Accounting for Business Decisions - Study Material and Solved Assignments

VerifiedAdded on 2023/06/09

|11

|1481

|389

AI Summary

This study material covers various topics related to Accounting for Business Decisions, including bank reconciliation, journal entries, cost of sales, depreciation, adjustment entries, and closing entries. It also includes references to relevant books and journals.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCOUNTING

FOR

BUSINESS

DECISIONS

FOR

BUSINESS

DECISIONS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

MAIN BODY...................................................................................................................................3

Question No 1:........................................................................................................................3

Question No 2:........................................................................................................................3

Question No 3:........................................................................................................................4

Question No 4:........................................................................................................................4

Question No 5:........................................................................................................................5

Question No 6:........................................................................................................................6

REFERENCES................................................................................................................................8

MAIN BODY...................................................................................................................................3

Question No 1:........................................................................................................................3

Question No 2:........................................................................................................................3

Question No 3:........................................................................................................................4

Question No 4:........................................................................................................................4

Question No 5:........................................................................................................................5

Question No 6:........................................................................................................................6

REFERENCES................................................................................................................................8

MAIN BODY

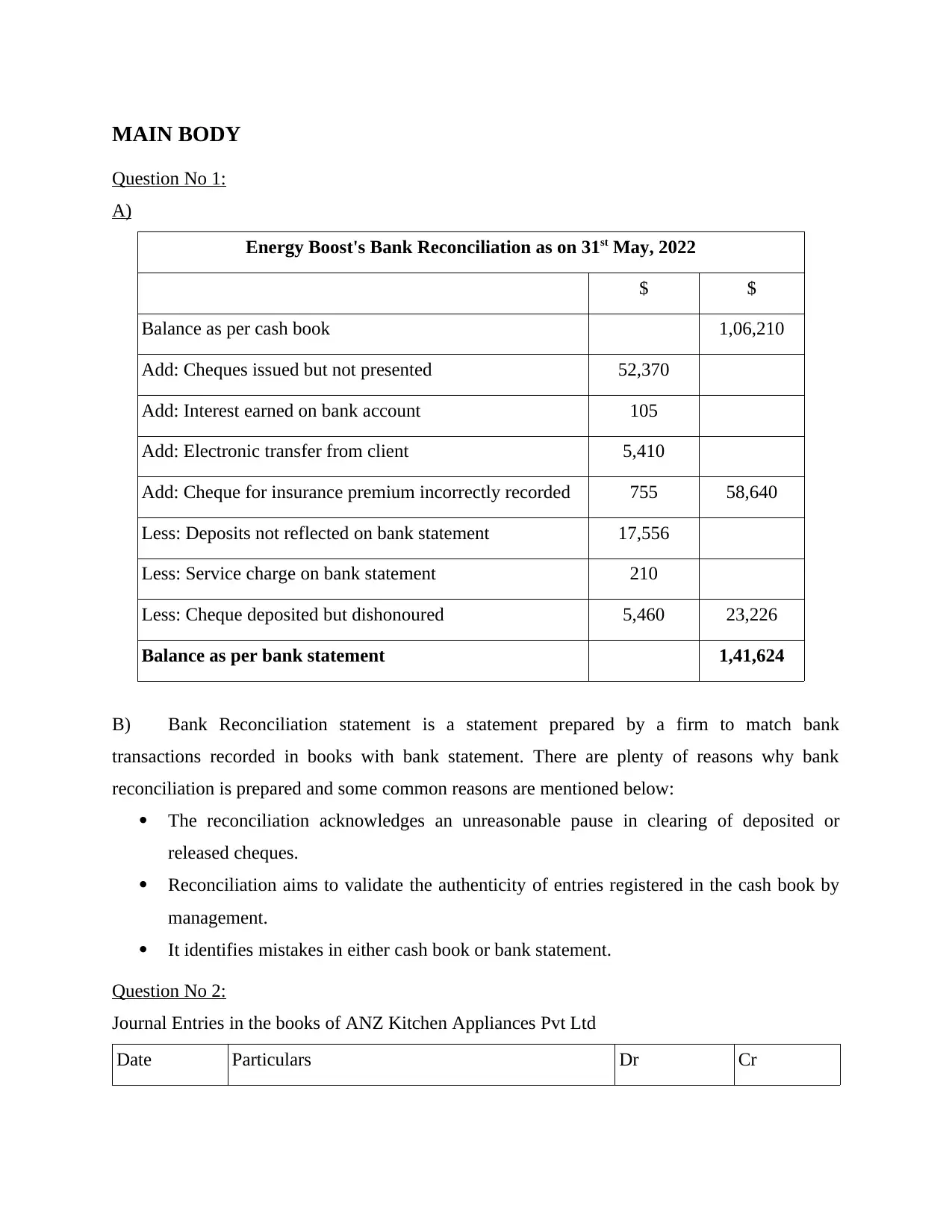

Question No 1:

A)

Energy Boost's Bank Reconciliation as on 31st May, 2022

$ $

Balance as per cash book 1,06,210

Add: Cheques issued but not presented 52,370

Add: Interest earned on bank account 105

Add: Electronic transfer from client 5,410

Add: Cheque for insurance premium incorrectly recorded 755 58,640

Less: Deposits not reflected on bank statement 17,556

Less: Service charge on bank statement 210

Less: Cheque deposited but dishonoured 5,460 23,226

Balance as per bank statement 1,41,624

B) Bank Reconciliation statement is a statement prepared by a firm to match bank

transactions recorded in books with bank statement. There are plenty of reasons why bank

reconciliation is prepared and some common reasons are mentioned below:

The reconciliation acknowledges an unreasonable pause in clearing of deposited or

released cheques.

Reconciliation aims to validate the authenticity of entries registered in the cash book by

management.

It identifies mistakes in either cash book or bank statement.

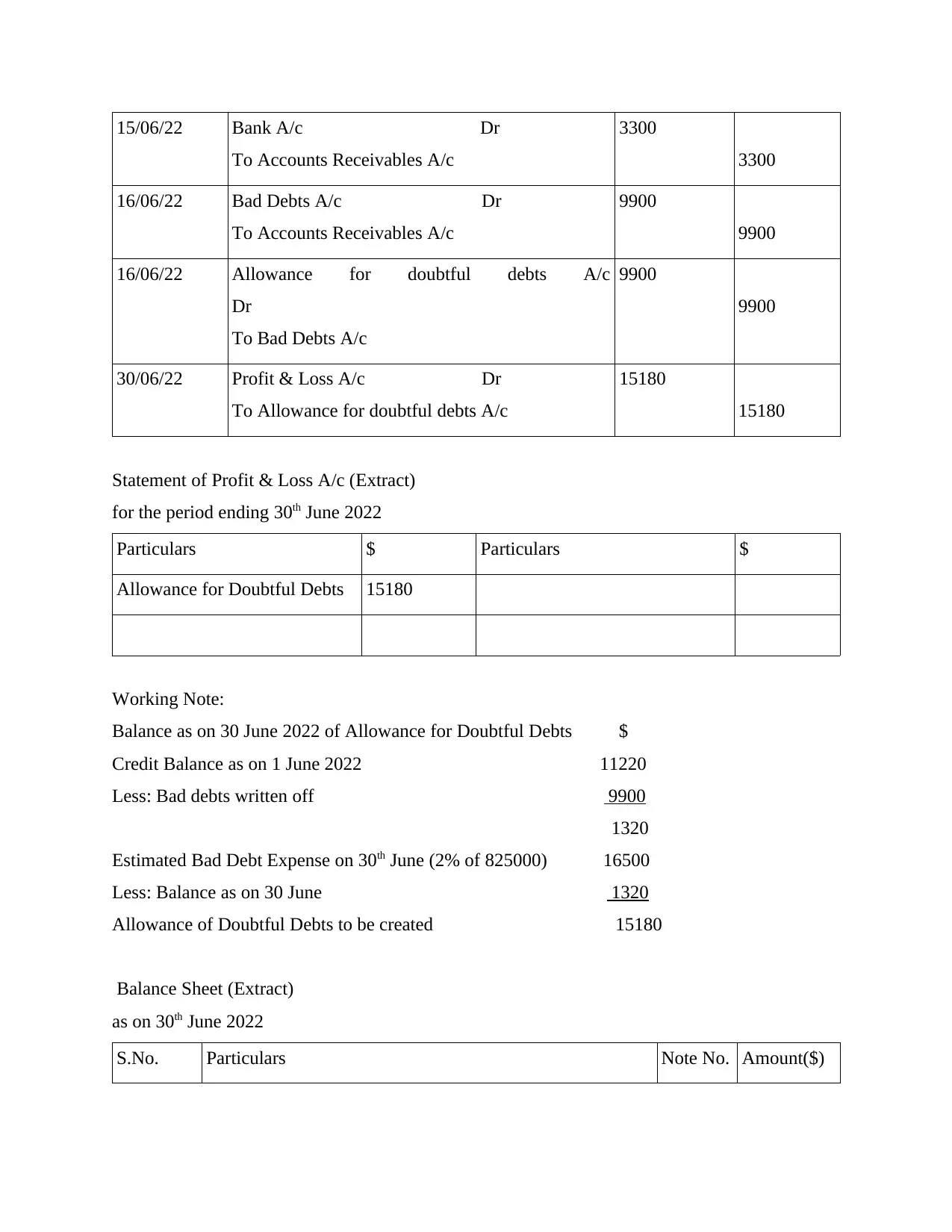

Question No 2:

Journal Entries in the books of ANZ Kitchen Appliances Pvt Ltd

Date Particulars Dr Cr

Question No 1:

A)

Energy Boost's Bank Reconciliation as on 31st May, 2022

$ $

Balance as per cash book 1,06,210

Add: Cheques issued but not presented 52,370

Add: Interest earned on bank account 105

Add: Electronic transfer from client 5,410

Add: Cheque for insurance premium incorrectly recorded 755 58,640

Less: Deposits not reflected on bank statement 17,556

Less: Service charge on bank statement 210

Less: Cheque deposited but dishonoured 5,460 23,226

Balance as per bank statement 1,41,624

B) Bank Reconciliation statement is a statement prepared by a firm to match bank

transactions recorded in books with bank statement. There are plenty of reasons why bank

reconciliation is prepared and some common reasons are mentioned below:

The reconciliation acknowledges an unreasonable pause in clearing of deposited or

released cheques.

Reconciliation aims to validate the authenticity of entries registered in the cash book by

management.

It identifies mistakes in either cash book or bank statement.

Question No 2:

Journal Entries in the books of ANZ Kitchen Appliances Pvt Ltd

Date Particulars Dr Cr

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

15/06/22 Bank A/c Dr

To Accounts Receivables A/c

3300

3300

16/06/22 Bad Debts A/c Dr

To Accounts Receivables A/c

9900

9900

16/06/22 Allowance for doubtful debts A/c

Dr

To Bad Debts A/c

9900

9900

30/06/22 Profit & Loss A/c Dr

To Allowance for doubtful debts A/c

15180

15180

Statement of Profit & Loss A/c (Extract)

for the period ending 30th June 2022

Particulars $ Particulars $

Allowance for Doubtful Debts 15180

Working Note:

Balance as on 30 June 2022 of Allowance for Doubtful Debts $

Credit Balance as on 1 June 2022 11220

Less: Bad debts written off 9900

1320

Estimated Bad Debt Expense on 30th June (2% of 825000) 16500

Less: Balance as on 30 June 1320

Allowance of Doubtful Debts to be created 15180

Balance Sheet (Extract)

as on 30th June 2022

S.No. Particulars Note No. Amount($)

To Accounts Receivables A/c

3300

3300

16/06/22 Bad Debts A/c Dr

To Accounts Receivables A/c

9900

9900

16/06/22 Allowance for doubtful debts A/c

Dr

To Bad Debts A/c

9900

9900

30/06/22 Profit & Loss A/c Dr

To Allowance for doubtful debts A/c

15180

15180

Statement of Profit & Loss A/c (Extract)

for the period ending 30th June 2022

Particulars $ Particulars $

Allowance for Doubtful Debts 15180

Working Note:

Balance as on 30 June 2022 of Allowance for Doubtful Debts $

Credit Balance as on 1 June 2022 11220

Less: Bad debts written off 9900

1320

Estimated Bad Debt Expense on 30th June (2% of 825000) 16500

Less: Balance as on 30 June 1320

Allowance of Doubtful Debts to be created 15180

Balance Sheet (Extract)

as on 30th June 2022

S.No. Particulars Note No. Amount($)

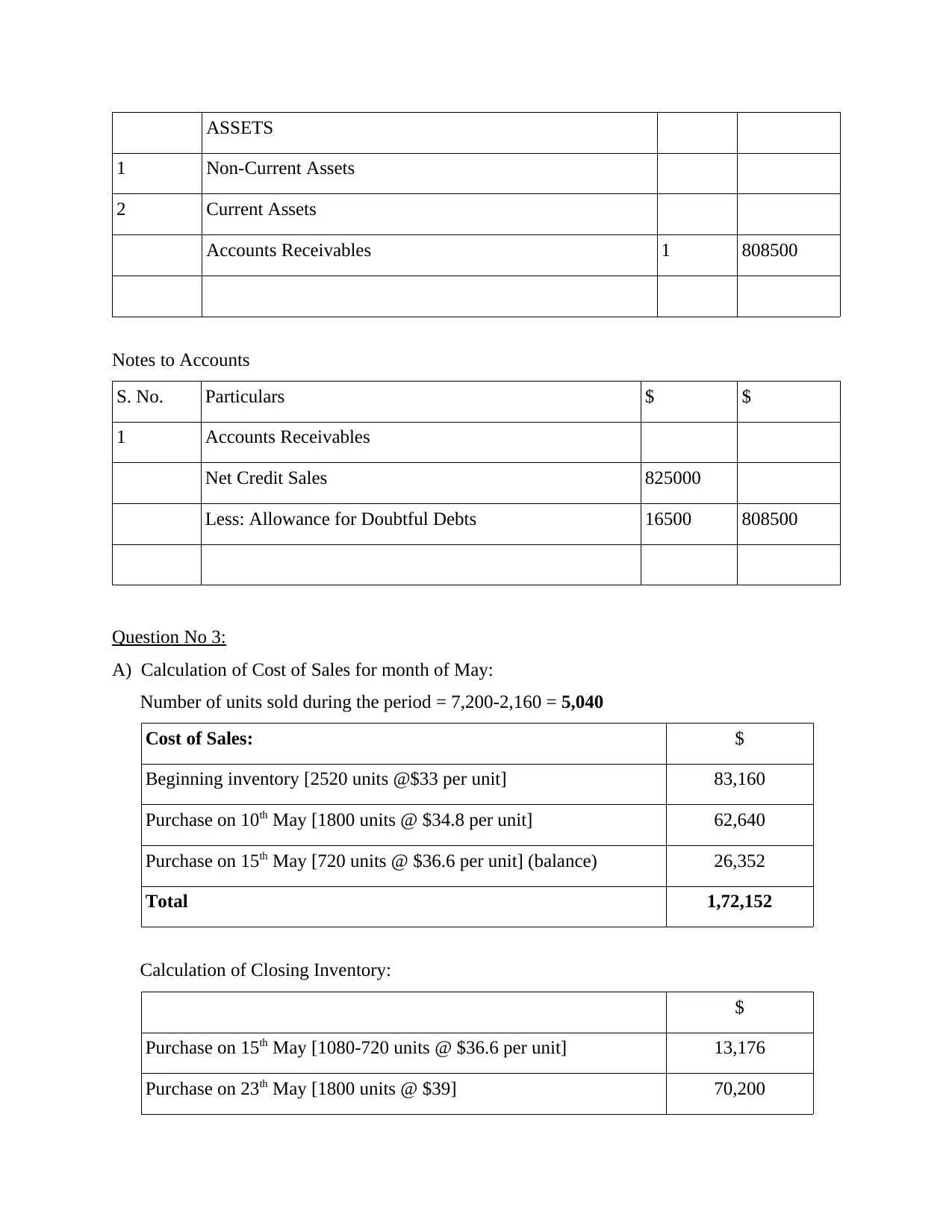

ASSETS

1 Non-Current Assets

2 Current Assets

Accounts Receivables 1 808500

Notes to Accounts

S. No. Particulars $ $

1 Accounts Receivables

Net Credit Sales 825000

Less: Allowance for Doubtful Debts 16500 808500

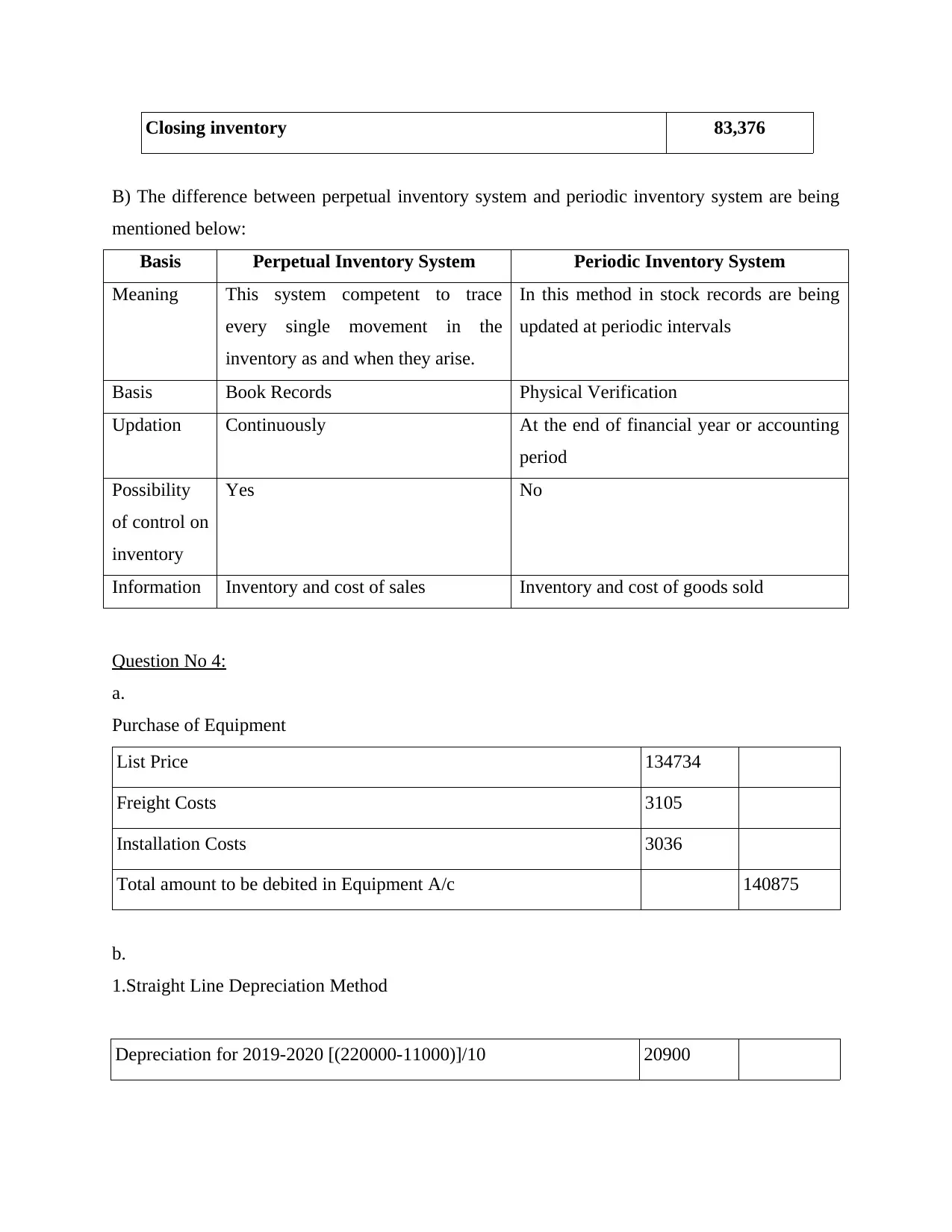

Question No 3:

A) Calculation of Cost of Sales for month of May:

Number of units sold during the period = 7,200-2,160 = 5,040

Cost of Sales: $

Beginning inventory [2520 units @$33 per unit] 83,160

Purchase on 10th May [1800 units @ $34.8 per unit] 62,640

Purchase on 15th May [720 units @ $36.6 per unit] (balance) 26,352

Total 1,72,152

Calculation of Closing Inventory:

$

Purchase on 15th May [1080-720 units @ $36.6 per unit] 13,176

Purchase on 23th May [1800 units @ $39] 70,200

1 Non-Current Assets

2 Current Assets

Accounts Receivables 1 808500

Notes to Accounts

S. No. Particulars $ $

1 Accounts Receivables

Net Credit Sales 825000

Less: Allowance for Doubtful Debts 16500 808500

Question No 3:

A) Calculation of Cost of Sales for month of May:

Number of units sold during the period = 7,200-2,160 = 5,040

Cost of Sales: $

Beginning inventory [2520 units @$33 per unit] 83,160

Purchase on 10th May [1800 units @ $34.8 per unit] 62,640

Purchase on 15th May [720 units @ $36.6 per unit] (balance) 26,352

Total 1,72,152

Calculation of Closing Inventory:

$

Purchase on 15th May [1080-720 units @ $36.6 per unit] 13,176

Purchase on 23th May [1800 units @ $39] 70,200

Closing inventory 83,376

B) The difference between perpetual inventory system and periodic inventory system are being

mentioned below:

Basis Perpetual Inventory System Periodic Inventory System

Meaning This system competent to trace

every single movement in the

inventory as and when they arise.

In this method in stock records are being

updated at periodic intervals

Basis Book Records Physical Verification

Updation Continuously At the end of financial year or accounting

period

Possibility

of control on

inventory

Yes No

Information Inventory and cost of sales Inventory and cost of goods sold

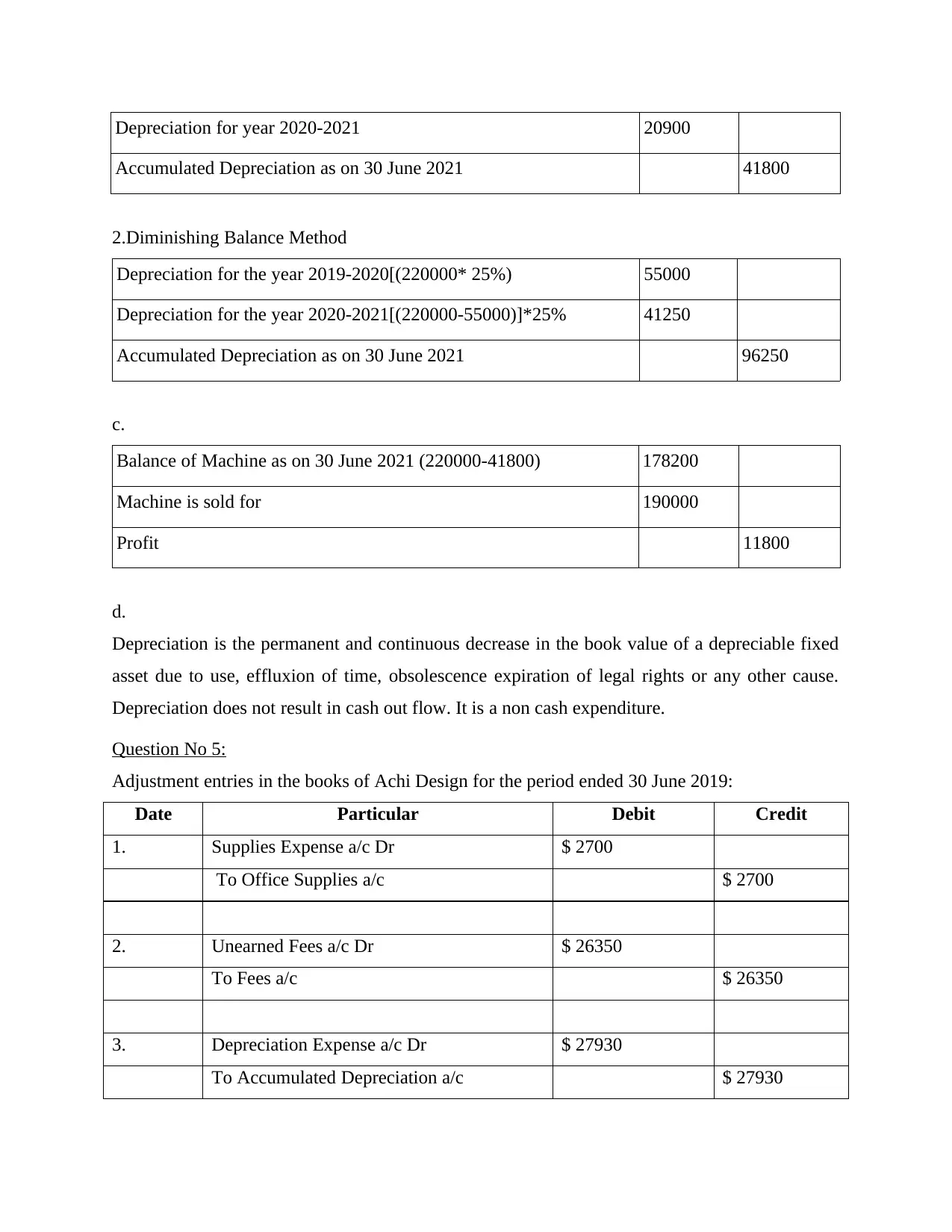

Question No 4:

a.

Purchase of Equipment

List Price 134734

Freight Costs 3105

Installation Costs 3036

Total amount to be debited in Equipment A/c 140875

b.

1.Straight Line Depreciation Method

Depreciation for 2019-2020 [(220000-11000)]/10 20900

B) The difference between perpetual inventory system and periodic inventory system are being

mentioned below:

Basis Perpetual Inventory System Periodic Inventory System

Meaning This system competent to trace

every single movement in the

inventory as and when they arise.

In this method in stock records are being

updated at periodic intervals

Basis Book Records Physical Verification

Updation Continuously At the end of financial year or accounting

period

Possibility

of control on

inventory

Yes No

Information Inventory and cost of sales Inventory and cost of goods sold

Question No 4:

a.

Purchase of Equipment

List Price 134734

Freight Costs 3105

Installation Costs 3036

Total amount to be debited in Equipment A/c 140875

b.

1.Straight Line Depreciation Method

Depreciation for 2019-2020 [(220000-11000)]/10 20900

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Depreciation for year 2020-2021 20900

Accumulated Depreciation as on 30 June 2021 41800

2.Diminishing Balance Method

Depreciation for the year 2019-2020[(220000* 25%) 55000

Depreciation for the year 2020-2021[(220000-55000)]*25% 41250

Accumulated Depreciation as on 30 June 2021 96250

c.

Balance of Machine as on 30 June 2021 (220000-41800) 178200

Machine is sold for 190000

Profit 11800

d.

Depreciation is the permanent and continuous decrease in the book value of a depreciable fixed

asset due to use, effluxion of time, obsolescence expiration of legal rights or any other cause.

Depreciation does not result in cash out flow. It is a non cash expenditure.

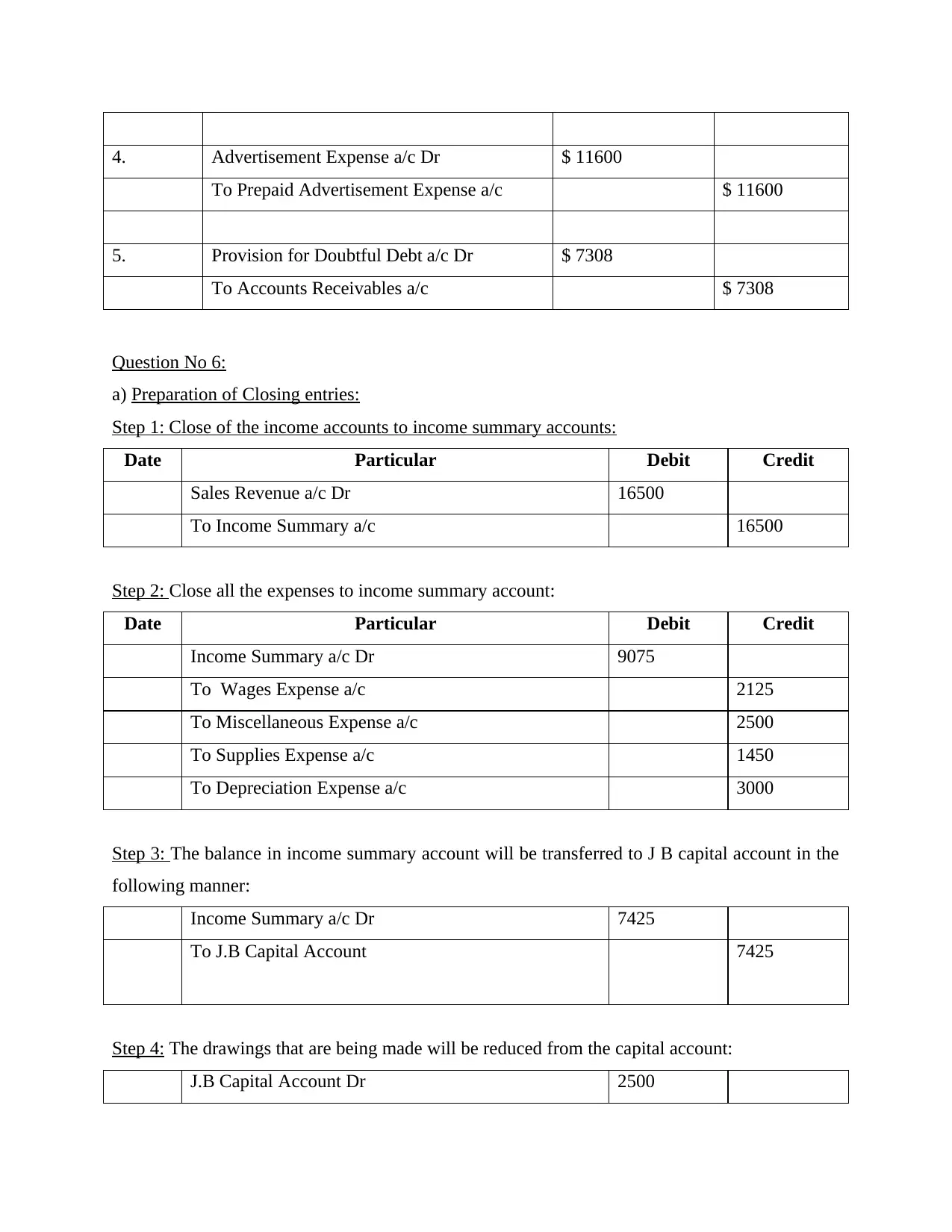

Question No 5:

Adjustment entries in the books of Achi Design for the period ended 30 June 2019:

Date Particular Debit Credit

1. Supplies Expense a/c Dr $ 2700

To Office Supplies a/c $ 2700

2. Unearned Fees a/c Dr $ 26350

To Fees a/c $ 26350

3. Depreciation Expense a/c Dr $ 27930

To Accumulated Depreciation a/c $ 27930

Accumulated Depreciation as on 30 June 2021 41800

2.Diminishing Balance Method

Depreciation for the year 2019-2020[(220000* 25%) 55000

Depreciation for the year 2020-2021[(220000-55000)]*25% 41250

Accumulated Depreciation as on 30 June 2021 96250

c.

Balance of Machine as on 30 June 2021 (220000-41800) 178200

Machine is sold for 190000

Profit 11800

d.

Depreciation is the permanent and continuous decrease in the book value of a depreciable fixed

asset due to use, effluxion of time, obsolescence expiration of legal rights or any other cause.

Depreciation does not result in cash out flow. It is a non cash expenditure.

Question No 5:

Adjustment entries in the books of Achi Design for the period ended 30 June 2019:

Date Particular Debit Credit

1. Supplies Expense a/c Dr $ 2700

To Office Supplies a/c $ 2700

2. Unearned Fees a/c Dr $ 26350

To Fees a/c $ 26350

3. Depreciation Expense a/c Dr $ 27930

To Accumulated Depreciation a/c $ 27930

4. Advertisement Expense a/c Dr $ 11600

To Prepaid Advertisement Expense a/c $ 11600

5. Provision for Doubtful Debt a/c Dr $ 7308

To Accounts Receivables a/c $ 7308

Question No 6:

a) Preparation of Closing entries:

Step 1: Close of the income accounts to income summary accounts:

Date Particular Debit Credit

Sales Revenue a/c Dr 16500

To Income Summary a/c 16500

Step 2: Close all the expenses to income summary account:

Date Particular Debit Credit

Income Summary a/c Dr 9075

To Wages Expense a/c 2125

To Miscellaneous Expense a/c 2500

To Supplies Expense a/c 1450

To Depreciation Expense a/c 3000

Step 3: The balance in income summary account will be transferred to J B capital account in the

following manner:

Income Summary a/c Dr 7425

To J.B Capital Account 7425

Step 4: The drawings that are being made will be reduced from the capital account:

J.B Capital Account Dr 2500

To Prepaid Advertisement Expense a/c $ 11600

5. Provision for Doubtful Debt a/c Dr $ 7308

To Accounts Receivables a/c $ 7308

Question No 6:

a) Preparation of Closing entries:

Step 1: Close of the income accounts to income summary accounts:

Date Particular Debit Credit

Sales Revenue a/c Dr 16500

To Income Summary a/c 16500

Step 2: Close all the expenses to income summary account:

Date Particular Debit Credit

Income Summary a/c Dr 9075

To Wages Expense a/c 2125

To Miscellaneous Expense a/c 2500

To Supplies Expense a/c 1450

To Depreciation Expense a/c 3000

Step 3: The balance in income summary account will be transferred to J B capital account in the

following manner:

Income Summary a/c Dr 7425

To J.B Capital Account 7425

Step 4: The drawings that are being made will be reduced from the capital account:

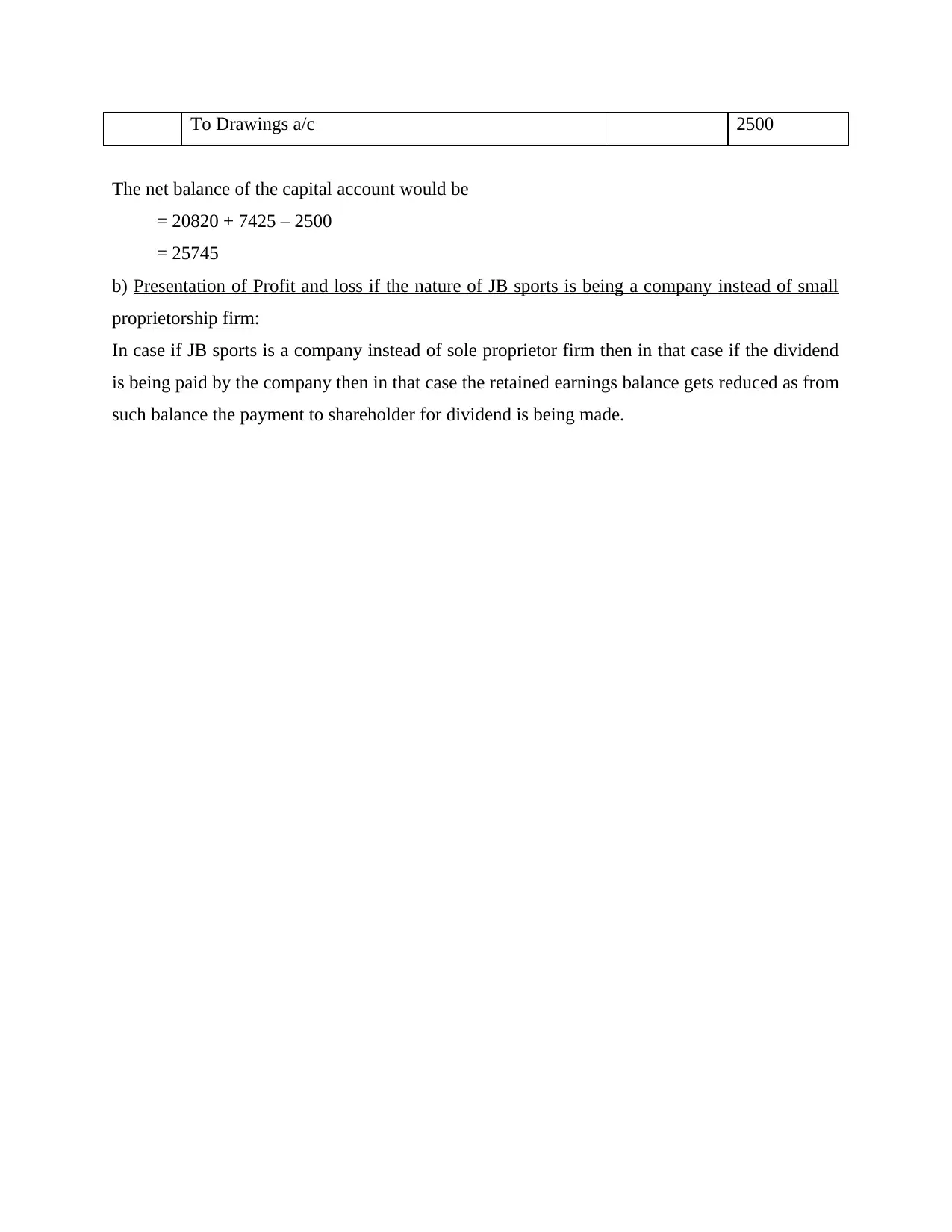

J.B Capital Account Dr 2500

To Drawings a/c 2500

The net balance of the capital account would be

= 20820 + 7425 – 2500

= 25745

b) Presentation of Profit and loss if the nature of JB sports is being a company instead of small

proprietorship firm:

In case if JB sports is a company instead of sole proprietor firm then in that case if the dividend

is being paid by the company then in that case the retained earnings balance gets reduced as from

such balance the payment to shareholder for dividend is being made.

The net balance of the capital account would be

= 20820 + 7425 – 2500

= 25745

b) Presentation of Profit and loss if the nature of JB sports is being a company instead of small

proprietorship firm:

In case if JB sports is a company instead of sole proprietor firm then in that case if the dividend

is being paid by the company then in that case the retained earnings balance gets reduced as from

such balance the payment to shareholder for dividend is being made.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Aldeia, S., 2021. The accounting role in determining the corporate tax base in India. Academy of

Strategic Management Journal, 20, pp.1-7.

Almagtome, A.H., 2021. Artificial Intelligence Applications in Accounting and Financial

Reporting Systems: An International Perspective. In Handbook of Research on Applied

AI for International Business and Marketing Applications (pp. 540-558). IGI Global.

Anderson, S.B., Hodder, L.D. and Hopkins, P.E., 2020. Money Illusion and the Effect of

Reporting Components of Accounting Estimates on Financial Statement Users’

Investment Decisions. Available at SSRN 3688524.

Kreilkamp, N., Schmidt, M. and Wöhrmann, A., 2020. Debiasing as a powerful management

accounting tool? Evidence from German firms. Journal of Accounting &

Organizational Change.

Rimmel, G. ed., 2020. Accounting for Sustainability. Routledge.

Saliy, V.V., Ishchenko, O.V., and Abyzova, E.V., 2021. Accounting and analytical systems as an

integral element of contemporary accounting. In Frontier Information Technology and

Systems Research in Cooperative Economics (pp. 739-746). Springer, Cham.

San-Jose, L., Mendizabal, X. and Retolaza, J.L., 2020. Social Accounting and Business

Legitimacy. In Handbook of Business Legitimacy (pp. 967-981). Springer, Cham.

Shokiraliyevich, G.I., 2021. Role of information and communication technologies in accounting

and digital economy. South Asian Journal of Marketing & Management

Research, 11(5), pp.17-20.

Sudhamathi, R.K., 2022. Artificial intelligence in accounting profession: A way forward. Asian

Journal of Research in Banking and Finance, 12(3), pp.7-9.

Zhang, Y., Liu, H., and Wang, S., 2019, October. Research on the influence of distributed

accounting technology on accounting. In 2019 6th International Conference on

Behavioral, Economic and Socio-Cultural Computing (BESC) (pp. 1-6). IEEE.

Books and Journals

Aldeia, S., 2021. The accounting role in determining the corporate tax base in India. Academy of

Strategic Management Journal, 20, pp.1-7.

Almagtome, A.H., 2021. Artificial Intelligence Applications in Accounting and Financial

Reporting Systems: An International Perspective. In Handbook of Research on Applied

AI for International Business and Marketing Applications (pp. 540-558). IGI Global.

Anderson, S.B., Hodder, L.D. and Hopkins, P.E., 2020. Money Illusion and the Effect of

Reporting Components of Accounting Estimates on Financial Statement Users’

Investment Decisions. Available at SSRN 3688524.

Kreilkamp, N., Schmidt, M. and Wöhrmann, A., 2020. Debiasing as a powerful management

accounting tool? Evidence from German firms. Journal of Accounting &

Organizational Change.

Rimmel, G. ed., 2020. Accounting for Sustainability. Routledge.

Saliy, V.V., Ishchenko, O.V., and Abyzova, E.V., 2021. Accounting and analytical systems as an

integral element of contemporary accounting. In Frontier Information Technology and

Systems Research in Cooperative Economics (pp. 739-746). Springer, Cham.

San-Jose, L., Mendizabal, X. and Retolaza, J.L., 2020. Social Accounting and Business

Legitimacy. In Handbook of Business Legitimacy (pp. 967-981). Springer, Cham.

Shokiraliyevich, G.I., 2021. Role of information and communication technologies in accounting

and digital economy. South Asian Journal of Marketing & Management

Research, 11(5), pp.17-20.

Sudhamathi, R.K., 2022. Artificial intelligence in accounting profession: A way forward. Asian

Journal of Research in Banking and Finance, 12(3), pp.7-9.

Zhang, Y., Liu, H., and Wang, S., 2019, October. Research on the influence of distributed

accounting technology on accounting. In 2019 6th International Conference on

Behavioral, Economic and Socio-Cultural Computing (BESC) (pp. 1-6). IEEE.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.