Accounting & Finance Homework: Investment Analysis and Returns

VerifiedAdded on 2023/06/14

|12

|2470

|250

Homework Assignment

AI Summary

This assignment solution covers several key areas of accounting and finance, including investment analysis, tax implications, and portfolio returns. It begins by calculating the present value of a cash flow stream to determine the investment's worth, followed by computing loan payments and investment values with compound interest. The impact of a corporate tax rate reduction in Australia is analyzed, considering potential benefits like increased investment and job opportunities, as well as drawbacks such as reduced government revenue. The solution also assesses the monthly returns, standard deviation, and annual holding period returns for NAB, BHP, and AORD stocks. Finally, it uses the Capital Asset Pricing Model (CAPM) and Security Market Line (SML) to evaluate investment decisions, concluding with a recommendation to invest in BHP Billiton based on its higher average monthly return. Desklib provides a platform for students to access similar solved assignments and study resources.

Running head: ACCOUNTING AND FINANCE

Accounting and finance

Name of the Student

Name of the University

Author Note

Accounting and finance

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING AND FINANCE

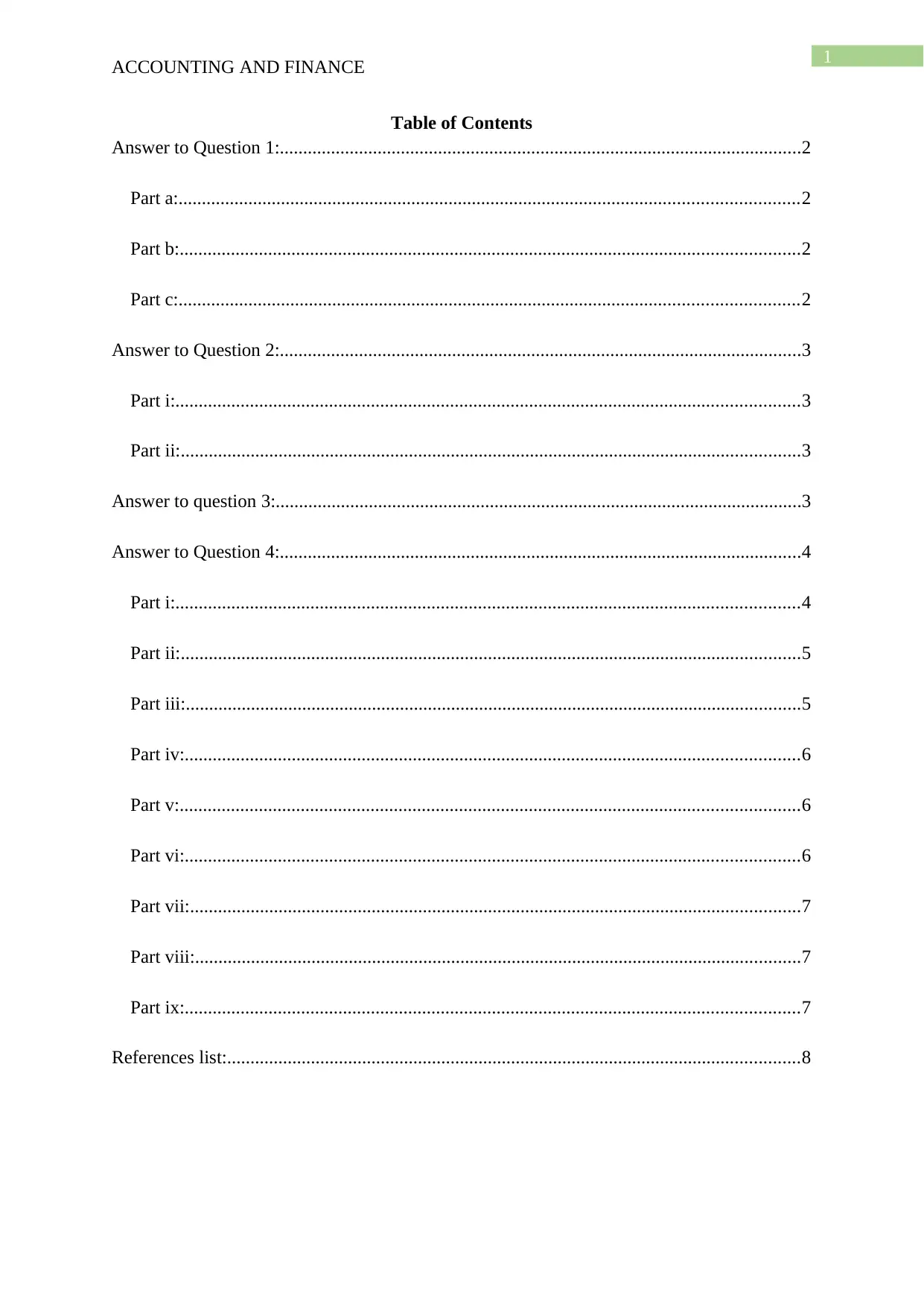

Table of Contents

Answer to Question 1:................................................................................................................2

Part a:.....................................................................................................................................2

Part b:.....................................................................................................................................2

Part c:.....................................................................................................................................2

Answer to Question 2:................................................................................................................3

Part i:......................................................................................................................................3

Part ii:.....................................................................................................................................3

Answer to question 3:.................................................................................................................3

Answer to Question 4:................................................................................................................4

Part i:......................................................................................................................................4

Part ii:.....................................................................................................................................5

Part iii:....................................................................................................................................5

Part iv:....................................................................................................................................6

Part v:.....................................................................................................................................6

Part vi:....................................................................................................................................6

Part vii:...................................................................................................................................7

Part viii:..................................................................................................................................7

Part ix:....................................................................................................................................7

References list:...........................................................................................................................8

ACCOUNTING AND FINANCE

Table of Contents

Answer to Question 1:................................................................................................................2

Part a:.....................................................................................................................................2

Part b:.....................................................................................................................................2

Part c:.....................................................................................................................................2

Answer to Question 2:................................................................................................................3

Part i:......................................................................................................................................3

Part ii:.....................................................................................................................................3

Answer to question 3:.................................................................................................................3

Answer to Question 4:................................................................................................................4

Part i:......................................................................................................................................4

Part ii:.....................................................................................................................................5

Part iii:....................................................................................................................................5

Part iv:....................................................................................................................................6

Part v:.....................................................................................................................................6

Part vi:....................................................................................................................................6

Part vii:...................................................................................................................................7

Part viii:..................................................................................................................................7

Part ix:....................................................................................................................................7

References list:...........................................................................................................................8

2

ACCOUNTING AND FINANCE

Answer to Question 1:

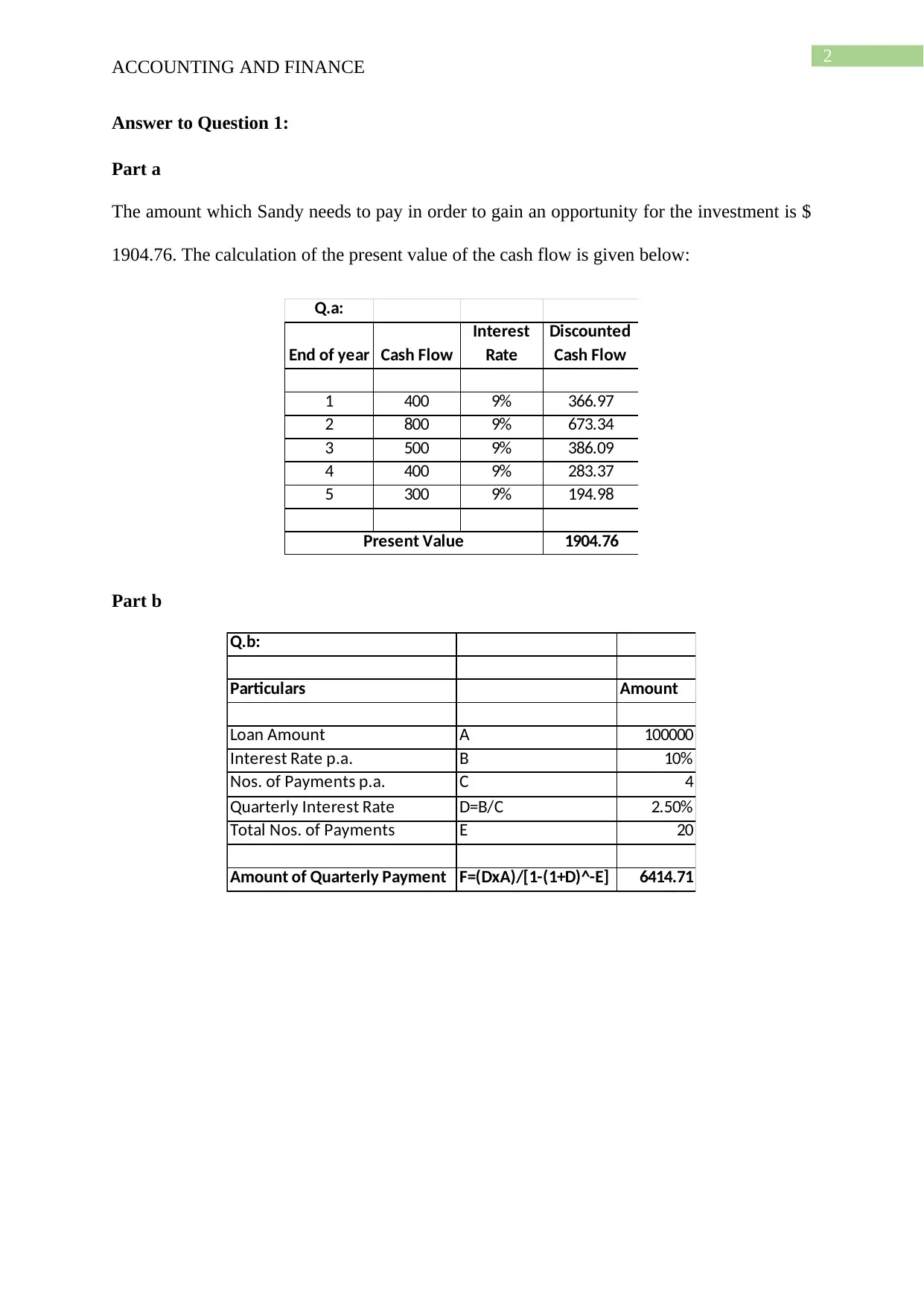

Part a

The amount which Sandy needs to pay in order to gain an opportunity for the investment is $

1904.76. The calculation of the present value of the cash flow is given below:

Q.a:

End of year Cash Flow

Interest

Rate

Discounted

Cash Flow

1 400 9% 366.97

2 800 9% 673.34

3 500 9% 386.09

4 400 9% 283.37

5 300 9% 194.98

1904.76Present Value

Part b

Q.b:

Particulars Amount

Loan Amount A 100000

Interest Rate p.a. B 10%

Nos. of Payments p.a. C 4

Quarterly Interest Rate D=B/C 2.50%

Total Nos. of Payments E 20

Amount of Quarterly Payment F=(DxA)/[1-(1+D)^-E] 6414.71

ACCOUNTING AND FINANCE

Answer to Question 1:

Part a

The amount which Sandy needs to pay in order to gain an opportunity for the investment is $

1904.76. The calculation of the present value of the cash flow is given below:

Q.a:

End of year Cash Flow

Interest

Rate

Discounted

Cash Flow

1 400 9% 366.97

2 800 9% 673.34

3 500 9% 386.09

4 400 9% 283.37

5 300 9% 194.98

1904.76Present Value

Part b

Q.b:

Particulars Amount

Loan Amount A 100000

Interest Rate p.a. B 10%

Nos. of Payments p.a. C 4

Quarterly Interest Rate D=B/C 2.50%

Total Nos. of Payments E 20

Amount of Quarterly Payment F=(DxA)/[1-(1+D)^-E] 6414.71

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING AND FINANCE

Part c

Q.c:

Particulars Amount

Investment Value A $2,00,000

Interest Rate p.a. B 10%

Nos. of Compounding Periods

p.a. C 12

Monthly Interest Rate D=B/C 0.83%

Total Period (in years) E 2

Total Compounding Periods F=CxE 24

Investment Value after 2 years G= A x (1+D)^F $2,44,078.19

Nos. of Monthly Payments H 150

Amount of Monthly Payments I= (GxD)/[1-(1+D)^-H] $2,856.69

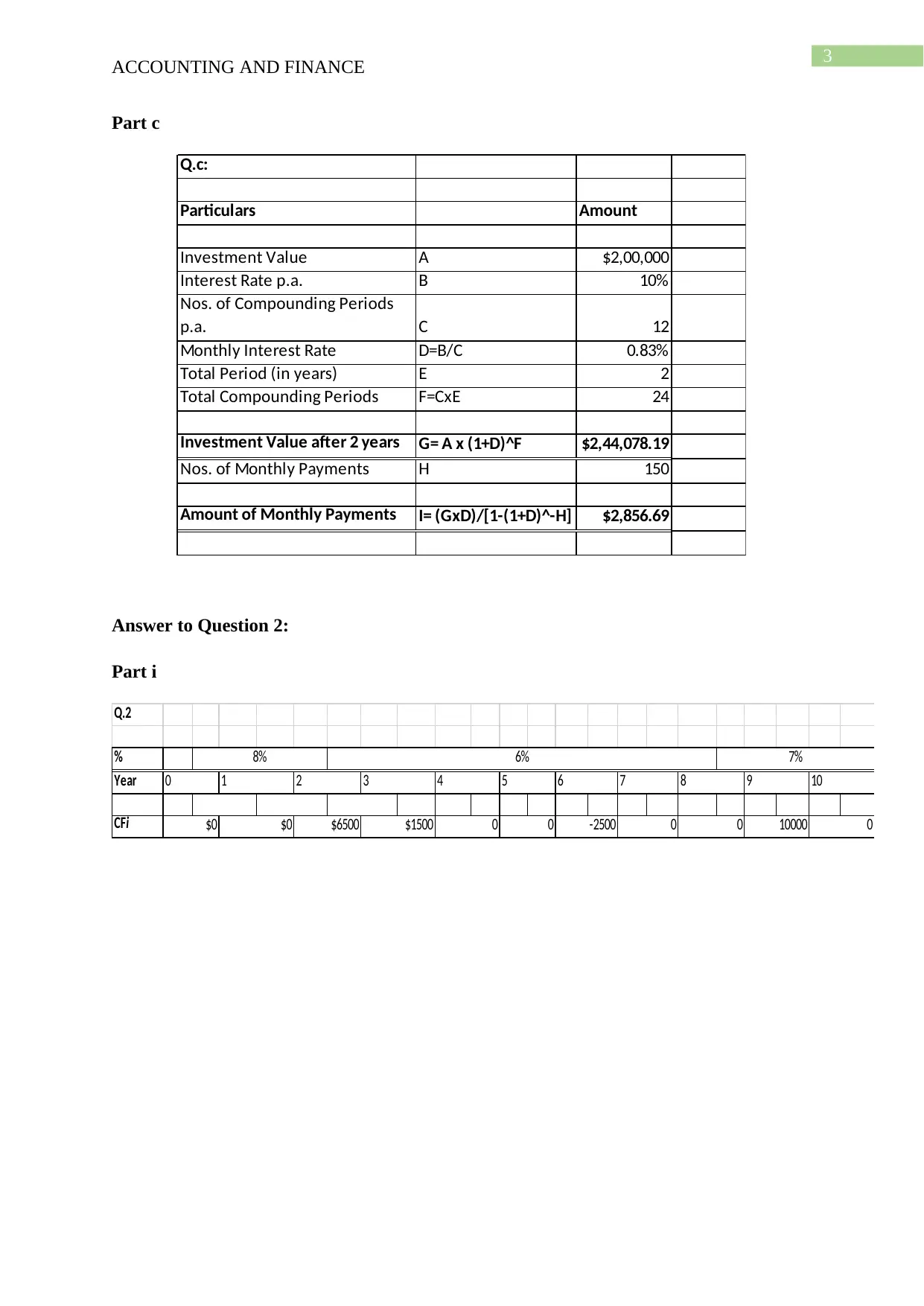

Answer to Question 2:

Part i

Q.2

%

Year

CFi 10000 0

6% 7%

6 7 8 9 10

0 0 -2500 0 0

5

8%

3

$1500

4

$0

0

$0

1 2

$6500

ACCOUNTING AND FINANCE

Part c

Q.c:

Particulars Amount

Investment Value A $2,00,000

Interest Rate p.a. B 10%

Nos. of Compounding Periods

p.a. C 12

Monthly Interest Rate D=B/C 0.83%

Total Period (in years) E 2

Total Compounding Periods F=CxE 24

Investment Value after 2 years G= A x (1+D)^F $2,44,078.19

Nos. of Monthly Payments H 150

Amount of Monthly Payments I= (GxD)/[1-(1+D)^-H] $2,856.69

Answer to Question 2:

Part i

Q.2

%

Year

CFi 10000 0

6% 7%

6 7 8 9 10

0 0 -2500 0 0

5

8%

3

$1500

4

$0

0

$0

1 2

$6500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING AND FINANCE

Part ii

Year

Cash

Flow

Interest

Rate DCF

Cumulative

DCF

0 $0 $0 $0

1 $0 8% $0 $0

2 $6,500 8% $5,573 $5,573

3 $1,500 6% $1,259 $6,832

4 $0 6% $0 $6,832

5 $0 6% $0 $6,832

6 -$2,500 6% -$1,762 $5,070

7 $0 6% $0 $5,070

8 $0 6% $0 $5,070

9 $10,000 7% $5,439 $10,509

10 $0 7% $0 $10,509

Answer to question 3:

The plan which has been developed by the Australian government for increasing the

overall job opportunities and investments in the country. The plan involves lowering of

corporate tax rate which is charged on companies. The plan of the government is to lower the

corporate tax rate to 25% which as per the expectation of the government will be having

positive impacts on the economy as a whole (Evers, Miller & Spengel, 2015).

As per the government the lower of tax rate will improve the investments in the

country thereby creating more job opportunities in the market. The amount of tax which is

paid by a corporate house forms a part of the total cost which is incurred by a business. When

the tax rate is reduced there will be savings in such a cost which can increase the profit of the

company. in addition to this in recent times reduction of tax rate has been used as a tool by

many countries for increasing the overall investments in the economy (Gordon, 2013). In this

case also the Australian government wants to employ such a tool so that the country can

attract foreign investors and increase the investments in the economy. However, there is a

side affect of such a tool which affects the national income of the country (Stiglitz, &

ACCOUNTING AND FINANCE

Part ii

Year

Cash

Flow

Interest

Rate DCF

Cumulative

DCF

0 $0 $0 $0

1 $0 8% $0 $0

2 $6,500 8% $5,573 $5,573

3 $1,500 6% $1,259 $6,832

4 $0 6% $0 $6,832

5 $0 6% $0 $6,832

6 -$2,500 6% -$1,762 $5,070

7 $0 6% $0 $5,070

8 $0 6% $0 $5,070

9 $10,000 7% $5,439 $10,509

10 $0 7% $0 $10,509

Answer to question 3:

The plan which has been developed by the Australian government for increasing the

overall job opportunities and investments in the country. The plan involves lowering of

corporate tax rate which is charged on companies. The plan of the government is to lower the

corporate tax rate to 25% which as per the expectation of the government will be having

positive impacts on the economy as a whole (Evers, Miller & Spengel, 2015).

As per the government the lower of tax rate will improve the investments in the

country thereby creating more job opportunities in the market. The amount of tax which is

paid by a corporate house forms a part of the total cost which is incurred by a business. When

the tax rate is reduced there will be savings in such a cost which can increase the profit of the

company. in addition to this in recent times reduction of tax rate has been used as a tool by

many countries for increasing the overall investments in the economy (Gordon, 2013). In this

case also the Australian government wants to employ such a tool so that the country can

attract foreign investors and increase the investments in the economy. However, there is a

side affect of such a tool which affects the national income of the country (Stiglitz, &

5

ACCOUNTING AND FINANCE

Rosengard, 2015). Taxes forms a part of the major sources of revenues for the government

and especially corporate taxes. If such a tax is reduced there will be a reduction in the amount

of revenue which was being earned by the government. This can be overcome if there are

sufficient foreign investments in the stocks and securities of the company and it makes for the

loss of revenue due to reduction of tax rate (Erceg & Lindé, 2013). In addition to this, the

reduction in tax rate will also imply that the general people of the country will be having

more money in their hands which can be used for the purpose of savings, further investments

and also for consumption. In other words, reduction of taxes is expected to increase the

overall standard of living of the general people of the country. Moreover, with the reduction

of tax rate, the corporate savings will also increase and also the overall profitability of the

companies in the long run. The certain advantages of reducing the tax structure from the point

of view of the households and consumers as then they will be having a higher percentage of

profits in their hand which can be used for consumption purposes or even can be used for

savings purposes. The Australian government follows dividend imputation system, which is

known to provide tax payers, residents and even the companies which are operating in low

income level for franking credits which can reduce their tax liability. This is an indirect

indication that the lower income group companies will be paying lower amount of taxes if the

overall tax rate for companies are reduced and will results in more savings generations for

such companies which can lead to overall development of such companies. There is also the

fact that with the lowering of the tax rate the corporate houses of the country will have a lot

of savings in their hands which can be used for reinvestments in the business and also for

financing of activities which can be innovative and lead to overall developments of the

economy as a whole (Cogan et al., 2013). Then there is the advantage of the additional cash

inflows in the economy through foreign investments which will improve the investment and

savings structure of the country.

ACCOUNTING AND FINANCE

Rosengard, 2015). Taxes forms a part of the major sources of revenues for the government

and especially corporate taxes. If such a tax is reduced there will be a reduction in the amount

of revenue which was being earned by the government. This can be overcome if there are

sufficient foreign investments in the stocks and securities of the company and it makes for the

loss of revenue due to reduction of tax rate (Erceg & Lindé, 2013). In addition to this, the

reduction in tax rate will also imply that the general people of the country will be having

more money in their hands which can be used for the purpose of savings, further investments

and also for consumption. In other words, reduction of taxes is expected to increase the

overall standard of living of the general people of the country. Moreover, with the reduction

of tax rate, the corporate savings will also increase and also the overall profitability of the

companies in the long run. The certain advantages of reducing the tax structure from the point

of view of the households and consumers as then they will be having a higher percentage of

profits in their hand which can be used for consumption purposes or even can be used for

savings purposes. The Australian government follows dividend imputation system, which is

known to provide tax payers, residents and even the companies which are operating in low

income level for franking credits which can reduce their tax liability. This is an indirect

indication that the lower income group companies will be paying lower amount of taxes if the

overall tax rate for companies are reduced and will results in more savings generations for

such companies which can lead to overall development of such companies. There is also the

fact that with the lowering of the tax rate the corporate houses of the country will have a lot

of savings in their hands which can be used for reinvestments in the business and also for

financing of activities which can be innovative and lead to overall developments of the

economy as a whole (Cogan et al., 2013). Then there is the advantage of the additional cash

inflows in the economy through foreign investments which will improve the investment and

savings structure of the country.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING AND FINANCE

The problems which are associated with the reduction of tax rate is that the market of

the country might look uncompetitive in nature and potential investors might not be willing to

invest their money in such an uncompetitive market. The lower of tax rate will thus result in

making the Australian market look unattractive and uncompetitive in nature amore moreover

from the perspective of the investors the market might be weak and unworthy for further

investments. The government should also look out for the negative impacts which are

associated with the lowering of taxes in the country.

Thus, from the above discussions it is clear that the economy will greatly benefit with

the reduction of tax rate for corporate houses even though there are some disadvantages but

the advantages of the policy is more. Thus, the government should lower the corporate tax

rate to increase the overall savings in the economy.

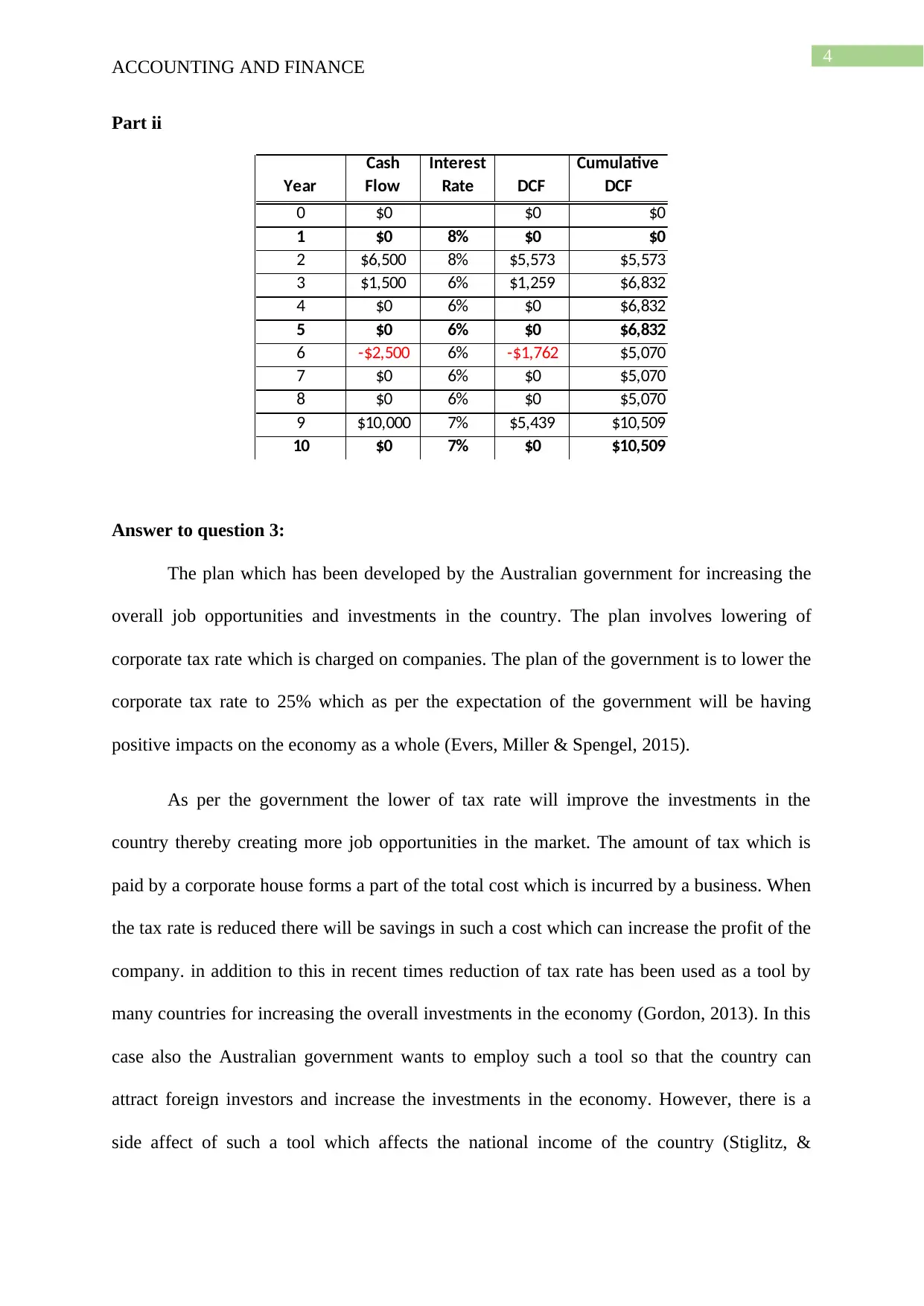

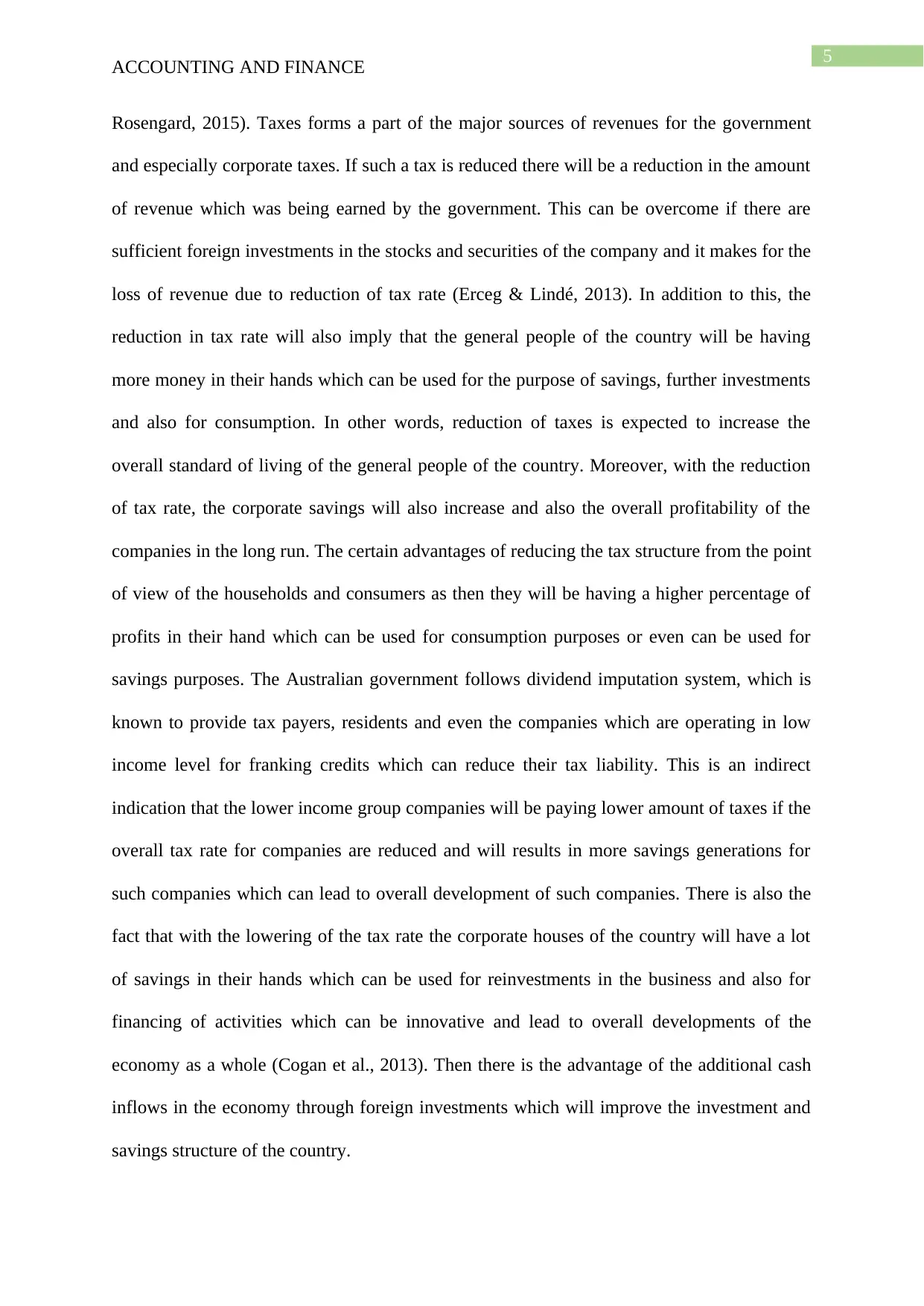

Answer to Question 4:

Part i:

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Monthly Returns

NAB BHP AORD

ACCOUNTING AND FINANCE

The problems which are associated with the reduction of tax rate is that the market of

the country might look uncompetitive in nature and potential investors might not be willing to

invest their money in such an uncompetitive market. The lower of tax rate will thus result in

making the Australian market look unattractive and uncompetitive in nature amore moreover

from the perspective of the investors the market might be weak and unworthy for further

investments. The government should also look out for the negative impacts which are

associated with the lowering of taxes in the country.

Thus, from the above discussions it is clear that the economy will greatly benefit with

the reduction of tax rate for corporate houses even though there are some disadvantages but

the advantages of the policy is more. Thus, the government should lower the corporate tax

rate to increase the overall savings in the economy.

Answer to Question 4:

Part i:

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Monthly Returns

NAB BHP AORD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING AND FINANCE

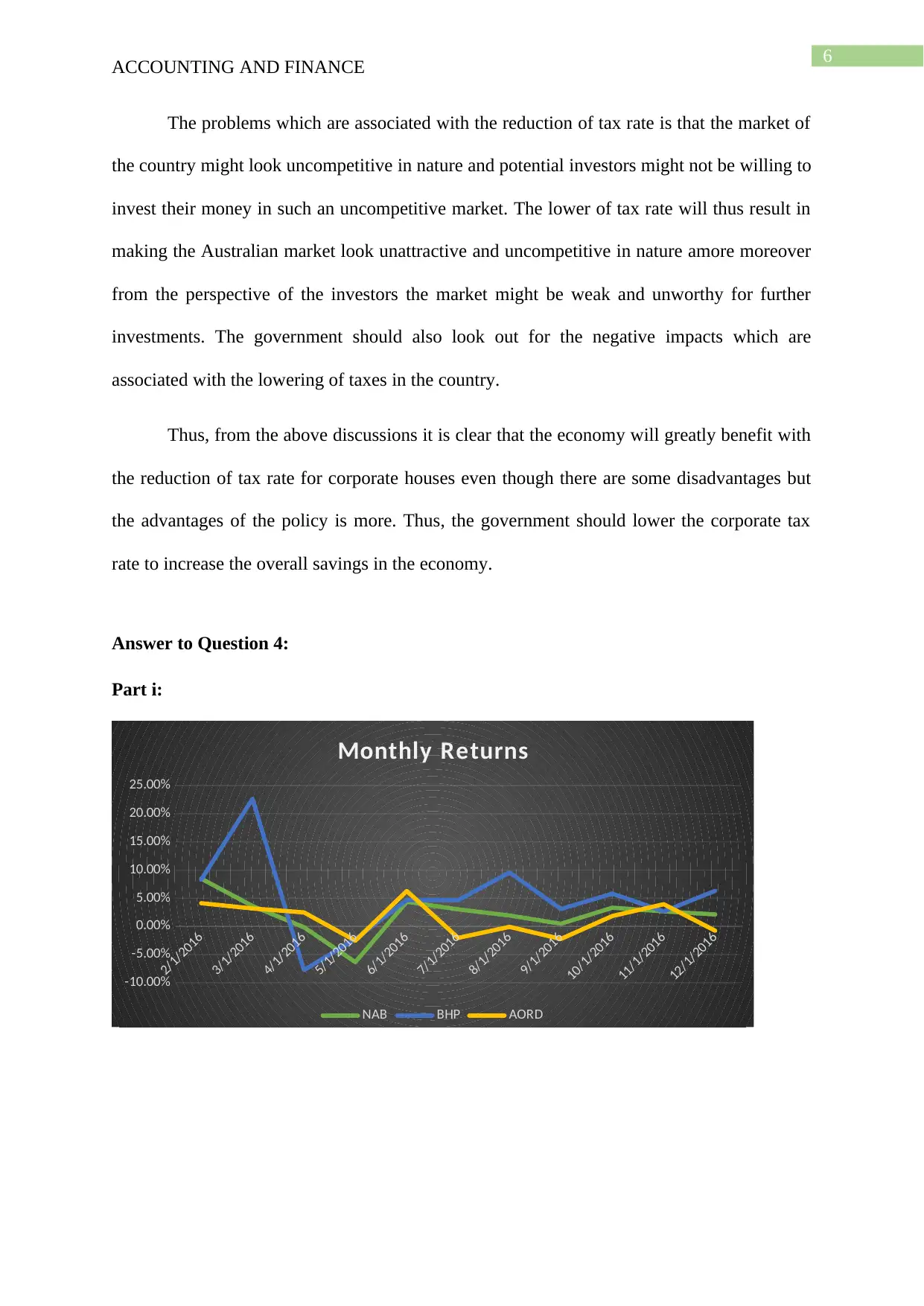

Part ii:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Average Monthly Return

NAB BHP AORD

2.14% 1.29%5.24%

Part iii:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Annual Holding Period Return

NAB BHP AORD

1.90% 1.15%4.58%

ACCOUNTING AND FINANCE

Part ii:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Average Monthly Return

NAB BHP AORD

2.14% 1.29%5.24%

Part iii:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Annual Holding Period Return

NAB BHP AORD

1.90% 1.15%4.58%

8

ACCOUNTING AND FINANCE

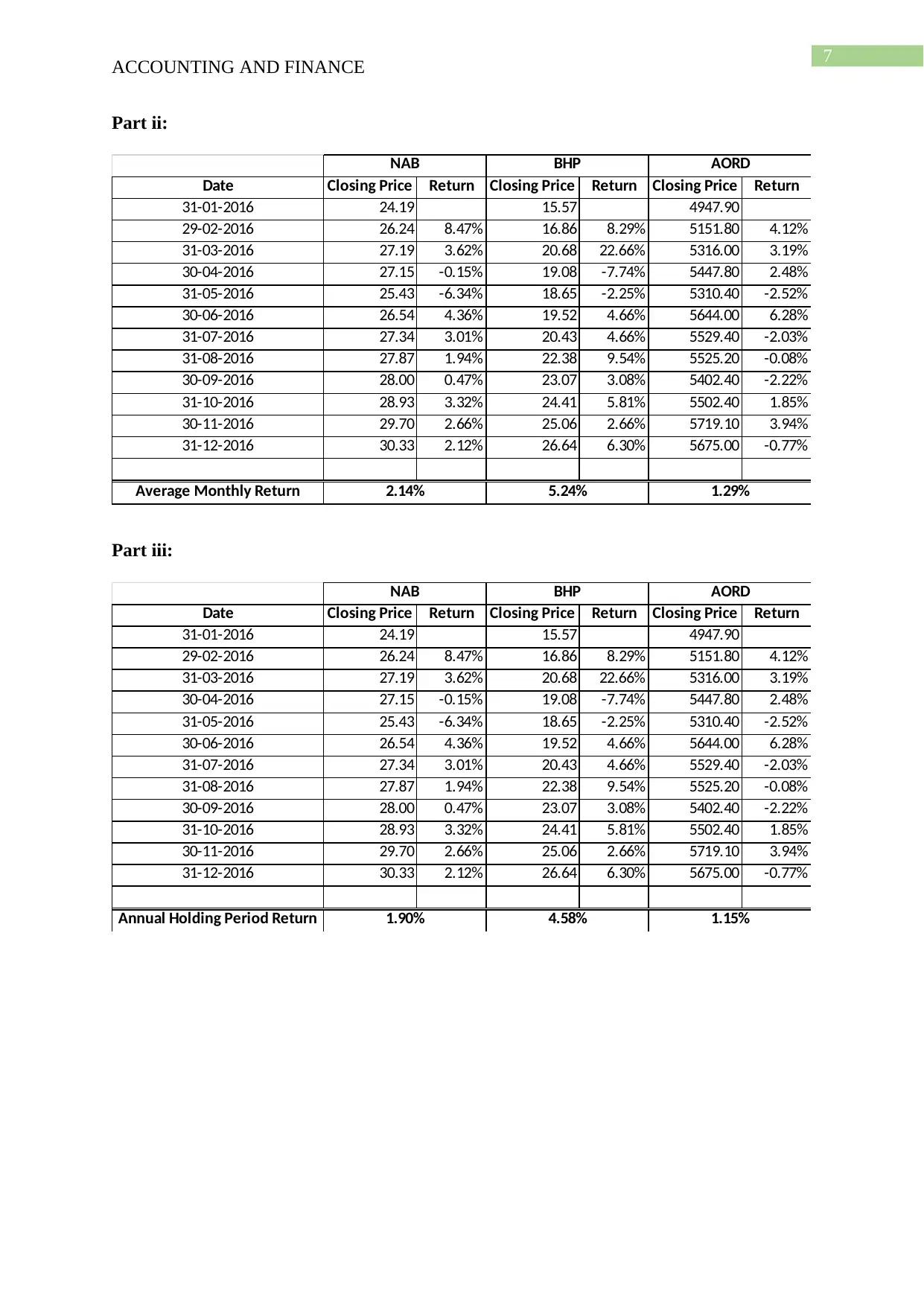

Part iv:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Standard Deviation

NAB BHP AORD

3.60% 2.99%7.54%

Part v:

2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

AORD; 1.15%

BHP; 4.58%

NAB; 1.90%

Annual Return & Risk

NAB BHP AORD

Part vi:

Beta

Risk Free Rate

Market Return

Expected Return

NAB BHP

1.23

2.95%

6.50%

7.32%

0.9

2.95%

6.50%

6.15%

ACCOUNTING AND FINANCE

Part iv:

Date Closing Price Return Closing Price Return Closing Price Return

31-01-2016 24.19 15.57 4947.90

29-02-2016 26.24 8.47% 16.86 8.29% 5151.80 4.12%

31-03-2016 27.19 3.62% 20.68 22.66% 5316.00 3.19%

30-04-2016 27.15 -0.15% 19.08 -7.74% 5447.80 2.48%

31-05-2016 25.43 -6.34% 18.65 -2.25% 5310.40 -2.52%

30-06-2016 26.54 4.36% 19.52 4.66% 5644.00 6.28%

31-07-2016 27.34 3.01% 20.43 4.66% 5529.40 -2.03%

31-08-2016 27.87 1.94% 22.38 9.54% 5525.20 -0.08%

30-09-2016 28.00 0.47% 23.07 3.08% 5402.40 -2.22%

31-10-2016 28.93 3.32% 24.41 5.81% 5502.40 1.85%

30-11-2016 29.70 2.66% 25.06 2.66% 5719.10 3.94%

31-12-2016 30.33 2.12% 26.64 6.30% 5675.00 -0.77%

Standard Deviation

NAB BHP AORD

3.60% 2.99%7.54%

Part v:

2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

AORD; 1.15%

BHP; 4.58%

NAB; 1.90%

Annual Return & Risk

NAB BHP AORD

Part vi:

Beta

Risk Free Rate

Market Return

Expected Return

NAB BHP

1.23

2.95%

6.50%

7.32%

0.9

2.95%

6.50%

6.15%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING AND FINANCE

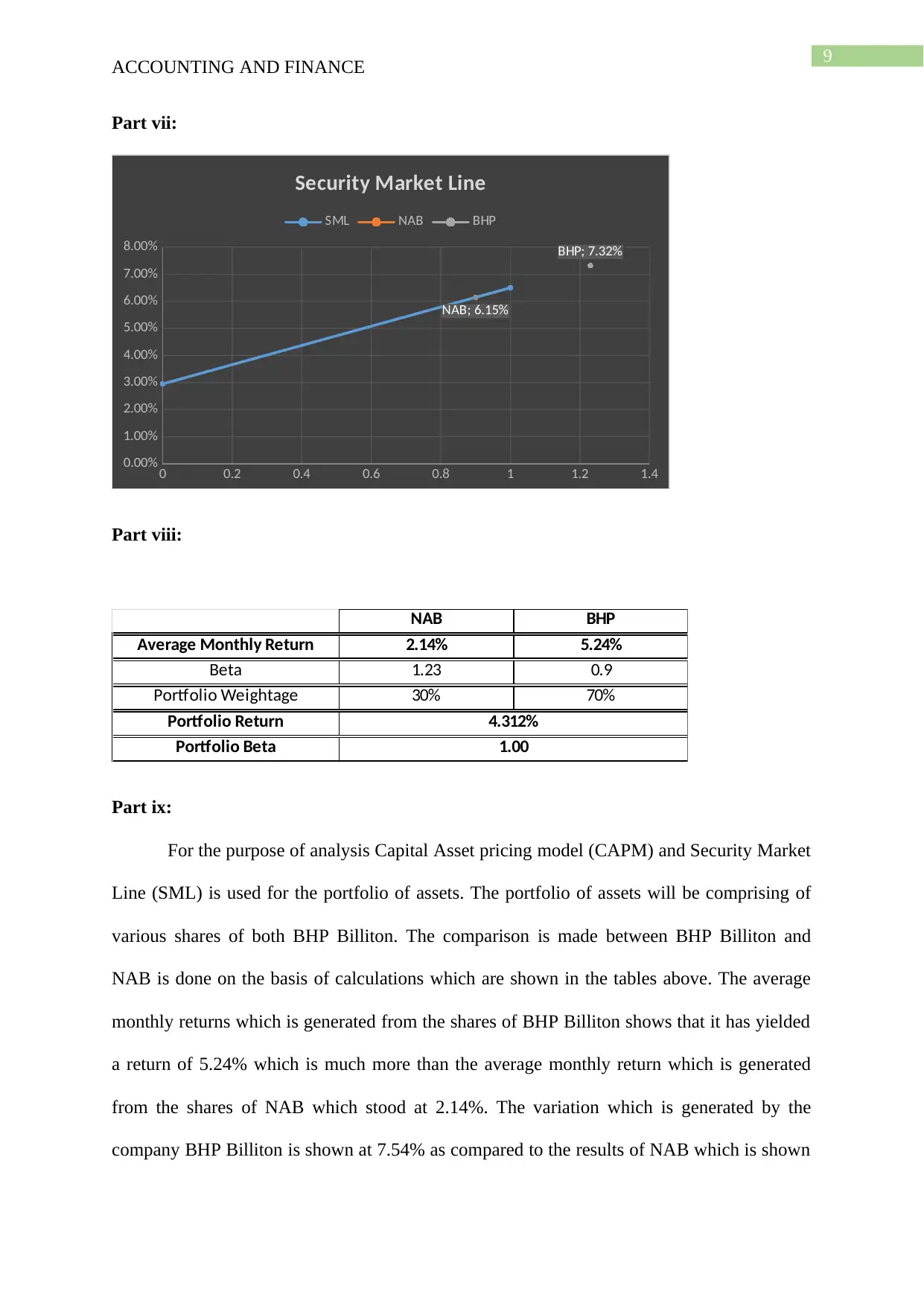

Part vii:

0 0.2 0.4 0.6 0.8 1 1.2 1.4

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00% BHP; 7.32%

NAB; 6.15%

Security Market Line

SML NAB BHP

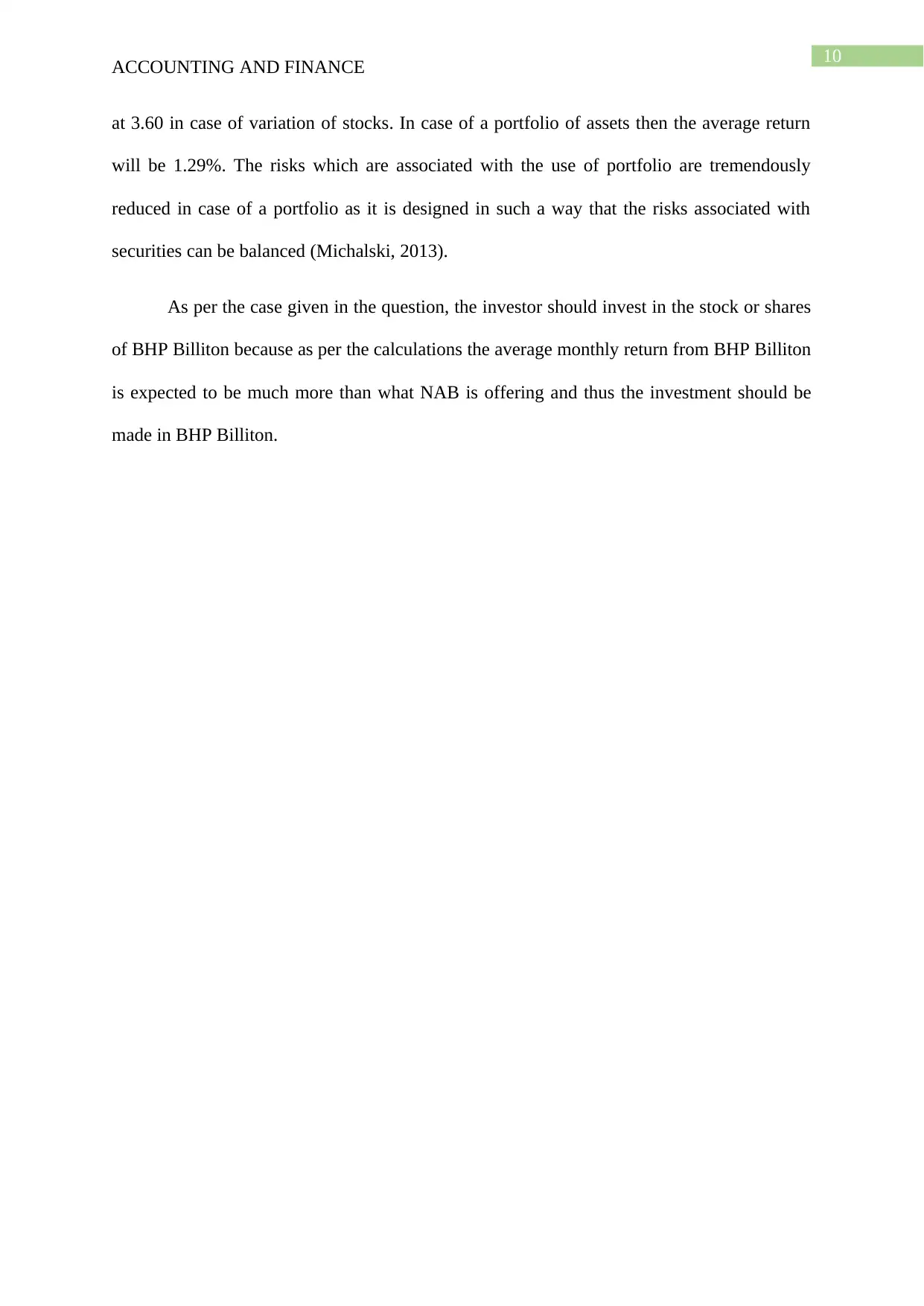

Part viii:

Average Monthly Return

Beta

Portfolio Weightage

Portfolio Return

Portfolio Beta

NAB BHP

4.312%

1.00

2.14%

1.23

70%30%

5.24%

0.9

Part ix:

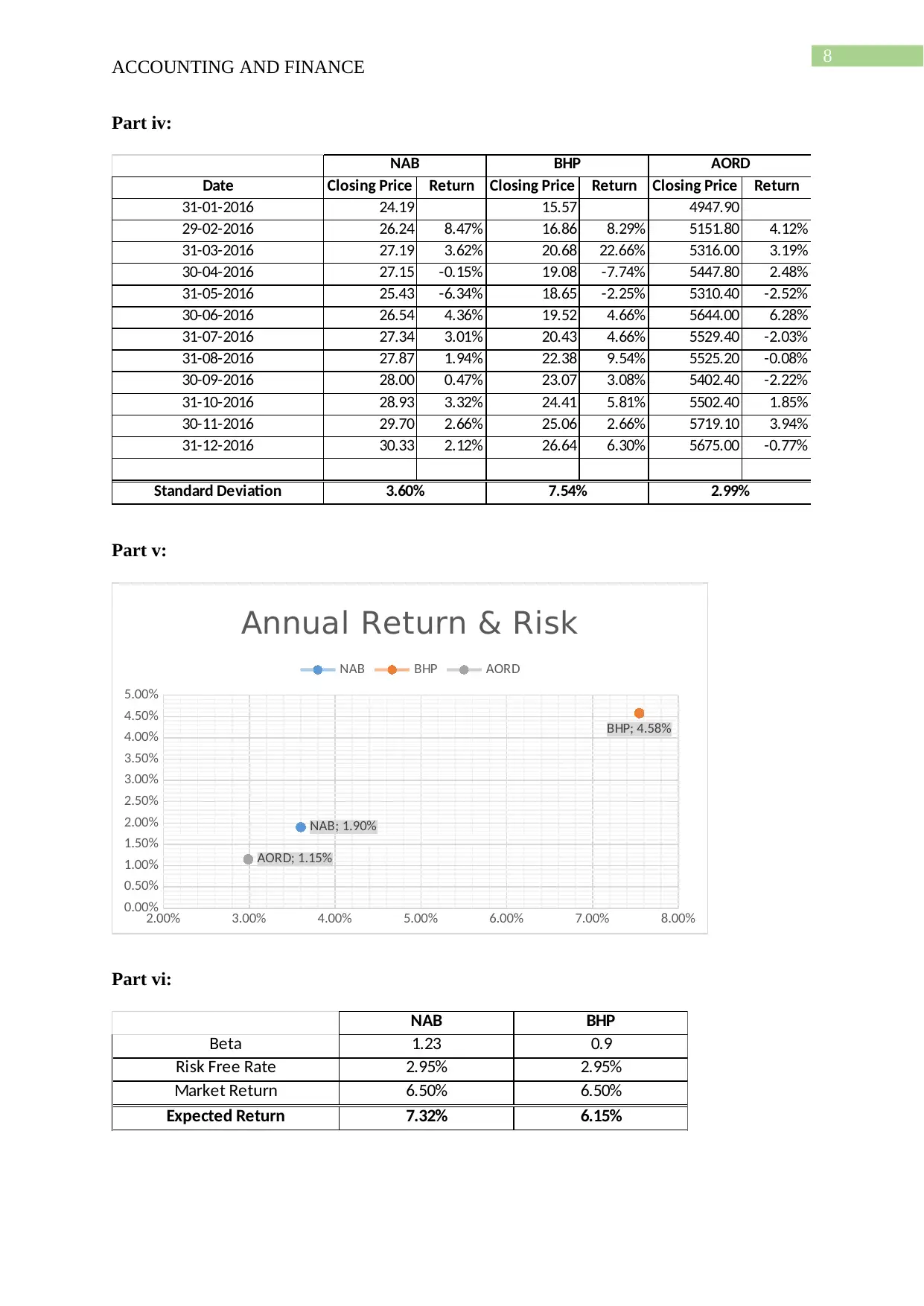

For the purpose of analysis Capital Asset pricing model (CAPM) and Security Market

Line (SML) is used for the portfolio of assets. The portfolio of assets will be comprising of

various shares of both BHP Billiton. The comparison is made between BHP Billiton and

NAB is done on the basis of calculations which are shown in the tables above. The average

monthly returns which is generated from the shares of BHP Billiton shows that it has yielded

a return of 5.24% which is much more than the average monthly return which is generated

from the shares of NAB which stood at 2.14%. The variation which is generated by the

company BHP Billiton is shown at 7.54% as compared to the results of NAB which is shown

ACCOUNTING AND FINANCE

Part vii:

0 0.2 0.4 0.6 0.8 1 1.2 1.4

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00% BHP; 7.32%

NAB; 6.15%

Security Market Line

SML NAB BHP

Part viii:

Average Monthly Return

Beta

Portfolio Weightage

Portfolio Return

Portfolio Beta

NAB BHP

4.312%

1.00

2.14%

1.23

70%30%

5.24%

0.9

Part ix:

For the purpose of analysis Capital Asset pricing model (CAPM) and Security Market

Line (SML) is used for the portfolio of assets. The portfolio of assets will be comprising of

various shares of both BHP Billiton. The comparison is made between BHP Billiton and

NAB is done on the basis of calculations which are shown in the tables above. The average

monthly returns which is generated from the shares of BHP Billiton shows that it has yielded

a return of 5.24% which is much more than the average monthly return which is generated

from the shares of NAB which stood at 2.14%. The variation which is generated by the

company BHP Billiton is shown at 7.54% as compared to the results of NAB which is shown

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ACCOUNTING AND FINANCE

at 3.60 in case of variation of stocks. In case of a portfolio of assets then the average return

will be 1.29%. The risks which are associated with the use of portfolio are tremendously

reduced in case of a portfolio as it is designed in such a way that the risks associated with

securities can be balanced (Michalski, 2013).

As per the case given in the question, the investor should invest in the stock or shares

of BHP Billiton because as per the calculations the average monthly return from BHP Billiton

is expected to be much more than what NAB is offering and thus the investment should be

made in BHP Billiton.

ACCOUNTING AND FINANCE

at 3.60 in case of variation of stocks. In case of a portfolio of assets then the average return

will be 1.29%. The risks which are associated with the use of portfolio are tremendously

reduced in case of a portfolio as it is designed in such a way that the risks associated with

securities can be balanced (Michalski, 2013).

As per the case given in the question, the investor should invest in the stock or shares

of BHP Billiton because as per the calculations the average monthly return from BHP Billiton

is expected to be much more than what NAB is offering and thus the investment should be

made in BHP Billiton.

11

ACCOUNTING AND FINANCE

References list:

Cogan, J. F., Taylor, J. B., Wieland, V., & Wolters, M. H. (2013). Fiscal consolidation

strategy. Journal of Economic Dynamics and Control, 37(2), 404-421.

Erceg, C. J., & Lindé, J. (2013). Fiscal consolidation in a currency union: Spending cuts vs.

tax hikes. Journal of Economic Dynamics and Control, 37(2), 422-445.

Evers, L., Miller, H., & Spengel, C. (2015). Intellectual property box regimes: effective tax

rates and tax policy considerations. International Tax and Public Finance, 22(3), 502-530.

Gordon, G. L. (2013). Strategic planning for local government. ICMA Publishing.

Michalski, G. (2013). Portfolio management approach in trade credit decision making. arXiv

preprint arXiv:1301.3823.

Stiglitz, J. E., & Rosengard, J. K. (2015). Economics of the Public Sector: Fourth

International Student Edition. WW Norton & Company.

ACCOUNTING AND FINANCE

References list:

Cogan, J. F., Taylor, J. B., Wieland, V., & Wolters, M. H. (2013). Fiscal consolidation

strategy. Journal of Economic Dynamics and Control, 37(2), 404-421.

Erceg, C. J., & Lindé, J. (2013). Fiscal consolidation in a currency union: Spending cuts vs.

tax hikes. Journal of Economic Dynamics and Control, 37(2), 422-445.

Evers, L., Miller, H., & Spengel, C. (2015). Intellectual property box regimes: effective tax

rates and tax policy considerations. International Tax and Public Finance, 22(3), 502-530.

Gordon, G. L. (2013). Strategic planning for local government. ICMA Publishing.

Michalski, G. (2013). Portfolio management approach in trade credit decision making. arXiv

preprint arXiv:1301.3823.

Stiglitz, J. E., & Rosengard, J. K. (2015). Economics of the Public Sector: Fourth

International Student Edition. WW Norton & Company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.