Financial Performance Analysis: Horizon Oil Ltd vs Tap Oil Ltd, 2018

VerifiedAdded on 2023/06/14

|17

|2821

|303

Report

AI Summary

This report presents a comparative financial analysis of Horizon Oil Limited and Tap Oil Limited, conducted for Business Smart's client, Company A (Horizon Oil Limited), using Tap Oil Limited as a benchmark. The analysis employs profitability, efficiency, liquidity, and stability ratios to evaluate the financial performance and associated risks of both companies. Findings indicate that Horizon Oil Limited is more profitable, having significantly improved its net profit from a substantial loss to a positive figure, while Tap Oil Limited's profitability ratios declined. The report also addresses non-financial issues, such as Horizon Oil Limited's stock market risk, and environmental concerns related to Tap Oil Limited. Ultimately, the report aims to provide insights for decision-making and risk management, with a recommendation focused on balancing profitability with sustainability.

Running head: ACCOUNTING FOR MANAGEMENT

Accounting for Management

Name of the Student:

Name of the University:

Author Note

Accounting for Management

Name of the Student:

Name of the University:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING FOR MANAGEMENT

Executive Summary

The issue that has been presented in the question is that the analysis of a particular

company with the name Horizon Oil Limited and Tap Oil Limited has been carried out in order

to determine the particular fact as to which company is more profitable. Moreover, such a

purpose has been fulfilled with the help of the significant ratios like the profitability ratios,

efficiency ratios, liquidity ratios and stability ratios.

Furthermore, it has been found out that the Horizon Oil Limited is much more profitable

than the Tap Oil Limited in regards to profitability.

Executive Summary

The issue that has been presented in the question is that the analysis of a particular

company with the name Horizon Oil Limited and Tap Oil Limited has been carried out in order

to determine the particular fact as to which company is more profitable. Moreover, such a

purpose has been fulfilled with the help of the significant ratios like the profitability ratios,

efficiency ratios, liquidity ratios and stability ratios.

Furthermore, it has been found out that the Horizon Oil Limited is much more profitable

than the Tap Oil Limited in regards to profitability.

2ACCOUNTING FOR MANAGEMENT

Table of Contents

Introduction......................................................................................................................................3

Issue.................................................................................................................................................3

Findings...........................................................................................................................................4

Comparison between Horizon Oil Limited and Tap Oil Limited................................................4

Analysis of the profitability ratios...............................................................................................5

Analysis of the Efficiency ratios..................................................................................................6

Analysis of Liquidity ratios.........................................................................................................7

Analysis of stability ratios...........................................................................................................8

Analysis of the profitability ratios...............................................................................................9

Analysis of the efficiency ratios................................................................................................10

Analysis of the liquidity ratios...................................................................................................11

Analysis of the stability ratios...................................................................................................12

Non-financial issue in regards to Horizon Oil Limited.................................................................13

Environmental issues in regards to Tap Oil Limited.....................................................................13

Recommendation and Conclusion.................................................................................................14

References......................................................................................................................................15

Appendix........................................................................................................................................16

Table of Contents

Introduction......................................................................................................................................3

Issue.................................................................................................................................................3

Findings...........................................................................................................................................4

Comparison between Horizon Oil Limited and Tap Oil Limited................................................4

Analysis of the profitability ratios...............................................................................................5

Analysis of the Efficiency ratios..................................................................................................6

Analysis of Liquidity ratios.........................................................................................................7

Analysis of stability ratios...........................................................................................................8

Analysis of the profitability ratios...............................................................................................9

Analysis of the efficiency ratios................................................................................................10

Analysis of the liquidity ratios...................................................................................................11

Analysis of the stability ratios...................................................................................................12

Non-financial issue in regards to Horizon Oil Limited.................................................................13

Environmental issues in regards to Tap Oil Limited.....................................................................13

Recommendation and Conclusion.................................................................................................14

References......................................................................................................................................15

Appendix........................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING FOR MANAGEMENT

Introduction

The issue that has been presented in the question is that the post the joining of the finance

and business consultation firm, Business Smart, the manager of the firm Mr. James Brown had

decided to take up a family leave. This has led to the preparation of a consultation report for an

important client, Company A.

This particular study aims to focus on the particular aspect of the selected company A

(Horizon Oil Limited) and the chosen benchmarking company, B with the particular name of

Tap Oil Limited. Furthermore, the essential ratios have been computed for the purpose of

evaluating the financial performance of the company and the related risks associated with the

business operations.

Issue

It has been further mentioned in the case study that Company A that is the Horizon Oil

Limited carries out the particular decision of appointing a new Chief Executive Officer. Thus

before the arrival of the new CEO the management of the corporate entity has decided the fact

that the assessment of the financial performance of the company and the particular risks faced

should be carried out. This is essentially done in order to execute the preparation of the financial

statements in an accurate way and the particular issues in regards to the performance of the

business can be potentially identified. Moreover, it has been further mentioned in the case study

that the particular Company A has been operating under public scrutiny due to the fact of high

carbon emissions and consumption of the required amount of energy. In order to resolve this

particular problem in regards to sustainability the members of the Board has been discussing the

considerable improvement in the sustainability reporting of the company by improving the

Introduction

The issue that has been presented in the question is that the post the joining of the finance

and business consultation firm, Business Smart, the manager of the firm Mr. James Brown had

decided to take up a family leave. This has led to the preparation of a consultation report for an

important client, Company A.

This particular study aims to focus on the particular aspect of the selected company A

(Horizon Oil Limited) and the chosen benchmarking company, B with the particular name of

Tap Oil Limited. Furthermore, the essential ratios have been computed for the purpose of

evaluating the financial performance of the company and the related risks associated with the

business operations.

Issue

It has been further mentioned in the case study that Company A that is the Horizon Oil

Limited carries out the particular decision of appointing a new Chief Executive Officer. Thus

before the arrival of the new CEO the management of the corporate entity has decided the fact

that the assessment of the financial performance of the company and the particular risks faced

should be carried out. This is essentially done in order to execute the preparation of the financial

statements in an accurate way and the particular issues in regards to the performance of the

business can be potentially identified. Moreover, it has been further mentioned in the case study

that the particular Company A has been operating under public scrutiny due to the fact of high

carbon emissions and consumption of the required amount of energy. In order to resolve this

particular problem in regards to sustainability the members of the Board has been discussing the

considerable improvement in the sustainability reporting of the company by improving the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING FOR MANAGEMENT

reporting of the company on environmental challenges and strategies for the protection of the

environment. However, it must be noted here that a particular number of Board members have

opposed to this particular strategy due to the consideration of the risk that has been associated

with lifting such a report. These Board members have been of the opinion that the firm should

focus on the major areas of business and the regaining of profit (Afonso, Baxa and Slavik 2018).

Findings

Comparison between Horizon Oil Limited and Tap Oil Limited

The particular company that has been more profitable in nature is the Horizon Oil

Limited. This is because this particular entity has acquired a profit of $5,400,416. This means

that the net profit acquired by the firm of Horizon Oil Limited has directly leaped from a

negative figure of -$199729329 to $5400416. This is a huge success that has been managed by

the entity of the corporate firm. It must be further explained with the help of the pre-tax profit

component. The pre-tax refers to that particular component that has been derived after deducting

the necessary expenses from the gross profit of the firm. The net profit is a potential indicator of

the profitability of the firm. Therefore, it can be evidently concluded that in regards to the Tap

Oil Limited that has been considered as a benchmark company, the particular corporate entity of

Horizon Oil Limited has obtained a greater amount of profit.

Furthermore, the comparison of the different financial components can be carried out

with the help of the essential or the significant ratios that aim to provide an overview into the

financial performance of the company with the help of the carrying out of the computations of

the different kinds of financial ratios like the asset turnover ratios, the efficiency ratios and the

liquidity ratios.

reporting of the company on environmental challenges and strategies for the protection of the

environment. However, it must be noted here that a particular number of Board members have

opposed to this particular strategy due to the consideration of the risk that has been associated

with lifting such a report. These Board members have been of the opinion that the firm should

focus on the major areas of business and the regaining of profit (Afonso, Baxa and Slavik 2018).

Findings

Comparison between Horizon Oil Limited and Tap Oil Limited

The particular company that has been more profitable in nature is the Horizon Oil

Limited. This is because this particular entity has acquired a profit of $5,400,416. This means

that the net profit acquired by the firm of Horizon Oil Limited has directly leaped from a

negative figure of -$199729329 to $5400416. This is a huge success that has been managed by

the entity of the corporate firm. It must be further explained with the help of the pre-tax profit

component. The pre-tax refers to that particular component that has been derived after deducting

the necessary expenses from the gross profit of the firm. The net profit is a potential indicator of

the profitability of the firm. Therefore, it can be evidently concluded that in regards to the Tap

Oil Limited that has been considered as a benchmark company, the particular corporate entity of

Horizon Oil Limited has obtained a greater amount of profit.

Furthermore, the comparison of the different financial components can be carried out

with the help of the essential or the significant ratios that aim to provide an overview into the

financial performance of the company with the help of the carrying out of the computations of

the different kinds of financial ratios like the asset turnover ratios, the efficiency ratios and the

liquidity ratios.

5ACCOUNTING FOR MANAGEMENT

It should be noted here that there are certain limitations that the significant ratios might

be subjected to. These limitations are that the ratios have been conducted for a period of two

consecutive years which limit the ability of the significant ratios to potentially reflect or forecast

the financial health of a company. Moreover, the figures might have been affected by a certain

economical event that might impose a certain effect that is short term in nature thus misleading

the user who depends on the results forecasted by the significant ratios (Afonso, Baxa and Slavik

2018).

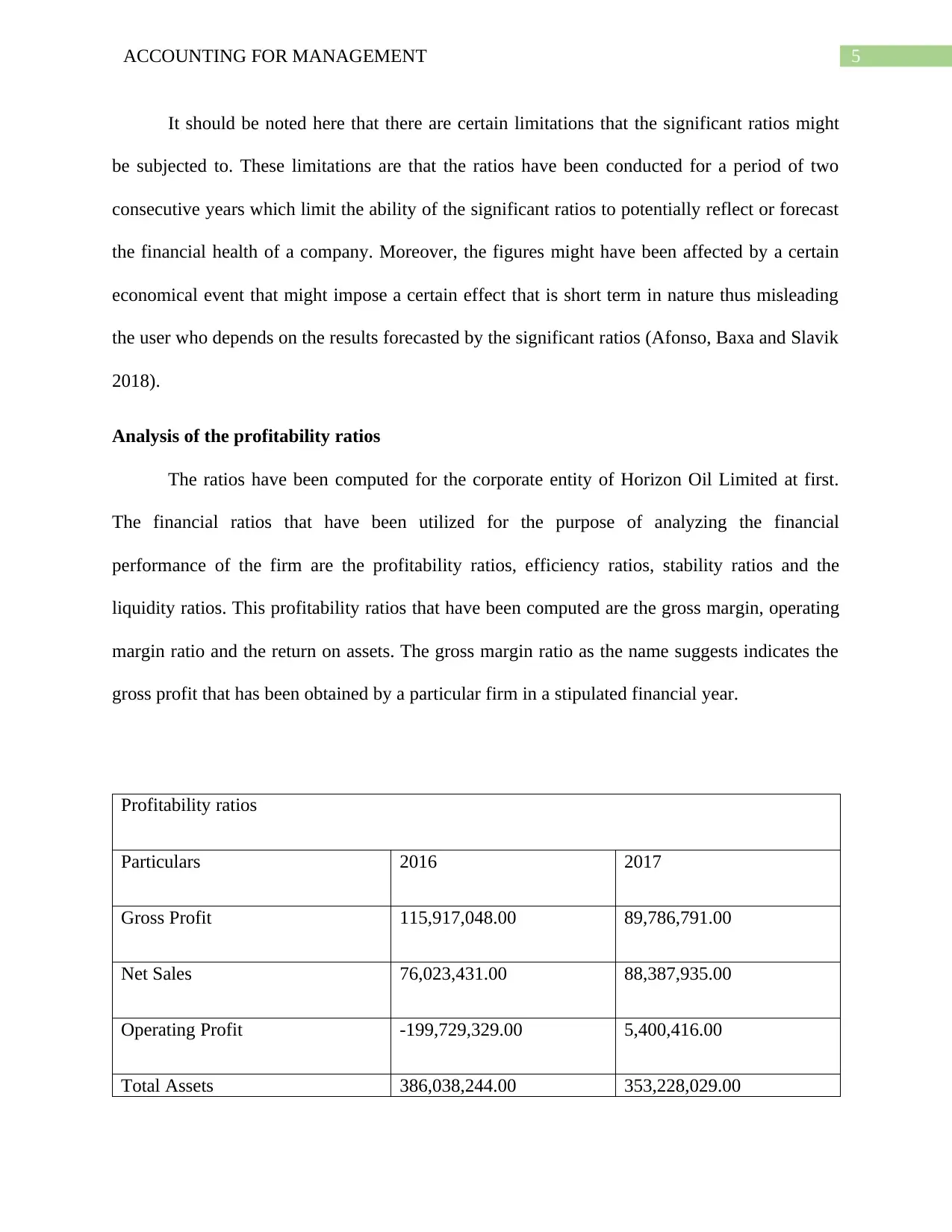

Analysis of the profitability ratios

The ratios have been computed for the corporate entity of Horizon Oil Limited at first.

The financial ratios that have been utilized for the purpose of analyzing the financial

performance of the firm are the profitability ratios, efficiency ratios, stability ratios and the

liquidity ratios. This profitability ratios that have been computed are the gross margin, operating

margin ratio and the return on assets. The gross margin ratio as the name suggests indicates the

gross profit that has been obtained by a particular firm in a stipulated financial year.

Profitability ratios

Particulars 2016 2017

Gross Profit 115,917,048.00 89,786,791.00

Net Sales 76,023,431.00 88,387,935.00

Operating Profit -199,729,329.00 5,400,416.00

Total Assets 386,038,244.00 353,228,029.00

It should be noted here that there are certain limitations that the significant ratios might

be subjected to. These limitations are that the ratios have been conducted for a period of two

consecutive years which limit the ability of the significant ratios to potentially reflect or forecast

the financial health of a company. Moreover, the figures might have been affected by a certain

economical event that might impose a certain effect that is short term in nature thus misleading

the user who depends on the results forecasted by the significant ratios (Afonso, Baxa and Slavik

2018).

Analysis of the profitability ratios

The ratios have been computed for the corporate entity of Horizon Oil Limited at first.

The financial ratios that have been utilized for the purpose of analyzing the financial

performance of the firm are the profitability ratios, efficiency ratios, stability ratios and the

liquidity ratios. This profitability ratios that have been computed are the gross margin, operating

margin ratio and the return on assets. The gross margin ratio as the name suggests indicates the

gross profit that has been obtained by a particular firm in a stipulated financial year.

Profitability ratios

Particulars 2016 2017

Gross Profit 115,917,048.00 89,786,791.00

Net Sales 76,023,431.00 88,387,935.00

Operating Profit -199,729,329.00 5,400,416.00

Total Assets 386,038,244.00 353,228,029.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING FOR MANAGEMENT

Gross Margin ratio 1.52 1.02

Operating margin ratio -2.63 0.06

Return on Assets -0.52 0.02

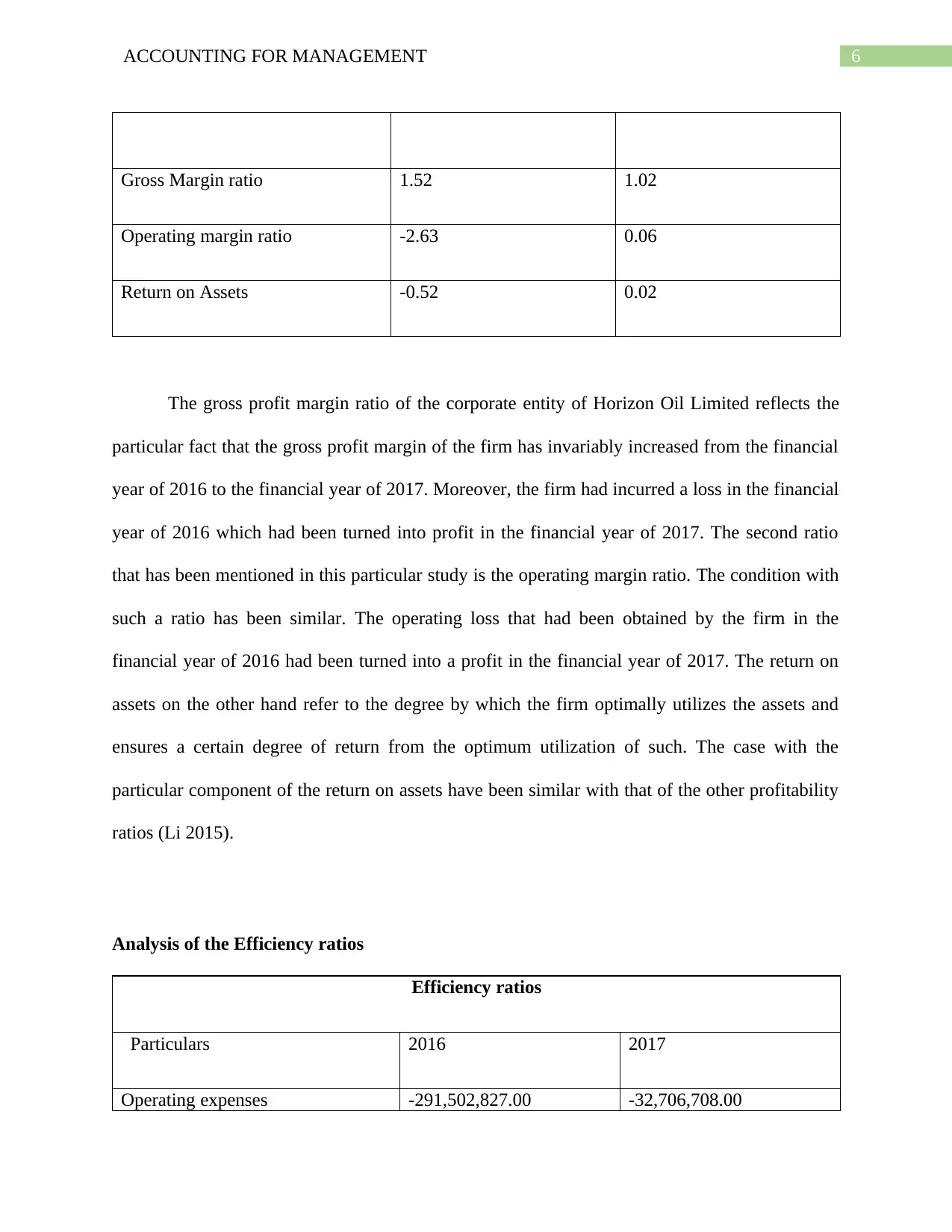

The gross profit margin ratio of the corporate entity of Horizon Oil Limited reflects the

particular fact that the gross profit margin of the firm has invariably increased from the financial

year of 2016 to the financial year of 2017. Moreover, the firm had incurred a loss in the financial

year of 2016 which had been turned into profit in the financial year of 2017. The second ratio

that has been mentioned in this particular study is the operating margin ratio. The condition with

such a ratio has been similar. The operating loss that had been obtained by the firm in the

financial year of 2016 had been turned into a profit in the financial year of 2017. The return on

assets on the other hand refer to the degree by which the firm optimally utilizes the assets and

ensures a certain degree of return from the optimum utilization of such. The case with the

particular component of the return on assets have been similar with that of the other profitability

ratios (Li 2015).

Analysis of the Efficiency ratios

Efficiency ratios

Particulars 2016 2017

Operating expenses -291,502,827.00 -32,706,708.00

Gross Margin ratio 1.52 1.02

Operating margin ratio -2.63 0.06

Return on Assets -0.52 0.02

The gross profit margin ratio of the corporate entity of Horizon Oil Limited reflects the

particular fact that the gross profit margin of the firm has invariably increased from the financial

year of 2016 to the financial year of 2017. Moreover, the firm had incurred a loss in the financial

year of 2016 which had been turned into profit in the financial year of 2017. The second ratio

that has been mentioned in this particular study is the operating margin ratio. The condition with

such a ratio has been similar. The operating loss that had been obtained by the firm in the

financial year of 2016 had been turned into a profit in the financial year of 2017. The return on

assets on the other hand refer to the degree by which the firm optimally utilizes the assets and

ensures a certain degree of return from the optimum utilization of such. The case with the

particular component of the return on assets have been similar with that of the other profitability

ratios (Li 2015).

Analysis of the Efficiency ratios

Efficiency ratios

Particulars 2016 2017

Operating expenses -291,502,827.00 -32,706,708.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING FOR MANAGEMENT

Revenue 39,893,617.00 1,398,855.00

Total Assets 386,038,244.00 353,228,029.00

Asset turnover ratio 0.10 0.00

Operating expense ratio -7.31 -23.38

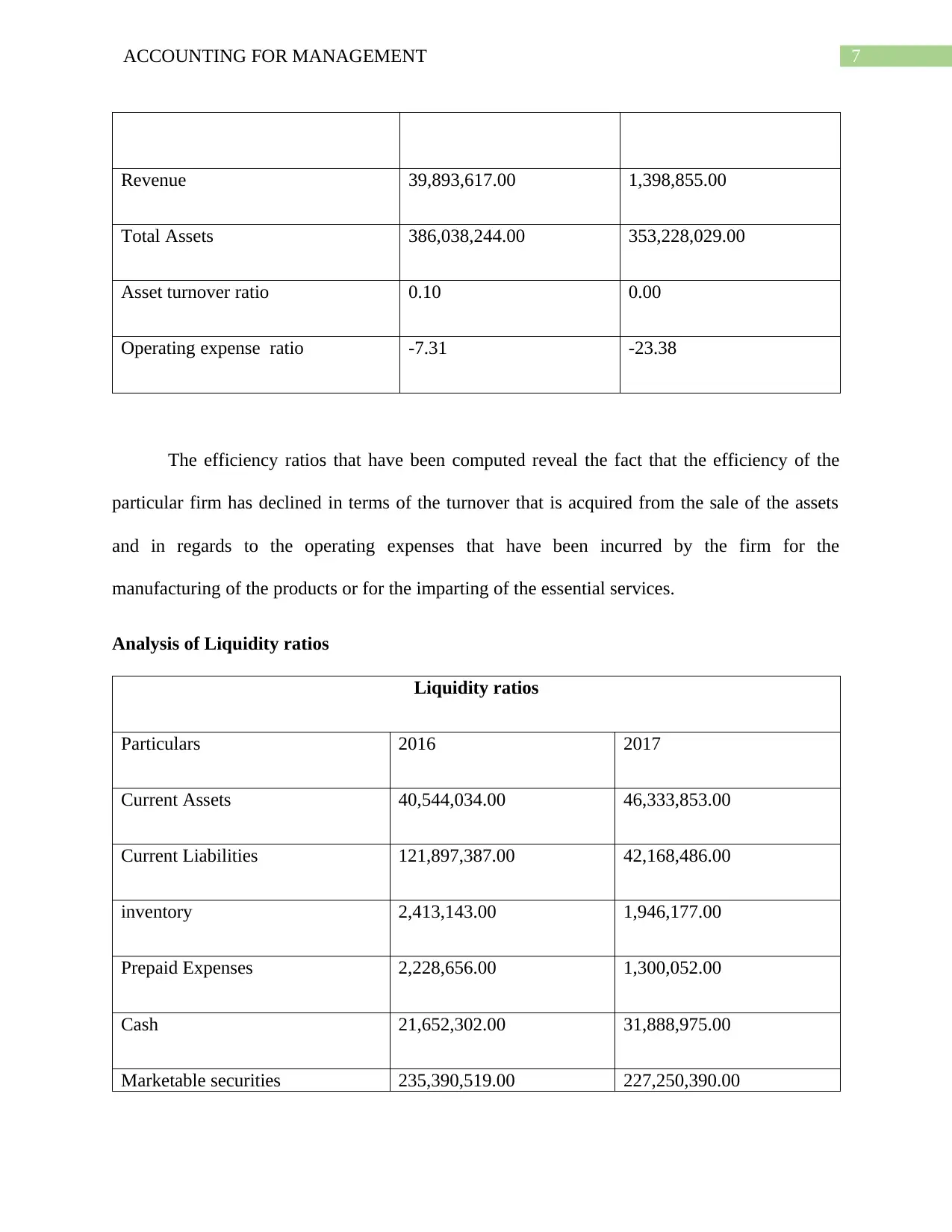

The efficiency ratios that have been computed reveal the fact that the efficiency of the

particular firm has declined in terms of the turnover that is acquired from the sale of the assets

and in regards to the operating expenses that have been incurred by the firm for the

manufacturing of the products or for the imparting of the essential services.

Analysis of Liquidity ratios

Liquidity ratios

Particulars 2016 2017

Current Assets 40,544,034.00 46,333,853.00

Current Liabilities 121,897,387.00 42,168,486.00

inventory 2,413,143.00 1,946,177.00

Prepaid Expenses 2,228,656.00 1,300,052.00

Cash 21,652,302.00 31,888,975.00

Marketable securities 235,390,519.00 227,250,390.00

Revenue 39,893,617.00 1,398,855.00

Total Assets 386,038,244.00 353,228,029.00

Asset turnover ratio 0.10 0.00

Operating expense ratio -7.31 -23.38

The efficiency ratios that have been computed reveal the fact that the efficiency of the

particular firm has declined in terms of the turnover that is acquired from the sale of the assets

and in regards to the operating expenses that have been incurred by the firm for the

manufacturing of the products or for the imparting of the essential services.

Analysis of Liquidity ratios

Liquidity ratios

Particulars 2016 2017

Current Assets 40,544,034.00 46,333,853.00

Current Liabilities 121,897,387.00 42,168,486.00

inventory 2,413,143.00 1,946,177.00

Prepaid Expenses 2,228,656.00 1,300,052.00

Cash 21,652,302.00 31,888,975.00

Marketable securities 235,390,519.00 227,250,390.00

8ACCOUNTING FOR MANAGEMENT

Current Liabilities 245,270,670.00 214,478,679.00

Current ratio 0.33 1.10

Absolute liquidity ratio 1.05 1.21

The liquidity ratios indicate the liquidity of a particular firm. To be precise, the aspect of

liquidity refers to the ability of the current assets of the firm to pay for the short term obligations

or the current liabilities in a particular stipulated time period. The liquidity of Horizon Oil

Limited as evident from the table reveals the particular fact that the liquidity of the particular

corporate entity has invariably increased for the financial year of 2017. This means that the

liquidity position of the firm has been high further indicating a healthy business

Analysis of stability ratios

Stability ratios

Particulars 2016 2017

Equity 140,767,573.00 138,749,349.00

Total Assets 386,038,244.00 353,228,029.00

Liability 245,270,670.00 214,478,679.00

Equity ratio 0.36 0.39

Gearing ratio 0.64 0.61

Current Liabilities 245,270,670.00 214,478,679.00

Current ratio 0.33 1.10

Absolute liquidity ratio 1.05 1.21

The liquidity ratios indicate the liquidity of a particular firm. To be precise, the aspect of

liquidity refers to the ability of the current assets of the firm to pay for the short term obligations

or the current liabilities in a particular stipulated time period. The liquidity of Horizon Oil

Limited as evident from the table reveals the particular fact that the liquidity of the particular

corporate entity has invariably increased for the financial year of 2017. This means that the

liquidity position of the firm has been high further indicating a healthy business

Analysis of stability ratios

Stability ratios

Particulars 2016 2017

Equity 140,767,573.00 138,749,349.00

Total Assets 386,038,244.00 353,228,029.00

Liability 245,270,670.00 214,478,679.00

Equity ratio 0.36 0.39

Gearing ratio 0.64 0.61

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING FOR MANAGEMENT

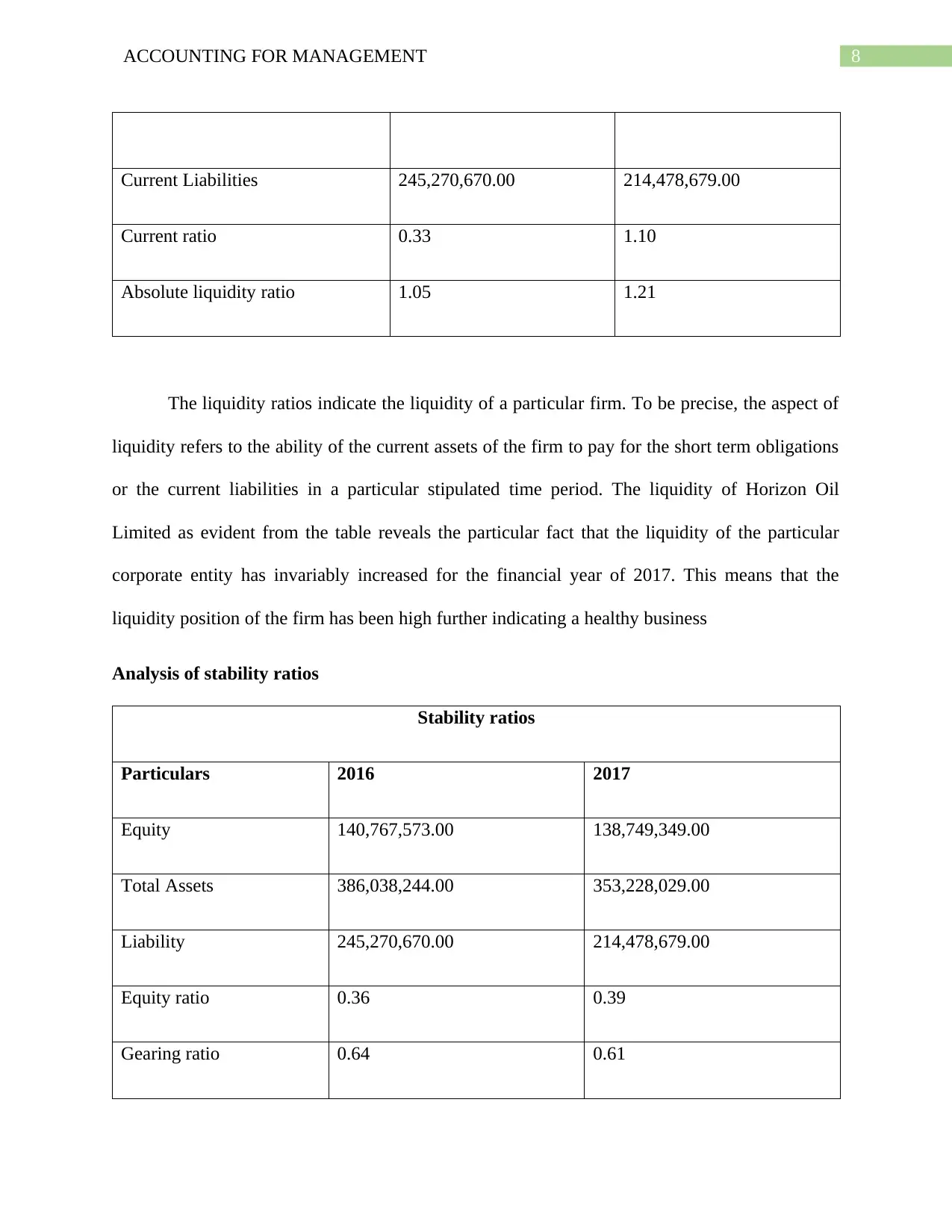

Lastly, the stability ratios that have been discussed in this particular study are the equity

ratio and the gearing ratio. The equity ratio conveys the rate of utilization of the shareholder’s

equity and the gearing ratio indicates the debt position of the firm that is the amount of third

party debt that has been borrowed by the corporate entity in addition to the utilization of the

shareholder’s equity. Both the firms have displayed a stable position in regards to these ratios

indicating that the equity position and the debt position of the firms have been stable (Wolfson

2017).

Next, the particular ratios that have been considered for the particular organization of Tap

Oil Limited has been as follows:

Analysis of the profitability ratios

Profitability ratios

Particulars 2016 2017

Gross Profit 88,066,611.00 57,589,743.00

Net Sales 88,007,186.00 60,476,923.00

Operating Profit -16,686,014.00 -2,184,615.00

Total Assets 129,846,600.00 87,803,846.00

Gross Margin ratio 1.00 0.95

Operating margin ratio -0.19 -0.04

Return on Assets -0.13 -0.02

Lastly, the stability ratios that have been discussed in this particular study are the equity

ratio and the gearing ratio. The equity ratio conveys the rate of utilization of the shareholder’s

equity and the gearing ratio indicates the debt position of the firm that is the amount of third

party debt that has been borrowed by the corporate entity in addition to the utilization of the

shareholder’s equity. Both the firms have displayed a stable position in regards to these ratios

indicating that the equity position and the debt position of the firms have been stable (Wolfson

2017).

Next, the particular ratios that have been considered for the particular organization of Tap

Oil Limited has been as follows:

Analysis of the profitability ratios

Profitability ratios

Particulars 2016 2017

Gross Profit 88,066,611.00 57,589,743.00

Net Sales 88,007,186.00 60,476,923.00

Operating Profit -16,686,014.00 -2,184,615.00

Total Assets 129,846,600.00 87,803,846.00

Gross Margin ratio 1.00 0.95

Operating margin ratio -0.19 -0.04

Return on Assets -0.13 -0.02

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING FOR MANAGEMENT

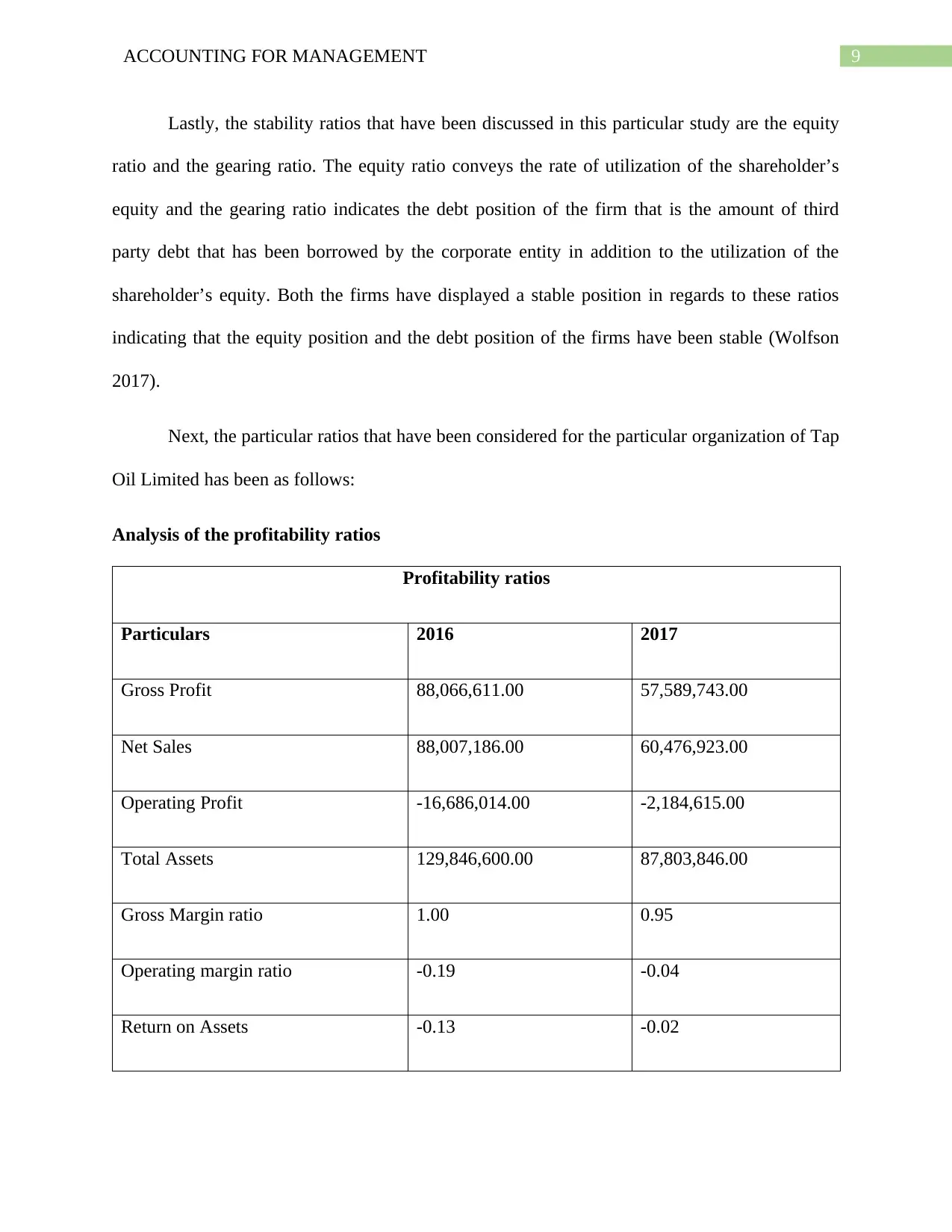

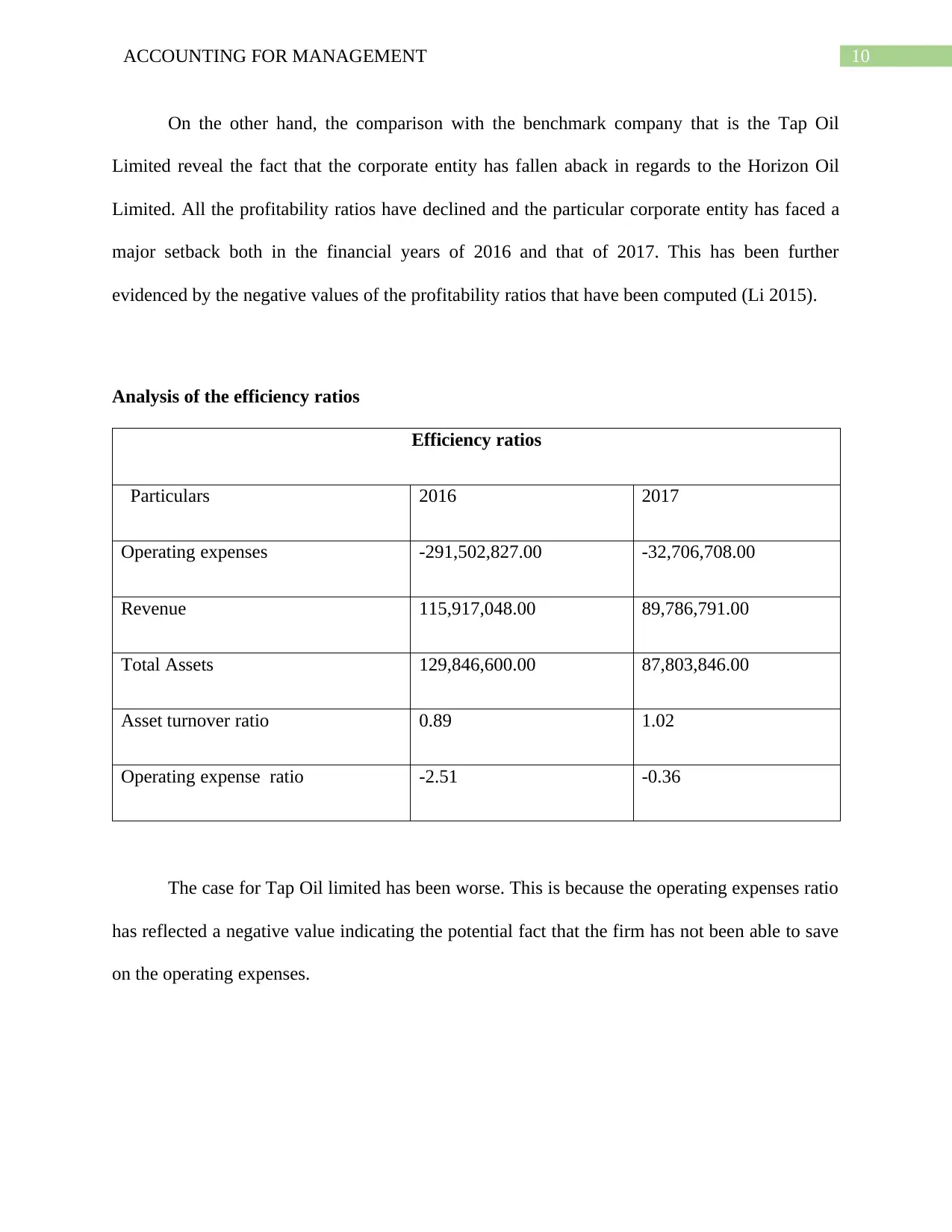

On the other hand, the comparison with the benchmark company that is the Tap Oil

Limited reveal the fact that the corporate entity has fallen aback in regards to the Horizon Oil

Limited. All the profitability ratios have declined and the particular corporate entity has faced a

major setback both in the financial years of 2016 and that of 2017. This has been further

evidenced by the negative values of the profitability ratios that have been computed (Li 2015).

Analysis of the efficiency ratios

Efficiency ratios

Particulars 2016 2017

Operating expenses -291,502,827.00 -32,706,708.00

Revenue 115,917,048.00 89,786,791.00

Total Assets 129,846,600.00 87,803,846.00

Asset turnover ratio 0.89 1.02

Operating expense ratio -2.51 -0.36

The case for Tap Oil limited has been worse. This is because the operating expenses ratio

has reflected a negative value indicating the potential fact that the firm has not been able to save

on the operating expenses.

On the other hand, the comparison with the benchmark company that is the Tap Oil

Limited reveal the fact that the corporate entity has fallen aback in regards to the Horizon Oil

Limited. All the profitability ratios have declined and the particular corporate entity has faced a

major setback both in the financial years of 2016 and that of 2017. This has been further

evidenced by the negative values of the profitability ratios that have been computed (Li 2015).

Analysis of the efficiency ratios

Efficiency ratios

Particulars 2016 2017

Operating expenses -291,502,827.00 -32,706,708.00

Revenue 115,917,048.00 89,786,791.00

Total Assets 129,846,600.00 87,803,846.00

Asset turnover ratio 0.89 1.02

Operating expense ratio -2.51 -0.36

The case for Tap Oil limited has been worse. This is because the operating expenses ratio

has reflected a negative value indicating the potential fact that the firm has not been able to save

on the operating expenses.

11ACCOUNTING FOR MANAGEMENT

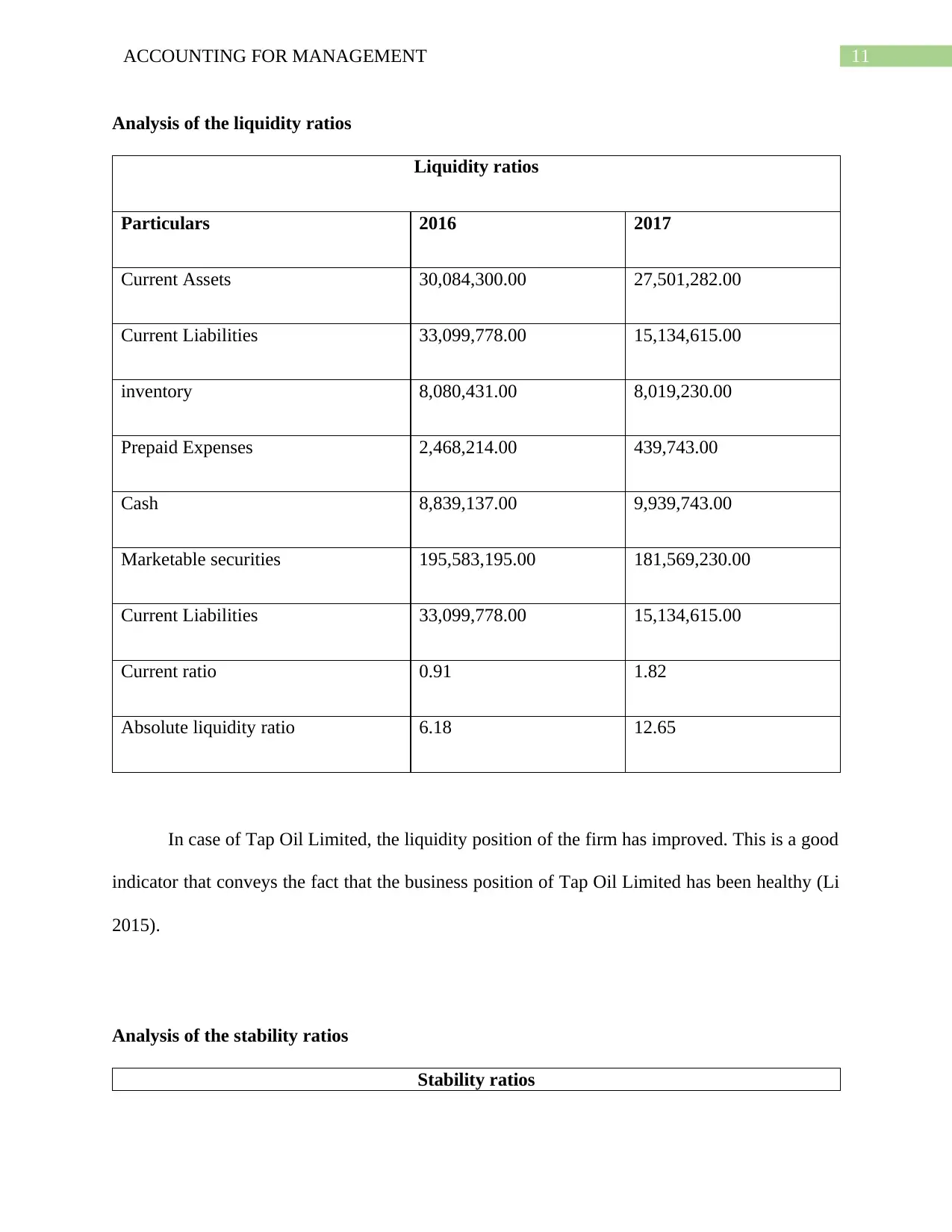

Analysis of the liquidity ratios

Liquidity ratios

Particulars 2016 2017

Current Assets 30,084,300.00 27,501,282.00

Current Liabilities 33,099,778.00 15,134,615.00

inventory 8,080,431.00 8,019,230.00

Prepaid Expenses 2,468,214.00 439,743.00

Cash 8,839,137.00 9,939,743.00

Marketable securities 195,583,195.00 181,569,230.00

Current Liabilities 33,099,778.00 15,134,615.00

Current ratio 0.91 1.82

Absolute liquidity ratio 6.18 12.65

In case of Tap Oil Limited, the liquidity position of the firm has improved. This is a good

indicator that conveys the fact that the business position of Tap Oil Limited has been healthy (Li

2015).

Analysis of the stability ratios

Stability ratios

Analysis of the liquidity ratios

Liquidity ratios

Particulars 2016 2017

Current Assets 30,084,300.00 27,501,282.00

Current Liabilities 33,099,778.00 15,134,615.00

inventory 8,080,431.00 8,019,230.00

Prepaid Expenses 2,468,214.00 439,743.00

Cash 8,839,137.00 9,939,743.00

Marketable securities 195,583,195.00 181,569,230.00

Current Liabilities 33,099,778.00 15,134,615.00

Current ratio 0.91 1.82

Absolute liquidity ratio 6.18 12.65

In case of Tap Oil Limited, the liquidity position of the firm has improved. This is a good

indicator that conveys the fact that the business position of Tap Oil Limited has been healthy (Li

2015).

Analysis of the stability ratios

Stability ratios

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.