ACCOUNTING STATEMENT ANALYSIS

VerifiedAdded on 2022/08/26

|8

|713

|22

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNITNG STATEMENT ANALYSIS

Accounting Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Accounting Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING STATEMENT ANALYSIS

Table of Contents

General Journal:...............................................................................................................................2

Stock Card:......................................................................................................................................4

Revenue section of Income Statement.............................................................................................6

Bibliography....................................................................................................................................7

Table of Contents

General Journal:...............................................................................................................................2

Stock Card:......................................................................................................................................4

Revenue section of Income Statement.............................................................................................6

Bibliography....................................................................................................................................7

2ACCOUNTING STATEMENT ANALYSIS

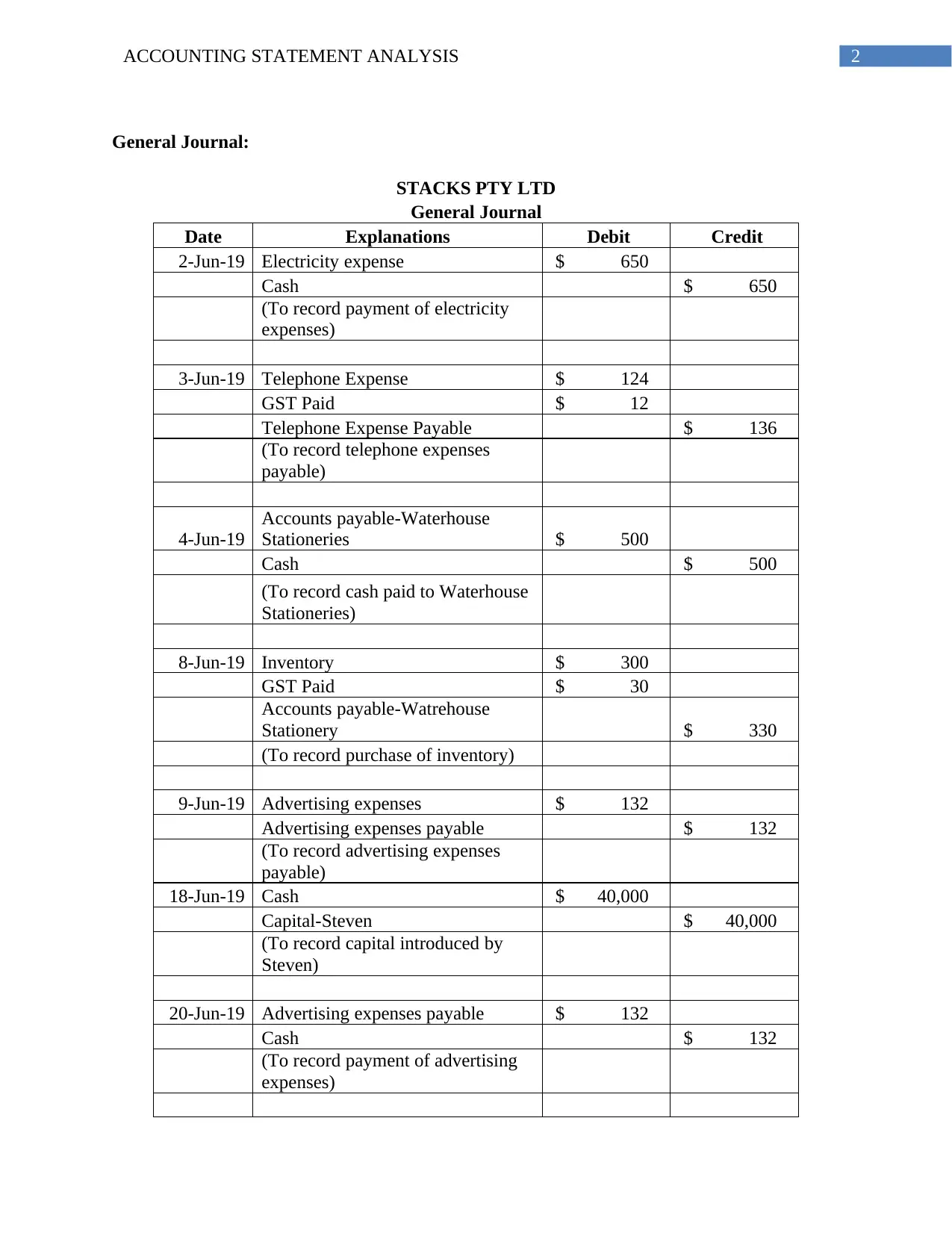

General Journal:

STACKS PTY LTD

General Journal

Date Explanations Debit Credit

2-Jun-19 Electricity expense $ 650

Cash $ 650

(To record payment of electricity

expenses)

3-Jun-19 Telephone Expense $ 124

GST Paid $ 12

Telephone Expense Payable $ 136

(To record telephone expenses

payable)

4-Jun-19

Accounts payable-Waterhouse

Stationeries $ 500

Cash $ 500

(To record cash paid to Waterhouse

Stationeries)

8-Jun-19 Inventory $ 300

GST Paid $ 30

Accounts payable-Watrehouse

Stationery $ 330

(To record purchase of inventory)

9-Jun-19 Advertising expenses $ 132

Advertising expenses payable $ 132

(To record advertising expenses

payable)

18-Jun-19 Cash $ 40,000

Capital-Steven $ 40,000

(To record capital introduced by

Steven)

20-Jun-19 Advertising expenses payable $ 132

Cash $ 132

(To record payment of advertising

expenses)

General Journal:

STACKS PTY LTD

General Journal

Date Explanations Debit Credit

2-Jun-19 Electricity expense $ 650

Cash $ 650

(To record payment of electricity

expenses)

3-Jun-19 Telephone Expense $ 124

GST Paid $ 12

Telephone Expense Payable $ 136

(To record telephone expenses

payable)

4-Jun-19

Accounts payable-Waterhouse

Stationeries $ 500

Cash $ 500

(To record cash paid to Waterhouse

Stationeries)

8-Jun-19 Inventory $ 300

GST Paid $ 30

Accounts payable-Watrehouse

Stationery $ 330

(To record purchase of inventory)

9-Jun-19 Advertising expenses $ 132

Advertising expenses payable $ 132

(To record advertising expenses

payable)

18-Jun-19 Cash $ 40,000

Capital-Steven $ 40,000

(To record capital introduced by

Steven)

20-Jun-19 Advertising expenses payable $ 132

Cash $ 132

(To record payment of advertising

expenses)

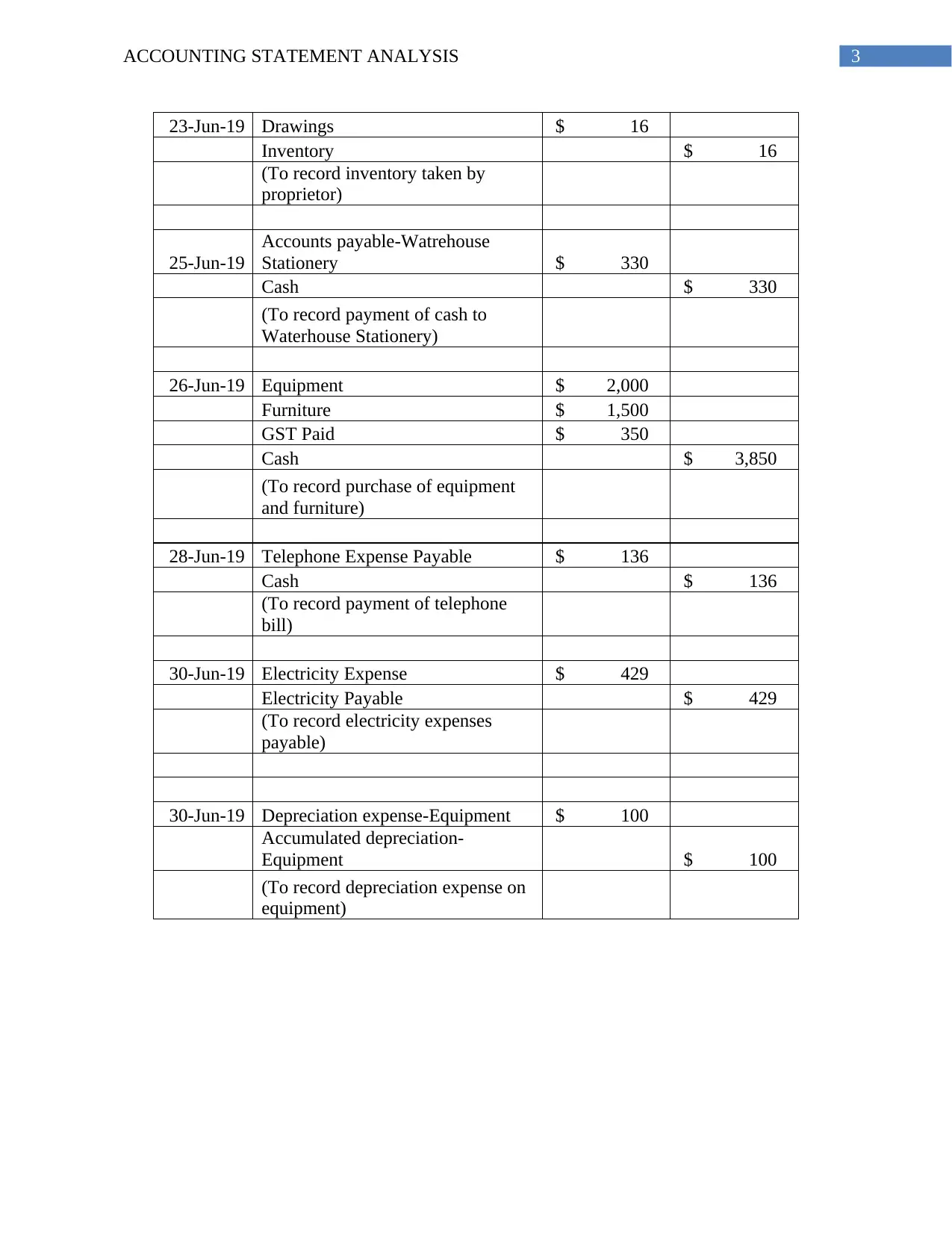

3ACCOUNTING STATEMENT ANALYSIS

23-Jun-19 Drawings $ 16

Inventory $ 16

(To record inventory taken by

proprietor)

25-Jun-19

Accounts payable-Watrehouse

Stationery $ 330

Cash $ 330

(To record payment of cash to

Waterhouse Stationery)

26-Jun-19 Equipment $ 2,000

Furniture $ 1,500

GST Paid $ 350

Cash $ 3,850

(To record purchase of equipment

and furniture)

28-Jun-19 Telephone Expense Payable $ 136

Cash $ 136

(To record payment of telephone

bill)

30-Jun-19 Electricity Expense $ 429

Electricity Payable $ 429

(To record electricity expenses

payable)

30-Jun-19 Depreciation expense-Equipment $ 100

Accumulated depreciation-

Equipment $ 100

(To record depreciation expense on

equipment)

23-Jun-19 Drawings $ 16

Inventory $ 16

(To record inventory taken by

proprietor)

25-Jun-19

Accounts payable-Watrehouse

Stationery $ 330

Cash $ 330

(To record payment of cash to

Waterhouse Stationery)

26-Jun-19 Equipment $ 2,000

Furniture $ 1,500

GST Paid $ 350

Cash $ 3,850

(To record purchase of equipment

and furniture)

28-Jun-19 Telephone Expense Payable $ 136

Cash $ 136

(To record payment of telephone

bill)

30-Jun-19 Electricity Expense $ 429

Electricity Payable $ 429

(To record electricity expenses

payable)

30-Jun-19 Depreciation expense-Equipment $ 100

Accumulated depreciation-

Equipment $ 100

(To record depreciation expense on

equipment)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING STATEMENT ANALYSIS

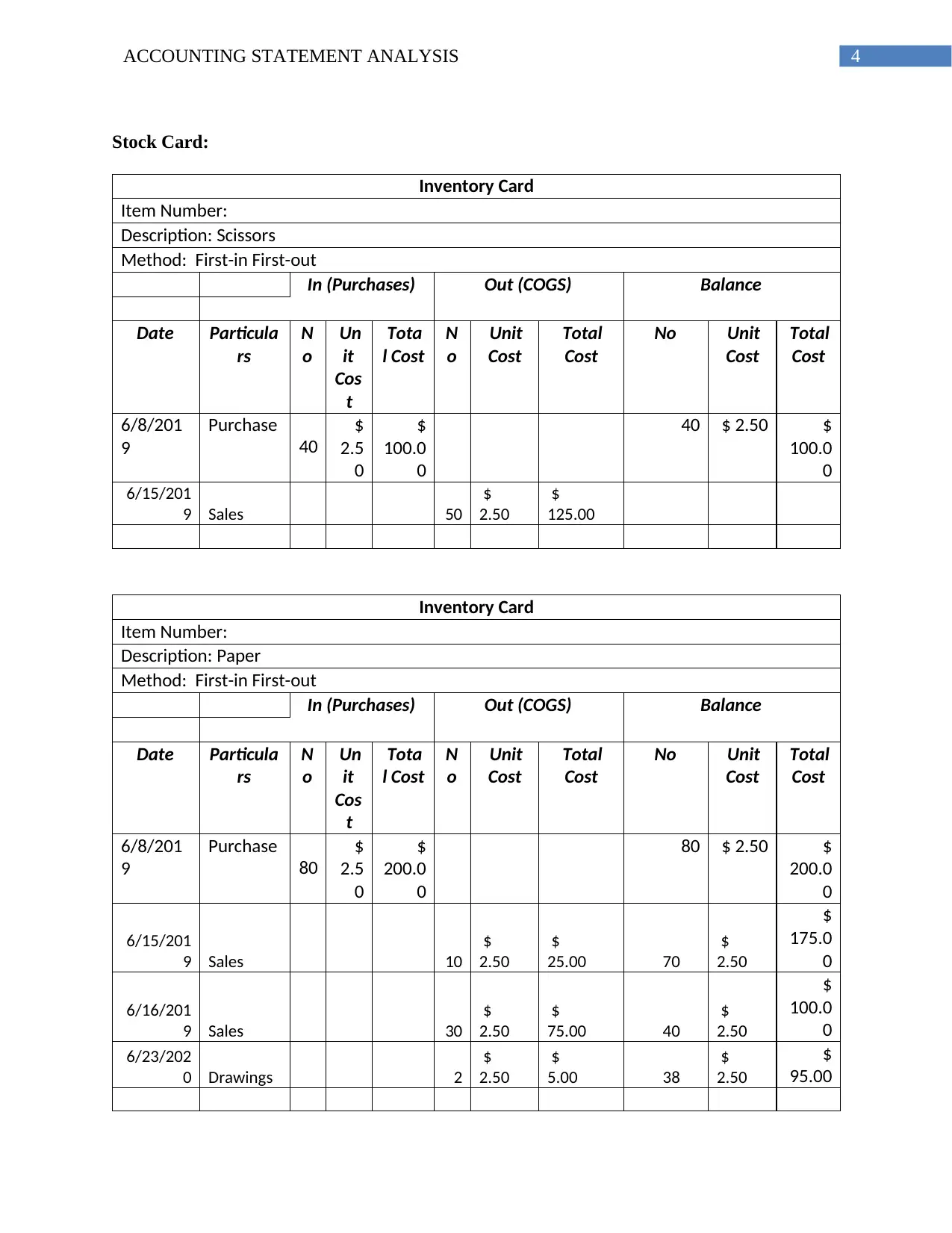

Stock Card:

Inventory Card

Item Number:

Description: Scissors

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/8/201

9

Purchase

40

$

2.5

0

$

100.0

0

40 $ 2.50 $

100.0

0

6/15/201

9 Sales 50

$

2.50

$

125.00

Inventory Card

Item Number:

Description: Paper

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/8/201

9

Purchase

80

$

2.5

0

$

200.0

0

80 $ 2.50 $

200.0

0

6/15/201

9 Sales 10

$

2.50

$

25.00 70

$

2.50

$

175.0

0

6/16/201

9 Sales 30

$

2.50

$

75.00 40

$

2.50

$

100.0

0

6/23/202

0 Drawings 2

$

2.50

$

5.00 38

$

2.50

$

95.00

Stock Card:

Inventory Card

Item Number:

Description: Scissors

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/8/201

9

Purchase

40

$

2.5

0

$

100.0

0

40 $ 2.50 $

100.0

0

6/15/201

9 Sales 50

$

2.50

$

125.00

Inventory Card

Item Number:

Description: Paper

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/8/201

9

Purchase

80

$

2.5

0

$

200.0

0

80 $ 2.50 $

200.0

0

6/15/201

9 Sales 10

$

2.50

$

25.00 70

$

2.50

$

175.0

0

6/16/201

9 Sales 30

$

2.50

$

75.00 40

$

2.50

$

100.0

0

6/23/202

0 Drawings 2

$

2.50

$

5.00 38

$

2.50

$

95.00

5ACCOUNTING STATEMENT ANALYSIS

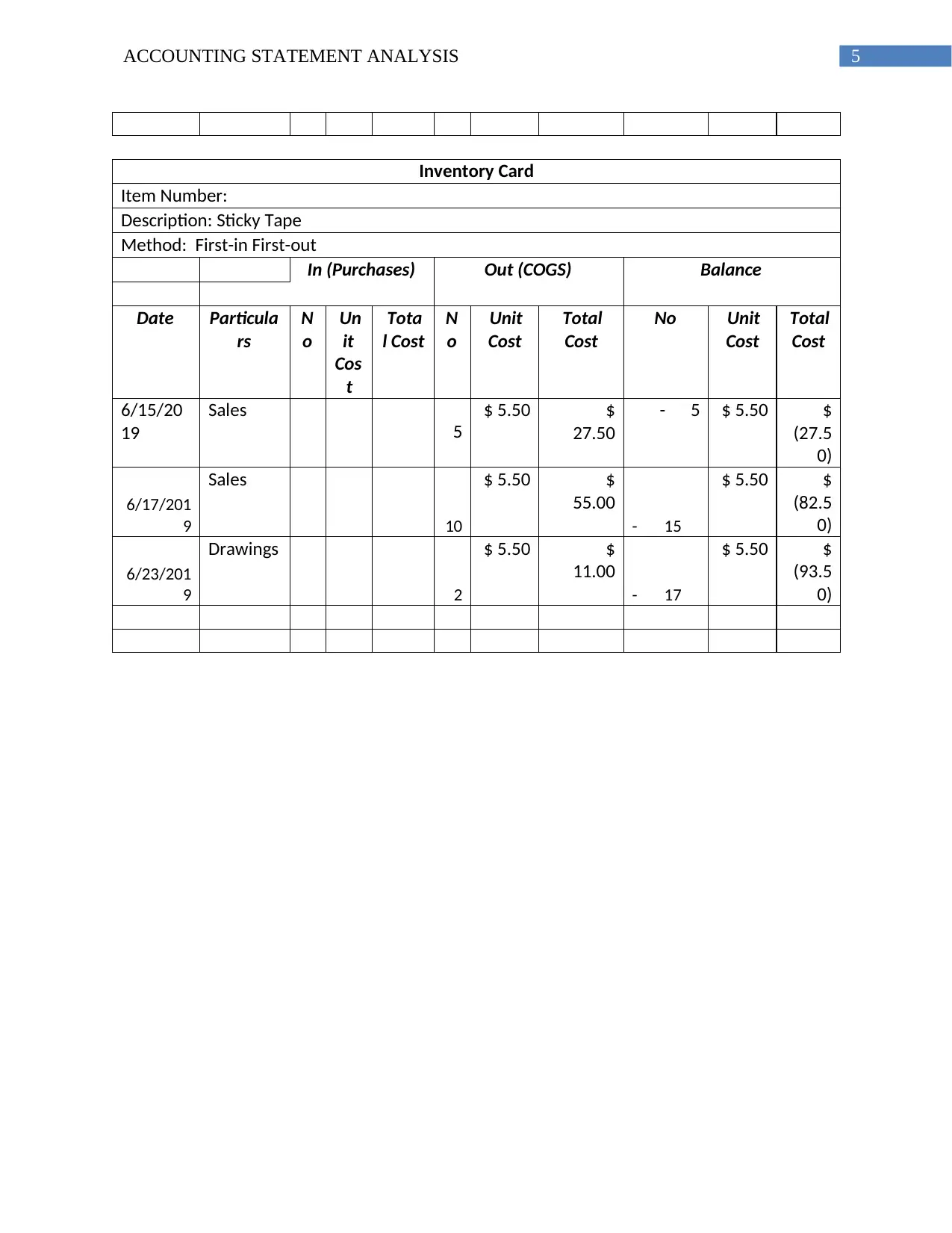

Inventory Card

Item Number:

Description: Sticky Tape

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/15/20

19

Sales

5

$ 5.50 $

27.50

- 5 $ 5.50 $

(27.5

0)

6/17/201

9

Sales

10

$ 5.50 $

55.00

- 15

$ 5.50 $

(82.5

0)

6/23/201

9

Drawings

2

$ 5.50 $

11.00

- 17

$ 5.50 $

(93.5

0)

Inventory Card

Item Number:

Description: Sticky Tape

Method: First-in First-out

In (Purchases) Out (COGS) Balance

Date Particula

rs

N

o

Un

it

Cos

t

Tota

l Cost

N

o

Unit

Cost

Total

Cost

No Unit

Cost

Total

Cost

6/15/20

19

Sales

5

$ 5.50 $

27.50

- 5 $ 5.50 $

(27.5

0)

6/17/201

9

Sales

10

$ 5.50 $

55.00

- 15

$ 5.50 $

(82.5

0)

6/23/201

9

Drawings

2

$ 5.50 $

11.00

- 17

$ 5.50 $

(93.5

0)

6ACCOUNTING STATEMENT ANALYSIS

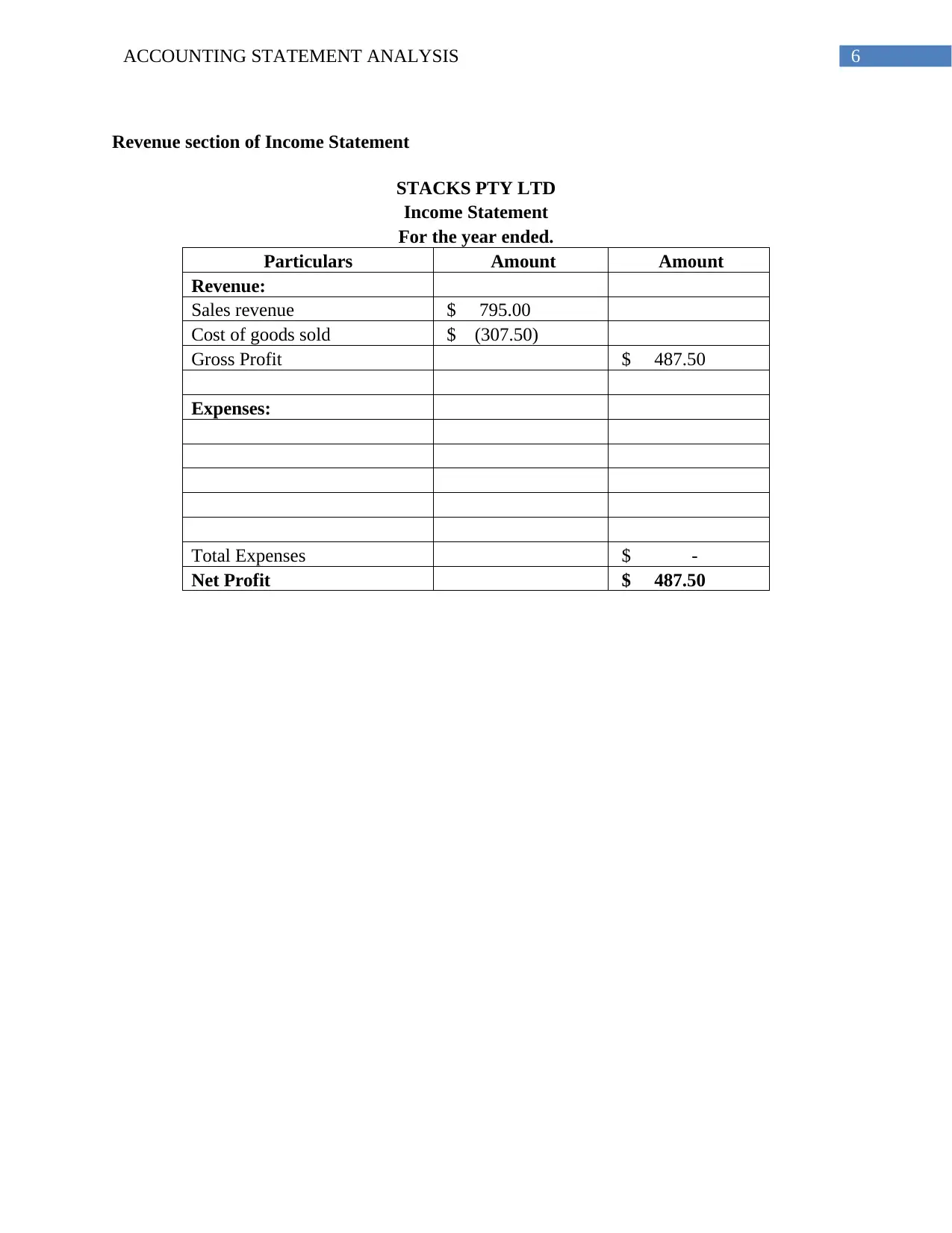

Revenue section of Income Statement

STACKS PTY LTD

Income Statement

For the year ended.

Particulars Amount Amount

Revenue:

Sales revenue $ 795.00

Cost of goods sold $ (307.50)

Gross Profit $ 487.50

Expenses:

Total Expenses $ -

Net Profit $ 487.50

Revenue section of Income Statement

STACKS PTY LTD

Income Statement

For the year ended.

Particulars Amount Amount

Revenue:

Sales revenue $ 795.00

Cost of goods sold $ (307.50)

Gross Profit $ 487.50

Expenses:

Total Expenses $ -

Net Profit $ 487.50

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING STATEMENT ANALYSIS

Bibliography

Budding, T., Grossi, G., & Tagesson, T. (Eds.). (2014). Public sector accounting. Routledge.

Maynard, J. (2017). Financial accounting, reporting, and analysis. Oxford University Press.

Phillips, F., Libby, R., & Libby, P. (2015). Fundamentals of Financial Accounting. McGraw-Hill

Education.

Pratt, J. (2016). Financial accounting in an economic context. John Wiley & Sons.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting. Wiley.

Williams, E. E., & Dobelman, J. A. (2017). Financial statement analysis. World Scientific Book

Chapters, 109-169.

Bibliography

Budding, T., Grossi, G., & Tagesson, T. (Eds.). (2014). Public sector accounting. Routledge.

Maynard, J. (2017). Financial accounting, reporting, and analysis. Oxford University Press.

Phillips, F., Libby, R., & Libby, P. (2015). Fundamentals of Financial Accounting. McGraw-Hill

Education.

Pratt, J. (2016). Financial accounting in an economic context. John Wiley & Sons.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting. Wiley.

Williams, E. E., & Dobelman, J. A. (2017). Financial statement analysis. World Scientific Book

Chapters, 109-169.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.