Financial Analysis: IAS 16 & IAS 38 Report - Griffith College Dublin

VerifiedAdded on 2023/06/10

|8

|1383

|464

Report

AI Summary

This financial analysis report focuses on International Accounting Standards (IAS) 16 and 38, addressing the accounting treatment of property, plant, equipment, and intangible assets. It explains the objectives, recognition, measurement, and disclosure requirements of IAS 16. The report also details the accounting treatment for research and development costs under IAS 38, differentiating between research expenses (which are expensed) and development costs (which may be capitalized under specific conditions). Furthermore, the report includes specific accounting treatments for various items, such as depreciation on buildings and plants, government grants, vehicle depreciation, and the handling of fully depreciated fixtures, providing a thorough overview of how these assets are reported in financial statements according to international accounting standards. The report adheres to IFRS guidelines.

Running head: ACCOUNTING FINANCIAL ANALYSIS REPORT

Accounting financial analysis report

Name of the student

Name of the university

Student ID

Author ID

Accounting financial analysis report

Name of the student

Name of the university

Student ID

Author ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING FINANCIAL ANALYSIS REPORT

Table of Contents

Answer 1....................................................................................................................................2

(a) IAS 16 – Property plant and equipment......................................................................2

(b) IAS 38 on research and development..........................................................................2

Answer 2....................................................................................................................................2

Reference....................................................................................................................................6

ACCOUNTING FINANCIAL ANALYSIS REPORT

Table of Contents

Answer 1....................................................................................................................................2

(a) IAS 16 – Property plant and equipment......................................................................2

(b) IAS 38 on research and development..........................................................................2

Answer 2....................................................................................................................................2

Reference....................................................................................................................................6

2

ACCOUNTING FINANCIAL ANALYSIS REPORT

Answer 1

(a) IAS 16 – Property plant and equipment

Main objective of IAS 16 - Property plant and equipment is prescribing the

accounting treatment for plant, property and equipment. Plant, property and equipment shall

be recognized as an asset if it is probable that the future economic benefits related to the asset

will inflow to the company and the asset cost can be reliably measured. Initially the item is

recognised at cost and subsequent to initial recognition the item is carried at the amount of

cost reduced by accumulated depreciation and amount of impairment, if any. However, in

case of revaluation the asset is carried at the revalued amount. Revalued amount is the fair

value reduced by accumulated depreciation and amount of impairment, if any (Ifrs.org 2018).

(b) IAS 38 on research and development

Accounting treatment for research – Research expenses are charged to expenses

Accounting treatment for development – development costs are capitalised only if the project

is commercially viable and technically feasible.

If the research phase of any internal project cannot be distinguished from the

development phase, the entire expense is treated as research expenses at cost (Ifrs.org 2018).

Answer 2

The accounting treatment for the items as per relevant IAS (International Accounting

Standard) will be as follows –

Item a

ACCOUNTING FINANCIAL ANALYSIS REPORT

Answer 1

(a) IAS 16 – Property plant and equipment

Main objective of IAS 16 - Property plant and equipment is prescribing the

accounting treatment for plant, property and equipment. Plant, property and equipment shall

be recognized as an asset if it is probable that the future economic benefits related to the asset

will inflow to the company and the asset cost can be reliably measured. Initially the item is

recognised at cost and subsequent to initial recognition the item is carried at the amount of

cost reduced by accumulated depreciation and amount of impairment, if any. However, in

case of revaluation the asset is carried at the revalued amount. Revalued amount is the fair

value reduced by accumulated depreciation and amount of impairment, if any (Ifrs.org 2018).

(b) IAS 38 on research and development

Accounting treatment for research – Research expenses are charged to expenses

Accounting treatment for development – development costs are capitalised only if the project

is commercially viable and technically feasible.

If the research phase of any internal project cannot be distinguished from the

development phase, the entire expense is treated as research expenses at cost (Ifrs.org 2018).

Answer 2

The accounting treatment for the items as per relevant IAS (International Accounting

Standard) will be as follows –

Item a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING FINANCIAL ANALYSIS REPORT

Depreciation on building was at 2% per annum and the cost of building was €

348,000. Hence, amount of depreciation for 1 year period will be = € 348,000 * 2% = €

6,960. Therefore, the amount of depreciation that is € 6,960 will be recognised under profit

and loss statement (Zuca 2013). Under the balance sheet land amount of (€ 468,000 - €

348,000) = € 120,000 will remain same as the land is non-depreciable asset. Hence, amount

of land and building for the year ended 31st January 2018 will be recorded at (€ 120,000 + €

348,000 - € 6,960) = € 461,040.

Item b

Recognition of plant costing 88,000 that was charged at 10% depreciation is

recognized as having useful life of 5 years. Hence, the depreciation will be = € 88,000 / 5 = €

17,600 per year for remaining 5 years (Trifan and Anton 2014).

Carrying amount of that plant for the year ended 31st January 2016 will be = € 88000 – €

17600 = € 70,400

Carrying amount of that plant for the year ended 31st January 2017 will be = € 70,400 – €

17600 = € 52,800

Therefore, carrying amount of remaining plant and machinery for the year ended 31st January

2017 = € 153,600 – € 52,800 = € 100,800.

Depreciation on remaining plant and machinery at 10% will be = € 100,800 * 10% = €

10,080

Therefore, total amount of depreciation chargeable to profit and loss account will be = €

10,080 + € 17,600 = € 27,680.

Carrying amount of plant and machinery in the balance sheet for the year ended 31st January

2018 will be = (€ 100,800 – € 10080) + (€ 52,800 – € 17,600) = € 125,920

ACCOUNTING FINANCIAL ANALYSIS REPORT

Depreciation on building was at 2% per annum and the cost of building was €

348,000. Hence, amount of depreciation for 1 year period will be = € 348,000 * 2% = €

6,960. Therefore, the amount of depreciation that is € 6,960 will be recognised under profit

and loss statement (Zuca 2013). Under the balance sheet land amount of (€ 468,000 - €

348,000) = € 120,000 will remain same as the land is non-depreciable asset. Hence, amount

of land and building for the year ended 31st January 2018 will be recorded at (€ 120,000 + €

348,000 - € 6,960) = € 461,040.

Item b

Recognition of plant costing 88,000 that was charged at 10% depreciation is

recognized as having useful life of 5 years. Hence, the depreciation will be = € 88,000 / 5 = €

17,600 per year for remaining 5 years (Trifan and Anton 2014).

Carrying amount of that plant for the year ended 31st January 2016 will be = € 88000 – €

17600 = € 70,400

Carrying amount of that plant for the year ended 31st January 2017 will be = € 70,400 – €

17600 = € 52,800

Therefore, carrying amount of remaining plant and machinery for the year ended 31st January

2017 = € 153,600 – € 52,800 = € 100,800.

Depreciation on remaining plant and machinery at 10% will be = € 100,800 * 10% = €

10,080

Therefore, total amount of depreciation chargeable to profit and loss account will be = €

10,080 + € 17,600 = € 27,680.

Carrying amount of plant and machinery in the balance sheet for the year ended 31st January

2018 will be = (€ 100,800 – € 10080) + (€ 52,800 – € 17,600) = € 125,920

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING FINANCIAL ANALYSIS REPORT

Item c

As per IAS 20 government grants received for purchasing the asset shall be deducted

from the carrying amount of the asset. However, if the company follows deferred credit

method for recording the government grants the amount shall be recorded as deferred income

rather than deducting it from the carrying amount of asset. Therefore, the government grant

amounting to € 20,000 shall be recorded as deferred income.

Plant that was acquired on 1st August 2017 shall be depreciated at 10%. Therefore, the

depreciation will be = € 100000 * 10% = € 10,000 and it will be charged to profit and loss

account for the year ended 31st January 2018.

Carrying amount of plant and machinery in the balance sheet for the year ended 31st

January 2018 will be = € 125,920 + (€ 100,000 - € 10,000) = € 215,920.

Item d

As the depreciation is always provided on cost of the asset 20% depreciation will be

charged on vehicle on cost price of € 19,000. Therefore, depreciation for the year ended 31st

January 2017 as well as for the year ended 31st January 2018 will be = € 19,000 * 20% = €

3,800 (Tsamis and Liapis 2014)

Carrying amount of vehicle for the year ended 31st January 2018 will be € 19,000 - € 3,800 -

€ 3,800 = € 11,400.

Carrying amount of other motor and vehicles as on 31st January 2017 will be = € 38,000 - €

19,000 - € 3,800 = € 15,200.

Depreciation on above = € 15,200 *20% = € 3,040.

Total carrying amount of motor and vehicles = € 15,200 - € 3,040 + € 11,400 = € 23,560

ACCOUNTING FINANCIAL ANALYSIS REPORT

Item c

As per IAS 20 government grants received for purchasing the asset shall be deducted

from the carrying amount of the asset. However, if the company follows deferred credit

method for recording the government grants the amount shall be recorded as deferred income

rather than deducting it from the carrying amount of asset. Therefore, the government grant

amounting to € 20,000 shall be recorded as deferred income.

Plant that was acquired on 1st August 2017 shall be depreciated at 10%. Therefore, the

depreciation will be = € 100000 * 10% = € 10,000 and it will be charged to profit and loss

account for the year ended 31st January 2018.

Carrying amount of plant and machinery in the balance sheet for the year ended 31st

January 2018 will be = € 125,920 + (€ 100,000 - € 10,000) = € 215,920.

Item d

As the depreciation is always provided on cost of the asset 20% depreciation will be

charged on vehicle on cost price of € 19,000. Therefore, depreciation for the year ended 31st

January 2017 as well as for the year ended 31st January 2018 will be = € 19,000 * 20% = €

3,800 (Tsamis and Liapis 2014)

Carrying amount of vehicle for the year ended 31st January 2018 will be € 19,000 - € 3,800 -

€ 3,800 = € 11,400.

Carrying amount of other motor and vehicles as on 31st January 2017 will be = € 38,000 - €

19,000 - € 3,800 = € 15,200.

Depreciation on above = € 15,200 *20% = € 3,040.

Total carrying amount of motor and vehicles = € 15,200 - € 3,040 + € 11,400 = € 23,560

5

ACCOUNTING FINANCIAL ANALYSIS REPORT

Total depreciation amounting to € 3,040 + € 3,800 = € 6,840 will be charged to profit and

loss.

Item e

As the fixtures were fully depreciated and scrapped and the company does not provide

depreciation in the year of disposal fixtures will not be shown in the balance sheet for the

period ended 31st January 2018 (Christensen and Nikolaev 2013).

Item f

As the project is commercially viable and technically feasible the expenses amounted

to € 85,000 incurred on the project will be capitalised and recorded under cash flow statement

as capital expenditure. Further, as per IAS 38 – recognition of intangible assets, as the cost

can be measured reliably the asset shall be recognised and recorded in the balance sheet as

intangible asset (Triki-Damak and Halioui 2013).

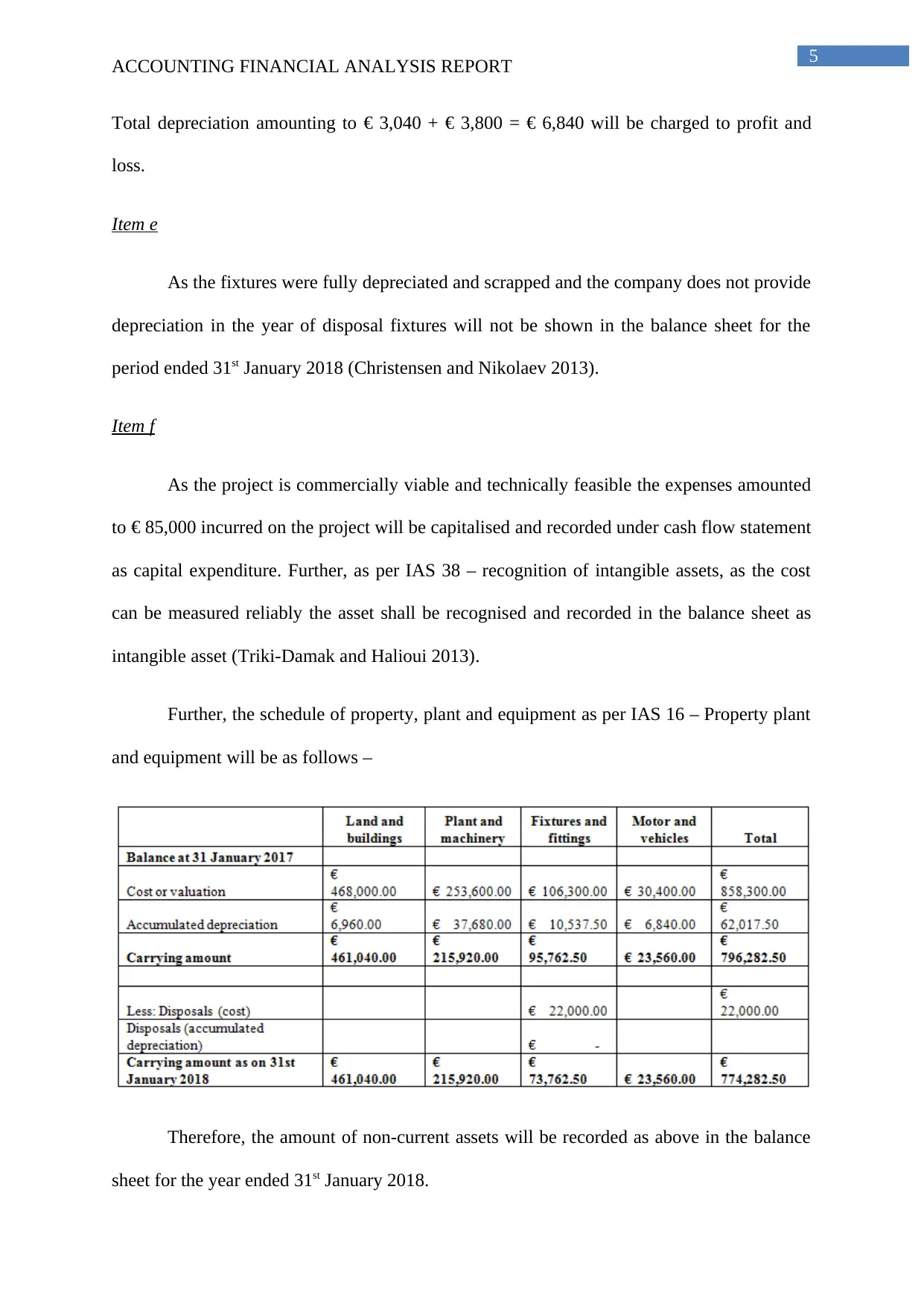

Further, the schedule of property, plant and equipment as per IAS 16 – Property plant

and equipment will be as follows –

Therefore, the amount of non-current assets will be recorded as above in the balance

sheet for the year ended 31st January 2018.

ACCOUNTING FINANCIAL ANALYSIS REPORT

Total depreciation amounting to € 3,040 + € 3,800 = € 6,840 will be charged to profit and

loss.

Item e

As the fixtures were fully depreciated and scrapped and the company does not provide

depreciation in the year of disposal fixtures will not be shown in the balance sheet for the

period ended 31st January 2018 (Christensen and Nikolaev 2013).

Item f

As the project is commercially viable and technically feasible the expenses amounted

to € 85,000 incurred on the project will be capitalised and recorded under cash flow statement

as capital expenditure. Further, as per IAS 38 – recognition of intangible assets, as the cost

can be measured reliably the asset shall be recognised and recorded in the balance sheet as

intangible asset (Triki-Damak and Halioui 2013).

Further, the schedule of property, plant and equipment as per IAS 16 – Property plant

and equipment will be as follows –

Therefore, the amount of non-current assets will be recorded as above in the balance

sheet for the year ended 31st January 2018.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING FINANCIAL ANALYSIS REPORT

Reference

Christensen, H.B. and Nikolaev, V.V., 2013. Does fair value accounting for non-financial

assets pass the market test?. Review of Accounting Studies, 18(3), pp.734-775.

Ifrs.org., 2018. IFRS . [online] Available at: https://www.ifrs.org/issued-standards/list-of-

standards/ias-38-intangible-assets/ [Accessed 1 Aug. 2018].

Ifrs.org., 2018. IFRS . [online] Available at: https://www.ifrs.org/issued-standards/list-of-

standards/ias-16-property-plant-and-equipment/ [Accessed 1 Aug. 2018].

Trifan, A. and Anton, C., 2014. ACCOUNTING TREATMENT FOR PROPERTY, PLANT

AND EQUIPMENT REVALUATIONS. Management & Marketing, 9(2).

Triki-Damak, S. and Halioui, K., 2013. Accounting treatment of R&D expenditures and

earnings management: an empirical study on French listed companies. Global Business and

Economics Research Journal, 2(1), pp.50-71.

Tsamis, A. and Liapis, K., 2014. Fair Value and Cost Accounting, Depreciation Methods,

Recognition and Measurement for Fixed Assets. International Journal of Economics and

Business Administration, 2(3), pp.115-133.

Zuca, M.R., 2013. THE ACCOUNTING TREATMENT OF ASSET DEPRECIATION AND

THE IMPACT ON RESULT. Annals of the University of Petrosani Economics, 13(2).

ACCOUNTING FINANCIAL ANALYSIS REPORT

Reference

Christensen, H.B. and Nikolaev, V.V., 2013. Does fair value accounting for non-financial

assets pass the market test?. Review of Accounting Studies, 18(3), pp.734-775.

Ifrs.org., 2018. IFRS . [online] Available at: https://www.ifrs.org/issued-standards/list-of-

standards/ias-38-intangible-assets/ [Accessed 1 Aug. 2018].

Ifrs.org., 2018. IFRS . [online] Available at: https://www.ifrs.org/issued-standards/list-of-

standards/ias-16-property-plant-and-equipment/ [Accessed 1 Aug. 2018].

Trifan, A. and Anton, C., 2014. ACCOUNTING TREATMENT FOR PROPERTY, PLANT

AND EQUIPMENT REVALUATIONS. Management & Marketing, 9(2).

Triki-Damak, S. and Halioui, K., 2013. Accounting treatment of R&D expenditures and

earnings management: an empirical study on French listed companies. Global Business and

Economics Research Journal, 2(1), pp.50-71.

Tsamis, A. and Liapis, K., 2014. Fair Value and Cost Accounting, Depreciation Methods,

Recognition and Measurement for Fixed Assets. International Journal of Economics and

Business Administration, 2(3), pp.115-133.

Zuca, M.R., 2013. THE ACCOUNTING TREATMENT OF ASSET DEPRECIATION AND

THE IMPACT ON RESULT. Annals of the University of Petrosani Economics, 13(2).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING FINANCIAL ANALYSIS REPORT

ACCOUNTING FINANCIAL ANALYSIS REPORT

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.