Accounting and Audit Framework: Risk, Control, and Fair Value Analysis

VerifiedAdded on 2023/06/07

|13

|3817

|460

Report

AI Summary

This report provides a detailed analysis of accounting and audit frameworks, focusing on various key aspects. It begins by discussing the risks and controls associated with the application of Electronic Data Interchange (EDI), including security, privacy, and processing integrity, and proposes effective controls to minimize these risks. The report then explains general IT controls found in computer-based information systems, categorized as preventive, detective, and corrective controls. Furthermore, it addresses the problems associated with fair value accounting, contrasting it with the historical cost method and highlighting the benefits of the latter. The limitations of internal control are also explored, along with potential issues arising from dependence on senior management. The report also covers the development of an audit plan and the circumstances under which an auditor may share client information with third parties, emphasizing ethical obligations. Finally, the report includes a financial ratio analysis, examining gross profit margin, return on capital employed, operating profit margin, asset turnover ratio, and gearing ratio.

Accounting and Audit

Framework

Framework

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Question 1........................................................................................................................................3

a. Discuss risk and controls associated with application of electronic data interchange.......3

b. Explain general It controls that are found in a computer based information system by an

auditor.....................................................................................................................................4

Question 2........................................................................................................................................5

a) Three problem associated with using fair value of accounting..........................................5

b) Discuss why fair value method is more relevant than historical accounting method........5

c) Mention three benefit of conventional historical cost method...........................................5

Question 3........................................................................................................................................6

a) Mention five limitation of internal control.........................................................................6

b) Explain some of the problem that may arise because of the dependence on senior

management............................................................................................................................6

Question No 4..................................................................................................................................7

a) Audit Plan...........................................................................................................................7

b) Auditor’s consent...............................................................................................................8

Question 5........................................................................................................................................9

Gross profit margin:...............................................................................................................9

Return on capital employed..................................................................................................10

Operating profit margin........................................................................................................10

Asset turnover ratio..............................................................................................................11

Gearing ratio.........................................................................................................................12

REFERENCES..............................................................................................................................13

Question 1........................................................................................................................................3

a. Discuss risk and controls associated with application of electronic data interchange.......3

b. Explain general It controls that are found in a computer based information system by an

auditor.....................................................................................................................................4

Question 2........................................................................................................................................5

a) Three problem associated with using fair value of accounting..........................................5

b) Discuss why fair value method is more relevant than historical accounting method........5

c) Mention three benefit of conventional historical cost method...........................................5

Question 3........................................................................................................................................6

a) Mention five limitation of internal control.........................................................................6

b) Explain some of the problem that may arise because of the dependence on senior

management............................................................................................................................6

Question No 4..................................................................................................................................7

a) Audit Plan...........................................................................................................................7

b) Auditor’s consent...............................................................................................................8

Question 5........................................................................................................................................9

Gross profit margin:...............................................................................................................9

Return on capital employed..................................................................................................10

Operating profit margin........................................................................................................10

Asset turnover ratio..............................................................................................................11

Gearing ratio.........................................................................................................................12

REFERENCES..............................................................................................................................13

Question 1

a. Discuss risk and controls associated with application of electronic data interchange.

Electronic Data Interchange is the electronic exchange of business information by utilising

a standardized form. It is a procedure which permits one organisation to transfer data to another

organisation electronically instead of using paper. Business concerns running business

electronically are termed as trading partners (Albawwat, 2021). General examples of EDI include

purchase orders (EDI 850), shipping statues (EDI 214), confirmations of payment (EDI 820) and

documenting inventory. The customary EDI format permits systems to generate EDI documents.

Risk associated with application of EDI

Security and confidentiality: Advanced reach and transferring data usually requires

opening of information system so that data can be accessed and shared. This may also

lead to presentation of sections of organisation to digital security threats that can results

in disrupt the accessibility, honesty and confidentiality of information system on which

economic and social activities of Wise Limited depends. Unauthorised access, decline of

purchase transactions, hacker and other network break-inn are also a threat to company.

Violation of privacy: In case where individuals and companies agrees and give consent

to particular terms for data sharing which includes the motive for which the data should

be accessed, still there is a level of risk associated to third party that whether intentionally

or unintentionally they will utilise data in a different manner. Certain threats have been

framed as ethical, to permit the requirement to identify the significance of problems such

as fairness, respect for human dignity etc.

Processing Integrity: Sometimes invalid data entered by the vendors also creates

possibilities of risk in Wise Limited. Errors associated with back end system and

incomplete audit trail also creates situation of risk in the organisation (Dai, He, and Yu,

2019). Availability: Failure of system due to technical errors and attacks by viruses and worms

can also leads to creation of risk in Wise Limited. Sometimes denial of services by

hackers also generated risk in the organisation.

Effective Controls to minimize risks

a. Discuss risk and controls associated with application of electronic data interchange.

Electronic Data Interchange is the electronic exchange of business information by utilising

a standardized form. It is a procedure which permits one organisation to transfer data to another

organisation electronically instead of using paper. Business concerns running business

electronically are termed as trading partners (Albawwat, 2021). General examples of EDI include

purchase orders (EDI 850), shipping statues (EDI 214), confirmations of payment (EDI 820) and

documenting inventory. The customary EDI format permits systems to generate EDI documents.

Risk associated with application of EDI

Security and confidentiality: Advanced reach and transferring data usually requires

opening of information system so that data can be accessed and shared. This may also

lead to presentation of sections of organisation to digital security threats that can results

in disrupt the accessibility, honesty and confidentiality of information system on which

economic and social activities of Wise Limited depends. Unauthorised access, decline of

purchase transactions, hacker and other network break-inn are also a threat to company.

Violation of privacy: In case where individuals and companies agrees and give consent

to particular terms for data sharing which includes the motive for which the data should

be accessed, still there is a level of risk associated to third party that whether intentionally

or unintentionally they will utilise data in a different manner. Certain threats have been

framed as ethical, to permit the requirement to identify the significance of problems such

as fairness, respect for human dignity etc.

Processing Integrity: Sometimes invalid data entered by the vendors also creates

possibilities of risk in Wise Limited. Errors associated with back end system and

incomplete audit trail also creates situation of risk in the organisation (Dai, He, and Yu,

2019). Availability: Failure of system due to technical errors and attacks by viruses and worms

can also leads to creation of risk in Wise Limited. Sometimes denial of services by

hackers also generated risk in the organisation.

Effective Controls to minimize risks

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Authentication: Controls can be exercised by monitoring and accessing the user Id,

passwords of the employees and also keep an eye on the log-in procedures, level of

access and authority tables to reduce the impact of risk associated with security.

Input Controls: It includes routine filed check, validity check, limit check and

reasonableness check of Wise Limited. It also focusses on software testing and computer

logs to reduce the effect of risk (Eierle, Hartlieb, and Ojala, 2021).

Business planning: Backup data and systems are planned in such a way that they assist

Wise limited in a situation of risk. Firewall, encryption, detection of intrusion,

penetration test and vulnerability assessment are taken place to reduce risk.

Network controls: In order to communicate in an effective and efficient manner,

network participants must be capable of transferring and receiving valid business

documents on which both the parties of an agreement agrees. In order to accomplish this

goal, organisation must ensure that fraudulent activities which are using EDI technique

are done at a controlled level.

b. Explain general It controls that are found in a computer based information system by an

auditor.

IT controls used by an Auditor

In order to safeguard the business of Wise Limited against cyberattacks and breaches of

data a number of information controls are used by an auditor. Basic information security controls

fall into three categories namely Preventive controls, Detective controls and Corrective Controls

(Faccia, De Lucia, and Pio Leonardo Cavaliere, 2020). These Controls are further grouped

below:

Physical access controls

Cyber access controls

Procedural controls

Technical controls

Compliance controls

passwords of the employees and also keep an eye on the log-in procedures, level of

access and authority tables to reduce the impact of risk associated with security.

Input Controls: It includes routine filed check, validity check, limit check and

reasonableness check of Wise Limited. It also focusses on software testing and computer

logs to reduce the effect of risk (Eierle, Hartlieb, and Ojala, 2021).

Business planning: Backup data and systems are planned in such a way that they assist

Wise limited in a situation of risk. Firewall, encryption, detection of intrusion,

penetration test and vulnerability assessment are taken place to reduce risk.

Network controls: In order to communicate in an effective and efficient manner,

network participants must be capable of transferring and receiving valid business

documents on which both the parties of an agreement agrees. In order to accomplish this

goal, organisation must ensure that fraudulent activities which are using EDI technique

are done at a controlled level.

b. Explain general It controls that are found in a computer based information system by an

auditor.

IT controls used by an Auditor

In order to safeguard the business of Wise Limited against cyberattacks and breaches of

data a number of information controls are used by an auditor. Basic information security controls

fall into three categories namely Preventive controls, Detective controls and Corrective Controls

(Faccia, De Lucia, and Pio Leonardo Cavaliere, 2020). These Controls are further grouped

below:

Physical access controls

Cyber access controls

Procedural controls

Technical controls

Compliance controls

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 2

a) Three problem associated with using fair value of accounting

There is different way of accounting cost of a possession in books of account such as

market value of the asset or its original acquired cost. All the method has its own benefits and

drawbacks. Fair value accounting is the method in which assets and liabilities are recorded at

current value prevailing in the market (Kend and Nguyen, 2022). But this method has certain

problem associated with usage they are as following: Risk of losing investors interest- when the fair value method is used there is income loss

when the value of the asset goes down. This reflects in the investor’s portfolio as net loss,

since most of the investor are trading everyday this would bring them loss. Company have to face lot of fluctuation- This accounting method is not at all useful for

some business. There are times when due to some reason assets and liabilities value

fluctuate a lot either becomes too high or too low. Due to this reason accounting them

would result in misleading in short term. When things could be different if long term

financial picture is taken.

Historical valuation is lost- If company is showing net loss due to its asset being valued

at reduced amount. Historical value should have some relevance so that accurate results

are produced. Due to fair valuation organisation would face a artificial loss when actually

it is in profit.

b) Discuss why fair value method is more relevant than historical accounting method

The books of accounts of an organisation provide full information to the investor which is

considered fair and original. Fair value of method gives more appropriate value of the assets and

liabilities. This is because valuation should be given after adjusting goodwill, depreciation and

impairments. This might increase the volatility but is essential for effective decision making.

And also important for transparency and fair disclosers to the stakeholders (Khalid, Haron, and

Masron, 2018). Hence, fair value method is more relevant than historical cost method.

c) Mention three benefit of conventional historical cost method.

Objectivity and reliability of accounting information- This method increases the

accuracy and reliability of the data. Since there is no room for adjustment no

increase decrease in the original value takes place manipulation is not possible.

a) Three problem associated with using fair value of accounting

There is different way of accounting cost of a possession in books of account such as

market value of the asset or its original acquired cost. All the method has its own benefits and

drawbacks. Fair value accounting is the method in which assets and liabilities are recorded at

current value prevailing in the market (Kend and Nguyen, 2022). But this method has certain

problem associated with usage they are as following: Risk of losing investors interest- when the fair value method is used there is income loss

when the value of the asset goes down. This reflects in the investor’s portfolio as net loss,

since most of the investor are trading everyday this would bring them loss. Company have to face lot of fluctuation- This accounting method is not at all useful for

some business. There are times when due to some reason assets and liabilities value

fluctuate a lot either becomes too high or too low. Due to this reason accounting them

would result in misleading in short term. When things could be different if long term

financial picture is taken.

Historical valuation is lost- If company is showing net loss due to its asset being valued

at reduced amount. Historical value should have some relevance so that accurate results

are produced. Due to fair valuation organisation would face a artificial loss when actually

it is in profit.

b) Discuss why fair value method is more relevant than historical accounting method

The books of accounts of an organisation provide full information to the investor which is

considered fair and original. Fair value of method gives more appropriate value of the assets and

liabilities. This is because valuation should be given after adjusting goodwill, depreciation and

impairments. This might increase the volatility but is essential for effective decision making.

And also important for transparency and fair disclosers to the stakeholders (Khalid, Haron, and

Masron, 2018). Hence, fair value method is more relevant than historical cost method.

c) Mention three benefit of conventional historical cost method.

Objectivity and reliability of accounting information- This method increases the

accuracy and reliability of the data. Since there is no room for adjustment no

increase decrease in the original value takes place manipulation is not possible.

Simplicity and convenience- This concept is more simple while reporting the

assets and liabilities in accounting. There is no requirement of changing the value

every year and adjustment of the values. Next it does not mislead investor by

giving an amount that is not reliable in long term financial picture (Kotze, 2022).

Consistency and comparability- this reporting method make comparability easy

as statements of one financial year can be compared to the financial records of the

other year. Also comparison with other entity is also simplified. Both inter and

intra comparison is easy and financial position can be ascertaining conveniently.

Question 3

a) Mention five limitation of internal control

Internal control is controls, policies and rules that is use for effective management to

minimize risk. Reasonable Assurance- Such measures a meant for preventing, detecting and rectifying

errors existing in current system. The organisation believes that it is enough however

such controls are not effective in each areas in which the company operates. Inappropriate management override controls- The management of the company should

not override the controls implemented. The controls are successful only if its

management and employees follow them. This system lacks in proper applicability in the

organisation.

Human error- Other disadvantage of internal controls are that they are dependent on

human input. Due to this factor error and mistakes are possible any time. This would

result in inaccurate results and proper management of organisation.

b) Explain some of the problem that may arise because of the dependence on senior

management.

Senior management of the company is responsible for effective management, proper

utilisation of the resources, framing policies and maintaining internal control system for the

organisation (Latan, Chiappetta Jabbour, and Lopes de Sousa Jabbour, 2019). However heavy

dependency on the top level management may lead to:

assets and liabilities in accounting. There is no requirement of changing the value

every year and adjustment of the values. Next it does not mislead investor by

giving an amount that is not reliable in long term financial picture (Kotze, 2022).

Consistency and comparability- this reporting method make comparability easy

as statements of one financial year can be compared to the financial records of the

other year. Also comparison with other entity is also simplified. Both inter and

intra comparison is easy and financial position can be ascertaining conveniently.

Question 3

a) Mention five limitation of internal control

Internal control is controls, policies and rules that is use for effective management to

minimize risk. Reasonable Assurance- Such measures a meant for preventing, detecting and rectifying

errors existing in current system. The organisation believes that it is enough however

such controls are not effective in each areas in which the company operates. Inappropriate management override controls- The management of the company should

not override the controls implemented. The controls are successful only if its

management and employees follow them. This system lacks in proper applicability in the

organisation.

Human error- Other disadvantage of internal controls are that they are dependent on

human input. Due to this factor error and mistakes are possible any time. This would

result in inaccurate results and proper management of organisation.

b) Explain some of the problem that may arise because of the dependence on senior

management.

Senior management of the company is responsible for effective management, proper

utilisation of the resources, framing policies and maintaining internal control system for the

organisation (Latan, Chiappetta Jabbour, and Lopes de Sousa Jabbour, 2019). However heavy

dependency on the top level management may lead to:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Delayed results – being depended on the top level management may result in late

decisions, because they have tot to do. But due to all the burden and responsibility

manager may suffer ignorance of important matters. Delegation of authority increases

accuracy in the business entity.

Reduces productivity– when the employees are fully dependent on the senior

management for each and every decision they avoid creativity. Employees do not use

creative approach to solve a problem and dependence on the seniors to accomplish a task

which effects the overall productivity of the organisation (Miftahol Horri, 2018).

Question No 4

a) Audit Plan

The auditor should plan his work to enable him to conduct an effective audit in an e cientffi

and timely manner. Plans should be based on knowledge of the client’s business.

Plans should be made to cover, among other things:

Acquiring knowledge of the client’s accounting systems, policies and internal control

procedures;

Establishing the expected degree of reliance to be placed on internal control;

Determining and programming the nature, timing, and extent of the audit procedures to

be performed; and

Coordinating the work to be performed.

Plans should be further developed and revised as necessary

Matters to be consider by auditor in development of audit plan:

The nature, timing and extent of planned risk assessment procedures, as determined under

relevant standards of auditing named as “Identifying and Assessing the Risks of Material

Misstatement through Understanding the Entity and Its Environment” (Rozario and

Vasarhelyi, 2018).

The nature, timing and extent of planned further audit procedures at the assertion level, as

determined under SA named as “The Auditor’s Responses to Assessed Risks”.

Other planned audit procedures that are required to be carried out so that the engagement

complies with SAs.

decisions, because they have tot to do. But due to all the burden and responsibility

manager may suffer ignorance of important matters. Delegation of authority increases

accuracy in the business entity.

Reduces productivity– when the employees are fully dependent on the senior

management for each and every decision they avoid creativity. Employees do not use

creative approach to solve a problem and dependence on the seniors to accomplish a task

which effects the overall productivity of the organisation (Miftahol Horri, 2018).

Question No 4

a) Audit Plan

The auditor should plan his work to enable him to conduct an effective audit in an e cientffi

and timely manner. Plans should be based on knowledge of the client’s business.

Plans should be made to cover, among other things:

Acquiring knowledge of the client’s accounting systems, policies and internal control

procedures;

Establishing the expected degree of reliance to be placed on internal control;

Determining and programming the nature, timing, and extent of the audit procedures to

be performed; and

Coordinating the work to be performed.

Plans should be further developed and revised as necessary

Matters to be consider by auditor in development of audit plan:

The nature, timing and extent of planned risk assessment procedures, as determined under

relevant standards of auditing named as “Identifying and Assessing the Risks of Material

Misstatement through Understanding the Entity and Its Environment” (Rozario and

Vasarhelyi, 2018).

The nature, timing and extent of planned further audit procedures at the assertion level, as

determined under SA named as “The Auditor’s Responses to Assessed Risks”.

Other planned audit procedures that are required to be carried out so that the engagement

complies with SAs.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The audit plan is more detailed than the overall audit strategy that includes the nature,

timing and extent of audit procedures to be performed by engagement team members.

Planning for these audit procedures takes place over the course of the audit as the audit

plan for the engagement develops.

Benefits of Audit Planning:

It provides the assistant carrying out the audit with total and clear set of instructions of

the work generally to be done.

It is essential, particularly for major audits, to provide a total perspective of the work to

be performed (Widuri, Handoko, and Prabowo, 2019).

Selection of assistants for the jobs on the basis of capability becomes easier when the

work is rationally planned, defined and segregated.

b) Auditor’s consent

Situation where client information will be shared by the auditor to third party are being

mentioned below:

Where in case the Government department such as tax authority would require the same

specially when the client case is under supervision with tax authority’s

Sometime the requirement of law states that the information must be shared by the

auditor. In that case it is essential for the auditor to share the information.

The professional codes states that it is mandatory for an auditor to disclose the

confidential information when there is professional duty for him or there is a right to

disclose the same when it is not prohibited by the statute in order to comply with ethical

standards and ethical requirement.

The obligations imposed by ethical principles of professional competence and due care on

chartered accountants are being mentioned below:

The auditor shall comply with relevant ethical requirements, including those pertaining to

independence, relating to financial statement audit engagements (Wu and Xie, 2021).

Professional Skepticism: The auditor shall plan and perform an audit with professional

skepticism recognising that circumstances may exist that cause the financial statements to

be materially misstated.

Professional Judgment: The auditor shall exercise professional judgment in planning and

performing an audit of financial statements.

timing and extent of audit procedures to be performed by engagement team members.

Planning for these audit procedures takes place over the course of the audit as the audit

plan for the engagement develops.

Benefits of Audit Planning:

It provides the assistant carrying out the audit with total and clear set of instructions of

the work generally to be done.

It is essential, particularly for major audits, to provide a total perspective of the work to

be performed (Widuri, Handoko, and Prabowo, 2019).

Selection of assistants for the jobs on the basis of capability becomes easier when the

work is rationally planned, defined and segregated.

b) Auditor’s consent

Situation where client information will be shared by the auditor to third party are being

mentioned below:

Where in case the Government department such as tax authority would require the same

specially when the client case is under supervision with tax authority’s

Sometime the requirement of law states that the information must be shared by the

auditor. In that case it is essential for the auditor to share the information.

The professional codes states that it is mandatory for an auditor to disclose the

confidential information when there is professional duty for him or there is a right to

disclose the same when it is not prohibited by the statute in order to comply with ethical

standards and ethical requirement.

The obligations imposed by ethical principles of professional competence and due care on

chartered accountants are being mentioned below:

The auditor shall comply with relevant ethical requirements, including those pertaining to

independence, relating to financial statement audit engagements (Wu and Xie, 2021).

Professional Skepticism: The auditor shall plan and perform an audit with professional

skepticism recognising that circumstances may exist that cause the financial statements to

be materially misstated.

Professional Judgment: The auditor shall exercise professional judgment in planning and

performing an audit of financial statements.

Sufficient Appropriate Audit Evidence and Audit Risk: To obtain reasonable assurance,

the auditor shall obtain sufficient appropriate audit evidence to reduce audit risk to an

acceptably low level and thereby enable the auditor to draw reasonable conclusions on

which to base the auditor’s opinion.

Conduct of an Audit in Accordance with Professional Standards: It is essential for an

auditor to conduct an audit in accordance with standards of auditing. The audited

financial statement is being reliable for the users who are using the same (Zhou, Li, and

Zhao, 2022).

Complying with standards Relevant to the Audit: The auditor shall comply with all SAs

relevant to the audit. An SA is relevant to the audit when the SA is in effect and the

circumstances addressed by the SA exist. The auditor shall have an understanding of the

entire text of an SA, including its application and other explanatory material, to

understand its objectives and to apply its requirements properly

Ethical rules to be followed by auditor while handling the client money:

It is essential for the auditor to kept money of the client in a separate bank account in order

to ensure that such money must be kept separately and could be used for the purpose for which it

has been obtained such as payment of tax dues etc.

Question 5

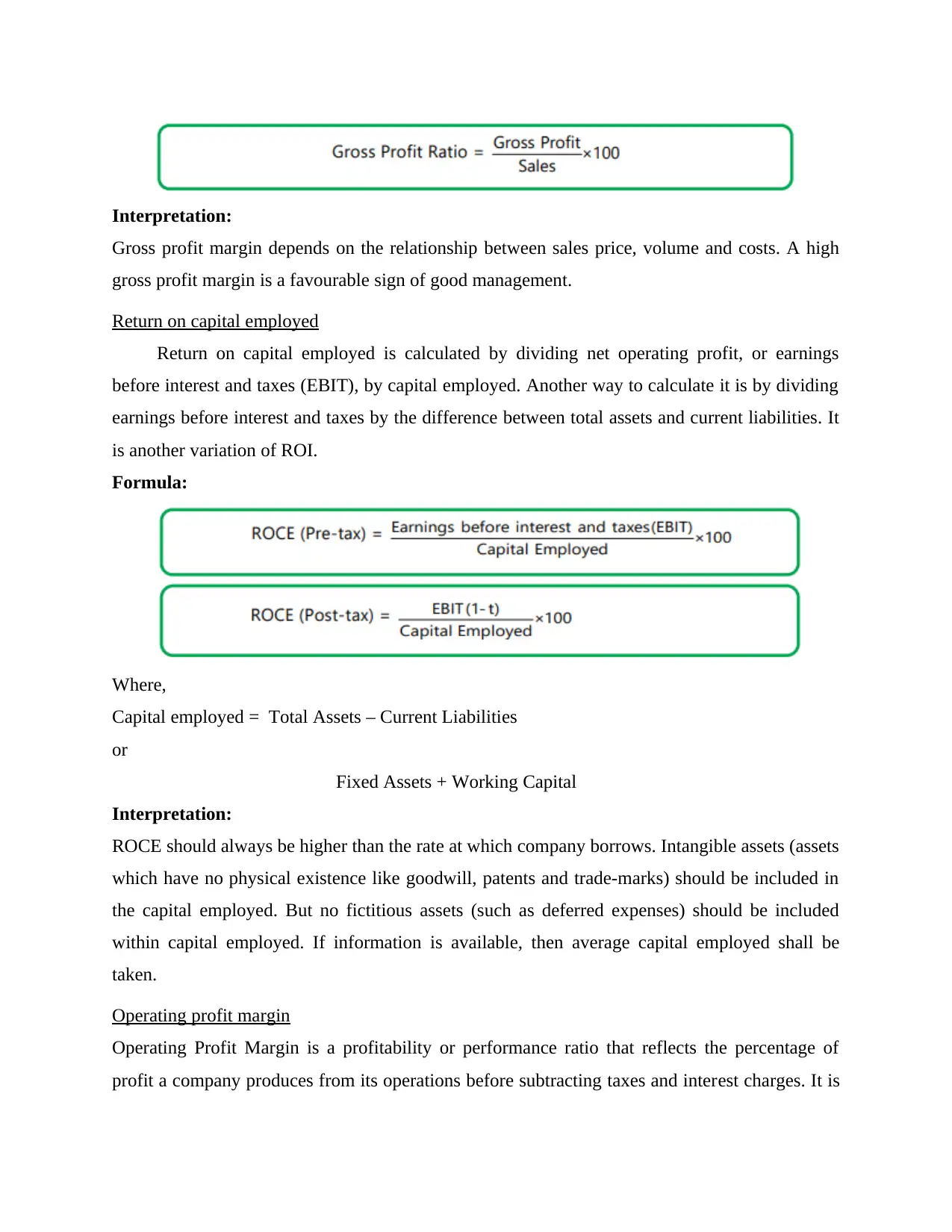

Gross profit margin:

The gross profit margin provides a correlation between gross profit and operating revenues i.e.

sales of net. This ratio is measured and seen in proportion. It measures the percentage of each

sale in rupees remaining after payment for the goods sold. It’s one of three major profitability

ratios, the others being operating profit margin and net profit margin. Arguably, it’s the most

important of the three profitability measures. The gross profit margin is calculated by subtracting

direct expenses or cost of goods sold (COGS) from net sales which gives gross profit. That

number is divided by net sales, then multiplied by 100% to calculate the gross profit margin

ratio.

Formula:

the auditor shall obtain sufficient appropriate audit evidence to reduce audit risk to an

acceptably low level and thereby enable the auditor to draw reasonable conclusions on

which to base the auditor’s opinion.

Conduct of an Audit in Accordance with Professional Standards: It is essential for an

auditor to conduct an audit in accordance with standards of auditing. The audited

financial statement is being reliable for the users who are using the same (Zhou, Li, and

Zhao, 2022).

Complying with standards Relevant to the Audit: The auditor shall comply with all SAs

relevant to the audit. An SA is relevant to the audit when the SA is in effect and the

circumstances addressed by the SA exist. The auditor shall have an understanding of the

entire text of an SA, including its application and other explanatory material, to

understand its objectives and to apply its requirements properly

Ethical rules to be followed by auditor while handling the client money:

It is essential for the auditor to kept money of the client in a separate bank account in order

to ensure that such money must be kept separately and could be used for the purpose for which it

has been obtained such as payment of tax dues etc.

Question 5

Gross profit margin:

The gross profit margin provides a correlation between gross profit and operating revenues i.e.

sales of net. This ratio is measured and seen in proportion. It measures the percentage of each

sale in rupees remaining after payment for the goods sold. It’s one of three major profitability

ratios, the others being operating profit margin and net profit margin. Arguably, it’s the most

important of the three profitability measures. The gross profit margin is calculated by subtracting

direct expenses or cost of goods sold (COGS) from net sales which gives gross profit. That

number is divided by net sales, then multiplied by 100% to calculate the gross profit margin

ratio.

Formula:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation:

Gross profit margin depends on the relationship between sales price, volume and costs. A high

gross profit margin is a favourable sign of good management.

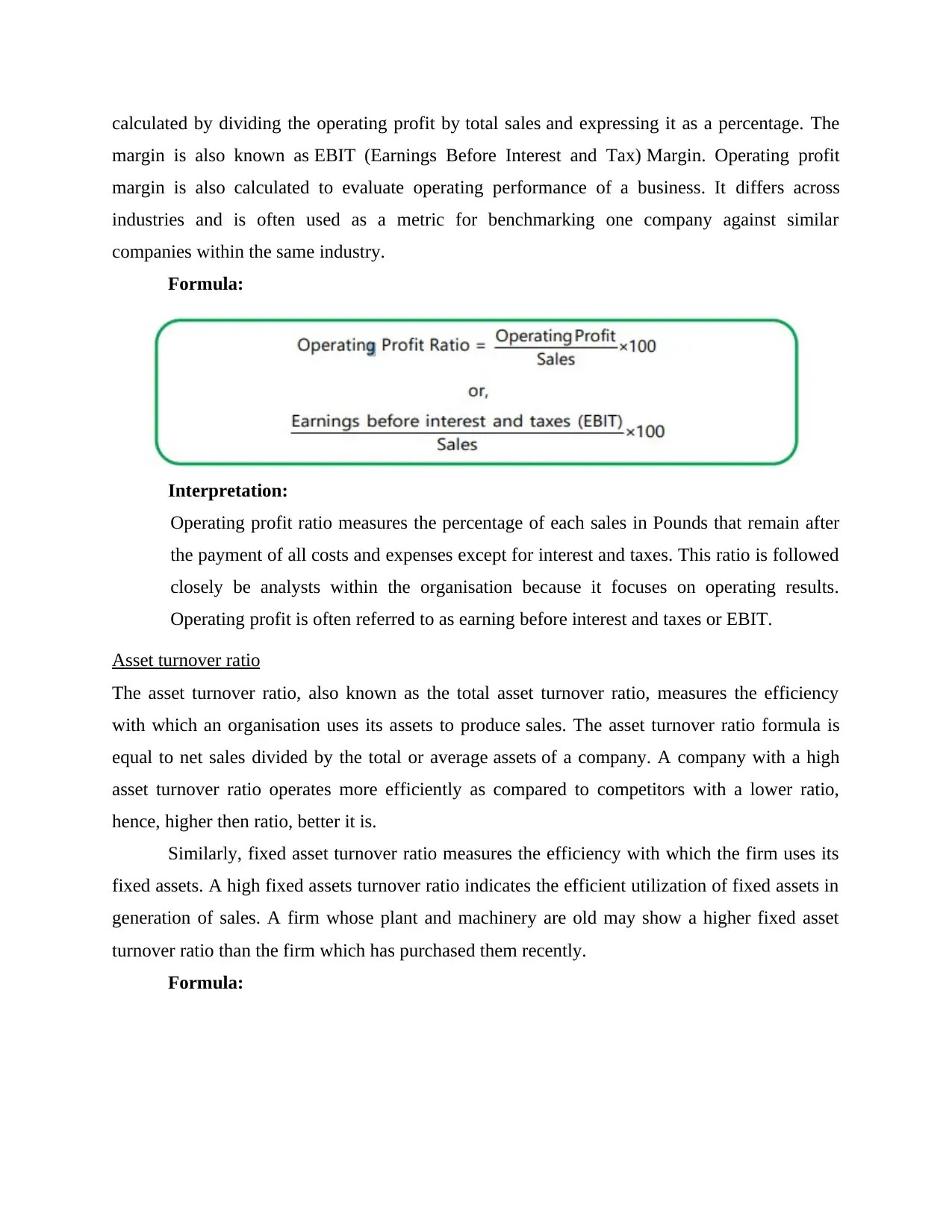

Return on capital employed

Return on capital employed is calculated by dividing net operating profit, or earnings

before interest and taxes (EBIT), by capital employed. Another way to calculate it is by dividing

earnings before interest and taxes by the difference between total assets and current liabilities. It

is another variation of ROI.

Formula:

Where,

Capital employed = Total Assets – Current Liabilities

or

Fixed Assets + Working Capital

Interpretation:

ROCE should always be higher than the rate at which company borrows. Intangible assets (assets

which have no physical existence like goodwill, patents and trade-marks) should be included in

the capital employed. But no fictitious assets (such as deferred expenses) should be included

within capital employed. If information is available, then average capital employed shall be

taken.

Operating profit margin

Operating Profit Margin is a profitability or performance ratio that reflects the percentage of

profit a company produces from its operations before subtracting taxes and interest charges. It is

Gross profit margin depends on the relationship between sales price, volume and costs. A high

gross profit margin is a favourable sign of good management.

Return on capital employed

Return on capital employed is calculated by dividing net operating profit, or earnings

before interest and taxes (EBIT), by capital employed. Another way to calculate it is by dividing

earnings before interest and taxes by the difference between total assets and current liabilities. It

is another variation of ROI.

Formula:

Where,

Capital employed = Total Assets – Current Liabilities

or

Fixed Assets + Working Capital

Interpretation:

ROCE should always be higher than the rate at which company borrows. Intangible assets (assets

which have no physical existence like goodwill, patents and trade-marks) should be included in

the capital employed. But no fictitious assets (such as deferred expenses) should be included

within capital employed. If information is available, then average capital employed shall be

taken.

Operating profit margin

Operating Profit Margin is a profitability or performance ratio that reflects the percentage of

profit a company produces from its operations before subtracting taxes and interest charges. It is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

calculated by dividing the operating profit by total sales and expressing it as a percentage. The

margin is also known as EBIT (Earnings Before Interest and Tax) Margin. Operating profit

margin is also calculated to evaluate operating performance of a business. It differs across

industries and is often used as a metric for benchmarking one company against similar

companies within the same industry.

Formula:

Interpretation:

Operating profit ratio measures the percentage of each sales in Pounds that remain after

the payment of all costs and expenses except for interest and taxes. This ratio is followed

closely be analysts within the organisation because it focuses on operating results.

Operating profit is often referred to as earning before interest and taxes or EBIT.

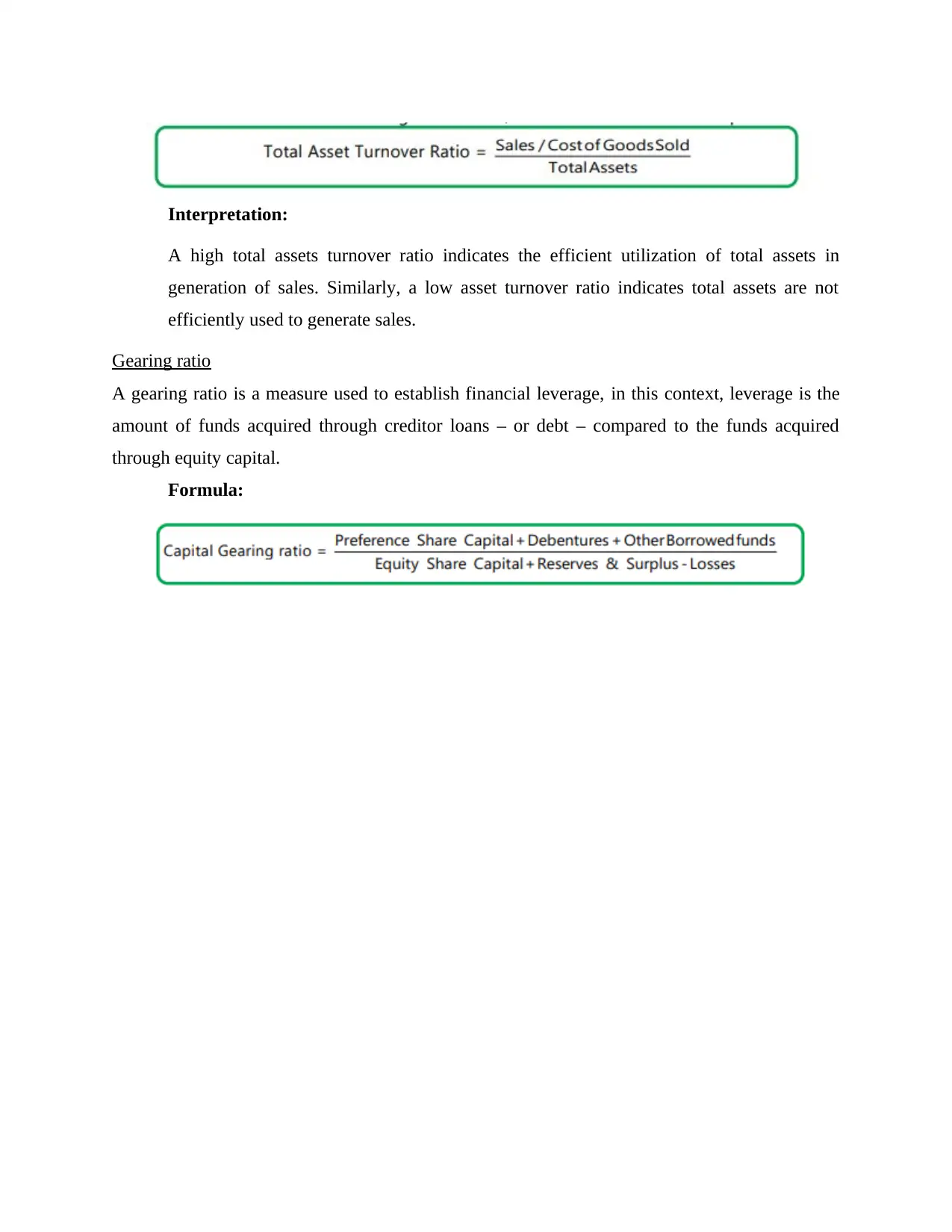

Asset turnover ratio

The asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency

with which an organisation uses its assets to produce sales. The asset turnover ratio formula is

equal to net sales divided by the total or average assets of a company. A company with a high

asset turnover ratio operates more efficiently as compared to competitors with a lower ratio,

hence, higher then ratio, better it is.

Similarly, fixed asset turnover ratio measures the efficiency with which the firm uses its

fixed assets. A high fixed assets turnover ratio indicates the efficient utilization of fixed assets in

generation of sales. A firm whose plant and machinery are old may show a higher fixed asset

turnover ratio than the firm which has purchased them recently.

Formula:

margin is also known as EBIT (Earnings Before Interest and Tax) Margin. Operating profit

margin is also calculated to evaluate operating performance of a business. It differs across

industries and is often used as a metric for benchmarking one company against similar

companies within the same industry.

Formula:

Interpretation:

Operating profit ratio measures the percentage of each sales in Pounds that remain after

the payment of all costs and expenses except for interest and taxes. This ratio is followed

closely be analysts within the organisation because it focuses on operating results.

Operating profit is often referred to as earning before interest and taxes or EBIT.

Asset turnover ratio

The asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency

with which an organisation uses its assets to produce sales. The asset turnover ratio formula is

equal to net sales divided by the total or average assets of a company. A company with a high

asset turnover ratio operates more efficiently as compared to competitors with a lower ratio,

hence, higher then ratio, better it is.

Similarly, fixed asset turnover ratio measures the efficiency with which the firm uses its

fixed assets. A high fixed assets turnover ratio indicates the efficient utilization of fixed assets in

generation of sales. A firm whose plant and machinery are old may show a higher fixed asset

turnover ratio than the firm which has purchased them recently.

Formula:

Interpretation:

A high total assets turnover ratio indicates the efficient utilization of total assets in

generation of sales. Similarly, a low asset turnover ratio indicates total assets are not

efficiently used to generate sales.

Gearing ratio

A gearing ratio is a measure used to establish financial leverage, in this context, leverage is the

amount of funds acquired through creditor loans – or debt – compared to the funds acquired

through equity capital.

Formula:

A high total assets turnover ratio indicates the efficient utilization of total assets in

generation of sales. Similarly, a low asset turnover ratio indicates total assets are not

efficiently used to generate sales.

Gearing ratio

A gearing ratio is a measure used to establish financial leverage, in this context, leverage is the

amount of funds acquired through creditor loans – or debt – compared to the funds acquired

through equity capital.

Formula:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.