Applying Finance Models: A Market Valuation Analysis of TUI Group

VerifiedAdded on 2023/04/11

|22

|1854

|56

Report

AI Summary

This report provides a comprehensive analysis of TUI Group's market valuation through the application of various financial models, including the Miller and Modigliani capital structure theorem, Pecking Order Theory, Agency Theory, Shareholder Value Analysis (SVA), and Discounted Cash Flow (DCF) model. It examines TUI's capital structure, market valuation, and shareholder value, considering factors such as debt, equity, weighted average cost of capital (WACC), sales growth, and operating profit margin. The report also includes a sensitivity analysis to assess the impact of changes in sales growth on shareholder value, ultimately concluding with a recommendation for institutional investors based on the predicted future performance and potential returns of TUI Group. Desklib provides access to this and other solved assignments for students.

Accounting and finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Application of Finance Models on TUI

Preposition: 1. In the absence of taxation

• In this preposition, it has been believed that, change in leverage and mix of

debt and equity will not have any effect on firm’s value and cost of capital,

thus, capital structure is irrelevant.

• As per the theory, TUI can gathered funds either from the use of debt or equity

capital each has different benefits and shortcoming as well and each of the

investors in the market have a same access to buy or sell their holdings.

Miller and Modigliani(1958) Capital structure theorem

Preposition: 1. In the absence of taxation

• In this preposition, it has been believed that, change in leverage and mix of

debt and equity will not have any effect on firm’s value and cost of capital,

thus, capital structure is irrelevant.

• As per the theory, TUI can gathered funds either from the use of debt or equity

capital each has different benefits and shortcoming as well and each of the

investors in the market have a same access to buy or sell their holdings.

Miller and Modigliani(1958) Capital structure theorem

Preposition: 2. With the presence of taxation (Trade-

off theory)

• This theory is termed as trade-off theory, in which, it has been discovered

that debt is a cheaper financial source relatively to the cost of equity. The

reason behind this is interest paid on borrowed money is tax deductible,

therefore, it provides tax benefits to the TUI Group.

• However, such kind of benefits will not be available on equity financing as

dividend on equity capital will not give tax advantage to the company.

• Thus, on the basis of this theory, TUI Group must make use of debt capital

to a threshold point in their capital structure so as to reduce the overall cost

of capital and rise firm’s value.

• However, beyond a threshold point, if debt are increase then it gives rises

to the equity capital risk, which in turn, result in higher cost.

• Therefore, in accordance with the theory, TUI Group must makes use of

debt capital to a specified point in order to reduce WACC and maximize

shareholders value.

off theory)

• This theory is termed as trade-off theory, in which, it has been discovered

that debt is a cheaper financial source relatively to the cost of equity. The

reason behind this is interest paid on borrowed money is tax deductible,

therefore, it provides tax benefits to the TUI Group.

• However, such kind of benefits will not be available on equity financing as

dividend on equity capital will not give tax advantage to the company.

• Thus, on the basis of this theory, TUI Group must make use of debt capital

to a threshold point in their capital structure so as to reduce the overall cost

of capital and rise firm’s value.

• However, beyond a threshold point, if debt are increase then it gives rises

to the equity capital risk, which in turn, result in higher cost.

• Therefore, in accordance with the theory, TUI Group must makes use of

debt capital to a specified point in order to reduce WACC and maximize

shareholders value.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Pecking Order Theory

It is one of the most influential theory of corporate leverage that

demonstrates that availability of asymmetric information to the

managers affects the selection of internal and external financing.

It believes that retained earnings is the most effective source of

finance because it is available at nil financial cost and have no

adverse impact. While, if they need to raise money through

external finance, then debt gains preference over equity because

share capital is more riskier and costlier because of higher

premium.

The reason behind this is debt interest is fixed and also give tax

benefits, whereas, external investors need higher return in return

for the risk undertaken.

It is one of the most influential theory of corporate leverage that

demonstrates that availability of asymmetric information to the

managers affects the selection of internal and external financing.

It believes that retained earnings is the most effective source of

finance because it is available at nil financial cost and have no

adverse impact. While, if they need to raise money through

external finance, then debt gains preference over equity because

share capital is more riskier and costlier because of higher

premium.

The reason behind this is debt interest is fixed and also give tax

benefits, whereas, external investors need higher return in return

for the risk undertaken.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Agency Theory

This theory says that agency costs arises when managers of the firm

owns a proportion of total share capital. As a result, they can work

in the interest of stakeholders.

This theory proposes that indebtedness can be considered as a way

to resolve conflicts between both the managers and shareholders.

The theory indicates that indebtedness gives rises to three type of

costs that are control and justification, higher risk and bankruptcy

as well.

Thus optimal capital structure gives huge assistance to the firm to

minimize agency cost and to appeal for external funds to meet out

long-term capital requirement.

This theory says that agency costs arises when managers of the firm

owns a proportion of total share capital. As a result, they can work

in the interest of stakeholders.

This theory proposes that indebtedness can be considered as a way

to resolve conflicts between both the managers and shareholders.

The theory indicates that indebtedness gives rises to three type of

costs that are control and justification, higher risk and bankruptcy

as well.

Thus optimal capital structure gives huge assistance to the firm to

minimize agency cost and to appeal for external funds to meet out

long-term capital requirement.

TUI’s capital structure

2015 (GBP

million)

2016 (GBP

million)

Long-term

debt 1218.33 1300.62

Shareholder

s equity 1781.33 2810.08

Debt to

equity 0.68 0.46

2015 (GBP

million)

2016 (GBP

million)

0

500

1000

1500

2000

2500

3000

Debt and equity

(In GB P million)

2015 (GBP

million)

2016 (GBP

million)

Long-term

debt 1218.33 1300.62

Shareholder

s equity 1781.33 2810.08

Debt to

equity 0.68 0.46

2015 (GBP

million)

2016 (GBP

million)

0

500

1000

1500

2000

2500

3000

Debt and equity

(In GB P million)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation

• In 2016, TUI group enhanced its debt from 1218.33 to 1300.62 GBP

million by 6.75%. However, excessive additional capital

requirement has been fulfilled by issuing more share capital.

• As in 2016, it has been increased from 1781.33 to 2810.08 by

57.75% resulted in declined gearing or leverage from 0.68:1 to

0.46:1 indicates lower financial risk. But still, it is a little bit far

away from the ideal ratio of debt to equity of 0.5:1.

• Thus, on the basis of this, it can be suggested to the firm to raise

additional money through taking external borrowings via debt

capital to get more tax benefits and improved solvency.

• Moreover, it will also drive benefits of trading on equity (TOE),

under this TUI group can use debt to raise earnings for the equity

shareholders and satisfy them.

• In 2016, TUI group enhanced its debt from 1218.33 to 1300.62 GBP

million by 6.75%. However, excessive additional capital

requirement has been fulfilled by issuing more share capital.

• As in 2016, it has been increased from 1781.33 to 2810.08 by

57.75% resulted in declined gearing or leverage from 0.68:1 to

0.46:1 indicates lower financial risk. But still, it is a little bit far

away from the ideal ratio of debt to equity of 0.5:1.

• Thus, on the basis of this, it can be suggested to the firm to raise

additional money through taking external borrowings via debt

capital to get more tax benefits and improved solvency.

• Moreover, it will also drive benefits of trading on equity (TOE),

under this TUI group can use debt to raise earnings for the equity

shareholders and satisfy them.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Application of Finance Models on TUI

TUI’s market valuation

• Shareholder value analysis, shortened to SVA refers to the

process of examining and forecasting the affect of business

decisions over net present value (NPV) to the shareholders.

• In corporate world, this analysis is often used by the firms to

measure their ability to earn excessive over the cost of capital

(WACC).

• Thus, it provides a framework to the firms for analyzing options

so as to drive improvement in the shareholders value.

TUI’s market valuation

• Shareholder value analysis, shortened to SVA refers to the

process of examining and forecasting the affect of business

decisions over net present value (NPV) to the shareholders.

• In corporate world, this analysis is often used by the firms to

measure their ability to earn excessive over the cost of capital

(WACC).

• Thus, it provides a framework to the firms for analyzing options

so as to drive improvement in the shareholders value.

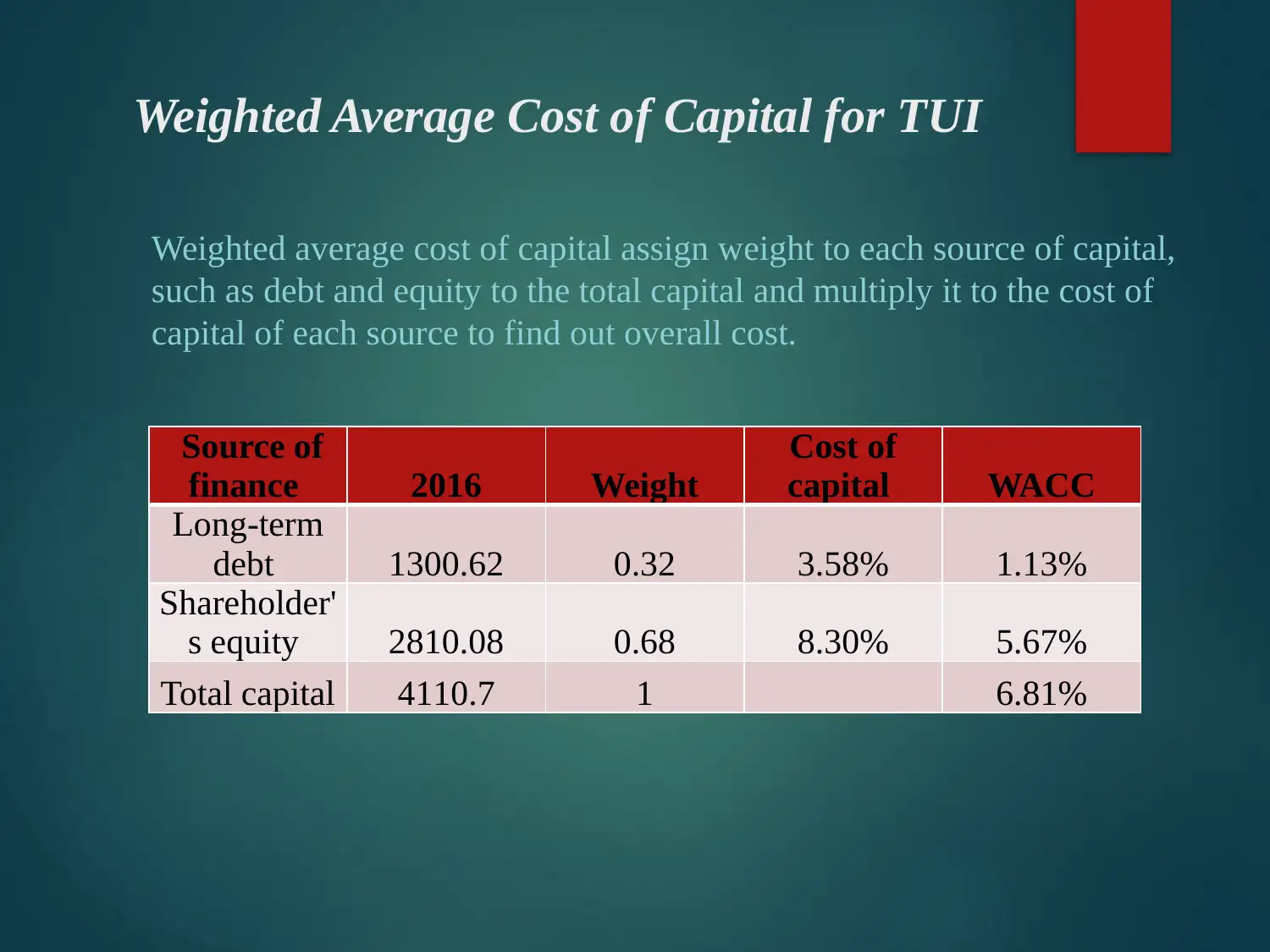

Weighted Average Cost of Capital for TUI

Weighted average cost of capital assign weight to each source of capital,

such as debt and equity to the total capital and multiply it to the cost of

capital of each source to find out overall cost.

Source of

finance 2016 Weight

Cost of

capital WACC

Long-term

debt 1300.62 0.32 3.58% 1.13%

Shareholder'

s equity 2810.08 0.68 8.30% 5.67%

Total capital 4110.7 1 6.81%

Weighted average cost of capital assign weight to each source of capital,

such as debt and equity to the total capital and multiply it to the cost of

capital of each source to find out overall cost.

Source of

finance 2016 Weight

Cost of

capital WACC

Long-term

debt 1300.62 0.32 3.58% 1.13%

Shareholder'

s equity 2810.08 0.68 8.30% 5.67%

Total capital 4110.7 1 6.81%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Shareholders value analysis model

• SVA analysis is used by corporations to maximize their

shareholders value and in order to fulfil these aim, companies are

required to measure their key value drivers.

• Most importantly, business have to quantify the expected growth

in revenues (sales), operating profit, taxes, fixed assets, increase

in working capital and so on.

• SVA analysis is used by corporations to maximize their

shareholders value and in order to fulfil these aim, companies are

required to measure their key value drivers.

• Most importantly, business have to quantify the expected growth

in revenues (sales), operating profit, taxes, fixed assets, increase

in working capital and so on.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Application of Finance Models on TUI

Shareholder Value Analysis Model (Value drivers)

1 Sales growth (last year % change) 3.26% per year

Operating profit margin (5 year average) 3.89 % of sales p.a.

2 Taxes (5 year average) 20.46% of operating profit

p.a.

3 Depreciation (5 year average) 31.40% of fixed assets

4 Fixed capital investment (5 years average) 50.31% of sales p.a.

5 Incremental working capital investment (5 year average) 14.62% of sales p.a.

6 The planning horizon 10 years

7 The required rate of return (WACC calculated above) 6.81% per annum

Shareholder Value Analysis Model (Value drivers)

1 Sales growth (last year % change) 3.26% per year

Operating profit margin (5 year average) 3.89 % of sales p.a.

2 Taxes (5 year average) 20.46% of operating profit

p.a.

3 Depreciation (5 year average) 31.40% of fixed assets

4 Fixed capital investment (5 years average) 50.31% of sales p.a.

5 Incremental working capital investment (5 year average) 14.62% of sales p.a.

6 The planning horizon 10 years

7 The required rate of return (WACC calculated above) 6.81% per annum

Application of Finance Models on TUI

• Supporters of SVA model comment that the SVA model is comparatively the

most prominent and admirable model for analysing the financial repercussions

of strategies and mark it as the key input to the corporate planning of the

decade.

• Managers applying the model in TUI Group are not so much supportive to this

model as the complex calculations involved along with obstructive assumptions

make it a challenge for them.

• In practical, the users of the model also comment on the susceptibility of the

model towards manipulation. The manipulations in the reported data in TUI’s

annual report can turn the analysis in to the favours for some thereby resulting

in the undervalue to the corporation.

Shareholder Value Analysis Model

(Practical applications)

• Supporters of SVA model comment that the SVA model is comparatively the

most prominent and admirable model for analysing the financial repercussions

of strategies and mark it as the key input to the corporate planning of the

decade.

• Managers applying the model in TUI Group are not so much supportive to this

model as the complex calculations involved along with obstructive assumptions

make it a challenge for them.

• In practical, the users of the model also comment on the susceptibility of the

model towards manipulation. The manipulations in the reported data in TUI’s

annual report can turn the analysis in to the favours for some thereby resulting

in the undervalue to the corporation.

Shareholder Value Analysis Model

(Practical applications)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.