ACC306 - Portfolio and FCF Analysis: Stock Performance Review

VerifiedAdded on 2020/05/28

|18

|2614

|87

Project

AI Summary

This ACC306 project analyzes the performance of a stock portfolio over a 10-week period, including the percentage change in stock prices for companies like Harvey Norman, BHP Billiton, Oil Search, and OM Holdings. The analysis compares the portfolio's returns with those of other students and the Australian Securities Exchange (ASX) index. It also examines the influence of the Australian market and foreign currency exchange rates on the performance of Australian-based multinational corporations and foreign stocks. Furthermore, the project delves into free cash flow (FCF) analysis for 2009, evaluating FCF with and without growth projections. The student reviews annual reports and news articles to support the financial analysis and determine whether foreign stock prices are correlated. Overall, the assignment offers a comprehensive financial analysis of stock performance, portfolio returns, and FCF valuation.

Running head: ACC306

ACC306

Name of the Student:

Name of the University:

Authors Note:

ACC306

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACC306

1

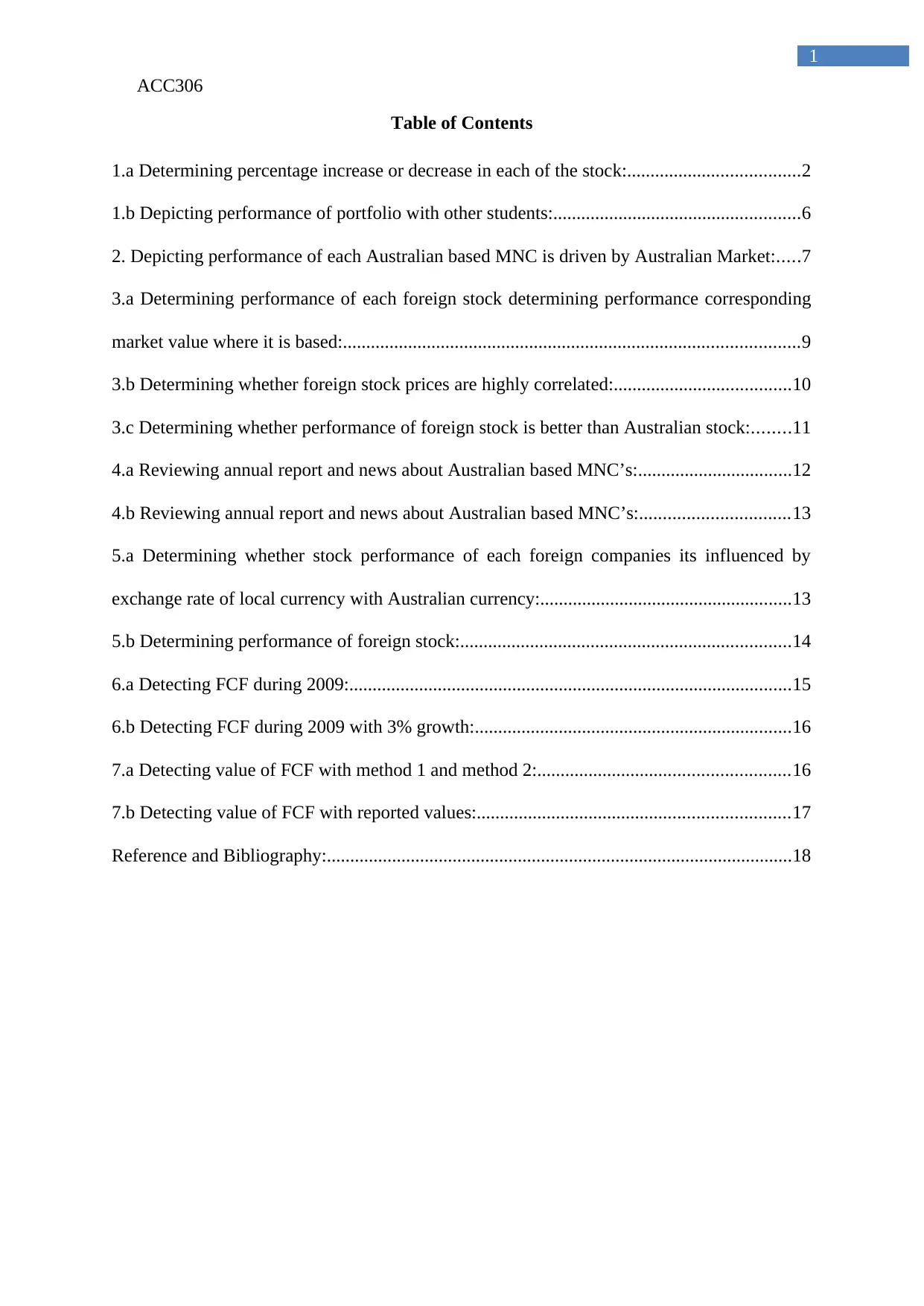

Table of Contents

1.a Determining percentage increase or decrease in each of the stock:.....................................2

1.b Depicting performance of portfolio with other students:.....................................................6

2. Depicting performance of each Australian based MNC is driven by Australian Market:.....7

3.a Determining performance of each foreign stock determining performance corresponding

market value where it is based:..................................................................................................9

3.b Determining whether foreign stock prices are highly correlated:......................................10

3.c Determining whether performance of foreign stock is better than Australian stock:........11

4.a Reviewing annual report and news about Australian based MNC’s:.................................12

4.b Reviewing annual report and news about Australian based MNC’s:................................13

5.a Determining whether stock performance of each foreign companies its influenced by

exchange rate of local currency with Australian currency:......................................................13

5.b Determining performance of foreign stock:.......................................................................14

6.a Detecting FCF during 2009:...............................................................................................15

6.b Detecting FCF during 2009 with 3% growth:....................................................................16

7.a Detecting value of FCF with method 1 and method 2:......................................................16

7.b Detecting value of FCF with reported values:...................................................................17

Reference and Bibliography:....................................................................................................18

1

Table of Contents

1.a Determining percentage increase or decrease in each of the stock:.....................................2

1.b Depicting performance of portfolio with other students:.....................................................6

2. Depicting performance of each Australian based MNC is driven by Australian Market:.....7

3.a Determining performance of each foreign stock determining performance corresponding

market value where it is based:..................................................................................................9

3.b Determining whether foreign stock prices are highly correlated:......................................10

3.c Determining whether performance of foreign stock is better than Australian stock:........11

4.a Reviewing annual report and news about Australian based MNC’s:.................................12

4.b Reviewing annual report and news about Australian based MNC’s:................................13

5.a Determining whether stock performance of each foreign companies its influenced by

exchange rate of local currency with Australian currency:......................................................13

5.b Determining performance of foreign stock:.......................................................................14

6.a Detecting FCF during 2009:...............................................................................................15

6.b Detecting FCF during 2009 with 3% growth:....................................................................16

7.a Detecting value of FCF with method 1 and method 2:......................................................16

7.b Detecting value of FCF with reported values:...................................................................17

Reference and Bibliography:....................................................................................................18

ACC306

2

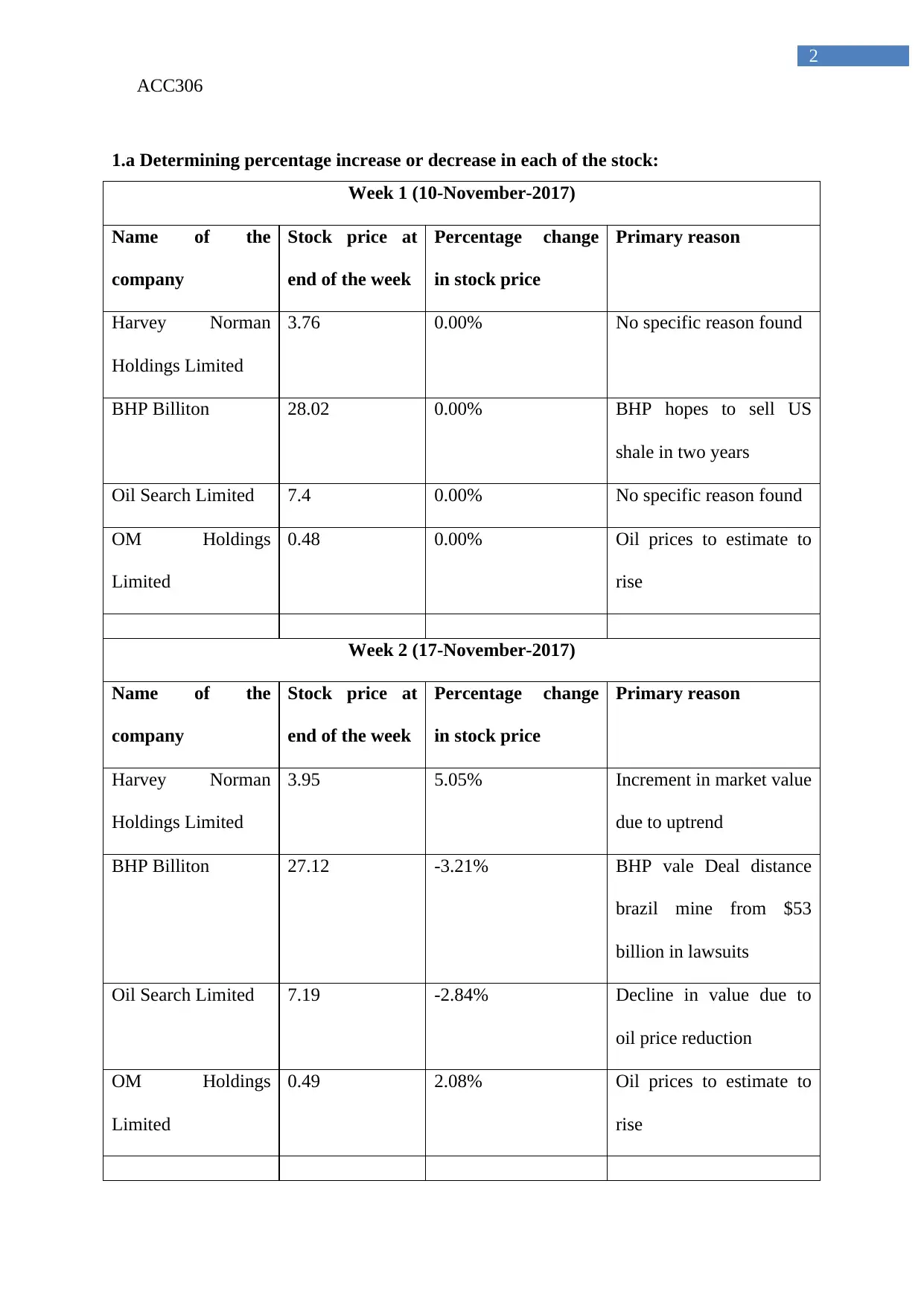

1.a Determining percentage increase or decrease in each of the stock:

Week 1 (10-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.76 0.00% No specific reason found

BHP Billiton 28.02 0.00% BHP hopes to sell US

shale in two years

Oil Search Limited 7.4 0.00% No specific reason found

OM Holdings

Limited

0.48 0.00% Oil prices to estimate to

rise

Week 2 (17-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.95 5.05% Increment in market value

due to uptrend

BHP Billiton 27.12 -3.21% BHP vale Deal distance

brazil mine from $53

billion in lawsuits

Oil Search Limited 7.19 -2.84% Decline in value due to

oil price reduction

OM Holdings

Limited

0.49 2.08% Oil prices to estimate to

rise

2

1.a Determining percentage increase or decrease in each of the stock:

Week 1 (10-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.76 0.00% No specific reason found

BHP Billiton 28.02 0.00% BHP hopes to sell US

shale in two years

Oil Search Limited 7.4 0.00% No specific reason found

OM Holdings

Limited

0.48 0.00% Oil prices to estimate to

rise

Week 2 (17-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.95 5.05% Increment in market value

due to uptrend

BHP Billiton 27.12 -3.21% BHP vale Deal distance

brazil mine from $53

billion in lawsuits

Oil Search Limited 7.19 -2.84% Decline in value due to

oil price reduction

OM Holdings

Limited

0.49 2.08% Oil prices to estimate to

rise

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACC306

3

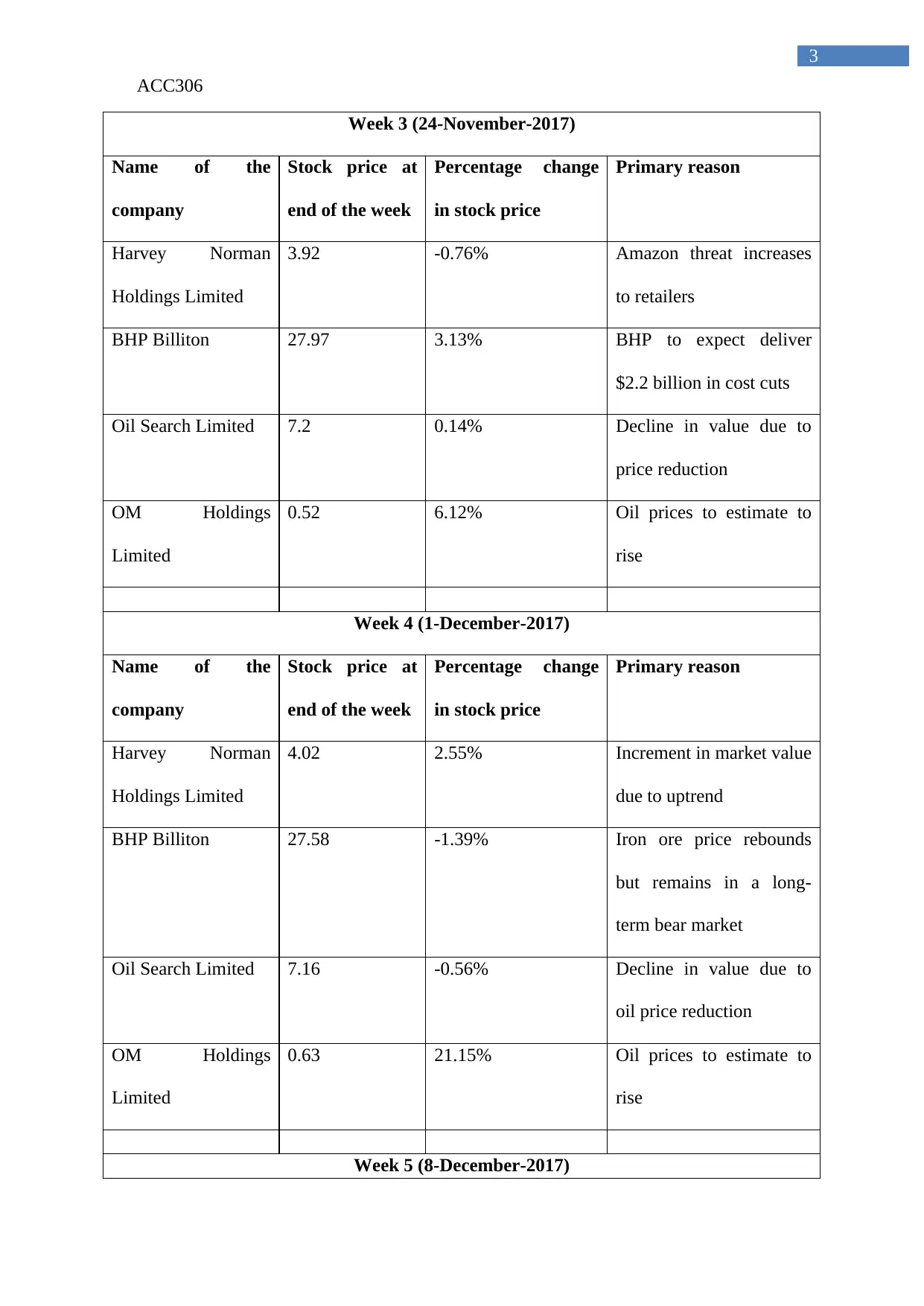

Week 3 (24-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.92 -0.76% Amazon threat increases

to retailers

BHP Billiton 27.97 3.13% BHP to expect deliver

$2.2 billion in cost cuts

Oil Search Limited 7.2 0.14% Decline in value due to

price reduction

OM Holdings

Limited

0.52 6.12% Oil prices to estimate to

rise

Week 4 (1-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.02 2.55% Increment in market value

due to uptrend

BHP Billiton 27.58 -1.39% Iron ore price rebounds

but remains in a long-

term bear market

Oil Search Limited 7.16 -0.56% Decline in value due to

oil price reduction

OM Holdings

Limited

0.63 21.15% Oil prices to estimate to

rise

Week 5 (8-December-2017)

3

Week 3 (24-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

3.92 -0.76% Amazon threat increases

to retailers

BHP Billiton 27.97 3.13% BHP to expect deliver

$2.2 billion in cost cuts

Oil Search Limited 7.2 0.14% Decline in value due to

price reduction

OM Holdings

Limited

0.52 6.12% Oil prices to estimate to

rise

Week 4 (1-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.02 2.55% Increment in market value

due to uptrend

BHP Billiton 27.58 -1.39% Iron ore price rebounds

but remains in a long-

term bear market

Oil Search Limited 7.16 -0.56% Decline in value due to

oil price reduction

OM Holdings

Limited

0.63 21.15% Oil prices to estimate to

rise

Week 5 (8-December-2017)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACC306

4

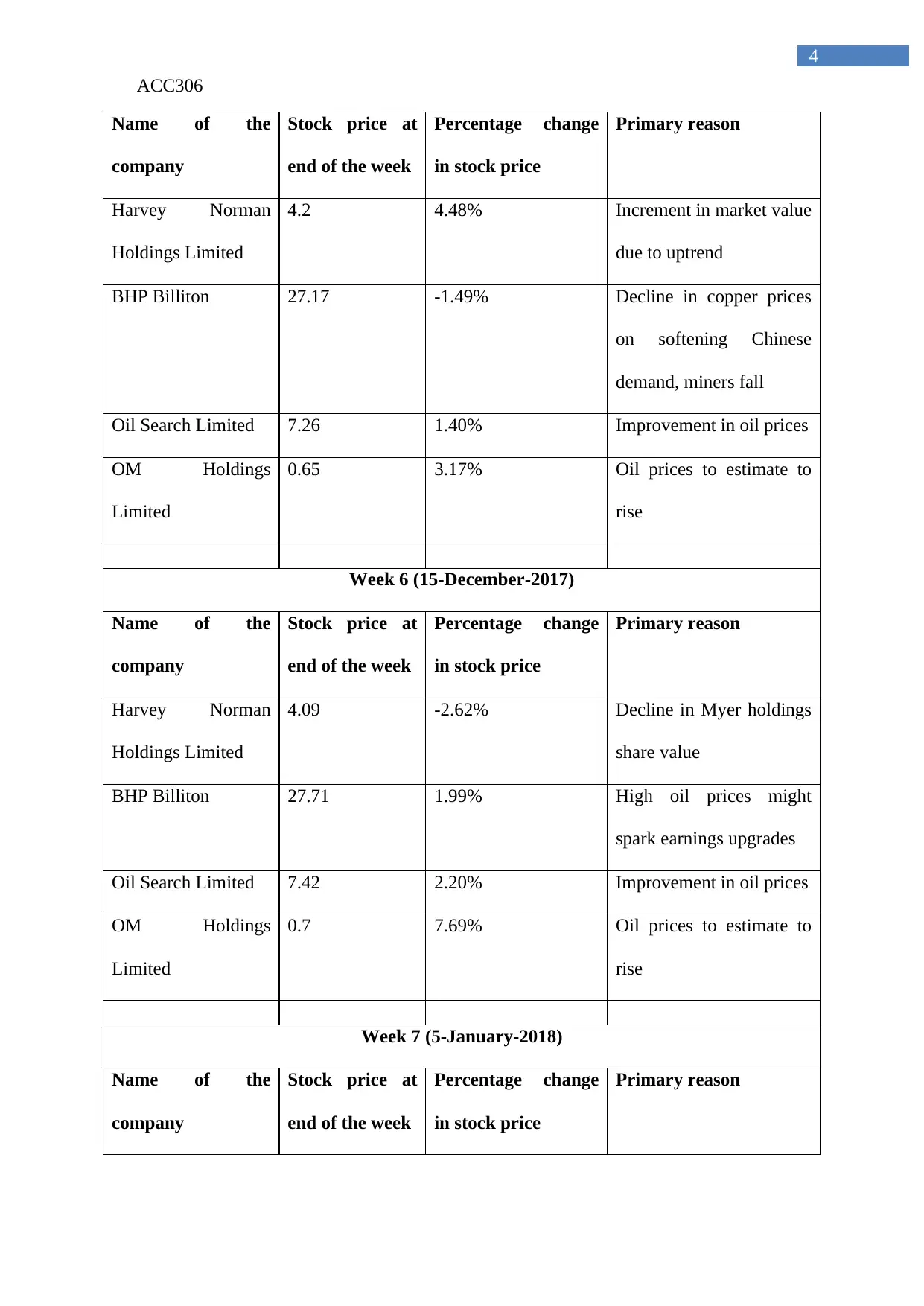

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.2 4.48% Increment in market value

due to uptrend

BHP Billiton 27.17 -1.49% Decline in copper prices

on softening Chinese

demand, miners fall

Oil Search Limited 7.26 1.40% Improvement in oil prices

OM Holdings

Limited

0.65 3.17% Oil prices to estimate to

rise

Week 6 (15-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.09 -2.62% Decline in Myer holdings

share value

BHP Billiton 27.71 1.99% High oil prices might

spark earnings upgrades

Oil Search Limited 7.42 2.20% Improvement in oil prices

OM Holdings

Limited

0.7 7.69% Oil prices to estimate to

rise

Week 7 (5-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

4

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.2 4.48% Increment in market value

due to uptrend

BHP Billiton 27.17 -1.49% Decline in copper prices

on softening Chinese

demand, miners fall

Oil Search Limited 7.26 1.40% Improvement in oil prices

OM Holdings

Limited

0.65 3.17% Oil prices to estimate to

rise

Week 6 (15-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.09 -2.62% Decline in Myer holdings

share value

BHP Billiton 27.71 1.99% High oil prices might

spark earnings upgrades

Oil Search Limited 7.42 2.20% Improvement in oil prices

OM Holdings

Limited

0.7 7.69% Oil prices to estimate to

rise

Week 7 (5-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

ACC306

5

Harvey Norman

Holdings Limited

4.32 5.62% Increment in market value

due to uptrend

BHP Billiton 30.58 10.36% BHP Bilition to spend

$253 million in Brazil for

exploration

Oil Search Limited 8.01 7.95% Improvement in oil prices

OM Holdings

Limited

1.15 64.29% Oil prices to estimated to

hit $100 a barrel due to

rise in demand

Week 8 (12-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.38 1.39% Increment in market value

due to uptrend

BHP Billiton 31.53 3.11% Expectation of Iron Ore

to hiy USD100 in 2018

Oil Search Limited 7.97 -0.50% Stagnation due to market

consolidation

OM Holdings

Limited

0.99 -13.91% Exposure of oil

companies to LNG gult

Week 9 (19-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

5

Harvey Norman

Holdings Limited

4.32 5.62% Increment in market value

due to uptrend

BHP Billiton 30.58 10.36% BHP Bilition to spend

$253 million in Brazil for

exploration

Oil Search Limited 8.01 7.95% Improvement in oil prices

OM Holdings

Limited

1.15 64.29% Oil prices to estimated to

hit $100 a barrel due to

rise in demand

Week 8 (12-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.38 1.39% Increment in market value

due to uptrend

BHP Billiton 31.53 3.11% Expectation of Iron Ore

to hiy USD100 in 2018

Oil Search Limited 7.97 -0.50% Stagnation due to market

consolidation

OM Holdings

Limited

0.99 -13.91% Exposure of oil

companies to LNG gult

Week 9 (19-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACC306

6

Harvey Norman

Holdings Limited

4.41 0.68% Increment in market value

due to uptrend

BHP Billiton 30.69 -2.66% Mega miners pose losing

streaks

Oil Search Limited 7.66 -3.89% Decline in market value

OM Holdings

Limited

1.02 3.03% Oil prices to hit $75 a

barrel due to rise in

demand

Week 10 (26-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.39 -0.45% Amazon threats increases

to Harvey Norman

BHP Billiton 30.85 0.52% Top China Nickles

producer Joins BHP in

prepping for EV Broom

Oil Search Limited 7.88 2.87% Improvement in oil prices

OM Holdings

Limited

1.16 13.73% Oil prices to hit $75 a

barrel due to rise in

demand

1.b Depicting performance of portfolio with other students:

Stock Purchase price Current price Return

Harvey Norman Holdings Limited 3.95 4.39 11.14%

6

Harvey Norman

Holdings Limited

4.41 0.68% Increment in market value

due to uptrend

BHP Billiton 30.69 -2.66% Mega miners pose losing

streaks

Oil Search Limited 7.66 -3.89% Decline in market value

OM Holdings

Limited

1.02 3.03% Oil prices to hit $75 a

barrel due to rise in

demand

Week 10 (26-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Harvey Norman

Holdings Limited

4.39 -0.45% Amazon threats increases

to Harvey Norman

BHP Billiton 30.85 0.52% Top China Nickles

producer Joins BHP in

prepping for EV Broom

Oil Search Limited 7.88 2.87% Improvement in oil prices

OM Holdings

Limited

1.16 13.73% Oil prices to hit $75 a

barrel due to rise in

demand

1.b Depicting performance of portfolio with other students:

Stock Purchase price Current price Return

Harvey Norman Holdings Limited 3.95 4.39 11.14%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACC306

7

BHP Billiton 27.12 30.85 13.75%

Oil Search Limited 7.19 7.88 9.60%

OM Holdings Limited 0.49 1.16 136.73%

Total Returns from the portfolio 171.22%

The above table mainly represent the overall return that is provided by the portfolio

over the period of 10 weeks. Majority of the stocks in the portfolio performed adequately,

while Om Holding Limited portrayed exuberant returns in the [past 10 weeks, which led to a

return of 136.72% from the stock. The overall portfolio provided a return of 171.22%, while

some of the student’s portfolio only provided a return of 20.37%. this relevant decision was

mainly conducted due to the market and industry in which the company conduct its

operations.

2. Depicting performance of each Australian based MNC is driven by Australian

Market:

Figure 1: Depicting the performance of BHP and ASX

(Source: Au.finance.yahoo.com, 2018)

7

BHP Billiton 27.12 30.85 13.75%

Oil Search Limited 7.19 7.88 9.60%

OM Holdings Limited 0.49 1.16 136.73%

Total Returns from the portfolio 171.22%

The above table mainly represent the overall return that is provided by the portfolio

over the period of 10 weeks. Majority of the stocks in the portfolio performed adequately,

while Om Holding Limited portrayed exuberant returns in the [past 10 weeks, which led to a

return of 136.72% from the stock. The overall portfolio provided a return of 171.22%, while

some of the student’s portfolio only provided a return of 20.37%. this relevant decision was

mainly conducted due to the market and industry in which the company conduct its

operations.

2. Depicting performance of each Australian based MNC is driven by Australian

Market:

Figure 1: Depicting the performance of BHP and ASX

(Source: Au.finance.yahoo.com, 2018)

ACC306

8

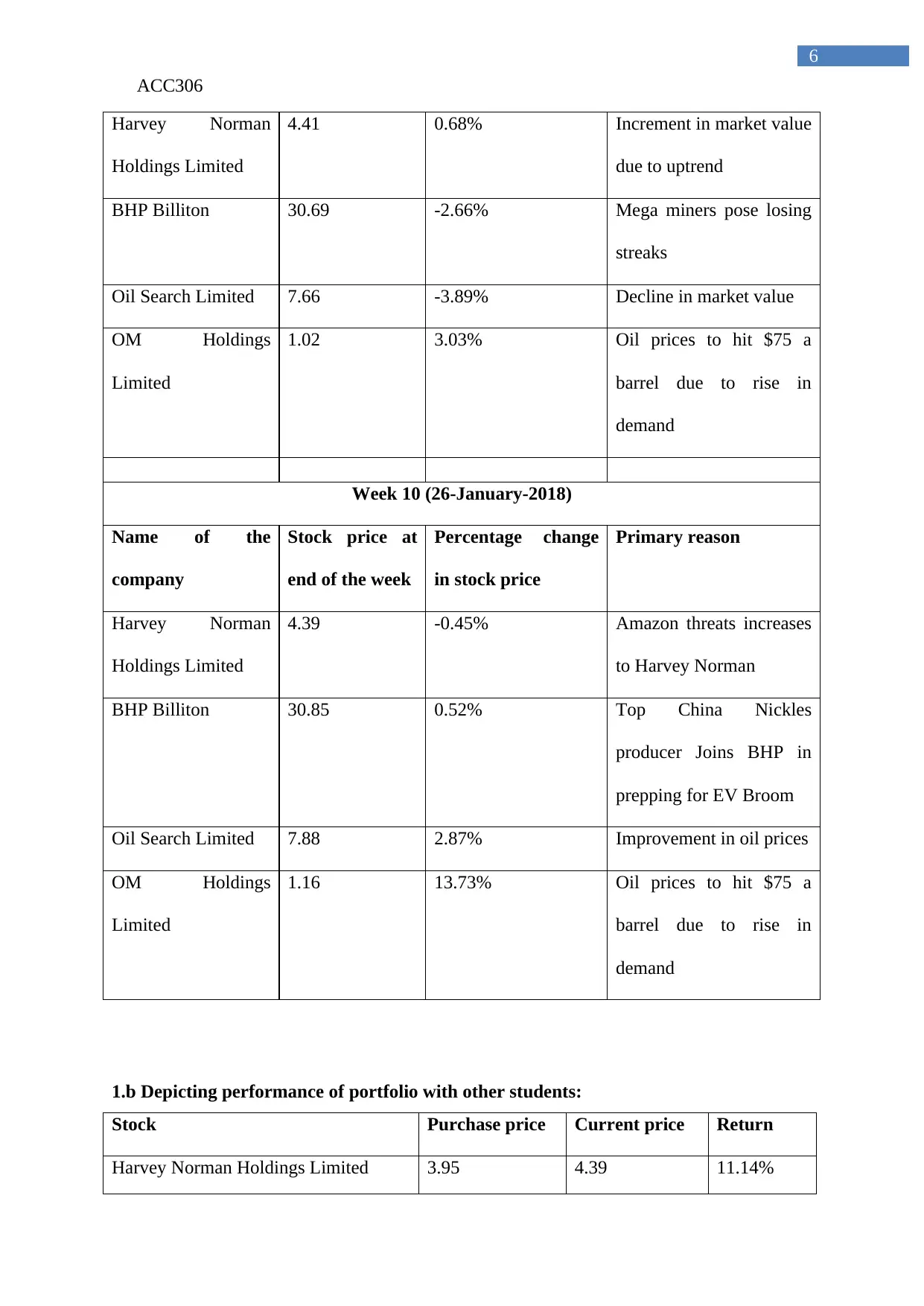

The comparison BHP against the ASX mainly indicates the high performance

conducted by the company during the past fiscal years. This company has provided higher

return in comparison with the Australian index, which could be identified from the above

figure.

Figure 2: Depicting the performance of HNV and ASX

(Source: Au.finance.yahoo.com, 2018)

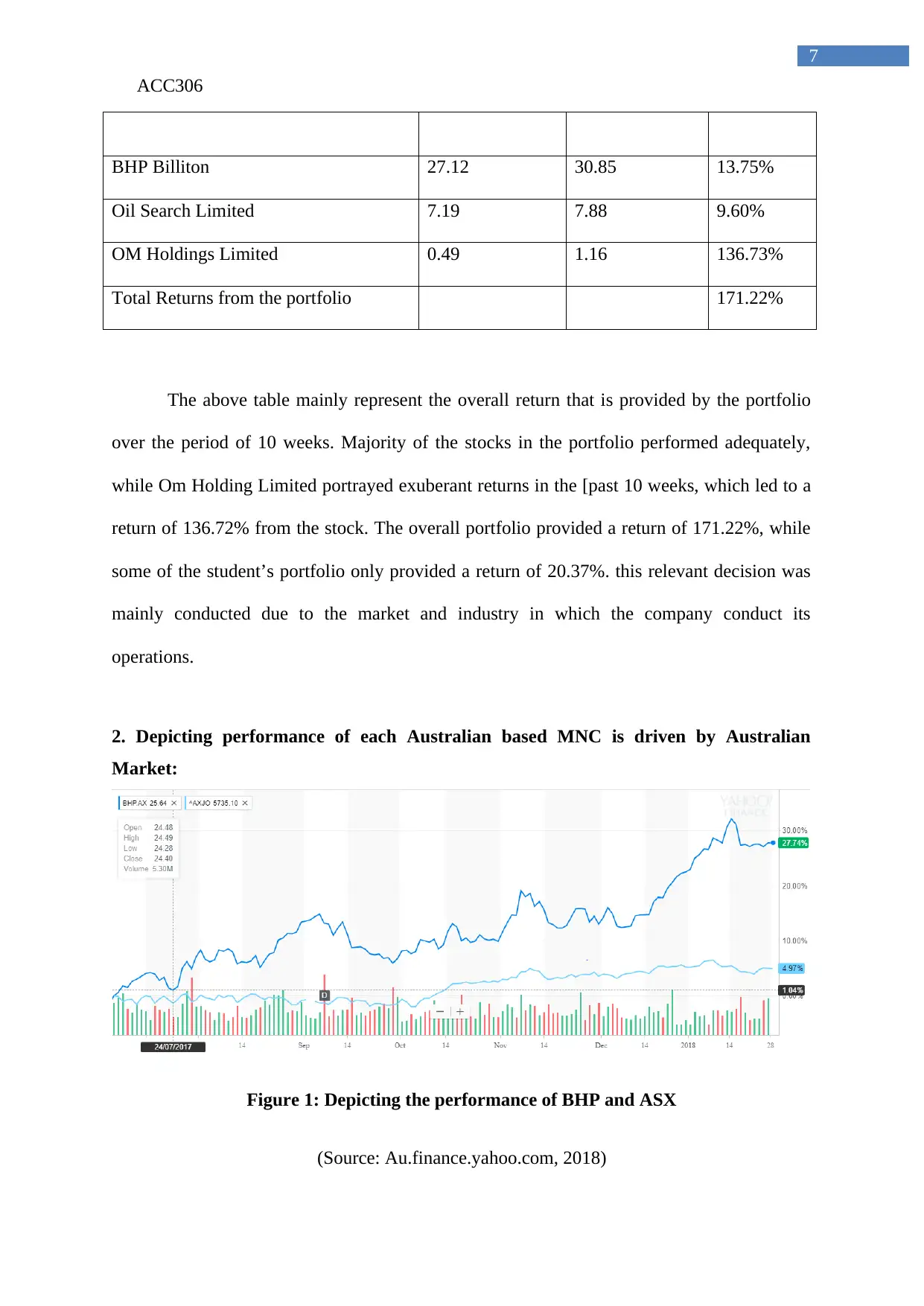

The evaluation of above figure mainly represents the overall performance of Harvey

Norman stock against the ASX. The company has not performed in accordance with the ASX

index, which indicates the low return provided by the company. The comparison indicates

low capability of the company to generate high returns from investment as comparted to the

Australian index.

8

The comparison BHP against the ASX mainly indicates the high performance

conducted by the company during the past fiscal years. This company has provided higher

return in comparison with the Australian index, which could be identified from the above

figure.

Figure 2: Depicting the performance of HNV and ASX

(Source: Au.finance.yahoo.com, 2018)

The evaluation of above figure mainly represents the overall performance of Harvey

Norman stock against the ASX. The company has not performed in accordance with the ASX

index, which indicates the low return provided by the company. The comparison indicates

low capability of the company to generate high returns from investment as comparted to the

Australian index.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACC306

9

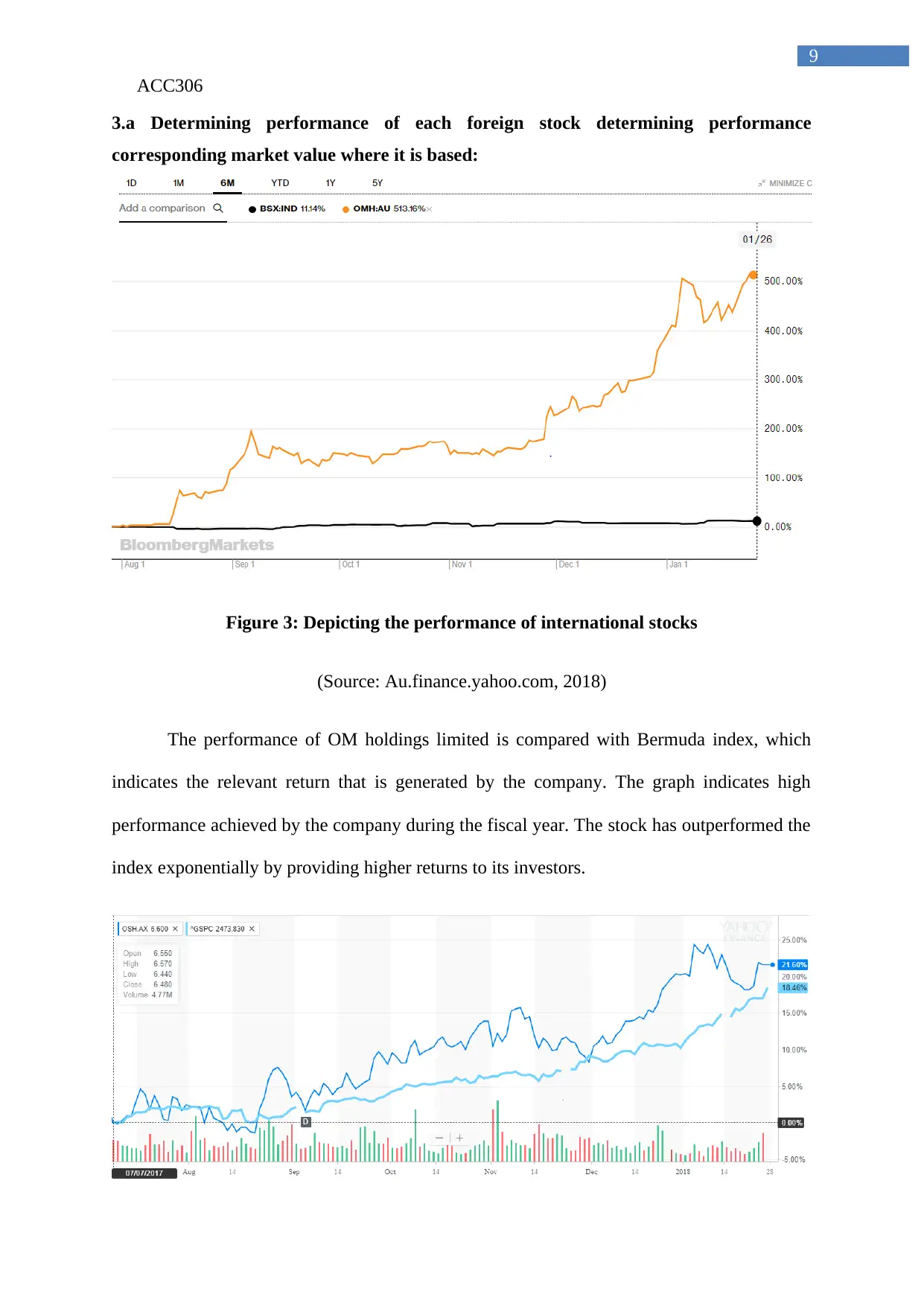

3.a Determining performance of each foreign stock determining performance

corresponding market value where it is based:

Figure 3: Depicting the performance of international stocks

(Source: Au.finance.yahoo.com, 2018)

The performance of OM holdings limited is compared with Bermuda index, which

indicates the relevant return that is generated by the company. The graph indicates high

performance achieved by the company during the fiscal year. The stock has outperformed the

index exponentially by providing higher returns to its investors.

9

3.a Determining performance of each foreign stock determining performance

corresponding market value where it is based:

Figure 3: Depicting the performance of international stocks

(Source: Au.finance.yahoo.com, 2018)

The performance of OM holdings limited is compared with Bermuda index, which

indicates the relevant return that is generated by the company. The graph indicates high

performance achieved by the company during the fiscal year. The stock has outperformed the

index exponentially by providing higher returns to its investors.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACC306

10

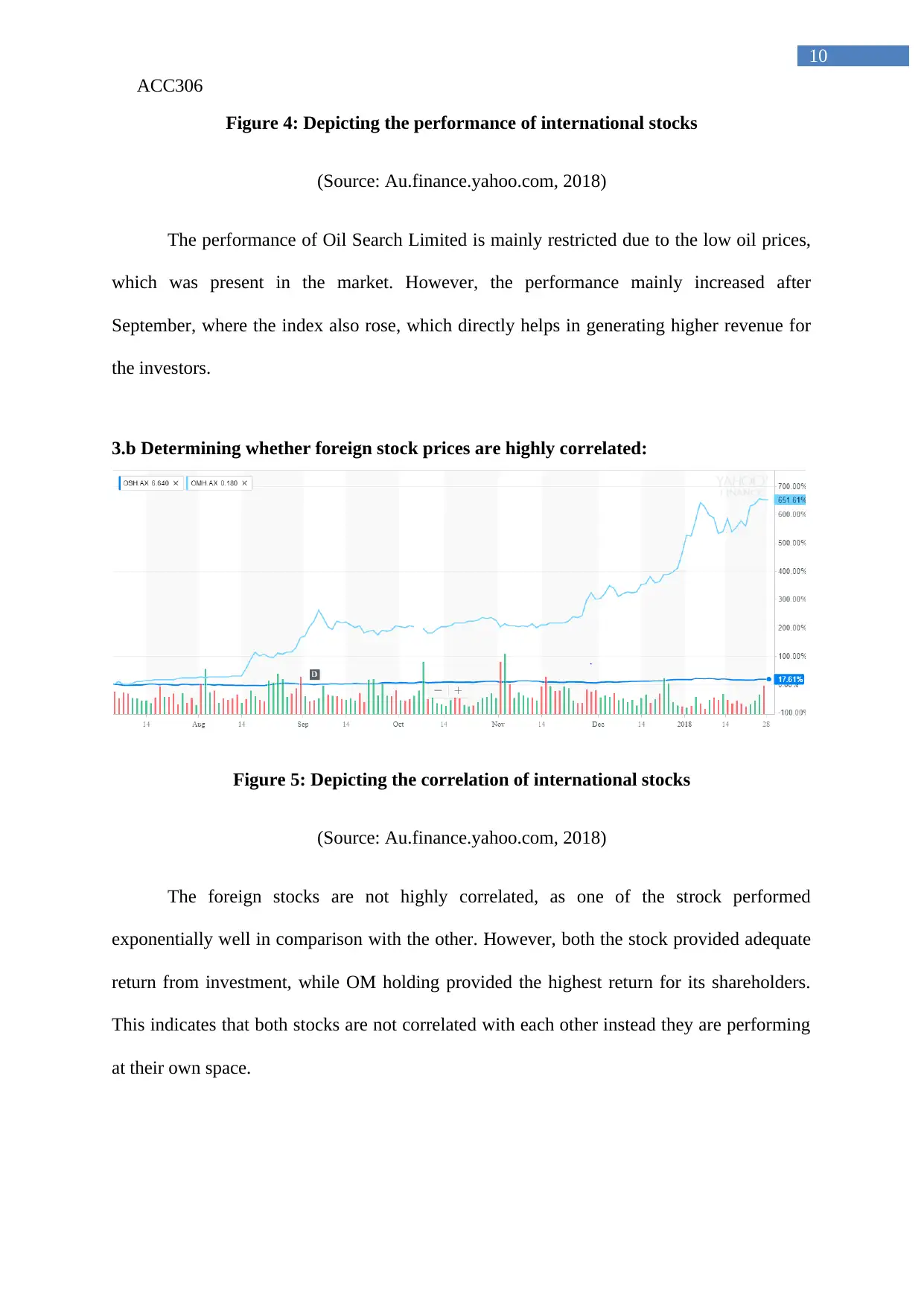

Figure 4: Depicting the performance of international stocks

(Source: Au.finance.yahoo.com, 2018)

The performance of Oil Search Limited is mainly restricted due to the low oil prices,

which was present in the market. However, the performance mainly increased after

September, where the index also rose, which directly helps in generating higher revenue for

the investors.

3.b Determining whether foreign stock prices are highly correlated:

Figure 5: Depicting the correlation of international stocks

(Source: Au.finance.yahoo.com, 2018)

The foreign stocks are not highly correlated, as one of the strock performed

exponentially well in comparison with the other. However, both the stock provided adequate

return from investment, while OM holding provided the highest return for its shareholders.

This indicates that both stocks are not correlated with each other instead they are performing

at their own space.

10

Figure 4: Depicting the performance of international stocks

(Source: Au.finance.yahoo.com, 2018)

The performance of Oil Search Limited is mainly restricted due to the low oil prices,

which was present in the market. However, the performance mainly increased after

September, where the index also rose, which directly helps in generating higher revenue for

the investors.

3.b Determining whether foreign stock prices are highly correlated:

Figure 5: Depicting the correlation of international stocks

(Source: Au.finance.yahoo.com, 2018)

The foreign stocks are not highly correlated, as one of the strock performed

exponentially well in comparison with the other. However, both the stock provided adequate

return from investment, while OM holding provided the highest return for its shareholders.

This indicates that both stocks are not correlated with each other instead they are performing

at their own space.

ACC306

11

3.c Determining whether performance of foreign stock is better than Australian stock:

Figure 6: Comparing performance of international stock with ASX

(Source: Au.finance.yahoo.com, 2018)

From the evaluation of the above figure it could be understood that the stock

performance is not driven by the ASSX market. Instead the company’s performance has

mainly increased their overall share price in the ASX market. The performance of the

company is not based on the ASX market as seen the above figure.

Figure 7: Comparing performance of international stock with ASX

(Source: Au.finance.yahoo.com, 2018)

11

3.c Determining whether performance of foreign stock is better than Australian stock:

Figure 6: Comparing performance of international stock with ASX

(Source: Au.finance.yahoo.com, 2018)

From the evaluation of the above figure it could be understood that the stock

performance is not driven by the ASSX market. Instead the company’s performance has

mainly increased their overall share price in the ASX market. The performance of the

company is not based on the ASX market as seen the above figure.

Figure 7: Comparing performance of international stock with ASX

(Source: Au.finance.yahoo.com, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.