University Financial Analysis: Tesco Plc Performance 2015-2018 Report

VerifiedAdded on 2023/04/10

|19

|3755

|456

Report

AI Summary

This report presents a financial analysis of Tesco Plc, a major British grocery company, covering the period from 2015 to 2018. The analysis employs ratio analysis, including gross profit margin, operating profit margin, return on assets, and return on equity, to assess profitability. Liquidity and leverage are evaluated through current and gearing ratios. Horizontal and vertical analyses are performed to identify trends and changes in financial statement figures. The report also examines Tesco's business and growth strategies, focusing on consumer demands, operational efficiency, and external factors like competition and brand reputation. Limitations of ratio analysis are acknowledged, and the report concludes with an overview of Tesco's financial performance and strategic focus on sustainable growth.

Running head: ACCOUNTING FOR DECISION MAKERS

Accounting for Decision Makers

Name of the Student:

Name of the University:

Author’s Note:

Word Count: 1655

Accounting for Decision Makers

Name of the Student:

Name of the University:

Author’s Note:

Word Count: 1655

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR DECISION MAKERS

Executive Summary

The aim of the report is to conduct a financial analysis on the Tesco Plc. Company and

analyse the financial performance of the company in the trend period of 2015-2018. The

financial analysis of the company was done with the help of the ratio analysis and horizontal

and vertical analysis of the company. Profitability, liquidity and leverage of the company

were some of the key factors that were analysed in the due course of the assignment.

Horizontal and Vertical Analysis of a company are some of the crucial steps that were

performed for analysing the company.

Executive Summary

The aim of the report is to conduct a financial analysis on the Tesco Plc. Company and

analyse the financial performance of the company in the trend period of 2015-2018. The

financial analysis of the company was done with the help of the ratio analysis and horizontal

and vertical analysis of the company. Profitability, liquidity and leverage of the company

were some of the key factors that were analysed in the due course of the assignment.

Horizontal and Vertical Analysis of a company are some of the crucial steps that were

performed for analysing the company.

2ACCOUNTING FOR DECISION MAKERS

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................3

Ratio Analysis........................................................................................................................3

Horizontal and Vertical Analysis...........................................................................................5

Year Wise Performance.........................................................................................................5

Business and Growth Strategy...............................................................................................6

Limitation of Ratio Analysis..................................................................................................6

Conclusion..................................................................................................................................6

References..................................................................................................................................8

Appendix..................................................................................................................................10

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................3

Ratio Analysis........................................................................................................................3

Horizontal and Vertical Analysis...........................................................................................5

Year Wise Performance.........................................................................................................5

Business and Growth Strategy...............................................................................................6

Limitation of Ratio Analysis..................................................................................................6

Conclusion..................................................................................................................................6

References..................................................................................................................................8

Appendix..................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING FOR DECISION MAKERS

Introduction

Tesco Plc. Company is one of the largest Multinational British Grocery Company

operating in the United Kingdom. The company in terms of revenue is said to be the world’s

third largest company globally. The company is having operations globally across seven

major countries Asia, Europe, Thailand, Ireland, Hungary and UK. The company is listed in

the London Stock Exchange with its ticker symbol as “TSCO” and is also a part of the FTSE

100 Index (Wood, Coe and Wrigley 2016).

Discussion

Ratio Analysis

The financial analysis of the Tesco Plc. Company was done with the help of the

quantitative assessment tool; ratio analysis for the trend period 2015-2018.

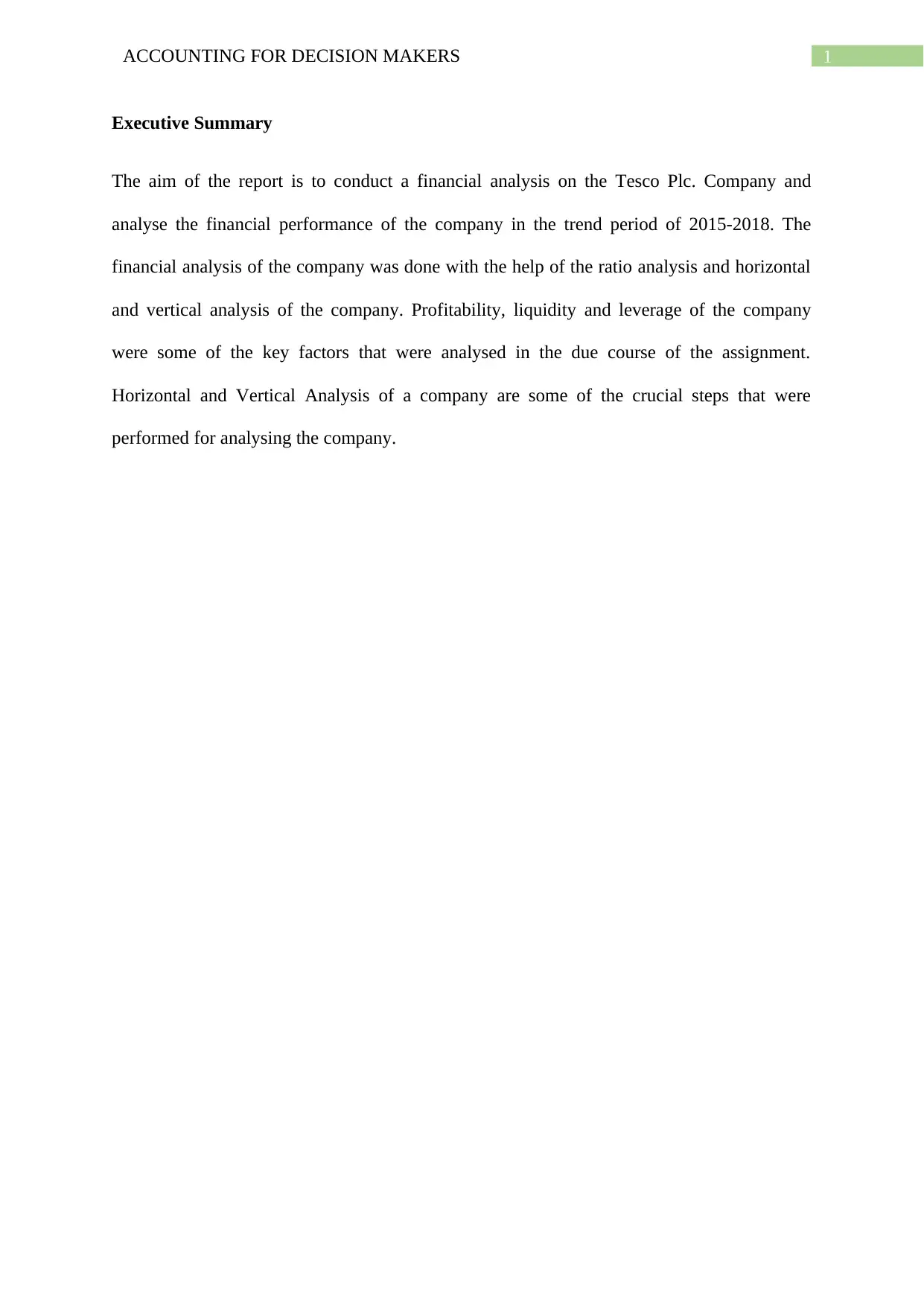

Gross Profit Margin: The gross profitability of the company changed has shown a

consistent upward trend for the company in the trend period from -3.87% in the year 2015

and was around 5.83% in the year 2018 (Wood, Wrigley and Coe 2016). The gross

profitability of the company has been consistent for the company where the growth of

revenue and costs were comparatively equally.

FY 2018 FY 2017 FY 2016 FY 2015

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00% 5.83% 5.19% 5.24%

-3.87%

Gross margin ratio = Gross

profit/Net Sales

Introduction

Tesco Plc. Company is one of the largest Multinational British Grocery Company

operating in the United Kingdom. The company in terms of revenue is said to be the world’s

third largest company globally. The company is having operations globally across seven

major countries Asia, Europe, Thailand, Ireland, Hungary and UK. The company is listed in

the London Stock Exchange with its ticker symbol as “TSCO” and is also a part of the FTSE

100 Index (Wood, Coe and Wrigley 2016).

Discussion

Ratio Analysis

The financial analysis of the Tesco Plc. Company was done with the help of the

quantitative assessment tool; ratio analysis for the trend period 2015-2018.

Gross Profit Margin: The gross profitability of the company changed has shown a

consistent upward trend for the company in the trend period from -3.87% in the year 2015

and was around 5.83% in the year 2018 (Wood, Wrigley and Coe 2016). The gross

profitability of the company has been consistent for the company where the growth of

revenue and costs were comparatively equally.

FY 2018 FY 2017 FY 2016 FY 2015

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00% 5.83% 5.19% 5.24%

-3.87%

Gross margin ratio = Gross

profit/Net Sales

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR DECISION MAKERS

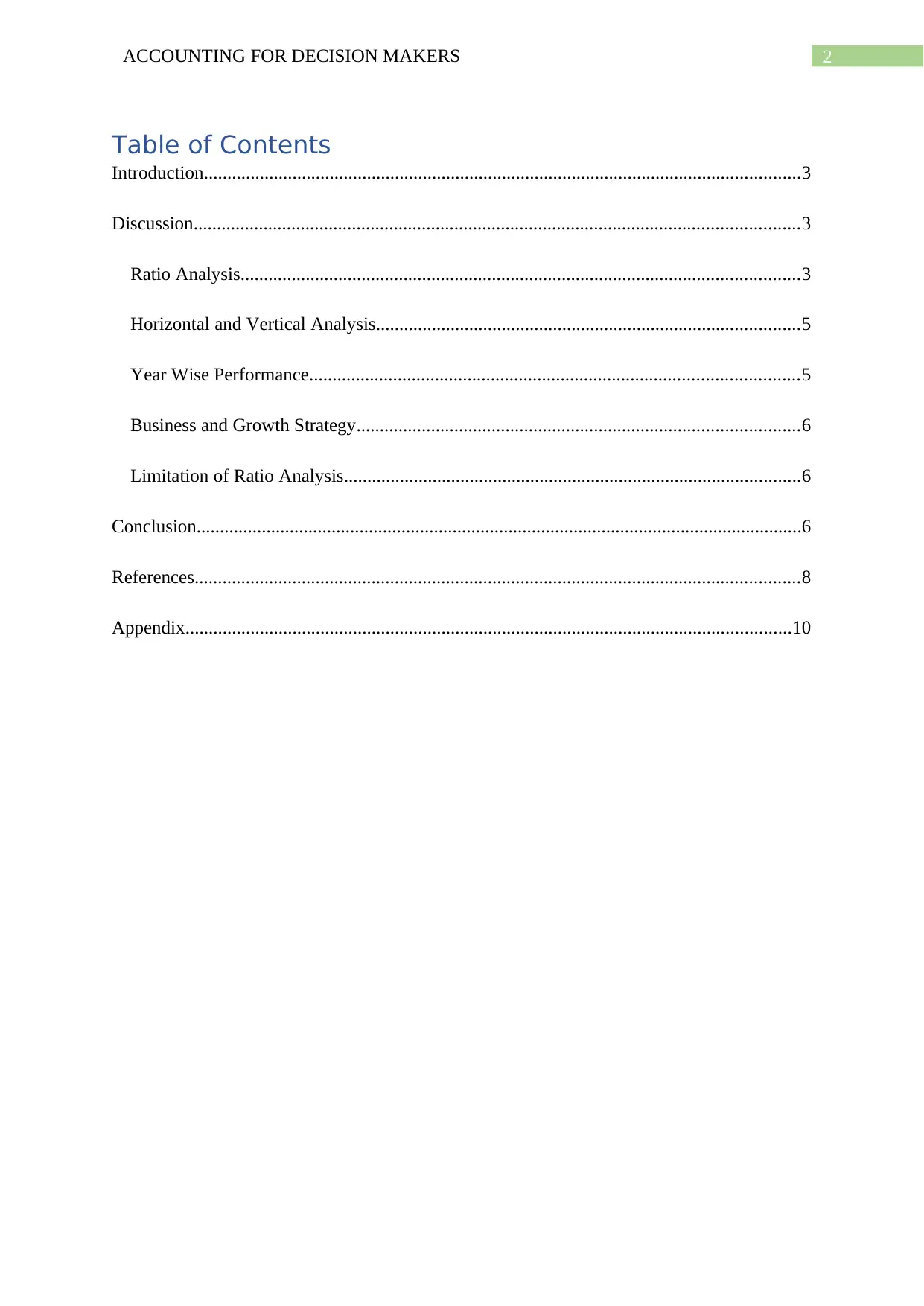

Operating Profit Margin: The operating profit margin of the company saw major increase

reflecting the firm’s ability in management of the resources of the company. The operating

profit for the company was around -10.10% in the year 2015 which increased to 3.20% in

2018 due to the increase in the revenue base with decreasing cost of the company in contrast

to the sales growth (Maynard 2017).

FY 2018 FY 2017 FY 2016 FY 2015

-12.00%

-10.00%

-8.00%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00% 3.20% 1.82% 1.92%

-10.10%

Operating margin ratio = Operating

Income/Net Sales

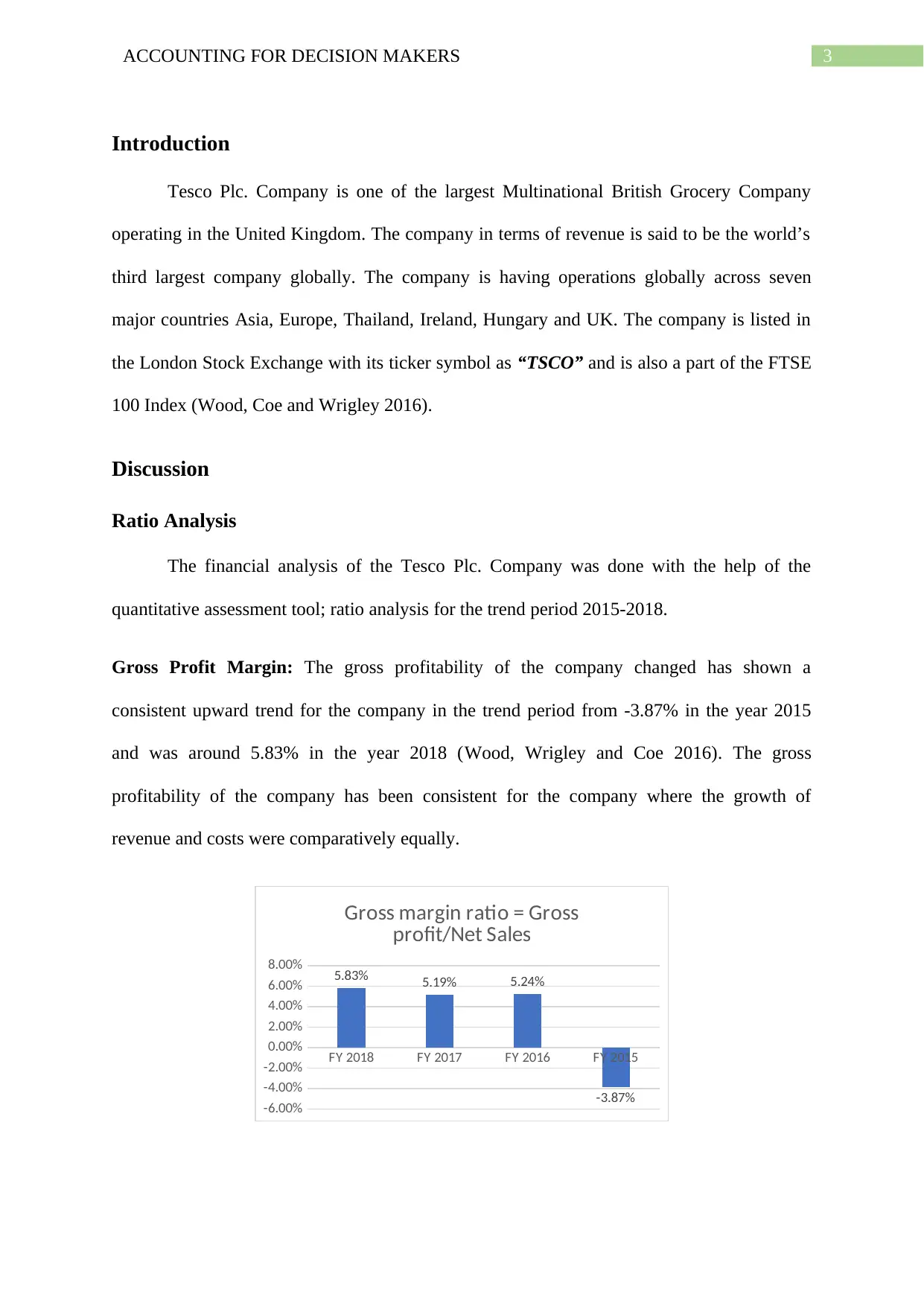

Major Expenses/Revenue: The major expenses of the company reported in the financial

statement was the cost of goods sold for the company, which comprised of 94% of the

revenue earned by the company. The major expenses of the company has consistently

decreased for the company in the trend period analysed for the company.

FY 2018 FY 2017 FY 2016 FY 2015

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

94.17% 94.81% 94.76%

103.87%

Major Expenses/Revenue

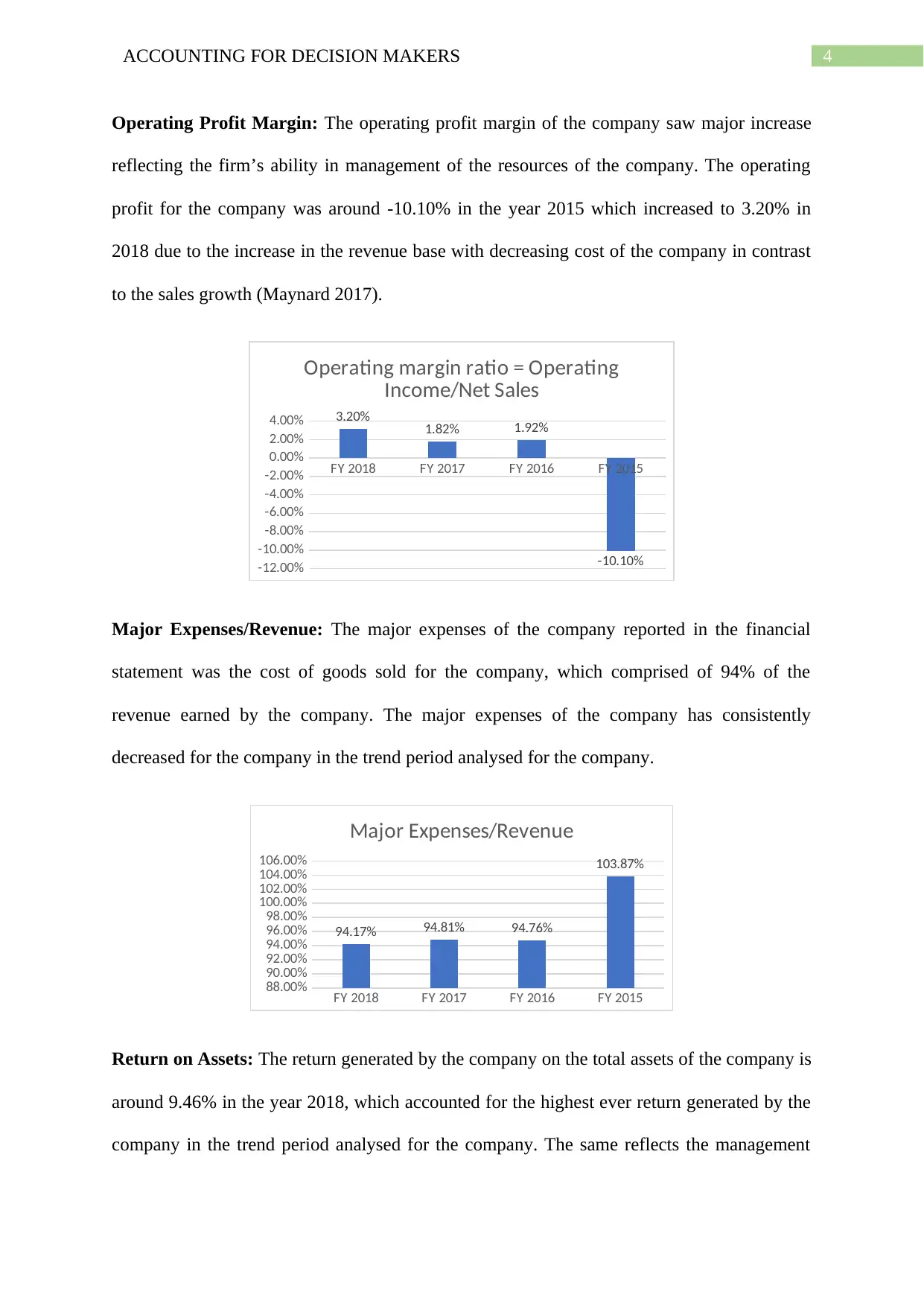

Return on Assets: The return generated by the company on the total assets of the company is

around 9.46% in the year 2018, which accounted for the highest ever return generated by the

company in the trend period analysed for the company. The same reflects the management

Operating Profit Margin: The operating profit margin of the company saw major increase

reflecting the firm’s ability in management of the resources of the company. The operating

profit for the company was around -10.10% in the year 2015 which increased to 3.20% in

2018 due to the increase in the revenue base with decreasing cost of the company in contrast

to the sales growth (Maynard 2017).

FY 2018 FY 2017 FY 2016 FY 2015

-12.00%

-10.00%

-8.00%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00% 3.20% 1.82% 1.92%

-10.10%

Operating margin ratio = Operating

Income/Net Sales

Major Expenses/Revenue: The major expenses of the company reported in the financial

statement was the cost of goods sold for the company, which comprised of 94% of the

revenue earned by the company. The major expenses of the company has consistently

decreased for the company in the trend period analysed for the company.

FY 2018 FY 2017 FY 2016 FY 2015

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

94.17% 94.81% 94.76%

103.87%

Major Expenses/Revenue

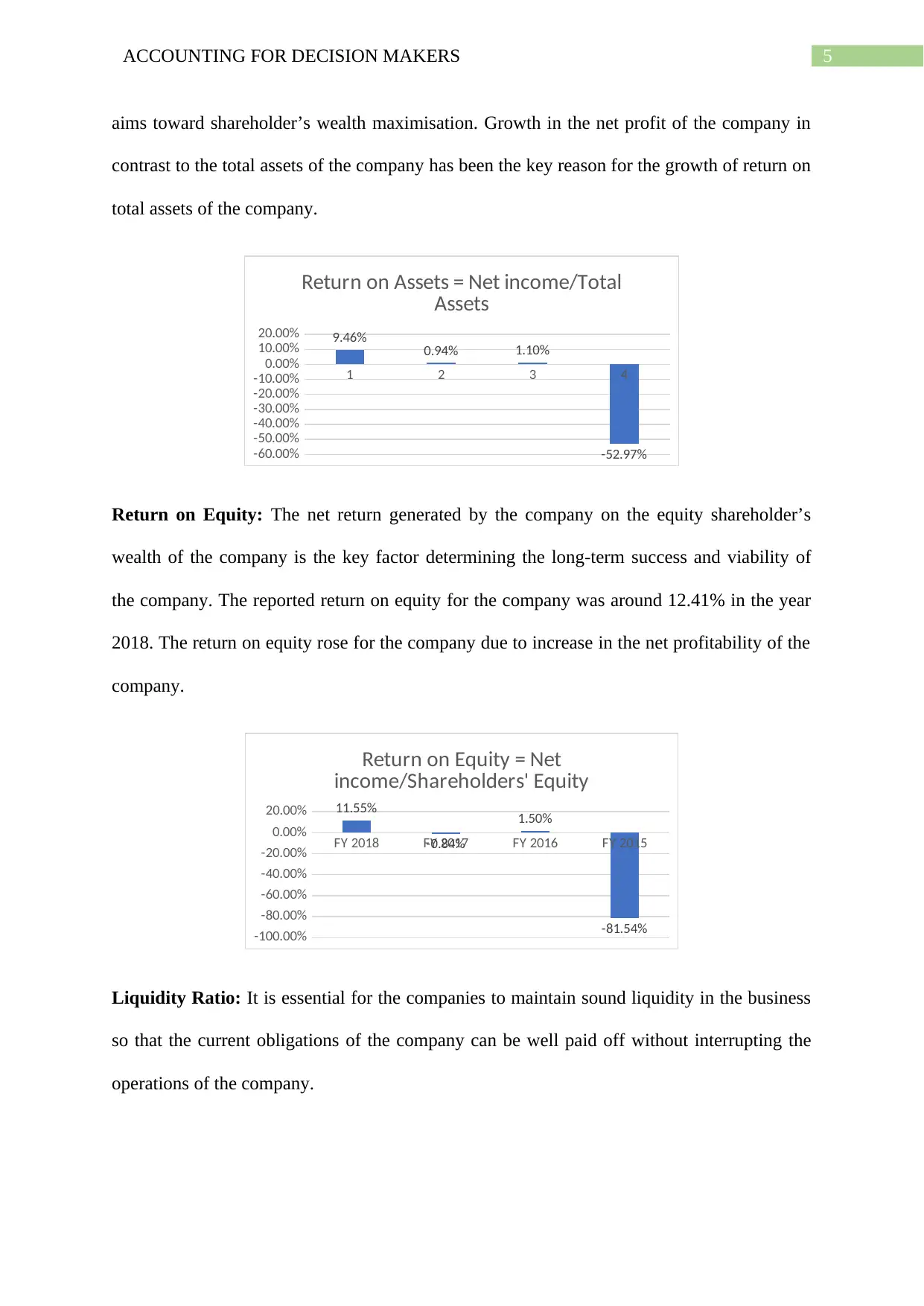

Return on Assets: The return generated by the company on the total assets of the company is

around 9.46% in the year 2018, which accounted for the highest ever return generated by the

company in the trend period analysed for the company. The same reflects the management

5ACCOUNTING FOR DECISION MAKERS

aims toward shareholder’s wealth maximisation. Growth in the net profit of the company in

contrast to the total assets of the company has been the key reason for the growth of return on

total assets of the company.

1 2 3 4

-60.00%

-50.00%

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00% 9.46% 0.94% 1.10%

-52.97%

Return on Assets = Net income/Total

Assets

Return on Equity: The net return generated by the company on the equity shareholder’s

wealth of the company is the key factor determining the long-term success and viability of

the company. The reported return on equity for the company was around 12.41% in the year

2018. The return on equity rose for the company due to increase in the net profitability of the

company.

FY 2018 FY 2017 FY 2016 FY 2015

-100.00%

-80.00%

-60.00%

-40.00%

-20.00%

0.00%

20.00% 11.55%

-0.84%

1.50%

-81.54%

Return on Equity = Net

income/Shareholders' Equity

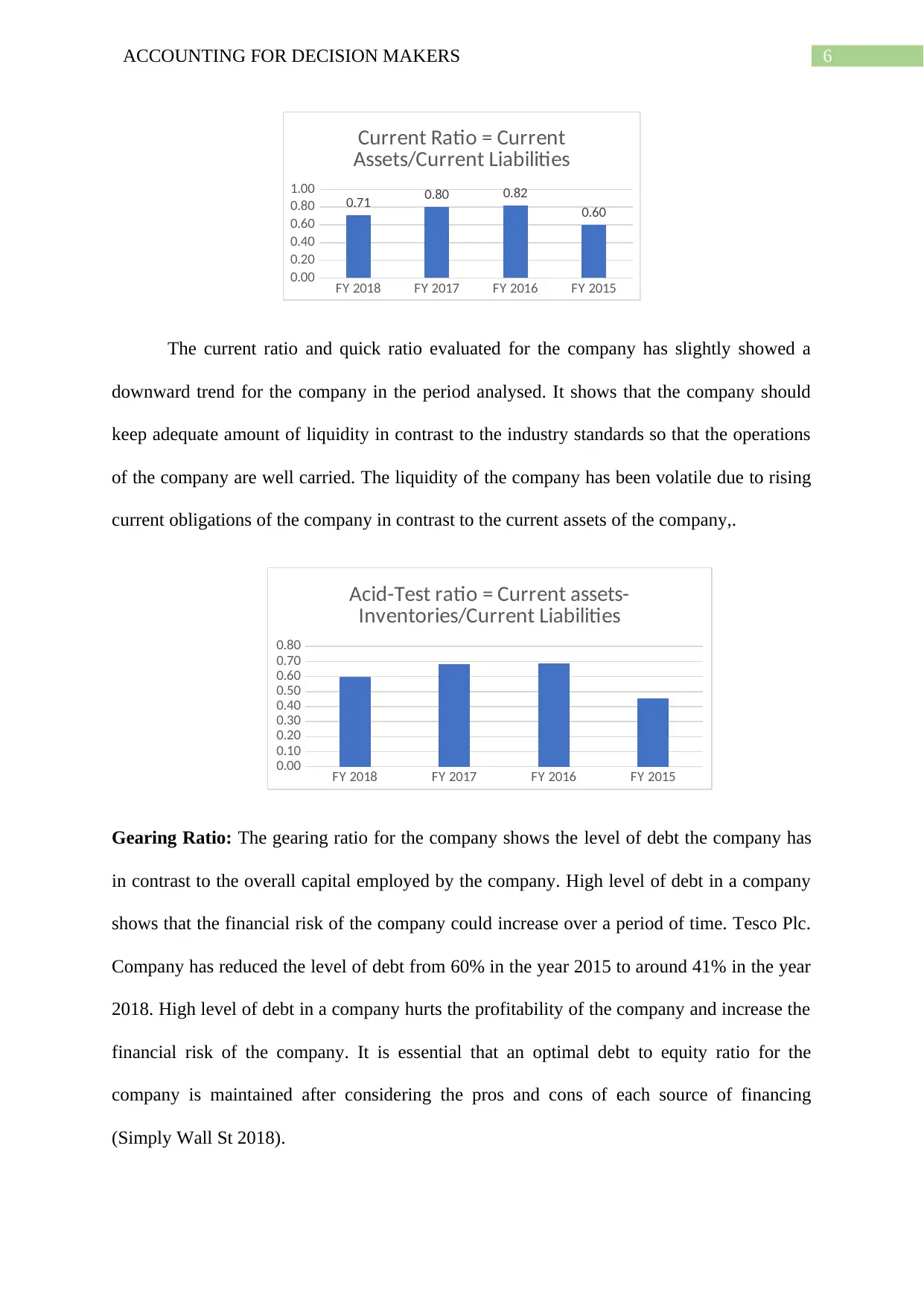

Liquidity Ratio: It is essential for the companies to maintain sound liquidity in the business

so that the current obligations of the company can be well paid off without interrupting the

operations of the company.

aims toward shareholder’s wealth maximisation. Growth in the net profit of the company in

contrast to the total assets of the company has been the key reason for the growth of return on

total assets of the company.

1 2 3 4

-60.00%

-50.00%

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00% 9.46% 0.94% 1.10%

-52.97%

Return on Assets = Net income/Total

Assets

Return on Equity: The net return generated by the company on the equity shareholder’s

wealth of the company is the key factor determining the long-term success and viability of

the company. The reported return on equity for the company was around 12.41% in the year

2018. The return on equity rose for the company due to increase in the net profitability of the

company.

FY 2018 FY 2017 FY 2016 FY 2015

-100.00%

-80.00%

-60.00%

-40.00%

-20.00%

0.00%

20.00% 11.55%

-0.84%

1.50%

-81.54%

Return on Equity = Net

income/Shareholders' Equity

Liquidity Ratio: It is essential for the companies to maintain sound liquidity in the business

so that the current obligations of the company can be well paid off without interrupting the

operations of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR DECISION MAKERS

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.20

0.40

0.60

0.80

1.00

0.71 0.80 0.82

0.60

Current Ratio = Current

Assets/Current Liabilities

The current ratio and quick ratio evaluated for the company has slightly showed a

downward trend for the company in the period analysed. It shows that the company should

keep adequate amount of liquidity in contrast to the industry standards so that the operations

of the company are well carried. The liquidity of the company has been volatile due to rising

current obligations of the company in contrast to the current assets of the company,.

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

Acid-Test ratio = Current assets-

Inventories/Current Liabilities

Gearing Ratio: The gearing ratio for the company shows the level of debt the company has

in contrast to the overall capital employed by the company. High level of debt in a company

shows that the financial risk of the company could increase over a period of time. Tesco Plc.

Company has reduced the level of debt from 60% in the year 2015 to around 41% in the year

2018. High level of debt in a company hurts the profitability of the company and increase the

financial risk of the company. It is essential that an optimal debt to equity ratio for the

company is maintained after considering the pros and cons of each source of financing

(Simply Wall St 2018).

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.20

0.40

0.60

0.80

1.00

0.71 0.80 0.82

0.60

Current Ratio = Current

Assets/Current Liabilities

The current ratio and quick ratio evaluated for the company has slightly showed a

downward trend for the company in the period analysed. It shows that the company should

keep adequate amount of liquidity in contrast to the industry standards so that the operations

of the company are well carried. The liquidity of the company has been volatile due to rising

current obligations of the company in contrast to the current assets of the company,.

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

Acid-Test ratio = Current assets-

Inventories/Current Liabilities

Gearing Ratio: The gearing ratio for the company shows the level of debt the company has

in contrast to the overall capital employed by the company. High level of debt in a company

shows that the financial risk of the company could increase over a period of time. Tesco Plc.

Company has reduced the level of debt from 60% in the year 2015 to around 41% in the year

2018. High level of debt in a company hurts the profitability of the company and increase the

financial risk of the company. It is essential that an optimal debt to equity ratio for the

company is maintained after considering the pros and cons of each source of financing

(Simply Wall St 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR DECISION MAKERS

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

Gearing Ratio = Long Term Liabilities/

Capital Employed

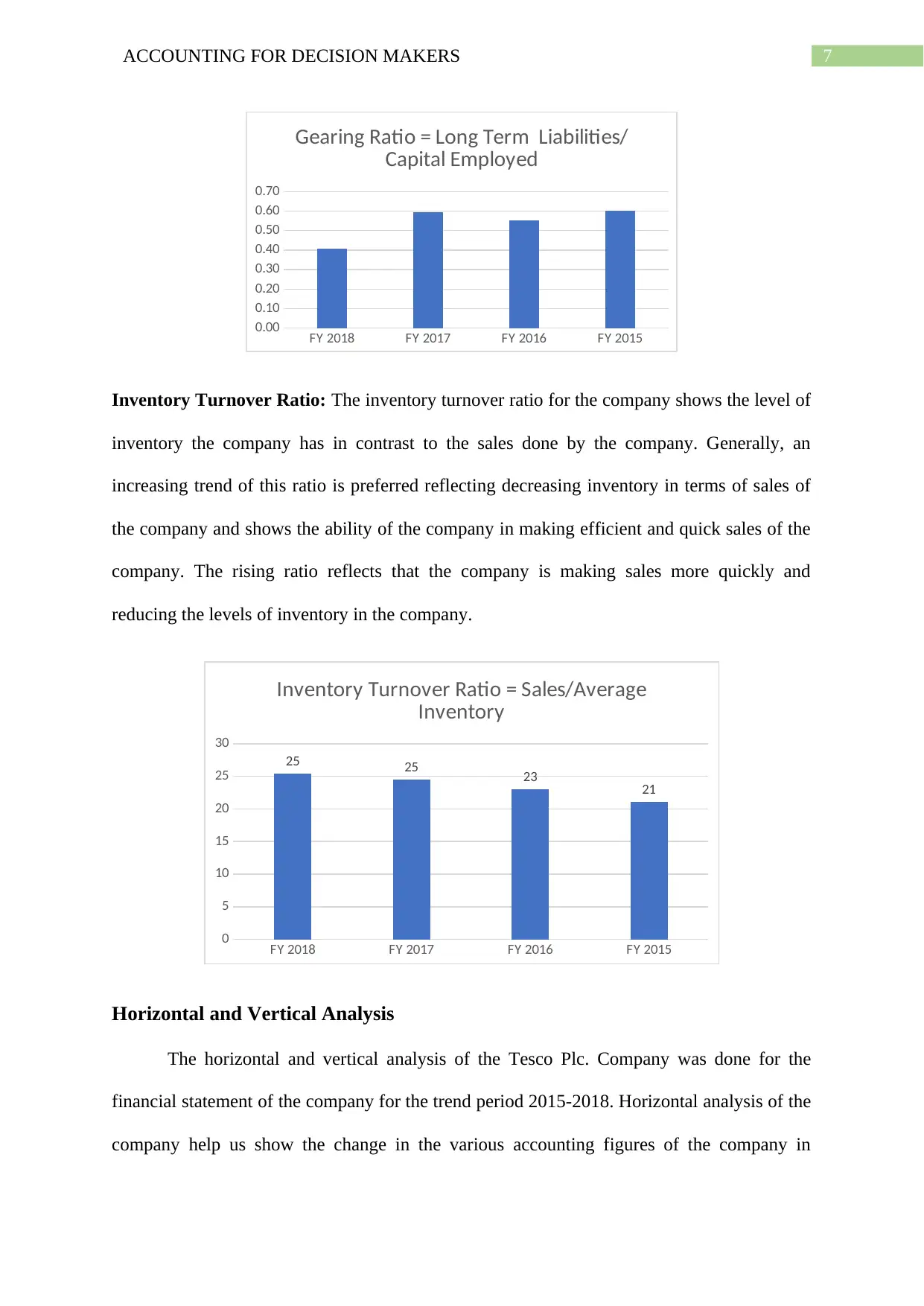

Inventory Turnover Ratio: The inventory turnover ratio for the company shows the level of

inventory the company has in contrast to the sales done by the company. Generally, an

increasing trend of this ratio is preferred reflecting decreasing inventory in terms of sales of

the company and shows the ability of the company in making efficient and quick sales of the

company. The rising ratio reflects that the company is making sales more quickly and

reducing the levels of inventory in the company.

FY 2018 FY 2017 FY 2016 FY 2015

0

5

10

15

20

25

30

25 25 23 21

Inventory Turnover Ratio = Sales/Average

Inventory

Horizontal and Vertical Analysis

The horizontal and vertical analysis of the Tesco Plc. Company was done for the

financial statement of the company for the trend period 2015-2018. Horizontal analysis of the

company help us show the change in the various accounting figures of the company in

FY 2018 FY 2017 FY 2016 FY 2015

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

Gearing Ratio = Long Term Liabilities/

Capital Employed

Inventory Turnover Ratio: The inventory turnover ratio for the company shows the level of

inventory the company has in contrast to the sales done by the company. Generally, an

increasing trend of this ratio is preferred reflecting decreasing inventory in terms of sales of

the company and shows the ability of the company in making efficient and quick sales of the

company. The rising ratio reflects that the company is making sales more quickly and

reducing the levels of inventory in the company.

FY 2018 FY 2017 FY 2016 FY 2015

0

5

10

15

20

25

30

25 25 23 21

Inventory Turnover Ratio = Sales/Average

Inventory

Horizontal and Vertical Analysis

The horizontal and vertical analysis of the Tesco Plc. Company was done for the

financial statement of the company for the trend period 2015-2018. Horizontal analysis of the

company help us show the change in the various accounting figures of the company in

8ACCOUNTING FOR DECISION MAKERS

accordance to the last year figures. The key features of horizontal analysis is that it reflects a

percentage change observed in the financial statement of the company over a trend period.

Vertical Analysis for the Income Statement of the Tesco Plc. was done by taking the

revenue of the company as the base and making the various accounts in terms of the revenue

percentage. On the other hand side the Balance sheet of the company shows the total assets

and total liabilities of the company as the base for analysing the various accounts (Schmidlin

2014).

The purpose and key feature of the vertical and horizontal analysis is that the same

allows the comparison of the financial performance and the financial position of the company

easily.

Year Wise Performance

On a yearly basis the performance of the company has shown a growth trend for the

company. The financial analysis of the company was done with the help of the changes in the

financial performance of the company. The key account which could be taken into

consideration is the operating cash flow generated by the company in contrast to the debt of

the company (Simply Wall St 2018). The revenue growth of the company and the operating

margin of the company are some of the key factors that would be taken into consideration for

the purpose of the financial analysis of the company (Tesco plc 2018).

Business and Growth Strategy

The business and growth strategy followed by the company is focusing on the key

factors and the stakeholders of the Tesco Plc. Company affecting the growth and the

performance of the company. Focusing on the demands of the consumers, focusing on high

profit margins company and bringing operational efficiency in the company with the help of

technological changes has been the key reason for the growth of the company. Various other

accordance to the last year figures. The key features of horizontal analysis is that it reflects a

percentage change observed in the financial statement of the company over a trend period.

Vertical Analysis for the Income Statement of the Tesco Plc. was done by taking the

revenue of the company as the base and making the various accounts in terms of the revenue

percentage. On the other hand side the Balance sheet of the company shows the total assets

and total liabilities of the company as the base for analysing the various accounts (Schmidlin

2014).

The purpose and key feature of the vertical and horizontal analysis is that the same

allows the comparison of the financial performance and the financial position of the company

easily.

Year Wise Performance

On a yearly basis the performance of the company has shown a growth trend for the

company. The financial analysis of the company was done with the help of the changes in the

financial performance of the company. The key account which could be taken into

consideration is the operating cash flow generated by the company in contrast to the debt of

the company (Simply Wall St 2018). The revenue growth of the company and the operating

margin of the company are some of the key factors that would be taken into consideration for

the purpose of the financial analysis of the company (Tesco plc 2018).

Business and Growth Strategy

The business and growth strategy followed by the company is focusing on the key

factors and the stakeholders of the Tesco Plc. Company affecting the growth and the

performance of the company. Focusing on the demands of the consumers, focusing on high

profit margins company and bringing operational efficiency in the company with the help of

technological changes has been the key reason for the growth of the company. Various other

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING FOR DECISION MAKERS

external factors like the rising competition, brand, reputation and goodwill of the company

has been the key factors which the company made through its various initiative of social

activities undertaken (Fernández-Vilas et al. 2017).

Limitation of Ratio Analysis

Accounting figures is the key estimate used in the financial analysis of the company

and the same are taken into analysis for the purpose of comparison. Companies may employ

different and various purpose for the purpose of manipulating the accounting figures such as

applying FIFO valuation rather than LIFO method of valuation. Inflation is the key macro-

economic variable which is ignored while applying the ratio analysis as the financial

statement of the company contains figures which are based on historical estimates. There are

several accounting figures which are based on the assumptions made by the management of

the company and the accounting principles that may not reflect economic reality (Your

Article Library 2017).

Conclusion

The financial company was covered for a trend period of 2015-18 and the financial

performance of the company was taken into consideration for the purpose of analysis. The

financial data of the company reflected that the company has started focusing on the

profitability and the sustainable growth rate of the company thereby accounting various

factors which can bring operational and financial efficiency in the company.

external factors like the rising competition, brand, reputation and goodwill of the company

has been the key factors which the company made through its various initiative of social

activities undertaken (Fernández-Vilas et al. 2017).

Limitation of Ratio Analysis

Accounting figures is the key estimate used in the financial analysis of the company

and the same are taken into analysis for the purpose of comparison. Companies may employ

different and various purpose for the purpose of manipulating the accounting figures such as

applying FIFO valuation rather than LIFO method of valuation. Inflation is the key macro-

economic variable which is ignored while applying the ratio analysis as the financial

statement of the company contains figures which are based on historical estimates. There are

several accounting figures which are based on the assumptions made by the management of

the company and the accounting principles that may not reflect economic reality (Your

Article Library 2017).

Conclusion

The financial company was covered for a trend period of 2015-18 and the financial

performance of the company was taken into consideration for the purpose of analysis. The

financial data of the company reflected that the company has started focusing on the

profitability and the sustainable growth rate of the company thereby accounting various

factors which can bring operational and financial efficiency in the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING FOR DECISION MAKERS

References

Fernández-Vilas, A., Evans, L., Owda, M., Redondo, R.P.D. and Crockett, K., 2017, August.

Experiment for analysing the impact of financial events on twitter. In International

Conference on Algorithms and Architectures for Parallel Processing (pp. 407-419). Springer,

Cham.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Schmidlin, N., 2014. The art of company valuation and financial statement analysis: a value

investor's guide with real-life case studies. John Wiley & Sons.

Simply Wall St. (2018). Is Tesco PLC’s Balance Sheet A Threat To Its Future. [online]

Available at: https://simplywall.st/stocks/gb/consumer-retailing/lse-tsco/tesco-shares/news/is-

tesco-plcs-lontsco-balance-sheet-a-threat-to-its-future/ [Accessed 20 Mar. 2019].

Tesco plc. (2018). Financial performance. [online] Available at:

https://www.tescoplc.com/investors/reports-results-and-presentations/financial-performance/

[Accessed 20 Mar. 2019].

Tescoplc.com. (2018). Annual Report 2018. [online] Available at:

https://www.tescoplc.com/media/474793/tesco_ar_2018.pdf [Accessed 20 Mar. 2019].

Wood, S., Coe, N.M. and Wrigley, N., 2016. Multi-scalar localization and capability

transference: exploring embeddedness in the Asian retail expansion of Tesco. Regional

Studies, 50(3), pp.475-495.

Wood, S., Wrigley, N. and Coe, N.M., 2016. Capital discipline and financial market relations

in retail globalization: insights from the case of Tesco plc. Journal of Economic

Geography, 17(1), pp.31-57.

References

Fernández-Vilas, A., Evans, L., Owda, M., Redondo, R.P.D. and Crockett, K., 2017, August.

Experiment for analysing the impact of financial events on twitter. In International

Conference on Algorithms and Architectures for Parallel Processing (pp. 407-419). Springer,

Cham.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Schmidlin, N., 2014. The art of company valuation and financial statement analysis: a value

investor's guide with real-life case studies. John Wiley & Sons.

Simply Wall St. (2018). Is Tesco PLC’s Balance Sheet A Threat To Its Future. [online]

Available at: https://simplywall.st/stocks/gb/consumer-retailing/lse-tsco/tesco-shares/news/is-

tesco-plcs-lontsco-balance-sheet-a-threat-to-its-future/ [Accessed 20 Mar. 2019].

Tesco plc. (2018). Financial performance. [online] Available at:

https://www.tescoplc.com/investors/reports-results-and-presentations/financial-performance/

[Accessed 20 Mar. 2019].

Tescoplc.com. (2018). Annual Report 2018. [online] Available at:

https://www.tescoplc.com/media/474793/tesco_ar_2018.pdf [Accessed 20 Mar. 2019].

Wood, S., Coe, N.M. and Wrigley, N., 2016. Multi-scalar localization and capability

transference: exploring embeddedness in the Asian retail expansion of Tesco. Regional

Studies, 50(3), pp.475-495.

Wood, S., Wrigley, N. and Coe, N.M., 2016. Capital discipline and financial market relations

in retail globalization: insights from the case of Tesco plc. Journal of Economic

Geography, 17(1), pp.31-57.

11ACCOUNTING FOR DECISION MAKERS

Your Article Library. (2017). 5 Limitations of Financial Ratios. [online] Available at:

http://www.yourarticlelibrary.com/accounting/financial-statements/5-limitations-of-financial-

ratios/53045 [Accessed 20 Mar. 2019].

Your Article Library. (2017). 5 Limitations of Financial Ratios. [online] Available at:

http://www.yourarticlelibrary.com/accounting/financial-statements/5-limitations-of-financial-

ratios/53045 [Accessed 20 Mar. 2019].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19