ACC515 Accounting & Finance Project: Investment and Analysis

VerifiedAdded on 2023/04/21

|16

|3571

|121

Project

AI Summary

This project report provides a comprehensive analysis of accounting and finance principles, focusing on investment decisions and financial calculations. It includes a calculation of monthly deposit required to achieve a specific face value, followed by an evaluation of an investment opportunity in the mining business using NPV calculations. The report further calculates total financial assets and monthly pension amounts. It delves into the concept of real interest rates using the Fisher equation and discusses the impact of negative gearing on the Australian housing market. The analysis extends to calculating BHP's monthly return, average monthly return, and annual holding period return for both global and Australian stakeholders. The report also assesses the risk of BHP using CAPM and SML graphs and determines portfolio return and beta. This document is available on Desklib, a platform offering a range of study tools and resources for students.

Running Head: Accounting and Finance

1

Project Report: Accounting and Finance

1

Project Report: Accounting and Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance

2

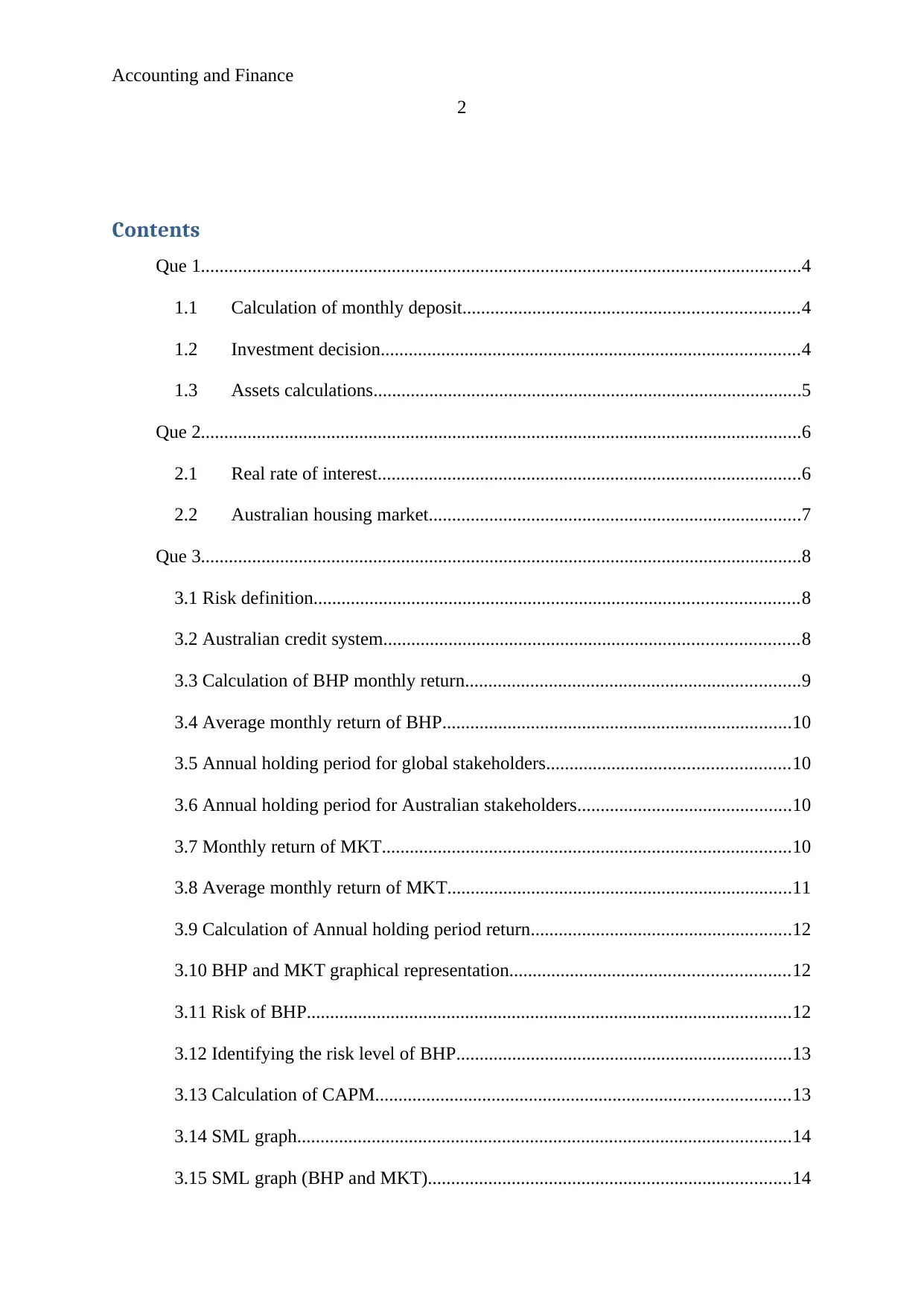

Contents

Que 1.................................................................................................................................4

1.1 Calculation of monthly deposit........................................................................4

1.2 Investment decision..........................................................................................4

1.3 Assets calculations............................................................................................5

Que 2.................................................................................................................................6

2.1 Real rate of interest...........................................................................................6

2.2 Australian housing market................................................................................7

Que 3.................................................................................................................................8

3.1 Risk definition........................................................................................................8

3.2 Australian credit system.........................................................................................8

3.3 Calculation of BHP monthly return........................................................................9

3.4 Average monthly return of BHP...........................................................................10

3.5 Annual holding period for global stakeholders....................................................10

3.6 Annual holding period for Australian stakeholders..............................................10

3.7 Monthly return of MKT........................................................................................10

3.8 Average monthly return of MKT..........................................................................11

3.9 Calculation of Annual holding period return........................................................12

3.10 BHP and MKT graphical representation............................................................12

3.11 Risk of BHP........................................................................................................12

3.12 Identifying the risk level of BHP........................................................................13

3.13 Calculation of CAPM.........................................................................................13

3.14 SML graph..........................................................................................................14

3.15 SML graph (BHP and MKT)..............................................................................14

2

Contents

Que 1.................................................................................................................................4

1.1 Calculation of monthly deposit........................................................................4

1.2 Investment decision..........................................................................................4

1.3 Assets calculations............................................................................................5

Que 2.................................................................................................................................6

2.1 Real rate of interest...........................................................................................6

2.2 Australian housing market................................................................................7

Que 3.................................................................................................................................8

3.1 Risk definition........................................................................................................8

3.2 Australian credit system.........................................................................................8

3.3 Calculation of BHP monthly return........................................................................9

3.4 Average monthly return of BHP...........................................................................10

3.5 Annual holding period for global stakeholders....................................................10

3.6 Annual holding period for Australian stakeholders..............................................10

3.7 Monthly return of MKT........................................................................................10

3.8 Average monthly return of MKT..........................................................................11

3.9 Calculation of Annual holding period return........................................................12

3.10 BHP and MKT graphical representation............................................................12

3.11 Risk of BHP........................................................................................................12

3.12 Identifying the risk level of BHP........................................................................13

3.13 Calculation of CAPM.........................................................................................13

3.14 SML graph..........................................................................................................14

3.15 SML graph (BHP and MKT)..............................................................................14

Accounting and Finance

3

3.16 Portfolio’s return and beta..................................................................................15

References.......................................................................................................................16

3

3.16 Portfolio’s return and beta..................................................................................15

References.......................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance

4

Que 1:

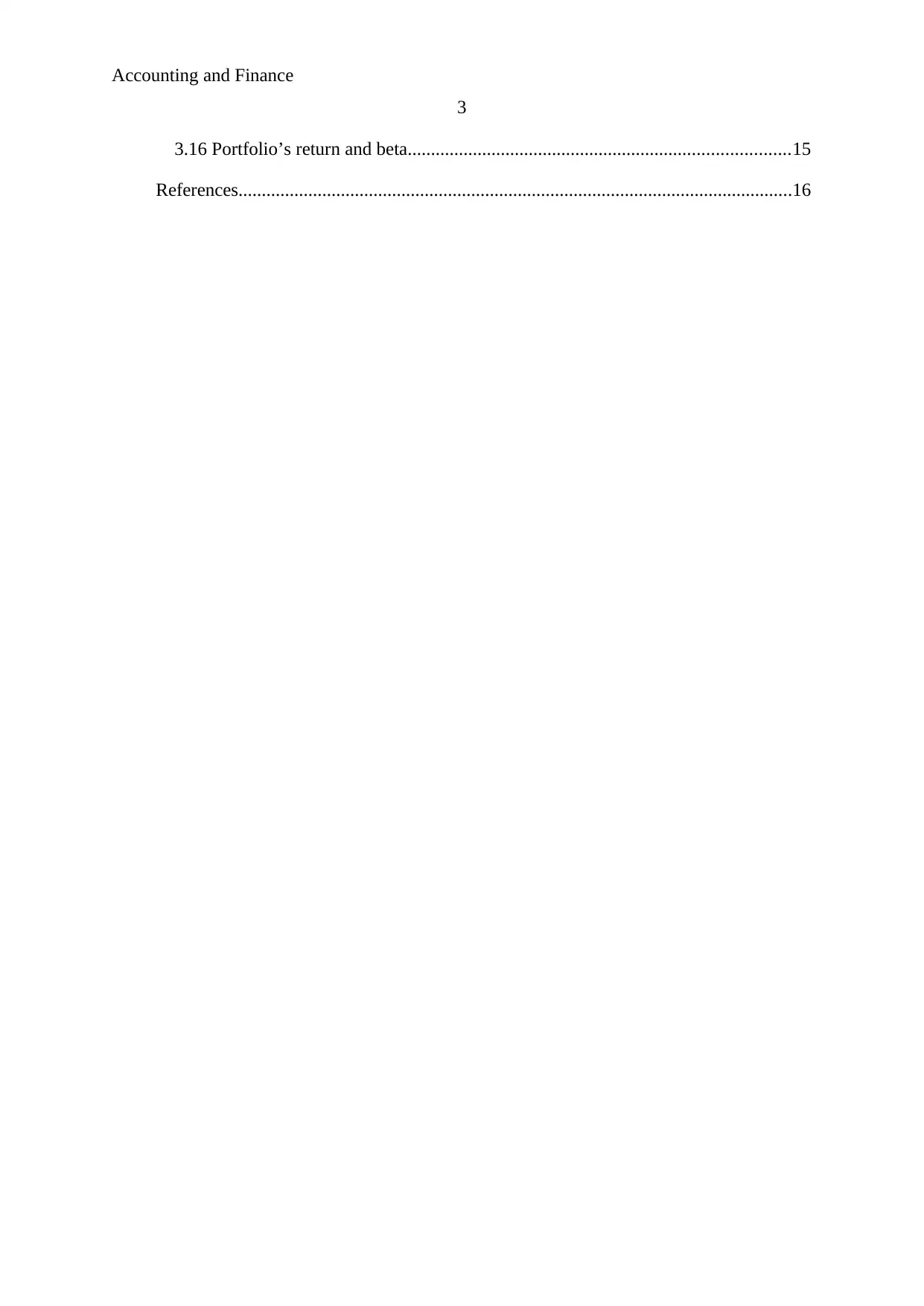

1.1 Calculation of monthly deposit:

Particulars Value

Face value $ 20,000

Interest 6%

Monthly interest

rate 0.005

Time (months) 15

Deposit amount $ 1,287.29

The above calculations explain that if $ 20,000 is required after 15 months then the

deposit amount should be $ 1287.29 monthly.

1.2 Investment decision:

a. NPV calculations:

In order to identify the investment opportunity in the mining business, net

present value calculations have been conducted on the project. Below are the

calculations:

Calculation of Net present value

Year

Cash Flow (Amt in

$'000)

Rate

(15%) NPV

0 $ (16,000.0) 1.00 $(16,000.0)

1 $ (2,500.0) 0.87 $ (2,173.9)

2 $ - 0.76 $ -

3 $ 5,000.0 0.66 $ 3,287.6

4 $ 6,800.0 0.57 $ 3,887.9

5 $ 7,000.0 0.50 $ 3,480.2

6 $ 7,000.0 0.43 $ 3,026.3

7 $ 9,500.0 0.38 $ 3,571.4

8 $ 5,500.0 0.33 $ 1,798.0

9 $ 2,000.0 0.28 $ 568.5

10 $ (4,500.0) 0.25 $ (1,112.3)

NPV $ 333.7

On the basis of above table, it has been recognized that NPV of the project is $ 333.7

which defines that the proposal must be accepted by the business.

4

Que 1:

1.1 Calculation of monthly deposit:

Particulars Value

Face value $ 20,000

Interest 6%

Monthly interest

rate 0.005

Time (months) 15

Deposit amount $ 1,287.29

The above calculations explain that if $ 20,000 is required after 15 months then the

deposit amount should be $ 1287.29 monthly.

1.2 Investment decision:

a. NPV calculations:

In order to identify the investment opportunity in the mining business, net

present value calculations have been conducted on the project. Below are the

calculations:

Calculation of Net present value

Year

Cash Flow (Amt in

$'000)

Rate

(15%) NPV

0 $ (16,000.0) 1.00 $(16,000.0)

1 $ (2,500.0) 0.87 $ (2,173.9)

2 $ - 0.76 $ -

3 $ 5,000.0 0.66 $ 3,287.6

4 $ 6,800.0 0.57 $ 3,887.9

5 $ 7,000.0 0.50 $ 3,480.2

6 $ 7,000.0 0.43 $ 3,026.3

7 $ 9,500.0 0.38 $ 3,571.4

8 $ 5,500.0 0.33 $ 1,798.0

9 $ 2,000.0 0.28 $ 568.5

10 $ (4,500.0) 0.25 $ (1,112.3)

NPV $ 333.7

On the basis of above table, it has been recognized that NPV of the project is $ 333.7

which defines that the proposal must be accepted by the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance

5

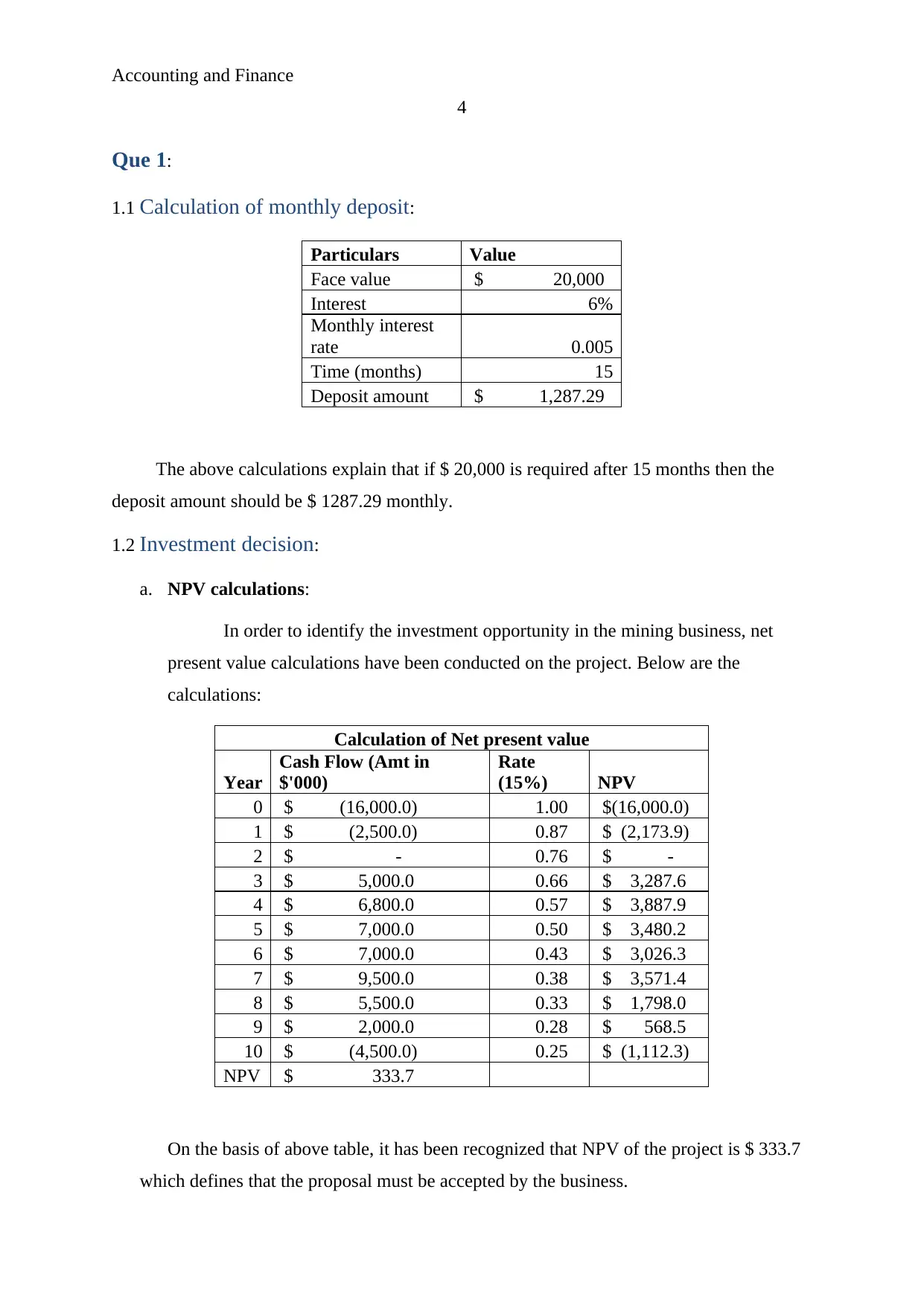

b. Cash flows at the end of 2nd month:

At the end of 2nd month, the cash flows of the project would be $ (18,173.9). Below are

the calculations of cash flows:

Amount at the end of 2nd year

Year

Cash Flow (Amt in

$'000) Rate (15%) NPV

0 $ (16,000.0) 1.00 $(16,000.0)

1 $ (2,500.0) 0.87 $ (2,173.9)

2 $ - 0.76 $ -

Total $(18,173.9)

1.3 Assets calculations:

a) Total financial assets worth of the company has been calculated as follows:

Particulars Value

Portfolio $ 125,000

Rate 6%

year 15.00

Face value $299,569.77

Face value $ 299,569.77

Particulars Value

Amount $ 750,000

Monthly contribution $ 1,000

Rate 8.00%

Monthly rate 0.67%

year 15.00

Months 180.00

Face Value $2,826,229.33

Financial assets value of

Gaye’s $ 3,125,799.10

It explains that the financial assets of Gaye at this retirement age would be $

3,125,799.10.

b) Monthly pension amount after retirement:

5

b. Cash flows at the end of 2nd month:

At the end of 2nd month, the cash flows of the project would be $ (18,173.9). Below are

the calculations of cash flows:

Amount at the end of 2nd year

Year

Cash Flow (Amt in

$'000) Rate (15%) NPV

0 $ (16,000.0) 1.00 $(16,000.0)

1 $ (2,500.0) 0.87 $ (2,173.9)

2 $ - 0.76 $ -

Total $(18,173.9)

1.3 Assets calculations:

a) Total financial assets worth of the company has been calculated as follows:

Particulars Value

Portfolio $ 125,000

Rate 6%

year 15.00

Face value $299,569.77

Face value $ 299,569.77

Particulars Value

Amount $ 750,000

Monthly contribution $ 1,000

Rate 8.00%

Monthly rate 0.67%

year 15.00

Months 180.00

Face Value $2,826,229.33

Financial assets value of

Gaye’s $ 3,125,799.10

It explains that the financial assets of Gaye at this retirement age would be $

3,125,799.10.

b) Monthly pension amount after retirement:

Accounting and Finance

6

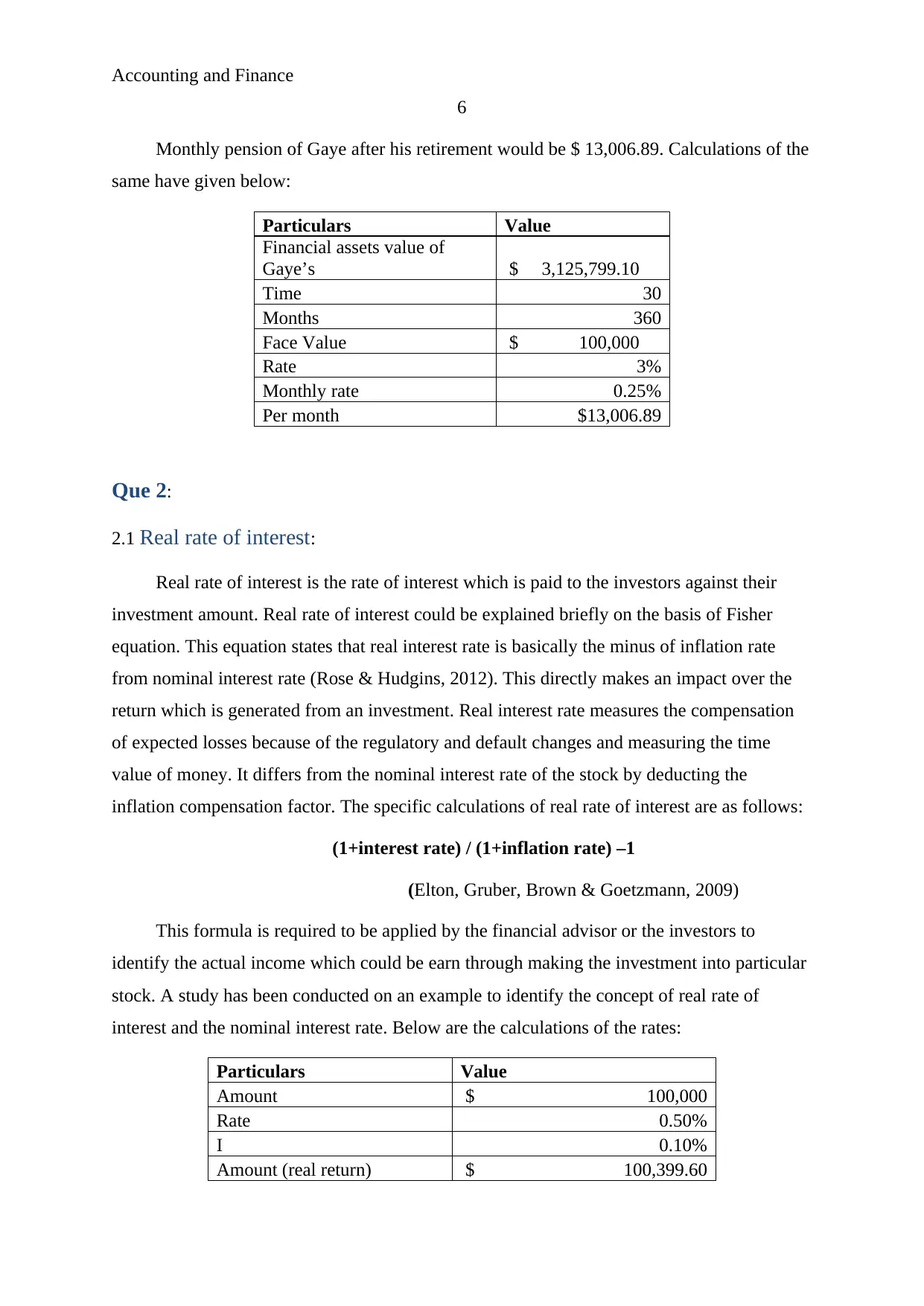

Monthly pension of Gaye after his retirement would be $ 13,006.89. Calculations of the

same have given below:

Particulars Value

Financial assets value of

Gaye’s $ 3,125,799.10

Time 30

Months 360

Face Value $ 100,000

Rate 3%

Monthly rate 0.25%

Per month $13,006.89

Que 2:

2.1 Real rate of interest:

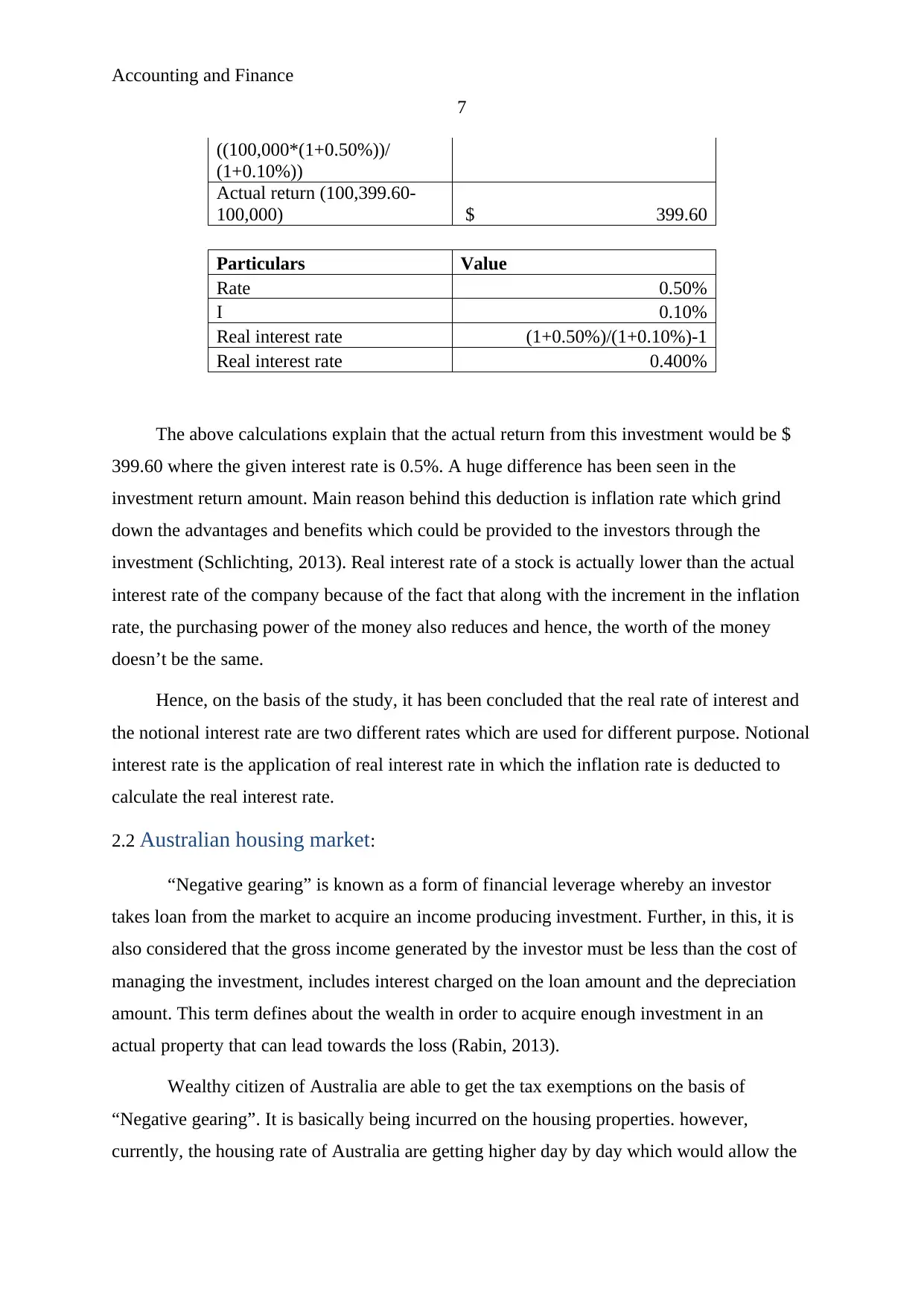

Real rate of interest is the rate of interest which is paid to the investors against their

investment amount. Real rate of interest could be explained briefly on the basis of Fisher

equation. This equation states that real interest rate is basically the minus of inflation rate

from nominal interest rate (Rose & Hudgins, 2012). This directly makes an impact over the

return which is generated from an investment. Real interest rate measures the compensation

of expected losses because of the regulatory and default changes and measuring the time

value of money. It differs from the nominal interest rate of the stock by deducting the

inflation compensation factor. The specific calculations of real rate of interest are as follows:

(1+interest rate) / (1+inflation rate) –1

(Elton, Gruber, Brown & Goetzmann, 2009)

This formula is required to be applied by the financial advisor or the investors to

identify the actual income which could be earn through making the investment into particular

stock. A study has been conducted on an example to identify the concept of real rate of

interest and the nominal interest rate. Below are the calculations of the rates:

Particulars Value

Amount $ 100,000

Rate 0.50%

I 0.10%

Amount (real return) $ 100,399.60

6

Monthly pension of Gaye after his retirement would be $ 13,006.89. Calculations of the

same have given below:

Particulars Value

Financial assets value of

Gaye’s $ 3,125,799.10

Time 30

Months 360

Face Value $ 100,000

Rate 3%

Monthly rate 0.25%

Per month $13,006.89

Que 2:

2.1 Real rate of interest:

Real rate of interest is the rate of interest which is paid to the investors against their

investment amount. Real rate of interest could be explained briefly on the basis of Fisher

equation. This equation states that real interest rate is basically the minus of inflation rate

from nominal interest rate (Rose & Hudgins, 2012). This directly makes an impact over the

return which is generated from an investment. Real interest rate measures the compensation

of expected losses because of the regulatory and default changes and measuring the time

value of money. It differs from the nominal interest rate of the stock by deducting the

inflation compensation factor. The specific calculations of real rate of interest are as follows:

(1+interest rate) / (1+inflation rate) –1

(Elton, Gruber, Brown & Goetzmann, 2009)

This formula is required to be applied by the financial advisor or the investors to

identify the actual income which could be earn through making the investment into particular

stock. A study has been conducted on an example to identify the concept of real rate of

interest and the nominal interest rate. Below are the calculations of the rates:

Particulars Value

Amount $ 100,000

Rate 0.50%

I 0.10%

Amount (real return) $ 100,399.60

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance

7

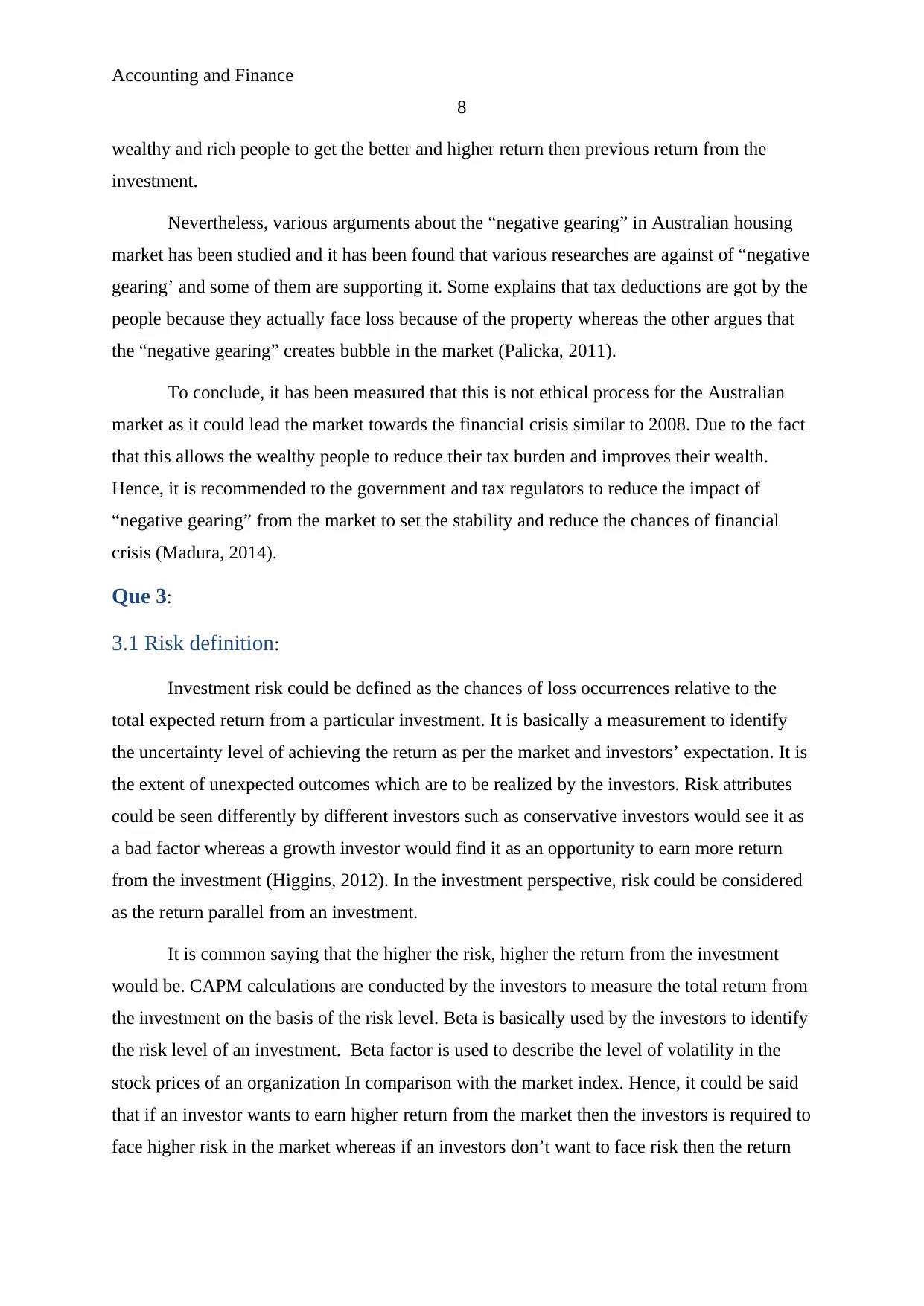

((100,000*(1+0.50%))/

(1+0.10%))

Actual return (100,399.60-

100,000) $ 399.60

Particulars Value

Rate 0.50%

I 0.10%

Real interest rate (1+0.50%)/(1+0.10%)-1

Real interest rate 0.400%

The above calculations explain that the actual return from this investment would be $

399.60 where the given interest rate is 0.5%. A huge difference has been seen in the

investment return amount. Main reason behind this deduction is inflation rate which grind

down the advantages and benefits which could be provided to the investors through the

investment (Schlichting, 2013). Real interest rate of a stock is actually lower than the actual

interest rate of the company because of the fact that along with the increment in the inflation

rate, the purchasing power of the money also reduces and hence, the worth of the money

doesn’t be the same.

Hence, on the basis of the study, it has been concluded that the real rate of interest and

the notional interest rate are two different rates which are used for different purpose. Notional

interest rate is the application of real interest rate in which the inflation rate is deducted to

calculate the real interest rate.

2.2 Australian housing market:

“Negative gearing” is known as a form of financial leverage whereby an investor

takes loan from the market to acquire an income producing investment. Further, in this, it is

also considered that the gross income generated by the investor must be less than the cost of

managing the investment, includes interest charged on the loan amount and the depreciation

amount. This term defines about the wealth in order to acquire enough investment in an

actual property that can lead towards the loss (Rabin, 2013).

Wealthy citizen of Australia are able to get the tax exemptions on the basis of

“Negative gearing”. It is basically being incurred on the housing properties. however,

currently, the housing rate of Australia are getting higher day by day which would allow the

7

((100,000*(1+0.50%))/

(1+0.10%))

Actual return (100,399.60-

100,000) $ 399.60

Particulars Value

Rate 0.50%

I 0.10%

Real interest rate (1+0.50%)/(1+0.10%)-1

Real interest rate 0.400%

The above calculations explain that the actual return from this investment would be $

399.60 where the given interest rate is 0.5%. A huge difference has been seen in the

investment return amount. Main reason behind this deduction is inflation rate which grind

down the advantages and benefits which could be provided to the investors through the

investment (Schlichting, 2013). Real interest rate of a stock is actually lower than the actual

interest rate of the company because of the fact that along with the increment in the inflation

rate, the purchasing power of the money also reduces and hence, the worth of the money

doesn’t be the same.

Hence, on the basis of the study, it has been concluded that the real rate of interest and

the notional interest rate are two different rates which are used for different purpose. Notional

interest rate is the application of real interest rate in which the inflation rate is deducted to

calculate the real interest rate.

2.2 Australian housing market:

“Negative gearing” is known as a form of financial leverage whereby an investor

takes loan from the market to acquire an income producing investment. Further, in this, it is

also considered that the gross income generated by the investor must be less than the cost of

managing the investment, includes interest charged on the loan amount and the depreciation

amount. This term defines about the wealth in order to acquire enough investment in an

actual property that can lead towards the loss (Rabin, 2013).

Wealthy citizen of Australia are able to get the tax exemptions on the basis of

“Negative gearing”. It is basically being incurred on the housing properties. however,

currently, the housing rate of Australia are getting higher day by day which would allow the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance

8

wealthy and rich people to get the better and higher return then previous return from the

investment.

Nevertheless, various arguments about the “negative gearing” in Australian housing

market has been studied and it has been found that various researches are against of “negative

gearing’ and some of them are supporting it. Some explains that tax deductions are got by the

people because they actually face loss because of the property whereas the other argues that

the “negative gearing” creates bubble in the market (Palicka, 2011).

To conclude, it has been measured that this is not ethical process for the Australian

market as it could lead the market towards the financial crisis similar to 2008. Due to the fact

that this allows the wealthy people to reduce their tax burden and improves their wealth.

Hence, it is recommended to the government and tax regulators to reduce the impact of

“negative gearing” from the market to set the stability and reduce the chances of financial

crisis (Madura, 2014).

Que 3:

3.1 Risk definition:

Investment risk could be defined as the chances of loss occurrences relative to the

total expected return from a particular investment. It is basically a measurement to identify

the uncertainty level of achieving the return as per the market and investors’ expectation. It is

the extent of unexpected outcomes which are to be realized by the investors. Risk attributes

could be seen differently by different investors such as conservative investors would see it as

a bad factor whereas a growth investor would find it as an opportunity to earn more return

from the investment (Higgins, 2012). In the investment perspective, risk could be considered

as the return parallel from an investment.

It is common saying that the higher the risk, higher the return from the investment

would be. CAPM calculations are conducted by the investors to measure the total return from

the investment on the basis of the risk level. Beta is basically used by the investors to identify

the risk level of an investment. Beta factor is used to describe the level of volatility in the

stock prices of an organization In comparison with the market index. Hence, it could be said

that if an investor wants to earn higher return from the market then the investors is required to

face higher risk in the market whereas if an investors don’t want to face risk then the return

8

wealthy and rich people to get the better and higher return then previous return from the

investment.

Nevertheless, various arguments about the “negative gearing” in Australian housing

market has been studied and it has been found that various researches are against of “negative

gearing’ and some of them are supporting it. Some explains that tax deductions are got by the

people because they actually face loss because of the property whereas the other argues that

the “negative gearing” creates bubble in the market (Palicka, 2011).

To conclude, it has been measured that this is not ethical process for the Australian

market as it could lead the market towards the financial crisis similar to 2008. Due to the fact

that this allows the wealthy people to reduce their tax burden and improves their wealth.

Hence, it is recommended to the government and tax regulators to reduce the impact of

“negative gearing” from the market to set the stability and reduce the chances of financial

crisis (Madura, 2014).

Que 3:

3.1 Risk definition:

Investment risk could be defined as the chances of loss occurrences relative to the

total expected return from a particular investment. It is basically a measurement to identify

the uncertainty level of achieving the return as per the market and investors’ expectation. It is

the extent of unexpected outcomes which are to be realized by the investors. Risk attributes

could be seen differently by different investors such as conservative investors would see it as

a bad factor whereas a growth investor would find it as an opportunity to earn more return

from the investment (Higgins, 2012). In the investment perspective, risk could be considered

as the return parallel from an investment.

It is common saying that the higher the risk, higher the return from the investment

would be. CAPM calculations are conducted by the investors to measure the total return from

the investment on the basis of the risk level. Beta is basically used by the investors to identify

the risk level of an investment. Beta factor is used to describe the level of volatility in the

stock prices of an organization In comparison with the market index. Hence, it could be said

that if an investor wants to earn higher return from the market then the investors is required to

face higher risk in the market whereas if an investors don’t want to face risk then the return

Accounting and Finance

9

level from the investment would also be lower. Risk plays as a return exposure role in the

market.

3.2 Australian credit system:

Australian dividend imputation system is a tax system of corporation in which tax

paid by an organization may be imputed or attributed to the stakeholders through the way to

reduce the tax credit to manage the income tax payable or distribution. The dividend

imputation credit system is basically defines about the Australia’s investors. In this credit

system, they are able to get little relevant tax credit on the dividend amount which has been

provided by the organization. The organization’s shareholder is provided dividend amount to

the shareholders from the total profit of the company t reduce the tax burden of the company

(Chandra, 2011).

This basically reduces the possibility of the double taxation system as the tax on the

dividend is already paid by the organization and shareholders are not required to pay

additional taxation system on the dividend return amount. The Australian dividend

imputation system allows both international and Australian stakeholders of the business get

the benefit from the dividend amount which has been generated through investing in the stock

of organization (Baker & Nofsinger, 2010). It improves the overall return and performance of

investment.

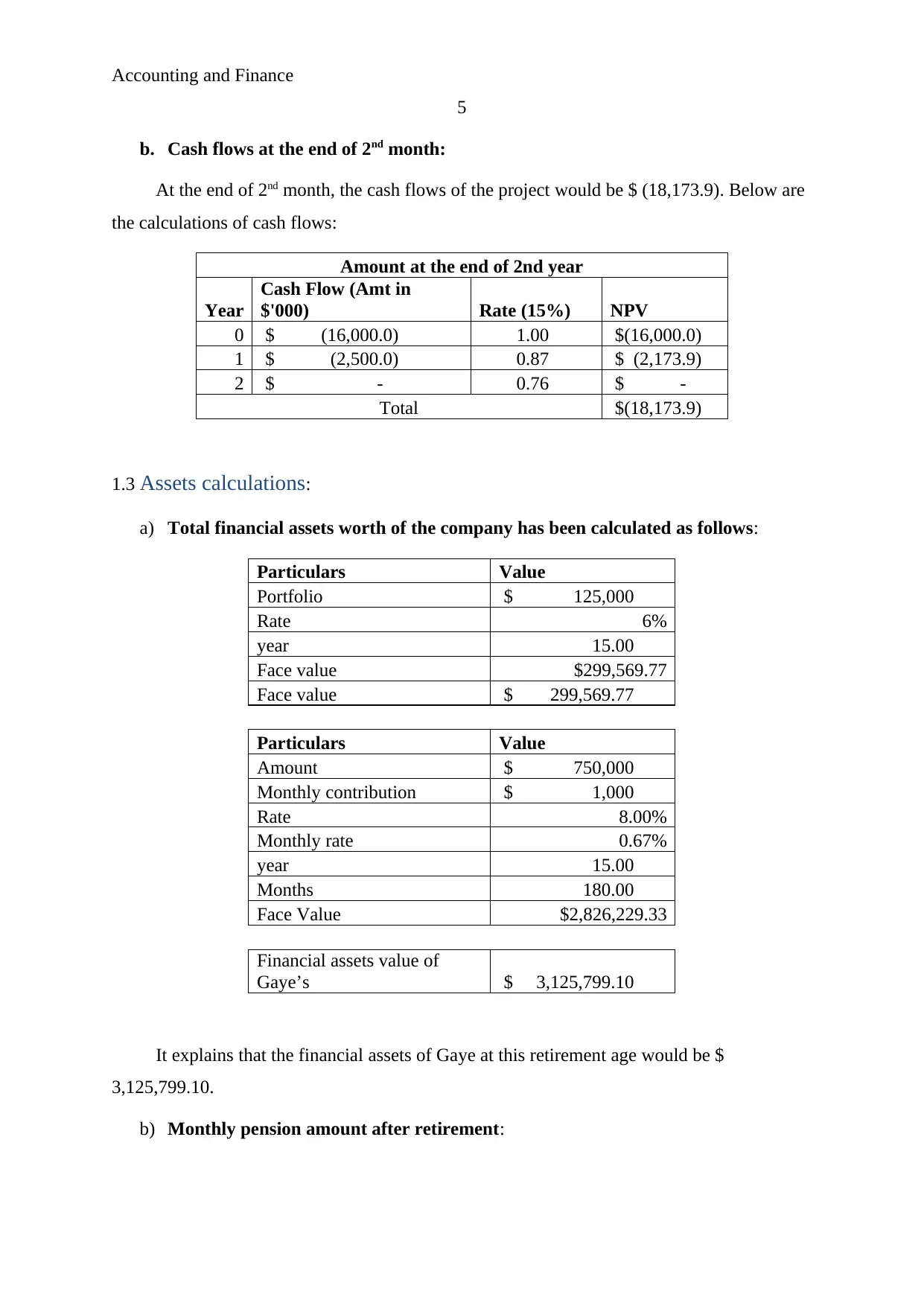

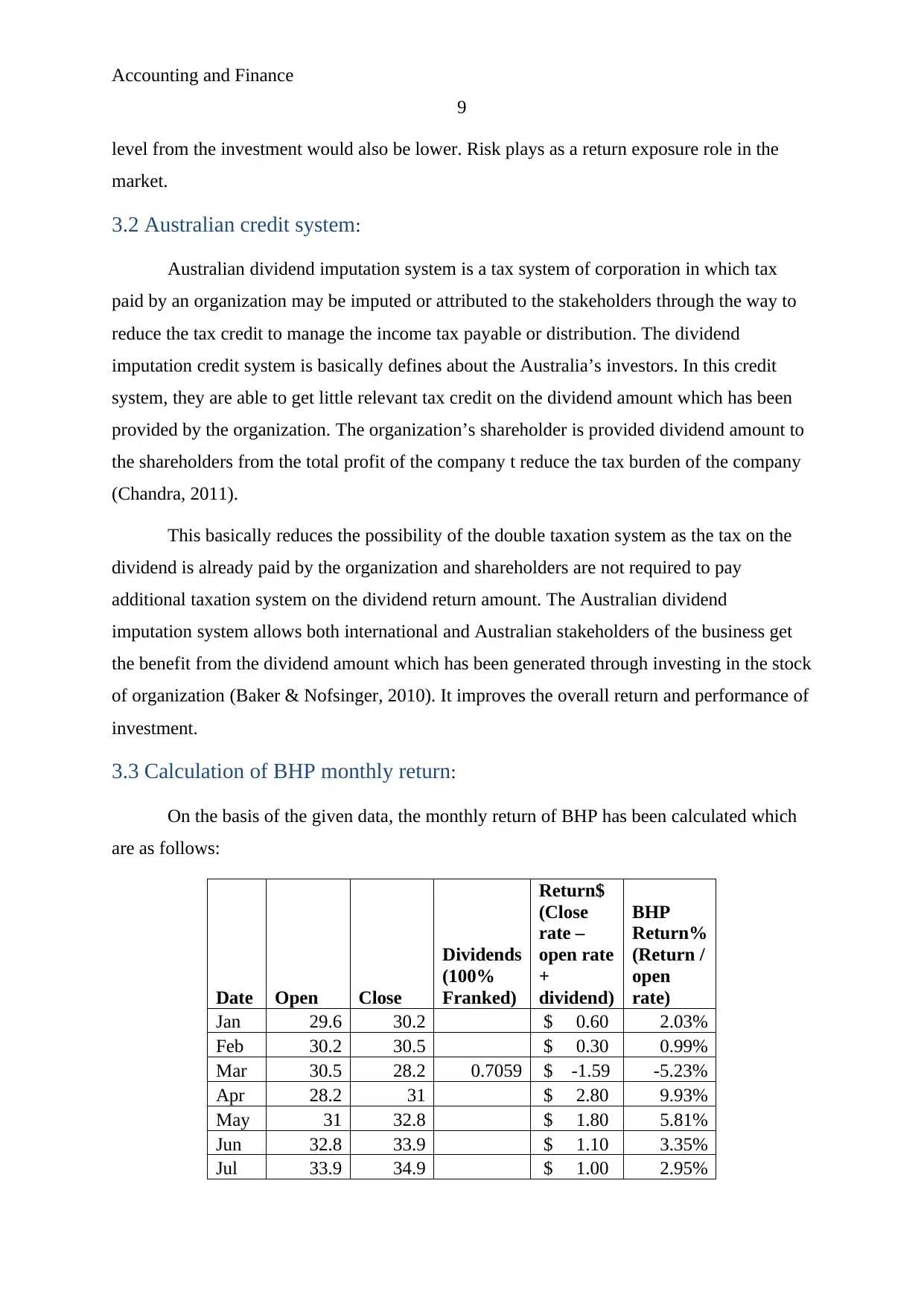

3.3 Calculation of BHP monthly return:

On the basis of the given data, the monthly return of BHP has been calculated which

are as follows:

Date Open Close

Dividends

(100%

Franked)

Return$

(Close

rate –

open rate

+

dividend)

BHP

Return%

(Return /

open

rate)

Jan 29.6 30.2 $ 0.60 2.03%

Feb 30.2 30.5 $ 0.30 0.99%

Mar 30.5 28.2 0.7059 $ -1.59 -5.23%

Apr 28.2 31 $ 2.80 9.93%

May 31 32.8 $ 1.80 5.81%

Jun 32.8 33.9 $ 1.10 3.35%

Jul 33.9 34.9 $ 1.00 2.95%

9

level from the investment would also be lower. Risk plays as a return exposure role in the

market.

3.2 Australian credit system:

Australian dividend imputation system is a tax system of corporation in which tax

paid by an organization may be imputed or attributed to the stakeholders through the way to

reduce the tax credit to manage the income tax payable or distribution. The dividend

imputation credit system is basically defines about the Australia’s investors. In this credit

system, they are able to get little relevant tax credit on the dividend amount which has been

provided by the organization. The organization’s shareholder is provided dividend amount to

the shareholders from the total profit of the company t reduce the tax burden of the company

(Chandra, 2011).

This basically reduces the possibility of the double taxation system as the tax on the

dividend is already paid by the organization and shareholders are not required to pay

additional taxation system on the dividend return amount. The Australian dividend

imputation system allows both international and Australian stakeholders of the business get

the benefit from the dividend amount which has been generated through investing in the stock

of organization (Baker & Nofsinger, 2010). It improves the overall return and performance of

investment.

3.3 Calculation of BHP monthly return:

On the basis of the given data, the monthly return of BHP has been calculated which

are as follows:

Date Open Close

Dividends

(100%

Franked)

Return$

(Close

rate –

open rate

+

dividend)

BHP

Return%

(Return /

open

rate)

Jan 29.6 30.2 $ 0.60 2.03%

Feb 30.2 30.5 $ 0.30 0.99%

Mar 30.5 28.2 0.7059 $ -1.59 -5.23%

Apr 28.2 31 $ 2.80 9.93%

May 31 32.8 $ 1.80 5.81%

Jun 32.8 33.9 $ 1.10 3.35%

Jul 33.9 34.9 $ 1.00 2.95%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance

10

Aug 34.9 33.2 $ -1.70 -4.87%

Sep 33.2 34.6 0.856 $ 2.26 6.80%

Oct 34.6 32.2 $ -2.40 -6.94%

Nov 32.2 30.7 $ -1.50 -4.66%

Dec 30.7 34.2 $ 3.50 11.40%

It indicates that the return of the company was moreover positive in all the 12 months.

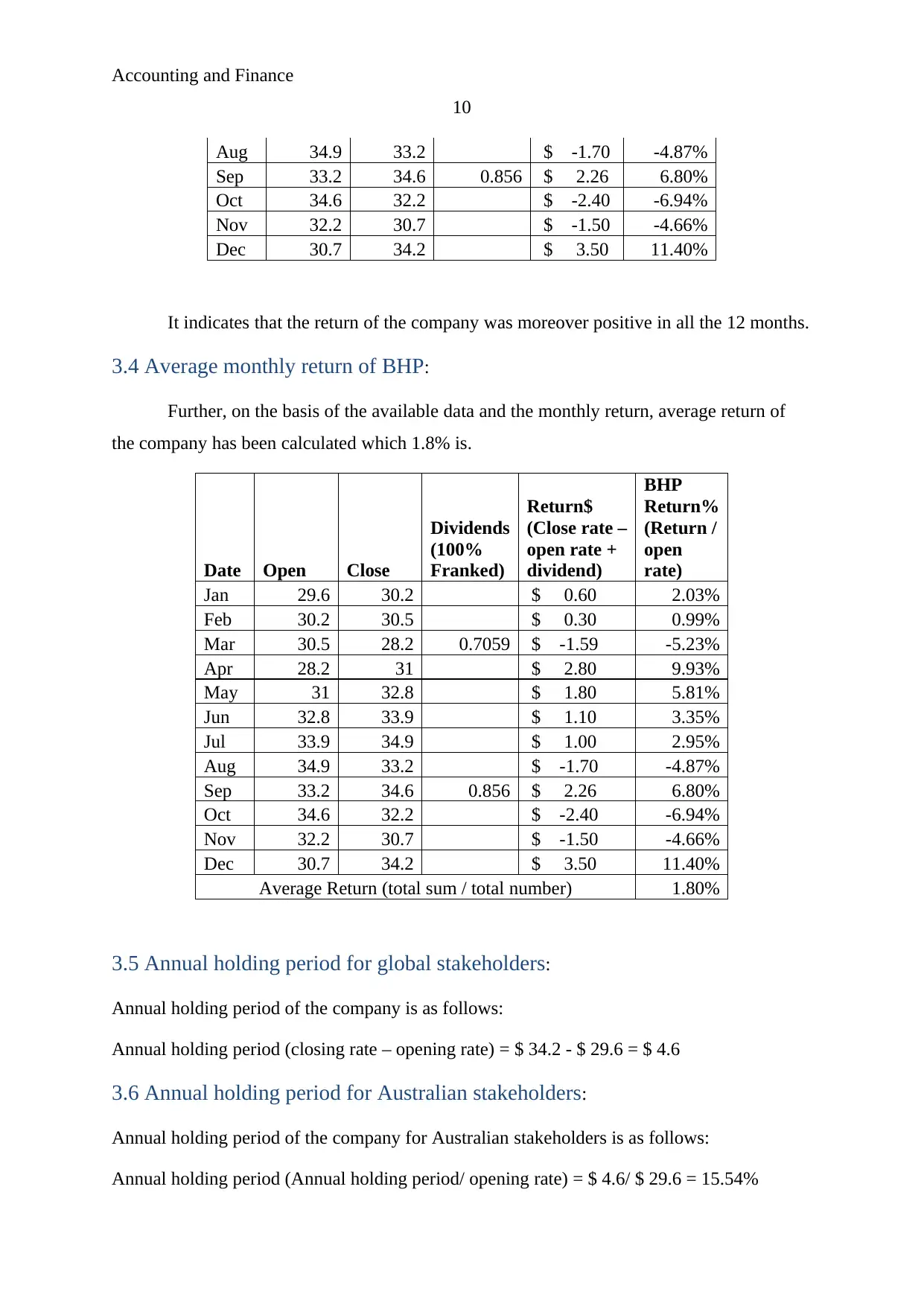

3.4 Average monthly return of BHP:

Further, on the basis of the available data and the monthly return, average return of

the company has been calculated which 1.8% is.

Date Open Close

Dividends

(100%

Franked)

Return$

(Close rate –

open rate +

dividend)

BHP

Return%

(Return /

open

rate)

Jan 29.6 30.2 $ 0.60 2.03%

Feb 30.2 30.5 $ 0.30 0.99%

Mar 30.5 28.2 0.7059 $ -1.59 -5.23%

Apr 28.2 31 $ 2.80 9.93%

May 31 32.8 $ 1.80 5.81%

Jun 32.8 33.9 $ 1.10 3.35%

Jul 33.9 34.9 $ 1.00 2.95%

Aug 34.9 33.2 $ -1.70 -4.87%

Sep 33.2 34.6 0.856 $ 2.26 6.80%

Oct 34.6 32.2 $ -2.40 -6.94%

Nov 32.2 30.7 $ -1.50 -4.66%

Dec 30.7 34.2 $ 3.50 11.40%

Average Return (total sum / total number) 1.80%

3.5 Annual holding period for global stakeholders:

Annual holding period of the company is as follows:

Annual holding period (closing rate – opening rate) = $ 34.2 - $ 29.6 = $ 4.6

3.6 Annual holding period for Australian stakeholders:

Annual holding period of the company for Australian stakeholders is as follows:

Annual holding period (Annual holding period/ opening rate) = $ 4.6/ $ 29.6 = 15.54%

10

Aug 34.9 33.2 $ -1.70 -4.87%

Sep 33.2 34.6 0.856 $ 2.26 6.80%

Oct 34.6 32.2 $ -2.40 -6.94%

Nov 32.2 30.7 $ -1.50 -4.66%

Dec 30.7 34.2 $ 3.50 11.40%

It indicates that the return of the company was moreover positive in all the 12 months.

3.4 Average monthly return of BHP:

Further, on the basis of the available data and the monthly return, average return of

the company has been calculated which 1.8% is.

Date Open Close

Dividends

(100%

Franked)

Return$

(Close rate –

open rate +

dividend)

BHP

Return%

(Return /

open

rate)

Jan 29.6 30.2 $ 0.60 2.03%

Feb 30.2 30.5 $ 0.30 0.99%

Mar 30.5 28.2 0.7059 $ -1.59 -5.23%

Apr 28.2 31 $ 2.80 9.93%

May 31 32.8 $ 1.80 5.81%

Jun 32.8 33.9 $ 1.10 3.35%

Jul 33.9 34.9 $ 1.00 2.95%

Aug 34.9 33.2 $ -1.70 -4.87%

Sep 33.2 34.6 0.856 $ 2.26 6.80%

Oct 34.6 32.2 $ -2.40 -6.94%

Nov 32.2 30.7 $ -1.50 -4.66%

Dec 30.7 34.2 $ 3.50 11.40%

Average Return (total sum / total number) 1.80%

3.5 Annual holding period for global stakeholders:

Annual holding period of the company is as follows:

Annual holding period (closing rate – opening rate) = $ 34.2 - $ 29.6 = $ 4.6

3.6 Annual holding period for Australian stakeholders:

Annual holding period of the company for Australian stakeholders is as follows:

Annual holding period (Annual holding period/ opening rate) = $ 4.6/ $ 29.6 = 15.54%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance

11

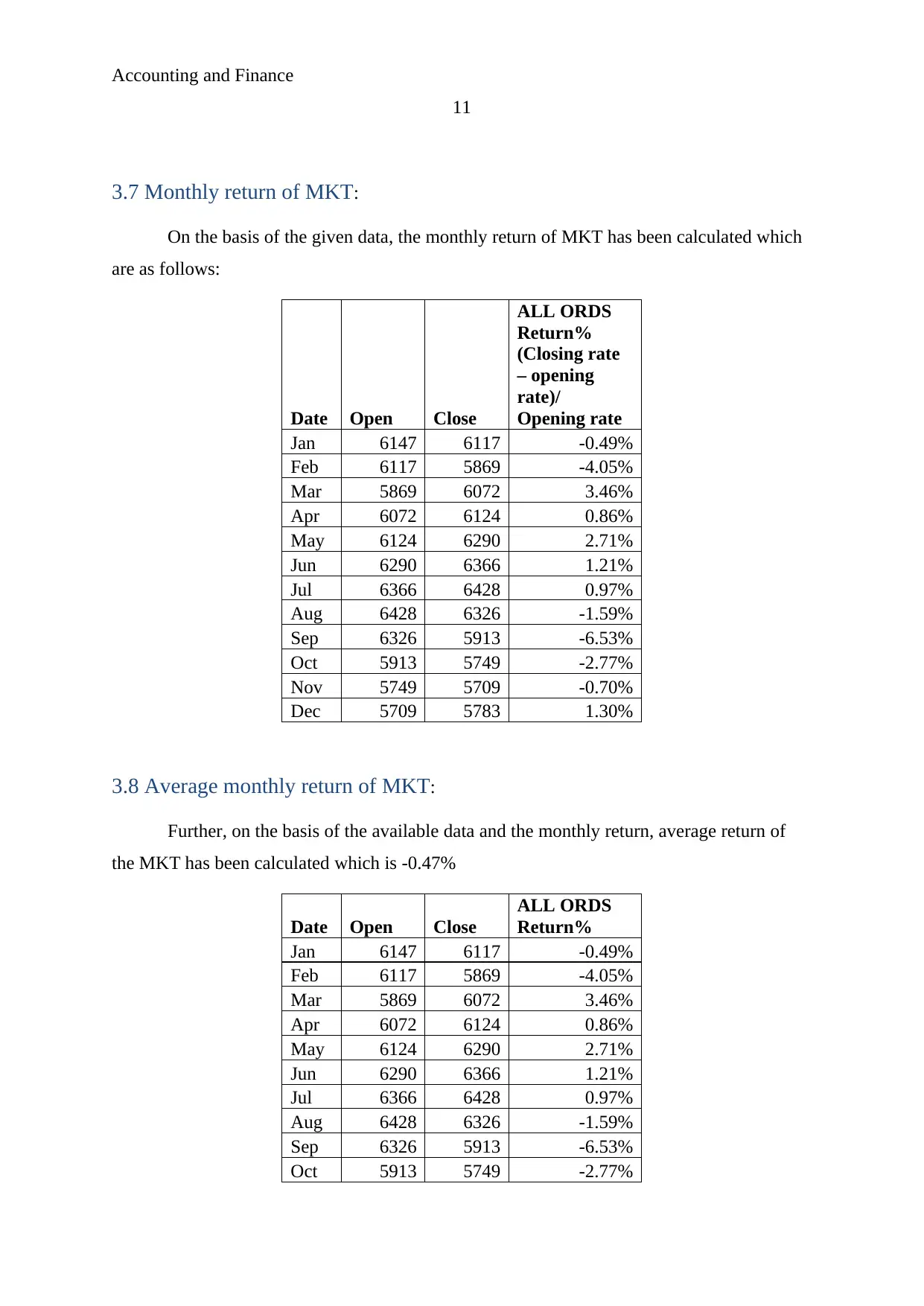

3.7 Monthly return of MKT:

On the basis of the given data, the monthly return of MKT has been calculated which

are as follows:

Date Open Close

ALL ORDS

Return%

(Closing rate

– opening

rate)/

Opening rate

Jan 6147 6117 -0.49%

Feb 6117 5869 -4.05%

Mar 5869 6072 3.46%

Apr 6072 6124 0.86%

May 6124 6290 2.71%

Jun 6290 6366 1.21%

Jul 6366 6428 0.97%

Aug 6428 6326 -1.59%

Sep 6326 5913 -6.53%

Oct 5913 5749 -2.77%

Nov 5749 5709 -0.70%

Dec 5709 5783 1.30%

3.8 Average monthly return of MKT:

Further, on the basis of the available data and the monthly return, average return of

the MKT has been calculated which is -0.47%

Date Open Close

ALL ORDS

Return%

Jan 6147 6117 -0.49%

Feb 6117 5869 -4.05%

Mar 5869 6072 3.46%

Apr 6072 6124 0.86%

May 6124 6290 2.71%

Jun 6290 6366 1.21%

Jul 6366 6428 0.97%

Aug 6428 6326 -1.59%

Sep 6326 5913 -6.53%

Oct 5913 5749 -2.77%

11

3.7 Monthly return of MKT:

On the basis of the given data, the monthly return of MKT has been calculated which

are as follows:

Date Open Close

ALL ORDS

Return%

(Closing rate

– opening

rate)/

Opening rate

Jan 6147 6117 -0.49%

Feb 6117 5869 -4.05%

Mar 5869 6072 3.46%

Apr 6072 6124 0.86%

May 6124 6290 2.71%

Jun 6290 6366 1.21%

Jul 6366 6428 0.97%

Aug 6428 6326 -1.59%

Sep 6326 5913 -6.53%

Oct 5913 5749 -2.77%

Nov 5749 5709 -0.70%

Dec 5709 5783 1.30%

3.8 Average monthly return of MKT:

Further, on the basis of the available data and the monthly return, average return of

the MKT has been calculated which is -0.47%

Date Open Close

ALL ORDS

Return%

Jan 6147 6117 -0.49%

Feb 6117 5869 -4.05%

Mar 5869 6072 3.46%

Apr 6072 6124 0.86%

May 6124 6290 2.71%

Jun 6290 6366 1.21%

Jul 6366 6428 0.97%

Aug 6428 6326 -1.59%

Sep 6326 5913 -6.53%

Oct 5913 5749 -2.77%

Accounting and Finance

12

Nov 5749 5709 -0.70%

Dec 5709 5783 1.30%

Average return -0.47%

3.9 Calculation of Annual holding period return:

Annual holding period of the company is as follows:

Annual holding period (closing rate – opening rate)/ Opening rate

= (5783- 6147)/ 6147 = -5.92%

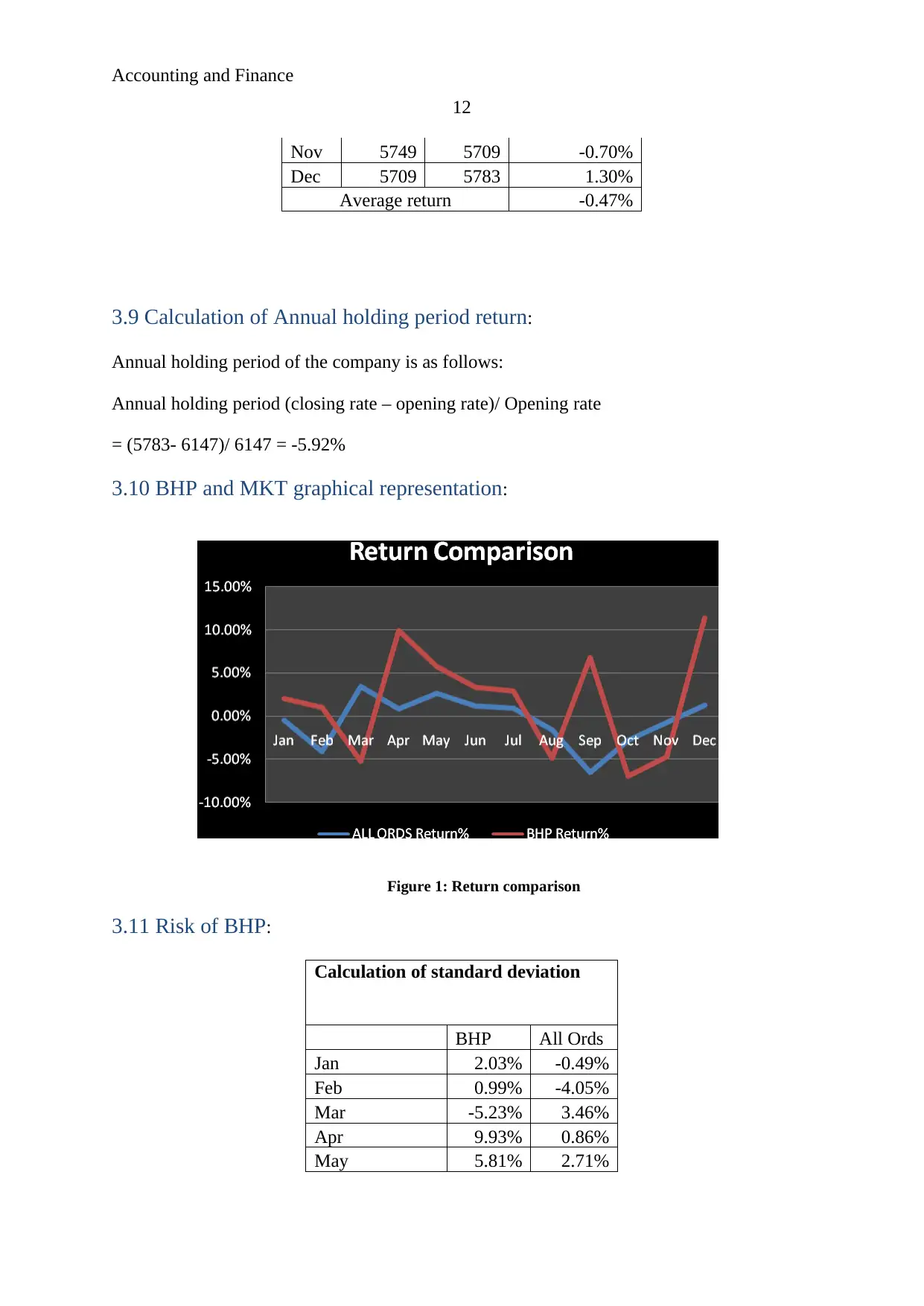

3.10 BHP and MKT graphical representation:

Figure 1: Return comparison

3.11 Risk of BHP:

Calculation of standard deviation

BHP All Ords

Jan 2.03% -0.49%

Feb 0.99% -4.05%

Mar -5.23% 3.46%

Apr 9.93% 0.86%

May 5.81% 2.71%

12

Nov 5749 5709 -0.70%

Dec 5709 5783 1.30%

Average return -0.47%

3.9 Calculation of Annual holding period return:

Annual holding period of the company is as follows:

Annual holding period (closing rate – opening rate)/ Opening rate

= (5783- 6147)/ 6147 = -5.92%

3.10 BHP and MKT graphical representation:

Figure 1: Return comparison

3.11 Risk of BHP:

Calculation of standard deviation

BHP All Ords

Jan 2.03% -0.49%

Feb 0.99% -4.05%

Mar -5.23% 3.46%

Apr 9.93% 0.86%

May 5.81% 2.71%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.