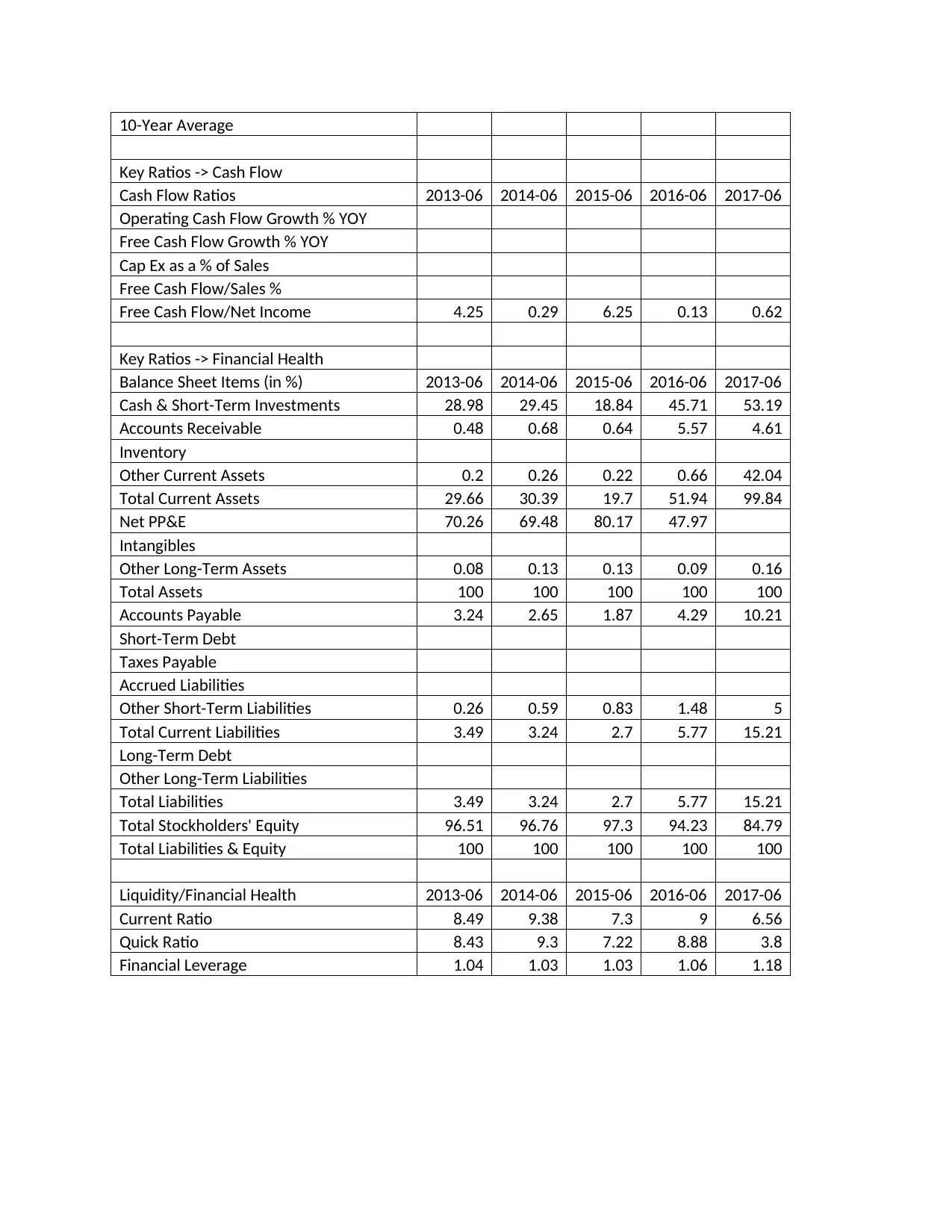

Key Ratios -> Financial Health

Balance Sheet Items (in %) 2013-06 2014-06 2015-06 2016-06 2017-06

Cash & Short-Term Investments 28.98 29.45 18.84 45.71 53.19

Accounts Receivable 0.48 0.68 0.64 5.57 4.61

Inventory

Other Current Assets 0.2 0.26 0.22 0.66 42.04

Total Current Assets 29.66 30.39 19.7 51.94 99.84

Net PP&E 70.26 69.48 80.17 47.97

Intangibles

Other Long-Term Assets 0.08 0.13 0.13 0.09 0.16

Total Assets 100 100 100 100 100

Accounts Payable 3.24 2.65 1.87 4.29 10.21

Short-Term Debt

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 0.26 0.59 0.83 1.48 5

Total Current Liabilities 3.49 3.24 2.7 5.77 15.21

Long-Term Debt

Other Long-Term Liabilities

Total Liabilities 3.49 3.24 2.7 5.77 15.21

Total Stockholders' Equity 96.51 96.76 97.3 94.23 84.79

Total Liabilities & Equity 100 100 100 100 100

Liquidity/Financial Health 2013-06 2014-06 2015-06 2016-06 2017-06

Current Ratio 8.49 9.38 7.3 9 6.56

Quick Ratio 8.43 9.3 7.22 8.88 3.8

Financial Leverage 1.04 1.03 1.03 1.06 1.18

Key Ratios -> Cash Flow

Cash Flow Ratios 2013-06 2014-06 2015-06 2016-06 2017-06

Operating Cash Flow Growth % YOY

Free Cash Flow Growth % YOY

Cap Ex as a % of Sales

Free Cash Flow/Sales %

Free Cash Flow/Net Income 4.25 0.29 6.25 0.13 0.62

Key Ratios -> Financial Health

Balance Sheet Items (in %) 2013-06 2014-06 2015-06 2016-06 2017-06

Cash & Short-Term Investments 28.98 29.45 18.84 45.71 53.19

Accounts Receivable 0.48 0.68 0.64 5.57 4.61

Inventory

Other Current Assets 0.2 0.26 0.22 0.66 42.04

Total Current Assets 29.66 30.39 19.7 51.94 99.84

Net PP&E 70.26 69.48 80.17 47.97

Intangibles

Other Long-Term Assets 0.08 0.13 0.13 0.09 0.16

Total Assets 100 100 100 100 100

Accounts Payable 3.24 2.65 1.87 4.29 10.21

Short-Term Debt

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 0.26 0.59 0.83 1.48 5

Total Current Liabilities 3.49 3.24 2.7 5.77 15.21

Long-Term Debt

Other Long-Term Liabilities

Total Liabilities 3.49 3.24 2.7 5.77 15.21

Total Stockholders' Equity 96.51 96.76 97.3 94.23 84.79

Total Liabilities & Equity 100 100 100 100 100

Liquidity/Financial Health 2013-06 2014-06 2015-06 2016-06 2017-06

Current Ratio 8.49 9.38 7.3 9 6.56

Quick Ratio 8.43 9.3 7.22 8.88 3.8

Financial Leverage 1.04 1.03 1.03 1.06 1.18

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.