Financial Reporting Analysis: Blackmores Plc Performance Report

VerifiedAdded on 2020/02/24

Accounting and Financial Reporting: Blackmores Plc Australia

Paraphrase This Document

Executive Summary of Findings

Blackmores is leader in the field of healthcare products and supplements. Its focus is maintaining

health with the use of natural products since 1930. Blackmores is having command in vitamins,

minerals, herbs and various nutrients based supplements with over 250 varieties. In 2016

Blackmores was awarded with the ‘Most Trusted Brand’. It established its business in more than

17 countries with more than 1000 employees. The vision is to produce health giving property

based on natural herbs and minerals.

There are some mandatory requirements for proper working of an organization. Accounting of

the various transactions helps to disclose financial statements in a very clear form which is very

important for the companies. It is crucial in terms of disclosure of information and comparison of

the performance in industry. It also helps to review and understand the trend of the company

whether it is improving from past performance or not. This results to implementation decisions.

Stakeholders also depend on the financial information of the companies as it is analyzed as the

parameter for the current condition in terms of finance, market share and performance. The

internal stakeholders use this information for current performance and to plan future strategy.

Whereas external stakeholders are interested in profits and impact of decisions on financial

condition of the company as profits and sales figures are the key indicators for performance. The

main statements viewed by stakeholders are balance sheet, income and cash flow statements.

The profit in year 2012 was 13,565 thousand Australian dollars which increased to 10.7%, 53%,

115% in respective years from 2012 to 2015. Afterwards the profits and sales decreased by

around 40% in 2016. It can be stated that there is a huge difference between the asset of 2016

and 2015 as AUS$2,94,624 and AUS$1,87,844 which can influence the decisions of

stakeholders. Current liabilities of company is measured as AUS$2,53,430 in year 2016 This

happened due to change in preferences and an online seller from china backed off from selling

Blackmores products. Cash and cash equivalents has also been generate at lower rate as

AUS$2191 and increased up to the AUS$37653. Sales is also decreased in comparison to 2015

from AU$ 341433000 to AU$322129000 as on 31 December 2016.

The business operating cash flows are $83.7 million which is about 18% growth from past year

2015. The cash conversion ratio of 81% shows that it focused on success in operational strategy.

The gearing ratio as a group remained low at 9.1% with comparison to 5.1% in 2015. After the

acquisition of Global therapeutics still company is having net interest cover ratio at 80.2 times

which is far more than 21.1 times in 2015. Equity of the company also increased to $181 from

$133 million at the end of the year 2016. Around $48 million growth due to group Net profit

after tax, retained earnings and joint venture profits.

EPS of the company is also increased around $6 than past year so ROA and EPS shows that

Blackmores on right track in terms of profitability and it is the takeovers and new ventures that

are responsible for the fluctuations in the financial statements. The other ratio such as liquidity

ratio shows good position of the company to pay for the debts and fulfilling the working capital

requirements. There is also requirement to maintain safety and standards of the products as high

regulation is observed on the manufacturers and suppliers of health related products. It is also a

sensitive product which can lead to serious damage to the company financial position in case of

negative news or bad consequences of the products supplied.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

This report is presented to demonstrate the reliability and efficiency of accounting and financial

reporting over the company. As ASX listed company, Blackmore’s financial statements are

evaluated with reference to financial reporting. Information is presented in reliable and

transparent manner to represent the actual financial performance of company. It also includes the

financial ratios analysis to support the efficiency of financial statement which creates a clear

picture for the performance of business.

Paraphrase This Document

Slide 1: Accounting and Financial Reporting

Slide 2: Table of Content

Slide 3: Presentation Introduction

Slide 4: Company Background: Blackmores

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Blackmores limited is the one of the top brands in the category of the natural health in Australia.

It deals in various products such as minerals, herbal, vitamin and nutritional supplements. It

provides more than 250 varieties of vitamin, herbal, minerals and nutritional supplements.

Maurice Blackmore established the Blackmores limited in 1930 (Blackmores (2017). The

headquarter of Blackmores limited is in New South Wales, Australia. The Blackmores limited

manages its business in various countries such as China, New Zealand, Singapore, Malaysia,

Japan, Thailand, Korea, Cambodia, United States, and Macau. Since last 8 years, the Blackmores

has been winning most trusted brand in the Australia for vitamins and supplements.

Slide 5: Company Background

Share price is also indicator for the financial performance of the company based on the trend in

the stock price and the management decisions the stake holders decide to stay or exit from an

investment. The good profits results to increase in the share price of a company on the other side

it can be said that high share price of a company indicated increased profits of the company.

Paraphrase This Document

From year 2013 to year 2015 the company was performing average due to several takeover

decisions. But its profits increased suddenly in 2015-16 due to its entry in Asian market. So the

share price is at peak of AUD $217.18 in this period of time and the decisions of the

management is having direct impact on the share performance as stakeholders depends on the

financial and accounting information of a company (BKL AU, 2017).

Slide 6: Financial Performance Evaluation of Blackmores

From the observation of balance sheet, it can be stated that there is a huge difference between the

asset of 2016 and 2015 as AUS$2,94,624 and AUS$1,87,844 which can influence the decisions

of stakeholders. On the other hand, current liabilities of company is measured as AUS$2,53,430

in year 2016 which can also a point that the liabilities over the companies are also increasing that

also have adverse impact over the stakeholders to judge the stability of company in perspective

market. On the other hand, the liabilities and assets both are increasing with huge turn so, it can

be derived that the market capture strategy brought the impact over the financial data of

Blackmore. In terms of equity, it can be inferences that reserve funding of business has reduced

from AUS$8063 to AUS$5252 M. On the other side it is also assessed that the total equity of

company has also increased with reference to year 2015 to 2016.

Further, over the income statement observation, it can be said that the sales of company has

jumped in turbulent manner. With this, net revenue for the Blackmore has also increased so it

shows the satisfactory performance for the stakeholders to take the affirmative decisions. Profit

and loss data indicates the good performance of company in year 2016 as compare to 2015. It is

also reviewed that the income tax burden over the company has increased as it might taken the

loan from the financial institutions; it can affect the position of company adversely.

Slide 7: Financial Performance Contd.

Over the looking of cash flow, it is captured that good amount of cash has been generated from

the operating activities but most of it would be adjusted in the payment of employees and

suppliers. On the other hand, the investing and financing activities have generated negative cash

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

flow over the year 2016. It is positively noted that cash and cash equilent has also been generate

at lower rate as AUS$2191 and increased up to the AUS$37653. Overall, it has generated $100

million profit for the financial year 2016 and it has stumbled the growth as 115% in relation to

last financial year performance. These data are indicating the good financial position left out

interest on activities. Along with this the, market cap values for the company has also tapped as

AUS$1,757,380,000 which is also experienced the significant market capture at this time.

On the basis of above performance, it is reviewed that the shareholder’s equity has increased

with rapid changes. At the same time, the gear ratio has dumped in year 2015 but the year 2016

has experiencing good positive reflection over geared ratio of Blackmore as the figures are

indicating.

Slide 8: Financial Performance Contd.

The above cited graph is indicating the gearing ratio of Blackmore as it had downward in year

2015 where, it was above 40 and it got down by 10 which is not good for the company. As the

Paraphrase This Document

movement of ratio from the year 2016 it is upward which signs the increasing movement of

company’s gearing performance ratio.

Slide 9: Measurement of Key Factors

Impact of Convention over Accounting: Accounting conventions have significant impact over

the accounting assessment as it influences by its rules and regulations of standards to follow

while creating financial report of performance of business. Assets is influenced by the

conventions as the company has shown the higher assets that it can create challenges for the

stakeholders to found the actual asset for company as Blackmores has shown huge difference

between the asset of 2015 and 2016 which can affect the management also to present the

evidence to the financial reporting authority in order to prove the asset management. At the same

time, the shareholders and owner’s equity should be separate from the business transactions.

In concern to the convention, management should produce the real and reliable information for

the external stakeholder’s to intake decision while investing in business because the data derives

the real picture for the performance of business (Needles, et. al, 2013). At the same time,

owner’s equity should be treated separately from the business to assess the position of business.

Along with this, the convention of consistency should be taken into accounting while preparing

the financial statements as it essential to follow the principles and procedure to present the

accounting information in effective manner.

Managerial Judgment: Materiality convention is directly linked to the management judgment that

enforces the accountant management to consider the standard while assessing and presenting the

information in real manner.

Relevance of Information: It is important to consider the relevancy of information with the

performance of business as the shown graph indicates about the significant performance of

business, it should be related to the exact information because it might dilutes the stakeholders

such as sales of business has increased (V. 2011). Faithful Presentation: Faithful presentation of

financial performance leads to the reliability of company’s presence in perspective market. So,

following the accounting standards, it should not make any error and omission to evaluating the

viability of company.

Slide 10: Financial Ratio Analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

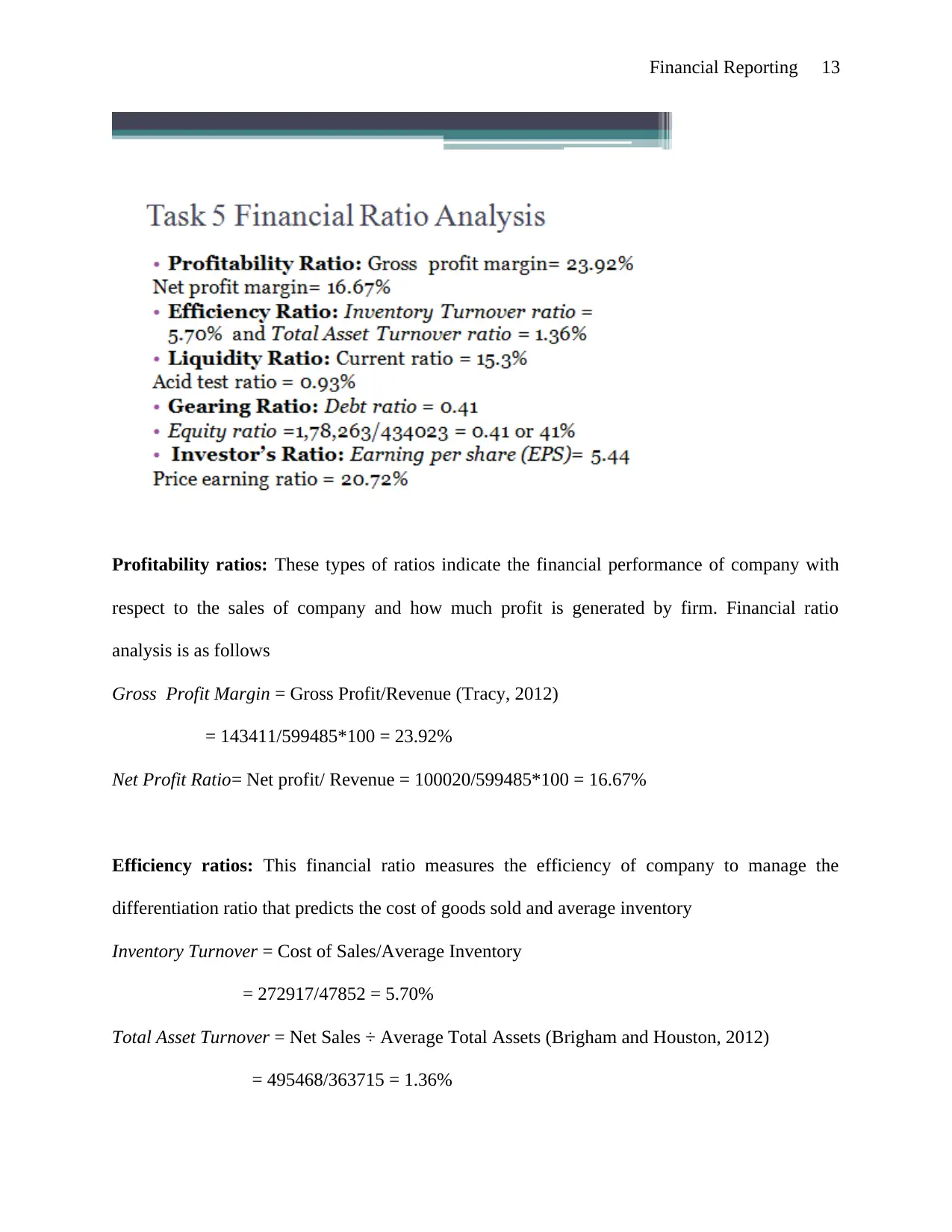

Profitability ratios: These types of ratios indicate the financial performance of company with

respect to the sales of company and how much profit is generated by firm. Financial ratio

analysis is as follows

Gross Profit Margin = Gross Profit/Revenue (Tracy, 2012)

= 143411/599485*100 = 23.92%

Net Profit Ratio= Net profit/ Revenue = 100020/599485*100 = 16.67%

Efficiency ratios: This financial ratio measures the efficiency of company to manage the

differentiation ratio that predicts the cost of goods sold and average inventory

Inventory Turnover = Cost of Sales/Average Inventory

= 272917/47852 = 5.70%

Total Asset Turnover = Net Sales ÷ Average Total Assets (Brigham and Houston, 2012)

= 495468/363715 = 1.36%

Paraphrase This Document

Liquidity ratios: Liquidity of firm is assessed over the current ratio and quick ratio evaluation.

Assess the ability of the firm to manage working capital and its ability to pay its short-term debts

without running.

Current ratio = Current asset/Current Liability = 294,624 / 192,279 = 1.53%

Acid test ratio = Current asset –Inventories / Current Liabilities = 294624-116,486/192279 =

0.93%

(Drake and Fabozzi, 2012)

Gearing ratios: Assess the long-term capital structure of the business

Debt ratio = Total debt/Total asset

= 17,793/434,023 = 0.041

Equity ratio = Shareholder’s funds/Total asset

= 1,78,263/434023 = 0.41 or 41%

In terms of the relative quantities of debt and equity capital

Investor ratios: This type of ratio indicates the shareholders about the performance of company

to equate the debt to equity and market debt of company within specific time duration.

Earnings per share (EPS) = Net income –Preferred dividends/Share issued outstanding

= 100,020 –6285 /17225

= 5.44

Price-Earnings Ratio = Market Price per Share ÷ Earnings per Share

= 119.57/5.76 =20.72%

The above analyzed ratio indicates the good financial position of company over the performance

of Blackmores in year 2016 as compare to the year 2015.

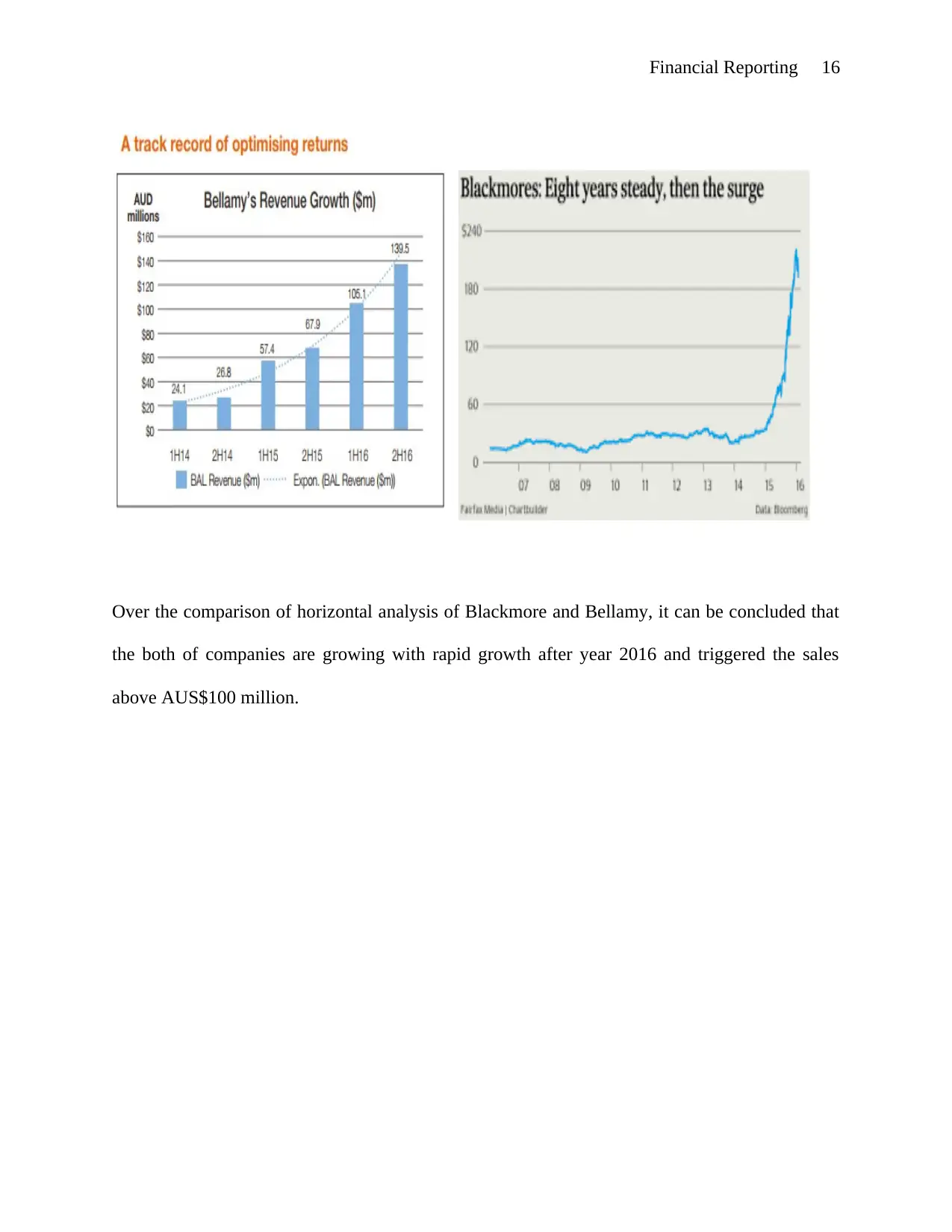

Slide 11: Horizontal Analysis

In concerned to the horizontal analysis of company, it is presented to measure the financial

performance of company with reference the Bellamy's Australia Limited which also deals in the

consumer staples (Businessinsider, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

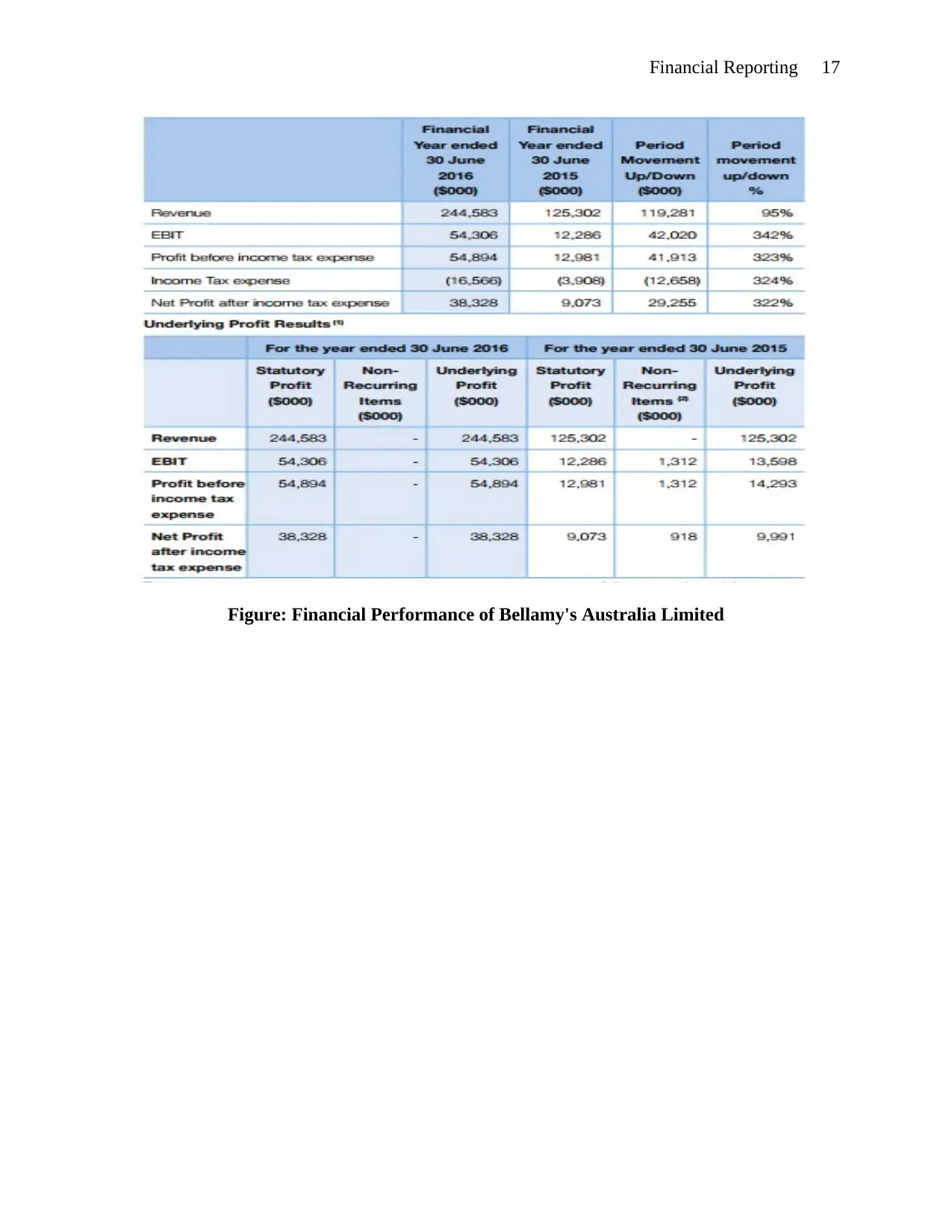

Over the comparison of horizontal analysis of Blackmore and Bellamy, it can be concluded that

the both of companies are growing with rapid growth after year 2016 and triggered the sales

above AUS$100 million.

Paraphrase This Document

Figure: Financial Performance of Bellamy's Australia Limited

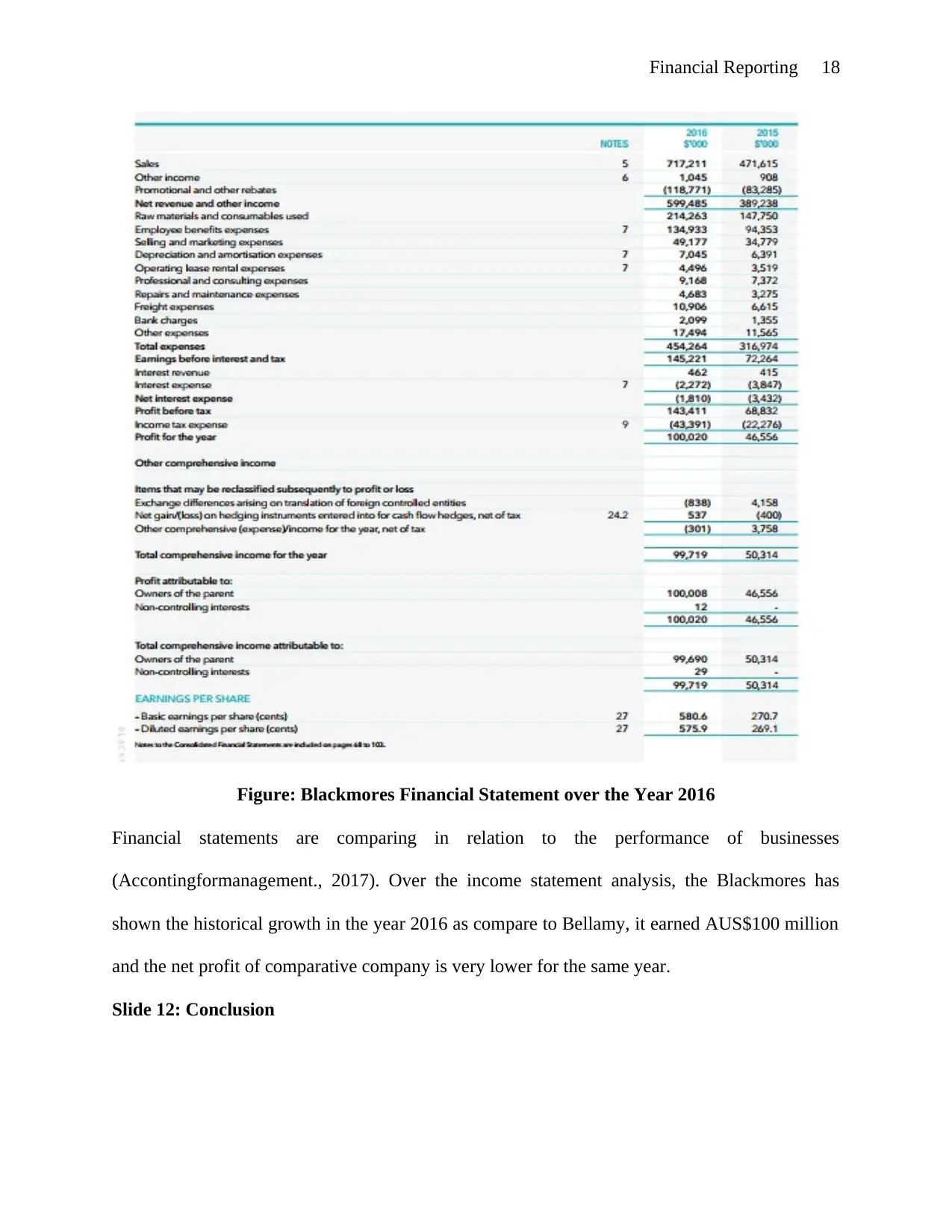

Figure: Blackmores Financial Statement over the Year 2016

Financial statements are comparing in relation to the performance of businesses

(Accontingformanagement., 2017). Over the income statement analysis, the Blackmores has

shown the historical growth in the year 2016 as compare to Bellamy, it earned AUS$100 million

and the net profit of comparative company is very lower for the same year.

Slide 12: Conclusion

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is concluded that companies needs investments from shareholders and investors. Stakeholders

depend upon the financial reporting and financial steps of a company so it becomes vital for the

companies to have transparency and full disclosure of information. Following accounting

standards and principles will results to build trust and confidence of the all related factors

towards the companies.

Slide 13: References

Paraphrase This Document

References

Accountingformanagement, (2017). Horizontal or trend analysis of financial statements.

Available at: https://www.accountingformanagement.org/horizontal-analysis-of-financial-

statements/ (Accessed: August 25, 2017).

Annualreports, (2016). Annual Report of BELLAMY’S 2016. Available at:

http://www.annualreports.com/HostedData/AnnualReports/PDF/ASX_BAL_2016.pd

(Accessed: August 25, 2017).

BKL AU (2017). Bloomberg markets. Retrieved from:

https://www.bloomberg.com/quote/BKL:AU

Black mores (2016). Annual report 2016. Retrieved From: http://blackmores2016.annual-

report.com.au/

Blackmores (2017). About us. Retrieved from: https://www.blackmores.com.au/about-us

Brigham, E. and Houston, J. (2012). Fundamentals of Financial Management. USA: Cengage

Learning.

Businessinsider, (2017) 2 ways to analyze an income statement. Available at:

http://www.businessinsider.com/horizontal-and-vertical-analysis-of-income-statements-2017-3?

IR=T (Accessed: August 25, 2017).

Drake, P. and Fabozzi, F. (2012). Analysis of Financial Statements. UK: John Wiley and Sons.

Needles, B., Powers, M. and Crosson, D. (2013). Principles of Accounting. USA: Cengage

Learning.

Tracy, A. (2012). Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to

Analyze Any Business on the Planet. USA: RatioAnalysis.Net.

V. R. (2011). Financial Accounting. India: Pearson Education.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.