Thomas Cook's Financial Performance: A Comprehensive Analysis

VerifiedAdded on 2023/01/17

|11

|2402

|80

Report

AI Summary

This report provides a detailed financial analysis of Thomas Cook, examining its performance from 2015 to 2018, and comparing it to TUI Travels. The analysis covers profitability ratios (gross profit, net profit), liquidity ratios (current ratio, quick ratio), solvency ratios (debt-equity ratio, gearing rat...

ACCOUNTING FOR

MANAGERS

MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

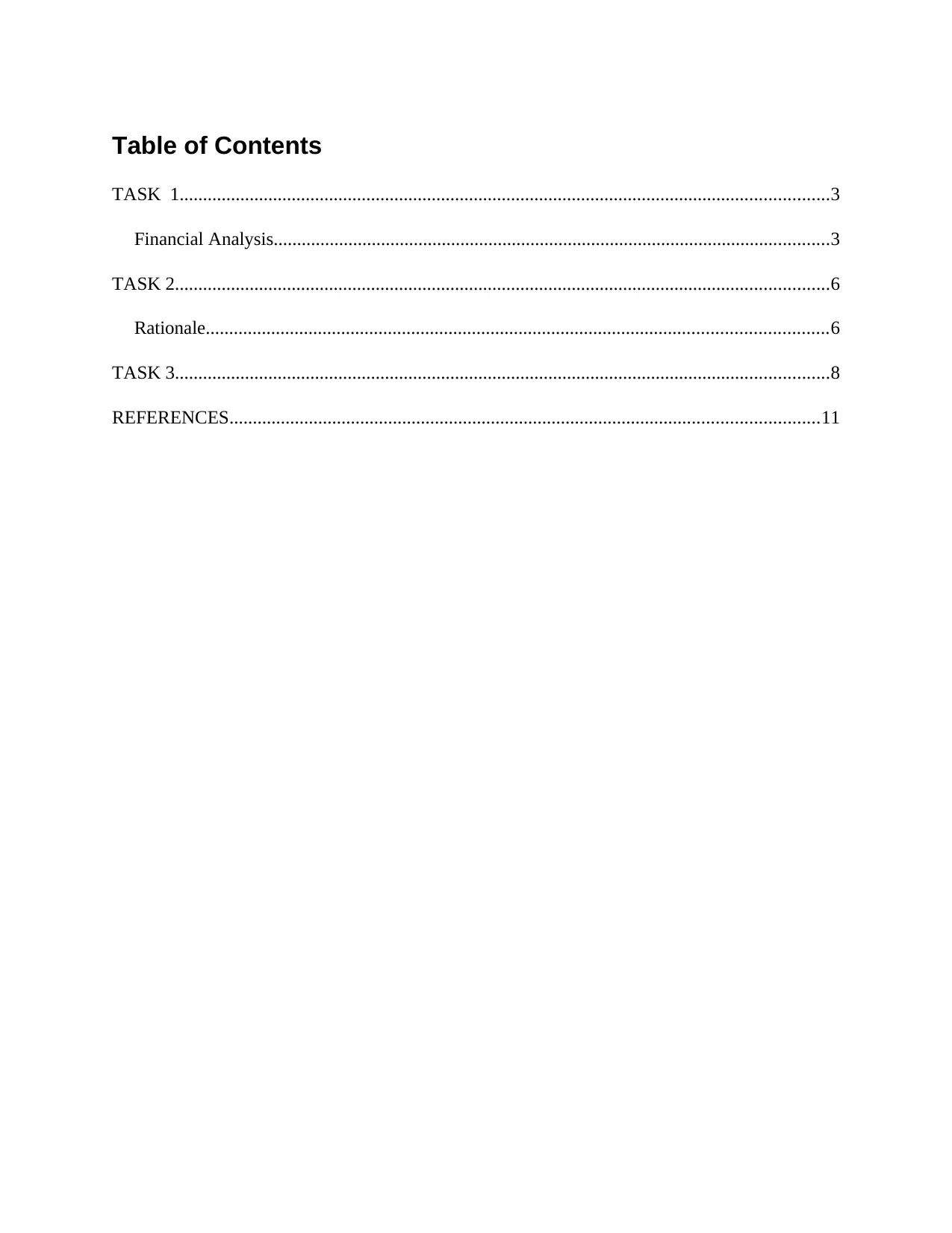

Table of Contents

TASK 1...........................................................................................................................................3

Financial Analysis.......................................................................................................................3

TASK 2............................................................................................................................................6

Rationale.....................................................................................................................................6

TASK 3............................................................................................................................................8

REFERENCES..............................................................................................................................11

TASK 1...........................................................................................................................................3

Financial Analysis.......................................................................................................................3

TASK 2............................................................................................................................................6

Rationale.....................................................................................................................................6

TASK 3............................................................................................................................................8

REFERENCES..............................................................................................................................11

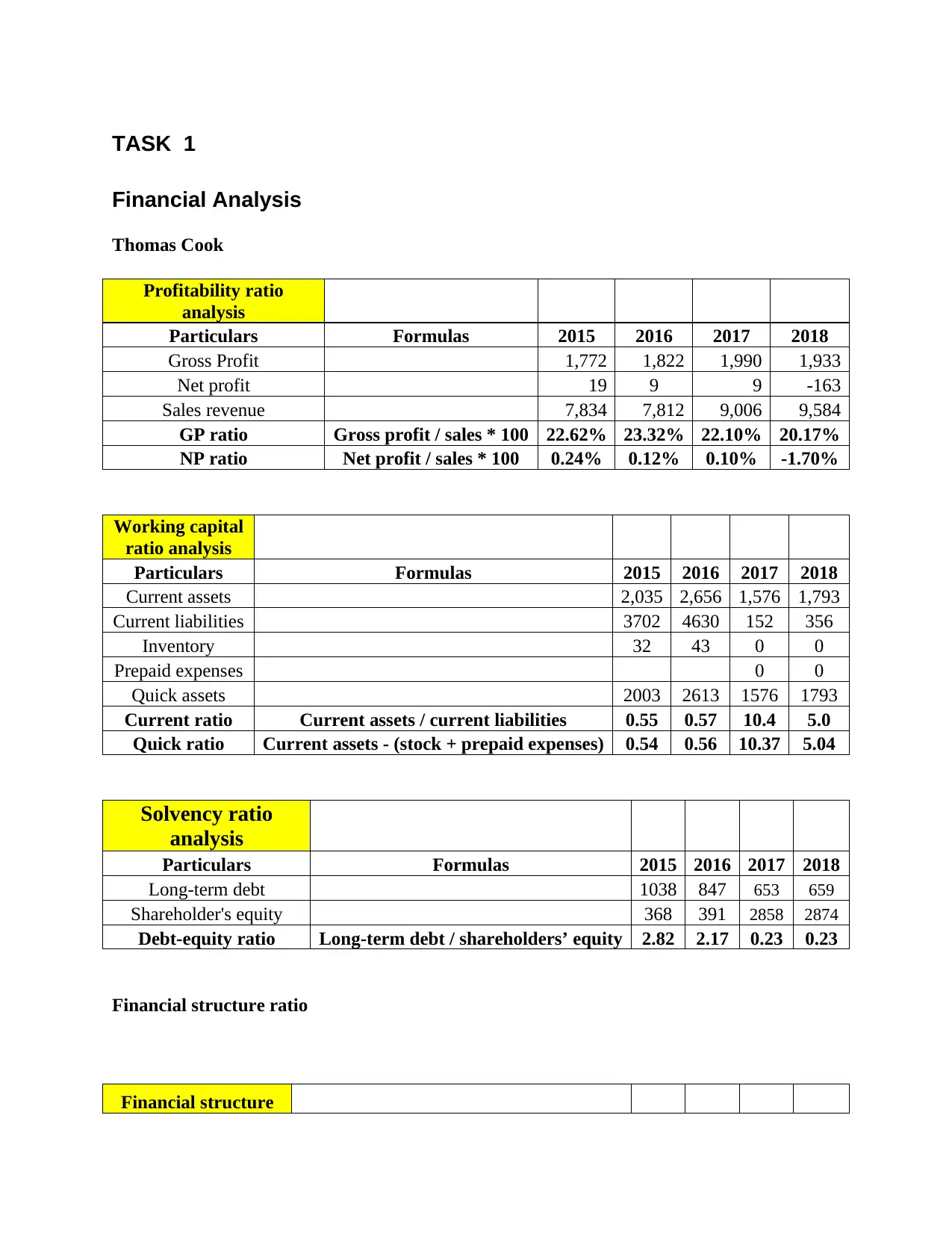

TASK 1

Financial Analysis

Thomas Cook

Profitability ratio

analysis

Particulars Formulas 2015 2016 2017 2018

Gross Profit 1,772 1,822 1,990 1,933

Net profit 19 9 9 -163

Sales revenue 7,834 7,812 9,006 9,584

GP ratio Gross profit / sales * 100 22.62% 23.32% 22.10% 20.17%

NP ratio Net profit / sales * 100 0.24% 0.12% 0.10% -1.70%

Working capital

ratio analysis

Particulars Formulas 2015 2016 2017 2018

Current assets 2,035 2,656 1,576 1,793

Current liabilities 3702 4630 152 356

Inventory 32 43 0 0

Prepaid expenses 0 0

Quick assets 2003 2613 1576 1793

Current ratio Current assets / current liabilities 0.55 0.57 10.4 5.0

Quick ratio Current assets - (stock + prepaid expenses) 0.54 0.56 10.37 5.04

Solvency ratio

analysis

Particulars Formulas 2015 2016 2017 2018

Long-term debt 1038 847 653 659

Shareholder's equity 368 391 2858 2874

Debt-equity ratio Long-term debt / shareholders’ equity 2.82 2.17 0.23 0.23

Financial structure ratio

Financial structure

Financial Analysis

Thomas Cook

Profitability ratio

analysis

Particulars Formulas 2015 2016 2017 2018

Gross Profit 1,772 1,822 1,990 1,933

Net profit 19 9 9 -163

Sales revenue 7,834 7,812 9,006 9,584

GP ratio Gross profit / sales * 100 22.62% 23.32% 22.10% 20.17%

NP ratio Net profit / sales * 100 0.24% 0.12% 0.10% -1.70%

Working capital

ratio analysis

Particulars Formulas 2015 2016 2017 2018

Current assets 2,035 2,656 1,576 1,793

Current liabilities 3702 4630 152 356

Inventory 32 43 0 0

Prepaid expenses 0 0

Quick assets 2003 2613 1576 1793

Current ratio Current assets / current liabilities 0.55 0.57 10.4 5.0

Quick ratio Current assets - (stock + prepaid expenses) 0.54 0.56 10.37 5.04

Solvency ratio

analysis

Particulars Formulas 2015 2016 2017 2018

Long-term debt 1038 847 653 659

Shareholder's equity 368 391 2858 2874

Debt-equity ratio Long-term debt / shareholders’ equity 2.82 2.17 0.23 0.23

Financial structure ratio

Financial structure

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

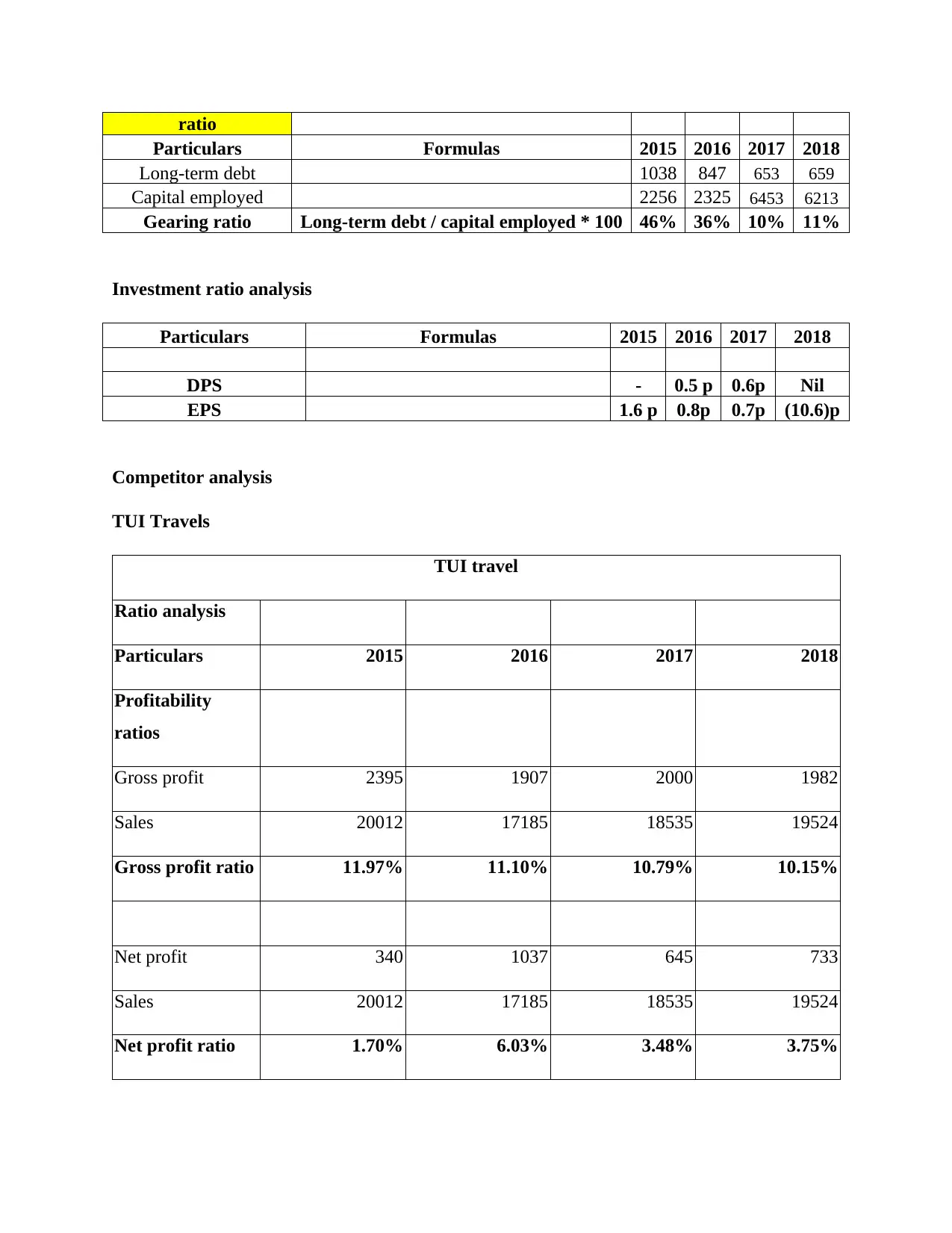

ratio

Particulars Formulas 2015 2016 2017 2018

Long-term debt 1038 847 653 659

Capital employed 2256 2325 6453 6213

Gearing ratio Long-term debt / capital employed * 100 46% 36% 10% 11%

Investment ratio analysis

Particulars Formulas 2015 2016 2017 2018

DPS - 0.5 p 0.6p Nil

EPS 1.6 p 0.8p 0.7p (10.6)p

Competitor analysis

TUI Travels

TUI travel

Ratio analysis

Particulars 2015 2016 2017 2018

Profitability

ratios

Gross profit 2395 1907 2000 1982

Sales 20012 17185 18535 19524

Gross profit ratio 11.97% 11.10% 10.79% 10.15%

Net profit 340 1037 645 733

Sales 20012 17185 18535 19524

Net profit ratio 1.70% 6.03% 3.48% 3.75%

Particulars Formulas 2015 2016 2017 2018

Long-term debt 1038 847 653 659

Capital employed 2256 2325 6453 6213

Gearing ratio Long-term debt / capital employed * 100 46% 36% 10% 11%

Investment ratio analysis

Particulars Formulas 2015 2016 2017 2018

DPS - 0.5 p 0.6p Nil

EPS 1.6 p 0.8p 0.7p (10.6)p

Competitor analysis

TUI Travels

TUI travel

Ratio analysis

Particulars 2015 2016 2017 2018

Profitability

ratios

Gross profit 2395 1907 2000 1982

Sales 20012 17185 18535 19524

Gross profit ratio 11.97% 11.10% 10.79% 10.15%

Net profit 340 1037 645 733

Sales 20012 17185 18535 19524

Net profit ratio 1.70% 6.03% 3.48% 3.75%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

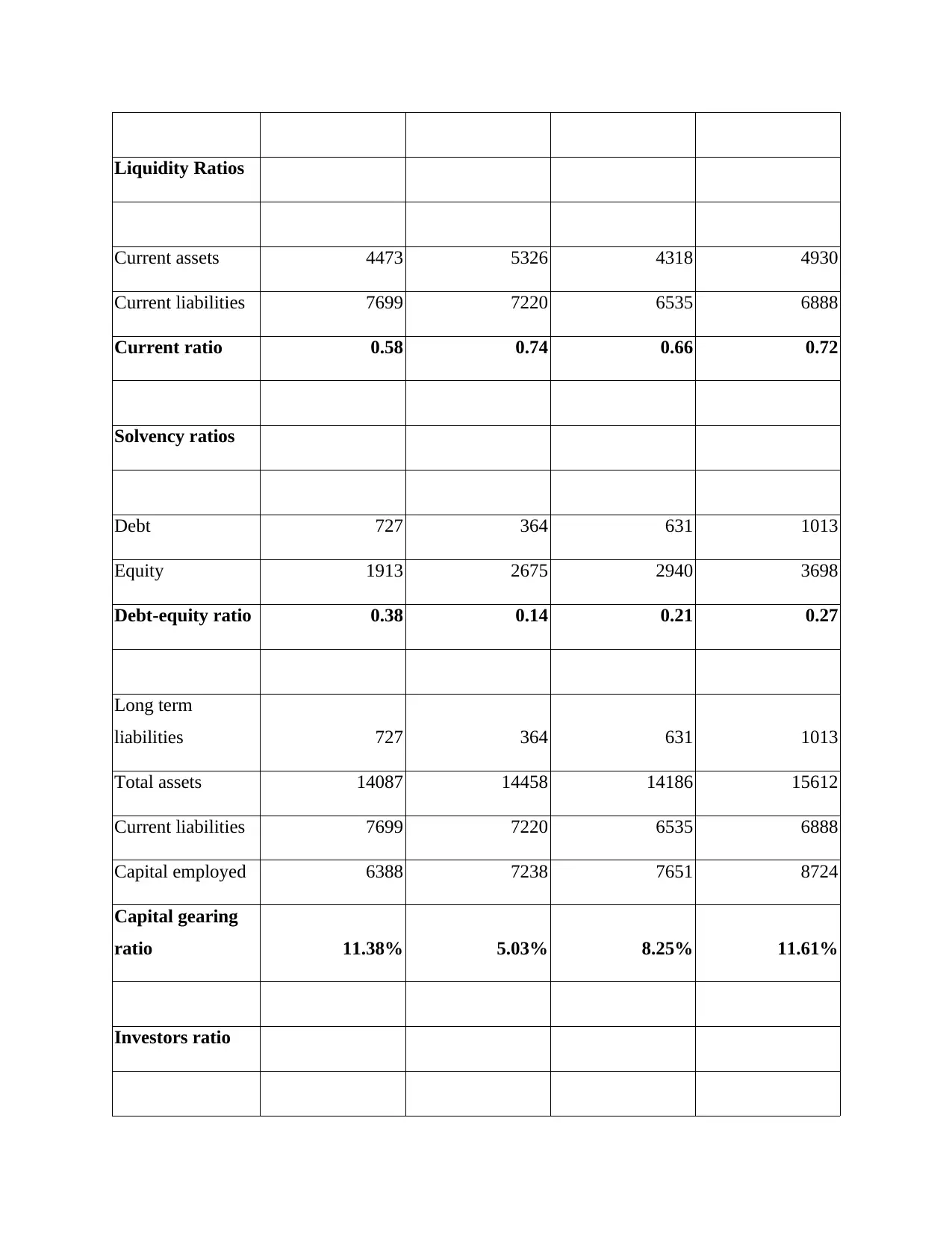

Liquidity Ratios

Current assets 4473 5326 4318 4930

Current liabilities 7699 7220 6535 6888

Current ratio 0.58 0.74 0.66 0.72

Solvency ratios

Debt 727 364 631 1013

Equity 1913 2675 2940 3698

Debt-equity ratio 0.38 0.14 0.21 0.27

Long term

liabilities 727 364 631 1013

Total assets 14087 14458 14186 15612

Current liabilities 7699 7220 6535 6888

Capital employed 6388 7238 7651 8724

Capital gearing

ratio 11.38% 5.03% 8.25% 11.61%

Investors ratio

Current assets 4473 5326 4318 4930

Current liabilities 7699 7220 6535 6888

Current ratio 0.58 0.74 0.66 0.72

Solvency ratios

Debt 727 364 631 1013

Equity 1913 2675 2940 3698

Debt-equity ratio 0.38 0.14 0.21 0.27

Long term

liabilities 727 364 631 1013

Total assets 14087 14458 14186 15612

Current liabilities 7699 7220 6535 6888

Capital employed 6388 7238 7651 8724

Capital gearing

ratio 11.38% 5.03% 8.25% 11.61%

Investors ratio

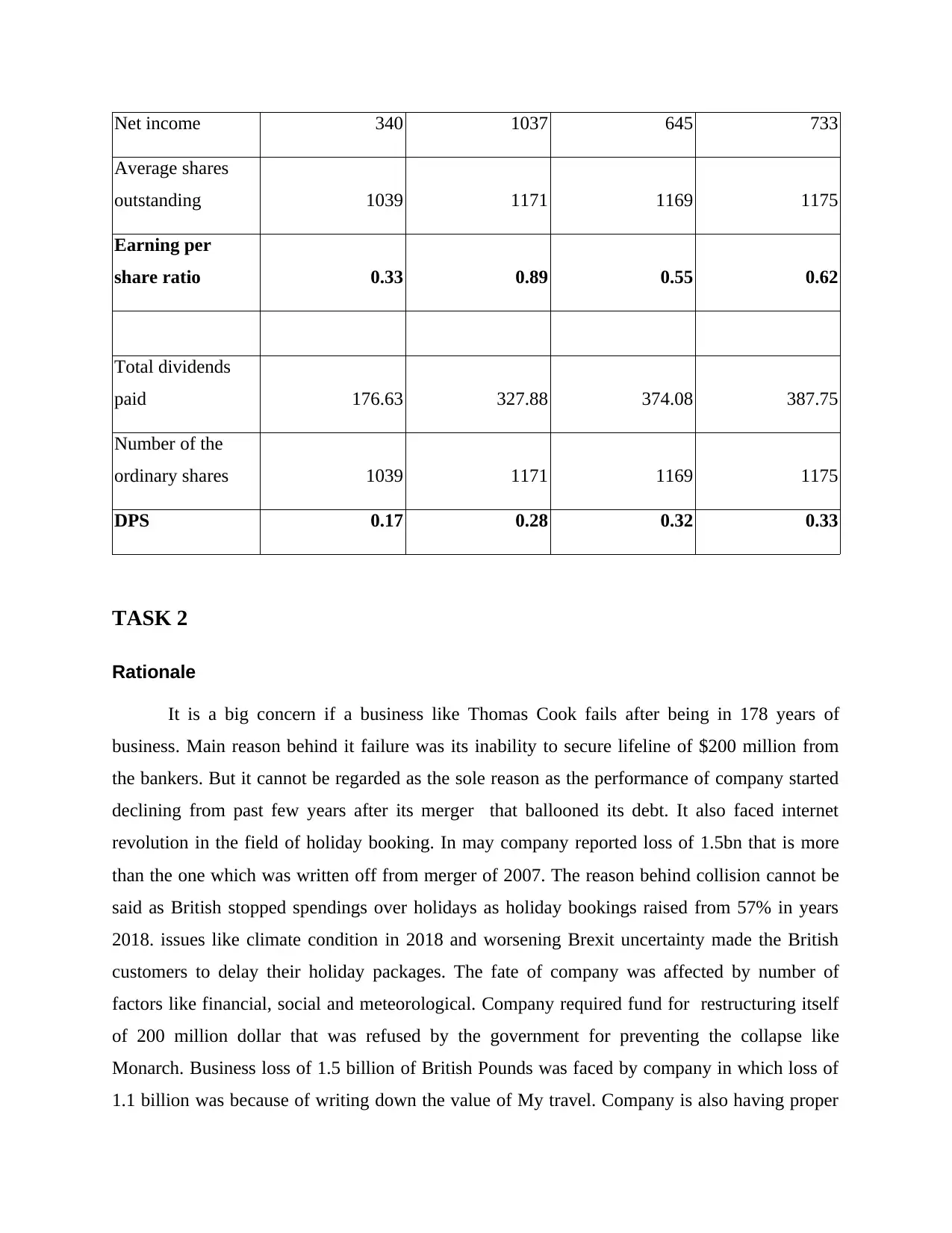

Net income 340 1037 645 733

Average shares

outstanding 1039 1171 1169 1175

Earning per

share ratio 0.33 0.89 0.55 0.62

Total dividends

paid 176.63 327.88 374.08 387.75

Number of the

ordinary shares 1039 1171 1169 1175

DPS 0.17 0.28 0.32 0.33

TASK 2

Rationale

It is a big concern if a business like Thomas Cook fails after being in 178 years of

business. Main reason behind it failure was its inability to secure lifeline of $200 million from

the bankers. But it cannot be regarded as the sole reason as the performance of company started

declining from past few years after its merger that ballooned its debt. It also faced internet

revolution in the field of holiday booking. In may company reported loss of 1.5bn that is more

than the one which was written off from merger of 2007. The reason behind collision cannot be

said as British stopped spendings over holidays as holiday bookings raised from 57% in years

2018. issues like climate condition in 2018 and worsening Brexit uncertainty made the British

customers to delay their holiday packages. The fate of company was affected by number of

factors like financial, social and meteorological. Company required fund for restructuring itself

of 200 million dollar that was refused by the government for preventing the collapse like

Monarch. Business loss of 1.5 billion of British Pounds was faced by company in which loss of

1.1 billion was because of writing down the value of My travel. Company is also having proper

Average shares

outstanding 1039 1171 1169 1175

Earning per

share ratio 0.33 0.89 0.55 0.62

Total dividends

paid 176.63 327.88 374.08 387.75

Number of the

ordinary shares 1039 1171 1169 1175

DPS 0.17 0.28 0.32 0.33

TASK 2

Rationale

It is a big concern if a business like Thomas Cook fails after being in 178 years of

business. Main reason behind it failure was its inability to secure lifeline of $200 million from

the bankers. But it cannot be regarded as the sole reason as the performance of company started

declining from past few years after its merger that ballooned its debt. It also faced internet

revolution in the field of holiday booking. In may company reported loss of 1.5bn that is more

than the one which was written off from merger of 2007. The reason behind collision cannot be

said as British stopped spendings over holidays as holiday bookings raised from 57% in years

2018. issues like climate condition in 2018 and worsening Brexit uncertainty made the British

customers to delay their holiday packages. The fate of company was affected by number of

factors like financial, social and meteorological. Company required fund for restructuring itself

of 200 million dollar that was refused by the government for preventing the collapse like

Monarch. Business loss of 1.5 billion of British Pounds was faced by company in which loss of

1.1 billion was because of writing down the value of My travel. Company is also having proper

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management problems. Company stopped paying dividends, pensions and than also compile the

debt amounting to 16 bn.

Considering the financial factors over the past four years it could be identified how

company collapsed and what would have prevented it. Analysing the profitability ration of the

company, it could be seen that major variations are not seen in the gross profit ratio of the

company. Being a travel company it does not have high direct costs therefore the gross profit

ratios of the company should be above 50 %. As company has not been able to increase it gross

profit over the past four years it was not left with sufficient amount to carry out its operations.

Net profit of the company in last four years is below 1% and in 2019 it went negative. The

continuous declining net profits shows that company has not efficiently managed it indirect costs

and direct cost even after continuous rise in revenues.

The liquidity ratios of the company shows very strong liquid position of the company. In

2017 company was having current ration of 10 and within a year it declined to 5 in 2019. The

large variations are seen due to short term debts raised by the company for meeting its working

capital requirements. Company for increasing the liquidity position should not raise the short

term debts that affect the liquidity of company. Company can raise long term debts for meeting

the working capital requirements. ]

Analysing the solvency ration of company it could be seen that company is highly in

taking loans from the outside lending bodies. The debt of the company as that against the

shareholders equity in 2017 and 2018 are very low in comparison to year 2015 and 2016. The

debt ration has improved as company has issued new share capital for the company without

decreasing the loan amount. Increasing the share capital will create more sharing of the profits.

Company is having very low profits. Raising funds through share capital was better decisions by

the company as company is not required to pay any fixed rate of interests from its profits. Main

reason behind the collapse was increased debt of company.

Earning per share and the dividend per share of the Thomas cook is seen as lower than its

competitor TUI travels. This clearly shows that Thomas Cook is not earning or generating

higher returns on its per share and not distributing sufficient amount of dividends to its

shareholders as compared to its rivalry. This in turn shows that company is performing

debt amounting to 16 bn.

Considering the financial factors over the past four years it could be identified how

company collapsed and what would have prevented it. Analysing the profitability ration of the

company, it could be seen that major variations are not seen in the gross profit ratio of the

company. Being a travel company it does not have high direct costs therefore the gross profit

ratios of the company should be above 50 %. As company has not been able to increase it gross

profit over the past four years it was not left with sufficient amount to carry out its operations.

Net profit of the company in last four years is below 1% and in 2019 it went negative. The

continuous declining net profits shows that company has not efficiently managed it indirect costs

and direct cost even after continuous rise in revenues.

The liquidity ratios of the company shows very strong liquid position of the company. In

2017 company was having current ration of 10 and within a year it declined to 5 in 2019. The

large variations are seen due to short term debts raised by the company for meeting its working

capital requirements. Company for increasing the liquidity position should not raise the short

term debts that affect the liquidity of company. Company can raise long term debts for meeting

the working capital requirements. ]

Analysing the solvency ration of company it could be seen that company is highly in

taking loans from the outside lending bodies. The debt of the company as that against the

shareholders equity in 2017 and 2018 are very low in comparison to year 2015 and 2016. The

debt ration has improved as company has issued new share capital for the company without

decreasing the loan amount. Increasing the share capital will create more sharing of the profits.

Company is having very low profits. Raising funds through share capital was better decisions by

the company as company is not required to pay any fixed rate of interests from its profits. Main

reason behind the collapse was increased debt of company.

Earning per share and the dividend per share of the Thomas cook is seen as lower than its

competitor TUI travels. This clearly shows that Thomas Cook is not earning or generating

higher returns on its per share and not distributing sufficient amount of dividends to its

shareholders as compared to its rivalry. This in turn shows that company is performing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

competitively against its competitor and must have take corrective measures in order to gain

competitive advantage.

Comparison with that of its competitors

Profitability ratio- The gross profit ratio of Thomas Cook is higher than TUI travels which

shows that the company is earning sufficient profits after paying off its variable costs. However,

as per the results generated it has been assessed that the net profit margin of Thomas Cook is

resulting as negative in comparison to its peer that is TUI travels. This means that Thomas cook

is not performing well and does not enough money in meeting all the cost and the tax expenses

as it is incurring loss.

Liquidity ratio- From the above analysis it has been reflected that the current ratio of

Thomas cook is increasing and reaching as too high over the years that is 5. This indicates that

the company is not making effective use of their current assets. However, the current ratio of

TUI travels is seen as better as compared to Thomas cook so this clearly shows that liquidity

position of Thomas cook is not good.

Solvency ratio- the debt equity ratio of Thomas cook is higher than TUI travels which

means that company is bearing high risk and has high level of debt financing and more financial

burden. This shows that solvency position of TUI travels is better than Thomas cook.

Long term financial structure ratio- Capital gearing ratio is the tool that is used for

assessing capital structure of an entity. If the large quantity of capital is been composed then the

company is said as low geared. Specifically it has been provided that the capital gearing ratio

that lies between 25% to 50% is counted as optimal. As Thomas cook resulting high ratio as

compared to its rivalry, this means that company is facing high risk and is highly leveraged.

TASK 3

Thomas Cook group is a British travel company which tends to offer distinct travel

packages and services to the travellers. The strategic alliance of the Thomas Cook tends to focus

on providing integrated services associated with the transportation, tourist and accommodation.

The key strategy which has been developed by the Thomas Cook is that it mainly focuses on

maximizing the value of the mainstream, becoming leading independent travel provider and also

competitive advantage.

Comparison with that of its competitors

Profitability ratio- The gross profit ratio of Thomas Cook is higher than TUI travels which

shows that the company is earning sufficient profits after paying off its variable costs. However,

as per the results generated it has been assessed that the net profit margin of Thomas Cook is

resulting as negative in comparison to its peer that is TUI travels. This means that Thomas cook

is not performing well and does not enough money in meeting all the cost and the tax expenses

as it is incurring loss.

Liquidity ratio- From the above analysis it has been reflected that the current ratio of

Thomas cook is increasing and reaching as too high over the years that is 5. This indicates that

the company is not making effective use of their current assets. However, the current ratio of

TUI travels is seen as better as compared to Thomas cook so this clearly shows that liquidity

position of Thomas cook is not good.

Solvency ratio- the debt equity ratio of Thomas cook is higher than TUI travels which

means that company is bearing high risk and has high level of debt financing and more financial

burden. This shows that solvency position of TUI travels is better than Thomas cook.

Long term financial structure ratio- Capital gearing ratio is the tool that is used for

assessing capital structure of an entity. If the large quantity of capital is been composed then the

company is said as low geared. Specifically it has been provided that the capital gearing ratio

that lies between 25% to 50% is counted as optimal. As Thomas cook resulting high ratio as

compared to its rivalry, this means that company is facing high risk and is highly leveraged.

TASK 3

Thomas Cook group is a British travel company which tends to offer distinct travel

packages and services to the travellers. The strategic alliance of the Thomas Cook tends to focus

on providing integrated services associated with the transportation, tourist and accommodation.

The key strategy which has been developed by the Thomas Cook is that it mainly focuses on

maximizing the value of the mainstream, becoming leading independent travel provider and also

focuses on strengthening the business and investment for the growth. Another effective strategy

opted by the Thomas cook is that, it mainly focuses on capturing the growth and value with the

help of strategic alliance, merger and acquisition and partnership (Mundt, 2015). The package

tour business model of Thomas cook company was highly successful for approximately 178

years. On the contrary, change in the demand of the customers and travel booking business

moving online is considered to be one of the major issue because Thomas Cook's company did

not move online which in turn resulted in the failure in the operations of the company. The

company had a debt of around 1.7 billion pounds and around 600,000 travellers from across the

world were stranded due to the closure of Thomas Cook's company. Package holidays are

changing. Thomas Cook has evaluated that, package tour business model had its own weakness

in terms of risk associated with the pre- buying of airline seats and room blocks in order to create

packages when they didn't own any airlines and hotels (Rodríguez and O’Connell, 2018). Non-

adaption to digital technology and low cost carrier were the major reason for failure of the

Thomas Cook's company.

Pechlaner, (2015) determine the fact that, The key reason for collision of Thomas Cook

after 178 years is due to the ballooning debts of the company and also the revolution associated

with the holiday booking. Thomas Cook tends to own about 560 high street showrooms or

outlets. The uncertainty associated with the Brexit is considered to be one of the major reason

associated with the collision of the Thomas cook company. The main reason of the collision of

the Thomas Cook company is mainly because of the decision of merging with the company who

has made profit one in the past 6 years. This deals in turn has left Thomas Cook with huge debts

which results in lower operational performance and productivity of the business. The climate

crisis is considered to be one of the major issue which results in collision of Thomas Cook

company. Wide heatwave has reduced the demand of holiday sharply which in turn results in

lower operational performance and productivity (de Wit and Zuidberg, 2017). In the year 2019,

the British customers were postponing their holiday plans because of the risk associated with the

Brexit and the hit of sterling buying power in abroad. The travel booking business has reached

online, but Thomas Cook's business were not performing the business operations online which in

turn is considered to be one of the major cause of business failure. This company mainly relied

on the physical stores and assistance provided through telephone. Mwesiumo, Halpern and

Buvik, (2019) sought to determine the fact that, the major reason associated with the failure in

opted by the Thomas cook is that, it mainly focuses on capturing the growth and value with the

help of strategic alliance, merger and acquisition and partnership (Mundt, 2015). The package

tour business model of Thomas cook company was highly successful for approximately 178

years. On the contrary, change in the demand of the customers and travel booking business

moving online is considered to be one of the major issue because Thomas Cook's company did

not move online which in turn resulted in the failure in the operations of the company. The

company had a debt of around 1.7 billion pounds and around 600,000 travellers from across the

world were stranded due to the closure of Thomas Cook's company. Package holidays are

changing. Thomas Cook has evaluated that, package tour business model had its own weakness

in terms of risk associated with the pre- buying of airline seats and room blocks in order to create

packages when they didn't own any airlines and hotels (Rodríguez and O’Connell, 2018). Non-

adaption to digital technology and low cost carrier were the major reason for failure of the

Thomas Cook's company.

Pechlaner, (2015) determine the fact that, The key reason for collision of Thomas Cook

after 178 years is due to the ballooning debts of the company and also the revolution associated

with the holiday booking. Thomas Cook tends to own about 560 high street showrooms or

outlets. The uncertainty associated with the Brexit is considered to be one of the major reason

associated with the collision of the Thomas cook company. The main reason of the collision of

the Thomas Cook company is mainly because of the decision of merging with the company who

has made profit one in the past 6 years. This deals in turn has left Thomas Cook with huge debts

which results in lower operational performance and productivity of the business. The climate

crisis is considered to be one of the major issue which results in collision of Thomas Cook

company. Wide heatwave has reduced the demand of holiday sharply which in turn results in

lower operational performance and productivity (de Wit and Zuidberg, 2017). In the year 2019,

the British customers were postponing their holiday plans because of the risk associated with the

Brexit and the hit of sterling buying power in abroad. The travel booking business has reached

online, but Thomas Cook's business were not performing the business operations online which in

turn is considered to be one of the major cause of business failure. This company mainly relied

on the physical stores and assistance provided through telephone. Mwesiumo, Halpern and

Buvik, (2019) sought to determine the fact that, the major reason associated with the failure in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

declining interest in the tour packages. This in turn largely affects or influences the cash flows of

the Thomas Cook's company. Another major reason associated with the failure in the operations

of the company is mainly linked with high operational and financial cost associated with the

operation of its own airlines linked with 34 planes with fleet travelling to around 82 destinations

(How Could Travel Giant Thomas Cook Fail?, 2019). This results in higher operational cost and

lower profitability for the Thomas Cook's company.

Brexit is considered to be one of the major issue which in turn mainly results in the

failure of the company (Rodríguez and O’Connell, 2018). Sterling losing value and operating

business at low cost carriers made it difficult for the company to operate its business operations.

Market uncertainty and falling value in the currency is considered to be one of the major factor

linked with failure in the operations of the business (How Could Travel Giant Thomas Cook

Fail?, 2019).

the Thomas Cook's company. Another major reason associated with the failure in the operations

of the company is mainly linked with high operational and financial cost associated with the

operation of its own airlines linked with 34 planes with fleet travelling to around 82 destinations

(How Could Travel Giant Thomas Cook Fail?, 2019). This results in higher operational cost and

lower profitability for the Thomas Cook's company.

Brexit is considered to be one of the major issue which in turn mainly results in the

failure of the company (Rodríguez and O’Connell, 2018). Sterling losing value and operating

business at low cost carriers made it difficult for the company to operate its business operations.

Market uncertainty and falling value in the currency is considered to be one of the major factor

linked with failure in the operations of the business (How Could Travel Giant Thomas Cook

Fail?, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Mwesiumo, D., Halpern, N. and Buvik, A., 2019. Effect of detailed contracts and partner

irreplaceability on interfirm conflict in cross-border package tour operations: Inbound tour

operator’s perspective. Journal of Travel research.58(2). pp.298-312.

Pechlaner, H., 2015. Thomas Cook: Pionier des Tourismus. European Journal of Tourism

Research, 10, p.145.

Rodríguez, A.M. and O’Connell, J.F., 2018. Can low-cost long-haul carriers replace Charter

airlines in the long-haul market? A European perspective. Tourism Economics.24(1).

pp.64-78.

Mundt, J.W., 2015. Thomas Cook: Pionier des Tourismus. Konstanz. European Journal of

Tourism Research: Volume 10, Year: 2015.222.pp.145-147.

de Wit, J.G. and Zuidberg, J., 2017. The growth limits of the low cost carrier model. In Low Cost

Carriers(pp. 383-390). Routledge.

Online

How Could Travel Giant Thomas Cook Fail?. 2019. [ONLINE]. Available

through:<https://www.nytimes.com/2019/09/23/travel/why-thomas-cook-travel-collapsed.html>

Books and Journals

Mwesiumo, D., Halpern, N. and Buvik, A., 2019. Effect of detailed contracts and partner

irreplaceability on interfirm conflict in cross-border package tour operations: Inbound tour

operator’s perspective. Journal of Travel research.58(2). pp.298-312.

Pechlaner, H., 2015. Thomas Cook: Pionier des Tourismus. European Journal of Tourism

Research, 10, p.145.

Rodríguez, A.M. and O’Connell, J.F., 2018. Can low-cost long-haul carriers replace Charter

airlines in the long-haul market? A European perspective. Tourism Economics.24(1).

pp.64-78.

Mundt, J.W., 2015. Thomas Cook: Pionier des Tourismus. Konstanz. European Journal of

Tourism Research: Volume 10, Year: 2015.222.pp.145-147.

de Wit, J.G. and Zuidberg, J., 2017. The growth limits of the low cost carrier model. In Low Cost

Carriers(pp. 383-390). Routledge.

Online

How Could Travel Giant Thomas Cook Fail?. 2019. [ONLINE]. Available

through:<https://www.nytimes.com/2019/09/23/travel/why-thomas-cook-travel-collapsed.html>

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.