Audit and assurance services Assignment

VerifiedAdded on 2021/06/14

|17

|4665

|94

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACC5AAS

ADVANCED AUDITING AND ASSURANCE

1

ADVANCED AUDITING AND ASSURANCE

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive Summary

This report is based on audit and assurance services provided by auditors to the business organisation

has been discussed. Vectus Bio-systems Limited is the business engaged in the business of

pharmaceutical has been taken for the purpose of this report. This report discusses the profile and

business operations of Vectus and this includes preliminary screening of business organisation.

Pharmaceutical business organisations has to follows The Therapeutic Goods Act 1989, Safety,

Standards and Regulation, Listing and Pricing of the product, Competition Law in Australia and

many other legislations and regulations while conducting business operations. Every business

organisation has its own internal and external environmental factors that impact business operation of

the same. In case of Vectus, Cyber Security, Global Anti-Corruption, Increasing competition and

commercialisation of new products and Taxation Risk are some business risk factors. Sales account,

administration and corporate expenses, cash and cash equivalents and trade and other payables are

risky accounts identified during audit planning. Based in these concerns, decision has been taken not

to take audit of Vectus Bio-systems Limited.

2

This report is based on audit and assurance services provided by auditors to the business organisation

has been discussed. Vectus Bio-systems Limited is the business engaged in the business of

pharmaceutical has been taken for the purpose of this report. This report discusses the profile and

business operations of Vectus and this includes preliminary screening of business organisation.

Pharmaceutical business organisations has to follows The Therapeutic Goods Act 1989, Safety,

Standards and Regulation, Listing and Pricing of the product, Competition Law in Australia and

many other legislations and regulations while conducting business operations. Every business

organisation has its own internal and external environmental factors that impact business operation of

the same. In case of Vectus, Cyber Security, Global Anti-Corruption, Increasing competition and

commercialisation of new products and Taxation Risk are some business risk factors. Sales account,

administration and corporate expenses, cash and cash equivalents and trade and other payables are

risky accounts identified during audit planning. Based in these concerns, decision has been taken not

to take audit of Vectus Bio-systems Limited.

2

Contents

Introduction.............................................................................................................................................3

1. Provide an overview of the client’s operations and industry in which it operates. Your overview of

the client’s operations must include at least one recent major development..........................................4

2. Pharmaceutical companies are required to follow a number of regulations and legislative

requirements for therapeutic goods. You need to Identify and briefly describe four (4) legal

requirements (acts/regulations) for pharmaceutical goods......................................................................5

3. Identify FOUR significant business risk factors that the auditor needs to consider for the Vectus

group engagement. Describe how these risks may lead to potential material misstatements in the

financial report........................................................................................................................................7

4: Using the 2017 Vectus annual report, identify at least FOUR accounts/areas of concern. Why do

you consider the chosen areas/accounts to be risky? Your answers should be reflective of your in-

depth understanding of Vectus Group and its environment....................................................................9

5. With specific reference to Vectus’s corporate governance arrangements, you need to assess the

likelihood of the potential reliance that could be placed on the overall control environment. Your

conclusion should be supported by at least three factors......................................................................11

6: Based on your understanding of the client and assessment of the client’s business and audit risks,

would you undertake the audit? Why?..................................................................................................12

Conclusion.............................................................................................................................................13

3

Introduction.............................................................................................................................................3

1. Provide an overview of the client’s operations and industry in which it operates. Your overview of

the client’s operations must include at least one recent major development..........................................4

2. Pharmaceutical companies are required to follow a number of regulations and legislative

requirements for therapeutic goods. You need to Identify and briefly describe four (4) legal

requirements (acts/regulations) for pharmaceutical goods......................................................................5

3. Identify FOUR significant business risk factors that the auditor needs to consider for the Vectus

group engagement. Describe how these risks may lead to potential material misstatements in the

financial report........................................................................................................................................7

4: Using the 2017 Vectus annual report, identify at least FOUR accounts/areas of concern. Why do

you consider the chosen areas/accounts to be risky? Your answers should be reflective of your in-

depth understanding of Vectus Group and its environment....................................................................9

5. With specific reference to Vectus’s corporate governance arrangements, you need to assess the

likelihood of the potential reliance that could be placed on the overall control environment. Your

conclusion should be supported by at least three factors......................................................................11

6: Based on your understanding of the client and assessment of the client’s business and audit risks,

would you undertake the audit? Why?..................................................................................................12

Conclusion.............................................................................................................................................13

3

Introduction

With the increasing demand for the drugs that could cure major diseases such as cardiac arrest, brain

stokes diabetes and another such level of diseases, regular research and development are done. Such

research of new formulas to develop a salt which could act as a drug is done by the biotechnical

companies. In this report, we have discussed the working of such company which deals in such

research and development Vectus Bio-system Limited. This report is prepared from the point of view

of an auditor, which would help them in auditing the working of the company. This report includes

introduction to the working of the company, the various rules and regulations that govern the working

of biotechnical and pharmaceutical companies, the business risk involved with such companies, the

area of working which are considered risky considering the annual report for the year 2017, analysis

of the internal work control of the company in accordance to its corporate governance arrangements

and the reasons because of which the auditor undertook the audit if Vectus Bio-system Limited. The

report is ended by providing a conclusion to the finding of the report.

4

With the increasing demand for the drugs that could cure major diseases such as cardiac arrest, brain

stokes diabetes and another such level of diseases, regular research and development are done. Such

research of new formulas to develop a salt which could act as a drug is done by the biotechnical

companies. In this report, we have discussed the working of such company which deals in such

research and development Vectus Bio-system Limited. This report is prepared from the point of view

of an auditor, which would help them in auditing the working of the company. This report includes

introduction to the working of the company, the various rules and regulations that govern the working

of biotechnical and pharmaceutical companies, the business risk involved with such companies, the

area of working which are considered risky considering the annual report for the year 2017, analysis

of the internal work control of the company in accordance to its corporate governance arrangements

and the reasons because of which the auditor undertook the audit if Vectus Bio-system Limited. The

report is ended by providing a conclusion to the finding of the report.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1. Provide an overview of the client’s operations and industry in which it

operates. Your overview of the client’s operations must include at least one

recent major development.

It is observed that the client company is Research and Development Company. It is engaged in the

medical research and development operations in Australia. From almost 20 years back from now, the

owner of the company Dr Karen Duggan came up with a discovery where there was a metabolic

change occurred from intake of a salt. Such salt enables the reverse of fibrosis which is caused due to

hypertension and any other chronic diseases. A few years later from then, in 2005 Vectus Biosystem

Limited was found considering the discovery of Dr Karen Duggan. The salt was given a form of

medicine since then and further research with such concept was initiated. Today Vectus has patented

its formula with Vasoactive Intestinal Peptide (VIP). Vectus operates as a biotechnological company.

The industry it belongs to is Biotech and Parma and the sub-industry it operates in is a biotech

industry. It provides preclinical substantial animal and human cell toxicity testing services. The

operations of the company also include the development of technology which aims at speeding up and

improving accuracy for measuring the amount of DNA and RNA in the samples which are available

at the laboratories. In the year 2006, the company was able to successfully launch an IPO on the

Australian Stock Exchange (ASX) and had raised a$5.1 million through it (Tabuena, 2012). The

funds that were raised through the IPO are used in the development of the key compound VB0004.

In the resent year there study of toxicology and pharmacokinetic was in process by the company.

Such study is in the process has shown successful trails on animals’ ad it was observed that there

were no side effects after 2000 milligrams per kilo were administered to the second species on daily

basis for seven days. The company is also under regular follow up for developing engagements with

various pharmaceutical companies. During the year the successful good management practice was

completed, which improved the cost efficiency and the yield per dose. The key patent of the company

has now also been granted in the USA, Japan, South Korea, Singapore, China, and Israel and also by

the African Regional Intellectual Property Organisation (Berezhniy, 2017). Also, the company had

made a good progress in Philippines and Europe. Vectus Biotechnology Limited has also received

recognition at the conference attended by the board of the company and the industrial leaders of

Australia, USA and New Zealand had appreciated the efforts made for the noble cause (Anon, 2012).

According to the annual report of the company, it is observed that the company is planning to expand

5

operates. Your overview of the client’s operations must include at least one

recent major development.

It is observed that the client company is Research and Development Company. It is engaged in the

medical research and development operations in Australia. From almost 20 years back from now, the

owner of the company Dr Karen Duggan came up with a discovery where there was a metabolic

change occurred from intake of a salt. Such salt enables the reverse of fibrosis which is caused due to

hypertension and any other chronic diseases. A few years later from then, in 2005 Vectus Biosystem

Limited was found considering the discovery of Dr Karen Duggan. The salt was given a form of

medicine since then and further research with such concept was initiated. Today Vectus has patented

its formula with Vasoactive Intestinal Peptide (VIP). Vectus operates as a biotechnological company.

The industry it belongs to is Biotech and Parma and the sub-industry it operates in is a biotech

industry. It provides preclinical substantial animal and human cell toxicity testing services. The

operations of the company also include the development of technology which aims at speeding up and

improving accuracy for measuring the amount of DNA and RNA in the samples which are available

at the laboratories. In the year 2006, the company was able to successfully launch an IPO on the

Australian Stock Exchange (ASX) and had raised a$5.1 million through it (Tabuena, 2012). The

funds that were raised through the IPO are used in the development of the key compound VB0004.

In the resent year there study of toxicology and pharmacokinetic was in process by the company.

Such study is in the process has shown successful trails on animals’ ad it was observed that there

were no side effects after 2000 milligrams per kilo were administered to the second species on daily

basis for seven days. The company is also under regular follow up for developing engagements with

various pharmaceutical companies. During the year the successful good management practice was

completed, which improved the cost efficiency and the yield per dose. The key patent of the company

has now also been granted in the USA, Japan, South Korea, Singapore, China, and Israel and also by

the African Regional Intellectual Property Organisation (Berezhniy, 2017). Also, the company had

made a good progress in Philippines and Europe. Vectus Biotechnology Limited has also received

recognition at the conference attended by the board of the company and the industrial leaders of

Australia, USA and New Zealand had appreciated the efforts made for the noble cause (Anon, 2012).

According to the annual report of the company, it is observed that the company is planning to expand

5

its research program in their area of interest which is cardiovascular diseases, non-alcoholic

steatohepatitis and alcoholic steatohepatitis (liver diseases) and pulmonary fibrosis (related to lungs).

6

steatohepatitis and alcoholic steatohepatitis (liver diseases) and pulmonary fibrosis (related to lungs).

6

2. Pharmaceutical companies are required to follow a number of regulations

and legislative requirements for therapeutic goods. You need to Identify and

briefly describe four (4) legal requirements (acts/regulations) for

pharmaceutical goods.

The regulations that govern are required to be followed by the pharmaceutical companies for

therapeutic goods are:

The Therapeutic Goods Act 1989- The objectives of The Therapeutic Goods Act, 1989 is to

establish a maintenance system nationally which would control the quality, timely availability, safety

and the efficiency of the goods. The Act is applicable to the following set of goods

- Goods which are used in Australia, whether or not manufactured in Australia.

- Goods which are exported from Australia and

- The goods that are used to provide a framework used by the states and the territories, so that a

uniform approach is followed. This is done to control the availability and the accessibility

along with the safe handling of poison in Australia.

Safety, Standards and Regulation- As it is a well-known fact that any product which is available in

the Australian market and contains or involves biotechnology needs to surpass the safety and standard

regulations. The regulations are maintained in order to provide correct medicinal value to the

customer. A range for the safety and standards which are to maintained are provided by the regulatory

authority (Anon, 2016)

Listing and Pricing of the product- It is found that in Australian market any pharmaceutical product

which is sold is required to be approved from TGA (Therapeutic Goods Administration) and needs to

be prescribed from a doctor. Most of the drugs which are prescribed are sole through the

Pharmaceutical Benefits Scheme (PBS). This is because it helps the customers to purchase them at

the lower price. Hence, for the listing at PBS, a positive recommendation for that drug is required by

the Pharmaceutical Benefits Advisory Committee (PBAC). PBAC is an independent body under

National Health Act, 1943.

Competition Law in Australia- the Competition and Consumer Act, 2010 provides a set of laws for

Australian competition. This body is an independent statutory authority managed by the Australian

Competition and Consumer Commission Act. The regulations of the competition and consumer act,

7

and legislative requirements for therapeutic goods. You need to Identify and

briefly describe four (4) legal requirements (acts/regulations) for

pharmaceutical goods.

The regulations that govern are required to be followed by the pharmaceutical companies for

therapeutic goods are:

The Therapeutic Goods Act 1989- The objectives of The Therapeutic Goods Act, 1989 is to

establish a maintenance system nationally which would control the quality, timely availability, safety

and the efficiency of the goods. The Act is applicable to the following set of goods

- Goods which are used in Australia, whether or not manufactured in Australia.

- Goods which are exported from Australia and

- The goods that are used to provide a framework used by the states and the territories, so that a

uniform approach is followed. This is done to control the availability and the accessibility

along with the safe handling of poison in Australia.

Safety, Standards and Regulation- As it is a well-known fact that any product which is available in

the Australian market and contains or involves biotechnology needs to surpass the safety and standard

regulations. The regulations are maintained in order to provide correct medicinal value to the

customer. A range for the safety and standards which are to maintained are provided by the regulatory

authority (Anon, 2016)

Listing and Pricing of the product- It is found that in Australian market any pharmaceutical product

which is sold is required to be approved from TGA (Therapeutic Goods Administration) and needs to

be prescribed from a doctor. Most of the drugs which are prescribed are sole through the

Pharmaceutical Benefits Scheme (PBS). This is because it helps the customers to purchase them at

the lower price. Hence, for the listing at PBS, a positive recommendation for that drug is required by

the Pharmaceutical Benefits Advisory Committee (PBAC). PBAC is an independent body under

National Health Act, 1943.

Competition Law in Australia- the Competition and Consumer Act, 2010 provides a set of laws for

Australian competition. This body is an independent statutory authority managed by the Australian

Competition and Consumer Commission Act. The regulations of the competition and consumer act,

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2010 is virtually applicable to all the business companies dealing in pharmaceuticals (Ranson, 2010).

The following conduct is the most relevant of the CCA-

1. Mergers and Acquisitions which could lead to substantial reduction of competition

2. Resale price maintenance by the wholesaler who specifies the resale price.

3. Contract and arrangements between the companies which to affect the competition in the market.

4. The cartel behaviour which includes price fixing and restriction on the outcome.

There are some of the legal requirement that is to be considered by the auditor while auditing the

reports and documents of Vectus.

8

The following conduct is the most relevant of the CCA-

1. Mergers and Acquisitions which could lead to substantial reduction of competition

2. Resale price maintenance by the wholesaler who specifies the resale price.

3. Contract and arrangements between the companies which to affect the competition in the market.

4. The cartel behaviour which includes price fixing and restriction on the outcome.

There are some of the legal requirement that is to be considered by the auditor while auditing the

reports and documents of Vectus.

8

3. Identify FOUR significant business risk factors that the auditor needs to

consider the Vectus group engagement. Describe how these risks may lead

to potential material misstatements in the financial report.

It is observed that the pharmaceutical companies are facing various legal challenges increasingly.

This industry has recently expanded into the markets and this has increased its risk factor. By

identifying the risks associated with this industry it would be easy for the companies to make

proactive policies and procedures for the working (Lu, Wu & Yu, 2017). If such foresightedness is

not developed by the companies it may reduce the potential of the company financially and legally.

The risks which the auditors of Vectus Biosystem Limited is associated with are:

Cyber Security: According to the research, it is found that in 2004 a group of hackers targeted the

pharmaceutical and biotechnology companies in stealing the non-public data from their emails. Such

data was related to the formulas with the help of which the salt for the medicines and also to attempt

insider trading activities. After the investigation of the crime by the cyber cell, there was no guarantee

given to the victim companies (Sisodia, Soares & Ferreira, 2016). Hence, still in today's time the data

and the confidential information that is shared by the companies over the internet is not safe. This risk

if gets attracted to a company can lead to heavy losses without recovery.

In order to protect the data from hackers, the company provide misstatements in the financial reports

which would not attract them. But this leads to dissemination of untrue information to the

stakeholders.

Global Anti-Corruption: It is observed that the business of pharmaceuticals has been expanded its

virtues internationally also. In order to obtain the license for the setup of this business, there are many

companies who have approached the government officials illegally. There have been records with the

regulatory bodies who have investigated such companies offering any value to the government

officials so that the licence for this business could be obtained (Deby & Tigor, 2018).

Because of such malpractices of a few companies, other companies which work ethically are at risk of

an investigation under Foreign Corrupt Practices Act. In order to keep an eye on the pharma

companies, heavy regulations and vigorous compliances are set up. Hence, the risk of an investigation

may lead to delay in the working of the company.

9

consider the Vectus group engagement. Describe how these risks may lead

to potential material misstatements in the financial report.

It is observed that the pharmaceutical companies are facing various legal challenges increasingly.

This industry has recently expanded into the markets and this has increased its risk factor. By

identifying the risks associated with this industry it would be easy for the companies to make

proactive policies and procedures for the working (Lu, Wu & Yu, 2017). If such foresightedness is

not developed by the companies it may reduce the potential of the company financially and legally.

The risks which the auditors of Vectus Biosystem Limited is associated with are:

Cyber Security: According to the research, it is found that in 2004 a group of hackers targeted the

pharmaceutical and biotechnology companies in stealing the non-public data from their emails. Such

data was related to the formulas with the help of which the salt for the medicines and also to attempt

insider trading activities. After the investigation of the crime by the cyber cell, there was no guarantee

given to the victim companies (Sisodia, Soares & Ferreira, 2016). Hence, still in today's time the data

and the confidential information that is shared by the companies over the internet is not safe. This risk

if gets attracted to a company can lead to heavy losses without recovery.

In order to protect the data from hackers, the company provide misstatements in the financial reports

which would not attract them. But this leads to dissemination of untrue information to the

stakeholders.

Global Anti-Corruption: It is observed that the business of pharmaceuticals has been expanded its

virtues internationally also. In order to obtain the license for the setup of this business, there are many

companies who have approached the government officials illegally. There have been records with the

regulatory bodies who have investigated such companies offering any value to the government

officials so that the licence for this business could be obtained (Deby & Tigor, 2018).

Because of such malpractices of a few companies, other companies which work ethically are at risk of

an investigation under Foreign Corrupt Practices Act. In order to keep an eye on the pharma

companies, heavy regulations and vigorous compliances are set up. Hence, the risk of an investigation

may lead to delay in the working of the company.

9

The companies associated with the malpractice of corruption would lead to misstatements in the

financial reports to hide such practice.

Increasing competition and commercialisation of new products: With the emergence of new

technology the research and development have increased to a greater extent. This has increased

competition in the market. The commercialisation of the products has increased brand publicity and

the customer is attracted to such specific brands only. This risk can only be curbed when there is an

increase in the sale of the company (Yu & Chan, 2016).

Such risk is prone to display of wrong information. In order to increase the customer’s attention in

the sales of the products, there could be chances that the financial report is manipulated in such

manner which would show wrong information.

Taxation Risk: With the dynamicity of the rules and regulation of this industry there are chances of

regular increment in the taxes that could be levied on them (Rooney & Cuganesan, 2015).

If a company would have a will to get rid of the taxes levied they might show wrong sales and

turnover value so that the tax rate applicable would be less.

10

financial reports to hide such practice.

Increasing competition and commercialisation of new products: With the emergence of new

technology the research and development have increased to a greater extent. This has increased

competition in the market. The commercialisation of the products has increased brand publicity and

the customer is attracted to such specific brands only. This risk can only be curbed when there is an

increase in the sale of the company (Yu & Chan, 2016).

Such risk is prone to display of wrong information. In order to increase the customer’s attention in

the sales of the products, there could be chances that the financial report is manipulated in such

manner which would show wrong information.

Taxation Risk: With the dynamicity of the rules and regulation of this industry there are chances of

regular increment in the taxes that could be levied on them (Rooney & Cuganesan, 2015).

If a company would have a will to get rid of the taxes levied they might show wrong sales and

turnover value so that the tax rate applicable would be less.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

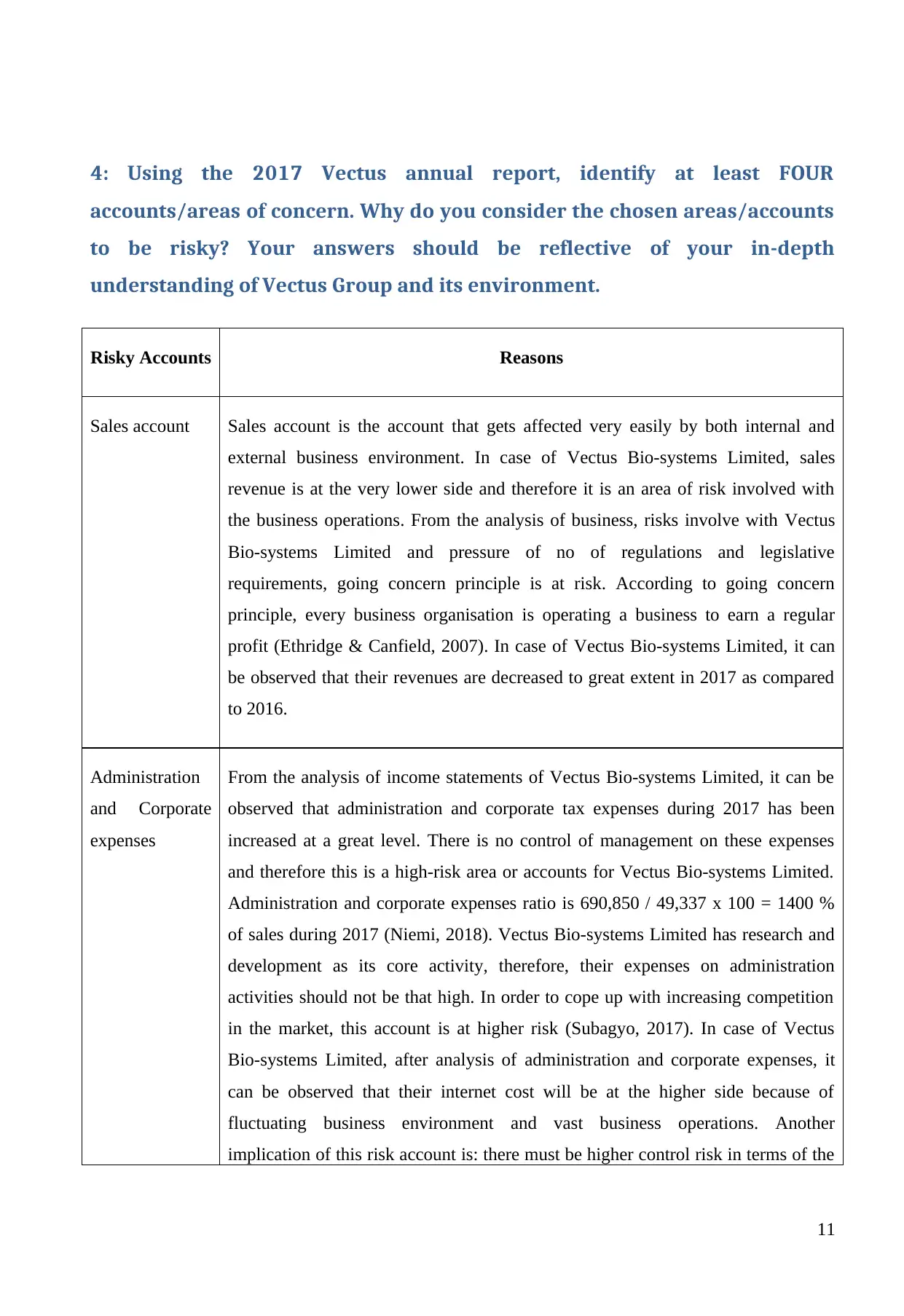

4: Using the 2017 Vectus annual report, identify at least FOUR

accounts/areas of concern. Why do you consider the chosen areas/accounts

to be risky? Your answers should be reflective of your in-depth

understanding of Vectus Group and its environment.

Risky Accounts Reasons

Sales account Sales account is the account that gets affected very easily by both internal and

external business environment. In case of Vectus Bio-systems Limited, sales

revenue is at the very lower side and therefore it is an area of risk involved with

the business operations. From the analysis of business, risks involve with Vectus

Bio-systems Limited and pressure of no of regulations and legislative

requirements, going concern principle is at risk. According to going concern

principle, every business organisation is operating a business to earn a regular

profit (Ethridge & Canfield, 2007). In case of Vectus Bio-systems Limited, it can

be observed that their revenues are decreased to great extent in 2017 as compared

to 2016.

Administration

and Corporate

expenses

From the analysis of income statements of Vectus Bio-systems Limited, it can be

observed that administration and corporate tax expenses during 2017 has been

increased at a great level. There is no control of management on these expenses

and therefore this is a high-risk area or accounts for Vectus Bio-systems Limited.

Administration and corporate expenses ratio is 690,850 / 49,337 x 100 = 1400 %

of sales during 2017 (Niemi, 2018). Vectus Bio-systems Limited has research and

development as its core activity, therefore, their expenses on administration

activities should not be that high. In order to cope up with increasing competition

in the market, this account is at higher risk (Subagyo, 2017). In case of Vectus

Bio-systems Limited, after analysis of administration and corporate expenses, it

can be observed that their internet cost will be at the higher side because of

fluctuating business environment and vast business operations. Another

implication of this risk account is: there must be higher control risk in terms of the

11

accounts/areas of concern. Why do you consider the chosen areas/accounts

to be risky? Your answers should be reflective of your in-depth

understanding of Vectus Group and its environment.

Risky Accounts Reasons

Sales account Sales account is the account that gets affected very easily by both internal and

external business environment. In case of Vectus Bio-systems Limited, sales

revenue is at the very lower side and therefore it is an area of risk involved with

the business operations. From the analysis of business, risks involve with Vectus

Bio-systems Limited and pressure of no of regulations and legislative

requirements, going concern principle is at risk. According to going concern

principle, every business organisation is operating a business to earn a regular

profit (Ethridge & Canfield, 2007). In case of Vectus Bio-systems Limited, it can

be observed that their revenues are decreased to great extent in 2017 as compared

to 2016.

Administration

and Corporate

expenses

From the analysis of income statements of Vectus Bio-systems Limited, it can be

observed that administration and corporate tax expenses during 2017 has been

increased at a great level. There is no control of management on these expenses

and therefore this is a high-risk area or accounts for Vectus Bio-systems Limited.

Administration and corporate expenses ratio is 690,850 / 49,337 x 100 = 1400 %

of sales during 2017 (Niemi, 2018). Vectus Bio-systems Limited has research and

development as its core activity, therefore, their expenses on administration

activities should not be that high. In order to cope up with increasing competition

in the market, this account is at higher risk (Subagyo, 2017). In case of Vectus

Bio-systems Limited, after analysis of administration and corporate expenses, it

can be observed that their internet cost will be at the higher side because of

fluctuating business environment and vast business operations. Another

implication of this risk account is: there must be higher control risk in terms of the

11

internal control system of Vectus Bio-systems Limited (Pickett, 2011).

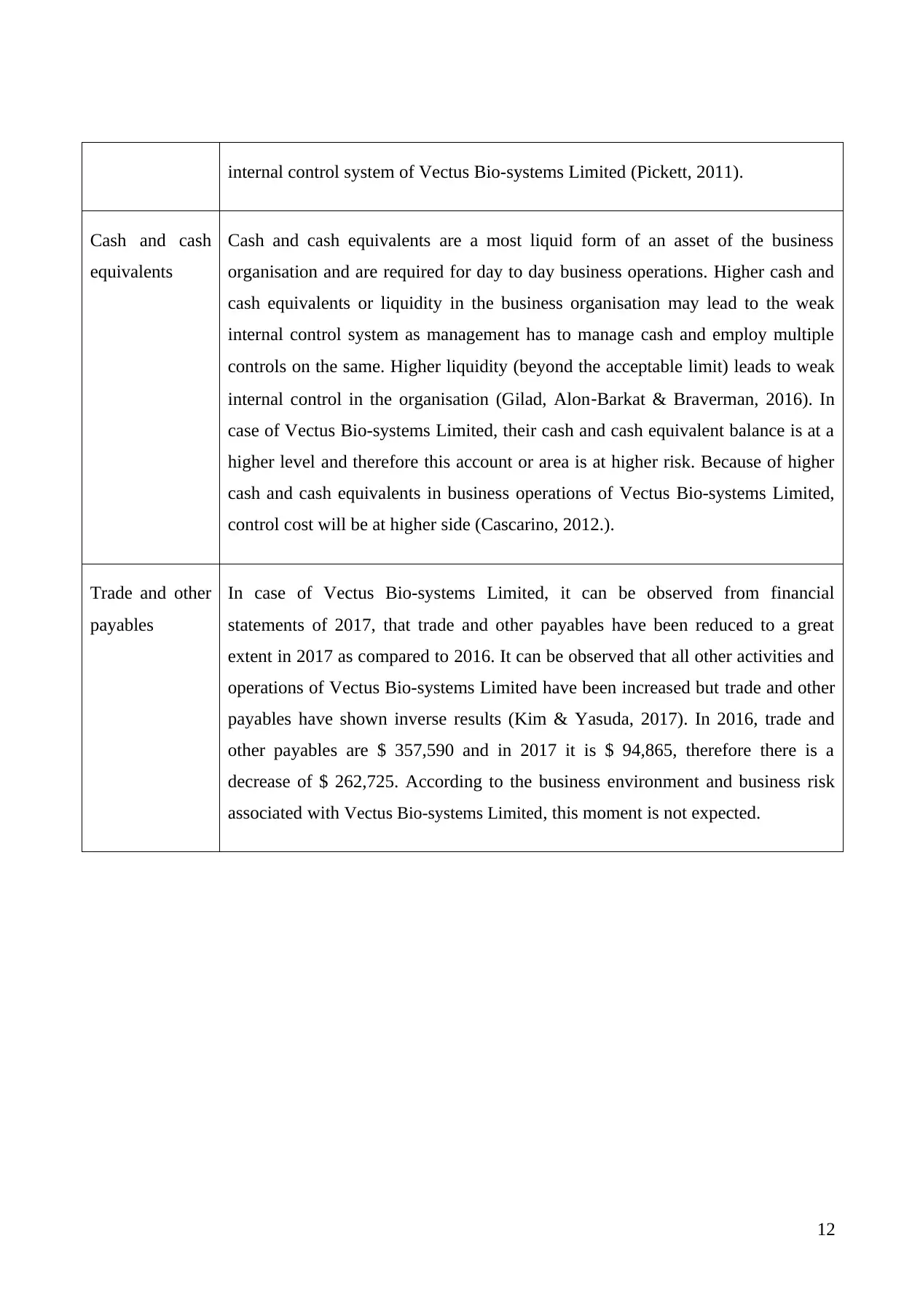

Cash and cash

equivalents

Cash and cash equivalents are a most liquid form of an asset of the business

organisation and are required for day to day business operations. Higher cash and

cash equivalents or liquidity in the business organisation may lead to the weak

internal control system as management has to manage cash and employ multiple

controls on the same. Higher liquidity (beyond the acceptable limit) leads to weak

internal control in the organisation (Gilad, Alon‐Barkat & Braverman, 2016). In

case of Vectus Bio-systems Limited, their cash and cash equivalent balance is at a

higher level and therefore this account or area is at higher risk. Because of higher

cash and cash equivalents in business operations of Vectus Bio-systems Limited,

control cost will be at higher side (Cascarino, 2012.).

Trade and other

payables

In case of Vectus Bio-systems Limited, it can be observed from financial

statements of 2017, that trade and other payables have been reduced to a great

extent in 2017 as compared to 2016. It can be observed that all other activities and

operations of Vectus Bio-systems Limited have been increased but trade and other

payables have shown inverse results (Kim & Yasuda, 2017). In 2016, trade and

other payables are $ 357,590 and in 2017 it is $ 94,865, therefore there is a

decrease of $ 262,725. According to the business environment and business risk

associated with Vectus Bio-systems Limited, this moment is not expected.

12

Cash and cash

equivalents

Cash and cash equivalents are a most liquid form of an asset of the business

organisation and are required for day to day business operations. Higher cash and

cash equivalents or liquidity in the business organisation may lead to the weak

internal control system as management has to manage cash and employ multiple

controls on the same. Higher liquidity (beyond the acceptable limit) leads to weak

internal control in the organisation (Gilad, Alon‐Barkat & Braverman, 2016). In

case of Vectus Bio-systems Limited, their cash and cash equivalent balance is at a

higher level and therefore this account or area is at higher risk. Because of higher

cash and cash equivalents in business operations of Vectus Bio-systems Limited,

control cost will be at higher side (Cascarino, 2012.).

Trade and other

payables

In case of Vectus Bio-systems Limited, it can be observed from financial

statements of 2017, that trade and other payables have been reduced to a great

extent in 2017 as compared to 2016. It can be observed that all other activities and

operations of Vectus Bio-systems Limited have been increased but trade and other

payables have shown inverse results (Kim & Yasuda, 2017). In 2016, trade and

other payables are $ 357,590 and in 2017 it is $ 94,865, therefore there is a

decrease of $ 262,725. According to the business environment and business risk

associated with Vectus Bio-systems Limited, this moment is not expected.

12

5. With specific reference to Vectus’s corporate governance arrangements,

you need to assess the likelihood of the potential reliance that could be

placed on the overall control environment. Your conclusion should be

supported by at least three factors.

Considering the corporate governance manual of Vectus Bio-systems Limited, the corporate

governance manual adopted by the company is formal. The Board of Directors of the company is

responsible for regular review of the corporate governance manual. After going through the system

formed by the company for compliance with the corporate governance, it could be said that the

control system maintained internally could be relied on. This is said after considering the following

factors:

Audit and Risk Management Committee Charter- This committee is made considering the risk which

is associated with the internal working of the company. It is a well-known fact that any type of risk

associated with the company is dangerous for the working of the same. After formation of this

committee, Vectus has a complete audit of each and every working department on regular basis and

the meeting held are for the discussion of the faults found in the audit (Wright, 2016.). Hence, this

strengthens the internal management and control of Vectus.

Continuous Disclosure Policy- In order to maintain the faith and reliance on the stakeholders of the

company it is important for the management to disclosure the essential information of time and with

correctness. At Vectus Limited under the continuous disclosure policy time of disclosure and the

information that is to be disclosed is explained. This helps the internal management to understand the

reporting properly.

Shareholder Communication Policy- The shareholders are considered the owners of Vectus Limited.

Proper communication of information and any information on demand by them is provided to the

shareholders on time. Such work is possible as there is a policy made for it which explains each and

every factor related to the communication made (Graham, Bedard & Dutta, 2018).

13

you need to assess the likelihood of the potential reliance that could be

placed on the overall control environment. Your conclusion should be

supported by at least three factors.

Considering the corporate governance manual of Vectus Bio-systems Limited, the corporate

governance manual adopted by the company is formal. The Board of Directors of the company is

responsible for regular review of the corporate governance manual. After going through the system

formed by the company for compliance with the corporate governance, it could be said that the

control system maintained internally could be relied on. This is said after considering the following

factors:

Audit and Risk Management Committee Charter- This committee is made considering the risk which

is associated with the internal working of the company. It is a well-known fact that any type of risk

associated with the company is dangerous for the working of the same. After formation of this

committee, Vectus has a complete audit of each and every working department on regular basis and

the meeting held are for the discussion of the faults found in the audit (Wright, 2016.). Hence, this

strengthens the internal management and control of Vectus.

Continuous Disclosure Policy- In order to maintain the faith and reliance on the stakeholders of the

company it is important for the management to disclosure the essential information of time and with

correctness. At Vectus Limited under the continuous disclosure policy time of disclosure and the

information that is to be disclosed is explained. This helps the internal management to understand the

reporting properly.

Shareholder Communication Policy- The shareholders are considered the owners of Vectus Limited.

Proper communication of information and any information on demand by them is provided to the

shareholders on time. Such work is possible as there is a policy made for it which explains each and

every factor related to the communication made (Graham, Bedard & Dutta, 2018).

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6: Based on your understanding of the client and assessment of the client’s

business and audit risks, would you undertake the audit? Why?

Accepting audit of any business organisation involves many considerations that auditor is required to

undertake before giving acceptance to the business entity. There are fundamental principles of

auditing are required to be accessed and the decision should be based on those assessed findings.

There should not be any potential threat to integrity and professional behaviour for the auditor and

this should be assessed before confirming for the audit. In case of Vectus Bio-systems Limited, there

are various issues involved in their business operations and in a business environment (Sonu, Ahn, &

Choi, 2017). It can be analysed from the business risk assessment and regulations and legislative

requirements that Vectus Bio-systems needs to undergo, there is undue influence on the management.

Before accepting an audit of Vectus Bio-systems unacceptable risk or in controllable risk needs to be

identified and impact of same is required to be assessed. From the analysis of business risk involved

with Vectus Bio-systems, it can be observed that their inherited risk is at higher side and this implies

that there will be various uncontrollable factors that auditor is required to deal with. Factors related to

business operations or business activities of Vectus Bio-systems Limited can be hampered because of

uncontrollable factors. Therefore in this situation, auditor or management of Vectus Bio-systems

Limited cannot do anything (Sonu, Ahn & Choi, 2017).

Another factor related to Vectus Bio-systems Limited is of the weak control system and control

planning by the management of their business operations. Auditors are not responsible for

establishing internal control system in the business process of the organisation but management is

responsible. In case of Vectus Bio-systems Limited, the internal control system has shown adverse

results and therefore is weak in terms of implementation. Therefore it is very risky to give acceptance

of audit of Vectus Bio-systems Limited for the current year.

Recommendation: Therefore on the basis of above contention, an audit of Vectus Bio-systems

Limited should be accepted.

14

business and audit risks, would you undertake the audit? Why?

Accepting audit of any business organisation involves many considerations that auditor is required to

undertake before giving acceptance to the business entity. There are fundamental principles of

auditing are required to be accessed and the decision should be based on those assessed findings.

There should not be any potential threat to integrity and professional behaviour for the auditor and

this should be assessed before confirming for the audit. In case of Vectus Bio-systems Limited, there

are various issues involved in their business operations and in a business environment (Sonu, Ahn, &

Choi, 2017). It can be analysed from the business risk assessment and regulations and legislative

requirements that Vectus Bio-systems needs to undergo, there is undue influence on the management.

Before accepting an audit of Vectus Bio-systems unacceptable risk or in controllable risk needs to be

identified and impact of same is required to be assessed. From the analysis of business risk involved

with Vectus Bio-systems, it can be observed that their inherited risk is at higher side and this implies

that there will be various uncontrollable factors that auditor is required to deal with. Factors related to

business operations or business activities of Vectus Bio-systems Limited can be hampered because of

uncontrollable factors. Therefore in this situation, auditor or management of Vectus Bio-systems

Limited cannot do anything (Sonu, Ahn & Choi, 2017).

Another factor related to Vectus Bio-systems Limited is of the weak control system and control

planning by the management of their business operations. Auditors are not responsible for

establishing internal control system in the business process of the organisation but management is

responsible. In case of Vectus Bio-systems Limited, the internal control system has shown adverse

results and therefore is weak in terms of implementation. Therefore it is very risky to give acceptance

of audit of Vectus Bio-systems Limited for the current year.

Recommendation: Therefore on the basis of above contention, an audit of Vectus Bio-systems

Limited should be accepted.

14

Conclusion

At the end of this report, it could be said that Vectus Bio-systems Limited is a biotech pharmaceutical

company which does research and development of the salt for curing high-level diseases. The auditor

of the company needs to keep in mind many points while performing the audit process. This is

because such industry is governed by plenty of rules and regulations for which reporting and

documentation need to be proper. Along with this, the risk associated with the business are not easily

curable, but they need proper planning for the same. For this coming to the corporate governance of

the company, it seems well designed and stable. With such stability and proper management in

accordance with the corporate governance policies, it is would lead to the better internal control

system. At the end, Vectus Bio-systems Limited needs to majorly focus in commercialising its work

done and understand the needs and requirements of the shareholders for a sustainable future.

15

At the end of this report, it could be said that Vectus Bio-systems Limited is a biotech pharmaceutical

company which does research and development of the salt for curing high-level diseases. The auditor

of the company needs to keep in mind many points while performing the audit process. This is

because such industry is governed by plenty of rules and regulations for which reporting and

documentation need to be proper. Along with this, the risk associated with the business are not easily

curable, but they need proper planning for the same. For this coming to the corporate governance of

the company, it seems well designed and stable. With such stability and proper management in

accordance with the corporate governance policies, it is would lead to the better internal control

system. At the end, Vectus Bio-systems Limited needs to majorly focus in commercialising its work

done and understand the needs and requirements of the shareholders for a sustainable future.

15

References

Anon, 2012. How to get your drug registered in Australia? BioSpectrum Asia, pp.BioSpectrum Asia,

Sept 26, 2012.

Anon, 2016. MEDICINAL CANNABIS SCHEME LICENCE APPLICATIONS OPEN. States News

Service, pp.States News Service, Oct 30, 2016.

Anonymous, 2010. Audit risk. Laboratory Compliance Insider, 7(10), p.6.

Begin, Lucie & Boisvert, Hugues, 2002. E-commerce evaluating the external business environment.

(Special Focus on E-Business Strategies.(electronic commerce, analysis). CMA Management, 76(2),

pp.16–21.

Berezhniy Yevgeniy B, 2017. The Theoretical and Empirical Approaches to the Definition of Audit

Risk. Bìznes Inform, 12(479), pp.365–369.

Cascarino, R., 2012. Auditor's guide to IT auditing 2nd ed., Hoboken, N.J.: Wiley.

Deby Suryani & Tigor Sitorus, 2018. The Client Risk and The Audit Planning: Influence of

Acceptance of Audit Engagement. International Research Journal of Business Studies, 10(3),

pp.183–198.

Ethridge, J. & Canfield, K., 2007. Engagement Risk: A Preliminary Analysis Of Audit Firms' Client

Acceptance Decisions. Academy of Accounting and Financial Studies Journal, 11(1), pp.1–8.

Gilad, S., Alon‐Barkat, S. & Braverman, A., 2016. Large‐Scale Social Protest: A Business Risk and a

Bureaucratic Opportunity. Governance, 29(3), pp.371–392.

Graham, L., Bedard, J.C. & Dutta, S., 2018. Managing group audit risk in a multicomponent audit

setting. International Journal of Auditing, 22(1), pp.40–54.

Kim & Yasuda, 2017. Business risk disclosure and firm risk: Evidence from Japan. Research in

International Business and Finance, pp.Research in International Business and Finance.

Lu, L.Y., Wu, H. & Yu, Y., 2017. Investment-Related Pressure and Audit Risk. Auditing: A Journal

of Practice & Theory, 36(3), pp.137–157.

16

Anon, 2012. How to get your drug registered in Australia? BioSpectrum Asia, pp.BioSpectrum Asia,

Sept 26, 2012.

Anon, 2016. MEDICINAL CANNABIS SCHEME LICENCE APPLICATIONS OPEN. States News

Service, pp.States News Service, Oct 30, 2016.

Anonymous, 2010. Audit risk. Laboratory Compliance Insider, 7(10), p.6.

Begin, Lucie & Boisvert, Hugues, 2002. E-commerce evaluating the external business environment.

(Special Focus on E-Business Strategies.(electronic commerce, analysis). CMA Management, 76(2),

pp.16–21.

Berezhniy Yevgeniy B, 2017. The Theoretical and Empirical Approaches to the Definition of Audit

Risk. Bìznes Inform, 12(479), pp.365–369.

Cascarino, R., 2012. Auditor's guide to IT auditing 2nd ed., Hoboken, N.J.: Wiley.

Deby Suryani & Tigor Sitorus, 2018. The Client Risk and The Audit Planning: Influence of

Acceptance of Audit Engagement. International Research Journal of Business Studies, 10(3),

pp.183–198.

Ethridge, J. & Canfield, K., 2007. Engagement Risk: A Preliminary Analysis Of Audit Firms' Client

Acceptance Decisions. Academy of Accounting and Financial Studies Journal, 11(1), pp.1–8.

Gilad, S., Alon‐Barkat, S. & Braverman, A., 2016. Large‐Scale Social Protest: A Business Risk and a

Bureaucratic Opportunity. Governance, 29(3), pp.371–392.

Graham, L., Bedard, J.C. & Dutta, S., 2018. Managing group audit risk in a multicomponent audit

setting. International Journal of Auditing, 22(1), pp.40–54.

Kim & Yasuda, 2017. Business risk disclosure and firm risk: Evidence from Japan. Research in

International Business and Finance, pp.Research in International Business and Finance.

Lu, L.Y., Wu, H. & Yu, Y., 2017. Investment-Related Pressure and Audit Risk. Auditing: A Journal

of Practice & Theory, 36(3), pp.137–157.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Lu, L.Y., Wu, H. & Yu, Y., 2017. Investment-Related Pressure and Audit Risk. Auditing: A Journal

of Practice & Theory, 36(3), pp.137–157.

Niemi, L. et al., 2018. Responsiveness of Auditors to the Audit Risk Standards: Unique Evidence

from Big 4 Audit Firms. Accounting in Europe, 15(1), pp.33–54.

Pickett, K.H.S., 2011. The essential guide to internal auditing 2nd ed., Chichester, West Sussex:

Wiley.

Ranson, Brian J., 2010. Chapter 11: Retail (consumer) and small business credit risk.(Company

overview). Credit Risk Management, pp.11-i.

Rooney, J. & Cuganesan, S., 2015. Managerial auditing journal : perspectives of risk management -

attenuation, leadership, incentives and complementation,

Sisodia, Soares & Ferreira, 2016. Modeling business risk: The effect of regulatory revision on

renewable energy investment - The Iberian case. Renewable Energy, 95, pp.303–313.

Sonu, C.H., Ahn, H. & Choi, A., 2017. Audit fee pressure and audit risk: evidence from the financial

crisis of 2008 *. Asia-Pacific Journal of Accounting & Economics, 24(1-2), pp.127–144.

Sonu, C.H., Ahn, H. & Choi, A., 2017. Audit fee pressure and audit risk: evidence from the financial

crisis of 2008 *. Asia-Pacific Journal of Accounting & Economics, 24(1-2), pp.127–144.

Subagyo Ahmad, 2017. Correlation and Relationship Analisys for Business Risk and Company

Assets. Economics (Bijeljina), 5(2), pp.47–53.

Tabuena, J., 2012. Internal Audit Priorities: The Audit Risk Assessment. Compliance Week, 9(101),

pp.30–31.

Wright, W.F., 2016. Client business models, process business risks and the risk of material

misstatement of revenue. Accounting, Organizations and Society, 48, pp.43–55.

Yu-Ting Hsieh & Chan-Jane Lin, 2016. Audit firms' client acceptance decisions: does partner-level

industry expertise matter? , 35(2), pp.97–120.

17

of Practice & Theory, 36(3), pp.137–157.

Niemi, L. et al., 2018. Responsiveness of Auditors to the Audit Risk Standards: Unique Evidence

from Big 4 Audit Firms. Accounting in Europe, 15(1), pp.33–54.

Pickett, K.H.S., 2011. The essential guide to internal auditing 2nd ed., Chichester, West Sussex:

Wiley.

Ranson, Brian J., 2010. Chapter 11: Retail (consumer) and small business credit risk.(Company

overview). Credit Risk Management, pp.11-i.

Rooney, J. & Cuganesan, S., 2015. Managerial auditing journal : perspectives of risk management -

attenuation, leadership, incentives and complementation,

Sisodia, Soares & Ferreira, 2016. Modeling business risk: The effect of regulatory revision on

renewable energy investment - The Iberian case. Renewable Energy, 95, pp.303–313.

Sonu, C.H., Ahn, H. & Choi, A., 2017. Audit fee pressure and audit risk: evidence from the financial

crisis of 2008 *. Asia-Pacific Journal of Accounting & Economics, 24(1-2), pp.127–144.

Sonu, C.H., Ahn, H. & Choi, A., 2017. Audit fee pressure and audit risk: evidence from the financial

crisis of 2008 *. Asia-Pacific Journal of Accounting & Economics, 24(1-2), pp.127–144.

Subagyo Ahmad, 2017. Correlation and Relationship Analisys for Business Risk and Company

Assets. Economics (Bijeljina), 5(2), pp.47–53.

Tabuena, J., 2012. Internal Audit Priorities: The Audit Risk Assessment. Compliance Week, 9(101),

pp.30–31.

Wright, W.F., 2016. Client business models, process business risks and the risk of material

misstatement of revenue. Accounting, Organizations and Society, 48, pp.43–55.

Yu-Ting Hsieh & Chan-Jane Lin, 2016. Audit firms' client acceptance decisions: does partner-level

industry expertise matter? , 35(2), pp.97–120.

17

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.