Business Management: P&L, Balance Sheet, and Ratio Analysis Report

VerifiedAdded on 2023/06/18

|9

|1460

|181

Report

AI Summary

This report provides a comprehensive analysis of financial statements, focusing on the practical implications of preparing a Profit and Loss (P&L) statement and a Balance Sheet for Dysn Ltd. It identifies limitations associated with both financial statements, such as the accrual concept, potential for manipulation, and reliance on historical costs. The report also includes a ratio analysis, calculating and interpreting inventory days, trade payable days, and trade receivable days to assess the company's financial health and areas for improvement. Key recommendations include enhancing forecasting, optimizing pricing strategies, and improving credit control to enhance Dysn Ltd's financial performance. This document is contributed by a student and available on Desklib, a platform offering study tools and resources for students.

ACCOUNTING FOR

BUSINESS MANAGEMENT

BUSINESS MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Task 1 P&L......................................................................................................................................2

Task 2 Balance Sheet.......................................................................................................................3

Task 3: Limitation of Profit and Loss Statement.............................................................................4

Task 4: Limitation of Balance sheet................................................................................................5

Task 5 Ratio analysis.......................................................................................................................5

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

1

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Task 1 P&L......................................................................................................................................2

Task 2 Balance Sheet.......................................................................................................................3

Task 3: Limitation of Profit and Loss Statement.............................................................................4

Task 4: Limitation of Balance sheet................................................................................................5

Task 5 Ratio analysis.......................................................................................................................5

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

1

INTRODUCTION

Financial statements are the reports that determine the company’s financial information. It

acts as base that will lead to the making of decision along with determination of company’s

performance (Lessambo, 2018). This report will highlight the practical implication of financial

statements in terms of its preparation along with an analysis of ratio with its interpretation in the

context of Dysn Ltd.

MAIN BODY

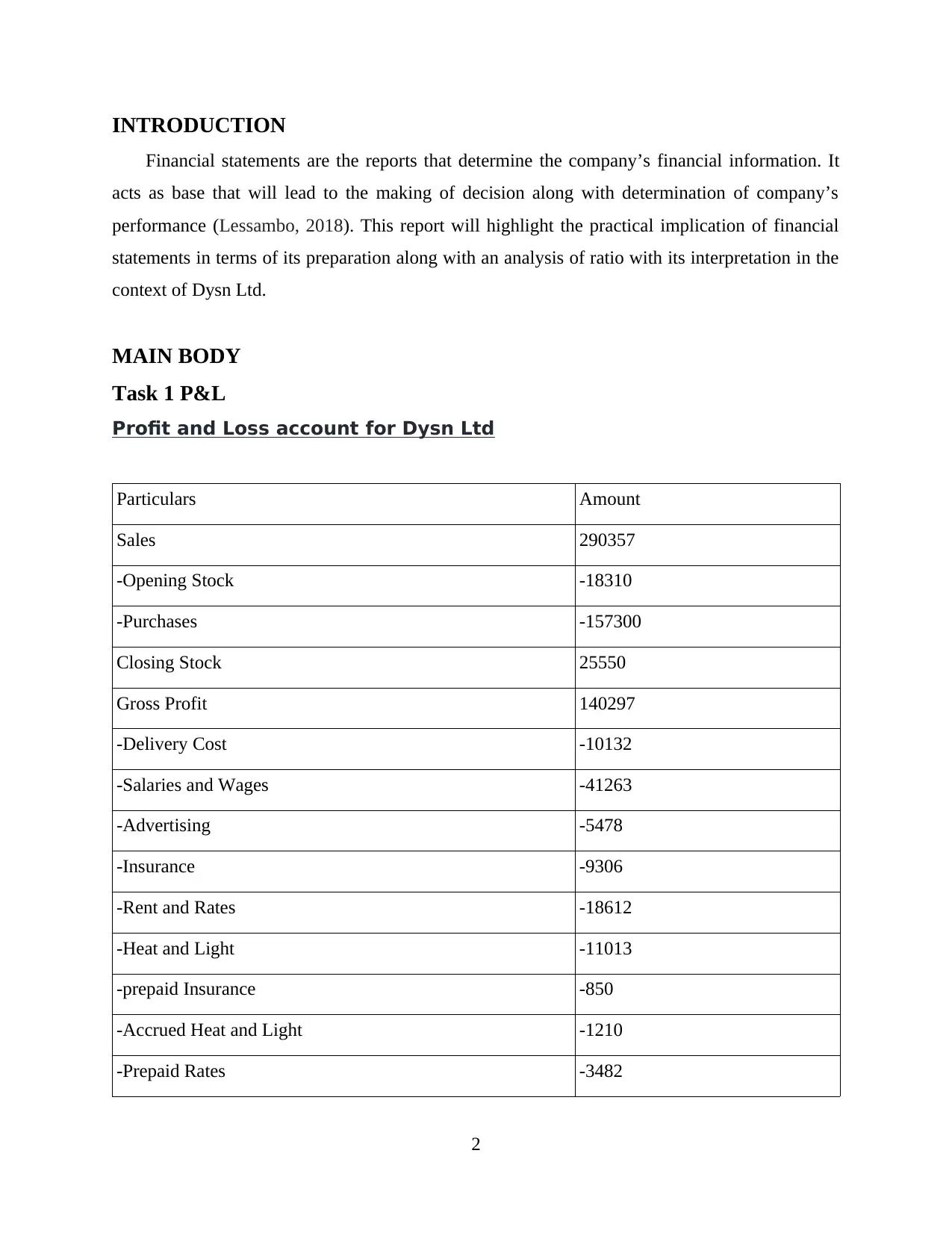

Task 1 P&L

Profit and Loss account for Dysn Ltd

Particulars Amount

Sales 290357

-Opening Stock -18310

-Purchases -157300

Closing Stock 25550

Gross Profit 140297

-Delivery Cost -10132

-Salaries and Wages -41263

-Advertising -5478

-Insurance -9306

-Rent and Rates -18612

-Heat and Light -11013

-prepaid Insurance -850

-Accrued Heat and Light -1210

-Prepaid Rates -3482

2

Financial statements are the reports that determine the company’s financial information. It

acts as base that will lead to the making of decision along with determination of company’s

performance (Lessambo, 2018). This report will highlight the practical implication of financial

statements in terms of its preparation along with an analysis of ratio with its interpretation in the

context of Dysn Ltd.

MAIN BODY

Task 1 P&L

Profit and Loss account for Dysn Ltd

Particulars Amount

Sales 290357

-Opening Stock -18310

-Purchases -157300

Closing Stock 25550

Gross Profit 140297

-Delivery Cost -10132

-Salaries and Wages -41263

-Advertising -5478

-Insurance -9306

-Rent and Rates -18612

-Heat and Light -11013

-prepaid Insurance -850

-Accrued Heat and Light -1210

-Prepaid Rates -3482

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

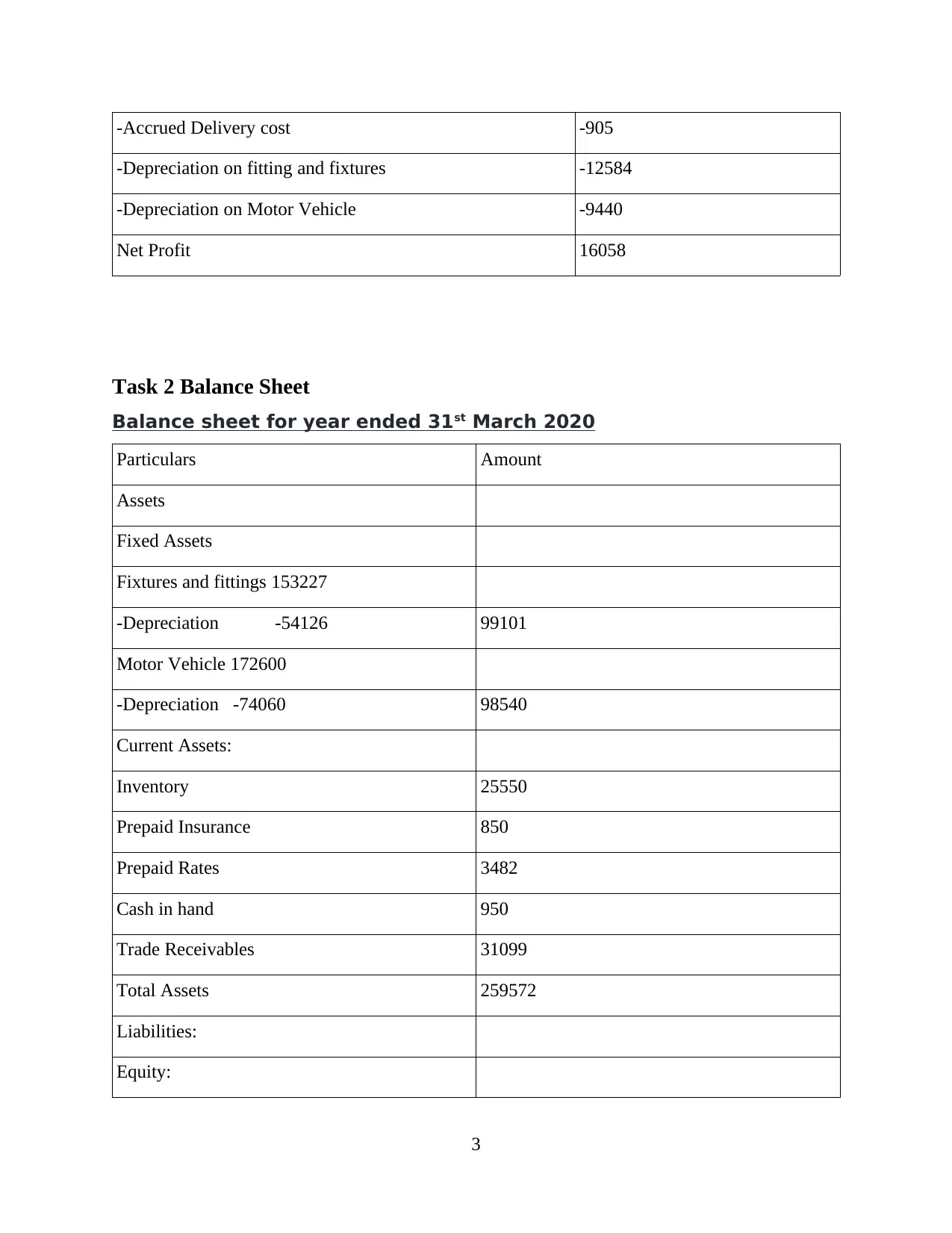

-Accrued Delivery cost -905

-Depreciation on fitting and fixtures -12584

-Depreciation on Motor Vehicle -9440

Net Profit 16058

Task 2 Balance Sheet

Balance sheet for year ended 31st March 2020

Particulars Amount

Assets

Fixed Assets

Fixtures and fittings 153227

-Depreciation -54126 99101

Motor Vehicle 172600

-Depreciation -74060 98540

Current Assets:

Inventory 25550

Prepaid Insurance 850

Prepaid Rates 3482

Cash in hand 950

Trade Receivables 31099

Total Assets 259572

Liabilities:

Equity:

3

-Depreciation on fitting and fixtures -12584

-Depreciation on Motor Vehicle -9440

Net Profit 16058

Task 2 Balance Sheet

Balance sheet for year ended 31st March 2020

Particulars Amount

Assets

Fixed Assets

Fixtures and fittings 153227

-Depreciation -54126 99101

Motor Vehicle 172600

-Depreciation -74060 98540

Current Assets:

Inventory 25550

Prepaid Insurance 850

Prepaid Rates 3482

Cash in hand 950

Trade Receivables 31099

Total Assets 259572

Liabilities:

Equity:

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

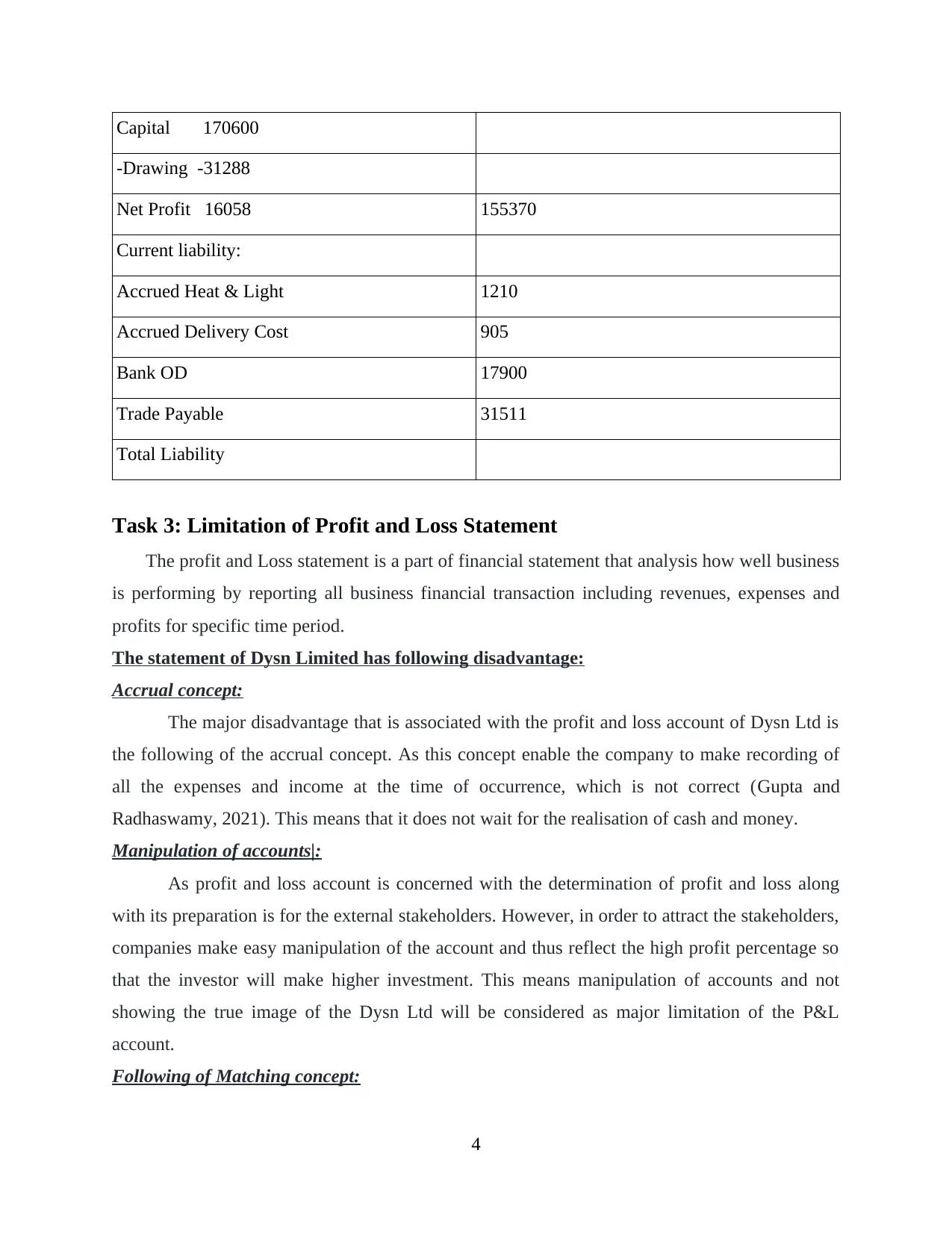

Capital 170600

-Drawing -31288

Net Profit 16058 155370

Current liability:

Accrued Heat & Light 1210

Accrued Delivery Cost 905

Bank OD 17900

Trade Payable 31511

Total Liability

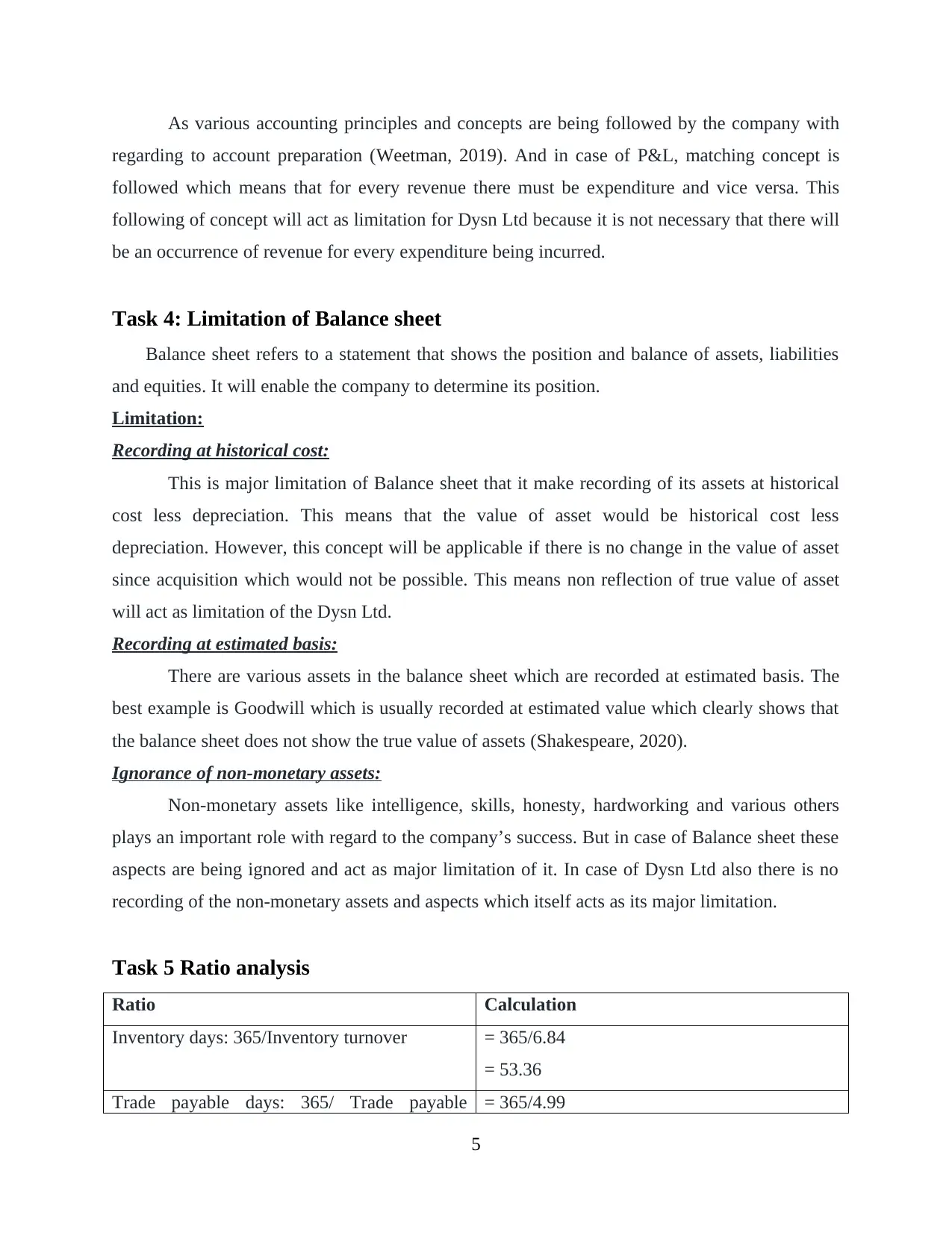

Task 3: Limitation of Profit and Loss Statement

The profit and Loss statement is a part of financial statement that analysis how well business

is performing by reporting all business financial transaction including revenues, expenses and

profits for specific time period.

The statement of Dysn Limited has following disadvantage:

Accrual concept:

The major disadvantage that is associated with the profit and loss account of Dysn Ltd is

the following of the accrual concept. As this concept enable the company to make recording of

all the expenses and income at the time of occurrence, which is not correct (Gupta and

Radhaswamy, 2021). This means that it does not wait for the realisation of cash and money.

Manipulation of accounts|:

As profit and loss account is concerned with the determination of profit and loss along

with its preparation is for the external stakeholders. However, in order to attract the stakeholders,

companies make easy manipulation of the account and thus reflect the high profit percentage so

that the investor will make higher investment. This means manipulation of accounts and not

showing the true image of the Dysn Ltd will be considered as major limitation of the P&L

account.

Following of Matching concept:

4

-Drawing -31288

Net Profit 16058 155370

Current liability:

Accrued Heat & Light 1210

Accrued Delivery Cost 905

Bank OD 17900

Trade Payable 31511

Total Liability

Task 3: Limitation of Profit and Loss Statement

The profit and Loss statement is a part of financial statement that analysis how well business

is performing by reporting all business financial transaction including revenues, expenses and

profits for specific time period.

The statement of Dysn Limited has following disadvantage:

Accrual concept:

The major disadvantage that is associated with the profit and loss account of Dysn Ltd is

the following of the accrual concept. As this concept enable the company to make recording of

all the expenses and income at the time of occurrence, which is not correct (Gupta and

Radhaswamy, 2021). This means that it does not wait for the realisation of cash and money.

Manipulation of accounts|:

As profit and loss account is concerned with the determination of profit and loss along

with its preparation is for the external stakeholders. However, in order to attract the stakeholders,

companies make easy manipulation of the account and thus reflect the high profit percentage so

that the investor will make higher investment. This means manipulation of accounts and not

showing the true image of the Dysn Ltd will be considered as major limitation of the P&L

account.

Following of Matching concept:

4

As various accounting principles and concepts are being followed by the company with

regarding to account preparation (Weetman, 2019). And in case of P&L, matching concept is

followed which means that for every revenue there must be expenditure and vice versa. This

following of concept will act as limitation for Dysn Ltd because it is not necessary that there will

be an occurrence of revenue for every expenditure being incurred.

Task 4: Limitation of Balance sheet

Balance sheet refers to a statement that shows the position and balance of assets, liabilities

and equities. It will enable the company to determine its position.

Limitation:

Recording at historical cost:

This is major limitation of Balance sheet that it make recording of its assets at historical

cost less depreciation. This means that the value of asset would be historical cost less

depreciation. However, this concept will be applicable if there is no change in the value of asset

since acquisition which would not be possible. This means non reflection of true value of asset

will act as limitation of the Dysn Ltd.

Recording at estimated basis:

There are various assets in the balance sheet which are recorded at estimated basis. The

best example is Goodwill which is usually recorded at estimated value which clearly shows that

the balance sheet does not show the true value of assets (Shakespeare, 2020).

Ignorance of non-monetary assets:

Non-monetary assets like intelligence, skills, honesty, hardworking and various others

plays an important role with regard to the company’s success. But in case of Balance sheet these

aspects are being ignored and act as major limitation of it. In case of Dysn Ltd also there is no

recording of the non-monetary assets and aspects which itself acts as its major limitation.

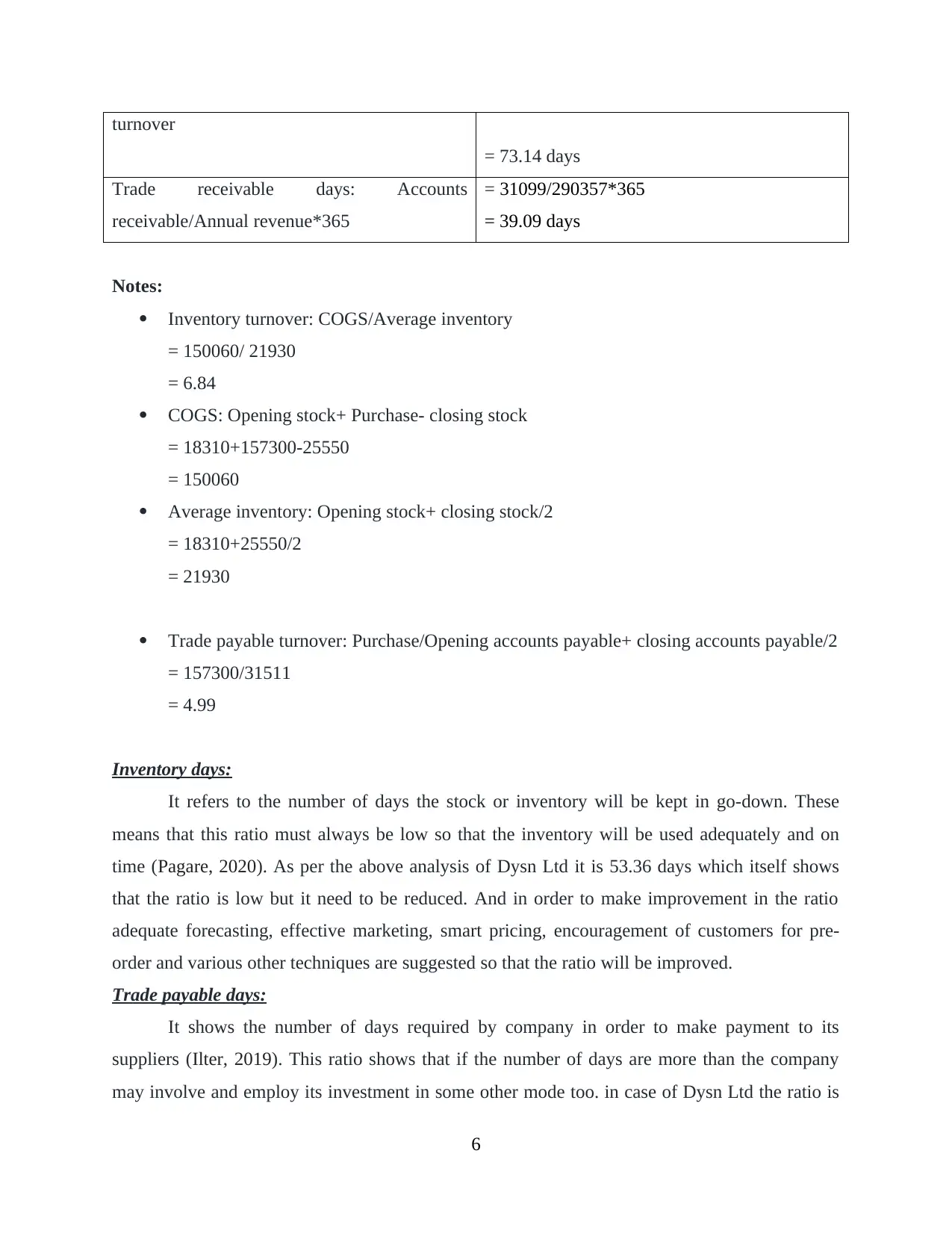

Task 5 Ratio analysis

Ratio Calculation

Inventory days: 365/Inventory turnover = 365/6.84

= 53.36

Trade payable days: 365/ Trade payable = 365/4.99

5

regarding to account preparation (Weetman, 2019). And in case of P&L, matching concept is

followed which means that for every revenue there must be expenditure and vice versa. This

following of concept will act as limitation for Dysn Ltd because it is not necessary that there will

be an occurrence of revenue for every expenditure being incurred.

Task 4: Limitation of Balance sheet

Balance sheet refers to a statement that shows the position and balance of assets, liabilities

and equities. It will enable the company to determine its position.

Limitation:

Recording at historical cost:

This is major limitation of Balance sheet that it make recording of its assets at historical

cost less depreciation. This means that the value of asset would be historical cost less

depreciation. However, this concept will be applicable if there is no change in the value of asset

since acquisition which would not be possible. This means non reflection of true value of asset

will act as limitation of the Dysn Ltd.

Recording at estimated basis:

There are various assets in the balance sheet which are recorded at estimated basis. The

best example is Goodwill which is usually recorded at estimated value which clearly shows that

the balance sheet does not show the true value of assets (Shakespeare, 2020).

Ignorance of non-monetary assets:

Non-monetary assets like intelligence, skills, honesty, hardworking and various others

plays an important role with regard to the company’s success. But in case of Balance sheet these

aspects are being ignored and act as major limitation of it. In case of Dysn Ltd also there is no

recording of the non-monetary assets and aspects which itself acts as its major limitation.

Task 5 Ratio analysis

Ratio Calculation

Inventory days: 365/Inventory turnover = 365/6.84

= 53.36

Trade payable days: 365/ Trade payable = 365/4.99

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

turnover

= 73.14 days

Trade receivable days: Accounts

receivable/Annual revenue*365

= 31099/290357*365

= 39.09 days

Notes:

Inventory turnover: COGS/Average inventory

= 150060/ 21930

= 6.84

COGS: Opening stock+ Purchase- closing stock

= 18310+157300-25550

= 150060

Average inventory: Opening stock+ closing stock/2

= 18310+25550/2

= 21930

Trade payable turnover: Purchase/Opening accounts payable+ closing accounts payable/2

= 157300/31511

= 4.99

Inventory days:

It refers to the number of days the stock or inventory will be kept in go-down. These

means that this ratio must always be low so that the inventory will be used adequately and on

time (Pagare, 2020). As per the above analysis of Dysn Ltd it is 53.36 days which itself shows

that the ratio is low but it need to be reduced. And in order to make improvement in the ratio

adequate forecasting, effective marketing, smart pricing, encouragement of customers for pre-

order and various other techniques are suggested so that the ratio will be improved.

Trade payable days:

It shows the number of days required by company in order to make payment to its

suppliers (Ilter, 2019). This ratio shows that if the number of days are more than the company

may involve and employ its investment in some other mode too. in case of Dysn Ltd the ratio is

6

= 73.14 days

Trade receivable days: Accounts

receivable/Annual revenue*365

= 31099/290357*365

= 39.09 days

Notes:

Inventory turnover: COGS/Average inventory

= 150060/ 21930

= 6.84

COGS: Opening stock+ Purchase- closing stock

= 18310+157300-25550

= 150060

Average inventory: Opening stock+ closing stock/2

= 18310+25550/2

= 21930

Trade payable turnover: Purchase/Opening accounts payable+ closing accounts payable/2

= 157300/31511

= 4.99

Inventory days:

It refers to the number of days the stock or inventory will be kept in go-down. These

means that this ratio must always be low so that the inventory will be used adequately and on

time (Pagare, 2020). As per the above analysis of Dysn Ltd it is 53.36 days which itself shows

that the ratio is low but it need to be reduced. And in order to make improvement in the ratio

adequate forecasting, effective marketing, smart pricing, encouragement of customers for pre-

order and various other techniques are suggested so that the ratio will be improved.

Trade payable days:

It shows the number of days required by company in order to make payment to its

suppliers (Ilter, 2019). This ratio shows that if the number of days are more than the company

may involve and employ its investment in some other mode too. in case of Dysn Ltd the ratio is

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

73 days which is a determinant of high ratio. This means that the Dysn Ltd is making slow

payment to its suppliers and making employing its funds in some other investments and thereby

raising is profit, changing of payment terms, improvement in stock controlling, enable credit

control are some technique that could decline the ratio.

Trade receivable days:

This ratio shows the number of days that are being taken by company in order to receive

payment from the debtors (Jones, 2019). This ratio should always be low so that the company

may have sufficient funds to meet its needs. With respect to Dysn Ltd the ratio is 39 days.

Although it is low but in order to make further improvement, Dysn Ltd can adopt the practice of

negotiating at the time of sales, enabling discounting policy and others.

CONCLUSION

From the above report it can be concluded that financial statements and its preparation will

enable the company tom determine its position and performance. Likewise, with the analysis of

ratio company can determine that where there is a need of improvement along with performance

determination.

7

payment to its suppliers and making employing its funds in some other investments and thereby

raising is profit, changing of payment terms, improvement in stock controlling, enable credit

control are some technique that could decline the ratio.

Trade receivable days:

This ratio shows the number of days that are being taken by company in order to receive

payment from the debtors (Jones, 2019). This ratio should always be low so that the company

may have sufficient funds to meet its needs. With respect to Dysn Ltd the ratio is 39 days.

Although it is low but in order to make further improvement, Dysn Ltd can adopt the practice of

negotiating at the time of sales, enabling discounting policy and others.

CONCLUSION

From the above report it can be concluded that financial statements and its preparation will

enable the company tom determine its position and performance. Likewise, with the analysis of

ratio company can determine that where there is a need of improvement along with performance

determination.

7

REFERENCES

Books and journals

Gupta, R.L. and Radhaswamy, M., 2021. Corporate Accounting. Sultan Chand & Sons.

Ilter, C., 2019. A Discussion Paper on Accounts Payable Ratio. Acta Oeconomica

Pragensia. 2019(3-4). pp.85-94.

Jones, S.A., 2019. Trade and Receivables Finance. In The Trade and Receivables Finance

Companion (pp. 389-419). Palgrave Macmillan, Cham.

Lessambo, F.I., 2018. Financial Statements. Analysis and Reporting.

Pagare, S., 2020. Inventory Control: Problems.

Shakespeare, C., 2020. Reporting matters: the real effects of financial reporting on investing and

financing decisions. Accounting and Business Research. 50(5). pp.425-442.

Weetman, P., 2019. Financial and management accounting. Pearson UK.

8

Books and journals

Gupta, R.L. and Radhaswamy, M., 2021. Corporate Accounting. Sultan Chand & Sons.

Ilter, C., 2019. A Discussion Paper on Accounts Payable Ratio. Acta Oeconomica

Pragensia. 2019(3-4). pp.85-94.

Jones, S.A., 2019. Trade and Receivables Finance. In The Trade and Receivables Finance

Companion (pp. 389-419). Palgrave Macmillan, Cham.

Lessambo, F.I., 2018. Financial Statements. Analysis and Reporting.

Pagare, S., 2020. Inventory Control: Problems.

Shakespeare, C., 2020. Reporting matters: the real effects of financial reporting on investing and

financing decisions. Accounting and Business Research. 50(5). pp.425-442.

Weetman, P., 2019. Financial and management accounting. Pearson UK.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.