Accounting for Managers: Calculation of Ratios, Comparison of Ratios, Accounting Treatment of Transactions

VerifiedAdded on 2023/06/15

|10

|1905

|279

AI Summary

This report analyzes the financial statements of Nimbin Pty Ltd and calculates various ratios to determine the company's profitability and liquidity. It also discusses the effect of various transactions on the financial statements. The report concludes that the day-to-day business transactions will definitely affect company’s financial statements.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: ACCOUNTING FOR MANAGERS

accounting concepts

accounting concepts

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting for Managers 1

Contents

Introduction................................................................................................................................2

Calculation of Ratios..................................................................................................................2

Comparison of Ratios.................................................................................................................5

Accounting treatment of transactions.........................................................................................6

Conclusion..................................................................................................................................7

References..................................................................................................................................8

Contents

Introduction................................................................................................................................2

Calculation of Ratios..................................................................................................................2

Comparison of Ratios.................................................................................................................5

Accounting treatment of transactions.........................................................................................6

Conclusion..................................................................................................................................7

References..................................................................................................................................8

Accounting for Managers 2

Introduction

Analysis of final accounts of a company reflects its financial position in the market. This

analysis is done to know about the overall financial condition of a company (Vogel,

2014).This report shows the calculation of various ratios on the basis of financial statements

of Nimbin Pty Ltd and their comparison with the industry standards in order to determine

profitability and liquidity of the company. The report also indicates the effect of various

transactions on the financial statements prepared by a company.

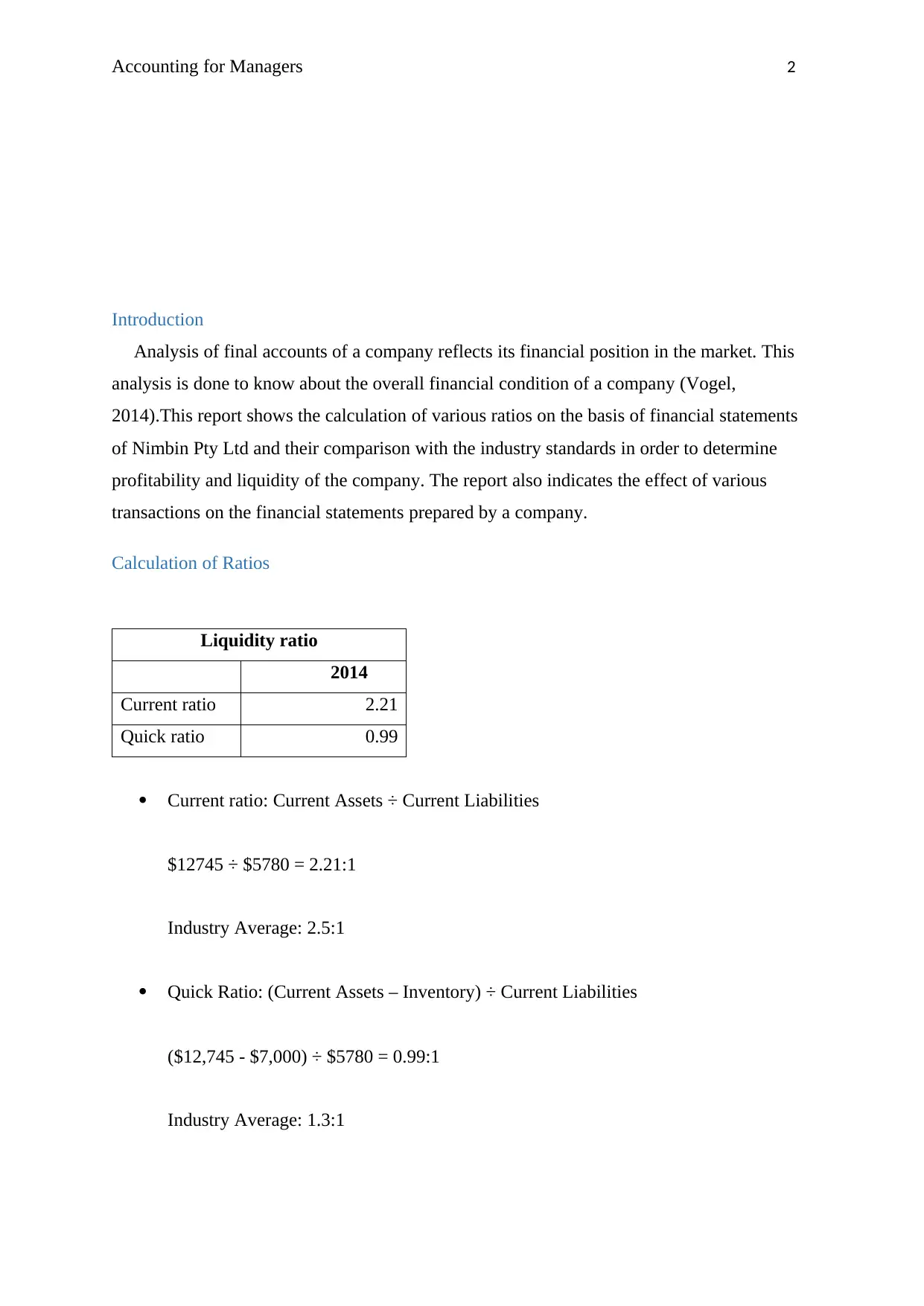

Calculation of Ratios

Liquidity ratio

2014

Current ratio 2.21

Quick ratio 0.99

Current ratio: Current Assets ÷ Current Liabilities

$12745 ÷ $5780 = 2.21:1

Industry Average: 2.5:1

Quick Ratio: (Current Assets – Inventory) ÷ Current Liabilities

($12,745 - $7,000) ÷ $5780 = 0.99:1

Industry Average: 1.3:1

Introduction

Analysis of final accounts of a company reflects its financial position in the market. This

analysis is done to know about the overall financial condition of a company (Vogel,

2014).This report shows the calculation of various ratios on the basis of financial statements

of Nimbin Pty Ltd and their comparison with the industry standards in order to determine

profitability and liquidity of the company. The report also indicates the effect of various

transactions on the financial statements prepared by a company.

Calculation of Ratios

Liquidity ratio

2014

Current ratio 2.21

Quick ratio 0.99

Current ratio: Current Assets ÷ Current Liabilities

$12745 ÷ $5780 = 2.21:1

Industry Average: 2.5:1

Quick Ratio: (Current Assets – Inventory) ÷ Current Liabilities

($12,745 - $7,000) ÷ $5780 = 0.99:1

Industry Average: 1.3:1

Accounting for Managers 3

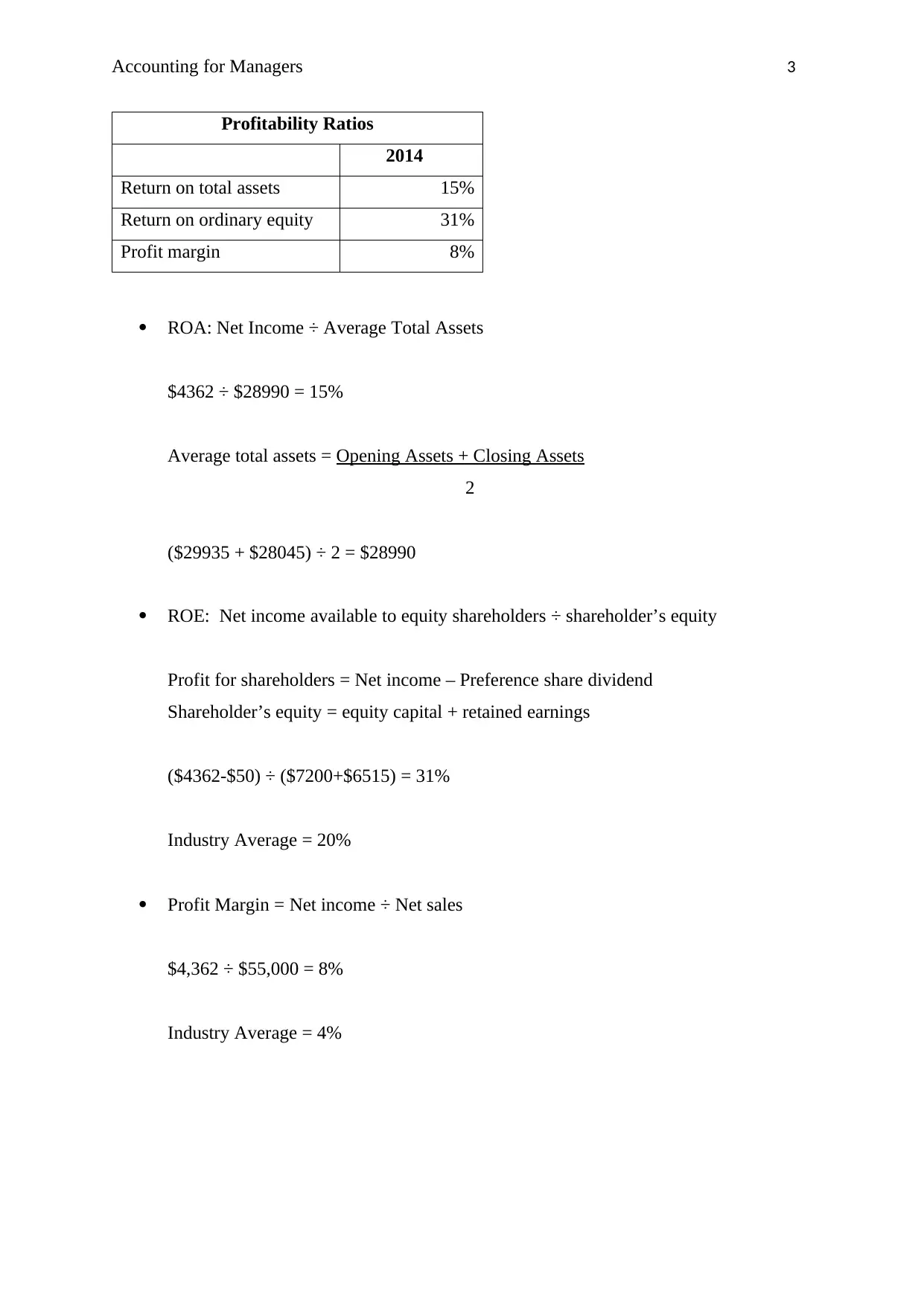

Profitability Ratios

2014

Return on total assets 15%

Return on ordinary equity 31%

Profit margin 8%

ROA: Net Income ÷ Average Total Assets

$4362 ÷ $28990 = 15%

Average total assets = Opening Assets + Closing Assets

2

($29935 + $28045) ÷ 2 = $28990

ROE: Net income available to equity shareholders ÷ shareholder’s equity

Profit for shareholders = Net income – Preference share dividend

Shareholder’s equity = equity capital + retained earnings

($4362-$50) ÷ ($7200+$6515) = 31%

Industry Average = 20%

Profit Margin = Net income ÷ Net sales

$4,362 ÷ $55,000 = 8%

Industry Average = 4%

Profitability Ratios

2014

Return on total assets 15%

Return on ordinary equity 31%

Profit margin 8%

ROA: Net Income ÷ Average Total Assets

$4362 ÷ $28990 = 15%

Average total assets = Opening Assets + Closing Assets

2

($29935 + $28045) ÷ 2 = $28990

ROE: Net income available to equity shareholders ÷ shareholder’s equity

Profit for shareholders = Net income – Preference share dividend

Shareholder’s equity = equity capital + retained earnings

($4362-$50) ÷ ($7200+$6515) = 31%

Industry Average = 20%

Profit Margin = Net income ÷ Net sales

$4,362 ÷ $55,000 = 8%

Industry Average = 4%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting for Managers 4

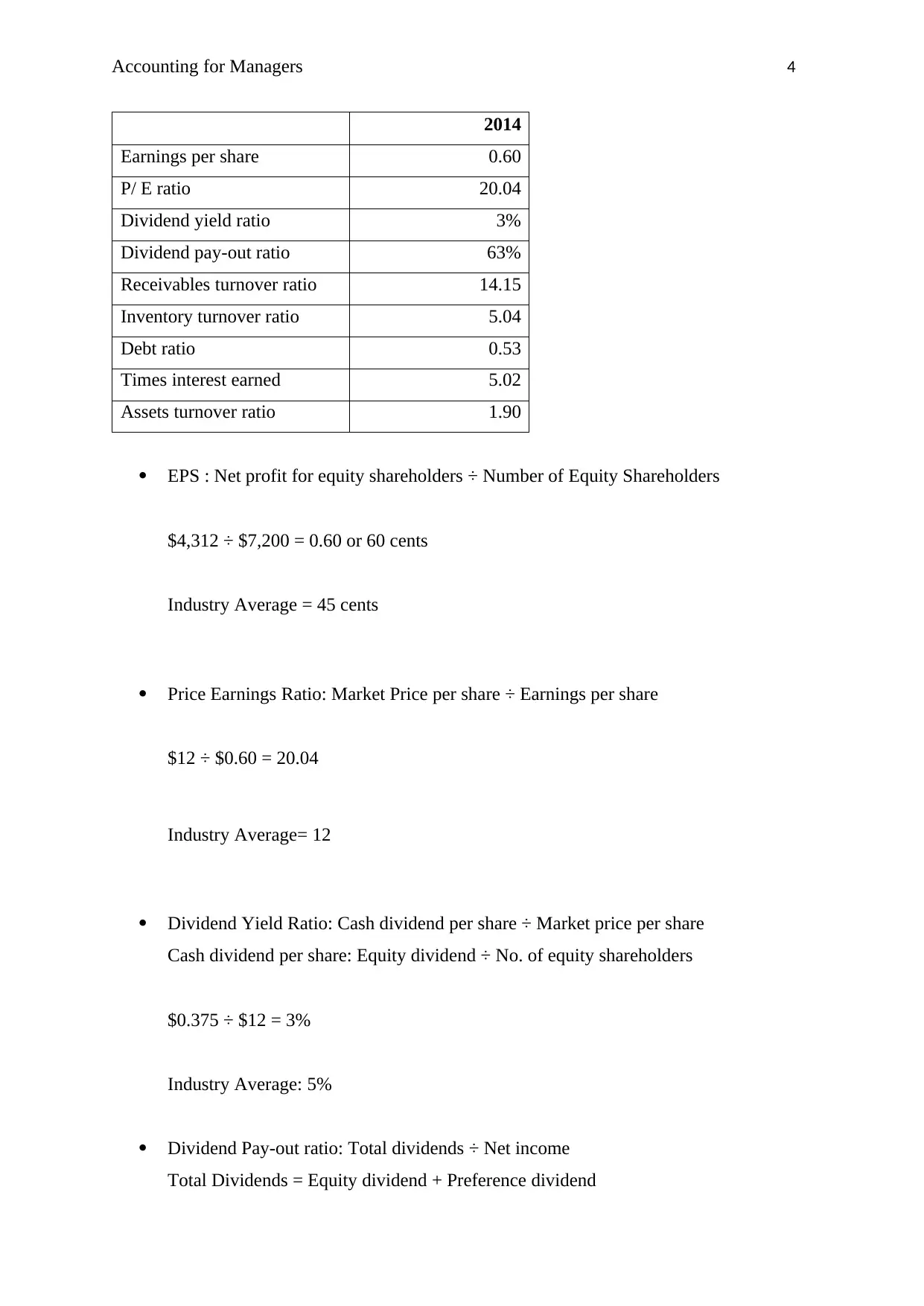

2014

Earnings per share 0.60

P/ E ratio 20.04

Dividend yield ratio 3%

Dividend pay-out ratio 63%

Receivables turnover ratio 14.15

Inventory turnover ratio 5.04

Debt ratio 0.53

Times interest earned 5.02

Assets turnover ratio 1.90

EPS : Net profit for equity shareholders ÷ Number of Equity Shareholders

$4,312 ÷ $7,200 = 0.60 or 60 cents

Industry Average = 45 cents

Price Earnings Ratio: Market Price per share ÷ Earnings per share

$12 ÷ $0.60 = 20.04

Industry Average= 12

Dividend Yield Ratio: Cash dividend per share ÷ Market price per share

Cash dividend per share: Equity dividend ÷ No. of equity shareholders

$0.375 ÷ $12 = 3%

Industry Average: 5%

Dividend Pay-out ratio: Total dividends ÷ Net income

Total Dividends = Equity dividend + Preference dividend

2014

Earnings per share 0.60

P/ E ratio 20.04

Dividend yield ratio 3%

Dividend pay-out ratio 63%

Receivables turnover ratio 14.15

Inventory turnover ratio 5.04

Debt ratio 0.53

Times interest earned 5.02

Assets turnover ratio 1.90

EPS : Net profit for equity shareholders ÷ Number of Equity Shareholders

$4,312 ÷ $7,200 = 0.60 or 60 cents

Industry Average = 45 cents

Price Earnings Ratio: Market Price per share ÷ Earnings per share

$12 ÷ $0.60 = 20.04

Industry Average= 12

Dividend Yield Ratio: Cash dividend per share ÷ Market price per share

Cash dividend per share: Equity dividend ÷ No. of equity shareholders

$0.375 ÷ $12 = 3%

Industry Average: 5%

Dividend Pay-out ratio: Total dividends ÷ Net income

Total Dividends = Equity dividend + Preference dividend

Accounting for Managers 5

($2702+$50) ÷ $4362 = 63%

Industry Average= 70%

Receivable turnover ratio: Net credit sales ÷ Average Debtors

$55,000 ÷ $3,887.5 = 14.15

Average Debtors = Opening Receivables + Closing Receivables

2

($3,675+$4,100) ÷ 2 = $3,887.5

Industry Average: 13

Inventory Turnover ratio: COGS ÷ Average inventory

$35,100 ÷ $6,965 = 5.04

Average Inventory= Opening Inventory + Closing Inventory

2

($6,930+$7,000) ÷ 2 = $6,965

Industry Average = 6

Debt Ratio: Total Liabilities ÷ Total Assets

$15,720 ÷ $29,935 = 53%

Industry Average= 40%

Times Interest Earned: EBIT ÷ Interest expense

$7,830 ÷ $1,560 = 5.02

EBIT= Profit before tax + Interest expense

($6270+$1560) = $7,830

Industry Average= 6

($2702+$50) ÷ $4362 = 63%

Industry Average= 70%

Receivable turnover ratio: Net credit sales ÷ Average Debtors

$55,000 ÷ $3,887.5 = 14.15

Average Debtors = Opening Receivables + Closing Receivables

2

($3,675+$4,100) ÷ 2 = $3,887.5

Industry Average: 13

Inventory Turnover ratio: COGS ÷ Average inventory

$35,100 ÷ $6,965 = 5.04

Average Inventory= Opening Inventory + Closing Inventory

2

($6,930+$7,000) ÷ 2 = $6,965

Industry Average = 6

Debt Ratio: Total Liabilities ÷ Total Assets

$15,720 ÷ $29,935 = 53%

Industry Average= 40%

Times Interest Earned: EBIT ÷ Interest expense

$7,830 ÷ $1,560 = 5.02

EBIT= Profit before tax + Interest expense

($6270+$1560) = $7,830

Industry Average= 6

Accounting for Managers 6

Asset Turnover Ratio: Total Revenue ÷ Average total assets

$55,000 ÷ $28,990 = 1.90

Average Total Assets= Opening Total Assets+ Closing Total Assets

2

($28,045+$29,935) ÷ 2 = $28,990

Industry Average= 1.8

Comparison of Ratios

Profitability

Analysis of the ratios like return on equity, ROA and profit margin will help in determining

the profitability of a company. These ratios show the potential of the company in making

profits.

The profit margin maintained by the company is 8% which is more than the industry average

of 4%, this means that the company is making more profits than the expected margin. It is

performing effectively and efficiently to make more profits.

Return on asset ratio indicates about how efficiently a company is generating its revenue with

the use of its total assets. Company’s ROA is 15% as compare to the industry ratio of 22%.

This shows that company is not maintaining its assets in an efficient manner in order to

generate more revenue (Jenter and Lewellen, 2015). As far as, return on ordinary equity ratio

is concerned, it point out the potential of a company to generate return form its investment.

Company’s ROE is 31% and industry benchmark is 20%. Having a ROE more than industry

expectations shows that company is capable of making high returns from its investment and

has a strong profitability position. Investor can find it profitable to invest in as they will be

getting high returns from their investment. (Penman, Reggiani, Richardson and Tuna, 2017).

Liquidity:

Liquidity ratios are the ones which tells how capable a company is in converting its assets

into liquid form. Current ratio and quick ratio are type of liquidity ratios which are measure

Asset Turnover Ratio: Total Revenue ÷ Average total assets

$55,000 ÷ $28,990 = 1.90

Average Total Assets= Opening Total Assets+ Closing Total Assets

2

($28,045+$29,935) ÷ 2 = $28,990

Industry Average= 1.8

Comparison of Ratios

Profitability

Analysis of the ratios like return on equity, ROA and profit margin will help in determining

the profitability of a company. These ratios show the potential of the company in making

profits.

The profit margin maintained by the company is 8% which is more than the industry average

of 4%, this means that the company is making more profits than the expected margin. It is

performing effectively and efficiently to make more profits.

Return on asset ratio indicates about how efficiently a company is generating its revenue with

the use of its total assets. Company’s ROA is 15% as compare to the industry ratio of 22%.

This shows that company is not maintaining its assets in an efficient manner in order to

generate more revenue (Jenter and Lewellen, 2015). As far as, return on ordinary equity ratio

is concerned, it point out the potential of a company to generate return form its investment.

Company’s ROE is 31% and industry benchmark is 20%. Having a ROE more than industry

expectations shows that company is capable of making high returns from its investment and

has a strong profitability position. Investor can find it profitable to invest in as they will be

getting high returns from their investment. (Penman, Reggiani, Richardson and Tuna, 2017).

Liquidity:

Liquidity ratios are the ones which tells how capable a company is in converting its assets

into liquid form. Current ratio and quick ratio are type of liquidity ratios which are measure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting for Managers 7

in order to determine the liquidity position of the company (Higgins, 2012). The current ratio

is 2.21:1, which is less than the industry ratio of 2.5:1. It shows that company is not efficient

enough to deal with its liquidity problems. On the top of that, the quick ratio of 0.99:1 is also

considerably lower than the industry’s ratio of 1.3:1, which indicates that the company is

unable to meet its short term obligations using its liquid assets. Hence, the company’s

liquidity position is not very well. (Saleem and Rehman, 2011).

Financial gearing:

The proportion of debt and equity which is used by the company in conducting its business is

known as financial gearing. It defines the overall capital structure of the company. Debt ratio

means the amount of assets of the company which are taken through debt. The debt ratio of

53% is quite higher than the industry average of 40%. It indicates that the company has high

financial risk because of its excessive use of debt in conducting its operations (Levi and

Segal, 2015).

Accounting treatment of transactions

The chef is definitely an asset for the company as it contributes in the success of the

restaurant. It carries out all the operations of the business successfully which results in

increasing the profitability and meeting the requirements of the customers efficiently.

However, the chef is a human resource and does not have a monetary value.

Moreover, there is not set method or standard for the measurement and recognition of

human resource assets. As a result, chef cannot be shown in the balance sheet as the

valuation cannot be done in quantitative form.

Effect of transactions on financial statements

1. An increase in total assets and decrease in cash will be there. This effect will be

shown in balance sheet on the asset side as well as in cash flow statement under the

head investing activities as cash reduces.

2. In balance sheet, increase in receivables (assets) and increase in equity will be shown.

In income statement, increase in income will be there.

3. Decrease in cash and decrease in liability will be reflected in the balance sheet. Cash

flow statement will show a decrease in cash under operating activities.

4. An increase in the capital account and increase in cash will be recorded in balance

sheet. Statement of cash flow will also be affected as there is an increase in cash

shown under financing activities. Increase in equity is also there.

in order to determine the liquidity position of the company (Higgins, 2012). The current ratio

is 2.21:1, which is less than the industry ratio of 2.5:1. It shows that company is not efficient

enough to deal with its liquidity problems. On the top of that, the quick ratio of 0.99:1 is also

considerably lower than the industry’s ratio of 1.3:1, which indicates that the company is

unable to meet its short term obligations using its liquid assets. Hence, the company’s

liquidity position is not very well. (Saleem and Rehman, 2011).

Financial gearing:

The proportion of debt and equity which is used by the company in conducting its business is

known as financial gearing. It defines the overall capital structure of the company. Debt ratio

means the amount of assets of the company which are taken through debt. The debt ratio of

53% is quite higher than the industry average of 40%. It indicates that the company has high

financial risk because of its excessive use of debt in conducting its operations (Levi and

Segal, 2015).

Accounting treatment of transactions

The chef is definitely an asset for the company as it contributes in the success of the

restaurant. It carries out all the operations of the business successfully which results in

increasing the profitability and meeting the requirements of the customers efficiently.

However, the chef is a human resource and does not have a monetary value.

Moreover, there is not set method or standard for the measurement and recognition of

human resource assets. As a result, chef cannot be shown in the balance sheet as the

valuation cannot be done in quantitative form.

Effect of transactions on financial statements

1. An increase in total assets and decrease in cash will be there. This effect will be

shown in balance sheet on the asset side as well as in cash flow statement under the

head investing activities as cash reduces.

2. In balance sheet, increase in receivables (assets) and increase in equity will be shown.

In income statement, increase in income will be there.

3. Decrease in cash and decrease in liability will be reflected in the balance sheet. Cash

flow statement will show a decrease in cash under operating activities.

4. An increase in the capital account and increase in cash will be recorded in balance

sheet. Statement of cash flow will also be affected as there is an increase in cash

shown under financing activities. Increase in equity is also there.

Accounting for Managers 8

5. Balance sheet will show an increase in asset that is cash and decrease in asset that is

accounts receivables. Increase cash from operating activities will be reported in cash

flow statement.

6. In Balance sheet, decrease in asset (cash) and decrease equity. In income statement,

increase in expenses and in statement of cash flow decrease in cash under operating

activities.

7. Increase in liability (accounts payable) and decrease equity will be shown in balance

sheet. Expenses increase, reflected in income statement.

8. Balance sheet will report an increase in cash and decrease in asset. Increase cash flow

under investing activities will be recorded in statement of cash flow.

9. In Balance sheet, decrease in capital account (owner’s equity) and decrease in current

asset (cash). In statement of cash flow, decreased cash.

10. Increase in cash (asset) and increase in liability will be shown in balance sheet and

increased cash flow will be recorded in cash flow statement.

Conclusion

The report concludes that to measure company’s profitability, liquidity and use of financial

gearing, method of ratio analysis is adopted as the calculated ratios gives a clear view about

the position of company in regard with these three terms. In addition to this, it can also be

concluded that the day-to-day business transactions will definitely affect company’s financial

statements. Whenever, a company makes any transaction, it has to be recorded in its final

accounts which get affected by the transaction made.

References

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

5. Balance sheet will show an increase in asset that is cash and decrease in asset that is

accounts receivables. Increase cash from operating activities will be reported in cash

flow statement.

6. In Balance sheet, decrease in asset (cash) and decrease equity. In income statement,

increase in expenses and in statement of cash flow decrease in cash under operating

activities.

7. Increase in liability (accounts payable) and decrease equity will be shown in balance

sheet. Expenses increase, reflected in income statement.

8. Balance sheet will report an increase in cash and decrease in asset. Increase cash flow

under investing activities will be recorded in statement of cash flow.

9. In Balance sheet, decrease in capital account (owner’s equity) and decrease in current

asset (cash). In statement of cash flow, decreased cash.

10. Increase in cash (asset) and increase in liability will be shown in balance sheet and

increased cash flow will be recorded in cash flow statement.

Conclusion

The report concludes that to measure company’s profitability, liquidity and use of financial

gearing, method of ratio analysis is adopted as the calculated ratios gives a clear view about

the position of company in regard with these three terms. In addition to this, it can also be

concluded that the day-to-day business transactions will definitely affect company’s financial

statements. Whenever, a company makes any transaction, it has to be recorded in its final

accounts which get affected by the transaction made.

References

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Accounting for Managers 9

Jenter, D. and Lewellen, K., 2015. CEO preferences and acquisitions. The Journal of

Finance, 70(6), pp.2813-2852.

Levi, S. and Segal, B., 2015. The Impact of Debt-Equity Reporting Classifications on the

Firm's Decision to Issue Hybrid Securities. European Accounting Review, 24(4), pp.801-822.

Penman, S.H., Reggiani, F., Richardson, S.A. and Tuna, A., 2017. A Framework for

Identifying Accounting Characteristics for Asset Pricing Models, with an Evaluation of

Book-To-Price.

Saleem, Q. and Rehman, R.U., 2011. Impacts of liquidity ratios on

profitability. Interdisciplinary Journal of Research in Business, 1(7), pp.95-98.

Vogel, H.L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Jenter, D. and Lewellen, K., 2015. CEO preferences and acquisitions. The Journal of

Finance, 70(6), pp.2813-2852.

Levi, S. and Segal, B., 2015. The Impact of Debt-Equity Reporting Classifications on the

Firm's Decision to Issue Hybrid Securities. European Accounting Review, 24(4), pp.801-822.

Penman, S.H., Reggiani, F., Richardson, S.A. and Tuna, A., 2017. A Framework for

Identifying Accounting Characteristics for Asset Pricing Models, with an Evaluation of

Book-To-Price.

Saleem, Q. and Rehman, R.U., 2011. Impacts of liquidity ratios on

profitability. Interdisciplinary Journal of Research in Business, 1(7), pp.95-98.

Vogel, H.L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.