Accounting and Finance Report: APN Outdoor Group and Competitors

VerifiedAdded on 2020/04/01

|9

|1421

|43

Report

AI Summary

This report provides a comprehensive analysis of the accounting and finance aspects of APN Outdoor Group. It begins with an examination of capital budgeting techniques, including Net Present Value (NPV), profitability index, and other methods used for project evaluation. The report then delves into the evaluation of APN's capital structure, computing the Weighted Average Cost of Capital (WACC) and analyzing key financial ratios. It assesses APN's financial performance, including earnings per share and liquidity ratios, and compares its performance with competitors like Ooh Media. The analysis highlights the evolution of APN's capital structure, emphasizing the mix of equity and debt financing, and discusses the impact of these changes on WACC and shareholder returns. The report concludes by summarizing the financial health and strategic decisions of APN Outdoor Group, and the implications for stakeholders.

Running head: ACCOUNTING AND FINANCE

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING AND FINANCE

Table of Contents

Answer to Part A........................................................................................................................2

Requirement 1........................................................................................................................2

Requirement 2:.......................................................................................................................4

Requirement 3........................................................................................................................4

Answer to Part B........................................................................................................................5

Introduction............................................................................................................................5

Evaluation of the Capital Structure of APN...........................................................................5

Computation of After-Tax WACC.........................................................................................6

APN Outdoor and the performance of their competitors.......................................................6

Capital Structure of APN Outdoor Group..............................................................................7

Conclusion..............................................................................................................................7

Reference List............................................................................................................................8

ACCOUNTING AND FINANCE

Table of Contents

Answer to Part A........................................................................................................................2

Requirement 1........................................................................................................................2

Requirement 2:.......................................................................................................................4

Requirement 3........................................................................................................................4

Answer to Part B........................................................................................................................5

Introduction............................................................................................................................5

Evaluation of the Capital Structure of APN...........................................................................5

Computation of After-Tax WACC.........................................................................................6

APN Outdoor and the performance of their competitors.......................................................6

Capital Structure of APN Outdoor Group..............................................................................7

Conclusion..............................................................................................................................7

Reference List............................................................................................................................8

2

ACCOUNTING AND FINANCE

Answer to Part A

Requirement 1

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,589,500 $1,748,450 $1,923,295 $2,115,625 $2,327,187 $2,559,906 $2,815,896

Staff Cost ($900,000) ($954,000) ($1,011,240) ($1,071,914) ($1,136,229) ($1,204,403) ($1,276,667) ($1,353,267)

Material Costs ($210,000) ($222,600) ($235,956) ($250,113) ($265,120) ($281,027) ($297,889) ($315,762)

Marketing Costs ($46,000) ($48,760) ($51,686) ($54,787) ($58,074) ($61,558) ($65,252) ($69,167)

Other Costs ($25,000) ($26,500) ($28,090) ($29,775) ($31,562) ($33,456) ($35,463) ($37,591)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $131,390 $215,228 $310,455 $418,389 $540,493 $678,385 $833,859

Less: Tax on Profit ($17,325) ($39,417) ($64,569) ($93,137) ($125,517) ($162,148) ($203,515) ($250,158)

Net Profit after Tax $40,425 $91,973 $150,660 $217,319 $292,872 $378,345 $474,869 $583,701

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $298,223 $356,910 $423,569 $499,122 $584,595 $681,119 $789,951

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $298,223 $356,910 $423,569 $499,122 $584,595 $681,119 $889,951

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,105,102) ($748,192) ($324,624) $174,499 $759,094 $1,440,213 $2,330,164

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $221,628 $228,657 $233,933 $237,639 $239,942 $241,000 $271,458

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,215,721) ($987,064) ($753,131) ($515,492) ($275,550) ($34,549) $236,908

Discounted Payback period

Net Present Value

Profitability Index

4.65

7.13

$236,908

114.36%

Period

Capital Budgeting for Base-Case:

ACCOUNTING AND FINANCE

Answer to Part A

Requirement 1

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,589,500 $1,748,450 $1,923,295 $2,115,625 $2,327,187 $2,559,906 $2,815,896

Staff Cost ($900,000) ($954,000) ($1,011,240) ($1,071,914) ($1,136,229) ($1,204,403) ($1,276,667) ($1,353,267)

Material Costs ($210,000) ($222,600) ($235,956) ($250,113) ($265,120) ($281,027) ($297,889) ($315,762)

Marketing Costs ($46,000) ($48,760) ($51,686) ($54,787) ($58,074) ($61,558) ($65,252) ($69,167)

Other Costs ($25,000) ($26,500) ($28,090) ($29,775) ($31,562) ($33,456) ($35,463) ($37,591)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $131,390 $215,228 $310,455 $418,389 $540,493 $678,385 $833,859

Less: Tax on Profit ($17,325) ($39,417) ($64,569) ($93,137) ($125,517) ($162,148) ($203,515) ($250,158)

Net Profit after Tax $40,425 $91,973 $150,660 $217,319 $292,872 $378,345 $474,869 $583,701

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $298,223 $356,910 $423,569 $499,122 $584,595 $681,119 $789,951

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $298,223 $356,910 $423,569 $499,122 $584,595 $681,119 $889,951

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,105,102) ($748,192) ($324,624) $174,499 $759,094 $1,440,213 $2,330,164

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $221,628 $228,657 $233,933 $237,639 $239,942 $241,000 $271,458

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,215,721) ($987,064) ($753,131) ($515,492) ($275,550) ($34,549) $236,908

Discounted Payback period

Net Present Value

Profitability Index

4.65

7.13

$236,908

114.36%

Period

Capital Budgeting for Base-Case:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,531,700 $1,623,602 $1,721,018 $1,824,279 $1,933,736 $2,049,760 $2,172,746

Staff Cost ($900,000) ($990,000) ($1,089,000) ($1,197,900) ($1,317,690) ($1,449,459) ($1,594,405) ($1,753,845)

Material Costs ($210,000) ($231,000) ($254,100) ($279,510) ($307,461) ($338,207) ($372,028) ($409,231)

Marketing Costs ($46,000) ($50,600) ($55,660) ($61,226) ($67,349) ($74,083) ($81,492) ($89,641)

Other Costs ($25,000) ($27,500) ($30,250) ($33,275) ($36,603) ($40,263) ($44,289) ($48,718)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $26,350 ($11,658) ($57,143) ($111,073) ($174,526) ($248,703) ($334,939)

Less: Tax on Profit ($17,325) ($7,905) $3,497 $17,143 $33,322 $52,358 $74,611 $100,482

Net Profit after Tax $40,425 $18,445 ($8,161) ($40,000) ($77,751) ($122,168) ($174,092) ($234,457)

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $224,695 $198,089 $166,250 $128,499 $84,082 $32,158 ($28,207)

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $224,695 $198,089 $166,250 $128,499 $84,082 $32,158 $71,793

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,178,630) ($980,541) ($814,291) ($685,792) ($601,710) ($569,552) ($497,760)

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $166,985 $126,907 $91,818 $61,180 $34,511 $11,378 $21,899

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,270,364) ($1,143,457) ($1,051,638) ($990,458) ($955,948) ($944,569) ($922,671)

Discounted Payback period

Net Present Value

Profitability Index

Capital Budgeting for Worst-Case:

Period

10.34

50.13

($922,671)

44.08%

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,531,700 $1,623,602 $1,721,018 $1,824,279 $1,933,736 $2,049,760 $2,172,746

Staff Cost ($900,000) ($990,000) ($1,089,000) ($1,197,900) ($1,317,690) ($1,449,459) ($1,594,405) ($1,753,845)

Material Costs ($210,000) ($231,000) ($254,100) ($279,510) ($307,461) ($338,207) ($372,028) ($409,231)

Marketing Costs ($46,000) ($50,600) ($55,660) ($61,226) ($67,349) ($74,083) ($81,492) ($89,641)

Other Costs ($25,000) ($27,500) ($30,250) ($33,275) ($36,603) ($40,263) ($44,289) ($48,718)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $26,350 ($11,658) ($57,143) ($111,073) ($174,526) ($248,703) ($334,939)

Less: Tax on Profit ($17,325) ($7,905) $3,497 $17,143 $33,322 $52,358 $74,611 $100,482

Net Profit after Tax $40,425 $18,445 ($8,161) ($40,000) ($77,751) ($122,168) ($174,092) ($234,457)

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $224,695 $198,089 $166,250 $128,499 $84,082 $32,158 ($28,207)

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $224,695 $198,089 $166,250 $128,499 $84,082 $32,158 $71,793

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,178,630) ($980,541) ($814,291) ($685,792) ($601,710) ($569,552) ($497,760)

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $166,985 $126,907 $91,818 $61,180 $34,511 $11,378 $21,899

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,270,364) ($1,143,457) ($1,051,638) ($990,458) ($955,948) ($944,569) ($922,671)

Discounted Payback period

Net Present Value

Profitability Index

Capital Budgeting for Worst-Case:

Period

10.34

50.13

($922,671)

44.08%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,661,750 $1,911,013 $2,197,664 $2,527,314 $2,906,411 $3,342,373 $3,843,729

Staff Cost ($900,000) ($927,000) ($954,810) ($983,454) ($1,012,958) ($1,043,347) ($1,074,647) ($1,106,886)

Material Costs ($210,000) ($216,300) ($222,789) ($229,473) ($236,357) ($243,448) ($250,751) ($258,274)

Marketing Costs ($46,000) ($47,380) ($48,801) ($50,265) ($51,773) ($53,327) ($54,926) ($56,574)

Other Costs ($25,000) ($25,750) ($26,523) ($27,318) ($28,138) ($28,982) ($29,851) ($30,747)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $239,070 $451,840 $700,904 $991,838 $1,331,058 $1,725,947 $2,184,998

Less: Tax on Profit ($17,325) ($71,721) ($135,552) ($210,271) ($297,551) ($399,318) ($517,784) ($655,499)

Net Profit after Tax $40,425 $167,349 $316,288 $490,633 $694,287 $931,741 $1,208,163 $1,529,498

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $373,599 $522,538 $696,883 $900,537 $1,137,991 $1,414,413 $1,735,748

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $373,599 $522,538 $696,883 $900,537 $1,137,991 $1,414,413 $1,835,748

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,029,726) ($507,188) $189,694 $1,090,231 $2,228,222 $3,642,635 $5,478,383

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $277,645 $334,768 $384,882 $428,757 $467,080 $500,461 $559,950

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,159,704) ($824,936) ($440,054) ($11,297) $455,782 $956,244 $1,516,194

Discounted Payback period

Net Present Value

Profitability Index

Capital Budgeting for Best-Case:

Period

3.79

5.29

$1,516,194

191.89%

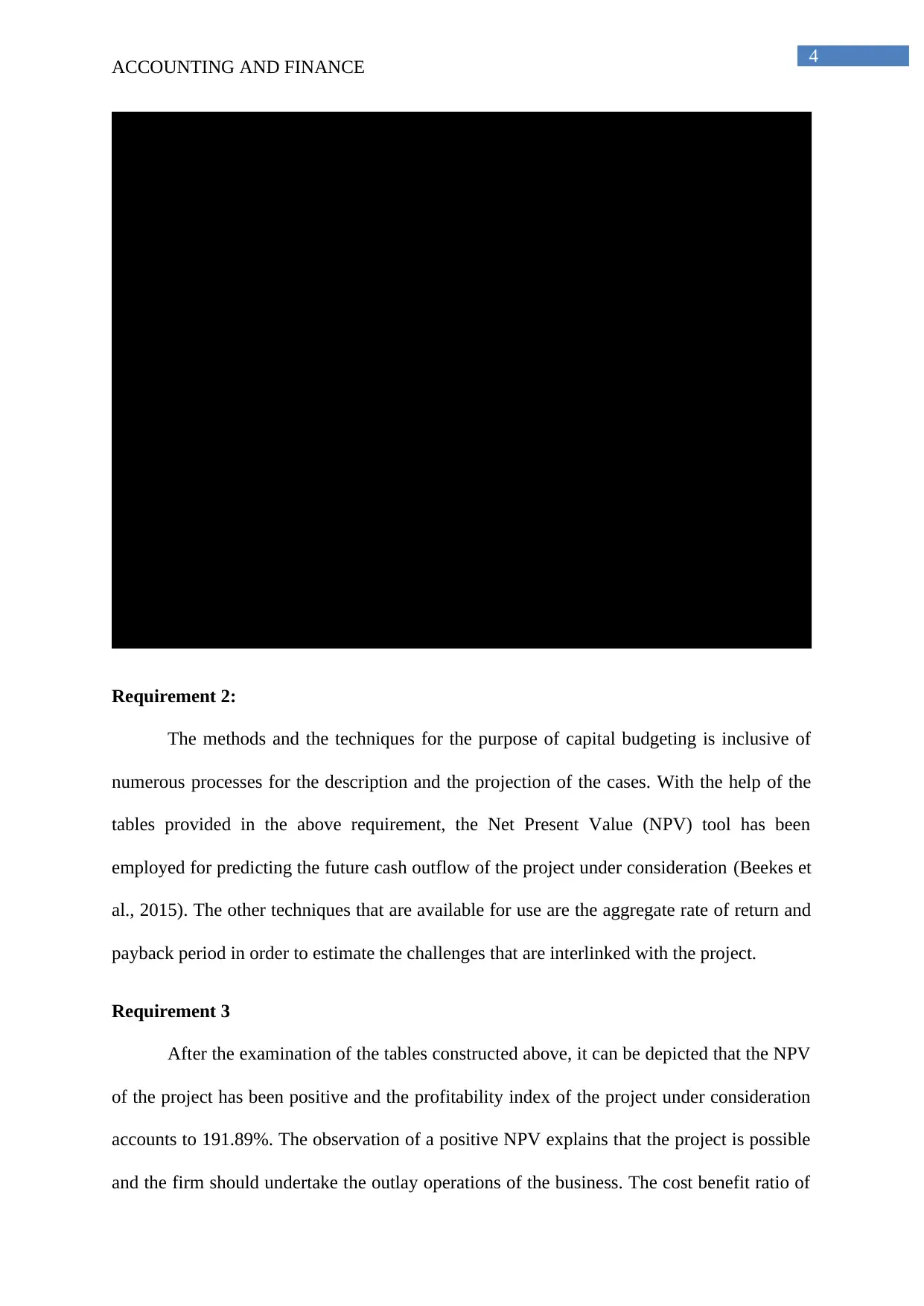

Requirement 2:

The methods and the techniques for the purpose of capital budgeting is inclusive of

numerous processes for the description and the projection of the cases. With the help of the

tables provided in the above requirement, the Net Present Value (NPV) tool has been

employed for predicting the future cash outflow of the project under consideration (Beekes et

al., 2015). The other techniques that are available for use are the aggregate rate of return and

payback period in order to estimate the challenges that are interlinked with the project.

Requirement 3

After the examination of the tables constructed above, it can be depicted that the NPV

of the project has been positive and the profitability index of the project under consideration

accounts to 191.89%. The observation of a positive NPV explains that the project is possible

and the firm should undertake the outlay operations of the business. The cost benefit ratio of

ACCOUNTING AND FINANCE

Particulars 0 1 2 3 4 5 6 7 8

Initial Investment ($1,650,000)

Annual Cash Flow:

Incremental Revene $1,445,000 $1,661,750 $1,911,013 $2,197,664 $2,527,314 $2,906,411 $3,342,373 $3,843,729

Staff Cost ($900,000) ($927,000) ($954,810) ($983,454) ($1,012,958) ($1,043,347) ($1,074,647) ($1,106,886)

Material Costs ($210,000) ($216,300) ($222,789) ($229,473) ($236,357) ($243,448) ($250,751) ($258,274)

Marketing Costs ($46,000) ($47,380) ($48,801) ($50,265) ($51,773) ($53,327) ($54,926) ($56,574)

Other Costs ($25,000) ($25,750) ($26,523) ($27,318) ($28,138) ($28,982) ($29,851) ($30,747)

Depreciation of Lab ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250) ($206,250)

Net Profit before Tax $57,750 $239,070 $451,840 $700,904 $991,838 $1,331,058 $1,725,947 $2,184,998

Less: Tax on Profit ($17,325) ($71,721) ($135,552) ($210,271) ($297,551) ($399,318) ($517,784) ($655,499)

Net Profit after Tax $40,425 $167,349 $316,288 $490,633 $694,287 $931,741 $1,208,163 $1,529,498

Add: Depreciation $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250 $206,250

Annual After-Tax Cash Flow $246,675 $373,599 $522,538 $696,883 $900,537 $1,137,991 $1,414,413 $1,735,748

Salvage Value $100,000

Net Annual Cash Flow ($1,650,000) $246,675 $373,599 $522,538 $696,883 $900,537 $1,137,991 $1,414,413 $1,835,748

Cumulative Cash Flow ($1,650,000) ($1,403,325) ($1,029,726) ($507,188) $189,694 $1,090,231 $2,228,222 $3,642,635 $5,478,383

Payback Period

Required Rate of Return 16% 16% 16% 16% 16% 16% 16% 16% 16%

Discounted Cash Flow ($1,650,000) $212,651 $277,645 $334,768 $384,882 $428,757 $467,080 $500,461 $559,950

Cumulative Discounted Cash Flow ($1,650,000) ($1,437,349) ($1,159,704) ($824,936) ($440,054) ($11,297) $455,782 $956,244 $1,516,194

Discounted Payback period

Net Present Value

Profitability Index

Capital Budgeting for Best-Case:

Period

3.79

5.29

$1,516,194

191.89%

Requirement 2:

The methods and the techniques for the purpose of capital budgeting is inclusive of

numerous processes for the description and the projection of the cases. With the help of the

tables provided in the above requirement, the Net Present Value (NPV) tool has been

employed for predicting the future cash outflow of the project under consideration (Beekes et

al., 2015). The other techniques that are available for use are the aggregate rate of return and

payback period in order to estimate the challenges that are interlinked with the project.

Requirement 3

After the examination of the tables constructed above, it can be depicted that the NPV

of the project has been positive and the profitability index of the project under consideration

accounts to 191.89%. The observation of a positive NPV explains that the project is possible

and the firm should undertake the outlay operations of the business. The cost benefit ratio of

5

ACCOUNTING AND FINANCE

the associated plan is constructed with the assistance of the profitability index, which has

been 191.89%, which proposes that the NPV of the future cash flow is more than the primary

outlay value that has been paid by the company. The other data in accordance to the approval

and refusal of the project can be constructed by taking assistance of the incorporation of the

other techniques of capital budgeting that includes the payback period and the aggregate rate

of return (Gitman et al., 2015).

Answer to Part B

Introduction

The financial declaration has been computed so that knowledge about APN Outdoor

Group’s structure of capital can be known. The company has been known to be an ASX listed

organization. The declaration has depicted that the calculation of the WACC and the

examination of the critical financial ratios of the company.

Evaluation of the Capital Structure of APN

The WACC of APN has been 8.32% and an additional amount of $181.8 of equity has

been established by the firm in 2016 in order to establish an innovative capital framework.

The firm has the intention of lowering the cost of capital with the assistance of the

preservation of the ideal capital framework. By taking help of the examination of the annual

financial report, it is cited that during the accounting year of 2016, the debt capital proportion

in the structure has fallen. APN’s cost of capital can fall further by increasing the debt

proportion value in their capital structure. The factor has been the equity capital that has been

issued and he interest bearing liabilities has fallen in the present year (McKay, and Haque

2016). Hence, for conclusion it is depicted that value of equity has stayed at 38.1 in the

current year and the debt capital overall value has accounted to 27.61.

ACCOUNTING AND FINANCE

the associated plan is constructed with the assistance of the profitability index, which has

been 191.89%, which proposes that the NPV of the future cash flow is more than the primary

outlay value that has been paid by the company. The other data in accordance to the approval

and refusal of the project can be constructed by taking assistance of the incorporation of the

other techniques of capital budgeting that includes the payback period and the aggregate rate

of return (Gitman et al., 2015).

Answer to Part B

Introduction

The financial declaration has been computed so that knowledge about APN Outdoor

Group’s structure of capital can be known. The company has been known to be an ASX listed

organization. The declaration has depicted that the calculation of the WACC and the

examination of the critical financial ratios of the company.

Evaluation of the Capital Structure of APN

The WACC of APN has been 8.32% and an additional amount of $181.8 of equity has

been established by the firm in 2016 in order to establish an innovative capital framework.

The firm has the intention of lowering the cost of capital with the assistance of the

preservation of the ideal capital framework. By taking help of the examination of the annual

financial report, it is cited that during the accounting year of 2016, the debt capital proportion

in the structure has fallen. APN’s cost of capital can fall further by increasing the debt

proportion value in their capital structure. The factor has been the equity capital that has been

issued and he interest bearing liabilities has fallen in the present year (McKay, and Haque

2016). Hence, for conclusion it is depicted that value of equity has stayed at 38.1 in the

current year and the debt capital overall value has accounted to 27.61.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING AND FINANCE

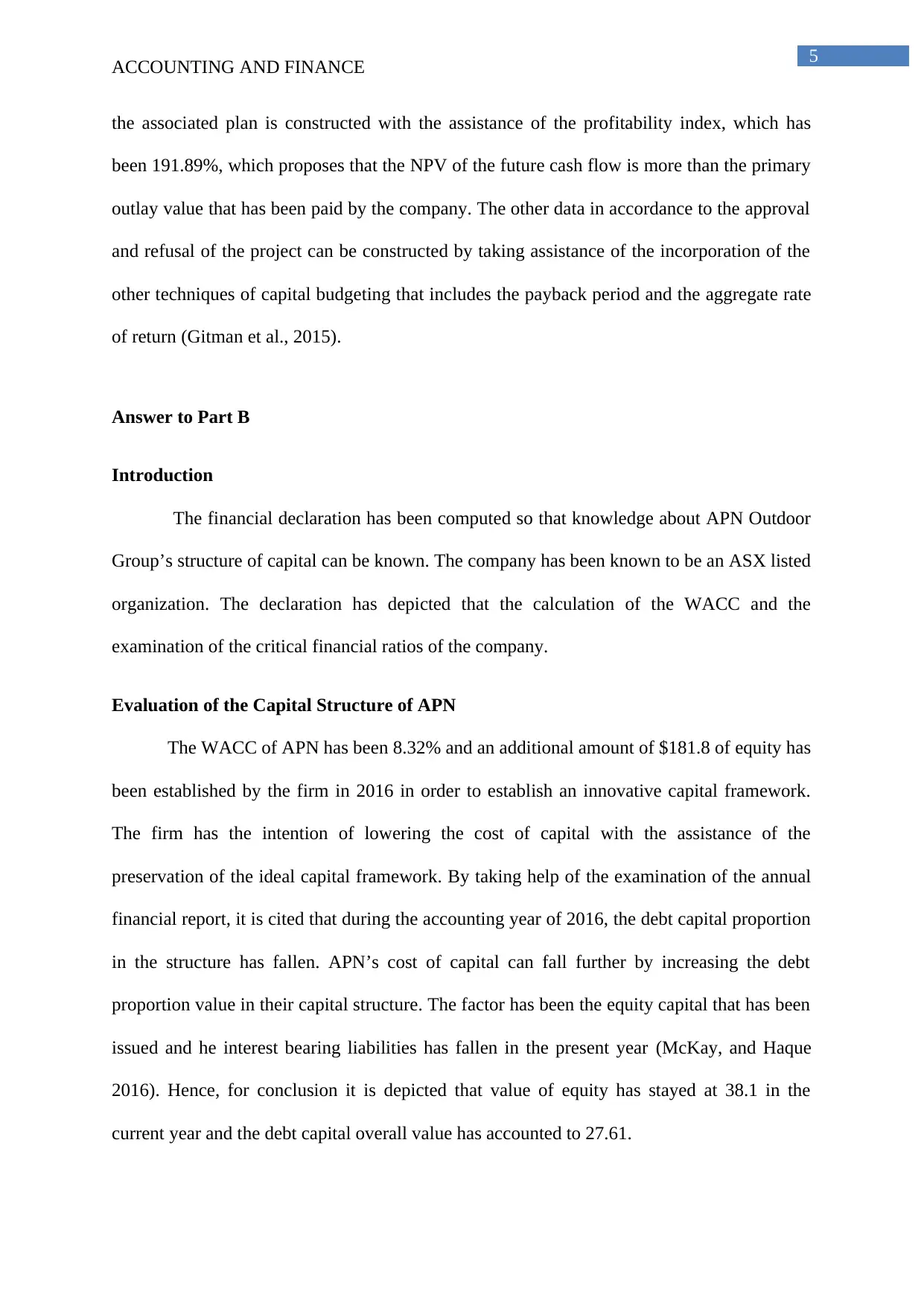

Computation of After-Tax WACC

Particulars Amount Weightage Return Rate

Weighted

Return

Total Equity Capital $836,465 83.83% 8.38% 7.03%

Total Debt Capital $161,309 16.17% 11.42% 1.85%

Tax Rate 30%

After-Tax Weighted Average Cost

of Capital 8.32%

Computation of After-Tax Weighted Avergae Cost of Capital:

APN’s net operating cash has reduced for the last three years and the per share

earnings of the company has been lower by 19% than the target of the present strategies and

the amount has accounted to 0.29 in the current year. The earnings per share have reduced to

31.4 in the year 2016 and this value has been lower than the previous year value of 44.4. The

price earnings ratio has been found to be 16.92 in 2017.

The assessment of the liquidity scenario of the company has been understood by

looking at the values of ratios of cash, quick and current (Ali, 2016). The cash ratio has been

0.38; current ratio has been 1.90 while the quick ratio has been 1.89. On the other hand, the

interest coverage ratio has accounted to 25.96 and the debt to asset ratio valuing at 0.23.

APN Outdoor and the performance of their competitors

Ooh Media has been one of the key competitors of APN. The capital framework of

the firm is mingling of the equity and loans. The capital equity amount rises with the

company loans and therefore it can be defined that the capital structure of APN is a mixture

of the debt and capital. There has been a transition in the capital framework of APN for the

past three years and they have been based on the equity financing loan (Unda, 2015).

Therefore, it can be said that the capital framework of the organizations is a mixture of

ACCOUNTING AND FINANCE

Computation of After-Tax WACC

Particulars Amount Weightage Return Rate

Weighted

Return

Total Equity Capital $836,465 83.83% 8.38% 7.03%

Total Debt Capital $161,309 16.17% 11.42% 1.85%

Tax Rate 30%

After-Tax Weighted Average Cost

of Capital 8.32%

Computation of After-Tax Weighted Avergae Cost of Capital:

APN’s net operating cash has reduced for the last three years and the per share

earnings of the company has been lower by 19% than the target of the present strategies and

the amount has accounted to 0.29 in the current year. The earnings per share have reduced to

31.4 in the year 2016 and this value has been lower than the previous year value of 44.4. The

price earnings ratio has been found to be 16.92 in 2017.

The assessment of the liquidity scenario of the company has been understood by

looking at the values of ratios of cash, quick and current (Ali, 2016). The cash ratio has been

0.38; current ratio has been 1.90 while the quick ratio has been 1.89. On the other hand, the

interest coverage ratio has accounted to 25.96 and the debt to asset ratio valuing at 0.23.

APN Outdoor and the performance of their competitors

Ooh Media has been one of the key competitors of APN. The capital framework of

the firm is mingling of the equity and loans. The capital equity amount rises with the

company loans and therefore it can be defined that the capital structure of APN is a mixture

of the debt and capital. There has been a transition in the capital framework of APN for the

past three years and they have been based on the equity financing loan (Unda, 2015).

Therefore, it can be said that the capital framework of the organizations is a mixture of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING AND FINANCE

financing their assets (Sivathaasan, 2016). APN has obtained an effective cash flow that aids

in funding the projects and establishes favourable earnings to the shareholders.

Capital Structure of APN Outdoor Group

APN’s capital structure is a mixture of equity and debt with the idea of funding the

asset. The cost of capital is the rate of return that is predicted by the company on the revenue

over the capital as an alternate amount of investment with the existence of risk. (Gallagher et

al., 2015) The transitions on the capital framework have a straight effect on the WACC.

Thus, to increase the market value, it is vital for the firm to reduce their cost of capital. The

cost of capital of a company can be declined with the assistance of redeveloping their capital

framework and it is to be scrutinised that the cost of capital does not exceed the anticipated

return rate. The cost of capital being lower would make funding in the new projects more

reasonable (Gippel et al., 2015).

Conclusion

After the evaluation of the above case study, it can be depicted that the capital

framework of APN comprises of debts and equity, they have been providing feasible returns

to the shareholders and hence provides increased dividends to their stakeholders. The revenue

and the returns before interest and tax of the firm have undergone an upward movement that

has help in establishing feasible returns to the stakeholders.

ACCOUNTING AND FINANCE

financing their assets (Sivathaasan, 2016). APN has obtained an effective cash flow that aids

in funding the projects and establishes favourable earnings to the shareholders.

Capital Structure of APN Outdoor Group

APN’s capital structure is a mixture of equity and debt with the idea of funding the

asset. The cost of capital is the rate of return that is predicted by the company on the revenue

over the capital as an alternate amount of investment with the existence of risk. (Gallagher et

al., 2015) The transitions on the capital framework have a straight effect on the WACC.

Thus, to increase the market value, it is vital for the firm to reduce their cost of capital. The

cost of capital of a company can be declined with the assistance of redeveloping their capital

framework and it is to be scrutinised that the cost of capital does not exceed the anticipated

return rate. The cost of capital being lower would make funding in the new projects more

reasonable (Gippel et al., 2015).

Conclusion

After the evaluation of the above case study, it can be depicted that the capital

framework of APN comprises of debts and equity, they have been providing feasible returns

to the shareholders and hence provides increased dividends to their stakeholders. The revenue

and the returns before interest and tax of the firm have undergone an upward movement that

has help in establishing feasible returns to the stakeholders.

8

ACCOUNTING AND FINANCE

Reference List

Ali, S. (2016). Corporate governance and stock liquidity in Australia: A pitch. Jo

Beekes, W., Brown, P., & Zhang, Q. (2015). Corporate governance and the informativeness

of disclosures in Australia: a re‐examination. Accounting & Finance, 55(4), 931-963.

Gallagher, D. R., Ignatieva, K., & McCulloch, J. (2015). Industry concentration, excess

returns and innovation in Australia. Accounting & Finance, 55(2), 443-466.

Gippel, J., Smith, T., & Zhu, Y. (2015). Endogeneity in Accounting and Finance Research:

Natural Experiments as a State‐of‐the‐Art Solution. Abacus, 51(2), 143-168.

Gitman, L. J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson

Higher Education AU.

McKay, W., & Haque, T. (2016). A study of industry cost of equity in Australia using the

Fama and French 5 Factor model and the Capital Asset Pricing Model (CAPM): A

pitch. Journal of Accounting and Management Information Systems, 15(3), 618-623.

Sivathaasan, N. (2016). Corporate governance and leverage in Australia: A pitch. Journal of

Accounting and Management Information Systems, 15(4), 819-825.

Unda, L. A. (2015). Board of directors characteristics and credit union financial performance:

a pitch. Accounting & Finance, 55(2), 353-360.

ACCOUNTING AND FINANCE

Reference List

Ali, S. (2016). Corporate governance and stock liquidity in Australia: A pitch. Jo

Beekes, W., Brown, P., & Zhang, Q. (2015). Corporate governance and the informativeness

of disclosures in Australia: a re‐examination. Accounting & Finance, 55(4), 931-963.

Gallagher, D. R., Ignatieva, K., & McCulloch, J. (2015). Industry concentration, excess

returns and innovation in Australia. Accounting & Finance, 55(2), 443-466.

Gippel, J., Smith, T., & Zhu, Y. (2015). Endogeneity in Accounting and Finance Research:

Natural Experiments as a State‐of‐the‐Art Solution. Abacus, 51(2), 143-168.

Gitman, L. J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson

Higher Education AU.

McKay, W., & Haque, T. (2016). A study of industry cost of equity in Australia using the

Fama and French 5 Factor model and the Capital Asset Pricing Model (CAPM): A

pitch. Journal of Accounting and Management Information Systems, 15(3), 618-623.

Sivathaasan, N. (2016). Corporate governance and leverage in Australia: A pitch. Journal of

Accounting and Management Information Systems, 15(4), 819-825.

Unda, L. A. (2015). Board of directors characteristics and credit union financial performance:

a pitch. Accounting & Finance, 55(2), 353-360.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.