Accounting and Finance Report: Capital Budgeting, Structure and Ratios

VerifiedAdded on 2021/06/17

|17

|2299

|69

Report

AI Summary

This report provides a comprehensive analysis of financial and accounting concepts through two case studies. Part A focuses on Saturn Pet Care, evaluating capital budgeting for two potential manufacturing sites (Wodonga and Bathurst) using Net Present Value, payback period, and profitability index. The analysis concludes that Wodonga is the more profitable option. Part B assesses the capital structure and financial performance of ARB Ltd, including the calculation of Weighted Average Cost of Capital (WACC) and the cost of equity using the Capital Asset Pricing Model (CAPM). The report compares ARB Ltd's capital structure with Modine Ltd, analyzes key financial ratios, and suggests recommendations for improving shareholder wealth and optimizing the capital structure, emphasizing the importance of incorporating debt capital.

Running head: ACCOUNTING AND FINANCE

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING AND FINANCE

Executive Summary

This report is in respect to two different scenarios, which are associated with two different

circumstances. The scenario that has been taken in the first instance is with respect to Saturn Pet

care, which is a company that is associated with manufacturing products that are being used by

the pets. The firm is looking to enhance their business line by incorporating new product lines

within the economy and it is seen that the organization has two alternatives from two

manufacturing locations, and they are Wodonga and Bathurst. This report would be therefore be

related to having an understanding of the capital budgeting processes for the intention of gaining

an understanding of the production site that would be suitable for the company. The case study

that has been explained in the second situation is related with ARB Ltd, which engages their

business with the manufacture of accessories related to road motors. This section would associate

with the assessment of the capital framework of ARB Ltd and even addresses the efficiency level

of the company.

ACCOUNTING AND FINANCE

Executive Summary

This report is in respect to two different scenarios, which are associated with two different

circumstances. The scenario that has been taken in the first instance is with respect to Saturn Pet

care, which is a company that is associated with manufacturing products that are being used by

the pets. The firm is looking to enhance their business line by incorporating new product lines

within the economy and it is seen that the organization has two alternatives from two

manufacturing locations, and they are Wodonga and Bathurst. This report would be therefore be

related to having an understanding of the capital budgeting processes for the intention of gaining

an understanding of the production site that would be suitable for the company. The case study

that has been explained in the second situation is related with ARB Ltd, which engages their

business with the manufacture of accessories related to road motors. This section would associate

with the assessment of the capital framework of ARB Ltd and even addresses the efficiency level

of the company.

2

ACCOUNTING AND FINANCE

Table of Contents

Part A...............................................................................................................................................3

Capital Budgeting (Wodonga and Bathurst Site..........................................................................3

Product Cannibalization...............................................................................................................5

Amending the excessive sales that has been recorded.................................................................5

Inclusion of original cost of the old factory shed........................................................................6

Part B...............................................................................................................................................7

Introduction..................................................................................................................................7

Cost of Capital and Capital Structure..........................................................................................7

Weighted Average Cost of Capital..............................................................................................7

Cost of Capital under CAPM.......................................................................................................8

Comparison between Modine Ltd and ARB Ltd.........................................................................9

Financial Ratios of ARB Ltd.....................................................................................................10

Alterations in the Capital Structure...........................................................................................12

Wealth Maximisation.................................................................................................................12

Recommendations and Conclusion............................................................................................13

Reference List................................................................................................................................14

ACCOUNTING AND FINANCE

Table of Contents

Part A...............................................................................................................................................3

Capital Budgeting (Wodonga and Bathurst Site..........................................................................3

Product Cannibalization...............................................................................................................5

Amending the excessive sales that has been recorded.................................................................5

Inclusion of original cost of the old factory shed........................................................................6

Part B...............................................................................................................................................7

Introduction..................................................................................................................................7

Cost of Capital and Capital Structure..........................................................................................7

Weighted Average Cost of Capital..............................................................................................7

Cost of Capital under CAPM.......................................................................................................8

Comparison between Modine Ltd and ARB Ltd.........................................................................9

Financial Ratios of ARB Ltd.....................................................................................................10

Alterations in the Capital Structure...........................................................................................12

Wealth Maximisation.................................................................................................................12

Recommendations and Conclusion............................................................................................13

Reference List................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING AND FINANCE

Part A

Capital Budgeting (Wodonga and Bathurst Site)

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$27,500,000

Factory Building -$8,000,000

Infrastructure Grant $2,500,000

Total Initial Investment -$33,000,000

Operational Cash Flow:

Sales Growth Rate 10% 10% 10% 10% 10% 10% 10% 10% 10%

MAC 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

Annual Sales $30,000,000 $33,000,000 $36,300,000 $39,930,000 $43,923,000 $48,315,300 $53,146,830 $58,461,513 $64,307,664 $70,738,431

Conversion Cost -$21,000,000 -$23,100,000 -$25,410,000 -$27,951,000 -$30,746,100 -$33,820,710 -$37,202,781 -$40,923,059 -$45,015,365 -$49,516,902

Rebate on Municipal Rate $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000

Depreciation on Plant & Equipment -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000

Depreciation on Building -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000

Net Profit before Tax $6,430,000 $7,330,000 $8,320,000 $9,409,000 $10,606,900 $11,924,590 $13,374,049 $14,968,454 $16,722,299 $18,651,529

Less: Income Tax @ 30% -$1,929,000 -$2,199,000 -$2,496,000 -$2,822,700 -$3,182,070 -$3,577,377 -$4,012,215 -$4,490,536 -$5,016,690 -$5,595,459

Net Profit after Tax $4,501,000 $5,131,000 $5,824,000 $6,586,300 $7,424,830 $8,347,213 $9,361,834 $10,477,918 $11,705,610 $13,056,070

Add: Depreciation on Plant $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000

Add: Depreciation on Building $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000

After-Tax Cash Flows $7,571,000 $8,201,000 $8,894,000 $9,656,300 $10,494,830 $11,417,213 $12,431,834 $13,547,918 $14,775,610 $16,126,070

Net Cash Flow -$33,000,000 $7,571,000 $8,201,000 $8,894,000 $9,656,300 $10,494,830 $11,417,213 $12,431,834 $13,547,918 $14,775,610 $16,126,070

Cumulative Cash Flow -$33,000,000 -$25,429,000 -$17,228,000 -$8,334,000 $1,322,300 $11,817,130 $23,234,343 $35,666,177 $49,214,095 $63,989,705 $80,115,775

Discount Rate 22% 22% 22% 22% 22% 22% 22% 22% 22% 22% 22%

Discounted Cash Flow -$33,000,000 $6,205,738 $5,509,944 $4,897,987 $4,358,845 $3,883,079 $3,462,590 $3,090,412 $2,760,539 $2,467,783 $2,207,650

Payback Period (in years) 3.863

Net Present Value $5,844,567

Profitability Index 1.177

Years

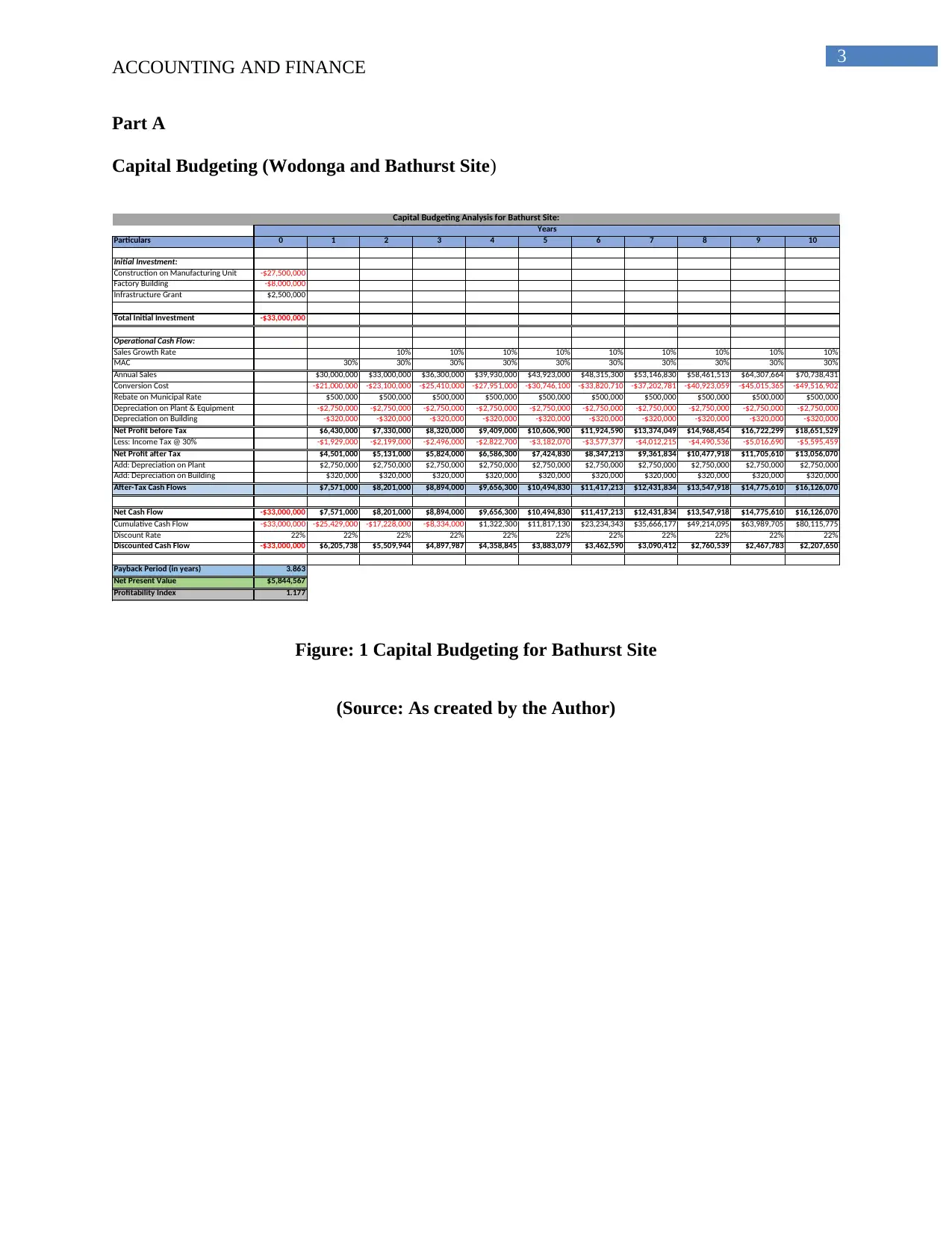

Capital Budgeting Analysis for Bathurst Site:

Figure: 1 Capital Budgeting for Bathurst Site

(Source: As created by the Author)

ACCOUNTING AND FINANCE

Part A

Capital Budgeting (Wodonga and Bathurst Site)

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$27,500,000

Factory Building -$8,000,000

Infrastructure Grant $2,500,000

Total Initial Investment -$33,000,000

Operational Cash Flow:

Sales Growth Rate 10% 10% 10% 10% 10% 10% 10% 10% 10%

MAC 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

Annual Sales $30,000,000 $33,000,000 $36,300,000 $39,930,000 $43,923,000 $48,315,300 $53,146,830 $58,461,513 $64,307,664 $70,738,431

Conversion Cost -$21,000,000 -$23,100,000 -$25,410,000 -$27,951,000 -$30,746,100 -$33,820,710 -$37,202,781 -$40,923,059 -$45,015,365 -$49,516,902

Rebate on Municipal Rate $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000

Depreciation on Plant & Equipment -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000

Depreciation on Building -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000 -$320,000

Net Profit before Tax $6,430,000 $7,330,000 $8,320,000 $9,409,000 $10,606,900 $11,924,590 $13,374,049 $14,968,454 $16,722,299 $18,651,529

Less: Income Tax @ 30% -$1,929,000 -$2,199,000 -$2,496,000 -$2,822,700 -$3,182,070 -$3,577,377 -$4,012,215 -$4,490,536 -$5,016,690 -$5,595,459

Net Profit after Tax $4,501,000 $5,131,000 $5,824,000 $6,586,300 $7,424,830 $8,347,213 $9,361,834 $10,477,918 $11,705,610 $13,056,070

Add: Depreciation on Plant $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000

Add: Depreciation on Building $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000 $320,000

After-Tax Cash Flows $7,571,000 $8,201,000 $8,894,000 $9,656,300 $10,494,830 $11,417,213 $12,431,834 $13,547,918 $14,775,610 $16,126,070

Net Cash Flow -$33,000,000 $7,571,000 $8,201,000 $8,894,000 $9,656,300 $10,494,830 $11,417,213 $12,431,834 $13,547,918 $14,775,610 $16,126,070

Cumulative Cash Flow -$33,000,000 -$25,429,000 -$17,228,000 -$8,334,000 $1,322,300 $11,817,130 $23,234,343 $35,666,177 $49,214,095 $63,989,705 $80,115,775

Discount Rate 22% 22% 22% 22% 22% 22% 22% 22% 22% 22% 22%

Discounted Cash Flow -$33,000,000 $6,205,738 $5,509,944 $4,897,987 $4,358,845 $3,883,079 $3,462,590 $3,090,412 $2,760,539 $2,467,783 $2,207,650

Payback Period (in years) 3.863

Net Present Value $5,844,567

Profitability Index 1.177

Years

Capital Budgeting Analysis for Bathurst Site:

Figure: 1 Capital Budgeting for Bathurst Site

(Source: As created by the Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$27,500,000

Value of Wodonga Site

Total Initial Investment -$27,500,000

Operational Cash Flow:

Sales Growth Rate 10% 10% 10% 10% 10% 10% 10% 10% 10%

MAC 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

Annual Sales $30,000,000 $33,000,000 $36,300,000 $39,930,000 $43,923,000 $48,315,300 $53,146,830 $58,461,513 $64,307,664 $70,738,431

Conversion Cost -$21,000,000 -$23,100,000 -$25,410,000 -$27,951,000 -$30,746,100 -$33,820,710 -$37,202,781 -$40,923,059 -$45,015,365 -$49,516,902

Depreciation on Plant & Equipment -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000

Depreciation on Building $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net Profit before Tax $6,250,000 $7,150,000 $8,140,000 $9,229,000 $10,426,900 $11,744,590 $13,194,049 $14,788,454 $16,542,299 $18,471,529

Less: Income Tax @ 30% -$1,875,000 -$2,145,000 -$2,442,000 -$2,768,700 -$3,128,070 -$3,523,377 -$3,958,215 -$4,436,536 -$4,962,690 -$5,541,459

Net Profit after Tax $4,375,000 $5,005,000 $5,698,000 $6,460,300 $7,298,830 $8,221,213 $9,235,834 $10,351,918 $11,579,610 $12,930,070

Add: Depreciation on Plant $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000

Add: Depreciation on Building $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

After-Tax Cash Flows $7,125,000 $7,755,000 $8,448,000 $9,210,300 $10,048,830 $10,971,213 $11,985,834 $13,101,918 $14,329,610 $15,680,070

Net Cash Flow -$27,500,000 $7,125,000 $7,755,000 $8,448,000 $9,210,300 $10,048,830 $10,971,213 $11,985,834 $13,101,918 $14,329,610 $15,680,070

Cumulative Cash Flow -$27,500,000 -$20,375,000 -$12,620,000 -$4,172,000 $5,038,300 $15,087,130 $26,058,343 $38,044,177 $51,146,095 $65,475,705 $81,155,775

Discount Rate 22% 22% 22% 22% 22% 22% 22% 22% 22% 22% 22%

Discounted Cash Flow -$27,500,000 $5,840,164 $5,210,293 $4,652,372 $4,157,521 $3,718,060 $3,327,328 $2,979,542 $2,669,662 $2,393,293 $2,146,593

Payback Period (in years) 3.453

Net Present Value $9,594,827

Profitability Index 1.349

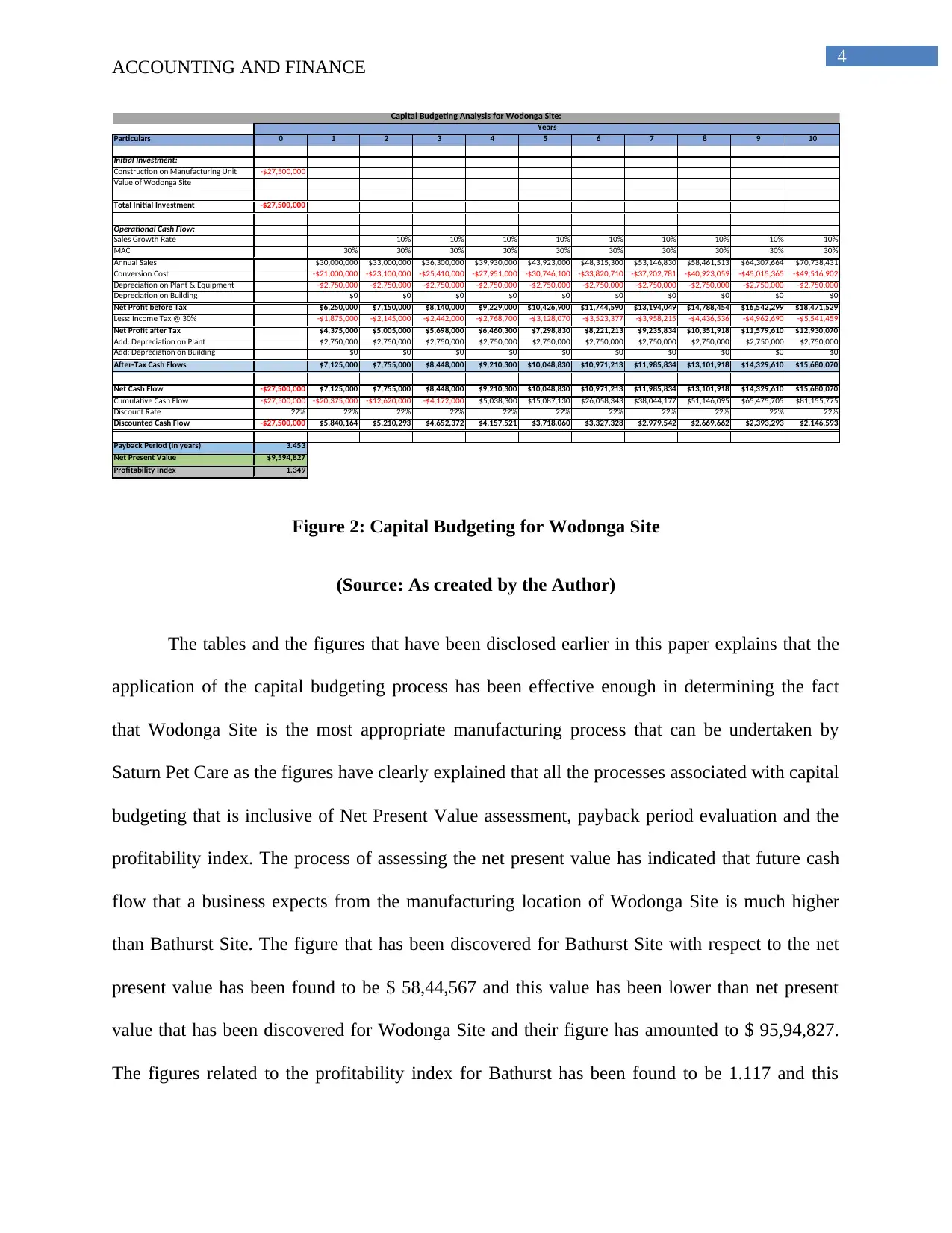

Capital Budgeting Analysis for Wodonga Site:

Years

Figure 2: Capital Budgeting for Wodonga Site

(Source: As created by the Author)

The tables and the figures that have been disclosed earlier in this paper explains that the

application of the capital budgeting process has been effective enough in determining the fact

that Wodonga Site is the most appropriate manufacturing process that can be undertaken by

Saturn Pet Care as the figures have clearly explained that all the processes associated with capital

budgeting that is inclusive of Net Present Value assessment, payback period evaluation and the

profitability index. The process of assessing the net present value has indicated that future cash

flow that a business expects from the manufacturing location of Wodonga Site is much higher

than Bathurst Site. The figure that has been discovered for Bathurst Site with respect to the net

present value has been found to be $ 58,44,567 and this value has been lower than net present

value that has been discovered for Wodonga Site and their figure has amounted to $ 95,94,827.

The figures related to the profitability index for Bathurst has been found to be 1.117 and this

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$27,500,000

Value of Wodonga Site

Total Initial Investment -$27,500,000

Operational Cash Flow:

Sales Growth Rate 10% 10% 10% 10% 10% 10% 10% 10% 10%

MAC 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

Annual Sales $30,000,000 $33,000,000 $36,300,000 $39,930,000 $43,923,000 $48,315,300 $53,146,830 $58,461,513 $64,307,664 $70,738,431

Conversion Cost -$21,000,000 -$23,100,000 -$25,410,000 -$27,951,000 -$30,746,100 -$33,820,710 -$37,202,781 -$40,923,059 -$45,015,365 -$49,516,902

Depreciation on Plant & Equipment -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000 -$2,750,000

Depreciation on Building $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net Profit before Tax $6,250,000 $7,150,000 $8,140,000 $9,229,000 $10,426,900 $11,744,590 $13,194,049 $14,788,454 $16,542,299 $18,471,529

Less: Income Tax @ 30% -$1,875,000 -$2,145,000 -$2,442,000 -$2,768,700 -$3,128,070 -$3,523,377 -$3,958,215 -$4,436,536 -$4,962,690 -$5,541,459

Net Profit after Tax $4,375,000 $5,005,000 $5,698,000 $6,460,300 $7,298,830 $8,221,213 $9,235,834 $10,351,918 $11,579,610 $12,930,070

Add: Depreciation on Plant $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000 $2,750,000

Add: Depreciation on Building $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

After-Tax Cash Flows $7,125,000 $7,755,000 $8,448,000 $9,210,300 $10,048,830 $10,971,213 $11,985,834 $13,101,918 $14,329,610 $15,680,070

Net Cash Flow -$27,500,000 $7,125,000 $7,755,000 $8,448,000 $9,210,300 $10,048,830 $10,971,213 $11,985,834 $13,101,918 $14,329,610 $15,680,070

Cumulative Cash Flow -$27,500,000 -$20,375,000 -$12,620,000 -$4,172,000 $5,038,300 $15,087,130 $26,058,343 $38,044,177 $51,146,095 $65,475,705 $81,155,775

Discount Rate 22% 22% 22% 22% 22% 22% 22% 22% 22% 22% 22%

Discounted Cash Flow -$27,500,000 $5,840,164 $5,210,293 $4,652,372 $4,157,521 $3,718,060 $3,327,328 $2,979,542 $2,669,662 $2,393,293 $2,146,593

Payback Period (in years) 3.453

Net Present Value $9,594,827

Profitability Index 1.349

Capital Budgeting Analysis for Wodonga Site:

Years

Figure 2: Capital Budgeting for Wodonga Site

(Source: As created by the Author)

The tables and the figures that have been disclosed earlier in this paper explains that the

application of the capital budgeting process has been effective enough in determining the fact

that Wodonga Site is the most appropriate manufacturing process that can be undertaken by

Saturn Pet Care as the figures have clearly explained that all the processes associated with capital

budgeting that is inclusive of Net Present Value assessment, payback period evaluation and the

profitability index. The process of assessing the net present value has indicated that future cash

flow that a business expects from the manufacturing location of Wodonga Site is much higher

than Bathurst Site. The figure that has been discovered for Bathurst Site with respect to the net

present value has been found to be $ 58,44,567 and this value has been lower than net present

value that has been discovered for Wodonga Site and their figure has amounted to $ 95,94,827.

The figures related to the profitability index for Bathurst has been found to be 1.117 and this

5

ACCOUNTING AND FINANCE

figure has been lower than the index of Wodonga in relation to their profitability and the value

amounts to 1.349. The assessment of the payback period has indicated that site for Wodonga is

much more effective with respect to the site in Bathurst as it permits the organization to regain

the primary value that has been invested for the purpose of manufacturing at a very limited time

period. Therefore, by looking at the assessment that has been taken into consideration it is seen

that manufacturing process that has undertaken by Wodonga site is much more profitable.

Product Cannibalization

The word “product cannibalization” is associated to a plan or a strategy, which is

generally undertaken by an organization and in which in order to incorporate and advertise a

fresh product in the market, it is seen that the organzaiiton looks to lower their sales of their

other products (Loughran, & McDonald 2016). In accordance to Saturn Pet Care, there are

possibilities that this company is making use of such a process in order to improve their new

product line, which is in the mind-set of the management.

Amending the excessive sales that has been recorded

According to the question, it is seen that one of the directors of the company who is

named as Nathan, has an idea that the department of marketing has expected the sales to be more

and hence this error needs to be amended in order to mitigate the effect that it would have on the

method of planning that is undertaken by the management (Beaumont, 2015). The error of

estimation can be amended by making use of the process of net present value analysis with the

help of which the estimates of the cash flow can be enhanced a bit in order to counteract the error

of estimation that have taken place at a certain point of time earlier.

ACCOUNTING AND FINANCE

figure has been lower than the index of Wodonga in relation to their profitability and the value

amounts to 1.349. The assessment of the payback period has indicated that site for Wodonga is

much more effective with respect to the site in Bathurst as it permits the organization to regain

the primary value that has been invested for the purpose of manufacturing at a very limited time

period. Therefore, by looking at the assessment that has been taken into consideration it is seen

that manufacturing process that has undertaken by Wodonga site is much more profitable.

Product Cannibalization

The word “product cannibalization” is associated to a plan or a strategy, which is

generally undertaken by an organization and in which in order to incorporate and advertise a

fresh product in the market, it is seen that the organzaiiton looks to lower their sales of their

other products (Loughran, & McDonald 2016). In accordance to Saturn Pet Care, there are

possibilities that this company is making use of such a process in order to improve their new

product line, which is in the mind-set of the management.

Amending the excessive sales that has been recorded

According to the question, it is seen that one of the directors of the company who is

named as Nathan, has an idea that the department of marketing has expected the sales to be more

and hence this error needs to be amended in order to mitigate the effect that it would have on the

method of planning that is undertaken by the management (Beaumont, 2015). The error of

estimation can be amended by making use of the process of net present value analysis with the

help of which the estimates of the cash flow can be enhanced a bit in order to counteract the error

of estimation that have taken place at a certain point of time earlier.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING AND FINANCE

Inclusion of original cost of the old factory shed

The director named Nathan even has the idea that the actual expense of the factory

location needs to be added within the investment that has been made initially in order to bring in

a precise estimation (Unda, 2015). The point of view of Nathan is not perfect as the assessment

of the net present value only regards the factory locations that have been newly constructed and

this has been developed for the purpose of the option of the manufacturing locations.

ACCOUNTING AND FINANCE

Inclusion of original cost of the old factory shed

The director named Nathan even has the idea that the actual expense of the factory

location needs to be added within the investment that has been made initially in order to bring in

a precise estimation (Unda, 2015). The point of view of Nathan is not perfect as the assessment

of the net present value only regards the factory locations that have been newly constructed and

this has been developed for the purpose of the option of the manufacturing locations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING AND FINANCE

Part B

Introduction

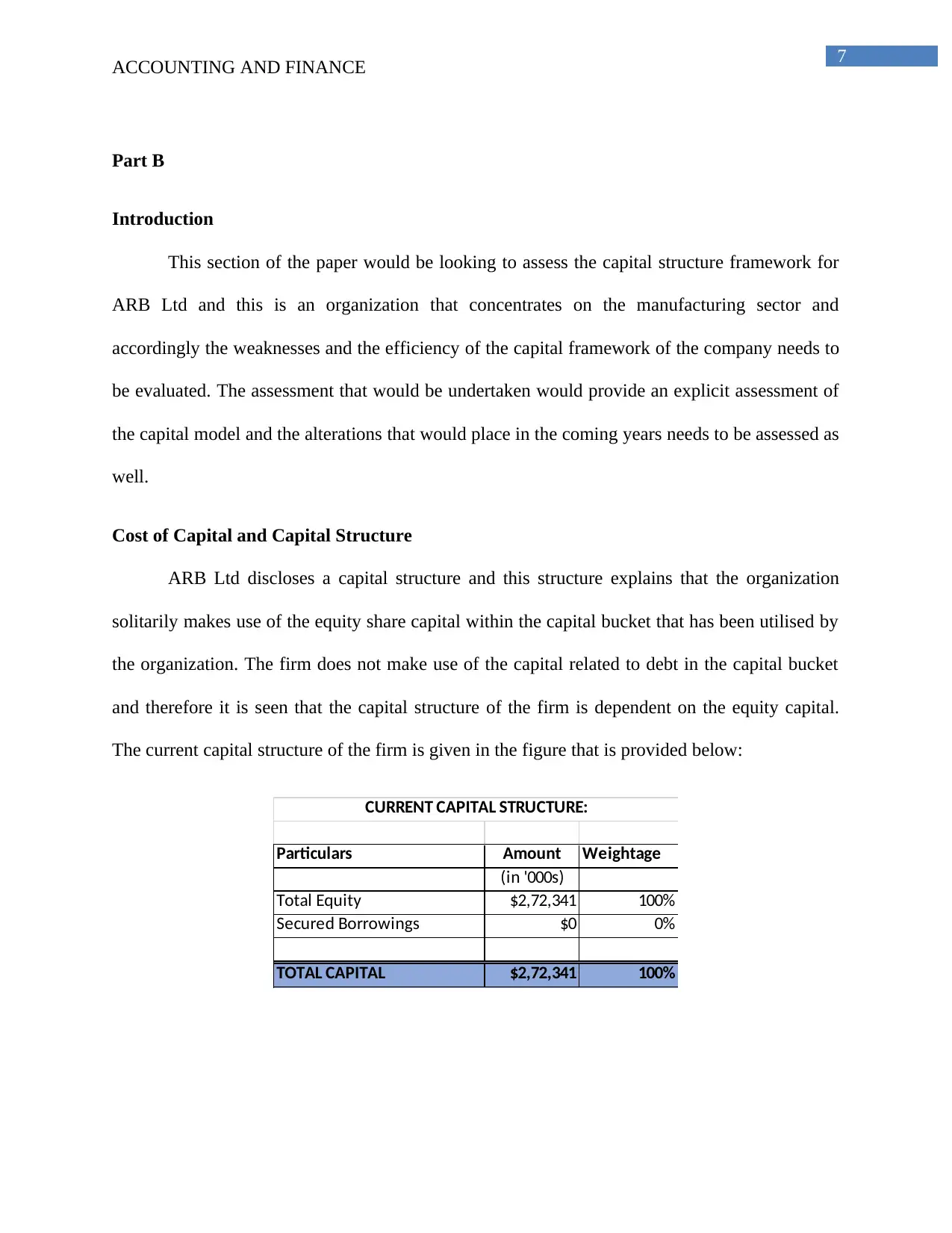

This section of the paper would be looking to assess the capital structure framework for

ARB Ltd and this is an organization that concentrates on the manufacturing sector and

accordingly the weaknesses and the efficiency of the capital framework of the company needs to

be evaluated. The assessment that would be undertaken would provide an explicit assessment of

the capital model and the alterations that would place in the coming years needs to be assessed as

well.

Cost of Capital and Capital Structure

ARB Ltd discloses a capital structure and this structure explains that the organization

solitarily makes use of the equity share capital within the capital bucket that has been utilised by

the organization. The firm does not make use of the capital related to debt in the capital bucket

and therefore it is seen that the capital structure of the firm is dependent on the equity capital.

The current capital structure of the firm is given in the figure that is provided below:

Particulars Amount Weightage

(in '000s)

Total Equity $2,72,341 100%

Secured Borrowings $0 0%

TOTAL CAPITAL $2,72,341 100%

CURRENT CAPITAL STRUCTURE:

ACCOUNTING AND FINANCE

Part B

Introduction

This section of the paper would be looking to assess the capital structure framework for

ARB Ltd and this is an organization that concentrates on the manufacturing sector and

accordingly the weaknesses and the efficiency of the capital framework of the company needs to

be evaluated. The assessment that would be undertaken would provide an explicit assessment of

the capital model and the alterations that would place in the coming years needs to be assessed as

well.

Cost of Capital and Capital Structure

ARB Ltd discloses a capital structure and this structure explains that the organization

solitarily makes use of the equity share capital within the capital bucket that has been utilised by

the organization. The firm does not make use of the capital related to debt in the capital bucket

and therefore it is seen that the capital structure of the firm is dependent on the equity capital.

The current capital structure of the firm is given in the figure that is provided below:

Particulars Amount Weightage

(in '000s)

Total Equity $2,72,341 100%

Secured Borrowings $0 0%

TOTAL CAPITAL $2,72,341 100%

CURRENT CAPITAL STRUCTURE:

8

ACCOUNTING AND FINANCE

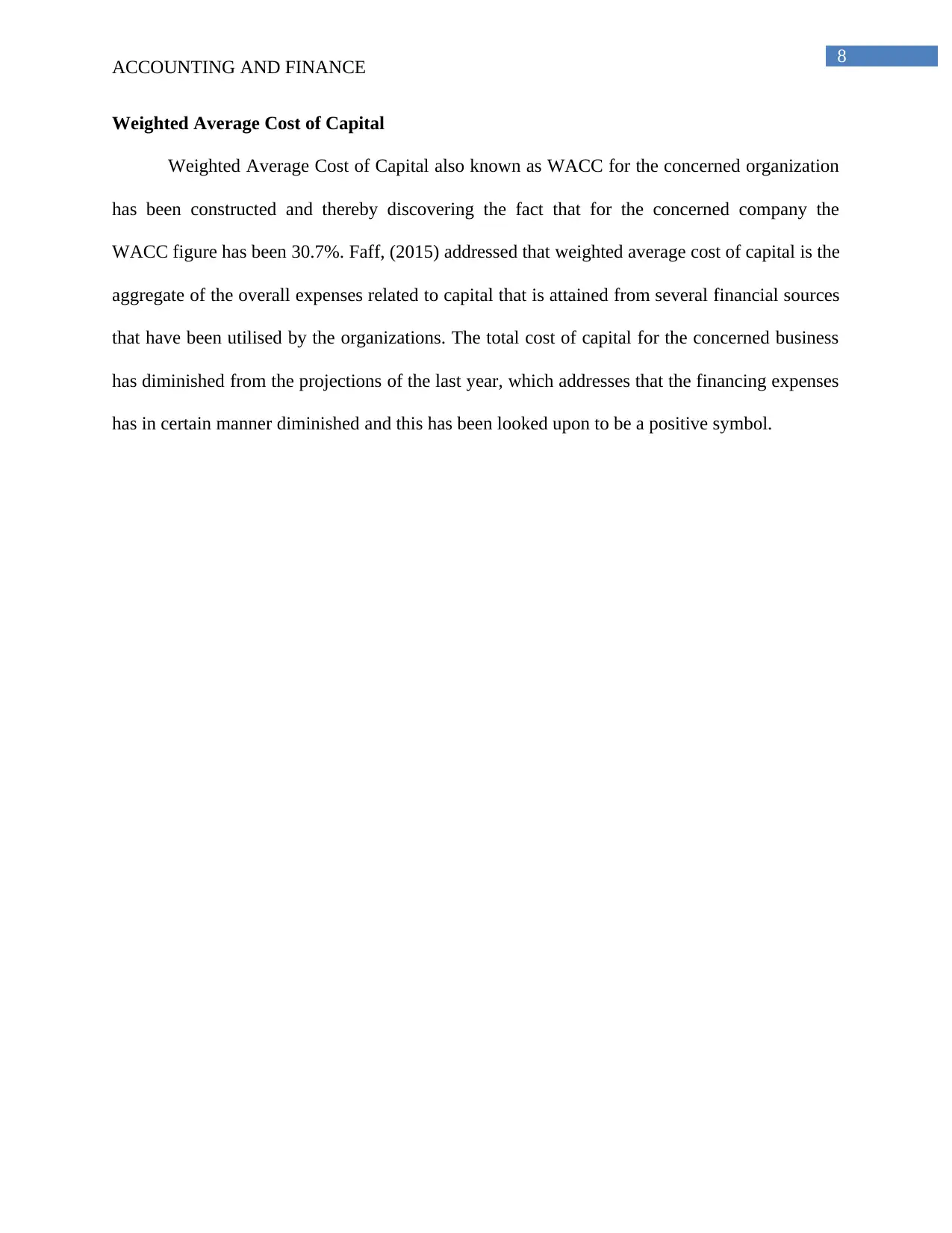

Weighted Average Cost of Capital

Weighted Average Cost of Capital also known as WACC for the concerned organization

has been constructed and thereby discovering the fact that for the concerned company the

WACC figure has been 30.7%. Faff, (2015) addressed that weighted average cost of capital is the

aggregate of the overall expenses related to capital that is attained from several financial sources

that have been utilised by the organizations. The total cost of capital for the concerned business

has diminished from the projections of the last year, which addresses that the financing expenses

has in certain manner diminished and this has been looked upon to be a positive symbol.

ACCOUNTING AND FINANCE

Weighted Average Cost of Capital

Weighted Average Cost of Capital also known as WACC for the concerned organization

has been constructed and thereby discovering the fact that for the concerned company the

WACC figure has been 30.7%. Faff, (2015) addressed that weighted average cost of capital is the

aggregate of the overall expenses related to capital that is attained from several financial sources

that have been utilised by the organizations. The total cost of capital for the concerned business

has diminished from the projections of the last year, which addresses that the financing expenses

has in certain manner diminished and this has been looked upon to be a positive symbol.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING AND FINANCE

WACC:

Particulars 2017

(in '000s)

EPS (in cents) $0.62

Dividend per share (in cents) $0.34

Dividend Payout Rate 55%

Net profit after Tax $49,152

Total Equity $2,72,341

ROE 18.05%

Growth Rate 27.93%

Market price per share on 30/6/2017 $15.71

Cost of equity 30.70%

Nos. of Shares 79184214

Total Value of Shares (in million) $1,244

Weightage of Equity 100.00%

Interest Expenses for secured

borrowings 0

Secured Borrowings $0

Cost of Debt 0%

Weightage of Debt 0%

Tax Rate 30%

WACC 30.70%

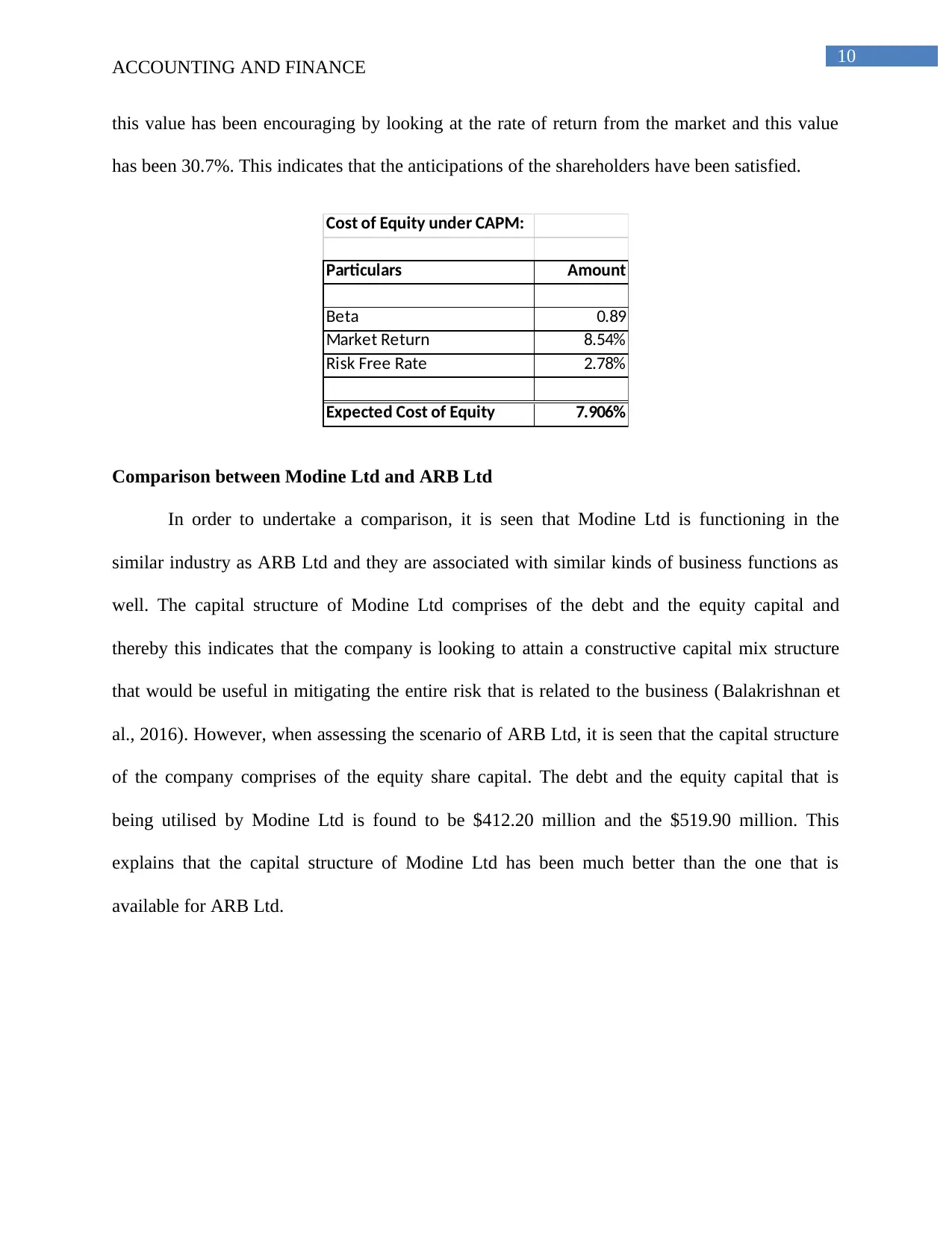

Cost of Capital under CAPM

The cost of capital that is constructed with regards to the CAPM process looks to take

into account various kinds of variables like the rate of return that is risk free in nature, rate of

return of the market and the risk free factor that is even known as Beta (Ratiu, 2015). The cost of

equity that is determined in accordance to the process of CAPM is constructed to be 7.906% and

ACCOUNTING AND FINANCE

WACC:

Particulars 2017

(in '000s)

EPS (in cents) $0.62

Dividend per share (in cents) $0.34

Dividend Payout Rate 55%

Net profit after Tax $49,152

Total Equity $2,72,341

ROE 18.05%

Growth Rate 27.93%

Market price per share on 30/6/2017 $15.71

Cost of equity 30.70%

Nos. of Shares 79184214

Total Value of Shares (in million) $1,244

Weightage of Equity 100.00%

Interest Expenses for secured

borrowings 0

Secured Borrowings $0

Cost of Debt 0%

Weightage of Debt 0%

Tax Rate 30%

WACC 30.70%

Cost of Capital under CAPM

The cost of capital that is constructed with regards to the CAPM process looks to take

into account various kinds of variables like the rate of return that is risk free in nature, rate of

return of the market and the risk free factor that is even known as Beta (Ratiu, 2015). The cost of

equity that is determined in accordance to the process of CAPM is constructed to be 7.906% and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ACCOUNTING AND FINANCE

this value has been encouraging by looking at the rate of return from the market and this value

has been 30.7%. This indicates that the anticipations of the shareholders have been satisfied.

Cost of Equity under CAPM:

Particulars Amount

Beta 0.89

Market Return 8.54%

Risk Free Rate 2.78%

Expected Cost of Equity 7.906%

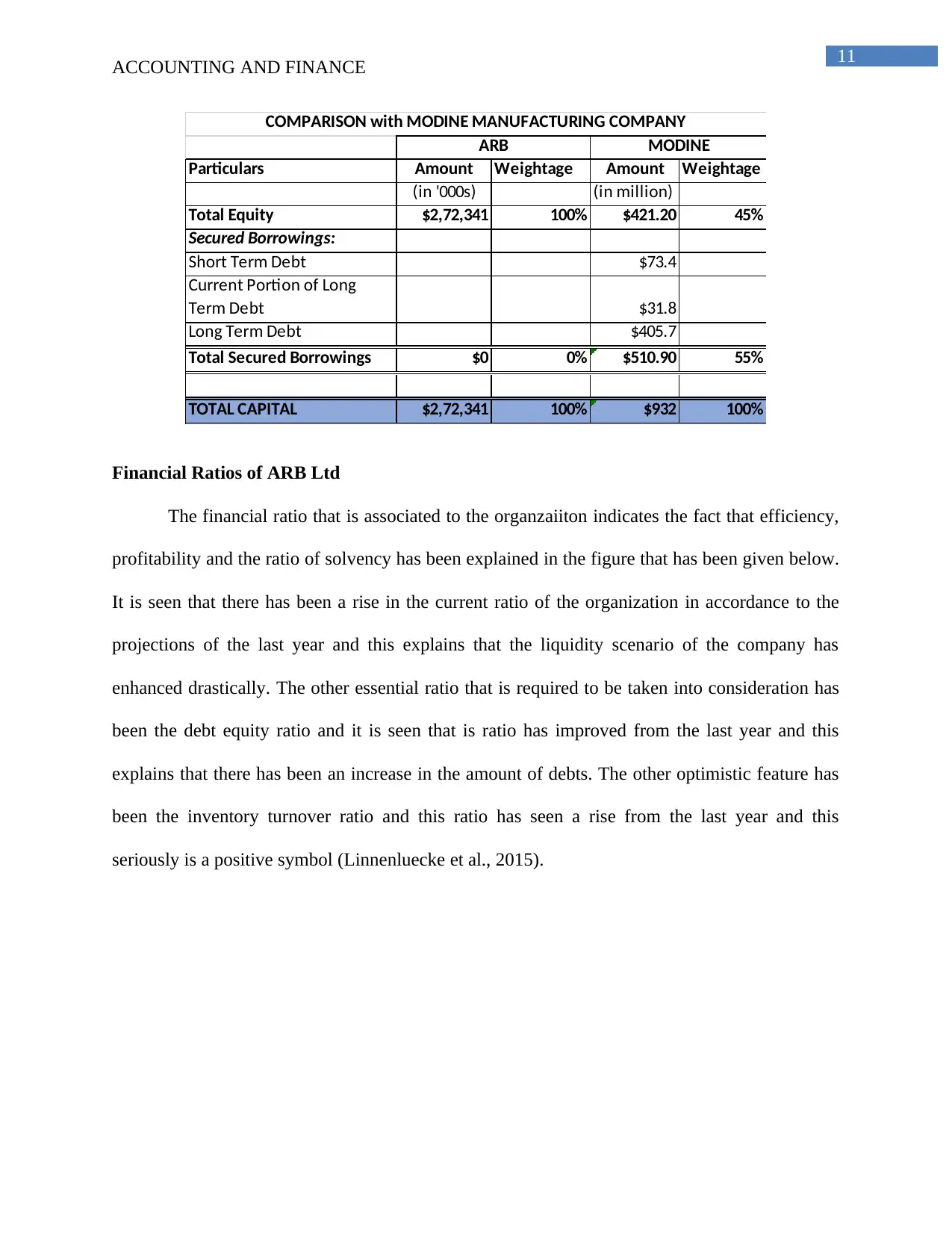

Comparison between Modine Ltd and ARB Ltd

In order to undertake a comparison, it is seen that Modine Ltd is functioning in the

similar industry as ARB Ltd and they are associated with similar kinds of business functions as

well. The capital structure of Modine Ltd comprises of the debt and the equity capital and

thereby this indicates that the company is looking to attain a constructive capital mix structure

that would be useful in mitigating the entire risk that is related to the business (Balakrishnan et

al., 2016). However, when assessing the scenario of ARB Ltd, it is seen that the capital structure

of the company comprises of the equity share capital. The debt and the equity capital that is

being utilised by Modine Ltd is found to be $412.20 million and the $519.90 million. This

explains that the capital structure of Modine Ltd has been much better than the one that is

available for ARB Ltd.

ACCOUNTING AND FINANCE

this value has been encouraging by looking at the rate of return from the market and this value

has been 30.7%. This indicates that the anticipations of the shareholders have been satisfied.

Cost of Equity under CAPM:

Particulars Amount

Beta 0.89

Market Return 8.54%

Risk Free Rate 2.78%

Expected Cost of Equity 7.906%

Comparison between Modine Ltd and ARB Ltd

In order to undertake a comparison, it is seen that Modine Ltd is functioning in the

similar industry as ARB Ltd and they are associated with similar kinds of business functions as

well. The capital structure of Modine Ltd comprises of the debt and the equity capital and

thereby this indicates that the company is looking to attain a constructive capital mix structure

that would be useful in mitigating the entire risk that is related to the business (Balakrishnan et

al., 2016). However, when assessing the scenario of ARB Ltd, it is seen that the capital structure

of the company comprises of the equity share capital. The debt and the equity capital that is

being utilised by Modine Ltd is found to be $412.20 million and the $519.90 million. This

explains that the capital structure of Modine Ltd has been much better than the one that is

available for ARB Ltd.

11

ACCOUNTING AND FINANCE

Particulars Amount Weightage Amount Weightage

(in '000s) (in million)

Total Equity $2,72,341 100% $421.20 45%

Secured Borrowings:

Short Term Debt $73.4

Current Portion of Long

Term Debt $31.8

Long Term Debt $405.7

Total Secured Borrowings $0 0% $510.90 55%

TOTAL CAPITAL $2,72,341 100% $932 100%

ARB MODINE

COMPARISON with MODINE MANUFACTURING COMPANY

Financial Ratios of ARB Ltd

The financial ratio that is associated to the organzaiiton indicates the fact that efficiency,

profitability and the ratio of solvency has been explained in the figure that has been given below.

It is seen that there has been a rise in the current ratio of the organization in accordance to the

projections of the last year and this explains that the liquidity scenario of the company has

enhanced drastically. The other essential ratio that is required to be taken into consideration has

been the debt equity ratio and it is seen that is ratio has improved from the last year and this

explains that there has been an increase in the amount of debts. The other optimistic feature has

been the inventory turnover ratio and this ratio has seen a rise from the last year and this

seriously is a positive symbol (Linnenluecke et al., 2015).

ACCOUNTING AND FINANCE

Particulars Amount Weightage Amount Weightage

(in '000s) (in million)

Total Equity $2,72,341 100% $421.20 45%

Secured Borrowings:

Short Term Debt $73.4

Current Portion of Long

Term Debt $31.8

Long Term Debt $405.7

Total Secured Borrowings $0 0% $510.90 55%

TOTAL CAPITAL $2,72,341 100% $932 100%

ARB MODINE

COMPARISON with MODINE MANUFACTURING COMPANY

Financial Ratios of ARB Ltd

The financial ratio that is associated to the organzaiiton indicates the fact that efficiency,

profitability and the ratio of solvency has been explained in the figure that has been given below.

It is seen that there has been a rise in the current ratio of the organization in accordance to the

projections of the last year and this explains that the liquidity scenario of the company has

enhanced drastically. The other essential ratio that is required to be taken into consideration has

been the debt equity ratio and it is seen that is ratio has improved from the last year and this

explains that there has been an increase in the amount of debts. The other optimistic feature has

been the inventory turnover ratio and this ratio has seen a rise from the last year and this

seriously is a positive symbol (Linnenluecke et al., 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.