Accounting & Costing for Business: Financial Statements and Variances

VerifiedAdded on 2022/01/13

|18

|3921

|225

Homework Assignment

AI Summary

This assignment solution covers various aspects of accounting and costing for business. It begins with journal and ledger entries, culminating in a trial balance. The solution then delves into financial statements, discussing their importance and providing examples of a trading and profit and loss account and a balance sheet. Furthermore, it explores cost classification for new products and provides a detailed variance analysis, including sales, direct material, direct labor, and overhead variances, along with potential causes and corrective actions. The assignment also includes the calculation of variances and the identification of possible causes for the variances, and recommends corrective actions for them. Overall, the document offers a comprehensive overview of financial accounting and costing concepts.

1

Accounting & Costing for Business

Accounting & Costing for Business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

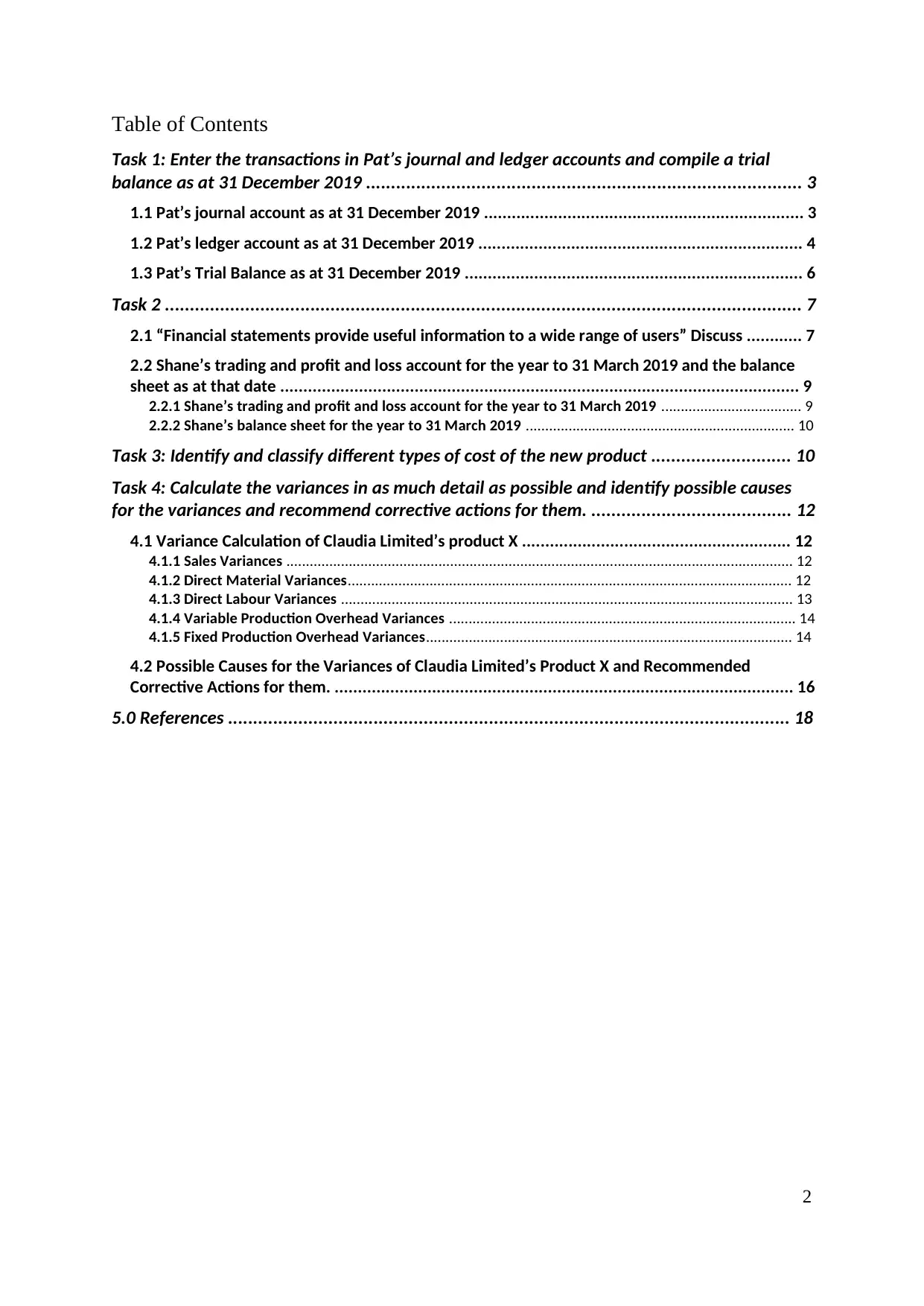

Table of Contents

Task 1: Enter the transactions in Pat’s journal and ledger accounts and compile a trial

balance as at 31 December 2019 ....................................................................................... 3

1.1 Pat’s journal account as at 31 December 2019 ..................................................................... 3

1.2 Pat’s ledger account as at 31 December 2019 ...................................................................... 4

1.3 Pat’s Trial Balance as at 31 December 2019 ......................................................................... 6

Task 2 ............................................................................................................................... 7

2.1 “Financial statements provide useful information to a wide range of users” Discuss ............ 7

2.2 Shane’s trading and profit and loss account for the year to 31 March 2019 and the balance

sheet as at that date ................................................................................................................ 9

2.2.1 Shane’s trading and profit and loss account for the year to 31 March 2019 .................................... 9

2.2.2 Shane’s balance sheet for the year to 31 March 2019 ..................................................................... 10

Task 3: Identify and classify different types of cost of the new product ............................ 10

Task 4: Calculate the variances in as much detail as possible and identify possible causes

for the variances and recommend corrective actions for them. ........................................ 12

4.1 Variance Calculation of Claudia Limited’s product X .......................................................... 12

4.1.1 Sales Variances .................................................................................................................................. 12

4.1.2 Direct Material Variances.................................................................................................................. 12

4.1.3 Direct Labour Variances .................................................................................................................... 13

4.1.4 Variable Production Overhead Variances ......................................................................................... 14

4.1.5 Fixed Production Overhead Variances.............................................................................................. 14

4.2 Possible Causes for the Variances of Claudia Limited’s Product X and Recommended

Corrective Actions for them. ................................................................................................... 16

5.0 References ................................................................................................................ 18

Table of Contents

Task 1: Enter the transactions in Pat’s journal and ledger accounts and compile a trial

balance as at 31 December 2019 ....................................................................................... 3

1.1 Pat’s journal account as at 31 December 2019 ..................................................................... 3

1.2 Pat’s ledger account as at 31 December 2019 ...................................................................... 4

1.3 Pat’s Trial Balance as at 31 December 2019 ......................................................................... 6

Task 2 ............................................................................................................................... 7

2.1 “Financial statements provide useful information to a wide range of users” Discuss ............ 7

2.2 Shane’s trading and profit and loss account for the year to 31 March 2019 and the balance

sheet as at that date ................................................................................................................ 9

2.2.1 Shane’s trading and profit and loss account for the year to 31 March 2019 .................................... 9

2.2.2 Shane’s balance sheet for the year to 31 March 2019 ..................................................................... 10

Task 3: Identify and classify different types of cost of the new product ............................ 10

Task 4: Calculate the variances in as much detail as possible and identify possible causes

for the variances and recommend corrective actions for them. ........................................ 12

4.1 Variance Calculation of Claudia Limited’s product X .......................................................... 12

4.1.1 Sales Variances .................................................................................................................................. 12

4.1.2 Direct Material Variances.................................................................................................................. 12

4.1.3 Direct Labour Variances .................................................................................................................... 13

4.1.4 Variable Production Overhead Variances ......................................................................................... 14

4.1.5 Fixed Production Overhead Variances.............................................................................................. 14

4.2 Possible Causes for the Variances of Claudia Limited’s Product X and Recommended

Corrective Actions for them. ................................................................................................... 16

5.0 References ................................................................................................................ 18

3

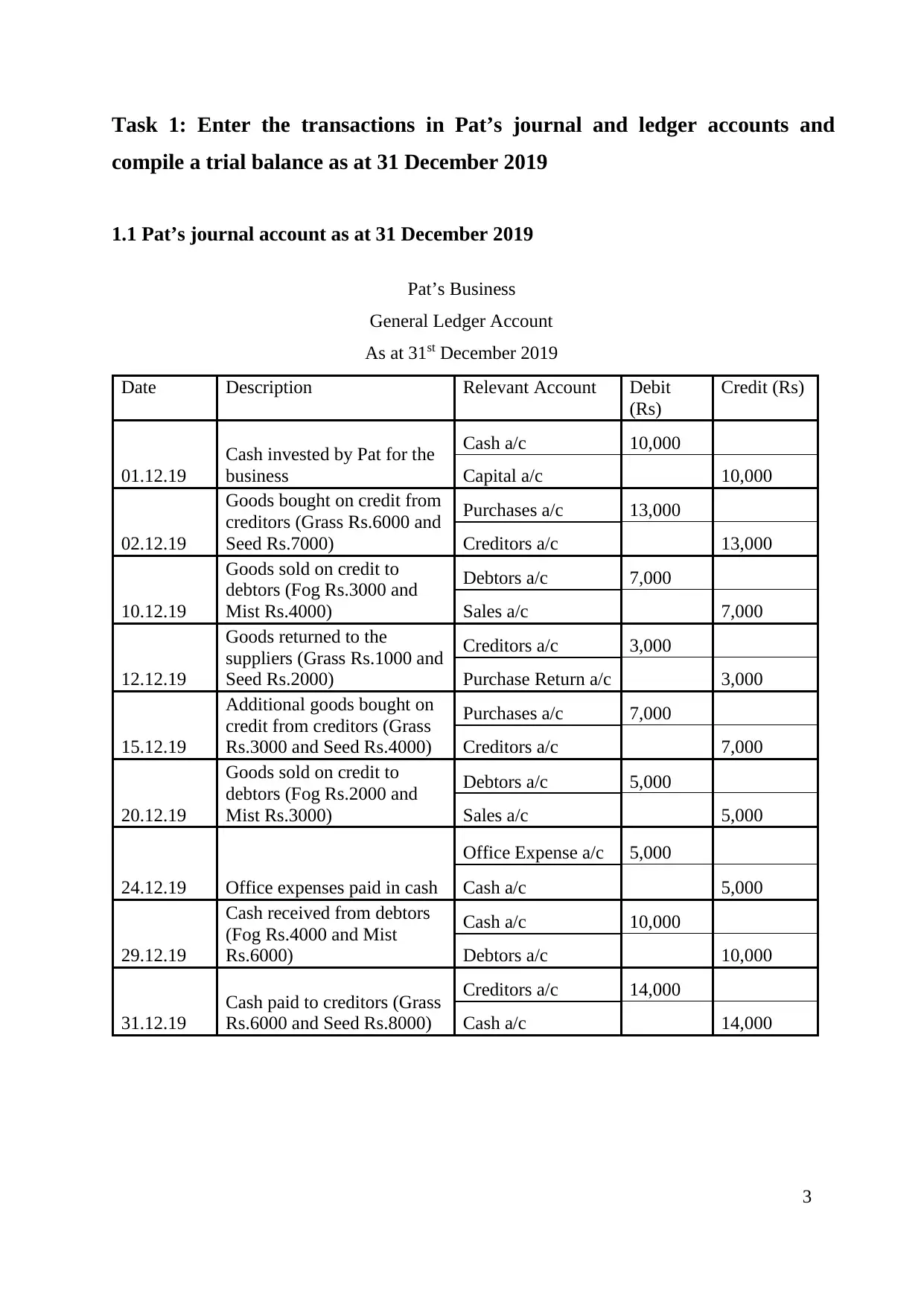

Task 1: Enter the transactions in Pat’s journal and ledger accounts and

compile a trial balance as at 31 December 2019

1.1 Pat’s journal account as at 31 December 2019

Pat’s Business

General Ledger Account

As at 31st December 2019

Date Description Relevant Account Debit

(Rs)

Credit (Rs)

01.12.19

Cash invested by Pat for the

business

Cash a/c 10,000

Capital a/c 10,000

02.12.19

Goods bought on credit from

creditors (Grass Rs.6000 and

Seed Rs.7000)

Purchases a/c 13,000

Creditors a/c 13,000

10.12.19

Goods sold on credit to

debtors (Fog Rs.3000 and

Mist Rs.4000)

Debtors a/c 7,000

Sales a/c 7,000

12.12.19

Goods returned to the

suppliers (Grass Rs.1000 and

Seed Rs.2000)

Creditors a/c 3,000

Purchase Return a/c 3,000

15.12.19

Additional goods bought on

credit from creditors (Grass

Rs.3000 and Seed Rs.4000)

Purchases a/c 7,000

Creditors a/c 7,000

20.12.19

Goods sold on credit to

debtors (Fog Rs.2000 and

Mist Rs.3000)

Debtors a/c 5,000

Sales a/c 5,000

24.12.19 Office expenses paid in cash

Office Expense a/c 5,000

Cash a/c 5,000

29.12.19

Cash received from debtors

(Fog Rs.4000 and Mist

Rs.6000)

Cash a/c 10,000

Debtors a/c 10,000

31.12.19

Cash paid to creditors (Grass

Rs.6000 and Seed Rs.8000)

Creditors a/c 14,000

Cash a/c 14,000

Task 1: Enter the transactions in Pat’s journal and ledger accounts and

compile a trial balance as at 31 December 2019

1.1 Pat’s journal account as at 31 December 2019

Pat’s Business

General Ledger Account

As at 31st December 2019

Date Description Relevant Account Debit

(Rs)

Credit (Rs)

01.12.19

Cash invested by Pat for the

business

Cash a/c 10,000

Capital a/c 10,000

02.12.19

Goods bought on credit from

creditors (Grass Rs.6000 and

Seed Rs.7000)

Purchases a/c 13,000

Creditors a/c 13,000

10.12.19

Goods sold on credit to

debtors (Fog Rs.3000 and

Mist Rs.4000)

Debtors a/c 7,000

Sales a/c 7,000

12.12.19

Goods returned to the

suppliers (Grass Rs.1000 and

Seed Rs.2000)

Creditors a/c 3,000

Purchase Return a/c 3,000

15.12.19

Additional goods bought on

credit from creditors (Grass

Rs.3000 and Seed Rs.4000)

Purchases a/c 7,000

Creditors a/c 7,000

20.12.19

Goods sold on credit to

debtors (Fog Rs.2000 and

Mist Rs.3000)

Debtors a/c 5,000

Sales a/c 5,000

24.12.19 Office expenses paid in cash

Office Expense a/c 5,000

Cash a/c 5,000

29.12.19

Cash received from debtors

(Fog Rs.4000 and Mist

Rs.6000)

Cash a/c 10,000

Debtors a/c 10,000

31.12.19

Cash paid to creditors (Grass

Rs.6000 and Seed Rs.8000)

Creditors a/c 14,000

Cash a/c 14,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

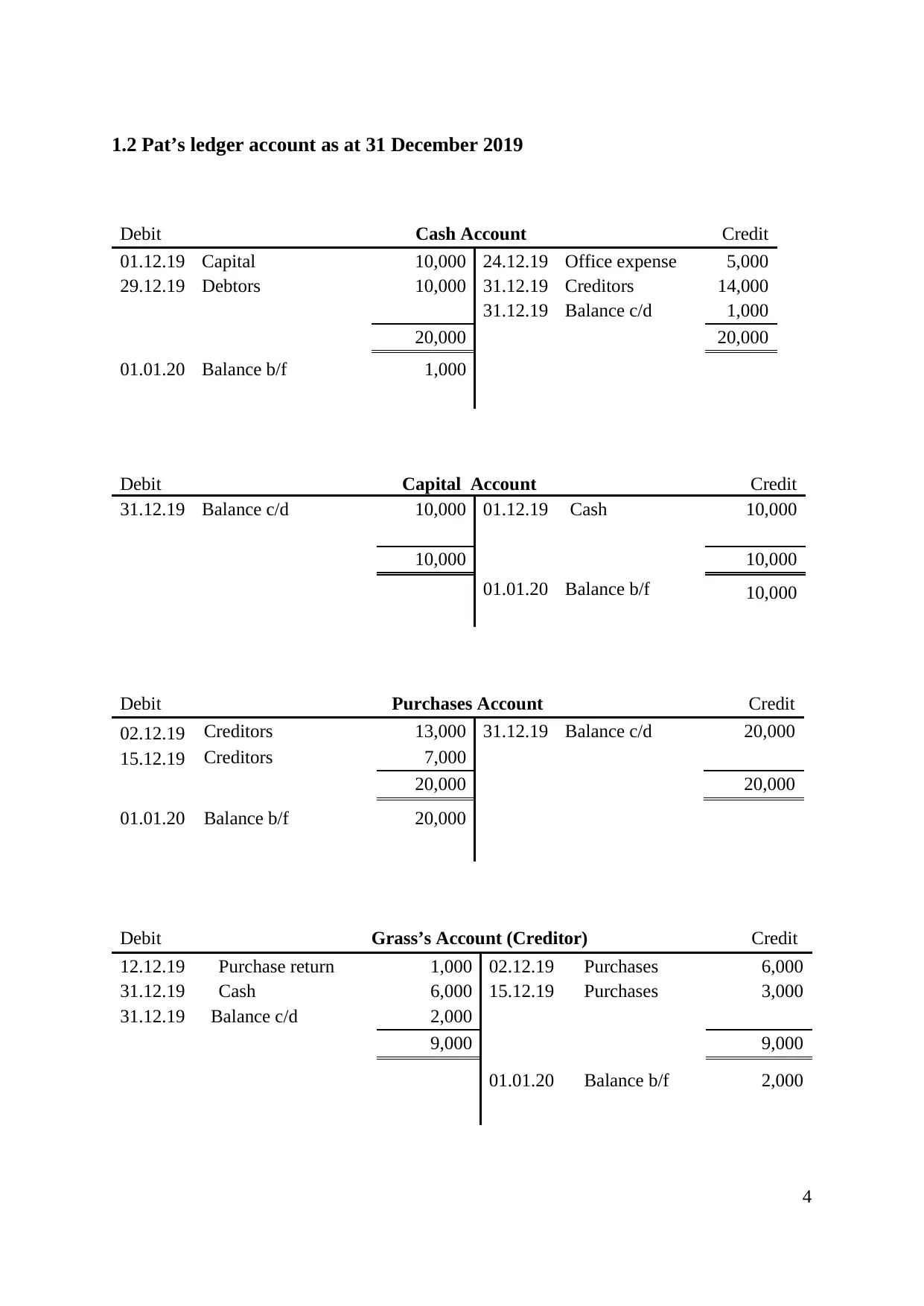

1.2 Pat’s ledger account as at 31 December 2019

Debit Cash Account Credit

01.12.19 Capital 10,000 24.12.19 Office expense 5,000

29.12.19 Debtors 10,000 31.12.19 Creditors 14,000

31.12.19 Balance c/d 1,000

20,000 20,000

01.01.20 Balance b/f 1,000

Debit Capital Account Credit

31.12.19 Balance c/d 10,000 01.12.19 Cash 10,000

10,000 10,000

01.01.20 Balance b/f 10,000

Debit Purchases Account Credit

02.12.19 Creditors 13,000 31.12.19 Balance c/d 20,000

15.12.19 Creditors 7,000

20,000 20,000

01.01.20 Balance b/f 20,000

Debit Grass’s Account (Creditor) Credit

12.12.19 Purchase return 1,000 02.12.19 Purchases 6,000

31.12.19 Cash 6,000 15.12.19 Purchases 3,000

31.12.19 Balance c/d 2,000

9,000 9,000

01.01.20 Balance b/f 2,000

1.2 Pat’s ledger account as at 31 December 2019

Debit Cash Account Credit

01.12.19 Capital 10,000 24.12.19 Office expense 5,000

29.12.19 Debtors 10,000 31.12.19 Creditors 14,000

31.12.19 Balance c/d 1,000

20,000 20,000

01.01.20 Balance b/f 1,000

Debit Capital Account Credit

31.12.19 Balance c/d 10,000 01.12.19 Cash 10,000

10,000 10,000

01.01.20 Balance b/f 10,000

Debit Purchases Account Credit

02.12.19 Creditors 13,000 31.12.19 Balance c/d 20,000

15.12.19 Creditors 7,000

20,000 20,000

01.01.20 Balance b/f 20,000

Debit Grass’s Account (Creditor) Credit

12.12.19 Purchase return 1,000 02.12.19 Purchases 6,000

31.12.19 Cash 6,000 15.12.19 Purchases 3,000

31.12.19 Balance c/d 2,000

9,000 9,000

01.01.20 Balance b/f 2,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

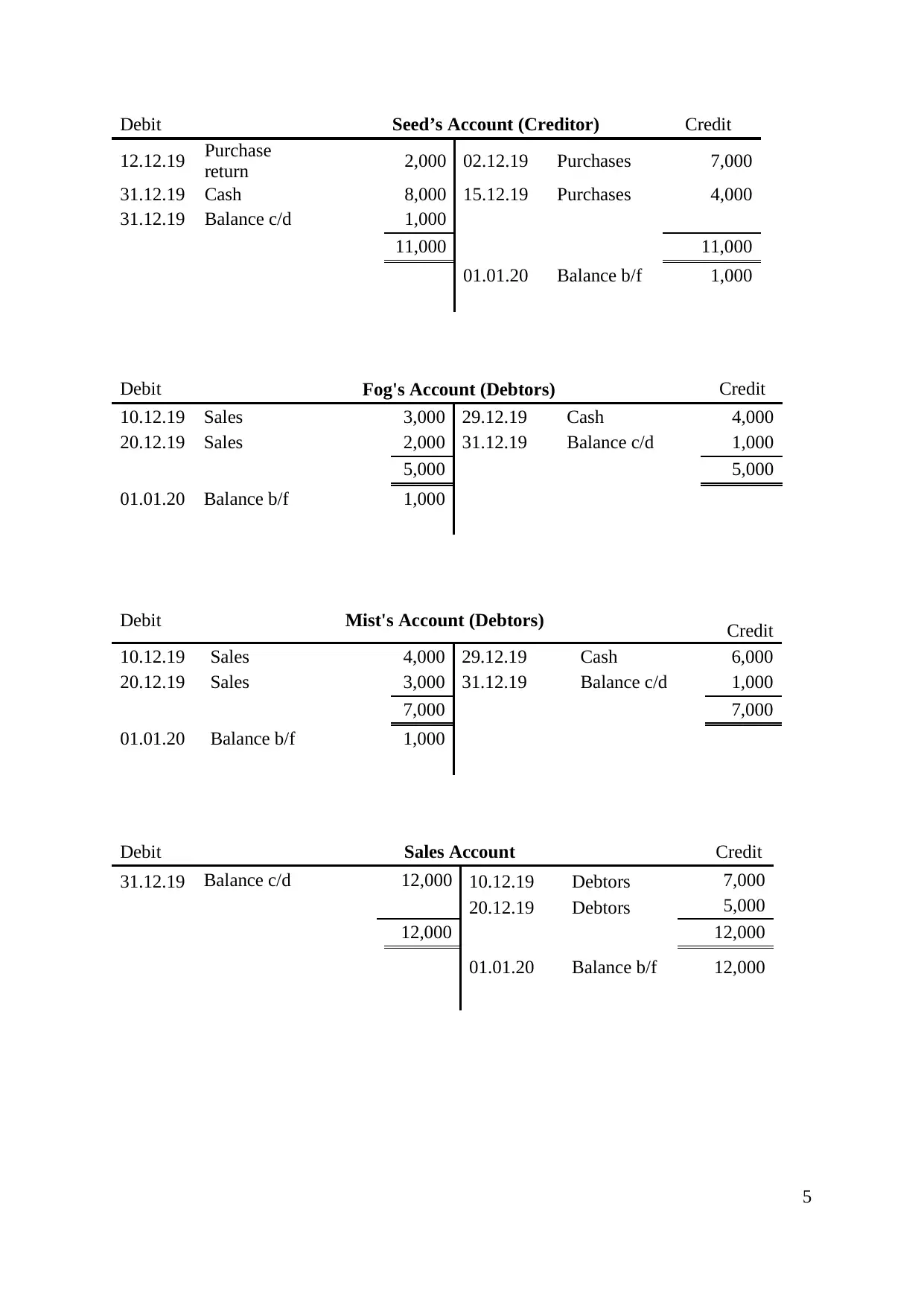

Debit Seed’s Account (Creditor) Credit

12.12.19 Purchase

return 2,000 02.12.19 Purchases 7,000

31.12.19 Cash 8,000 15.12.19 Purchases 4,000

31.12.19 Balance c/d 1,000

11,000 11,000

01.01.20 Balance b/f 1,000

Debit Fog's Account (Debtors) Credit

10.12.19 Sales 3,000 29.12.19 Cash 4,000

20.12.19 Sales 2,000 31.12.19 Balance c/d 1,000

5,000 5,000

01.01.20 Balance b/f 1,000

Debit Mist's Account (Debtors) Credit

10.12.19 Sales 4,000 29.12.19 Cash 6,000

20.12.19 Sales 3,000 31.12.19 Balance c/d 1,000

7,000 7,000

01.01.20 Balance b/f 1,000

Debit Sales Account Credit

31.12.19 Balance c/d 12,000 10.12.19 Debtors 7,000

20.12.19 Debtors 5,000

12,000 12,000

01.01.20 Balance b/f 12,000

Debit Seed’s Account (Creditor) Credit

12.12.19 Purchase

return 2,000 02.12.19 Purchases 7,000

31.12.19 Cash 8,000 15.12.19 Purchases 4,000

31.12.19 Balance c/d 1,000

11,000 11,000

01.01.20 Balance b/f 1,000

Debit Fog's Account (Debtors) Credit

10.12.19 Sales 3,000 29.12.19 Cash 4,000

20.12.19 Sales 2,000 31.12.19 Balance c/d 1,000

5,000 5,000

01.01.20 Balance b/f 1,000

Debit Mist's Account (Debtors) Credit

10.12.19 Sales 4,000 29.12.19 Cash 6,000

20.12.19 Sales 3,000 31.12.19 Balance c/d 1,000

7,000 7,000

01.01.20 Balance b/f 1,000

Debit Sales Account Credit

31.12.19 Balance c/d 12,000 10.12.19 Debtors 7,000

20.12.19 Debtors 5,000

12,000 12,000

01.01.20 Balance b/f 12,000

6

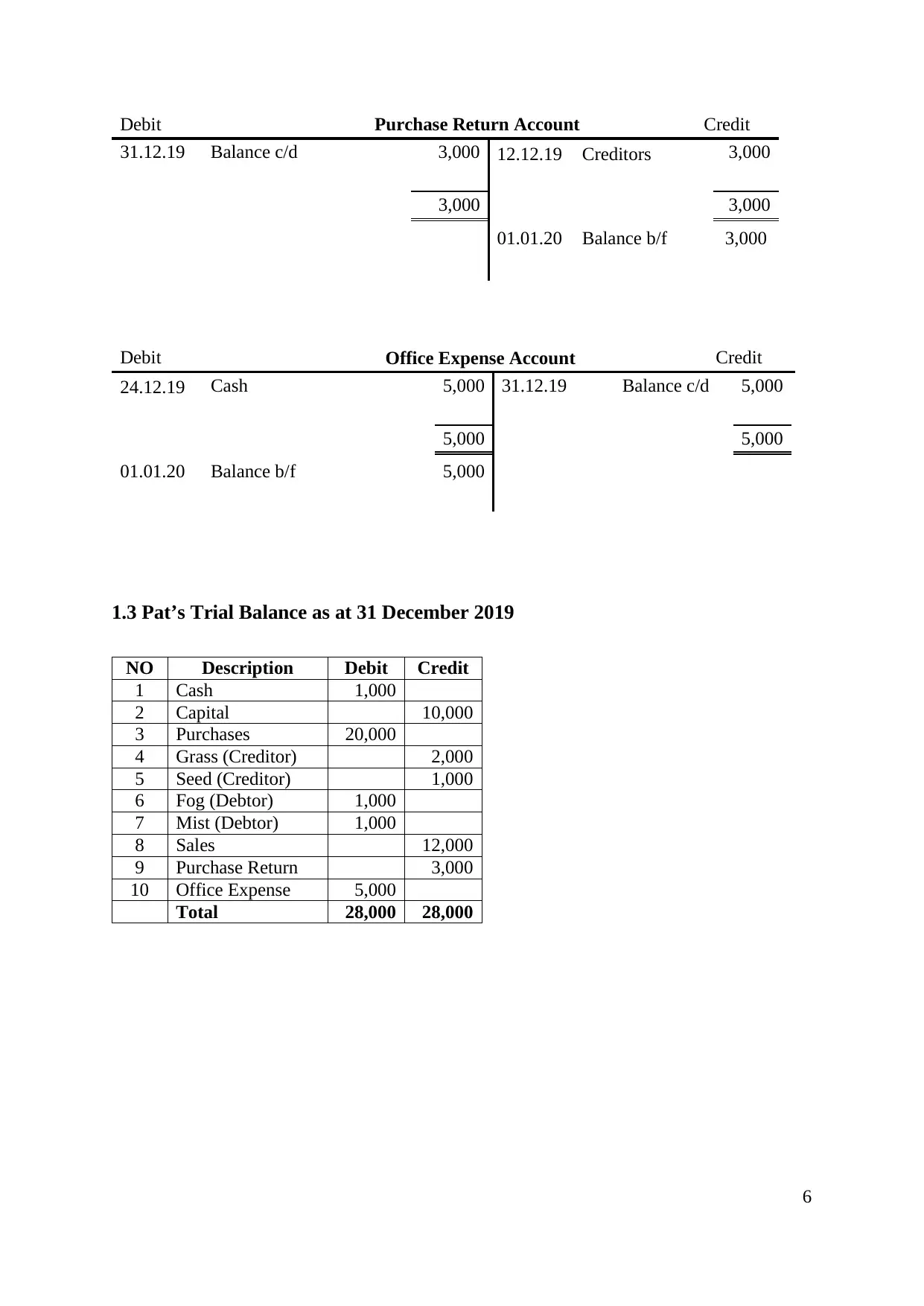

Debit Purchase Return Account Credit

31.12.19 Balance c/d 3,000 12.12.19 Creditors 3,000

3,000 3,000

01.01.20 Balance b/f 3,000

Debit Office Expense Account Credit

24.12.19 Cash 5,000 31.12.19 Balance c/d 5,000

5,000 5,000

01.01.20 Balance b/f 5,000

1.3 Pat’s Trial Balance as at 31 December 2019

NO Description Debit Credit

1 Cash 1,000

2 Capital 10,000

3 Purchases 20,000

4 Grass (Creditor) 2,000

5 Seed (Creditor) 1,000

6 Fog (Debtor) 1,000

7 Mist (Debtor) 1,000

8 Sales 12,000

9 Purchase Return 3,000

10 Office Expense 5,000

Total 28,000 28,000

Debit Purchase Return Account Credit

31.12.19 Balance c/d 3,000 12.12.19 Creditors 3,000

3,000 3,000

01.01.20 Balance b/f 3,000

Debit Office Expense Account Credit

24.12.19 Cash 5,000 31.12.19 Balance c/d 5,000

5,000 5,000

01.01.20 Balance b/f 5,000

1.3 Pat’s Trial Balance as at 31 December 2019

NO Description Debit Credit

1 Cash 1,000

2 Capital 10,000

3 Purchases 20,000

4 Grass (Creditor) 2,000

5 Seed (Creditor) 1,000

6 Fog (Debtor) 1,000

7 Mist (Debtor) 1,000

8 Sales 12,000

9 Purchase Return 3,000

10 Office Expense 5,000

Total 28,000 28,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Task 2

2.1 “Financial statements provide useful information to a wide range of users”

Discuss

Financial statements are formal records of an organization’s financial activities and the

financial performance (Murphy, 2020). There are several financial statements such as;

Statement of profit or loss

Statement of financial position

Statement of changes in equity

Statement of cash flows

The main purpose of financial statements is to provide information about an organisation’s

financial performance, position, cash flows and changes in equity to a wide range of users to

make successful economic decisions. Mostly stakeholders of a company are interest in the

information provided in the financial statements for different purposes such as;

Managers use financial statements to assess the present and past transactions and to

evaluate the financial performance and position of the company and its rivals, with the

intention of taking efficient future business decisions and to maximise shareholder

wealth and to gain competitive advantage.

Shareholders assess returns and risks of their investments in a company to make future

investment decisions.

Suppliers are interested in the financial statements to evaluate the credit worthiness of

a company, to decide whether to supply goods on credit and to set credit terms based

on a company’s financial status.

Customers refer financial statements to evaluate whether the company has adequate

resources to make sure there is a stable supply of goods in the future. Mostly customers

who are depending on specialized products are keen on a steady supply based on their

demand.

Task 2

2.1 “Financial statements provide useful information to a wide range of users”

Discuss

Financial statements are formal records of an organization’s financial activities and the

financial performance (Murphy, 2020). There are several financial statements such as;

Statement of profit or loss

Statement of financial position

Statement of changes in equity

Statement of cash flows

The main purpose of financial statements is to provide information about an organisation’s

financial performance, position, cash flows and changes in equity to a wide range of users to

make successful economic decisions. Mostly stakeholders of a company are interest in the

information provided in the financial statements for different purposes such as;

Managers use financial statements to assess the present and past transactions and to

evaluate the financial performance and position of the company and its rivals, with the

intention of taking efficient future business decisions and to maximise shareholder

wealth and to gain competitive advantage.

Shareholders assess returns and risks of their investments in a company to make future

investment decisions.

Suppliers are interested in the financial statements to evaluate the credit worthiness of

a company, to decide whether to supply goods on credit and to set credit terms based

on a company’s financial status.

Customers refer financial statements to evaluate whether the company has adequate

resources to make sure there is a stable supply of goods in the future. Mostly customers

who are depending on specialized products are keen on a steady supply based on their

demand.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Employees evaluates a company’s profitability using financial statements to have

understanding about their future remuneration and job security.

Competitors use financial statements to compare their performance with rival

companies to gain knowledge and develop strategies with the intention of obtaining a

competitive advantage.

Governments analyse financial statements to keep records on economic progress of

companies and to determine the accuracy of the taxes.

Financial institutes such as banks decides on whether to grant loans to a company by

assessing the information on liquidity and the availability of assets presented in a

company’s financial statements.

General public is interest in how a company’s activities effects the economy,

environment and the local community therefore, to assess it they use the information

provided by financial statements.

In conclusion by considering the information provided above, it is clear that financial

statements provide useful information to a wide range of users. Such information supports them

to take appropriate decisions regarding business matters and become successful.

Employees evaluates a company’s profitability using financial statements to have

understanding about their future remuneration and job security.

Competitors use financial statements to compare their performance with rival

companies to gain knowledge and develop strategies with the intention of obtaining a

competitive advantage.

Governments analyse financial statements to keep records on economic progress of

companies and to determine the accuracy of the taxes.

Financial institutes such as banks decides on whether to grant loans to a company by

assessing the information on liquidity and the availability of assets presented in a

company’s financial statements.

General public is interest in how a company’s activities effects the economy,

environment and the local community therefore, to assess it they use the information

provided by financial statements.

In conclusion by considering the information provided above, it is clear that financial

statements provide useful information to a wide range of users. Such information supports them

to take appropriate decisions regarding business matters and become successful.

9

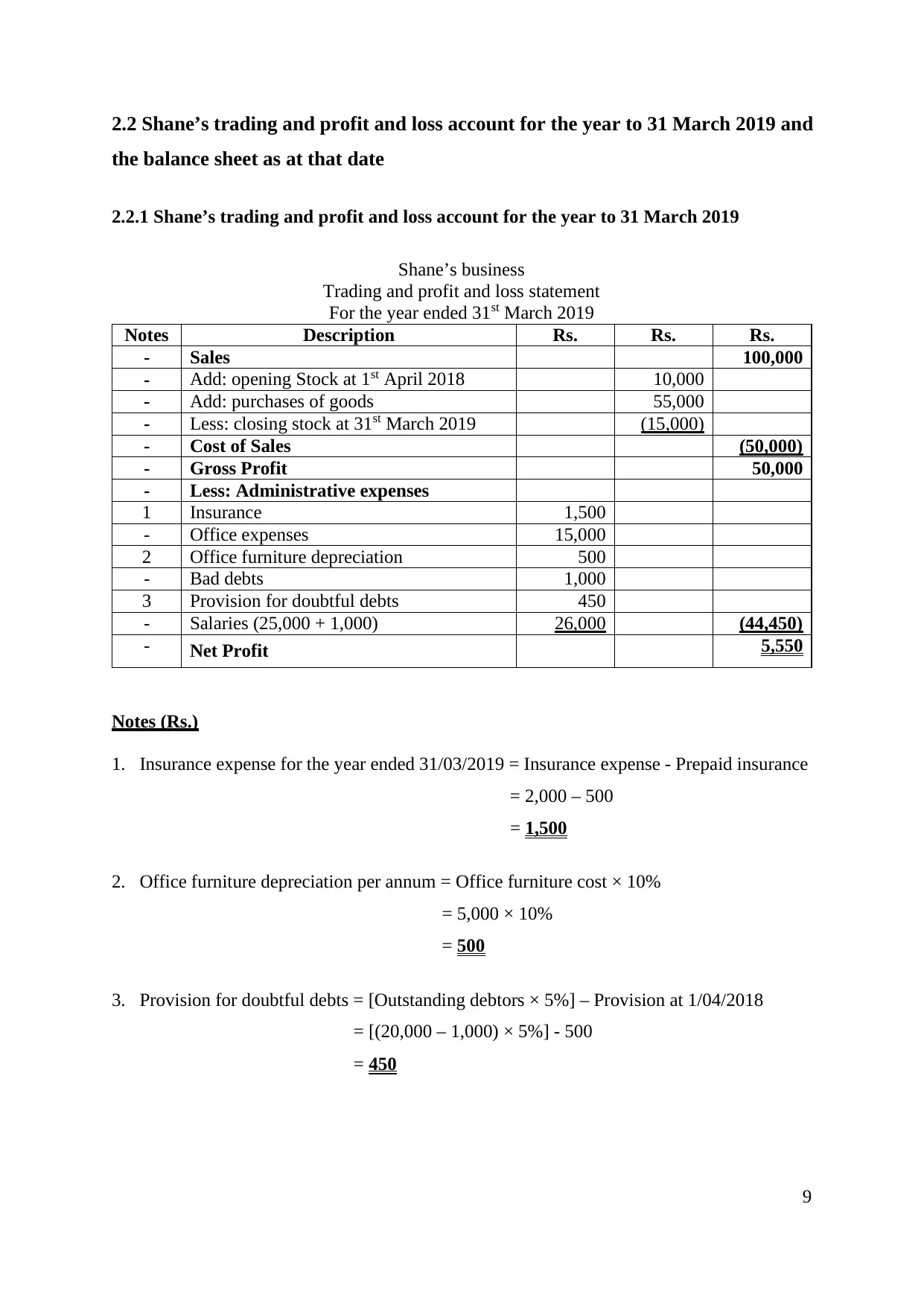

2.2 Shane’s trading and profit and loss account for the year to 31 March 2019 and

the balance sheet as at that date

2.2.1 Shane’s trading and profit and loss account for the year to 31 March 2019

Shane’s business

Trading and profit and loss statement

For the year ended 31st March 2019

Notes Description Rs. Rs. Rs.

- Sales 100,000

- Add: opening Stock at 1st April 2018 10,000

- Add: purchases of goods 55,000

- Less: closing stock at 31st March 2019 (15,000)

- Cost of Sales (50,000)

- Gross Profit 50,000

- Less: Administrative expenses

1 Insurance 1,500

- Office expenses 15,000

2 Office furniture depreciation 500

- Bad debts 1,000

3 Provision for doubtful debts 450

- Salaries (25,000 + 1,000) 26,000 (44,450)

- Net Profit 5,550

Notes (Rs.)

1. Insurance expense for the year ended 31/03/2019 = Insurance expense - Prepaid insurance

= 2,000 – 500

= 1,500

2. Office furniture depreciation per annum = Office furniture cost × 10%

= 5,000 × 10%

= 500

3. Provision for doubtful debts = [Outstanding debtors × 5%] – Provision at 1/04/2018

= [(20,000 – 1,000) × 5%] - 500

= 450

2.2 Shane’s trading and profit and loss account for the year to 31 March 2019 and

the balance sheet as at that date

2.2.1 Shane’s trading and profit and loss account for the year to 31 March 2019

Shane’s business

Trading and profit and loss statement

For the year ended 31st March 2019

Notes Description Rs. Rs. Rs.

- Sales 100,000

- Add: opening Stock at 1st April 2018 10,000

- Add: purchases of goods 55,000

- Less: closing stock at 31st March 2019 (15,000)

- Cost of Sales (50,000)

- Gross Profit 50,000

- Less: Administrative expenses

1 Insurance 1,500

- Office expenses 15,000

2 Office furniture depreciation 500

- Bad debts 1,000

3 Provision for doubtful debts 450

- Salaries (25,000 + 1,000) 26,000 (44,450)

- Net Profit 5,550

Notes (Rs.)

1. Insurance expense for the year ended 31/03/2019 = Insurance expense - Prepaid insurance

= 2,000 – 500

= 1,500

2. Office furniture depreciation per annum = Office furniture cost × 10%

= 5,000 × 10%

= 500

3. Provision for doubtful debts = [Outstanding debtors × 5%] – Provision at 1/04/2018

= [(20,000 – 1,000) × 5%] - 500

= 450

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

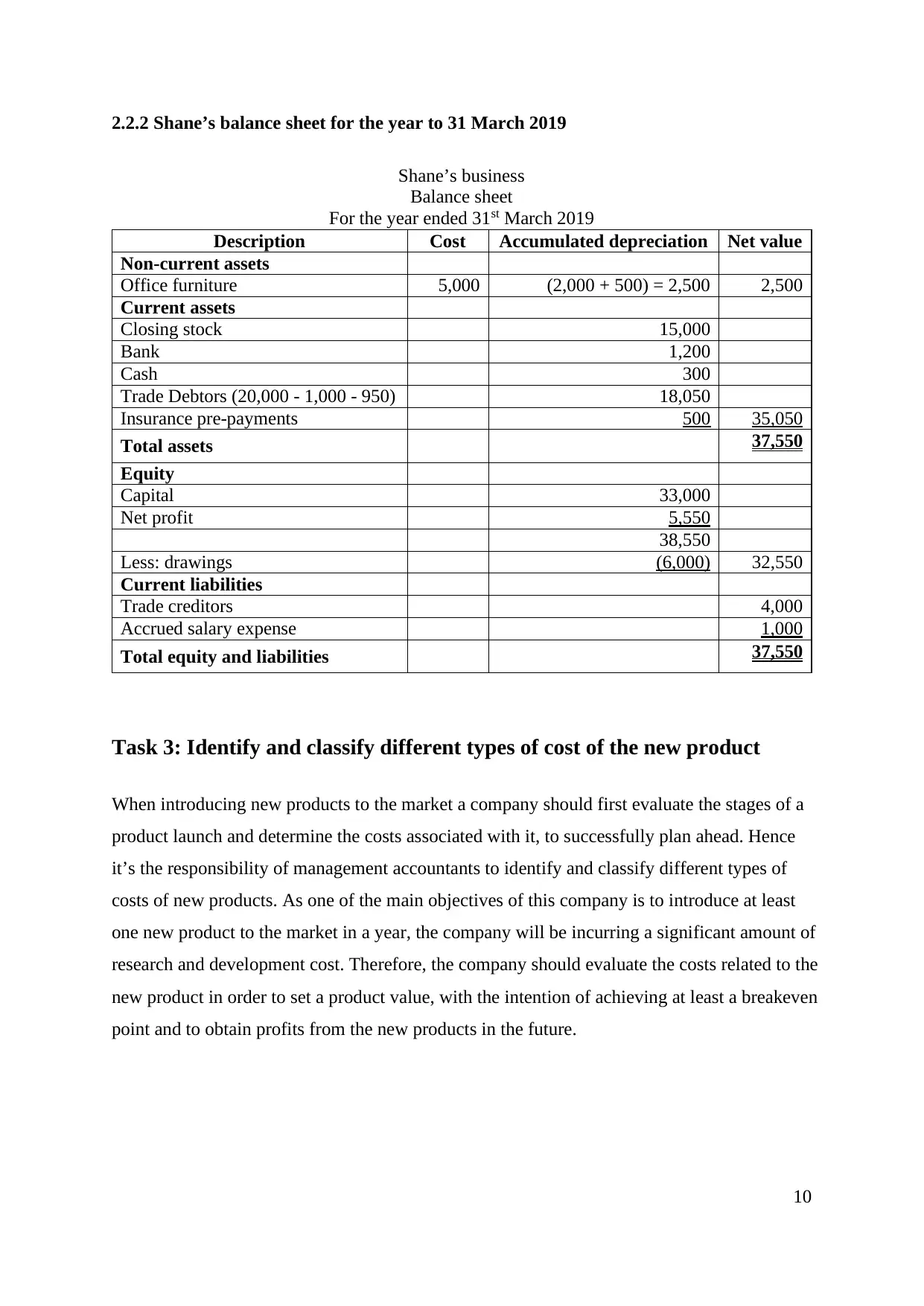

2.2.2 Shane’s balance sheet for the year to 31 March 2019

Shane’s business

Balance sheet

For the year ended 31st March 2019

Description Cost Accumulated depreciation Net value

Non-current assets

Office furniture 5,000 (2,000 + 500) = 2,500 2,500

Current assets

Closing stock 15,000

Bank 1,200

Cash 300

Trade Debtors (20,000 - 1,000 - 950) 18,050

Insurance pre-payments 500 35,050

Total assets 37,550

Equity

Capital 33,000

Net profit 5,550

38,550

Less: drawings (6,000) 32,550

Current liabilities

Trade creditors 4,000

Accrued salary expense 1,000

Total equity and liabilities 37,550

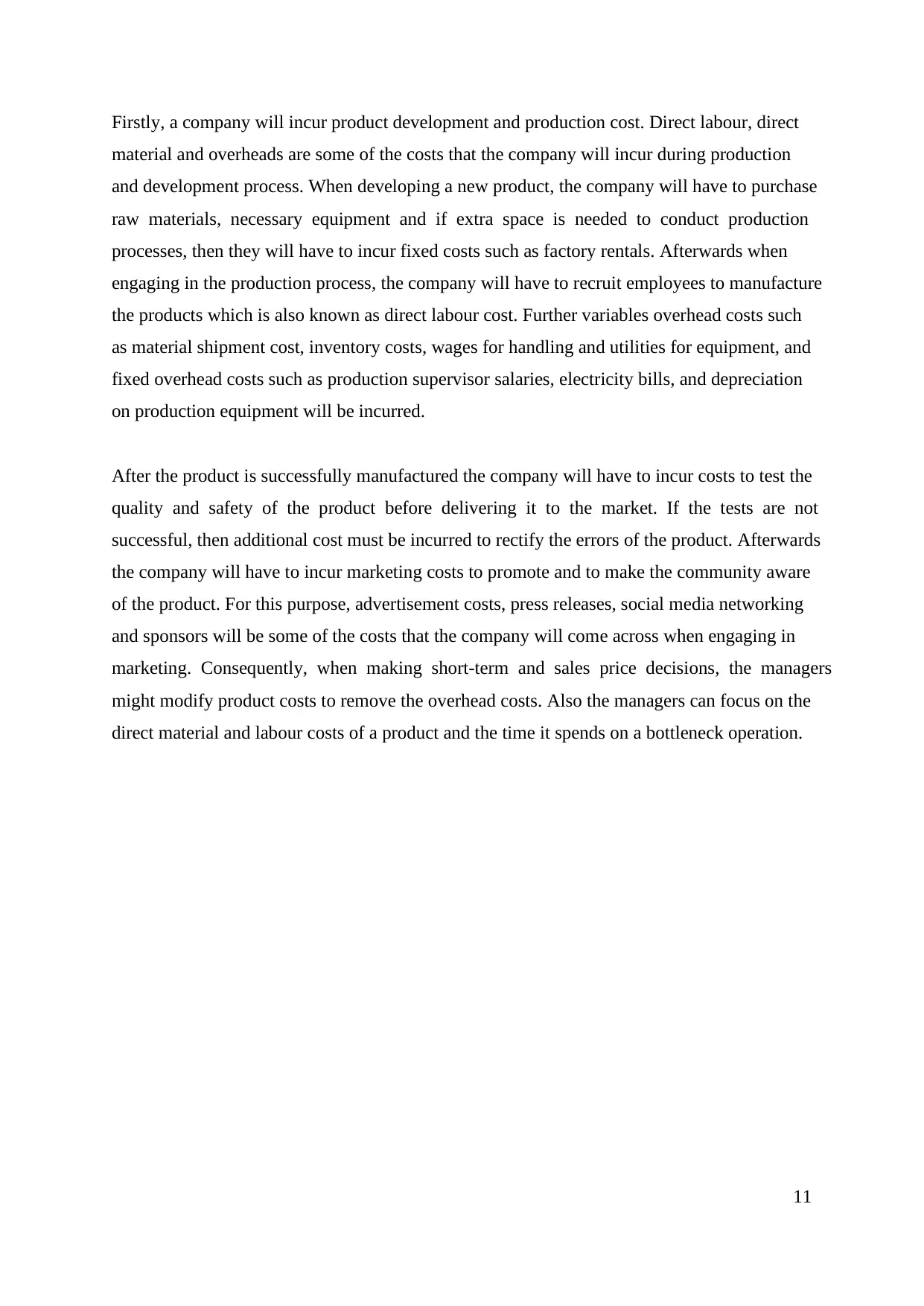

Task 3: Identify and classify different types of cost of the new product

When introducing new products to the market a company should first evaluate the stages of a

product launch and determine the costs associated with it, to successfully plan ahead. Hence

it’s the responsibility of management accountants to identify and classify different types of

costs of new products. As one of the main objectives of this company is to introduce at least

one new product to the market in a year, the company will be incurring a significant amount of

research and development cost. Therefore, the company should evaluate the costs related to the

new product in order to set a product value, with the intention of achieving at least a breakeven

point and to obtain profits from the new products in the future.

2.2.2 Shane’s balance sheet for the year to 31 March 2019

Shane’s business

Balance sheet

For the year ended 31st March 2019

Description Cost Accumulated depreciation Net value

Non-current assets

Office furniture 5,000 (2,000 + 500) = 2,500 2,500

Current assets

Closing stock 15,000

Bank 1,200

Cash 300

Trade Debtors (20,000 - 1,000 - 950) 18,050

Insurance pre-payments 500 35,050

Total assets 37,550

Equity

Capital 33,000

Net profit 5,550

38,550

Less: drawings (6,000) 32,550

Current liabilities

Trade creditors 4,000

Accrued salary expense 1,000

Total equity and liabilities 37,550

Task 3: Identify and classify different types of cost of the new product

When introducing new products to the market a company should first evaluate the stages of a

product launch and determine the costs associated with it, to successfully plan ahead. Hence

it’s the responsibility of management accountants to identify and classify different types of

costs of new products. As one of the main objectives of this company is to introduce at least

one new product to the market in a year, the company will be incurring a significant amount of

research and development cost. Therefore, the company should evaluate the costs related to the

new product in order to set a product value, with the intention of achieving at least a breakeven

point and to obtain profits from the new products in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

Firstly, a company will incur product development and production cost. Direct labour, direct

material and overheads are some of the costs that the company will incur during production

and development process. When developing a new product, the company will have to purchase

raw materials, necessary equipment and if extra space is needed to conduct production

processes, then they will have to incur fixed costs such as factory rentals. Afterwards when

engaging in the production process, the company will have to recruit employees to manufacture

the products which is also known as direct labour cost. Further variables overhead costs such

as material shipment cost, inventory costs, wages for handling and utilities for equipment, and

fixed overhead costs such as production supervisor salaries, electricity bills, and depreciation

on production equipment will be incurred.

After the product is successfully manufactured the company will have to incur costs to test the

quality and safety of the product before delivering it to the market. If the tests are not

successful, then additional cost must be incurred to rectify the errors of the product. Afterwards

the company will have to incur marketing costs to promote and to make the community aware

of the product. For this purpose, advertisement costs, press releases, social media networking

and sponsors will be some of the costs that the company will come across when engaging in

marketing. Consequently, when making short-term and sales price decisions, the managers

might modify product costs to remove the overhead costs. Also the managers can focus on the

direct material and labour costs of a product and the time it spends on a bottleneck operation.

Firstly, a company will incur product development and production cost. Direct labour, direct

material and overheads are some of the costs that the company will incur during production

and development process. When developing a new product, the company will have to purchase

raw materials, necessary equipment and if extra space is needed to conduct production

processes, then they will have to incur fixed costs such as factory rentals. Afterwards when

engaging in the production process, the company will have to recruit employees to manufacture

the products which is also known as direct labour cost. Further variables overhead costs such

as material shipment cost, inventory costs, wages for handling and utilities for equipment, and

fixed overhead costs such as production supervisor salaries, electricity bills, and depreciation

on production equipment will be incurred.

After the product is successfully manufactured the company will have to incur costs to test the

quality and safety of the product before delivering it to the market. If the tests are not

successful, then additional cost must be incurred to rectify the errors of the product. Afterwards

the company will have to incur marketing costs to promote and to make the community aware

of the product. For this purpose, advertisement costs, press releases, social media networking

and sponsors will be some of the costs that the company will come across when engaging in

marketing. Consequently, when making short-term and sales price decisions, the managers

might modify product costs to remove the overhead costs. Also the managers can focus on the

direct material and labour costs of a product and the time it spends on a bottleneck operation.

12

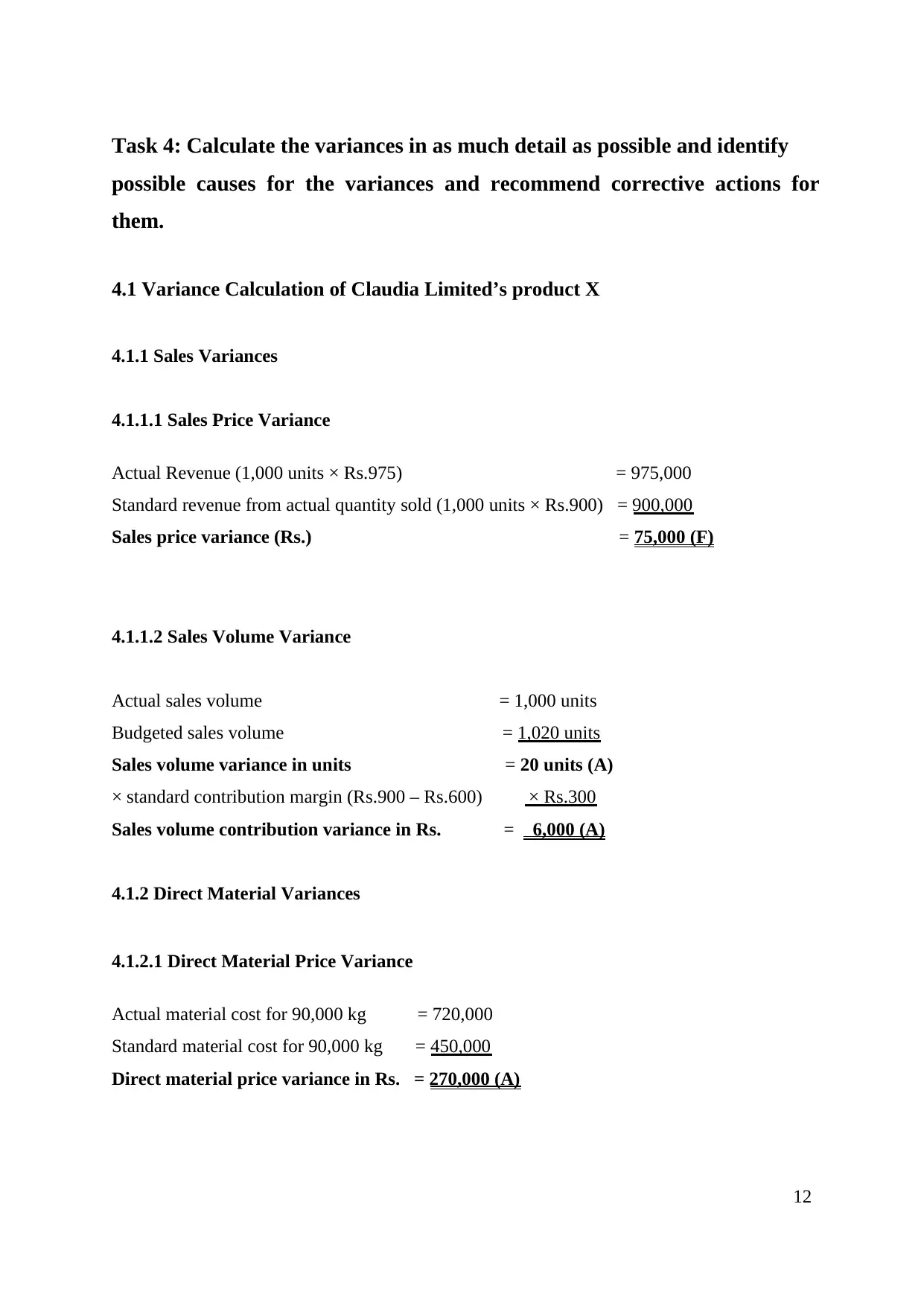

Task 4: Calculate the variances in as much detail as possible and identify

possible causes for the variances and recommend corrective actions for

them.

4.1 Variance Calculation of Claudia Limited’s product X

4.1.1 Sales Variances

4.1.1.1 Sales Price Variance

Actual Revenue (1,000 units × Rs.975) = 975,000

Standard revenue from actual quantity sold (1,000 units × Rs.900) = 900,000

Sales price variance (Rs.) = 75,000 (F)

4.1.1.2 Sales Volume Variance

Actual sales volume = 1,000 units

Budgeted sales volume = 1,020 units

Sales volume variance in units = 20 units (A)

× standard contribution margin (Rs.900 – Rs.600) × Rs.300

Sales volume contribution variance in Rs. = 6,000 (A)

4.1.2 Direct Material Variances

4.1.2.1 Direct Material Price Variance

Actual material cost for 90,000 kg = 720,000

Standard material cost for 90,000 kg = 450,000

Direct material price variance in Rs. = 270,000 (A)

Task 4: Calculate the variances in as much detail as possible and identify

possible causes for the variances and recommend corrective actions for

them.

4.1 Variance Calculation of Claudia Limited’s product X

4.1.1 Sales Variances

4.1.1.1 Sales Price Variance

Actual Revenue (1,000 units × Rs.975) = 975,000

Standard revenue from actual quantity sold (1,000 units × Rs.900) = 900,000

Sales price variance (Rs.) = 75,000 (F)

4.1.1.2 Sales Volume Variance

Actual sales volume = 1,000 units

Budgeted sales volume = 1,020 units

Sales volume variance in units = 20 units (A)

× standard contribution margin (Rs.900 – Rs.600) × Rs.300

Sales volume contribution variance in Rs. = 6,000 (A)

4.1.2 Direct Material Variances

4.1.2.1 Direct Material Price Variance

Actual material cost for 90,000 kg = 720,000

Standard material cost for 90,000 kg = 450,000

Direct material price variance in Rs. = 270,000 (A)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.