ACC508: Information Systems, Decision Support, and Finance Report

VerifiedAdded on 2020/04/01

|16

|2256

|461

Report

AI Summary

This report analyzes Riverlea's decision to supply a private label confectionery to Wowcoles, assessing the viability of the investment through capital budgeting techniques. The report is divided into two sections. The first section focuses on determining Riverlea's discount rate using the CAPM model, calculating after-tax cash flows under a base scenario, and conducting sensitivity analysis through two additional scenarios. The analysis includes calculating Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index (PI) to evaluate the project's financial attractiveness. The second section tests the semi-strong form market efficiency by examining Riverlea's stock price movement before and after the announcement of the new project. The analysis concludes that based on the positive NPV, IRR, and PI under all scenarios, Riverlea should invest in the project, and that the company’s stock price is consistent with semi-strong form market efficiency.

Corporate Finance Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

To assess the viability of an investment such as the purchase or replacement of plant or

equipment, or a new product line, a company will need to perform capital budgeting

(Accounting Explained, 2017).

There are various techniques that may be used for capital budgeting. These include the

payback period, discounted payback period, internal rate of return, the net present value

and profitability index. These techniques can either be used alone or in a combination

for better results.

The hurdle rate or discount rate is the minimum return that a business expects to earn

on an investment. The cost of capital may be taken as a good initial point to assess the

company’s hurdle rate (Tucker, 2009).

Informational efficiency measures how the market reacts and responds to new

information. For example, when a company announces plans to invest in a new product

line or similar project, this news may have an effect on the company’s share price. The

semi-strong form of efficiency states all publicly available information will be reflected in

the firm’s share prices (Investopedia, 2017).

.

i

To assess the viability of an investment such as the purchase or replacement of plant or

equipment, or a new product line, a company will need to perform capital budgeting

(Accounting Explained, 2017).

There are various techniques that may be used for capital budgeting. These include the

payback period, discounted payback period, internal rate of return, the net present value

and profitability index. These techniques can either be used alone or in a combination

for better results.

The hurdle rate or discount rate is the minimum return that a business expects to earn

on an investment. The cost of capital may be taken as a good initial point to assess the

company’s hurdle rate (Tucker, 2009).

Informational efficiency measures how the market reacts and responds to new

information. For example, when a company announces plans to invest in a new product

line or similar project, this news may have an effect on the company’s share price. The

semi-strong form of efficiency states all publicly available information will be reflected in

the firm’s share prices (Investopedia, 2017).

.

i

TABLE OF CONTENTS

EXECUTIVE SUMMARY..........................................................................................................................i

TABLE OF CONTENTS...........................................................................................................................ii

LIST OF TABLES.....................................................................................................................................iii

LIST OF FIGURES..................................................................................................................................iv

CHAPTER 1 : SECTION ONE- CAPITAL BUDGETING.....................................................................1

1.1 Introduction.....................................................................................................................................1

1.2 Discount or Hurdle Rate................................................................................................................1

1.3 Base Scenario- After Tax Cash Flows........................................................................................1

1.4 Sensitivity Analysis- - After Tax Cash Flows..............................................................................3

1.5 Conclusion.......................................................................................................................................6

CHAPTER 2 : SECTION TWO- SEMI-STRONG FORM MARKET EFFICIENCY...........................7

2.1 Introduction.....................................................................................................................................7

2.2 Semi-Strong Form Market Hypothesis........................................................................................7

2.3 Test for Semi-Strong Form Market Hypothesis..........................................................................7

2.4 Conclusion.......................................................................................................................................8

REFERENCES..........................................................................................................................................9

APPENDIX...............................................................................................................................................10

ii

EXECUTIVE SUMMARY..........................................................................................................................i

TABLE OF CONTENTS...........................................................................................................................ii

LIST OF TABLES.....................................................................................................................................iii

LIST OF FIGURES..................................................................................................................................iv

CHAPTER 1 : SECTION ONE- CAPITAL BUDGETING.....................................................................1

1.1 Introduction.....................................................................................................................................1

1.2 Discount or Hurdle Rate................................................................................................................1

1.3 Base Scenario- After Tax Cash Flows........................................................................................1

1.4 Sensitivity Analysis- - After Tax Cash Flows..............................................................................3

1.5 Conclusion.......................................................................................................................................6

CHAPTER 2 : SECTION TWO- SEMI-STRONG FORM MARKET EFFICIENCY...........................7

2.1 Introduction.....................................................................................................................................7

2.2 Semi-Strong Form Market Hypothesis........................................................................................7

2.3 Test for Semi-Strong Form Market Hypothesis..........................................................................7

2.4 Conclusion.......................................................................................................................................8

REFERENCES..........................................................................................................................................9

APPENDIX...............................................................................................................................................10

ii

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LIST OF TABLES

Table 1-1: After Tax Cash Flow Operations.....................................................................2

Table 1-2: Cash Flows Investment...................................................................................2

Table 1-3: After Tax Cash Flows -Base Scenario............................................................3

Table 1-4: NPV, IRR, PBP, PI- Base Scenario................................................................3

Table 1-5: After Tax Cash Flows - Scenario 1.................................................................4

Table 1-6: NPV, IRR, PBP, PI- Scenario One..................................................................5

Table 1-7: After Tax Cash Flows - Scenario 2.................................................................5

Table 1-8: NPV, IRR, PBP, PI- Scenario Two..................................................................6

iii

Table 1-1: After Tax Cash Flow Operations.....................................................................2

Table 1-2: Cash Flows Investment...................................................................................2

Table 1-3: After Tax Cash Flows -Base Scenario............................................................3

Table 1-4: NPV, IRR, PBP, PI- Base Scenario................................................................3

Table 1-5: After Tax Cash Flows - Scenario 1.................................................................4

Table 1-6: NPV, IRR, PBP, PI- Scenario One..................................................................5

Table 1-7: After Tax Cash Flows - Scenario 2.................................................................5

Table 1-8: NPV, IRR, PBP, PI- Scenario Two..................................................................6

iii

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIST OF FIGURES

Figure 2-1: Riverlea stock price....................................................................................... 7

iv

Figure 2-1: Riverlea stock price....................................................................................... 7

iv

CHAPTER 1: SECTION ONE- CAPITAL BUDGETING

1.1 Introduction –Capital Budgeting

The aim of this report is to analyze effects of Riverleas’ decision to supply a private

label confectionery to Wowcoles. The report is divided into two sections. In this section

we analyze Riverlea’s discount rate and after tax cash flows based on the three

scenarios.

1.2 Discount or Hurdle Rate

The discount or hurdle rate of a firm is the minimum rate of return the firm will expect to

earn on the investment. The cost of capital may be used as a good starting point to

determine the hurdle rate (Tucker, 2009).

The WACC is calculated as the average after tax cost of debt and equity (Investopedia,

2017). Given that Riverlea is described as 100% equity firm, the WACC will equal the

cost of equity. The CAPM model can be used to determine the cost of equity:-

Re = rf +β(rm –rf) where rf = Risk free rate, β= Beta, (rm –rf)= Risk premium

The 10-year Australian government bond will be used to represent the return on risk

free asset. It was calculated as 5.05%. A beta value of 1.553 was calculated using the

slope function in excel on the excess returns of Riverlea and the market index (see

appendix). The return on the market was the average mean of returns over the period

1997-2016. It was calculated as 9.52%. Therefore, based on CAPM approach

Riverlea’s discount rate is 11.99%.

1.3 Base Scenario- After Tax Cash Flows

To determine the after tax cash flows under the base scenario, the following

assumptions were made:-

Assumptions

New Machine cost $1,700,000 (cost $1,500,000 plus $200,000 installation)

1

1.1 Introduction –Capital Budgeting

The aim of this report is to analyze effects of Riverleas’ decision to supply a private

label confectionery to Wowcoles. The report is divided into two sections. In this section

we analyze Riverlea’s discount rate and after tax cash flows based on the three

scenarios.

1.2 Discount or Hurdle Rate

The discount or hurdle rate of a firm is the minimum rate of return the firm will expect to

earn on the investment. The cost of capital may be used as a good starting point to

determine the hurdle rate (Tucker, 2009).

The WACC is calculated as the average after tax cost of debt and equity (Investopedia,

2017). Given that Riverlea is described as 100% equity firm, the WACC will equal the

cost of equity. The CAPM model can be used to determine the cost of equity:-

Re = rf +β(rm –rf) where rf = Risk free rate, β= Beta, (rm –rf)= Risk premium

The 10-year Australian government bond will be used to represent the return on risk

free asset. It was calculated as 5.05%. A beta value of 1.553 was calculated using the

slope function in excel on the excess returns of Riverlea and the market index (see

appendix). The return on the market was the average mean of returns over the period

1997-2016. It was calculated as 9.52%. Therefore, based on CAPM approach

Riverlea’s discount rate is 11.99%.

1.3 Base Scenario- After Tax Cash Flows

To determine the after tax cash flows under the base scenario, the following

assumptions were made:-

Assumptions

New Machine cost $1,700,000 (cost $1,500,000 plus $200,000 installation)

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Depreciation $300,000 (20% * $1,500,00)

Resale Value $200,000

Revenue growth % 10%

Variable costs 40%

Initial net working capital $50,000.00 (Subsequent Net working capital $10,000.00)

Tax 30%

Discount Rate 11.99% (calculated in section 1.2)

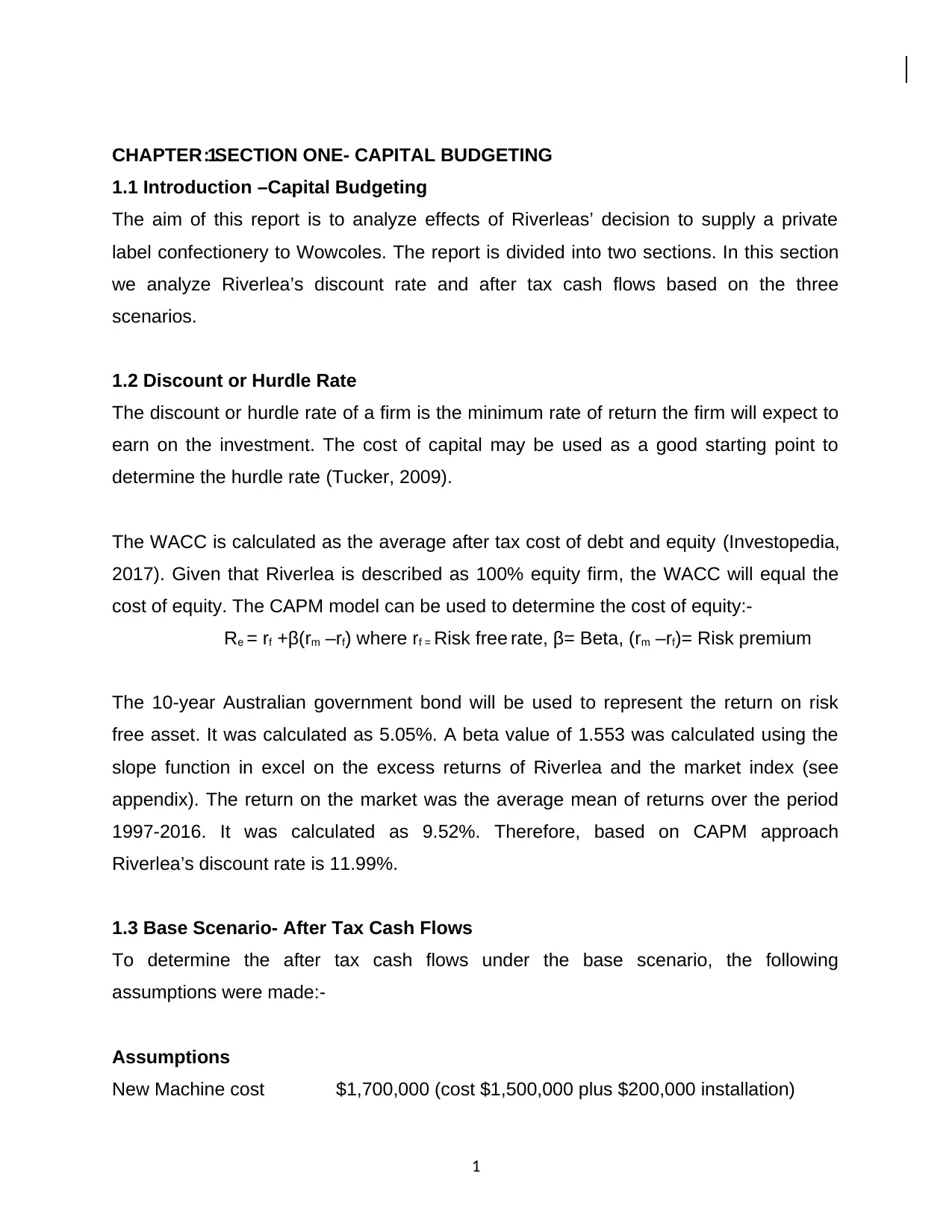

Table 1-1 shows the after tax cash flows from Riverlea’s operations over period.

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 800,000 880,000 968,000 1,064,800 1,171,280 1,288,408 1,417,249 1,558,974 1,714,871 1,886,358

Plus Operating cost savings 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000

Less loss of Revenue 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000

Less operating costs 320,000 352,000 387,200 425,920 468,512 515,363 566,900 623,589 685,948 754,543.26

Operating profit 360,000 408,000 460,800 518,880 582,768 653,045 730,349 815,384 908,923 1,011,815

Less Depreciation Exp 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Net Income before tax 60,000 108,000 160,800 218,880 282,768 353,045 430,349 515,384 608,923 711,815

Less Income Tax 18,000 32,400 48,240 65,664 84,830 105,913 129,105 154,615 182,677 213,544

Net Income after Tax 42,000 75,600 112,560 153,216 197,938 247,131 301,244 360,769 426,246 498,270

Add Depreciation 342,000 375,600 412,560 453,216 497,938 547,131 601,244 660,769 726,246 798,270

After Tax Cash inflow operations 384,000 451,200 525,120 606,432 695,875 794,263 902,489 1,021,538 1,152,492 1,296,541

Table 1-1: After Tax Cash Flow Operations

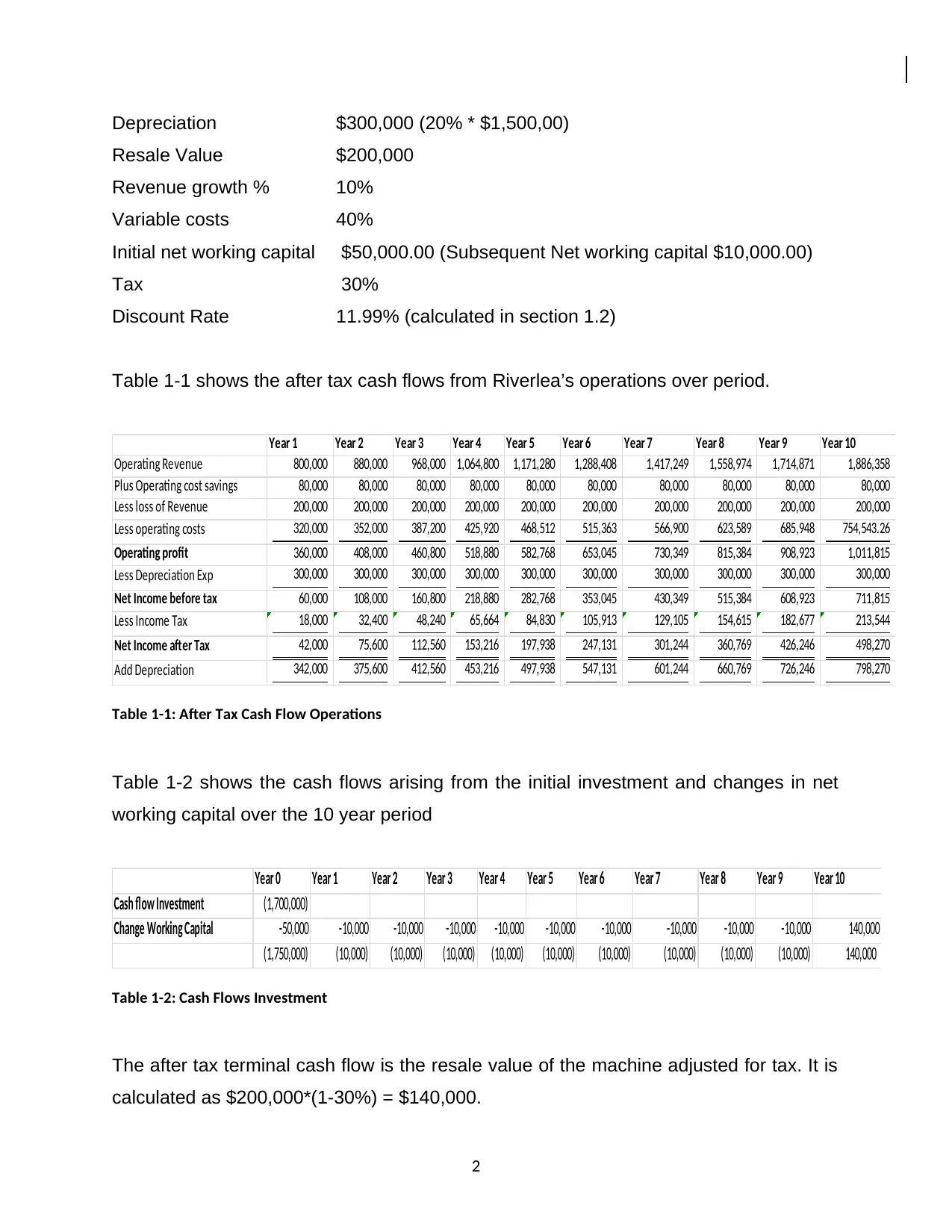

Table 1-2 shows the cash flows arising from the initial investment and changes in net

working capital over the 10 year period

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Cash flow Investment (1,700,000)

Change Working Capital -50,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 140,000

(1,750,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) 140,000

Table 1-2: Cash Flows Investment

The after tax terminal cash flow is the resale value of the machine adjusted for tax. It is

calculated as $200,000*(1-30%) = $140,000.

2

Resale Value $200,000

Revenue growth % 10%

Variable costs 40%

Initial net working capital $50,000.00 (Subsequent Net working capital $10,000.00)

Tax 30%

Discount Rate 11.99% (calculated in section 1.2)

Table 1-1 shows the after tax cash flows from Riverlea’s operations over period.

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 800,000 880,000 968,000 1,064,800 1,171,280 1,288,408 1,417,249 1,558,974 1,714,871 1,886,358

Plus Operating cost savings 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000

Less loss of Revenue 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000

Less operating costs 320,000 352,000 387,200 425,920 468,512 515,363 566,900 623,589 685,948 754,543.26

Operating profit 360,000 408,000 460,800 518,880 582,768 653,045 730,349 815,384 908,923 1,011,815

Less Depreciation Exp 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Net Income before tax 60,000 108,000 160,800 218,880 282,768 353,045 430,349 515,384 608,923 711,815

Less Income Tax 18,000 32,400 48,240 65,664 84,830 105,913 129,105 154,615 182,677 213,544

Net Income after Tax 42,000 75,600 112,560 153,216 197,938 247,131 301,244 360,769 426,246 498,270

Add Depreciation 342,000 375,600 412,560 453,216 497,938 547,131 601,244 660,769 726,246 798,270

After Tax Cash inflow operations 384,000 451,200 525,120 606,432 695,875 794,263 902,489 1,021,538 1,152,492 1,296,541

Table 1-1: After Tax Cash Flow Operations

Table 1-2 shows the cash flows arising from the initial investment and changes in net

working capital over the 10 year period

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Cash flow Investment (1,700,000)

Change Working Capital -50,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 -10,000 140,000

(1,750,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) 140,000

Table 1-2: Cash Flows Investment

The after tax terminal cash flow is the resale value of the machine adjusted for tax. It is

calculated as $200,000*(1-30%) = $140,000.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 1-3 shows the after tax cash flows from both investing and operating activities

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 537,131

Year 7 $ 591,244

Year 8 $ 650,769

Year 9 $ 716,246

Year 10 $ 1,078,270

Table 1-3: After Tax Cash Flows -Base Scenario

Using a discount rate of 11.99%, the NPV is calculated as $1,091,623. Since NPV is

positive, Riverlea should accept the project.

Table 1-4 shows other capital budgeting measurements. We observe under all rules

that the project should be accepted i.e. IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

NPV $ 1,091,623

IRR 23%

Payback Period 3.42

Profitability Index (PVI) 1.62

Table 1-4: NPV, IRR, PBP, PI- Base Scenario

1.4 Sensitivity Analysis - After Tax Cash Flows

To perform sensitivity analysis on the cash flows, the following two scenarios were

investigated as per the recommendation of the CEO.

3

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 537,131

Year 7 $ 591,244

Year 8 $ 650,769

Year 9 $ 716,246

Year 10 $ 1,078,270

Table 1-3: After Tax Cash Flows -Base Scenario

Using a discount rate of 11.99%, the NPV is calculated as $1,091,623. Since NPV is

positive, Riverlea should accept the project.

Table 1-4 shows other capital budgeting measurements. We observe under all rules

that the project should be accepted i.e. IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

NPV $ 1,091,623

IRR 23%

Payback Period 3.42

Profitability Index (PVI) 1.62

Table 1-4: NPV, IRR, PBP, PI- Base Scenario

1.4 Sensitivity Analysis - After Tax Cash Flows

To perform sensitivity analysis on the cash flows, the following two scenarios were

investigated as per the recommendation of the CEO.

3

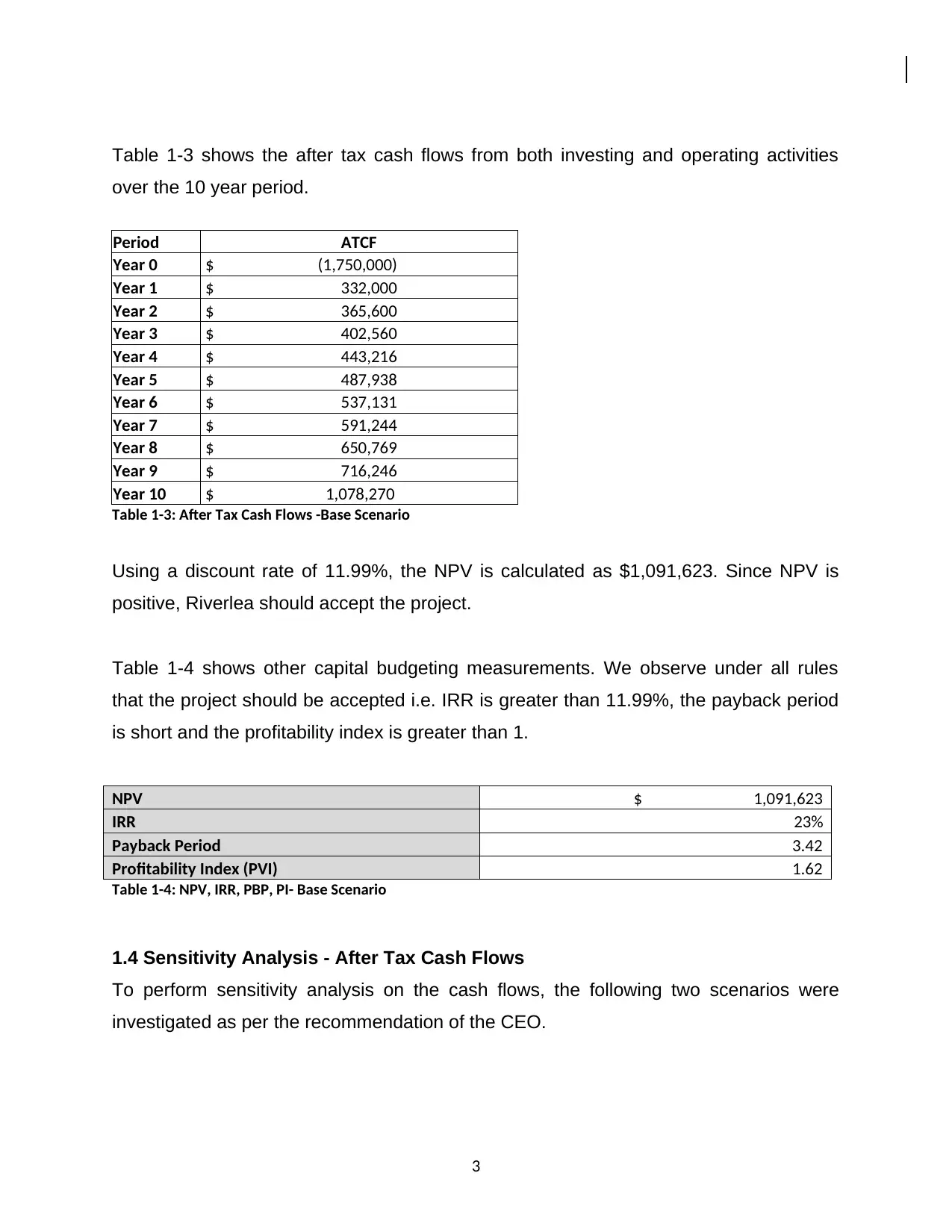

Scenario 1

To determine the after tax cash flows under the scenario 1, the following additional

assumptions were included:-

Assumptions

Revenue growth (period 1-5) 10% (probability 100%)

Revenue growth (period 6-10) 6% (probability 40%)

Revenue growth (period 6-10) 10% (probability 60%)

Table 1-4 shows the after tax cash flows from both investing and operating activities

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 450,550

Year 7 $ 416,005

Year 8 $ 384,084

Year 9 $ 354,590

Year 10 $ 617,337

Table 1-5: After Tax Cash Flows - Scenario 1

Using a discount rate of 11.99%, the NPV is $581,734. Since NPV is positive, Riverlea

should accept the project.

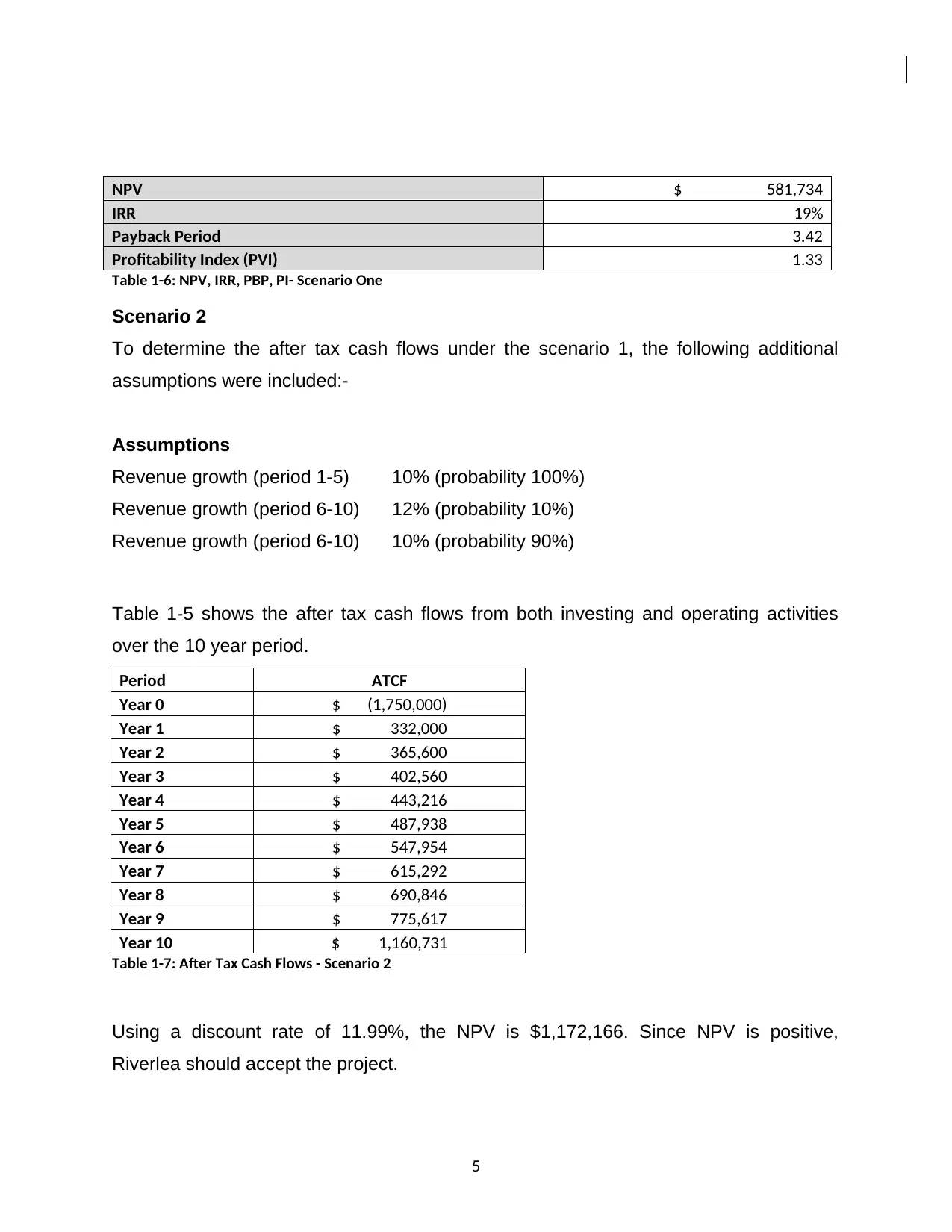

Table 1-6 shows other capital budgeting measurements. We observe under all methods

that the project should be accepted i.e IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

4

To determine the after tax cash flows under the scenario 1, the following additional

assumptions were included:-

Assumptions

Revenue growth (period 1-5) 10% (probability 100%)

Revenue growth (period 6-10) 6% (probability 40%)

Revenue growth (period 6-10) 10% (probability 60%)

Table 1-4 shows the after tax cash flows from both investing and operating activities

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 450,550

Year 7 $ 416,005

Year 8 $ 384,084

Year 9 $ 354,590

Year 10 $ 617,337

Table 1-5: After Tax Cash Flows - Scenario 1

Using a discount rate of 11.99%, the NPV is $581,734. Since NPV is positive, Riverlea

should accept the project.

Table 1-6 shows other capital budgeting measurements. We observe under all methods

that the project should be accepted i.e IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

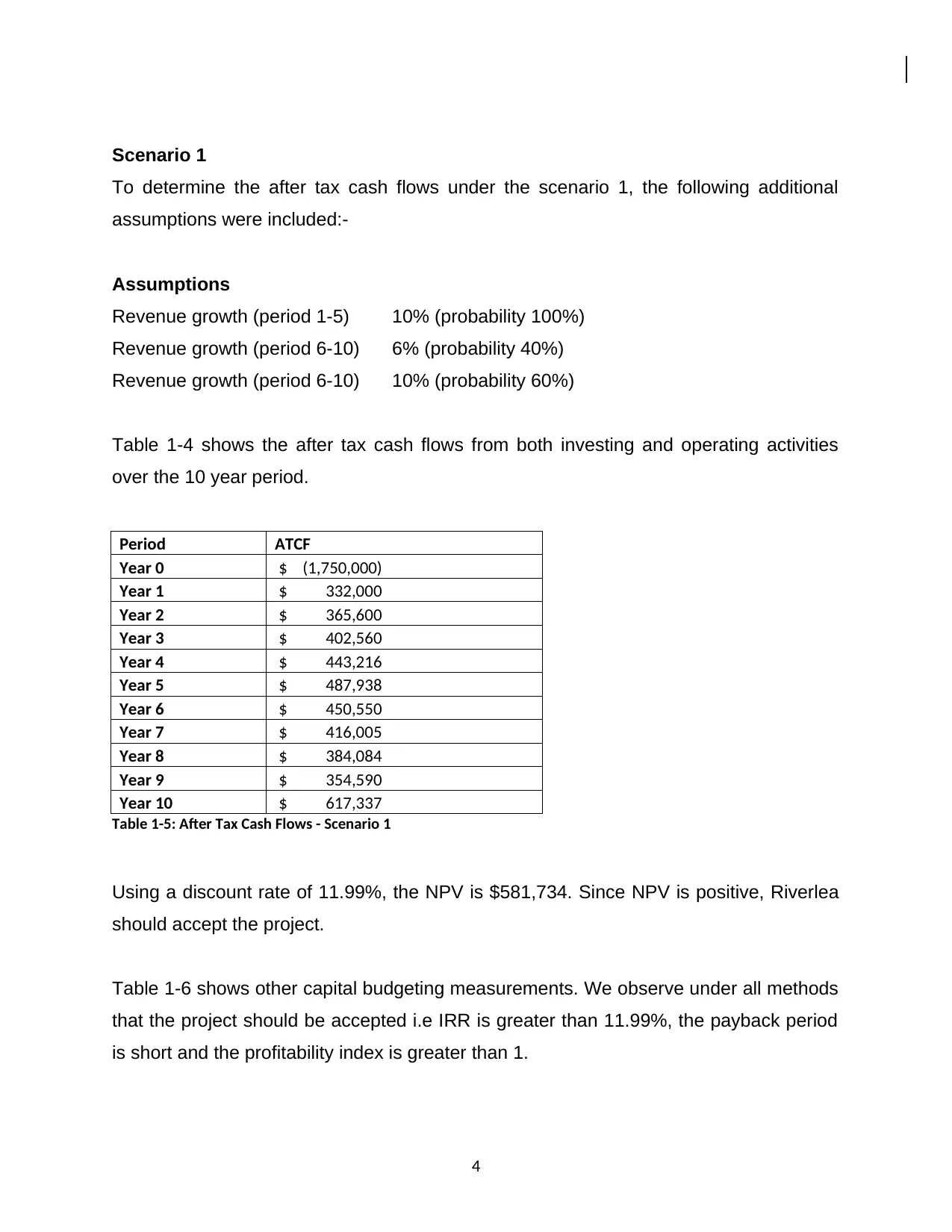

NPV $ 581,734

IRR 19%

Payback Period 3.42

Profitability Index (PVI) 1.33

Table 1-6: NPV, IRR, PBP, PI- Scenario One

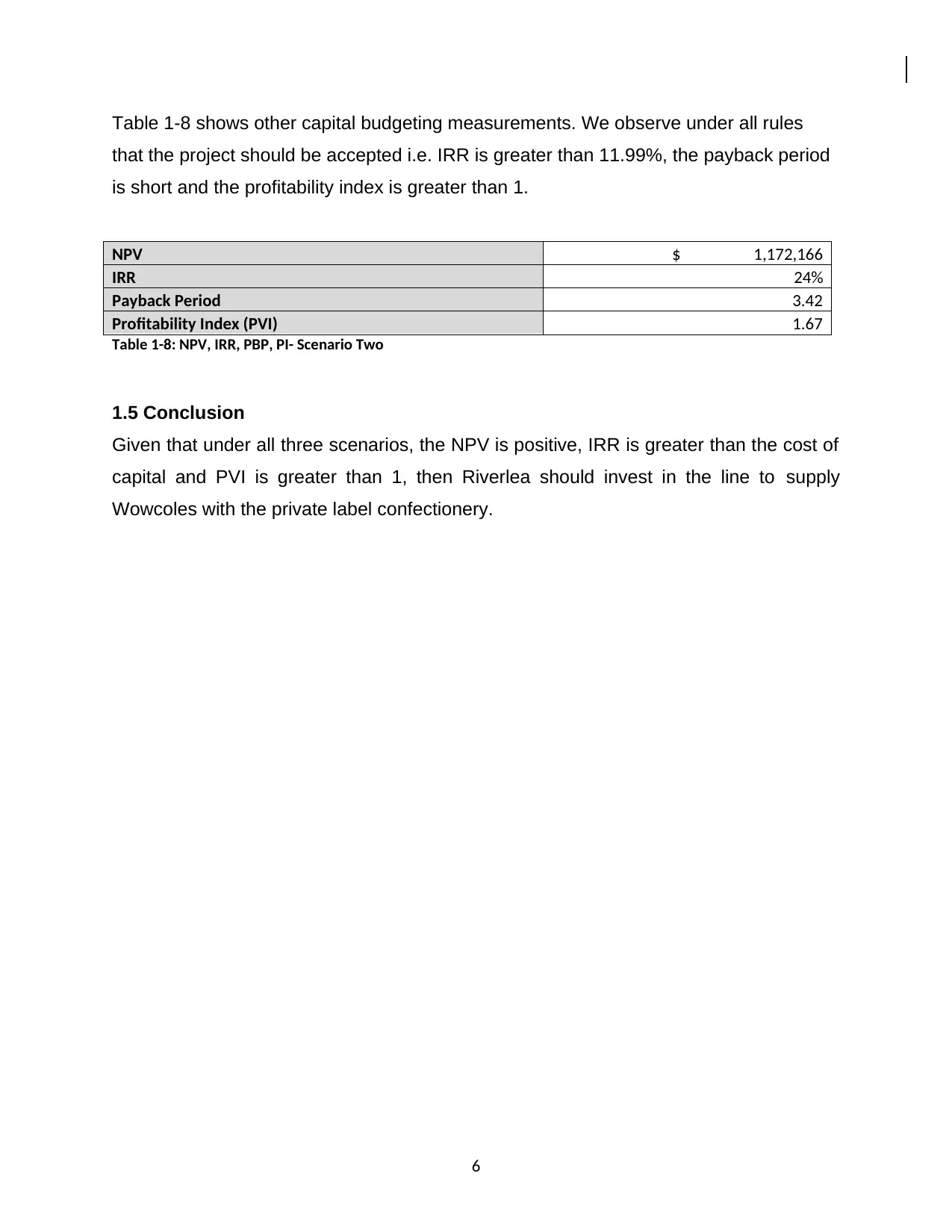

Scenario 2

To determine the after tax cash flows under the scenario 1, the following additional

assumptions were included:-

Assumptions

Revenue growth (period 1-5) 10% (probability 100%)

Revenue growth (period 6-10) 12% (probability 10%)

Revenue growth (period 6-10) 10% (probability 90%)

Table 1-5 shows the after tax cash flows from both investing and operating activities

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 547,954

Year 7 $ 615,292

Year 8 $ 690,846

Year 9 $ 775,617

Year 10 $ 1,160,731

Table 1-7: After Tax Cash Flows - Scenario 2

Using a discount rate of 11.99%, the NPV is $1,172,166. Since NPV is positive,

Riverlea should accept the project.

5

IRR 19%

Payback Period 3.42

Profitability Index (PVI) 1.33

Table 1-6: NPV, IRR, PBP, PI- Scenario One

Scenario 2

To determine the after tax cash flows under the scenario 1, the following additional

assumptions were included:-

Assumptions

Revenue growth (period 1-5) 10% (probability 100%)

Revenue growth (period 6-10) 12% (probability 10%)

Revenue growth (period 6-10) 10% (probability 90%)

Table 1-5 shows the after tax cash flows from both investing and operating activities

over the 10 year period.

Period ATCF

Year 0 $ (1,750,000)

Year 1 $ 332,000

Year 2 $ 365,600

Year 3 $ 402,560

Year 4 $ 443,216

Year 5 $ 487,938

Year 6 $ 547,954

Year 7 $ 615,292

Year 8 $ 690,846

Year 9 $ 775,617

Year 10 $ 1,160,731

Table 1-7: After Tax Cash Flows - Scenario 2

Using a discount rate of 11.99%, the NPV is $1,172,166. Since NPV is positive,

Riverlea should accept the project.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 1-8 shows other capital budgeting measurements. We observe under all rules

that the project should be accepted i.e. IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

NPV $ 1,172,166

IRR 24%

Payback Period 3.42

Profitability Index (PVI) 1.67

Table 1-8: NPV, IRR, PBP, PI- Scenario Two

1.5 Conclusion

Given that under all three scenarios, the NPV is positive, IRR is greater than the cost of

capital and PVI is greater than 1, then Riverlea should invest in the line to supply

Wowcoles with the private label confectionery.

6

that the project should be accepted i.e. IRR is greater than 11.99%, the payback period

is short and the profitability index is greater than 1.

NPV $ 1,172,166

IRR 24%

Payback Period 3.42

Profitability Index (PVI) 1.67

Table 1-8: NPV, IRR, PBP, PI- Scenario Two

1.5 Conclusion

Given that under all three scenarios, the NPV is positive, IRR is greater than the cost of

capital and PVI is greater than 1, then Riverlea should invest in the line to supply

Wowcoles with the private label confectionery.

6

CHAPTER 2: SECTION TWO- SEMI-STRONG FORM MARKET EFFICIENCY

2.1 Introduction

In this section we test whether Riverlea’s stock price changes before, during and after

the announcement of its new project, is consistent with semi-strong form market

hypothesis.

2.2 Semi-Strong Form Market Hypothesis

The semi strong-form hypothesis states that all publicly available information regarding

the prospects of a firm must be reflected in its share price (Investopedia, 2017).

Examples of public information includes, management quality, fundamental data on a

product line, forecasts on earnings, accounting standards, composition of its balance

sheet and past prices. If an investor has this information, then it should be reflected in

stock prices (Vialar, 2009).

In other words, according to the semi strong-form, it is not fruitful trying to make any

prediction using public information i.e. information that is publicly available (Shleifer &

Vishny, 1997). Examples of public information include analyst’s report, news one can

read in the newspaper, business magazine etc.

2.3 Test for Semi-Strong Form Market Hypothesis

When testing whether a market is efficient with respect to publicly available information,

researchers often choose an information event and investigate if the market responded

quickly and sensibly to the information. This test is the basis for an “event study” (Fama,

1970).

Riverlea Price Movement Before and After Announcement

The event study under investigation is Riverlea’s decision to supply the private label

confectionary to Wowcoles. We observe in figure 2-1 the Riverlea share price rose from

$2.16 (Day -1) to $4.35 on the day of the announcement of the product line. The reason

for increase in price is it is expected that the new supply private label will increase the

value of Riverlea and thus create value for shareholder’s.

7

2.1 Introduction

In this section we test whether Riverlea’s stock price changes before, during and after

the announcement of its new project, is consistent with semi-strong form market

hypothesis.

2.2 Semi-Strong Form Market Hypothesis

The semi strong-form hypothesis states that all publicly available information regarding

the prospects of a firm must be reflected in its share price (Investopedia, 2017).

Examples of public information includes, management quality, fundamental data on a

product line, forecasts on earnings, accounting standards, composition of its balance

sheet and past prices. If an investor has this information, then it should be reflected in

stock prices (Vialar, 2009).

In other words, according to the semi strong-form, it is not fruitful trying to make any

prediction using public information i.e. information that is publicly available (Shleifer &

Vishny, 1997). Examples of public information include analyst’s report, news one can

read in the newspaper, business magazine etc.

2.3 Test for Semi-Strong Form Market Hypothesis

When testing whether a market is efficient with respect to publicly available information,

researchers often choose an information event and investigate if the market responded

quickly and sensibly to the information. This test is the basis for an “event study” (Fama,

1970).

Riverlea Price Movement Before and After Announcement

The event study under investigation is Riverlea’s decision to supply the private label

confectionary to Wowcoles. We observe in figure 2-1 the Riverlea share price rose from

$2.16 (Day -1) to $4.35 on the day of the announcement of the product line. The reason

for increase in price is it is expected that the new supply private label will increase the

value of Riverlea and thus create value for shareholder’s.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.