Account Statement Analysis: In-Depth Financial Statement Examination

VerifiedAdded on 2023/05/29

|8

|1166

|331

Homework Assignment

AI Summary

This assignment provides a detailed analysis of an account statement, covering various aspects of financial reporting. It addresses key questions related to depreciation, impairment losses, equity income, gains on sales, and working capital adjustments. The analysis includes adjustments for receivables and payables, the impact of interest rates, and the identification of non-recurring items. Furthermore, it calculates EBITDA after removing the effects of non-recurring items and examines discontinued operations and foreign currency translations. The assignment also includes journal entries and calculations related to factored invoices, providing a comprehensive overview of the account statement and its implications for the company's financial health. This document is available on Desklib, a platform offering a wide array of study resources for students.

Running head: ACCOUNT STATEMENT ANALYSIS

Account statement analysis

Name of the student

Name of the university

Student ID

Author note

Account statement analysis

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNT STATEMENT ANALYSIS

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................2

Answer 3....................................................................................................................................2

Answer 4....................................................................................................................................2

Answer 5....................................................................................................................................2

Answer 6....................................................................................................................................3

Answer 7....................................................................................................................................3

Answer 8....................................................................................................................................3

Answer 9....................................................................................................................................3

Answer 10..................................................................................................................................4

Answer 11..................................................................................................................................4

Answer 12..................................................................................................................................4

Answer 13..................................................................................................................................4

Answer 14..................................................................................................................................5

Answer 15..................................................................................................................................5

Answer 16..................................................................................................................................5

Answer 17..................................................................................................................................6

Answer 18..................................................................................................................................7

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................2

Answer 3....................................................................................................................................2

Answer 4....................................................................................................................................2

Answer 5....................................................................................................................................2

Answer 6....................................................................................................................................3

Answer 7....................................................................................................................................3

Answer 8....................................................................................................................................3

Answer 9....................................................................................................................................3

Answer 10..................................................................................................................................4

Answer 11..................................................................................................................................4

Answer 12..................................................................................................................................4

Answer 13..................................................................................................................................4

Answer 14..................................................................................................................................5

Answer 15..................................................................................................................................5

Answer 16..................................................................................................................................5

Answer 17..................................................................................................................................6

Answer 18..................................................................................................................................7

2ACCOUNT STATEMENT ANALYSIS

Answer 1

c. The higher book depreciation $ 100 million will lower pre-tax book income by $ 100

million. It will lower deferred tax expenses by $ 35 million but will not affect current taxes.

Thus, the net income will be lower by $ 65 million less net income but the higher

depreciation of $ 100 million will be added back and there will be a smaller add back of

deferred taxes of $ 35. This will leave the operating cash flow unchanged.

Answer 2

b. The impairment losses are added back because they lower net income but do not result in

any operating payments.

Answer 3

a.Cemex books its share of equity accounted investees when they report profits. However,

Cemex does not receive cash at that time. It receives cash when dividends are received.

Therefore, it subtracts the equity income, net of any dividends received on the indirect format

because it is income that is not received in cash.

Answer 4

b. It is a gain included in net income that is not an operating inflow. Instead, it is included in

investing inflow as part of proceeds from sale.

Answer 5

c. The company added back financial expenses in one line of the operating cash flows and

then subtracted the related payments in a separate line item in the operating section of the

cash flow statement.

Answer 1

c. The higher book depreciation $ 100 million will lower pre-tax book income by $ 100

million. It will lower deferred tax expenses by $ 35 million but will not affect current taxes.

Thus, the net income will be lower by $ 65 million less net income but the higher

depreciation of $ 100 million will be added back and there will be a smaller add back of

deferred taxes of $ 35. This will leave the operating cash flow unchanged.

Answer 2

b. The impairment losses are added back because they lower net income but do not result in

any operating payments.

Answer 3

a.Cemex books its share of equity accounted investees when they report profits. However,

Cemex does not receive cash at that time. It receives cash when dividends are received.

Therefore, it subtracts the equity income, net of any dividends received on the indirect format

because it is income that is not received in cash.

Answer 4

b. It is a gain included in net income that is not an operating inflow. Instead, it is included in

investing inflow as part of proceeds from sale.

Answer 5

c. The company added back financial expenses in one line of the operating cash flows and

then subtracted the related payments in a separate line item in the operating section of the

cash flow statement.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNT STATEMENT ANALYSIS

Answer 6

c. The company added back tax expenses in one line of the operating cash flows and then

subtracted the related payments in a separate line item in the operating section of the cash

flow statement.

Answer 7

b. Cemex decreased the need for working capital over the year.

Answer 8

Adjustment for the receivable that is listed under “changes in working capital, excluding

income taxes” is negative for the year 2016. The explanation for this is that the increase in

accounts receivable at the end of the year indicates that the company could collect lower

amount of money from its customers as compared to sales recorded during the year under the

income statement. It will have negative impact on working capital as well as on the cash flow

statement.

Answer 9

Adjustment for the trade payable that is listed under “changes in working capital, excluding

income taxes” is positive for the year 2016. The explanation for this is that the decrease in

accounts payable at the end of the year indicates that the company paid higher amount of

money to its creditors as compared to purchases recorded during the year under the income

statement. It will have positive impact on working capital as well as on the cash flow

statement.

Answer 6

c. The company added back tax expenses in one line of the operating cash flows and then

subtracted the related payments in a separate line item in the operating section of the cash

flow statement.

Answer 7

b. Cemex decreased the need for working capital over the year.

Answer 8

Adjustment for the receivable that is listed under “changes in working capital, excluding

income taxes” is negative for the year 2016. The explanation for this is that the increase in

accounts receivable at the end of the year indicates that the company could collect lower

amount of money from its customers as compared to sales recorded during the year under the

income statement. It will have negative impact on working capital as well as on the cash flow

statement.

Answer 9

Adjustment for the trade payable that is listed under “changes in working capital, excluding

income taxes” is positive for the year 2016. The explanation for this is that the decrease in

accounts payable at the end of the year indicates that the company paid higher amount of

money to its creditors as compared to purchases recorded during the year under the income

statement. It will have positive impact on working capital as well as on the cash flow

statement.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNT STATEMENT ANALYSIS

Answer 10

This will definitely help the entity to be sustained going forward as decreases in accounts

payable will improve the liquidity position of the company. Strong liquidity position will

make it sustainable for long time as the company will have more short term asset to meet its

short term obligation. In case of increase in interest rates higher working capital will help the

company to obtain competitive advantage through having the available cash in need. In

normal scenario increase in interest rate will – (i) increase the finance cost (ii) reduce the net

profit (iii) reduce the cash flow from financing activities

Answer 11

Non-recurring items –

11.1 Impairment losses for long-lived assets – 2,516 Mexican Pesos

11.2 Results from assets disposal – 1,741 Mexican Pesos

11.3 Restructuring costs – 778 Mexican Pesos

Answer 12

C. Both cost of sales and operating expenses

Answer 13

Non-recurring item –

Impairment losses and re-measurement of assets held for sale = 2,516

Restructuring cost = 778

Charitable contribution = 93

Results from the sale of assets and others, net (gain) = 1741

Answer 10

This will definitely help the entity to be sustained going forward as decreases in accounts

payable will improve the liquidity position of the company. Strong liquidity position will

make it sustainable for long time as the company will have more short term asset to meet its

short term obligation. In case of increase in interest rates higher working capital will help the

company to obtain competitive advantage through having the available cash in need. In

normal scenario increase in interest rate will – (i) increase the finance cost (ii) reduce the net

profit (iii) reduce the cash flow from financing activities

Answer 11

Non-recurring items –

11.1 Impairment losses for long-lived assets – 2,516 Mexican Pesos

11.2 Results from assets disposal – 1,741 Mexican Pesos

11.3 Restructuring costs – 778 Mexican Pesos

Answer 12

C. Both cost of sales and operating expenses

Answer 13

Non-recurring item –

Impairment losses and re-measurement of assets held for sale = 2,516

Restructuring cost = 778

Charitable contribution = 93

Results from the sale of assets and others, net (gain) = 1741

5ACCOUNT STATEMENT ANALYSIS

Depreciation and amortization included in operating expenses = 1848

Operating earnings as given = 33,618

EBITDA after removing the effect of non-recurring items are calculated as follows –

Operating earnings as given + Depreciation and amortization included in operating expenses

+ Impairment losses and re-measurement of assets held for sale + Restructuring cost +

Charitable contribution - Results from the sale of assets and others, net

= 33,618 + 1848 + 2,516 + 778 + 93 – 1,848

= 37,005 Mexican Peso

Answer 14

a. Cost of sales

b. Distribution expenses

c. Cost of sales

Answer 15

Discontinued operations – Impact of discontinued pertains are not considerable on current

and past revenues. Further, the statements of the operation were reclassified to the single line

item known as discontinued operations.

Other disposable items – for disposal of foreign investment, earnings are reversed. Further,

investment is recognised as item available for the purpose of sale at fair values and alterations

in valuations are transacted under other comprehensive loss till the time of disposal.

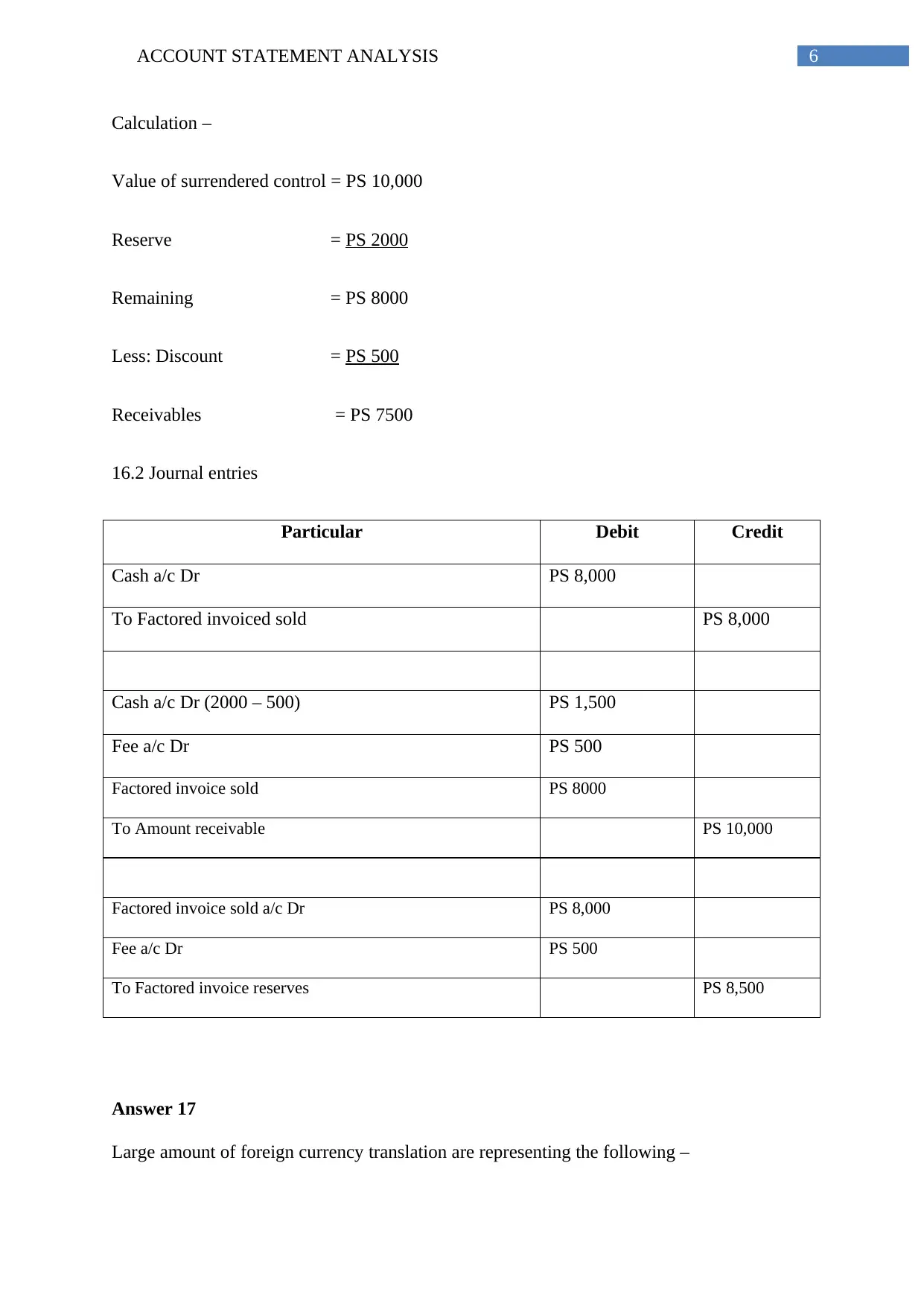

Answer 16

16.1 Cemex will receive PS 7500

Depreciation and amortization included in operating expenses = 1848

Operating earnings as given = 33,618

EBITDA after removing the effect of non-recurring items are calculated as follows –

Operating earnings as given + Depreciation and amortization included in operating expenses

+ Impairment losses and re-measurement of assets held for sale + Restructuring cost +

Charitable contribution - Results from the sale of assets and others, net

= 33,618 + 1848 + 2,516 + 778 + 93 – 1,848

= 37,005 Mexican Peso

Answer 14

a. Cost of sales

b. Distribution expenses

c. Cost of sales

Answer 15

Discontinued operations – Impact of discontinued pertains are not considerable on current

and past revenues. Further, the statements of the operation were reclassified to the single line

item known as discontinued operations.

Other disposable items – for disposal of foreign investment, earnings are reversed. Further,

investment is recognised as item available for the purpose of sale at fair values and alterations

in valuations are transacted under other comprehensive loss till the time of disposal.

Answer 16

16.1 Cemex will receive PS 7500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNT STATEMENT ANALYSIS

Calculation –

Value of surrendered control = PS 10,000

Reserve = PS 2000

Remaining = PS 8000

Less: Discount = PS 500

Receivables = PS 7500

16.2 Journal entries

Particular Debit Credit

Cash a/c Dr PS 8,000

To Factored invoiced sold PS 8,000

Cash a/c Dr (2000 – 500) PS 1,500

Fee a/c Dr PS 500

Factored invoice sold PS 8000

To Amount receivable PS 10,000

Factored invoice sold a/c Dr PS 8,000

Fee a/c Dr PS 500

To Factored invoice reserves PS 8,500

Answer 17

Large amount of foreign currency translation are representing the following –

Calculation –

Value of surrendered control = PS 10,000

Reserve = PS 2000

Remaining = PS 8000

Less: Discount = PS 500

Receivables = PS 7500

16.2 Journal entries

Particular Debit Credit

Cash a/c Dr PS 8,000

To Factored invoiced sold PS 8,000

Cash a/c Dr (2000 – 500) PS 1,500

Fee a/c Dr PS 500

Factored invoice sold PS 8000

To Amount receivable PS 10,000

Factored invoice sold a/c Dr PS 8,000

Fee a/c Dr PS 500

To Factored invoice reserves PS 8,500

Answer 17

Large amount of foreign currency translation are representing the following –

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNT STATEMENT ANALYSIS

Results from the translation of financial statements for foreign subsidiaries

Amount is generated from the foreign exchange fluctuations on the notional amount

of debt

Fluctuations in foreign exchange that generates from balances with related parties in

foreign currencies of long term investment

Answer 18

Large adjustment amount will reduce profit shown in income statement, will reduce income

in comprehensive income, will increase liabilities shown in balance sheet and will increase

amount from financing activities shown in cash flow statement.

Results from the translation of financial statements for foreign subsidiaries

Amount is generated from the foreign exchange fluctuations on the notional amount

of debt

Fluctuations in foreign exchange that generates from balances with related parties in

foreign currencies of long term investment

Answer 18

Large adjustment amount will reduce profit shown in income statement, will reduce income

in comprehensive income, will increase liabilities shown in balance sheet and will increase

amount from financing activities shown in cash flow statement.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.