ACC00724 Accounting for Managers Report: Financial Performance

VerifiedAdded on 2023/06/07

|9

|1591

|456

Report

AI Summary

This report analyzes the financial performance of JB Hi-Fi and Telesmart Ltd. It begins with a cash flow analysis of JB Hi-Fi, examining operating, investing, and financing activities over several years, and evaluating trends. The report then assesses Telesmart Ltd's financial data, considering sales, costs, and profitability under different scenarios proposed by management. It includes calculations for various options to increase profitability, like improving product quality, increasing marketing, and offering rebates. The report also addresses a production capacity scenario for Telesmart Ltd, evaluating the financial implications of accepting a special offer at different production levels, and considering advantages and disadvantages of the proposed deals.

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Name of the Student:

Name of the University:

Author’s Note:

Accounting for Managers

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING FOR MANAGERS

Table of Contents

Question 1........................................................................................................................................2

Question 2........................................................................................................................................3

Question 3........................................................................................................................................5

Reference.........................................................................................................................................8

ACCOUNTING FOR MANAGERS

Table of Contents

Question 1........................................................................................................................................2

Question 2........................................................................................................................................3

Question 3........................................................................................................................................5

Reference.........................................................................................................................................8

2

ACCOUNTING FOR MANAGERS

Question 1

The cash flow statement of JB HiFi is prepared following the general accounting

framework which consist of Cash flow from operating activities, cash flow from investing

activities and cash flow from financing activities. The operating activities of the business shows

receipts from customers during the year 2017 which is shown to be significantly increased during

the year. The cash payments which are made to the suppliers during the year has also increased

as shown in the cash flow statement of the business. The overall increase in both these estimates

suggest that the business have scaled up the operations of the business due to which both

revenues and expenses of the business has increased significantly. The net cash flow from

operating activities of the business are shown to have increased slightly as the figure increases

from $ 185.1 million in 2016 to 190.6 million in 2017 (JB Hi-Fi Investors. 2018). The cash from

operating activities of the business reveals that the main cash which is earned by the business is

through the operations of the business. The major cash flow from investing activities is through

payment from business combinations and proceeds of borrowings. The financing activities of the

business for the year 2017 shows that the main cash flows of the business are through Share

proceeds and borrowings proceeds.

ACCOUNTING FOR MANAGERS

Question 1

The cash flow statement of JB HiFi is prepared following the general accounting

framework which consist of Cash flow from operating activities, cash flow from investing

activities and cash flow from financing activities. The operating activities of the business shows

receipts from customers during the year 2017 which is shown to be significantly increased during

the year. The cash payments which are made to the suppliers during the year has also increased

as shown in the cash flow statement of the business. The overall increase in both these estimates

suggest that the business have scaled up the operations of the business due to which both

revenues and expenses of the business has increased significantly. The net cash flow from

operating activities of the business are shown to have increased slightly as the figure increases

from $ 185.1 million in 2016 to 190.6 million in 2017 (JB Hi-Fi Investors. 2018). The cash from

operating activities of the business reveals that the main cash which is earned by the business is

through the operations of the business. The major cash flow from investing activities is through

payment from business combinations and proceeds of borrowings. The financing activities of the

business for the year 2017 shows that the main cash flows of the business are through Share

proceeds and borrowings proceeds.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING FOR MANAGERS

Question 2

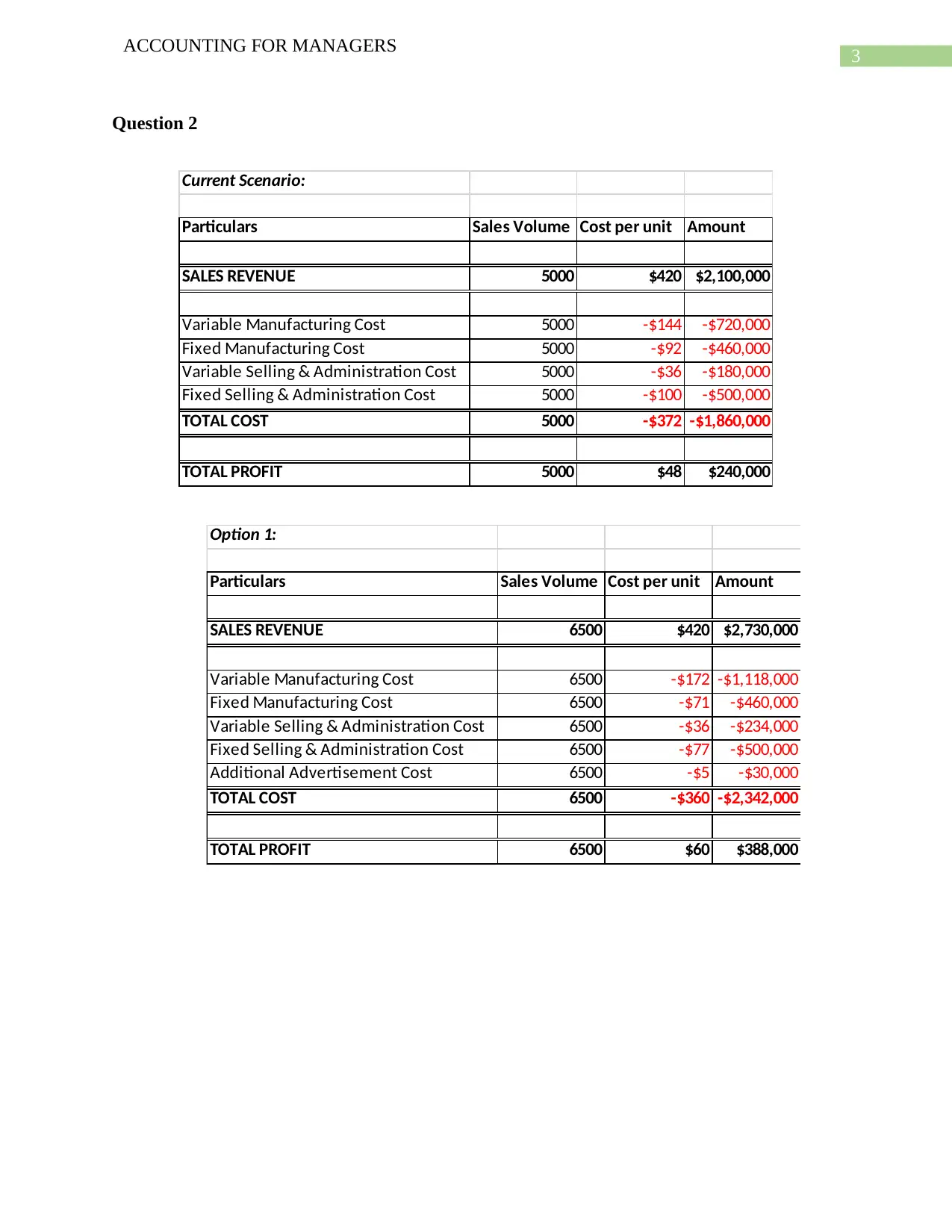

Current Scenario:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 5000 $420 $2,100,000

Variable Manufacturing Cost 5000 -$144 -$720,000

Fixed Manufacturing Cost 5000 -$92 -$460,000

Variable Selling & Administration Cost 5000 -$36 -$180,000

Fixed Selling & Administration Cost 5000 -$100 -$500,000

TOTAL COST 5000 -$372 -$1,860,000

TOTAL PROFIT 5000 $48 $240,000

Option 1:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 6500 $420 $2,730,000

Variable Manufacturing Cost 6500 -$172 -$1,118,000

Fixed Manufacturing Cost 6500 -$71 -$460,000

Variable Selling & Administration Cost 6500 -$36 -$234,000

Fixed Selling & Administration Cost 6500 -$77 -$500,000

Additional Advertisement Cost 6500 -$5 -$30,000

TOTAL COST 6500 -$360 -$2,342,000

TOTAL PROFIT 6500 $60 $388,000

ACCOUNTING FOR MANAGERS

Question 2

Current Scenario:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 5000 $420 $2,100,000

Variable Manufacturing Cost 5000 -$144 -$720,000

Fixed Manufacturing Cost 5000 -$92 -$460,000

Variable Selling & Administration Cost 5000 -$36 -$180,000

Fixed Selling & Administration Cost 5000 -$100 -$500,000

TOTAL COST 5000 -$372 -$1,860,000

TOTAL PROFIT 5000 $48 $240,000

Option 1:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 6500 $420 $2,730,000

Variable Manufacturing Cost 6500 -$172 -$1,118,000

Fixed Manufacturing Cost 6500 -$71 -$460,000

Variable Selling & Administration Cost 6500 -$36 -$234,000

Fixed Selling & Administration Cost 6500 -$77 -$500,000

Additional Advertisement Cost 6500 -$5 -$30,000

TOTAL COST 6500 -$360 -$2,342,000

TOTAL PROFIT 6500 $60 $388,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING FOR MANAGERS

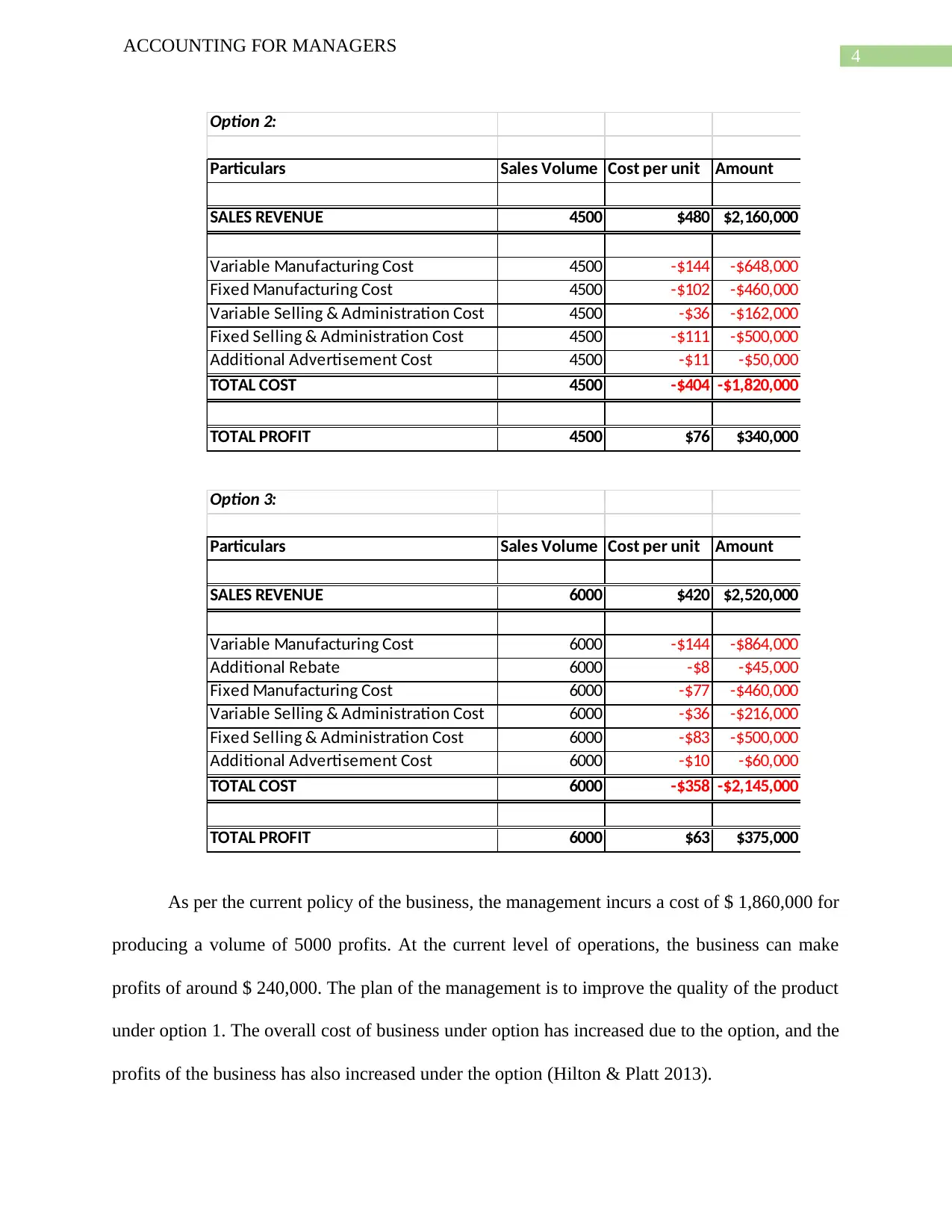

Option 2:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 4500 $480 $2,160,000

Variable Manufacturing Cost 4500 -$144 -$648,000

Fixed Manufacturing Cost 4500 -$102 -$460,000

Variable Selling & Administration Cost 4500 -$36 -$162,000

Fixed Selling & Administration Cost 4500 -$111 -$500,000

Additional Advertisement Cost 4500 -$11 -$50,000

TOTAL COST 4500 -$404 -$1,820,000

TOTAL PROFIT 4500 $76 $340,000

Option 3:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 6000 $420 $2,520,000

Variable Manufacturing Cost 6000 -$144 -$864,000

Additional Rebate 6000 -$8 -$45,000

Fixed Manufacturing Cost 6000 -$77 -$460,000

Variable Selling & Administration Cost 6000 -$36 -$216,000

Fixed Selling & Administration Cost 6000 -$83 -$500,000

Additional Advertisement Cost 6000 -$10 -$60,000

TOTAL COST 6000 -$358 -$2,145,000

TOTAL PROFIT 6000 $63 $375,000

As per the current policy of the business, the management incurs a cost of $ 1,860,000 for

producing a volume of 5000 profits. At the current level of operations, the business can make

profits of around $ 240,000. The plan of the management is to improve the quality of the product

under option 1. The overall cost of business under option has increased due to the option, and the

profits of the business has also increased under the option (Hilton & Platt 2013).

ACCOUNTING FOR MANAGERS

Option 2:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 4500 $480 $2,160,000

Variable Manufacturing Cost 4500 -$144 -$648,000

Fixed Manufacturing Cost 4500 -$102 -$460,000

Variable Selling & Administration Cost 4500 -$36 -$162,000

Fixed Selling & Administration Cost 4500 -$111 -$500,000

Additional Advertisement Cost 4500 -$11 -$50,000

TOTAL COST 4500 -$404 -$1,820,000

TOTAL PROFIT 4500 $76 $340,000

Option 3:

Particulars Sales Volume Cost per unit Amount

SALES REVENUE 6000 $420 $2,520,000

Variable Manufacturing Cost 6000 -$144 -$864,000

Additional Rebate 6000 -$8 -$45,000

Fixed Manufacturing Cost 6000 -$77 -$460,000

Variable Selling & Administration Cost 6000 -$36 -$216,000

Fixed Selling & Administration Cost 6000 -$83 -$500,000

Additional Advertisement Cost 6000 -$10 -$60,000

TOTAL COST 6000 -$358 -$2,145,000

TOTAL PROFIT 6000 $63 $375,000

As per the current policy of the business, the management incurs a cost of $ 1,860,000 for

producing a volume of 5000 profits. At the current level of operations, the business can make

profits of around $ 240,000. The plan of the management is to improve the quality of the product

under option 1. The overall cost of business under option has increased due to the option, and the

profits of the business has also increased under the option (Hilton & Platt 2013).

5

ACCOUNTING FOR MANAGERS

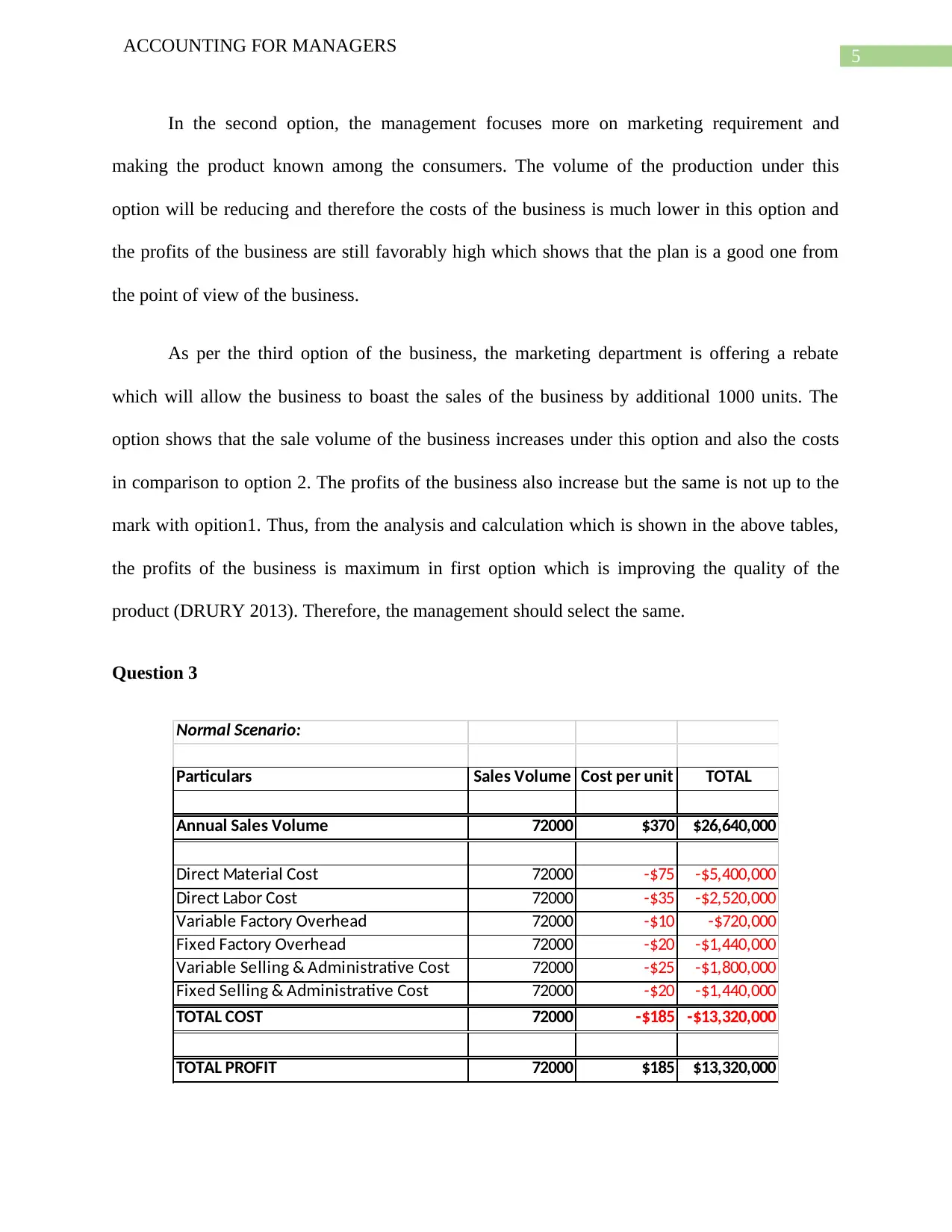

In the second option, the management focuses more on marketing requirement and

making the product known among the consumers. The volume of the production under this

option will be reducing and therefore the costs of the business is much lower in this option and

the profits of the business are still favorably high which shows that the plan is a good one from

the point of view of the business.

As per the third option of the business, the marketing department is offering a rebate

which will allow the business to boast the sales of the business by additional 1000 units. The

option shows that the sale volume of the business increases under this option and also the costs

in comparison to option 2. The profits of the business also increase but the same is not up to the

mark with opition1. Thus, from the analysis and calculation which is shown in the above tables,

the profits of the business is maximum in first option which is improving the quality of the

product (DRURY 2013). Therefore, the management should select the same.

Question 3

Normal Scenario:

Particulars Sales Volume Cost per unit TOTAL

Annual Sales Volume 72000 $370 $26,640,000

Direct Material Cost 72000 -$75 -$5,400,000

Direct Labor Cost 72000 -$35 -$2,520,000

Variable Factory Overhead 72000 -$10 -$720,000

Fixed Factory Overhead 72000 -$20 -$1,440,000

Variable Selling & Administrative Cost 72000 -$25 -$1,800,000

Fixed Selling & Administrative Cost 72000 -$20 -$1,440,000

TOTAL COST 72000 -$185 -$13,320,000

TOTAL PROFIT 72000 $185 $13,320,000

ACCOUNTING FOR MANAGERS

In the second option, the management focuses more on marketing requirement and

making the product known among the consumers. The volume of the production under this

option will be reducing and therefore the costs of the business is much lower in this option and

the profits of the business are still favorably high which shows that the plan is a good one from

the point of view of the business.

As per the third option of the business, the marketing department is offering a rebate

which will allow the business to boast the sales of the business by additional 1000 units. The

option shows that the sale volume of the business increases under this option and also the costs

in comparison to option 2. The profits of the business also increase but the same is not up to the

mark with opition1. Thus, from the analysis and calculation which is shown in the above tables,

the profits of the business is maximum in first option which is improving the quality of the

product (DRURY 2013). Therefore, the management should select the same.

Question 3

Normal Scenario:

Particulars Sales Volume Cost per unit TOTAL

Annual Sales Volume 72000 $370 $26,640,000

Direct Material Cost 72000 -$75 -$5,400,000

Direct Labor Cost 72000 -$35 -$2,520,000

Variable Factory Overhead 72000 -$10 -$720,000

Fixed Factory Overhead 72000 -$20 -$1,440,000

Variable Selling & Administrative Cost 72000 -$25 -$1,800,000

Fixed Selling & Administrative Cost 72000 -$20 -$1,440,000

TOTAL COST 72000 -$185 -$13,320,000

TOTAL PROFIT 72000 $185 $13,320,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING FOR MANAGERS

Production Capacity - 100,000 units:

Particulars Cost per unit Normal Sale Special Offer TOTAL

Sales Volume 72000 25000 97000

SALES REVENUE $370.00 $26,640,000 $9,250,000 $35,890,000

Direct Material Cost -$75.00 -$5,400,000 -$1,875,000 -$7,275,000

Direct Labor Cost -$35.00 -$2,520,000 -$875,000 -$3,395,000

Variable Factory Overhead -$10.00 -$720,000 -$250,000 -$970,000

Fixed Factory Overhead -$14.85 -$1,440,000

Variable Selling & Administrative Cost -$18.56 -$1,800,000

Fixed Selling & Administrative Cost -$14.85 -$1,440,000

TOTAL COST -$168.25 -$16,320,000

TOTAL PROFIT $201.75 $19,570,000

Production Capacity - 90,000 units:

Particulars Cost per unit Normal Sale Special Offer TOTAL

Sales Volume 65000 25000 90000

SALES REVENUE $370.00 $24,050,000 $9,250,000 $33,300,000

Direct Material Cost -$75.00 -$4,875,000 -$1,875,000 -$6,750,000

Direct Labor Cost -$35.00 -$2,275,000 -$875,000 -$3,150,000

Variable Factory Overhead -$10.00 -$650,000 -$250,000 -$900,000

Fixed Factory Overhead -$16.00 -$1,440,000

Variable Selling & Administrative Cost -$20.00 -$1,800,000

Fixed Selling & Administrative Cost -$16.00 -$1,440,000

TOTAL COST -$172.00 -$15,480,000

TOTAL PROFIT $198.00 $17,820,000

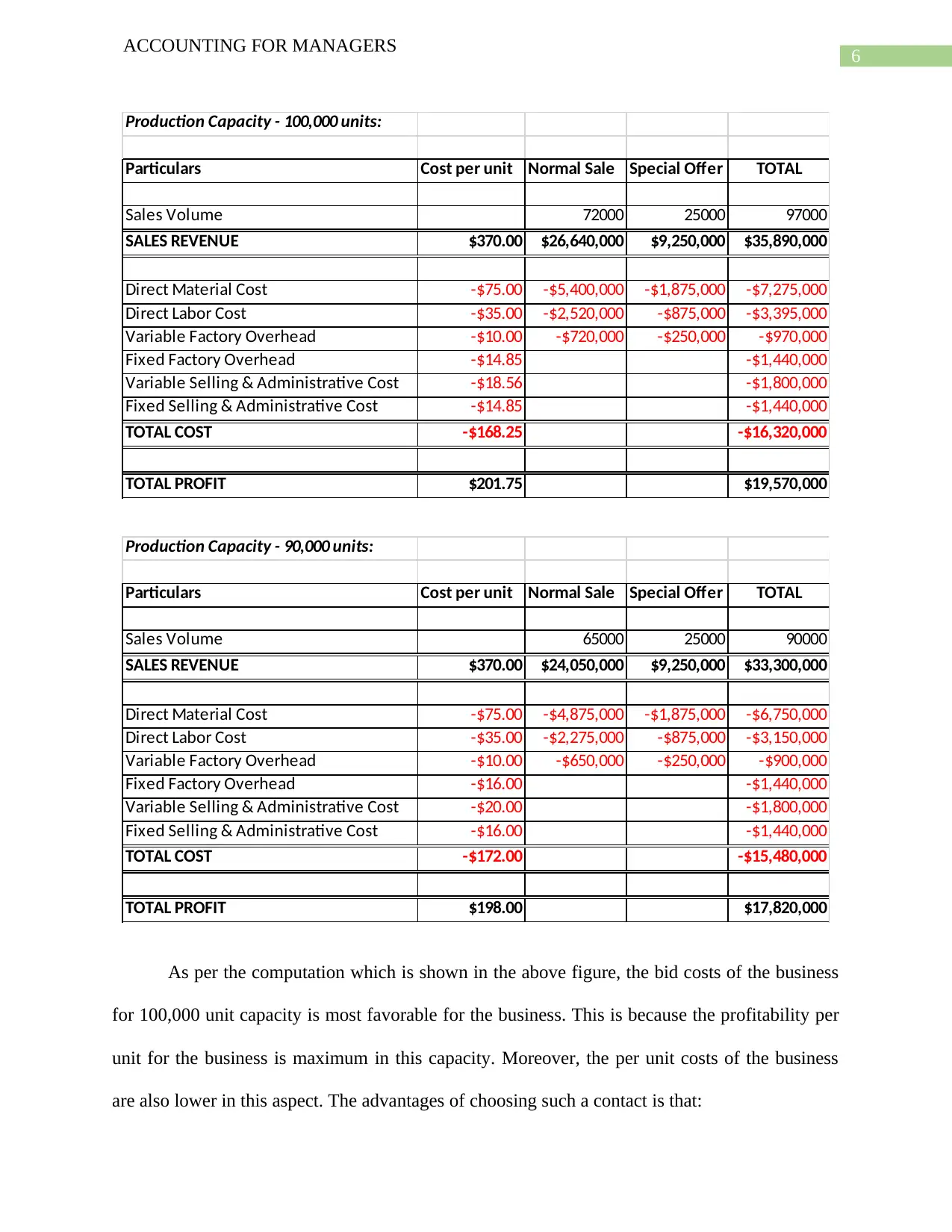

As per the computation which is shown in the above figure, the bid costs of the business

for 100,000 unit capacity is most favorable for the business. This is because the profitability per

unit for the business is maximum in this capacity. Moreover, the per unit costs of the business

are also lower in this aspect. The advantages of choosing such a contact is that:

ACCOUNTING FOR MANAGERS

Production Capacity - 100,000 units:

Particulars Cost per unit Normal Sale Special Offer TOTAL

Sales Volume 72000 25000 97000

SALES REVENUE $370.00 $26,640,000 $9,250,000 $35,890,000

Direct Material Cost -$75.00 -$5,400,000 -$1,875,000 -$7,275,000

Direct Labor Cost -$35.00 -$2,520,000 -$875,000 -$3,395,000

Variable Factory Overhead -$10.00 -$720,000 -$250,000 -$970,000

Fixed Factory Overhead -$14.85 -$1,440,000

Variable Selling & Administrative Cost -$18.56 -$1,800,000

Fixed Selling & Administrative Cost -$14.85 -$1,440,000

TOTAL COST -$168.25 -$16,320,000

TOTAL PROFIT $201.75 $19,570,000

Production Capacity - 90,000 units:

Particulars Cost per unit Normal Sale Special Offer TOTAL

Sales Volume 65000 25000 90000

SALES REVENUE $370.00 $24,050,000 $9,250,000 $33,300,000

Direct Material Cost -$75.00 -$4,875,000 -$1,875,000 -$6,750,000

Direct Labor Cost -$35.00 -$2,275,000 -$875,000 -$3,150,000

Variable Factory Overhead -$10.00 -$650,000 -$250,000 -$900,000

Fixed Factory Overhead -$16.00 -$1,440,000

Variable Selling & Administrative Cost -$20.00 -$1,800,000

Fixed Selling & Administrative Cost -$16.00 -$1,440,000

TOTAL COST -$172.00 -$15,480,000

TOTAL PROFIT $198.00 $17,820,000

As per the computation which is shown in the above figure, the bid costs of the business

for 100,000 unit capacity is most favorable for the business. This is because the profitability per

unit for the business is maximum in this capacity. Moreover, the per unit costs of the business

are also lower in this aspect. The advantages of choosing such a contact is that:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING FOR MANAGERS

The business will be producing at full capacity and thereby has the possibility of

increasing the normal sales of the business as well (Fullerton, Kennedy & Widener

2013).

If CEO of Cycle World ltd are satisfied with the products of the business then there is a

possibility of more future deals which is beneficial for the business.

The disadvantages which can be pointed out are shown below:

There is a chance of overproduction which will leave the business with overstock of final

products problem if the sales of the business does not increase.

The cost of operations of the business are also very high in this capacity and therefore the

overall risks of the business are also high.

ACCOUNTING FOR MANAGERS

The business will be producing at full capacity and thereby has the possibility of

increasing the normal sales of the business as well (Fullerton, Kennedy & Widener

2013).

If CEO of Cycle World ltd are satisfied with the products of the business then there is a

possibility of more future deals which is beneficial for the business.

The disadvantages which can be pointed out are shown below:

There is a chance of overproduction which will leave the business with overstock of final

products problem if the sales of the business does not increase.

The cost of operations of the business are also very high in this capacity and therefore the

overall risks of the business are also high.

8

ACCOUNTING FOR MANAGERS

Reference

DRURY, C.M., 2013. Management and cost accounting. Springer.

Fullerton, R.R., Kennedy, F.A. & Widener, S.K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society, 38(1),

pp.50-71.

Hilton, R.W. & Platt, D.E., 2013. Managerial accounting: creating value in a dynamic business

environment. McGraw-Hill Education.

JB Hi-Fi Investors. 2018. Annual Reports | JB Hi-Fi Solutions. [online] Available at:

https://investors.jbhifi.com.au/annual-reports/ [Accessed 6 Sep. 2018].

ACCOUNTING FOR MANAGERS

Reference

DRURY, C.M., 2013. Management and cost accounting. Springer.

Fullerton, R.R., Kennedy, F.A. & Widener, S.K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society, 38(1),

pp.50-71.

Hilton, R.W. & Platt, D.E., 2013. Managerial accounting: creating value in a dynamic business

environment. McGraw-Hill Education.

JB Hi-Fi Investors. 2018. Annual Reports | JB Hi-Fi Solutions. [online] Available at:

https://investors.jbhifi.com.au/annual-reports/ [Accessed 6 Sep. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.