Accounting and Finance for Managers

VerifiedAdded on 2022/12/29

|17

|3929

|348

AI Summary

This assignment provides a detailed review of three organizations in the food industry - Green Core Group PLC, Hilton Food Group PLC, and Premier Foods PLC. It discusses their strategies, financial and non-financial ratios, and analyzes their performance. The assignment focuses on Accounting and Finance for Managers.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounting

And

Finance for Managers

And

Finance for Managers

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION...........................................................................................................................3

SECTION A.....................................................................................................................................3

SECTION B...................................................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

SECTION A.....................................................................................................................................3

SECTION B...................................................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

This assignment signifies detailed review of three organisations named as Premier food

group, Green Core Group as well as the Hilton food group these are belong to similar economy

and they are determined as a competitive firm. The analysis of ratio and improvement of

direction, aim of this kind of undertaking are assessed from first portion in addition to this

second section provide discussion regarding multiple way related to lengthier financing (De

Villiers and Maroun, 2017).

SECTION A

1a.

Green Core Group PLC in enhancing food market, the organisation need to increase

competition level on two largest part; broadening consumer offering as well as influencing user

to purchase more. In addition to this, the strategy of organisation is to reinforce relevance to

consumer that help in increasing income level through a supply chain and enhance value under

different portfolio in addition with performing different business for client. The achievement of

company aim is based on different strength such as power of individual person, cooked meal at

home, organisation performance as well as honesty of Green Core. The implementation of this

plan includes broad knowledge of business or organisation that is known as Green Core that is

shared by organisation.

Hilton food group PLC for a longer period of time, the organisation focuses on

increasing expectation level to perform their business in an appropriate manner. The success and

growth of business is depending upon its client. Therefore, the main focus is to perform their

business in an appropriate manner. The organisation duty is to aid assistance that now

organisation corporate partner emphasis on achieving competitive edge over rivalries at

marketplace. The objective of organisation is to bring absolute coordination their need is to

increase success of business organisation in future period of time. Managerial personnel focus is

on conducting their core activity of performing business in an appropriate manner. The principle

of organisation signifies the method in which they believe that entity should perform their

business in an appropriate manner. Apart from this, the organisation focuses on performing

different activity of organisation in order to satisfy its client (Halioui, Neifar and Abdelaziz,

2016). The background related to corporate ethnic was determined as a different and also

This assignment signifies detailed review of three organisations named as Premier food

group, Green Core Group as well as the Hilton food group these are belong to similar economy

and they are determined as a competitive firm. The analysis of ratio and improvement of

direction, aim of this kind of undertaking are assessed from first portion in addition to this

second section provide discussion regarding multiple way related to lengthier financing (De

Villiers and Maroun, 2017).

SECTION A

1a.

Green Core Group PLC in enhancing food market, the organisation need to increase

competition level on two largest part; broadening consumer offering as well as influencing user

to purchase more. In addition to this, the strategy of organisation is to reinforce relevance to

consumer that help in increasing income level through a supply chain and enhance value under

different portfolio in addition with performing different business for client. The achievement of

company aim is based on different strength such as power of individual person, cooked meal at

home, organisation performance as well as honesty of Green Core. The implementation of this

plan includes broad knowledge of business or organisation that is known as Green Core that is

shared by organisation.

Hilton food group PLC for a longer period of time, the organisation focuses on

increasing expectation level to perform their business in an appropriate manner. The success and

growth of business is depending upon its client. Therefore, the main focus is to perform their

business in an appropriate manner. The organisation duty is to aid assistance that now

organisation corporate partner emphasis on achieving competitive edge over rivalries at

marketplace. The objective of organisation is to bring absolute coordination their need is to

increase success of business organisation in future period of time. Managerial personnel focus is

on conducting their core activity of performing business in an appropriate manner. The principle

of organisation signifies the method in which they believe that entity should perform their

business in an appropriate manner. Apart from this, the organisation focuses on performing

different activity of organisation in order to satisfy its client (Halioui, Neifar and Abdelaziz,

2016). The background related to corporate ethnic was determined as a different and also

significant. The staff or organisation depend upon basic principle and make appropriate strategy

in order to make important or appropriate relation.

Premier food PLC the purpose of business organisation is to provide delicious food to

its client and also provide nutrients to their client and they focus on providing food that is easily

cooked by them during the particular phase of time period. The organisation focuses on satisfy

its client by providing them product according to their need. Therefore, the client looks their

goods in around 94% of whole part of British household. The organisation focuses on promoting

its brand with excellent or superior prices and its main purpose is to display by nutrition agency

focuses on collaboration in an appropriate manner. The company's emphasized on building

superior operational site in order to satisfy its client. The actual principle of organisation offer

worker along with taking appropriate decisions and also they focus on serving or influencing

them in order to perform their job in an appropriate manner. From past three years, the

substantial improvement has achieved along with integrating corporate principle as well as

priorities within an organisation growing improvement in order to collaborate and interact with

subordinate in an appropriate manner (Kent and Zunker, 2017).

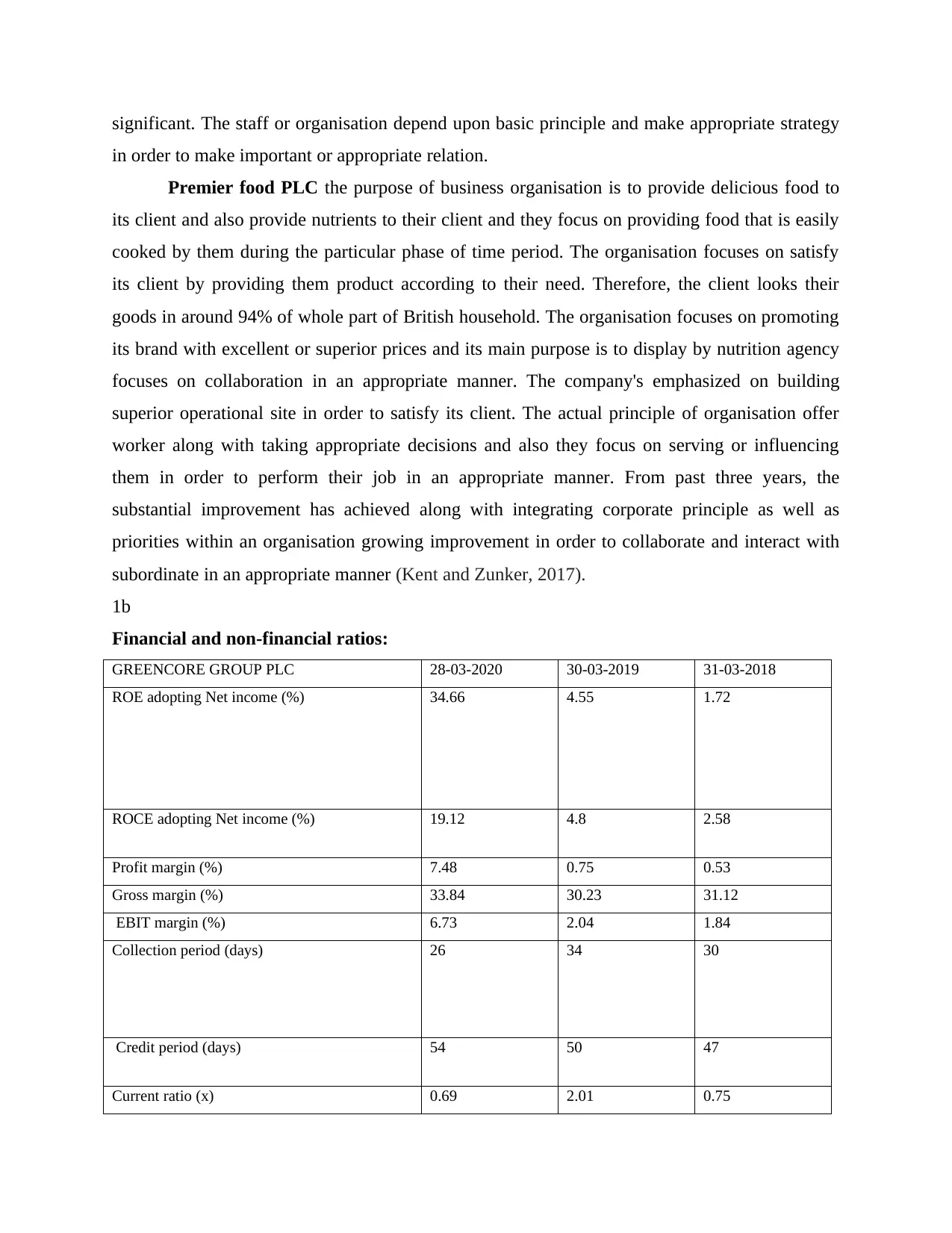

1b

Financial and non-financial ratios:

GREENCORE GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 34.66 4.55 1.72

ROCE adopting Net income (%) 19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period (days) 26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

in order to make important or appropriate relation.

Premier food PLC the purpose of business organisation is to provide delicious food to

its client and also provide nutrients to their client and they focus on providing food that is easily

cooked by them during the particular phase of time period. The organisation focuses on satisfy

its client by providing them product according to their need. Therefore, the client looks their

goods in around 94% of whole part of British household. The organisation focuses on promoting

its brand with excellent or superior prices and its main purpose is to display by nutrition agency

focuses on collaboration in an appropriate manner. The company's emphasized on building

superior operational site in order to satisfy its client. The actual principle of organisation offer

worker along with taking appropriate decisions and also they focus on serving or influencing

them in order to perform their job in an appropriate manner. From past three years, the

substantial improvement has achieved along with integrating corporate principle as well as

priorities within an organisation growing improvement in order to collaborate and interact with

subordinate in an appropriate manner (Kent and Zunker, 2017).

1b

Financial and non-financial ratios:

GREENCORE GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 34.66 4.55 1.72

ROCE adopting Net income (%) 19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period (days) 26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Gearing (%) 156.67 90.47 119.39

Net assets turnover (x) 2.06 1.81 1.49

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds as per employee (th) 26 64 58

Total assets as per employee (th) 100 173 167

HILTON FOOD GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 17.23 17.95 15.2

∟ ROCE adopting Net income (%) 9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

∟ Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period (days) 37 31 30

∟ Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

Net assets turnover (x) 2.06 1.81 1.49

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds as per employee (th) 26 64 58

Total assets as per employee (th) 100 173 167

HILTON FOOD GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 17.23 17.95 15.2

∟ ROCE adopting Net income (%) 9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

∟ Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period (days) 37 31 30

∟ Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

Net assets turnover (x) 3.58 5.56 6.53

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds as per employee (th) 38 38 44

Total assets as per employee (th) 181 121 116

PREMIER FOODS PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 2.77 -3.51 0.76

ROCE adopting Net income (%) 3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

∟ Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period (days) 27 29 24

∟ Credit period (days) 65 65 59

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds as per employee (th) 38 38 44

Total assets as per employee (th) 181 121 116

PREMIER FOODS PLC 28-03-2020 30-03-2019 31-03-2018

ROE adopting Net income (%) 2.77 -3.51 0.76

ROCE adopting Net income (%) 3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

∟ Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period (days) 27 29 24

∟ Credit period (days) 65 65 59

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds as per employee (th) 404 230 234

Total assets as per employee (th) 729 533 540

ROE using Net income (%)-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

-10

-5

0

5

10

15

20

25

30

35

40

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

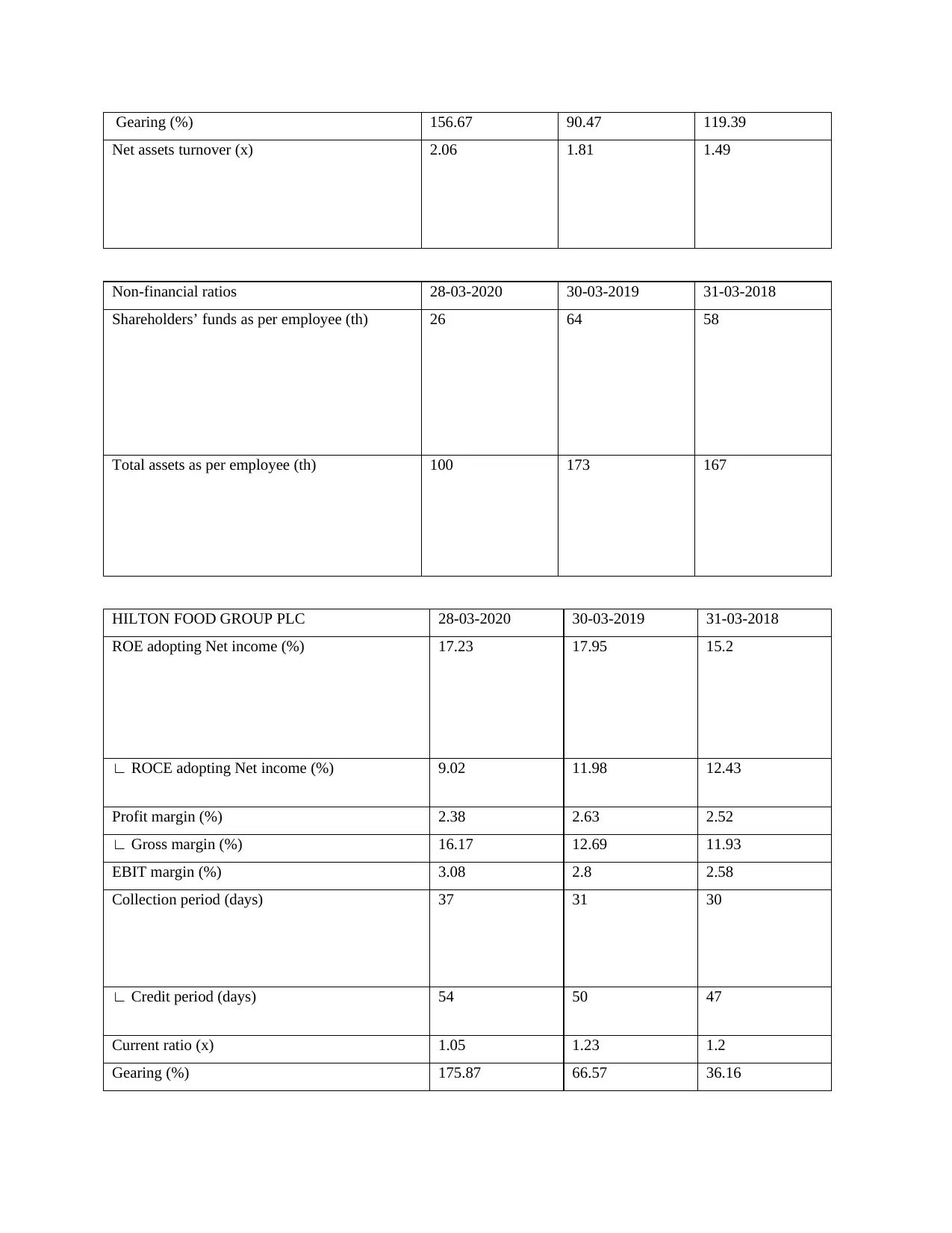

Analyses- As per above given table, it has been analysed that in year of 2019 and in 2020

the earning in context of Green Core has been increased. Therefore, it is assess that there is an

important improvement in level of productivity in above given organisation that provide returns.

In addition to this, Hilton organisation, the success of an organisation was determined as a stable

in year of 2019 as well as in 2020 that provide suggestions that they handle to accomplishing

equity yields. It has been measured that Premiere food organisation have poor level productivity

in comparison to other organisations which is given in the table above (Kian, Pourheydari and

Kamyab, 2018).

Shareholders’ funds as per employee (th) 404 230 234

Total assets as per employee (th) 729 533 540

ROE using Net income (%)-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

-10

-5

0

5

10

15

20

25

30

35

40

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses- As per above given table, it has been analysed that in year of 2019 and in 2020

the earning in context of Green Core has been increased. Therefore, it is assess that there is an

important improvement in level of productivity in above given organisation that provide returns.

In addition to this, Hilton organisation, the success of an organisation was determined as a stable

in year of 2019 as well as in 2020 that provide suggestions that they handle to accomplishing

equity yields. It has been measured that Premiere food organisation have poor level productivity

in comparison to other organisations which is given in the table above (Kian, Pourheydari and

Kamyab, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ROCE (%)

01/03/2018

01/05/2018

01/07/2018

01/09/2018

01/11/2018

01/01/2019

01/03/2019

01/05/2019

01/07/2019

01/09/2019

01/11/2019

01/01/2020

01/03/2020

0

5

10

15

20

25

2.58

4.8

19.12

12.43 11.98

9.02

2.94

1.16

3.37

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

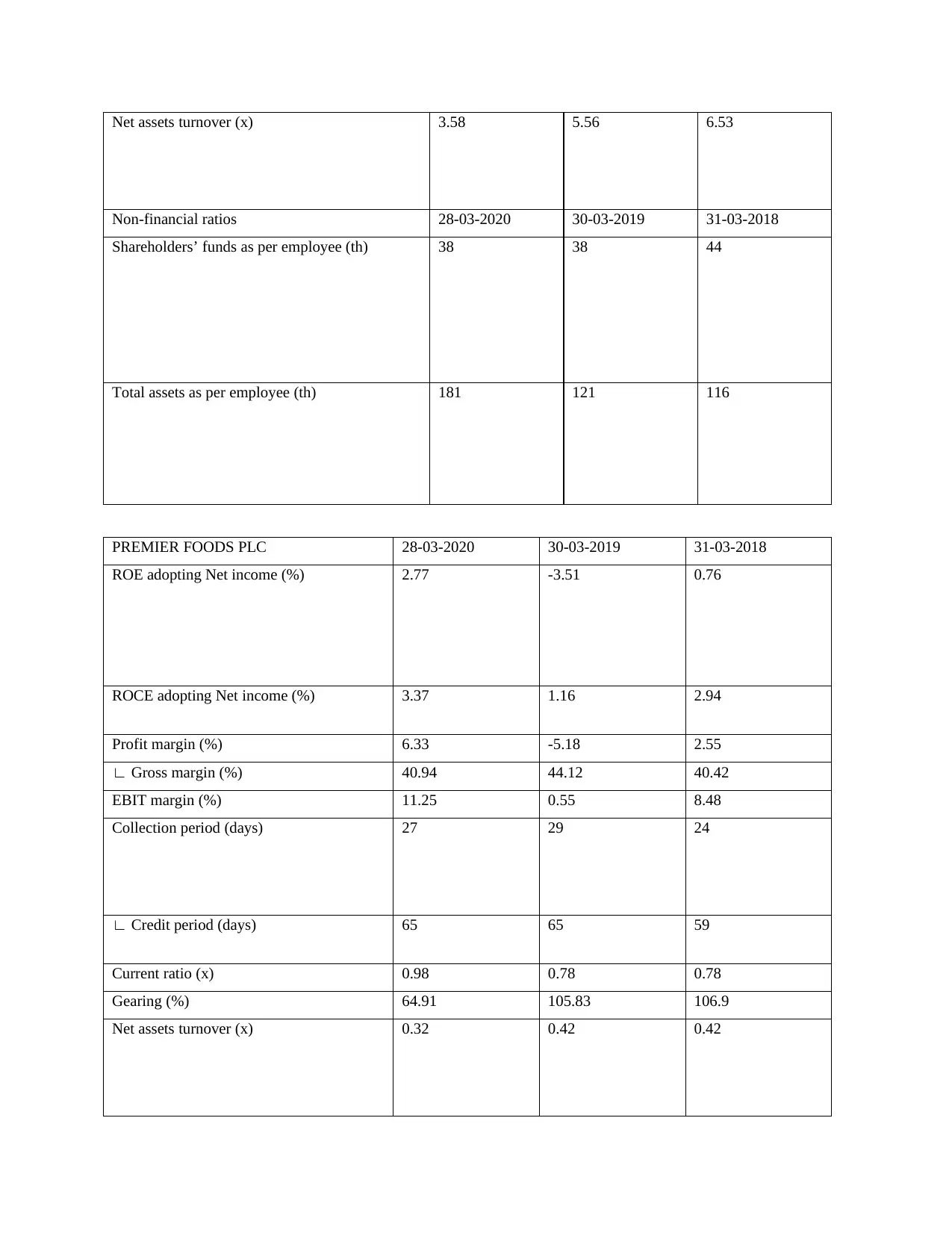

Analysis- According to given charts as well as figures, it has been analysed that in

comparison to other organisation Green Core provides superior profitability ratio that is around a

19.12 percent. In addition to this, there is only exception related to different ratio of Hilton food

organisation that is reduced by 2.96 % in year of 2020. Therefore, deficiency related to Premium

food organisation is determined as an ineffective in relation to other organisation that is above

mentioned and that enhances capital expenses.

Net profit margin:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

-6

-4

-2

0

2

4

6

8

10

0.53 0.75

7.48

2.52 2.63 2.382.55

-5.18

6.33

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

01/03/2018

01/05/2018

01/07/2018

01/09/2018

01/11/2018

01/01/2019

01/03/2019

01/05/2019

01/07/2019

01/09/2019

01/11/2019

01/01/2020

01/03/2020

0

5

10

15

20

25

2.58

4.8

19.12

12.43 11.98

9.02

2.94

1.16

3.37

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis- According to given charts as well as figures, it has been analysed that in

comparison to other organisation Green Core provides superior profitability ratio that is around a

19.12 percent. In addition to this, there is only exception related to different ratio of Hilton food

organisation that is reduced by 2.96 % in year of 2020. Therefore, deficiency related to Premium

food organisation is determined as an ineffective in relation to other organisation that is above

mentioned and that enhances capital expenses.

Net profit margin:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

-6

-4

-2

0

2

4

6

8

10

0.53 0.75

7.48

2.52 2.63 2.382.55

-5.18

6.33

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

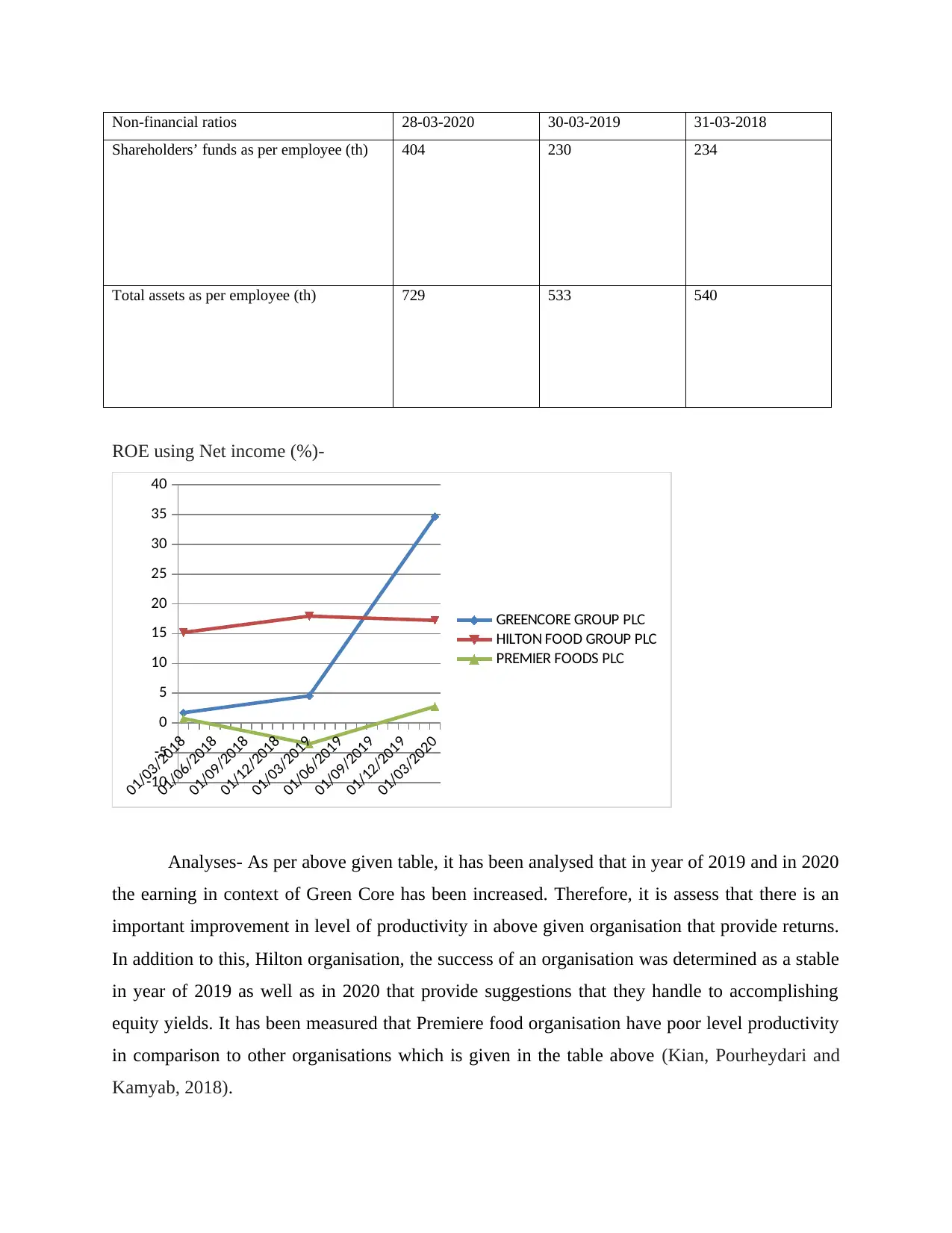

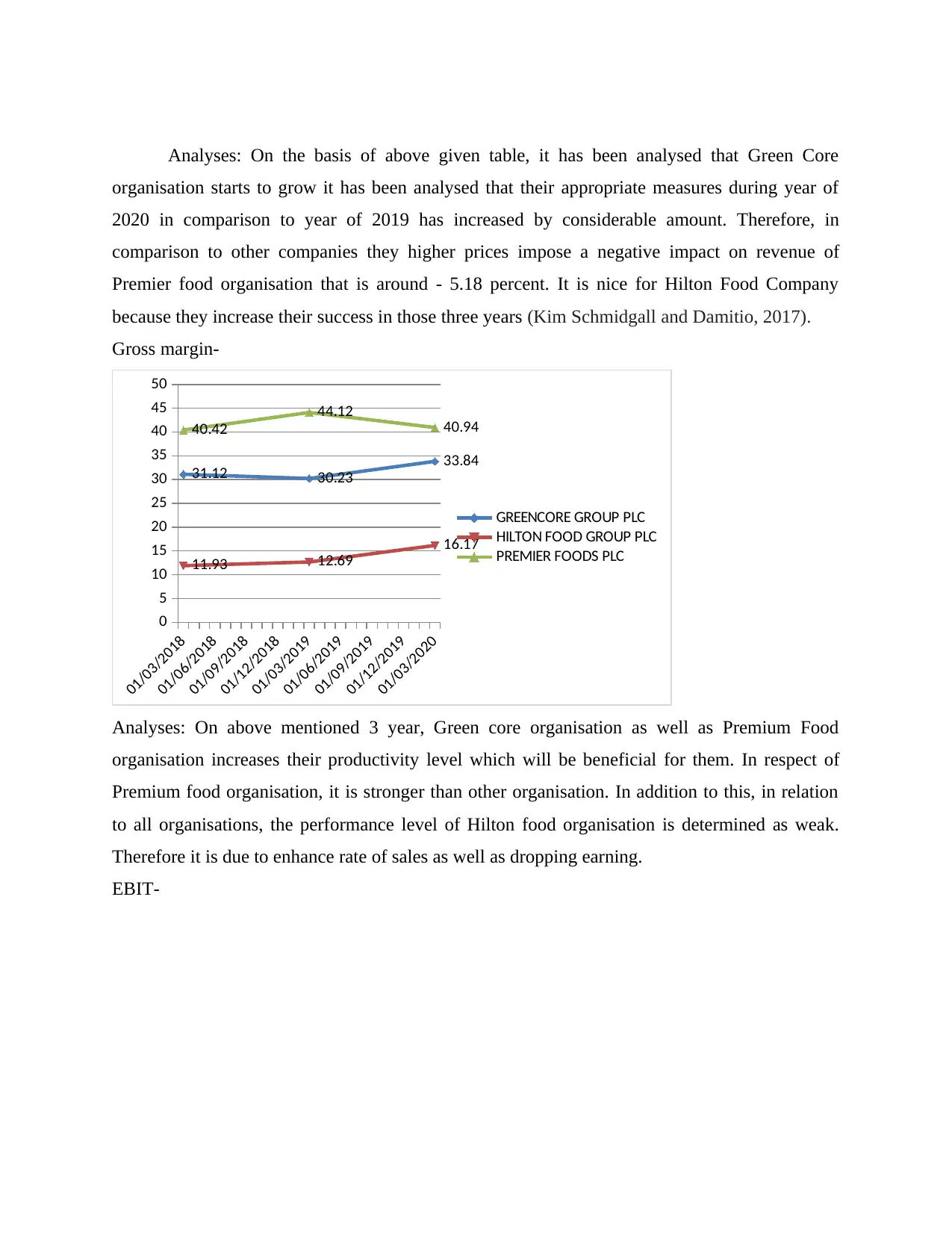

Analyses: On the basis of above given table, it has been analysed that Green Core

organisation starts to grow it has been analysed that their appropriate measures during year of

2020 in comparison to year of 2019 has increased by considerable amount. Therefore, in

comparison to other companies they higher prices impose a negative impact on revenue of

Premier food organisation that is around - 5.18 percent. It is nice for Hilton Food Company

because they increase their success in those three years (Kim Schmidgall and Damitio, 2017).

Gross margin-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

5

10

15

20

25

30

35

40

45

50

31.12 30.23

33.84

11.93 12.69

16.17

40.42

44.12 40.94

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

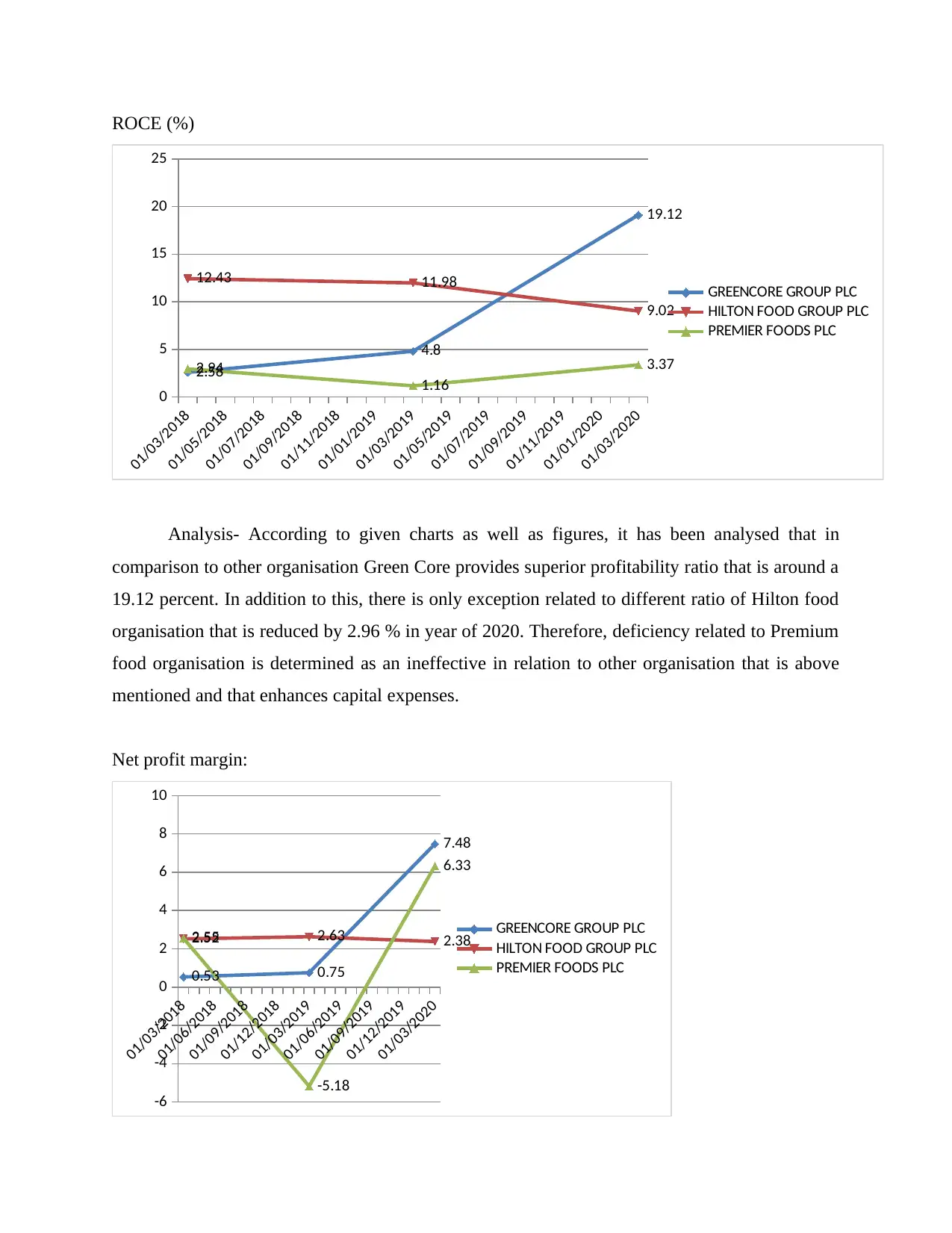

Analyses: On above mentioned 3 year, Green core organisation as well as Premium Food

organisation increases their productivity level which will be beneficial for them. In respect of

Premium food organisation, it is stronger than other organisation. In addition to this, in relation

to all organisations, the performance level of Hilton food organisation is determined as weak.

Therefore it is due to enhance rate of sales as well as dropping earning.

EBIT-

organisation starts to grow it has been analysed that their appropriate measures during year of

2020 in comparison to year of 2019 has increased by considerable amount. Therefore, in

comparison to other companies they higher prices impose a negative impact on revenue of

Premier food organisation that is around - 5.18 percent. It is nice for Hilton Food Company

because they increase their success in those three years (Kim Schmidgall and Damitio, 2017).

Gross margin-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

5

10

15

20

25

30

35

40

45

50

31.12 30.23

33.84

11.93 12.69

16.17

40.42

44.12 40.94

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses: On above mentioned 3 year, Green core organisation as well as Premium Food

organisation increases their productivity level which will be beneficial for them. In respect of

Premium food organisation, it is stronger than other organisation. In addition to this, in relation

to all organisations, the performance level of Hilton food organisation is determined as weak.

Therefore it is due to enhance rate of sales as well as dropping earning.

EBIT-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

2

4

6

8

10

12

1.84 2.04

6.73

2.58 2.8 3.08

8.48

0.55

11.25

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

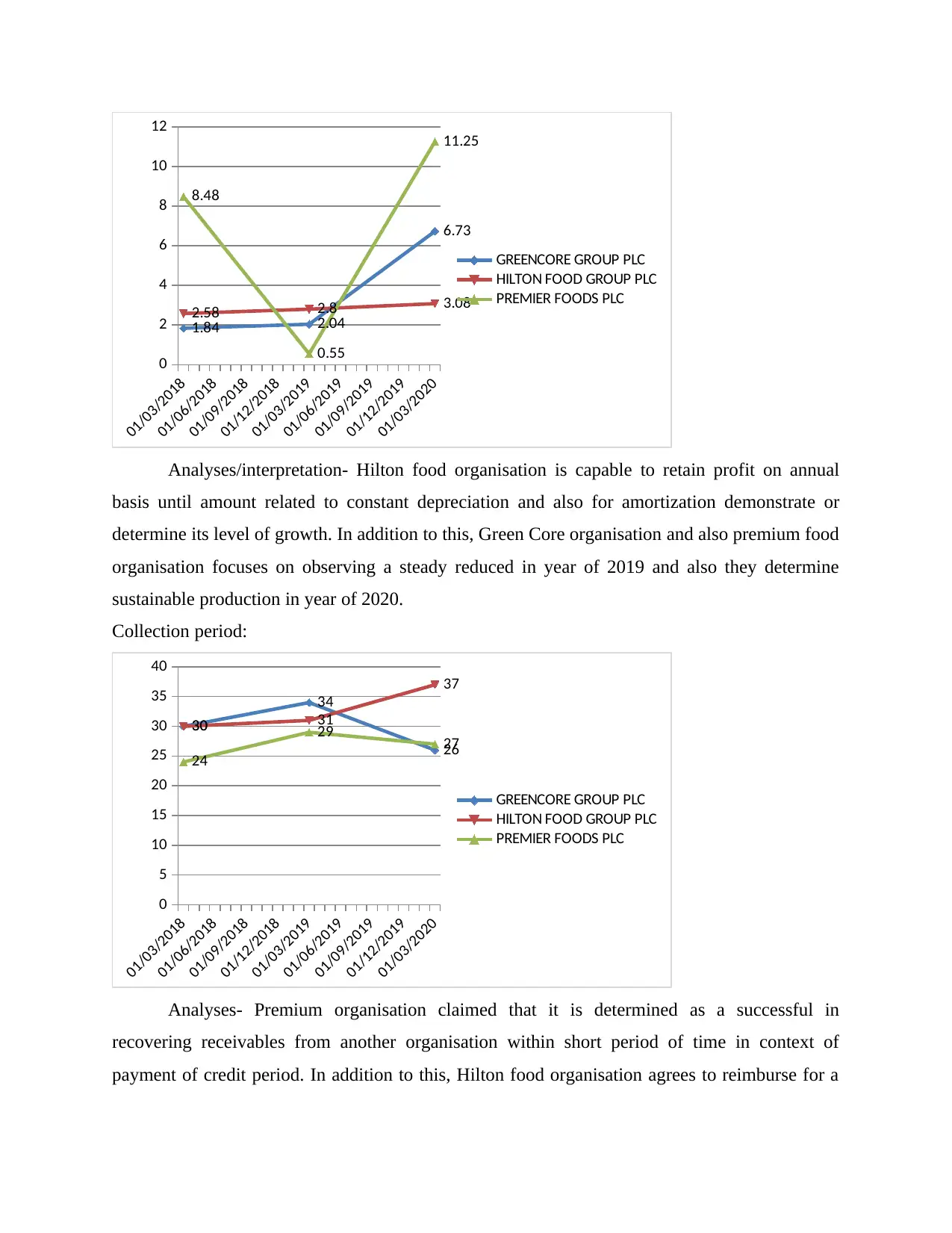

Analyses/interpretation- Hilton food organisation is capable to retain profit on annual

basis until amount related to constant depreciation and also for amortization demonstrate or

determine its level of growth. In addition to this, Green Core organisation and also premium food

organisation focuses on observing a steady reduced in year of 2019 and also they determine

sustainable production in year of 2020.

Collection period:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

5

10

15

20

25

30

35

40

30

34

26

30 31

37

24

29 27

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses- Premium organisation claimed that it is determined as a successful in

recovering receivables from another organisation within short period of time in context of

payment of credit period. In addition to this, Hilton food organisation agrees to reimburse for a

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

2

4

6

8

10

12

1.84 2.04

6.73

2.58 2.8 3.08

8.48

0.55

11.25

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses/interpretation- Hilton food organisation is capable to retain profit on annual

basis until amount related to constant depreciation and also for amortization demonstrate or

determine its level of growth. In addition to this, Green Core organisation and also premium food

organisation focuses on observing a steady reduced in year of 2019 and also they determine

sustainable production in year of 2020.

Collection period:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

5

10

15

20

25

30

35

40

30

34

26

30 31

37

24

29 27

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses- Premium organisation claimed that it is determined as a successful in

recovering receivables from another organisation within short period of time in context of

payment of credit period. In addition to this, Hilton food organisation agrees to reimburse for a

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

longer period of time. In addition to this Green food organisation is capable to reduce time

related to turn around of trade in short period of time in 2020 in context of 2019.

Credit period:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

10

20

30

40

50

60

70

47 50 54

59

65 65

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

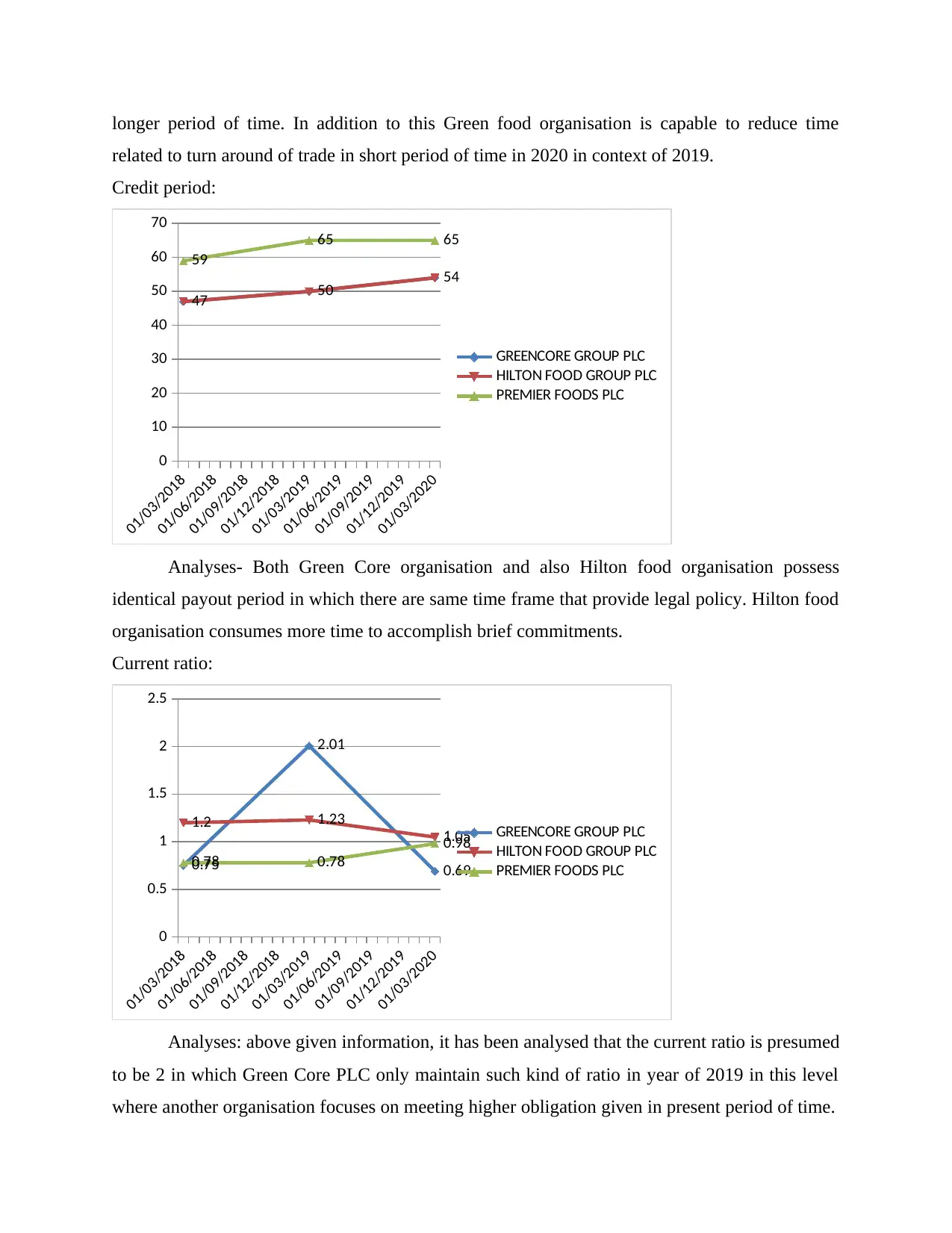

Analyses- Both Green Core organisation and also Hilton food organisation possess

identical payout period in which there are same time frame that provide legal policy. Hilton food

organisation consumes more time to accomplish brief commitments.

Current ratio:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

0.5

1

1.5

2

2.5

0.75

2.01

0.69

1.2 1.23

1.05

0.78 0.78

0.98 GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses: above given information, it has been analysed that the current ratio is presumed

to be 2 in which Green Core PLC only maintain such kind of ratio in year of 2019 in this level

where another organisation focuses on meeting higher obligation given in present period of time.

related to turn around of trade in short period of time in 2020 in context of 2019.

Credit period:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

10

20

30

40

50

60

70

47 50 54

59

65 65

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses- Both Green Core organisation and also Hilton food organisation possess

identical payout period in which there are same time frame that provide legal policy. Hilton food

organisation consumes more time to accomplish brief commitments.

Current ratio:

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

0.5

1

1.5

2

2.5

0.75

2.01

0.69

1.2 1.23

1.05

0.78 0.78

0.98 GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analyses: above given information, it has been analysed that the current ratio is presumed

to be 2 in which Green Core PLC only maintain such kind of ratio in year of 2019 in this level

where another organisation focuses on meeting higher obligation given in present period of time.

Net assets turnover ratio

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

1

2

3

4

5

6

7

1.49 1.81 2.06

6.53

5.56

3.58

0.42 0.42 0.32

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

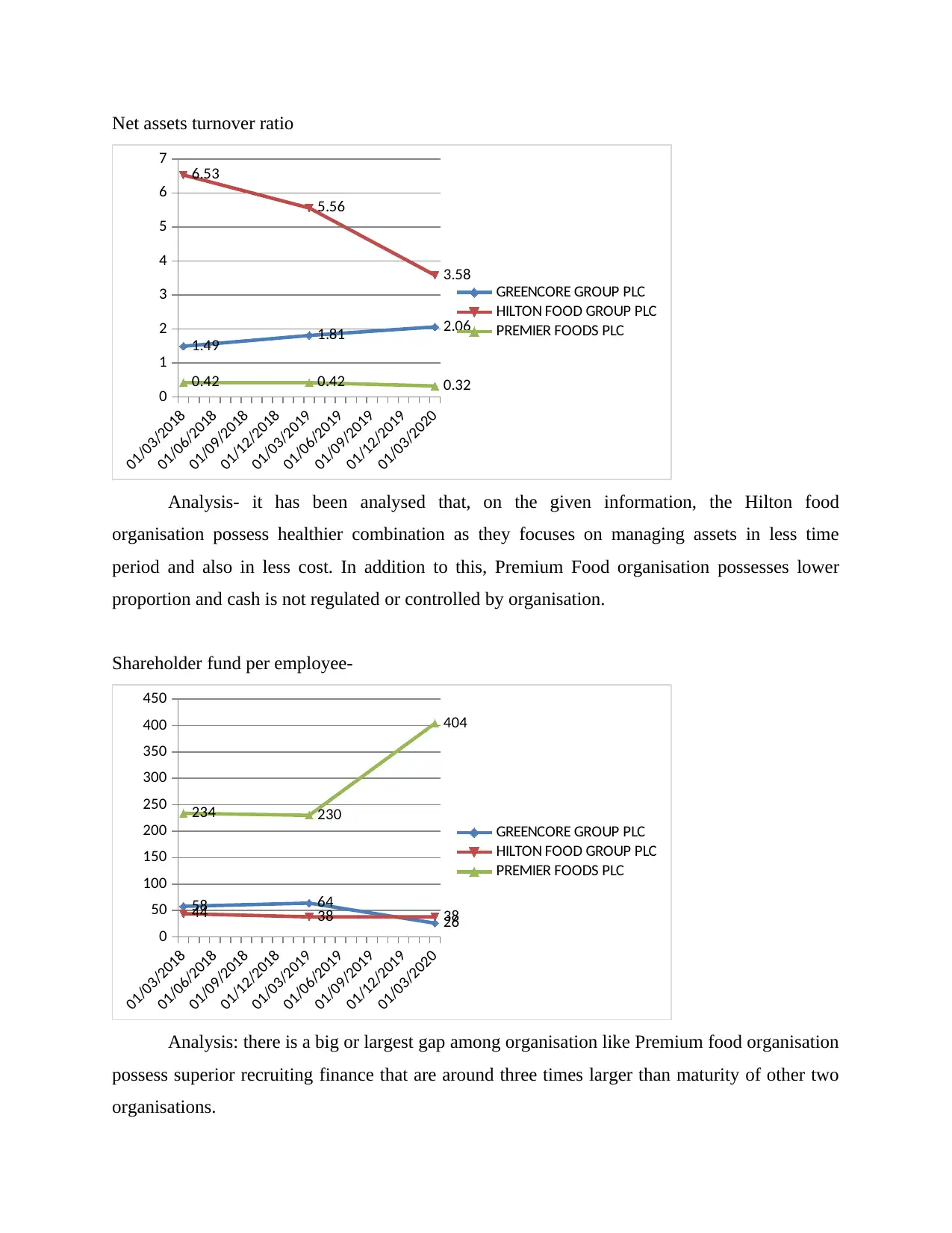

Analysis- it has been analysed that, on the given information, the Hilton food

organisation possess healthier combination as they focuses on managing assets in less time

period and also in less cost. In addition to this, Premium Food organisation possesses lower

proportion and cash is not regulated or controlled by organisation.

Shareholder fund per employee-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

50

100

150

200

250

300

350

400

450

58 64

26

44 38 38

234 230

404

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis: there is a big or largest gap among organisation like Premium food organisation

possess superior recruiting finance that are around three times larger than maturity of other two

organisations.

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

1

2

3

4

5

6

7

1.49 1.81 2.06

6.53

5.56

3.58

0.42 0.42 0.32

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis- it has been analysed that, on the given information, the Hilton food

organisation possess healthier combination as they focuses on managing assets in less time

period and also in less cost. In addition to this, Premium Food organisation possesses lower

proportion and cash is not regulated or controlled by organisation.

Shareholder fund per employee-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

50

100

150

200

250

300

350

400

450

58 64

26

44 38 38

234 230

404

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis: there is a big or largest gap among organisation like Premium food organisation

possess superior recruiting finance that are around three times larger than maturity of other two

organisations.

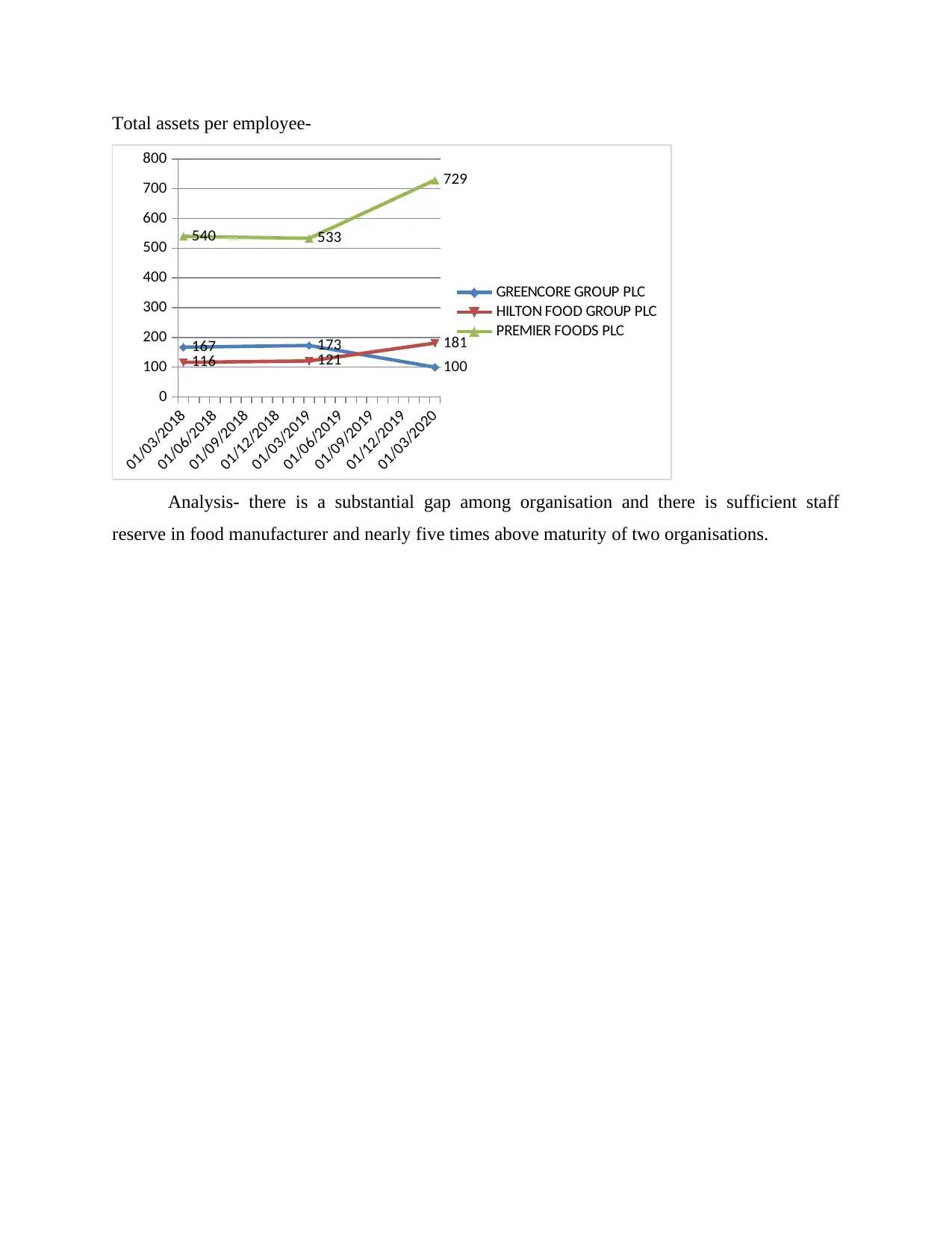

Total assets per employee-

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

100

200

300

400

500

600

700

800

167 173

100116 121

181

540 533

729

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis- there is a substantial gap among organisation and there is sufficient staff

reserve in food manufacturer and nearly five times above maturity of two organisations.

01/03/2018

01/06/2018

01/09/2018

01/12/2018

01/03/2019

01/06/2019

01/09/2019

01/12/2019

01/03/2020

0

100

200

300

400

500

600

700

800

167 173

100116 121

181

540 533

729

GREENCORE GROUP PLC

HILTON FOOD GROUP PLC

PREMIER FOODS PLC

Analysis- there is a substantial gap among organisation and there is sufficient staff

reserve in food manufacturer and nearly five times above maturity of two organisations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 c

It has been assess that on basis of above given financial review related to three organisation

that Green Core seller have an understanding regarding best rank in context of performance. As

they focus on maintaining or produces more level of income and dividend during particular

phase of time period. The sector focuses on increasing their investment level during period of

time.

Investment enticement is determined as a situation where consumer has a potential to take

advantage of something that focuses on gain profit in future period of time. The secret related to

generating wealth in order to understand advantage or benefit of and how to manage money.

Therefore, Green Core Company, the ecosystem of green core provide superior opportunities

related to investment for user as organisation focuses on menu producing larger yield in

upcoming year (McLaney and Atrill, 2016).

SECTION B

2a

In internal data signifies their finances are provided through ecosystem by availability of

finance. In addition to this, there is lending as well as borrowing or capital that is initially

considered by organisation which is opposed or different in term of financing like loan which is

issued by financial organisation as different atmosphere. The information related to finance

focuses on generating income investment and deliberately managing cash flow. The organisation

focuses on making effective utilisation of resources during the period of time.

Retaining earning deferred income which is listed on financial statement is determined

as an inherent source of finance for organisation. On basis of above company, there is must final

income. Retained earnings are considered as an income that keeps after distributed all expenses

that is given to shareholder and any other miscellaneous expenses. Interest income in addition

with lengthier rental as well as obligation as it is determined as a lengthier source related to

corporate financing when there is not any kind of mandatory maturity arises. Earning such as

loan finance is not characterized by using fix obligation according to repayment method.

Equity financing for getting more and more finance, equity investment focuses on

selling or marketing sample weight. The shareholder who focuses on purchasing stock will also

emphasize on purchasing voting rights related to company. Therefore, marketing of fair value

like ordinary share equity options must be connected to equity capital of organisation. They

It has been assess that on basis of above given financial review related to three organisation

that Green Core seller have an understanding regarding best rank in context of performance. As

they focus on maintaining or produces more level of income and dividend during particular

phase of time period. The sector focuses on increasing their investment level during period of

time.

Investment enticement is determined as a situation where consumer has a potential to take

advantage of something that focuses on gain profit in future period of time. The secret related to

generating wealth in order to understand advantage or benefit of and how to manage money.

Therefore, Green Core Company, the ecosystem of green core provide superior opportunities

related to investment for user as organisation focuses on menu producing larger yield in

upcoming year (McLaney and Atrill, 2016).

SECTION B

2a

In internal data signifies their finances are provided through ecosystem by availability of

finance. In addition to this, there is lending as well as borrowing or capital that is initially

considered by organisation which is opposed or different in term of financing like loan which is

issued by financial organisation as different atmosphere. The information related to finance

focuses on generating income investment and deliberately managing cash flow. The organisation

focuses on making effective utilisation of resources during the period of time.

Retaining earning deferred income which is listed on financial statement is determined

as an inherent source of finance for organisation. On basis of above company, there is must final

income. Retained earnings are considered as an income that keeps after distributed all expenses

that is given to shareholder and any other miscellaneous expenses. Interest income in addition

with lengthier rental as well as obligation as it is determined as a lengthier source related to

corporate financing when there is not any kind of mandatory maturity arises. Earning such as

loan finance is not characterized by using fix obligation according to repayment method.

Equity financing for getting more and more finance, equity investment focuses on

selling or marketing sample weight. The shareholder who focuses on purchasing stock will also

emphasize on purchasing voting rights related to company. Therefore, marketing of fair value

like ordinary share equity options must be connected to equity capital of organisation. They

confront any requirement for additional finance for expanding that focuses on acquiring two

main directions debt as well as equity. Equity finance focuses on marketing and providing share

of organisation by taking cash. The percentage of organisation to be provided in equity finance

that is depend upon investor who increase their investment in organisation at end of finance and

what kind of expenditure or expenses they are valued and they focus on spending around

$600,000 in begin of organisation. For example: will ultimately own overall remaining stock.

Debt financing debt financing arises as a organisation focuses on raising finance by

using marketing or sale security to individual person and the organisation focuses on investing,

capital spending. The individual person or organisation take a guarantee in which they provided

loan amount and their principal amount or amount of interest is returned. They will need 3

months to secure their finances when organisation needs finance by funding, borrowing capital

as well as other combination of two. Equity signifies the portion related to shares of organisation

and they provide claims on profit which is owned by investor so that they repaid that amount in

full. Equity investor focuses on earning compensation if organisation was bust. Therefore, the

other way is debt finance; the organisation focuses on increasing their money by using that is

debt issuance (MohammadRezaei and Mohd‐Saleh, 2018).

Term loan a term loan signifies kind of lender along with pre-decided maturity period

for specific amounts or have a concessionary level of interest. For prevailing small organisation

along with report related to solid finance rate of loan is suitable. In assistance of this, reduce in

whole cost related to mortgage or loan their focus is on conducting different activity in an

appropriate manner in financing organisation revolving loan is among 25 years in relation to

machinery, property improvement and many more. Sometime small organisation adopt money

from revolving loan to purchase capital assets for manufacturing option like machinery as well as

new home and many more. Therefore, any organisation borrows money required by using

monthly instalment to perform their work. Thus, the bank focuses on improving program related

to term loan to provide support to organisation in an appropriate manner.

2b

Retained earnings are a popular method related to lengthier funding in all selected

organisation. Therefore, it is possible to adopt remaining revenue of organisation and although it

have several consequences for right of prevailing stakeholder during particular phase of time

main directions debt as well as equity. Equity finance focuses on marketing and providing share

of organisation by taking cash. The percentage of organisation to be provided in equity finance

that is depend upon investor who increase their investment in organisation at end of finance and

what kind of expenditure or expenses they are valued and they focus on spending around

$600,000 in begin of organisation. For example: will ultimately own overall remaining stock.

Debt financing debt financing arises as a organisation focuses on raising finance by

using marketing or sale security to individual person and the organisation focuses on investing,

capital spending. The individual person or organisation take a guarantee in which they provided

loan amount and their principal amount or amount of interest is returned. They will need 3

months to secure their finances when organisation needs finance by funding, borrowing capital

as well as other combination of two. Equity signifies the portion related to shares of organisation

and they provide claims on profit which is owned by investor so that they repaid that amount in

full. Equity investor focuses on earning compensation if organisation was bust. Therefore, the

other way is debt finance; the organisation focuses on increasing their money by using that is

debt issuance (MohammadRezaei and Mohd‐Saleh, 2018).

Term loan a term loan signifies kind of lender along with pre-decided maturity period

for specific amounts or have a concessionary level of interest. For prevailing small organisation

along with report related to solid finance rate of loan is suitable. In assistance of this, reduce in

whole cost related to mortgage or loan their focus is on conducting different activity in an

appropriate manner in financing organisation revolving loan is among 25 years in relation to

machinery, property improvement and many more. Sometime small organisation adopt money

from revolving loan to purchase capital assets for manufacturing option like machinery as well as

new home and many more. Therefore, any organisation borrows money required by using

monthly instalment to perform their work. Thus, the bank focuses on improving program related

to term loan to provide support to organisation in an appropriate manner.

2b

Retained earnings are a popular method related to lengthier funding in all selected

organisation. Therefore, it is possible to adopt remaining revenue of organisation and although it

have several consequences for right of prevailing stakeholder during particular phase of time

period. The comprehensive discussion in context of how this kind of origin will influence

interest of parties in reference of Green Core organisation.

Stakeholder or shareholder the adoption of retained earnings would impose direct impact

on equity and financial institution trust as retaining earning are intended to dispersed between

existing manager.

Provider and lender the allocation related to cash flow would impose direct effect on

image of organisation as the focus is on shortcoming in present realistic condition.

Worker the residual advantages usage imposes positive effect on fund of organisation that

is provided to each subordinate. Each individual or subordinate focuses on decreasing wealth that

impose direct effect on performance level of work force related to success of finance which

results in rise in size of subordinate which is unemployed (Paiva, Lourenço and Branco, 2016).

CONCLUSION

On given report, it is assess that the analysis of ratio and improvement of direction, aim

of this kind of undertaking are assessed from first portion in addition to this second section

provide discussion regarding multiple way related to lengthier financing. This assignment

signifies detailed review of three organisations that are belonging to similar economy and they

are determined as a competitive firm.

interest of parties in reference of Green Core organisation.

Stakeholder or shareholder the adoption of retained earnings would impose direct impact

on equity and financial institution trust as retaining earning are intended to dispersed between

existing manager.

Provider and lender the allocation related to cash flow would impose direct effect on

image of organisation as the focus is on shortcoming in present realistic condition.

Worker the residual advantages usage imposes positive effect on fund of organisation that

is provided to each subordinate. Each individual or subordinate focuses on decreasing wealth that

impose direct effect on performance level of work force related to success of finance which

results in rise in size of subordinate which is unemployed (Paiva, Lourenço and Branco, 2016).

CONCLUSION

On given report, it is assess that the analysis of ratio and improvement of direction, aim

of this kind of undertaking are assessed from first portion in addition to this second section

provide discussion regarding multiple way related to lengthier financing. This assignment

signifies detailed review of three organisations that are belonging to similar economy and they

are determined as a competitive firm.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

De Villiers, C. and Maroun, W. eds., 2017. Sustainability accounting and integrated reporting.

Routledge.

Halioui, K., Neifar, S. and Abdelaziz, F.B., 2016. Corporate governance, CEO compensation and

tax aggressiveness. Review of Accounting and Finance.

Kent, P. and Zunker, T., 2017. A stakeholder analysis of employee disclosures in annual

reports. Accounting & Finance, 57(2), pp.533-563.

Kian, A., Pourheydari, O. and Kamyab, Y., 2018. Investigating of Managers Behavior in Using

Mental Accounting in Income Statement Reporting. Empirical Studies in Financial

Accounting, 15(58), pp.1-26.

Kim, M., Schmidgall, R.S. and Damitio, J.W., 2017. Key managerial accounting skills for

lodging industry managers: The third phase of a repeated cross-sectional study. International

Journal of Hospitality & Tourism Administration, 18(1), pp.23-40.

McLaney, E. and Atrill, P., 2016. Accounting and finance: an introduction. Prentice Hill.

MohammadRezaei, F. and Mohd‐Saleh, N., 2018. Audit report lag: the role of auditor type and

increased competition in the audit market. Accounting & Finance, 58(3), pp.885-920.

Paiva, I.S., Lourenço, I.C. and Branco, M.C., 2016. Earnings management in family firms:

current state of knowledge and opportunities for future research. Review of Accounting and

Finance.

Books and journals

De Villiers, C. and Maroun, W. eds., 2017. Sustainability accounting and integrated reporting.

Routledge.

Halioui, K., Neifar, S. and Abdelaziz, F.B., 2016. Corporate governance, CEO compensation and

tax aggressiveness. Review of Accounting and Finance.

Kent, P. and Zunker, T., 2017. A stakeholder analysis of employee disclosures in annual

reports. Accounting & Finance, 57(2), pp.533-563.

Kian, A., Pourheydari, O. and Kamyab, Y., 2018. Investigating of Managers Behavior in Using

Mental Accounting in Income Statement Reporting. Empirical Studies in Financial

Accounting, 15(58), pp.1-26.

Kim, M., Schmidgall, R.S. and Damitio, J.W., 2017. Key managerial accounting skills for

lodging industry managers: The third phase of a repeated cross-sectional study. International

Journal of Hospitality & Tourism Administration, 18(1), pp.23-40.

McLaney, E. and Atrill, P., 2016. Accounting and finance: an introduction. Prentice Hill.

MohammadRezaei, F. and Mohd‐Saleh, N., 2018. Audit report lag: the role of auditor type and

increased competition in the audit market. Accounting & Finance, 58(3), pp.885-920.

Paiva, I.S., Lourenço, I.C. and Branco, M.C., 2016. Earnings management in family firms:

current state of knowledge and opportunities for future research. Review of Accounting and

Finance.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.