Comprehensive Accounting for Cost Structure Solutions

VerifiedAdded on 2019/10/30

|13

|1496

|213

Homework Assignment

AI Summary

This document presents a detailed solution to an accounting assignment focusing on cost structure. It includes journal entries for employee stock options, foreign currency transactions, forward rate agreements, and lease capitalization. The solution also covers bond valuation, including calculations for issue price and amortization of premium. Furthermore, it addresses topics such as goodwill calculation in business combinations, revaluation and impairment of assets, and accounting for dismantling costs. The assignment incorporates practical examples and calculations to illustrate key accounting concepts, providing a comprehensive understanding of cost structure and related financial reporting requirements. Finally, the document includes a bibliography of relevant accounting textbooks and resources.

Running head: ACCOUNTING FOR COST STRUCTURE

Accounting for Cost Structure

Name of the Student:

Name of the University:

Author’s Note:

Accounting for Cost Structure

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR COST STRUCTURE

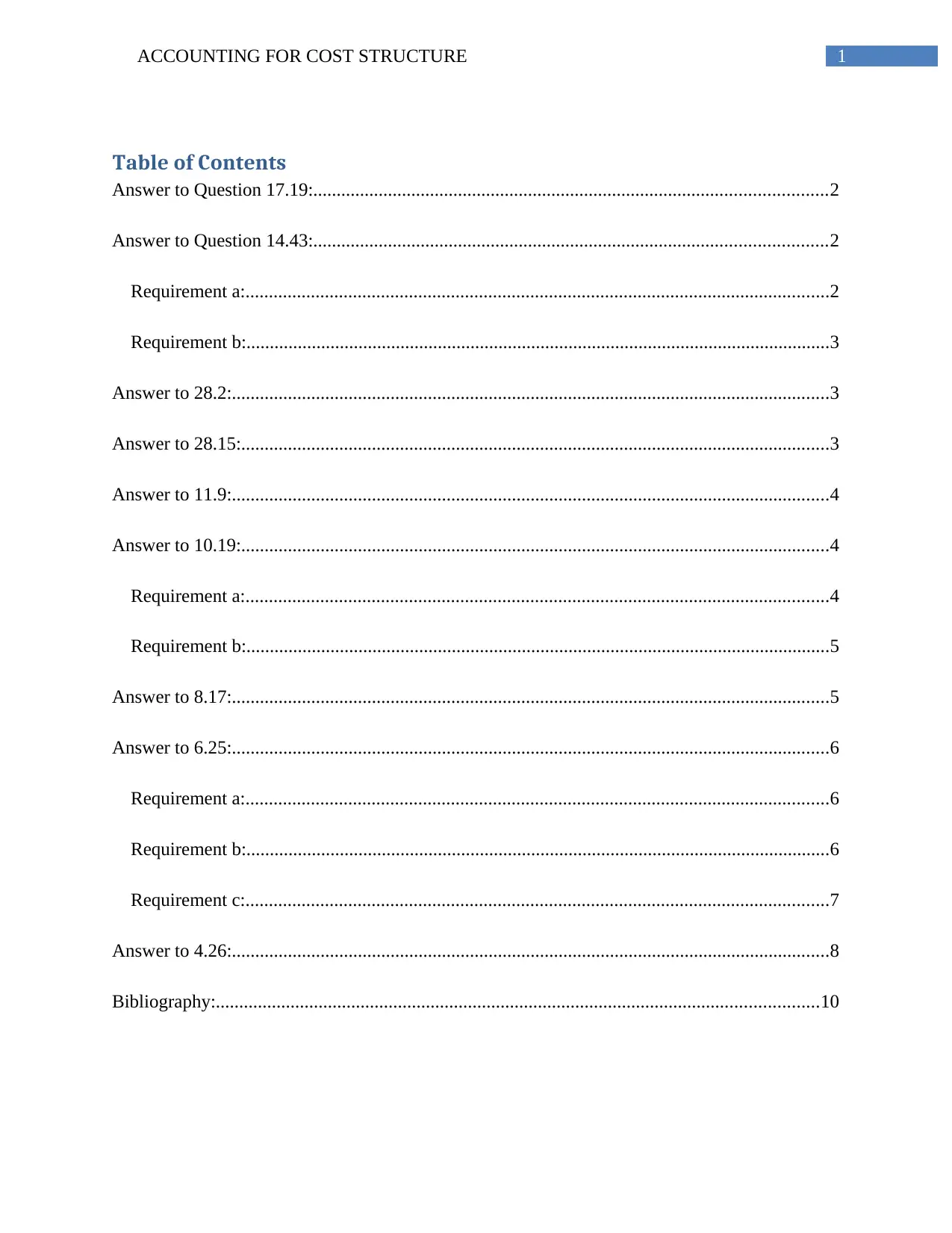

Table of Contents

Answer to Question 17.19:..............................................................................................................2

Answer to Question 14.43:..............................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Answer to 28.2:................................................................................................................................3

Answer to 28.15:..............................................................................................................................3

Answer to 11.9:................................................................................................................................4

Answer to 10.19:..............................................................................................................................4

Requirement a:.............................................................................................................................4

Requirement b:.............................................................................................................................5

Answer to 8.17:................................................................................................................................5

Answer to 6.25:................................................................................................................................6

Requirement a:.............................................................................................................................6

Requirement b:.............................................................................................................................6

Requirement c:.............................................................................................................................7

Answer to 4.26:................................................................................................................................8

Bibliography:.................................................................................................................................10

Table of Contents

Answer to Question 17.19:..............................................................................................................2

Answer to Question 14.43:..............................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Answer to 28.2:................................................................................................................................3

Answer to 28.15:..............................................................................................................................3

Answer to 11.9:................................................................................................................................4

Answer to 10.19:..............................................................................................................................4

Requirement a:.............................................................................................................................4

Requirement b:.............................................................................................................................5

Answer to 8.17:................................................................................................................................5

Answer to 6.25:................................................................................................................................6

Requirement a:.............................................................................................................................6

Requirement b:.............................................................................................................................6

Requirement c:.............................................................................................................................7

Answer to 4.26:................................................................................................................................8

Bibliography:.................................................................................................................................10

2ACCOUNTING FOR COST STRUCTURE

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING FOR COST STRUCTURE

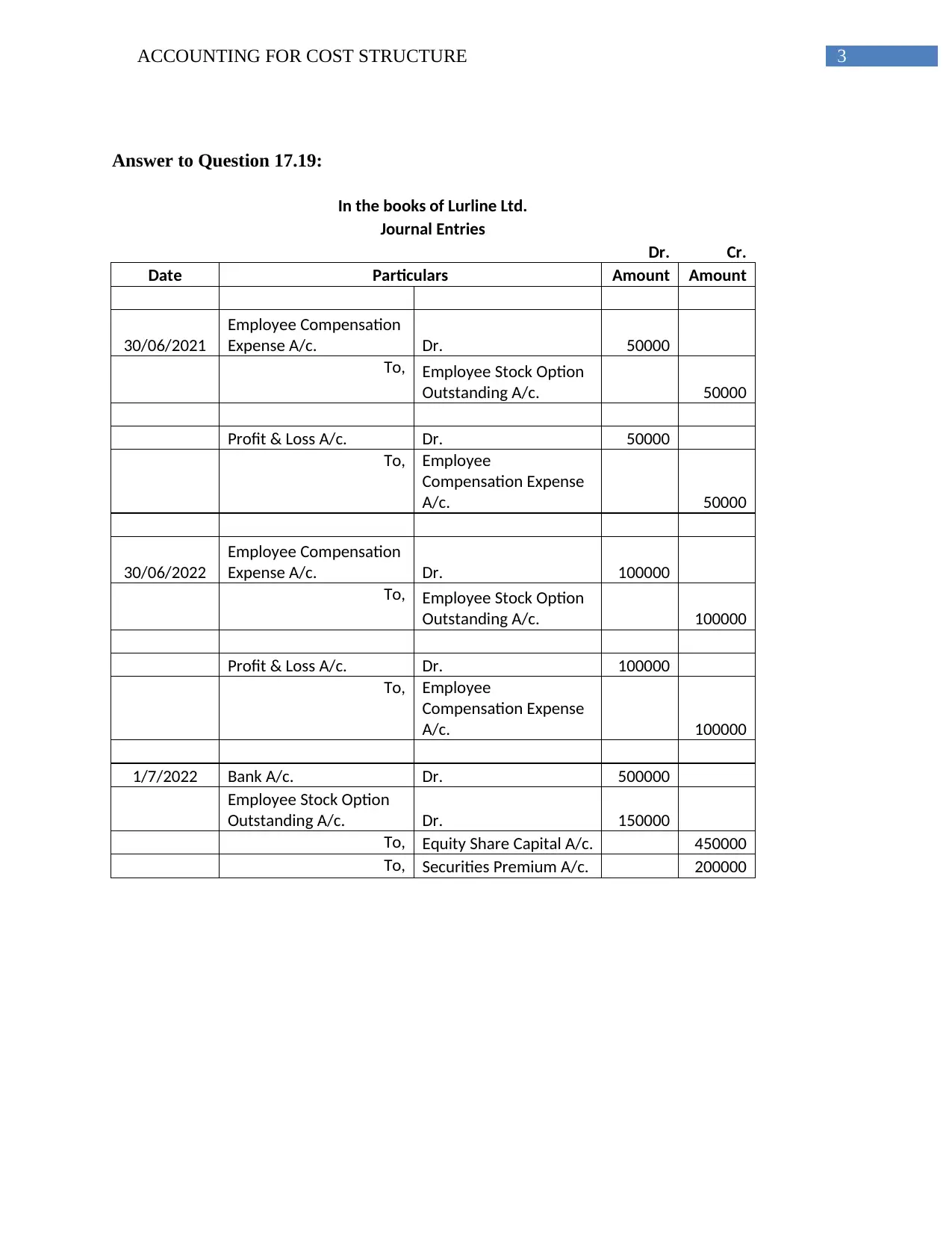

Answer to Question 17.19:

In the books of Lurline Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/06/2021

Employee Compensation

Expense A/c. Dr. 50000

To, Employee Stock Option

Outstanding A/c. 50000

Profit & Loss A/c. Dr. 50000

To, Employee

Compensation Expense

A/c. 50000

30/06/2022

Employee Compensation

Expense A/c. Dr. 100000

To, Employee Stock Option

Outstanding A/c. 100000

Profit & Loss A/c. Dr. 100000

To, Employee

Compensation Expense

A/c. 100000

1/7/2022 Bank A/c. Dr. 500000

Employee Stock Option

Outstanding A/c. Dr. 150000

To, Equity Share Capital A/c. 450000

To, Securities Premium A/c. 200000

Answer to Question 17.19:

In the books of Lurline Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/06/2021

Employee Compensation

Expense A/c. Dr. 50000

To, Employee Stock Option

Outstanding A/c. 50000

Profit & Loss A/c. Dr. 50000

To, Employee

Compensation Expense

A/c. 50000

30/06/2022

Employee Compensation

Expense A/c. Dr. 100000

To, Employee Stock Option

Outstanding A/c. 100000

Profit & Loss A/c. Dr. 100000

To, Employee

Compensation Expense

A/c. 100000

1/7/2022 Bank A/c. Dr. 500000

Employee Stock Option

Outstanding A/c. Dr. 150000

To, Equity Share Capital A/c. 450000

To, Securities Premium A/c. 200000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR COST STRUCTURE

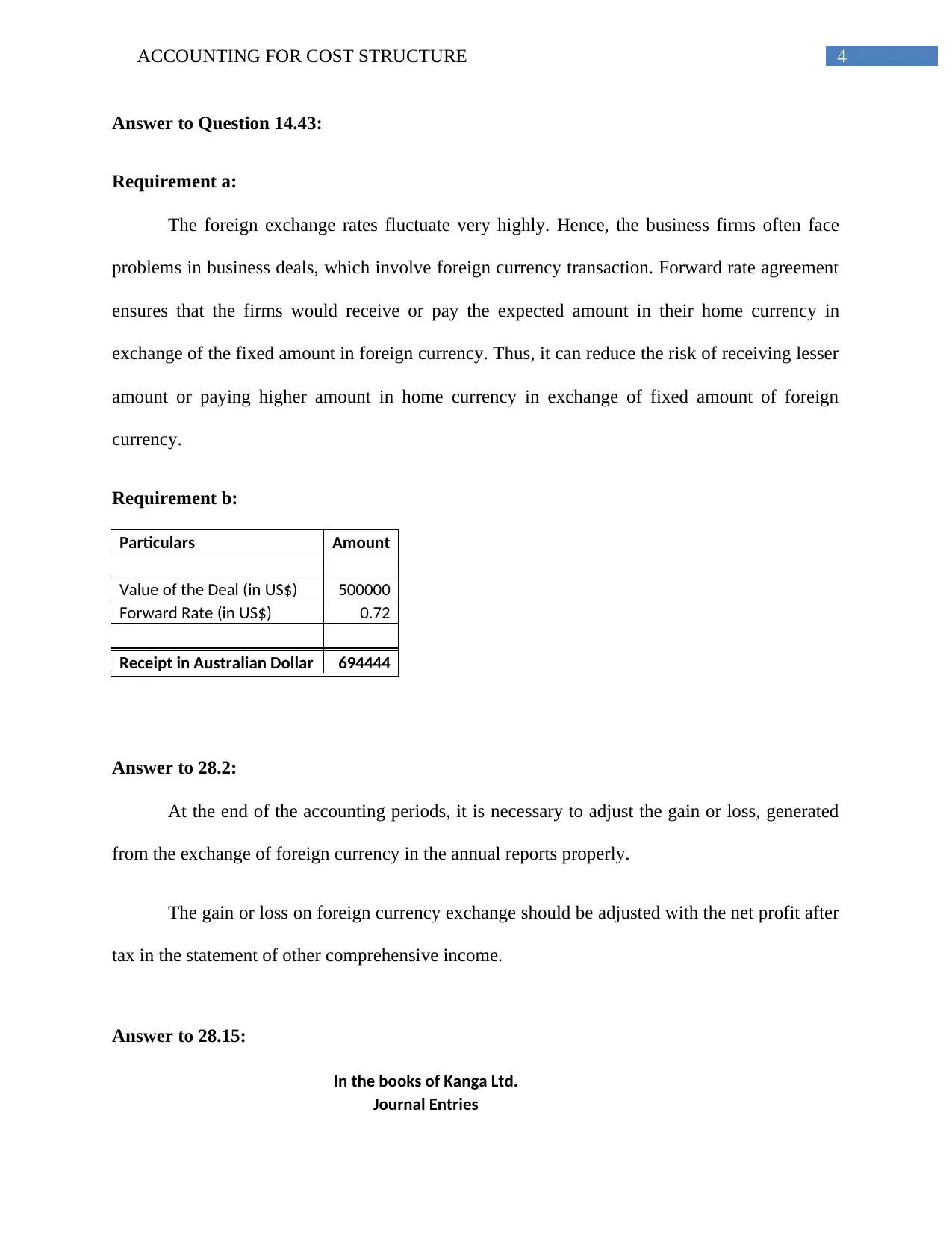

Answer to Question 14.43:

Requirement a:

The foreign exchange rates fluctuate very highly. Hence, the business firms often face

problems in business deals, which involve foreign currency transaction. Forward rate agreement

ensures that the firms would receive or pay the expected amount in their home currency in

exchange of the fixed amount in foreign currency. Thus, it can reduce the risk of receiving lesser

amount or paying higher amount in home currency in exchange of fixed amount of foreign

currency.

Requirement b:

Particulars Amount

Value of the Deal (in US$) 500000

Forward Rate (in US$) 0.72

Receipt in Australian Dollar 694444

Answer to 28.2:

At the end of the accounting periods, it is necessary to adjust the gain or loss, generated

from the exchange of foreign currency in the annual reports properly.

The gain or loss on foreign currency exchange should be adjusted with the net profit after

tax in the statement of other comprehensive income.

Answer to 28.15:

In the books of Kanga Ltd.

Journal Entries

Answer to Question 14.43:

Requirement a:

The foreign exchange rates fluctuate very highly. Hence, the business firms often face

problems in business deals, which involve foreign currency transaction. Forward rate agreement

ensures that the firms would receive or pay the expected amount in their home currency in

exchange of the fixed amount in foreign currency. Thus, it can reduce the risk of receiving lesser

amount or paying higher amount in home currency in exchange of fixed amount of foreign

currency.

Requirement b:

Particulars Amount

Value of the Deal (in US$) 500000

Forward Rate (in US$) 0.72

Receipt in Australian Dollar 694444

Answer to 28.2:

At the end of the accounting periods, it is necessary to adjust the gain or loss, generated

from the exchange of foreign currency in the annual reports properly.

The gain or loss on foreign currency exchange should be adjusted with the net profit after

tax in the statement of other comprehensive income.

Answer to 28.15:

In the books of Kanga Ltd.

Journal Entries

5ACCOUNTING FOR COST STRUCTURE

Dr. Cr.

Date Particulars Amount Amount

30/6/201

8 Derivative Position A/c. Dr. 595238

To, Other Comprehensive

Income A/c. 595238

1/8/2018 Derivative Position A/c. Dr. 101626

To, Other Comprehensive

Income A/c. 101626

Other Comprehensive

Income A/c. Dr. 696864

Purchase A/c. Dr.

357142

9

To,

Bank A/c.

357142

9

To, Derivative A/c. 696864

Answer to 11.9:

If the lease transaction is to be capitalized, then the lesser of fair market value of the

present values of lease payments should be recorded as the amount of lease assets and the

amount of lease liability should be equal to lease assets.

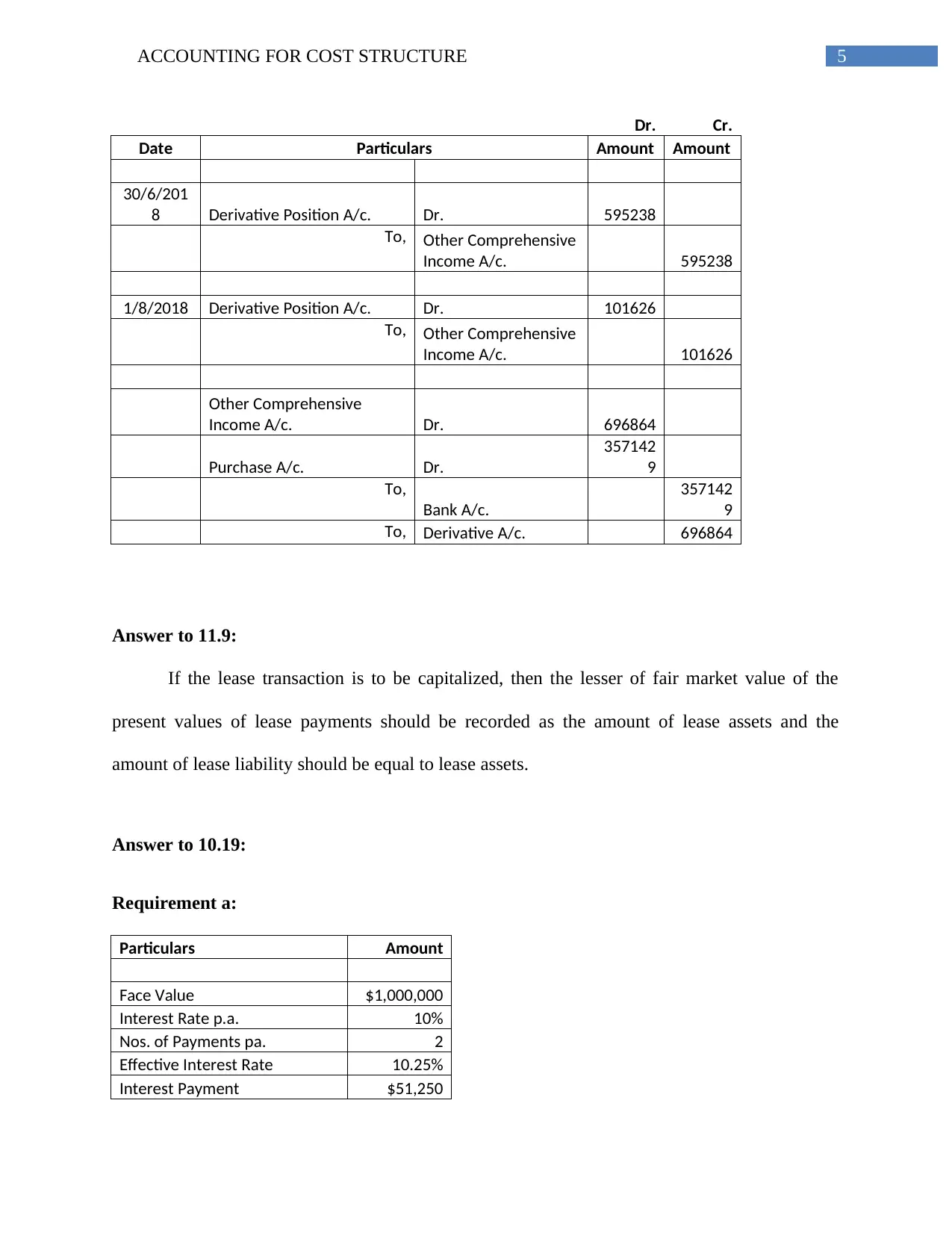

Answer to 10.19:

Requirement a:

Particulars Amount

Face Value $1,000,000

Interest Rate p.a. 10%

Nos. of Payments pa. 2

Effective Interest Rate 10.25%

Interest Payment $51,250

Dr. Cr.

Date Particulars Amount Amount

30/6/201

8 Derivative Position A/c. Dr. 595238

To, Other Comprehensive

Income A/c. 595238

1/8/2018 Derivative Position A/c. Dr. 101626

To, Other Comprehensive

Income A/c. 101626

Other Comprehensive

Income A/c. Dr. 696864

Purchase A/c. Dr.

357142

9

To,

Bank A/c.

357142

9

To, Derivative A/c. 696864

Answer to 11.9:

If the lease transaction is to be capitalized, then the lesser of fair market value of the

present values of lease payments should be recorded as the amount of lease assets and the

amount of lease liability should be equal to lease assets.

Answer to 10.19:

Requirement a:

Particulars Amount

Face Value $1,000,000

Interest Rate p.a. 10%

Nos. of Payments pa. 2

Effective Interest Rate 10.25%

Interest Payment $51,250

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR COST STRUCTURE

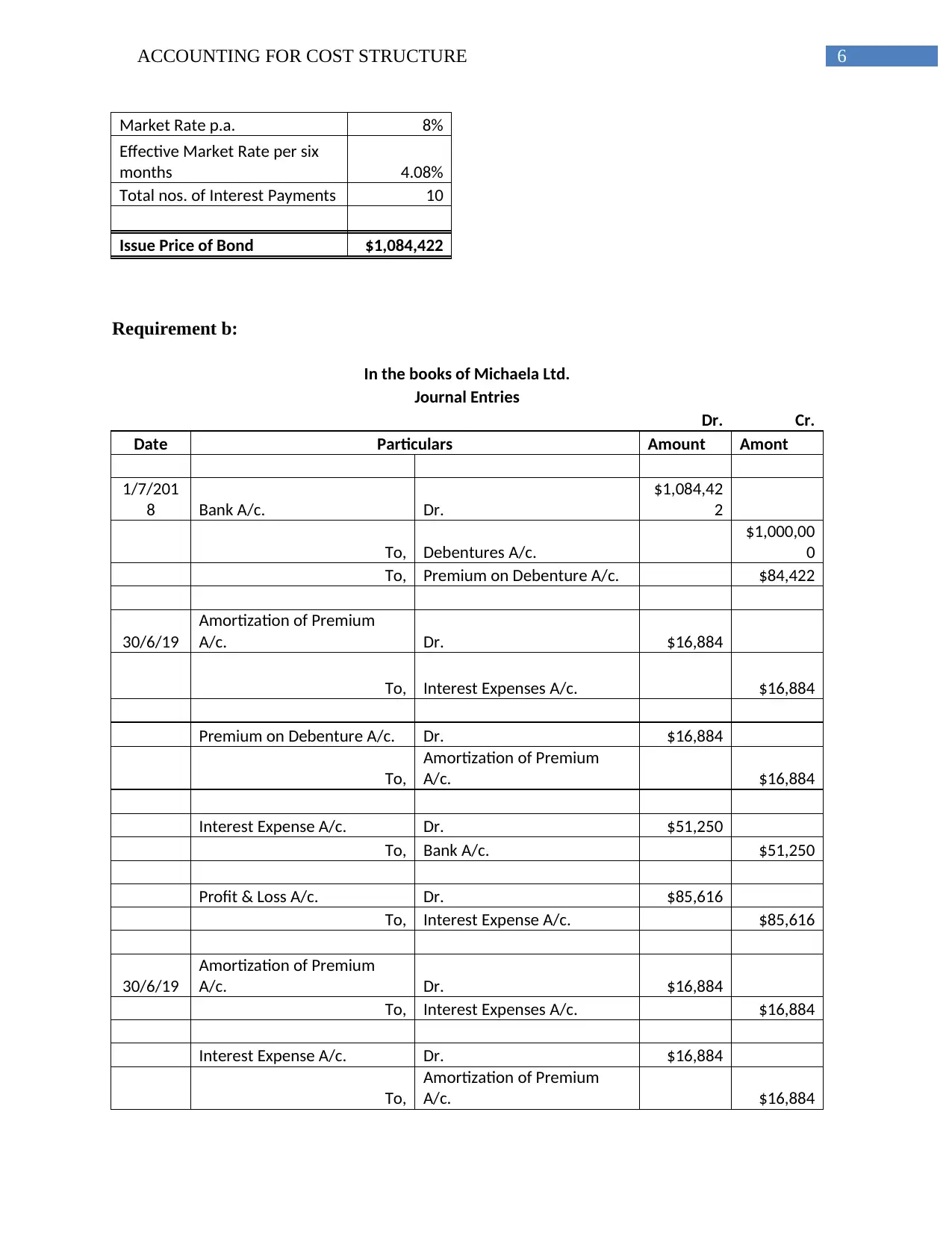

Market Rate p.a. 8%

Effective Market Rate per six

months 4.08%

Total nos. of Interest Payments 10

Issue Price of Bond $1,084,422

Requirement b:

In the books of Michaela Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amont

1/7/201

8 Bank A/c. Dr.

$1,084,42

2

To, Debentures A/c.

$1,000,00

0

To, Premium on Debenture A/c. $84,422

30/6/19

Amortization of Premium

A/c. Dr. $16,884

To, Interest Expenses A/c. $16,884

Premium on Debenture A/c. Dr. $16,884

To,

Amortization of Premium

A/c. $16,884

Interest Expense A/c. Dr. $51,250

To, Bank A/c. $51,250

Profit & Loss A/c. Dr. $85,616

To, Interest Expense A/c. $85,616

30/6/19

Amortization of Premium

A/c. Dr. $16,884

To, Interest Expenses A/c. $16,884

Interest Expense A/c. Dr. $16,884

To,

Amortization of Premium

A/c. $16,884

Market Rate p.a. 8%

Effective Market Rate per six

months 4.08%

Total nos. of Interest Payments 10

Issue Price of Bond $1,084,422

Requirement b:

In the books of Michaela Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amont

1/7/201

8 Bank A/c. Dr.

$1,084,42

2

To, Debentures A/c.

$1,000,00

0

To, Premium on Debenture A/c. $84,422

30/6/19

Amortization of Premium

A/c. Dr. $16,884

To, Interest Expenses A/c. $16,884

Premium on Debenture A/c. Dr. $16,884

To,

Amortization of Premium

A/c. $16,884

Interest Expense A/c. Dr. $51,250

To, Bank A/c. $51,250

Profit & Loss A/c. Dr. $85,616

To, Interest Expense A/c. $85,616

30/6/19

Amortization of Premium

A/c. Dr. $16,884

To, Interest Expenses A/c. $16,884

Interest Expense A/c. Dr. $16,884

To,

Amortization of Premium

A/c. $16,884

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR COST STRUCTURE

Interest Expense A/c. Dr. $51,250

To, Bank A/c. $51,250

Profit & Loss A/c. Dr. $85,616

To, Interest Expense A/c. $85,616

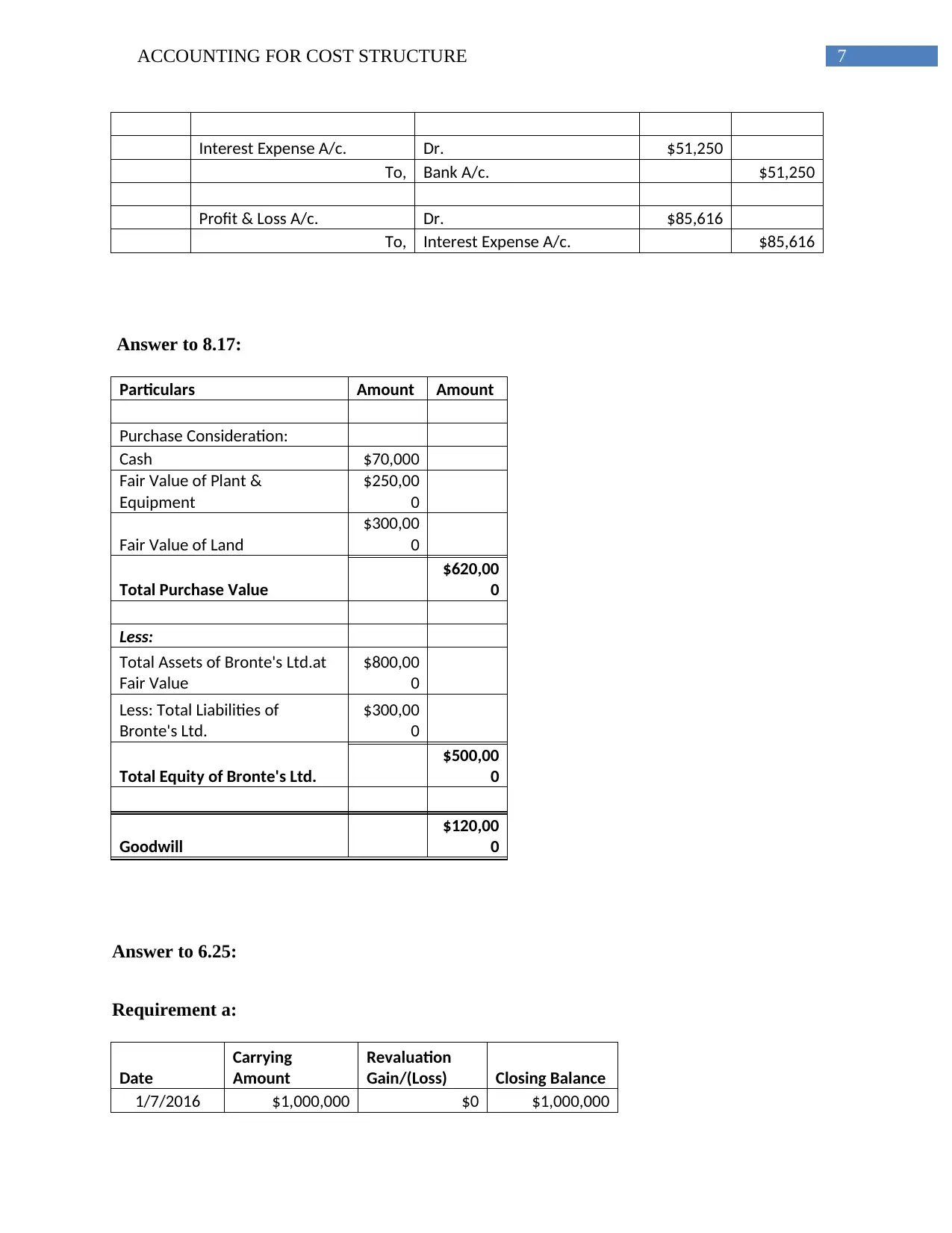

Answer to 8.17:

Particulars Amount Amount

Purchase Consideration:

Cash $70,000

Fair Value of Plant &

Equipment

$250,00

0

Fair Value of Land

$300,00

0

Total Purchase Value

$620,00

0

Less:

Total Assets of Bronte's Ltd.at

Fair Value

$800,00

0

Less: Total Liabilities of

Bronte's Ltd.

$300,00

0

Total Equity of Bronte's Ltd.

$500,00

0

Goodwill

$120,00

0

Answer to 6.25:

Requirement a:

Date

Carrying

Amount

Revaluation

Gain/(Loss) Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

Interest Expense A/c. Dr. $51,250

To, Bank A/c. $51,250

Profit & Loss A/c. Dr. $85,616

To, Interest Expense A/c. $85,616

Answer to 8.17:

Particulars Amount Amount

Purchase Consideration:

Cash $70,000

Fair Value of Plant &

Equipment

$250,00

0

Fair Value of Land

$300,00

0

Total Purchase Value

$620,00

0

Less:

Total Assets of Bronte's Ltd.at

Fair Value

$800,00

0

Less: Total Liabilities of

Bronte's Ltd.

$300,00

0

Total Equity of Bronte's Ltd.

$500,00

0

Goodwill

$120,00

0

Answer to 6.25:

Requirement a:

Date

Carrying

Amount

Revaluation

Gain/(Loss) Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

8ACCOUNTING FOR COST STRUCTURE

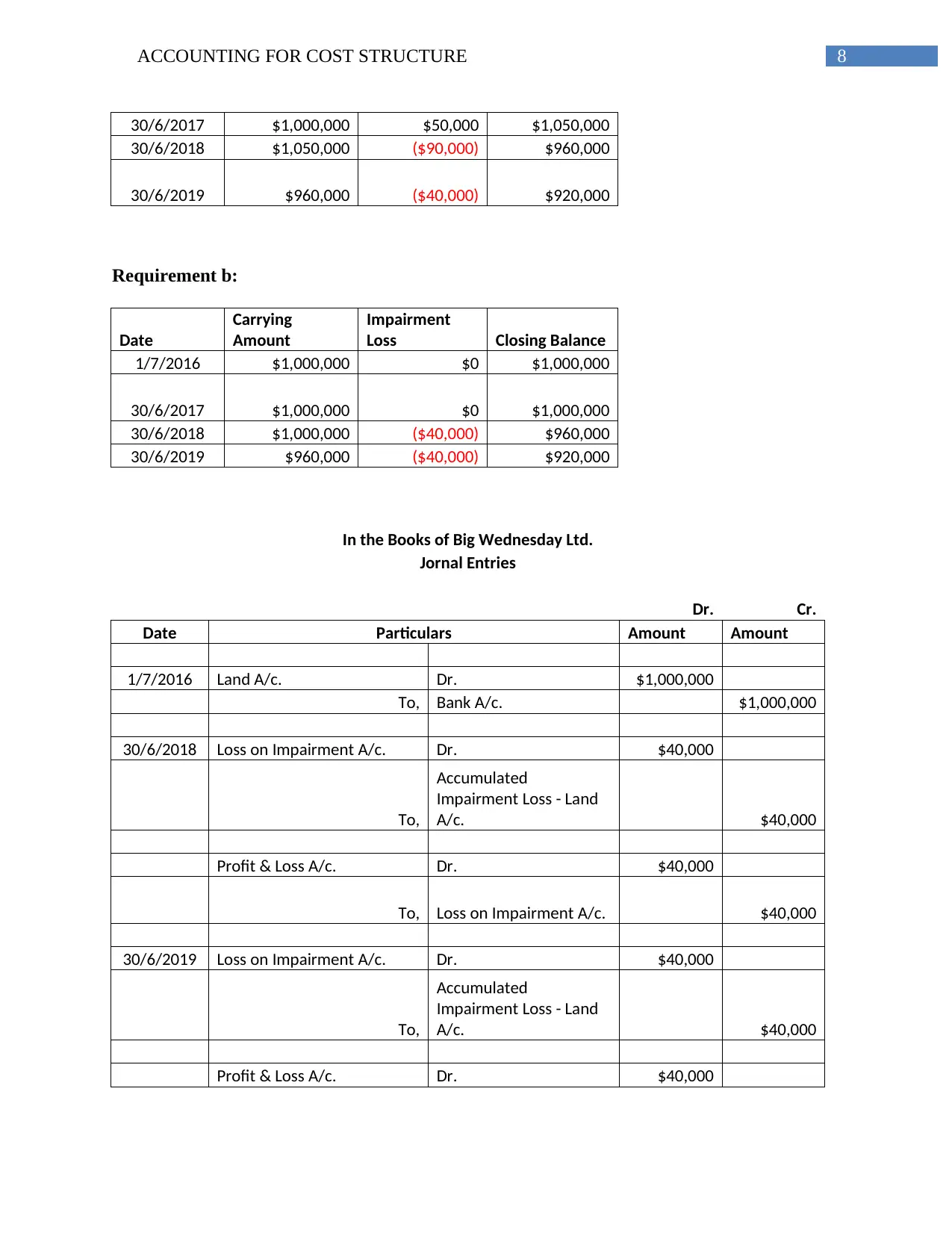

30/6/2017 $1,000,000 $50,000 $1,050,000

30/6/2018 $1,050,000 ($90,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

Requirement b:

Date

Carrying

Amount

Impairment

Loss Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

30/6/2017 $1,000,000 $0 $1,000,000

30/6/2018 $1,000,000 ($40,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

In the Books of Big Wednesday Ltd.

Jornal Entries

Dr. Cr.

Date Particulars Amount Amount

1/7/2016 Land A/c. Dr. $1,000,000

To, Bank A/c. $1,000,000

30/6/2018 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss - Land

A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To, Loss on Impairment A/c. $40,000

30/6/2019 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss - Land

A/c. $40,000

Profit & Loss A/c. Dr. $40,000

30/6/2017 $1,000,000 $50,000 $1,050,000

30/6/2018 $1,050,000 ($90,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

Requirement b:

Date

Carrying

Amount

Impairment

Loss Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

30/6/2017 $1,000,000 $0 $1,000,000

30/6/2018 $1,000,000 ($40,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

In the Books of Big Wednesday Ltd.

Jornal Entries

Dr. Cr.

Date Particulars Amount Amount

1/7/2016 Land A/c. Dr. $1,000,000

To, Bank A/c. $1,000,000

30/6/2018 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss - Land

A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To, Loss on Impairment A/c. $40,000

30/6/2019 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss - Land

A/c. $40,000

Profit & Loss A/c. Dr. $40,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING FOR COST STRUCTURE

To, Loss on Impairment A/c. $40,000

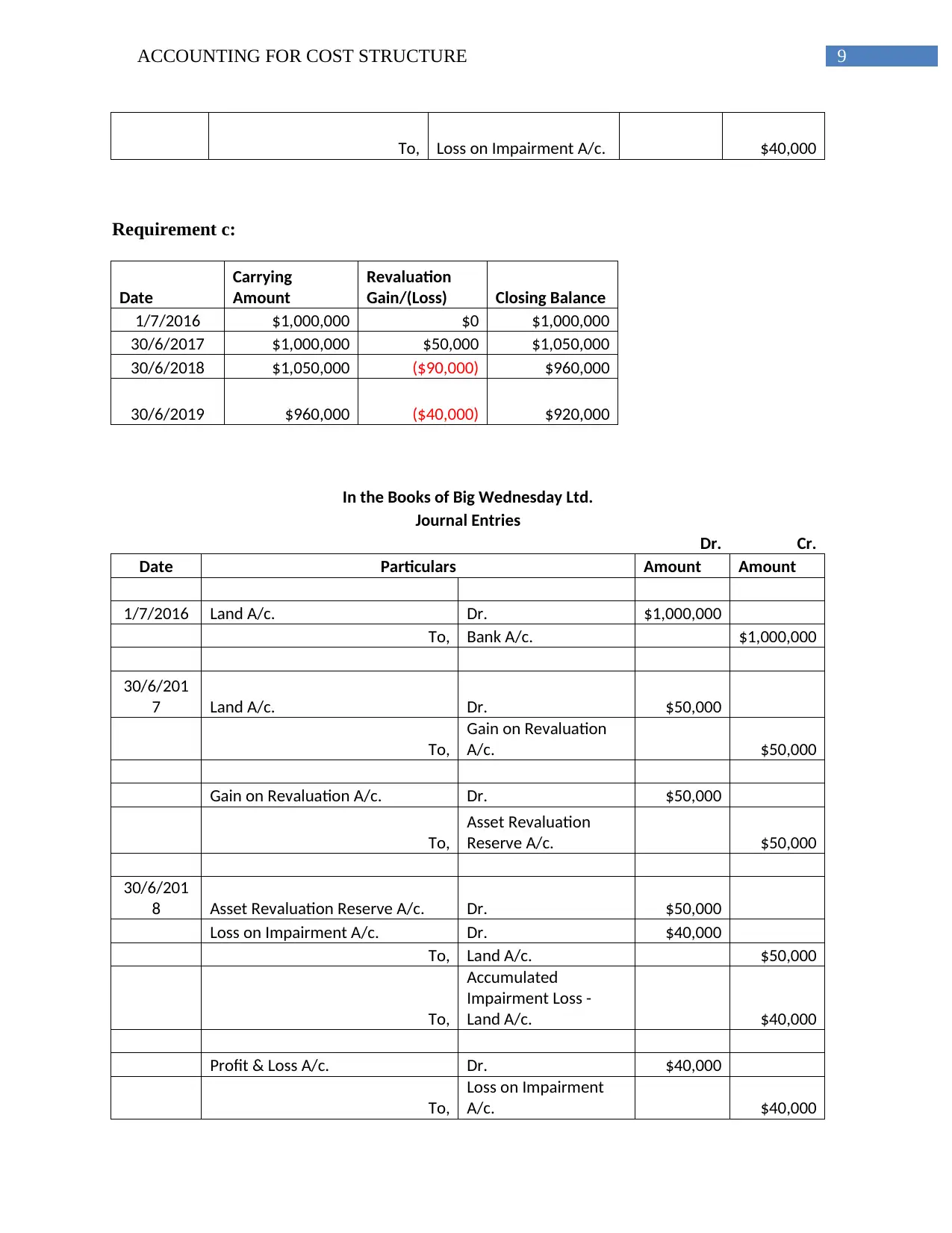

Requirement c:

Date

Carrying

Amount

Revaluation

Gain/(Loss) Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

30/6/2017 $1,000,000 $50,000 $1,050,000

30/6/2018 $1,050,000 ($90,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

In the Books of Big Wednesday Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

1/7/2016 Land A/c. Dr. $1,000,000

To, Bank A/c. $1,000,000

30/6/201

7 Land A/c. Dr. $50,000

To,

Gain on Revaluation

A/c. $50,000

Gain on Revaluation A/c. Dr. $50,000

To,

Asset Revaluation

Reserve A/c. $50,000

30/6/201

8 Asset Revaluation Reserve A/c. Dr. $50,000

Loss on Impairment A/c. Dr. $40,000

To, Land A/c. $50,000

To,

Accumulated

Impairment Loss -

Land A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To,

Loss on Impairment

A/c. $40,000

To, Loss on Impairment A/c. $40,000

Requirement c:

Date

Carrying

Amount

Revaluation

Gain/(Loss) Closing Balance

1/7/2016 $1,000,000 $0 $1,000,000

30/6/2017 $1,000,000 $50,000 $1,050,000

30/6/2018 $1,050,000 ($90,000) $960,000

30/6/2019 $960,000 ($40,000) $920,000

In the Books of Big Wednesday Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

1/7/2016 Land A/c. Dr. $1,000,000

To, Bank A/c. $1,000,000

30/6/201

7 Land A/c. Dr. $50,000

To,

Gain on Revaluation

A/c. $50,000

Gain on Revaluation A/c. Dr. $50,000

To,

Asset Revaluation

Reserve A/c. $50,000

30/6/201

8 Asset Revaluation Reserve A/c. Dr. $50,000

Loss on Impairment A/c. Dr. $40,000

To, Land A/c. $50,000

To,

Accumulated

Impairment Loss -

Land A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To,

Loss on Impairment

A/c. $40,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING FOR COST STRUCTURE

30/6/201

9 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss -

Land A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To,

Loss on Impairment

A/c. $40,000

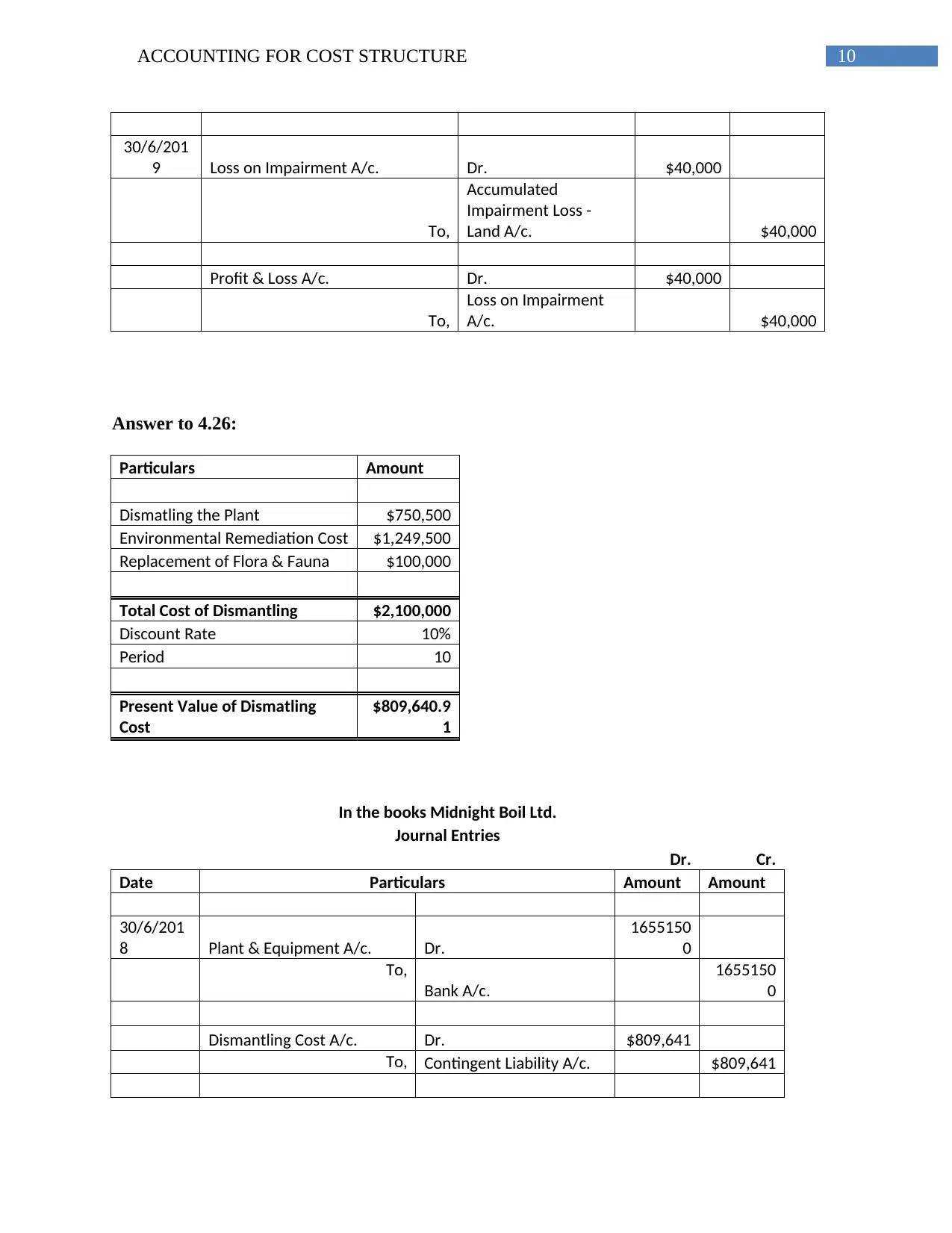

Answer to 4.26:

Particulars Amount

Dismatling the Plant $750,500

Environmental Remediation Cost $1,249,500

Replacement of Flora & Fauna $100,000

Total Cost of Dismantling $2,100,000

Discount Rate 10%

Period 10

Present Value of Dismatling

Cost

$809,640.9

1

In the books Midnight Boil Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/6/201

8 Plant & Equipment A/c. Dr.

1655150

0

To,

Bank A/c.

1655150

0

Dismantling Cost A/c. Dr. $809,641

To, Contingent Liability A/c. $809,641

30/6/201

9 Loss on Impairment A/c. Dr. $40,000

To,

Accumulated

Impairment Loss -

Land A/c. $40,000

Profit & Loss A/c. Dr. $40,000

To,

Loss on Impairment

A/c. $40,000

Answer to 4.26:

Particulars Amount

Dismatling the Plant $750,500

Environmental Remediation Cost $1,249,500

Replacement of Flora & Fauna $100,000

Total Cost of Dismantling $2,100,000

Discount Rate 10%

Period 10

Present Value of Dismatling

Cost

$809,640.9

1

In the books Midnight Boil Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/6/201

8 Plant & Equipment A/c. Dr.

1655150

0

To,

Bank A/c.

1655150

0

Dismantling Cost A/c. Dr. $809,641

To, Contingent Liability A/c. $809,641

11ACCOUNTING FOR COST STRUCTURE

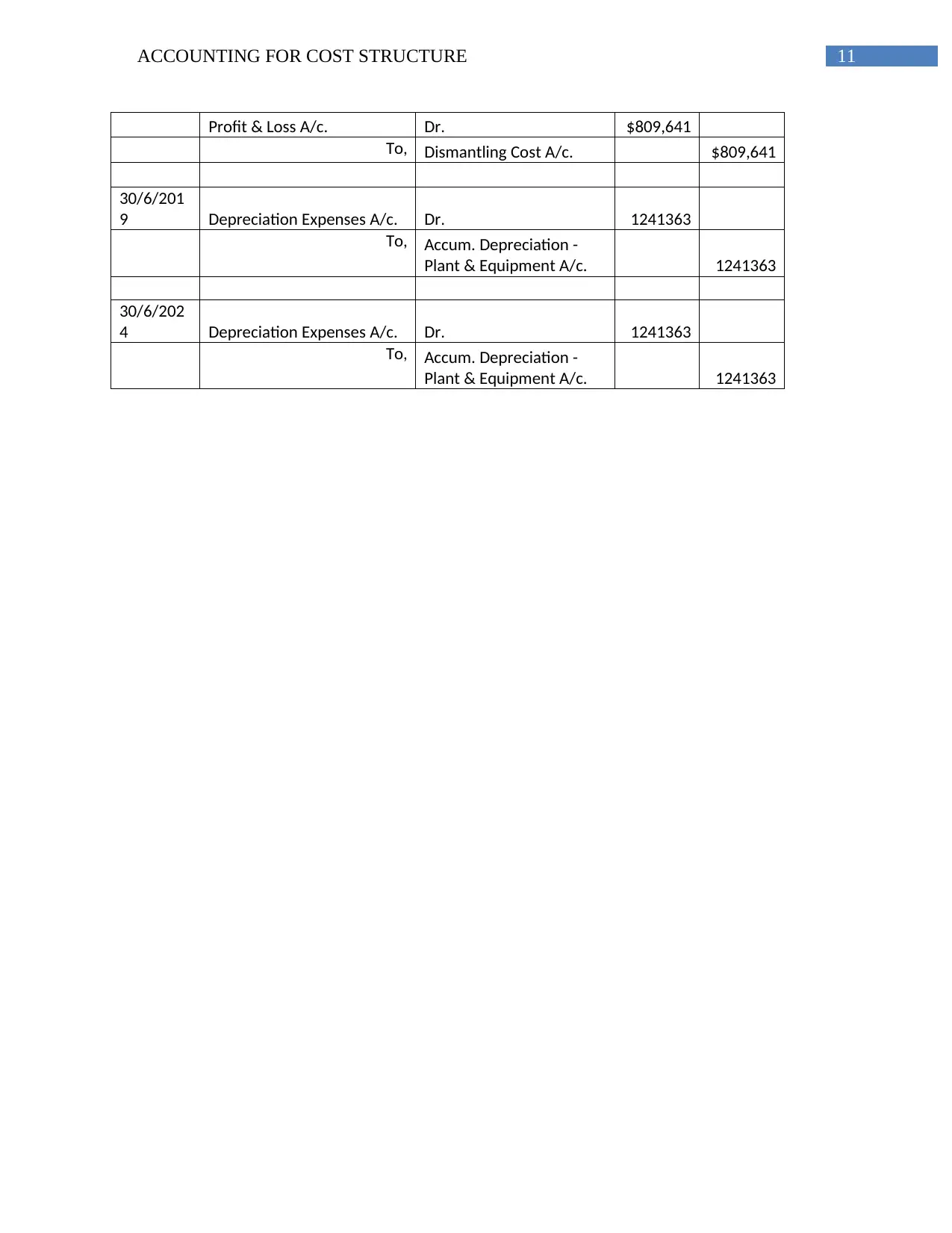

Profit & Loss A/c. Dr. $809,641

To, Dismantling Cost A/c. $809,641

30/6/201

9 Depreciation Expenses A/c. Dr. 1241363

To, Accum. Depreciation -

Plant & Equipment A/c. 1241363

30/6/202

4 Depreciation Expenses A/c. Dr. 1241363

To, Accum. Depreciation -

Plant & Equipment A/c. 1241363

Profit & Loss A/c. Dr. $809,641

To, Dismantling Cost A/c. $809,641

30/6/201

9 Depreciation Expenses A/c. Dr. 1241363

To, Accum. Depreciation -

Plant & Equipment A/c. 1241363

30/6/202

4 Depreciation Expenses A/c. Dr. 1241363

To, Accum. Depreciation -

Plant & Equipment A/c. 1241363

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.