Superstore Ltd Financial Statement Analysis and Accounting Treatment

VerifiedAdded on 2023/06/08

|23

|2540

|398

Report

AI Summary

This assignment provides a detailed analysis of various accounting issues faced by Superstore Ltd, including changes in the useful life of manufacturing equipment, unrecorded repair invoices, fluctuations in the value of shares, and fraudulent activities. It explains the correct accounting treatments according to AASB standards, including necessary journal entries and disclosures in the financial statements. The report also covers share capital transactions, tax implications, and the calculation of taxable income, deferred tax assets, and liabilities. Additionally, it addresses the revaluation of equipment and impairment losses on various assets, providing a comprehensive overview of accounting principles and their practical application. Desklib offers a wealth of similar solved assignments and past papers to aid students in their studies.

ACCOUNTING 1

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 2

Question 1:

Part 1:

On 1 July 2017, the directors made a decision, using information obtained over the last

couple of years, to revise the useful life of an item of manufacturing equipment. The

equipment was acquired on 1 July 2015 for $800,000, and has been depreciated on a

straight-line basis, based on an estimated useful life of 10 years and residual value of nil.

Superstore Ltd uses the cost model for manufacturing equipment. The directors

estimate that as at 1 July 2017, the equipment has a remaining useful life of 6 years and

a residual value of nil. No depreciation has been recorded as yet for the year ended 30

June 2018 as the directors were unsure how to account for the change in the 2018

financial statements, and unsure whether the 2016 and 2017 financial statements will

need to be revised as a result of the change:

As per the rules that have been laid down by the AASB, the company is allowed to change

the method of depreciation only in the case when the same is required by law. Or if the

financial results would be represented in a fair manner due to the adoption of the new method

of deprecation. As and when the change in the methods of depreciation are taken, that change

has to be considered to be the change in an accounting estimate. Hence, that effect must be

shown in the financial year in which that change had taken place. This would result in that

years financial statements and also, in the income of the previous years. The standard states

that the change would be retrospective and nay amount of additional or excess depreciation

shall be charged back (AASB, 2018).

Hence, in the given case, the company had valued the equipment using the cost model which

is correct. Then, in 2017, the company decided that the asset has the remaining life of lesser

years and hence, charged no depreciation.

Question 1:

Part 1:

On 1 July 2017, the directors made a decision, using information obtained over the last

couple of years, to revise the useful life of an item of manufacturing equipment. The

equipment was acquired on 1 July 2015 for $800,000, and has been depreciated on a

straight-line basis, based on an estimated useful life of 10 years and residual value of nil.

Superstore Ltd uses the cost model for manufacturing equipment. The directors

estimate that as at 1 July 2017, the equipment has a remaining useful life of 6 years and

a residual value of nil. No depreciation has been recorded as yet for the year ended 30

June 2018 as the directors were unsure how to account for the change in the 2018

financial statements, and unsure whether the 2016 and 2017 financial statements will

need to be revised as a result of the change:

As per the rules that have been laid down by the AASB, the company is allowed to change

the method of depreciation only in the case when the same is required by law. Or if the

financial results would be represented in a fair manner due to the adoption of the new method

of deprecation. As and when the change in the methods of depreciation are taken, that change

has to be considered to be the change in an accounting estimate. Hence, that effect must be

shown in the financial year in which that change had taken place. This would result in that

years financial statements and also, in the income of the previous years. The standard states

that the change would be retrospective and nay amount of additional or excess depreciation

shall be charged back (AASB, 2018).

Hence, in the given case, the company had valued the equipment using the cost model which

is correct. Then, in 2017, the company decided that the asset has the remaining life of lesser

years and hence, charged no depreciation.

ACCOUNTING 3

The correct accounting treatment of this entry should have been that the company should

have charged the depreciation since year ended 2018 at $(800000-160000-0)/6=$106,667

which is the original cost of asset-depreciation charged till date (80000*2)-salvage value in

2018 divided by the number of useful lives.

Since, the company has not charged in the depreciation till now, it shall now charge it at the

above stated amount.

The following would be its entry:

Depreciation expense Dr 106,667

To Accumulated depreciation 106,667

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Part 2:

In June 2018, the accounts payable officer discovered that an invoice for repairs to

equipment, with an amount due of $20,000, incurred in June 2017, had not been paid or

provided for in the 2017 financial statements. The invoice was paid on 12 July 2018. The

repairs are deductible for tax purposes. The accountant responsible for preparing the

company’s income tax returns will amend the 2017 tax return, and the company will

receive a tax refund of $6,000 as a result (30% x $20,000). No journal entries have been

done as yet in the accounting records of Superstore Ltd, as the directors are unsure how

to account for this situation, and what period adjustments need to be made in:

In June 2018, the accounts payable officer discovered that an invoice for repairs to

equipment, with an amount due of $20,000, incurred in June 2017, had not been paid or

provided for in the 2017 financial statements. The invoice was paid on 12 July 2018. The

repairs are deductible for tax purposes. The accountant responsible for preparing the

The correct accounting treatment of this entry should have been that the company should

have charged the depreciation since year ended 2018 at $(800000-160000-0)/6=$106,667

which is the original cost of asset-depreciation charged till date (80000*2)-salvage value in

2018 divided by the number of useful lives.

Since, the company has not charged in the depreciation till now, it shall now charge it at the

above stated amount.

The following would be its entry:

Depreciation expense Dr 106,667

To Accumulated depreciation 106,667

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Part 2:

In June 2018, the accounts payable officer discovered that an invoice for repairs to

equipment, with an amount due of $20,000, incurred in June 2017, had not been paid or

provided for in the 2017 financial statements. The invoice was paid on 12 July 2018. The

repairs are deductible for tax purposes. The accountant responsible for preparing the

company’s income tax returns will amend the 2017 tax return, and the company will

receive a tax refund of $6,000 as a result (30% x $20,000). No journal entries have been

done as yet in the accounting records of Superstore Ltd, as the directors are unsure how

to account for this situation, and what period adjustments need to be made in:

In June 2018, the accounts payable officer discovered that an invoice for repairs to

equipment, with an amount due of $20,000, incurred in June 2017, had not been paid or

provided for in the 2017 financial statements. The invoice was paid on 12 July 2018. The

repairs are deductible for tax purposes. The accountant responsible for preparing the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 4

company’s income tax returns will amend the 2017 tax return, and the company will receive a

tax refund of $6,000 as a result (30% x $20,000). No journal entries have been done as yet in

the accounting records of Superstore Ltd, as the directors are unsure how to account for this

situation, and what period adjustments need to be made in.

The AASB states the fact that any amount which has not been recognised as either costs or

revenue and though should have, should have shown as the revenue or loss from the prior

period.

Hence, in the given case too, the company shall record in the expense of $20,000 in the books

of accounts of the year ended 2018 (EY, 2018).

The following would be its entry:

Repairs on equipment expense Dr 20,000

To Profit and Loss A/c 20,000

With regard to the notes in financial statements, the fact shall not be recorded in the notes.

Part 3:

Superstore Ltd holds shares in a listed public company, ABC Ltd, which are valued in

the draft financial statements on 30 June 2018 at their market value on that date -

$600,000. A major fall in the stock market occurred on 10 July 2018, and the value of

Superstore’s shares in ABC Ltd declined to $250,000:

AASB 13 states that any asset or the liability that is held by the company shall be reported at

its fair value. The fair value has been defined as the amount that any asset would fetch when

sold in the open market. The standard further states 2 types of accounting of these sorts of

assets.

company’s income tax returns will amend the 2017 tax return, and the company will receive a

tax refund of $6,000 as a result (30% x $20,000). No journal entries have been done as yet in

the accounting records of Superstore Ltd, as the directors are unsure how to account for this

situation, and what period adjustments need to be made in.

The AASB states the fact that any amount which has not been recognised as either costs or

revenue and though should have, should have shown as the revenue or loss from the prior

period.

Hence, in the given case too, the company shall record in the expense of $20,000 in the books

of accounts of the year ended 2018 (EY, 2018).

The following would be its entry:

Repairs on equipment expense Dr 20,000

To Profit and Loss A/c 20,000

With regard to the notes in financial statements, the fact shall not be recorded in the notes.

Part 3:

Superstore Ltd holds shares in a listed public company, ABC Ltd, which are valued in

the draft financial statements on 30 June 2018 at their market value on that date -

$600,000. A major fall in the stock market occurred on 10 July 2018, and the value of

Superstore’s shares in ABC Ltd declined to $250,000:

AASB 13 states that any asset or the liability that is held by the company shall be reported at

its fair value. The fair value has been defined as the amount that any asset would fetch when

sold in the open market. The standard further states 2 types of accounting of these sorts of

assets.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 5

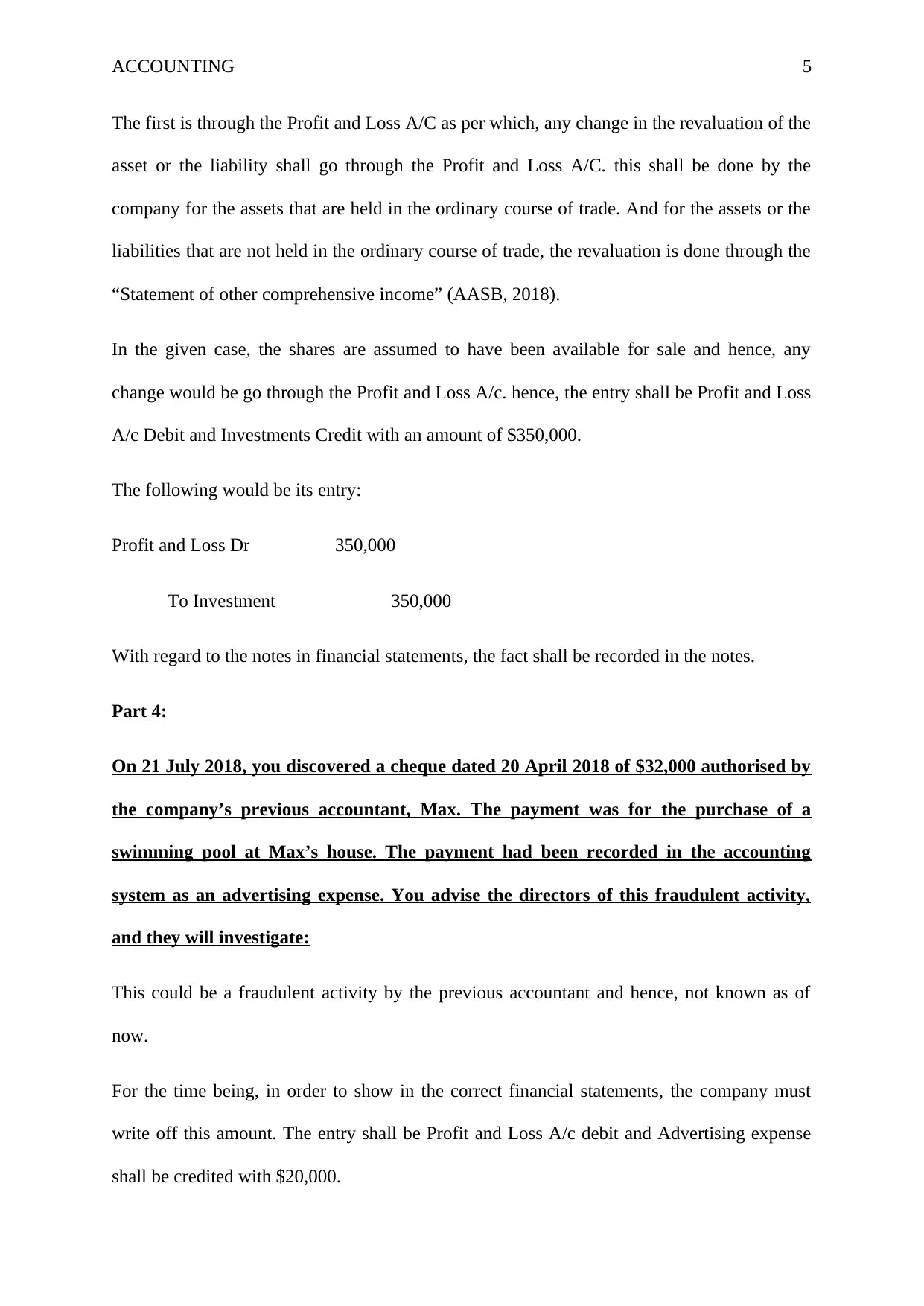

The first is through the Profit and Loss A/C as per which, any change in the revaluation of the

asset or the liability shall go through the Profit and Loss A/C. this shall be done by the

company for the assets that are held in the ordinary course of trade. And for the assets or the

liabilities that are not held in the ordinary course of trade, the revaluation is done through the

“Statement of other comprehensive income” (AASB, 2018).

In the given case, the shares are assumed to have been available for sale and hence, any

change would be go through the Profit and Loss A/c. hence, the entry shall be Profit and Loss

A/c Debit and Investments Credit with an amount of $350,000.

The following would be its entry:

Profit and Loss Dr 350,000

To Investment 350,000

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Part 4:

On 21 July 2018, you discovered a cheque dated 20 April 2018 of $32,000 authorised by

the company’s previous accountant, Max. The payment was for the purchase of a

swimming pool at Max’s house. The payment had been recorded in the accounting

system as an advertising expense. You advise the directors of this fraudulent activity,

and they will investigate:

This could be a fraudulent activity by the previous accountant and hence, not known as of

now.

For the time being, in order to show in the correct financial statements, the company must

write off this amount. The entry shall be Profit and Loss A/c debit and Advertising expense

shall be credited with $20,000.

The first is through the Profit and Loss A/C as per which, any change in the revaluation of the

asset or the liability shall go through the Profit and Loss A/C. this shall be done by the

company for the assets that are held in the ordinary course of trade. And for the assets or the

liabilities that are not held in the ordinary course of trade, the revaluation is done through the

“Statement of other comprehensive income” (AASB, 2018).

In the given case, the shares are assumed to have been available for sale and hence, any

change would be go through the Profit and Loss A/c. hence, the entry shall be Profit and Loss

A/c Debit and Investments Credit with an amount of $350,000.

The following would be its entry:

Profit and Loss Dr 350,000

To Investment 350,000

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Part 4:

On 21 July 2018, you discovered a cheque dated 20 April 2018 of $32,000 authorised by

the company’s previous accountant, Max. The payment was for the purchase of a

swimming pool at Max’s house. The payment had been recorded in the accounting

system as an advertising expense. You advise the directors of this fraudulent activity,

and they will investigate:

This could be a fraudulent activity by the previous accountant and hence, not known as of

now.

For the time being, in order to show in the correct financial statements, the company must

write off this amount. The entry shall be Profit and Loss A/c debit and Advertising expense

shall be credited with $20,000.

ACCOUNTING 6

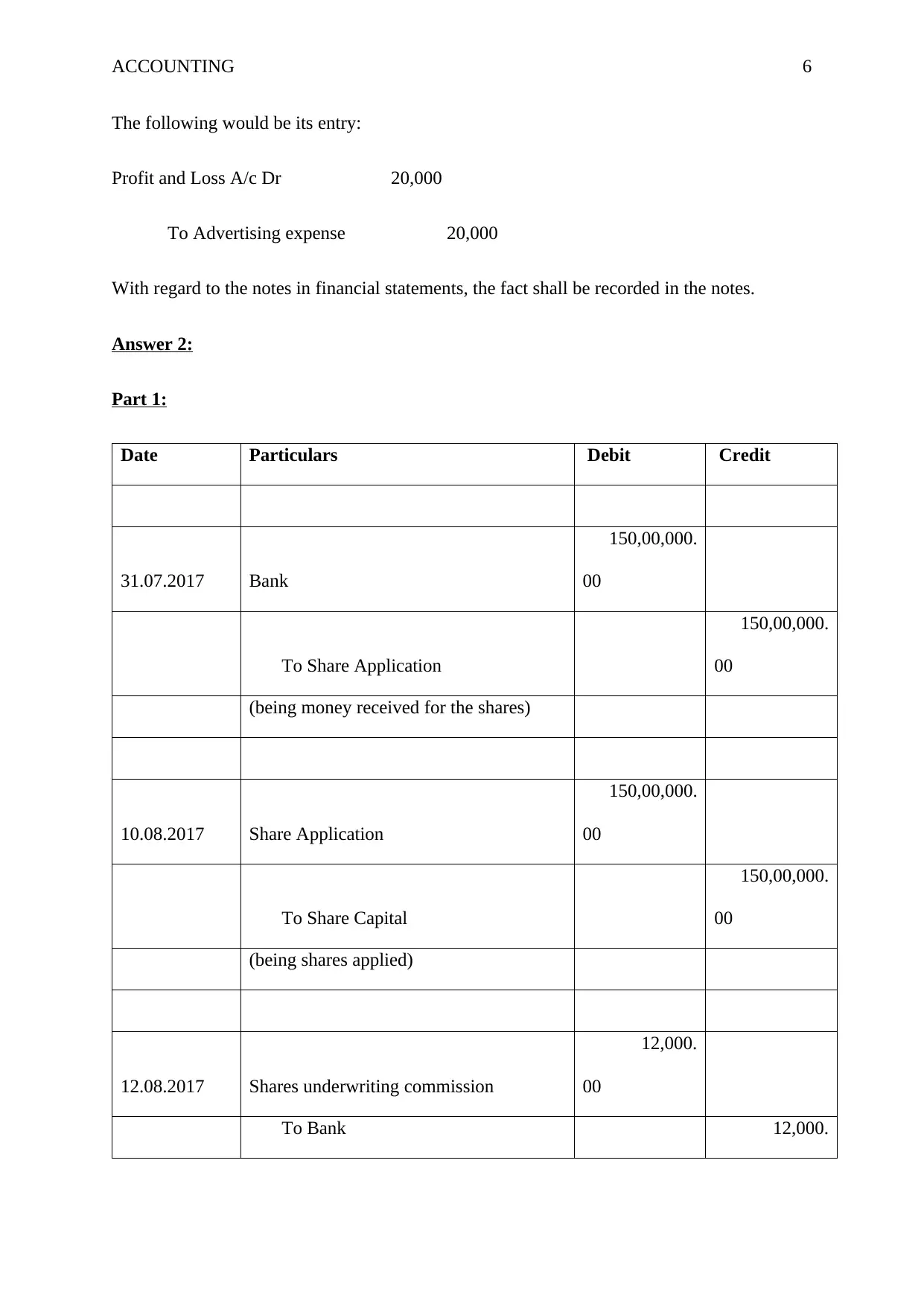

The following would be its entry:

Profit and Loss A/c Dr 20,000

To Advertising expense 20,000

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Answer 2:

Part 1:

Date Particulars Debit Credit

31.07.2017 Bank

150,00,000.

00

To Share Application

150,00,000.

00

(being money received for the shares)

10.08.2017 Share Application

150,00,000.

00

To Share Capital

150,00,000.

00

(being shares applied)

12.08.2017 Shares underwriting commission

12,000.

00

To Bank 12,000.

The following would be its entry:

Profit and Loss A/c Dr 20,000

To Advertising expense 20,000

With regard to the notes in financial statements, the fact shall be recorded in the notes.

Answer 2:

Part 1:

Date Particulars Debit Credit

31.07.2017 Bank

150,00,000.

00

To Share Application

150,00,000.

00

(being money received for the shares)

10.08.2017 Share Application

150,00,000.

00

To Share Capital

150,00,000.

00

(being shares applied)

12.08.2017 Shares underwriting commission

12,000.

00

To Bank 12,000.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

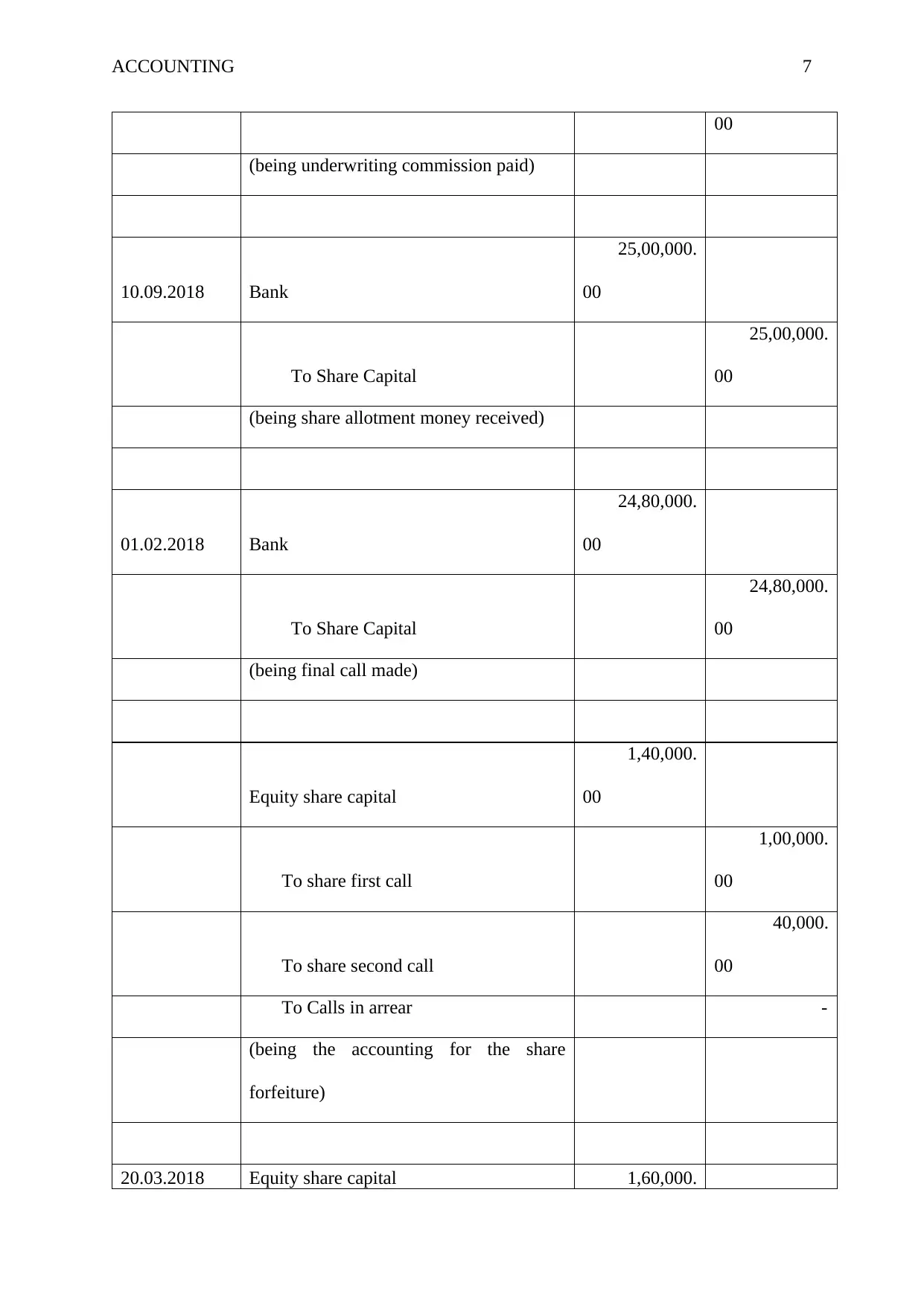

ACCOUNTING 7

00

(being underwriting commission paid)

10.09.2018 Bank

25,00,000.

00

To Share Capital

25,00,000.

00

(being share allotment money received)

01.02.2018 Bank

24,80,000.

00

To Share Capital

24,80,000.

00

(being final call made)

Equity share capital

1,40,000.

00

To share first call

1,00,000.

00

To share second call

40,000.

00

To Calls in arrear -

(being the accounting for the share

forfeiture)

20.03.2018 Equity share capital 1,60,000.

00

(being underwriting commission paid)

10.09.2018 Bank

25,00,000.

00

To Share Capital

25,00,000.

00

(being share allotment money received)

01.02.2018 Bank

24,80,000.

00

To Share Capital

24,80,000.

00

(being final call made)

Equity share capital

1,40,000.

00

To share first call

1,00,000.

00

To share second call

40,000.

00

To Calls in arrear -

(being the accounting for the share

forfeiture)

20.03.2018 Equity share capital 1,60,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

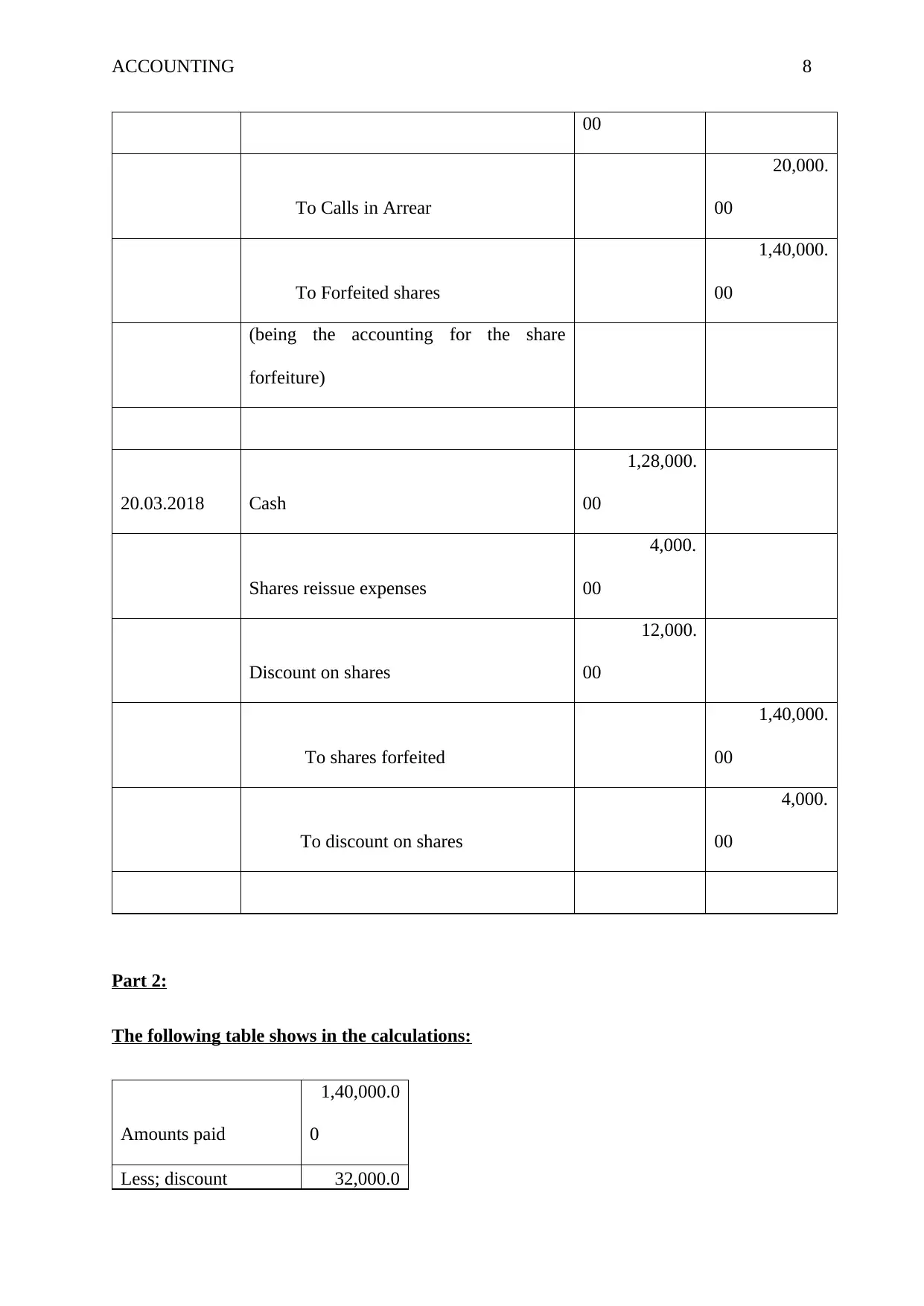

ACCOUNTING 8

00

To Calls in Arrear

20,000.

00

To Forfeited shares

1,40,000.

00

(being the accounting for the share

forfeiture)

20.03.2018 Cash

1,28,000.

00

Shares reissue expenses

4,000.

00

Discount on shares

12,000.

00

To shares forfeited

1,40,000.

00

To discount on shares

4,000.

00

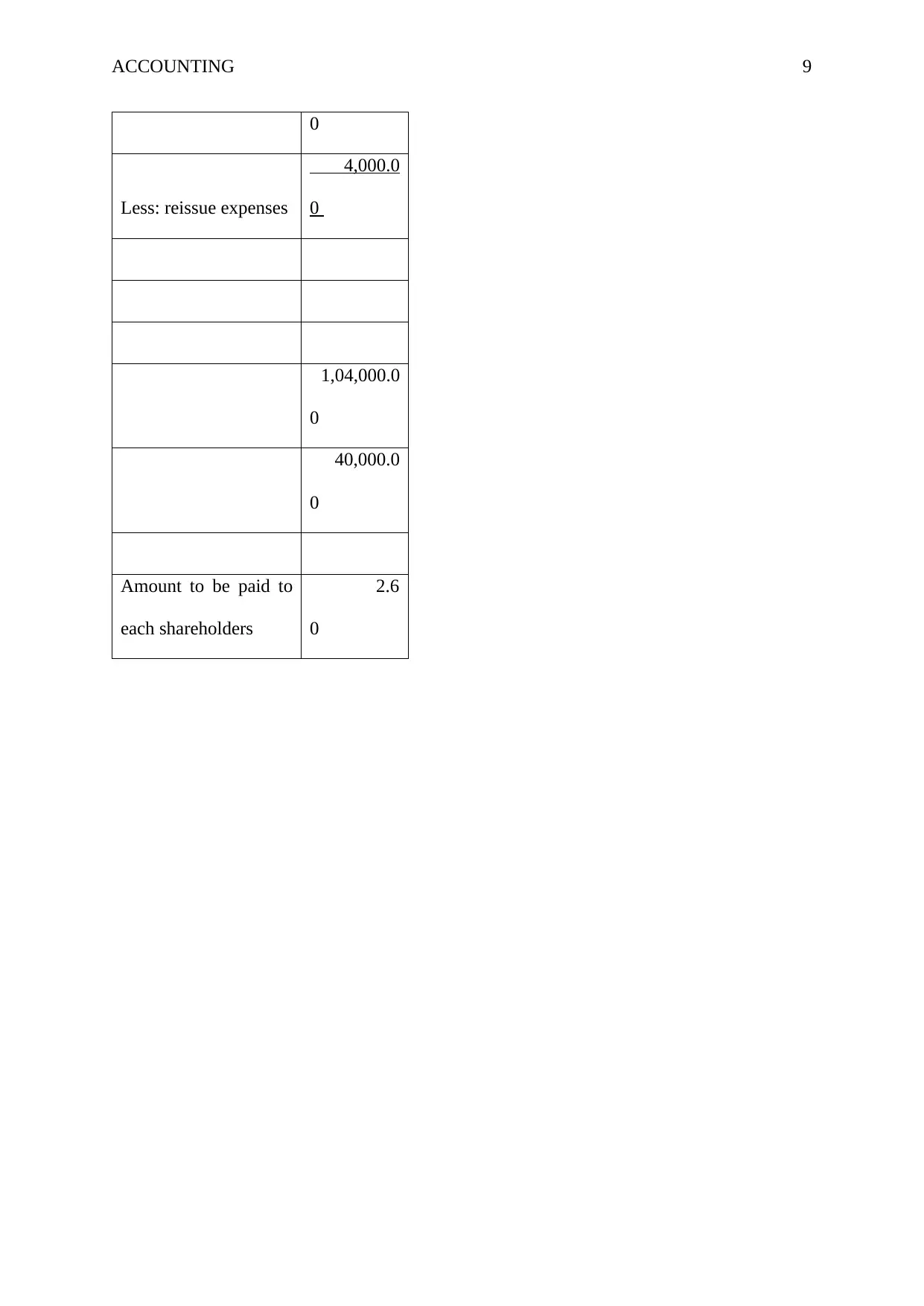

Part 2:

The following table shows in the calculations:

Amounts paid

1,40,000.0

0

Less; discount 32,000.0

00

To Calls in Arrear

20,000.

00

To Forfeited shares

1,40,000.

00

(being the accounting for the share

forfeiture)

20.03.2018 Cash

1,28,000.

00

Shares reissue expenses

4,000.

00

Discount on shares

12,000.

00

To shares forfeited

1,40,000.

00

To discount on shares

4,000.

00

Part 2:

The following table shows in the calculations:

Amounts paid

1,40,000.0

0

Less; discount 32,000.0

ACCOUNTING 9

0

Less: reissue expenses

4,000.0

0

1,04,000.0

0

40,000.0

0

Amount to be paid to

each shareholders

2.6

0

0

Less: reissue expenses

4,000.0

0

1,04,000.0

0

40,000.0

0

Amount to be paid to

each shareholders

2.6

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 10

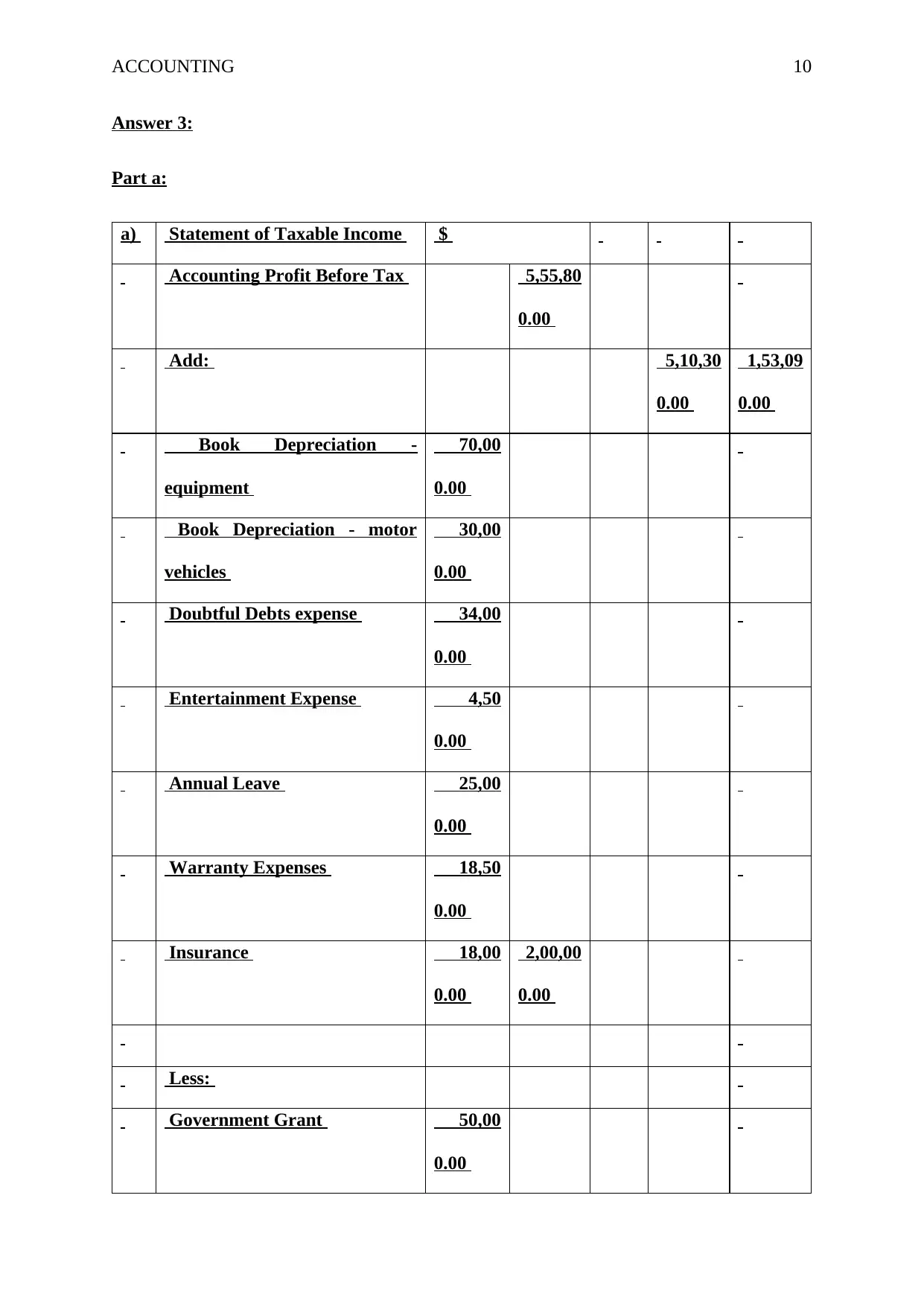

Answer 3:

Part a:

a) Statement of Taxable Income $

Accounting Profit Before Tax 5,55,80

0.00

Add: 5,10,30

0.00

1,53,09

0.00

Book Depreciation -

equipment

70,00

0.00

Book Depreciation - motor

vehicles

30,00

0.00

Doubtful Debts expense 34,00

0.00

Entertainment Expense 4,50

0.00

Annual Leave 25,00

0.00

Warranty Expenses 18,50

0.00

Insurance 18,00

0.00

2,00,00

0.00

Less:

Government Grant 50,00

0.00

Answer 3:

Part a:

a) Statement of Taxable Income $

Accounting Profit Before Tax 5,55,80

0.00

Add: 5,10,30

0.00

1,53,09

0.00

Book Depreciation -

equipment

70,00

0.00

Book Depreciation - motor

vehicles

30,00

0.00

Doubtful Debts expense 34,00

0.00

Entertainment Expense 4,50

0.00

Annual Leave 25,00

0.00

Warranty Expenses 18,50

0.00

Insurance 18,00

0.00

2,00,00

0.00

Less:

Government Grant 50,00

0.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

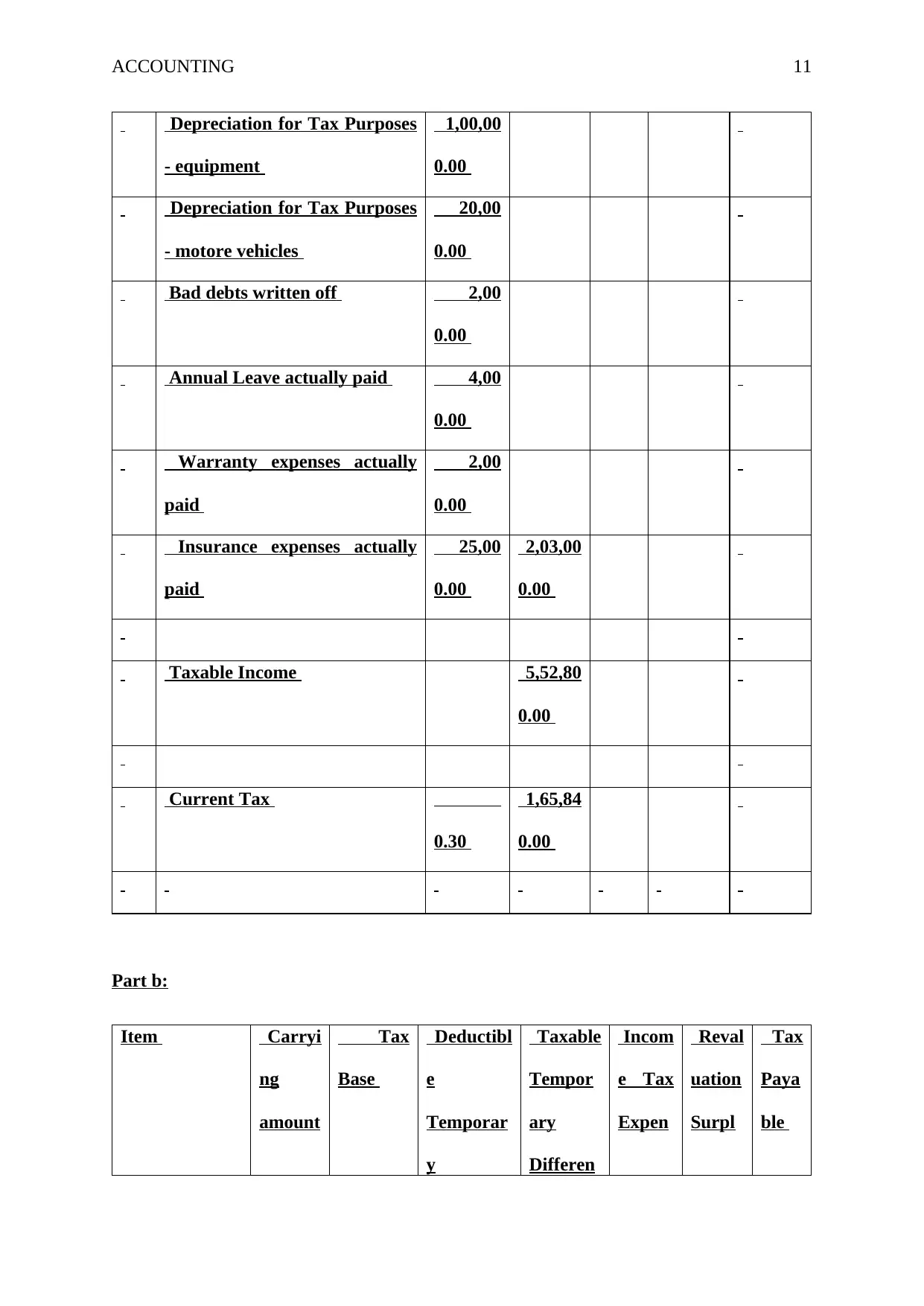

ACCOUNTING 11

Depreciation for Tax Purposes

- equipment

1,00,00

0.00

Depreciation for Tax Purposes

- motore vehicles

20,00

0.00

Bad debts written off 2,00

0.00

Annual Leave actually paid 4,00

0.00

Warranty expenses actually

paid

2,00

0.00

Insurance expenses actually

paid

25,00

0.00

2,03,00

0.00

Taxable Income 5,52,80

0.00

Current Tax

0.30

1,65,84

0.00

Part b:

Item Carryi

ng

amount

Tax

Base

Deductibl

e

Temporar

y

Taxable

Tempor

ary

Differen

Incom

e Tax

Expen

Reval

uation

Surpl

Tax

Paya

ble

Depreciation for Tax Purposes

- equipment

1,00,00

0.00

Depreciation for Tax Purposes

- motore vehicles

20,00

0.00

Bad debts written off 2,00

0.00

Annual Leave actually paid 4,00

0.00

Warranty expenses actually

paid

2,00

0.00

Insurance expenses actually

paid

25,00

0.00

2,03,00

0.00

Taxable Income 5,52,80

0.00

Current Tax

0.30

1,65,84

0.00

Part b:

Item Carryi

ng

amount

Tax

Base

Deductibl

e

Temporar

y

Taxable

Tempor

ary

Differen

Incom

e Tax

Expen

Reval

uation

Surpl

Tax

Paya

ble

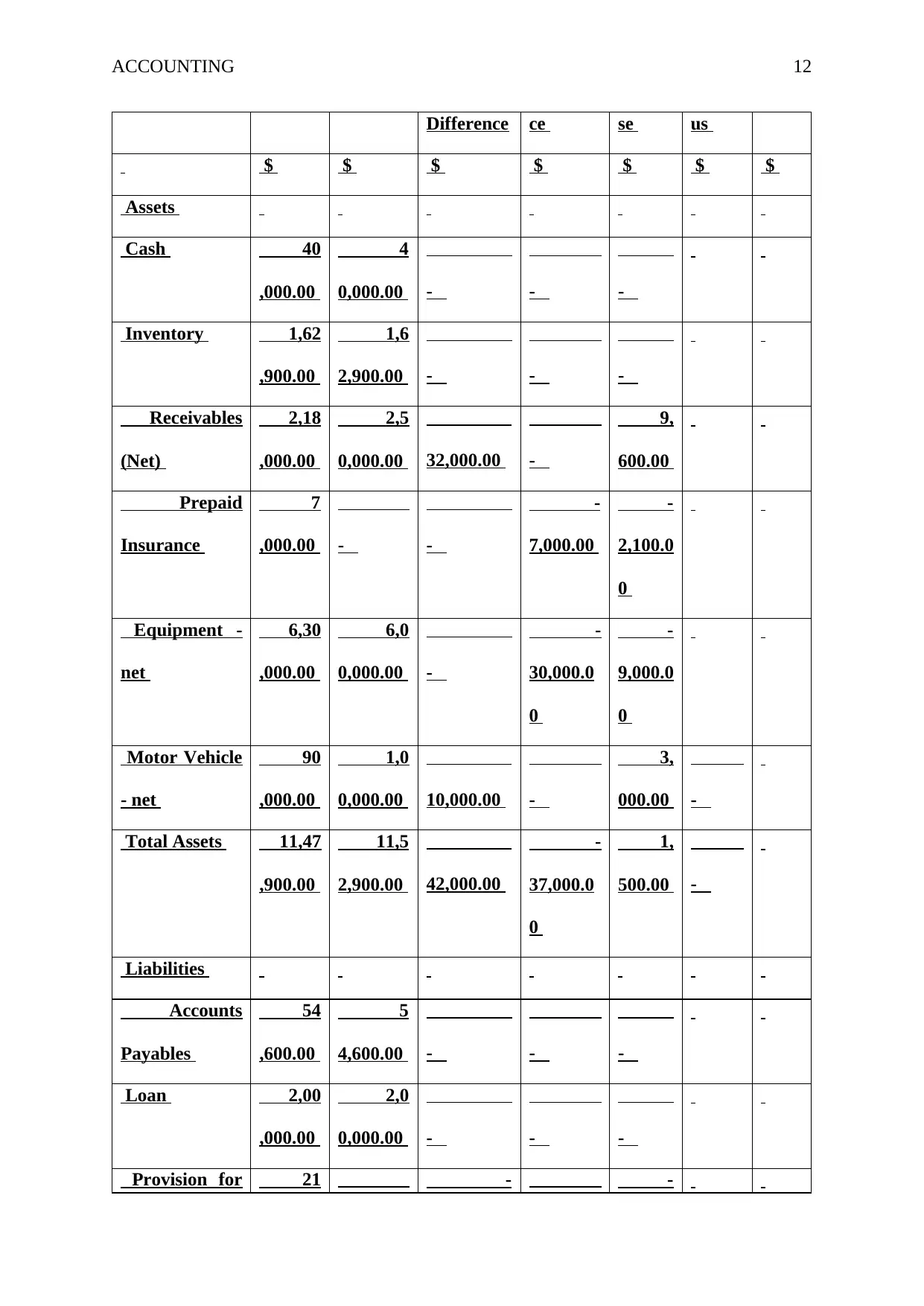

ACCOUNTING 12

Difference ce se us

$ $ $ $ $ $ $

Assets

Cash 40

,000.00

4

0,000.00 - - -

Inventory 1,62

,900.00

1,6

2,900.00 - - -

Receivables

(Net)

2,18

,000.00

2,5

0,000.00 32,000.00 -

9,

600.00

Prepaid

Insurance

7

,000.00 - -

-

7,000.00

-

2,100.0

0

Equipment -

net

6,30

,000.00

6,0

0,000.00 -

-

30,000.0

0

-

9,000.0

0

Motor Vehicle

- net

90

,000.00

1,0

0,000.00 10,000.00 -

3,

000.00 -

Total Assets 11,47

,900.00

11,5

2,900.00 42,000.00

-

37,000.0

0

1,

500.00 -

Liabilities

Accounts

Payables

54

,600.00

5

4,600.00 - - -

Loan 2,00

,000.00

2,0

0,000.00 - - -

Provision for 21 - -

Difference ce se us

$ $ $ $ $ $ $

Assets

Cash 40

,000.00

4

0,000.00 - - -

Inventory 1,62

,900.00

1,6

2,900.00 - - -

Receivables

(Net)

2,18

,000.00

2,5

0,000.00 32,000.00 -

9,

600.00

Prepaid

Insurance

7

,000.00 - -

-

7,000.00

-

2,100.0

0

Equipment -

net

6,30

,000.00

6,0

0,000.00 -

-

30,000.0

0

-

9,000.0

0

Motor Vehicle

- net

90

,000.00

1,0

0,000.00 10,000.00 -

3,

000.00 -

Total Assets 11,47

,900.00

11,5

2,900.00 42,000.00

-

37,000.0

0

1,

500.00 -

Liabilities

Accounts

Payables

54

,600.00

5

4,600.00 - - -

Loan 2,00

,000.00

2,0

0,000.00 - - -

Provision for 21 - -

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.