Accounting and Finance: APN Outdoor Group Financial Report Analysis

VerifiedAdded on 2020/04/07

|13

|1587

|36

Report

AI Summary

This report provides a comprehensive financial analysis of APN Outdoor Group, focusing on capital budgeting and financial performance. Part A of the report conducts investment appraisal techniques, including NPV, payback period, and ARR, under base-case, worst-case, and best-case scenarios, concluding the project's viability. Part B delves into APN's capital structure, assessing financial ratios such as current and quick ratios, and profitability ratios. The report calculates the after-tax WACC, compares APN's performance with competitors like Ooh Media, and evaluates the impact of equity versus debt financing. The analysis highlights APN's financial stability and potential for future growth, emphasizing the importance of reducing the cost of capital through strategic financial decisions. The conclusion summarizes the positive financial condition and supports management decisions based on the analysis.

Running head: ACCOUNTING & FINANCE

Accounting & Finance

Name of the Student:

Name of the University:

Author’s Note:

Accounting & Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCE

Table of Contents

Part A:..............................................................................................................................................2

1a. Capital budgeting for Base-Case Scenario:...............................................................................2

1b. Capital budgeting for Worst-Case Scenario:.............................................................................3

1c. Capital budgeting for Best-Case Scenario:................................................................................4

PART B:..........................................................................................................................................5

Introduction:....................................................................................................................................5

Depicting the APN’s capital structure:............................................................................................5

Calculating the Depiction of After-Tax WACC:.............................................................................6

Evaluation of the financial ratios:....................................................................................................6

Identifying the performance of competitor’s:..................................................................................7

Depicting the Capital structure of APN:..........................................................................................7

Conclusion:......................................................................................................................................8

References and Bibliography:........................................................................................................10

Table of Contents

Part A:..............................................................................................................................................2

1a. Capital budgeting for Base-Case Scenario:...............................................................................2

1b. Capital budgeting for Worst-Case Scenario:.............................................................................3

1c. Capital budgeting for Best-Case Scenario:................................................................................4

PART B:..........................................................................................................................................5

Introduction:....................................................................................................................................5

Depicting the APN’s capital structure:............................................................................................5

Calculating the Depiction of After-Tax WACC:.............................................................................6

Evaluation of the financial ratios:....................................................................................................6

Identifying the performance of competitor’s:..................................................................................7

Depicting the Capital structure of APN:..........................................................................................7

Conclusion:......................................................................................................................................8

References and Bibliography:........................................................................................................10

ACCOUNTING & FINANCE

Part A:

1. Conducting investment appraisal techniques:

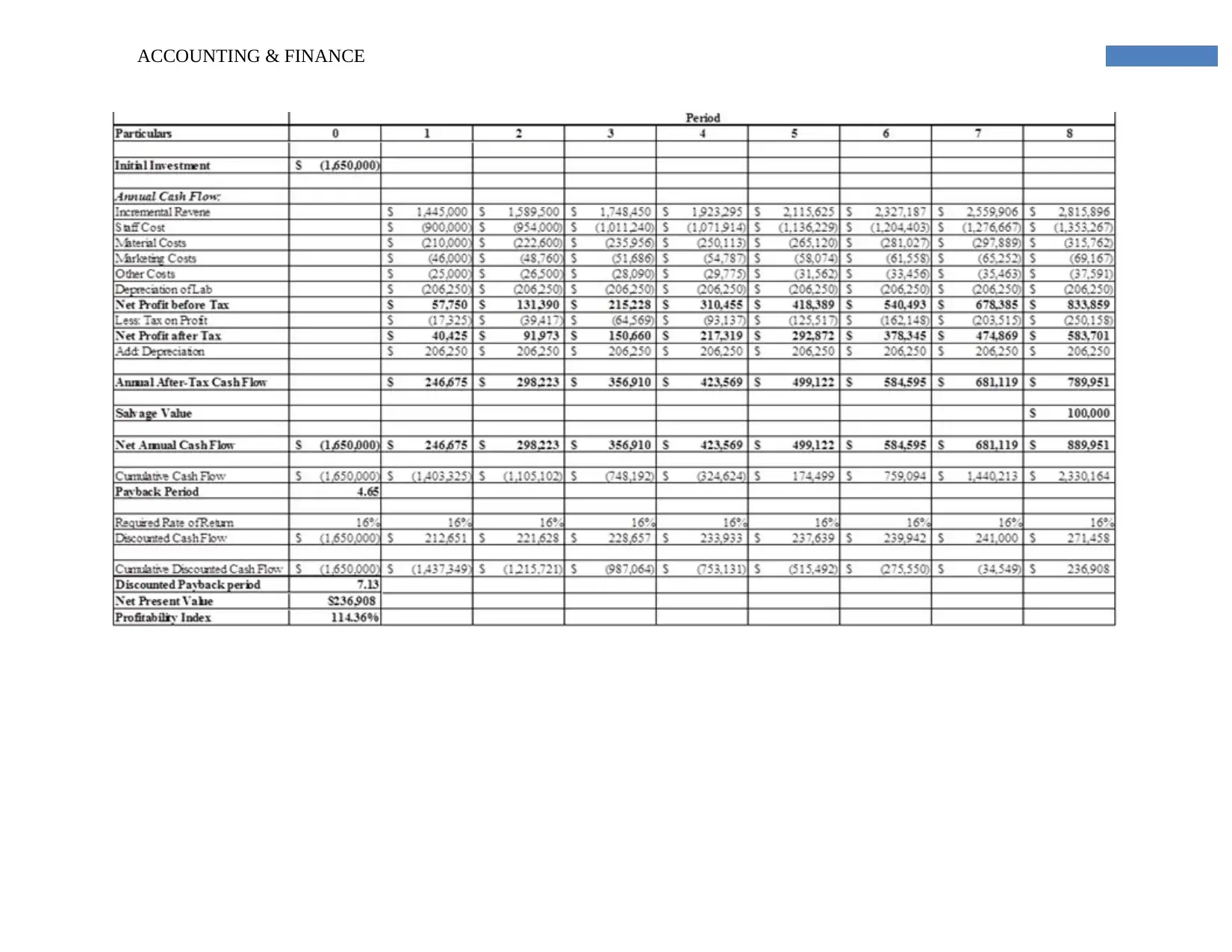

1a. Capital budgeting for Base-Case Scenario:

Part A:

1. Conducting investment appraisal techniques:

1a. Capital budgeting for Base-Case Scenario:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING & FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCE

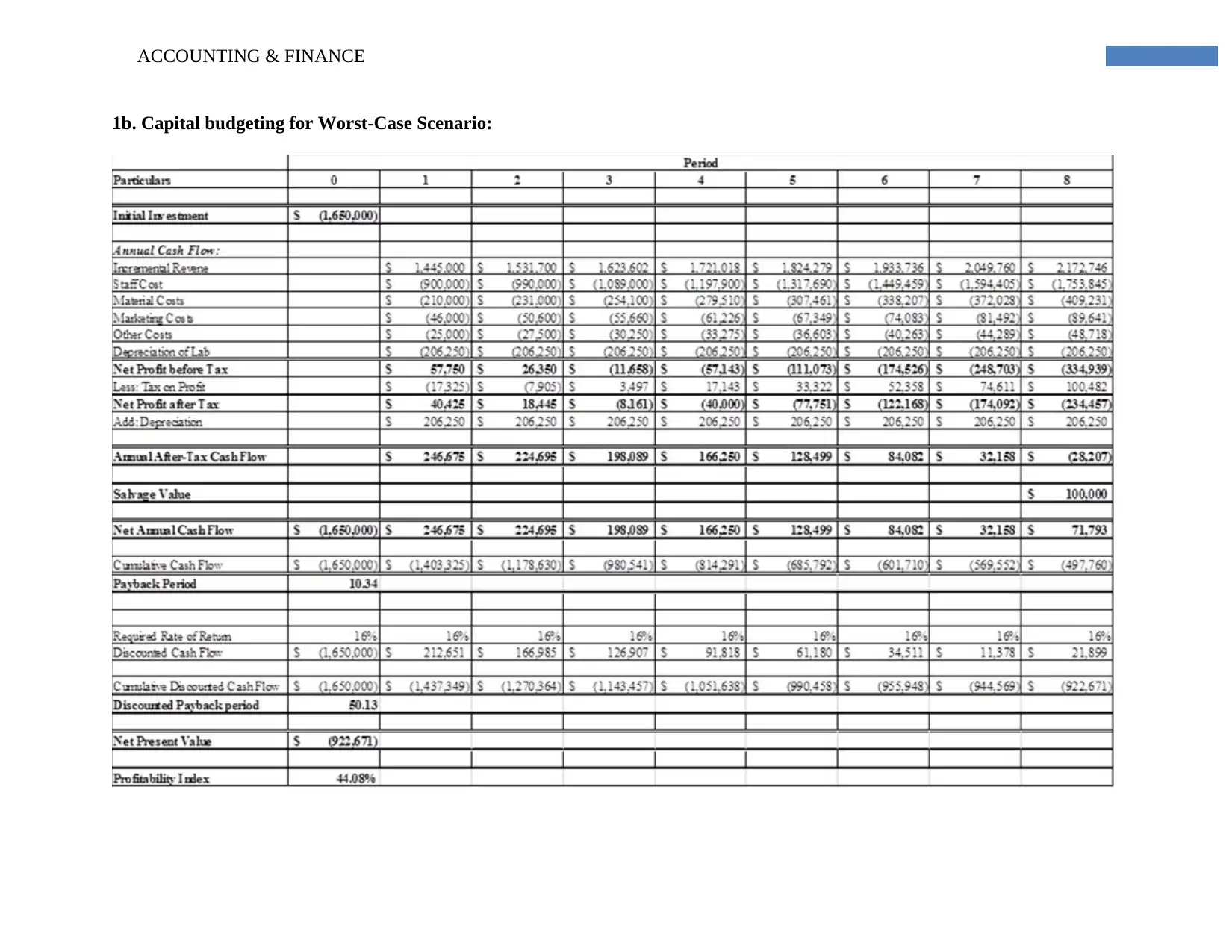

1b. Capital budgeting for Worst-Case Scenario:

1b. Capital budgeting for Worst-Case Scenario:

ACCOUNTING & FINANCE

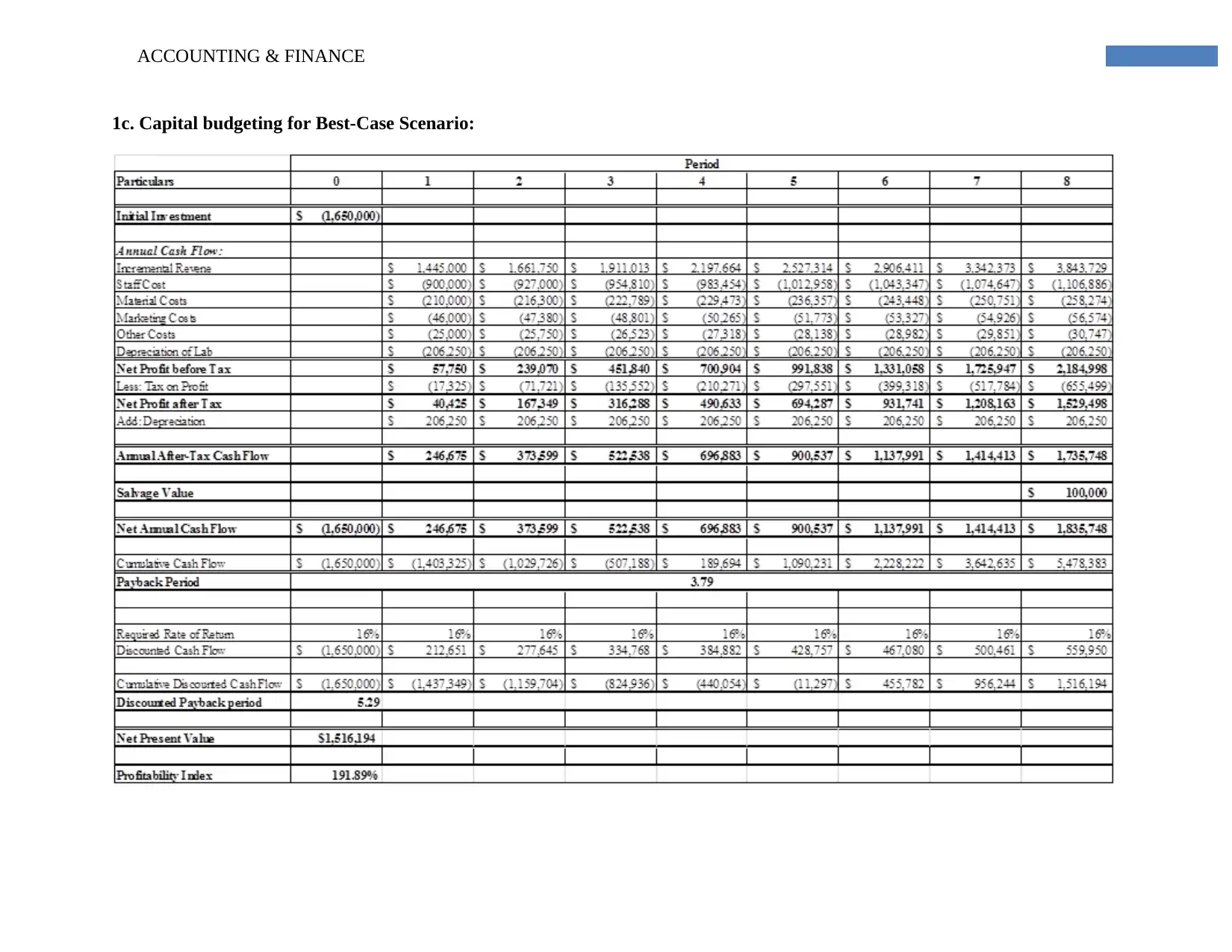

1c. Capital budgeting for Best-Case Scenario:

1c. Capital budgeting for Best-Case Scenario:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING & FINANCE

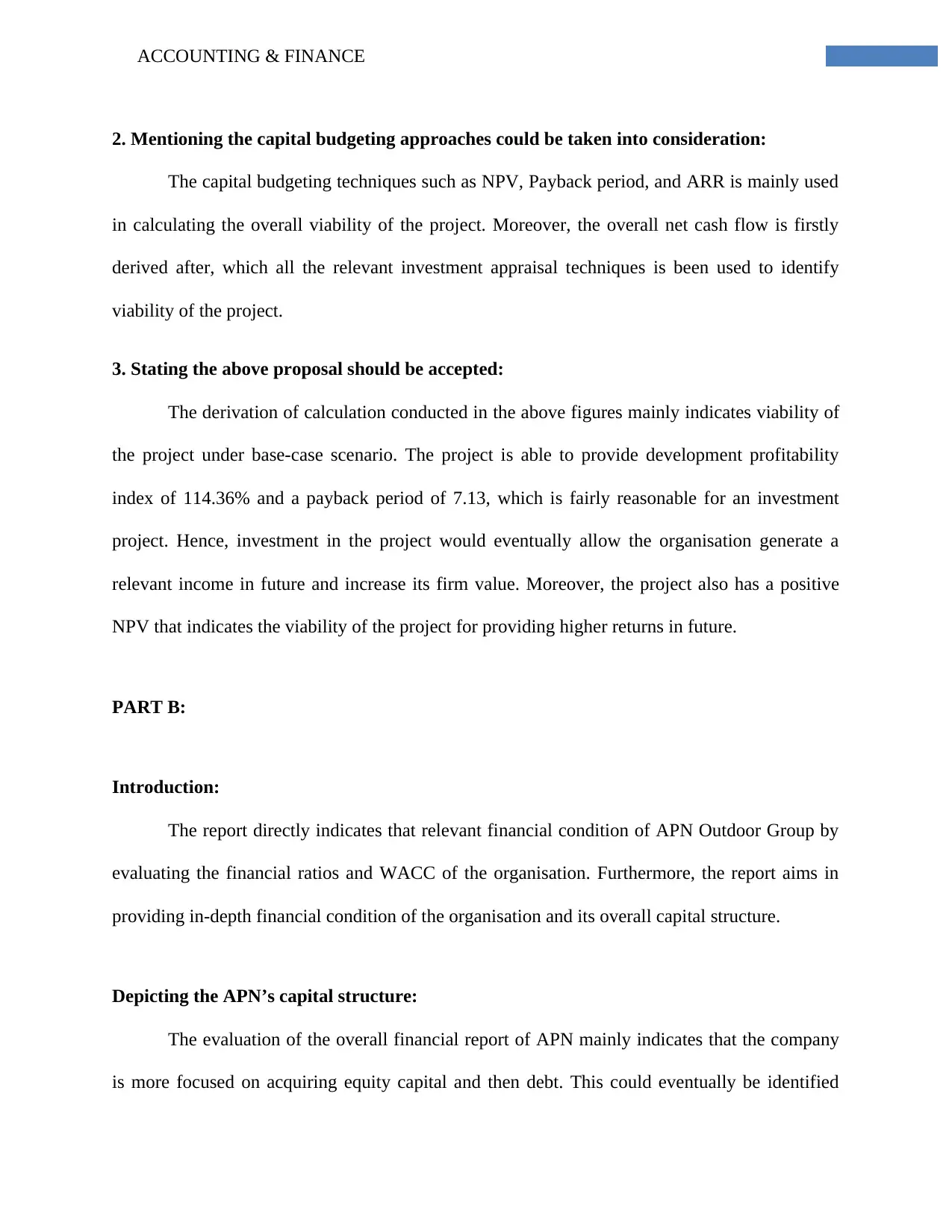

2. Mentioning the capital budgeting approaches could be taken into consideration:

The capital budgeting techniques such as NPV, Payback period, and ARR is mainly used

in calculating the overall viability of the project. Moreover, the overall net cash flow is firstly

derived after, which all the relevant investment appraisal techniques is been used to identify

viability of the project.

3. Stating the above proposal should be accepted:

The derivation of calculation conducted in the above figures mainly indicates viability of

the project under base-case scenario. The project is able to provide development profitability

index of 114.36% and a payback period of 7.13, which is fairly reasonable for an investment

project. Hence, investment in the project would eventually allow the organisation generate a

relevant income in future and increase its firm value. Moreover, the project also has a positive

NPV that indicates the viability of the project for providing higher returns in future.

PART B:

Introduction:

The report directly indicates that relevant financial condition of APN Outdoor Group by

evaluating the financial ratios and WACC of the organisation. Furthermore, the report aims in

providing in-depth financial condition of the organisation and its overall capital structure.

Depicting the APN’s capital structure:

The evaluation of the overall financial report of APN mainly indicates that the company

is more focused on acquiring equity capital and then debt. This could eventually be identified

2. Mentioning the capital budgeting approaches could be taken into consideration:

The capital budgeting techniques such as NPV, Payback period, and ARR is mainly used

in calculating the overall viability of the project. Moreover, the overall net cash flow is firstly

derived after, which all the relevant investment appraisal techniques is been used to identify

viability of the project.

3. Stating the above proposal should be accepted:

The derivation of calculation conducted in the above figures mainly indicates viability of

the project under base-case scenario. The project is able to provide development profitability

index of 114.36% and a payback period of 7.13, which is fairly reasonable for an investment

project. Hence, investment in the project would eventually allow the organisation generate a

relevant income in future and increase its firm value. Moreover, the project also has a positive

NPV that indicates the viability of the project for providing higher returns in future.

PART B:

Introduction:

The report directly indicates that relevant financial condition of APN Outdoor Group by

evaluating the financial ratios and WACC of the organisation. Furthermore, the report aims in

providing in-depth financial condition of the organisation and its overall capital structure.

Depicting the APN’s capital structure:

The evaluation of the overall financial report of APN mainly indicates that the company

is more focused on acquiring equity capital and then debt. This could eventually be identified

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCE

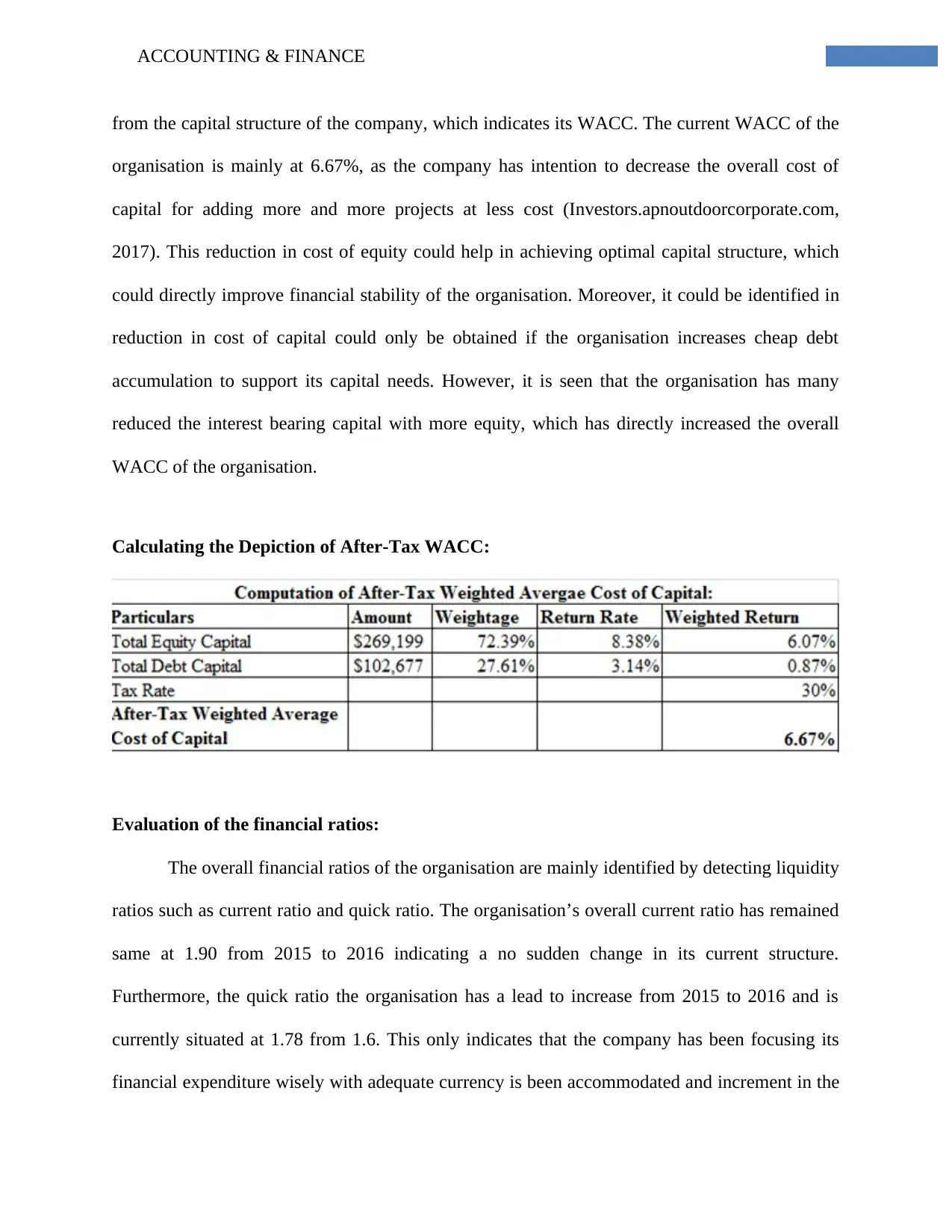

from the capital structure of the company, which indicates its WACC. The current WACC of the

organisation is mainly at 6.67%, as the company has intention to decrease the overall cost of

capital for adding more and more projects at less cost (Investors.apnoutdoorcorporate.com,

2017). This reduction in cost of equity could help in achieving optimal capital structure, which

could directly improve financial stability of the organisation. Moreover, it could be identified in

reduction in cost of capital could only be obtained if the organisation increases cheap debt

accumulation to support its capital needs. However, it is seen that the organisation has many

reduced the interest bearing capital with more equity, which has directly increased the overall

WACC of the organisation.

Calculating the Depiction of After-Tax WACC:

Evaluation of the financial ratios:

The overall financial ratios of the organisation are mainly identified by detecting liquidity

ratios such as current ratio and quick ratio. The organisation’s overall current ratio has remained

same at 1.90 from 2015 to 2016 indicating a no sudden change in its current structure.

Furthermore, the quick ratio the organisation has a lead to increase from 2015 to 2016 and is

currently situated at 1.78 from 1.6. This only indicates that the company has been focusing its

financial expenditure wisely with adequate currency is been accommodated and increment in the

from the capital structure of the company, which indicates its WACC. The current WACC of the

organisation is mainly at 6.67%, as the company has intention to decrease the overall cost of

capital for adding more and more projects at less cost (Investors.apnoutdoorcorporate.com,

2017). This reduction in cost of equity could help in achieving optimal capital structure, which

could directly improve financial stability of the organisation. Moreover, it could be identified in

reduction in cost of capital could only be obtained if the organisation increases cheap debt

accumulation to support its capital needs. However, it is seen that the organisation has many

reduced the interest bearing capital with more equity, which has directly increased the overall

WACC of the organisation.

Calculating the Depiction of After-Tax WACC:

Evaluation of the financial ratios:

The overall financial ratios of the organisation are mainly identified by detecting liquidity

ratios such as current ratio and quick ratio. The organisation’s overall current ratio has remained

same at 1.90 from 2015 to 2016 indicating a no sudden change in its current structure.

Furthermore, the quick ratio the organisation has a lead to increase from 2015 to 2016 and is

currently situated at 1.78 from 1.6. This only indicates that the company has been focusing its

financial expenditure wisely with adequate currency is been accommodated and increment in the

ACCOUNTING & FINANCE

efficiency of the inventory can be identified (Lueg, Punda & Burkert, 2014). Moreover the

profitability ratio of the organisation indicates an increment from 13.67% to 14.66% in 2016

(Investors.apnoutdoorcorporate.com, 2017). This financial ratios directly they keep overall

financial stability of the organisation and its current financial position.

The overall total long term debt to Assets of the organisation is mainly at 0.23 while

interest coverage ratio stands at 25.96. This mainly indicates that the overall financial stability of

the organisation is adequate where more debt could be accommodated as APN could pay

adequate interest on loans.

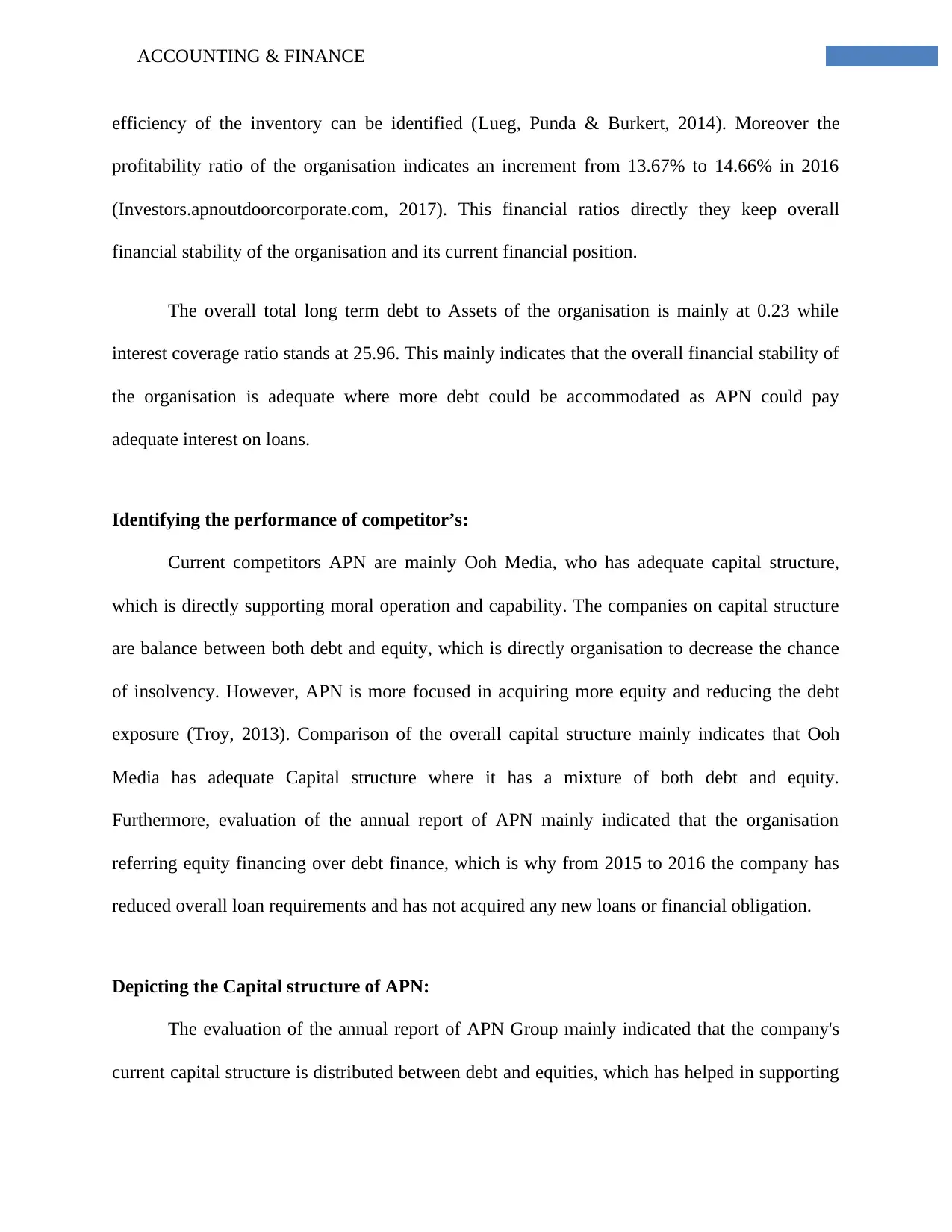

Identifying the performance of competitor’s:

Current competitors APN are mainly Ooh Media, who has adequate capital structure,

which is directly supporting moral operation and capability. The companies on capital structure

are balance between both debt and equity, which is directly organisation to decrease the chance

of insolvency. However, APN is more focused in acquiring more equity and reducing the debt

exposure (Troy, 2013). Comparison of the overall capital structure mainly indicates that Ooh

Media has adequate Capital structure where it has a mixture of both debt and equity.

Furthermore, evaluation of the annual report of APN mainly indicated that the organisation

referring equity financing over debt finance, which is why from 2015 to 2016 the company has

reduced overall loan requirements and has not acquired any new loans or financial obligation.

Depicting the Capital structure of APN:

The evaluation of the annual report of APN Group mainly indicated that the company's

current capital structure is distributed between debt and equities, which has helped in supporting

efficiency of the inventory can be identified (Lueg, Punda & Burkert, 2014). Moreover the

profitability ratio of the organisation indicates an increment from 13.67% to 14.66% in 2016

(Investors.apnoutdoorcorporate.com, 2017). This financial ratios directly they keep overall

financial stability of the organisation and its current financial position.

The overall total long term debt to Assets of the organisation is mainly at 0.23 while

interest coverage ratio stands at 25.96. This mainly indicates that the overall financial stability of

the organisation is adequate where more debt could be accommodated as APN could pay

adequate interest on loans.

Identifying the performance of competitor’s:

Current competitors APN are mainly Ooh Media, who has adequate capital structure,

which is directly supporting moral operation and capability. The companies on capital structure

are balance between both debt and equity, which is directly organisation to decrease the chance

of insolvency. However, APN is more focused in acquiring more equity and reducing the debt

exposure (Troy, 2013). Comparison of the overall capital structure mainly indicates that Ooh

Media has adequate Capital structure where it has a mixture of both debt and equity.

Furthermore, evaluation of the annual report of APN mainly indicated that the organisation

referring equity financing over debt finance, which is why from 2015 to 2016 the company has

reduced overall loan requirements and has not acquired any new loans or financial obligation.

Depicting the Capital structure of APN:

The evaluation of the annual report of APN Group mainly indicated that the company's

current capital structure is distributed between debt and equities, which has helped in supporting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING & FINANCE

its operational capability and financing needs. Furthermore, viability of the capital structure of

the organisation can only be identified with the help of WACC, which is relatively higher as the

management indicated to review its cost of capital (Investors.apnoutdoorcorporate.com, 2017).

Moreover, any kind of decisions that is taken by appropriate authorities is directly reflected on

the overall capital structure organisation. Hence, APN Group management mainly wants the

overall cost of capital of your organisation to reduce, as it might help in starting new projects to

generate higher returns from investment.

The overall aim of APN Group is to reduce the cost of capital, which is directly achieved

by reducing your on equity funding and acquiring low cost debt funding. This accumulation of

low debt funding could eventually allow APN Group to reduce the overall cost of capital and

achieve all the relevant measures that was taken by the management. The acquiring of low cost

debt is one of the methods that is used by organisation. The other method is mainly to reduce the

equity capital, which could directly help in reducing cost of capital. The use of bonds, bank

loans, overdraft, and other financial obligations are directly used by organisation to increase debt

exposure (Ferrer & Tang, 2016).

Conclusion:

The evaluation of the overall report indicates that the current financial condition of the

organisation is relatively adequate. In addition, the financial ratios portray a positive financial

condition of the organisation which directly states that future progress and sustainability that

could be obtained by the organisation. The overall return that is provided by the organisation is

also adequate and supports management decisions.

its operational capability and financing needs. Furthermore, viability of the capital structure of

the organisation can only be identified with the help of WACC, which is relatively higher as the

management indicated to review its cost of capital (Investors.apnoutdoorcorporate.com, 2017).

Moreover, any kind of decisions that is taken by appropriate authorities is directly reflected on

the overall capital structure organisation. Hence, APN Group management mainly wants the

overall cost of capital of your organisation to reduce, as it might help in starting new projects to

generate higher returns from investment.

The overall aim of APN Group is to reduce the cost of capital, which is directly achieved

by reducing your on equity funding and acquiring low cost debt funding. This accumulation of

low debt funding could eventually allow APN Group to reduce the overall cost of capital and

achieve all the relevant measures that was taken by the management. The acquiring of low cost

debt is one of the methods that is used by organisation. The other method is mainly to reduce the

equity capital, which could directly help in reducing cost of capital. The use of bonds, bank

loans, overdraft, and other financial obligations are directly used by organisation to increase debt

exposure (Ferrer & Tang, 2016).

Conclusion:

The evaluation of the overall report indicates that the current financial condition of the

organisation is relatively adequate. In addition, the financial ratios portray a positive financial

condition of the organisation which directly states that future progress and sustainability that

could be obtained by the organisation. The overall return that is provided by the organisation is

also adequate and supports management decisions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING & FINANCE

.

.

ACCOUNTING & FINANCE

References and Bibliography:

Abdul-Baki, Z., Uthman, A. B., & Sannia, M. (2014). Financial ratios as performance measure:

A comparison of IFRS and Nigerian GAAP. Accounting and Management Information

Systems, 13(1), 82.

Ferrer, R. C., & Tang, A. (2016). An Empirical Investigation of the Impact of Financial Ratios

and Business Combination on Stock Price among the Service Firms in the Philippines. Academy

of Accounting and Financial Studies Journal, 20(2), 104.

Investors.apnoutdoorcorporate.com. (2017). APN Outdoor | Investor Centre. [online] Available

at: http://investors.apnoutdoorcorporate.com/Investor-Centre/?page=Annual-Reports [Accessed

19 Sep. 2017].

Le, M. H. N., Nguyen, T. M., Nguyen, T. T. T., Ho, S. Q. D., & Tran, N. Q. H. (2015). Impact of

financial market ratios to individual investors decision in Vietnam (Doctoral dissertation, FUG

HCM).

Lueg, R., Punda, P., & Burkert, M. (2014). Does transition to IFRS substantially affect key

financial ratios in shareholder-oriented common law regimes? Evidence from the UK. Advances

in Accounting, 30(1), 241-250.

Pech, C. O. T., Noguera, M., & White, S. (2015). Financial ratios used by equity analysts in

Mexico and stock returns. Contaduría y Administración, 60(3), 578-592.

References and Bibliography:

Abdul-Baki, Z., Uthman, A. B., & Sannia, M. (2014). Financial ratios as performance measure:

A comparison of IFRS and Nigerian GAAP. Accounting and Management Information

Systems, 13(1), 82.

Ferrer, R. C., & Tang, A. (2016). An Empirical Investigation of the Impact of Financial Ratios

and Business Combination on Stock Price among the Service Firms in the Philippines. Academy

of Accounting and Financial Studies Journal, 20(2), 104.

Investors.apnoutdoorcorporate.com. (2017). APN Outdoor | Investor Centre. [online] Available

at: http://investors.apnoutdoorcorporate.com/Investor-Centre/?page=Annual-Reports [Accessed

19 Sep. 2017].

Le, M. H. N., Nguyen, T. M., Nguyen, T. T. T., Ho, S. Q. D., & Tran, N. Q. H. (2015). Impact of

financial market ratios to individual investors decision in Vietnam (Doctoral dissertation, FUG

HCM).

Lueg, R., Punda, P., & Burkert, M. (2014). Does transition to IFRS substantially affect key

financial ratios in shareholder-oriented common law regimes? Evidence from the UK. Advances

in Accounting, 30(1), 241-250.

Pech, C. O. T., Noguera, M., & White, S. (2015). Financial ratios used by equity analysts in

Mexico and stock returns. Contaduría y Administración, 60(3), 578-592.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.