Accounting and Finance Report: Case Studies and Financial Analysis

VerifiedAdded on 2021/05/31

|12

|1670

|20

Report

AI Summary

This report presents a comprehensive analysis of accounting and finance principles through two distinct case studies. Part A focuses on Saturn Pet Care, evaluating two projects using capital budgeting techniques such as Net Present Value (NPV), Profitability Index, and Payback Period. It explores product cannibalization and addresses the impact of estimated sales errors and the valuation of a vacant factory. Part B shifts to an evaluation of ARB Limited's financial performance, examining its capital structure, Weighted Average Cost of Capital (WACC), and the application of the Capital Asset Pricing Model (CAPM) to determine the cost of equity. The report compares ARB Limited's capital structure to industry peers, analyzes key financial ratios (profitability, efficiency, and solvency), and identifies changes in capital structure over time. It concludes with recommendations to improve financial performance, focusing on cost reduction and capital structure optimization. The report utilizes financial ratios, capital budgeting tools, and comparative analysis to provide a detailed assessment of the companies' financial positions and strategic decisions.

Running head: ACCOUNTING AND FINANCE

Accounting and Finance

Name of the Student

Name of the University

Author Note

Accounting and Finance

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

Executive summary:

This particular assignment is about two case studies divided into two section that is Part A

and Part B. In Part A, the case depicts about the Saturn pet care where the two projects

undertaken by company have been analyzed. In section part, evaluation of financial

performance of firm named ARB limited has been done by using different analysis tools.

Executive summary:

This particular assignment is about two case studies divided into two section that is Part A

and Part B. In Part A, the case depicts about the Saturn pet care where the two projects

undertaken by company have been analyzed. In section part, evaluation of financial

performance of firm named ARB limited has been done by using different analysis tools.

ACCOUNTING AND FINANCE

Table of Contents

Part A:........................................................................................................................................3

Analysis of Bathurst project using Capital budgeting:..............................................................3

Analysis of Wodonga project using Capital budgeting:............................................................4

Capital budgeting decision and product cannibalization:..........................................................5

Application of capital budgeting tool when analyzing the estimated sales errors:....................5

Addressing the issues of original value of vacant Wodonga factory:........................................5

Part B:.........................................................................................................................................5

Introduction:...............................................................................................................................5

Discussion:.................................................................................................................................5

Categorizing ARB limited capital structure:..............................................................................5

WACC computation:..................................................................................................................5

Determination of appropriate return using CAPM”:..................................................................5

Comparison of capital structure of ARB limited with other firm:.............................................5

Analyzing key financial ratios of ARB limited:........................................................................5

Identification of changes in capital structure of ARB limited:..................................................5

Evaluation of success of ARM limited in generating shareholder wealth:................................5

Recommendations:.....................................................................................................................6

Table of Contents

Part A:........................................................................................................................................3

Analysis of Bathurst project using Capital budgeting:..............................................................3

Analysis of Wodonga project using Capital budgeting:............................................................4

Capital budgeting decision and product cannibalization:..........................................................5

Application of capital budgeting tool when analyzing the estimated sales errors:....................5

Addressing the issues of original value of vacant Wodonga factory:........................................5

Part B:.........................................................................................................................................5

Introduction:...............................................................................................................................5

Discussion:.................................................................................................................................5

Categorizing ARB limited capital structure:..............................................................................5

WACC computation:..................................................................................................................5

Determination of appropriate return using CAPM”:..................................................................5

Comparison of capital structure of ARB limited with other firm:.............................................5

Analyzing key financial ratios of ARB limited:........................................................................5

Identification of changes in capital structure of ARB limited:..................................................5

Evaluation of success of ARM limited in generating shareholder wealth:................................5

Recommendations:.....................................................................................................................6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING AND FINANCE

Part A:

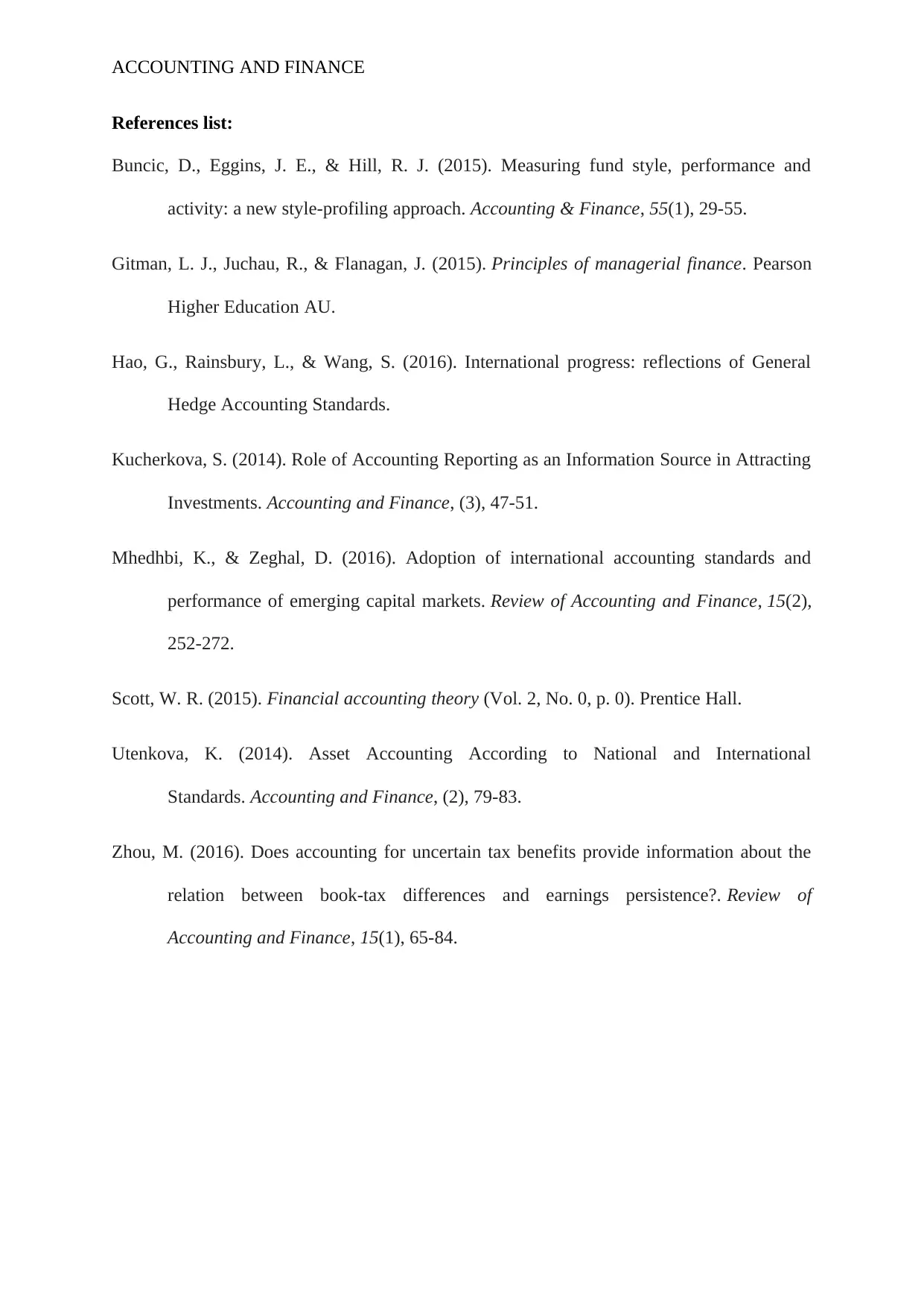

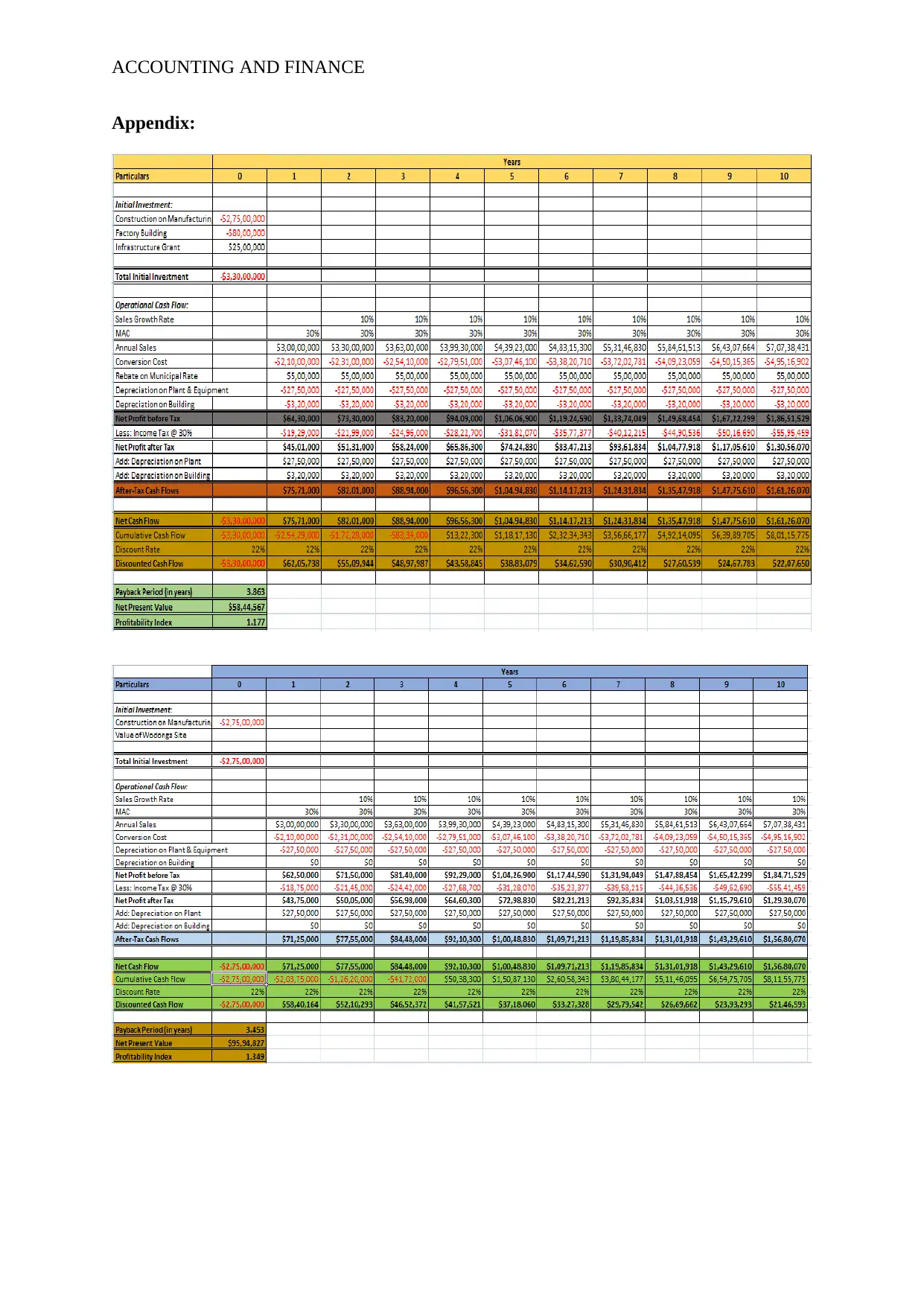

Analysis of Bathurst and Wodonga project using Capital budgeting:

Evaluation of the two projects that is Bathurst and Woodonga project is done by the

capital budgeting tool such as net present value, profitability index and payback period. It is

depicted from the table that net present value of Bathurst project is more than that of

Wodonga project at value of $ 9594827. When looking at the profitability index value, it can

be seen that profitability index of Wodonga project is higher at value 1.34 than Bathurst

project at value of 1.17. The payback period of Wodonga project is less than that of Bathurst

project indicating that making investment in former project will enable organization to

recover initial investment in less time as against later (Buncic et al., 2015).

Capital budgeting decision and product cannibalization:

Product cannibalization refers to the strategy implemented by organization for

promoting the sales their new developed product by reducing the market share, sales volume

and sales revenue of the existing product. This particular measures is adopted by organization

to increase the sales volume of new product by using the techniques of capital budgeting.

Any fall in profits from selling of new product should be treated as loss and this strategy

considerably impacts the capital budgeting analysis of the new project that is undertaken.

Application of capital budgeting tool when analyzing the estimated sales errors:

The management of Saturn Pet Care has evaluated that the sales budget that have been

estimated is unusually high that would have influence on the analysis of capital budgeting.

Such errors inn estimation would have direct impact on capital budgeting analysis and

ultimately impacting the investment decision. Therefore, in order to neutralize the impact of

such errors in estimation, it is required by Saturn Pet Care to take proper measures. In this

Part A:

Analysis of Bathurst and Wodonga project using Capital budgeting:

Evaluation of the two projects that is Bathurst and Woodonga project is done by the

capital budgeting tool such as net present value, profitability index and payback period. It is

depicted from the table that net present value of Bathurst project is more than that of

Wodonga project at value of $ 9594827. When looking at the profitability index value, it can

be seen that profitability index of Wodonga project is higher at value 1.34 than Bathurst

project at value of 1.17. The payback period of Wodonga project is less than that of Bathurst

project indicating that making investment in former project will enable organization to

recover initial investment in less time as against later (Buncic et al., 2015).

Capital budgeting decision and product cannibalization:

Product cannibalization refers to the strategy implemented by organization for

promoting the sales their new developed product by reducing the market share, sales volume

and sales revenue of the existing product. This particular measures is adopted by organization

to increase the sales volume of new product by using the techniques of capital budgeting.

Any fall in profits from selling of new product should be treated as loss and this strategy

considerably impacts the capital budgeting analysis of the new project that is undertaken.

Application of capital budgeting tool when analyzing the estimated sales errors:

The management of Saturn Pet Care has evaluated that the sales budget that have been

estimated is unusually high that would have influence on the analysis of capital budgeting.

Such errors inn estimation would have direct impact on capital budgeting analysis and

ultimately impacting the investment decision. Therefore, in order to neutralize the impact of

such errors in estimation, it is required by Saturn Pet Care to take proper measures. In this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

regard, Saturn should employ technique of net present value as it would help in neutralizing

the effect of such wrong estimation.

Addressing the issues of original value of vacant Wodonga factory:

Considering the original value of vacant factory at the Wodonga site in the analysis of

capital budgeting is one of the concerns faced by management of Saturn Pet Care. When

computing the net present value, the original cost of such factory should be involved as

opined by the strategy finance manager of company. Nevertheless, the inclusion of such

original cost would significantly influence analysis of net present value. This would ultimate

have an impact on the business decision taken by Saturn.

Part B:

Introduction:

The report is prepared for evaluating the financial performance of ARB limited using

the technique of ratio. It also demonstrates the change in capital structure by comparing with

other firms in the industry. Cost of capital has been analyzed by computation of weighted

average cost of capita using CAPM.

Discussion:

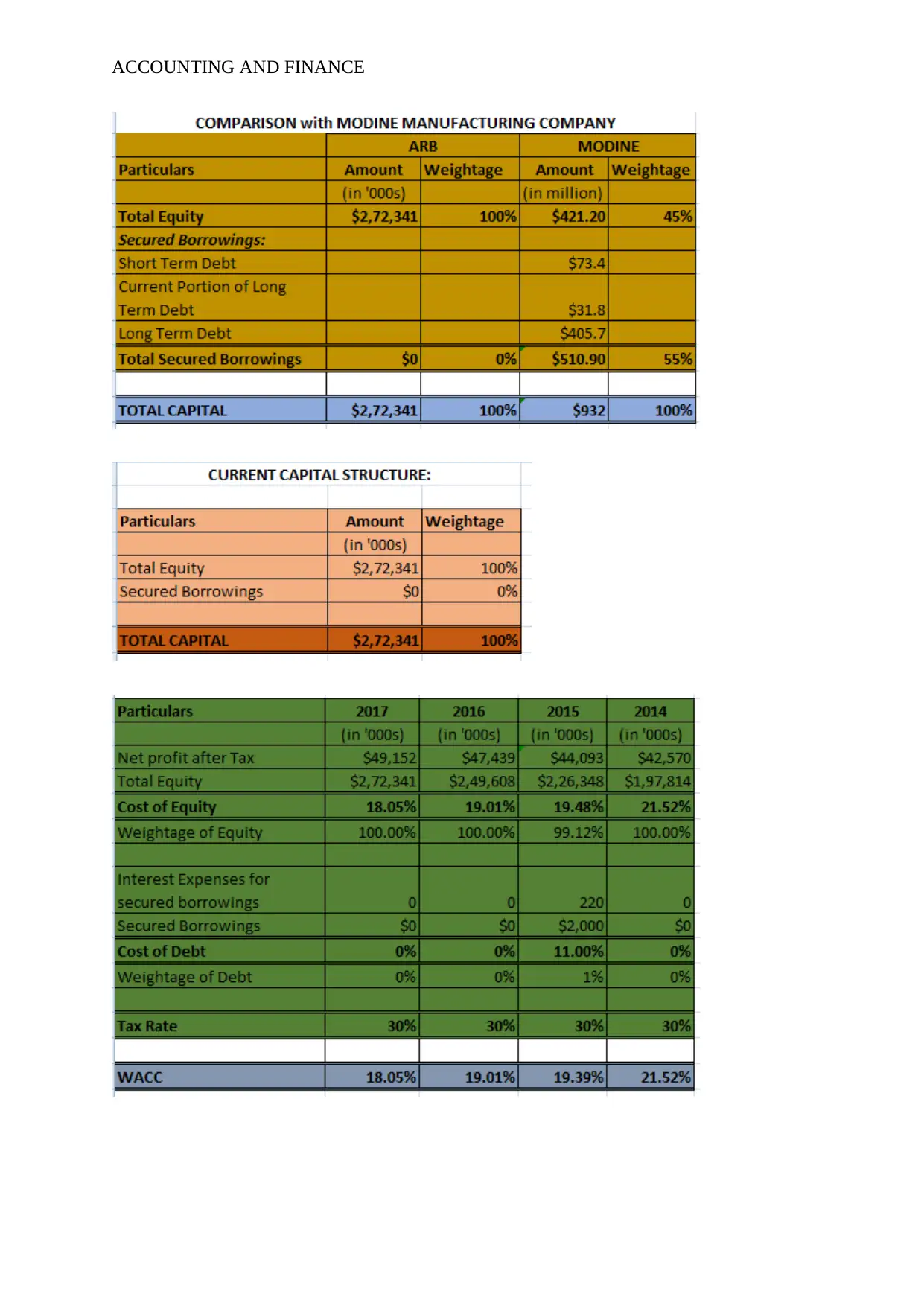

Categorizing ARB limited capital structure:

The capital structure of ARB limited comprises of 100% of equity and there is no

reliance on the external borrowings by company. Total amount of capital stood at $ 272341.

regard, Saturn should employ technique of net present value as it would help in neutralizing

the effect of such wrong estimation.

Addressing the issues of original value of vacant Wodonga factory:

Considering the original value of vacant factory at the Wodonga site in the analysis of

capital budgeting is one of the concerns faced by management of Saturn Pet Care. When

computing the net present value, the original cost of such factory should be involved as

opined by the strategy finance manager of company. Nevertheless, the inclusion of such

original cost would significantly influence analysis of net present value. This would ultimate

have an impact on the business decision taken by Saturn.

Part B:

Introduction:

The report is prepared for evaluating the financial performance of ARB limited using

the technique of ratio. It also demonstrates the change in capital structure by comparing with

other firms in the industry. Cost of capital has been analyzed by computation of weighted

average cost of capita using CAPM.

Discussion:

Categorizing ARB limited capital structure:

The capital structure of ARB limited comprises of 100% of equity and there is no

reliance on the external borrowings by company. Total amount of capital stood at $ 272341.

ACCOUNTING AND FINANCE

WACC computation:

The above table depicts that there is a change in weighted average cost of capital by

considerable amount. WACC stood at 21.52% in year 2014 as against 18.05% in year 2017.

It is suggested by figure that there is continuous fall in WACC.

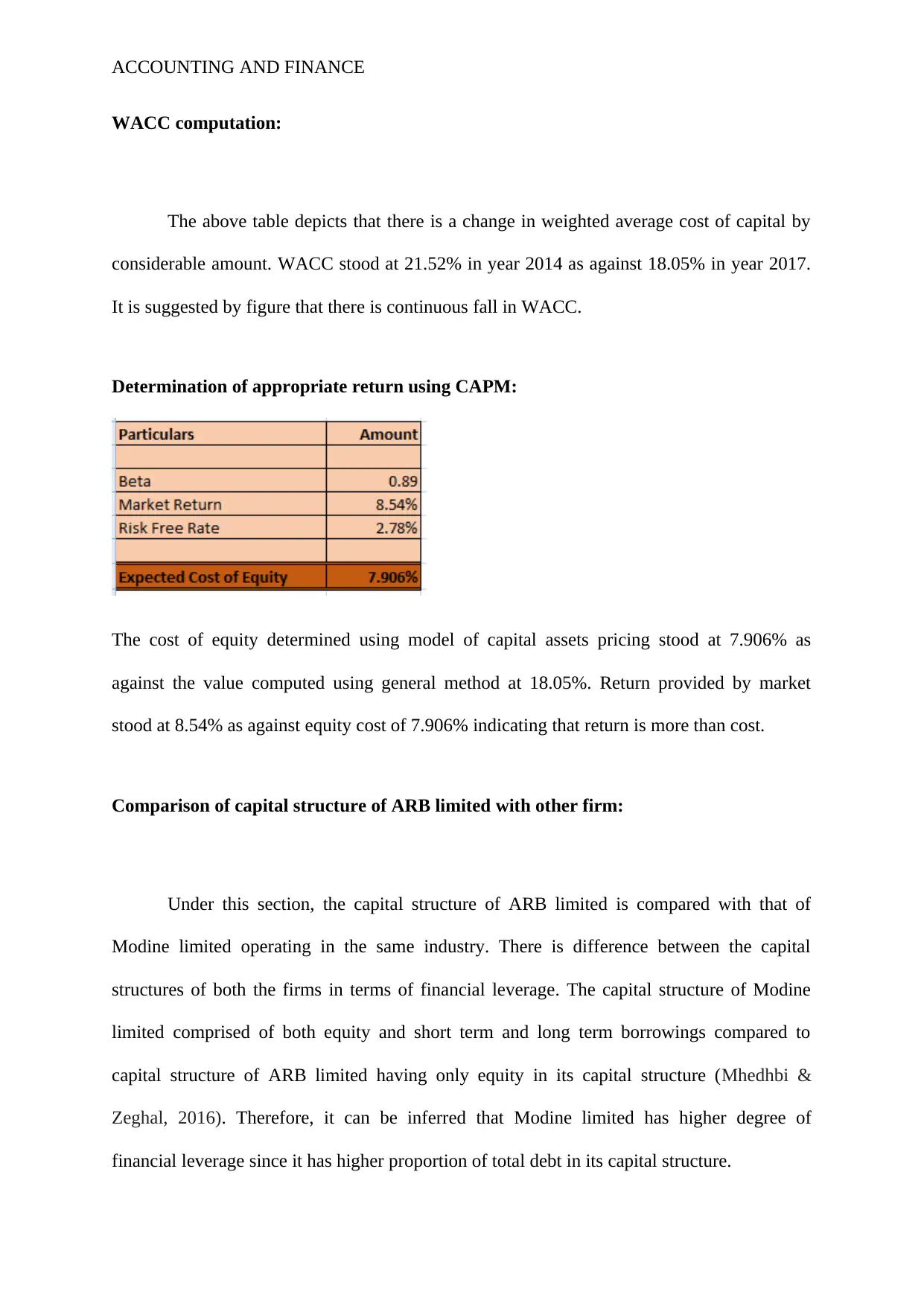

Determination of appropriate return using CAPM:

The cost of equity determined using model of capital assets pricing stood at 7.906% as

against the value computed using general method at 18.05%. Return provided by market

stood at 8.54% as against equity cost of 7.906% indicating that return is more than cost.

Comparison of capital structure of ARB limited with other firm:

Under this section, the capital structure of ARB limited is compared with that of

Modine limited operating in the same industry. There is difference between the capital

structures of both the firms in terms of financial leverage. The capital structure of Modine

limited comprised of both equity and short term and long term borrowings compared to

capital structure of ARB limited having only equity in its capital structure (Mhedhbi &

Zeghal, 2016). Therefore, it can be inferred that Modine limited has higher degree of

financial leverage since it has higher proportion of total debt in its capital structure.

WACC computation:

The above table depicts that there is a change in weighted average cost of capital by

considerable amount. WACC stood at 21.52% in year 2014 as against 18.05% in year 2017.

It is suggested by figure that there is continuous fall in WACC.

Determination of appropriate return using CAPM:

The cost of equity determined using model of capital assets pricing stood at 7.906% as

against the value computed using general method at 18.05%. Return provided by market

stood at 8.54% as against equity cost of 7.906% indicating that return is more than cost.

Comparison of capital structure of ARB limited with other firm:

Under this section, the capital structure of ARB limited is compared with that of

Modine limited operating in the same industry. There is difference between the capital

structures of both the firms in terms of financial leverage. The capital structure of Modine

limited comprised of both equity and short term and long term borrowings compared to

capital structure of ARB limited having only equity in its capital structure (Mhedhbi &

Zeghal, 2016). Therefore, it can be inferred that Modine limited has higher degree of

financial leverage since it has higher proportion of total debt in its capital structure.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING AND FINANCE

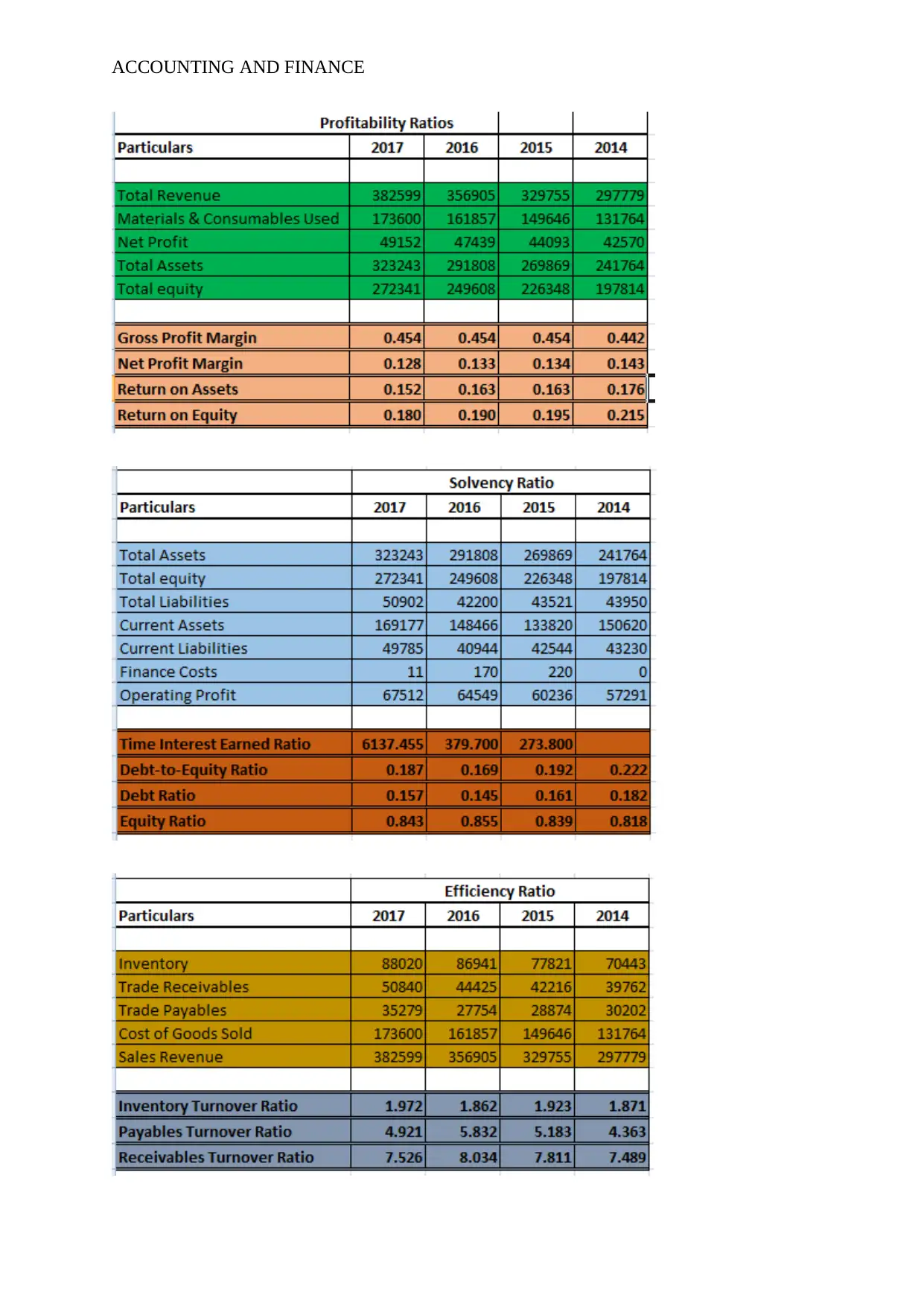

Analyzing key financial ratios of ARB limited:

Under this section, three financial ratios that are profitability ratios, efficiency ratios

and solvency ratios have been computed.

When looking at profitability ratios, it can be seen that net profit margin, return on

assets and return on equity has declined year on year. However, gross profit margin remained

at same value of 0.454 for three continuous years. Therefore, the overall profitability position

company has declined.

Solvency ratio has been analyzed by the computation of debt ratio, debt to equity

ratio, time interest earned ratio and equity ratio. There has been considerable decline in all the

ratios year on year and this is indicative of the fact that the solvency position of company

have deteriorated.

The efficiency position of company has been analyzed by computing inventory

turnover ratio, receivables turnover ratio and payables turnover ratio (Kucherkova, 2014).

From the above table, it can be inferred that efficiency position of company has reduced.

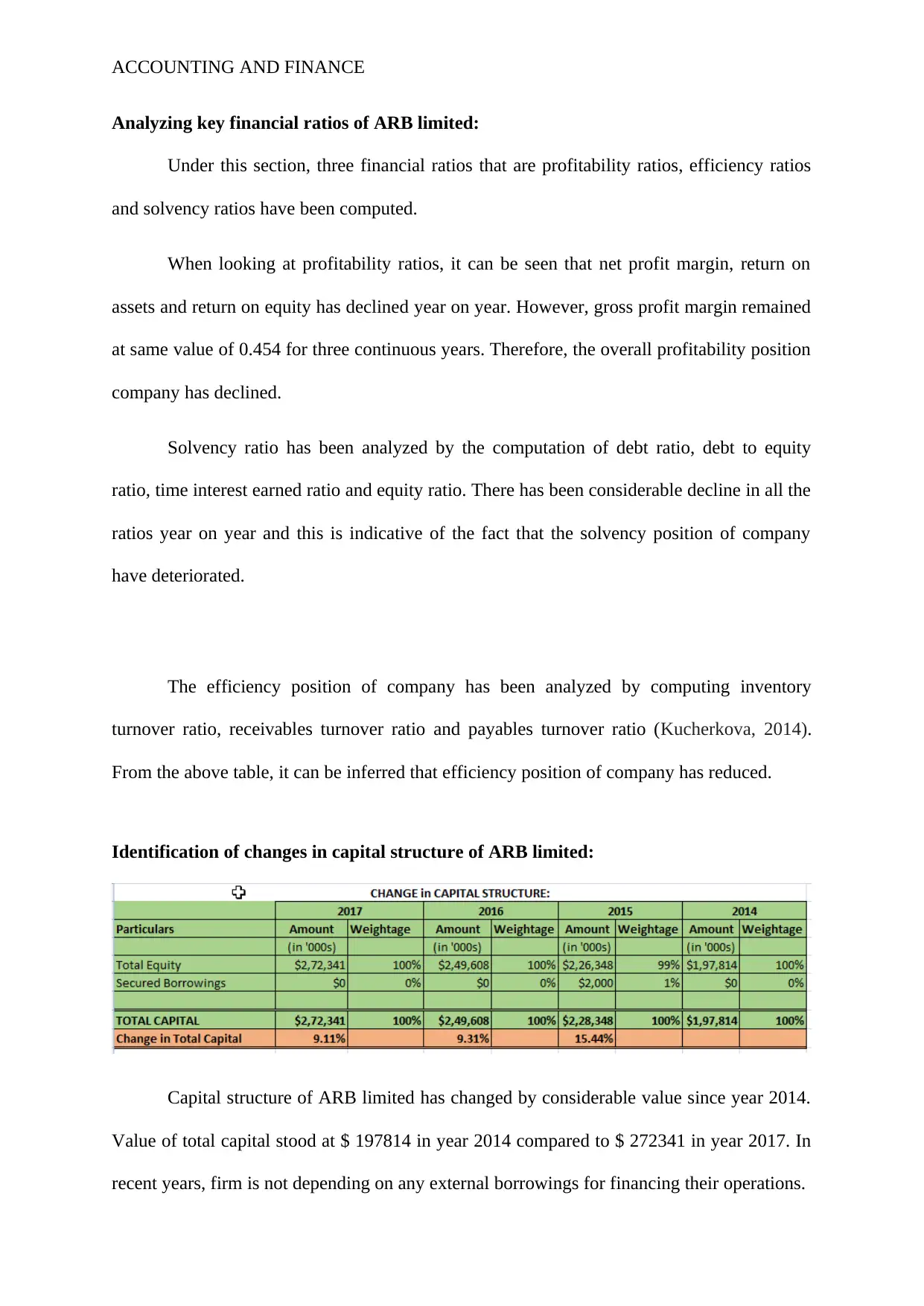

Identification of changes in capital structure of ARB limited:

Capital structure of ARB limited has changed by considerable value since year 2014.

Value of total capital stood at $ 197814 in year 2014 compared to $ 272341 in year 2017. In

recent years, firm is not depending on any external borrowings for financing their operations.

Analyzing key financial ratios of ARB limited:

Under this section, three financial ratios that are profitability ratios, efficiency ratios

and solvency ratios have been computed.

When looking at profitability ratios, it can be seen that net profit margin, return on

assets and return on equity has declined year on year. However, gross profit margin remained

at same value of 0.454 for three continuous years. Therefore, the overall profitability position

company has declined.

Solvency ratio has been analyzed by the computation of debt ratio, debt to equity

ratio, time interest earned ratio and equity ratio. There has been considerable decline in all the

ratios year on year and this is indicative of the fact that the solvency position of company

have deteriorated.

The efficiency position of company has been analyzed by computing inventory

turnover ratio, receivables turnover ratio and payables turnover ratio (Kucherkova, 2014).

From the above table, it can be inferred that efficiency position of company has reduced.

Identification of changes in capital structure of ARB limited:

Capital structure of ARB limited has changed by considerable value since year 2014.

Value of total capital stood at $ 197814 in year 2014 compared to $ 272341 in year 2017. In

recent years, firm is not depending on any external borrowings for financing their operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

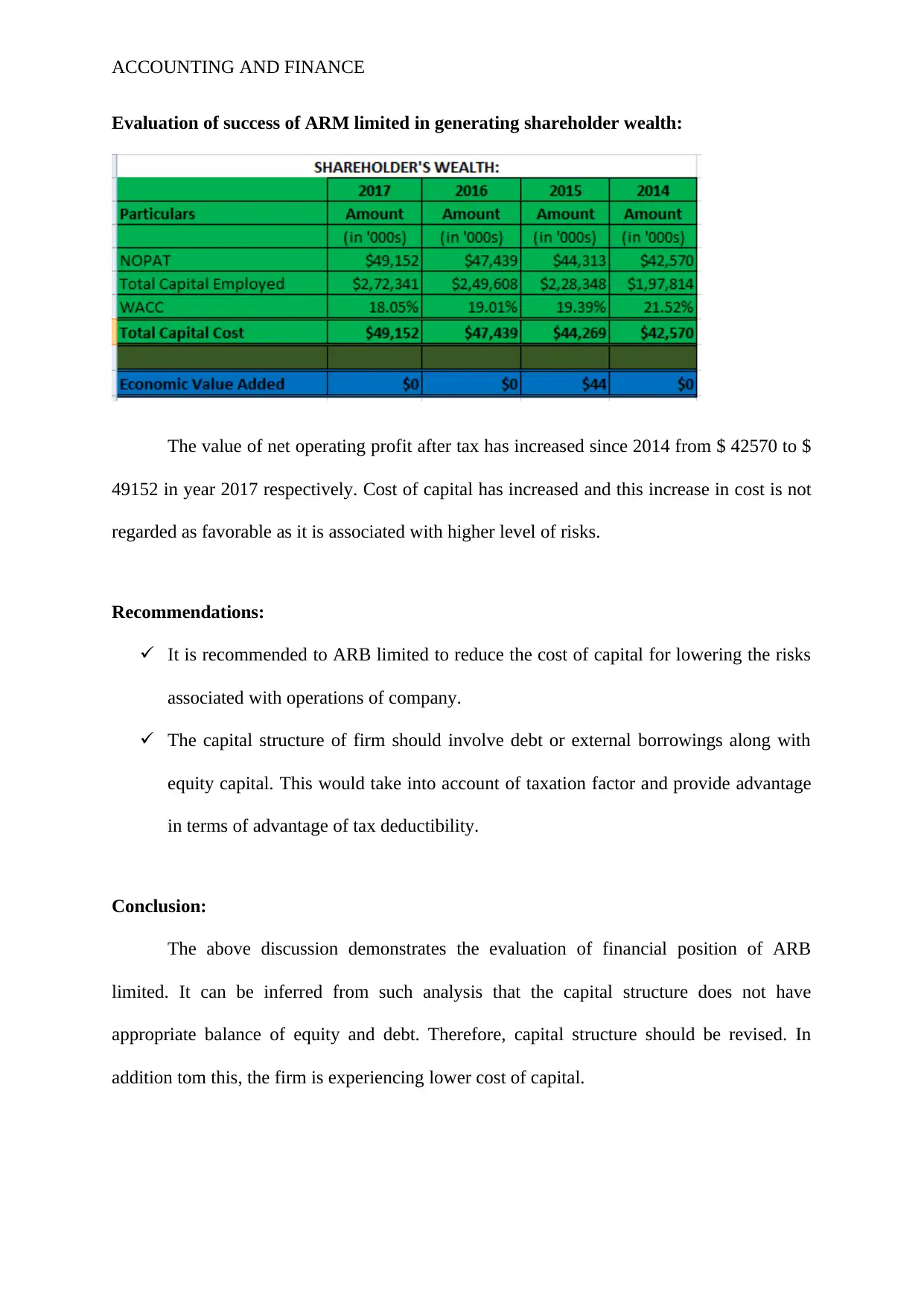

Evaluation of success of ARM limited in generating shareholder wealth:

The value of net operating profit after tax has increased since 2014 from $ 42570 to $

49152 in year 2017 respectively. Cost of capital has increased and this increase in cost is not

regarded as favorable as it is associated with higher level of risks.

Recommendations:

It is recommended to ARB limited to reduce the cost of capital for lowering the risks

associated with operations of company.

The capital structure of firm should involve debt or external borrowings along with

equity capital. This would take into account of taxation factor and provide advantage

in terms of advantage of tax deductibility.

Conclusion:

The above discussion demonstrates the evaluation of financial position of ARB

limited. It can be inferred from such analysis that the capital structure does not have

appropriate balance of equity and debt. Therefore, capital structure should be revised. In

addition tom this, the firm is experiencing lower cost of capital.

Evaluation of success of ARM limited in generating shareholder wealth:

The value of net operating profit after tax has increased since 2014 from $ 42570 to $

49152 in year 2017 respectively. Cost of capital has increased and this increase in cost is not

regarded as favorable as it is associated with higher level of risks.

Recommendations:

It is recommended to ARB limited to reduce the cost of capital for lowering the risks

associated with operations of company.

The capital structure of firm should involve debt or external borrowings along with

equity capital. This would take into account of taxation factor and provide advantage

in terms of advantage of tax deductibility.

Conclusion:

The above discussion demonstrates the evaluation of financial position of ARB

limited. It can be inferred from such analysis that the capital structure does not have

appropriate balance of equity and debt. Therefore, capital structure should be revised. In

addition tom this, the firm is experiencing lower cost of capital.

ACCOUNTING AND FINANCE

References list:

Buncic, D., Eggins, J. E., & Hill, R. J. (2015). Measuring fund style, performance and

activity: a new style‐profiling approach. Accounting & Finance, 55(1), 29-55.

Gitman, L. J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson

Higher Education AU.

Hao, G., Rainsbury, L., & Wang, S. (2016). International progress: reflections of General

Hedge Accounting Standards.

Kucherkova, S. (2014). Role of Accounting Reporting as an Information Source in Attracting

Investments. Accounting and Finance, (3), 47-51.

Mhedhbi, K., & Zeghal, D. (2016). Adoption of international accounting standards and

performance of emerging capital markets. Review of Accounting and Finance, 15(2),

252-272.

Scott, W. R. (2015). Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Utenkova, K. (2014). Asset Accounting According to National and International

Standards. Accounting and Finance, (2), 79-83.

Zhou, M. (2016). Does accounting for uncertain tax benefits provide information about the

relation between book-tax differences and earnings persistence?. Review of

Accounting and Finance, 15(1), 65-84.

References list:

Buncic, D., Eggins, J. E., & Hill, R. J. (2015). Measuring fund style, performance and

activity: a new style‐profiling approach. Accounting & Finance, 55(1), 29-55.

Gitman, L. J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson

Higher Education AU.

Hao, G., Rainsbury, L., & Wang, S. (2016). International progress: reflections of General

Hedge Accounting Standards.

Kucherkova, S. (2014). Role of Accounting Reporting as an Information Source in Attracting

Investments. Accounting and Finance, (3), 47-51.

Mhedhbi, K., & Zeghal, D. (2016). Adoption of international accounting standards and

performance of emerging capital markets. Review of Accounting and Finance, 15(2),

252-272.

Scott, W. R. (2015). Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Utenkova, K. (2014). Asset Accounting According to National and International

Standards. Accounting and Finance, (2), 79-83.

Zhou, M. (2016). Does accounting for uncertain tax benefits provide information about the

relation between book-tax differences and earnings persistence?. Review of

Accounting and Finance, 15(1), 65-84.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING AND FINANCE

Appendix:

Appendix:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

ACCOUNTING AND FINANCE

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.