Accounting & Finance Assignment .

VerifiedAdded on 2023/05/28

|12

|1738

|490

AI Summary

This assignment covers topics like effective interest rate, annuity, dividend imputation, CAPM model, holding period returns, standard deviation and more in Accounting & Finance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCOUNTING & FINANCE

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question 1

a) (i) In order to decide as to which payment option should Jayne choose, it is imperative to

compute the effective interest rate for both the options and then choose the cheaper option.

EAR (4.55% p.a. compounded weekly) = (1+(4.55/5200))52 – 1 = 4.65%

With regards to the other option, the nominal rate is 4.75% and when the same would be

adjusted for nominal payment, then the effective annual rate would be much higher. As a

result, the interest rate of 4.55% p.a. compounded weekly would be preferred.

(ii) The formula for the principal repayment instalment is indicated below.

Instalment = P*R*(1+R)N/([1+R)N -1]

For the given question, P = $ 500,000, R = (4.55%/52) per week, Instalment = $ 1,000, N = ?

1000 = 500000*(4.55%/52)*(1+(4.55%/52))N/(1+(4.55%/52))N -1)

Solving the above, we get N = 657.85 weeks

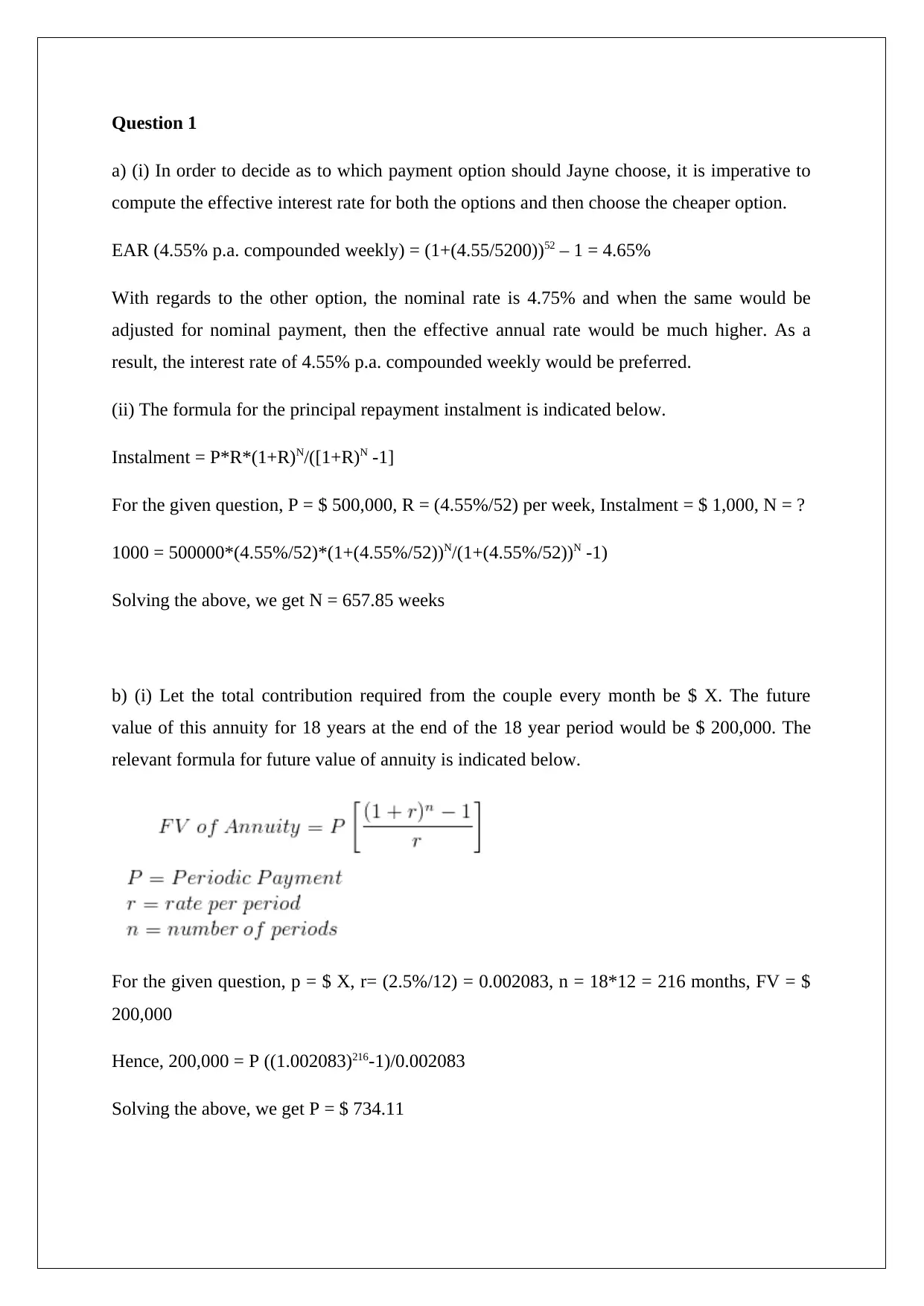

b) (i) Let the total contribution required from the couple every month be $ X. The future

value of this annuity for 18 years at the end of the 18 year period would be $ 200,000. The

relevant formula for future value of annuity is indicated below.

For the given question, p = $ X, r= (2.5%/12) = 0.002083, n = 18*12 = 216 months, FV = $

200,000

Hence, 200,000 = P ((1.002083)216-1)/0.002083

Solving the above, we get P = $ 734.11

a) (i) In order to decide as to which payment option should Jayne choose, it is imperative to

compute the effective interest rate for both the options and then choose the cheaper option.

EAR (4.55% p.a. compounded weekly) = (1+(4.55/5200))52 – 1 = 4.65%

With regards to the other option, the nominal rate is 4.75% and when the same would be

adjusted for nominal payment, then the effective annual rate would be much higher. As a

result, the interest rate of 4.55% p.a. compounded weekly would be preferred.

(ii) The formula for the principal repayment instalment is indicated below.

Instalment = P*R*(1+R)N/([1+R)N -1]

For the given question, P = $ 500,000, R = (4.55%/52) per week, Instalment = $ 1,000, N = ?

1000 = 500000*(4.55%/52)*(1+(4.55%/52))N/(1+(4.55%/52))N -1)

Solving the above, we get N = 657.85 weeks

b) (i) Let the total contribution required from the couple every month be $ X. The future

value of this annuity for 18 years at the end of the 18 year period would be $ 200,000. The

relevant formula for future value of annuity is indicated below.

For the given question, p = $ X, r= (2.5%/12) = 0.002083, n = 18*12 = 216 months, FV = $

200,000

Hence, 200,000 = P ((1.002083)216-1)/0.002083

Solving the above, we get P = $ 734.11

Since Jennifer contributes 30% to the above amount, hence, monthly payments made by

Jennifer = 0.3*734.11 = $ 220.23

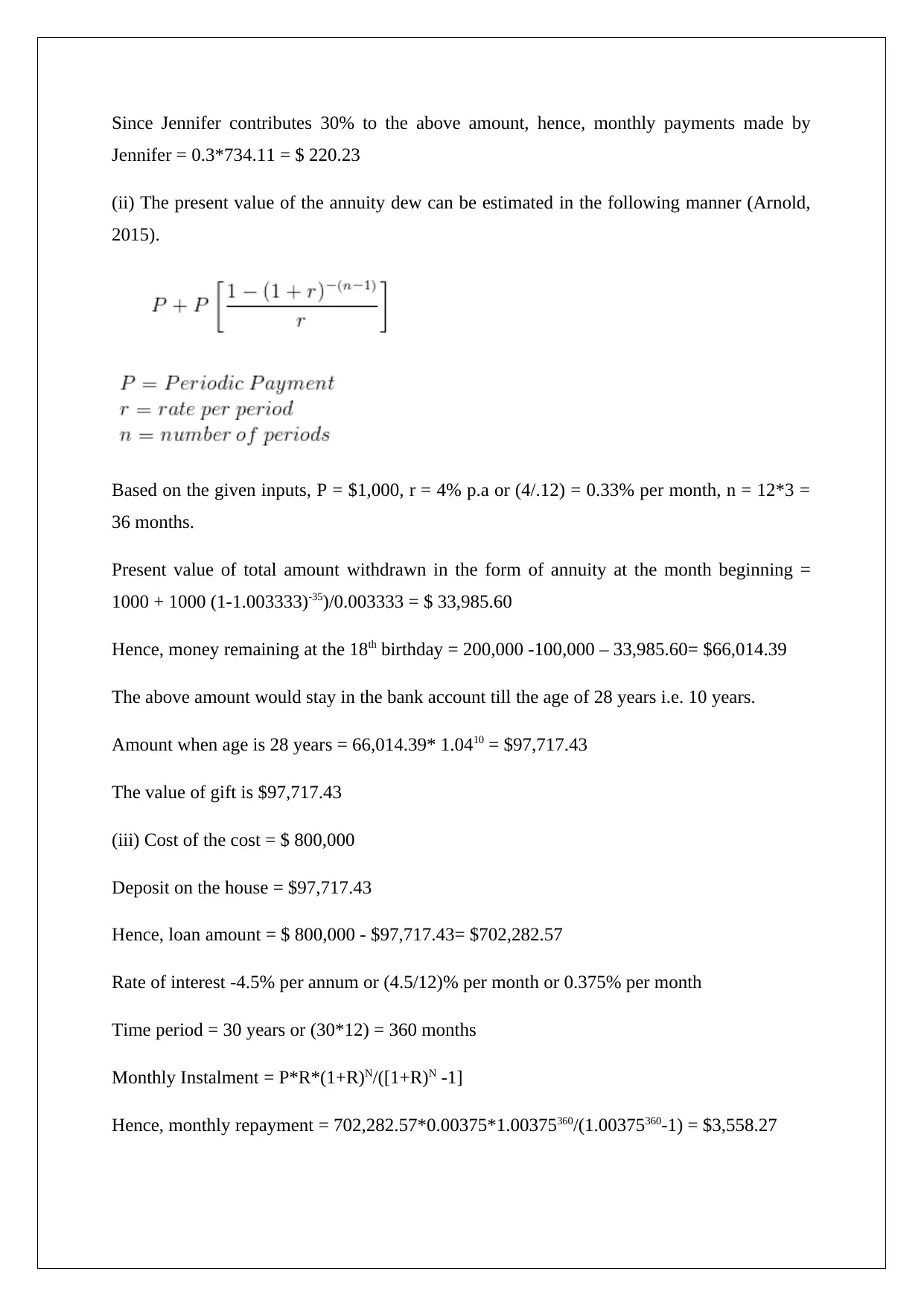

(ii) The present value of the annuity dew can be estimated in the following manner (Arnold,

2015).

Based on the given inputs, P = $1,000, r = 4% p.a or (4/.12) = 0.33% per month, n = 12*3 =

36 months.

Present value of total amount withdrawn in the form of annuity at the month beginning =

1000 + 1000 (1-1.003333)-35)/0.003333 = $ 33,985.60

Hence, money remaining at the 18th birthday = 200,000 -100,000 – 33,985.60= $66,014.39

The above amount would stay in the bank account till the age of 28 years i.e. 10 years.

Amount when age is 28 years = 66,014.39* 1.0410 = $97,717.43

The value of gift is $97,717.43

(iii) Cost of the cost = $ 800,000

Deposit on the house = $97,717.43

Hence, loan amount = $ 800,000 - $97,717.43= $702,282.57

Rate of interest -4.5% per annum or (4.5/12)% per month or 0.375% per month

Time period = 30 years or (30*12) = 360 months

Monthly Instalment = P*R*(1+R)N/([1+R)N -1]

Hence, monthly repayment = 702,282.57*0.00375*1.00375360/(1.00375360-1) = $3,558.27

Jennifer = 0.3*734.11 = $ 220.23

(ii) The present value of the annuity dew can be estimated in the following manner (Arnold,

2015).

Based on the given inputs, P = $1,000, r = 4% p.a or (4/.12) = 0.33% per month, n = 12*3 =

36 months.

Present value of total amount withdrawn in the form of annuity at the month beginning =

1000 + 1000 (1-1.003333)-35)/0.003333 = $ 33,985.60

Hence, money remaining at the 18th birthday = 200,000 -100,000 – 33,985.60= $66,014.39

The above amount would stay in the bank account till the age of 28 years i.e. 10 years.

Amount when age is 28 years = 66,014.39* 1.0410 = $97,717.43

The value of gift is $97,717.43

(iii) Cost of the cost = $ 800,000

Deposit on the house = $97,717.43

Hence, loan amount = $ 800,000 - $97,717.43= $702,282.57

Rate of interest -4.5% per annum or (4.5/12)% per month or 0.375% per month

Time period = 30 years or (30*12) = 360 months

Monthly Instalment = P*R*(1+R)N/([1+R)N -1]

Hence, monthly repayment = 702,282.57*0.00375*1.00375360/(1.00375360-1) = $3,558.27

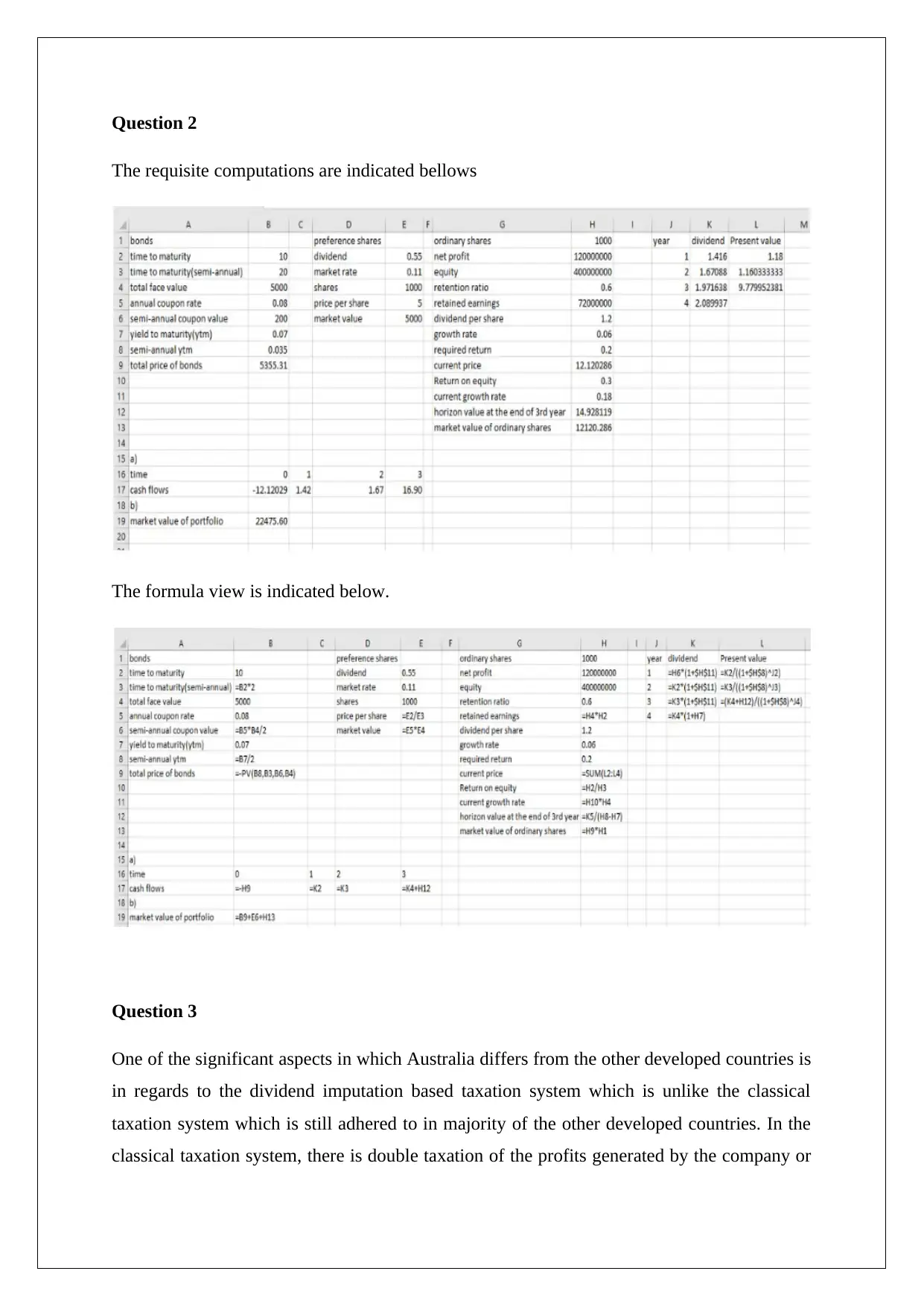

Question 2

The requisite computations are indicated bellows

The formula view is indicated below.

Question 3

One of the significant aspects in which Australia differs from the other developed countries is

in regards to the dividend imputation based taxation system which is unlike the classical

taxation system which is still adhered to in majority of the other developed countries. In the

classical taxation system, there is double taxation of the profits generated by the company or

The requisite computations are indicated bellows

The formula view is indicated below.

Question 3

One of the significant aspects in which Australia differs from the other developed countries is

in regards to the dividend imputation based taxation system which is unlike the classical

taxation system which is still adhered to in majority of the other developed countries. In the

classical taxation system, there is double taxation of the profits generated by the company or

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

business. This is because of the profits generated by the company, it would have to pay

corporate tax. Further, when the after –tax earnings are distributed as dividends to

shareholders, then these payments tend to contribute to the income of shareholders who

would be taxed at the income tax rate prevalent. This is sharply in contrast with the dividend

imputation system where the profits of the company do not suffer double taxation as

imputation credits are provided to the shareholders on account of the tax paid by the

company. As a result, at the end of the shareholders, tax on dividends received is applicable

only when the marginal tax rate applicable to the shareholders is greater than the corporate

tax rate and to the extent that it exceeds the corporate tax rate (Parrino & Kidwell, 2014).

The above difference between the two tax systems can be understood through an example.

Consider, a company which generates a pre-tax profit of $ 1,000 and the corporate tax rate

applicable is 30%. Hence, a post-tax income of $ 700 would be generated by the company.

Consider than $ 500 from the above $ 700 is paid as dividends by the company. Assume that

the marginal tax rate for the underlying shareholders is 30%. Hence, a 30% *500 or $ 150 tax

would be levied on the investors who received dividend. Thus, total tax burden in the above

example comes out as 300 + 150 = $ 450 or 45% of pre-tax income. In contrast, if the same

situation arising in the dividend imputation based tax system, then the tax liability would be

much lower. Thus, for a pre-tax income of $ 1,000, a corporate tax of $ 300 is paid. On the

post-tax income of $700, assume a dividend of $ 500 is paid. The imputation credit that the

shareholders would earn is (500/(1-0.3)) – 500 = $ 214.29. This imputation credit is added to

the taxable income of the shareholders. Hence, the total dividend income becomes = 500 +

214.29 = $ 714.29. On this, the marginal tax rate of shareholder is applicable which has been

taken as 30%. Thus, tax liability would be 0.3*714.29 = $ 214.29 which has already been

paid and hence no tax would need to be paid by the shareholders on the receipt of dividend.

As a result, the total effective tax in the process is 30% unlike 45% in the classical taxation

system.

In the recent times, as major countries such as USA are cutting down the corporate tax rate,

there is demand in Australia as well to reduce the tax rate so as to ensure that Australia

remains a preferable destination for foreign companies (Smith, 2015). However, a key aspect

which needs to be highlighted in this regards is that the other countries that have cut their

rates tend to follow a classical taxation model unlike Australia which has a dividend

imputation system in place. The effective tax rate in Australia is comparable to these nations

despite the other nations lowering their rate (Montgomery, 2018). With regards to tax rate

corporate tax. Further, when the after –tax earnings are distributed as dividends to

shareholders, then these payments tend to contribute to the income of shareholders who

would be taxed at the income tax rate prevalent. This is sharply in contrast with the dividend

imputation system where the profits of the company do not suffer double taxation as

imputation credits are provided to the shareholders on account of the tax paid by the

company. As a result, at the end of the shareholders, tax on dividends received is applicable

only when the marginal tax rate applicable to the shareholders is greater than the corporate

tax rate and to the extent that it exceeds the corporate tax rate (Parrino & Kidwell, 2014).

The above difference between the two tax systems can be understood through an example.

Consider, a company which generates a pre-tax profit of $ 1,000 and the corporate tax rate

applicable is 30%. Hence, a post-tax income of $ 700 would be generated by the company.

Consider than $ 500 from the above $ 700 is paid as dividends by the company. Assume that

the marginal tax rate for the underlying shareholders is 30%. Hence, a 30% *500 or $ 150 tax

would be levied on the investors who received dividend. Thus, total tax burden in the above

example comes out as 300 + 150 = $ 450 or 45% of pre-tax income. In contrast, if the same

situation arising in the dividend imputation based tax system, then the tax liability would be

much lower. Thus, for a pre-tax income of $ 1,000, a corporate tax of $ 300 is paid. On the

post-tax income of $700, assume a dividend of $ 500 is paid. The imputation credit that the

shareholders would earn is (500/(1-0.3)) – 500 = $ 214.29. This imputation credit is added to

the taxable income of the shareholders. Hence, the total dividend income becomes = 500 +

214.29 = $ 714.29. On this, the marginal tax rate of shareholder is applicable which has been

taken as 30%. Thus, tax liability would be 0.3*714.29 = $ 214.29 which has already been

paid and hence no tax would need to be paid by the shareholders on the receipt of dividend.

As a result, the total effective tax in the process is 30% unlike 45% in the classical taxation

system.

In the recent times, as major countries such as USA are cutting down the corporate tax rate,

there is demand in Australia as well to reduce the tax rate so as to ensure that Australia

remains a preferable destination for foreign companies (Smith, 2015). However, a key aspect

which needs to be highlighted in this regards is that the other countries that have cut their

rates tend to follow a classical taxation model unlike Australia which has a dividend

imputation system in place. The effective tax rate in Australia is comparable to these nations

despite the other nations lowering their rate (Montgomery, 2018). With regards to tax rate

cut, it would not be useful for domestic companies as the tax burden would shift from the

companies to the shareholders by doing away with dividend imputation. The main

beneficiaries of any tax cut would be foreign businesses that tend to repatriate profits.

However, for these businesses the current tax regime in Australia is competitive. As a result,

the case for a corporate tax rate cut in Australia does not seem to be too strong owing to the

presence of dividend imputation system (Taylor, 2018).

Question 4

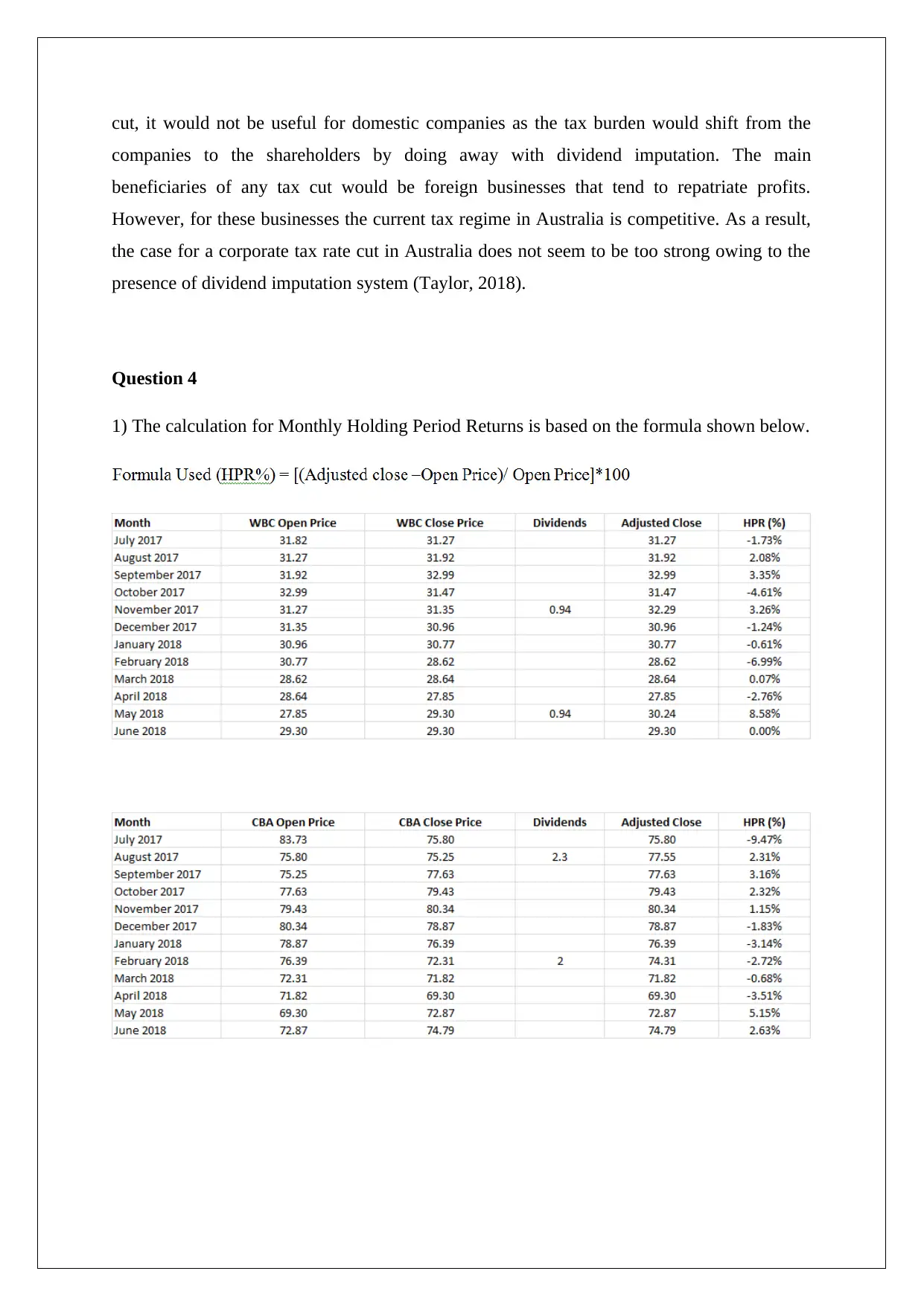

1) The calculation for Monthly Holding Period Returns is based on the formula shown below.

companies to the shareholders by doing away with dividend imputation. The main

beneficiaries of any tax cut would be foreign businesses that tend to repatriate profits.

However, for these businesses the current tax regime in Australia is competitive. As a result,

the case for a corporate tax rate cut in Australia does not seem to be too strong owing to the

presence of dividend imputation system (Taylor, 2018).

Question 4

1) The calculation for Monthly Holding Period Returns is based on the formula shown below.

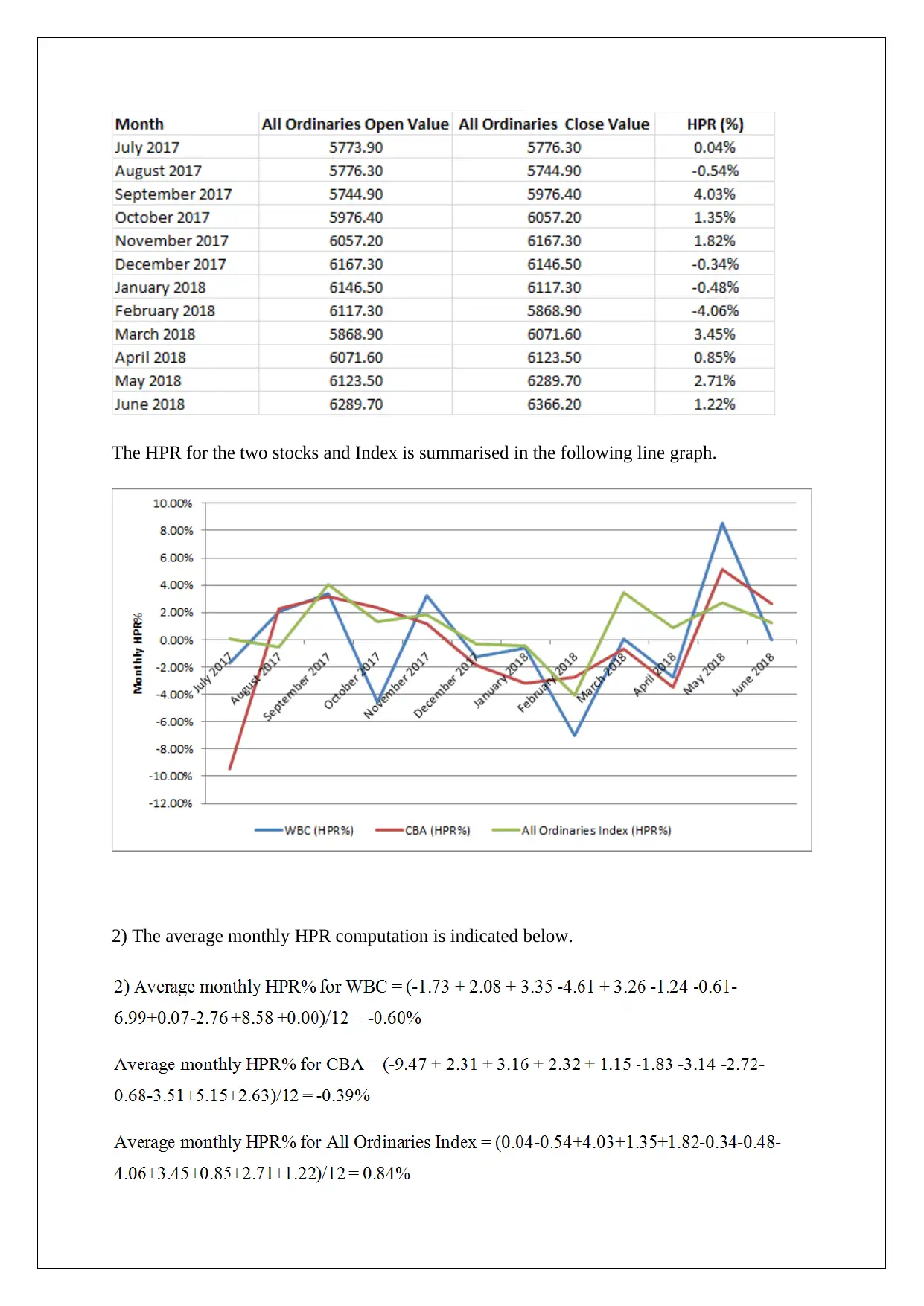

The HPR for the two stocks and Index is summarised in the following line graph.

2) The average monthly HPR computation is indicated below.

2) The average monthly HPR computation is indicated below.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

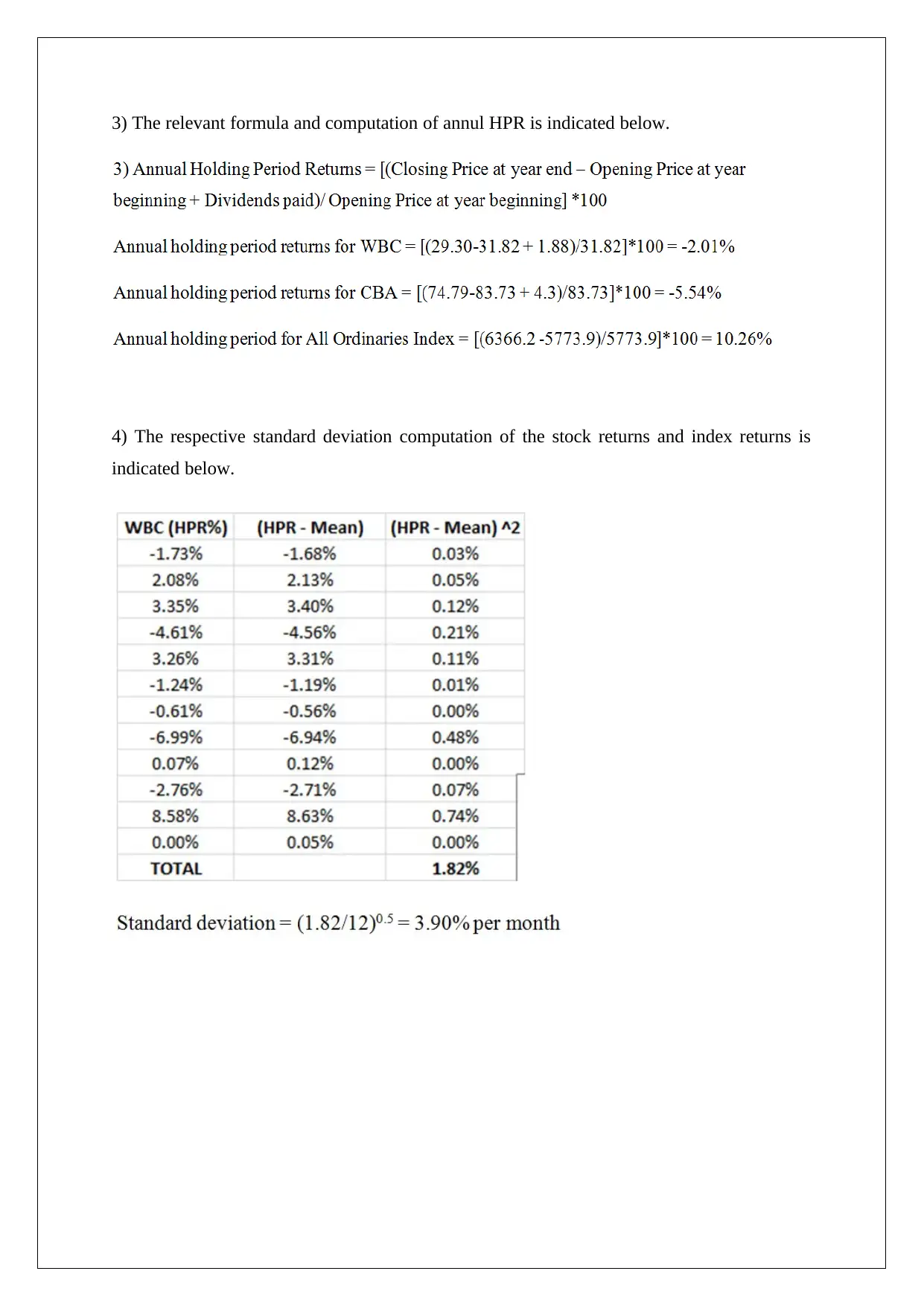

3) The relevant formula and computation of annul HPR is indicated below.

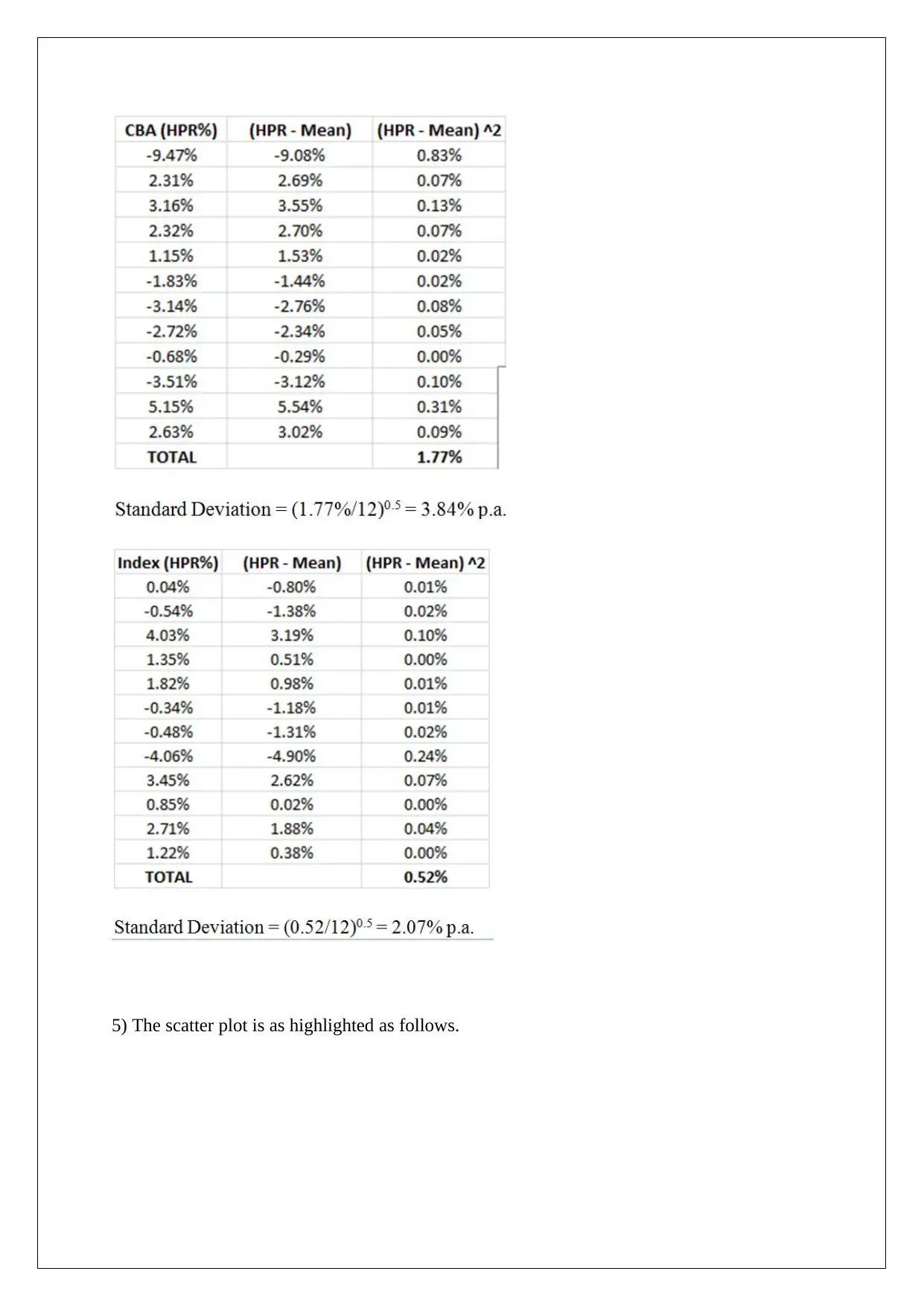

4) The respective standard deviation computation of the stock returns and index returns is

indicated below.

4) The respective standard deviation computation of the stock returns and index returns is

indicated below.

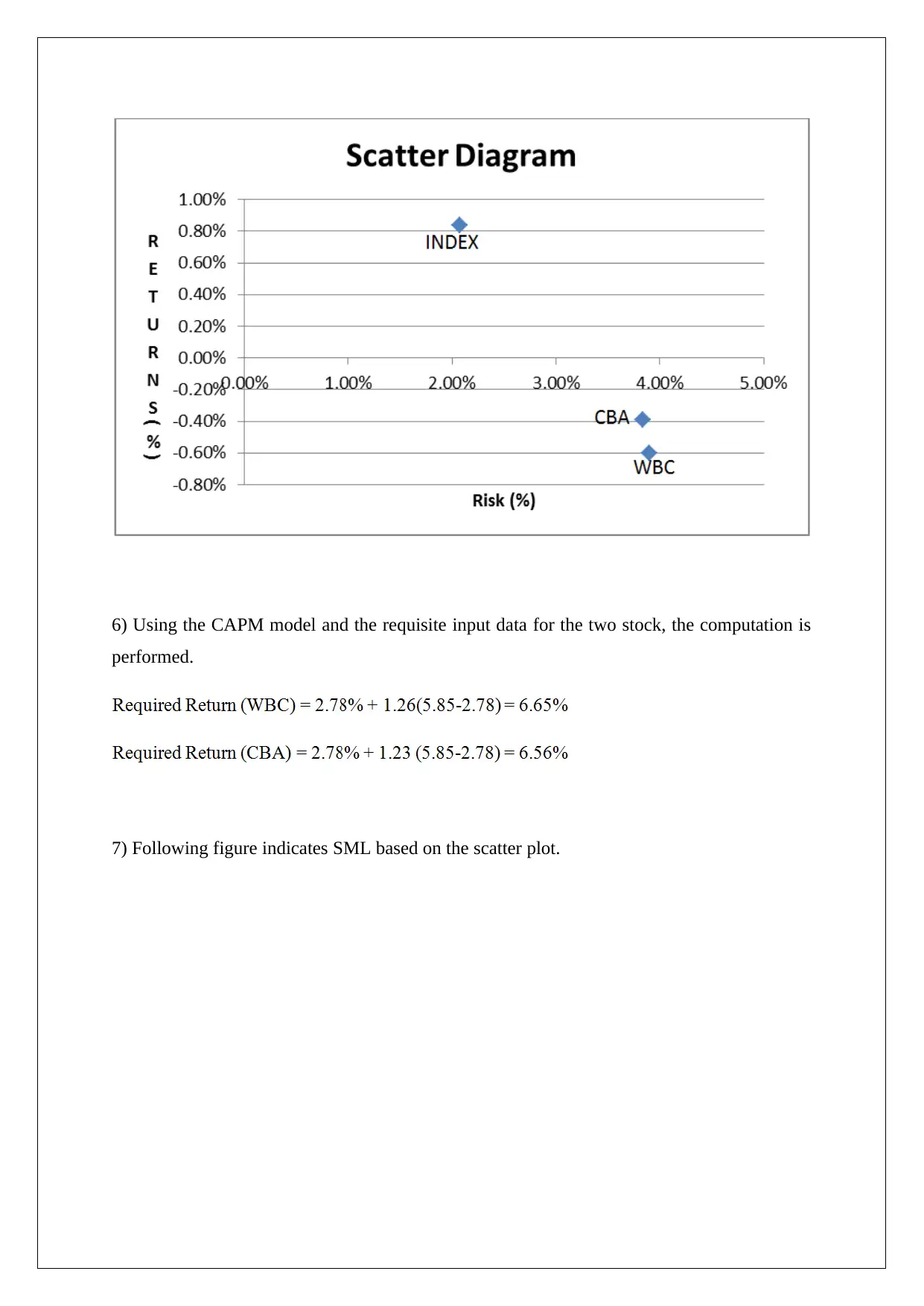

5) The scatter plot is as highlighted as follows.

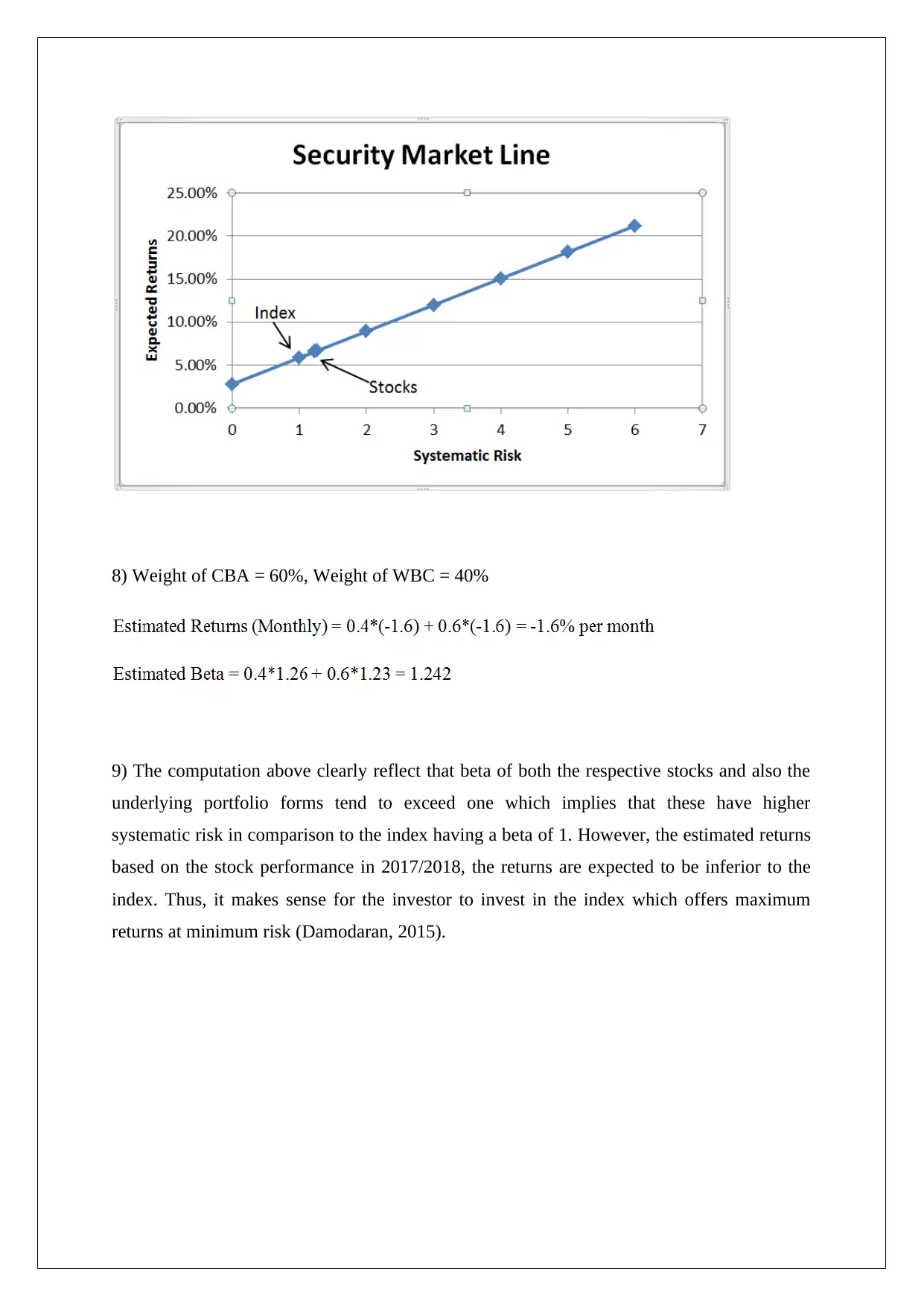

6) Using the CAPM model and the requisite input data for the two stock, the computation is

performed.

7) Following figure indicates SML based on the scatter plot.

performed.

7) Following figure indicates SML based on the scatter plot.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

8) Weight of CBA = 60%, Weight of WBC = 40%

9) The computation above clearly reflect that beta of both the respective stocks and also the

underlying portfolio forms tend to exceed one which implies that these have higher

systematic risk in comparison to the index having a beta of 1. However, the estimated returns

based on the stock performance in 2017/2018, the returns are expected to be inferior to the

index. Thus, it makes sense for the investor to invest in the index which offers maximum

returns at minimum risk (Damodaran, 2015).

9) The computation above clearly reflect that beta of both the respective stocks and also the

underlying portfolio forms tend to exceed one which implies that these have higher

systematic risk in comparison to the index having a beta of 1. However, the estimated returns

based on the stock performance in 2017/2018, the returns are expected to be inferior to the

index. Thus, it makes sense for the investor to invest in the index which offers maximum

returns at minimum risk (Damodaran, 2015).

References

Arnold, G. (2015) Corporate Financial Management. 3rd ed. Sydney: Financial Times

Management.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. & Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Montgomery, R. (2018, February, 19).Should Australia cut the corporate tax rate ? Retrieved

from https://rogermontgomery.com/should-australia-cut-the-corporate-tax-rate/

Smith , W. (2015, February 10). FactCheck: is Australia’s corporate tax rate not competitive

with the rest of the region. Retrieved from https://theconversation.com/factcheck-is-

australias-corporate-tax-rate-not-competitive-with-the-rest-of-the-region-37226

Taylor, D. (2018, March 29). Corporate tax cuts: What are the key issues in the

debate? Retrieved from http://www.abc.net.au/news/2018-03-29/corporate-tax-cuts-

explained/9600004

.

Arnold, G. (2015) Corporate Financial Management. 3rd ed. Sydney: Financial Times

Management.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. & Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Montgomery, R. (2018, February, 19).Should Australia cut the corporate tax rate ? Retrieved

from https://rogermontgomery.com/should-australia-cut-the-corporate-tax-rate/

Smith , W. (2015, February 10). FactCheck: is Australia’s corporate tax rate not competitive

with the rest of the region. Retrieved from https://theconversation.com/factcheck-is-

australias-corporate-tax-rate-not-competitive-with-the-rest-of-the-region-37226

Taylor, D. (2018, March 29). Corporate tax cuts: What are the key issues in the

debate? Retrieved from http://www.abc.net.au/news/2018-03-29/corporate-tax-cuts-

explained/9600004

.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.