Financial Statement Analysis: Crystal Hotel - BIZ201 Case Study

VerifiedAdded on 2023/06/13

|9

|1865

|419

Case Study

AI Summary

This financial analysis report evaluates Crystal Hotel Private Limited's performance using accounting principles. It includes a comparative income statement analysis, ratio analysis (profitability, solvency, liquidity, and efficiency), and industry-specific benchmarks. The report identifies areas where the hotel excels, such as room revenue, and areas needing improvement, like cost of sales and liquidity. The analysis compares Crystal Hotel's financial position to industry standards, providing recommendations for enhancing financial strategies and overall performance. The report concludes that while Crystal Hotel has strengths, improvements in solvency and liquidity are needed to align with industry benchmarks. Desklib provides solved assignments and past papers for students.

Running Head: Accounting Financial Analysis Report

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting Financial Analysis Report 2

Contents

Part 1.................................................................................................................................3

Part 2.................................................................................................................................3

Introduction...................................................................................................................3

Income statement comparative analysis.......................................................................3

Ratio analysis................................................................................................................4

Industry specific benchmark.........................................................................................5

Conclusion....................................................................................................................6

References.........................................................................................................................7

Appendix...........................................................................................................................8

Contents

Part 1.................................................................................................................................3

Part 2.................................................................................................................................3

Introduction...................................................................................................................3

Income statement comparative analysis.......................................................................3

Ratio analysis................................................................................................................4

Industry specific benchmark.........................................................................................5

Conclusion....................................................................................................................6

References.........................................................................................................................7

Appendix...........................................................................................................................8

Accounting Financial Analysis Report 3

Part 1:

Refer to excel file.

Part 2:

Introduction:

Accounting financial analysis is a procedure of business which is done by the

professionals to identify and evaluate the performance and the position of the company. It

briefs about the financial performance of the company and this process suggests the

management of the company to make few changes into its financial strategies or the

performance to enhance the position of the company (Higgins, 2012). Accounting financial

analysis is a common process which is done by the all the companies and financial analyst to

evaluate the performance of the company and make a better decision on the basis of that.

In the given case, crystal hotel private limited’s financial accounts have been

evaluated. This company is operating its business in Sydney. The capacity and the revenue of

the hotel have been evaluated and further the financial performance of the company has been

identified which would assist the company to compare the performance with industry and

make changes accordingly.

Income statement comparative analysis:

Income statement is one of the crucial final financial statements of an organization. It

briefs about the total turnover, operating and non operating expenses, net profit, gross profit

etc of the company. Income statement of crystal hotel private limited has been analyzed and it

has been compared with the industry data to analyze the performance of the company

(Titman and Martin, 2014). The income statement of the company briefs that the financial

performance and the position of the company is quite competitive in the industry. The

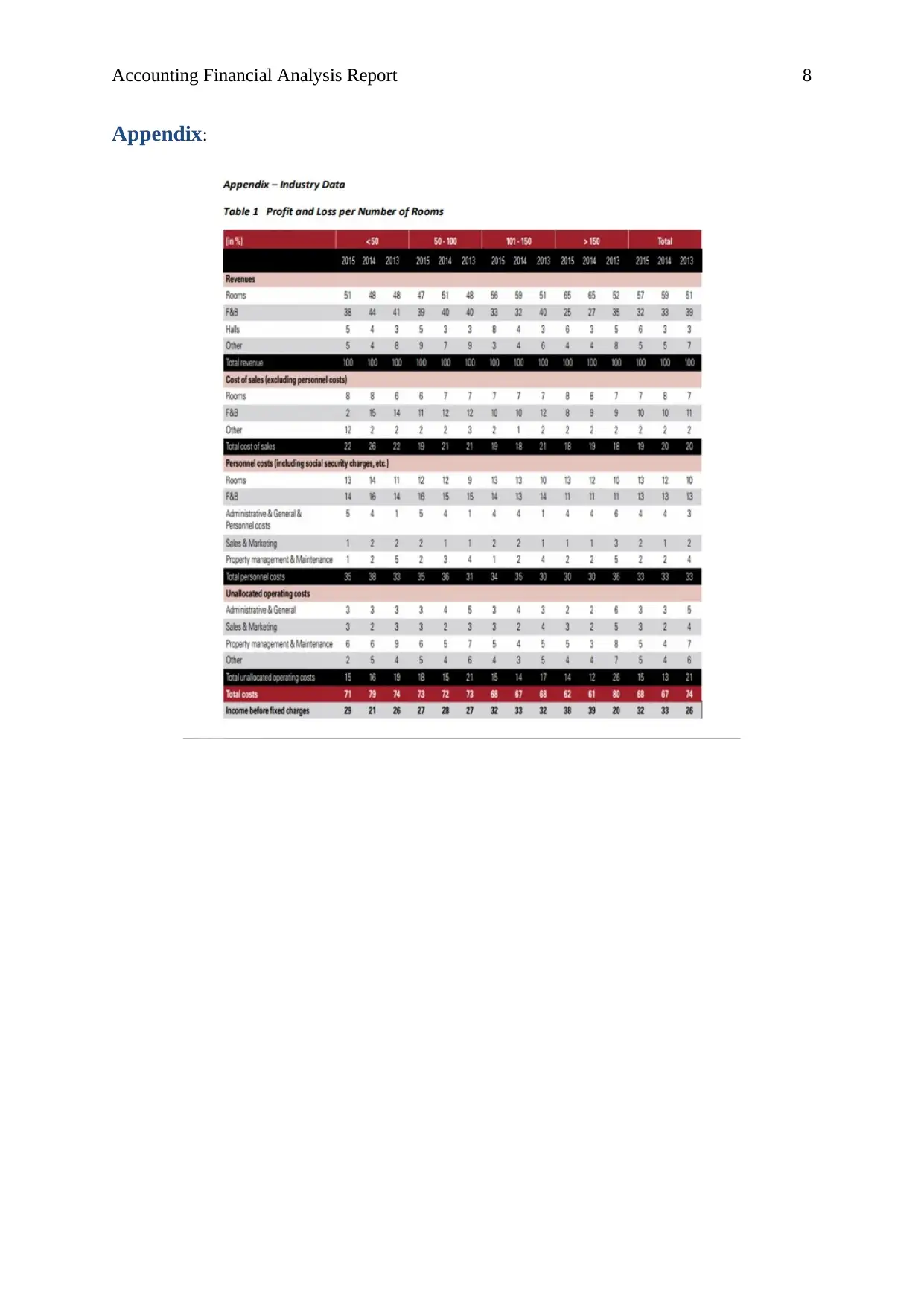

appendix table 1 briefs that the company should work on its total capacity. At this level, the

company would be able to earn more profits. Further, it briefs that the current income

statement of the company briefs about better position of the company.

According to the case, the room’s revenue of the company should be 51% which is

quite higher than the industry benchmark. Further, the F&B revenue, halls revenue and other

revenue of industry is 39%, 3% and 7% whereas the company revenue is 14.46%, 14.86%

Part 1:

Refer to excel file.

Part 2:

Introduction:

Accounting financial analysis is a procedure of business which is done by the

professionals to identify and evaluate the performance and the position of the company. It

briefs about the financial performance of the company and this process suggests the

management of the company to make few changes into its financial strategies or the

performance to enhance the position of the company (Higgins, 2012). Accounting financial

analysis is a common process which is done by the all the companies and financial analyst to

evaluate the performance of the company and make a better decision on the basis of that.

In the given case, crystal hotel private limited’s financial accounts have been

evaluated. This company is operating its business in Sydney. The capacity and the revenue of

the hotel have been evaluated and further the financial performance of the company has been

identified which would assist the company to compare the performance with industry and

make changes accordingly.

Income statement comparative analysis:

Income statement is one of the crucial final financial statements of an organization. It

briefs about the total turnover, operating and non operating expenses, net profit, gross profit

etc of the company. Income statement of crystal hotel private limited has been analyzed and it

has been compared with the industry data to analyze the performance of the company

(Titman and Martin, 2014). The income statement of the company briefs that the financial

performance and the position of the company is quite competitive in the industry. The

appendix table 1 briefs that the company should work on its total capacity. At this level, the

company would be able to earn more profits. Further, it briefs that the current income

statement of the company briefs about better position of the company.

According to the case, the room’s revenue of the company should be 51% which is

quite higher than the industry benchmark. Further, the F&B revenue, halls revenue and other

revenue of industry is 39%, 3% and 7% whereas the company revenue is 14.46%, 14.86%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting Financial Analysis Report 4

and 8.83%. It briefs that the level of room’s revenue and the functions are quite higher and it

is required for the company to focus on food and beverages.

In addition, cost of sales of the company has been evaluated and compared with the

industry benchmark. On the basis of analysis, it has been found that the total cost of sales %

of industry is 19% in 2015 which is quite lesser than the company’s cost of sales. The

company’s cost of sales is 27.59% which briefs that the gross profit level of the comapny is

lower and it is required for the company to manage the production cost (Madhura, 2011).

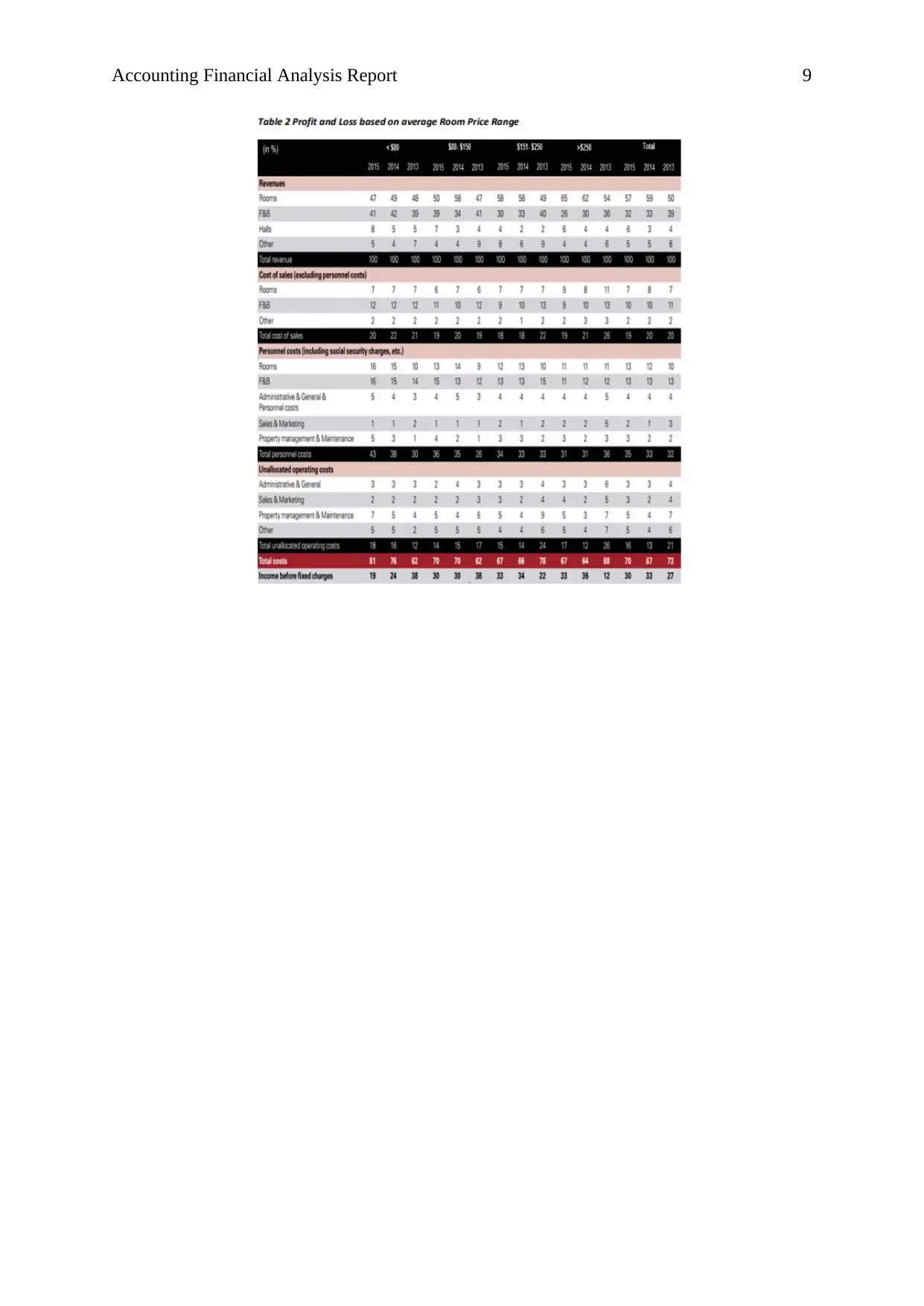

Further, the personal cost, unallocated operating cost and total cost of the company

has been evaluated. The total personnel cost of industry is 33% and the company’s cost is

25.38% which briefs about better position of the company. In addition, unallocated operating

cost of the company is 18.31% which is 15% in industry benchmark. It explains that the

expenses of the company are quite higher (Appendix 2).

The total cost and the net profit level of the industry is 68% and 32% respectively

whereas the net income level of the company is 19.53% (Brown, 2012). It briefs that the

financial position of the company is not that much strong and it is important for the

management of the company to enhance the level of the revenues in comparison of expenses

so that the net profit level could be enhanced.

Ratio analysis:

Ratio analysis is a financial analysis process which is conducted by the managers of

the company and the financial analysts to evaluate the performance and the position of the

company (Brooks, 2015). It briefs about the different positions of the company. Ratio

analysis study of Crystal hotel briefs about the profitability level, solvency level, liquidity

level and efficiency level of the company.

Profitability ratio:

Profitability ratio of the company briefs the gross profit level, net profit level, return

on assets and return on equity level of the company. Gross profit margin of the company is

72.41% which is lower from 81% (industry benchmark ratio). Further, the level of net profit

margin is quite higher and on the other hand, the return on assets and return on equity ratio of

the company is also higher than the industry benchmark ratio (Gibson, 2011). It explains that

the financial profitability position of the company is quite better and thus the company should

maintain the same level.

and 8.83%. It briefs that the level of room’s revenue and the functions are quite higher and it

is required for the company to focus on food and beverages.

In addition, cost of sales of the company has been evaluated and compared with the

industry benchmark. On the basis of analysis, it has been found that the total cost of sales %

of industry is 19% in 2015 which is quite lesser than the company’s cost of sales. The

company’s cost of sales is 27.59% which briefs that the gross profit level of the comapny is

lower and it is required for the company to manage the production cost (Madhura, 2011).

Further, the personal cost, unallocated operating cost and total cost of the company

has been evaluated. The total personnel cost of industry is 33% and the company’s cost is

25.38% which briefs about better position of the company. In addition, unallocated operating

cost of the company is 18.31% which is 15% in industry benchmark. It explains that the

expenses of the company are quite higher (Appendix 2).

The total cost and the net profit level of the industry is 68% and 32% respectively

whereas the net income level of the company is 19.53% (Brown, 2012). It briefs that the

financial position of the company is not that much strong and it is important for the

management of the company to enhance the level of the revenues in comparison of expenses

so that the net profit level could be enhanced.

Ratio analysis:

Ratio analysis is a financial analysis process which is conducted by the managers of

the company and the financial analysts to evaluate the performance and the position of the

company (Brooks, 2015). It briefs about the different positions of the company. Ratio

analysis study of Crystal hotel briefs about the profitability level, solvency level, liquidity

level and efficiency level of the company.

Profitability ratio:

Profitability ratio of the company briefs the gross profit level, net profit level, return

on assets and return on equity level of the company. Gross profit margin of the company is

72.41% which is lower from 81% (industry benchmark ratio). Further, the level of net profit

margin is quite higher and on the other hand, the return on assets and return on equity ratio of

the company is also higher than the industry benchmark ratio (Gibson, 2011). It explains that

the financial profitability position of the company is quite better and thus the company should

maintain the same level.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting Financial Analysis Report 5

Solvency level:

Solvency ratio of the company briefs the equity and debt position of the company to

manage its capital structure and the cost and risk of the company. Debt to equity, debt ratio,

equity ratio and interest coverage ratio has been evaluated. All these ratios brief the debt level

of the company is quite lower from equity level and thus the cost of the company is quite

lesser but on the other hand, risk level of the company is quite higher. It explains that the

financial solvency position of the company is not good and it is suggested to the company to

manage the optimal capital structure.

Liquidity level:

Liquidity ratio of the company briefs the position of the company to pay its short term

current debt through current assets of the company. Current ratio and quick ratio of the

company has been evaluated. Current ratio of the company is 1.86 which is lower from 3.2

(industry benchmark ratio). Further, the level of quick ratio is also lower than the industry

ratio. It explains that the financial liquidity position of the company is not good and it is

suggested to the company to enhance the level of current assets so that better liquidity

position could be maintained (Brigham and Houston, 2012).

Efficiency level:

Efficiency ratio of the company briefs the position of the company to manage its long

term debt as well as the working capital management. Inventory turnover ratio and accounts

receivable turnover ratio of the company has been evaluated. Inventory turnover ratio of the

company is 0.15 which is lower from 8.6 (industry benchmark ratio). Further, the level of

accounts receivable collection period is quite higher than the industry ratio. It explains that

the efficiency position of the company is not according to the industry so it is suggested to

the company to manage the efficiency level.

Industry specific benchmark:

Further, the industry’s performance has been compared with the company’s

performance on the basis of various other benchmarks such as the total price of the rooms,

employee’s turnover and credit policies of the company. The total price of the rooms has

been evaluated firstly and it has been found that the average price per room of the company is

$ 148 whereas the industry is charging different rates on the basis of hotel ratings and other

facilities. The total profitability position of the company on the basis of total price per room

Solvency level:

Solvency ratio of the company briefs the equity and debt position of the company to

manage its capital structure and the cost and risk of the company. Debt to equity, debt ratio,

equity ratio and interest coverage ratio has been evaluated. All these ratios brief the debt level

of the company is quite lower from equity level and thus the cost of the company is quite

lesser but on the other hand, risk level of the company is quite higher. It explains that the

financial solvency position of the company is not good and it is suggested to the company to

manage the optimal capital structure.

Liquidity level:

Liquidity ratio of the company briefs the position of the company to pay its short term

current debt through current assets of the company. Current ratio and quick ratio of the

company has been evaluated. Current ratio of the company is 1.86 which is lower from 3.2

(industry benchmark ratio). Further, the level of quick ratio is also lower than the industry

ratio. It explains that the financial liquidity position of the company is not good and it is

suggested to the company to enhance the level of current assets so that better liquidity

position could be maintained (Brigham and Houston, 2012).

Efficiency level:

Efficiency ratio of the company briefs the position of the company to manage its long

term debt as well as the working capital management. Inventory turnover ratio and accounts

receivable turnover ratio of the company has been evaluated. Inventory turnover ratio of the

company is 0.15 which is lower from 8.6 (industry benchmark ratio). Further, the level of

accounts receivable collection period is quite higher than the industry ratio. It explains that

the efficiency position of the company is not according to the industry so it is suggested to

the company to manage the efficiency level.

Industry specific benchmark:

Further, the industry’s performance has been compared with the company’s

performance on the basis of various other benchmarks such as the total price of the rooms,

employee’s turnover and credit policies of the company. The total price of the rooms has

been evaluated firstly and it has been found that the average price per room of the company is

$ 148 whereas the industry is charging different rates on the basis of hotel ratings and other

facilities. The total profitability position of the company on the basis of total price per room

Accounting Financial Analysis Report 6

is quite different to the industry ratio. It briefs the company is managing the cost and revenue

at different level (Brigham and Ehrhardt, 2013).

Further, the employee turnover of the company has been evaluated and it has been

recognized that the performance of the company is quite lower in terms of motivating and

retaining the customers. The industry’s employee turnover level is quite lower than the

company and thus it becomes important for the company to look over the issue and resolve it

at serious level (Brigham and Daves, 2012). In addition, the credit policy of the company has

also been evaluated and t has been found that various issues are faced by the company due to

its credit policies which are required to be changed. So, the performance and the position of

the company could be better.

These changes would assist the company to manage the better position in the industry

as well as it would also assist the company to reduce the level of expenses and enhance the

level of the cash inflows of the company. These changes would make the company more

competitive.

Conclusion:

To conclude, crystal hotel private limited’s financial accounts are quite different to

the final financial accounts of the industry. This company is using the different strategies to

maintain the financial performance and the position. The capacity and the revenue of the

hotel have been evaluated and further the financial performance of the company has been

identified and it has been found that the financial performance of the company is required to

be better in terms of solvency position and the liquidity position. Further, the company is also

required to reduce the level of the undistributed operating cost and the personnel cost.

is quite different to the industry ratio. It briefs the company is managing the cost and revenue

at different level (Brigham and Ehrhardt, 2013).

Further, the employee turnover of the company has been evaluated and it has been

recognized that the performance of the company is quite lower in terms of motivating and

retaining the customers. The industry’s employee turnover level is quite lower than the

company and thus it becomes important for the company to look over the issue and resolve it

at serious level (Brigham and Daves, 2012). In addition, the credit policy of the company has

also been evaluated and t has been found that various issues are faced by the company due to

its credit policies which are required to be changed. So, the performance and the position of

the company could be better.

These changes would assist the company to manage the better position in the industry

as well as it would also assist the company to reduce the level of expenses and enhance the

level of the cash inflows of the company. These changes would make the company more

competitive.

Conclusion:

To conclude, crystal hotel private limited’s financial accounts are quite different to

the final financial accounts of the industry. This company is using the different strategies to

maintain the financial performance and the position. The capacity and the revenue of the

hotel have been evaluated and further the financial performance of the company has been

identified and it has been found that the financial performance of the company is required to

be better in terms of solvency position and the liquidity position. Further, the company is also

required to reduce the level of the undistributed operating cost and the personnel cost.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting Financial Analysis Report 7

References:

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Gibson, C.H., 2011. Financial reporting and analysis. South-Western Cengage Learning.

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Madura, J., 2011. International financial management. Cengage Learning.

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed.

References:

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Gibson, C.H., 2011. Financial reporting and analysis. South-Western Cengage Learning.

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Madura, J., 2011. International financial management. Cengage Learning.

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting Financial Analysis Report 8

Appendix:

Appendix:

Accounting Financial Analysis Report 9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.