ACC91210 Finance: Capital Structure and Payout Policy Analysis

VerifiedAdded on 2023/03/30

|14

|2786

|130

Case Study

AI Summary

This case study solution analyzes JB-Hi-Fi's capital structure and payout policies using historical data and relevant financial theories. It evaluates debt-to-equity ratios, dividend payout ratios, and factors influencing these policies. The analysis determines that JB-Hi-Fi relies heavily on debt financing ...

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Name of the Student:

Name of the University:

Authors Note:

Accounting for Managers

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

1

Table of Contents

Introduction:...............................................................................................................................2

Task 1:........................................................................................................................................2

1. Describing the policy based on the current and historical data of JB-Hi-Fi:.........................2

2. Evaluating the policy and drawing on the practical and theory applied by the company’s

current characteristics and situation:..........................................................................................5

Task 2: Analysing the proposed project, while presenting the OnePack’s CEO with relevant

justification for the different levels of sensitivity analysis........................................................6

Conclusion:..............................................................................................................................10

References and Bibliography:..................................................................................................11

Appendices:..............................................................................................................................13

1

Table of Contents

Introduction:...............................................................................................................................2

Task 1:........................................................................................................................................2

1. Describing the policy based on the current and historical data of JB-Hi-Fi:.........................2

2. Evaluating the policy and drawing on the practical and theory applied by the company’s

current characteristics and situation:..........................................................................................5

Task 2: Analysing the proposed project, while presenting the OnePack’s CEO with relevant

justification for the different levels of sensitivity analysis........................................................6

Conclusion:..............................................................................................................................10

References and Bibliography:..................................................................................................11

Appendices:..............................................................................................................................13

ACCOUNTING FOR MANAGERS

2

Introduction:

The assessment aims in evaluating the analysis of the overall capital structure of JB-

Hi-Fi for the past three financial years, which can eventually help in determining the policy

used by the organisation in formulating their capital structure. Further evaluation has been

conducted on the memorandum, which is presented to the CEO of Onepack Limited and

directly evaluates the financial viability of the proposed project. Further analysis is conducted

on the decision-making process and capital budgeting techniques, which directly evaluates

the financial viability of the investment option. Moreover, sensitivity analysis is also

conducted for the proposed project, as it examines the overall performance of the project and

determines the financial viability of the investment.

Task 1:

1. Describing the policy based on the current and historical data of JB-Hi-Fi:

Capital Structure and Payout Ratios: -

Particulars 2016 2017 2018

FY 2019

[Q2]

Total assets $ 992,381 $ 2,459,800 $ 2,491,700

$

2,837,000.00

Total liabilities

$

587,679

$

1,606,300

$

1,544,100

$

1,781,800.00

Total equity

$

404,702

$

853,600

$

947,600

$

1,055,200.00

Dividend per share

1.0

0

1.1

8

1.3

2

$

1.37

Earnings per share

1.5

4

1.8

6

2.0

3

$

1.39

Debt ratio

0.5

9

0.6

5

0.6

2 63%

Equity ratio

0.4

1

0.3

5

0.3

8 37%

Debt to equity ratio

1.4

5

1.8

8

1.6

3 169%

Dividend payout 65.02% 63.44% 64.99% 98%

2

Introduction:

The assessment aims in evaluating the analysis of the overall capital structure of JB-

Hi-Fi for the past three financial years, which can eventually help in determining the policy

used by the organisation in formulating their capital structure. Further evaluation has been

conducted on the memorandum, which is presented to the CEO of Onepack Limited and

directly evaluates the financial viability of the proposed project. Further analysis is conducted

on the decision-making process and capital budgeting techniques, which directly evaluates

the financial viability of the investment option. Moreover, sensitivity analysis is also

conducted for the proposed project, as it examines the overall performance of the project and

determines the financial viability of the investment.

Task 1:

1. Describing the policy based on the current and historical data of JB-Hi-Fi:

Capital Structure and Payout Ratios: -

Particulars 2016 2017 2018

FY 2019

[Q2]

Total assets $ 992,381 $ 2,459,800 $ 2,491,700

$

2,837,000.00

Total liabilities

$

587,679

$

1,606,300

$

1,544,100

$

1,781,800.00

Total equity

$

404,702

$

853,600

$

947,600

$

1,055,200.00

Dividend per share

1.0

0

1.1

8

1.3

2

$

1.37

Earnings per share

1.5

4

1.8

6

2.0

3

$

1.39

Debt ratio

0.5

9

0.6

5

0.6

2 63%

Equity ratio

0.4

1

0.3

5

0.3

8 37%

Debt to equity ratio

1.4

5

1.8

8

1.6

3 169%

Dividend payout 65.02% 63.44% 64.99% 98%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

3

ratio

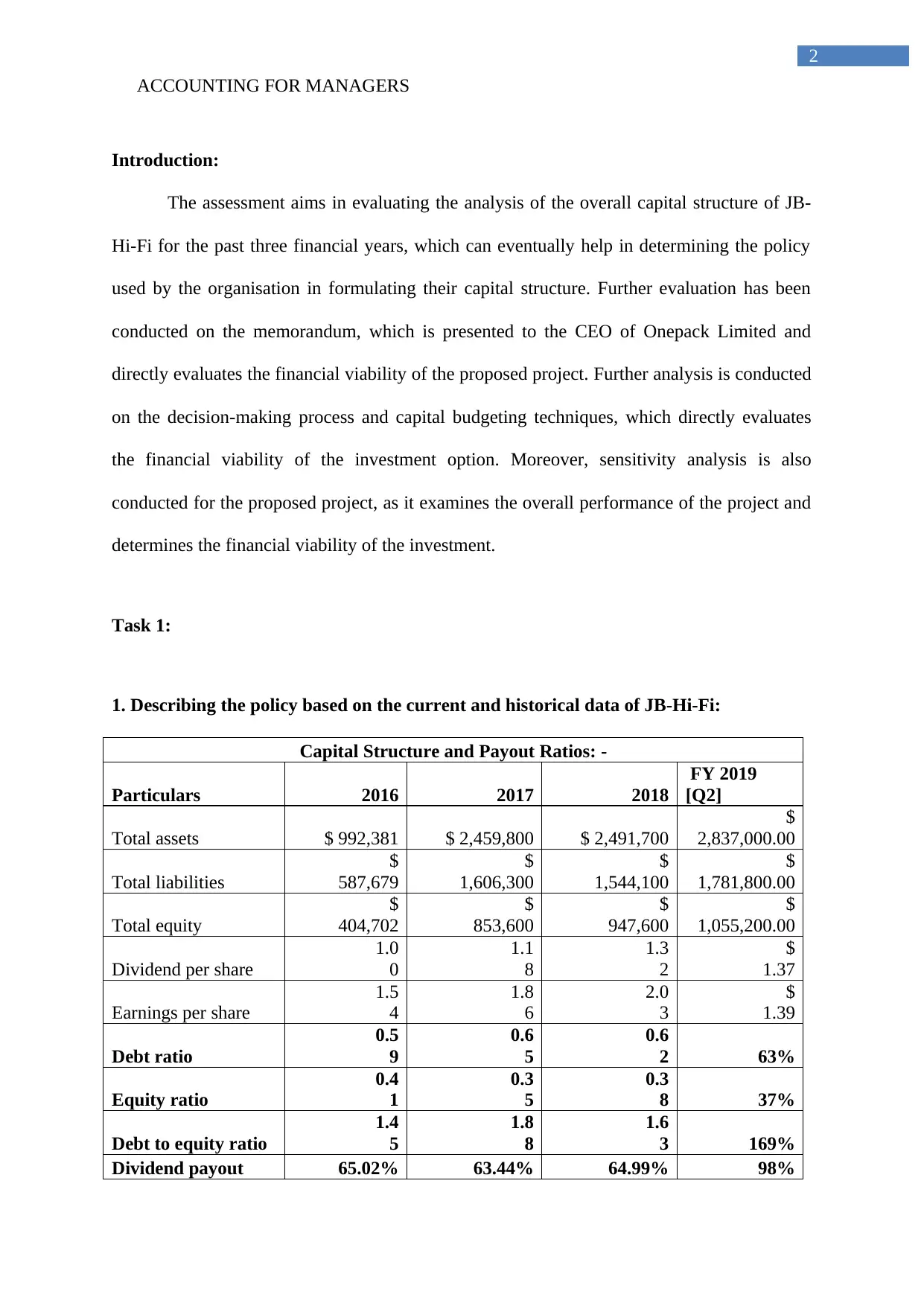

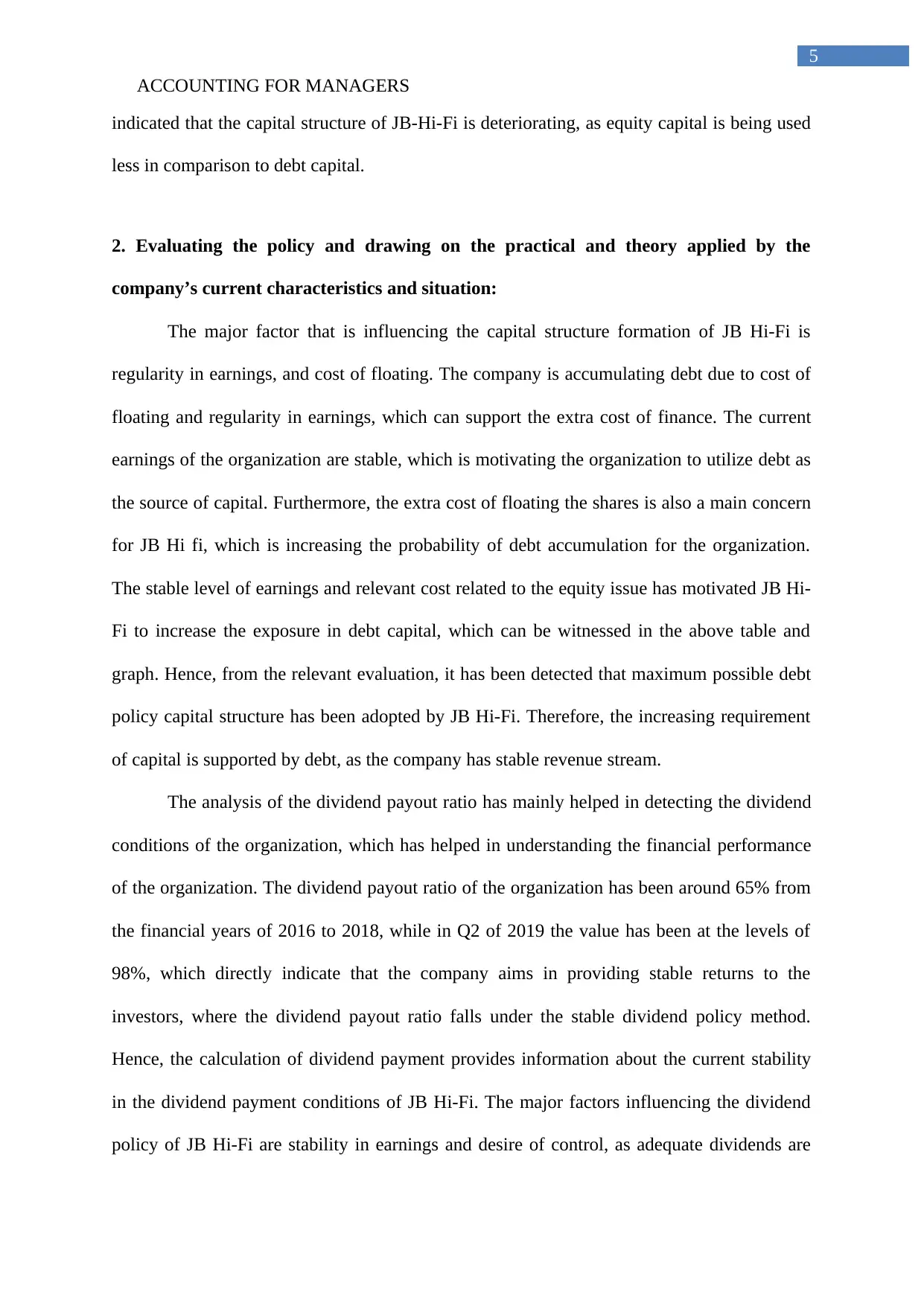

From the relevant analysis, it can be detected that the capital structure of JB-Hi-Fi is

relevantly accurate for valuation purposes, as it helps them to increase the level of income

from investment and reduce any kind of external risk. The above table directly provides all

the relevant information about the current capital structure conditions of the organisation,

which can directly have a negative impact on the performance of the organisation. The

relevant analysis has been conducted by analysing the debt, ratio, equity ratio, debt to equity

ratio and dividend payout ratio. Collier (2015) indicated that with the help of adequate capital

structure valuation, the financial performance of the company could be determined and

understood by the investors of the organisation.

2016 2017 2018 FY 2019 [Q2]

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

200%

Capital Structure and Payout Ratios

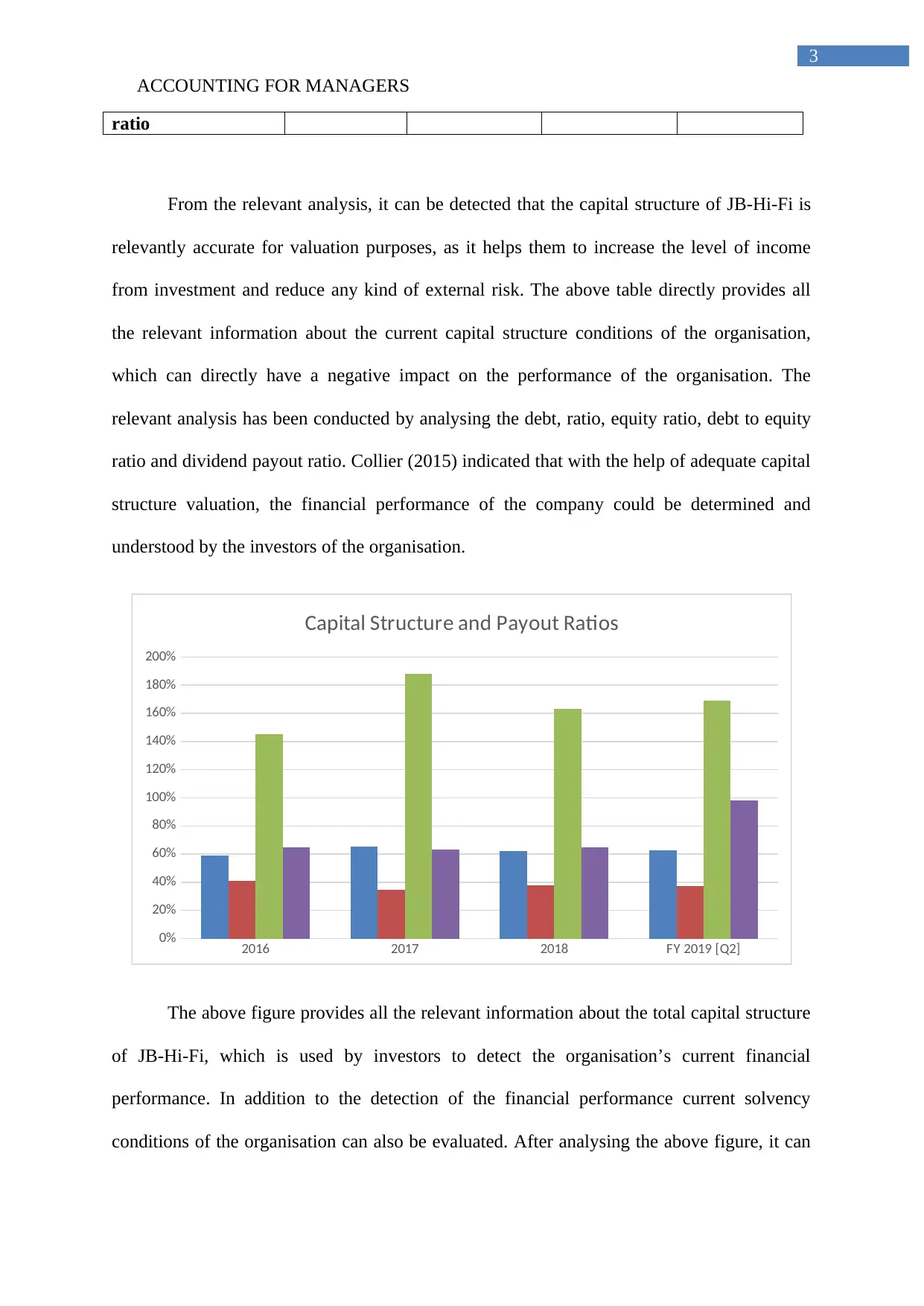

The above figure provides all the relevant information about the total capital structure

of JB-Hi-Fi, which is used by investors to detect the organisation’s current financial

performance. In addition to the detection of the financial performance current solvency

conditions of the organisation can also be evaluated. After analysing the above figure, it can

3

ratio

From the relevant analysis, it can be detected that the capital structure of JB-Hi-Fi is

relevantly accurate for valuation purposes, as it helps them to increase the level of income

from investment and reduce any kind of external risk. The above table directly provides all

the relevant information about the current capital structure conditions of the organisation,

which can directly have a negative impact on the performance of the organisation. The

relevant analysis has been conducted by analysing the debt, ratio, equity ratio, debt to equity

ratio and dividend payout ratio. Collier (2015) indicated that with the help of adequate capital

structure valuation, the financial performance of the company could be determined and

understood by the investors of the organisation.

2016 2017 2018 FY 2019 [Q2]

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

200%

Capital Structure and Payout Ratios

The above figure provides all the relevant information about the total capital structure

of JB-Hi-Fi, which is used by investors to detect the organisation’s current financial

performance. In addition to the detection of the financial performance current solvency

conditions of the organisation can also be evaluated. After analysing the above figure, it can

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

4

be detected that debt composition comprises of borrowings from bank loans, which has

increased since past three years. In addition, the values of debt ratio have increased from 0.59

to 0.62 in 2018 and 0.63 in 2019 Q2, which directly indicates about the problems that might

be faced by the company to comply with the operations. Therefore, increment in bank loan

has been witnessed from 2016 to 2018, which magnifies upside gains and downside losses.

Further analysis has directly indicated that the increment in debt condition is directly

reflected in the declining equity composition of JB-Hi-Fi. Thus, it can be detected that

relevant increment in debt from 0.59 to 0.62 in 2018 and 0.63 in 2019 Q2, while decline in

the percentage of equity from 0.41 to 0.38 in 2018 and 0.37 in 2019 Q2 is seem. In the

similar instance, the overall in debt to equity conditions of the organisation should mainly

increase from 2016 to 2019 Q2, where the values have increased to the level of 1.69 in 2019

Q2 as compared to 1.45 in 2016. Kaplan and Atkinson (2015) mentioned that with the help of

debt to equity calculation investors are able to understand the level of finance cost involved

in the operations.

However, the analysis of dividend payout ratio indicates about the dividends that have

been paid out during the financial year. The information of dividend payout ratio allows the

investors to understand the level of dividends that is paid by the organisation from the

earnings per share. Furthermore, the declining dividend pay-out ratio from 65.02% to 64.99%

in 2018 and 98% in 2019 Q2 of JB-Hi-Fi is directly reflecting on the dividend payment

conditions of the organisation. The payout policy is appropriate, as the company aims to

provide continuous dividend to the investors, which falls under the stable dividend policy

method that is used by JB Hi-Fi. Hence, from the relevant calculation, it can be detected that

the organisation is mainly focused on acquiring debt capital to support its operations while

reducing the composition of equity in the process. Henceforth, the quantitative analysis has

4

be detected that debt composition comprises of borrowings from bank loans, which has

increased since past three years. In addition, the values of debt ratio have increased from 0.59

to 0.62 in 2018 and 0.63 in 2019 Q2, which directly indicates about the problems that might

be faced by the company to comply with the operations. Therefore, increment in bank loan

has been witnessed from 2016 to 2018, which magnifies upside gains and downside losses.

Further analysis has directly indicated that the increment in debt condition is directly

reflected in the declining equity composition of JB-Hi-Fi. Thus, it can be detected that

relevant increment in debt from 0.59 to 0.62 in 2018 and 0.63 in 2019 Q2, while decline in

the percentage of equity from 0.41 to 0.38 in 2018 and 0.37 in 2019 Q2 is seem. In the

similar instance, the overall in debt to equity conditions of the organisation should mainly

increase from 2016 to 2019 Q2, where the values have increased to the level of 1.69 in 2019

Q2 as compared to 1.45 in 2016. Kaplan and Atkinson (2015) mentioned that with the help of

debt to equity calculation investors are able to understand the level of finance cost involved

in the operations.

However, the analysis of dividend payout ratio indicates about the dividends that have

been paid out during the financial year. The information of dividend payout ratio allows the

investors to understand the level of dividends that is paid by the organisation from the

earnings per share. Furthermore, the declining dividend pay-out ratio from 65.02% to 64.99%

in 2018 and 98% in 2019 Q2 of JB-Hi-Fi is directly reflecting on the dividend payment

conditions of the organisation. The payout policy is appropriate, as the company aims to

provide continuous dividend to the investors, which falls under the stable dividend policy

method that is used by JB Hi-Fi. Hence, from the relevant calculation, it can be detected that

the organisation is mainly focused on acquiring debt capital to support its operations while

reducing the composition of equity in the process. Henceforth, the quantitative analysis has

ACCOUNTING FOR MANAGERS

5

indicated that the capital structure of JB-Hi-Fi is deteriorating, as equity capital is being used

less in comparison to debt capital.

2. Evaluating the policy and drawing on the practical and theory applied by the

company’s current characteristics and situation:

The major factor that is influencing the capital structure formation of JB Hi-Fi is

regularity in earnings, and cost of floating. The company is accumulating debt due to cost of

floating and regularity in earnings, which can support the extra cost of finance. The current

earnings of the organization are stable, which is motivating the organization to utilize debt as

the source of capital. Furthermore, the extra cost of floating the shares is also a main concern

for JB Hi fi, which is increasing the probability of debt accumulation for the organization.

The stable level of earnings and relevant cost related to the equity issue has motivated JB Hi-

Fi to increase the exposure in debt capital, which can be witnessed in the above table and

graph. Hence, from the relevant evaluation, it has been detected that maximum possible debt

policy capital structure has been adopted by JB Hi-Fi. Therefore, the increasing requirement

of capital is supported by debt, as the company has stable revenue stream.

The analysis of the dividend payout ratio has mainly helped in detecting the dividend

conditions of the organization, which has helped in understanding the financial performance

of the organization. The dividend payout ratio of the organization has been around 65% from

the financial years of 2016 to 2018, while in Q2 of 2019 the value has been at the levels of

98%, which directly indicate that the company aims in providing stable returns to the

investors, where the dividend payout ratio falls under the stable dividend policy method.

Hence, the calculation of dividend payment provides information about the current stability

in the dividend payment conditions of JB Hi-Fi. The major factors influencing the dividend

policy of JB Hi-Fi are stability in earnings and desire of control, as adequate dividends are

5

indicated that the capital structure of JB-Hi-Fi is deteriorating, as equity capital is being used

less in comparison to debt capital.

2. Evaluating the policy and drawing on the practical and theory applied by the

company’s current characteristics and situation:

The major factor that is influencing the capital structure formation of JB Hi-Fi is

regularity in earnings, and cost of floating. The company is accumulating debt due to cost of

floating and regularity in earnings, which can support the extra cost of finance. The current

earnings of the organization are stable, which is motivating the organization to utilize debt as

the source of capital. Furthermore, the extra cost of floating the shares is also a main concern

for JB Hi fi, which is increasing the probability of debt accumulation for the organization.

The stable level of earnings and relevant cost related to the equity issue has motivated JB Hi-

Fi to increase the exposure in debt capital, which can be witnessed in the above table and

graph. Hence, from the relevant evaluation, it has been detected that maximum possible debt

policy capital structure has been adopted by JB Hi-Fi. Therefore, the increasing requirement

of capital is supported by debt, as the company has stable revenue stream.

The analysis of the dividend payout ratio has mainly helped in detecting the dividend

conditions of the organization, which has helped in understanding the financial performance

of the organization. The dividend payout ratio of the organization has been around 65% from

the financial years of 2016 to 2018, while in Q2 of 2019 the value has been at the levels of

98%, which directly indicate that the company aims in providing stable returns to the

investors, where the dividend payout ratio falls under the stable dividend policy method.

Hence, the calculation of dividend payment provides information about the current stability

in the dividend payment conditions of JB Hi-Fi. The major factors influencing the dividend

policy of JB Hi-Fi are stability in earnings and desire of control, as adequate dividends are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

6

being paid by the organization to support its investors. The evaluation of the dividend

stability is mainly conducted on the basis of dividends per share and earnings per share of the

organization. This has helped in understanding the current dividend payout ratio of the

organization, which is stable in nature, as dividend has been increasing from $1 in 2016 to

$1.37 in 2019 Q2. There is relevantly no uncertainty in deriving the dividend conditions, as

both earnings and dividend per share of the organisation can be derived from the annual

report.

Task 2: Analysing the proposed project, while presenting the OnePack’s CEO with

relevant justification for the different levels of sensitivity analysis

MEMORANDUM

To,

The CEO,

OnePack Limited

From: The Manager

Date: 09th June 2019

Subject: Analysing the financial viability of the investment option

Adequate analysis has been conducted on the financial performance of the proposed

project by evaluating the different level of investment appraisal techniques, which can help

the organization to improve performance and financial income in the long-run. More analysis

would eventually help in understanding the overall financial obligation and income that might

be experienced by the new proposed project, which would help in deciding whether to

develop the process on a commercial scale. Therefore, with the help of adequate analysis of

different aspects of the project would eventually help in the decision-making process.

Financial projections and cash inflows:

Particulars 0 1 2 3 4 5 6

6

being paid by the organization to support its investors. The evaluation of the dividend

stability is mainly conducted on the basis of dividends per share and earnings per share of the

organization. This has helped in understanding the current dividend payout ratio of the

organization, which is stable in nature, as dividend has been increasing from $1 in 2016 to

$1.37 in 2019 Q2. There is relevantly no uncertainty in deriving the dividend conditions, as

both earnings and dividend per share of the organisation can be derived from the annual

report.

Task 2: Analysing the proposed project, while presenting the OnePack’s CEO with

relevant justification for the different levels of sensitivity analysis

MEMORANDUM

To,

The CEO,

OnePack Limited

From: The Manager

Date: 09th June 2019

Subject: Analysing the financial viability of the investment option

Adequate analysis has been conducted on the financial performance of the proposed

project by evaluating the different level of investment appraisal techniques, which can help

the organization to improve performance and financial income in the long-run. More analysis

would eventually help in understanding the overall financial obligation and income that might

be experienced by the new proposed project, which would help in deciding whether to

develop the process on a commercial scale. Therefore, with the help of adequate analysis of

different aspects of the project would eventually help in the decision-making process.

Financial projections and cash inflows:

Particulars 0 1 2 3 4 5 6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

7

Revenue

$

440,00

0,000

$

460,020

,000

$

480,950,

910

$

502,83

4,176

$

525,713

,131

$

549,633,

079

Variable cost

$

(27,00

0,000)

$

(24,786,

000)

$

(22,753,

548)

$

(20,88

7,757)

$

(19,174,

961)

$

(17,602,

614)

Administrative

and general

expenses

$

(4,000,

000)

$

(4,000,0

00)

$

(4,000,0

00)

$

(4,000,

000)

$

(4,000,0

00)

$

(4,000,0

00)

Marketing cost

$

(13,00

0,000)

$

-

$

-

$

-

$

-

$

-

Total interest

costs

$

(1,200,

000)

$

(1,200,0

00)

$

(1,200,0

00)

$

(1,200,

000)

$

(1,200,0

00)

$

(1,200,0

00)

Salvage value

$

1,500,00

0

Depreciation

expense

(5,000,

000)

(5,000,0

00)

(5,000,0

00)

(5,000,

000)

(5,000,0

00)

(5,000,0

00)

Profit before tax

$

389,80

0,000

$

425,034

,000

$

447,997,

362

$

471,74

6,419

$

496,338

,170

$

523,330,

465

Tax

$

(116,9

40,000

)

$

(127,51

0,200)

$

(134,399

,209)

$

(141,5

23,926

)

$

(148,90

1,451)

$

(156,999

,139)

Profit after tax

$

272,86

0,000

$

297,523

,800

$

313,598,

153

$

330,22

2,494

$

347,436

,719

$

366,331,

325

Cash flow

$

(60,450,

000)

$

277,86

0,000

$

302,523

,800

$

318,598,

153

$

335,22

2,494

$

352,436

,719

$

375,731,

325

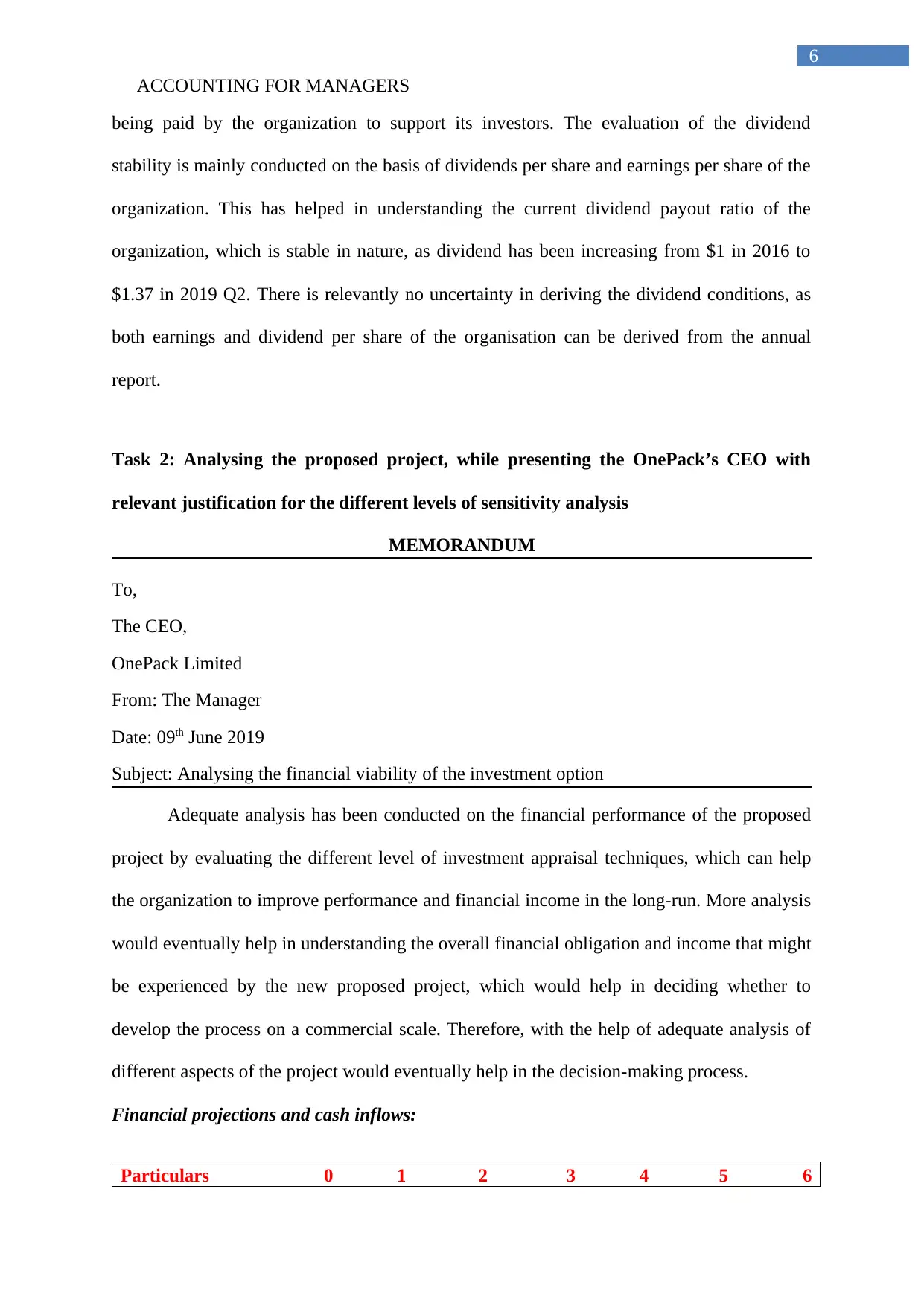

The above table provides information about the overall cash flow that has been

derived for the proposed project, which can help in utilizing the different level of investment

appraisal technique to detect its financial viability. From the relevant analysis, it could be

identified that the overall measures of revenue increment and variable cost increment are

directly conducted to determine the level of inflows and outflows that would be conducted for

the project. Moreover, the other expenses marketing cost, depreciation expense,

administration and general expenses are relatively utilized for determining the free cash flow

7

Revenue

$

440,00

0,000

$

460,020

,000

$

480,950,

910

$

502,83

4,176

$

525,713

,131

$

549,633,

079

Variable cost

$

(27,00

0,000)

$

(24,786,

000)

$

(22,753,

548)

$

(20,88

7,757)

$

(19,174,

961)

$

(17,602,

614)

Administrative

and general

expenses

$

(4,000,

000)

$

(4,000,0

00)

$

(4,000,0

00)

$

(4,000,

000)

$

(4,000,0

00)

$

(4,000,0

00)

Marketing cost

$

(13,00

0,000)

$

-

$

-

$

-

$

-

$

-

Total interest

costs

$

(1,200,

000)

$

(1,200,0

00)

$

(1,200,0

00)

$

(1,200,

000)

$

(1,200,0

00)

$

(1,200,0

00)

Salvage value

$

1,500,00

0

Depreciation

expense

(5,000,

000)

(5,000,0

00)

(5,000,0

00)

(5,000,

000)

(5,000,0

00)

(5,000,0

00)

Profit before tax

$

389,80

0,000

$

425,034

,000

$

447,997,

362

$

471,74

6,419

$

496,338

,170

$

523,330,

465

Tax

$

(116,9

40,000

)

$

(127,51

0,200)

$

(134,399

,209)

$

(141,5

23,926

)

$

(148,90

1,451)

$

(156,999

,139)

Profit after tax

$

272,86

0,000

$

297,523

,800

$

313,598,

153

$

330,22

2,494

$

347,436

,719

$

366,331,

325

Cash flow

$

(60,450,

000)

$

277,86

0,000

$

302,523

,800

$

318,598,

153

$

335,22

2,494

$

352,436

,719

$

375,731,

325

The above table provides information about the overall cash flow that has been

derived for the proposed project, which can help in utilizing the different level of investment

appraisal technique to detect its financial viability. From the relevant analysis, it could be

identified that the overall measures of revenue increment and variable cost increment are

directly conducted to determine the level of inflows and outflows that would be conducted for

the project. Moreover, the other expenses marketing cost, depreciation expense,

administration and general expenses are relatively utilized for determining the free cash flow

ACCOUNTING FOR MANAGERS

8

of the project for future years. The total returns inform of free cash flow for the period of six

years is relatively higher in comparison to the total initial investment that is conducted for the

project (Fields 2016). This would eventually help in determining the present value of future

cash inflows generated by the project and allow management to make adequate investment

decisions.

Investment Appraisal techniques:

Year Cash flow Discount rate Dis-cash flow Cum-cash flow

0

$(60,450,000.00) 1.00

$(60,450,000.00)

$(60,450,000.00)

1 $277,860,000.00 0.92 $254,917,431.19 $217,410,000.00

2 $302,523,800.00 0.84 $254,628,229.95 $519,933,800.00

3 $318,598,153.40 0.77 $246,016,230.83 $838,531,953.40

4 $335,222,493.54 0.71 $237,480,065.74 $1,173,754,446.94

5 $352,436,719.31 0.65 $229,059,685.57 $1,526,191,166.25

6 $375,731,325.31 0.60 $224,036,312.97 $1,901,922,491.56

NPV $1,385,687,956.24

Payback period 0.2

IRR 468%

Profitability

index

23.9

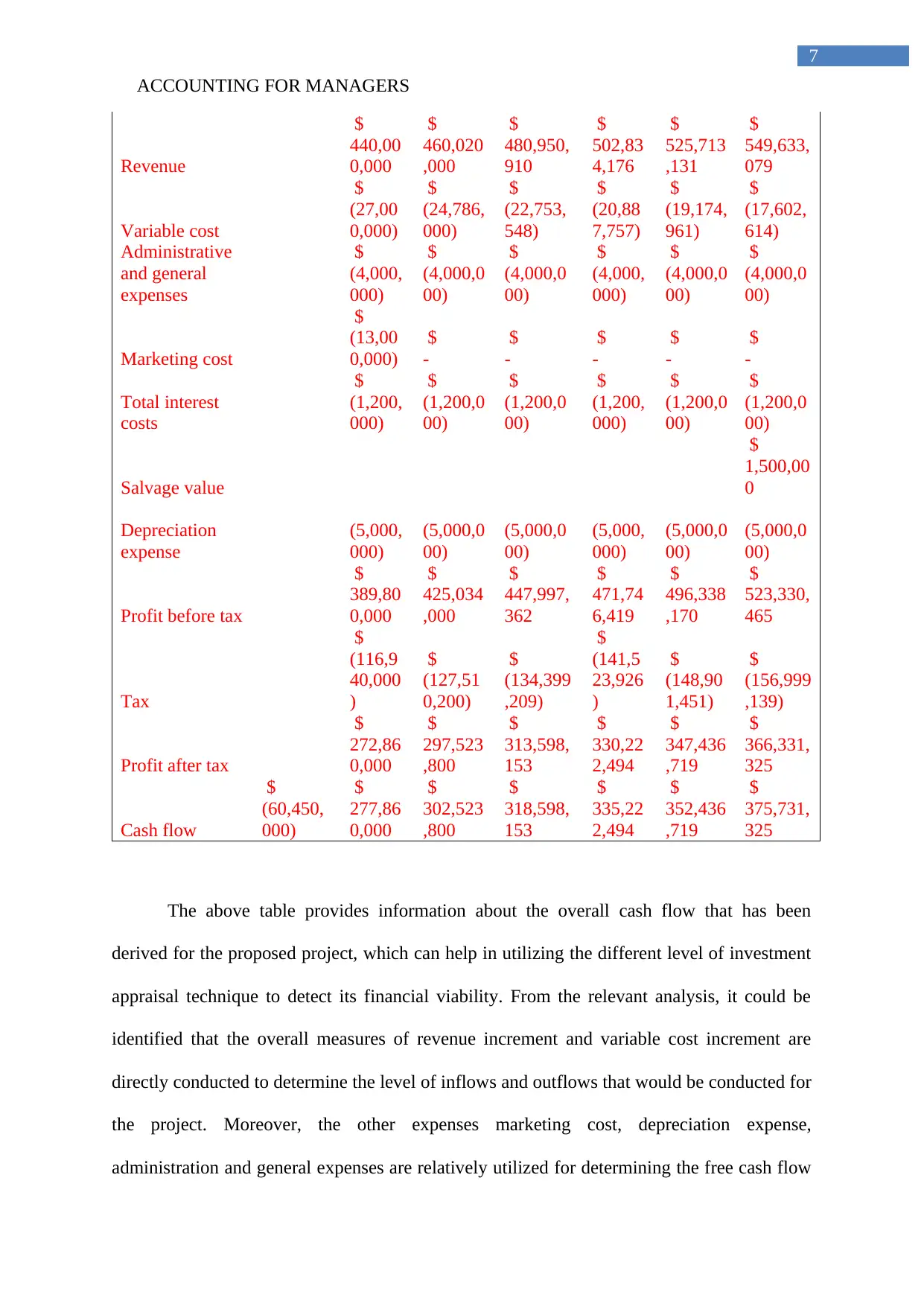

The above table highlights the overall investment appraisal techniques such as net

present value, internal rate of return, payback period, and profitability index. From the

element analysis, it is determined that the investment appraisal technique has provided a

positive indication about the total free cash flow that is provided by the project over a period

of 6 years. Hence, it could be understood that the investment is financially viable, which

would help in generating a high level of returns in the process (Kravet 2014). The net present

value is at the levels of $ 1,385,687,956.24, while the payback period is at the levels of 0.2

years. In addition, the internal rate of return is depicting a total return of 468%, while the

profitability index is at 23.9. Thus, investments might eventually help in generating a high

level of income from the investment.

8

of the project for future years. The total returns inform of free cash flow for the period of six

years is relatively higher in comparison to the total initial investment that is conducted for the

project (Fields 2016). This would eventually help in determining the present value of future

cash inflows generated by the project and allow management to make adequate investment

decisions.

Investment Appraisal techniques:

Year Cash flow Discount rate Dis-cash flow Cum-cash flow

0

$(60,450,000.00) 1.00

$(60,450,000.00)

$(60,450,000.00)

1 $277,860,000.00 0.92 $254,917,431.19 $217,410,000.00

2 $302,523,800.00 0.84 $254,628,229.95 $519,933,800.00

3 $318,598,153.40 0.77 $246,016,230.83 $838,531,953.40

4 $335,222,493.54 0.71 $237,480,065.74 $1,173,754,446.94

5 $352,436,719.31 0.65 $229,059,685.57 $1,526,191,166.25

6 $375,731,325.31 0.60 $224,036,312.97 $1,901,922,491.56

NPV $1,385,687,956.24

Payback period 0.2

IRR 468%

Profitability

index

23.9

The above table highlights the overall investment appraisal techniques such as net

present value, internal rate of return, payback period, and profitability index. From the

element analysis, it is determined that the investment appraisal technique has provided a

positive indication about the total free cash flow that is provided by the project over a period

of 6 years. Hence, it could be understood that the investment is financially viable, which

would help in generating a high level of returns in the process (Kravet 2014). The net present

value is at the levels of $ 1,385,687,956.24, while the payback period is at the levels of 0.2

years. In addition, the internal rate of return is depicting a total return of 468%, while the

profitability index is at 23.9. Thus, investments might eventually help in generating a high

level of income from the investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

9

Sensitivity Analysis:

Sensitivity analysis 1

NPV $1,385,687,956.24

$ 104,414,063 $328,830,247.43

$ 139,218,750 $438,440,329.91

$ 185,625,000 $584,587,106.54

$ 247,500,000 $779,449,475.39

$ 330,000,000 $1,039,265,967.18

$ 440,000,000 $1,385,687,956.24

$ 550,000,000 $1,732,109,945.31

$ 687,500,000 $2,165,137,431.63

$ 859,375,000 $2,706,421,789.54

$

1,074,218,750

$3,383,027,236.92

$

1,342,773,438

$4,228,784,046.16

Sensitivity analysis 2

IRR 468%

$ 104,414,063 111.02%

$ 139,218,750 148.02%

$ 185,625,000 197.37%

$ 247,500,000 263.15%

$ 330,000,000 350.87%

$ 440,000,000 467.83%

$ 550,000,000 584.79%

$ 687,500,000 730.98%

$ 859,375,000 913.73%

$ 1,074,218,750 1142.16%

$ 1,342,773,438 1427.70%

Sensitivity analysis 3

Profitability

index

23.9

$ 104,414,063 5.7

$ 139,218,750 7.6

$ 185,625,000 10.1

$ 247,500,000 13.5

$ 330,000,000 17.9

$ 440,000,000 23.9

9

Sensitivity Analysis:

Sensitivity analysis 1

NPV $1,385,687,956.24

$ 104,414,063 $328,830,247.43

$ 139,218,750 $438,440,329.91

$ 185,625,000 $584,587,106.54

$ 247,500,000 $779,449,475.39

$ 330,000,000 $1,039,265,967.18

$ 440,000,000 $1,385,687,956.24

$ 550,000,000 $1,732,109,945.31

$ 687,500,000 $2,165,137,431.63

$ 859,375,000 $2,706,421,789.54

$

1,074,218,750

$3,383,027,236.92

$

1,342,773,438

$4,228,784,046.16

Sensitivity analysis 2

IRR 468%

$ 104,414,063 111.02%

$ 139,218,750 148.02%

$ 185,625,000 197.37%

$ 247,500,000 263.15%

$ 330,000,000 350.87%

$ 440,000,000 467.83%

$ 550,000,000 584.79%

$ 687,500,000 730.98%

$ 859,375,000 913.73%

$ 1,074,218,750 1142.16%

$ 1,342,773,438 1427.70%

Sensitivity analysis 3

Profitability

index

23.9

$ 104,414,063 5.7

$ 139,218,750 7.6

$ 185,625,000 10.1

$ 247,500,000 13.5

$ 330,000,000 17.9

$ 440,000,000 23.9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

10

$ 550,000,000 29.9

$ 687,500,000 37.4

$ 859,375,000 46.7

$ 1,074,218,750 58.4

$ 1,342,773,438 73.0

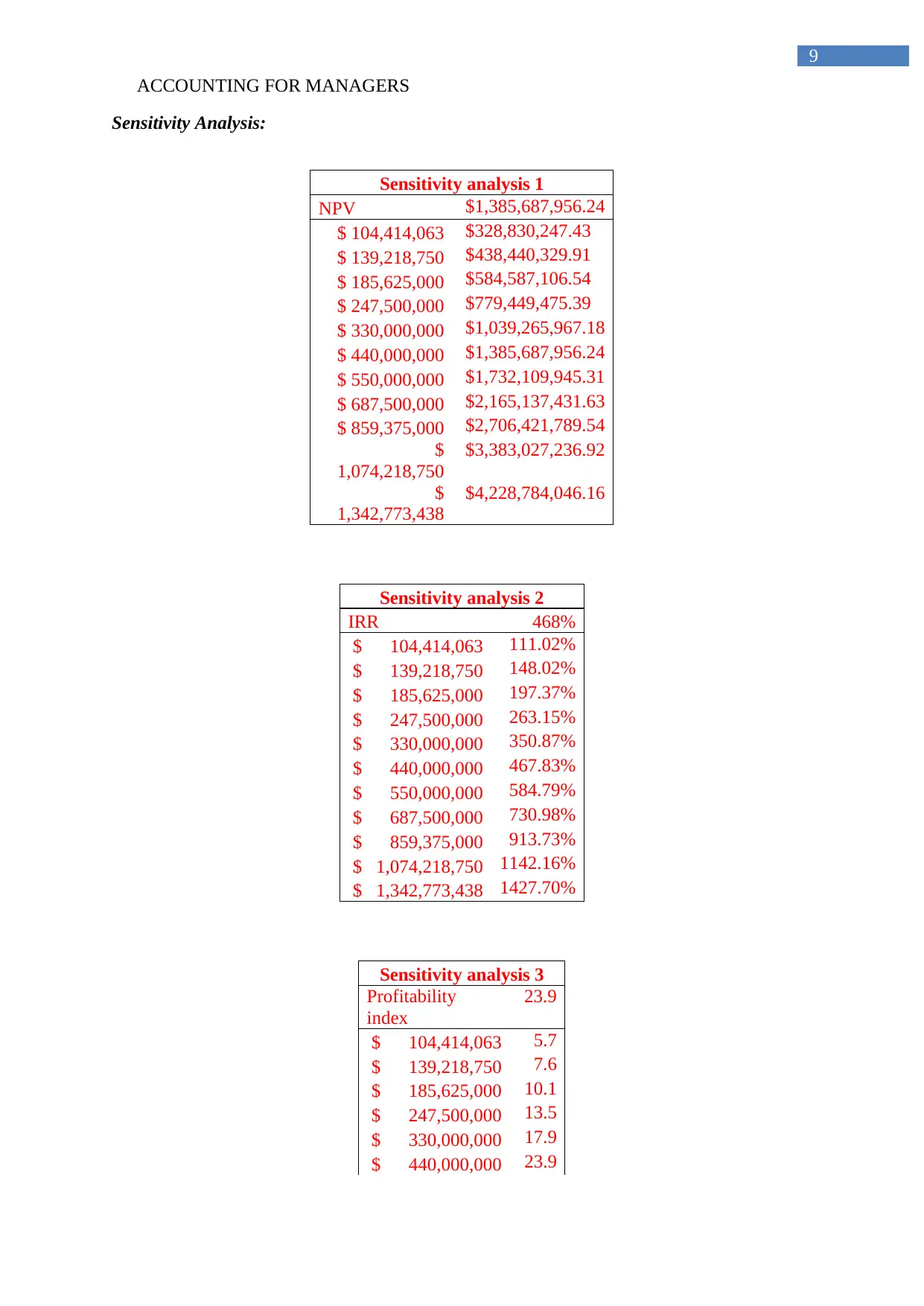

The three sensitivity analysis table directly indicates about the overall changes that

would be incurred with the alteration in the total revenues that would be generated by the

project during the first year of the commencement. All the relevant sensitivity analysis

directly stated that a positive NPV value will be generated for the project if the total revenues

are reduced to a lower level. In the process, it could be identified that the internal rate of

return is also putting a positive value with the alterations in the revenues which indicates the

financial viability of the project. Moreover, the profitability index is also providing a positive

indication, where the minimum value is at the levels of 5.7, which is relatively higher than

one and can allow the organization to improve its financial viability in the long run.

Hence, the project can be accepted by the CEO of OnePack Limited for increasing

financial stability and profitability in the long run.

Conclusion:

This customer directly evaluated the capital structure conditions of JB Hi-Fi Limited

which eventually helps in determining the current system that is used by the management to

ensure continuity of their operation. From the evaluation, it is determined that the current

capital structure is not relevant as death is increasing and equity conditions are decreasing

which is relatively declining the overall financial progress of the organization. However, the

analysis of the investment appraisal technique for One pack limited has directly indicated that

the management should select the project, as it is portraying positive financial viability.

10

$ 550,000,000 29.9

$ 687,500,000 37.4

$ 859,375,000 46.7

$ 1,074,218,750 58.4

$ 1,342,773,438 73.0

The three sensitivity analysis table directly indicates about the overall changes that

would be incurred with the alteration in the total revenues that would be generated by the

project during the first year of the commencement. All the relevant sensitivity analysis

directly stated that a positive NPV value will be generated for the project if the total revenues

are reduced to a lower level. In the process, it could be identified that the internal rate of

return is also putting a positive value with the alterations in the revenues which indicates the

financial viability of the project. Moreover, the profitability index is also providing a positive

indication, where the minimum value is at the levels of 5.7, which is relatively higher than

one and can allow the organization to improve its financial viability in the long run.

Hence, the project can be accepted by the CEO of OnePack Limited for increasing

financial stability and profitability in the long run.

Conclusion:

This customer directly evaluated the capital structure conditions of JB Hi-Fi Limited

which eventually helps in determining the current system that is used by the management to

ensure continuity of their operation. From the evaluation, it is determined that the current

capital structure is not relevant as death is increasing and equity conditions are decreasing

which is relatively declining the overall financial progress of the organization. However, the

analysis of the investment appraisal technique for One pack limited has directly indicated that

the management should select the project, as it is portraying positive financial viability.

ACCOUNTING FOR MANAGERS

11

References and Bibliography:

Agrawal, A. and Cooper, T., 2015. Insider trading before accounting scandals. Journal of

Corporate Finance, 34, pp.169-190.

Bebbington, J., Unerman, J. and O’DWYER, B.R.E.N.D.A.N., 2014. Introduction to

sustainability accounting and accountability. In Sustainability accounting and

accountability(pp. 21-32). Routledge.

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for

decision making. John Wiley & Sons.

Fields, E., 2016. The essentials of finance and accounting for nonfinancial managers.

Amacom.

García Lara, J.M., Garcia Osma, B. and Penalva, F., 2014. Information consequences of

accounting conservatism. European Accounting Review, 23(2), pp.173-198.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Kim, J.B. and Zhang, L., 2016. Accounting conservatism and stock price crash risk: Firm‐

level evidence. Contemporary Accounting Research, 33(1), pp.412-441.

Kravet, T.D., 2014. Accounting conservatism and managerial risk-taking: Corporate

acquisitions. Journal of Accounting and Economics, 57(2-3), pp.218-240.

Lev, B. and Gu, F., 2016. The end of accounting and the path forward for investors and

managers. John Wiley & Sons.

Mihăilă, M., 2014. Managerial accounting and decision making, in energy

industry. Procedia-Social and Behavioral Sciences, 109, pp.1199-1202.

11

References and Bibliography:

Agrawal, A. and Cooper, T., 2015. Insider trading before accounting scandals. Journal of

Corporate Finance, 34, pp.169-190.

Bebbington, J., Unerman, J. and O’DWYER, B.R.E.N.D.A.N., 2014. Introduction to

sustainability accounting and accountability. In Sustainability accounting and

accountability(pp. 21-32). Routledge.

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for

decision making. John Wiley & Sons.

Fields, E., 2016. The essentials of finance and accounting for nonfinancial managers.

Amacom.

García Lara, J.M., Garcia Osma, B. and Penalva, F., 2014. Information consequences of

accounting conservatism. European Accounting Review, 23(2), pp.173-198.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Kim, J.B. and Zhang, L., 2016. Accounting conservatism and stock price crash risk: Firm‐

level evidence. Contemporary Accounting Research, 33(1), pp.412-441.

Kravet, T.D., 2014. Accounting conservatism and managerial risk-taking: Corporate

acquisitions. Journal of Accounting and Economics, 57(2-3), pp.218-240.

Lev, B. and Gu, F., 2016. The end of accounting and the path forward for investors and

managers. John Wiley & Sons.

Mihăilă, M., 2014. Managerial accounting and decision making, in energy

industry. Procedia-Social and Behavioral Sciences, 109, pp.1199-1202.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

12

Nobes, C.W. and Stadler, C., 2015. The qualitative characteristics of financial information,

and managers’ accounting decisions: evidence from IFRS policy changes. Accounting and

Business Research, 45(5), pp.572-601.

Scase, R. and Goffee, R., 2017. Reluctant Managers (Routledge Revivals): Their Work and

Lifestyles. Routledge.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Smith, M., 2017. Research methods in accounting. Sage.

Tracy, J.A., 2016. Accounting for dummies. John Wiley & Sons.

Warren Jr, J.D., Moffitt, K.C. and Byrnes, P., 2015. How Big Data will change

accounting. Accounting Horizons, 29(2), pp.397-407.

12

Nobes, C.W. and Stadler, C., 2015. The qualitative characteristics of financial information,

and managers’ accounting decisions: evidence from IFRS policy changes. Accounting and

Business Research, 45(5), pp.572-601.

Scase, R. and Goffee, R., 2017. Reluctant Managers (Routledge Revivals): Their Work and

Lifestyles. Routledge.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Smith, M., 2017. Research methods in accounting. Sage.

Tracy, J.A., 2016. Accounting for dummies. John Wiley & Sons.

Warren Jr, J.D., Moffitt, K.C. and Byrnes, P., 2015. How Big Data will change

accounting. Accounting Horizons, 29(2), pp.397-407.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

13

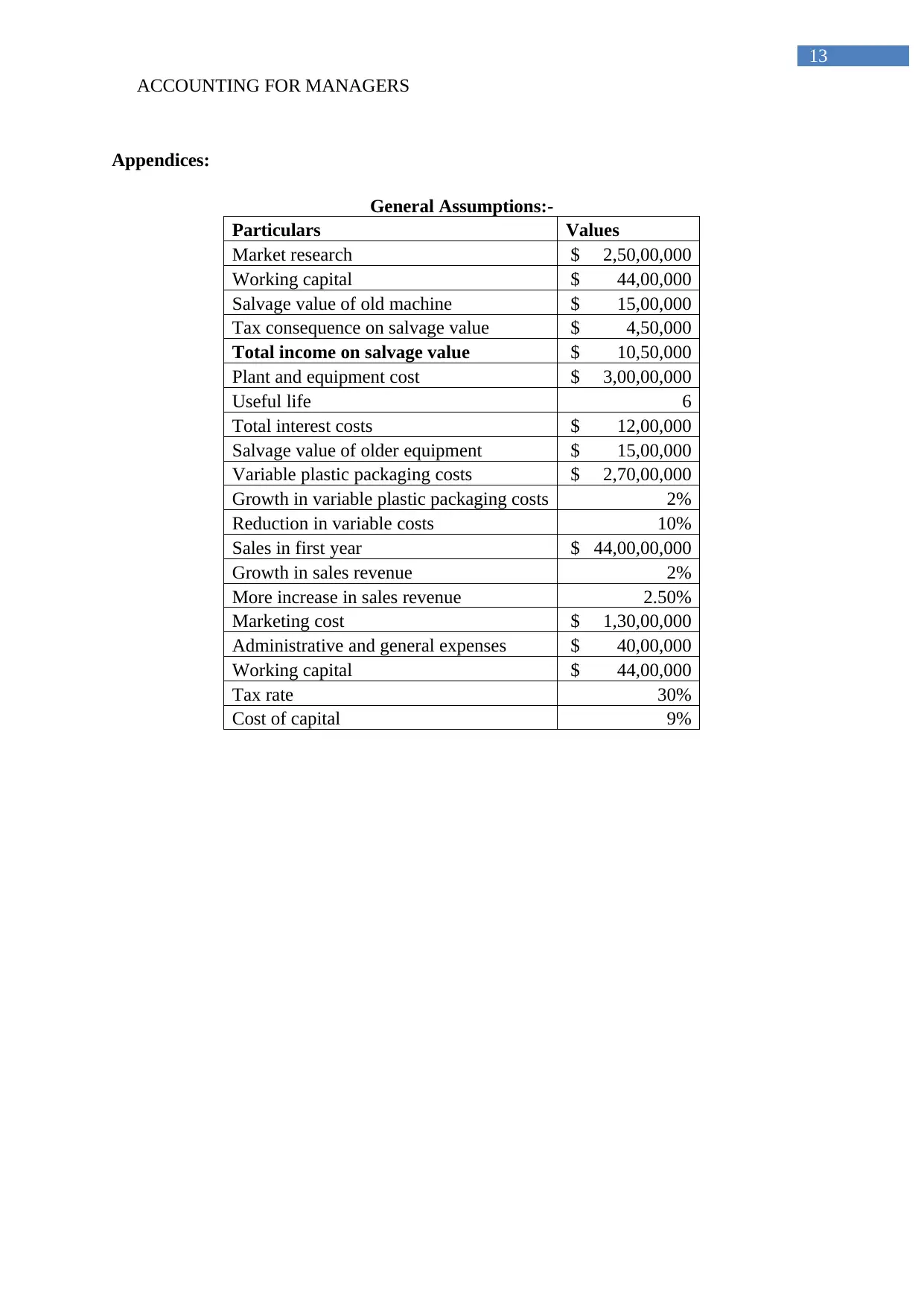

Appendices:

General Assumptions:-

Particulars Values

Market research $ 2,50,00,000

Working capital $ 44,00,000

Salvage value of old machine $ 15,00,000

Tax consequence on salvage value $ 4,50,000

Total income on salvage value $ 10,50,000

Plant and equipment cost $ 3,00,00,000

Useful life 6

Total interest costs $ 12,00,000

Salvage value of older equipment $ 15,00,000

Variable plastic packaging costs $ 2,70,00,000

Growth in variable plastic packaging costs 2%

Reduction in variable costs 10%

Sales in first year $ 44,00,00,000

Growth in sales revenue 2%

More increase in sales revenue 2.50%

Marketing cost $ 1,30,00,000

Administrative and general expenses $ 40,00,000

Working capital $ 44,00,000

Tax rate 30%

Cost of capital 9%

13

Appendices:

General Assumptions:-

Particulars Values

Market research $ 2,50,00,000

Working capital $ 44,00,000

Salvage value of old machine $ 15,00,000

Tax consequence on salvage value $ 4,50,000

Total income on salvage value $ 10,50,000

Plant and equipment cost $ 3,00,00,000

Useful life 6

Total interest costs $ 12,00,000

Salvage value of older equipment $ 15,00,000

Variable plastic packaging costs $ 2,70,00,000

Growth in variable plastic packaging costs 2%

Reduction in variable costs 10%

Sales in first year $ 44,00,00,000

Growth in sales revenue 2%

More increase in sales revenue 2.50%

Marketing cost $ 1,30,00,000

Administrative and general expenses $ 40,00,000

Working capital $ 44,00,000

Tax rate 30%

Cost of capital 9%

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.