Accounting for Business: Sales, Financial Viability, Break-Even Analysis

VerifiedAdded on 2023/06/18

|12

|1243

|232

AI Summary

This article covers topics such as sales, financial viability, and break-even analysis in Accounting for Business. It includes a statement of financial position, payback period, net present value, and more.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCOUNTING FOR

BUSINESS

BUSINESS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Section A...............................................................................................................................................3

Question 1.........................................................................................................................................3

SECTON B............................................................................................................................................4

Question 3.........................................................................................................................................4

Question 4.........................................................................................................................................6

REFERENCES....................................................................................................................................12

Section A...............................................................................................................................................3

Question 1.........................................................................................................................................3

SECTON B............................................................................................................................................4

Question 3.........................................................................................................................................4

Question 4.........................................................................................................................................6

REFERENCES....................................................................................................................................12

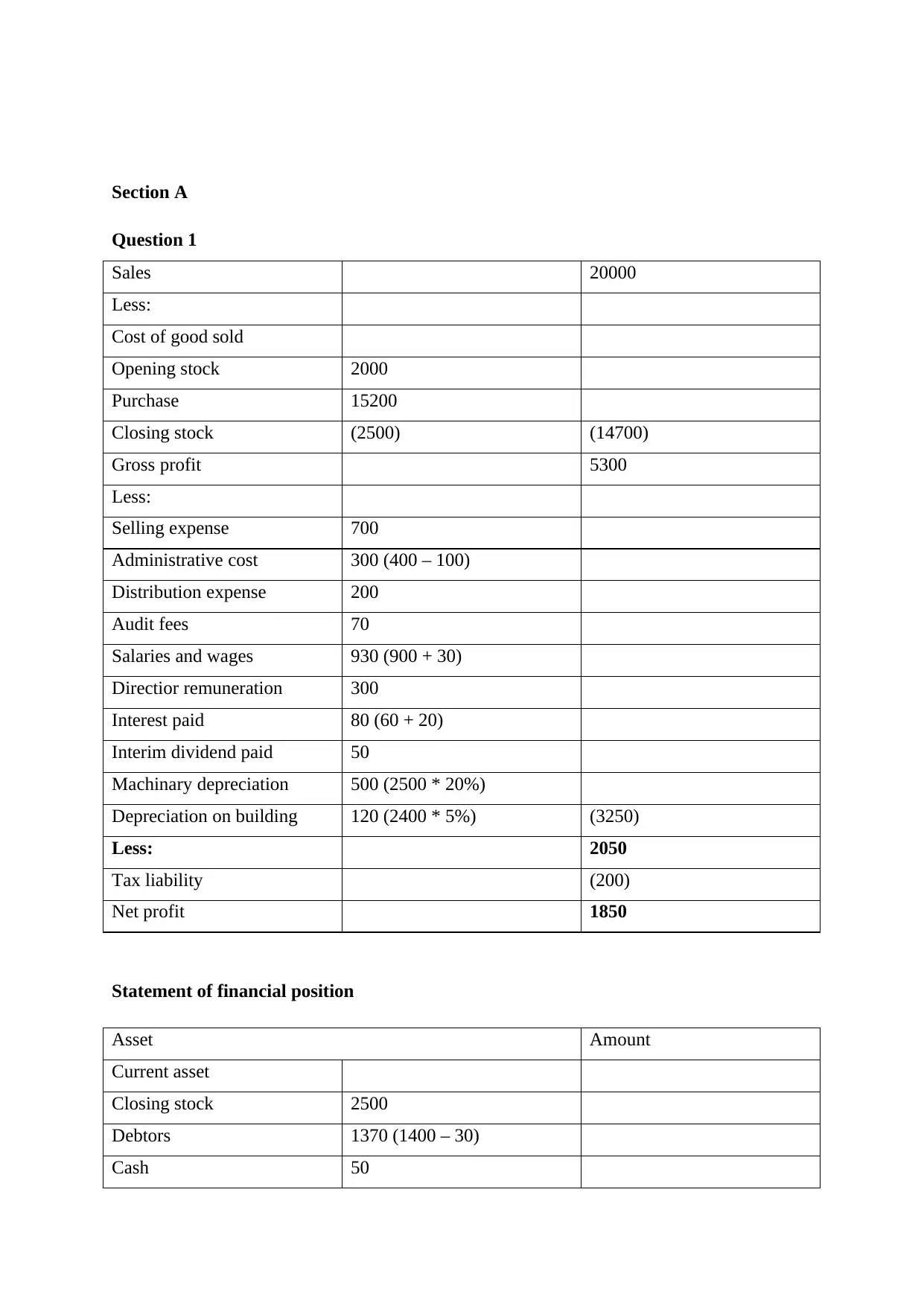

Section A

Question 1

Sales 20000

Less:

Cost of good sold

Opening stock 2000

Purchase 15200

Closing stock (2500) (14700)

Gross profit 5300

Less:

Selling expense 700

Administrative cost 300 (400 – 100)

Distribution expense 200

Audit fees 70

Salaries and wages 930 (900 + 30)

Directior remuneration 300

Interest paid 80 (60 + 20)

Interim dividend paid 50

Machinary depreciation 500 (2500 * 20%)

Depreciation on building 120 (2400 * 5%) (3250)

Less: 2050

Tax liability (200)

Net profit 1850

Statement of financial position

Asset Amount

Current asset

Closing stock 2500

Debtors 1370 (1400 – 30)

Cash 50

Question 1

Sales 20000

Less:

Cost of good sold

Opening stock 2000

Purchase 15200

Closing stock (2500) (14700)

Gross profit 5300

Less:

Selling expense 700

Administrative cost 300 (400 – 100)

Distribution expense 200

Audit fees 70

Salaries and wages 930 (900 + 30)

Directior remuneration 300

Interest paid 80 (60 + 20)

Interim dividend paid 50

Machinary depreciation 500 (2500 * 20%)

Depreciation on building 120 (2400 * 5%) (3250)

Less: 2050

Tax liability (200)

Net profit 1850

Statement of financial position

Asset Amount

Current asset

Closing stock 2500

Debtors 1370 (1400 – 30)

Cash 50

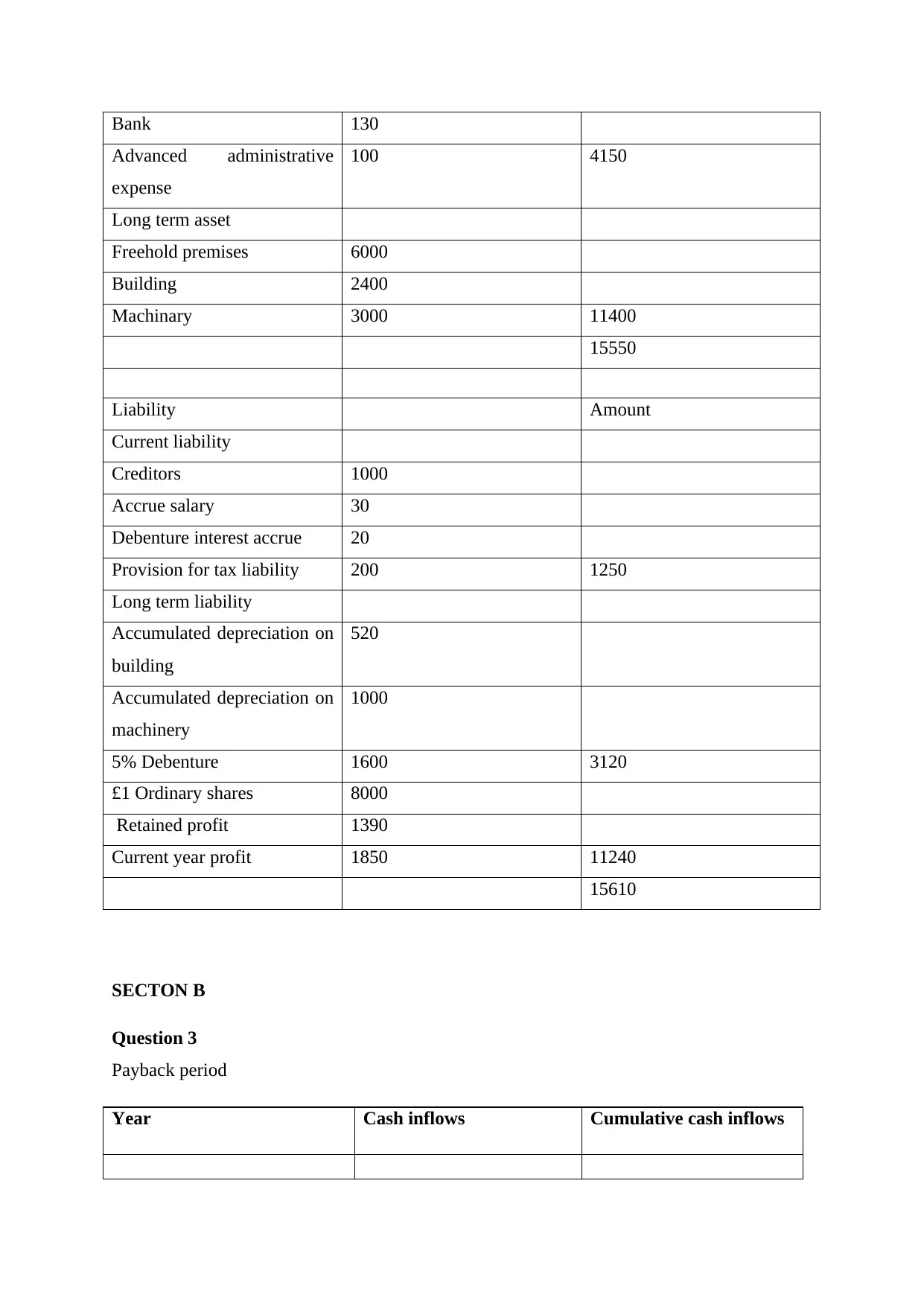

Bank 130

Advanced administrative

expense

100 4150

Long term asset

Freehold premises 6000

Building 2400

Machinary 3000 11400

15550

Liability Amount

Current liability

Creditors 1000

Accrue salary 30

Debenture interest accrue 20

Provision for tax liability 200 1250

Long term liability

Accumulated depreciation on

building

520

Accumulated depreciation on

machinery

1000

5% Debenture 1600 3120

£1 Ordinary shares 8000

Retained profit 1390

Current year profit 1850 11240

15610

SECTON B

Question 3

Payback period

Year Cash inflows Cumulative cash inflows

Advanced administrative

expense

100 4150

Long term asset

Freehold premises 6000

Building 2400

Machinary 3000 11400

15550

Liability Amount

Current liability

Creditors 1000

Accrue salary 30

Debenture interest accrue 20

Provision for tax liability 200 1250

Long term liability

Accumulated depreciation on

building

520

Accumulated depreciation on

machinery

1000

5% Debenture 1600 3120

£1 Ordinary shares 8000

Retained profit 1390

Current year profit 1850 11240

15610

SECTON B

Question 3

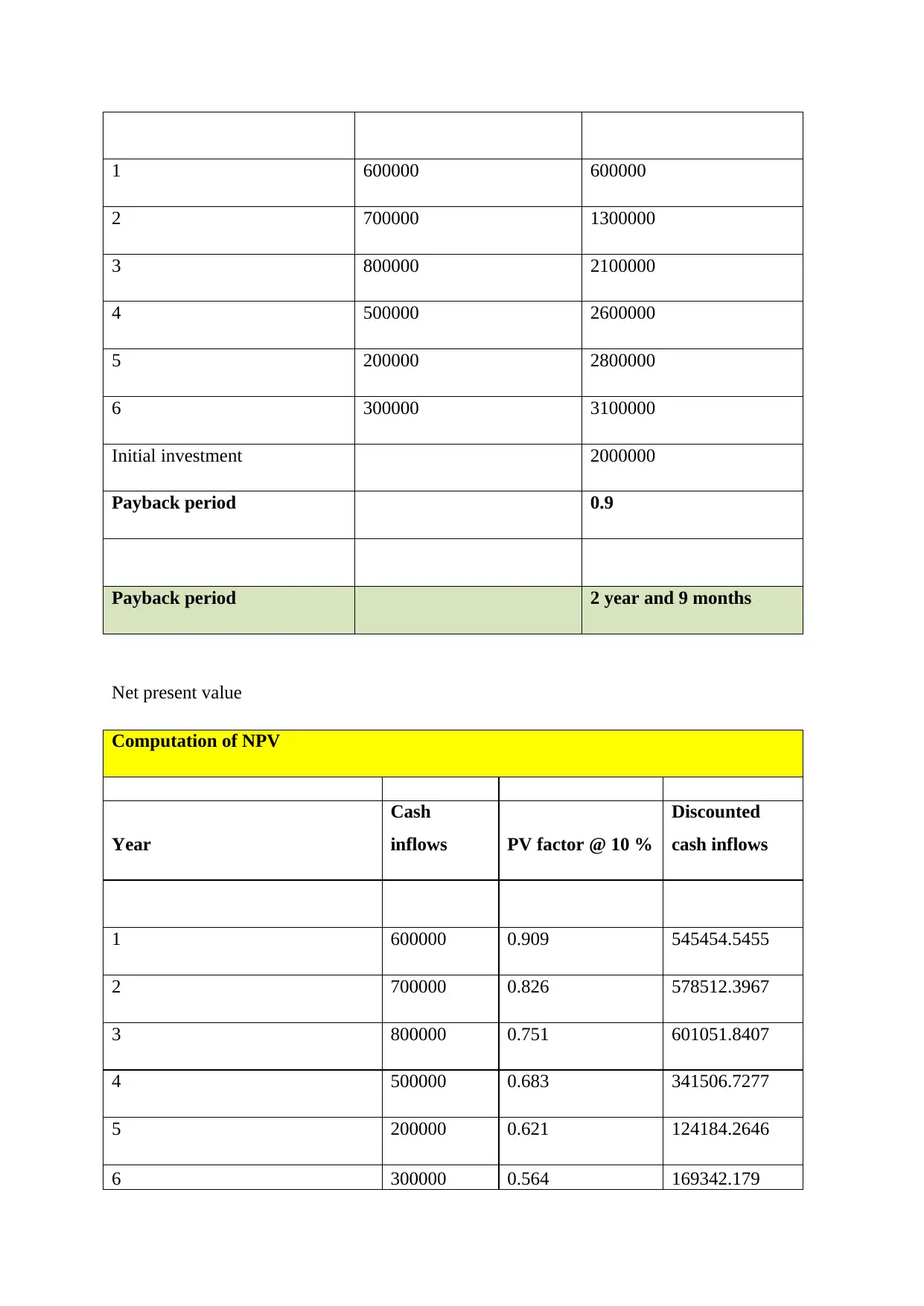

Payback period

Year Cash inflows Cumulative cash inflows

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1 600000 600000

2 700000 1300000

3 800000 2100000

4 500000 2600000

5 200000 2800000

6 300000 3100000

Initial investment 2000000

Payback period 0.9

Payback period 2 year and 9 months

Net present value

Computation of NPV

Year

Cash

inflows PV factor @ 10 %

Discounted

cash inflows

1 600000 0.909 545454.5455

2 700000 0.826 578512.3967

3 800000 0.751 601051.8407

4 500000 0.683 341506.7277

5 200000 0.621 124184.2646

6 300000 0.564 169342.179

2 700000 1300000

3 800000 2100000

4 500000 2600000

5 200000 2800000

6 300000 3100000

Initial investment 2000000

Payback period 0.9

Payback period 2 year and 9 months

Net present value

Computation of NPV

Year

Cash

inflows PV factor @ 10 %

Discounted

cash inflows

1 600000 0.909 545454.5455

2 700000 0.826 578512.3967

3 800000 0.751 601051.8407

4 500000 0.683 341506.7277

5 200000 0.621 124184.2646

6 300000 0.564 169342.179

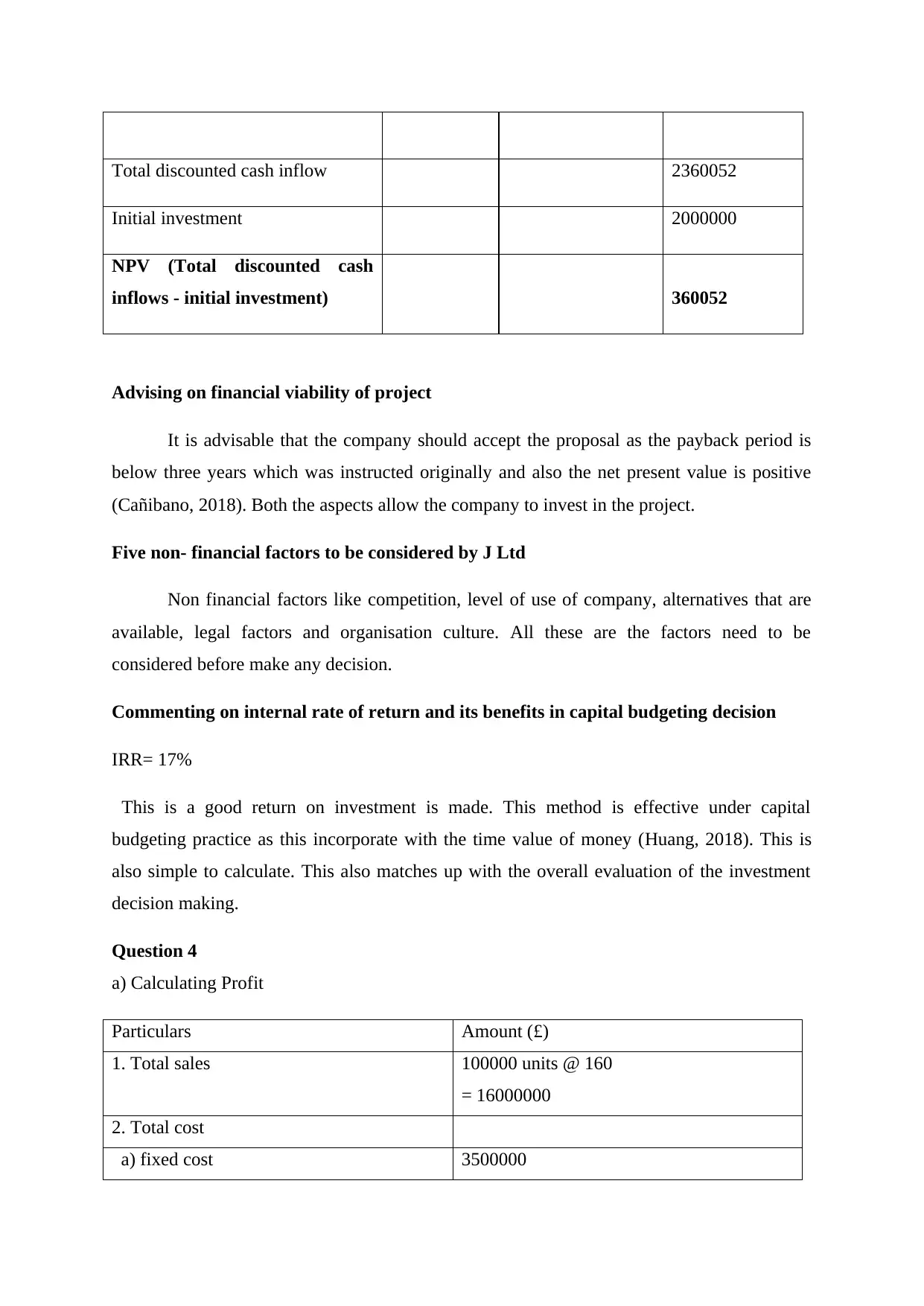

Total discounted cash inflow 2360052

Initial investment 2000000

NPV (Total discounted cash

inflows - initial investment) 360052

Advising on financial viability of project

It is advisable that the company should accept the proposal as the payback period is

below three years which was instructed originally and also the net present value is positive

(Cañibano, 2018). Both the aspects allow the company to invest in the project.

Five non- financial factors to be considered by J Ltd

Non financial factors like competition, level of use of company, alternatives that are

available, legal factors and organisation culture. All these are the factors need to be

considered before make any decision.

Commenting on internal rate of return and its benefits in capital budgeting decision

IRR= 17%

This is a good return on investment is made. This method is effective under capital

budgeting practice as this incorporate with the time value of money (Huang, 2018). This is

also simple to calculate. This also matches up with the overall evaluation of the investment

decision making.

Question 4

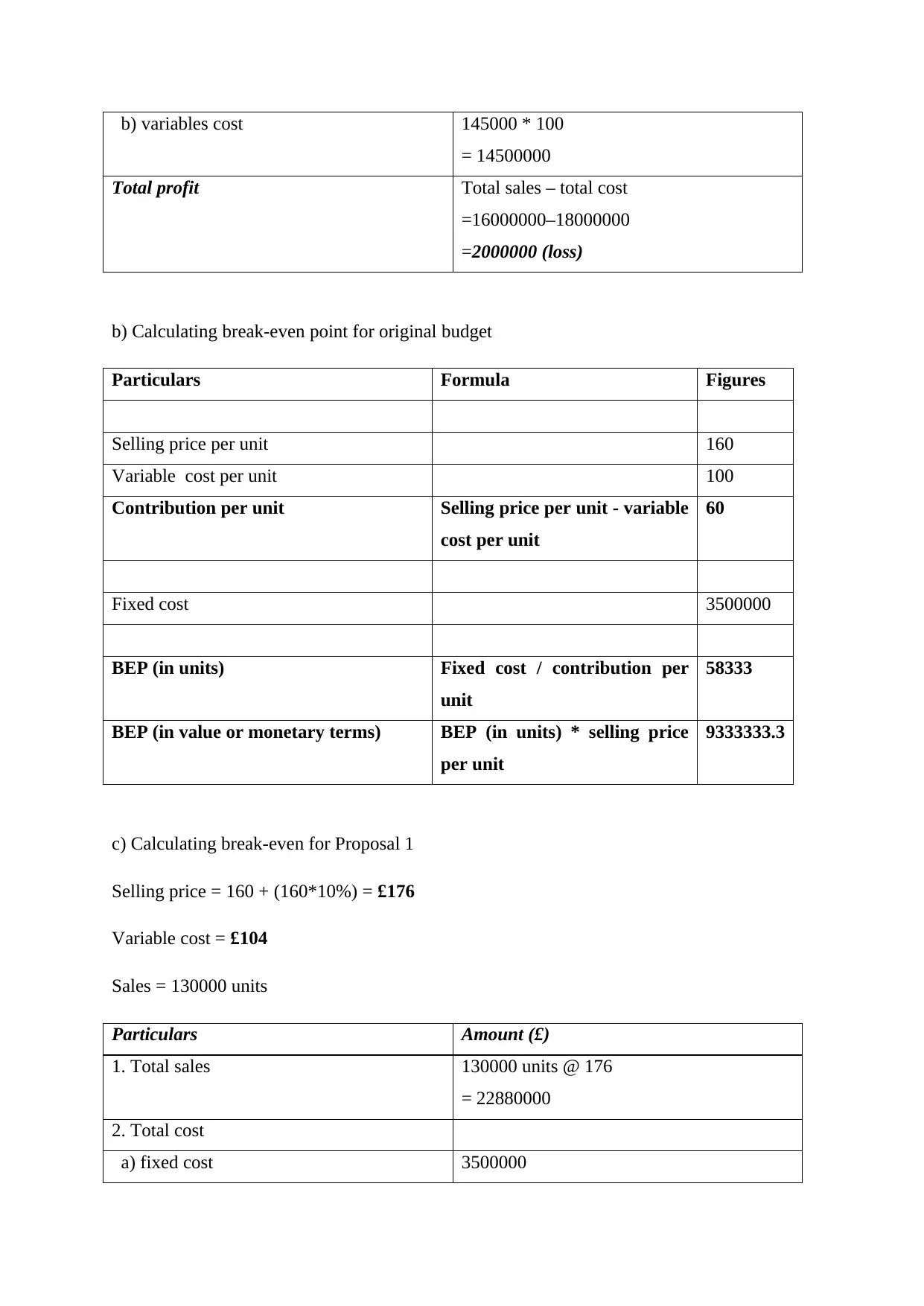

a) Calculating Profit

Particulars Amount (£)

1. Total sales 100000 units @ 160

= 16000000

2. Total cost

a) fixed cost 3500000

Initial investment 2000000

NPV (Total discounted cash

inflows - initial investment) 360052

Advising on financial viability of project

It is advisable that the company should accept the proposal as the payback period is

below three years which was instructed originally and also the net present value is positive

(Cañibano, 2018). Both the aspects allow the company to invest in the project.

Five non- financial factors to be considered by J Ltd

Non financial factors like competition, level of use of company, alternatives that are

available, legal factors and organisation culture. All these are the factors need to be

considered before make any decision.

Commenting on internal rate of return and its benefits in capital budgeting decision

IRR= 17%

This is a good return on investment is made. This method is effective under capital

budgeting practice as this incorporate with the time value of money (Huang, 2018). This is

also simple to calculate. This also matches up with the overall evaluation of the investment

decision making.

Question 4

a) Calculating Profit

Particulars Amount (£)

1. Total sales 100000 units @ 160

= 16000000

2. Total cost

a) fixed cost 3500000

b) variables cost 145000 * 100

= 14500000

Total profit Total sales – total cost

=16000000–18000000

=2000000 (loss)

b) Calculating break-even point for original budget

Particulars Formula Figures

Selling price per unit 160

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

60

Fixed cost 3500000

BEP (in units) Fixed cost / contribution per

unit

58333

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

9333333.3

c) Calculating break-even for Proposal 1

Selling price = 160 + (160*10%) = £176

Variable cost = £104

Sales = 130000 units

Particulars Amount (£)

1. Total sales 130000 units @ 176

= 22880000

2. Total cost

a) fixed cost 3500000

= 14500000

Total profit Total sales – total cost

=16000000–18000000

=2000000 (loss)

b) Calculating break-even point for original budget

Particulars Formula Figures

Selling price per unit 160

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

60

Fixed cost 3500000

BEP (in units) Fixed cost / contribution per

unit

58333

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

9333333.3

c) Calculating break-even for Proposal 1

Selling price = 160 + (160*10%) = £176

Variable cost = £104

Sales = 130000 units

Particulars Amount (£)

1. Total sales 130000 units @ 176

= 22880000

2. Total cost

a) fixed cost 3500000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

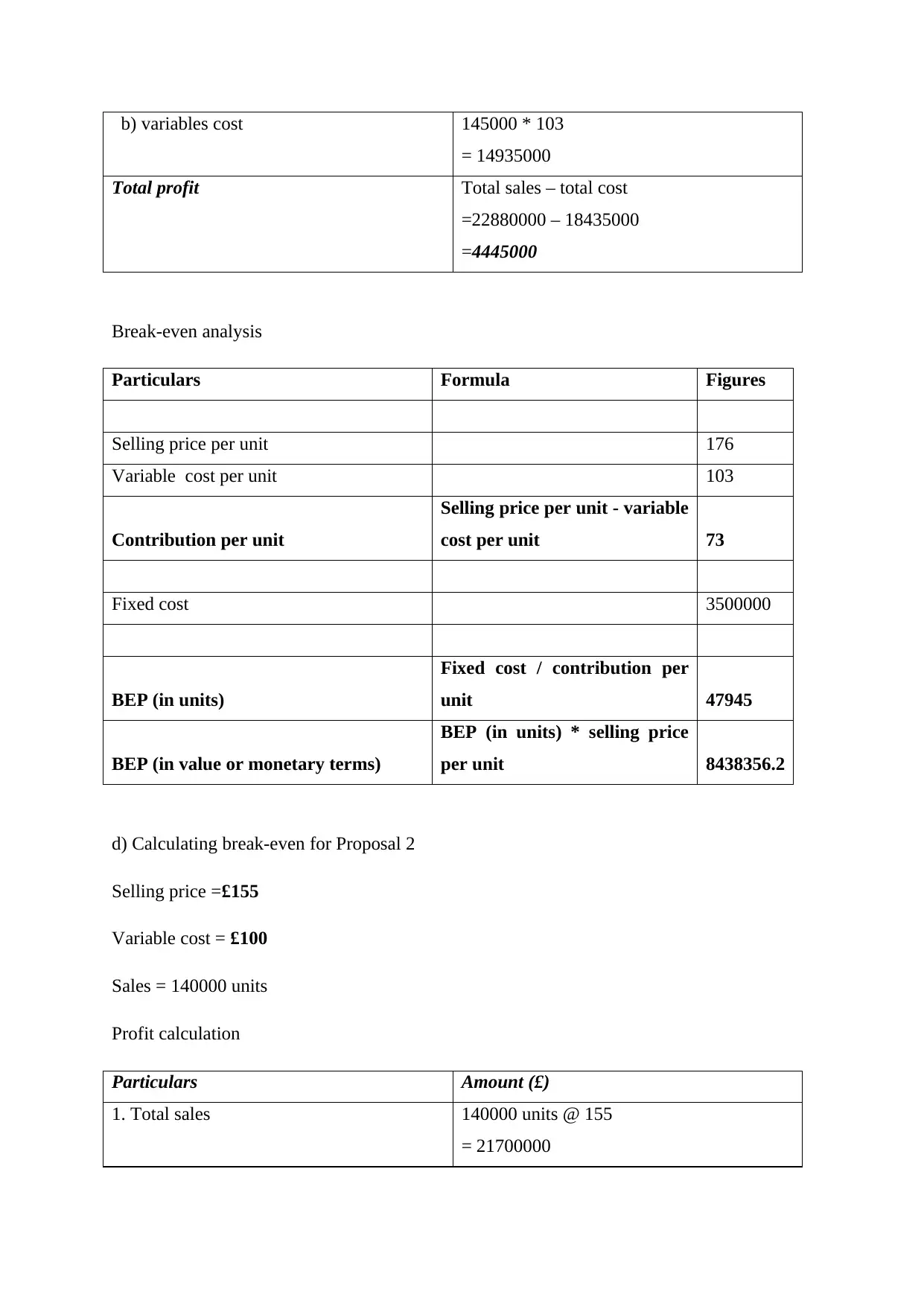

b) variables cost 145000 * 103

= 14935000

Total profit Total sales – total cost

=22880000 – 18435000

=4445000

Break-even analysis

Particulars Formula Figures

Selling price per unit 176

Variable cost per unit 103

Contribution per unit

Selling price per unit - variable

cost per unit 73

Fixed cost 3500000

BEP (in units)

Fixed cost / contribution per

unit 47945

BEP (in value or monetary terms)

BEP (in units) * selling price

per unit 8438356.2

d) Calculating break-even for Proposal 2

Selling price =£155

Variable cost = £100

Sales = 140000 units

Profit calculation

Particulars Amount (£)

1. Total sales 140000 units @ 155

= 21700000

= 14935000

Total profit Total sales – total cost

=22880000 – 18435000

=4445000

Break-even analysis

Particulars Formula Figures

Selling price per unit 176

Variable cost per unit 103

Contribution per unit

Selling price per unit - variable

cost per unit 73

Fixed cost 3500000

BEP (in units)

Fixed cost / contribution per

unit 47945

BEP (in value or monetary terms)

BEP (in units) * selling price

per unit 8438356.2

d) Calculating break-even for Proposal 2

Selling price =£155

Variable cost = £100

Sales = 140000 units

Profit calculation

Particulars Amount (£)

1. Total sales 140000 units @ 155

= 21700000

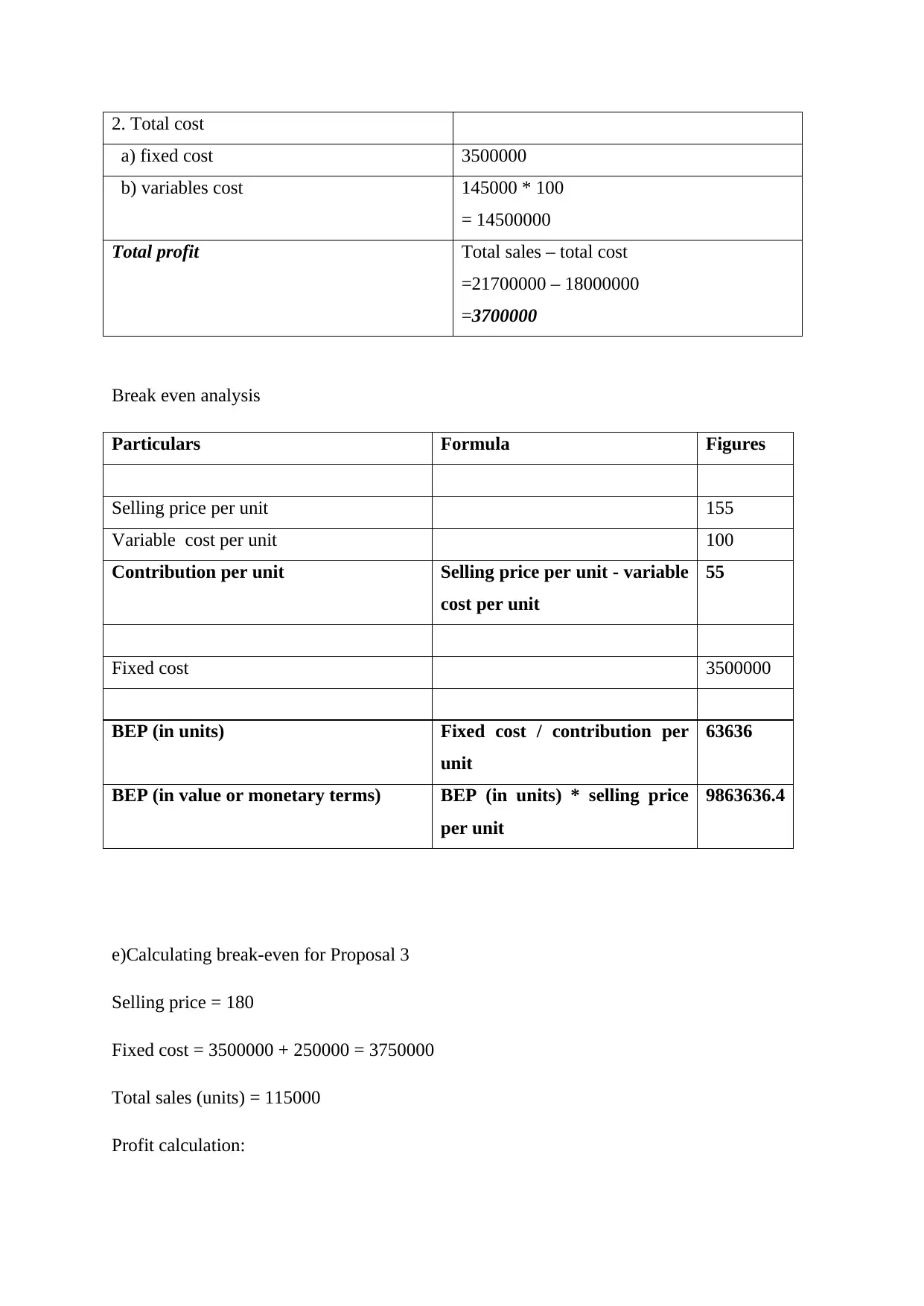

2. Total cost

a) fixed cost 3500000

b) variables cost 145000 * 100

= 14500000

Total profit Total sales – total cost

=21700000 – 18000000

=3700000

Break even analysis

Particulars Formula Figures

Selling price per unit 155

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

55

Fixed cost 3500000

BEP (in units) Fixed cost / contribution per

unit

63636

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

9863636.4

e)Calculating break-even for Proposal 3

Selling price = 180

Fixed cost = 3500000 + 250000 = 3750000

Total sales (units) = 115000

Profit calculation:

a) fixed cost 3500000

b) variables cost 145000 * 100

= 14500000

Total profit Total sales – total cost

=21700000 – 18000000

=3700000

Break even analysis

Particulars Formula Figures

Selling price per unit 155

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

55

Fixed cost 3500000

BEP (in units) Fixed cost / contribution per

unit

63636

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

9863636.4

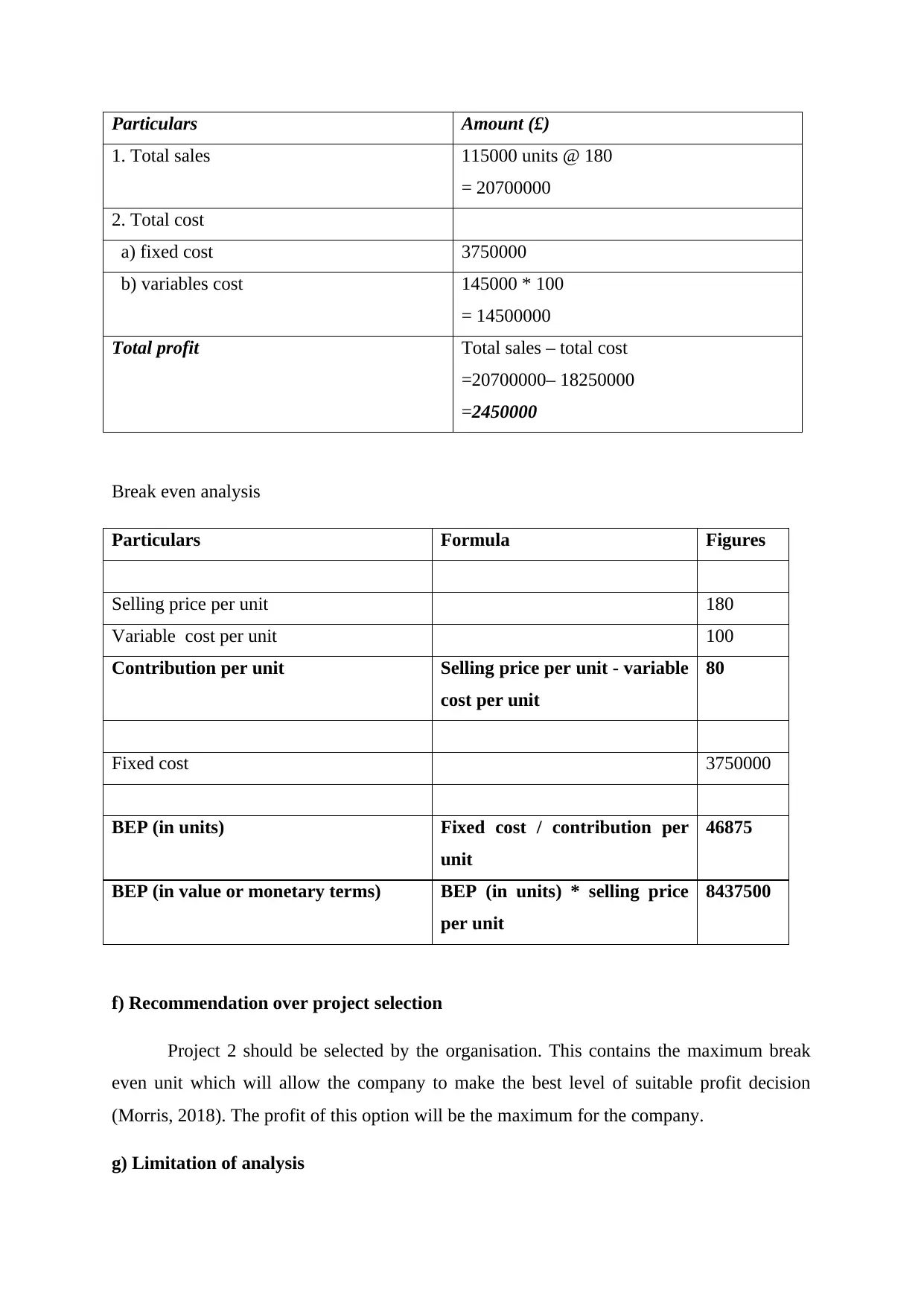

e)Calculating break-even for Proposal 3

Selling price = 180

Fixed cost = 3500000 + 250000 = 3750000

Total sales (units) = 115000

Profit calculation:

Particulars Amount (£)

1. Total sales 115000 units @ 180

= 20700000

2. Total cost

a) fixed cost 3750000

b) variables cost 145000 * 100

= 14500000

Total profit Total sales – total cost

=20700000– 18250000

=2450000

Break even analysis

Particulars Formula Figures

Selling price per unit 180

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

80

Fixed cost 3750000

BEP (in units) Fixed cost / contribution per

unit

46875

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

8437500

f) Recommendation over project selection

Project 2 should be selected by the organisation. This contains the maximum break

even unit which will allow the company to make the best level of suitable profit decision

(Morris, 2018). The profit of this option will be the maximum for the company.

g) Limitation of analysis

1. Total sales 115000 units @ 180

= 20700000

2. Total cost

a) fixed cost 3750000

b) variables cost 145000 * 100

= 14500000

Total profit Total sales – total cost

=20700000– 18250000

=2450000

Break even analysis

Particulars Formula Figures

Selling price per unit 180

Variable cost per unit 100

Contribution per unit Selling price per unit - variable

cost per unit

80

Fixed cost 3750000

BEP (in units) Fixed cost / contribution per

unit

46875

BEP (in value or monetary terms) BEP (in units) * selling price

per unit

8437500

f) Recommendation over project selection

Project 2 should be selected by the organisation. This contains the maximum break

even unit which will allow the company to make the best level of suitable profit decision

(Morris, 2018). The profit of this option will be the maximum for the company.

g) Limitation of analysis

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The above analysis is assumed that the other factors associated with the business are

influencing in the same manner over every proposal (Zahid and Simga-Mugan, 2019). Also

the other influence elements related to the investment decision are affecting in the same

capacity.

influencing in the same manner over every proposal (Zahid and Simga-Mugan, 2019). Also

the other influence elements related to the investment decision are affecting in the same

capacity.

REFERENCES

Books and Journal

Cañibano, L., 2018. Accounting and intangibles: Contabilidad e intangibles. Revista de

Contabilidad-Spanish Accounting Review. 21(1). pp.1-6.

Huang, L., 2018. The role of investor gut feel in managing complexity and extreme

risk. Academy of Management Journal. 61(5). pp.1821-1847.

Morris, R., 2018. Early Warning Indicators of Corporate Failure: A critical review of

previous research and further empirical evidence. Routledge.

Zahid, R. A. and Simga-Mugan, C., 2019. An analysis of IFRS and SME-IFRS adoption

determinants: a worldwide study. Emerging Markets Finance and Trade. 55(2).

pp.391-408.

Books and Journal

Cañibano, L., 2018. Accounting and intangibles: Contabilidad e intangibles. Revista de

Contabilidad-Spanish Accounting Review. 21(1). pp.1-6.

Huang, L., 2018. The role of investor gut feel in managing complexity and extreme

risk. Academy of Management Journal. 61(5). pp.1821-1847.

Morris, R., 2018. Early Warning Indicators of Corporate Failure: A critical review of

previous research and further empirical evidence. Routledge.

Zahid, R. A. and Simga-Mugan, C., 2019. An analysis of IFRS and SME-IFRS adoption

determinants: a worldwide study. Emerging Markets Finance and Trade. 55(2).

pp.391-408.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.