NPV Forecast Analysis and Decision Making

VerifiedAdded on 2020/05/04

|11

|1037

|47

AI Summary

This assignment presents two financial forecasts (Forecast 1 and Forecast 2) with projected cash flows over five years. Students are tasked with calculating the Net Present Value (NPV) for each forecast using a discount rate and provided PV factors. The analysis should compare the NPVs of both forecasts and recommend the preferred forecast based on the results. The assignment emphasizes the practical application of NPV in making investment decisions.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING

Accounting

Name of the Student:

Name of the University:

Authors Note:

Accounting

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................3

Answer to Question 3......................................................................................................................5

Answer to Question 4......................................................................................................................7

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................3

Answer to Question 3......................................................................................................................5

Answer to Question 4......................................................................................................................7

2ACCOUNTING

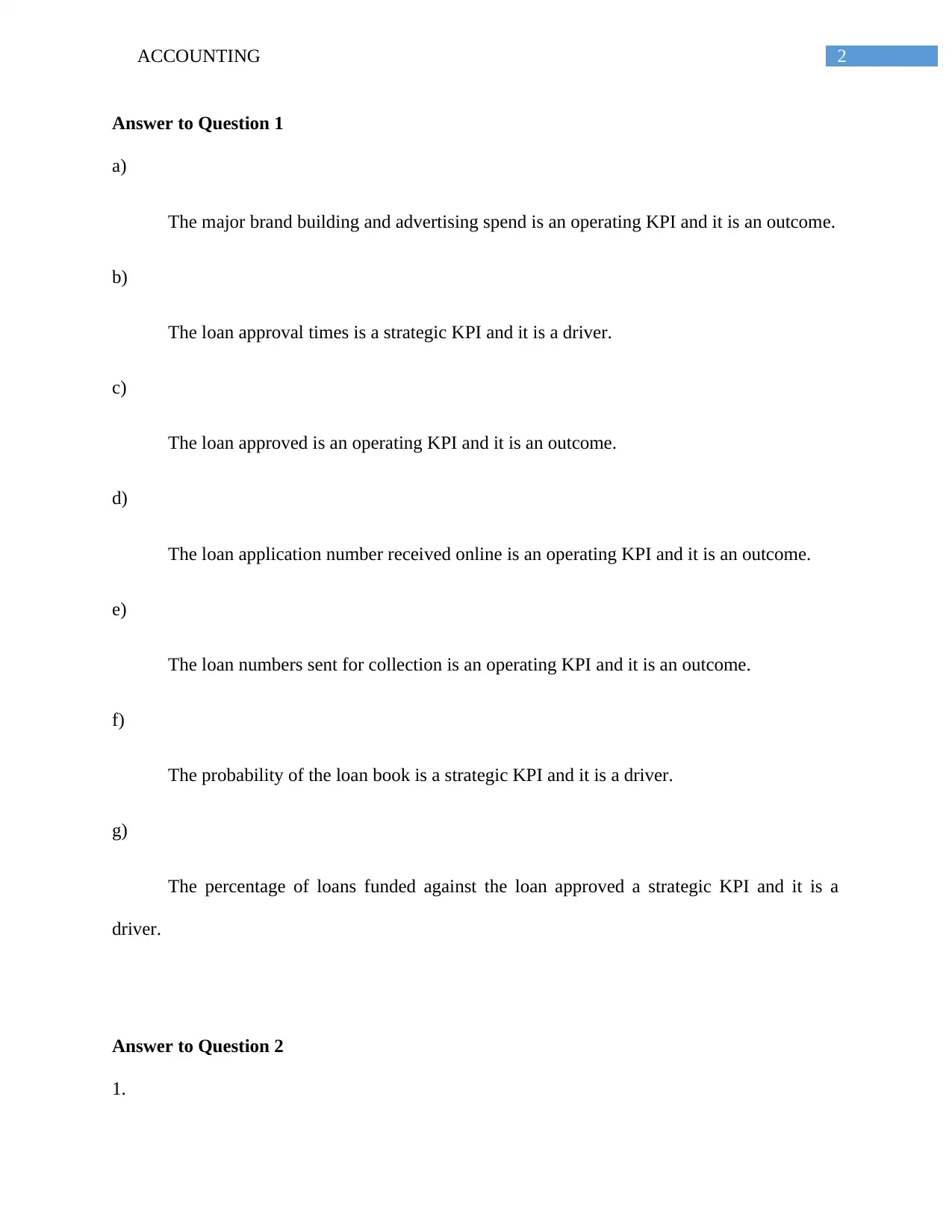

Answer to Question 1

a)

The major brand building and advertising spend is an operating KPI and it is an outcome.

b)

The loan approval times is a strategic KPI and it is a driver.

c)

The loan approved is an operating KPI and it is an outcome.

d)

The loan application number received online is an operating KPI and it is an outcome.

e)

The loan numbers sent for collection is an operating KPI and it is an outcome.

f)

The probability of the loan book is a strategic KPI and it is a driver.

g)

The percentage of loans funded against the loan approved a strategic KPI and it is a

driver.

Answer to Question 2

1.

Answer to Question 1

a)

The major brand building and advertising spend is an operating KPI and it is an outcome.

b)

The loan approval times is a strategic KPI and it is a driver.

c)

The loan approved is an operating KPI and it is an outcome.

d)

The loan application number received online is an operating KPI and it is an outcome.

e)

The loan numbers sent for collection is an operating KPI and it is an outcome.

f)

The probability of the loan book is a strategic KPI and it is a driver.

g)

The percentage of loans funded against the loan approved a strategic KPI and it is a

driver.

Answer to Question 2

1.

3ACCOUNTING

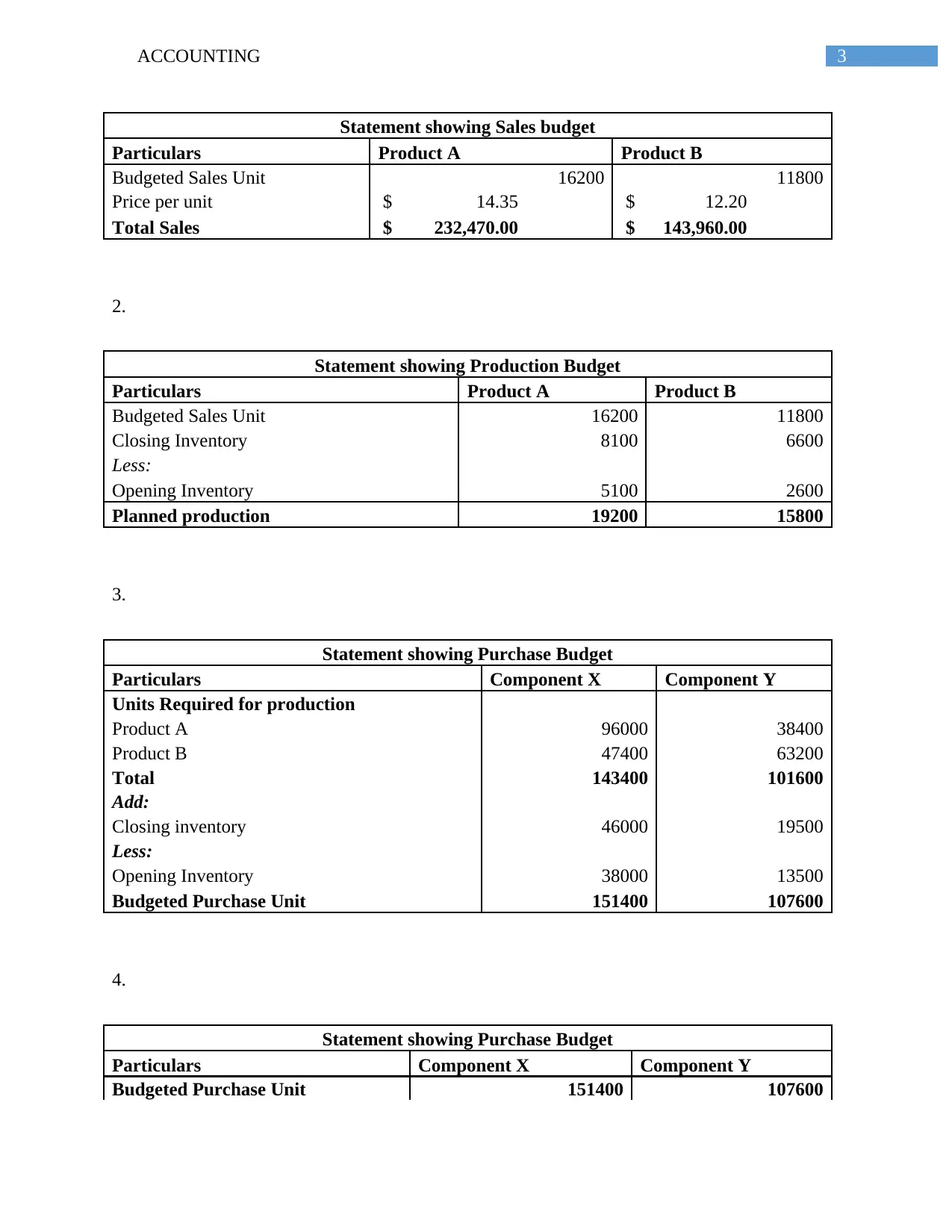

Statement showing Sales budget

Particulars Product A Product B

Budgeted Sales Unit 16200 11800

Price per unit $ 14.35 $ 12.20

Total Sales $ 232,470.00 $ 143,960.00

2.

Statement showing Production Budget

Particulars Product A Product B

Budgeted Sales Unit 16200 11800

Closing Inventory 8100 6600

Less:

Opening Inventory 5100 2600

Planned production 19200 15800

3.

Statement showing Purchase Budget

Particulars Component X Component Y

Units Required for production

Product A 96000 38400

Product B 47400 63200

Total 143400 101600

Add:

Closing inventory 46000 19500

Less:

Opening Inventory 38000 13500

Budgeted Purchase Unit 151400 107600

4.

Statement showing Purchase Budget

Particulars Component X Component Y

Budgeted Purchase Unit 151400 107600

Statement showing Sales budget

Particulars Product A Product B

Budgeted Sales Unit 16200 11800

Price per unit $ 14.35 $ 12.20

Total Sales $ 232,470.00 $ 143,960.00

2.

Statement showing Production Budget

Particulars Product A Product B

Budgeted Sales Unit 16200 11800

Closing Inventory 8100 6600

Less:

Opening Inventory 5100 2600

Planned production 19200 15800

3.

Statement showing Purchase Budget

Particulars Component X Component Y

Units Required for production

Product A 96000 38400

Product B 47400 63200

Total 143400 101600

Add:

Closing inventory 46000 19500

Less:

Opening Inventory 38000 13500

Budgeted Purchase Unit 151400 107600

4.

Statement showing Purchase Budget

Particulars Component X Component Y

Budgeted Purchase Unit 151400 107600

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING

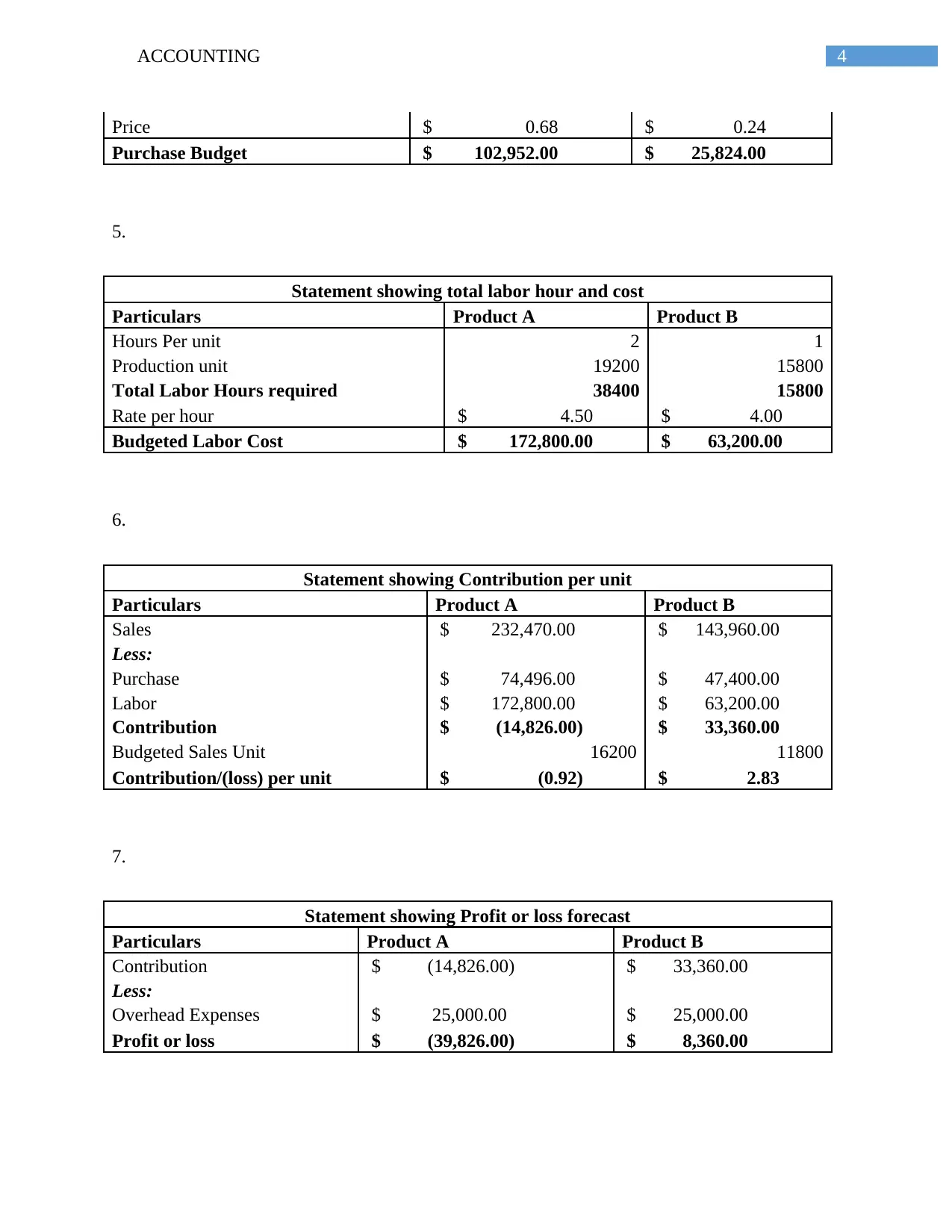

Price $ 0.68 $ 0.24

Purchase Budget $ 102,952.00 $ 25,824.00

5.

Statement showing total labor hour and cost

Particulars Product A Product B

Hours Per unit 2 1

Production unit 19200 15800

Total Labor Hours required 38400 15800

Rate per hour $ 4.50 $ 4.00

Budgeted Labor Cost $ 172,800.00 $ 63,200.00

6.

Statement showing Contribution per unit

Particulars Product A Product B

Sales $ 232,470.00 $ 143,960.00

Less:

Purchase $ 74,496.00 $ 47,400.00

Labor $ 172,800.00 $ 63,200.00

Contribution $ (14,826.00) $ 33,360.00

Budgeted Sales Unit 16200 11800

Contribution/(loss) per unit $ (0.92) $ 2.83

7.

Statement showing Profit or loss forecast

Particulars Product A Product B

Contribution $ (14,826.00) $ 33,360.00

Less:

Overhead Expenses $ 25,000.00 $ 25,000.00

Profit or loss $ (39,826.00) $ 8,360.00

Price $ 0.68 $ 0.24

Purchase Budget $ 102,952.00 $ 25,824.00

5.

Statement showing total labor hour and cost

Particulars Product A Product B

Hours Per unit 2 1

Production unit 19200 15800

Total Labor Hours required 38400 15800

Rate per hour $ 4.50 $ 4.00

Budgeted Labor Cost $ 172,800.00 $ 63,200.00

6.

Statement showing Contribution per unit

Particulars Product A Product B

Sales $ 232,470.00 $ 143,960.00

Less:

Purchase $ 74,496.00 $ 47,400.00

Labor $ 172,800.00 $ 63,200.00

Contribution $ (14,826.00) $ 33,360.00

Budgeted Sales Unit 16200 11800

Contribution/(loss) per unit $ (0.92) $ 2.83

7.

Statement showing Profit or loss forecast

Particulars Product A Product B

Contribution $ (14,826.00) $ 33,360.00

Less:

Overhead Expenses $ 25,000.00 $ 25,000.00

Profit or loss $ (39,826.00) $ 8,360.00

5ACCOUNTING

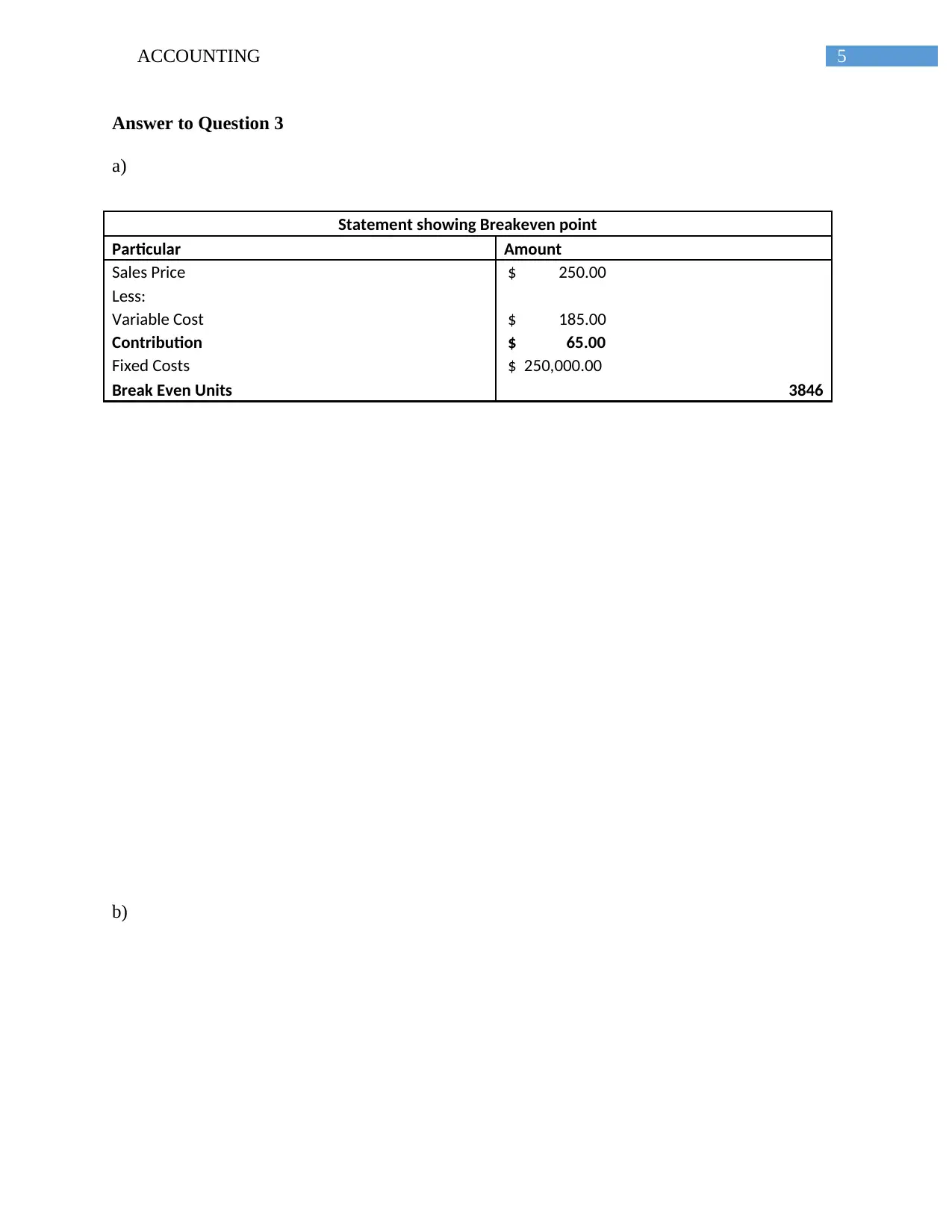

Answer to Question 3

a)

Statement showing Breakeven point

Particular Amount

Sales Price $ 250.00

Less:

Variable Cost $ 185.00

Contribution $ 65.00

Fixed Costs $ 250,000.00

Break Even Units 3846

b)

Answer to Question 3

a)

Statement showing Breakeven point

Particular Amount

Sales Price $ 250.00

Less:

Variable Cost $ 185.00

Contribution $ 65.00

Fixed Costs $ 250,000.00

Break Even Units 3846

b)

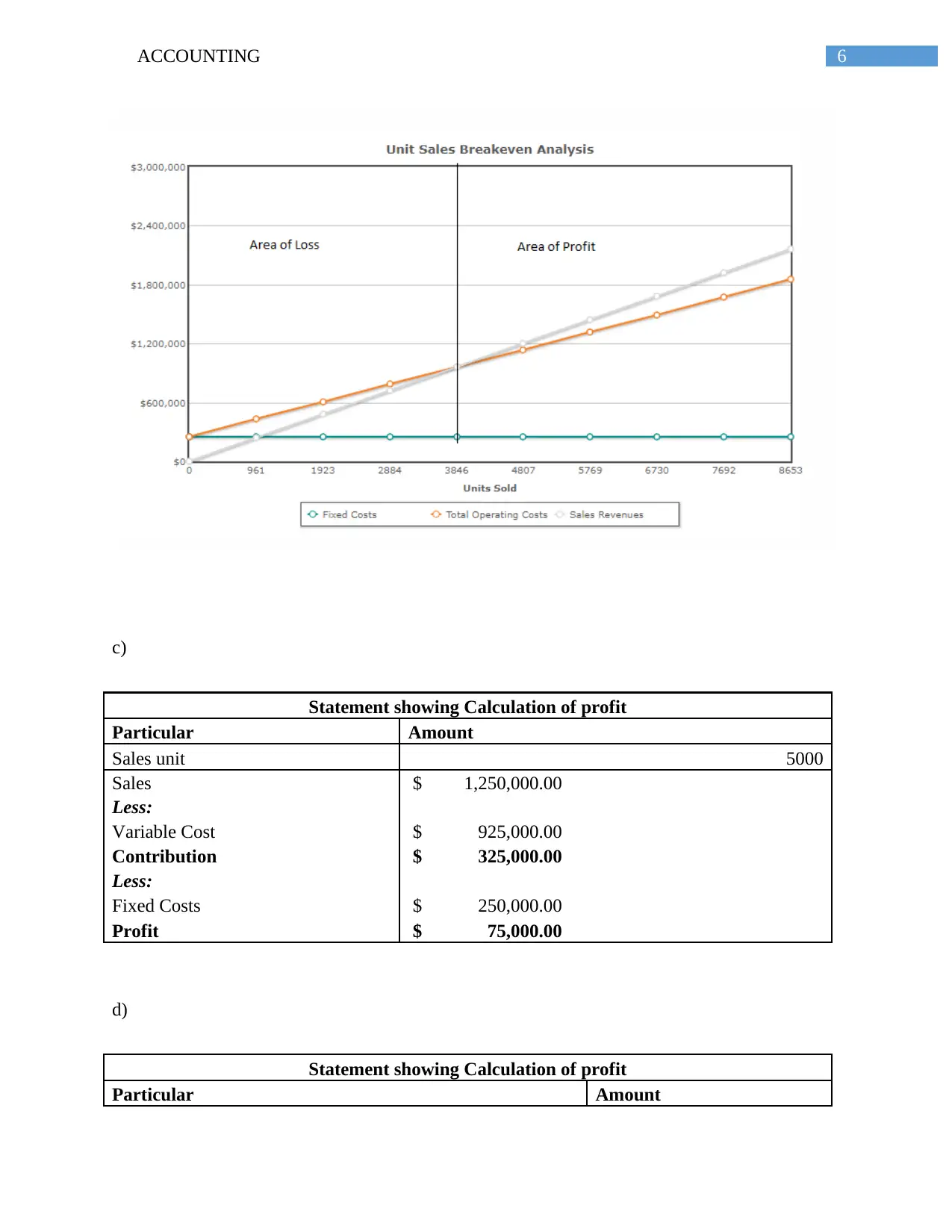

6ACCOUNTING

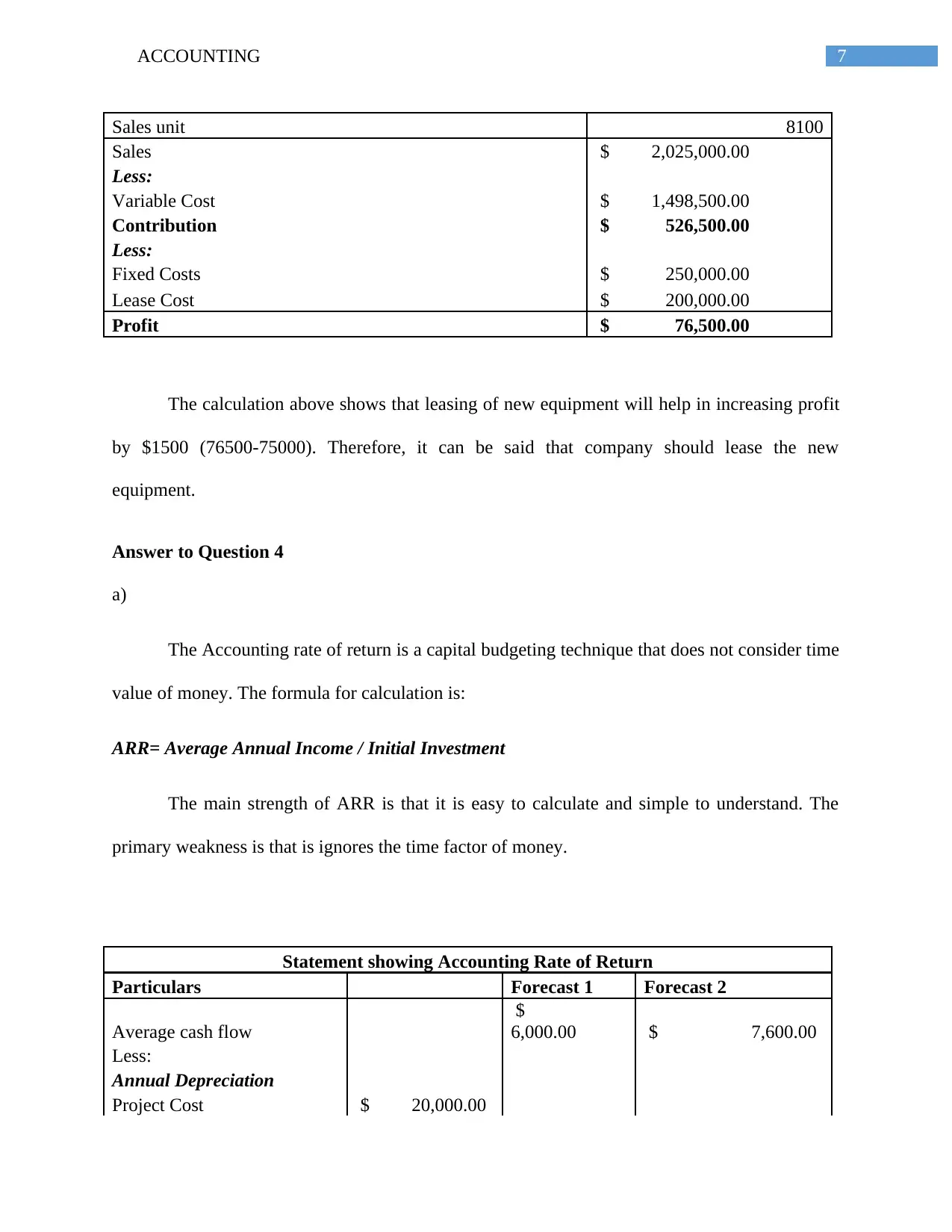

c)

Statement showing Calculation of profit

Particular Amount

Sales unit 5000

Sales $ 1,250,000.00

Less:

Variable Cost $ 925,000.00

Contribution $ 325,000.00

Less:

Fixed Costs $ 250,000.00

Profit $ 75,000.00

d)

Statement showing Calculation of profit

Particular Amount

c)

Statement showing Calculation of profit

Particular Amount

Sales unit 5000

Sales $ 1,250,000.00

Less:

Variable Cost $ 925,000.00

Contribution $ 325,000.00

Less:

Fixed Costs $ 250,000.00

Profit $ 75,000.00

d)

Statement showing Calculation of profit

Particular Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING

Sales unit 8100

Sales $ 2,025,000.00

Less:

Variable Cost $ 1,498,500.00

Contribution $ 526,500.00

Less:

Fixed Costs $ 250,000.00

Lease Cost $ 200,000.00

Profit $ 76,500.00

The calculation above shows that leasing of new equipment will help in increasing profit

by $1500 (76500-75000). Therefore, it can be said that company should lease the new

equipment.

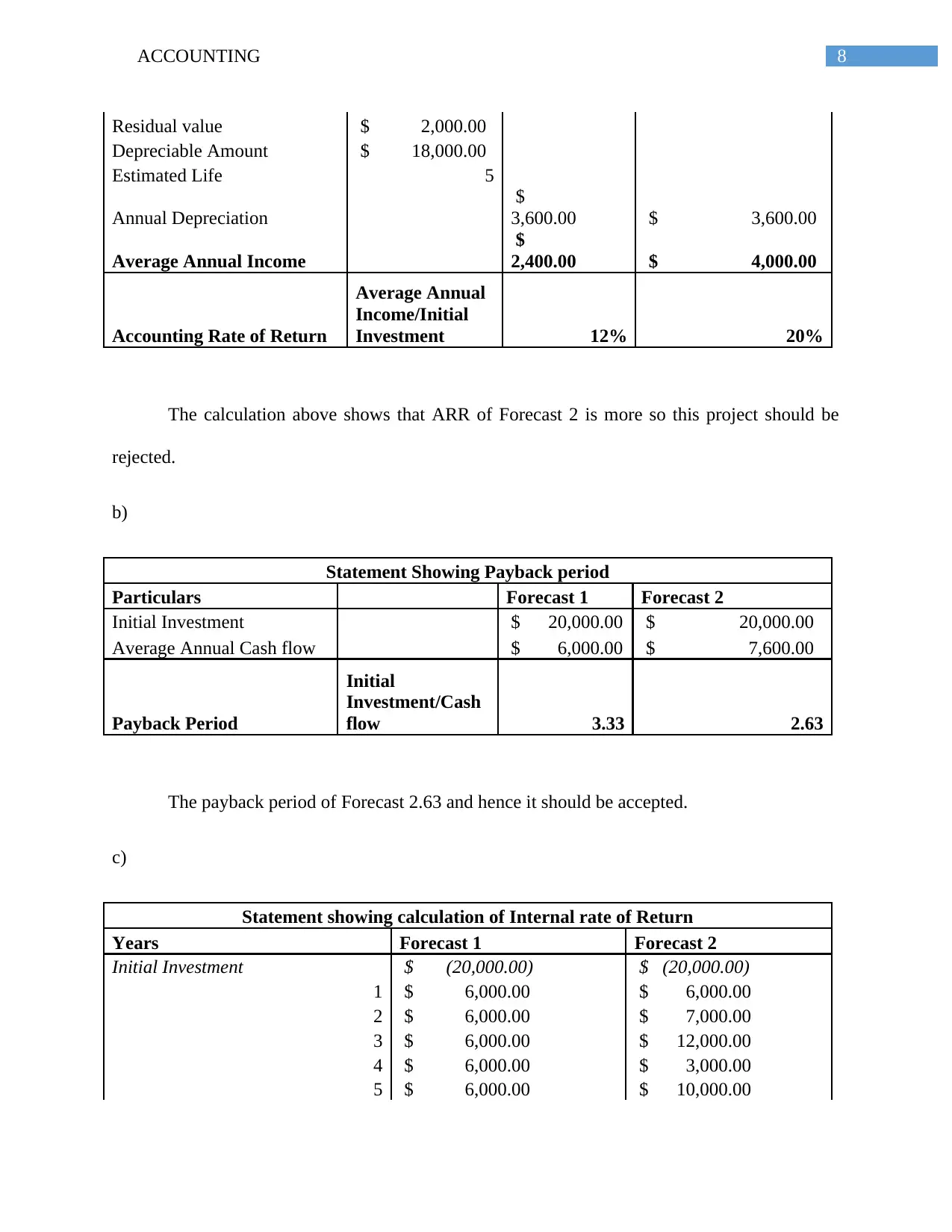

Answer to Question 4

a)

The Accounting rate of return is a capital budgeting technique that does not consider time

value of money. The formula for calculation is:

ARR= Average Annual Income / Initial Investment

The main strength of ARR is that it is easy to calculate and simple to understand. The

primary weakness is that is ignores the time factor of money.

Statement showing Accounting Rate of Return

Particulars Forecast 1 Forecast 2

Average cash flow

$

6,000.00 $ 7,600.00

Less:

Annual Depreciation

Project Cost $ 20,000.00

Sales unit 8100

Sales $ 2,025,000.00

Less:

Variable Cost $ 1,498,500.00

Contribution $ 526,500.00

Less:

Fixed Costs $ 250,000.00

Lease Cost $ 200,000.00

Profit $ 76,500.00

The calculation above shows that leasing of new equipment will help in increasing profit

by $1500 (76500-75000). Therefore, it can be said that company should lease the new

equipment.

Answer to Question 4

a)

The Accounting rate of return is a capital budgeting technique that does not consider time

value of money. The formula for calculation is:

ARR= Average Annual Income / Initial Investment

The main strength of ARR is that it is easy to calculate and simple to understand. The

primary weakness is that is ignores the time factor of money.

Statement showing Accounting Rate of Return

Particulars Forecast 1 Forecast 2

Average cash flow

$

6,000.00 $ 7,600.00

Less:

Annual Depreciation

Project Cost $ 20,000.00

8ACCOUNTING

Residual value $ 2,000.00

Depreciable Amount $ 18,000.00

Estimated Life 5

Annual Depreciation

$

3,600.00 $ 3,600.00

Average Annual Income

$

2,400.00 $ 4,000.00

Accounting Rate of Return

Average Annual

Income/Initial

Investment 12% 20%

The calculation above shows that ARR of Forecast 2 is more so this project should be

rejected.

b)

Statement Showing Payback period

Particulars Forecast 1 Forecast 2

Initial Investment $ 20,000.00 $ 20,000.00

Average Annual Cash flow $ 6,000.00 $ 7,600.00

Payback Period

Initial

Investment/Cash

flow 3.33 2.63

The payback period of Forecast 2.63 and hence it should be accepted.

c)

Statement showing calculation of Internal rate of Return

Years Forecast 1 Forecast 2

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 $ 6,000.00

2 $ 6,000.00 $ 7,000.00

3 $ 6,000.00 $ 12,000.00

4 $ 6,000.00 $ 3,000.00

5 $ 6,000.00 $ 10,000.00

Residual value $ 2,000.00

Depreciable Amount $ 18,000.00

Estimated Life 5

Annual Depreciation

$

3,600.00 $ 3,600.00

Average Annual Income

$

2,400.00 $ 4,000.00

Accounting Rate of Return

Average Annual

Income/Initial

Investment 12% 20%

The calculation above shows that ARR of Forecast 2 is more so this project should be

rejected.

b)

Statement Showing Payback period

Particulars Forecast 1 Forecast 2

Initial Investment $ 20,000.00 $ 20,000.00

Average Annual Cash flow $ 6,000.00 $ 7,600.00

Payback Period

Initial

Investment/Cash

flow 3.33 2.63

The payback period of Forecast 2.63 and hence it should be accepted.

c)

Statement showing calculation of Internal rate of Return

Years Forecast 1 Forecast 2

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 $ 6,000.00

2 $ 6,000.00 $ 7,000.00

3 $ 6,000.00 $ 12,000.00

4 $ 6,000.00 $ 3,000.00

5 $ 6,000.00 $ 10,000.00

9ACCOUNTING

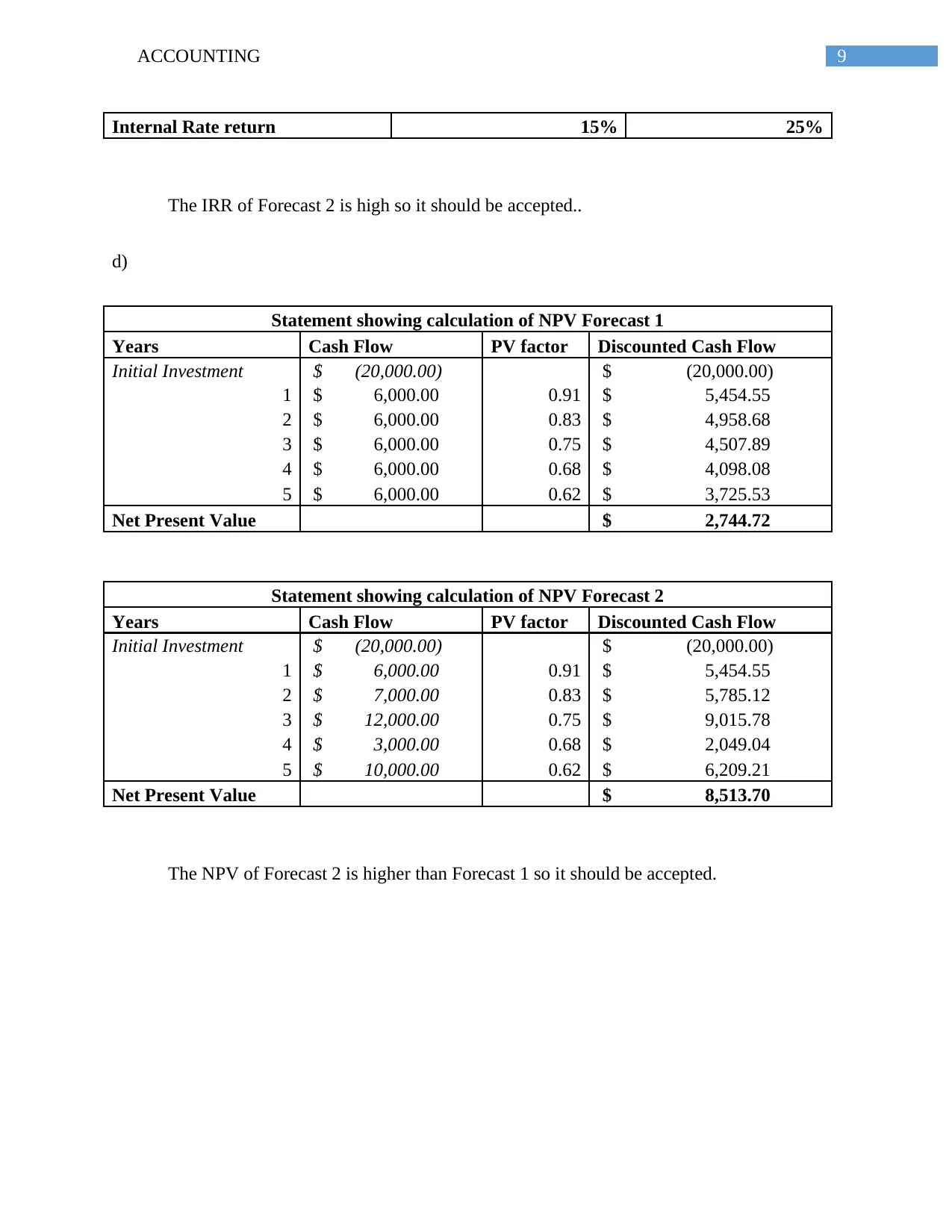

Internal Rate return 15% 25%

The IRR of Forecast 2 is high so it should be accepted..

d)

Statement showing calculation of NPV Forecast 1

Years Cash Flow PV factor Discounted Cash Flow

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 0.91 $ 5,454.55

2 $ 6,000.00 0.83 $ 4,958.68

3 $ 6,000.00 0.75 $ 4,507.89

4 $ 6,000.00 0.68 $ 4,098.08

5 $ 6,000.00 0.62 $ 3,725.53

Net Present Value $ 2,744.72

Statement showing calculation of NPV Forecast 2

Years Cash Flow PV factor Discounted Cash Flow

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 0.91 $ 5,454.55

2 $ 7,000.00 0.83 $ 5,785.12

3 $ 12,000.00 0.75 $ 9,015.78

4 $ 3,000.00 0.68 $ 2,049.04

5 $ 10,000.00 0.62 $ 6,209.21

Net Present Value $ 8,513.70

The NPV of Forecast 2 is higher than Forecast 1 so it should be accepted.

Internal Rate return 15% 25%

The IRR of Forecast 2 is high so it should be accepted..

d)

Statement showing calculation of NPV Forecast 1

Years Cash Flow PV factor Discounted Cash Flow

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 0.91 $ 5,454.55

2 $ 6,000.00 0.83 $ 4,958.68

3 $ 6,000.00 0.75 $ 4,507.89

4 $ 6,000.00 0.68 $ 4,098.08

5 $ 6,000.00 0.62 $ 3,725.53

Net Present Value $ 2,744.72

Statement showing calculation of NPV Forecast 2

Years Cash Flow PV factor Discounted Cash Flow

Initial Investment $ (20,000.00) $ (20,000.00)

1 $ 6,000.00 0.91 $ 5,454.55

2 $ 7,000.00 0.83 $ 5,785.12

3 $ 12,000.00 0.75 $ 9,015.78

4 $ 3,000.00 0.68 $ 2,049.04

5 $ 10,000.00 0.62 $ 6,209.21

Net Present Value $ 8,513.70

The NPV of Forecast 2 is higher than Forecast 1 so it should be accepted.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING

Reference

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

Dhamija, S., 2015. Financial Accounting for Managers, 2/e. Pearson Education India.

DRM13, M., 2016. ACCOUNTING FOR MANAGERS.

Webster, W.H., 2016. Accounting for managers.

Reference

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

Dhamija, S., 2015. Financial Accounting for Managers, 2/e. Pearson Education India.

DRM13, M., 2016. ACCOUNTING FOR MANAGERS.

Webster, W.H., 2016. Accounting for managers.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.