Accounting for Business: Financial Ratios and Investment Decisions

VerifiedAdded on 2023/06/14

|12

|1944

|378

Homework Assignment

AI Summary

This document presents a comprehensive solution to an accounting for business exam, covering key areas such as financial statement analysis and investment appraisal. The solution includes the preparation of an income statement and balance sheet, along with calculations and interpretations of financial ratios like gross profit ratio, net profit ratio, current ratio, and quick ratio for two companies. Furthermore, the document evaluates investment opportunities using payback period, net present value (NPV), and internal rate of return (IRR) methods, discussing the qualitative factors influencing investment decisions. This resource is ideal for students seeking to understand and master fundamental concepts in accounting and finance, with Desklib providing additional study tools and solved assignments.

EXAM Accounting for

Business

Business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

MAIN BODY...................................................................................................................................3

Q1.................................................................................................................................................3

Q2.................................................................................................................................................4

Q4.................................................................................................................................................7

REFERENCES................................................................................................................................1

MAIN BODY...................................................................................................................................3

Q1.................................................................................................................................................3

Q2.................................................................................................................................................4

Q4.................................................................................................................................................7

REFERENCES................................................................................................................................1

MAIN BODY

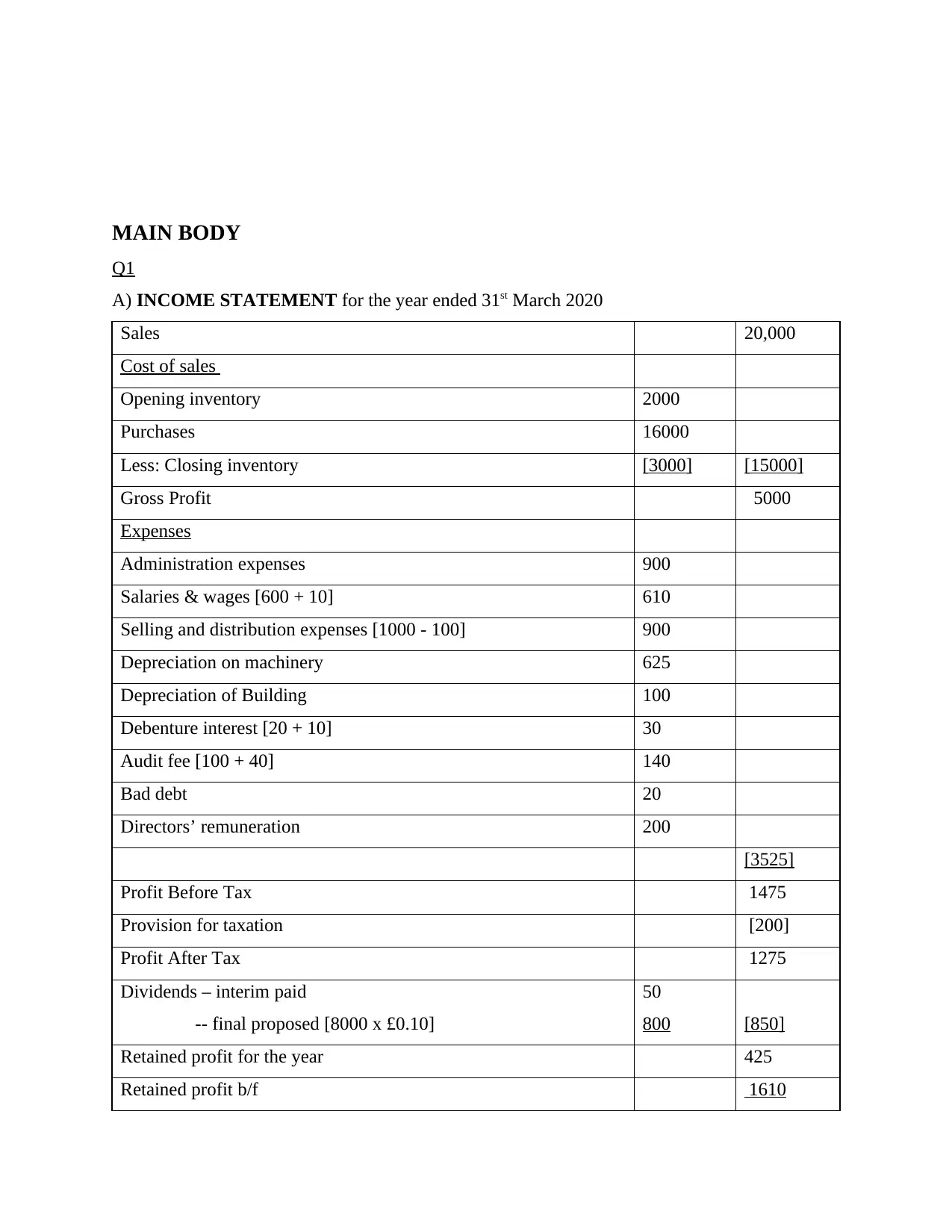

Q1

A) INCOME STATEMENT for the year ended 31st March 2020

Sales 20,000

Cost of sales

Opening inventory 2000

Purchases 16000

Less: Closing inventory [3000] [15000]

Gross Profit 5000

Expenses

Administration expenses 900

Salaries & wages [600 + 10] 610

Selling and distribution expenses [1000 - 100] 900

Depreciation on machinery 625

Depreciation of Building 100

Debenture interest [20 + 10] 30

Audit fee [100 + 40] 140

Bad debt 20

Directors’ remuneration 200

[3525]

Profit Before Tax 1475

Provision for taxation [200]

Profit After Tax 1275

Dividends – interim paid

-- final proposed [8000 x £0.10]

50

800 [850]

Retained profit for the year 425

Retained profit b/f 1610

Q1

A) INCOME STATEMENT for the year ended 31st March 2020

Sales 20,000

Cost of sales

Opening inventory 2000

Purchases 16000

Less: Closing inventory [3000] [15000]

Gross Profit 5000

Expenses

Administration expenses 900

Salaries & wages [600 + 10] 610

Selling and distribution expenses [1000 - 100] 900

Depreciation on machinery 625

Depreciation of Building 100

Debenture interest [20 + 10] 30

Audit fee [100 + 40] 140

Bad debt 20

Directors’ remuneration 200

[3525]

Profit Before Tax 1475

Provision for taxation [200]

Profit After Tax 1275

Dividends – interim paid

-- final proposed [8000 x £0.10]

50

800 [850]

Retained profit for the year 425

Retained profit b/f 1610

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

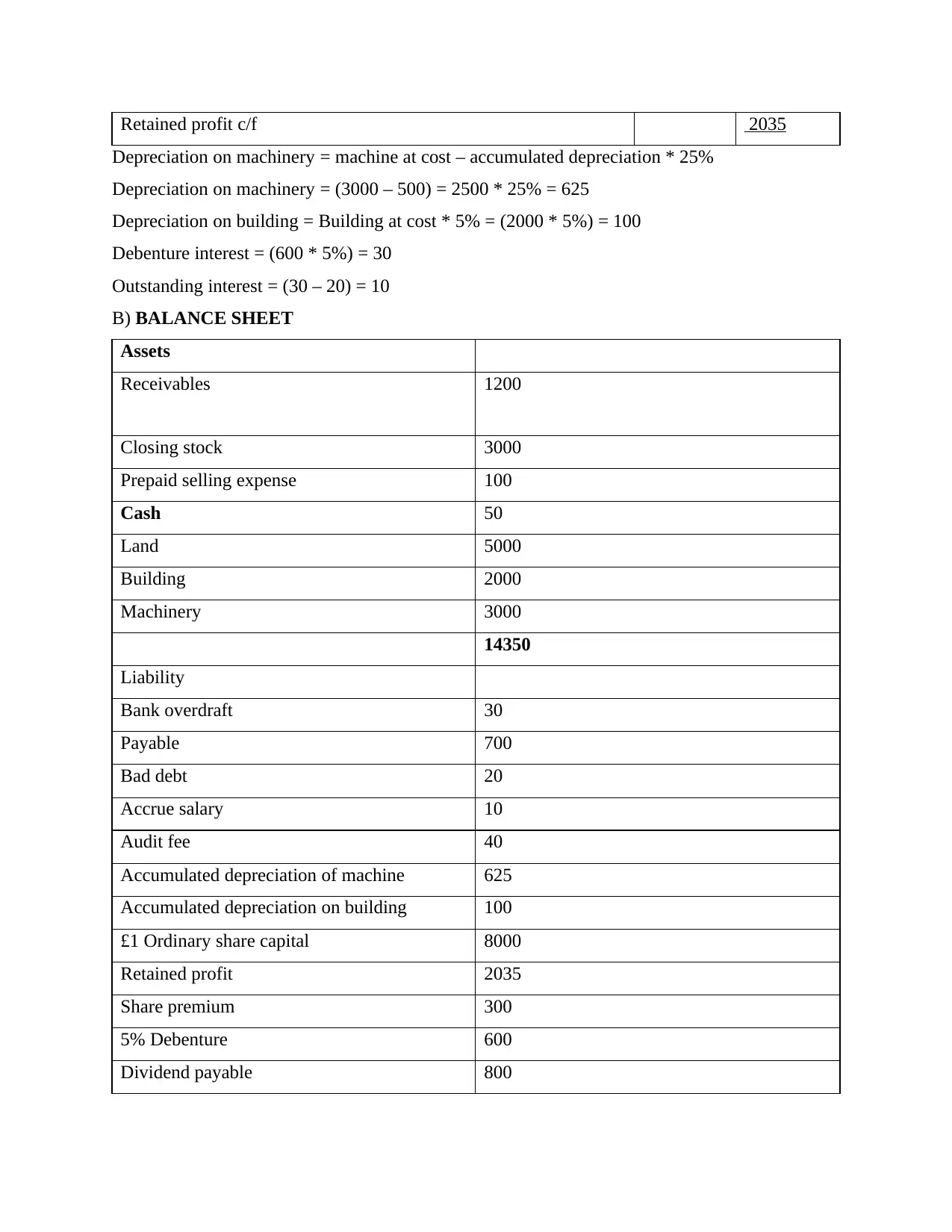

Retained profit c/f 2035

Depreciation on machinery = machine at cost – accumulated depreciation * 25%

Depreciation on machinery = (3000 – 500) = 2500 * 25% = 625

Depreciation on building = Building at cost * 5% = (2000 * 5%) = 100

Debenture interest = (600 * 5%) = 30

Outstanding interest = (30 – 20) = 10

B) BALANCE SHEET

Assets

Receivables 1200

Closing stock 3000

Prepaid selling expense 100

Cash 50

Land 5000

Building 2000

Machinery 3000

14350

Liability

Bank overdraft 30

Payable 700

Bad debt 20

Accrue salary 10

Audit fee 40

Accumulated depreciation of machine 625

Accumulated depreciation on building 100

£1 Ordinary share capital 8000

Retained profit 2035

Share premium 300

5% Debenture 600

Dividend payable 800

Depreciation on machinery = machine at cost – accumulated depreciation * 25%

Depreciation on machinery = (3000 – 500) = 2500 * 25% = 625

Depreciation on building = Building at cost * 5% = (2000 * 5%) = 100

Debenture interest = (600 * 5%) = 30

Outstanding interest = (30 – 20) = 10

B) BALANCE SHEET

Assets

Receivables 1200

Closing stock 3000

Prepaid selling expense 100

Cash 50

Land 5000

Building 2000

Machinery 3000

14350

Liability

Bank overdraft 30

Payable 700

Bad debt 20

Accrue salary 10

Audit fee 40

Accumulated depreciation of machine 625

Accumulated depreciation on building 100

£1 Ordinary share capital 8000

Retained profit 2035

Share premium 300

5% Debenture 600

Dividend payable 800

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14350

Q2

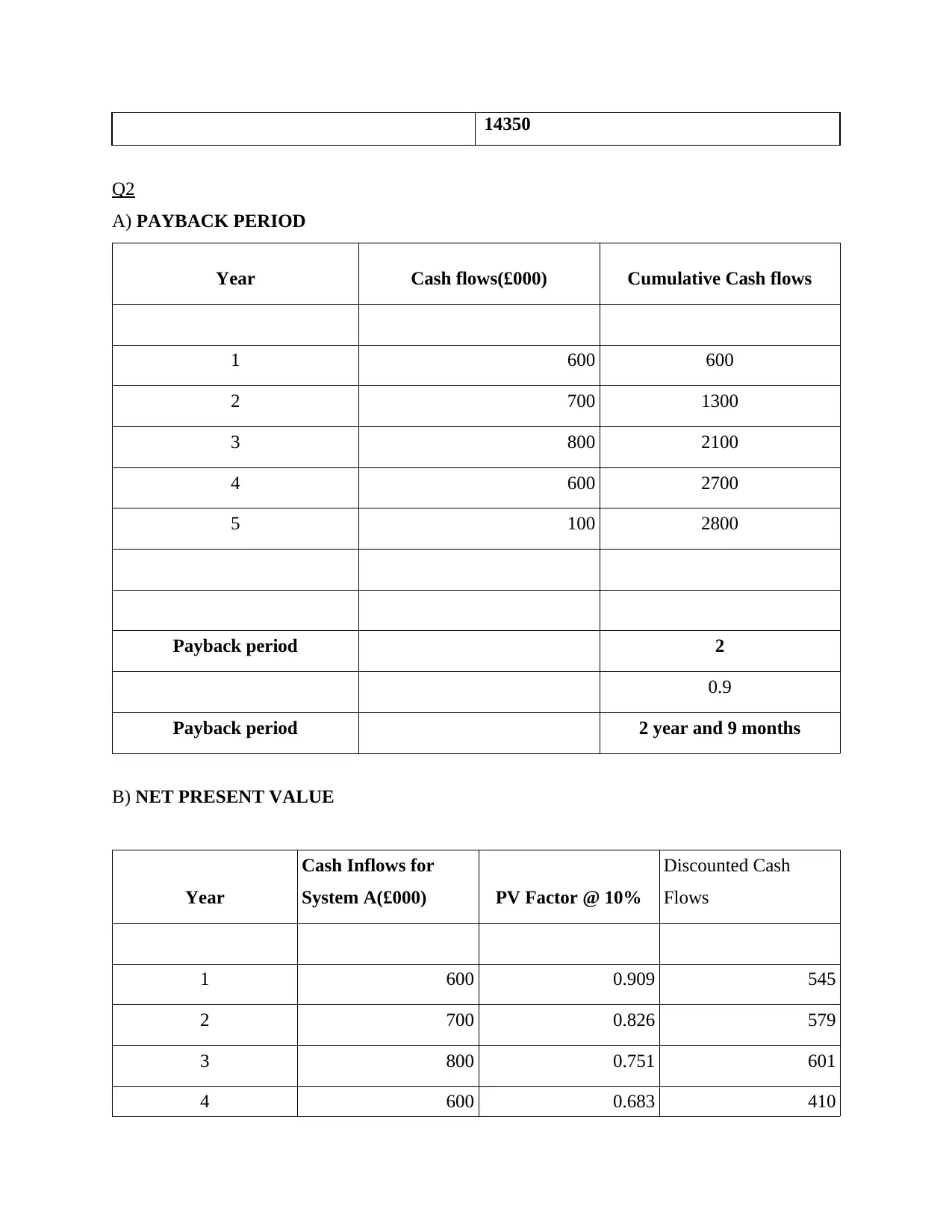

A) PAYBACK PERIOD

Year Cash flows(£000) Cumulative Cash flows

1 600 600

2 700 1300

3 800 2100

4 600 2700

5 100 2800

Payback period 2

0.9

Payback period 2 year and 9 months

B) NET PRESENT VALUE

Year

Cash Inflows for

System A(£000) PV Factor @ 10%

Discounted Cash

Flows

1 600 0.909 545

2 700 0.826 579

3 800 0.751 601

4 600 0.683 410

Q2

A) PAYBACK PERIOD

Year Cash flows(£000) Cumulative Cash flows

1 600 600

2 700 1300

3 800 2100

4 600 2700

5 100 2800

Payback period 2

0.9

Payback period 2 year and 9 months

B) NET PRESENT VALUE

Year

Cash Inflows for

System A(£000) PV Factor @ 10%

Discounted Cash

Flows

1 600 0.909 545

2 700 0.826 579

3 800 0.751 601

4 600 0.683 410

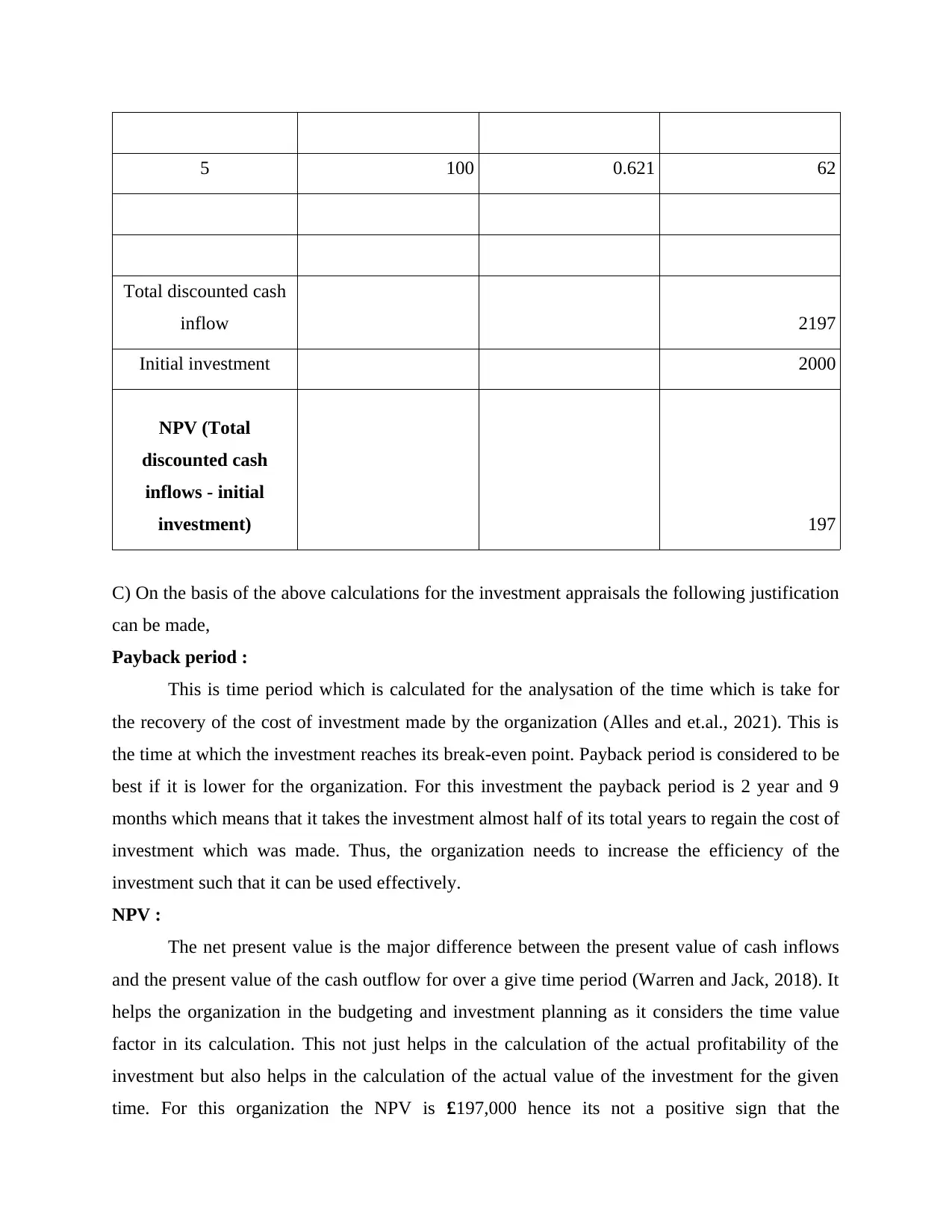

5 100 0.621 62

Total discounted cash

inflow 2197

Initial investment 2000

NPV (Total

discounted cash

inflows - initial

investment) 197

C) On the basis of the above calculations for the investment appraisals the following justification

can be made,

Payback period :

This is time period which is calculated for the analysation of the time which is take for

the recovery of the cost of investment made by the organization (Alles and et.al., 2021). This is

the time at which the investment reaches its break-even point. Payback period is considered to be

best if it is lower for the organization. For this investment the payback period is 2 year and 9

months which means that it takes the investment almost half of its total years to regain the cost of

investment which was made. Thus, the organization needs to increase the efficiency of the

investment such that it can be used effectively.

NPV :

The net present value is the major difference between the present value of cash inflows

and the present value of the cash outflow for over a give time period (Warren and Jack, 2018). It

helps the organization in the budgeting and investment planning as it considers the time value

factor in its calculation. This not just helps in the calculation of the actual profitability of the

investment but also helps in the calculation of the actual value of the investment for the given

time. For this organization the NPV is £197,000 hence its not a positive sign that the

Total discounted cash

inflow 2197

Initial investment 2000

NPV (Total

discounted cash

inflows - initial

investment) 197

C) On the basis of the above calculations for the investment appraisals the following justification

can be made,

Payback period :

This is time period which is calculated for the analysation of the time which is take for

the recovery of the cost of investment made by the organization (Alles and et.al., 2021). This is

the time at which the investment reaches its break-even point. Payback period is considered to be

best if it is lower for the organization. For this investment the payback period is 2 year and 9

months which means that it takes the investment almost half of its total years to regain the cost of

investment which was made. Thus, the organization needs to increase the efficiency of the

investment such that it can be used effectively.

NPV :

The net present value is the major difference between the present value of cash inflows

and the present value of the cash outflow for over a give time period (Warren and Jack, 2018). It

helps the organization in the budgeting and investment planning as it considers the time value

factor in its calculation. This not just helps in the calculation of the actual profitability of the

investment but also helps in the calculation of the actual value of the investment for the given

time. For this organization the NPV is £197,000 hence its not a positive sign that the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organization NPV is lowers than its initial investment. For improving the NPV the organization

needs to analyse the factors which will affect its decisions for investing and also improve the

efficiency of its performance.

D) Following are the qualitative financial factors which are needed to be considered during

making an investment decision,

Risk :

Risk is something which is related to the potential loss or harm which an investment can

cause to the organization. It makes the company plan whether the investment is safe or not be

effective towards the investment decisions.

Liquidity :

Depending on the liquidity of the investment made by the organization it can be

determined how easy will it be to sell off the asset for cash. According to which savings account

is the most liquid investment but purchasing a property is less because it is difficult to make cash

out of it.

Fluctuations at investment market :

The fluctuations in the market is considered to be the key determinant of the price of the

investment. The price of the investment effects profitability of the organization. Analysing the

market can help the organization invest at cheaper price and sell their investments at higher

price.

Investment planning factors :

These factors include the history of the investment, it also includes the area of risk which

is situated to the investment options. It is considered to be the method which helps in the

calculation of the interest which needs to be considered.

Tax Implications :

Depending on the kind of investment the tax implications in the on these investments

changes and as a result of this organization has to face the tax liability.

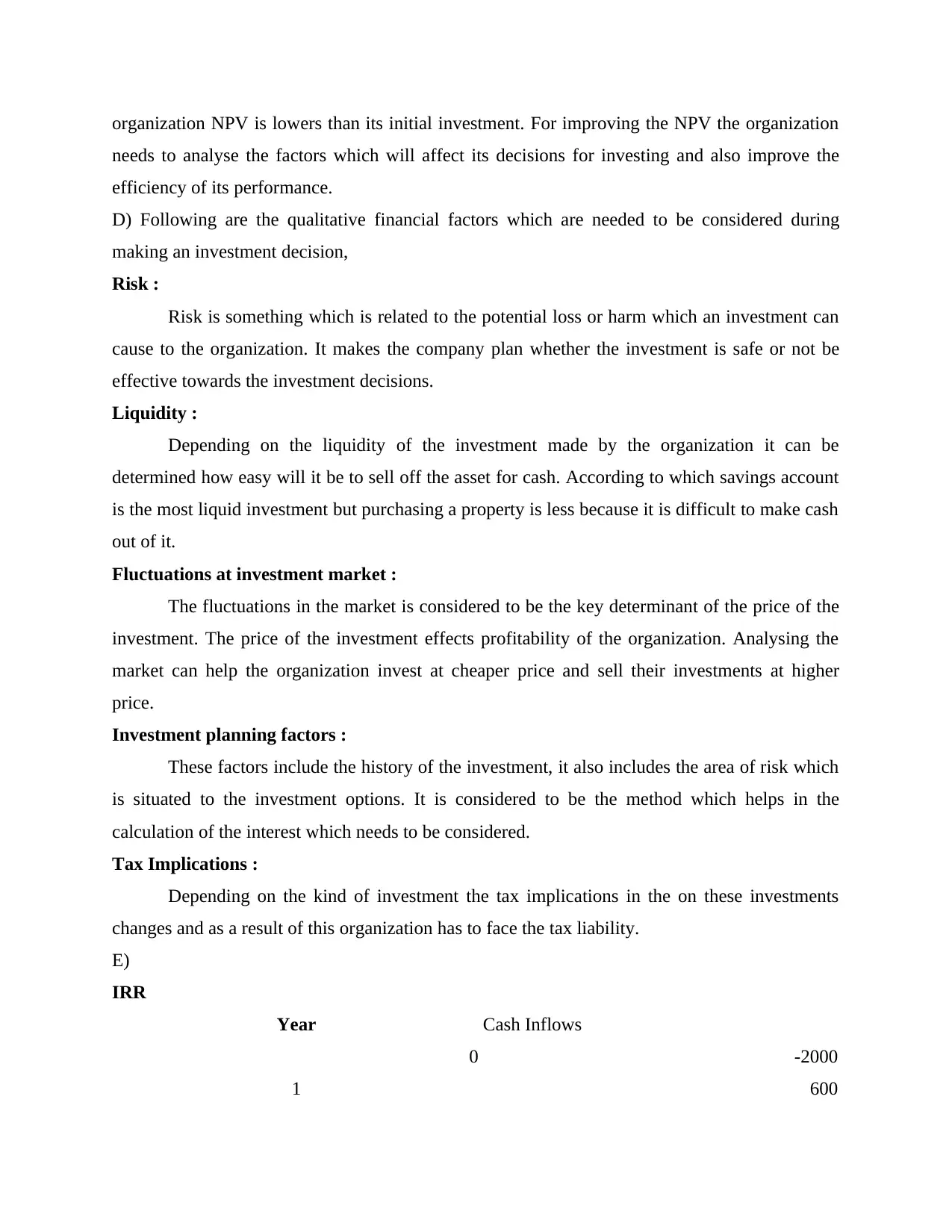

E)

IRR

Year Cash Inflows

0 -2000

1 600

needs to analyse the factors which will affect its decisions for investing and also improve the

efficiency of its performance.

D) Following are the qualitative financial factors which are needed to be considered during

making an investment decision,

Risk :

Risk is something which is related to the potential loss or harm which an investment can

cause to the organization. It makes the company plan whether the investment is safe or not be

effective towards the investment decisions.

Liquidity :

Depending on the liquidity of the investment made by the organization it can be

determined how easy will it be to sell off the asset for cash. According to which savings account

is the most liquid investment but purchasing a property is less because it is difficult to make cash

out of it.

Fluctuations at investment market :

The fluctuations in the market is considered to be the key determinant of the price of the

investment. The price of the investment effects profitability of the organization. Analysing the

market can help the organization invest at cheaper price and sell their investments at higher

price.

Investment planning factors :

These factors include the history of the investment, it also includes the area of risk which

is situated to the investment options. It is considered to be the method which helps in the

calculation of the interest which needs to be considered.

Tax Implications :

Depending on the kind of investment the tax implications in the on these investments

changes and as a result of this organization has to face the tax liability.

E)

IRR

Year Cash Inflows

0 -2000

1 600

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2 700

3 800

4 600

5 100

6

IRR 14%

Internal rate of return is a metric which is used for the estimation of the profitability of

the potential investments (Al-Mutairi, Naser and Saeid, 2018). IRR is the discounted rate which

makes the net present value of all cash flow equal to zero thus, the discounted cash flow analysis

is done in IRR. It is said to be the actual percentage of annual return if the investments NPV was

0. IRR shows the annualized rate of return for a give investment it can be calculated for any time

limited and with a give expected cash flow. It is essential for the IRR to be higher as it shows

that the investment is going to be more desirable for the company. In this calculation the IRR is

14% which is very average. Thus, it is very important for the organization to focus on how to

improve the effectiveness of there performance through this investment.

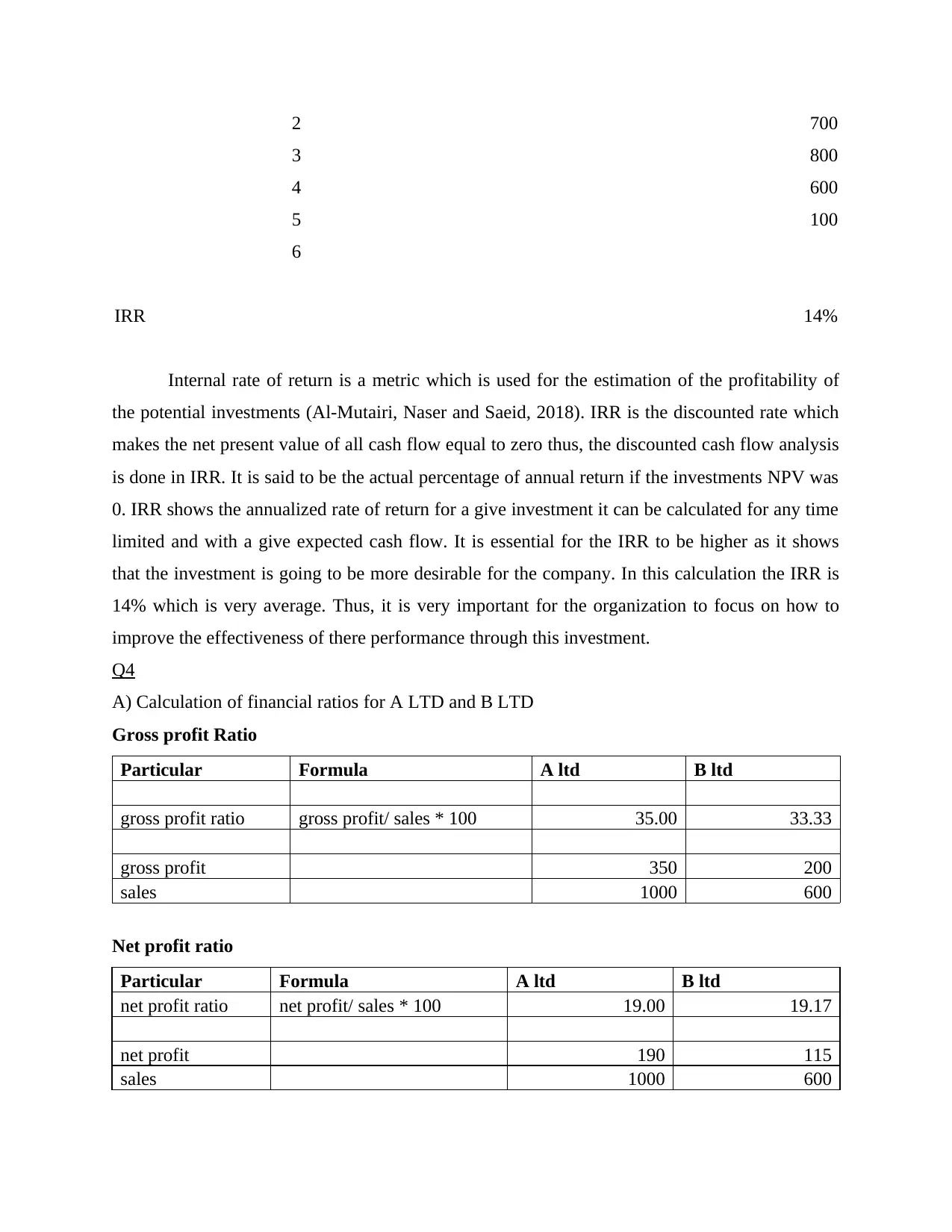

Q4

A) Calculation of financial ratios for A LTD and B LTD

Gross profit Ratio

Particular Formula A ltd B ltd

gross profit ratio gross profit/ sales * 100 35.00 33.33

gross profit 350 200

sales 1000 600

Net profit ratio

Particular Formula A ltd B ltd

net profit ratio net profit/ sales * 100 19.00 19.17

net profit 190 115

sales 1000 600

3 800

4 600

5 100

6

IRR 14%

Internal rate of return is a metric which is used for the estimation of the profitability of

the potential investments (Al-Mutairi, Naser and Saeid, 2018). IRR is the discounted rate which

makes the net present value of all cash flow equal to zero thus, the discounted cash flow analysis

is done in IRR. It is said to be the actual percentage of annual return if the investments NPV was

0. IRR shows the annualized rate of return for a give investment it can be calculated for any time

limited and with a give expected cash flow. It is essential for the IRR to be higher as it shows

that the investment is going to be more desirable for the company. In this calculation the IRR is

14% which is very average. Thus, it is very important for the organization to focus on how to

improve the effectiveness of there performance through this investment.

Q4

A) Calculation of financial ratios for A LTD and B LTD

Gross profit Ratio

Particular Formula A ltd B ltd

gross profit ratio gross profit/ sales * 100 35.00 33.33

gross profit 350 200

sales 1000 600

Net profit ratio

Particular Formula A ltd B ltd

net profit ratio net profit/ sales * 100 19.00 19.17

net profit 190 115

sales 1000 600

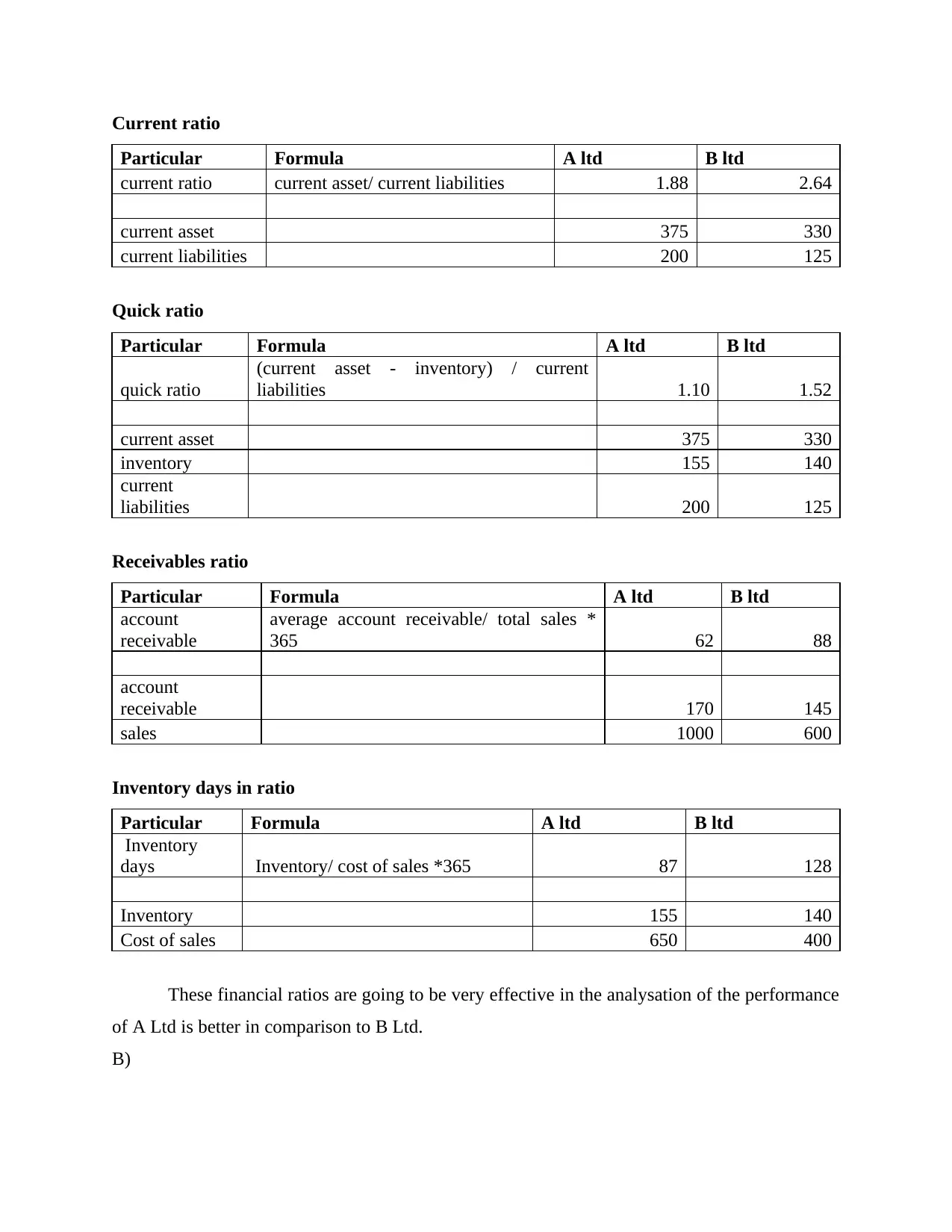

Current ratio

Particular Formula A ltd B ltd

current ratio current asset/ current liabilities 1.88 2.64

current asset 375 330

current liabilities 200 125

Quick ratio

Particular Formula A ltd B ltd

quick ratio

(current asset - inventory) / current

liabilities 1.10 1.52

current asset 375 330

inventory 155 140

current

liabilities 200 125

Receivables ratio

Particular Formula A ltd B ltd

account

receivable

average account receivable/ total sales *

365 62 88

account

receivable 170 145

sales 1000 600

Inventory days in ratio

Particular Formula A ltd B ltd

Inventory

days Inventory/ cost of sales *365 87 128

Inventory 155 140

Cost of sales 650 400

These financial ratios are going to be very effective in the analysation of the performance

of A Ltd is better in comparison to B Ltd.

B)

Particular Formula A ltd B ltd

current ratio current asset/ current liabilities 1.88 2.64

current asset 375 330

current liabilities 200 125

Quick ratio

Particular Formula A ltd B ltd

quick ratio

(current asset - inventory) / current

liabilities 1.10 1.52

current asset 375 330

inventory 155 140

current

liabilities 200 125

Receivables ratio

Particular Formula A ltd B ltd

account

receivable

average account receivable/ total sales *

365 62 88

account

receivable 170 145

sales 1000 600

Inventory days in ratio

Particular Formula A ltd B ltd

Inventory

days Inventory/ cost of sales *365 87 128

Inventory 155 140

Cost of sales 650 400

These financial ratios are going to be very effective in the analysation of the performance

of A Ltd is better in comparison to B Ltd.

B)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The financial comparison between A Ltd and B Ltd can be done through the comparison

of their financial ratios,

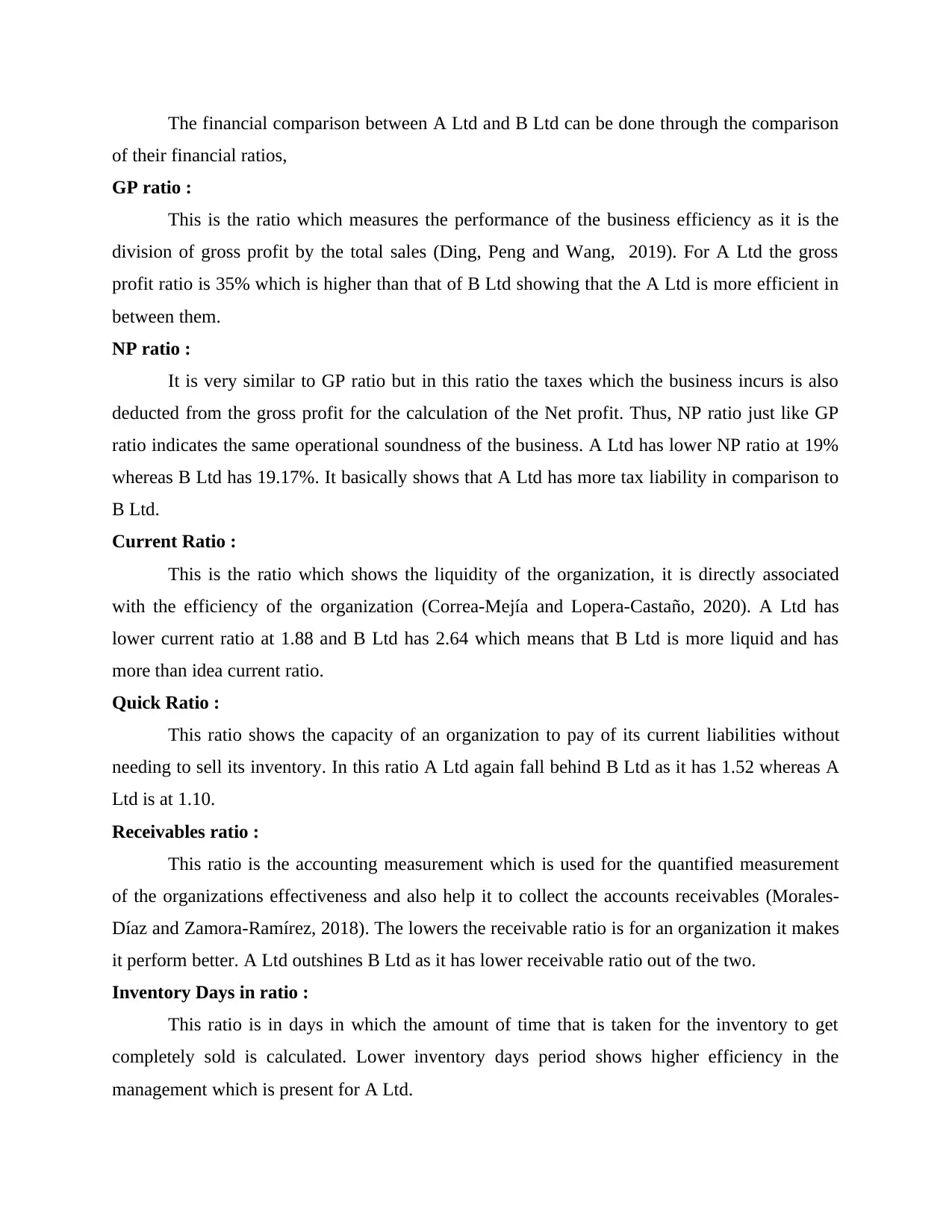

GP ratio :

This is the ratio which measures the performance of the business efficiency as it is the

division of gross profit by the total sales (Ding, Peng and Wang, 2019). For A Ltd the gross

profit ratio is 35% which is higher than that of B Ltd showing that the A Ltd is more efficient in

between them.

NP ratio :

It is very similar to GP ratio but in this ratio the taxes which the business incurs is also

deducted from the gross profit for the calculation of the Net profit. Thus, NP ratio just like GP

ratio indicates the same operational soundness of the business. A Ltd has lower NP ratio at 19%

whereas B Ltd has 19.17%. It basically shows that A Ltd has more tax liability in comparison to

B Ltd.

Current Ratio :

This is the ratio which shows the liquidity of the organization, it is directly associated

with the efficiency of the organization (Correa-Mejía and Lopera-Castaño, 2020). A Ltd has

lower current ratio at 1.88 and B Ltd has 2.64 which means that B Ltd is more liquid and has

more than idea current ratio.

Quick Ratio :

This ratio shows the capacity of an organization to pay of its current liabilities without

needing to sell its inventory. In this ratio A Ltd again fall behind B Ltd as it has 1.52 whereas A

Ltd is at 1.10.

Receivables ratio :

This ratio is the accounting measurement which is used for the quantified measurement

of the organizations effectiveness and also help it to collect the accounts receivables (Morales-

Díaz and Zamora-Ramírez, 2018). The lowers the receivable ratio is for an organization it makes

it perform better. A Ltd outshines B Ltd as it has lower receivable ratio out of the two.

Inventory Days in ratio :

This ratio is in days in which the amount of time that is taken for the inventory to get

completely sold is calculated. Lower inventory days period shows higher efficiency in the

management which is present for A Ltd.

of their financial ratios,

GP ratio :

This is the ratio which measures the performance of the business efficiency as it is the

division of gross profit by the total sales (Ding, Peng and Wang, 2019). For A Ltd the gross

profit ratio is 35% which is higher than that of B Ltd showing that the A Ltd is more efficient in

between them.

NP ratio :

It is very similar to GP ratio but in this ratio the taxes which the business incurs is also

deducted from the gross profit for the calculation of the Net profit. Thus, NP ratio just like GP

ratio indicates the same operational soundness of the business. A Ltd has lower NP ratio at 19%

whereas B Ltd has 19.17%. It basically shows that A Ltd has more tax liability in comparison to

B Ltd.

Current Ratio :

This is the ratio which shows the liquidity of the organization, it is directly associated

with the efficiency of the organization (Correa-Mejía and Lopera-Castaño, 2020). A Ltd has

lower current ratio at 1.88 and B Ltd has 2.64 which means that B Ltd is more liquid and has

more than idea current ratio.

Quick Ratio :

This ratio shows the capacity of an organization to pay of its current liabilities without

needing to sell its inventory. In this ratio A Ltd again fall behind B Ltd as it has 1.52 whereas A

Ltd is at 1.10.

Receivables ratio :

This ratio is the accounting measurement which is used for the quantified measurement

of the organizations effectiveness and also help it to collect the accounts receivables (Morales-

Díaz and Zamora-Ramírez, 2018). The lowers the receivable ratio is for an organization it makes

it perform better. A Ltd outshines B Ltd as it has lower receivable ratio out of the two.

Inventory Days in ratio :

This ratio is in days in which the amount of time that is taken for the inventory to get

completely sold is calculated. Lower inventory days period shows higher efficiency in the

management which is present for A Ltd.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Al-Mutairi, A., Naser, K. and Saeid, M., 2018. Capital budgeting practices by non-financial

companies listed on Kuwait Stock Exchange (KSE). Cogent Economics & Finance.

6(1). p.1468232.

Alles, L., and et.al., 2021. An investigation of the usage of capital budgeting techniques by small

and medium enterprises. Quality & Quantity. 55(3). pp.993-1006.

Correa-Mejía, D.A. and Lopera-Castaño, M., 2020. Financial ratios as a powerful instrument to

predict insolvency; a study using boosting algorithms in Colombian firms. Estudios

Gerenciales. 36(155). pp.229-238.

Ding, K., Peng, X. and Wang, Y., 2019. A machine learning-based peer selection method with

financial ratios. Accounting Horizons. 33(3). pp.75-87.

Morales-Díaz, J. and Zamora-Ramírez, C., 2018. The impact of IFRS 16 on key financial ratios:

A new methodological approach. Accounting in Europe. 15(1). pp.105-133.

Warren, L. and Jack, L., 2018. The capital budgeting process and the energy trilemma-A

strategic conduct analysis. The British Accounting Review. 50(5). pp.481-496.

1

Books and journals

Al-Mutairi, A., Naser, K. and Saeid, M., 2018. Capital budgeting practices by non-financial

companies listed on Kuwait Stock Exchange (KSE). Cogent Economics & Finance.

6(1). p.1468232.

Alles, L., and et.al., 2021. An investigation of the usage of capital budgeting techniques by small

and medium enterprises. Quality & Quantity. 55(3). pp.993-1006.

Correa-Mejía, D.A. and Lopera-Castaño, M., 2020. Financial ratios as a powerful instrument to

predict insolvency; a study using boosting algorithms in Colombian firms. Estudios

Gerenciales. 36(155). pp.229-238.

Ding, K., Peng, X. and Wang, Y., 2019. A machine learning-based peer selection method with

financial ratios. Accounting Horizons. 33(3). pp.75-87.

Morales-Díaz, J. and Zamora-Ramírez, C., 2018. The impact of IFRS 16 on key financial ratios:

A new methodological approach. Accounting in Europe. 15(1). pp.105-133.

Warren, L. and Jack, L., 2018. The capital budgeting process and the energy trilemma-A

strategic conduct analysis. The British Accounting Review. 50(5). pp.481-496.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.